#UAE Accounting

Explore tagged Tumblr posts

Text

Accounting Services in Dubai: Empowering Businesses for Financial Success

Dubai stands as a beacon of opportunity, attracting entrepreneurs and businesses from around the globe with its dynamic economy and strategic location. Amidst the bustling business landscape of this cosmopolitan city, one crucial aspect stands out as the backbone of success: accounting services. Let's delve into the world of accounting services in Dubai and explore how they empower businesses for financial success.

Understanding the Essence

Dubai's economic prowess is evident in its diverse business ecosystem, ranging from startups and SMEs to multinational corporations across various industries. However, amidst the flurry of activity, maintaining financial clarity and compliance becomes paramount. This is where accounting services emerge as indispensable allies, providing businesses with the expertise and support needed to navigate the financial landscape effectively.

Holistic Financial Solutions

Accounting services in Dubai offer a comprehensive array of solutions tailored to meet the diverse needs of businesses operating in the region. Here are some key services provided:

1. Bookkeeping and Financial Reporting

Accurate bookkeeping forms the foundation of sound financial management. Accounting firms in Dubai meticulously record financial transactions and prepare detailed financial reports, offering businesses insights into their financial health and facilitating informed decision-making.

2. Auditing and Assurance

Independent audits ensure transparency and integrity in financial reporting. Audit firms in Dubai conduct thorough examinations of financial statements, ensuring compliance with accounting standards and regulatory requirements, thereby instilling confidence in stakeholders.

3. Tax Advisory and Compliance

Navigating the intricacies of taxation is vital for businesses in Dubai. Tax consultants provide expert advice on tax planning, compliance, and optimization, helping businesses minimize tax liabilities and ensure adherence to local tax laws and regulations.

4. Financial Planning and Analysis

Strategic financial planning is essential for long-term success. Financial advisors analyze financial data, assess risks, and formulate strategies to optimize financial performance, enabling businesses to achieve their goals and objectives.

5. Specialized Consulting Services

In addition to core accounting services, firms offer specialized consulting services such as business valuation, forensic accounting, risk management, and CFO services, providing businesses with tailored solutions to address specific challenges and opportunities.

Driving Business Success

The value proposition of accounting services lies in their ability to go beyond numbers and serve as strategic partners in driving business success. By leveraging accounting services, businesses in Dubai can:

Ensure Compliance: Accounting firms ensure compliance with regulatory requirements, mitigating the risk of penalties and legal issues.

Enhance Efficiency: Streamlined financial processes and accurate reporting improve operational efficiency and resource allocation.

Minimize Risks: Expert financial analysis helps identify and mitigate risks, safeguarding businesses against financial downturns.

Facilitate Growth: Strategic financial planning and advisory services enable businesses to seize growth opportunities and expand their operations confidently.

Conclusion

In conclusion, accounting services in Dubai play a pivotal role in empowering businesses for financial success. From bookkeeping and auditing to tax advisory and specialized consulting, accounting firms offer a suite of services tailored to meet the diverse needs of businesses operating in the region. By partnering with accounting professionals, businesses can navigate the complexities of the financial landscape with confidence, unlocking their full potential and charting a path towards sustained growth and prosperity in the dynamic business landscape of Dubai.

0 notes

Text

14 notes

·

View notes

Text

2 notes

·

View notes

Text

Certified public accountants UAE

Unlock financial success with certified public accountants in the UAE! From expert auditing to strategic tax planning, trust the pros to ensure compliance, accuracy, and growth for your business.

2 notes

·

View notes

Text

💼 Unlocking Double Taxation Benefits in the UAE: How DTAA Can Save You Thousands

Are you an expat, NRI, investor, or business owner based in the UAE with international income streams? Then you’ve probably wondered how to avoid getting taxed twice on the same income. Good news: there’s a powerful solution—the Double Taxation Avoidance Agreement (DTAA).

At Tulpar Global Taxation Services, we make this complex process easy and profitable for you.

🌍 What is DTAA?

The Double Taxation Avoidance Agreement (DTAA) is a legal treaty between two countries that prevents individuals and businesses from being taxed twice on the same income. The UAE has signed over 137 DTAAs with countries including India, UK, USA, Singapore, Canada, and many more.

This agreement determines who has the right to tax various types of income (like salary, dividends, and business profits), and how much.

✅ Why DTAA Matters in the UAE

The UAE is known for having no personal income tax, but with the new 9% corporate tax introduced in 2023, things are changing. If you earn income from abroad, that foreign country may want to tax you—and without a DTAA, your income could be taxed in both places.

But with a DTAA, you can:

Avoid double taxation on salary, capital gains, and dividends

Claim tax relief through exemptions or foreign tax credits

Lower your withholding tax on income from abroad (e.g., from 30% to 10%)

Attract international investment and expand your business globally

🧾 How DTAA Works

There are two main ways DTAA benefits apply:

Exemption Method – Income is taxed in just one country

Tax Credit Method – Tax is paid in both countries, but credit is given in one

Example: You’re a UAE resident who earns income in India. Under the UAE-India DTAA, you can either avoid paying tax in India altogether or get a credit for Indian taxes paid when reporting in the UAE.

👤 Who Can Benefit?

NRIs living in the UAE earning income in India or elsewhere

Expatriates with global investments or freelance clients abroad

Multinational companies with international operations

Investors receiving foreign dividends, royalties, or rental income

📋 How to Claim DTAA Benefits – Step by Step

Get your Tax Residency Certificate (TRC) from the UAE’s Federal Tax Authority

Complete the DTAA claim form for the source country

Submit proof of income, such as salary slips or investment records

Provide residency or business documentation

Receive exemption or credit and reduce your tax burden

📑 Key Documents Needed

UAE Tax Residency Certificate (TRC)

Income proof (salary, rental income, dividends, etc.)

Business license (for companies)

PAN card (for Indian residents)

💼 Why Choose Tulpar Global Taxation?

At Tulpar, we provide complete support with:

✅ Tax Residency Certificate Application ✅ DTAA Claims & International Tax Compliance ✅ Cross-border Tax Planning & Advisory

Let us handle the paperwork and treaty complexities—so you can focus on growth and savings.

📞 Contact Us Today 📧 Email: [email protected] 📱 Phone: +971-54 444 5124

No double taxation. No guesswork. Just smart, compliant savings with Tulpar Global Taxation.

1 note

·

View note

Text

Maverick is pretty clearly a plant, with connections in the UAE, who keeps mixing in real women with Transgender or Inverted males. This fucker tried to accuse Princess Diana of being a male. Is this so that the public stops sympathizing with her? More people are becoming aware that Diana was sacrificed.

#Maverick#Twitter Foreign Account#Ties to UAE#Ties to Israel#Princess Diana Was Not A Male But She Was A Sacrifice

2 notes

·

View notes

Text

Looking for a luxurious and convenient short-term vacation rental in Dubai? Your Keys Holiday Home offers stunning flats in prime locations including Dubai Marina, District One, Arjan, and Al Jadaf. Whether you're seeking the vibrant energy of the Marina or the serene elegance of District One, we have the ideal accommodation for you!

✨ Why Choose Us? ✨

Prime locations across Dubai 🌆

Fully furnished and equipped flats 🛋️

Exceptional comfort and style 🏡

Perfect for business or leisure stays ✈️

Book your next vacation with us and experience the best of Dubai in style and comfort. 🏖️

📞 Contact us now to reserve your dream vacation home!

#DubaiMarina #DistrictOne #Arjan #AlJadaf #DubaiVacation #ShortTermRental #HolidayHome #DubaiLiving #LuxuryStay #DubaiTravel #VacationRental #DubaiApartments #YourKeysHolidayHome #TravelInStyle #DubaiGetaway #ExploreDubai #TravelDubai #DubaiExperience #ComfortableStay #ModernLiving #DubaiRental #TravelWithStyle #DubaiAccommodations #HolidayInDubai #DubaiLife #LuxuryVacation #DubaiProperties #StayInDubai #DubaiHomes #CityBreak #DubaiTourism #VacationInStyle #DubaiHoliday #BookNow

#dubaivape#dubai#dubai visa#business setup in dubai#abudhabi#uae#kuwait#dubailife#dubairealestate#100 days of productivity#accounting#80s#70s#1950s#19th century#academia#3d printing

6 notes

·

View notes

Text

Welcome, Aurion Business Consultants 🌟

Aurion Business Consultants, with over 15 years of expertise, is your go-to for seamless company incorporation in UAE Freezones, Offshore, and Mainland. Trust their PRO services, backed by a legacy of excellence. Get expert support for UAE Residence Visa, accounting, customs registration, bank account setup, and more. Success in business starts with Aurion.

Click here to discover their top-quality solutions- https://www.tradersfind.com/seller/aurion-business-consultants

Aurion Business Consultants

#businessconsultants#uaefreezone#companyIncorporation#proservices#uaevisa#accounting#businesssupport#isoconsulting#taxresidency#corporatebanking#aurionbusinessconsultants#uaebusiness#uae#b2b

2 notes

·

View notes

Text

Earn your Executive MBA online from the UK!

Program Highlights:

Triple Certification: Gain valuable credentials to enhance your resume.

180 UK Credits: Earn a recognized qualification.

Duration: 12-15 Months: Fit your studies around your busy schedule.

Study Mode: Online/Onsite: Choose the learning format that works for you.

Pursue your Executive MBA while you work! Our flexible online program allows you to gain the skills and knowledge you need to advance your career, without interrupting your busy schedule. Learn from world-class faculty and earn a degree that is recognized by employers around the globe.

#executivemba #ukmba #onlinemba #business #career #leadership #uk #mba

2 notes

·

View notes

Text

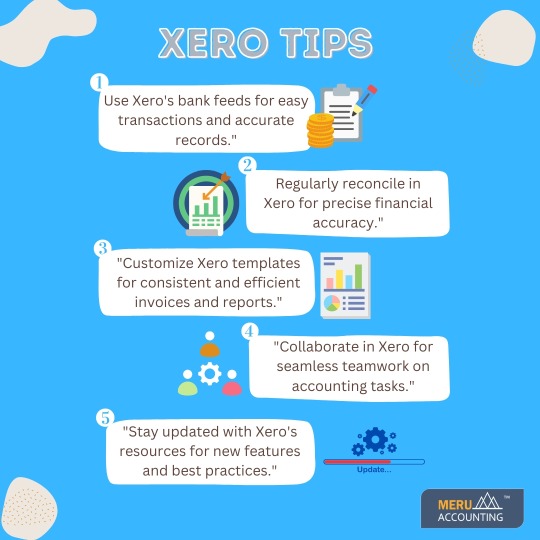

The power of seamless financial management with Xero! Our top tips help you to grow your business.

Meru Accounting is your trusted partner for top-notch accounting and bookkeeping services in the USA, UK, Canada, Australia, UAE, and New Zealand.

#MeruAccounting#xero#xerbookkeeping#xeroaccounting#bookkeepingtips#bookkeepingservices#bookkeepingandaccounting#accounting#accountingservices#usa#uk#canada#uae#australia#newzealand#india

2 notes

·

View notes

Text

Unlocking Business Potential: The Role of Accounting Firms in the UAE

The United Arab Emirates (UAE) is a hub of economic activity, attracting businesses from around the world. In this dynamic environment, accounting firms play a crucial role in providing essential financial services to businesses of all sizes. This article explores the significance of accounting firms in the UAE and the diverse range of services they offer to support businesses.

Diverse Range of Services Offered

Accounting firms in the UAE offer a comprehensive suite of services to meet the diverse needs of businesses. These include auditing to ensure financial transparency and compliance, taxation to manage tax obligations and optimize tax strategies, financial advisory to provide strategic guidance, and specialized services such as bookkeeping, VAT consultancy, and business valuation. By offering a wide range of services, accounting firms help businesses navigate complex financial challenges and achieve their goals.

Understanding the Role of CPA Firms

Certified Public Accountant (CPA) firms play a significant role in the accounting industry, offering assurance services such as audits, reviews, and compilations. These firms adhere to strict professional standards and undergo rigorous training and certification processes to ensure quality and reliability in their services. CPA firms provide independent verification of financial statements, helping businesses maintain transparency and credibility with stakeholders.

The Significance of Audit Firms

Audit firms play a vital role in ensuring the integrity of financial information by conducting independent audits of companies' financial statements. These audits help verify the accuracy of financial reporting, detect errors and irregularities, and provide assurance to investors, creditors, and other stakeholders. Audit firms employ skilled professionals with expertise in accounting principles and auditing standards to perform thorough and objective examinations of financial records.

Navigating Taxation with Tax Consultants

Tax consultancy services provided by accounting firms assist businesses in managing their tax obligations and optimizing tax strategies. Tax consultants help businesses navigate complex tax laws and regulations, minimize tax liabilities, and ensure compliance with legal requirements. By offering strategic tax planning and advisory services, tax consultants help businesses make informed decisions and mitigate tax risks.

Strategic Financial Advisory Services

Financial advisory services offered by accounting firms provide businesses with strategic guidance on financial planning, investment decisions, and risk management. Financial advisors analyze financial data, assess business performance, and provide actionable insights to help businesses achieve their financial goals. Whether it's expanding operations, restructuring debt, or exploring investment opportunities, financial advisors play a crucial role in guiding businesses towards success.

Efficient Bookkeeping Services

Accurate and organized bookkeeping is essential for businesses to maintain financial records, track expenses, and manage cash flow effectively. Accounting firms offer bookkeeping services to help businesses maintain accurate and up-to-date financial records, ensuring compliance with accounting standards and regulations. Outsourcing bookkeeping tasks to accounting firms allows businesses to focus on core operations while ensuring their financial records are in order.

VAT Consultancy in Dubai

Value Added Tax (VAT) consultancy services are crucial for businesses in Dubai following the implementation of VAT regulations. VAT consultants assist businesses in understanding VAT requirements, registering for VAT, preparing VAT returns, and ensuring compliance with VAT laws. By providing expert guidance and support, VAT consultants help businesses navigate the complexities of VAT regulations and minimize the risk of non-compliance.

Business Valuation Services

Business valuation services provided by accounting firms help businesses determine the fair market value of their assets, liabilities, and overall business worth. Business valuations are essential for various purposes, including mergers and acquisitions, financial reporting, shareholder transactions, and dispute resolution. Accounting firms employ specialized valuation techniques and methodologies to provide accurate and reliable valuations tailored to clients' specific needs.

Conclusion

In conclusion, accounting firms play a crucial role in unlocking the potential of businesses in the UAE by providing essential financial services and strategic guidance. From auditing and taxation to financial advisory and specialized services, accounting firms offer a wide range of solutions to meet the diverse needs of businesses. By leveraging professional accounting services, businesses in the UAE can navigate financial challenges, achieve compliance, and drive growth and success in a competitive business environment.

FAQs

How can I choose the right accounting firm for my business in the UAE?

When selecting an accounting firm, consider factors such as the firm's qualifications, experience, reputation, and range of services offered. It's essential to choose a firm that aligns with your business needs and goals.

What are the benefits of outsourcing bookkeeping tasks to an accounting firm?

Outsourcing bookkeeping tasks to an accounting firm allows businesses to access professional expertise, ensure accuracy and compliance, and free up time and resources to focus on core operations and strategic initiatives.

How can VAT consultancy services help my business in Dubai?

VAT consultancy services provide expert guidance on VAT registration, compliance, and reporting, helping businesses navigate the complexities of VAT regulations and minimize the risk of non-compliance and penalties.

What is the difference between a CPA firm and an audit firm?

While both CPA firms and audit firms provide assurance services such as audits, reviews, and compilations, CPA firms may offer a broader range of accounting and advisory services, including tax planning, financial reporting, and consulting.

What factors should I consider when valuing my business?

When valuing a business, consider factors such as its financial performance, market conditions, industry trends, asset values, and future growth prospects. It's advisable to consult with professional valuation experts to ensure an accurate and reliable valuation.

0 notes

Text

Dubai's Top Auditors - Accounting, VAT, Business Experts

Saif Chartered Accountants stands out as Dubai's premier auditors due to our unparalleled understanding of the regional market nuances. Our team's lifelong immersion in the UAE and GCC ensures insightful grasp of local business intricacies. We cultivate enduring client relationships, offering year-round expert advice, setting us apart in commitment and service.

2 notes

·

View notes

Text

Use UPI With International SIMs Cards From These 12 Countries For Free Of Cost; Know How

Last Updated:June 25, 2025, 14:20 IST NRI customers of this Bank can now make UPI payments in India using their international mobile numbers; Here’s how UPI Transaction Using International SIM UPI Transactions From International Numbers: Non-Resident Indian (NRI) customers of IDFC First Bank can now make UPI payments in India using their international mobile numbers, without any additional…

#free UPI for NRIs#how to use UPI from abroad#IDFC First Bank#IDFC UPI abroad#IDFC UPI registration#international mobile number UPI#international UPI access#mobile payments for NRIs.#NRI banking India#NRI UPI payments#UPI apps for NRI#UPI for Indian bank abroad#UPI for NRE accounts#UPI for NRIs#UPI for NRO accounts#UPI in Australia#UPI in Canada#UPI in UAE#UPI in UK#UPI in USA#UPI payments without charges#UPI with international number#UPI without Indian SIM#UPI without OTP in India

0 notes

Text

The Ultimate Guide to Business Account Opening in UAE in 2025

The United Arab Emirates has rapidly grown into one of the world’s most sought-after business destinations, attracting startups, SMEs, and global corporations alike. With zero personal income tax, flexible free zone options, and a dynamic business environment, the UAE offers countless advantages to entrepreneurs. However, one of the most crucial steps in setting up your venture is the business account opening in UAE.

Whether you're a freelancer, a tech startup, or a multinational firm, opening a corporate bank account in the UAE is essential to operate legally, receive payments, and manage your business finances efficiently. Thankfully, platforms like Biz Design are making the process smoother, faster, and completely compliant with local regulations.

Why You Need a Business Account Opening in UAE

Opening a business account isn’t just a formality—it’s a necessity. Here’s why:

Enables legal financial operations under UAE law

Separates personal and corporate finances

Builds business credibility with clients, suppliers, and partners

Gives access to online banking, payment gateways, and business loans

Essential for VAT registration and audit compliance

In a fast-evolving economy like the UAE, a reliable banking partner and the right account structure can make all the difference.

The Common Challenges in Company Bank Account Opening

Many entrepreneurs underestimate the complexity of company bank account opening. Each bank has its own compliance policies, and your business activity, shareholder nationality, and legal structure can impact approval timelines. Common obstacles include:

Confusing documentation requirements

Unclear eligibility criteria

Lengthy approval processes

Rejections due to industry classification or insufficient transparency

Lack of personalized banking support

This is where BizDesign comes into play. Their experienced consultants eliminate the guesswork and streamline your business account opening in UAE with end-to-end support.

How Biz Design Simplifies Company Bank Account Opening in UAE

With BizDesign, the stressful days of navigating UAE’s banking ecosystem alone are over. They offer personalized services that match your business with the right banks, ensuring quicker approvals and fewer hassles.

Here’s how BizDesign makes company bank account opening in UAE easier:

One-on-one consultation to understand your business model

Assistance with document collection and preparation

Strategic matchmaking with top banks based on your profile

Direct coordination with bank representatives

Ongoing advisory even after account activation

By choosing BizDesign, you save time, reduce errors, and ensure full compliance with UAE banking laws.

What Documents Are Needed for Business Account Opening in UAE

While each bank may have slight variations, these are the general documents required:

Valid Trade License (Free Zone or Mainland)

Shareholders’ Passport & Emirates ID (if applicable)

Memorandum of Association (MOA)

Company Incorporation Certificate

Utility Bill or Proof of Address

Business Plan or Description of Activities

Completed Bank Application Forms

BizDesign not only helps you gather these documents but also ensures they meet each bank’s specific formatting and compliance requirements.

Why Consider a Digital Business Bank Account UAE

The business world is going digital, and banking is no exception. A digital business bank account UAE offers unmatched flexibility and speed, especially for entrepreneurs and startups.

Benefits of Going Digital:

24/7 mobile and web access to your account

Instant transactions, invoicing, and account tracking

Integrated financial tools and dashboards

Seamless multi-currency transfers

Lower transaction fees compared to traditional banks

BizDesign partners with leading banks offering fully-digital banking solutions, ideal for modern businesses looking to scale fast.

Free Zone vs Mainland: Does It Affect Company Bank Account Opening?

Yes, it can. While both free zone and mainland companies can open bank accounts, some banks have stricter requirements for free zone entities, particularly if the business does not have a physical office in the UAE.

BizDesign specializes in both scenarios and helps structure your application for maximum approval success, regardless of your business zone.

Timeline for Business Account Opening in UAE

With BizDesign’s expert support, the average timeline for business account opening in UAE can be as quick as:

2–5 working days for initial document processing

1–2 weeks for bank review and approval

Immediate access upon account activation

These timelines can vary depending on the bank and your company structure, but BizDesign ensures minimal delays.

Who Can Benefit from Biz Design’s Services?

BizDesign’s banking support is ideal for:

Startups and SMEs

Freelancers and digital nomads

Tech entrepreneurs and e-commerce businesses

International firms expanding into the UAE

Investors managing multiple business accounts

Whether you're going for a digital business bank account UAE or a traditional banking route, Biz Design caters to all profiles.

Pro Tips for Smooth Account Approval

To maximize your chances of successful company bank account opening:

Maintain transparency about your business operations

Prepare detailed documentation

Keep all shareholder and UBO (Ultimate Beneficial Owner) details updated

Choose a bank that aligns with your business model

Work with experts like BizDesign to navigate red tape

Final Thoughts

Opening a business account in UAE is a critical step in your entrepreneurial journey. Whether you need a traditional account for a large-scale company or a digital business bank account UAE for a fast-moving startup, Biz Design has the tools, connections, and expertise to make it happen smoothly.

From assisting with company bank account opening in UAE to matching you with the right financial institutions, BizDesign takes the stress out of banking so you can focus on growing your business.

Ready to open your business bank account in the UAE?

Visit Biz Design today and take the first step toward smarter, faster, and fully-compliant banking solutions.

#business account opening in uae#company bank account opening in uae#digital business bank account uae

0 notes

Text

Why Choose Chartered Accountants for Your Financial Needs

In Dubai's quick financial landscape, every small, medium, and large business wants to grow quickly and adapt to their changing business environment and business ethics, consequently our top-rated company, Hussain Al Shemsi Chartered Accountants, offers the best and highest quality accounting and auditing services in the UAE. Our Expert Chartered Professional Accountants provide high-quality accounting services throughout the UAE, including Accounting, Tax Accounting, Consultancy and Advisory and other professional chartered accounting services.

What are Chartered Accountants?

Chartered Accountants are professional Certified Accountants who specialize in business accounting, auditing, financial statement activities, filing corporate tax returns, and also promote business consulting and advisory services. When it comes to Dubai, Ajman, Sharjah, and other UAE locations, our Hussain Al Shemsi Chartered Accountants (HALSCA) team is the most Experienced Chartered Professional Accountants. Our team specializes in auditing, accounting, consulting, tax advisory services, industry driving reviews, and other chartered accounting services in the UAE.

The Role of Chartered Accountants

Taxation Services

HALSCA, the Expert chartered accountants in Dubai, specialize in providing the Best Taxation Services in the UAE that will guide you through difficult tax issues. With intricate knowledge of tax-effectiveness and compliance with the law while managing your financial affairs, whether you are an individual taxpayer, a corporation, or a trust, Hussain Al Shemsi Chartered Accountants provides the top taxation services in the UAE.

Auditing and Assurance

Auditing is an important function in all businesses, hence the Audit and Assurance report is required for a variety of reasons. Audit and assurance is the process of evaluating business accounts and confirming data in financial statements using a variety of documents. The audit process can assist detect corporate risks.

Financial Planning and Advisory

Efficient financial planning and advisory is crucial for long-term prosperity in Dubai's changing economic environment. In order to help individuals and organizations reach their financial objectives, chartered accountants provide strategic advising services. They provide helpful advice and recommendations based on your particular situation, ranging from investment research to budgeting.

The Advantages of Using a Chartered Accountant

Professionalism and Expertise

Dubai's chartered professional accountants are highly knowledgeable and experienced in financial management. Their commitment and professionalism guarantee that your financial affairs are managed with the highest care and attention to detail.

Compliance with Regulations

Navigating the complex regulatory environment of Dubai, UAE, can be challenging without expert guidance. Chartered accountants reduce the possibility of non-compliance and the fines that come with it by making sure your financial procedures follow local laws and regulations.

Strategic Business Guidance

Chartered accountants are trusted advisors who provide strategic insights to propel corporate growth, going beyond simple math calculations. Their experience can assist you in navigating obstacles and seizing chances whether you're growing your business or venturing into new industries.

Accuracy and Efficiency of Finance

You can anticipate increased accuracy and efficiency in your operations when chartered accountants are in charge of your financial processes. They can find chances for optimization and simplify procedures thanks to their sophisticated accounting tools and thorough attention to detail.

Conclusion

Choosing Hussain Al Shemsi Chartered Accountants (HALSCA) Reliable Chartered Professional Accountants in Dubai, UAE, is a strategic move for anyone serious about their financial health. These experts bring a level of professionalism, expertise, and strategic insight that is unmatched in the financial sector. Whether you're a small business looking to optimize your operations, a large corporation seeking efficiency improvements, or an individual in need of personal financial advice, expert chartered accountants in Dubai can provide the guidance and support you need. Their comprehensive services, from tax planning to auditing and financial advisory, ensure that your financial needs are met with precision and care. By partnering with a chartered accountant, you are investing in a secure and prosperous financial future.

#best audit firm in dubai#top accounting firm in ajman#professional chartered accountants in ajman#professional chartered accountants near me#best audit firm in uae#best accounting firm in uae

3 notes

·

View notes