#UPI stocks

Text

Top UPI Stocks in India: Progress, Analysis, and Comparison | Insider.finology.in

Discover the progress made by UPI stocks in India, including stocks of companies like Paytm, Phone Pe, and Mobikwik. Learn about the growth of the UPI universe, the benefits of UPI payments, and the future of UPI stocks in India. Stay informed with a detailed analysis and comparison of UPI stocks.

0 notes

Text

Christine Jorgensen at the Silver Slipper, November 1955

“Christine Jorgensen, who was once a GI in the United States Army, is well on her way to achieving a new attendance record at the Silver Slipper where she appears four times nightly, seven days a week. Billed as "the world's most unique personality," the star is supported at the popular spot by the entire Silver Slipper Stock Company.” Review-Journal, 12/2/55

Photos by UPI, and Las Vegas News Bureau

808 notes

·

View notes

Text

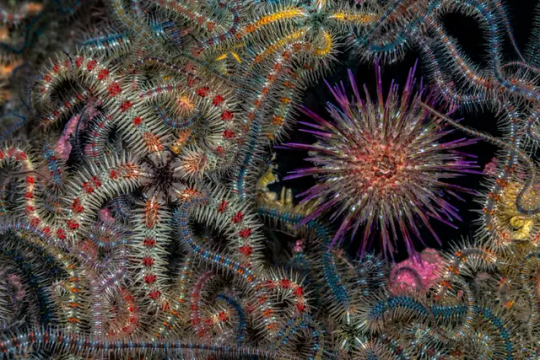

Jenny Stock’s photograph

Brittlestars, Scotland’s Lock Leven,

Image credit: Jenny Stock/UPY 2024

#art#photography#surreal#freaky#brittle stars#scotland#lock leven#underwater#wilderness#wildlife#jenny stock#UPY2024#life#colors

3 notes

·

View notes

Text

Nov. 3 (UPI) -- New York Attorney General Letitia James has secured a $30.5 million settlement from CBS after an investigation found that its senior leadership had concealed from the public, shareholders and regulators sexual assault allegations lodged against the network's former president and chief executive Leslie Moonves.

The agreement announced Wednesday states CBS is required to pay $28 million -- $22 million of which will be returned to CBS shareholders -- with $6 million to go toward strengthening mechanisms for reporting and investigating sexual harassment and assault complaints.

Moonves is required to pay the remaining $2.5 million, which will also go to CBS shareholders. Under the agreement, the former executive is barred from serving as an officer or director of any public company doing business in the state for five years without written approval by the attorney general's office.

"As a publicly traded company, CBS failed its most basic duty to be honest and transparent with the public and investors," James said in a statement announcing the settlement agreement. "After trying to bury the truth to protect their fortunes, today, CBS and Leslie Moonves are paying millions of dollars for their wrongdoing."

RELATEDTrump settles lawsuit with demonstrators over alleged security assault

The settlement agreement follows an investigation conducted by James' office that found Moonves and CBS attempted to conceal several sexual assault complaints made against the chief executive knowing that if they came to light he would lose his job, which would affect the company's bottomline knowing that he'd be difficult to replace.

Moonves resigned from CBS in Sept. 9, 2018, after several women accused him of sexual assault and harassment over three decades.

According to a 37-page report by Jame's office, prior to him stepping down, Moonves and CBS worked to conceal the allegations against him staring Nov. 10, 2017, when an unidentified women walked into the Hollywood Division of the Los Angeles Police Department to file a report accusing Moonves of sexually abusing her and workplace retaliation in the 1980s.

That night, a commanding officer of the division contacted an executive at CBS to inform them of the allegation. The officer then shared the unredacted police report of the allegation with the executive who then shared it with Moonves and other CBS executives.

"Each of the executives then went to work to deal with the impending crisis," the report said, adding that "[o]ver the next few days and months, the LAPD Captain continued to secretly provide Moonves and CBS executives with the statues updates of the LAPD's investigation."

In June 2018 amid the suppression effort and six weeks before the allegation was made public, one of the executives with knowledge of the complaint sold 160,709 shares of CBS stock valued at more than $8.8 million, the report states.

"CBS and Leslie Moonves' attempts to silence victims, lie to the public and mislead investors can only be described as reprehensible," James said, adding that "[t]oday's action should send a strong message to companies across New York that profiting off injustice will not be tolerated and those who violate the law will be held accountable."

According to the agreement, neither CBS nor Moonves admit wrongdoing.

"We are pleased to have reached an agreement in principle to resolve this matter concerning events from 2018 with the New York attorney general's office, without any admission of liability or wrongdoing," a spokesperson with Paramount, CBS' parent company, said in a statement to the Los Angeles Times.

6 notes

·

View notes

Text

Empower Your Pharmacy with Truetab’s Innovative Software and Delivery App

As the healthcare landscape evolves, pharmacies need cutting-edge solutions to stay competitive and provide the best service possible. Truetab is here to revolutionize your pharmacy operations with its advanced pharmacy software and seamless online pharmacy delivery app. Our solutions are built to optimize store management and offer convenience to your customers, helping you meet the demands of the modern healthcare environment.

Optimize Pharmacy Operations with Truetab

Managing a pharmacy involves complex tasks such as inventory control, billing, and prescription management. Truetab simplifies these processes with comprehensive software that automates routine tasks, freeing up valuable time for pharmacy staff to focus on customer care. Whether you run a small pharmacy or a large chain, our software adapts to your needs, ensuring smooth and efficient operations.

Key Benefits of Truetab’s Pharmacy Software

Real-Time Inventory Monitoring

With Truetab, managing your stock is hassle-free. Our software provides real-time inventory tracking, sends alerts for low-stock items, and automates the reordering process. This ensures your shelves are always stocked with essential medicines, avoiding the risk of running out or overstocking.

Accurate and Fast Billing

The billing process is made simple with Truetab. You can generate detailed invoices instantly and accept multiple payment methods, including UPI, credit cards, and digital wallets. Whether it's for in-store purchases or online orders, the software ensures error-free billing and smooth transactions.

Streamlined Prescription Management

Managing prescriptions is easier with Truetab. Pharmacists can scan and store digital prescriptions, set automatic reminders for refills, and track customer medication history. This ensures that prescriptions are handled with precision and customers receive timely service.

Comprehensive Business Reports

Data is key to running a successful pharmacy. Truetab’s software provides detailed analytics, allowing you to track sales, customer trends, and stock movements. These insights help you make informed decisions to boost profitability and enhance overall performance.

Boost Customer Convenience with the Online Pharmacy Delivery App

In the age of e-commerce, customer expectations have shifted towards convenience and quick access to services. With Truetab’s online pharmacy delivery app, you can offer your customers a simple, fast, and secure way to order medications online and have them delivered directly to their homes.

Features of the Online Pharmacy Delivery App:

Simple and Easy-to-Use

Our delivery app is designed to offer an intuitive shopping experience. Customers can browse products, upload prescriptions, and place orders with just a few taps, making it easy for them to get their medications without stepping into the store.

Track Orders in Real Time

Customers can monitor their orders through real-time tracking, from the moment the order is placed to the point of delivery. This transparency ensures customer satisfaction and builds trust in your service.

Multiple Secure Payment Options

The app supports a range of secure payment methods, including credit cards, UPI, and digital wallets. This flexibility ensures customers can pay for their medications with ease and confidence.

Prescription Upload and Review

Customers can upload prescriptions directly through the app, and pharmacists can review and approve them digitally. This feature ensures compliance with regulations and eliminates the need for paper prescriptions.

One-Click Reordering

Regular customers can reorder their medications with a single click, saving time and improving convenience. This feature encourages repeat business and enhances customer loyalty.

Why Your Pharmacy Needs Truetab’s Software and Delivery App

Truetab’s solutions are designed to keep your pharmacy competitive in today’s market. Our pharmacy software ensures smooth in-store operations, while the online pharmacy delivery app extends your reach to customers who prefer the convenience of online ordering. By integrating both solutions, you can enhance your services, improve customer satisfaction, and stay ahead of the competition.

Conclusion

In today’s fast-paced world, pharmacies must adapt to new challenges and customer expectations. Truetab’s pharmacy software and online pharmacy delivery app provide the perfect combination of tools to streamline your business and offer a superior customer experience. With our innovative solutions, you can optimize your pharmacy operations and grow your business in a competitive market. Choose Truetab and lead your pharmacy into the future of healthcare.

0 notes

Text

Best Salon Software in India: Elevate Your Salon’s Efficiency and Growth

Why Salon Software Is Essential for Your Business

In India’s fast-paced beauty industry, managing appointments, tracking inventory, handling billing, and keeping clients happy can be overwhelming without the right system in place. Salon Software in India is designed to address these challenges, providing salon owners with an all-in-one solution to manage every aspect of their business.

Whether you run a small salon or a chain of beauty outlets, the best salon software can help you streamline your operations. It allows you to manage appointments efficiently, reducing the chances of double bookings and no-shows. Additionally, it helps in maintaining a detailed database of your clients, which can be used to personalize services and enhance customer loyalty.

Features of the Best Salon Software for Small Businesses

For small businesses, investing in the right salon software can be a game-changer. Here are some key features that make VIPsline one of the best salon software for small businesses in India:

Appointment Scheduling: Easily manage appointments with an intuitive calendar system. Clients can book online, and staff can track and manage bookings seamlessly, reducing the chances of errors.

Client Management: Maintain a detailed client database that includes service history, preferences, and contact information. This allows you to offer personalized services and improve client satisfaction.

Inventory Management: Keep track of your stock with automated alerts for low inventory. This ensures that you never run out of essential products and can manage your resources more effectively.

Billing and POS Integration: VIPsline’s Salon Management Software integrates with POS systems to ensure smooth billing processes. It supports various payment methods popular in India, including UPI, digital wallets, and credit/debit cards.

Analytics and Reporting: Get insights into your salon’s performance with detailed reports on sales, client behavior, and inventory. This data-driven approach helps you make informed decisions to boost your business growth.

Why Choose VIPsline for Your Salon Software Needs?

VIPsline offers a robust and user-friendly solution that caters specifically to the needs of Indian salons. With features tailored to the unique challenges of the Indian market, VIPsline’s software is designed to help you manage your salon efficiently while enhancing the client experience.

For small businesses, VIPsline provides an affordable yet comprehensive solution that doesn’t compromise on quality. Whether you’re just starting or looking to upgrade your current system, VIPsline’s Salon Software in India is a smart investment that can help you scale your business.

Conclusion

Choosing the right salon software is critical to the success of your salon. With VIPsline’s Salon Management Software, you get a powerful tool that simplifies operations, improves customer satisfaction, and supports business growth. If you’re looking for the best salon software in India, VIPsline offers a solution that is both effective and tailored to the needs of small businesses.

Invest in VIPsline and take the first step towards transforming your salon into a well-oiled machine that delivers exceptional service every time.

1 note

·

View note

Text

5 Impactful Investing Opportunities in India in 2024

Investing in startups in India has emerged as a promising avenue for investors seeking high-growth opportunities and impactful returns. With a vibrant entrepreneurial ecosystem, technological innovation, and supportive government policies, India offers a conducive environment for startup investments. In this comprehensive guide, we will explore five impactful investing opportunities in India in 2024, providing insights into emerging trends, sectors, and investment strategies that have the potential to generate significant returns and drive positive societal impact.

1. Fintech Innovation:

Fintech, or financial technology, is one of the most dynamic and rapidly evolving sectors in India's startup ecosystem. With the proliferation of smartphones, internet connectivity, and digital payment infrastructure, fintech startups are revolutionizing the way people access financial services, manage their finances, and conduct transactions. Opportunities abound in areas such as digital banking, mobile payments, peer-to-peer lending, robo-advisory services, and blockchain-based solutions. Investing in fintech startups allows investors to capitalize on India's digital transformation, financial inclusion initiatives, and the transition towards a cashless economy. By supporting innovative fintech solutions, investors can drive financial empowerment, promote economic growth, and create value for underserved segments of the population.

Here's a detailed explanation of why fintech innovation is an impactful investing opportunity in India in 2024:

1. Digital Transformation of Financial Services:

Fintech startups are at the forefront of India's digital transformation journey, offering innovative solutions to meet the evolving needs of consumers and businesses in the financial services sector. With the widespread adoption of smartphones, internet banking, and digital payment platforms, fintech startups are leveraging technology to deliver seamless, accessible, and user-friendly financial services, including digital banking, mobile payments, remittances, wealth management, and insurance.

2. Financial Inclusion and Access:

Fintech innovation is driving financial inclusion and expanding access to financial services for underserved and unbanked segments of the population in India. By leveraging mobile technology, biometric authentication, and digital KYC (Know Your Customer) processes, fintech startups are overcoming traditional barriers to banking, enabling individuals and businesses in remote areas to open bank accounts, access credit, make digital payments, and manage their finances more effectively.

3. Disruption of Traditional Banking Models:

Fintech startups are disrupting traditional banking models and challenging incumbents by offering agile, customer-centric, and cost-effective alternatives to traditional banking services. Digital-only banks, peer-to-peer lending platforms, and fintech-driven lending solutions are gaining traction among tech-savvy consumers and millennials who prioritize convenience, transparency, and personalized financial services.

4. Innovation in Payment Systems:

Fintech startups are driving innovation in payment systems and reshaping the payments landscape in India. Mobile wallets, UPI (Unified Payments Interface), contactless payments, and QR code-based payment solutions have transformed the way people transact and conduct business, offering speed, security, and interoperability across different payment platforms. Fintech startups are also exploring emerging technologies such as blockchain and cryptocurrency to enable cross-border payments, reduce transaction costs, and enhance financial inclusion.

5. Wealth Management and Investment Solutions:

Fintech startups are democratizing access to wealth management and investment solutions, making it easier for individuals to invest in stocks, mutual funds, and other financial instruments. Robo-advisors, algorithmic trading platforms, and online investment platforms offer personalized investment advice, portfolio management services, and automated investment strategies tailored to individual risk profiles and investment goals.

6. Regulatory Support and Innovation Sandbox:

The Indian government and regulatory authorities have been supportive of fintech innovation, introducing policies and regulatory frameworks to promote digital payments, encourage fintech investments, and foster innovation in the financial services sector. Initiatives such as the Regulatory Sandbox Framework and the Bharat Bill Payment System (BBPS) provide a conducive environment for fintech startups to test innovative solutions, collaborate with traditional financial institutions, and scale their operations while ensuring compliance with regulatory requirements.

7. Global Expansion and Market Opportunities:

Fintech startups in India are well-positioned to expand their footprint and tap into global markets, leveraging India's strong technology talent pool, English-speaking workforce, and growing reputation as a fintech hub. With increasing investor interest, strategic partnerships, and cross-border collaborations, Indian fintech startups have the opportunity to scale their operations internationally, address global challenges, and drive financial inclusion and innovation on a global scale.

2. Healthcare Technology:

Healthcare technology, or healthtech, is experiencing unprecedented growth and innovation in India, fueled by factors such as rising healthcare costs, increasing chronic diseases, and the need for accessible and affordable healthcare solutions. Healthtech startups are leveraging technologies such as artificial intelligence, telemedicine, remote monitoring, and electronic health records to improve healthcare delivery, diagnosis, and patient outcomes. Investing in healthtech startups offers investors the opportunity to address critical healthcare challenges, enhance access to quality healthcare services, and promote preventive care and wellness. By supporting innovative healthtech solutions, investors can contribute to improved healthcare access, reduced healthcare costs, and better health outcomes for millions of people across India.

Here's a detailed explanation of why healthcare technology presents an impactful investing opportunity in India in 2024:

1. Addressing Healthcare Challenges:

India faces significant healthcare challenges, including inadequate infrastructure, shortage of healthcare professionals, uneven distribution of healthcare services, and rising disease burden. Healthtech startups are leveraging technology to address these challenges by offering innovative solutions in areas such as telemedicine, remote patient monitoring, digital diagnostics, electronic health records (EHR), and healthcare analytics. By improving access to healthcare services, enhancing diagnostic capabilities, and optimizing healthcare delivery, healthtech startups have the potential to transform India's healthcare landscape and drive positive health outcomes.

2. Telemedicine and Remote Consultations:

Telemedicine platforms allow patients to consult with healthcare providers remotely through video calls, chat sessions, and virtual consultations. These platforms enable patients to access medical advice, diagnosis, and treatment from the comfort of their homes, reducing the need for physical visits to healthcare facilities and overcoming geographical barriers to healthcare access. Telemedicine startups are leveraging artificial intelligence (AI), machine learning (ML), and data analytics to offer personalized, evidence-based healthcare recommendations and improve patient outcomes.

3. Remote Patient Monitoring and IoT Devices:

Remote patient monitoring (RPM) solutions and Internet of Things (IoT) devices enable continuous monitoring of patients' vital signs, health parameters, and medication adherence outside of traditional healthcare settings. Wearable devices, smart sensors, and mobile health apps collect real-time data on patients' health status, allowing healthcare providers to track disease progression, manage chronic conditions, and intervene proactively in case of emergencies. RPM startups are leveraging IoT technology to empower patients to take control of their health, prevent hospital readmissions, and reduce healthcare costs associated with chronic disease management.

4. Digital Diagnostics and Imaging:

Digital diagnostics startups are revolutionizing medical imaging, pathology, and diagnostic testing through the use of advanced imaging techniques, AI algorithms, and cloud-based platforms. AI-powered diagnostic tools analyze medical images, laboratory results, and patient data to detect abnormalities, identify diseases, and assist healthcare providers in making accurate diagnoses. Digital diagnostics solutions enable faster, more accurate diagnosis, reduce diagnostic errors, and improve patient outcomes by facilitating early detection and treatment of diseases such as cancer, cardiovascular disorders, and infectious diseases.

5. Electronic Health Records and Interoperability:

Electronic health records (EHR) platforms digitize patients' medical records, histories, and treatment plans, enabling secure storage, retrieval, and sharing of health information across healthcare providers and institutions. Interoperable EHR systems facilitate seamless exchange of patient data, medical histories, and diagnostic reports between hospitals, clinics, pharmacies, and laboratories, ensuring continuity of care and coordination among healthcare providers. EHR startups are leveraging blockchain technology and secure data exchange protocols to ensure patient privacy, data security, and compliance with regulatory requirements such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation).

6. Healthcare Analytics and Predictive Modeling:

Healthcare analytics startups analyze large volumes of healthcare data, including clinical records, claims data, and patient demographics, to derive actionable insights, identify trends, and optimize healthcare delivery. Predictive analytics models leverage machine learning algorithms to forecast disease outbreaks, predict patient outcomes, and optimize resource allocation in healthcare facilities. Healthcare analytics solutions enable evidence-based decision-making, resource optimization, and cost-effective healthcare delivery, leading to improved patient outcomes, reduced healthcare costs, and enhanced operational efficiency in healthcare organizations.

7. Regulatory Support and Policy Initiatives:

The Indian government and regulatory authorities have introduced policies and initiatives to support healthcare technology innovation, promote digital health adoption, and improve healthcare access and affordability. Initiatives such as the National Digital Health Mission (NDHM), Digital India Healthcare Vision, and Telemedicine Practice Guidelines provide a conducive environment for healthtech startups to develop and deploy innovative solutions, collaborate with healthcare providers, and scale their operations while ensuring compliance with regulatory requirements and quality standards.

3. Clean Energy and Sustainability:

Clean energy and sustainability have emerged as priority areas for investment in India, driven by environmental concerns, climate change mitigation efforts, and the transition towards renewable energy sources. Startups in the clean energy sector are developing innovative solutions in areas such as solar power, wind energy, energy storage, electric vehicles, and sustainable agriculture. Investing in clean energy startups allows investors to support India's renewable energy goals, reduce carbon emissions, and promote environmental sustainability. By backing innovative clean energy solutions, investors can contribute to India's energy security, create green jobs, and mitigate the adverse impacts of climate change on communities and ecosystems.

4. Edtech Revolution:

The education technology, or edtech, sector in India is undergoing a rapid transformation, driven by factors such as digitization of education, remote learning trends, and the adoption of online education platforms. Edtech startups are leveraging technology to deliver personalized, interactive, and accessible learning experiences across various subjects and skill levels. Opportunities abound in areas such as online tutoring, test preparation, skill development, vocational training, and lifelong learning. Investing in edtech startups allows investors to support inclusive and equitable education, bridge the digital divide, and empower learners of all ages to acquire knowledge and skills for personal and professional growth. By backing innovative edtech solutions, investors can contribute to India's human capital development, workforce productivity, and socio-economic progress.

5. Agritech Innovation:

Agritech, or agricultural technology, is poised for significant growth and innovation in India, driven by the need to enhance agricultural productivity, improve farmer livelihoods, and ensure food security. Agritech startups are leveraging technologies such as precision farming, IoT sensors, drones, AI-powered analytics, and supply chain optimization to address challenges across the agricultural value chain. Opportunities abound in areas such as farm management software, precision agriculture, crop monitoring, market linkages, and post-harvest management. Investing in agritech startups allows investors to support sustainable agriculture practices, increase farm efficiency, and reduce food waste. By backing innovative agritech solutions, investors can contribute to rural development, farmer prosperity, and food sustainability in India.

In conclusion, investing in startups in India presents investors with five impactful opportunities to drive positive change and achieve financial returns in 2024. By strategically allocating capital to sectors such as fintech, healthtech, clean energy, edtech, and agritech, investors can support innovative solutions, promote socio-economic development, and address pressing challenges facing India and the world. However, startup investing carries inherent risks, and investors should conduct thorough due diligence, diversify their portfolios, and seek professional advice to mitigate risks and maximize returns. With the right investment strategies, investors can play a significant role in fueling innovation, driving economic growth, and creating lasting impact through startup investments in India.

This post was originally published on: Foxnangel

#investing opportunities#startups in india#investing in startups in india#start up investment in india#startup investments#investment strategies#fintech innovations#invest in startups india#foxnangel

1 note

·

View note

Text

Is the IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card Your Next Best Choice?

The IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card has been officially unveiled by Poonawalla Fincorp. This co-branded card is aimed at delivering personalized financial solutions tailored to meet the diverse needs of their clientele.

Elevating Financial Services

Through a strategic collaboration with IndusInd Bank, Poonawalla Fincorp has launched the eLITE RuPay Platinum Credit Card. This card is designed to enhance the customer experience by offering an extensive array of benefits and rewards, emphasizing Poonawalla Fincorp’s commitment to innovation and customer-focused financial solutions.

Exceptional Features of the eLITE RuPay Platinum Card

The IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card stands out in the competitive credit card market due to its numerous attractive features. Here is an in-depth look at what it offers:

No Joining or Annual Fees

One of the card's most appealing aspects is the absence of joining and annual fees, making it highly accessible and affordable for customers to enjoy its benefits without extra costs.

Exciting Reward Points on Every Transaction

Cardholders can earn reward points for every ₹100 spent, excluding fuel purchases. This includes everyday transactions, allowing users to quickly accumulate points.

High-Value Reward Points

Accumulated reward points can be converted into cash credit at a rate of ₹0.40 per point, significantly enhancing the value proposition for cardholders.

Enhanced Rewards for E-commerce

Online shoppers can benefit from 2.5 times the reward points on e-commerce transactions, excluding fuel, travel, and low interchange MCC, making online purchases even more rewarding.

Movie Ticket Offers

The card offers a Buy One Get One free movie ticket offer through BookMyShow, up to ₹200, once a month. This is perfect for those who enjoy frequenting the cinema.

Also Read: Who is Abhay Bhutada?

Rewards on UPI Transactions

Recognizing the rising popularity of digital payments, the card offers rewards on UPI transactions. This is particularly beneficial for users who frequently utilize the Scan & Pay feature.

Fuel Surcharge Waiver

Cardholders enjoy a 1% fuel surcharge waiver, adding to their savings and making travel more economical.

Milestone Rewards

Cardholders can earn 3000 reward points by reaching specific spending milestones, encouraging frequent card use to maximize benefits.

Also Read: Unveiling Abhay Bhutada: A Leader’s Inspiring Odyssey In Finance

Envisioning the Future

Expressing his excitement about the new card, Poonawalla Fincorp’s spokesperson, stated, “We are thrilled to launch the IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card. This initiative reflects our commitment to enabling our customers' dreams. By offering this card, we aim to enhance digital engagement with our existing customers while reaching out to new ones.”

About Poonawalla Fincorp Limited

Poonawalla Fincorp Limited, part of the Cyrus Poonawalla Group, is a non-deposit-taking systemically important non-banking finance company (ND-SI-NBFC) registered with the Reserve Bank of India (RBI). With a legacy of nearly three decades, the company is listed on both the BSE Limited (BSE) and the National Stock Exchange of India Limited (NSE).

The company operates on five key pillars: Passion, Principles, Purpose, People, and Possibilities. With a presence in 19 states and a standalone AUM of ₹25,003 crore as of March 31, 2024, Poonawalla Fincorp employs around 2300 people. Their diverse range of products includes pre-owned car finance, personal loans, loans to professionals, business loans, loans against property, supply chain finance, machinery loans, medical equipment loans, and consumer loans.

Also Read: Journey Of Poonawalla Fincorp’s Managing Director — Abhay Bhutada

Customer Experience Is The Priority

The launch of the IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card signifies Poonawalla Fincorp’s dedication to improving the customer experience. By incorporating valuable features such as no fees, generous reward points, and exclusive offers, this card sets a new standard in the financial sector.

For customers, this card is more than just a payment tool; it opens the door to a range of benefits and rewards. It is designed to make everyday transactions more rewarding, provide savings on entertainment and fuel, and offer high-value reward points that are easily redeemable.

Conclusion

The IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card is a testament to Poonawalla Fincorp’s commitment to providing tailored financial solutions that enhance the lifestyle of its users. With its comprehensive features and benefits, this card is poised to become a favorite among customers seeking value and rewards in their everyday transactions.

0 notes

Text

Digitalisation: A Double-Edged Sword for Consumers and Financial Systems, Says RBI Report

In its Report on Currency and Finance (RCF) for 2023–24, the Reserve Bank of India (RBI) highlighted the transformative yet challenging impacts of digitalisation on consumer behavior and financial systems. Released on Monday, the report underscores how the convenience and accessibility brought by digitalisation can also lead to impulsive spending, herd behavior, and heightened risks of data breaches.

Benefits and Risks of Digitalisation

Digitalisation undoubtedly enhances the ease with which consumers can access financial services. However, it also introduces new risks. The RBI report points out that the rapid spread of financial trends and choices through digital platforms can influence consumers to follow the crowd, leading to impulsive spending and herd behavior. This is particularly evident during market frenzies, where mass buying or selling of stocks can trigger similar actions from other consumers.

Moreover, the interconnected nature of the digital financial system can complicate financial stability. For instance, widespread withdrawal of deposits due to herd behavior could lead to bank runs or failures.

Data Breaches: A Growing Concern

The report also highlights the growing threat of data breaches. In 2023, the average cost of a data breach in India was $2.18 million, marking a 28% increase since 2020. Common attacks include phishing and the use of stolen or compromised credentials. These breaches pose significant risks to both consumers and financial institutions.

Implications for Monetary Policy

Digitalisation impacts inflation, output dynamics, and the transmission of monetary policy in various ways. The report suggests that if digitalisation shifts credit supply from regulated banks to less-regulated non-banks, it could dampen the effectiveness of monetary policy. As such, central banks must integrate digitalisation considerations into their models to ensure effective monetary policy and financial stability.

Proactive Measures and International Collaboration

The RBI has been proactive in leveraging the benefits of digitalisation while mitigating associated risks. Digitalisation holds the potential to boost India’s external trade in goods and services, particularly in modern services exports. It can also reduce the cost of international remittances, benefiting recipients through higher incomes or savings.

In a significant step towards enhancing cross-border payments, the RBI joined Project Nexus, aiming to interlink domestic Fast Payments Systems (FPS) across several countries, including Malaysia, the Philippines, Singapore, and Thailand. This follows the integration of India’s Unified Payments Interface (UPI) with Singapore’s PayNow, facilitating faster and more affordable remittances between the two nations. Similarly, an MoU with the Central Bank of UAE aims to link India’s UPI with UAE’s Instant Payment Platform (IPP).

The Rise of UPI

The report highlights the explosive growth of UPI, which has seen a tenfold increase in volume over the past four years. From 12.5 billion transactions in 2019–20 to 131 billion in 2023–24, UPI now accounts for 80% of all digital payment volumes in India. As of June 2024, UPI is recording nearly 14 billion transactions monthly, driven by 424 million unique users.

Future Outlook

Cross-border digital trade policies will be crucial in leveraging new opportunities and ensuring data security and cybersecurity. The internationalisation of the rupee is also progressing, supported by a comprehensive policy approach.

In summary, while digitalisation brings significant benefits, it also poses new challenges. The RBI’s report emphasizes the need for a balanced approach to harness its advantages while managing the associated risks to consumer behavior, financial stability, and data security.

0 notes

Text

Understanding the Upcoming SME IPOs: A Comprehensive Guide

Initial Public Offerings (IPOs) are a major event for any company, offering a way to raise capital and gain public visibility. While many investors are familiar with mainline IPOs, the world of SME IPOs (Small and Medium Enterprises) is equally dynamic and offers unique investment opportunities. This article provides an in-depth look at upcoming SME IPO, their significance, and how investors can participate.

Introduction to SME IPOs

An SME IPO allows a small or medium-sized company to go public by offering its shares to the general public for the first time. IPO are listed on specialized platforms like BSE SME and NSE Emerge, which cater specifically to smaller enterprises. By listing on these platforms, SMEs can raise funds needed for expansion, debt repayment, and other business activities.

What Makes SME IPOs Unique?

SME IPOs differ from mainline IPO primarily in terms of scale and regulatory requirements. The key characteristics include:

Smaller Issue Size: SME IPOs typically involve a smaller number of shares compared to mainline IPOs.

Listing Platforms: These IPOs are listed on BSE SME or NSE Emerge, which are designed to support smaller companies.

Investor Categories: Investors in SME IPOs are generally categorized as Non-Institutional Investors (NIIs), Retail Investors, and sometimes Qualified Institutional Buyers (QIBs).

Latest Trends in Upcoming SME IPOs

The year 2024 has seen a steady stream of SME IPOs. Here are some notable upcoming SME IPO that investors should keep an eye on:

Winny Immigration & Education Services Ltd:

Open Date: June 20, 2024

Close Date: June 24, 2024

Issue Size: ₹9.13 Crores

Price Range: ₹140 per share

Medicamen Organics Ltd:

Open Date: June 21, 2024

Close Date: June 25, 2024

Issue Size: ₹9.92 - 10.54 Crores

Price Range: ₹32 per share

Shivalic Power Control Ltd:

Open Date: June 24, 2024

Close Date: June 26, 2024

Issue Size: ₹61.10 - 64.32 Crores

Price Range: ₹95 per share

Sylvan Plyboard (India) Ltd:

Open Date: June 24, 2024

Close Date: June 26, 2024

Issue Size: ₹28.05 Crores

Price Range: ₹55 per share

These listings show the diversity of industries and the scale of operations within the SME sector.

Importance of SME IPOs

For investors, SME IPOs offer several advantages:

Growth Potential: Investing in SMEs can be highly rewarding, given their potential for rapid growth and expansion.

Diverse Opportunities: SME IPOs span a wide range of industries, providing investors with varied investment options.

Market Entry: For smaller investors, SME IPOs can be an affordable entry point into the stock market.

How to Participate in SME IPOs

Investing in SME IPOs involves a straightforward process, though it requires careful consideration. Here’s how you can apply:

UPI-based Application: Use your Demat account app (e.g., 5paisa) to select the IPO and apply with your UPI ID. Approve the mandate in your bank or Google Pay account.

ASBA (Application Supported by Blocked Amount): Log in to your bank account, fill in the necessary details like Demat account number and PAN, and submit the application.

Broker Assistance: Contact your broker to fill out the application form and submit it.

Conclusion

Upcoming SME IPO presents a promising avenue for investors looking to diversify their portfolios and capitalize on the growth potential of smaller companies. By understanding the unique aspects of SME IPOs, staying informed about the latest listings, and knowing how to apply, investors can make well-informed decisions. Additionally, keeping an eye on MCX natural gas prices and natural gas price trends can provide valuable insights into broader market conditions.

Staying updated on these topics ensures that you are well-prepared to navigate the investment landscape, making the most of emerging opportunities in SME IPOs and the natural gas market.

0 notes

Text

How Personal Finance Management is Being Changed by Fintech Software?

In recent years, the landscape of personal finance management has undergone a significant transformation, largely driven by advancements in fintech software and services. Fintech (financial technology) has revolutionized how individuals manage their finances, offering innovative solutions that enhance convenience, efficiency, and accessibility. This article explores the ways in which fintech software is reshaping personal finance management and empowering consumers worldwide.

The Rise of Fintech Software

Fintech software encompasses a diverse range of technologies and applications designed to improve financial services delivery, automate processes, and enhance user experience. From mobile banking apps to investment platforms and budgeting tools, fintech solutions cater to various aspects of personal finance management, empowering individuals to take control of their financial health.

Key Aspects of Fintech Software in Personal Finance Management

Digital Banking and Payments:

Fintech software has streamlined banking operations through mobile banking apps and digital payment solutions. Users can manage their accounts, transfer funds, pay bills, and track transactions in real-time, reducing reliance on traditional banking methods.

Example: Mobile banking apps integrated with UPI (Unified Payments Interface) allow users to initiate instant payments, check account balances, and manage recurring payments directly from their smartphones.

Budgeting and Expense Tracking:

Fintech software offers robust budgeting tools that enable users to set financial goals, create budgets, and track expenses effortlessly. These tools categorize transactions, provide spending insights, and offer alerts to help users stay within their budgetary limits.

Example: Apps like Mint and YNAB (You Need A Budget) analyze spending patterns, offer personalized budgeting advice, and help users optimize their financial decisions based on real-time data.

Investment Management:

Fintech platforms have democratized investment opportunities by offering easy access to investment products such as stocks, mutual funds, and exchange-traded funds (ETFs). Robo-advisors use algorithms to provide automated investment advice based on user preferences and risk tolerance.

Example: Platforms like Robinhood and Wealthfront allow users to invest in diversified portfolios, automate investment contributions, and monitor portfolio performance through intuitive dashboards.

Credit Monitoring and Management:

Fintech services provide tools for monitoring credit scores, tracking credit utilization, and managing debt repayment strategies. These tools offer personalized recommendations to improve creditworthiness and negotiate better loan terms.

Example: Credit Karma and Credit Sesame offer free credit score monitoring, personalized financial tips, and access to credit products tailored to individual credit profiles.

Financial Planning and Advice:

Fintech software empowers users to access personalized financial advice and planning tools previously reserved for affluent clients of traditional financial advisors. Virtual advisors leverage artificial intelligence (AI) and machine learning (ML) to deliver tailored financial recommendations.

Example: Platforms like Betterment and Personal Capital provide comprehensive financial planning services, retirement calculators, and tax optimization strategies based on individual financial goals and circumstances.

Impact of Fintech Software on Personal Finance Management

Accessibility and Convenience:

Fintech software enhances accessibility to financial services, allowing users to manage their finances anytime, anywhere via mobile devices. This convenience reduces the need for physical visits to banks and enables seamless financial transactions on-the-go.

Cost Efficiency:

Fintech solutions often offer lower fees and transaction costs compared to traditional financial services, making investing, banking, and money transfers more affordable for users. This cost efficiency democratizes access to financial products and services.

Empowerment through Education:

Fintech platforms educate users about financial literacy and best practices through interactive tools, tutorials, and personalized recommendations. This empowerment enables individuals to make informed financial decisions and improve their financial well-being over time.

Customization and Personalization:

Fintech software provides personalized financial insights and recommendations based on user data and preferences. This customization helps users align their financial strategies with their long-term goals and adapt to changing financial circumstances.

Enhanced Security and Fraud Prevention:

Advanced security features, including encryption, biometric authentication, and real-time transaction monitoring, safeguard users' financial information and prevent unauthorized access or fraudulent activities. Fintech companies prioritize data protection to build trust and reliability among users.

Challenges and Future Outlook

While fintech software offers numerous benefits, challenges such as regulatory compliance, data privacy concerns, and technological scalability remain significant considerations for fintech companies and users alike. However, ongoing innovations in AI, blockchain technology, and cybersecurity continue to drive the evolution of fintech software, promising even greater advancements in personal finance management.

Conclusion

Fintech software has revolutionized personal finance management by providing accessible, efficient, and personalized solutions that empower individuals to take control of their financial futures. From digital banking and budgeting tools to investment management and financial planning services, fintech innovations continue to reshape how consumers interact with their finances, fostering financial inclusion and improving overall financial well-being globally. As fintech software evolves, its transformative impact on personal finance management is set to expand, offering new opportunities for financial empowerment and innovation in the digital age.

1 note

·

View note

Text

youtube

In this video, we explore why India is currently the world's fastest-growing major economy. With an impressive 8.4% growth rate in the October-December quarter of the financial year 2023-24, India has outpaced several major economies and climbed to the fifth position globally. 👉 Subscribe to my channel to stay tuned: / @economyobsession

India's GDP has experienced a massive growth of 8.4%, solidifying its position as the world's fastest-growing major economy. We cover India's recent economic achievements, including its rapid GDP growth and rise in global economic rankings. It compares India's economic journey with other major economies, particularly China, and discusses India's potential to become the world's second-largest economy by 2075.

There are various facets of India's economy, including its stock market performance, export growth, digital payment innovations, and the significant role of the service sector. It also addresses challenges such as manufacturing sector growth, education, and job creation.

India's economic growth is primarily driven by domestic demand, with significant investments in infrastructure and a strong service sector. Despite rapid growth, India faces challenges in job creation, education, and healthcare, which are crucial for sustainable development. The country is leveraging digital advancements, like the Unified Payments Interface (UPI), and aims to enhance global competitiveness through initiatives like Make in India.

0 notes

Text

June 10 (UPI) -- Armed militants over the weekend opened fire on a bus transporting Hindu pilgrims in the disputed Jammu and Kashmir region, killing at least eight people and injuring nearly three dozen others, officials and authorities said.

The incident happened at about 6:10 p.m. local time Sunday in the Reasi district of the Muslim-majority Jammu and Kashmir, which both India and Pakistan lay claims to and control a portion of.

Reasi police said the bus was transporting the Hindu pilgrims from the famous Shiv Khori cave shrines to Katra when the vehicle came under fire.

"The driver was hit and lost control, resulting in the bus sliding into the nearby gorge," Distric Police Reasi said in a statement.

All passengers were evacuated from the vehicle by 8:10 p.m. with the injured transported to local hospitals.

According to police, eight deaths have so far been confirmed and another 33 injured. Police had earlier said that nine were "feared dead."

The Resistance Front has claimed responsibility for the attack, India Today reported, citing a statement from the Pakistan-based militant organization.

TRF is a proxy group for Lashkar-E-Taiba, a Pakistani terrorist organization based in the disputed Jammu and Kashmir region. It has been designated by India as a terrorist organization.

TRF warned in its statement that more attacks on tourists and locals would be conducted, calling Sunday's assault the "beginning of a renewed start."

Lt. Gov. Manoj Sinha of Jammu and Kashmir has issued a statement saying local security forces have launched an operation "to hunt down the terrorists."

"I strongly condemn the cowardly terror attack on a bus in Reasi," he said.

"My condolences to the family members of the martyred civilians."

He added that Prime Minister Narendra Modi of India has taken "stock of the situation."

"All those behind this heinous act will be punished soon," he vowed.

He later said he visited injured pilgrims in the hospital.

India and Pakistan have feuded over Jammu and Kashmir since Britain's withdrawal in 1947, with their first war over the region ending with a U.N.-brokered cease-fire in 1949.

India has repeatedly accused Pakistan of harboring militants who have committed terrorists attacks in the region, and there were a number of skirmishes between the two countries over the military Line of Control in 2019.

The recent attack comes days after Modi's Hindu nationalist party declared victory in national elections.

1 note

·

View note

Text

Introducing The IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Card

Poonawalla Fincorp has partnered with IndusInd Bank to launch an innovative product in the credit card market: the eLITE RuPay Platinum Credit Card. Designed to cater to a broad range of customer needs, this card aims to provide a seamless and rewarding banking experience. Abhay Bhutada, Managing Director of Poonawalla Fincorp, has shared insights into the numerous advantages this card offers.

Key Features of the eLITE RuPay Platinum Card

The IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card is packed with features that are tailored to meet the modern consumer's needs. Let’s explore the key features that make this card stand out.

No Joining or Annual Fees

A major highlight of the eLITE RuPay Platinum Credit Card is that it does not have any joining or annual fees. This makes the card accessible to a wider audience, ensuring that cardholders can enjoy its benefits without worrying about extra costs.

Also Read: Unveiling Abhay Bhutada’s Salary Journey And Impact As MD Of Poonawalla Fincorp

Reward Points on Every Transaction

The card offers reward points for every ₹100 spent on transactions, excluding fuel. This includes daily purchases, making it easy for users to accumulate points rapidly. Whether it’s groceries, dining, or shopping, every transaction brings you closer to exciting rewards.

Rewards on UPI Transactions

In alignment with the increasing trend of digital payments, this card provides rewards for UPI transactions. Users who frequently use the Scan & Pay feature will find this particularly beneficial, as it adds value to their everyday spending.

Enhanced Rewards for E-commerce

For those who enjoy online shopping, the eLITE RuPay Platinum Credit Card offers 2.5 times reward points on e-commerce transactions, excluding fuel, travel, and low interchange MCC. This feature enhances the online shopping experience, making it more rewarding.

High-Value Reward Points

Cardholders can convert their accumulated reward points into cash credit at a higher value of ₹0.40 per point. This feature increases the value proposition of the card, ensuring that users get the most out of their spending.

Movie Ticket Offers

Entertainment is another area where the eLITE RuPay Platinum Credit Card shines. Cardholders can avail a Buy One Get One free movie ticket offer through BookMyShow, up to a maximum of ₹200, once a month. This is a great perk for movie enthusiasts who enjoy regular outings.

Fuel Surcharge Waiver

The card offers a 1% fuel surcharge waiver, which can lead to significant savings for those who frequently travel by car. This benefit is a thoughtful addition, catering to the needs of daily commuters and travelers alike.

Also Read: Unveiling Abhay Bhutada: A Leader’s Inspiring Odyssey In Finance

Milestone Rewards

The eLITE RuPay Platinum Credit Card encourages users to utilize their card more often by offering 3000 reward points for achieving certain spending milestones. This feature incentivizes cardholders to make the most of their card to reap additional rewards.

Abhay Bhutada’s Vision

Abhay Bhutada, MD of Poonawalla Fincorp, expressed his enthusiasm about the new card, stating, “We are excited to launch the IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card, which reflects our commitment to enabling the dreams of our customers. By offering this card, we aim to enhance engagement with our existing customers digitally while also extending our reach to new customers.”

About Poonawalla Fincorp Limited

Poonawalla Fincorp Limited, part of the Cyrus Poonawalla Group, is a prominent non-deposit-taking systemically important non-banking finance company (ND-SI-NBFC) registered with the Reserve Bank of India (RBI). With a legacy spanning nearly three decades, the company is listed on both the BSE Limited (BSE) and the National Stock Exchange of India Limited (NSE).

The company’s identity is built on five key pillars: Passion, Principles, Purpose, People, and Possibilities. With a presence across 19 states and a standalone AUM of ₹25,003 crore as of March 31, 2024, Poonawalla Fincorp employs around 2300 people. Their diverse product offerings include pre-owned car finance, personal loans, loans to professionals, business loans, loans against property, supply chain finance, machinery loans, medical equipment loans, and consumer loans.

Also Read: Journey Of Poonawalla Fincorp’s Managing Director – Abhay Bhutada

A Card That Redefines Banking Experience

The launch of the IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card signifies Poonawalla Fincorp’s and Abhay Bhutada’s commitment to providing enhanced customer experiences. With features like no fees, substantial reward points, and exclusive offers, this card sets a new benchmark in the credit card industry.

For customers, the eLITE RuPay Platinum Credit Card is not just a payment tool but a gateway to numerous benefits and rewards. It is designed to make everyday transactions more rewarding, offer savings on entertainment and fuel, and provide high-value reward points that can be easily redeemed.

Conclusion

The IndusInd Bank Poonawalla Fincorp eLITE RuPay Platinum Credit Card is a testament to Poonawalla Fincorp’s dedication to offering tailored financial solutions that enhance the lifestyle of its users. With its extensive features and benefits, this card is poised to become a favorite among customers seeking value and rewards in their daily transactions.

0 notes

Text

Paytm stock hits 5% : Adani Deal or Market Mirage? Stock Soars Despite Denial

On Wednesday, May 29, 2024, the stock price of One97 Communications’ Paytm, an enormous fintech company based in India, saw a sharp increase. This increase coincided with unverified rumors pointing to the Adani Group, a significant Indian corporation, possibly acquiring a share. It’s interesting to note that this price rise took place despite One97 Communications’ formal denial of any current negotiations for this kind of agreement.

Market Reaction and Official Denial

Paytm’s (PAYT) shares on the Bombay Stock Exchange (BSE) saw a sharp increase, closing at ₹359.55 after hitting the 5% upper circuit. The S&P BSE Sensex was down 0.33% at the moment, thus this upward rise stood in stark contrast to the general tone of the market. At least some of the Paytm stock price increase can be ascribed to conjecture about a possible Adani Group purchase.

But One97 Communications responded quickly, providing an explanation in a stock market filing. The business categorically refuted the press stories, calling them only hypothetical. They made it clear that there were “no discussions” going on about the Adani Group acquiring any interest.

Media Reports Fueling the Speculation

The Times of India released a piece that sparked the rumors of a possible merger. According to the report, the founder and CEO of Paytm, Vijay Shekhar Sharma, and Adani Group chairman Gautam Adani were in negotiations to buy a share in One97 Communications. The story went on to say that on Tuesday, Sharma met with Adani in his Ahmedabad office to settle the terms of the contract.

The increase in Paytm’s stock price was probably influenced by this news item, which acquired popularity. But One97 Communications’ formal rejection raised questions about the veracity of these assertions.

Adani Group’s Expanding Digital Footprint

The Times of India story emphasizes the Adani Group’s increasing interest in the world of digital payments, even though the rumored takeover discussions may not be taking place right now. This is consistent with earlier Financial Times reporting mentioning the Adani Group’s possible application for a license to use the Unified Payments Interface (UPI) network in India. Furthermore, it has been stated that the company is in talks to introduce a co-branded credit card with banks.

These events imply that the billionaire Gautam Adani’s Adani Group is aggressively working to increase its digital presence in India. A big step in this approach would be for the Adani Group to join the UPI network, which would provide them access to a large number of digital payment users. Furthermore,

Market Analysis and Future Implications

The recent fluctuations in Paytm’s stock price demonstrate how susceptible the market is to even unfounded allegations. Even if the rumored takeover discussions were withdrawn, it is impossible to overlook the Adani Group’s underlying interest. The rising significance of digital payments in India’s economy and the industry’s potential for rapid expansion are reflected in this interest.

Whether or whether Paytm and the Adani Group have any actual conversations in the future is still to be seen. The Adani Group may investigate alternative routes to join the digital payments industry in India, notwithstanding their growing emphasis on the digital sphere. This might be solo projects, alliances with other participants, or even a resurgence of interest in purchasing stock in Paytm.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News

0 notes

Text

Comprehensive guide to computer courses

Uses of Computers

Computers are used in various fields. There are also many computer courses applications are:

1. Business

A computer can perform a high-speed calculation more efficiently and accurately, due to which it is used in all business organisations. In business, computers are used for:

Payroll calculations

Budgeting

Sales analysis

Maintenance of stocks

Managing employee databases

2. Education

Computers are very useful in the education system. Especially now, during the COVID time, online education has become the need of the hour. There are miscellaneous ways through which an institution can use computers to educate students.

3. Health Care

Hospitals, labs, and dispensaries now mostly rely on computers. They are employed in the diagnosis and scanning of many illnesses. Computerized devices do several types of scans, such as CT, ECG, and ultrasound scans. They are also utilized in hospitals to maintain patient and medication records.

We also have seen that in the medicals facilities there are so many machines that can be operated by the computers to detect the situation of the patient and also it gives current situation so that they can a better treatment.

4. Defence

Computers are largely used in defence. The military employs computerised control systems, modern tanks, missiles, weapons, etc. It uses computers for communication, operation and planning, smart weapons, etc.

For more interesting contents visit on our home page growdigitalaudience

5. Government

Computers play an important role in government services. Some major fields are:

Computation of male/female ratio

Computerisation of PAN card

Income Tax Department

Budgets

Weather forecasting

Computerisation of voters’ lists

Sales Tax Department

6. Communication

Transmitting an idea, a message, a picture, a voice, or any type of text, audio, or video clip is called communication. That's what computers can accomplish. We can communicate with each other via chat, email, video conferences, and other means via computers.

That’s why by the use of computer communication becomes easier. People from anywhere can come in contact with their respective person very fastly and frequently.

7. Banking

Nowadays, to a large extent, banking is dependent on computers. Banks provide an online accounting facility, which includes checking current balances, making deposits and overdrafts, checking interest charges, shares, trustee records, netbanking upi transactions, neft facilities etc.

The ATM machines, which are fully automated, use computers, making it easier for customers to deal with banking transactions.

8. Marketing

In marketing, computers are mainly used for advertising and home shopping. Also computers are main base of the marketing because if we have to promote our business on digital platform and to provide online shopping platform for consumers to buy thing from their home so we need a computer so that we promote our business on the digital platform.

Computer are not only used in advertising but also we grow their business on the international also and by that they can earn very good income.

Similarly, there are various other applications of computers in other fields, such as insurance, engineering, design, etc.

To know more follow me on facebook GD Audience

0 notes