#WebScrapingRetailWebsitesData

Explore tagged Tumblr posts

Text

How to Analyze the Impact of Inflation by Extracting Grocery Price Data from US Retailers?

Like an unseen current, inflation silently shapes economic landscapes, gradually eroding consumer purchasing power while making its mark on diverse industries. Elevated costs, hiring delays, and stagnant earnings pose substantial business challenges. One sector susceptible to inflation's effects is the grocery industry, where the potential for rising prices can weigh heavily on the minds of average consumers.

Rising Inflation: A Catalyst for Changing Shopping Dynamics

Over the past year and beyond, the United States has witnessed a pronounced uptick in inflation, sparking concerns and altering how we approach essential purchases. The price surge denotes the escalating raw materials, transportation, and labor costs. Further complicating matters, disruptions in global supply chains and fluctuations in currency exchange rates amplify the situation's complexity, weaving an intricate tapestry of interdependencies.

Navigating Inflation: Strategies Of Prominent E-Retailers

After extracting grocery price data, we took a comprehensive analysis to grasp the scale of this phenomenon among leading e-retailers, focusing on four major retail giants: Walmart, Amazon, Target, and Kroger.

the prolonged period of elevated prices and the potential macroeconomic pressures, the retailer adopts a cautious stance. In contrast, Amazon's eCommerce division experienced a significant shift, reporting a net loss of $2.7 billion in 2022, diverging starkly from the $33.4 billion profit of the prior year.

Amid these intricate circumstances, comprehending trends in grocery pricing and the accompanying strategies becomes paramount for online and brick-and-mortar retailers. Successfully navigating and thriving within the current economic landscape hinges on a nuanced understanding of these dynamics. Analyzing pricing trends using grocery data scraping services offer invaluable insights into how these corporate giants adeptly steer through the challenges posed by the grocery industry in the face of inflation's backdrop.

Methodology Of Our Research

The foundation of our analysis comprised a comprehensive assortment of products, spanning the spectrum from pantry essentials like flour and rice to perishable items such as dairy and produce. It encompassed approximately 600 Stock Keeping Units (SKUs) meticulously matched across Amazon, Kroger, Target, and Walmart. The data collection using product data scraping spanned January 2022 to February 2023.

Furthermore, we examined the pricing dynamics using web scraping retail websites data for a smaller subset of over 30 high-demand daily essentials. These particular items hold the potential to generate elevated sales and margins for the retailers in focus.

Insights Into Average Selling Prices Of Grocery Items

Our thorough analysis uncovered notable trends in the average selling prices of various grocery products. Among the retailers studied, Walmart consistently emerged as the front-runner in offering the most competitive prices. Price monitoring showed that there were around 8% lower than its closest competitor, Target. Despite an annual price increment of roughly 5%, Walmart's strategy prioritized "stability and predictability." This strategic approach yields results, as evidenced by the retailer's 8% growth in the last quarter. Nevertheless, it is essential to recognize that while this strategy brings benefits, it might exert pressure on Walmart's profit margins concurrently.

Strategies To Navigate Inflationary Pressures

In response to the challenges posed by inflation, Walmart is adopting a measured approach to growth while concurrently concentrating on safeguarding profit margins. Sources indicate that the retailer has negotiated with consumer packaged goods (CPG) manufacturers, pushing back against price hikes aimed at offsetting inflation-driven cost pressures early in 2023. Notably, part of Walmart's growth and heightened sales to an unexpected trend—higher-income households, facing diminishing spending power, now actively seek deals and discounts at Walmart.

Amazon's Surprising Pricing Position

Contrary to common consumer perception associating Amazon with the most budget-friendly prices, data reveals a different narrative. Amazon emerges as the highest-priced retailer among the ones studied, with Kroger following closely. Over the year, Kroger implemented a 10% price increase. Despite this, Amazon maintains its strong market standing, charging prices 12% to 18% higher than Walmart's for groceries. Amazon sustained its success even as its online sales dipped by 4%, and the year 2022 witnessed a substantial 9% surge in revenue from third-party seller services, encompassing aspects like warehousing, packaging, and delivery. Amazon's robust logistics and same-day delivery capabilities confer a distinct competitive edge, bolstering revenue growth and preserving margins. This scenario allows Walmart and other retailers to increase prices while upholding their competitive pricing positions.

Kroger's Premium Perception Strategy

Kroger, in contrast, appears to be cultivating a premium price perception. The retailer has consistently pursued a strategy of raising prices, a trend evident across nearly every month. This approach places Kroger's pricing strategy closer to Amazon's tactics.

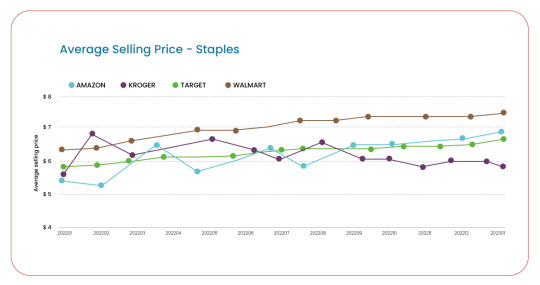

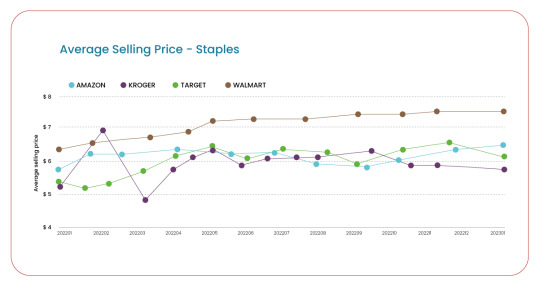

Analyzing High-Volume Daily Staples Pricing

Recognizing that pricing strategies can vary across product categories, our analysis delved deeper into a narrower subset of over 30 high-demand daily staples offered by different retailers. This subset encompasses baked goods, popular beverages, canned foods, frozen meals, dairy products, cereals, detergents, and similar essentials. By focusing on this subset, we gain a more granular understanding of how retailers adapt their pricing strategies to different types of products.

Walmart's Strategic Positioning Amidst Inflation

By perceiving the influence of inflation significantly, Walmart has steadfastly maintained its position as the price leader, possibly intending to augment its margins through higher sales volume.

Narrowing Price Disparity Among Retailers

The variance in prices across retailers in this context is understandably narrower, with Amazon and Kroger closely aligning their average prices with Walmart's.

Target's Peculiar Pricing Strategy

Distinctively, Target's pricing strategy distinguishes itself by consistently emerging as the highest-priced retailer for daily essentials, despite ranking among the more affordable retailers for a broader spectrum of grocery items. This anomaly implies that Target's underlying technological approach might need to be more finely tuned to adapt to market dynamics than other prominent retailers. It might be prudent for Target to bolster efforts in meticulously tracking pricing within this sub-category.

Data-Driven Solutions For Navigating Complexity

Amid a challenging economic landscape, retailers and grocery establishments must sustain their revenues and margins. A vital component of achieving this lies in embracing an all-encompassing and adaptable pricing strategy. An acute awareness of which product categories are witnessing price escalations among competitors can equip retailers with the insights needed to make well-informed pricing decisions at the category and individual product levels.

Rather than implementing sweeping price hikes that could undermine customer trust, retailers should balance margin performance and consumer willingness to pay. Navigating price adjustments can be intricate for both customers and sellers. Those retailers that adopt an approach fueled by data and insights stand a higher chance of success in this endeavor.

Product Data Scrape is committed to upholding the utmost standards of ethical conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations. With a global presence across multiple offices, we meet our customers' diverse needs with excellence and integrity.

#ExtractingGroceryPriceDataFromUS#GroceryDataScrapingServices#ScrapeTargetsPricingStrategy#ScrapeKrogersPricingStrategy#WebScrapingRetailWebsitesData#ExtractGroceryPriceData#ScrapeAmazonGroceryData

0 notes

Text

How to Analyze the Impact of Inflation by Extracting Grocery Price Data from US Retailers?

Explore the groceries inflation efferct by extracting grocery price data from top US retailers. Gain insights into pricing trends and strategies amid economic changes.

#ExtractingGroceryPriceDataFromUS#GroceryDataScrapingServices#ScrapeTargetsPricingStrategy#ScrapeKrogersPricingStrategy#WebScrapingRetailWebsitesData#ExtractGroceryPriceData#ScrapeAmazonGroceryData#ScrapeKrogerGroceryData

0 notes

Text

Empower the Surge of Online Alcohol Retail in the UK by Web Scraping Liquor Data

The Alcohol eCommerce sector has experienced rapid expansion, a trend accentuated by the pandemic. Post-pandemic, factors like convenience, safety, and home delivery gained prominence, propelling alcohol sales through eCommerce. In the UK, Kantar noted a £261 million surge in rising sales, with online and convenience stores emerging as the key beneficiaries. Intriguingly, the IWSR Drinks Market Analysis Report 2022 highlighted a global preference for websites over apps when purchasing alcohol online, except in China and Brazil. Notably, in the UK, major online alcohol purchases occur via retailer websites, not apps.

Research Approach

Our research was conducted through liqour data scraping, spanning February 2022 to June 2022. The focus of our study encompassed two prominent grocery retailers, namely Tesco and Ocado, along with three noteworthy grocery apps, namely Gorillas, Weezy, and Getir. The specific category under scrutiny throughout our analysis was alcohol.

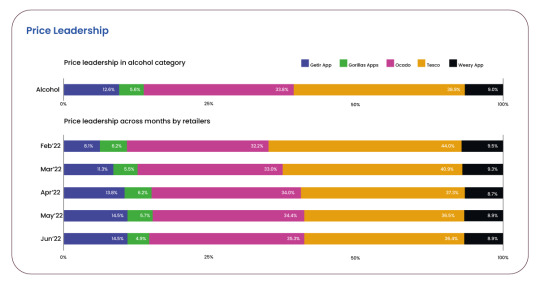

Identifying The Alcohol Price Leader

Tesco's Leadership In Alcohol Pricing

Throughout February to June 2022, Tesco consistently established itself as the front-runner in price leadership within the Alcohol category. Leveraging e-commerce data scraping, Tesco secured the lowest prices for 38.9% of its products. Ocado followed closely with 33.8%, while Gorillas exhibited the most minor dominance, leading in price for only 5.6% of its alcohol offerings.

Nonetheless, Tesco's grip on price leadership experienced a gradual erosion over the months. Commencing in February,e-commerce data scraping revealed Tesco's hold on the lowest price for 44% of its products, which tapered to just over 36% by June. Conversely, Ocado depicted an inverse trajectory—starting at a 32% price leadership in February, climbing to 35.3% by June.

An intriguing contender, illuminated through e-commerce data scraping, was Getir. Commencing with a modest 8.2% price leadership for its products in February, Getir's proportion progressively expanded, culminating at 14.5% in June.

Retailers Employing Discounts To Bolster Alcohol Sales

Leveraging discounts using liquor product data collection proves to be an effective strategy to attract consumers impacted by inflation. Through loyalty card discounts, reward vouchers, and various promotional tactics, retailers enhance the allure of their products, rendering them more competitive and appealing to customers. Maintaining competitiveness necessitates retailers' awareness of their rivals' discount offerings. Moreover, price monitoring helps comprehend the potential ramifications of substantial discounting and its influence on profit margins.

A wave of European and UK startups, including Jiffy, Dija, Weezy, Zapp, Getir, and Gorillas, entered the scene with a shared commitment: to provide the swiftest and most cost-effective grocery delivery services.

Our dataset uncovered intriguing discounting dynamics among these players. Gorillas maintained a discounting strategy in line with its competitors. Conversely, Getir appeared to adopt a more aggressive approach, veering towards deep discounting. Notably, Getir consistently offered the highest discounts throughout the observed period. In April, their discounts surged to nearly 9% more than those of Ocado—the runner-up in discounting.

As previously discussed, the period from February to June saw Getir securing price leadership. It's plausible that their strategy of deep discounting contributed to this accomplishment. In contrast, Gorillas opted for a different route, showcasing the lowest and almost negligible discounting practices.

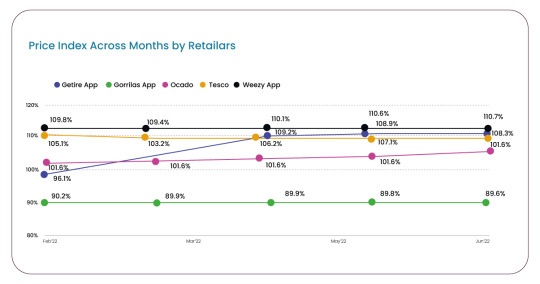

Observing Price Index Trends Over Five Monthss

Our focus shifted towards analyzing Price Index (PI) trends among these five retailers, encompassing February to June 2022. It enabled us to gauge the fluctuations in alcohol prices over this period.

Please note: Retailers operating at the 100% mark indicated they were selling at an optimal price, refraining from undercutting the market. The pricing sweet spot rested between 95% and 105%. Deviating lower would potentially jeopardize profit margins while exceeding this range indicated that the retailer needed to position more competitively.

Price Index Insights: Retailers' Strategic Positioning

Among the retailers, Weezy displayed the most optimal Price Index, residing within the 100% to 102% range.

Conversely, Gorillas held the lowest Price Index, from 89% to 91%.

Getir, initially boasting a lower Price Index of 96.1% in February, progressively climbed to surpass 110% in April, May, and June.

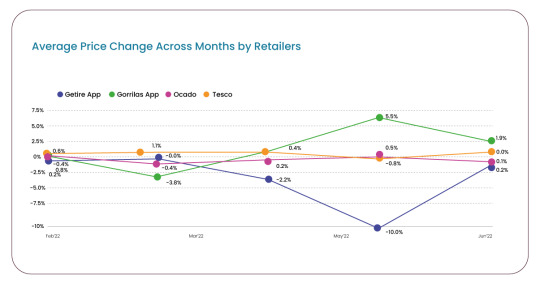

Agility In Price Adjustments: Identifying Leaders

Stability In Pricing Trends Among Retailers

Predominantly, most retailers adhered to a consistent pricing trajectory using liquor product data scraping, maintaining a degree of competitive alignment. Their pricing approaches were relatively well-matched.

Yet, Gorillas stood out for implementing significant price adjustments in specific months. Notably, they enacted a notable reduction of 3.8% in prices in March. Subsequently, in May, Gorillas increased 5.5% in their pricing.

In that same eventful May, Weezy embarked on a distinctive strategy, considerably slashing prices by 10%. This move widened the gap between Gorillas and Weezy.

Preserving Sales Through Stock Availability Management

Diverse Stock Availability Among Retailers

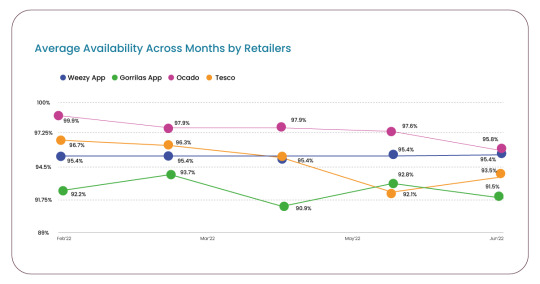

Our data analysis unveiled distinct levels of stock availability across the retailers. Ocado, in particular, maintained the highest availability throughout the observed five months. At a robust 100%, their stock levels gradually receded, concluding at 95.8% by June.

Tesco, on the other hand, encountered a pronounced decline in availability during May and June. At 97%, availability dwindled to 92-93%.

Gorillas consistently exhibited the lowest stock availability, fluctuating between 90% and 94% across the months.

Weezy demonstrated steadfast consistency, upholding a consistent 95% availability throughout five months.

Concluding Insights

In the UK market, a favorable inclination towards online alcohol purchases is evident, predominantly catalyzed by shifts in consumer behavior prompted by the pandemic. According to the IWSR Drinks Market Analysis Report 2022, markets primarily driven by websites, like the UK, prioritize a wide product range and competitive pricing. Both these factors wield significant influence in purchase decisions. Conversely, consumers in app-centric markets hold distinct preferences. While price remains a consideration, it is less vital than convenience and speed.

Product Data Scrape is committed to upholding the utmost standards of ethical conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations. With a global presence across multiple offices, we meet our customers' diverse needs with excellence and integrity.

#WebScrapingLiquorData#ScrapeUKAlcoholRetailIndustry#WebScrapingRetailWebsitesData#ScrapeUKRetailTrends#UKLiquorDataScraper#ScrapeLiquorData

0 notes

Text

How to Analyze the Impact of Inflation by Extracting Grocery Price Data from US Retailers?

Like an unseen current, inflation silently shapes economic landscapes, gradually eroding consumer purchasing power while making its mark on diverse industries. Elevated costs, hiring delays, and stagnant earnings pose substantial business challenges. One sector susceptible to inflation's effects is the grocery industry, where the potential for rising prices can weigh heavily on the minds of average consumers.

Rising Inflation: A Catalyst for Changing Shopping Dynamics

Over the past year and beyond, the United States has witnessed a pronounced uptick in inflation, sparking concerns and altering how we approach essential purchases. The price surge denotes the escalating raw materials, transportation, and labor costs. Further complicating matters, disruptions in global supply chains and fluctuations in currency exchange rates amplify the situation's complexity, weaving an intricate tapestry of interdependencies.

Navigating Inflation: Strategies Of Prominent E-Retailers

After extracting grocery price data, we took a comprehensive analysis to grasp the scale of this phenomenon among leading e-retailers, focusing on four major retail giants: Walmart, Amazon, Target, and Kroger.

the prolonged period of elevated prices and the potential macroeconomic pressures, the retailer adopts a cautious stance. In contrast, Amazon's eCommerce division experienced a significant shift, reporting a net loss of $2.7 billion in 2022, diverging starkly from the $33.4 billion profit of the prior year.

Amid these intricate circumstances, comprehending trends in grocery pricing and the accompanying strategies becomes paramount for online and brick-and-mortar retailers. Successfully navigating and thriving within the current economic landscape hinges on a nuanced understanding of these dynamics. Analyzing pricing trends using grocery data scraping services offer invaluable insights into how these corporate giants adeptly steer through the challenges posed by the grocery industry in the face of inflation's backdrop.

Methodology Of Our Research

The foundation of our analysis comprised a comprehensive assortment of products, spanning the spectrum from pantry essentials like flour and rice to perishable items such as dairy and produce. It encompassed approximately 600 Stock Keeping Units (SKUs) meticulously matched across Amazon, Kroger, Target, and Walmart. The data collection using product data scraping spanned January 2022 to February 2023.

Furthermore, we examined the pricing dynamics using web scraping retail websites data for a smaller subset of over 30 high-demand daily essentials. These particular items hold the potential to generate elevated sales and margins for the retailers in focus.

Insights Into Average Selling Prices Of Grocery Items

Our thorough analysis uncovered notable trends in the average selling prices of various grocery products. Among the retailers studied, Walmart consistently emerged as the front-runner in offering the most competitive prices. Price monitoring showed that there were around 8% lower than its closest competitor, Target. Despite an annual price increment of roughly 5%, Walmart's strategy prioritized "stability and predictability." This strategic approach yields results, as evidenced by the retailer's 8% growth in the last quarter. Nevertheless, it is essential to recognize that while this strategy brings benefits, it might exert pressure on Walmart's profit margins concurrently.

Strategies To Navigate Inflationary Pressures

In response to the challenges posed by inflation, Walmart is adopting a measured approach to growth while concurrently concentrating on safeguarding profit margins. Sources indicate that the retailer has negotiated with consumer packaged goods (CPG) manufacturers, pushing back against price hikes aimed at offsetting inflation-driven cost pressures early in 2023. Notably, part of Walmart's growth and heightened sales to an unexpected trend—higher-income households, facing diminishing spending power, now actively seek deals and discounts at Walmart.

Amazon's Surprising Pricing Position

Contrary to common consumer perception associating Amazon with the most budget-friendly prices, data reveals a different narrative. Amazon emerges as the highest-priced retailer among the ones studied, with Kroger following closely. Over the year, Kroger implemented a 10% price increase. Despite this, Amazon maintains its strong market standing, charging prices 12% to 18% higher than Walmart's for groceries. Amazon sustained its success even as its online sales dipped by 4%, and the year 2022 witnessed a substantial 9% surge in revenue from third-party seller services, encompassing aspects like warehousing, packaging, and delivery. Amazon's robust logistics and same-day delivery capabilities confer a distinct competitive edge, bolstering revenue growth and preserving margins. This scenario allows Walmart and other retailers to increase prices while upholding their competitive pricing positions.

Kroger's Premium Perception Strategy

Kroger, in contrast, appears to be cultivating a premium price perception. The retailer has consistently pursued a strategy of raising prices, a trend evident across nearly every month. This approach places Kroger's pricing strategy closer to Amazon's tactics.

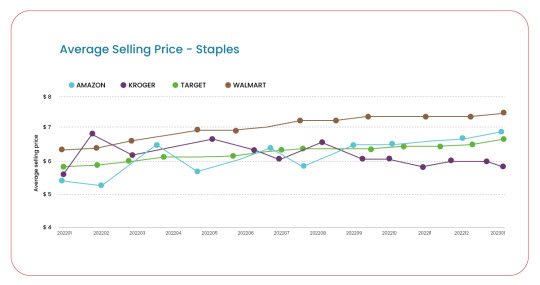

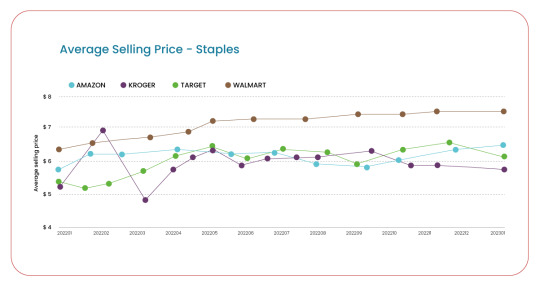

Analyzing High-Volume Daily Staples Pricing

Recognizing that pricing strategies can vary across product categories, our analysis delved deeper into a narrower subset of over 30 high-demand daily staples offered by different retailers. This subset encompasses baked goods, popular beverages, canned foods, frozen meals, dairy products, cereals, detergents, and similar essentials. By focusing on this subset, we gain a more granular understanding of how retailers adapt their pricing strategies to different types of products.

Walmart's Strategic Positioning Amidst Inflation

By perceiving the influence of inflation significantly, Walmart has steadfastly maintained its position as the price leader, possibly intending to augment its margins through higher sales volume.

Narrowing Price Disparity Among Retailers

The variance in prices across retailers in this context is understandably narrower, with Amazon and Kroger closely aligning their average prices with Walmart's.

Target's Peculiar Pricing Strategy

Distinctively, Target's pricing strategy distinguishes itself by consistently emerging as the highest-priced retailer for daily essentials, despite ranking among the more affordable retailers for a broader spectrum of grocery items. This anomaly implies that Target's underlying technological approach might need to be more finely tuned to adapt to market dynamics than other prominent retailers. It might be prudent for Target to bolster efforts in meticulously tracking pricing within this sub-category.

Data-Driven Solutions For Navigating Complexity

Amid a challenging economic landscape, retailers and grocery establishments must sustain their revenues and margins. A vital component of achieving this lies in embracing an all-encompassing and adaptable pricing strategy. An acute awareness of which product categories are witnessing price escalations among competitors can equip retailers with the insights needed to make well-informed pricing decisions at the category and individual product levels.

Rather than implementing sweeping price hikes that could undermine customer trust, retailers should balance margin performance and consumer willingness to pay. Navigating price adjustments can be intricate for both customers and sellers. Those retailers that adopt an approach fueled by data and insights stand a higher chance of success in this endeavor.

Product Data Scrape is committed to upholding the utmost standards of ethical conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations. With a global presence across multiple offices, we meet our customers' diverse needs with excellence and integrity.

#ExtractingGroceryPriceDataFromUS#GroceryDataScrapingServices#ScrapeGroceryPriceData#ScrapeGroceryPriceDataFromUS#ScrapeAmazonGroceryData#ScrapeKrogerGroceryData#WebScrapingRetailWebsitesData

0 notes

Text

How to Analyze the Impact of Inflation by Extracting Grocery Price Data from US Retailers?

Explore the groceries inflation efferct by extracting grocery price data from top US retailers. Gain insights into pricing trends and strategies amid economic changes.

#ExtractingGroceryPriceDataFromUS#Grocery DataScrapingServices#ScrapeGroceryPriceData#ScrapeAmazonGroceryData#ScrapeKrogerGroceryData#WebScrapingRetailWebsitesData

0 notes

Text

How to Analyze the Impact of Inflation by Extracting Grocery Price Data from US Retailers?

#ExtractingGroceryPriceDataFromUS#GroceryDataScrapingServices#WebScrapingRetailWebsitesData#ExtractGroceryPriceData#ScrapeAmazonGroceryData#ScrapeKrogerGroceryData

0 notes

Text

How to Analyze the Impact of Inflation by Extracting Grocery Price Data from US Retailers?

Like an unseen current, inflation silently shapes economic landscapes, gradually eroding consumer purchasing power while making its mark on diverse industries. Elevated costs, hiring delays, and stagnant earnings pose substantial business challenges. One sector susceptible to inflation's effects is the grocery industry, where the potential for rising prices can weigh heavily on the minds of average consumers.

Rising Inflation: A Catalyst for Changing Shopping Dynamics

Over the past year and beyond, the United States has witnessed a pronounced uptick in inflation, sparking concerns and altering how we approach essential purchases. The price surge denotes the escalating raw materials, transportation, and labor costs. Further complicating matters, disruptions in global supply chains and fluctuations in currency exchange rates amplify the situation's complexity, weaving an intricate tapestry of interdependencies.

Navigating Inflation: Strategies Of Prominent E-Retailers

After extracting grocery price data, we took a comprehensive analysis to grasp the scale of this phenomenon among leading e-retailers, focusing on four major retail giants: Walmart, Amazon, Target, and Kroger.

the prolonged period of elevated prices and the potential macroeconomic pressures, the retailer adopts a cautious stance. In contrast, Amazon's eCommerce division experienced a significant shift, reporting a net loss of $2.7 billion in 2022, diverging starkly from the $33.4 billion profit of the prior year.

Amid these intricate circumstances, comprehending trends in grocery pricing and the accompanying strategies becomes paramount for online and brick-and-mortar retailers. Successfully navigating and thriving within the current economic landscape hinges on a nuanced understanding of these dynamics. Analyzing pricing trends using grocery data scraping services offer invaluable insights into how these corporate giants adeptly steer through the challenges posed by the grocery industry in the face of inflation's backdrop.

Methodology Of Our Research

The foundation of our analysis comprised a comprehensive assortment of products, spanning the spectrum from pantry essentials like flour and rice to perishable items such as dairy and produce. It encompassed approximately 600 Stock Keeping Units (SKUs) meticulously matched across Amazon, Kroger, Target, and Walmart. The data collection using product data scraping spanned January 2022 to February 2023.

Furthermore, we examined the pricing dynamics using web scraping retail websites data for a smaller subset of over 30 high-demand daily essentials. These particular items hold the potential to generate elevated sales and margins for the retailers in focus.

Insights Into Average Selling Prices Of Grocery Items

Our thorough analysis uncovered notable trends in the average selling prices of various grocery products. Among the retailers studied, Walmart consistently emerged as the front-runner in offering the most competitive prices. Price monitoring showed that there were around 8% lower than its closest competitor, Target. Despite an annual price increment of roughly 5%, Walmart's strategy prioritized "stability and predictability." This strategic approach yields results, as evidenced by the retailer's 8% growth in the last quarter. Nevertheless, it is essential to recognize that while this strategy brings benefits, it might exert pressure on Walmart's profit margins concurrently.

Strategies To Navigate Inflationary Pressures

In response to the challenges posed by inflation, Walmart is adopting a measured approach to growth while concurrently concentrating on safeguarding profit margins. Sources indicate that the retailer has negotiated with consumer packaged goods (CPG) manufacturers, pushing back against price hikes aimed at offsetting inflation-driven cost pressures early in 2023. Notably, part of Walmart's growth and heightened sales to an unexpected trend—higher-income households, facing diminishing spending power, now actively seek deals and discounts at Walmart.

Amazon's Surprising Pricing Position

Contrary to common consumer perception associating Amazon with the most budget-friendly prices, data reveals a different narrative. Amazon emerges as the highest-priced retailer among the ones studied, with Kroger following closely. Over the year, Kroger implemented a 10% price increase. Despite this, Amazon maintains its strong market standing, charging prices 12% to 18% higher than Walmart's for groceries. Amazon sustained its success even as its online sales dipped by 4%, and the year 2022 witnessed a substantial 9% surge in revenue from third-party seller services, encompassing aspects like warehousing, packaging, and delivery. Amazon's robust logistics and same-day delivery capabilities confer a distinct competitive edge, bolstering revenue growth and preserving margins. This scenario allows Walmart and other retailers to increase prices while upholding their competitive pricing positions.

Kroger's Premium Perception Strategy

Kroger, in contrast, appears to be cultivating a premium price perception. The retailer has consistently pursued a strategy of raising prices, a trend evident across nearly every month. This approach places Kroger's pricing strategy closer to Amazon's tactics.

Analyzing High-Volume Daily Staples Pricing

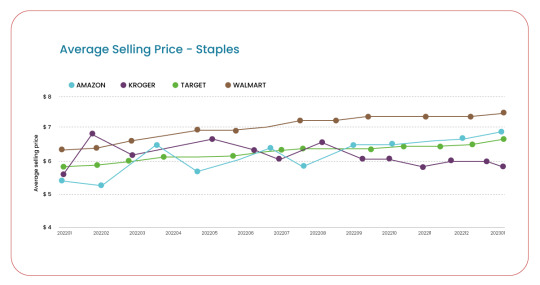

Recognizing that pricing strategies can vary across product categories, our analysis delved deeper into a narrower subset of over 30 high-demand daily staples offered by different retailers. This subset encompasses baked goods, popular beverages, canned foods, frozen meals, dairy products, cereals, detergents, and similar essentials. By focusing on this subset, we gain a more granular understanding of how retailers adapt their pricing strategies to different types of products.

Walmart's Strategic Positioning Amidst Inflation

By perceiving the influence of inflation significantly, Walmart has steadfastly maintained its position as the price leader, possibly intending to augment its margins through higher sales volume.

Narrowing Price Disparity Among Retailers

The variance in prices across retailers in this context is understandably narrower, with Amazon and Kroger closely aligning their average prices with Walmart's.

Target's Peculiar Pricing Strategy

Distinctively, Target's pricing strategy distinguishes itself by consistently emerging as the highest-priced retailer for daily essentials, despite ranking among the more affordable retailers for a broader spectrum of grocery items. This anomaly implies that Target's underlying technological approach might need to be more finely tuned to adapt to market dynamics than other prominent retailers. It might be prudent for Target to bolster efforts in meticulously tracking pricing within this sub-category.

Data-Driven Solutions For Navigating Complexity

Amid a challenging economic landscape, retailers and grocery establishments must sustain their revenues and margins. A vital component of achieving this lies in embracing an all-encompassing and adaptable pricing strategy. An acute awareness of which product categories are witnessing price escalations among competitors can equip retailers with the insights needed to make well-informed pricing decisions at the category and individual product levels.

Rather than implementing sweeping price hikes that could undermine customer trust, retailers should balance margin performance and consumer willingness to pay. Navigating price adjustments can be intricate for both customers and sellers. Those retailers that adopt an approach fueled by data and insights stand a higher chance of success in this endeavor.

Product Data Scrape is committed to upholding the utmost standards of ethical conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations. With a global presence across multiple offices, we meet our customers' diverse needs with excellence and integrity.

know more>>https://www.productdatascrape.com/impact-of-inflation-by-extracting-grocery-price-data-from-us-retailer.php

#ExtractingGroceryPriceDataFromUS#GroceryDataScrapingServices#WebScrapingRetailWebsitesData#ExtractGroceryPriceData#ScrapeAmazonGroceryData#ScrapeKrogerGroceryData

0 notes

Text

How to Analyze the Impact of Inflation by Extracting Grocery Price Data from US Retailers?

Explore the groceries inflation efferct by extracting grocery price data from top US retailers. Gain insights into pricing trends and strategies amid economic changes.

#GroceryPriceDatafromUSRetailers#GroceryDataScrapingServices#Webscrapingretailwebsitesdata#ExtractGroceryPriceData#ScrapeAmazonGroceryData#ScrapeKrogerGroceryData

0 notes