#What are the Functions of Accounts Receivable and Accounts Payable?

Explore tagged Tumblr posts

Text

Do you want a career in finance? Think about a career in accounts receivable and payable. You can learn about their functions here.

#What are the Functions of Accounts Receivable and Accounts Payable?#accounts payable and receivable job description

0 notes

Text

Mo Tuxuan is a character I haven't figured out as much on, but I have decided him literally being Mobei-jun reincarnated is funny so i'm rolling with it.

He was set up in a cold and distant home to be reborn in, professional, educated, powerful....kind of like being the royal family, but not quite. He was basically predestined to be the head of North Kingdom industries from the start and his entire life has been rearranged to that end. He's a little disappointed, his second life is almost the same as his first...but he's not technically royalty, and he's not a demon. Very little else has changed.

And then he's at a meeting with the CEO of another company and he encounters an account manager by the name of Shang Qingshui who seems off put by him but not....scared. Well, yes, scared, but not in the feeble sheep-like way most office workers are. He's carried his demon king aura and attitude with him, and it intimidates almost everyone he encounters. Qingshui immediately recognizes the aura and bristles bc there's NO WAY Mobei-jun is here, he CAN'T be this unlucky he'll just do his job and get out of the CEO's hair and maybe if he stonewalls the man he won't try to pull him back in.

Except Mo Tuxuan is so amazed there's a human who can stand up to him and casually disregard him he's actually kind of obsessed now. He needs to talk to that man more. He looks at Tuxuan like he's a WORM. No one else does that, no one else even dares to look at him like that. Everyone else looks up at him and cowers, Shang Qingshui looks up at him and narrows his eyes and digs in his heels.

Meanwhile on Qingshui's end, after his very first interaction with the man he sincerely hopes is not actually Mobei-jun because if he was that would be really fucked up right, he receives a message from the System announcing that he's just gained 1000 B Points! Quest line unlocked- North Kingdom Industries! What even, how did this happen. He was hoping being rude would make him not want to interact with him ever again. Instead, every time he does business with their company he insists that he be assisted by Shang Qingshui.

"Are you sure, sir? He's...just an accounts manager, not an assistant or anything." "Which accounts does he handle?" ".....payroll...." "I am interested in acquiring accounts from your company, I'll need to see how the payroll will function. I will require his help."

Shen Tianyu watching the whole thing playing out: "I think he's smitten with you something fierce. Remember how I looked back when Lianhua started coming around back in college?" "Or how Binghe looks at you...all the time?" "Yeah. That's how he looks at you." "....I am actively trying to bully him into leaving me alone." "I guess that's his kink." "Gross." "You're into it, though, I know you are."

Meanwhile Mo Tuxuan doesn't know why he can't stop thinking about the tiny human manager who reminds him a little of someone he knew in his previous life and who takes charge over him and is a wizard with paperwork and accounts payable and every part of him absolutely fills him with desire. The fact that they're both clearly aware how easily he could crush Qingshui and the fact that Qingshui still pushes back against him just makes Tuxuan's crush worse. He finds Shang Qingshui pathetic, not in a sad hamster way like Airplane, but in the epic boyfail way that he acts like he's hardcore and makes way too many unnecessary risks while trying to make himself seem unlikable and accidentally making himself into the cold-blooded rebel punk instead. It's even worse since Qingshui is educated and experienced enough by now that he should totally know better.

New Moshang after the identity reveal like "You killed me!" "And you killed me....." Shang Qingshui just sort of gives him a light backhand "don't say that in such a reverent tone like it's a marriage proposal, sir" But the blush increases bc that backtalk just makes Qingshui HOTTER.

7 notes

·

View notes

Text

Everything You Need to Know About Cosmolex Accounting Software

In today’s fast-paced business world, having the right accounting software is essential for smooth financial management. CosmoLex has emerged as a leading choice for businesses, particularly in the legal and professional services industries, offering comprehensive accounting solutions tailored to specific needs.

This guide will explore why CosmoLex stands out as the best accounting software, detailing its features, benefits, and unique selling points. We will also address common questions to help you understand if CosmoLex is the right tool for your business.

What is CosmoLex?

CosmoLex is a cloud-based accounting software solution designed with professionals in mind, especially those in the legal industry, such as law firms and solo practitioners. With an all-in-one platform, CosmoLex combines essential accounting functions with specialized features that cater to the unique needs of legal professionals. Unlike traditional accounting software, CosmoLex streamlines financial management while also addressing compliance and trust accounting requirements.

With features that extend beyond basic bookkeeping, CosmoLex helps firms manage time tracking, billing, client management, and compliance, all in one integrated system. The software's easy-to-use interface and powerful functionality have made it a go-to solution for professionals looking for efficiency and accuracy in their financial operations.

Key Features of CosmoLex

1. Trust Accounting Compliance

One of CosmoLex’s standout features is its trust accounting capabilities, specifically designed to meet the strict regulations of the legal industry. Trust accounts require meticulous record-keeping to ensure that client funds are handled appropriately. CosmoLex automates the process of tracking client trust balances, generating trust account reconciliations, and ensuring compliance with local bar association rules.

2. Integrated Time Tracking and Billing

CosmoLex combines time tracking and billing into one seamless process, making it easy for law firms to log billable hours and create invoices directly from the platform. This feature helps streamline the billing process, improves accuracy, and ensures that no billable time goes unaccounted for. Whether you need to track time spent on client meetings or specific case tasks, CosmoLex offers a user-friendly interface that simplifies time tracking and invoicing.

3. Comprehensive Financial Management

Beyond its specialized tools, CosmoLex provides full-service accounting capabilities, including accounts payable/receivable management, general ledger, and financial reporting. It allows businesses to manage their financial data accurately, create financial statements, and generate customizable reports that provide insights into their financial health.

4. Automated Bank Reconciliation

CosmoLex automates the process of bank reconciliation, which is crucial for maintaining accurate financial records. By connecting your bank accounting software, transactions are automatically imported, matched, and reconciled. This reduces the manual effort needed for reconciliation and minimizes the risk of human error.

5. Client and Matter Management

CosmoLex offers integrated client and matter management tools that allow you to organize client files, manage documents, and maintain case notes within the same system. This helps legal professionals keep track of all case-related information in one place, ensuring that critical documents are easily accessible when needed.

6. Billing Customization and Payment Processing

The software supports customizable invoice templates and allows you to set payment terms and accept online payments through integrated payment gateways. This feature not only streamlines the billing process but also provides clients with convenient payment options, thereby improving cash flow for the business.

7. Compliance and Security

CosmoLex prioritizes data security with encryption, secure cloud storage, and multi-factor authentication. Compliance is also a key focus, especially for law firms that must adhere to various legal and financial regulations. The platform ensures that all data is protected and compliant with the necessary guidelines for trust accounting.

Benefits of Using CosmoLex

1. All-in-One Solution

One of the major advantages of CosmoLex is that it combines various essential tools into a single platform. This eliminates the need for separate software solutions for accounting, time tracking, billing, and client management, streamlining workflow and reducing administrative overhead.

2. Enhanced Efficiency

CosmoLex’s user-friendly design and automated features help businesses save time on routine tasks. The time tracking, billing, and reconciliation automation allow professionals to focus on their core activities rather than spend valuable time on manual bookkeeping.

3. Accurate and Transparent Reporting

With real-time financial reporting capabilities, CosmoLex helps businesses keep a clear picture of their financial status. Customized financial reports can be generated for better insights, aiding in more informed decision-making and strategic planning.

4. Improved Cash Flow

By enabling easy online payment processing and accurate invoicing, CosmoLex helps businesses improve their cash flow. Clients can pay invoices directly through integrated payment gateways, which helps speed up the collection process.

5. Legal-Specific Features

CosmoLex is specifically designed for legal professionals, so it includes features that cater to the needs of law firms that other generic accounting software might not offer. This includes trust accounting compliance, case management, and billing features tailored for legal services.

How Does CosmoLex Compare to Other Accounting Software?

1. CosmoLex vs. QuickBooks

QuickBooks is one of the most widely used accounting platforms for small to medium-sized businesses. While it offers strong accounting capabilities, it does not provide specialized features tailored for legal professionals, such as trust accounting compliance and integrated client matter management. CosmoLex excels in this area by combining industry-specific tools with general accounting features.

2. CosmoLex vs. Clio

Clio is a popular practice management software for law firms that includes billing, case management, and document storage. However, while Clio does provide some financial features, it lacks full-service accounting capabilities such as automated bank reconciliation and comprehensive financial reporting that CosmoLex offers. CosmoLex integrates these features into one platform, making it an all-in-one solution.

3. CosmoLex vs. Xero

Xero is a well-known accounting software designed for a broad range of businesses. While it offers great financial management tools, it lacks the legal-specific features that CosmoLex has, such as trust accounting compliance and client matter management. For law firms needing specialized accounting and practice management, CosmoLex is the more comprehensive option.

Pros and Cons of Using CosmoLex

Pros:

All-in-One Platform: Combines accounting, time tracking, and client management.

Trust Accounting Compliance: Ideal for law firms that need to manage client trust accounts.

User-Friendly Interface: Easy to navigate, even for those without an accounting background.

Seamless Integration: Works well with payment gateways and other third-party tools.

Automated Features: Time-saving automation for bank reconciliation, billing, and reporting.

Cons:

Cost: CosmoLex can be more expensive compared to simpler, non-specialized accounting software.

Learning Curve: While the interface is user-friendly, new users may still need time to familiarize themselves with all the features.

Not Ideal for Non-Legal Firms: The software is best suited for law firms and may not provide enough value for businesses in other industries.

Final Thoughts

CosmoLex has established itself as one of the best accounting software solutions for legal professionals due to its comprehensive, all-in-one approach. From trust accounting compliance to integrated time tracking and billing, CosmoLex provides the tools needed to manage the financial and operational aspects of a law firm effectively. While it may come at a higher cost compared to simpler accounting software, its specialized features and time-saving automation make it a worthwhile investment for law firms and professional service providers. By choosing CosmoLex, businesses can enhance efficiency, ensure compliance, and focus on delivering excellent services to their clients.

FAQs

What Industries Benefit the most from CosmoLex?

CosmoLex is designed primarily for legal professionals and firms. It is best suited for law firms, solo practitioners, and accounting firms that handle legal trust accounting and billing.

How does CosmoLex Handle Data Security?

CosmoLex employs strong data security measures such as encryption, cloud storage, and multi-factor authentication to protect user data and ensure compliance with industry regulations.

Can I try CosmoLex before Purchasing?

Yes, CosmoLex offers a free trial for potential customers to test out the platform and determine if it fits their business needs.

Does CosmoLex Integrate with other Software?

CosmoLex integrates with popular tools and platforms like Xero, QuickBooks, and payment gateways, ensuring a seamless workflow for users who may need to use additional software for their operations.

Is CosmoLex Suitable for Solo Practitioners?

Yes, #CosmoLex is an excellent choice for solo practitioners who need a comprehensive accounting and practice management solution. Its user-friendly design and specialized features make it ideal for professionals who manage their own practices.

2 notes

·

View notes

Text

Maximize Efficiency with Expert Cash Management Solutions

In today’s fast-paced business environment, effective cash management is crucial for maintaining financial stability and supporting growth. Expert cash management solutions can help businesses streamline their operations, optimize liquidity, and enhance overall financial efficiency. This article explores how leveraging advanced cash management solutions can maximize efficiency and drive business success.

What is Cash Management?

Cash management involves the collection, handling, and use of cash in a business. The goal is to ensure that a company has enough cash on hand to meet its short-term obligations while optimizing the use of its funds. Effective cash management helps businesses avoid liquidity problems, reduce financing costs, and invest surplus cash wisely.

Key Benefits of Expert Cash Management Solutions

Improved Cash Flow Visibility

Expert cash management solutions provide real-time insights into cash flow. By integrating these solutions with your financial systems, you can gain a comprehensive view of your cash position, including incoming and outgoing funds. This visibility allows for better forecasting and planning, helping you anticipate cash needs and avoid potential shortfalls.

Enhanced Liquidity Management

Managing liquidity effectively is essential for ensuring that your business can meet its obligations without holding excessive cash. Advanced cash management tools help optimize liquidity by analyzing cash flow patterns and recommending strategies to manage working capital more efficiently. This includes managing accounts receivable and payable, optimizing cash reserves, and reducing idle cash.

Streamlined Cash Collection and Disbursement

Automated cash management solutions streamline the collection and disbursement processes. For example, electronic invoicing and payment systems can accelerate the receipt of payments, reducing the time it takes to convert receivables into cash. Similarly, automated disbursement systems help manage outgoing payments, ensuring that bills and payroll are processed efficiently and on time.

Enhanced Fraud Prevention and Security

Security is a critical aspect of cash management. Expert solutions offer robust security features to protect against fraud and unauthorized transactions. This includes encryption, multi-factor authentication, and transaction monitoring. By implementing these security measures, businesses can safeguard their cash and reduce the risk of financial losses due to fraud.

Optimized Investment Opportunities

Efficient cash management doesn’t just involve managing daily transactions; it also includes investing surplus cash to generate returns. Expert cash management solutions help identify and evaluate investment opportunities that align with your company’s risk tolerance and financial goals. Whether it’s investing in short-term instruments or managing liquidity portfolios, these solutions provide insights to make informed investment decisions.

Regulatory Compliance

Adhering to regulatory requirements is essential for avoiding penalties and maintaining financial integrity. Advanced cash management systems help ensure compliance with relevant regulations by automating reporting and record-keeping. This includes managing tax-related cash flows, regulatory filings, and maintaining accurate financial records.

Implementing Expert Cash Management Solutions

To maximize efficiency with expert cash management solutions, consider the following steps:

Assess Your Needs

Begin by evaluating your business’s cash management needs. Identify areas where improvements are needed, such as cash flow forecasting, liquidity management, or fraud prevention. This assessment will help you choose the right solutions that align with your business objectives.

Choose the Right Tools

Select cash management solutions that offer the features and functionality you need. Look for tools that integrate with your existing financial systems, provide real-time insights, and offer robust security measures. Consider solutions that are scalable and can grow with your business.

Implement and Integrate

Once you’ve selected the appropriate solutions, implement them within your organization. This may involve integrating the solutions with your current financial systems, training staff on how to use the tools, and establishing processes for managing cash flow effectively.

Monitor and Optimize

Regularly monitor the performance of your cash management solutions to ensure they are delivering the expected benefits. Use the insights provided by these tools to make data-driven decisions, optimize cash flow, and adjust your strategies as needed.

Review and Adjust

Periodically review your cash management practices and solutions to ensure they remain effective. As your business evolves, your cash management needs may change, requiring adjustments to your strategies and tools.

Conclusion

Expert cash management solutions are essential for maximizing efficiency and achieving financial stability in today’s competitive business landscape. By leveraging advanced tools and strategies, businesses can gain better visibility into their cash flow, optimize liquidity, streamline processes, and enhance security. Implementing these solutions helps ensure that your business can meet its financial obligations, invest wisely, and maintain a strong financial position. Embracing expert cash management practices not only improves day-to-day operations but also supports long-term growth and success.

For more details, visit us:

expense tracker software

Expense Management Software

invoice management system

best expense reimbursement software

3 notes

·

View notes

Text

Bookkeeping vs. Accounting: What is the Difference?

Bookkeeping and accounting are two essential functions that come into play when it comes to the management of financial records and the guaranteeing of a business's ability to operate without hiccups. There are substantial distinctions between the two, despite the fact that they are frequently used interchangeably with one another. In this blog post, we will discuss the fundamental distinctions between bookkeeping and accounting, as well as the contributions that each makes to the overall success of organisations operating in a variety of fields. VNC Global, a prominent bookkeeping services provider in Australia with more than a decade of expertise, is familiar with the complexities of these functions and is here to throw light on the distinctions.

The Essence of Bookkeeping:

The practice of maintaining accurate books and records is essential to any viable accounting system. It entails recording and organising in a methodical manner all of the financial transactions that have taken place. Bookkeepers are accountable for keeping records of a company's income and spending, accounts payable and receivable, along with other types of financial transactions, in a manner that is accurate and up to date. Their primary concern is making certain that all of the financial information is correctly recorded, categorised, and archived so that it can be accessed and analysed at a later time.

Key responsibilities of bookkeepers include:

Recording daily financial transactions

Maintaining general ledgers

Handling payroll processing

Managing bank reconciliations

Issuing and recording invoices

Monitoring accounts payable and receivable

Generating financial reports for management review

The Scope of Accounting:

On the other hand, accounting comprises a wider variety of operations related to financial management. It entails analysing, interpreting, and summarising the financial data that bookkeepers have recorded in the books. Accountants make use of this information in order to offer business owners and those in charge of decision-making important insights and strategic recommendations. Their knowledge is vital for ensuring that one may make well-informed judgements regarding one's finances and remain in accordance with applicable tax legislation.

Key responsibilities of accountants include:

Preparing financial statements like income statements, cash flow statements, balance sheets, etc.

Identify patterns and trends by analyzing the financial data

Providing financial advice and strategic planning

Conducting financial audits and ensuring compliance

Assisting in budgeting and forecasting

Tax planning and preparation

Skills and Qualifications:

Bookkeeping and accounting are two separate but related disciplines that demand distinct skill sets and qualifications. Bookkeepers often have extensive knowledge and experience in the areas of data input, and record keeping, and are conversant with accounting software. Although bookkeepers are not often required to have a formal degree, many do have certifications in their field, such as Xero or QuickBooks, to demonstrate their level of expertise.

On the other hand, it is common for employers to need accountants to have a higher degree of education in addition to certain professional certifications. The majority of accountants have degrees in accounting, finance, or other subjects linked to accounting, in addition to certificates like CPA (Certified Public Accountant) or CMA (Certified Management Accountant). Because of their in-depth understanding of fundamental financial concepts and their extensive experience in this area, they are able to deliver useful financial insights and make strategic recommendations for the company.

Timeframe and Frequency:

In most cases, the responsibilities associated with bookkeeping are completed once per day or once per week. It is essential to keep financial records up to date in order to maintain accuracy and ensure that accounting processes proceed without a hitch. In contrast, accounting duties are more periodic in nature and are typically carried out on a monthly, quarterly, or annual basis, depending on the demands of the company and the regulations imposed by the regulatory authorities.

Focus on Compliance and Strategy:

The primary goals of bookkeeping are to keep accurate records and to adhere to the rules and regulations that govern the industry. It lays the framework for proper financial reporting by ensuring that the financial transactions of the company are correctly recorded and organised. On the other side, accounting places a strong emphasis on decision-making, in addition to strategic planning and financial analysis. Bookkeepers generate financial data, which accountants then analyse in order to assist firms in understanding their current financial health, locating areas in which they may improve, and making long-term growth plans.

Final Thoughts:

Even though bookkeeping and accounting are very closely tied to one another, they are used for very different things when it comes to the management of a company's finances. VNC Global, which is regarded among the best bookkeepers services provider in Australia, is aware of the significance of both roles in ensuring the continued prosperity and financial well-being of a wide range of business sectors. Bookkeepers play a crucial role in the recording and organisation of financial data, while accountants offer useful insights and strategic counsel based on the information provided by bookkeepers. Bookkeepers play a fundamental role in documenting and organising financial data.

It is essential for companies that want to optimise their financial operations and make educated decisions to have a solid understanding of the differences between bookkeeping and accounting. VNC Global is your reliable partner, providing outsourced bookkeeping services in Australia. Whether you require accurate record-keeping or extensive financial analysis, VNC Global can provide both. Get in touch with us as soon as possible to take the financial management of your company to new heights.

2 notes

·

View notes

Text

Drive Business Growth with Strategic Accounts Receivable Outsourcing by Rightpath GS

Cash flow is the fuel of business growth, and poor management of receivables can drain it faster than expected. Businesses often face late payments, unstructured follow-ups, and manual errors, leading to reduced liquidity. This is why companies are choosing Rightpath Global Services for reliable accounts receivable outsourcing. Their expert-backed services not only automate the billing cycle but also enhance transparency, consistency, and performance across your finance function.

Rightpath GS offers more than just collections support—it builds a scalable receivables framework tailored to your industry and business model. Whether you're a fast-growing startup or an established enterprise, their team helps you outsource receivables with confidence. From timely invoice generation to intelligent reminders and customer communication, Rightpath GS reduces overdue payments and ensures cash hits your accounts faster. Their agile systems integrate directly with your internal finance tools, enabling you to monitor collections in real time.

What makes Rightpath GS especially effective is its broader financial service suite. Clients benefit from synchronized functions like General Ledger services, accounts payable outsourcing, and financial planning and analysis—ensuring every transaction is tracked, balanced, and optimized. With this end-to-end control, finance teams gain a complete picture of inflows and outflows, allowing for accurate forecasting and smarter decision-making. Their expertise in finance and accounting outsourcing ensures your books are always audit-ready, compliant, and clean.

Receivables, when poorly managed, can cause bottlenecks in budgeting, payroll, and procurement. With Rightpath GS, this risk is minimized. Their process-first approach, combined with automation and skilled professionals, ensures clients experience faster turnaround times and improved collection rates. And when paired with BPO accounting process support, businesses can remove operational inefficiencies and gain the benefits of a leaner, more agile finance department.

0 notes

Text

Transform Your Back Office with Rightpath

What’s the Difference Between Procure-to-Pay and Accounts Payable?

If you’ve ever wondered about the difference between Procure–to–Pay (P2P) and Accounts Payable (AP), you’re not alone. While these terms often get used interchangeably, they cover different parts of the process.

Think of Procure-to-Pay as the full journey – from the moment you realize you need something, to ordering it, receiving it, and finally paying the supplier. It’s the whole cycle.

Accounts Payable is just one piece of that puzzle. It specifically handles the part where invoices are processed, and payments are made. At Right Path, we believe that knowing this difference is the first step toward improving your processes.

What Does “Transformation” Really Mean?

The word “transformation” comes from the Latin word transformare, which means “to change from one form to another.” In business, it means making meaningful changes that help things work better – whether that’s speeding up workflows, cutting errors, or improving the experience for everyone involved.

Transformation isn’t just about using new technology – it’s about rethinking how you work and finding smarter, more efficient ways to get things done.

How AI is Changing the Game for AP

These days, many companies are exploring Artificial Intelligence (AI) to help improve their AP processes. Some have already seen impressive results – like automating invoice data entry, spotting mistakes early, and speeding up approvals. Others are still figuring out how to make AI work for them.

No matter where you are in your journey, AI has the potential to make a big difference – but only if you approach it strategically.

Expert Accounts Payable Services by Right Path: Efficiency & Accuracy

What Does It Take to Transform Your AP Process?

Transformation isn’t a quick fix. It’s a journey with important milestones along the way. To get it right, you’ll want to:

Right Path Global Services Pvt. Ltd.

∙ Understand how your current processes really work and spot where the bottlenecks are (process intelligence).

∙ Use automation to reduce manual work and errors.

∙ Prepare your team for changes and help them adopt new ways of working. ∙ Choose solutions that can grow as your business grows.

∙ Keep an eye on performance with real-time data to keep improving.

When you focus on these areas, your AP function can become faster, smarter, and more aligned with your business goals.

What’s Next?

In the next posts in this series, we’ll explore practical steps, technology tools, and real examples that show how businesses can simplify and improve their AP processes.

For now, ask yourself: Is your AP process working smoothly – or is it slowing you down?

Ready to Take the First Step? Try Our Free P2P Assessment

To help you get started, Right Path Global Services Pvt. Ltd. offers a free Procure-to-Pay (P2P) assessment. Our experts will review your current setup, highlight areas for improvement, and give you clear, actionable recommendations.

Explore our website to learn more and claim your free assessment today.

Let’s take the confusion out of your AP process and turn it into a powerful part of your business success. For more information click here: - https://rightpathgs.com/blogs/

0 notes

Text

Mastering ERP: Essential Training Tips for Beginners and Professionals

Enterprise Resource Planning (ERP) systems have become the backbone of modern business operations. From finance and inventory to human resources and customer management, ERP platforms unify data and processes across departments to improve productivity, accuracy, and decision-making. However, the complexity of ERP software means that both beginners and experienced users need well-structured training to truly master the system.

Whether you're implementing a new ERP solution or looking to enhance your team’s skills, this article outlines essential ERP training tips for both beginners and professionals to ensure smooth adoption, confidence, and long-term success.

Why ERP Mastery Matters

A powerful ERP system is only as effective as its users. Inadequate training can lead to data errors, workflow disruptions, and underutilization of key features. On the other hand, strong ERP knowledge empowers users to work more efficiently, adapt to change, and support business growth.

Mastering ERP helps users to:

Navigate the system confidently

Reduce dependency on IT support

Handle daily operations efficiently

Identify and resolve system-related issues

Leverage advanced features for strategic insight

Tips for ERP Beginners

If you or your team are just starting out with ERP software, the learning curve can be steep. Here’s how to ease the transition:

1. Understand the Big Picture

Before diving into screens and forms, beginners should understand the core purpose of the ERP system and how it supports the business.

Learn about:

How different modules (finance, HR, inventory, etc.) work together

Key business processes and where the ERP fits in

The benefits ERP brings to your specific role

2. Take Role-Based Training

Focus on the features and workflows most relevant to your daily responsibilities. You don’t need to learn everything at once—start with what matters most to your job.

Examples:

Finance users should focus on accounts payable/receivable, reporting, and general ledger tasks.

Warehouse staff need training on inventory transactions and logistics.

Sales reps should concentrate on CRM, order entry, and customer data.

3. Use Hands-On Practice

Theory is important, but real understanding comes through doing. Use a test environment or sandbox to practice tasks in a safe, no-risk setting.

Practice tasks might include:

Entering and editing transactions

Running reports

Navigating the user interface efficiently

4. Ask Questions and Use Support Resources

Don’t be afraid to ask questions. Engage with trainers, ERP champions in your company, or help desk teams. Leverage user guides, FAQs, and video tutorials for quick answers.

Tip: Keep a personal list of “how-tos” for daily tasks to refer back to.

5. Start with the Basics and Build Up

Start with foundational tasks and gradually expand your knowledge. Avoid overwhelm by focusing on core tasks first, then exploring advanced functions once you're confident.

Tips for ERP Professionals and Power Users

If you're already familiar with ERP basics, it’s time to build deeper expertise and become a resource for others in your organization.

1. Explore Advanced Features and Analytics

Many ERP systems offer powerful tools that are underused. Professionals should learn to:

Build custom dashboards and KPIs

Automate recurring tasks and approvals

Use forecasting and budgeting tools

Create advanced reports with data visualization

Tip: Attend vendor webinars or certification courses to stay up to date.

2. Understand System Configuration and Workflow Logic

Going beyond user tasks, experienced users should understand how and why the system works the way it does.

Study:

How workflows are set up and approved

How data flows between modules

How configurations affect outcomes (e.g., tax settings, inventory valuation methods)

3. Stay Updated on System Changes

ERP systems are regularly updated with new features, UI changes, or security enhancements. Staying current ensures you're using the system optimally and training others accurately.

Strategies:

Subscribe to vendor newsletters or release notes

Participate in user communities or forums

Attend annual ERP user conferences if available

4. Mentor and Train Others

Experienced ERP users play a key role in user adoption. Becoming an internal trainer or ERP champion not only reinforces your own knowledge but helps elevate team performance.

Ways to contribute:

Host lunch-and-learns or mini training sessions

Create quick-reference guides for coworkers

Offer to shadow new users and answer questions

5. Track and Analyze System Use

Use built-in ERP tools or reports to monitor usage and identify inefficiencies. You can help your team optimize processes by spotting bottlenecks or recommending improvements.

Example: Noticing repeated invoice errors? Consider additional training or revising the input process.

General Best Practices for All ERP Learners

Whether you're a novice or an advanced user, the following principles apply across all skill levels:

Be patient. ERP mastery doesn’t happen overnight. Continuous learning is key.

Document as you learn. Maintain a personal or shared log of helpful processes.

Practice regularly. Like any tool, proficiency improves with consistent use.

Keep learning. ERP systems evolve—your skills should too.

Focus on impact. Always connect your training back to how it supports business outcomes.

Final Thoughts

Mastering ERP is a journey—not a one-time event. With the right training, both beginners and experienced professionals can fully leverage the power of ERP to streamline operations, reduce errors, and make smarter decisions. Whether you're entering your first invoice or building advanced reports, these training tips will help you build confidence and contribute to your organization’s success.

Investing time in ERP mastery isn’t just good for personal development—it’s essential for driving efficiency, improving collaboration, and supporting long-term business growth.

Contact Info

1 Westbrook Corporate Center, Westchester, IL 60154, US

(708) 722–5385

0 notes

Text

Accounting Services for Small Business in US

Running a small business is no easy task. From managing operations and marketing to customer service and logistics, entrepreneurs juggle many responsibilities daily. However, one of the most critical — yet often overlooked — aspects of running a business is accounting. Whether you're a solo entrepreneur, a startup founder, or a growing company, understanding and utilizing professional Accounting Services for Small Business in US can be a game-changer.

In this blog post, we will explore what accounting services involve, why they're essential for small businesses, the types of Small Business Bookkeeping Services in US, and how to choose the right provider to ensure your financial success.

Why Are Accounting Services Crucial for Small Businesses?

Accounting is more than just keeping records. It is the foundation of good business management. Accurate financial records help business owners:

Understand cash flow

Track expenses and income

Make data-driven decisions

Stay compliant with tax laws

Avoid costly mistakes and penalties

Despite these benefits, many small business owners either handle bookkeeping themselves or assign it to someone without the right expertise. This can lead to inefficient processes, missed deductions, and inaccurate financial reporting.

This is where Accounting Services for Small Business in US become vital. These services not only ensure accurate record-keeping but also provide strategic insights that help small businesses grow.

What Do Accounting Services for Small Business in US Include?

Most professional accounting firms offer a range of services tailored to the needs of small businesses. Here’s what’s typically included:

1. Bookkeeping

Bookkeeping is the process of recording all financial transactions. It’s the most fundamental accounting function and includes:

Managing accounts payable and receivable

Reconciling bank statements

Recording sales and purchases

Handling payroll entries

Using Small Business Bookkeeping Services in US ensures that your daily financial transactions are recorded accurately and consistently.

2. Financial Reporting

Professional accountants prepare detailed financial statements such as:

Balance Sheets

Income Statements (Profit & Loss)

Cash Flow Statements

These reports are essential for understanding your business’s financial health.

3. Tax Preparation and Filing

Accounting services also include tax planning, preparation, and filing. This is especially valuable for small businesses in the US, where tax codes and laws frequently change. Proper tax filing reduces the risk of audits and ensures you maximize eligible deductions.

4. Payroll Processing

Managing payroll in-house can be time-consuming and error-prone. Accounting services offer payroll management that includes:

Employee payments

Tax withholdings

Payroll reporting

This ensures compliance with federal and state employment laws.

5. Budgeting and Forecasting

Accountants can help small business owners prepare budgets, forecast revenue, and plan for the future. This is an often-overlooked part of financial planning but is critical for long-term success.

Types of Small Business Bookkeeping Services in US

Bookkeeping services can vary depending on your industry, business size, and financial complexity. Here are some common types of Small Business Bookkeeping Services in US:

1. Manual Bookkeeping

Some businesses still maintain physical records or use spreadsheets to track income and expenses. While this might work for micro-businesses, it is time-consuming and prone to errors.

2. Online Bookkeeping Software

Cloud-based accounting software such as QuickBooks, Xero, and FreshBooks allow small business owners to automate much of their bookkeeping. These tools also integrate with banks, POS systems, and payroll platforms.

3. Outsourced Bookkeeping Services

This is where a third-party provider handles your bookkeeping. It’s ideal for business owners who want accuracy, convenience, and cost-efficiency. Outsourcing Small Business Bookkeeping Services in US provides access to expert accountants without the overhead of hiring in-house.

Benefits of Hiring Professional Accounting Services for Small Business in US

1. Saves Time

Business owners can spend more time on core operations and less time managing finances.

2. Improves Accuracy

Professional accountants use industry standards and best practices to ensure data accuracy.

3. Ensures Compliance

Tax laws in the US are complex. A professional accountant ensures that your business stays compliant with all federal, state, and local regulations.

4. Supports Business Growth

With proper financial insights, business owners can make informed decisions about scaling, hiring, pricing, and marketing.

5. Cost-Effective

While hiring an accountant might seem like an added expense, it often saves money by avoiding late fees, penalties, or costly financial mistakes.

Choosing the Right Small Business Bookkeeping Services in US

Finding the right provider for Small Business Bookkeeping Services in US can feel overwhelming. Here are a few tips to help you choose wisely:

1. Look for Experience

Choose a service provider with experience in your industry. Different sectors have different accounting requirements.

2. Check Credentials

Ensure your provider is certified. In the US, look for CPAs (Certified Public Accountants) or experienced bookkeepers with proper accreditation.

3. Understand Their Technology

Your accounting partner should use modern tools and offer cloud-based services so that you can access data anytime, anywhere.

4. Assess Communication

Choose someone who explains financial matters in a clear, understandable way. Good communication is key to a healthy business relationship.

5. Ask About Scalability

As your business grows, your accounting needs will change. Choose a firm that can scale their services accordingly.

How to Integrate Accounting Services Into Your Business

Here’s a step-by-step guide to integrating professional Accounting Services for Small Business in US into your operations:

Evaluate Your Current Process

Identify where your current accounting system falls short. Are you behind on tax filings? Are reports inconsistent?

Set Your Budget

Determine how much you can spend on accounting services. Remember, this is an investment, not an expense.

Find a Reputable Service

Search online for “Small Business Bookkeeping Services in US” or “Accounting Services for Small Business in US” and review ratings, testimonials, and service offerings.

Onboard Gradually

Start with basic services like bookkeeping and tax filing. As trust builds, you can add payroll, budgeting, and forecasting.

Review and Adjust

Review your financial reports monthly and adjust your accounting strategy as your business grows.

Popular Accounting Software for Small Businesses in US

Many small business owners use accounting software alongside professional services. Some of the most trusted platforms in the US include:

QuickBooks Online: Ideal for all types of small businesses with features like invoicing, payroll, and tax reporting.

Xero: Known for its clean interface and great integrations.

FreshBooks: Great for freelancers and service-based businesses.

Zoho Books: Budget-friendly with strong automation capabilities.

Using software in combination with Small Business Bookkeeping Services in US enhances accuracy and allows for real-time financial tracking.

Common Mistakes to Avoid in Small Business Accounting

Even with expert help, there are some common pitfalls business owners should avoid:

Mixing Personal and Business Finances: Always maintain separate accounts for clarity and compliance.

Not Backing Up Data: Use cloud services or secure local backups to avoid data loss.

Ignoring Reports: Don’t just generate financial reports — use them to inform business decisions.

Delaying Tax Preparation: Start early and keep documentation ready to avoid last-minute stress.

Conclusion: Invest in Your Financial Success

Professional Accounting Services for Small Business in US are no longer a luxury — they are a necessity. With rising competition, tighter regulations, and ever-changing tax laws, small businesses need reliable, accurate, and strategic financial services more than ever.

Whether you choose a local CPA, an outsourced firm, or a tech-savvy virtual bookkeeping service, integrating Small Business Bookkeeping Services in US into your operations will boost efficiency, increase profits, and set your business on the path to long-term success.

Don’t let poor accounting hold your business back. Take control of your finances today — and watch your business grow tomorrow. Need help finding the best Accounting Services for Small Business in US? Let us connect you with trusted providers who understand your business and deliver the financial clarity you need to thrive.

0 notes

Text

Rightpath GS bridging resource gaps in finance departments

Rightpath GS is more than just an outsourcing firm—it’s a strategic growth partner for finance functions. Focused on end-to-end finance and accounting transformation, Rightpath GS offers a broad portfolio of services, including Accounts Payable, Accounts Receivable, General Ledger, Record to Report, and Financial Planning & Analysis. Their value lies in blending automation technologies with human expertise, giving businesses the speed and precision required to compete in today’s fast-paced market.

What distinguishes Rightpath GS is its ability to design bespoke solutions tailored to each client’s challenges and scale. Whether a company is undergoing digital transformation, expanding globally, or simply seeking greater operational efficiency, Rightpath GS aligns its services to the client’s maturity level and industry demands. The result? Enhanced cash flow, reduced cycle times, better compliance, and empowered decision-making.

Their delivery model combines the best of both worlds: onshore responsiveness and offshore scalability. This hybrid approach ensures 24x7 service continuity and real-time resolution of issues. Moreover, Rightpath GS emphasizes data transparency through dashboards and KPIs, enabling CFOs to track operational health and make timely interventions.

Technology is at the heart of their delivery. With tools like RPA, OCR, and AI-powered analytics, Rightpath GS simplifies repetitive tasks, increases accuracy, and frees up internal teams for more strategic initiatives. Their reporting dashboards provide granular insight into financial metrics and workflow performance.

In addition to process efficiency, Rightpath GS emphasizes governance, security, and compliance. They work within global regulatory frameworks and offer controls to support audits, reducing risk and ensuring accountability. Their success spans across industries such as logistics, pharma, retail, and IT.

Whether it’s reducing overheads or enabling faster financial closings, Rightpath GS helps clients achieve tangible business outcomes. With a proven track record, agile approach, and continuous improvement culture, they have become a reliable engine for finance excellence.

For businesses seeking a long-term partner that understands both finance and innovation, Rightpath GS is the name to remember.

0 notes

Text

Top Industries Benefiting from Outsourced Accounting Services

Managing finances is one of the most critical yet challenging aspects of running a business. As companies strive to streamline operations and focus on their core functions, outsourced accounting services have emerged as a game-changing solution. Whether you're a startup or a growing enterprise, outsourcing your accounting needs can significantly reduce overhead, improve accuracy, and drive business growth.

In this blog, we’ll explore what outsourced accounting services are, their benefits, how they work, and why partnering with a professional firm like Capthical is the best choice.

What Are Outsourced Accounting Services?

Outsourced accounting services refer to hiring a third-party firm or agency to handle your business’s accounting and financial tasks. Instead of maintaining an in-house accounting team, businesses rely on external experts for services like bookkeeping, payroll processing, tax preparation, accounts payable/receivable, and financial reporting.

This strategic move not only helps reduce operational costs but also gives businesses access to experienced professionals, advanced tools, and a scalable solution for managing finances.

Benefits of Outsourced Accounting Services

There are numerous advantages to outsourcing your accounting functions. Below are some of the most impactful benefits:

1. Cost-Effective Financial Management

Outsourcing eliminates the need for full-time in-house accountants, saving businesses money on salaries, benefits, training, and infrastructure. You only pay for the services you use.

2. Access to Expertise

By choosing outsourced accounting services, you gain access to a team of highly skilled professionals who are up to date with the latest financial regulations, accounting standards, and industry trends.

3. Focus on Core Business Activities

With your finances in the hands of experts, you and your team can focus on what matters most — growing your business, improving customer service, and innovating products or services.

4. Improved Accuracy and Compliance

Professional accounting firms use sophisticated tools and double-check systems to ensure accuracy. They also help you stay compliant with tax regulations and financial laws, reducing the risk of audits or penalties.

5. Scalability and Flexibility

As your business grows, so do your financial needs. Outsourced accounting services are easily scalable — you can increase or reduce the scope of services as required without hiring new employees.

Types of Outsourced Accounting Services Offered

Outsourcing providers like Capthical offer a wide range of financial services tailored to meet diverse business needs:

1. Bookkeeping Services

Routine bookkeeping tasks like data entry, ledger management, and bank reconciliations are handled efficiently and accurately.

2. Payroll Processing

Managing employee payments, deductions, tax filings, and salary disbursements are part of comprehensive payroll services.

3. Tax Preparation and Filing

Outsourced accounting firms prepare accurate tax reports and ensure timely filing, helping you maximize deductions and remain compliant.

4. Financial Reporting and Analysis

Receive monthly, quarterly, and yearly financial reports that help you make informed business decisions.

5. Accounts Payable and Receivable Management

Keep track of your incoming and outgoing payments with expert handling of invoices, payments, and collections.

Why Businesses Are Switching to Outsourced Accounting Services

The shift to outsourced accounting isn’t just a trend — it’s a necessity for modern businesses. Here's why so many companies are making the switch:

Remote-friendly and digital-ready services allow seamless financial operations, even when working virtually.

Automation and cloud-based tools reduce manual errors and speed up financial workflows.

Custom packages are available to fit businesses of all sizes — from solopreneurs to enterprises.

Real-time financial insights provide better visibility into your company's performance.

How Capthical Excels in Outsourced Accounting Services

At Capthical (https://capthical.com/), we understand that managing your business finances requires more than just crunching numbers. Our outsourced accounting services are designed to deliver value, transparency, and scalability.

Here’s what sets us apart:

✅ Industry Experience

Our team comprises certified accountants and financial professionals with years of experience across various industries.

✅ Customized Solutions

We don't believe in one-size-fits-all. Whether you need end-to-end accounting or just monthly bookkeeping, we tailor our solutions to your exact needs.

✅ Advanced Technology

We use the latest cloud-based accounting software and tools to offer secure, real-time access to your financial data.

✅ Compliance and Accuracy

Our experts ensure full compliance with local and international financial regulations, giving you peace of mind and error-free reporting.

✅ Transparent Pricing

No hidden fees or surprises — our pricing is competitive and clear, making it easy for you to budget effectively.

Choosing the Right Partner for Outsourced Accounting Services

Before selecting a service provider, consider these key factors:

Reputation and client testimonials

Technology and tools used

Availability and communication

Industry expertise

Security and data protection measures

Capthical ticks all the boxes, making us your ideal partner in outsourcing financial functions.

Industries That Benefit from Outsourced Accounting Services

Outsourced accounting isn’t limited to any specific industry. It’s beneficial across:

E-commerce and retail

Healthcare and medical practices

IT and software companies

Manufacturing and logistics

Professional services (law firms, consultants)

Startups and growing businesses

No matter your industry, Capthical can customize accounting services to suit your unique requirements.

Take the Stress Out of Accounting — Partner with Capthical

If managing your accounts is draining your time and resources, it’s time to explore the benefits of outsourced accounting services. At Capthical, we offer expert financial solutions that help you stay compliant, accurate, and financially healthy — all while letting you focus on business growth.

🚀 Ready to transform your financial operations? 👉 Get in Touch with Capthical Today! 📞 Schedule a Free Consultation 📧 Contact Us for Customized Accounting Solutions

Let Capthical handle your books so you can handle your business!

0 notes

Text

Why More Businesses Are Choosing Accounting Outsourcing Companies in India

Managing your company's finances takes more than just number crunching — it requires precision, expertise, and the right tools. That’s why an increasing number of businesses across the globe are turning to accounting outsourcing companies in India. These firms offer a perfect blend of skilled manpower, advanced technology, and cost-efficiency to help organizations handle their financial operations more effectively.

India has earned a solid reputation as a trusted outsourcing destination. With highly qualified professionals and services that align with global accounting standards like IFRS and GAAP, Indian accounting firms provide dependable support across various financial functions.

Key Reasons to Outsource Accounting to India

Here’s why outsourcing your accounting functions to India is a smart move:

Affordable Services Save up to 70% on operational costs by outsourcing to India compared to maintaining in-house finance departments in the West.

Access to Financial Experts Work with certified professionals such as Chartered Accountants, CPAs, and tax consultants.

Use of Latest Software Indian firms are proficient with tools like QuickBooks, Xero, Zoho Books, SAP, and Tally.

Data Security Top companies comply with ISO and GDPR standards, ensuring the safety and confidentiality of your financial data.

Strategic Focus Outsourcing frees up internal teams so you can focus on growing your core business.

Services Offered by Indian Outsourcing Firms

The range of services provided is comprehensive and customizable:

Bookkeeping and financial record management

Payroll processing and compliance

Accounts payable and receivable

Tax filing (Income Tax, GST, TDS)

Financial reporting and analytics

Budgeting and cash flow forecasting

Year-end audit support

Industries That Rely on Accounting Outsourcing

Indian firms serve clients from a wide array of sectors, including:

IT and Software Development

Retail and E-commerce

Real Estate and Construction

Healthcare and Life Sciences

Manufacturing and Supply Chain

Travel, Hospitality, and Entertainment

Tips for Choosing the Right Outsourcing Company

Before you commit to any provider, keep these tips in mind:

Check their client portfolio and domain expertise

Ask about the technology stack they use

Ensure strong data protection policies are in place

Look for flexible pricing models and transparent processes

Read client testimonials or ask for case studies

What’s the Future of Accounting Outsourcing in India?

India’s accounting industry is rapidly evolving with the integration of AI, machine learning, and cloud technologies. These tools are helping outsourcing companies deliver real-time insights, faster reporting, and more accurate financial forecasting. This evolution only strengthens India's position as a global leader in outsourced finance and accounting services.

FAQs

Q: Why are Indian accounting outsourcing companies so popular? They combine expert knowledge, modern tech, and lower costs—making them ideal partners for global businesses.

Q: Will my financial data be safe? Yes, most firms follow strict data protection protocols and compliance standards.

Q: Are Indian firms trained in international accounting standards? Absolutely. Professionals in India are well-versed in IFRS, GAAP, and even US taxation systems.

Q: Can I outsource only a part of my accounting work? Yes. Most services are scalable and customizable to fit your business needs.

Final Thought

Whether you’re a startup or a large enterprise, teaming up with accounting outsourcing companies in India can help you save time, reduce costs, and ensure that your finances are handled professionally. The right partner will offer you peace of mind and a stronger foundation for business growth

1 note

·

View note

Text

What Makes the BPO Accounting Process So Effective?

The BPO accounting process allows businesses to delegate routine accounting tasks to specialized third-party providers. This includes handling accounts payable, receivables, payroll, and General Ledger activities. By outsourcing these functions, companies can reduce costs, improve accuracy, and increase operational focus.

BPO providers use automation, standardized workflows, and trained professionals to deliver fast and reliable accounting services. The process is particularly helpful for businesses expanding quickly or facing regulatory complexity. Outsourcing key financial functions gives them more flexibility and a stronger internal focus on growth.

When paired with financial planning and analysis, the BPO accounting process transforms reactive finance functions into proactive decision-making tools. Businesses gain insight into their current financial status and can make more strategic plans for the future.

Whether you're managing procurement outsourcing or balancing accounts receivable outsourcing, a well-structured BPO accounting process creates a strong foundation. It ensures that all parts of your financial operations work in sync, helping you maintain compliance and scale with confidence.

0 notes

Text

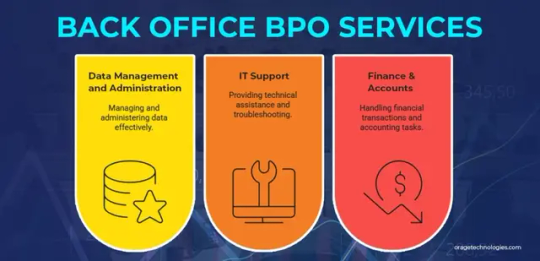

What is Back Office BPO: Benefits & Revenue Generation

While Front Office BPO is widely recognized for customer-facing roles, Back Office BPO encompasses critical internal operations like data management, IT support, finance, and HR. This blog explores what Back Office BPO entails, its key services, benefits, revenue models, and the human capital required for success.

What is Back Office BPO?

Back-office business Process Outsourcing (BPO) involves delegating non-core, internal tasks to specialized service providers. These tasks, such as accounting, payroll, data entry, and IT support, are essential for operations but do not directly engage customers or drive strategic goals. Industries like telecommunications, healthcare, real estate, and government agencies frequently leverage Back-Office BPO to streamline processes.

Key Back Office BPO Services

Below are the primary services offered under Back Office BPO:

Data Management and Administration

This involves handling tasks like data entry, form processing, and claims management, either manually or through automation. Service providers ensure ethical data collection, organization, and security, enabling front-end teams to focus on strategic priorities.

IT Support

Non-client-facing IT functions, such as troubleshooting software issues, maintaining hardware, and managing network infrastructure, are outsourced to specialists. These providers implement data protection, recovery procedures, and ticket management systems for efficient issue resolution.

Finance & Accounting

Service providers manage non-core financial tasks, including accounts payable/receivable, budgeting, forecasting, and audit report preparation. They ensure compliance with regulations, delivering accurate and timely financial reports.

Benefits of Back Office BPO

Back Office BPO creates mutual value for companies and service providers, with options for onshore or offshore outsourcing based on needs and expertise.

For Companies

Cost Savings: Outsourcing reduces overhead costs (salaries, infrastructure, equipment) by 20-25% for onshore and 40-60% for offshore, depending on location and task complexity.

Access to Expertise: Specialized talent standardizes workflows, improving accuracy and scalability to meet seasonal or growth demands.

Risk Mitigation: Providers ensure compliance, reducing operational risks, and maintain backup systems for disaster recovery.

Focus on Core Goals: Delegating back-office tasks frees leadership to prioritize strategic initiatives.

For Service Providers

Stable Revenue: Timely delivery builds credibility, fostering long-term contracts and predictable income.

Business Growth: A flexible approach allows providers to diversify services (e.g., finance, HR), increasing ROI.

Global Credibility: Offshore providers benefit from currency exchange advantages, while onshore providers gain contracts through faster, compliant implementation.

Referrals: Strong relationships attract new clients through word-of-mouth and cross-selling.

Revenue Generation in Back Office BPO

Back Office BPO is a profitable model for both parties, driven by financial and operational efficiencies.

For Companies

Cost Reduction: Manpower costs drop by 30-35% (onshore) or 50-60% (offshore). IT and infrastructure savings reach 65-70%, while hiring and training costs are eliminated.

Productivity Gains: Outsourcing boosts efficiency by 15-25%, allowing leadership to focus on strategy and innovation.

Intangible Benefits: Streamlined operations enhance decision-making and delegation effectiveness.

For Service Providers

Service Fees: Revenue comes from recurring fees or per-seat/hourly rates, with performance-based incentives tied to KPIs.

Scalability: Shared costs across multiple processes (e.g., technology, training) improve margins.

Client Acquisition: Long-term partnerships and referrals expand business opportunities, enhancing global reputation.

Human Capital Required

Effective Back Office BPO relies on skilled personnel at both the company and service provider levels.

For Companies

Contract Managers: Experienced staff to oversee third-party agreements.

Operations Team: A small team to address daily service provider queries.

Accounts Team: Personnel to verify and approve invoices.

Stakeholder Managers: Segment heads to ensure collaboration success and stakeholder satisfaction.

For Service Providers

Process-Specific Staff: For example, data management requires data entry operators, team leads, quality analysts, and operations managers.

Support Functions: HR and admin teams provide essential support for operational efficiency.

Leadership: Heads of departments advise, manage, and deliver outputs while maintaining stakeholder relationships.

Overview

Back Office BPO fosters a win-win partnership, driving economic growth by creating jobs locally and globally. The hierarchy typically includes front-line agents (handling tasks like data entry), supervisors (coaching teams), operations managers (overseeing process improvements and quality), and accounting teams (managing transactions). Leadership ensures strategic alignment and stakeholder satisfaction, making Back Office BPO a cornerstone of operational efficiency.

0 notes

Text

SAP FICO Interview Questions and Answers for Freshers

The Financial Accounting and Controlling (FICO) module in SAP ERP functions as an essential component which organisations use to handle financial operations and generate reports. Interview preparation for freshers who want to enter this field requires both fundamental knowledge of essential concepts and familiarity with typical interview questions. The following guide provides SAP FICO interview questions for freshers along with precise answers to support your interview success.

1. What is SAP FICO?

The term SAP FICO represents Financial Accounting (FI) and Controlling (CO) modules. Through the FI module, organisations handle financial transactions and general ledger operations as well as accounts payable and receivable management, together with asset accounting functions. The CO module supports cost and profit centre accounting, internal orders, and profitability analysis. The combined modules enable organisations to optimise financial management and reporting operations.

2. What are the key components of the SAP FI module?

The SAP FI module contains several key components, which include the following elements:

General Ledger (GL): The system controls financial accounting data and produces financial statements through this component.

Accounts Payable (AP): This system component controls the process of vendor payments, together with their associated liabilities.

Accounts Receivable (AR): The system uses this module to handle customer billing operations and payment collections.

Asset Accounting (AA): This system part tracks the whole lifecycle of fixed assets together with their depreciation values and disposal records.

Bank Accounting: This module controls all bank operations, together with bank statement reconciliation.

Travel Management: This system component monitors employee travel-related costs.

Special Purpose Ledger: This system component enables advanced reporting functions.

3. What are the main components of the SAP CO module?

The SAP CO module includes:

Cost Element Accounting: Tracks costs and revenues by category.

Cost Centre Accounting: Manages costs for organisational units.

Profit Centre Accounting: Evaluates profitability for business segments.

Internal Orders: Monitors costs for specific projects or tasks.

Product Cost Controlling: Calculates costs for manufacturing products.

Profitability Analysis (CO-PA): Analyses profitability by market segments.

4. What is the difference between SAP FI and SAP CO?

SAP FI concentrates on external financial reporting, which ensures organisations follow accounting rules such as GAAP and IFRS. This module tracks all transactions used in creating financial statements. SAP CO provides internal management reporting capabilities that enable organisations to plan and monitor their costs while controlling their profitability. The financial accounting module FI needs to be implemented for all organisations, but the managerial accounting module CO remains optional.

5. What is a Fiscal Year Variant in SAP FICO?

The foundation of a financial year organisation stands in Fiscal Year Variants, which define both posting periods and special periods for year-end adjustments. SAP uses this system to decide how financial transactions should be posted. The configuration of a non-calendar fiscal year variant applies to a fiscal year that begins in April and ends in March.

6. What is a Company Code in SAP?

A Company Code functions as the base organisational unit in SAP FI, which enables the maintenance of a complete set of accounts for external financial reporting. The company code functions as a legal entity which receives a chart of accounts assignment, and currency assignment, and a fiscal year variant assignment.

7. Explain the term "Chart of Accounts."

The Chart of Accounts (CoA) represents a precisely organised inventory of all general ledger accounts a company uses in its financial reporting activities. A Chart of Accounts exists in SAP through its connection to a company code and contains account numbers together with descriptions and account types such as assets and liabilities and revenues, and expenses.

8. What is a Posting Key in SAP FICO?

A Posting Key in SAP consists of a two-digit number which defines both the transaction type and the account classification (customer/vendor/general ledger). The posting key "40" indicates debit entries for G/L accounts, and "50" represents credit entries.

9. What is a Document Type in SAP?

SAP uses Document Types to organise various accounting records, which include invoices and payment documents, and journal entries. Examples include:

SA: General Ledger document,

KR: Vendor invoice,

DR: Customer invoice. Each document type controls the account types allowed and the number range for document numbers.

10. What is the purpose of the General Ledger in SAP FI?

The General Ledger (G/L) functions as a complete financial record of all company transactions, which shows its financial status. Through its functionality, the system enables immediate financial reporting and balance sheet generation while maintaining adherence to accounting standards.

11. What is a Cost Centre in SAP CO?

Organisations establish Cost Centres to record expenses which occur in specific units like departments (e.g., HR, IT). The system enables organisations to monitor and distribute their expenses through budgeting and internal reporting. The Cost centres receive their definition through the CO module while they connect to G/L accounts in FI.

12. What is the difference between a Cost Centre and a Profit Centre?

A Cost Centre tracks expenses for specific organisational units, focusing on cost control. A Profit Centre evaluates revenue and expenses to determine profitability for a business segment. While cost centres are cost-focused, profit centres are profit-focused.

13. What is an Internal Order in SAP CO?

An Internal Order is used to monitor costs for specific projects, events, or tasks with a defined duration. It helps track expenses and can be assigned to cost centres, assets, or other objects upon completion.

14. What is the purpose of the House Bank in SAP?

A House Bank represents a company’s bank account in SAP, used for managing payments, receipts, and bank reconciliations. Each house bank is linked to a bank account and a company code.

15. What is the Automatic Payment Program (APP) in SAP?

The Automatic Payment Program (APP) in SAP Financial Accounting provides automated processing for vendor payments. The system identifies invoices ready for payment, then creates payment recommendations and executes payments via bank transactions or checks, or other payment methods, thus reducing processing time and minimising errors.

16. What is Depreciation in SAP Asset Accounting?

The process of depreciation involves distributing an asset's cost throughout its operational duration. SAP uses depreciation calculations through straight-line and declining balance methods to generate financial reports by posting results to the General Ledger.

17. What is a Field Status Group in SAP? The Field Status Group manages how G/L account master data fields appear during transaction posting by determining their mandatory status or optional or suppressed status. The system maintains data standardization and business rule adherence. 18. What is the difference between a Company and a Company Code in SAP? A Company serves as a main organizational structure which unifies several company codes for financial consolidation. A Company Code represents a legal entity which produces independent financial statements and belongs to one company for reporting purposes. 19. What is Parallel Accounting in SAP? The SAP system enables businesses to maintain different accounting standards (such as IFRS and GAAP) through its Parallel Accounting feature. The system implements separate ledgers for each accounting standard. 20. How do you create a Vendor Master Record in SAP? A Vendor Master Record can be established through these steps: Enter the transaction code XK01 within SAP. Provide the company code and purchasing organization information for the vendor. Enter the vendor general information including name and address alongside company code payment terms and purchasing details when needed. The system will generate a vendor number after saving the record. FICO SAP interview preparation as a fresher requires mastering basic concepts and practicing typical questions to reach success. This blog provides essential SAP Financial Accounting and Controlling basics through questions about Company Codes and Charts of Accounts and Cost Centers and Automatic Payment Programs. The topics measure both your technical proficiency and your ability to apply SAP FICO functions to actual business operations. You should combine this knowledge with practical experience in SAP environments whenever possible and remain informed about current SAP developments to succeed in your interview. Prepare to describe how SAP FICO works together with other modules to achieve organizational objectives. The combination of confidence and clarity together with your eagerness to learn will set you apart from others. Good luck with your SAP FICO career and achieve success in your interview without difficulty.

0 notes

Text

How Rightpath GS Enhances Accounts Payable Services for Smarter Financial Management

Efficient financial operations are the backbone of any successful business. However, manual and outdated processes often lead to delays, errors, and compliance risks. This is why companies today are turning to specialists like Rightpath GS for accounts payable services that are accurate, scalable, and cost-effective. As a leader in finance and accounting outsourcing, Rightpath GS helps businesses simplify their payables and improve overall cash flow.

Outsourcing your payables isn’t just about saving time—it’s about gaining control over your financial processes. Rightpath GS offers comprehensive accounts payable outsourcing solutions that handle everything from invoice capture and approvals to payment processing and vendor reconciliation. With built-in compliance checks and automation tools, they ensure your accounts are always audit-ready and error-free. Their accounts payable outsourcing companies model integrates seamlessly with client systems, maintaining transparency and giving real-time access to financial data.