#Wisconsin Newspaper Association Awards

Text

Wausau Pilot earns five Wisconsin Newspaper Association Awards

Wausau Pilot & Review

The Wisconsin Newspaper Association honored the work of newspapers across the state including Wausau Pilot & Review during its 2023 Better Newspaper Contest Awards Banquet on Friday, March 15, at The Madison Concourse Hotel in downtown Madison.

The 2023 contest received 2,144 entries from 102 newspapers. Eligible entries were published between Sept. 1, 2022, and Aug. 31,…

View On WordPress

0 notes

Text

A conservative Wisconsin newspaper publisher is no doubt hoisting a cold one to a local jury that has ordered a brewery-owning liberal activist to pay $750,000 in the state's largest defamation judgment.

The previous record for a libel suit in Wisconsin was $450,000, said James Friedman, the attorney for the Wisconsin Newspaper Association.

On Friday, an Oneida County jury took only three hours — including a lunch break — to order Minocqua Brewing Co. owner Kirk Bangstad to pay $750,000 for defaming Lakeland Times publisher Gregg Walker in posts on the brewery's popular social media outlets.

Among other things, the 13-member jury found Bangstad had smeared Walker by calling him a "crook" and a "misogynist."

Bangstad, who operates a federal super PAC, also was found to have defamed Walker by claiming in a Facebook post that he had engaged in elder abuse and committed other crimes against family members so that he could inherit the newspaper business.

Under the jury verdict, Bangstad and his brewery are to pay $320,000 in compensatory damages, and Bangstad is to pay $430,000 in punitive damages out of his own pocket for his Facebook post about crimes against family members. The jury concluded Bangstad acted with "malice" with that Aug. 22, 2022, post.

Bangstad, who ran unsuccessfully as a Democrat for the Wisconsin Assembly in 2020, declined to discuss the case. The Lakeland Times' editorial page is conservative.

"I'll talk to the Journal Sentinel, but I would prefer not to talk to you," Bangstad told columnist Daniel Bice of the Milwaukee Journal Sentinel, part of the USA TODAY Network. Bangstad's super PAC recently asked state Supreme Court's new liberal majority to eliminate funding for the state's four taxpayer-funded school voucher programs and independent charter schools.

Minocqua Brewing owner Bangstad vows to appeal verdict

On Facebook, he said he would appeal the jury verdicts.

"I have to trust that Wisconsin’s Judicial System — its appellate system in particular — will ultimately be 'just' in this case," Bangstad wrote. "I have to believe this because I still believe in America, Wisconsin, and our institutions."

"And years ago, before Donald Trump, Tucker Carlson, Sarah Palin, Rush Limbaugh, and Fox News, our institutions, because they were strong and trusted by our citizens, were the envy of the world."

On Friday, he put it more bluntly, attacking Oneida County Circuit Judge Leon Stenz: "The long and the short of it is this Oneida County judge had it in for us."

Matthew Fernholz, the attorney for Walker, said he was pleased with the jury's conclusions.

"We feel like it was a solid jury verdict," Fernolz said. "It should be upheld."

Friedman, the Wisconsin Newspaper Association lawyer, said at least two cases have logged $450,000 awards, the previous record for the state, including a 1992 case against the Milwaukee Sentinel and a more recent one over a book claiming the 2012 Sandy Hook school shooting never happened.

"I'm quite certain there's never been like a million-dollar verdict in Wisconsin in a defamation case," said Friedman, an attorney at Godfrey & Kahn. "So I think this is the biggest one now."

What's interesting about the case — in addition to the amount of the jury verdict — is the role of the newspaper in the case.

Usually, a paper is the target of a libel suit, not the one bringing it.

"I'm not recalling a newspaper or news outlets suing someone for defamation," said Kathleen Bartzen Culver, an associate journalism professor at the University of Wisconsin-Madison. "Nothing is leaping to my mind."

Minocqua Brewing known for 'Progressive Beer' like 'Bernie Brew'

Bangstad has drawn attention for his outspoken political stances, hanging a giant "Biden/Harris" sign outside the brewery and battling with local government bodies.

He started selling "Progressive Beer" with names like "Bernie Brew" and "Fair Maps" in 2020, and he launched the Minocqua Brewing Co. SuperPAC in 2021.

The PAC has funded a lawsuit against the Waukesha School District for removing COVID precautions and another alleging three Wisconsin Republicans conspired to keep Democrat Joe Biden from becoming president.

Walker and Lakeland Printing Co. brought the defamation case against Bangstad and Minocqua Brewing in May 2021 after Walker became a frequent target of Bangstad on his popular social media outlets, where he often posts about Wisconsin politics.

Minocqua Brewing has 82,000 followers on Facebook. Bangstad soon started raising money off the litigation.

In its verdict, the jury found Bangstad and his brewery owed $40,000 for calling Walker a "crook," and $40,000 for calling him a "misogynist." The jury said Walker deserved $200,000 in compensatory damages for the post about his family and $430,000 in punitive damages.

33 notes

·

View notes

Photo

UW-Milwaukee student wins Collegiate Journalist of the Year Award

JAMS student Patricia McKnight received the first place award for the 2020 Collegiate Journalist of the Year from the Wisconsin Newspaper Association. Congrats, Patricia!

1 note

·

View note

Text

Selection 3 (Online): Native America Today

https://nativeamericatoday.com/

Native America Today (NAT) is a website which means to represent and spread news and perspectives of Native American communities. The site is associated with numerous other Native American organizations including Native American Media and NFIC (News from Indian Country). NFIC is itself an award-winning newspaper that is headquartered in Northern Wisconsin. NAT works to open avenues for equality and opportunity for Native Americans.

The website includes a list of hundreds of past and upcoming Pow Wows as well as other cultural events. In the month of August 2019, Wisconsin will contain two Pow Wow events. The community resources tab at the top of the site leads to another list of thirty categories of organizations which represent Native American interests. The names of some categories includes, ‘Educational Organizations’, ‘Elder and Senior Services’, and ‘Food and Recipes’ among many others.

Native American culture is manifold, and most of us living here today know so little about it. I remember learning about Native American tribes, history, and geography in elementary school, but the subject wasn’t part of my curriculum from seventh grade through Senior year of high school. Such an integral part of our land’s history should be explored more thoroughly than it has been, especially considering Native Americans have inhabited the United States’ space for many times more years than the United States has been a country. Evidence shows that village life has been present in the North American Southwest since around 2000 AD.

Pueblos began to be constructed around 750-900 AD

Like Deborah Willis’ book “Picturing Us: African-American Identity in Photography”, NAT is attempting to reclaim their history for themselves. “Picturing Us” features depictions of African-American culture as curated by white people to tell a story which alienates white people from African-American people as well as African-American people from themselves. Willis is critical of these propagandistic photographs and includes, in opposition, photographs taken by black people depicting their own culture.

NAT features articles which are meant to shed light on Native American culture, history and mythos. A top article explores a Vancouver church which has recently begun integrating Native American traditions into their belief system. Rev. Scheeler acknowledges that the appearance of their ceremonies is unimportant, but that they are “simply tools to connect: to connect us, to connect us to the creator”. People of Mohawk, Yakama, and Nez Pearce tribes attend the church.

All Saints Episcopal Church

- “History of North America.” History World, www.historyworld.net/wrldhis/PlainTextHistories.asp?historyid=aa78.

- “Native American News.” Native America Today, nativeamericatoday.com/.

- “Vancouver-Area Church Uses Christian, Indigenous Traditions.” Native America Today, 28 May 2019, nativeamericatoday.com/vancouver-area-church-uses-christian-indigenous-traditions/.

- Willis, Deborah, editor. Picturing Us: African-American Identity in Photography. Diane Publishing, 2006.

0 notes

Text

Lorraine Hansberry

Lorraine Hansberry was an author and activist known for writing the play A Raisin In The Sun. Lorraine is the youngest American and first Black playwright to win a New York's critics' Circle Award. A Raisin In The Sun was the first play produced on Broadway by an African-American woman.

Born May 19, 1930 in Chicago, IL, Hansberry was the youngest of four children raised by her parents, Nannie Louise and Carl Hansberry. In the mid 1930s, the Hansberry family migrated to a predominantly White housing development where they were taunted and harassed relentlessly. Confident in their rights, the family refused to move even after being urged to do so. The discrimination culminated in the US Supreme Court case of Hansberry v. Lee which ruled racially restrictive covenants illegal. Lorraine, only 10 years old at the time of the case, learned the power of standing for the rights of the oppressed.

Lorraine Hansberry briefly attended University of Wisconsin in Madison where she studied writing, but eventually withdrew her enrollment after 2 years to live in New York. While living in New York, Lorraine continued her studies at The New School. At The New School, Lorraine balanced life as a full time student, waitress, and associate editor of Paul Robeson’s newspaper, Freedom. In 1956, Lorraine quit her daytime occupations and committed herself to being a writer full time.

During this period of her life, Hansberry wrote The Crystal Stair, a play about a struggling black family in Chicago, which was later renamed A Raisin in the Sun, a line from a Langston Hughes poem. A Raisin in the Sun debuted on Broadway in 1959, making it the first play produced on Broadway by an African-American woman. Lorraine is the youngest American and first Black playwright to win a New York's critics' Circle Award. Unfortunately, her triumphs were complicated by homophobia and discrimination. After being outed as a lesbian, Hansberry became more secluded. During the early 60's, Lorraine became a prominent and passionate activist accompanying other well-known Black figures. In 1965, Hansberry's life was cut short by pancreatic cancer.

Lorraine Hansberry's legacy is continued by her grandniece Taye Hansberry renowned fashion icon, lifestyle blogger, and creator of StuffSheLikes.com.

#lorraine hansberry#activist#black lives matter#blm#chicago#lgbtq#womens history#modern history#Equality for HER

1 note

·

View note

Text

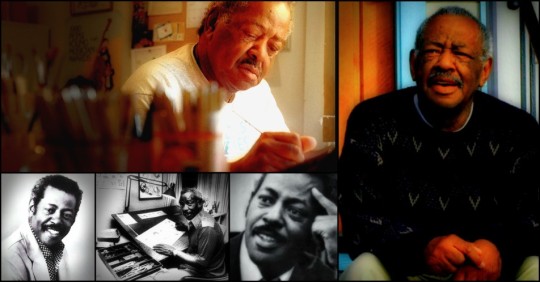

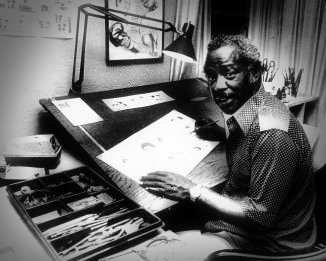

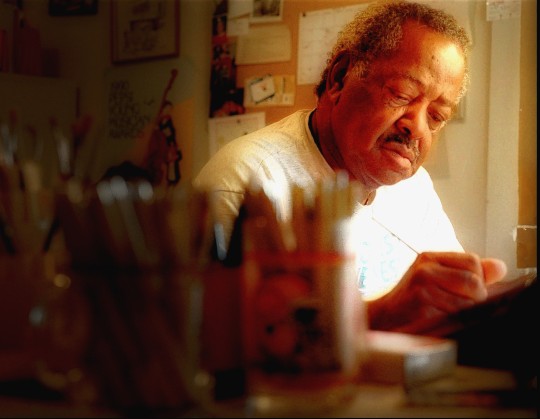

Morrie Turner

Morris Nolton "Morrie" Turner (December 11, 1923 – January 25, 2014) was an American cartoonist, creator of the strip Wee Pals, the first American syndicated strip with an integrated cast of characters.

Biography

Turner was raised in Oakland, California, the youngest child of a Pullman porter father and a homemaker and nurse mother.

Turner got his first training in cartooning via the Art Instruction, Inc. home study correspondence course. During World War II, where he served as a mechanic with Tuskegee Airmen, his illustrations appeared in the newspaper Stars and Stripes. After the war, while working for the Oakland Police Department, he created the comic strip Baker's Helper.

When Turner began questioning why there were no minorities in cartoons, his mentor, Charles M. Schulz of Peanuts fame, suggested he create one. Morris' first attempt, Dinky Fellas, featured an all-black cast, but found publication in only one newspaper, the Chicago Defender. Turner integrated the strip, renaming it Wee Pals, and in 1965 it became the first American syndicated comic strip to have a cast of diverse ethnicity. Although the strip was only originally carried by five newspapers, after Martin Luther King's assassination in 1968, it was picked up by more than 100 papers.

In 1970 Turner became a co-chairman of the White House Conference on Children and Youth.

Turner appeared as a guest on the May 14, 1973, episode of Mister Rogers' Neighborhood, where he showed the host pictures he had drawn of several of his neighbors. Turner also presented a clip from his Kid Power animated series, which was airing Saturday mornings on ABC at the time. As well, during the 1972-73, Wee Pals on the Go was aired by ABC's owned-and-operated station in San Francisco, KGO-TV. This Sunday morning show featured child actors who portrayed the main characters of Turner's comic strip: Nipper, Randy, Sybil, Connie and Oliver. With and through the kids, Turner explored venues, activities and objects such as a candy factory and a train locomotive.

As the comic strip continued, Turner added characters of more and more ethnicities, as well as a child with a physical disability.

During the Vietnam War, Turner and five other members of the National Cartoonist Society traveled to Vietnam, where they spent a month drawing more than 3,000 caricatures of service people.

Turner contributed his talents to concerts by the Bay Area Little Symphony of Oakland, California. He drew pictures to the music and of children in the audience. On May 25, 2009, Turner visited Westlake Middle School in Oakland to give a lesson to the OASES Comic Book Preachers Class of drawing. Turner collaborated with the class's students to create the book Wee the Kids from Oakland.

Turner died on January 25, 2014, at age 90.

Personal life

Turner married Letha Mae Harvey on April 6, 1946; they collaborated on "Soul Corner," the weekly supplement to Wee Pals. Morrie and Letha had one son, Morrie Jr; Letha died in 1994. Late in life, Turner's companion was Karol Trachtenburg of Sacramento.

Turner was an active member of the Center for Spiritual Awareness, a Science of Mind church in West Sacramento, California.

Tributes

The Family Circus character of Morrie, a playmate of Billy and the only recurring black character in the strip, is based on Turner. Family Circus creator Bil Keane created the character in 1967 as a tribute to his close friend.

Awards

In 2003, the National Cartoonists Society recognized Turner for his work on Wee Pals and others with the Milton Caniff Lifetime Achievement Award.

Throughout his career, Turner was showered with awards and community distinctions. For example, he received the Brotherhood Award from the National Conference of Christians and Jews and the Inter-Group Relations Award from the Anti-Defamation League of Bnai Brith. In 1971, he received the Alameda County (California) Education Association Layman's Annual Award.

In 2000, the Cartoon Art Museum presented Turner with the Sparky Award, named in honor of Charles Schulz.

Turner was honored a number of times at the San Diego Comic-Con: in 1981, he was given an Inkpot Award; and in 2012 he was given the Bob Clampett Humanitarian Award.

Bibliography

Wee Pals

collections

Wee Pals That "Kid Power" Gang in Rainbow Power (Signet Books, 1968) ASIN B002T6NAOG

Wee Pals (Signet Books, 1969) ASIN B003ZUKTLW — introduction by Charles M. Schulz

Kid Power (Signet Books, 1970), ASIN B001IKPRM2

Nipper (Westminster Press, 1971), ASIN B002IY2XOM

Nipper's Secret Power (Westminster Press, 1971) ISBN 978-0-664-32498-8

Wee Pals: Rainbow Power (Signet Books, 1973) ASIN B000M8UYII

Wee Pals: Doing Their Thing (Signet Books, 1973) ASIN B00129HWKO

Wee Pals' Nipper and Nipper's Secret Power (Signet Books, 1974) ASIN B001M5GOOS

Wee Pals: Book of Knowledge (Signet Books, 1974) ISBN 0451058003

Wee Pals: Staying Cool (Signet Books, 1974) ISBN 0451060768

Wee Pals: Funky Tales (New American Library, 1975) ASIN B00072KLVE

Wee Pals: Welcome to the Club (Rainbow Power Club Books, 1978) ASIN B003VC7JQW

Choosing a Health Career: Featuring Wee Pals, the Kid Power Gang (Dept. of Health, Education, and Welfare, Public Health Service, Health Resources Administration, 1979), ASIN B0006XCLLC

Wee Pals: A Full-Length Musical Comedy for Children or Young Teenagers (The Dramatic Publishing Company, 1981) ASIN B0006XW1I0

Wee Pals Make Friends with Music and Musical Instruments: Coloring Book (Stockton Symphony Association, 1982) ASIN B00072YGD8

Wee Pals, the Kid Power Gang: Thinking Well (Ingham County Health Department, 1983) ASIN B0007259DY

Wee Pals Doing the Right Thing Coloring Book (Oakland Police Department, 1991) ASIN B0006R4G98

Explore Black History with Wee Pals (Just us Books, 1998) ISBN 0940975793

The Kid Power Gang Salutes African-Americans in the Military Past and Present (Conway B. Jones, Jr., 2000), ASIN B0006RSDC4

Willis and his Friends

Ser un Hombre (Lear Siegler/Fearon Publishers, 1972) ISBN 0822474271

Prejudice (Fearon, 1972) ASIN B00071EIOG

The Vandals (Fearon, 1974) ASIN B0006WJ9JU

Other books

A Funny Thing Happened on the Way to Freedom (Ross Simmons, 1967) ASIN B0007HK27W

Black and White Coloring Book (Troubadour Press, 1969) — written with Letha Turner

Right On (Signet Books, 1969)

Getting It All Together (Signet Books, 1972)

Where's Herbie? A Sickle Cell Anemia Story and Coloring Book (Sickle Cell Anemia Workshop, 1972) ASIN B00BKQ85LE

Famous Black Americans (Judson Press, 1973) ISBN 0817005919

Happy Birthday America (Signet Book, 1975) ASIN B000RB1SGM

All God's Chillun Got Soul (Judson Press, 1980) ISBN 0817008926

Thinking Well (Wisconsin Clearing House, 1983), ASIN B00072F9E8

Black History Trivia: Quiz and Game Book (News America Syndicate, 1986) ASIN B000727N5Q

What About Gangs? Just Say No! (Oakland Police Department, 1994) ASIN B0006R58TA

Babcock (Scholastic, 1996) — by John Cottonwood and Morrie Turner, ISBN 059022221X

Mom Come Quick (Wright Pub Co., 1997) — by Joy Crawford and Morrie Turner, ISBN 0965236838

Super Sistahs: Featuring the Accomplishments of African-American Women Past and Present (Bye Publishing Services, 2005), ISBN 0965673952

Wikipedia

3 notes

·

View notes

Text

Existing Coin/Bullion Sales Tax Exemptions Under Attack

Right now, five states do not impose any state sales taxes (Alaska, Delaware, Montana, New Hampshire, Oregon) and 32 have complete or partial sales tax exemptions on the in-state retail sales of precious metals bullion and rare coins.

On July 1, West Virginia’s sales tax exemption on precious metals bullion and rare coins go into effect. It is possible that, before the end of 2019, there may be another state that adopts such a sales tax exemption. When West Virginia’s exemption is effective, that will leave only the states of Arkansas, Hawaii, Kansas, Kentucky, Maine, Mississippi, Nevada, New Jersey, New Mexico, Tennessee, Vermont, and Wisconsin and the District of Columbia that assess sales taxes on all retail sales of precious metals bullion and rare coins.

However, a disturbing trend is emerging as a consequence of the U.S. Supreme Court’s decision in June 2018 in South Dakota v. Wayfair. State governments may be able to require a greater number of out-of-state sellers to begin collecting sales tax on transactions beyond those businesses that already do. To accomplish this, state legislatures and treasury departments are enacting legislation and establishing regulations with varying thresholds above which out-of-state retailers would be required to register to collect sales taxes.

The acts of adopting legislation and regulations that impact out-of-state retailers is also leading state governments to review their existing sales tax exemptions and tax credits, with an eye toward finding additional sources of increased tax collections.

Already in 2019, the states of Nebraska, Ohio, and Washington have proposed eliminating existing sales tax exemptions on retail sales of precious metals bullion and retail sales. In these instances, the proposed change was part of a larger plan to restructure taxes that assumes the elimination of this exemption would result in a net increase in sales tax collections. (Note: as I write this, the exemptions are still in effect in these states.)

If doing only a static analysis, the prospect of collecting higher sales taxes appears to be a no-brainer. If a state imposes sales tax on merchandise that was previously exempt from the tax, then there will be higher tax collections on such products.

However, a static analysis is flawed. When tax laws change, people alter their financial behavior. Therefore, a dynamic analysis would present a better picture of the combined impact on all tax collections. When I led the effort that resulted in the 1999 adoption of a precious metals bullion and rare coins sales tax exemption in Michigan, I projected that the Michigan Treasury would realize higher tax collections despite forsaking the sales tax collections on bullion and coin sales. Later, I documented that the Michigan Treasury not only collected more sales taxes and other taxes as a result of the exemption, the results were greater than I projected.

In 2016, the Industry Council for Tangible Assets (ICTA), with my assistance, conducted a national coin dealer survey that confirmed that sales tax exemptions on precious metals bullion and rare coins resulted in higher tax collections!

How is it possible that when a state government gives up an existing amount of tax collections, the result could be higher total tax receipts?

With respect to precious metals bullion and rare coins, here is the answer.

Virtually all coin dealers sell other merchandise besides bullion and coins. They may sell jewelry, antiques, a variety of other collectibles, and hobby supplies. The ICTA survey found that the in-state retail sales of coins and bullion in states with sales tax exemptions were about 10 times the dollar volume per dealer than for dealers in states where bullion and coin sales are subject to sales tax. As dealers experience this growth in their in-state bullion and coin sales, they also sell a greater quantity of other products on which sales taxes are collected.

When volume increases for coin dealers, that encourages some other existing businesses to expand into this market and for other people to open new coin dealerships. This also results in higher sales of merchandise other than precious metals bullion and rare coins. In the ICTA survey, the increase in such sales tax collections on sales of other merchandise from existing and new coin dealers replaced about 2/3 of the lost sales tax collections on bullion and coins.

As in-state coin dealers enjoy more sales volume, they hire more employees. In Michigan, for instance, industry employment more than doubled after 1999. The Michigan Treasury did a research study in the 1990s concluding that 38.5% of Michigan payrolls were spent on merchandise on which Michigan sales tax was collected. The increased industry payrolls thus generated increased sales tax collections that almost certainly exceeded 100% of the sales tax collections lost from the exemption. As a bonus, those states that also had an income tax ended up collecting more of those taxes as payrolls increased.

The hospitality industry, including hotels and restaurants, collects more sales taxes when they have higher sales volume. The trend for a number of years has been for more and larger coin shows to be held in states with exemptions and fewer shows with smaller attendance in states without exemptions. Organizations such as the American Numismatic Association and Central States Numismatic Society have policies to hold future conventions only in states that have adopted sales tax exemptions for precious metals bullion and rare coins. Therefore, adopting such a sales tax exemption results in higher sales tax collections by the hospitality industry.

As a result of these factors, a state government that adopts a sales tax exemption on precious metals bullion and rare coins ends up collecting higher total sales taxes. As a bonus, depending on a state’s tax structure, it will also collect more individual income taxes and business taxes from the industry and also generates more of these tax collections for the hospitality industry.

The problem is that legislators do not understand the dynamics of how a tax exemption could actually result in higher tax collections. The staff at the state government fiscal agencies and treasury and revenue department may understand conceptually how this may happen, but they mostly don’t have access to “acceptable methodology” to make a dynamic tax analysis. They may use the State Tax Analysis Modeling Program (STAMP®) software but would need to input accurate date to get a valid result. Therefore, state governments could easily consider eliminating a precious metals bullion and rare coins sales tax exemption because of inaccurate or incomplete data and analyses.

By the way, the four states that have repealed precious metals bullion and rare coins sales tax exemptions in the past (Colorado, Florida, Louisiana—twice, and Ohio) have later re-enacted the same or similar exemptions. A major reason the exemptions were restored is that the state government discovered after the fact that revoking the exemption resulted in lower total sales tax collections and declines in other tax receipts as well. In Florida, for example, so many coin shows closed or moved to other states that the decline in sales taxes collected by the hospitality industry exceeded the gain in new sales taxes on precious metals bullion and rare coins sales.

Sadly, out of ignorance of how the dynamics of the precious metals bullion and rare coins industry functions, there is a good prospect that other state governments may soon consider revoking their sales tax exemptions. In order to devote resources to protecting existing exemptions, ICTA staff were unable to devote as much time to supporting efforts in other states seeking to gain such exemptions.

The more states that do not impose sales taxes on the retail sales of precious metals bullion and rare coins, the easier it is to gain exemptions in other states (and help protect those in states that already have exemptions). Since many coin dealers now face the prospect of having to register to collect sales taxes in multiple other states, they have a stronger incentive than ever to join ICTA and help expand the organization’s efforts. If you are a dealer who is not a current ICTA member, you owe it to your future livelihood to go to https://www.ictaonline.org/join-icta and join now. (Full disclosure: I have been the treasurer and a member of the board of directors of ICTA since 2002.)

Patrick A. Heller was the American Numismatic Association 2018 Glenn Smedley Memorial Service Award, 2017 Exemplary Service Award 2012 Harry Forman Dealer of the Year Award, and 2008 Presidential Award winner. He was also honored by the Numismatic Literary Guild in 2017 and 2016 for the Best Dealer-Published Magazine/Newspaper and for Best Radio Report. He is the communications officer of Liberty Coin Service in Lansing, Michigan and writes Liberty’s Outlook, a monthly newsletter on rare coins and precious metals subjects. Past newsletter issues can be viewed at http://www.libertycoinservice.com. Some of his radio commentaries titled “Things You ‘Know’ That Just Aren’t So, And Important News You Need To Know” can be heard at 8:45 AM Wednesday and Friday mornings on 1320-AM WILS in Lansing (which streams live and becomes part of the audio and text archives posted at http://www.1320wils.com).

The post Existing Coin/Bullion Sales Tax Exemptions Under Attack appeared first on Numismatic News.

0 notes

Text

Anton Media Group earned 12 awards in New York Press Association’s Better Newspaper Contest. Back row, from left: President Frank Virga, Publisher Angela Susan Anton, Dave Gil de Rubio, Jennifer Fauci, Alex Nunez; front row: Elizabeth Johnson, Kimberly Dijkstra, Christina Claus, Barbara Barnett, Anthony Murray

The New York Press Association (NYPA) held its annual spring conference in Albany this past weekend and presented 546 prestigious awards to members of the journalism community. Competing with other community newspapers across the state, Anton Media Group earned 12 awards for editorial, design and advertising excellence.

“I’m exceptionally proud that my talented staff received much deserved recognition at NYPA this year,” Publisher Angela Susan Anton said. “We strive to produce the highest quality community journalism and luxury content for our Gold Coast readers.”

Music aficionado Dave Gil de Rubio is a regular contributor to Anton’s arts and entertainment publication Long Island Weekly in addition to being editor of Garden City Life and Syosset-Jericho Tribune. For his pieces titled “Walking Down Memory Lane With Judd Apatow,” “Dare To Be Different,” “The Jazz Loft: A Long Island Music Mecca,” “Photographer Blows Hot And Cold,” and “Elliot Murphy: Suburban Bard Comes Home,” judges awarded him third place for Coverage of the Arts in Division 1 and said, “Excellent writing and layout. Diverse coverage, consistent quality.”

Former managing editor Betsy Abraham took third place for Best News Story in Division 1 for her Westbury Times article “Pets4Luv Hunts For New Home.” Judges said, “Pets4Luv story is very well written and certainly makes us feel the pressures that the shelter, volunteers and critters, had to go through.”

This slideshow requires JavaScript.

Editor Anthony Murray and ace reporter Kimberly Donahue investigated the issue of aggressive panhandling at the Mineola train station and published a three-part series last June in Mineola American—“Homelessness In Mineola,” “Enforcement At The Train Station,” and “Finding The Solution.” The judges offered these positive and constructive remarks for the third place winner of Best Feature Story, Division 1: “Three-part series on homelessness, including panhandling at train station; the village board’s proposal to curb the problem; and options in the community to help the homeless. The writers present the problem well and get voices of government and social service networks into the conversation, but would have been a stronger entry by including the voice of a homeless person.”

In the category of Best Editorials, Division 1, web editor Kimberly Dijkstra earned first place for her editorials titled “Arms for Teachers,” “Kenneling Children Is Un-American” and “Suppression Depression.” The judges said, “Incredibly strong starts that kept me going throughout. Hit me in the face with the strong argument right away.”

Judges from the Wisconsin Press Association offered many kind comments about the entries. Judges said, “Very well-done series on an unusual instance of NIMBY. Makes me want to know what happened next,” about Elizabeth Johnson’s medical marijuana dispensary series under the management of former editor-in-chief Steve Mosco. The Manhasset Press articles—“Medical Marijuana Company Seeks Manhasset Storefront,” “Demonstration Set Against Medical Marijuana Dispensary,” “Town Sets Hearing Date For Zoning Legislation,” “No Toking Over the Town Line” by Frank Rizzo, and “In North Hempstead, A No-Pot Zone” by Frank Rizzo—took first place for Coverage of Local Government, Division 1.

Following a recent win at Fair Media Council’s FOLIO awards, Port Washington News Magazine earned second place at NYPA. Judges had this to say about the company-wide collaborative effort helmed by executive editor Jennifer Fauci and art director Alex Nuñez: “You never get a second chance to make a first impression. You impressed with your gate fold cover and consistency throughout your entry. A lot of attention to detail and effort. Congratulations.”

Nuñez contributed his own original artwork to the magazine’s feature on Bay Walk Park. The watercolor earned first place in for Best Graphic Illustration, Division 1, and these remarks from the judges: “I like the original art rendering of the venue used in this capacity because it gives a real life representation of the location, so you get an overview of where you are and what the area has to offer. Plus it’s great artwork.”

Nuñez also created a house ad for Massapequa Observer that won third place in Division 1 for Best House Ad. Judges said, “Fun photo and bright, inviting colors. Good promotion.”

Long Island Weekly lead designer Barbara Barnett took second place in the Division 2 Graphic Illustration category for her eye-catching “Diner Drinks Decoded.” The judges said, “I love the clean and colorful magazine style use of the art in this section. Combined with the content it creates an easy to read article.”

Finally, senior artist Caren Donatelli took home three awards. Donatelli earned first place for Large Space Ad, Division 1, for an Umanoff Boyer Agency ad. Judges said, “Nice layout and use of space. Clever use of imagery.” She earned an honorable mention in the same category for a Cat Diggity Dog ad, with these comments: “Adorable! Attractive, easy to read and attention grabbing! Great use of the entire space.” And she was awarded third place for Best Advertising Campaign, Division 1, for a series of ads for Guttermans, prompting the judges to say, “The text is positioned well within the images and the overall ad campaign is clean, clear and cohesive.”

Anton Media Group brought home 12 awards from the New York Press Association's Better Newspaper Contest, a prestigious contest for community newspapers throughout the state. Check out which entries earned us top recognition. The New York Press Association (NYPA) held its annual spring conference in Albany this past weekend and presented 546 prestigious awards to members of the journalism community.

0 notes

Text

Wausau Pilot and Review wins 4 statewide newspaper association awards

We couldn't be more proud. What a great way to celebrate our 2-year anniversary!

WAUSAU PILOT AND REVIEW

MADISON, Wis. — Wausau Pilot and Review won four statewide newspaper association awards Thursday, including three first-place prizes.

The awards were announced Thursday at the Wisconsin Newspaper Contest Awards Banquet in Madison.

Shereen Siewert, founder and editor of Wausau Pilot and Review, won first-place awards in the investigative reporting, reporting on local…

View On WordPress

0 notes

Photo

#WCW😘💨❤️💛💚 Mama Jamala Rogers currently resides in St Louis, MO where she has devoted all of her adult life to creating a child-centered, family-oriented community–one that embraces, celebrates and protects human rights for all citizens regardless of race, ethnicity, class, gender, sexual orientation or religion. Because of the persistent barriers to this goal, it has naturally led her to being a leader in the struggle for justice, equality and peace. Jamala has held and currently holds leadership and membership in several organizations that share her vision for a more just and peaceful world. She is committed to a radical transformation of society where all peoples, especially children, can reach their full potential and prosper Jamala is also deeply involved in the development of women and increasing their full participation in society. She works tirelessly on issues such as health, violence and reproductive rights. Jamala has challenged the criminal industrial complex for decades focusing on police violence, prison reform, wrongful convictions and the death penalty. She is associated with the exonerations of several Missouri men and women including Ellen Reasonover, Joseph Amrine and Darryl Burton. Currently, she is the coordinator for the Justice for Reggie Clemons Campaign, an inmate on Missouri’s Death Row who many believe has been wrongfully convicted and sentenced to death Jamala has done presentations on classism, racism, sexism and heterosexism while promoting alliance-building across issues and social movements. She is available for speaking engagements Jamala is a featured columnist for the award-winning St. Louis American newspaper, St. Louis’ largest black weekly and is on the editorial boards of BlackCommentator.com and The Black Scholar. She has authored many articles for both local and national publications on issues that she is passionately involved in. She has received numerous awards and citations for her commitment to racial justice and gender equity. Jamala was an Alston-Bannerman fellow and is the 2017 Activist-in-Resident at the University of Wisconsin-Madison Jamala is the author of Ferguson is America: Roots of Rebellion

0 notes

Text

Lorraine Hansberry

Lorraine Hansberry

Author & Activist

Lorraine Hansberry was an author and activist known for writing the play A Raisin In The Sun.

Born May 19, 1930 in Chicago, IL, Hansberry was the youngest of four children raised by her parents, Nannie Perry and Carl Hansberry. In the mid 1930s, the Hansberry family migrated to a predominantly White housing development where they were taunted and harassed relentlessly. Confident in their rights, the family refused to move even after being urged to do so. The discrimination culminated in the US Supreme Court case of Hansberry v. Lee which ruled racially restrictive covenants illegal. Lorraine, only 10 years old at the time of the case, learned the power of standing for the rights of the oppressed.

Lorraine Hansberry briefly attended University of Wisconsin in Madison where she studied writing, but eventually withdrew her enrollment after 2 years to live in New York. While living in New York, Lorraine continued her studies at The New School. At The New School, Lorraine balanced life as a full time student, waitress, and associate editor of Paul Robeson’s newspaper, Freedom. In 1956, Lorraine quit her daytime occupations and committed herself to being a writer full time.

During this period of her life, Hansberry wrote The Crystal Stair, a play about a struggling black family in Chicago, which was later renamed A Raisin in the Sun, a line from a Langston Hughes poem. Lorraine is the youngest American and first Black playwright to win a New York's critics' Circle Award. Unfortunately, her triumphs were complicated by homophobia and discrimination. After being outed as a lesbian, Hansberry became more secluded. During the early 60's, Lorraine became a prominent and passionate activist accompanying other well-known Black figures. In 1965, Hansberry's life was cut short by pancreatic cancer.

3 notes

·

View notes

Text

Men's Soccer: Ohio State's season ends with 4 | soccer

Penn State women's soccer advanced to the second round of the NCAA tournament with a 7-0 win over Stony Brook on a bitterly cold Friday night at Jeffrey Field.

Corvallis senior David Nazario-Avalos and his teammates will be looking to bring home the Spartans' first boys soccer state title since 2009 on Saturday.

Six members of the Bradley soccer team received All-Missouri Valley Conference recognition during the annual MVC Soccer Awards Reception on Thursday night.

The Wisconsin women's soccer team took that to another level on Friday night, knocking off Toledo, 5-0, in the opening round of the NCAA tournament at the McClimon Complex.

MADISON, Wis. - Most teams hope to start a postseason off strong.

Motivation has not been lacking for the Corvallis High boys soccer.

Girls soccer: Fleetwood, Gov Mifflin continue title trek.US soccer star Hope Solo says former FIFA president Sepp Blatter grabbed her buttocks as they prepared to take the stage at an awards ceremony in 2013, the Portuguese newspaper Expresso reported.

The Southern New Hampshire University women's soccer team won its first-ever NCAA Division II tourney game on Friday.

But it didn't prevent SDSU's season from ending the the way it began, with a loss to the Bruins.

Laura Freigang netted a hat trick in the first half and Frankie Tagliaferri netted a pair of her own in the final 10 minutes of action as the Nittany Lions advanced to the second round of the NCAA Tournament with a 7-0 drubbing of Stony Brook.The Cape Breton University Capers men's soccer team advanced to the semifinals on the U Sports championship with a 3-0 win over University of Quebec Montreal on Thursday.

The University of Toledo women's soccer team saw its season come to an end at the hands of Wisconsin in the first round of the NCAA tournament on Friday.

Arizona and No. 2 UCLA. Here's how the action went: Arizona 2, TCU 1.

Fifth-seeded William and Mary beat top-seeded James Madison 1-0 Friday night in a Colonial Athletic Association semifinal at Sentara Park in Harrisonburg.

The Indiana men's soccer team defeated Ohio State in the semifinals of the Big Ten tournament on Saturday, ending the Buckeyes' 2017 season.

The Columbia College men's team defeated Central Baptist 2-0 on Friday at R. Marvin Owens Soccer Field to win the American Midwest Conference Tournament championship for the eighth time in program history.

This season has been history in the making for the Highland Park High School boys soccer program.

UF forward Melanie Monteagudo scored her first goal of the season on Friday against South Alabama in the first round of the NCAA Tournament.

No matter the route a team takes, the road to a state title is a perilous one.

The 2017 NCAA women's soccer tournament got underway Friday.

0 notes

Text

Update on coins, precious metals sales tax exemptions

As of right now, 37 states have either no state sales taxes at all (Alaska, Delaware, Montana, New Hampshire, and Oregon) or have complete or partial sales tax exemptions on the in-state retail sales of coins and precious metals bullion. That may soon change.

All ten of the most populous states and 17 of the 20 most populous have such exemptions, so that well over 80% of the nation’s residents have such an exemption where they live.

Last Friday, the West Virginia legislature overwhelmingly passed a coins and precious metals sales tax exemption (33-0 in the Senate and 90-9 in the House). It now awaits the governor’s signature to take effect on July 1.

A legislative committee in Tennessee has already passed a similar exemption bill. On March 13, the first legislative committee in Arkansas considered such legislation. There have also been coins and precious metals exemption bills introduced in the legislatures in Kansas, Maine, and Wisconsin.

Because of my past career as a certified public accountant and in leading Michigan’s effort to gain a coin and precious metals sales tax exemption in 1999, I have been heavily involved in such exemption efforts. After Michigan adopted its exemption, I later documented that the Michigan Treasury actually experienced an increase in total sales tax collections and also in other tax collections. This research, in conjunction with the Industry Council for Tangible Assets, has been used to subsequently help gain similar sales tax exemptions in the states of Alabama, Indiana, Iowa, Minnesota, Nebraska, North Carolina, Oklahoma, Ohio, Pennsylvania, South Carolina, and Virginia and to expand an existing exemption in Texas and Louisiana (and to help reinstate Louisiana’s exemption after it was suspended in 2016).

I have made multiple trips to Arkansas, Kansas, and Tennessee to speak with fiscal staff and legislators, generally with positive results. I also supplied my research to those working on the exemptions in Maine, West Virginia, and Wisconsin.

That’s the good news. The bad news is that the states of Nebraska and Washington have bills to revoke their current exemptions. These bills were to have committee hearings on March 13 and 14, respectively. In the past, four states have revoked such sales tax exemptions (Colorado, Florida, Louisiana—twice, and Ohio), but all later reinstated the same or similar exemptions.

On the surface, it might seem that ending sales tax collections on a category of items would result in a decline in total sales tax collections. However, when tax laws change, people change their financial activities. So, what changes bring on the result of sales tax collections actually increasing?

• Almost all coin dealers sell merchandise beyond coins and precious metals, many of which are still subject to sales tax. The most common examples are antiques, jewelry, hobby supplies, and other collectibles. In a national coin dealer survey conducted by the Industry Council for Tangible Assets in 2016 for the year 2015, it was calculated that greater store traffic in coin shops once a coin and precious metals exemption took effect resulted in higher sales of taxable merchandise—enough so that it replaced an average of 2/3 of the sales tax collections lost from the exemption.

• In the 1990s, the Michigan Treasury came out with a research study projecting that 38.5% of payrolls are spent on merchandise on which sales tax is collected. In my research, I documented that the higher payrolls at coin dealers after the exemption (industry employment more than doubled) replaced more than 100% of the sales tax collections lost from the exemption.

• Coin show attendance, especially by dealers and visitors from out of state, is much higher in states with coin and precious metals sales tax exemptions. That means that the hospitality industry sells more hotel room stays, restaurants serve more meals, gas stations sell more fuel, and other retailers also experience higher sales for which higher sales tax collections occur.

As more states adopt coin and precious metals sales tax exemptions, it becomes easier to gain exemptions in other states. Should the exemption efforts in all six states succeed this year, that will leave only the states of Hawaii, Kentucky, Mississippi, Nevada, New Jersey, New Mexico, Vermont, and the District of Columbia still taxing coin and precious metals transactions. While it is unusual for most exemption efforts to succeed in the first year of effort, one can only hope.

That is the overall good news for coin and precious metals sales tax exemptions at the state level. Unfortunately, what is happening in state legislatures and treasury departments as a result of last June’s U.S. Supreme Court decision in South Dakota v Wayfair is going to cripple coin dealerships (and all small businesses in general) across the country with higher paperwork burdens, registrations, and filing of tax forms. What has already occurred or is in the works in the states of California, New York, Pennsylvania, Texas, Washington, and elsewhere will be the subject of next week’s column.

In the meantime, the Industry Council for Tangible Assets is hard at work and well positioned to help coin dealers and other retailers lessen the burdens resulting from the Wayfair court case. It is critical for coin dealers (and even serious numismatic collectors) who are not already members of ICTA to join right now. Go to https://www.ictaonline.org/membership to do so today. (Full disclosure, I have served ICTA as treasurer and as a member of the board of directors and its executive committee since 2002, though the comments in this column are my personal comments and not official statements by ICTA.)

Patrick A. Heller was the American Numismatic Association 2018 Glenn Smedley Memorial Service Award, 2017 Exemplary Service Award, 2012 Harry Forman Dealer of the Year Award, and 2008 Presidential Award winner. He was also honored by the Numismatic Literary Guild in 2017 and 2016 for the Best Dealer-Published Magazine/Newspaper and for Best Radio Report. He is the communications officer of Liberty Coin Service in Lansing, Mich., and writes Liberty’s Outlook, a monthly newsletter on rare coins and precious metals subjects. Past newsletter issues can be viewed at http://www.libertycoinservice.com. Some of his radio commentaries titled “Things You ‘Know’ That Just Aren’t So, And Important News You Need To Know” can be heard at 8:45 AM Wednesday and Friday mornings on 1320-AM WILS in Lansing (which streams live and becomes part of the audio and text archives posted at http://www.1320wils.com).

This article was originally printed in Numismatic News Express. >> Subscribe today

If you like what you’ve read here, we invite you to visit our online bookstore to learn more about Numismatic News.

Learn more >>>

NumismaticNews.net is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com and affiliated websites.

The post Update on coins, precious metals sales tax exemptions appeared first on Numismatic News.

0 notes