#World Travel Market London 2019

Text

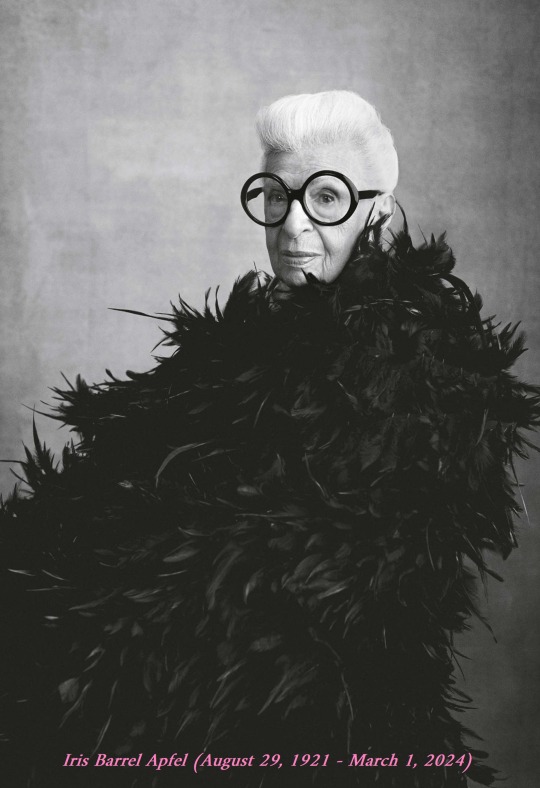

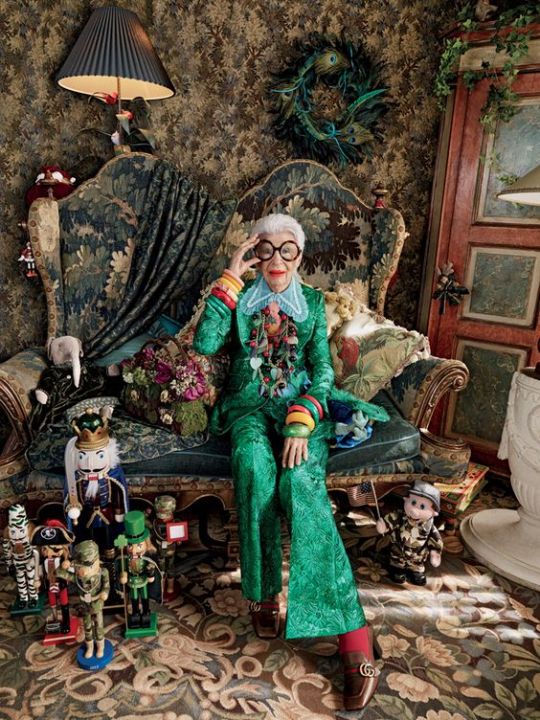

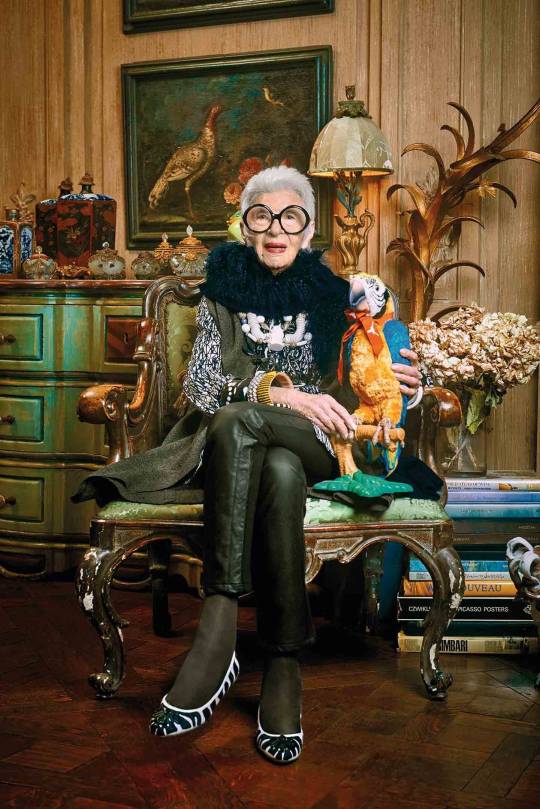

Iris Barrel Apfel, Decorator and Fashion Stylist

(August 29, 1921 – March 1, 2024)

Ms. Apfel was one of the most vivacious personalities in the worlds of fashion, textiles, and interior design, she has cultivated a personal style that is both witty and exuberantly idiosyncratic.

Her originality was typically revealed in her mixing of high and low fashions—Dior haute couture with flea market finds, nineteenth-century ecclesiastical vestments with Dolce & Gabbana lizard trousers.

With remarkable panache and discernment, she combines colors, textures, and patterns without regard to period, provenance, and, ultimately, aesthetic conventions. Paradoxically, her richly layered combinations—even at their most extreme and baroque—project a boldly graphic modernity.

Iris Barrel was born on Aug. 29, 1921, in Astoria, Queens, the only child of Samuel Barrel, who owned a glass and mirror business, and his Russian-born wife, Sadye, who owned a fashion boutique.

She studied art history at New York University, then qualified to teach and did so briefly in Wisconsin before fleeing back to New York to work on Women's Wear Daily, and for interior designer Elinor Johnson, decorating apartments for resale and honing her talent for sourcing rare items before opening her own design firm. She was also an assistant to illustrator Robert Goodman.

As a distinguished collector and authority on antique fabrics, Iris Apfel has consulted on numerous restoration projects that include work at the White House that spanned nine presidencies from Harry Truman to Bill Clinton.

Along with her husband, Carl, she founded Old World Weavers, an international textile manufacturing company and ran it until they retired in 1992. The Apfels specialized in the reproduction of fabrics from the 17th, 18th, and 19th centuries, and traveled to Europe twice a year in search of textiles they could not source in the United States.

The Metropolitan Museum of Art’s Costume Institute assembled 82 ensembles and 300 accessories from her personal collection in 2005 in a show about her called “Rara Avis”.

Almost overnight, Ms. Apfel became an international celebrity of pop fashion.

Ms. Apfel was seen in a television commercial for the French car DS 3, became the face of the Australian fashion brand Blue Illusion, and began a collaboration with the start-up WiseWear. A year later, Mattel created a one-of-a-kind Barbie doll in her image. Last year, she appeared in a beauty campaign for makeup with Ciaté London.

Six years after the Met show she started her fashion line "Rara Avis" with the Home Shopping Network.

She was cover girl of Dazed and Confused, among many other publications, window display artist at Bergdorf Goodman, designer and design consultant, then signed to IMG in 2019 as a model at age 97.

Ms. Iris Apfel became a visiting professor at the University of Texas at Austin in its Division of Textiles and Apparel, teaching about imagination, craft and tangible pleasures in a world of images.

In 2018, she published “Iris Apfel: Accidental Icon,” an autobiographical collection of musings, anecdotes and observations on life and style.

Ms. Apfel’s apartments in New York and Palm Beach were full of furnishings and tchotchkes that might have come from a Luis Buñuel film: porcelain cats, plush toys, statuary, ornate vases, gilt mirrors, fake fruit, stuffed parrots, paintings by Velázquez and Jean-Baptiste Greuze, a mannequin on an ostrich.

The Museum of Lifestyle & Fashion History in Boynton Beach, Florida, is designing a building that will house a dedicated gallery of Ms. Apfel's clothes, accessories, and furnishings.

Ms. Apfel’s work had a universal quality, It’s was a trend.

Rest in Power !

#art#design#fashion#icon#rip#iris apfel#luxury lifestyle#rip riris apfel#style icon#iconic#trend#rare avis#women's fashion#walking closet#muse#themet#style#history#renaissance#baroque#greta garbo#dior#chanel#montana#fendi#jewellery#high fashion#fantasy#women history month

154 notes

·

View notes

Photo

~ "Pocket watch in enamel, gold and diamonds created by Jehan Cremsdorff, circa 1650, Musée Patek Philippe, Geneva. This Jehan Cremsdorff signed pocket watch, which was manufactured around 1650, so it is almost 370 years old and arrived to us in excellent, like-new condition, is somewhat miraculous. Cremsdorff is so prestigious and sought after by pocketwatch collectors, that the last time a watch was sold was a real event. Part of the epic collection of pocketwatches belonging to a deceased German billionaire, which also includes the George Daniels Space Traveller I, the Cremsdorff watch is an extraordinary object that has been mysteriously well advised rotted in centuries old red, with only minimal polishing. Restoration. Although little known about him, Jehan Cremsdorff was an active clockwatch in Paris in the late eighteenth century. The very elaborate polish indicates that Cremsdorff probably made the watch for a royal or noble customer; the identity of the original owner has been lost over time, but the watch originated in Sweden when it was sold to camels to the audience for the first time. Consisted of fine gold leaf, the case is entirely enameled, inside and out, an artistic creation made by a Parisian enameler today unknown. The outer box is decorated with relief, which forms an extraordinarily complex and vivid floral pattern, and is adorned with diamonds on both sides. The interior faces of the case are finished in a hand-painted gloss turquoise nail polish, depicting patterns inspired by the xylographies of Abraham Bosse, a 17th-century Parisian artist. The Cremsdorff clock is large, the case has a diameter of 76 mm.Opening the clock reveals a particular movement invented in the 13th century. Rather primitive, almost rudimentary compared to modern clocks, the clocks of the seventeenth century had an accuracy of about 30 minutes, acceptable performance. It is one of the best preserved clocks of the 17th century in the world, and also one of the most richly decorated.Indeed, the only comparable clocks can be found in important museums, such as the Goullons clock at the Metropolitan Museum of Art or the one made for Queen Christine at the Royal Palace in Stockholm. The last time Cremsdorff hit the market, aka Christie's in Geneva in 1986, it sold for the staggering figure of 1.87 million Swiss francs, roughly $1 million. But times have changed and Cremsdorff goes up for auction at Sotheby's Treasures in London on 3 July 2019, estimated at just £700,000 to £1.0 million, or around $900,000 to $1.3 million.The Cremsdorff clock that you see in these images was purchased in July 2019 by a representative of the Musée Patek Philippe in Geneva for £2,175 million, which is approximately $2,734 million, including taxes. " ~

11 notes

·

View notes

Link

4 notes

·

View notes

Text

New Post has been published on All about business online

New Post has been published on https://yaroreviews.info/2023/10/hs2-why-rishi-sunaks-big-gamble-may-not-pay-off

HS2: Why Rishi Sunak's big gamble may not pay off

Getty Images

By Faisal Islam

Economics editor

When Rishi Sunak confirmed he was scrapping the huge infrastructure project of the West Midlands to Manchester leg of HS2 high speed rail, he said the project had come from a “false consensus” that links between big cities were “all that matters”.

The immediate pressing question is whether the UK is capable of delivering projects at this scale, at all. This was a nationally strategic project advertised to the world as a way for Britain’s regional cities to attract investment from the biggest investment funds in the world.

All of the Prime Minister’s secret conference projects were codenamed after trees. Scrapping HS2 was called “Project Redwood”. High speed rail in the UK has been shorn of its branches, and is now left as an expensive stump from London to Birmingham.

The escalating cost of this first phase was not a given. How was it allowed to balloon in cost so much to £45bn – and that’s in 2019 prices? The country is left with having built the most expensive part of the line, with the least need in terms of capacity, but without the connections to northern cities that would have been most beneficial.

Did it ever make sense to build what is largely a tunnel from London to Birmingham? Was the cash that should have extended the scheme to the north, the whole point of it, wasted on tunnels to hide it in southern countryside?

With rising costs, the government says that the HS2 scheme might not even give back as much back in benefits, as what is being spent on it. In contrast, some bus projects, for example, can give back £4 for a £1 government investment, they claim.

Tax cut plans?

Opponents accuse the government of scrapping a key piece of strategic infrastructure to create space for pre-election tax cuts. The government is adamant that this is not a way to fiddle the Treasury spreadsheets. While some detail remains on exactly when these new road and bus projects are delivered, their aim is not to free up cash.

The government also argues that the business case for HS2 lent significantly on business travellers. While overall passenger numbers have recovered to pre-pandemic levels, there are fewer business travellers now. Are these behavioural changes enough to mean the West Coast Main Line from London to Glasgow will not be at capacity?

The great prize of all of this was to change Britain’s economic geography, to create a counterweight to south east England, and in effect to create a single labour market across three major northern cities. Some of that effect will be retained if the £12bn earmarked for Liverpool to Manchester high speed line is delivered.

The money is being spent instead on everyday transport upgrades, rather than a single grand project. It is likely that the benefits of this will be quicker and more visible on the ground. They also lend themselves to being put on election leaflets next year.

The economic and political consensus had been that the gap between Britain’s second tier cities and the capital was significantly bigger than other major economies. Indeed some have argued this was a major cause of Britain’s low productivity. The Prime Minister has upended that consensus.

The opposition’s response will be very interesting. Rishi Sunak has basically dared Labour leader Sir Keir Starmer to reverse the cancellation decision, cut back the newly announced local transport projects, or borrow billions more.

These plans will probably reach more voters more quickly. But the risk is that Britain also develops a reputation as a place where big long-term projects are impossible, and cast iron cross party promises are easily disposed.

Mr Sunak has not just scrapped half a train line, he has suggested an entirely different approach to promoting British regional economic growth.

Related Topics

Companies

HS2

UK economy

0 notes

Text

Kraken, one of the world’s prominent Cryptocurrency exchanges, is News/articles/2023-09-07/kraken-plans-to-expand-in-crypto-derivatives-in-wake-of-ftx-fall?utm_campaign=socialflow-organic&utm_content=crypto&utm_source=twitter&utm_medium=social&sref=3REHEaVI#xj4y7vzkg">reportedly in advanced talks with the U.K.’s Financial Conduct Authority (FCA) to expand its London-based subsidiary, Crypto Facilities, into new avenues of asset custody and fiat-denominated futures contracts.Kraken’s Comeback To The UK Market Acquired by the Cryptocurrency exchange Kraken in 2019, Crypto Facilities is currently in discussions with the U.K.’s Financial Conduct Authority (FCA) to broaden its asset custody services, according to a recent report by Bloomberg.Mark Jennings, the CEO of the London-based company, revealed that they are also negotiating to introduce futures contracts that would be denominated in the fiat currencies held for their clients. The firm specializes in providing futures contracts in Cryptocurrency assets for institutional investors.The collapse of FTX last November sent bearish waves to the Market. The void left by FTX’s exit from the derivatives Market has created an opportunity that Kraken is keen to seize. To accomplish this, the company would need to extend its multilateral Trading license, obtained in 2020. Jennings anticipates that this expansion process could take anywhere from six to 12 months to complete.Jennings said, “It’s a key driver as we expand out what we do in the institutional Market across crypto. Prior to FTX we’d be hitting $700 million to $800 million a day in Trading volume. It is now closer to $100 million.”UK Brings Regulatory ObstaclesKraken recently unveiled a staged rollout of deposit support for both euros and British pounds via PayPal Holdings Inc. Launched earlier this week, this funding feature is presently accessible solely through Kraken’s mobile application. Users residing in Europe and the United Kingdom stand to benefit from this new offering by Kraken.However, the UK’s regulatory environment has forced PayPal to stop allowing UK Customers to buy crypto through its platform from October as it plans to comply with new rules on crypto promotions.Crypto companies in the U.K. have recently begun enforcing the “travel rule,” to combat money laundering activities. However, inconsistent global application of this rule complicates compliance efforts.Guidelines established by the Financial Action Task Force (FATF), which include mandating firms to disclose the identities behind transactions, have sparked debates within the crypto community. Criticism is rising mainly due to the adapting of these norms to unique aspects of the crypto, like self-custodied wallets that are not managed by any regulated entity. !function(f,b,e,v,n,t,s)

if(f.fbq)return;n=f.fbq=function()n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments);

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0';

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)(window,document,'script',

'

fbq('init', '887971145773722');

fbq('track', 'PageView');

0 notes

Link

0 notes

Text

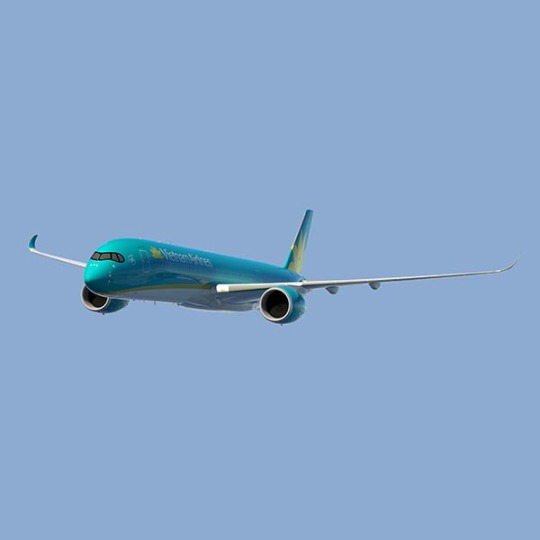

Vietnam Airlines: Nonstop nach Vietnam mit der 4-Sterne-Airline

Inhalt:Boeing 787-9 Dreamliner

Sitzkonfiguration in der Passagierkabine der Boeing Maschine 787-900 für die Strecke Frankfurt-Vietnam

Innenansichten der Vietnam Airlines Boeing B787-9 - zur Fotostrecke

Flüge Frankfurt Vietnam

Sommerflugplan 2023

Airbus A350-900

Die Kabine

Business Class

Premium Economy Class

Economy Class

Sitzplatzreservierung

Innenansichten des Vietnam Airlines A350-900 XWB - zur Fotostrecke

Vielfliegerprogramm Lotusmiles

Gepäck

Aufgabegepäck

Handgepäck

Am Boden

Flughäfen und Lounges

Auch interessant:

Weitere Artikel zu Vietnam:

Noch halten sich die Deutschen mit Reisen nach Vietnam zurück, bedauert Le Hung Viet, Marketing-Verantwortlicher des Büros von Vietnam Airlines in Frankfurt am Main. Im Jahr 2019 (vor der Pandemie) flogen mit Vietnam Airlines (IATA-Code VN, Ticket-Code 738), einschließlich Tochtergesellschaften, 29,1 Millionen Passagiere. 2021 waren es lediglich 7,1 Millionen Fluggäste.

Bereits im Jahr 1956 wurde die Fluggesellschaft gegründet. Der Beitritt zu SkyTeam-Allianz erfolgte im Juni 2020. Die Airlines wurde mehrfach mit 4 Sternen von SKYTRAC bedacht und mit den World Travel Awards 2022 für "Asia's Leading Cultural Airline" und "Asia's Leading Airline - Economy Class" ausgezeichnet.

Drehkreuze sind Hanoi (HAN) und Ho-Chi-Minh-Stadt (SGN). Vietnam Airlines hat das Vielfliegerprogramm Lotusmiles. Die Airline verfügt über 101 Flugzeuge mit einem Durchschnittsalter von 7,5 Jahren. Aufgeschlüsselt sind das 46 Airbus A321-200, 20 Airbus A321neo, 14 Airbus A350-900, 6 ATR 72-500, 11 Boeing 878-9 und 4 Boeing 787-10.

Boeing 787-9 Dreamliner

Im Mai 2015 nahm Vietnam Airlines das erste der bestellten Flugzeuge entgegen – eine Boeing 787-9 Dreamliner mit neugestalteter Kabine, verbessertem Komfort sowie einer fortschrittlichen technischen Ausstattung und höherer Kraftstoffeffizienz. Die Boeing 787 von Vietnam Airlines gibt es in drei verschiedenen Kabinen-Konfigurationen: Ein Teil der Flugzeuge verfügt über die Konfiguration 28 Business Class/35 Premium Economy/211 Economy (insgesamt 274), andere über die Konfiguration 28 Business Class/283 Economy (insgesamt 311) und dann gibt es noch die Konfiguration 24 Sitze in der Business Class und 343 Sitze in der Economy.

Für die Langstreckenverbindungen Frankfurt (FRA) – Vietnam (Hanoi = HAN und Ho-Chi-Minh-Stadt = SGN) und London (LHR) - Vietnam kommt die Boeing 787-900 (Dreamliner) mit einer Gesamtkapazität von 274 Sitzen zum Einsatz.

Im Mai 2015 nahm Vietnam Airlines das erste der bestellten Boeing 787-9 Dreamliner entgegen. Foto: Vietnam Airlines

Sitzkonfiguration in der Passagierkabine der Boeing Maschine 787-900 für die Strecke Frankfurt-Vietnam

Sitzkonfiguration in der Passagierkabine der Boeing Maschine 787-900 für die Strecke Frankfurt-Vietnam / Grafik: Vietnam Airlines

Business Class

1-2-1, 28 Sitze Full-Flat/Fischgrätenanordnung, 15,4-Zoll-Bildschirm (ca. 39 cm), Audio-Video on Demand, USB-Anschluss

Premium Economy Class

2-3-2, 35 Sitze, 107 cm Sitzabstand, 18 cm Sitzneigung, 10,6-Zoll-Monitor (ca. 27 cm), Audio-Video on Demand, USB-Anschluss

Economy Class

3-3-3, 211 Sitze, 82 cm Sitzabstand, 15 cm Sitzneigung, 10,6-Zoll-Monitor (ca. 27 cm), Audio-Video on Demand, USB-Anschluss

Ein Mangel: An Bord gibt es aktuell in keiner Klasse WLAN bzw. Internet.

Innenansichten der Vietnam Airlines Boeing B787-9 - zur Fotostrecke

Fotos: Vietnam Airlines

Das kannst du in Ho-Chi-Minh-Stadt unternehmen*

Flüge Frankfurt Vietnam

Sommerflugplan 2023

StreckeFlugnummerFlugtageAbflugzeitAnkunftszeitFlugdauer

Frankfurt (FRA) - Hanoi (HAN)VN36Montag, Dienstag, Donnerstag, Freitag, Samstag, Sonntag13:55 (1) (2)05:55 (+1 Tag) (1)

06:20 (+1 Tag) (2)11 Std. 25 Min. (2)

Hanoi (HAN) - Frankfurt (FRA) VN37Montag, Mittwoch, Donnerstag, Freitag, Samstag, Sonntag23:35 (1)

22:35 (2)06:35 (+1 Tag) (1)

06:00 (+1 Tag) (2)12 Std. 25 Min. (2)

Frankfurt (FRA) – Ho-Chi-Minh-Stadt / Saigon (SGN)VN30Montag, Mittwoch, Donnerstag, Samstag14:35 (1) (2)07:10 (+1 Tag) (1)

07:35 (+1 Tag) (2)12 Std. (2)

Ho-Chi-Minh-Stadt / Saigon (SGN) - Frankfurt (FRA)VN31Dienstag, Mittwoch, Freitag, Sonntag23:00 (1)

22:35 (2)06:30 (+1 Tag) (1) (2)12 Std. 55 Min.

Quelle: Vietnam Airlines / eigene Recherche

Copyright 2017-2023 WeltReisender.net

(1) Diese Angaben haben wir einem Flyer von Vietnam Airlines entnommen

(2) Diese Angaben haben wir einem Buchungsportal entnommen

Fluggäste von Vietnam Airlines können Rail&Fly-Tickets für die Anreise mit der Bahn zum/vom Flughafen Frankfurt erwerben. Dabei fahren Business Class Passagiere 1. Klasse mit der DB und Premium Economy Class sowie Economx Class Fluggäste 2. Klasse.

Finde Dein Hotel im ehemaligen Saigon*

Airbus A350-900

Den ersten von insgesamt 14 Airbus A350 erhielt Vietnam Airlines im Juni 2015. Der Airbus bietet Platz für 305 Passagiere und wird ebenfalls über zwei Konfigurationstypen verfügen: 29 Business Class / 45 Premium Economy / 231 Economy sowie 29 Business Class / 36 Premium Economy / 240 Economy. In Europa verkehrt der A350-900 zwischen Frankreich, Paris (CDG) und Vietnam.

Den ersten von insgesamt 14 Airbus A350 erhielt Vietnam Airlines im Juni 2015. Foto: Vietnam Airlines

Die Kabine

Business Class

Die Business Class von Vietnam Airlines verspricht einen Reisekomfort der besonderen Art: Durch eine 1-2-1-Sitzkonfiguration liegen alle 28 beziehungsweise 29 Full-Flat-Sitze direkt am Gang. Der Sitzabstand von insgesamt 112 Zentimetern bietet auch längeren Beinen genügend Freiraum. Das individuelle, erweiterte Bordunterhaltungsprogramm auf 15-Zoll-Bildschirmen (zuvor 10,6 Zoll) verfügt über eine große Auswahl an Filmen, Spielen und vielem mehr. Auch kulinarisch werden Business-Class-Gäste verwöhnt – mit einem A-la-Carte-Service, der neuerdings auch Speisen in Bio-Qualität enthält. Eine Open-Bar und zahlreiche Snacks stillen den kleinen Hunger oder Durst zwischendurch. Neue Amenity-Kits, Pantoffeln und Decken erhöhen den Reisekomfort.

Premium Economy Class

Vietnam Airlines bietet eine Zwischenklasse zwischen Economy Class und Business Class – die Premium Economy Class, in der Reisende gegen einen geringen Aufpreis von mehr Komfort und zahlreichen Serviceleistungen profitieren. Der Sitzabstand in der Premium Economy Class beträgt je nach Flugzeugtyp und Konfiguration:

- 91 Zentimeter (in vier der A350)

- 107 Zentimeter (in den B 787).

Die Rückenlehne lässt sich um 15 bis 20 Zentimeter nach hinten verstellen. In der Premium Economy des Dreamliners 18cm. Das individuelle Audio- und Videosystem auf 10,6-Zoll-Monitoren (rund 27cm, zuvor 6,4 Zoll) sorgt für Unterhaltung an Bord.

Economy Class

Die Economy im Dreamliner zählt 211 Sitze in der 3-3-3-Konfiguration mit einem Sitzabstand von 82cm und einer Sitzneigung von 15cm. Auch in der Economy gibt es das Audio-Video-System mit 27cm-Monitor und einen USB-Anschluss zum Aufladen.

Sitzplatzreservierung

Wenn Du mit Business oder Premium Economy Class fliegst, kannst Du kostenlos einen Sitzplatz reservieren. Economy Class-Passagiere können in den Buchungsklassen Y/B/M/S/H/K/L/Q/N/R ebenfalls kostenlos einen Sitzplatz reservieren.

Sitze mit mehr Beinfreiheit und Sitze im vorderen Teil der Kabine können in der Economy Class gegen Gebühr gebucht werden.

Die Bordverpflegung einschließlich der Getränke ist inklusive.

Das kannst Du in Hanoi und Umgebung unternehmen*

Innenansichten des Vietnam Airlines A350-900 XWB - zur Fotostrecke

Innenansichten des A350-900 von Vietnam Airlines / Fotos: Vietnam Airlines

Eine große Auswahl von Hotels in Hanoi*

Vielfliegerprogramm Lotusmiles

Auf den Flügen von Vietnam Airlines können mit dem Lotusmiles-Programm Meilenpunkte gesammelt werden. Lotusmiles-Mitglieder können Punkte bei allen Airlines von SkyTeam sammeln.

Vielfliegerprgramm Lotusmiles von Vietnam Airlines / Fotos: Vietnam Airlines

Gepäck

Aufgabegepäck

Das Freigepäck in der Business Class beträgt 2 x 32 kg pro Passagier, in der Premium Economy 2 x 23 kg und in der Economy 1 x 23 kg pro Reisendem. Jeder Passagier kann zudem bis zu 10 Gepäckstücke ab 100 US-$ pro Stück dazu buchen, wenn im Voraus gebucht und bezahlt wird. Beim Check-in kostet die zusätzliche Beförderung eines Gepäckstücks ab 150 US-$.

Handgepäck

In der Premium Economy und der Business Class können insgesamt drei Handgepäckstücke mit maximal 18 kg Gewicht mitgenommen werden. Dabei dürfen die größeren beiden Handgepäckstücke die Abmessungen von 56cm x 36cm x 23cm nicht überschreiten. Das kleinere Stück, von Vietnam Airlines Zubehör genannt, darf die Abmessungen 30cm x 15cm x 40cm nicht überschreiten.

In die Economy Class darf ein Handgepäckstück mit den Abmessungen 56cm x 36cm x 23cm und eines mit den maximalen Abmessungen 56cm x 23cm x 36cm mitgenommen werden. Beides zusammen darf ein Maximalgewicht von 12 kg nicht überschreiten.

In allen drei Klassen kann pro Passagier noch eines der folgenden persönlichen Gegenstände mit an Bord genommen werden: Regenschirm, Gehstock, Buch, Zeitung, Magazin, Jacke, Decke, Gehhilfen oder Babytragekorb.

Am Boden

Flughäfen und Lounges

Vietnam Airlines am Flughafen Frankfurt:

Terminal 2, Halle D

Check-in Schalter 886-890 und ggfs. bis zum Schalter 895

Lounge von Vietnam Airlines am Flughafen Frankfurt (Japan Airlines Lounge):

Terminal T2, Halle D, noch vor der Sicherheitskontrolle

Ausschließlich Inhaber von Business Class Tickets dürfen die Japan Airlines Lounge nutzen.

In den Flughäfen in Vietnam können auch Reisende ohne Business Class Ticket die Lounges gegen eine Gebühr von 15 bis 41 US-$ nutzen.

Homepage von Vietnam Airlines (in deutscher Sprache)

Titelfoto / Die Business Class. / Foto: Vietnam Airlines

(Der Beitrag wurde erstmals im Frebruar 2015 veröffentlicht und seitdem regelmäßig aktualisiert.)

Auch interessant:

Weitere Artikel zu Vietnam:

- Innenansichten des Vietnam Airlines B787-9 – Fotostrecke

Vietnam Airlines: Nonstop nach Vietnam mit der 4-Sterne-Airline

- Vietnam: Mit dem Rucksack von Hanoi zum Mekong-Delta

- Vietnam: Halong Bucht mit Flughafen und Kreuzfahrt-Terminal

- Die Low-Cost-Airline Scoot fliegt wieder ab Berlin

- Vietnam wird als Reiseziel immer beliebter

- Fotostrecke A350-900 XWB von Vietnam Airlines

Read the full article

0 notes

Text

Education and Learning Analytics Market Worth $36.59 Billion by 2029

According to a new market research report titled, “Education & Learning Analytics Market by Offering (Software, Services), Deployment, Application (People Acquisition & Retention, Operations, Performance Management, Others), User Group (Academic, Corporate) and Geography - Global Forecasts to 2029”, the global education & learning analytics market is expected to grow at a CAGR of 23.8% from 2022–2029 to reach $36.59 billion by 2029.

Download Free Sample Report Now @ https://www.meticulousresearch.com/download-sample-report/cp_id=5133

The market's growth is attributed to factors such as the growing need for data-driven decisions to improve the quality of education and extensive government initiatives for education modernization. The incorporation of machine learning and artificial intelligence in education & learning analytics is expected to create growth opportunities for the players operating in this market. However, a lack of awareness regarding education analytics standards and data hygiene among educational institutes can obstruct the market growth.

Impact of COVID-19 on the Education & Learning Analytics Market

The COVID-19 pandemic emerged in Wuhan, China, in December 2019. By March 2020, the pandemic had spread across most countries around the world, leading to the World Health Organization declaring COVID-19 a global pandemic. Governments across the globe imposed countrywide lockdowns and restrictions on travel and trade to ensure public health & safety. These lockdowns negatively impacted most sectors. Educational institutions worldwide were temporarily closed, severely affecting the education sector. According to the World Economic Forum, 1.2 billion students could not visit educational institutions leading to a considerable impact on learning. As a result, education changed dramatically with the advent of e-learning, wherein institutions started teaching remotely through digital platforms.

Before the outbreak of COVID-19, educational institutions had started effectively incorporating data analysis, slightly boosting the education & learning analytics market from its nascent stage. The shutting down of schools, academic institutions, and educational enterprises compelled learners to adopt the remote learning approach to manage their syllabus and courses. Many universities successfully transitioned to e-learning. For example, Zhejiang University (China) managed to get more than 5,000 courses online within just two weeks into the transition using DingTalk ZJU. Imperial College London started offering a course on the science of coronavirus, which was launched on Coursera, becoming the most enrolled course in 2020. Also, governments across the globe made efforts to devise open-source e-learning solutions to provide education to all students regardless of their technical barriers. For instance, the Government of India developed several free e-learning platforms such as SWAYAM, DIKSHA, and NPTEL for learners pursuing various courses.

Speak to our Analysts to Understand the Impact of COVID-19 on Your Business: https://www.meticulousresearch.com/speak-to-analyst/cp_id=5133

Thus, with the growing adoption of remote learning and e-learning platforms, institutions can leverage learner/student data to make future decisions to support institutional progress and improve learners’ performance. Thus, the adoption of learning analytics is expected to grow exponentially in the coming years. The COVID-19 pandemic had a significant impact on incomes, and as a result, many governments across the globe ordered schools and other educational institutions to reduce tuition fees to provide some relaxation to learners. This factor lowered the adoption of newer technologies among educational & academic institutions due to being largely considered non-essential. However, learners’ growing dependency on e-learning platforms is expected to encourage the adoption of learning analytics solutions & services among educational & academic institutes, boosting the growth of this market in the coming years.

The global education & learning analytics market is segmented by offering (software and services), deployment mode (on-premise and cloud-based), application (people acquisition & retention, operations, performance management, and others), user group (academic institutions and corporate users), and geography. The study also evaluates industry competitors and analyses the market at the country level.

Based on offering, the global education & learning analytics market is segmented into software and services. In 2022, the software segment is expected to account for a larger share of the global education & learning analytics market. The segment's growth is mainly attributed to software's ability to pinpoint individual learning styles and anchoring content that better matches the learner’s learning style. However, the services segment is projected to grow at a faster rate owing to the growing preferences of educational institutions concerning the technical support and maintenance of the education and learning analytics platforms.

Based on deployment mode, the global education & learning analytics market is segmented into on-premise and cloud-based. In 2022, the cloud-based segment is expected to account for a larger share of the global education & learning analytics market. This segment is also expected to grow at a higher CAGR during the forecast period. Benefits such as enhanced scalability, accessibility, and automated upgradation offered by cloud-based analytics solutions contribute to the growth of this segment.

Based on application, the education & learning analytics market is segmented into people acquisition & retention, curriculum development, operations management, finance management, performance management, and other applications. In 2022, the performance management segment is expected to account for the largest share of the global education & learning analytics market. The large share of this segment is mainly attributed to the growing need for monitoring the individual performance of learners and the growing demand from educational institutes to develop personalized content. The segment is also expected to grow at the highest CAGR during the forecast period.

Quick Buy – Education & Learning Analytics Market Research Report: https://www.meticulousresearch.com/Checkout/45888825

Based on geography, the market is broadly segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. In 2022, North America is expected to account for the largest share of the global Education & learning analytics market. The education and technology infrastructure in the U.S and Canada is approaching its maturity, and the region is home to a majority of recognized education and learning analytics providers. Besides, the constant incorporation of education and learning analytics by school districts and private schools is also helping the region retain its dominance in the global market. However, the Asia-Pacific region is expected to emerge as the fastest-growing market. Positive government initiatives for promoting education modernization and high population concentration with developing technological infrastructure are further expected to drive the demand for education & learning analytic tools in the region in the coming years.

The report also includes an extensive assessment of the key strategic developments adopted by the leading market participants in the industry over the past four years.

The global education & learning analytics market is consolidated and dominated by a few major players, namely, MicroStrategy Incorporated (U.S.), TIBCO Software Inc. (U.S.), Alteryx Inc. (U.S.), D2L Corporations (Canada), SAS Institute Inc. (U.S.), IBM Corporation (U.S.), Microsoft Corporations (U.S.), Cornerstone OnDemand, Inc. (U.S.), SAP SE (U.S.), Oracle Corporations (U.S.), Blackboard Inc. (U.S.), Tableau Software (U.S.), Qlik (U.S.), Yellowfin (Australia), and Latitude CG, LLC (U.S.), among others.

To gain more insights into the market with a detailed table of content and figures, click here: https://www.meticulousresearch.com/product/education-and-learning-analytics-market-5133

Scope of the Report:

Education & Learning Analytics Market, by Offering

Software

Services

Managed Services

Professional Services

Technical Support and Maintenance

Consulting Services

Education & Learning Analytics Market, by Deployment Mode

On-premise

Cloud-based

Education & Learning Analytics Market, by Application

People Acquisition & Retention

Curriculum Development

Operations Management

Finance Management

Performance Management

Other Applications

Education & Learning Analytics Market, by Region

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Rest of Europe

Asia-Pacific

Japan

China

India

South Korea

Rest of Asia-Pacific

Latin America

Mexico

Brazil

Rest of Latin America

Middle East & Africa

UAE

Israel

Rest of MEA

Download Free Sample Report Now @ https://www.meticulousresearch.com/download-sample-report/cp_id=5133

0 notes

Text

Ten Business Trends For 2023, and Forecasts For 15 Industries! A Global Round-up From The Economist Intelligence Unit

— The World Ahead | The World Ahead 2023

Ten Business Trends For 2023

1– America’s Federal Reserve and other Western central banks raise interest rates still further to battle inflation. China, though, keeps monetary policy loose.

2– The inflation crisis hurts shoppers and retailers; even e-commerce growth slows. Online retail is 14% of all sales—up from 10% in 2019 but barely beating 2022.

3– Covid-19 takes many more lives, but deaths dip to less than double the number from flu. China may loosen its zero-covid policy, risking a surge in cases.

4– Asia’s appetite for energy helps push global oil demand up by 1.5%, to exceed pre-pandemic levels. opec grudgingly expands output, suppressing prices somewhat.

5– Recession risks and rate increases do not prevent tech spending rising by more than 6%. Device sales disappoint, but the artificial-intelligence market swells to $500bn.

6– As they struggle to sign up new subscribers and take on competitors, streaming firms continue to invest heavily in content—$17bn, in Netflix’s case.

7– Global sales of new cars grow by just 1%, but those of electric vehicles increase by 25% as China reverses plans to scrap tax breaks to maintain demand.

8– America, the world’s biggest defence spender, boosts annual outlays to $800bn—more than three times China’s level. But budgets, adjusted for inflation, shrink.

9– Broad gauges of commodity prices retreat. This provides little relief to companies hampered by flagging production of some metals—or to 800m hungry people.

10– Air travel turns profitable as international arrivals soar by 30%. But they stay below pre-pandemic levels; many would-be business travellers opt to meet remotely instead.

Forecasts are for 2023 unless otherwise indicated. World totals based on 60 countries accounting for over 95% of World GDP. [email protected]

Business Environment

The war in Ukraine and the pandemic will drag on. Pricey commodities will help producers but worsen food insecurity and hurt many economies. Although global gdp growth will slow to 1.6% in 2023 from 2.8% in 2022, inflation will be a still-sizzling 6%, forcing central banks to raise interest rates further. China, though, will keep rates low—and may ease its zero-covid policy, boosting world trade.

Automotive

After three sputtering years, carmakers will stay in the slow lane in 2023. New-car sales will rise by 1% but remain 14% below 2019 levels. Commercial-vehicle sales, less hard-hit by the pandemic, will fall further. Supply-chain blockages will linger, though a shortage of chips will recede. Energy shortfalls and higher prices will take a bigger toll, particularly in Europe. Carmakers will struggle to pass on rising costs to buyers as inflation erodes consumers’ incomes and savings. Profits will drop.

Even electric vehicles will accelerate less sharply. Global sales, which doubled in 2021, will increase by 25% to 10.8m, or around 20% of the total new-car market. China will account for more than half of these as it backtracks on plans to scrap tax breaks for fear of stifling demand. China will also impose the world’s strictest emission standards for fossil-fuel vehicles. Germany’s sales of electrics will slip as it cuts subsidies. But electrics offer the best hope for carmakers in the long run, so they will launch more of them.

New electric models will tend to be bulkier, like Tesla’s delayed Cybertruck or sport-utility vehicles from bmw, Hyundai and others. Robotaxis will take to the roads in China, the United Arab Emirates and elsewhere. Two German cities will hold trials of “level four” autonomous vehicles, with human drivers barely needed.

TO WATCH: Drone ascent. Volkswagen China will conduct advanced tests of a passenger-drone prototype aimed at wealthy urbanites. The electric “air vehicle” will boast vertical take-off and landing capabilities and may eventually carry four passengers.

Defence and Aerospace

War in Ukraine and tensions over Taiwan will drive governments to fortify defence budgets. America, the world’s biggest spender, will raise outlays by nearly 9% in 2023, to $800bn, more than three times as much as second-placed China. Japan and Germany will pursue their goals of spending 2% of gdp on defence during the next five years. Even so, defence ministries will struggle to overcome high inflation, so spending will fall in real terms—a blow for defence and aerospace companies. Compounding their troubles will be labour and supply-chain issues, hitting just as Airbus and Boeing, the global leaders, try to lift post-pandemic aircraft production.

Still, new technologies will get a boost. America will step up research spending, while nato expands innovation funding. New emissions standards will apply to business jets, as Britain plots the first net-zero transatlantic flight. But manpower will matter, too, particularly in eastern Europe. The new “nato Force Model” will enable the alliance to deploy over 100,000 troops within ten days, another consequence of the war in Ukraine.

TO WATCH: Space invaders. nasa will reach for the Moon again in 2023 as its Lunar Trailblazer begins a search for water there. But private missions run by billionaires are also looking to the skies. Elon Musk’s SpaceX plans a lunar fly-by. Jeff Bezos’s Blue Origin will launch a new rocket, New Glenn. And Richard Branson’s Virgin Galactic hopes to start commercial services.

Energy

The energy crisis will deepen in 2023, particularly in Europe. Under Western sanctions, Russian hydrocarbon flows will dwindle as the eu widens bans on Russia’s oil and it retaliates by ending virtually all gas supplies. But Asia will help push up global oil demand, which will rise by around 1.5%—or 1.5m barrels a day (b/d)—to exceed pre-pandemic levels. opec will grudgingly raise oil output by 2.4m b/d, suppressing prices a bit. Winter will deplete Europe’s gas stocks, and flows of liquefied natural gas (lng) will fall short. Germany and Italy will open lng regasification terminals, but compete with buyers in Asia.

All this will keep oil and gas prices high, even as energy-consumption grows by a meagre 1%. The scramble for fuel will lift coal consumption to new records, with countries from Germany to China backtracking on planned cuts that were intended to tackle climate change. But solar power will also shine, raising demand for non-hydro renewables by 11%. Hydropower output will expand by 3% amid water shortages and doubts about its green credentials.

By November the cop28 climate summit in Dubai will bring new pledges to cut emissions, and a new deadline for wealthy countries to give poorer ones $100bn a year in green finance. They may succeed (three years late). One hot topic for attendees: energy-efficient air-conditioning for a warming world.

TO WATCH: Fission frisson. Interest in nuclear power will radiate around the globe in 2023. Newly nationalised edf will open the first of France’s next-generation nuclear-power stations, and China will launch an experimental fast-reactor. To avoid blackouts, Germany and South Korea will shelve plans to close nuclear plants.

Entertainment

As fears of covid-19 recede, more film fans will migrate from their saggy couches to cinemas’ comfy seats. Box-office revenues in 2023 will surpass those in 2019, welcome news for cinema chains lumbered with pandemic-era debts. Streaming firms will lose subscribers as monthly fees climb, but will nonetheless need to satisfy cravings for even more binge-worthy content. Netflix, the biggest streamer, will spend $17bn on this—but will prioritise squeezing more money from each user. Warner Bros will roll out a service combining hbo Max with Discovery+.

Streamers’ cash piles will help them harry conventional broadcasters in new arenas. Amazon’s Prime Video has led the race into sports broadcasting, long a preserve of traditional telly. From 2023, Apple tv+ will show live games from America’s Major League Soccer, thanks to a deal worth $2.5bn.

So far, the competition over sport has not drawn in Netflix. The company will be hoping that a cheaper advertising-supported service, which was launched in several markets in November 2022, will lure cash-strapped viewers and reignite subscriber growth. Globally, Netflix will thwart freeloaders by cracking down on password sharing.

WHAT IF? The EIU expects China’s GDP to grow by a reasonable 4.7% in 2023, but risks abound. Periodic Chinese covid lockdowns are still likely. The country’s property bubble looks perilously close to bursting. And the coming slowdowns in America and the EU, huge export markets, could dent Chinese growth. What if China goes into recession in 2023? This would mean a weaker Chinese appetite for imports, pushing down global metal and energy prices. Fewer imports would translate into less production of everything from apparel to solar panels. The impact would land hard in Shenzhen, the world’s biggest source of electronics. Also feeling the pain would be countries that provide goods to China: think of America, Japan and South Korea, which sell China cars, aeroplanes and much else. Worried companies would include Tesla, keen to boost sales in the biggest electric-car market. Also smarting would be American and EU consumer brands hoping to sell more in China to offset slowdowns at home. Among Chinese firms, property developers could be slammed by bad loans. The fallout from that would be felt worldwide, roiling stockmarkets and punching a hole in global growth.

Financial Services

A slowing economy will test financial stability in 2023. A 2008-style global crash is unlikely, given banks’ high reserves and tighter risk standards as Basel IV implementation starts. Rising interest rates will also bolster margins. Yet unsecured private investments may come unstuck. Wide-ranging financial sanctions against Russia will cause further losses and disruption for financial firms. Sovereign defaults are certain in Sri Lanka and possible in many other emerging markets, from Mongolia and Pakistan to Egypt and Tunisia. The imf warns that banks laden with risky foreign debt could then fail as currencies depreciate and repayment burdens soar.

Stockmarkets will tighten their standards. America will de-list companies (many of them Chinese) that flout audit rules; Hong Kong and Shanghai will benefit. China will face dangers, particularly in property: Evergrande, an indebted property giant, has until September 2023 to avoid being delisted in Hong Kong. Everywhere, more financial firms will turn to online and mobile channels, competing and co-operating with fintechs. Cross-border payments will see the next shake-up, spurred by the rise of digital currencies and by Russia’s exclusion from swift, a messaging network that underpins international payments.

TO WATCH: Harder than abc. It will be a crunch year for esg as regulators curb greenwashing—corporate spin touting a company’s environmental, social and governance credentials. New eu rules for esg accounting will apply from June, with America’s to follow.

Food and Farming

Food shortages loom in 2023 as a result of the war in Ukraine and climate change. The un expects 19m more people to be undernourished, with nearly 830m going hungry worldwide. Harvests will be thinner in many places. Planting will be hurt globally by a lack of fertilisers from Russia and high energy prices, and the aftermath of 2022’s droughts. Production of wheat and maize will fall, though rice output will climb. Grain exports from Ukraine will be low as Russia plays games with its blockades. Egypt, especially, will suffer.

Even so, sky-high food prices will decline as demand softens. Economist Intelligence’s (eiu) price index for food, beverages and feedstuffs will drop by 12%, led by oilseeds. Consumers will change their tastes to protect their pockets, switching from wheat to millet, or from sunflower oil to other vegetable oils. With food supplies at risk, some countries could turn to new food export bans, sending prices soaring again.

Green goals could suffer, too. To promote “sustainable” farming, the eu will push through its new common agricultural policy, but cut targets for land to be left fallow, to grow more food instead. Britain’s new land-use policy may favour food over solar farms, though it will pay some farmers for carbon cuts and conservation. America’s Farm Bill could do likewise.

TO WATCH: Lab lobsters. Singapore will gain ground as a hub for lab-grown food, as Shiok Meats launches its cell-based shrimp and lobster. In rival Hong Kong, Alt Farm will print wagyu beef. Eat Just, an American start-up, will open a plant there to fabricate chicken.

Health care

Covid-19 will infect millions more in 2023 but—provided no dangerous new variants flourish—deaths should fall to less than double the number from flu. Early in the pandemic, mortalities were over 200 times higher. China may loosen its zero-covid stance, risking a surge in cases. To pre-empt that, it will roll out more vaccines, including homegrown mrna shots. American and British researchers will test all-variant vaccines; monkeypox and malaria jabs will also attract more attention. With pandemic deaths waning, the un believes life expectancy at birth will start recovering in 2023, after decreasing by 1.8 years in 2020-21.

Governments will struggle to fund stretched health-care systems as economies sputter and costs rise. Drug sales and health-care spending per person will climb by about 5% in nominal dollar terms, but fall in real terms as inflation bites. Countries from India to Nigeria will extend universal health care. Finland will introduce far-reaching reforms. Debates about abortion will rage in America and beyond.

Pharma firms will step up acquisitions to cope with patent expiries and generic competition—notably for Abbvie’s anti-inflammatory Humira, the world’s bestselling drug. General Electric will press ahead with spinning off and listing ge Healthcare. Pfizer, planning a greener future, will switch its North American operations entirely to solar power in 2023.

TO WATCH: Baby steps. Genomics England, a government research body, will screen up to 100,000 newborns in 2023 to gather data on rare diseases. It is a small move towards routine whole-genome sequencing, which would be a huge boost for personalised medicine. Rare diseases afflict perhaps 400m people worldwide; three-quarters of such illnesses are genetic.

Infrastructure

For six straight years, gross fixed investment has risen as a share of world gdp, to over 25%. The steady expansion in this proxy for infrastructure spending will falter in 2023 for lack of government cash. Still, opportunities will abound. Globally, investment will be nearly $25trn. This includes pandemic stimulus of $3.2trn, according to the G20’s Global Infrastructure Hub. The G7 will raise $160m to kickstart a global infrastructure fund for emerging markets, in a move to challenge China’s decade-old Belt and Road Initiative.

Public investment planned before the war in Ukraine—including America’s infrastructure law, passed in 2021—will focus on transport, water and digitisation goals. Newer initiatives, such as those from the eu and Britain’s National Infrastructure Bank, will pour money into energy infrastructure. China will channel more funding into rural infrastructure and 5g networks. Unfortunately, inflation has already cut these investments’ value. Labour shortages and high building costs will make many projects profitless for many companies. At least they will keep revenues flowing in tricky times.

TO WATCH: Gas expansion. Investment in new ports and regasification infrastructure for liquefied natural gas will reach $32bn in 2023, as Europe and others wean themselves off piped Russian gas.

Information Technology

Recession risks and interest-rate hikes will not deter it spending in 2023. Companies will increasingly tap technology to predict demand, track supply and secure data. Gartner, a consultancy, expects tech spending to rise by more than 6% from the year before, propelled by firms’ need for software and it services. Device sales will disappoint, with high prices putting owners off replacing gizmos. But automation will accelerate as businesses work to counter high wages and supply problems. The artificial-intelligence market will swell to be worth $500bn, reckons idc, a research firm. Cloud computing will also grow, supporting remote work and companies’ desire to collect and crunch data. Spending on cloud services offered by tech giants such as Amazon and Microsoft will hit about $600bn, Gartner projects.

All this will prompt more firms to build private mobile networks to improve connectivity and tighten security. Spending on these will reach $12bn, says Juniper Research, with 60% of it coming from manufacturing, mining and energy companies. But digitisation increases cyber-security risks; so will geopolitical strife. In 2023 governments will tighten cyber controls, adding to red tape and imposing a big burden on small businesses.

TO WATCH: Cashing in. Computer chips are in demand for use in cars, consumer gadgets and all things digital. But supply woes and China’s threats to Taiwan worry Western governments. They are trying to increase chipmaking on their own shores, with some success. In 2023 South Korea’s sk Hynix will start building a semiconductor factory in America. Other companies will follow. America is offering $52bn in chipmaking subsidies to spur production in the country, and will start handing out the cash in 2023.

WHAT IF? Gene therapies hold great promise. Replacing a piece of a patient’s defective dna with a corrected version can treat everything from rare diseases to common cancers. Roll-out, though, has been very slow. Since 2018, American regulators have approved just 24 cell and gene therapies—most of them hugely expensive. What if there is a breakthrough in gene therapies? This could come through faster approvals, better ways of treating patients or cheaper production. On all fronts, the signs are hopeful. In America, more than a dozen gene therapies could be approved in 2023, according to cvs Health, a pharmacy chain. More than 300 clinical trials are under way worldwide. How these drugs are given to patients could be improved by using adapted viruses (“viral vectors”), newer versions of which could reduce side-effects. As for high prices, investment could cut production costs. In 2023 Biogen, an American firm, will open a new gene-therapy factory, as will Yposkesi, a French company. The biggest gains would come if governments and insurers paid for treatments over several years or rewarded drugmakers based on results. That could unlock gene therapies’ enormous potential.

Media

Following a post-pandemic surge in spending, the advertising business faces harder times. Dentsu, an advertising giant, expects global advertising revenues to grow by more than 5% in 2023, to almost $780bn. But this will be inflated by publishers charging more for adverts, and economic choppiness will hold back would-be advertisers—especially Western ones. Look for lay-offs at advertising and marketing agencies.

Trends seeded during the pandemic will bear fruit. Digital advertising will steal more print dollars, reaching 57% of total spending. Within this, expenditure on mobile ads will increase the fastest, thanks to popular games and short videos. Developing countries in which digital-media consumption is rising—such as Brazil and India—will lead the way. However, depreciating currencies in emerging markets will mean lower profits for America’s technology giants.

Privacy concerns will loom large. Regulators and consumers are pressing the ad world to do away with “cookies”, starving advertisers of precious user-data. Apple’s move to allow people to block third parties from collecting their data will keep digital advertisers on their toes. At least Google’s decision to delay cookie-blocking until 2024 promises some relief to advertisers and ad-dependent businesses. Suffering most from the backlash will be Meta, which depends more than its peers on third-party data. But retailers such as Amazon and Walmart, which own oodles of data on shoppers, will gain: other companies will want to use their websites to target consumers better.

Metals and Mining

After surging to a record high in 2022, eiu’s metals price index will fall by more than 7% in 2023 (though it will still be 40% higher than it was pre-covid). Demand for diamonds and gold will suffer most from the economic downturn, though Chinese stimulus spending will buoy metals needed for construction and manufacturing. North American steel use will hit an eight-year high.

Still, lofty energy prices and power crunches in China and Europe will hamper production of metals, including aluminium, steel and zinc. This could prompt governments to extend temporary bans on scrap-metal exports. Russian suppliers like Nornickel and Rusal will consider merging to limit the effects of sanctions over Ukraine.

The green-energy transition and digitisation will stoke demand for copper and other metals. Electric vehicles and electronics will fuel consumption of lithium, nickel and rare-earth metals.

TO WATCH: Not-so rare earths. American Rare Earths, an Australian mining firm, will release results from its Halleck Creek site in America, where it expects to find over 1bn tonnes of the 17 rare-earth minerals needed for battery production. With many of the world’s rare earths in China and Russia, the project will support America’s battery-security aims. Australia, Britain and the eu and are also boosting investment.

Property

Property-industry sales will be worth $5.8trn in 2023—a huge sum, but just 1% more than in 2022. Higher interest rates will weigh on mortgage lending and depress house prices in some markets. British prices may tumble by 5% as its Help to Buy scheme ends; Australia may see a 9% drop. America’s post-pandemic boom will slow, at the very least. Globally, the uncertainty will prolong a fall in new house starts and office developments, with builders wary of less demand, high costs and labour shortages. Even so, office completions will stay high in many cities, with investors eyeing safe havens and reliable rents to offset inflation.

eiu property figures do not include China, where data are sparse and the sector is fragile. Mortgage boycotts, debt defaults and a weak financing system will keep rocking Chinese confidence into 2023 despite official efforts to support credit growth. Even so, a gradual easing of covid restrictions should fuel demand there and in South-East Asia. India’s luxury market is likely to stay strong. Globally, second-home owners will be lured by sun, sea and seamless internet as they warm to hybrid working.

TO WATCH: Feeling the heat. Property owners will be encouraged, or compelled, to make buildings greener. In 2023 America will offer more tax credits for making energy-saving tweaks. Britain will set minimum energy-efficiency standards. Germany will impose emissions taxes, to be split between landlords and tenants.

Retail

The cost-of-living crisis will hurt shoppers and retailers alike. Even e-commerce’s growth will slow, especially in the West, where tight-fisted consumers and higher interest rates will hinder retailers’ expansion plans. In China, the world’s largest online-shopping market, economic pain will hamper growth; Chinese retail giants such as Alibaba and Pinduoduo will dangle low prices to lure Western consumers. In South-East Asia and Latin America, e-commerce will spread as mom-and-pop stores are digitised. Indeed, three developing countries—Colombia, Nigeria and South Africa—are expected to be among the five markets that Amazon plans to enter in 2023. Online retail-sales expansion will be slow, accounting for just over 14% of global retail sales, fractionally above the figure in 2022.

The online and offline universes will merge further. Click-and-collect will become consumers’ favourite format in richer countries, generating €11.9bn ($12bn) of revenue in Britain, more than triple 2013’s tally. Retailers will cut labour costs by automating warehouses and other back-end operations. At one new distribution hub, Australia’s Myer will deploy 200 robots that will be capable of handling seven out of ten of the company’s online orders. Fashion and luxury brands will experiment in the metaverse, aiming to tap Generation z—the quarter of humanity born after 1997.

TO WATCH: Plastic rules? Governments will clamp down on single-use plastics. Laws will range from Spain limiting sales of plastic-wrapped fruits and vegetables to Canada banning single-use plastics outright. For consumer-goods firms, this will be costly: about 10% of all plastic is used for textiles and nearly a third for packaging.

Telecoms

In 2023 mobile telecoms will boost the global economy by $4.8trn, mostly through improved productivity for its 5.5bn subscribers. So says the Global System for Mobile Communications Association (gsma), an industry body. The spread of 5g technology to middle-income countries such as Argentina, India and Vietnam will take 5g subscriptions past 1bn (though East Asia and North America will still boast more 5g users). But smartphone sales will flag amid recessions and semiconductor-supply problems.

Broadband will reach more homes in the developing world. Nigeria, for instance, is aiming for 50% penetration by 2023. Still, wobbly economies will curb telecoms operators’ spending. Despite raising prices for consumers, operators will struggle to finance investments in their networks. In Asia and Europe, firms under strain will try to merge, but regulators may stop them. European operators will watch to see whether Orange and MasMovil are allowed to combine in Spain, as planned, in 2023. Should they succeed, others will follow suit.

European governments want American tech firms to fund improvements to Europe’s digital infrastructure, claiming they are free-riders. Whether the eu will act, and risk damaging the West’s united front against China’s tech dominance, is uncertain. But eu regulators will tighten the noose around big tech anyway. The Digital Markets Act, due to take effect in early 2023, aims to help new players compete with the tech oligopolies.

Travel and Tourism

No longer grounded, the airline industry should turn profitable in 2023 as pent-up demand boosts international tourist arrivals by 30%, to 1.6bn. But global tourism will not return to normal. Arrivals will fall short of pre-pandemic levels of 1.8bn, held back by escalating living costs and China’s zero-covid policy. Tourism receipts, at around $1.4trn, will regain their 2019 heights only because of high energy, staff and food costs. Covid will cause further staff shortages, particularly in America and Europe. Business travel will stay subdued as online meetings persist.

Still, sporting and other events will spur travel. China has shied away from holding June’s afc Asian Cup football contest, but will ease restrictions to host the postponed Asian Games in September. China’s limited reopening will help Asia double its tourism arrivals in 2023. Meanwhile, France will hope to convert the Rugby World Cup into tourism gold. In Saudi Arabia, the haj will move from a lottery system to quotas, letting in more pilgrims.

TO WATCH: Full sails. No longer petri dishes for covid, cruise-ship bookings will return to pre-pandemic levels in 2023. France will even get a new cruise line, Compagnie Française de Croisières. Its service will be launched using a second-hand ship, which is aptly dubbed Renaissance.

0 notes

Text

What Makes Dubai The Best Place To Buy Luxury Homes Worldwide?

Dubai is renowned for being a tourist and transportation hub. The emirate is considered one of the most beautiful cities in the world. Thanks to its location, economic stability and policies that embrace the expats, the world is keen to be a part of the growing city.

High net worth individuals (HNWIs) around the globe are flocking to buy into luxury apartments in Dubai. There has been a surge in the number of foreigners relocating to Dubai. Some view it as a second home, whereas others have become citizens. So today, we will look at three reasons that make Dubai the perfect option for HNWIs to acquire luxury homes.

Affordable Luxury Quotient

Compared to other major cities, Dubai has the best value for luxury property. It was not until 2002 that foreign ownership was legalised in the city. Considering how Dubai is a newcomer to the global luxury home destinations list. The town now caters to a luxurious lifestyle of all flavours for every individual.

The Knight Frank 2019 wealth report analysed how luxury homes in Dubai are less pricey than those in other major cities like Monaco, Hong Kong, London, and New York. With $1 million or AED 3.6M in Dubai, you can get as much as 1,539 sq. ft. of luxury property, stated the report, compared to 334 sq. ft. of prime property in London and New York.

One might presume that the low cost of prime property might mean lower construction standards, but that couldn't be further from the truth. Dubai has a portfolio full of superlative property developments. The best real estate developers in Dubai allow the comfort of choice as an ultimate advantage to interested buyers. At the same time, such is the luxury on offer that one can get petrol home delivered at negligible extra cost!

It's Easier To Buy Luxury Property In Dubai

Dubai is a global city with a cosmopolitan population. This means that many people from different cultures and backgrounds are looking for luxury homes in the town. As a booming economy, it is one of the most prosperous cities in the world. Making it an ideal place to invest.

Foreign real estate investors benefit from the capital and income-tax-free system, with additional levies missing from property purchases in Dubai acting as the cherry on the top. This means you will have simpler transactions, more profit and more property to your name compared to other cities.

Combining this with a rapidly growing ROI in the emirate's residential market, steady population growth, and a premium standard of living makes luxury residential property for sale in Dubai an exciting prospect.

The Location Of Dubai

Dubai is situated on the Persian Gulf in the United Arab Emirates. It is roughly at sea level (the Persian Gulf is shallow compared to the oceans). Dubai shares boundaries with Abu Dhabi in the south, Sharjah in the northeast, and Oman's exclave of Musandam in the northwest. The north of Dubai is covered with desert, while the south has sandy beaches. The coastline along Dubai is about 87 kilometres or 54 miles long. At the same time, there are several off-shore islands like Palm Jumeirah, Deira Island and others that have been created using land reclamation.

The emirate geographically gives businesses the best of both the east and west worlds. The time zone it falls under is also convenient for businesses that aim to expand globally, acting as a centre point to match the timings of both the western and eastern sides. Besides, air travel connectivity is also an added privilege. Within a day, you can land in key cities in Asia, Europe, or the Middle East using air or water travel. Pair this with a long-term real estate visa, and nothing can hold the investor or business person in you from buying a luxury home.

Conclusion

Dubai has long been a sought-after destination for luxury home buyers from all over the world. And it's no wonder why – with its stunning architecture, world-class amenities, and incredible location, Dubai has everything you could ever want in a luxury home. If you're considering buying a luxury home in Dubai, Imperial Avenue Downtown Dubai by Shapoorji Properties should be at the top of your list.

FAQ

1) Which property is best to buy in Dubai?

Ans: Imperial Avenue, Downtown Dubai, by Shapoorji Pallonji, is a luxury residential property in the heart of Downtown Dubai. The project offers the finest living amenities like two infinity swimming pools, an indoor and outdoor play area, a mini theatre, and much more. Located in the vicinity of the legendary Burj Khalifa, the views of the majestic Dubai skyline paired with an exceptional living standard are hard to beat when it comes to properties in Dubai.

2) What are the benefits of buying property in Dubai?

Ans:

Availability of property in luxury areas

Affordable luxury homes for sale.

Availability of affordable off-plan property.

Availability of freehold areas.

Consistent development.

Dubai property visa.

Technological advancements.

Secure Living

3) Why is it the right time to buy luxury property in Dubai?

Ans: With the real estate market surging and a predicted uptrend in the following years, right now is the best to invest in Dubai to experience the highest Return on Investment. Dubai's foreign investment market is relatively young; thus, the government is nurturing an investment climate with schemes like a zero-income tax for residents and expats.

#imperial avenue downtown dubai#Shapoorji Properties#apartments for sale in downtown dubai#2 bedroom apartment in dubai#Top Developers in Dubai#real estate property developers in dubai#best real estate developer in dubai

0 notes

Text

Fuerteventura sieht dem ersten Tag der WTM mit einer deutlichen Zunahme der Flugverbindungen entgegen.

WTM 2022 -London

Fuerteventura sieht dem ersten Tag der WTM mit einer deutlichen Zunahme der Flugverbindungen entgegen.

Auf dem britischen Markt sind die Buchungen im Vergleich zu 2019 um 48 % gestiegen.

Montag, 7. November 2022

Fuerteventura beginnt seine Präsenz auf dem World Travel Market (WTM) mit sehr guten Daten vom britischen Markt, der die Insel weiterhin für seinen Urlaub wählt, mit…

View On WordPress

0 notes

Text

Reading Report 2 - Modernity

Shoshana takes us through the story of mass production, comparing Henry Ford’s rise in consumption of automobiles (first modernity), to the explosion of Apple products in the early 2000s (second modernity. Apple’s strategy used, for example, the digitalization of music to drop the cost of production in various elements like packaging, transportation, and physical retailing, while also giving listeners the opportunity to choose the order of their playlists at their will, making it much more dynamic than any physical version of music on the market (CDs, cassettes, vinyl, etc)

Zuboff counters the arguments that this success from Apple is given to people’s need for convenience but rather attributes this to the ever-growing, and perhaps ever always festering, need for a market that caters to each individual specifically, with products that you can customize to your own wants so much so that there will be no other device with the exact same components or data history as yours. A need that has been turned around against its consumers by surveillance capitalism in a way to make more profit, disregarding our digital privacy, as foreshadowed by the intro of this book.

The start of the first modernity, around 200 years ago, marks a time when some people were able to distance themselves from their identity beyond what their family, village, and community had in stock for them. For example, being able to move away from a feudal and agricultural society, to a more industrialized city, and choose where you would want to start over according to your desires, and who you want to be in this new place - still confined by the social hierarchies each individual is affected by within their given community, and the consequent pressure to obey to your social role. As the author puts it “you adapted to what the world had to offer, and you followed the rules” (p. 34).

In the latter half of the 20th century, or in her words, the second modernity, general improvements in quality of life, traveling, and access to a big flow of information and knowledge made grounds for the self and individual identity, opinions, and values to become undeniably important. All of this was soon to be amplified by the internet and the digital world, the perfect tool to exploit the need to be seen and heard, of community and connection while giving the corporate world a chance to market to us ever more specifically with their growing access to our data.

The second modernity gave us a sense of individual importance and control over our lives and identities, while the economic and political reality silently continues to worsen with little pushback from governments that have been shown to protect the interests of the financial elites that exploit us.

Zuboff, S. (2019) The age of surveillance capitalism: The fight for the future at the New Frontier of Power. London: Profile Books.

0 notes

Text

Highlights and lowlights

#HIGHLIGHTS AND LOWLIGHTS HOW TO#

I share tools, resources and brain bombs for your strategy comms for planners.Hidden statistic: The Lions held the ball for just 3:37 in the fourth quarter and gained 14 net yards.īest pass: Roethlisberger split two defenders with a bullet to running back Le’Veon Bell in the second quarter, and the play went for 43 yards. Sign up to my fortnightly Planning Dirty Newsletter. Have a great holidays and I wish you all the best in knocking it out of the park in 2020! So if you have a strategy assignment (>$25K) and would like to collaborate shoot me an email. I’m excited about 2020, I’ve learned a lot and Amber and I are making a move back to NYC. Working by yourself that muscle fades away.

#HIGHLIGHTS AND LOWLIGHTS HOW TO#

I loved growing as a manager and learning how to be a better leader. Managing the Comms Planning team at BBDO was a career highlight. Next year I’m going to get closer to the making of work. Seeing how much it impacts all other facets of my life it seems like something that deserves more attention.Īs a hired brain you don’t get to see the work all the way through to completion. Having spoken to a number of middle-aged guys, it seems that I’m not alone and that it’s an unspoken truth. Having been a social person I was surprised to experience it in a serious way this year.Ĭonsulting from home and moving to LA led to me not really speaking to many people every week and feeling isolated with everything being so far away. You have less than 48 hours to sign up for the early bird price of $199 (Available till December 19th). I’ve always been a big fan of Contagious and now we’re creating a course together on creating innovative campaigns. In less than 6 months it has grown to over 300 members and the feedback so far has been overwhelmingly positive. I have always liked teaching and now with the academy online I get to do it every week. If you would like to see the 26 strategy decks from 2019, it’s in the latest newsletter or you can sign up to the newsletter here. Three big things changed this year ĭavis Ballard came on and made my shit look hot, I opened myself up to collaborating with more folks, and I had an amazing group of translators helping the message get out to more strategists. Growing to 19,800 subscribers an additional 9,000 new subscribers in 2019. Planning Dirty newsletter growth has been bananas. An off-hand comment on a podcast turned into an opportunity to travel around the world with a good mate doing what we love. With my partner in crime Mark Pollard, we were able to run strategy classes to over 250 strategists in NYC, Chicago, LA, London, and Sao Paolo. I worked with some great agencies too, DDB, Deutsch, FCB, 21CB and Saatchi & Saatchi on a variety of projects from strategy operations to comms planning work sessions. Gallo Wines, I helped redesign their integrated marketing communication process for their 80+ wines Girlboss, I worked on an acquisition strategy for their new online platform Uber, I created the global creative strategy for their high capacity vehicle (Uber Van)ĭisney, I ran a scouting strategy workshop, uncovering their brand and comms strategy for one of their brands for 2020įacebook, I ran comms planning workshops across the Americas (Sao Paolo, LA, and Toronto) HighlightsĬonsulting has opened me up to an amazing group of clients working on a diverse range of strategy assignments. Consulting has been an exciting rollercoaster this year, here are the highs and lows.

1 note

·

View note

Text

How a 22-year-old "digital nomad" makes $11k a month traveling the world

How a 22-year-old “digital nomad” makes $11k a month traveling the world

Louise Truman, 22, says she “caught the travel bug” after jetting off to Tanzania to climb Mount Kilimanjaro in 2019. After completing high school that summer, Truman got a job as a digital marketer while studying for a degree in Spanish and history at King’s College London, a public research university located in London, England, in the U.K.

She said studying online due to the pandemic gave her…

View On WordPress

0 notes

Link

0 notes

Text

How Luxury Retail Businesses Can Safely Expand Online

COVID-19 has been an unprecedented challenge to luxury retail around the world, as brick-and-mortar mainstays had to close for extended periods of time. Even Harrods of London, famed for staying open during World War II, had to close its Knightsbridge store in March 2020 for 2 months.

Consumers have flocked online while stuck at home, leading to a quick shift in marketing dollars online for brands that already have an e-commerce presence. This has helped to tide over retailers that depend on tourist dollars; for example, Chinese consumers that have made up more than 33% of global spending on luxury goods 2019 are now going online.

But what about those retailers that don’t have a stable online presence?

Many have had to make unheard-of decisions. For example, luxury watch brand, Patek Philippe, had to announce that its watches were, for the first time in its 181-year old history, available to purchase online through select distributors.

Related Content:

Learn About The Four Countries In Asia-Pacific That Account for 20% Of Global Travel Spending

This has undoubtedly been a hard decision, as the brand prides itself on its exclusivity, and has said that it will go back to in-store only sales once the pandemic is over.

Early trends show long-lasting effects of e-Commerce during COVID-19

For brands that are trying to wait through this pandemic, data shows that consumer behaviour might have permanently changed.

As the pandemic has lasted an extended period of time, some consumers that were forced to buy food and groceries online short-term are now used to getting everything they need through e-commerce.

Older consumers (in this case 31 years and above), for example, made up of only 49% of online consumers in a January 2020 Yotpo report, but then jumped to 60% by the end of February.

This increase in demand for online shopping and engagement has gone beyond product type, price, and location. “Knight Frank , an estate agency, says online views of luxury homes valued at £10 million (11.4 million euro) or more were up 22 percent in the week ending March 28th, compared to the same period last year”, according to Luxury Society.

A permanent shift to online shopping may happen. Coupled with the decreasing brand loyalty, with consumers willing to switch to available competitors, luxury retailers that aren’t online will be handicapped.

The question now remains: how can luxury retailers take control of their presence online, and move forward while maintaining their brand identity?

3 Ways For Luxury Retailers To Build A Presence Online

1. Use third-party marketplaces and distributor relationships to sell online

For luxury brands that have established distributor relationships worldwide, relying on distributors to sell online can help to mitigate some of the more complicated logistical issues with e-commerce.