#activate cash app card via phone

Text

Cash App Limits: How Much Can You Withdraw, Send and Receive Daily?

Cash App is a payment app available for iOS and Android that is used to send and receive money, as well as make purchases and invest. Cash App, like similar payment apps, has limits for all of its transactions.

Cash App limits vary based on the transaction type and identity verification status. For example, unverified accounts have a 30-day sending and receiving limit of $1,000. However, that limit can be increased by meeting Cash App identity verification requirements.

Keep reading to learn more about Cash App’s sending and spending limits, and find out how you can increase yours.

What Is Cash App?

Cash App is a platform that allows you to send and receive money, make purchases, invest in stocks, buy and sell bitcoin, and complete other financial transactions. Cash App also partners with other financial institutions and banks to provide debit cards and brokerage services. You can even use Cash App to file your taxes and have your refund sent directly to your Cash App account.

Cash App Limits

Cash App limits apply to all accounts, and generally depend on whether the account is verified.

Cash App Sending and Receiving Limits

Unverified Cash App accounts can send and receive up to $1,000 within 30 days. When you reach these limits, Cash App will ask you to verify your identity right in the app. You will need to provide your full name, date of birth, and your Social Security number to increase your limits. Verifying your account may significantly increase your limits, potentially allowing transactions up to $7,500 weekly.

Cash App Withdrawal Limits and Spending

If you use the Cash App Cash Card a debit card that is connected to your Cash App balance — you may be subject to spending limits, similar to other debit cards. The Cash App limit per day and transaction for Cash Card users is $7,000. Daily limits reset at 6 p.m. Central Standard Time each day.

The Cash Card also has weekly and monthly limits. You can spend up to $10,000 per week and $15,000 per month. Weekly limits reset at 6 p.m. CST on Saturdays, while monthly limits reset at 6 p.m. on the last day of the month.

The Cash Card daily limitations cover all types of transactions. This includes purchases made in-store or online, ATM withdrawals, and even transactions that are declined. Essentially, any activity with your Cash Card counts towards this daily limit.

Cash App Limits for Users Under 18

With a Cash App family account, users under 18 will automatically have access to borrow money, make deposits via check, and contact phone support. With consent from a parent or guardian, these younger users can also send and receive money — up to $1,000 within 30 days — as well as have a personal debit card and transfer funds between Cash App and a linked bank account.

They can also transfer up to $7,500 per 30 days into their Cash App account and move up to $25,000 per seven days out of their Cash App account. In addition, users under 18 can make paper money deposits of up to $250 within seven days and $1,000 within 30 days.

Users under 18 who have a Cash Card are subject to the same spending and withdrawal limits as users over 18.

How To Increase Your Cash App Daily and Weekly Limits

Increasing your Cash App limits is relatively simple. After setting up your Cash App account, you just need to verify the following information to confirm your identity:

Your full name

Your date of birth

Your Social Security number

If you’re under 18, a parent or guardian must give consent to access certain features and increase your limits. In some cases, Cash App may need to request additional information if they are unable to verify your identity with just the information listed above.

How To Send Cash App Payments?

The Cash App platform is designed with ease in mind, so sending money to another Cash App user just takes a handful of simple steps:

Open the app and enter the amount you want to send.

Tap “Pay.”

Search for the recipient using an email address, phone number, or Cashtag.

Add a note describing the purpose of the payment.

Tap “Pay” again to complete the transaction.

Is Cash App Safe To Send and Receive Money?

Cash App has many security features to keep your money safe. In addition to using top-tier data encryption, Cash App accounts can be locked using a PIN, Touch ID, or Face ID, and users can enable account notifications to monitor activity. Cash Card users can disable their cards at any time, and Cash App also has security features specific to Bitcoin storage and fraud protection.

It’s important to note that Cash App sending limits are relatively low, especially compared to traditional bank accounts and some other money apps. If you send or receive money regularly, you should compare your options to make sure your transaction limits are high enough to meet your needs.

0 notes

Text

How Can You Protect Yourself from Scams on Cash App?

Cash App offers a convenient way to handle financial transactions, but it also attracts scammers looking to exploit unsuspecting users. Protecting yourself from scams is crucial to ensuring your financial security. Based on my experience and observations, here are some effective strategies to safeguard your Cash App account.

Be Wary of Unsolicited Requests for Money

One common scam involves receiving unsolicited requests for money. Scammers often create fake profiles or use deceptive messages to trick users into sending funds. I once received a message from someone claiming to be a friend in urgent need of money. They asked for financial help through Cash App, but I was suspicious of the request. Always verify the identity of anyone requesting money before sending any funds. Contact the person through a different communication channel to confirm their request’s legitimacy.

Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your Cash App account. I’ve found that enabling 2FA significantly reduces the risk of unauthorized access. To enable 2FA, go to the Cash App’s profile section, select "Privacy & Security," and then turn on two-factor authentication. This process usually involves linking your account to your phone number or email address. With 2FA enabled, you’ll receive a verification code whenever there’s an attempt to access your account from an unfamiliar device.

Avoid Sharing Personal Information

Scammers may attempt to trick you into sharing sensitive information such as your Cash App PIN or linked bank account details. It’s crucial to keep this information confidential. I’ve encountered scams where individuals posed as Cash App support representatives and asked for personal details. Remember, Cash App will never ask for your PIN or full card number via email or text. Be cautious about sharing any personal information and verify the identity of anyone requesting such details.

Monitor Your Account Activity

Regularly monitoring your account activity can help you detect any suspicious transactions early. I make it a habit to review my account statements and transaction history frequently. Look for any unauthorized transactions or unusual activity. If you spot anything suspicious, report it to Cash App support immediately. They can investigate and take appropriate action to secure your account.

Educate Yourself About Common Scams

Being aware of common scams can help you avoid falling victim to them. Some common scams include phishing attempts, fake customer support calls, and fraudulent investment offers. I’ve researched and learned about various scam tactics to stay informed and cautious. By understanding how scammers operate, you can better protect yourself and your financial information.

Use Secure Payment Methods

When making transactions on Cash App, use secure payment methods and avoid using unsecured or public networks. I’ve had issues with payment security when using public Wi-Fi networks, so I now use a secure and private connection whenever handling financial transactions. Ensure that your internet connection is safe and that you’re not using public or shared Wi-Fi for sensitive transactions.

By implementing these strategies, you can significantly reduce your risk of falling victim to scams on Cash App and protect your financial information. Staying vigilant and informed is key to maintaining the security of your account.

Discover IndustryArea.us: Your Comprehensive Source for USA Contact Information

For in-depth access to extensive USA contact details, explore the IndustryArea.us directory. Offering a wide array of listings, this resource ensures you can find specific contacts across various industries and regions within the United States. Whether you're searching for business contacts, customer service numbers, or professional connections, IndustryArea.us is a dependable platform to streamline your search. Utilize its userfriendly interface and vast database to access the most relevant and current contact

information tailored to your needs. Efficiently uncover detailed American business contact information with the IndustryArea.us directory today.

0 notes

Text

Parking scam warning as fraudsters print fake QR codes

Get the free Morning Headlines email for news from our reporters across the world

Sign up to our free Morning Headlines email

Drivers are being told to avoid QR codes to pay for parking following a spate of scams.

The RAC advised motorists to make payments only with cash, cards or official apps.

In recent weeks there have been incidents of fraudsters placing stickers featuring QR codes on parking signs in locations such as Barking and Dagenham, Northumberland, Northamptonshire, South Tyneside and Pembrokeshire.

Drivers who scan the codes with their phone are shown fraudulent websites asking them to enter their card details, which criminals use to spend money from their accounts.

A QR code, which is an abbreviation of quick response code, is a barcode which enables people to get rapid access to a website or download link by scanning it with their phone camera.

A QR code user (Getty Images/iStockphoto)

RAC head of policy Simon Williams said: “A car park is one of the last places where you’d expect to be caught out by online fraud.

“Unfortunately, the increasing popularity and ease of using QR codes appears to have made drivers more vulnerable to malicious scammers.

“For some, this sadly means a quick response code could in fact be a quick route to losing money.

“As if this scam isn’t nasty enough, it can also lead to drivers being caught out twice if they don’t realise they haven’t paid for parking and end up getting a hefty fine from the council.

“The safest course of action when paying for parking at a council-owned car park is to avoid using QR codes altogether.

“Most of these councils don’t even operate a QR code payment system, so if you’re in any doubt, steer well clear and only pay with cash, card or via an official app downloaded from your smartphone’s app store.”

He added that this “new wave of criminal activity” demonstrates why the UK is in “dire need” for a system which allows people to pay for parking with a single app.

Source link

via

The Novum Times

0 notes

Text

How to send money from Venmo to PayPal without a Bank account?

In today's digital age, the ability to seamlessly transfer money between various financial platforms is more important than ever. Venmo and PayPal are two of the most popular digital wallets available, offering users convenient ways to manage and transfer money. However, many users face challenges when trying to move funds between these two platforms without involving a traditional bank account. This article explores the methods available for transferring money from Venmo to PayPal without the need for a bank account, ensuring a smooth and hassle-free experience.

Understanding Venmo and PayPal

What is Venmo?

Venmo is a mobile payment service owned by PayPal that allows users to transfer money to one another using a mobile phone app. Venmo is known for its social media-like interface, where users can share and comment on transactions.

What is PayPal?

PayPal is an online payment system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders. PayPal is widely used for online shopping, business transactions, and personal transfers.

Differences between Venmo and PayPal

User Base: Venmo is more popular among younger users, while PayPal has a broader demographic.

Interface: Venmo incorporates social media features, whereas PayPal focuses on a more professional interface.

Fees: Fee structures differ for instant transfers and business transactions.

Similarities between Venmo and PayPal

Ownership: Both platforms are owned by PayPal Holdings, Inc.

Digital Wallets: Both serve as digital wallets allowing users to store and transfer money.

Mobile Apps: Both have user-friendly mobile applications for ease of use.

Setting Up Your Accounts

How to Create a Venmo Account?

Download the Venmo app: Available on iOS and Android.

Sign up: Use your email, mobile number, or Facebook account.

Verify your account: Complete the verification process by linking your phone number.

How to Create a PayPal Account?

Visit the PayPal website or download the app.

Sign up: Provide your email address and create a password.

Verify your account: Link your phone number and follow the verification steps.

Verifying Your Accounts

Both Venmo and PayPal require users to verify their identities to ensure security and comply with financial regulations. This often involves linking a phone number, and identifying, and confirming email addresses.

Funding Your Venmo Account

Adding Money to Venmo

Receive payments from friends: The simplest way to fund your account.

Bank transfer: Link a bank account to add money (if available).

Cash a check: Use the check-cashing feature within the app.

Requesting Money from Friends

Venmo allows users to request money from friends and family. This feature is particularly useful for splitting bills or shared expenses.

Using Venmo’s Cash Card

The Venmo Cash Card is a debit card that lets users spend their Venmo balance in stores or online, wherever Mastercard is accepted.

Using PayPal Cash Card

What is a PayPal Cash Card?

The PayPal Cash Card is a debit card linked directly to your PayPal balance, allowing you to use your funds wherever Mastercard is accepted.

How to Get a PayPal Cash Card?

Apply online: Through the PayPal website or app.

Verification: Complete identity verification.

Receive your card: Typically within 7-10 business days.

Activating Your PayPal Cash Card

Once you receive your card, activate it online or via the PayPal app to start using it.

Linking Venmo to PayPal

Why Linking Directly Isn’t Possible?

Currently, there is no direct way to link Venmo to PayPal due to the different operating mechanisms and policies of each platform.

Alternative Methods

Using intermediary services: Utilize services like TransferWise or Western Union.

Employing a third-party service: Services that can link different digital wallets.

Using Intermediary Services

Some services act as a bridge between Venmo and PayPal, allowing you to transfer money indirectly by routing through another account or service.

Transferring Money Indirectly

Using a Friend’s Bank Account

Send money to a trusted friend's bank account via Venmo.

Have them transfer the funds to your PayPal account.

Employing Third-Party Services

Services like Cash App can sometimes be used to transfer money between different digital wallets.

Utilizing Gift Cards

Purchase a gift card with your Venmo account and use it to fund your PayPal account.

Using Cryptocurrency as a Bridge

Introduction to Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses cryptography for security and can be used to transfer funds between different platforms.

Buying Cryptocurrency on Venmo

Enable cryptocurrency features in the Venmo app.

Purchase cryptocurrency using your Venmo balance.

Selling Cryptocurrency on PayPal

Enable cryptocurrency features in the PayPal app.

Sell the cryptocurrency and transfer the funds to your PayPal balance.

Using a Venmo Card to PayPal

Ordering a Venmo Card

Apply for a Venmo card through the app.

Wait for delivery: Typically within 7-10 business days.

Adding Your Venmo Card to PayPal

Go to PayPal settings.

Add a new card: Enter your Venmo card details.

Confirm the card: Follow the verification steps.

Transferring Funds Using the Venmo Card

Once added, you can use the Venmo card to make payments via PayPal.

Transferring Money Through Services Like Zelle

What is Zelle?

Zelle is a digital payment network that allows users to send and receive money directly between bank accounts.

Setting Up Zelle with Venmo

Link Zelle to your bank account.

Send money to Zelle from Venmo.

Using Zelle to Transfer to PayPal

Receive funds in Zelle.

Transfer to your linked PayPal account.

Benefits of Linking Venmo and PayPal

Convenience

Linking these accounts makes it easy to manage funds without needing a traditional bank account.

Speed of Transactions

Transfers between linked accounts are usually faster than other methods.

No Need for a Bank Account

These methods allow you to bypass the need for a traditional bank account entirely.

Challenges and Limitations

Security Concerns

Always be cautious of potential security risks when using multiple financial platforms.

Fees Involved

Be aware of any fees associated with transferring money through different methods.

Transaction Limits

Both Venmo and PayPal have transaction limits that might affect your ability to transfer large amounts.

Security Considerations

Keeping Your Accounts Safe

Use strong passwords and enable two-factor authentication.

Monitor your accounts regularly for any suspicious activity.

Recognizing and Avoiding Scams

Be cautious of phishing attempts.

Verify recipient information before transferring money.

Best Practices for Online Transactions

Use secure networks.

Keep software and apps updated to the latest versions.

Customer Support and Help

Contacting Venmo Support

Phone support: Available during business hours.

Email support: Typically responds within 24-48 hours.

Help Center: Online resources and FAQs.

Contacting PayPal Support

Phone support: Available 24/7.

Email support: Typically responds within 24-48 hours.

Help Center: Online resources and FAQs.

Community Forums and Help Centers

Both Venmo and PayPal offer community forums where users can ask questions and share experiences.

Expert Insights

Financial Expert Opinions on Digital Wallets

Experts highlight the convenience and growing importance of digital wallets in today's financial landscape.

Interviews with Frequent Users

Regular users often praise the ease of use and flexibility of both Venmo and PayPal.

Case Studies

Real-Life Examples of Successful Transfers

Case Study 1: User A successfully transferred $500 using a third-party service.

Case Study 2: User B used gift cards and cryptocurrency to move funds.

Lessons Learned from Others’ Experiences

Learning from the experiences of others can help you avoid common pitfalls and find the best methods for your needs.

Conclusion

Transferring money from Venmo to PayPal without a bank account may require a bit of creativity, but it is certainly possible with the right approach. By exploring various methods, such as using third-party services, cryptocurrency, or even gift cards, you can find a solution that works best for your needs. Embrace the flexibility and convenience of digital payments, and take advantage of the numerous options available to manage your finances effectively.

0 notes

Text

How to Retrieve Money from a Closed Cash App Account

When your Cash App account gets closed, it can be a frustrating experience, especially if you still have funds in the account. However, there are systematic steps you can follow to retrieve your money. In this article, we provide a comprehensive guide on how to recover your funds from a closed Cash App account.

Understanding Why Your Cash App Account Was Closed

The first step in resolving this issue is understanding why your cash app account was closed. Common reasons include:

Violation of Terms of Service: This could be due to fraudulent activities, multiple disputed transactions, or other breaches of Cash App policies.

Suspicious Activity: Unusual login attempts or transfers could trigger a security lockdown.

Unverified Information: Not completing the necessary verification steps can result in account closure.

Understanding the reason can help you address the specific issue and expedite the recovery process.

Steps to Recover Funds from a Closed Cash App Account

1. Contact Cash App Support

The most direct method to resolve account issues is by contacting Cash App support. Here’s how you can do it:

Via App:

Open the Cash App on your mobile device.

Tap the profile icon on your Cash App home screen.

Scroll down and select "Cash Support."

Choose “Something Else” and navigate to your issue.

Tap “Contact Support” and explain your problem.

Via Website:

Go to the Cash App website.

Scroll down to the bottom of the page and click on “Support.”

Sign in to your account.

Select your issue and click “Contact Support.”

Providing detailed information about your account and the issue will help expedite the process.

2. Verify Your Identity

If your cash app account was closed due to unverified information, you might need to provide additional documentation to verify your identity. This can include:

A government-issued ID

Proof of address

The last four digits of your Social Security Number (SSN)

Ensure all information matches the details you provided during the account setup.

3. Review Transaction History

To ensure you recover all your funds, review your transaction history. This includes:

Pending payments

Completed payments

Received payments

4. Link a New Bank Account or Debit Card

If your previous bank account or debit card is no longer accessible, you will need to link a new one. Here’s how:

In the App:

Open the Cash App and tap the profile icon.

Select “Linked Banks” or “Add Bank.”

Enter the new bank details and follow the prompts to verify.

5. Request a Cash Out

Once your account is accessible and verified, you can transfer the remaining funds to your

Linked bank account or debit card and Follow these steps to request cash out:

In the App:

Open the Cash App and go to the “Banking” tab.

Tap “Cash Out.”

Choose the amount you want to transfer.

Select the desired deposit speed (Instant or Standard).

Confirm with your PIN or Touch ID.

What to do if Support is Unresponsive

In cases where Cash App support is not responsive or the issue remains unresolved, consider the following steps:

1. Escalate the Issue

If initial support attempts fail, escalate the issue by:

Requesting to speak with a higher-level support representative.

Reaching out via multiple channels such as email, social media, or phone.

2. File a Complaint

If your issue persists, you can file a complaint with external agencies:

Better Business Bureau (BBB): Submitting a complaint to the BBB can sometimes prompt faster resolution.

Consumer Financial Protection Bureau (CFPB): This agency handles complaints related to financial products and services.

3. Seek Legal Advice

If all else fails, consult a legal professional who can provide advice on potential next steps, including possible legal action to recover your funds.

Preventing Future Account Closures

To avoid similar issues in the future, consider these preventive measures:

1. Follow Cash App’s Terms of Service

Always adhere to the platform’s terms and policies to prevent violations that could lead to account closure.

2. Verify Your Information

Ensure your personal information is up-to-date and fully verified to avoid any verification-related closures.

3. Monitor Account Activity

Regularly check your account for any suspicious activity and report it immediately to Cash App support.

4. Use Strong Security Practices

Enable two-factor authentication (2FA) on your Cash App account.

Use a unique, strong password and change it regularly.

Avoid sharing your login details with anyone.

By following these detailed steps, you can effectively recover your funds from a closed Cash App account and ensure smoother transactions in the future. Always stay vigilant and proactive to maintain the security and accessibility of your financial resources.

0 notes

Text

Tips for Using Taxis Safely and Effectively in Peterborough

Navigating Peterborough can be much easier with the convenience of taxis. However, to ensure a safe and efficient experience, it's important to be mindful of certain practices and tips. Whether you're a local resident or a visitor, here are some essential guidelines for using Peterborough taxis safely and effectively.

1. Choose a Reputable Taxi Service

The first step to a safe taxi ride is selecting a reputable service. Look for well-established taxi companies with positive reviews and a strong presence in the community. Avoid unlicensed or unmarked cabs, as they may not meet the necessary safety standards. A reliable taxi service will have clearly marked vehicles, professional drivers, and a way to track your ride.

2. Pre-Book When Possible

Whenever possible, pre-book your taxi. This not only ensures availability, especially during peak hours, but also allows you to verify the legitimacy of the service. Pre-booking can often be done via phone, online, or through a mobile app. Confirm the booking details, including the driver's name and the vehicle's license plate number, to ensure you get into the correct taxi.

3. Verify the Driver and Vehicle

Before getting into the taxi, check that the driver matches the information provided during the booking process. Look for a visible ID badge and confirm the vehicle's registration number. This extra step can prevent potential scams and ensure your safety. If anything seems suspicious, trust your instincts and avoid getting into the vehicle.

4. Share Your Ride Details

For added safety, share your ride details with a friend or family member. Many taxi services offer a ride-sharing feature within their apps, allowing you to send your trip information to someone you trust. This way, someone else is aware of your location and expected arrival time, providing an extra layer of security.

5. Use GPS and Map Applications

Using GPS or map applications during your ride can help you stay informed about your route. This is particularly useful if you are unfamiliar with Peterborough. Having a general idea of your route can prevent the driver from taking unnecessary detours and ensure you reach your destination efficiently. If you notice any significant deviations from the expected route, don't hesitate to ask the driver about it.

6. Keep Your Belongings Close

Always keep your personal belongings close to you, ideally on your lap or within arm's reach. Avoid placing valuable items on the seat next to you or in the back seat where they could be forgotten or easily stolen. Before exiting the taxi, double-check to make sure you have all your belongings with you.

7. Be Aware of Your Surroundings

While inside the taxi, stay aware of your surroundings. Pay attention to the driver's behavior and any unusual activity outside the vehicle. Avoid distractions such as using your phone excessively, and if you feel uncomfortable at any point, ask the driver to pull over in a safe, populated area.

8. Know the Fare Structure

Understanding the fare structure can help you avoid overcharging. Familiarize yourself with the typical rates, including any additional charges for late-night rides, luggage, or extra passengers. Most reputable taxi services have transparent pricing, which you can often find on their website or app. If you believe the fare is incorrect, discuss it calmly with the driver or contact the taxi company for clarification.

9. Pay Securely

When it comes to payment, use secure methods. Many taxis now accept credit/debit cards and mobile payments, reducing the need to carry large amounts of cash. If paying by card, ensure the transaction is completed before leaving the taxi. Request a receipt for your records, which can be useful if there are any disputes or issues later.

10. Provide Feedback

Providing feedback about your taxi experience helps improve the service for future riders. If you had a positive experience, let the taxi company know. Conversely, if there were issues, constructive feedback can help them address problems and enhance their service. Many companies have customer service options or feedback forms available online.

Conclusion

Using taxis in Peterborough can be a convenient and efficient way to get around, provided you follow these safety and effectiveness tips. Choose reputable services, pre-book when possible, verify driver and vehicle information, and stay aware of your surroundings. By taking these precautions, you can ensure a safe and pleasant taxi experience, allowing you to navigate the city with confidence and ease.

#Taxi Peterborough#Taxis Peterborough#Taxi in Peterborough#Taxis in Peterborough#Peterborough taxi#Peterborough taxis

0 notes

Text

Tada Review: How It Works, How Much It Pays

With the countless numbers of cashback and reward apps, it can be difficult to differentiate between legit and scam apps.

If you're curious about how legit the Tada app is, here's a review that covers all you need to know about the app.

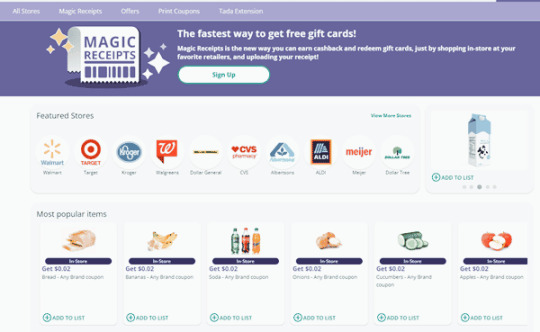

What is Tada Cashback?

Tada Cashback is a free application that compensates users with cashback for any online and in-store purchases made via its app. It also offers coupons, promo codes, and deals that reduce expenses.

Tada Review

Tada is owned by Prodege - popularly known as ShopAtHome. It also knows other popular and well-known cashback apps like Swagbucks, InboxDollars, and MyPoint.

Owned by one of the largest online incentives firms, Tada provides top-notch and legitimate cashback and rewards services.

Tada offers numerous opportunities for its users to earn cashback. It provides rewards to users on every purchase. Its incentive covers both online and in-store trades.

Users can earn a $10 signup bonus and up to $50 for completing surveys.

Although the app offers tons of benefits, its customer service chat window is a letdown. Nevertheless, Tada is a great website for anyone trying to make passive income through cashback.

Shop

Tada is affiliated with tons of retail stores. Hence, you can shop at your favorite store and enjoy promo deals via the Tada app. Tada is well-known for offering lower prices than goods sold at other stores.

Its affiliation with multiple brands and stores enables it to negotiate lower prices on your behalf.

Save

Tada enables its users to save money and cut down on costs when shopping for items. Coupons, discount codes, and cashback offers - Tada has it all.

Once you download and register on the app, shop for items via the app to receive discounts and vouchers.

Reward

Tada offers cash incentives to users who make use of its coupons, discount codes, and cashback services. For every reward-eligible activity you perform, you will receive points that can be redeemed for gift cards or cash via PayPal.

Tada Cashback, How It Works

To get started with Tada Cashback, download the app and register. Once your registration process is complete, navigate to the "All Store" menu/option to view all available cashback deals.

The "All Store" menu will redirect you to the number of available coupons and an alphabetical list of all retailers affiliated with Tada. You can also view cashback rewards associated with each purchase you make.

Not all listed stores on the Tada app offer Cashback rewards; hence, the Tada app lets you know which purchase you make is eligible for rewards.

If you cannot go through the list of stores affiliated with Tada, use the search menu to find your favorite store.

Another Interesting Article: 30 Best Cashback Rebate Sites

Tada Digital Rewards

You must accumulate at least $10 in your account to cash out your Tada balance. Once you reach its minimum threshold, you can exchange your earnings for gift cards, PayPal cash, or physical check via the mail.

Tada offers popular gift cards like Amazon, Starbucks, Target, etc.

Ways To Earn Money On Tada App

Here are some of the ways to earn money on the Tada application:

Coupons

Tada offers incentives to users who print and utilize its paper coupons.

You can print up to fifty coupons daily from the Tada coupon section. Tada pays $0.01 for each coupon you print out. It also pays $0.10 when you redeem the coupons.

Using the Tada coupon service lets you save between $1 and $4 for every purchase you make on groceries, cosmetics, or household items.

Tada Extension

If you prefer shopping directly from your favorite online store, you can install the Tada plugin/extension that monitors your online purchases with your phone.

Suppose you don't have the Tada app but want to make money, install the Tada extension. In that case, this extension monitors your online purchases and rewards you with cashback when you shop in any of its affiliated stores.

Once installed on your device, the Tada extension will notify you and add a promo code to your shopping cart if there are cashback offers available from a particular merchant.

Magic Receipts

Magic receipt is a feature included in most of the money-making applications owned by Prodege. This feature enables you to receive retroactive cashback when you upload pictures of your online or in-store purchase receipt. It also offers rewards when you print your coupons or make purchases via the Tada app.

The Magic Receipt feature is limited to some products. It only allows you to earn money from uploading receipts from your groceries, food, and drinks receipts.

How To Earn Cashback On Tada

If you shop at any of the hundreds of stores that partner with Tada, you will receive cashback rewards. Some retail stores affiliated with Tada include Target, Walmart, Home Depot, and more.

The process of earning is simple and straightforward. All you have to do is make a purchase via the Tada app or install the Tada extension that monitors all your online purchases.

Once you complete a Tada purchase, you will receive 1% to 15% cashback.

Scanning Receipts

Scanning or uploading purchase receipts is another way to earn on Tada. You can earn a reward for every in-store purchase you make with any of Tada's partner stores. However, the receipt must be uploaded within 30 days of the purchase.

Sometimes, you can connect your loyalty card to avoid uploading your receipt for every purchase.

Tada Rewards

Tada allows its users to cash out once they accumulate up to $10 worth of points. It has one of the highest minimum withdrawal amounts for cashback apps.

When you upload a purchase receipt or make a purchase via the app, you will receive points as a reward - these points can be exchanged for PayPal cash or gift card of any kind.

Pros Of The Tada App

-

It is supported by Prodege - a reputable money-making company.

-

Very user-friendly

-

Offers a substantial bonus

-

It enables users to convert points to cash via PayPal

Cons of the Tada App

-

Most users complain of bugs that prevent the app from tracking receipts and purchases.

-

It has a high minimum withdrawal amount.

-

Eligibility criteria for the bonus are strict

-

You must spend $25 within 30 days of signing up to enjoy the signup bonus.

-

The cashback shopping rates were substantially lower than those of competitors.

How Does Tada Earn Money?

Tada is free to use and has no signup or hidden costs. So how does it earn money?

Tada is a sizable affiliate marketing platform that generates revenue by linking customers like you with its affiliated merchants. It receives a commission each time a user registers or purchases something via its app.

So, each time you purchase via Tada, the app will receive a commission from its partner store. Part of this commission will be given to you as a reward.

Which Receipt App Pays The Most?

There are tons of receipt apps that offer similar services as Tada. Most of these apps pay more and offer better services than Tada.

Which receipt app pays the most? Rakuten!

Rakuten is a well-known platform that offers Cashback services and lets you receive rewards for uploading photos of your purchase receipt. It is affiliated with over 2,500 stores, including electronic stores, clothing, games, athletic goods, and more.

To get started with Rakuten, install its Chrome extension or create an account on the Rakuten application. Once you shop via the app, you will receive cash rewards via cheque or PayPal.

Rakuten offers up to 40% cashback on each purchase. It also provides a referral bonus when you refer others to the app.

Swagbucks Review

Swagbucks is an app that offers similar services as Tada. Users on this app can earn rewards by completely quick online tasks such as watching videos, surfing the web, participating in online surveys, and more.

Swagbucks offers rewards to users in points, also known as SBs. Once you accumulate enough points, you can exchange them for money or gift cards. You can transfer Swagbucks points into your PayPal account as cash or convert them to gift cards for stores like Amazon, Caffè Nero, and Tesco.

Swagbucks lets its users donate points to charity organizations such as Unicef, the Wounded Warrior Project, The Humane Society, and the Breast Cancer Research Foundation.

Download the app and sign up with your email address to start earning on Swagbucks. Membership is free, so you can participate in any of its money-making activities to earn points.

Another Interesting Article: Swagbucks Review: Here’s How To Earn $1000

Final Words

Overall, Tada is a trustworthy platform to earn money. However, it is not a get-rich-quick scheme. You can only earn passive income with the app, not a huge sum. It is legit, safe, and recommendable if you plan to earn through cashback.

Frequently Asked Questions On Tada

Where Can I Sell My Receipts

Tada, Rakuten, and Coupon.com are some of the best apps to sell receipts to. Simply scan your purchase receipts on any of the apps and wait for approval.

Can I Earn Money By Watching Videos

Yes! You can earn money by watching videos. Sites like Swagbucks and InboxDollars reward users for watching ads and videos on their sites. Rewards are in cash or gift cards for Amazon, Target, and Walmart.

Is Tada a Legit App?

Yes! The Tada app is legit and not a Ponzi scheme. Users can access discounts, coupons, and cashback rewards once they complete tasks on the app.

Read the full article

0 notes

Text

How to Borrow Money from Cash App?

Hey there, savvy users! Looking to navigate the world of borrowing money with ease? Well, grab a seat and let's dive into the world of Cash App, where sending money is just the beginning. We're here to unravel the mystery of How to Borrow Money from Cash App? +1 (850) 331-1331 — your ticket to quick and hassle-free borrowing!

Understanding Cash App Loans

In a world where instant gratification is the norm, +1 (850) 331-1331 +1 (850) 331-1331+1 (850) 331-1331Cash App loans are here to save the day. But what are they, you ask? Well, it's like a friend who's always got your back when you need a little extra cash. Cash App loans let you borrow money directly from the app – no banks, no paperwork, just a few taps on your phone!

And the best part? These loans are designed to be user-friendly. No complex procedures or confusing terms—just a straightforward way to get the funds you need when you need them.

Sure, here's a concise breakdown of how Cash App's borrowing works:

How does Cash Apps borrow feature work?

Sure, here's a concise breakdown of +1 (850) 331-1331 how Cash App's borrowing works:

Borrowing limit: Eligible clients can borrow anyplace somewhere in the range of $20 and $200.

Loan use: The credit is planned for individual or family purposes, not postsecondary instructive costs.

Interest and repayment: The sum borrowed, in addition to 5% financing cost, is to be taken care of to the application in four weeks or less.

Repayment: You can set up autopay or make manual installments through the application.

Defaulting: In the event that you neglect to make your installment by, you'll be charged an extra 1.25% each week late expense until the credit sum is reimbursed.

Remember, borrowing responsibly is crucial for a positive experience.

Eligibility and requirements

Now, before you start imagining yourself rolling in piles of cash, let's talk eligibility. Cash App loans +1 (850) 331-1331 have a few basic requirements, but nothing too fancy. To hop on the borrowing bandwagon, all you need is an active Cash App account and a history of consistent transactions. It's like having a ticket to a concert—you just need to show up to the party!

How to Borrow Money from Cash App?

Cash App's Borrow feature is easy to use for those with access to the loan feature.

Open Cash App.

Look for the word "Borrow." This can be found on the home screen or on the Banking screen.

Select "Borrow" if it's available. If you don't see this option in the menu, this feature is not available to you.

Click "Unlock" to request a loan. The app will identify how much (between $20 and $200) you can borrow based on regular deposits you make through the app.

Enter the amount you need.

Read and accept the loan agreement.

How to Repay and Manage Your Loan

Reimbursing your Cash App advance is simple and should be possible in three straightforward ways:

Autopay: Set up programmed installments through the app. Clients can set up repeating gradual installments throughout the span of the four-week reimbursement period or do a solitary singular amount installment.

Manual: Make manual installments through the app before the due date.

Via mail: Compose a check and send it via mail to the location recorded on your proclamation. The installment should be gotten by the organization by 4 p.m. CT to be credited that very day.

Assuming that you default on your +1 (850) 331-1331 Cash App Borrow credit, the exceptional equilibrium might be deducted from your Cash App equilibrium or charge card. You may likewise keep on collecting interest on your equilibrium until it is paid off. Your admittance to Cash App might be suspended too.

FAQs:

Why Cant I Borrow Money From Cash App?

If you don’t have the ‘borrow’ option in your +1 (850) 331-1331 Cash App account, you cannot borrow money from Cash App. The biggest reason you cannot borrow money is a lack of eligibility. The reasons behind that could be many. However, some of the highlighted ones are here:

You have a poor credit history.

Do not have a cash card.

The borrow option is unavailable at your location.

You do not use the Cash app regularly, etc.

How Do You Get $200 Fast on the Cash App?

When you are eligible for a cash app loan, you get up to $200 on the cash app fast. When eligible, you will see the ‘borrow’ option in the banking header in your cash application; just tap it. Click the ‘unlock’ option, know how much you can take from the cash app, choose the amount, and set the'repayment plan.’ Finally, collect money.

What App Will Give Me $100 Instantly?

Cash app can provide you loan of up to $100 instantly. However, you should become eligible for that. To find eligibility, you should use cash application regularly. Maintain good credit score. Get paid with direct deposit up to a decided amount regularly. Avoid being in fraud acts.

How Many Times Can I Borrow Money From Cash App?

On the Cash App, if you take a loan today, you will have to repay it within a 30-day (4-week) period. If you are successful in doing so, you will become eligible to take loan immediately. This means the process of taking a loan from cash Cash App is continuous; you can take another loan after paying the previous one on time. In each loan, the maximum up to $200 is the limit at a time.

Conclusion:

And there you have it, folks — your ultimate guide to How to Borrow Money from Cash App +1 (850) 331-1331! Say goodbye to complicated loan processes and hello to quick, convenient borrowing. Cash App loans are like the GPS of financial solutions, guiding you smoothly through the ups and downs of your financial journey.

0 notes

Text

How to completely delete your Venmo account

What is Venmo?

Initially, Venmo was a P2P (peer-to-peer) payment mobile app for Android phones and iPhones. This service is still free of cost, as is utilizing Venmo to make payments to participating merchants, who are in millions. You should be 18 or older to open a Venmo account.

However, a few other Venmo services have a fee. Payments via a credit card account instead of a savings or Venmo account have a 3% fee. Other miscellaneous charges exist for transacting assets immediately from Venmo to a savings account and depositing checks. Also, Venmo provides cards accepted by the increasing list of national and local retailers.

What Happens to a Deleted Venmo Account

Venmo does not make things complex once a user deletes the account. The company sends you an email containing your transaction history. From that time, the relationship between the users and Venmo ends. This is unless they come back.

You can’t retrieve your Venmo account once you close it. To use Venmo services again, you must open a new account, submit your details, and complete the sign-up procedure.

Also Read: How to Delete Your Amazon Account

Things to do Before Deleting the Venmo Account

There are a few things to remember before deleting your Venmo account. Venmo will not let you delete an account without doing these things first.

First, you must transact your assets to your savings account before deleting the Venmo account. Deleting an account will not automatically cash your assets to your connected financial institution. Nor will Venmo return the assets to the original sender. If you delete the account without withdrawing your assets, you must contact the Venmo customer support team directly to obtain your assets back.

Moreover, you can’t close your Venmo account with pending transactions. Venmo will inform you about the pending transactions, if any, and request you to clear those before deleting the account.

Also, you must remember that to close the account, you must sign into your Venmo account. If you cannot sign in, you should try resetting the password to access the account.

Steps to Delete a Venmo Account

If you have decided to delete the Venmo account, follow these instructions.

From a Browser

First, you must move to the official Venmo website using the URL Venmo.com.

After signing into your Vanmo account, hit the Settings tab in the left column.

Then, move to the Profile tab.

Scroll down and choose the Close Venmo Account option.

When ready, hit the Confirm button.

Via the Mobile App

Launch the Venmo app on your device and login in to your Venmo account.

Then, move to the Me tab and hit the Gear icon.

Next, choose the Account option under the Preferences section.

After this, tap the Close Venmo Account button.

Follow the prompts to finish the procedure.

Also Read: How to Close and Permanently Delete PayPal Account

Frequently Asked Questions

Ques: Is it possible to reactivate a deleted Venmo account?

Ans: Venmo usually lets users reactivate a suspended account if it deactivates it for any reason. But this doesn’t apply to the account you have deleted. Closing an account of your own choice will permanently delete it. You can sign up for a new account to use Venmo again.

Ques: Can I delete the business Venmo account without closing the personal account?

Ans: Yes! Users can delete their business Venmo account and keep their personal account active. However, you cannot do this via the app or website. You must contact the Venmo support team. You can call or file a ticket form. Unfortunately, the same does not exist in other ways. If you close your personal account, Venmo will delete both the business account and personal account because business accounts are not the full account. They are like profiles.

Ques: Can I delete the Venmo account of a deceased person?

Ans: You must contact the Venmo customer support team to sort out everything if you are managing the unfinished tasks of a deceased person. You can call the support team or file a ticket. They will request proof and other details.

Ques: What will happen to my assets if I delete my Venmo account?

Ans: Before deleting all your assets from your Venmo account, you must move them. Venmo can’t do it automatically once you close the account. If you close the account and leave assets in it, contacting Venmo customer service is the only way to obtain the assets back. You can call or file a ticket form.

Ques: Is it possible to close a Venmo account with pending transactions?

Ans: No! Venmo will not allow you to delete your account with pending transactions. You must take care of these before moving ahead.

Source:https://hariguide.com/how-to-completely-delete-your-venmo-account/

0 notes

Link

0 notes

Text

How Do You Get Paid Two Days Early on Cash App?

You don’t need to take any extra steps or fill in additional paperwork to receive your direct deposit two days early. Some traditional banks hold onto direct deposit funds for more than 5 days after the employer releases the money. Cash App releases the funds as soon as they are received. That is two days earlier than many banks.

There are no fees associated with the service. It’s also not a payday loan where you are borrowing money against your future paycheck. Instead, the money is yours and in your account when you need it.

What Time Does Direct Deposit Hit on Cash App?

When does Cash App direct deposit hit- According to Cash App, direct deposits will be available as soon as they are received from the employer. Cash App doesn’t wait until a specific time of day to release deposits. However, some sources have observed that a direct deposit usually hits by 12:30 a.m. EST on the day after it was initiated. It typically takes 1 to 5 business days after your employer sends the direct deposit for the funds to be available in your Cash App account.

The timing of funds availability can vary depending on when the direct deposit is submitted to Cash App. If your employer sends the direct deposit on a Friday or on the day before a holiday, it may not arrive until the following business day.

Why Is Your Cash App Direct Deposit Late?

If five business days have passed since you were supposed to receive your Cash App direct deposit and it hasn’t arrived, there could be a problem. Check to make sure:

You provided the correct information to your employer on the direct deposit form.

Your employer received the form and set up direct deposit for you.

Your employer processed the payment.

If all of the above checks out, contact Cash App support through the app or by calling 800-969-1940, Monday through Friday, 9:00 a.m. to 7:00 p.m. EST.

How Does Direct Deposit Work for Cash App?

You can set up your direct deposit on Cash App for a W-2 job or any side gigs that offer the option of paying via direct deposit. To set up a Cash App direct deposit, you’ll first need to order a Cash Card and activate it.

How To Activate Your Cash App Card

You can follow these steps to activate your Cash Card:

Click the Cash Card tab on the app’s home screen.

Then tap “Activate Card.”

Give Cash App permission to use your phone’s camera and scan the QR code mailed to you with your card.

If you no longer have the QR code, you can choose to activate your card using the CVV code and expiration date, instead.

How To Set Up Direct Deposit Through Cash App

Once your card is activated, you should provide your employer with your Cash App routing number and account number. Your employer may provide a direct deposit form you’ll need to fill out.

You should also fill out the direct deposit form provided by Cash App. You’ll need to include the employer information, the amount you’d like deposited from each paycheck, and your signature. You will then have to email it to the person who will be paying you.

Final Note

Getting paid on time should go without saying. But that’s not always the case. Bank delays may hold up your funds. You can receive your direct deposit two days earlier than most traditional banks if you use Cash App. The money will be available to access through your Cash App debit card as soon as your employer releases the funds to your bank.

0 notes

Text

How to Activate Cash App Card without Logging In?

Cash App has become a popular mobile payment platform, allowing users to send and receive money with just a few taps on their smartphones. Along with the digital payment features, Cash App provides users with a physical debit card called the Cash Card. However, you may wonder if you wonder how to activate Cash App card without logging in. You are at the right place here you learn about different scenarios and methods for activating your Cash App card, even if you cannot access your account. So, let’s begin and understand how to hassle-free activate your Cash App card.

Activating Cash App Card through the App

Activating your Cash App card through the app is the standard and recommended method. However, if you are unable to log in to the app for any reason, you can try the following alternatives:

· Contact Cash App Support: If you are having trouble logging in, contacting Cash App support should be your first step. They can provide guidance and assistance to help you regain access to your account and activate your Cash App card through the app.

· Reset Your Password: If you are having trouble logging in due to a forgotten password, you can attempt to reset it using the “Forgot Password” option on the login screen. Cash App will guide you through resetting your password, after which you can log in and activate your card.

Activating Cash App Card via Phone Call

If you cannot log in to the app or encounter technical difficulties, try to activate Cash App card by contacting customer support. Follow these steps:

· Open the Cash App website or quickly search for the official customer support number. Note it down for reference.

· Call the customer support number and explain that you cannot activate your Cash App card through the app. Provide the necessary information to verify your identity and request assistance activating your card.

· The support representative will guide you through card Cash App card activation over the phone. They may ask for specific details or provide alternative verification methods to ensure a secure activation process.

Activating Cash App Card through the Website

In certain situations, you may be able to activate your Cash App card without logging in to the app by utilizing the official Cash App website. Here is what you can do:

· Open your preferred web browser and visit the official Cash App website.

· Look for the option to activate your Cash App card. This page may be accessible directly or through the website’s support section.

· Enter the required details, such as the card number, expiration date, and CVV code. This information is typically found on the back of your Cash App card.

· Depending on the activation process, you may need to provide additional verification, such as your email address, phone number, or other personal information associated with your Cash App account.

· Follow the prompts and instructions on the website to complete the activation process for your Cash App card.

FAQs:

Q: Can I activate my Cash App card without logging in?

A: While activating your Cash App card through the app is recommended, alternative methods are available. You can contact Cash App support or try activating the card via the official Cash App website.

Q: What should I do if I cannot access the Cash App?

A: If you cannot log in to the Cash App, check your internet connection first and ensure you are using the correct login credentials. If the issue persists, contact Cash App support for assistance.

Q: Can I activate my Cash App card over the phone?

A: You can activate Cash App card by contacting Cash App customer support over the phone. They will guide you through the activation process and provide any necessary assistance.

Q: Is it necessary to activate the Cash App card to use it?

A: Yes, activating your Cash App card is essential to use it for transactions. Activation confirms your ownership of the card and ensures its functionality.

0 notes

Text

Can I withdraw money from a closed Cash App?

If you have money in a closed Cash App account, withdrawing those funds may seem challenging, but it is not impossible. Understanding the procedures and available options can help you retrieve your money efficiently. Here’s a detailed look at the steps and considerations for how to withdraw money from a closed Cash App account.

Understanding Account Closure

First, it's essential to understand why your Cash App account was closed. Accounts can be closed for various reasons, including:

Violation of Terms of Service: Engaging in prohibited activities like fraudulent transactions can lead to account closure.

Suspicious Activity: Unusual transactions or security concerns may trigger an account suspension or closure.

User-Initiated Closure: You might have closed the account yourself for personal reasons.

Accessing Your Funds

If your Cash App account is closed and you need to withdraw funds, follow these steps:

1. Contacting Customer Support

The primary and most effective way to address this issue is by contacting Cash App customer support. Here’s how you can do it:

Via the App: If you still have access, go to your profile icon, select “Support” or “Something Else,” and navigate to the help topics related to account closure or fund withdrawal.

Via the Website: Visit Cash App’s support page, where you can submit a request or find contact options such as email or a support form.

Via Social Media: Sometimes, reaching out through Cash App’s official social media channels (like Twitter @CashSupport) can expedite the process.

When contacting support, be prepared to provide details such as your registered email address, phone number, and any relevant transaction information. Explain that your cash app account is closed and you need assistance withdrawing your remaining funds.

2. Verification Process

Cash App will likely require you to verify your identity before they can assist with withdrawing funds. This process may involve providing identification documents such as a driver’s license or passport. This step ensures that the funds are returned to the rightful owner and helps prevent fraud.

3. Requesting a Balance Transfer

Once your identity is verified, request a transfer of the remaining balance to a linked bank account or another payment method. If your bank account was linked before the account closure, this might be the easiest route. If no bank account was linked, you might need to add one or provide alternative instructions for receiving your funds.

Alternative Methods

If the usual process is not applicable, consider the following alternatives:

1. Cash App Card

If you have a Cash App Card (Cash Card) linked to the closed account, you might still be able to use it to withdraw funds at an ATM or make purchases directly, provided the card is active.

2. Requesting a Check

In some cases, Cash App may agree to send a check for the remaining balance. This method is not standard and typically requires negotiation with customer support. It is a viable option if electronic transfer methods are not possible.

Preventative Measures

To avoid similar issues in the future, regularly review your account for any signs of trouble and ensure compliance with Cash App’s terms of service. Keeping your contact and banking information up-to-date can also prevent complications if your account status changes.

Conclusion

While withdrawing money from a closed Cash App account involves several steps, it is feasible with proper communication and verification through customer support. By understanding the reasons for account closure and taking the necessary actions to verify your identity, you can retrieve your funds efficiently. Taking preventative measures can also help avoid such issues in the future.

0 notes

Text

How To Activate A Venmo Card?

Are you tired of carrying around cash or bulky credit cards? Venmo is the solution for you! With Venmo, you can easily send and receive money with friends and family. But what about when you need to make purchases in-store or online? The answer: +1(855) 485-4020 activate your Venmo card! In this blog post, we'll guide you through the steps to sign up for a Venmo account, activate your new Venmo card, and start using it like a pro. Plus, we'll weigh the pros and cons of using Venmo compared to other payment options so that you can make an informed decision. Let's get started on how to activate your Venmo card today!

How To Sign up For a Venmo Account?

Signing up for a Venmo account is quick and easy. You can do it on your phone or computer in just a few minutes! Here are the steps to follow:

1. Download the Venmo app from the App Store or Google Play.

2. Open the app and tap "Sign Up."

3. Enter your information, including your name, email address, mobile phone number, and password.

4. Verify your phone number by entering the code that was sent to you via text message.

5. Add a payment method such as a debit card or bank account.

Once you've completed these steps, you'll have access to all of Venmo's features including sending and receiving money with friends and family members.

It's important to note that Venmo is only available for use within the United States at this time. Additionally, there may be fees associated with certain transactions such as instant transfers or using a credit card rather than a debit card as your funding source.

Signing up for a Venmo account is straightforward and user-friendly - making it an appealing option for those looking for an alternative payment solution!

How To Activate Your Venmo Card?

Activating your Venmo card is simple and straightforward. Once you receive your new card in the mail, you’ll need to follow a few steps to get it up and running.

First, make sure you have the latest version of the Venmo app installed on your smartphone. Then, open the app and navigate to the “☰” icon in the top left corner of your screen. From there, select “Venmo Card” and then tap “Activate My Card.”

Next, enter the 6-digit activation code that came with your card. If you don’t have this code handy, no problem! You can find it by logging into your Venmo account on a computer or mobile browser.

Once you’ve entered your activation code, just confirm a few final details about yourself, and voila! Your new Venmo card is now activated and ready for use.

It’s important to note that activating your Venmo card does not automatically link it to any funding sources (like bank accounts or credit cards). Be sure to check out our next section on how to use your Venmo card for more information on linking these payment methods.

How To Use Your Venmo Card?

Now that you have activated your Venmo card, it's time to start using it! The Venmo card can be used anywhere Mastercard is accepted, both in-store and online. Here are some tips on how to use the card effectively:

When making a purchase in-store, simply swipe or insert your card into the terminal and enter your PIN when prompted. For online purchases, enter your card information just like any other credit or debit card.

One of the great features of the Venmo card is its ability to automatically categorize transactions within the app. This means that every time you make a purchase with your Venmo card, it will show up in your transaction history with a category like "Food & Drink" or "Shopping". You can also add notes and emojis to each transaction for added organization.

Another useful feature is being able to split purchases with friends who also use Venmo. Simply select the transaction in question and choose which friends you want to split it with.

Keep track of your balance by checking the app regularly. You can view all recent transactions as well as see how much money you have available on your Venmo balance.

Using your Venmo Card should be simple and straightforward once activated – just remember these helpful tips!

Pros And Cons of Using Venmo

Venmo has become a popular mobile payment service that allows users to send and receive money from their friends, family, or businesses. While there are many advantages of using Venmo, there are also some downsides that you should consider before deciding to use the app.

One of the main benefits of using Venmo is its convenience. With just a few taps on your smartphone, you can quickly transfer money to anyone with a Venmo account. The app also makes it easy to split bills and expenses among friends and family members.

Another advantage of using Venmo is that it's free for most transactions. You can send or receive up to $3,000 per week without paying any fees. However, if you need to transfer larger amounts of money or use a credit card instead of a bank account, you may be charged fees.

On the other hand, one major disadvantage of using Venmo is its lack of buyer protection. Unlike services like PayPal or credit cards which offer fraud protection and dispute resolution processes when something goes wrong with a transaction, when you make payments through Venmo there's no guarantee that your purchase will go smoothly.

Additionally, because Venmo transactions are public by default (meaning they show up in your feed for all your contacts), this could lead to privacy concerns if people don't want others to know about their spending habits.

While there are pros and cons associated with utilizing Venmos' services - weighing out these factors objectively can help determine whether this payment method suits an individual's needs best

Alternatives to Venmo

While Venmo is a popular peer-to-peer payment app, there are other alternatives to consider. One such alternative is Zelle, which allows instant money transfers between bank accounts. It's available through many major banks and may already be included in your mobile banking app.

Another option is PayPal, which has been around for much longer than Venmo and offers more services like merchant payments and international money transfers. Its fees may be higher compared to other options though.

Cash App by Square is another choice that's similar to Venmo with its user-friendly interface for sending and receiving money. It also offers a debit card linked directly to your account for easy access to funds.

For those who value privacy, Signal Payments offers encrypted messaging as well as the ability to send and receive Bitcoin payments.

Ultimately, it comes down to individual preferences when choosing an alternative. Researching various options can help you find one that fits your specific needs better than Venmo does.

Conclusion

Activating your Venmo card is a simple process that allows you to make transactions conveniently and securely. With its easy-to-use interface, low fees, and fast transaction times, Venmo has become one of the most popular payment apps available today.

However, it’s important to keep in mind the potential risks associated with any financial app. Always be cautious when sharing personal information or making transactions online.

Venmo presents an excellent option for those looking for a hassle-free way to pay friends or businesses. But as with any financial tool, it’s important to do your own research and understand all aspects of using the service before diving in.

Now that you know how to activate your Venmo card and use it effectively, you can take advantage of all the benefits this innovative platform has to offer!

0 notes

Text

The Complete Process of Verifying Bitcoin on Cash App: A User-Friendly Guide

In recent years, cryptocurrencies, particularly Bitcoin, have gained significant popularity as a decentralised digital currency. Cash App, a widely used mobile payment service, enables users to buy, sell, and hold Bitcoin seamlessly. However, before engaging in Bitcoin transactions on Cash App, it is crucial to verify your account. This comprehensive step-by-step guide will explain how to verify bitcoin on Cash App, ensuring a smooth and secure experience.

Step 1: Download and Install the Cash App

Start by downloading the Cash App from your mobile app store. Once installed, open the app and sign up for an account by providing the required details. Follow the on-screen prompts to complete the registration process.

Step 2: Link a Bank Account or Debit Card

You must link a bank account or debit card to verify your Cash App account. Tap on the profile icon in the app screen’s upper-left corner. Select “Add Bank” or “Add Card” from the options menu to enter the necessary information. Cash App uses this information for verification and to facilitate Bitcoin transactions.

Step 3: Enable Bitcoin Transactions

After successfully linking your bank account or debit card, return to the profile icon and scroll down to find the “Bitcoin” option. Tap on it to access the Bitcoin settings. Enable the Bitcoin functionality by following the instructions provided. This step lets you buy, sell, and hold Bitcoin on Cash App.

Step 4: Complete the Verification Process

You must complete the Cash App Bitcoin verification process to ensure the security of Bitcoin transactions. Tap the profile icon again and navigate to the “Bitcoin” section. From there, select “Verify Identity” or a similar option. Cash App will prompt you to provide personal information, including your full name, date of birth, and social security number.

Step 5: Submit Required Documents

Cash App may request additional documentation to confirm your identity as part of the verification process. This typically includes a valid photo ID, such as a driver’s licence or passport. Take a clear picture of your ID using your phone’s camera and upload it securely through the app. Ensure that the photo is legible and all details are visible.

Step 6: Wait for Verification

Once you’ve submitted your documents, Cash App’s verification team will review them. The verification process usually takes a few hours to a few days, depending on the volume of requests. Cash App will notify you via email or within the app once your account is successfully verified.

Step 7: Start Using Bitcoin on Cash App

Once your account is verified, you can utilize Bitcoin on Cash App. You can buy Bitcoin by accessing the Bitcoin section, entering the amount you wish to purchase, and confirming the transaction. Similarly, you can sell Bitcoin and convert it into your preferred currency. Cash App allows you to send and receive Bitcoin from other users seamlessly.

FAQs:

Q1: Is Cash App safe for Bitcoin transactions?

A1: Cash App implements various security measures, including encryption and two-factor authentication, to protect user accounts and transactions. However, following best practices, such as using a strong password and enabling additional security features, is essential to enhance your account’s safety.

Q2: Can I verify my Cash App account without a social security number?

A2: No, Cash App requires a social security number for identity verification. This step ensures compliance with financial regulations and helps prevent fraud and illegal activities.

Q3: Are there any fees associated with Bitcoin transactions on Cash App?

A3: Cash App may charge fees for buying and selling Bitcoin. These fees are usually a percentage of the transaction amount and may vary based on market conditions. It is important to review the fee structure on Cash App or consult their website for the most up-to-date information regarding Bitcoin transaction fees.

Q4: Can I transfer Bitcoin from Cash App to an external wallet?

A4: Cash App allows users to transfer Bitcoin to an external wallet. In the Bitcoin section of the app, look for the “Withdraw Bitcoin” option. Enter the recipient’s wallet address and follow the prompts to complete the transfer. Remember that Cash App may charge a small fee for outgoing Bitcoin transfers.

Q5: What if my verification process takes longer than expected?

A5: In some cases, the Cash App Bitcoin verification process may take longer due to a high volume of requests or additional verification requirements. If your verification is delayed, it is advisable to contact Cash App’s customer support for assistance.

Q6: Can I use Cash App for Bitcoin trading?

A6: While Cash App offers the ability to buy, sell, and hold Bitcoin, it is primarily designed as a user-friendly payment app. If you are interested in more advanced Bitcoin trading features, you may consider using dedicated cryptocurrency exchanges that offer a wider range of trading options.

Conclusion:

Verifying your Bitcoin account on Cash App is necessary to ensure a secure and reliable experience when buying, selling, and holding Bitcoin. Following the step-by-step guide outlined above, you can seamlessly complete the verification process and unlock the full potential of Bitcoin transactions on Cash App. Remember to adhere to security best practices and stay informed about any fees or policy changes to make the most of your Bitcoin journey with Cash App.

0 notes