#advantages of copytrading

Text

How to make passive income through forex social trading

Have you ever come across the proverb that advises people to “work smarter, not harder”? The forex market is one area in which this proverb may be more pertinent than in most others. You may enter the field of foreign exchange trading and immediately begin generating passive income from it with just a small bit of prior knowledge. Discover how to make your investment goals a reality by learning how to get started with social copy trading, forex affiliate programmes, and partner programmes in this blog.

Forex social trading is advantageous since it allows you to create both active and passive income through a variety of methods. You may combine all of these strategies to increase your cash flow and quadruple your assets with minimal effort.

Active earnings come from trading. In addition to earning gains from your trades, you can also generate passive income. Ideas for passive income include social trade networks and referral payments.

Automation

Automating day trading can facilitate passive income generation. Automated systems, when utilised properly, may allow you to produce considerable revenues. This is because you can only manually execute a limited amount of deals every day. In contrast, a sophisticated system can automatically enter and quit positions when predefined conditions are met.

They also allow you to trade in multiple markets at the same time. In reality, after your criteria have been programmed, you can produce passive income while you sleep.

Copy Trading

Copy trading is a form of financial technique that consists of imitating the trades of other investors. The goal is to gain the knowledge of more seasoned traders while still managing your own investment portfolio. Copy trading can be performed manually, by manually following the transactions of another investor, or automatically through copy-trading systems. Automated copy-trading systems will execute trades based on the criteria you specify.

The advantage of Copy Trading is, you may, for instance, choose to imitate only the trades of investors with a track record of success or who trade in a certain asset class. It can be a wonderful method to diversify your portfolio and gain exposure to fresh trading tactics and ideas.

PAMM Trading

PAMM, which stands for Percentage Allocation Management Module, is an excellent approach to invest in the market if you lack the time or the confidence to trade on your own. This type of trading service is based on copy trading and allows you (and other traders) to connect your trading account to a “Master” account that controls several trading accounts.

The PAMM Master account collects the total deposits of all customers (or followers), and all trading positions executed by the Master account are proportionally reflected in the follower trading accounts, meaning all profits (and losses) are transferred proportionally to the managed accounts (or followers).

The agreement between a follower and the PAMM manager regarding profit/loss distribution, as well as the performance fees, the master commission, the minimum performance constraint, assignment commission, early revocation penalty, minimum required capital, etc., are outlined in the relationship between the two parties. These conditions are known as “offer parameters” and must be accepted by PAAM participants in order to participate.

IB program

An Introducing Broker (IB) is a person or company who consults, teaches, or guides novice traders while directing them to a trading company in exchange for commissions. IQ Option, like many other brokers, offers its own forex IB programme.

IBs serve primarily as intermediaries between brokers and traders. Thus, an IB can assist new clients with instruction, consulting, or support while earning a nominal fee. The majority of introducing brokers are also professional traders who can offer advice and assist individual traders with education and support to improve their outcomes.

An Introducing Broker also cares about their community, ensuring that traders are satisfied with their results and assisting them in making the best decisions, thus encouraging the expansion of their community. Similar to affiliates, introducing brokers typically identify and promote new traders to brokers by advertising and offering trading-related services such as:

Trading education and tutoring; schools and academies; seminars and webinars; signals, investment ideas, and financial consulting; and more events and services for traders.

Eligibility

There are virtually no restrictions on being an introducing broker. You do not have to be a professional trader or obtain any specific license or certifications. Still, the finest IBs are frequent traders who are willing to share their expertise and assist traders with education. Others simply have an online or offline community where traders can assist one another.

Individuals and businesses can become Introducing Brokers. Therefore, trading schools and academies or a local consulting office may occasionally advertise a forex trading platform.

Final remark

Obviously, most people would like to have passive income. Who wouldn’t like the thought of earning money while having a wonderful time? However, day trading has long been viewed as a time-intensive and physically demanding method of making money.

The advent of contemporary technology has made it possible for individuals to take a backseat and still generate a profit. However, you must choose a strategy that is appropriate for your unique circumstances, taking into account the associated risks and tax regulations.

Originally Published on Techannouncer

Source: https://techannouncer.com/how-to-make-passive-income-through-forex-social-trading/

0 notes

Text

Advantages of CopyTrading

If you are new to trading, copying the trades of experienced traders can help you learn about the market and improve your results. A beginner trader can have several copytrading advantages, such as access to the strategies and knowledge of experienced traders, increased confidence, and time savings. This article will briefly explain what copy trading is and the potential benefits it brings.

What is copy trading?

Simply put, copy trading allows you to copy trades made by other traders. The basic goal is to find another proven investor and start copying their trades. Your may get success and good results, but when it does not always go in your favor, which means it will also copy losses which may happen as trading is uncertain. Remember to constantly monitor and update the trading performance of the signal provider you are copying.

There are briefly three parties involved in copy trading:

Provider – In this case, trades are being copied from traders which also referred as a “master trader or signal provider”.

Follower - This is a person who copies the provider's trades in their own trading account.

Brokers – Brokers like Inveslo provide access to copy trading platforms (such as MetaTrader 4) that allow providers and followers to connect.

A worth choice for beginner traders

To note, Copytrading is useful for beginners who do not have time to create their own trading strategy and follow the market. At the same time, copy trading is attractive to experienced traders as well who want to diversify their trading.

Here are some of the key advantages of copytrading

1. Good for beginners

It enables traders to familiarize themselves with the financial markets for the first time and feel confident in their trading. Most copy trading platforms have a user-friendly and simple interface, which makes them suitable for beginners, otherwise the number of options and different order types in mainstream trading can be overwhelming for new traders.

2. Access to trade with limited knowledge

Copy trading offers investment opportunities for traders with limited knowledge, such as beginners or those who have little time to trade on their own. While it is beneficial to follow and imitate the strategies of experienced traders, it cannot completely eliminate the need to research and understand the market along with implementing a sound risk management strategy.

3. Saves time

Copy trading has an automatic mode that saves a lot of time. This ensures that transactions are carried out as quickly and efficiently as possible. The essence of copy trading is the fact that much of the process can be automated. Once you select a signal provider or trader to replicate, copy trading platforms usually facilitate the rest based on specific parameters set by the investor. This saves you more time than manually entering transactions.

4. Perfect learning platform

Copytrading gives you a platform to learn from traders with years of experience.

Some master traders remain anonymous, while others prefer to build communities around their services. This way you can learn from experienced traders and exchange ideas with other fellow traders.

5. Diversified portfolio

Portfolio diversification is an important aspect of risk management. This kind of diversification is easily possible in copy trading. Investors can choose from a variety of traders who trade different assets, on different timeframes and with different strategic approaches. All of these can be combined to provide balance and diversity within your portfolio.

6. Customizable trades

Most of the best copy trading platforms such as Inveslo not only allow users to directly copy the signal provider's trades and strategies, but also allow them to adjust certain parameters of the copying method. This means that investors can choose to copy trades, but in smaller volumes or only certain parts of trades. What and how much you copy from your signal provider is often flexible. This allows the copied trades to be tailored to different risk profiles and account levels.

7. Controlled risk

You can limit your losses with copy trading. If the provider does not meet expectations and the investment is not profitable, the customer can choose another trader to work with. Plus, copytrading gives you access to statistics - an important data that enables risk management. Users can view statistics and analyze trader's work characteristics before choosing him.

8. Profitable for experienced traders

Copy trading is not only useful for traders who do not have time to trade on their own, but it is also useful for pro traders. An experienced trader may choose to copy someone as a diversification tool to his trading activity. For example, a trader may be most comfortable using a swing trading strategy but may imitate someone who has had success with scalping. If opportunities are lacking, copy trading can make up for some of it.

Originally Published on Blogspot

Source: https://inveslo.blogspot.com/2022/09/advantages-of-copytrading.html

0 notes

Text

Orion Trading Academy: Reflect, Learn, and Trade Your Way to Success This Ramadan

大家好 (Hello everyone),I’m excited to share a unique opportunity that blends cultural reverence with financial empowerment, brought to you by Orion Trading Academy this Ramadan.

🌙 Orion Trading Academy Presents: The Ramadan Referral Festival! 🌙

In the spirit of Ramadan, a time for reflection, community, and growth, Orion Trading Academy invites you to not only draw your family and friends closer at the dinner table but also on a path to financial enlightenment. With the academy’s “From Fasting to Investing” initiative, you can celebrate the holy month by participating in an exclusive referral program designed to enrich both your wallet and your soul.

🎉 Exclusive Ramadan Referral Rewards for Orion’s 80% Winning-Rate Strategy:

Orion Trading Academy is offering an opportunity to access their 80% winning-rate strategy, a testament to their commitment to your success. Here’s what’s in store for you and those you refer:

For every one person referred, you unlock a one-month strategy subscription for free.

Transform your future: By referring twelve people, enjoy a whole year of our strategy subscription, absolutely free.

🌟 Special Ramadan Bonus: The crown jewel of our referral program is the chance to win a special grand prize for the top referrer by the end of the campaign. This mystery gift is poised to illuminate your trading journey, offering insights and advantages that are truly unparalleled. The campaign window is set from 8 March to 10 April 2024, marking a period of true potential and prosperity.

Why You Should Refer Your Friends and Families:

Earn up to US$2.70 on every lot made by your referrals, paving the way for a passive income stream that rewards you for spreading the word.

Receive up to 9% of your referrals’ copytrade profits, enhancing your earnings as they succeed.

Enjoy at least 10% of your referrals’ commission income, further incentivizing the sharing of this golden opportunity.

🔑 Unlock Your Potential:

This Ramadan, let’s embrace the opportunity to grow not just in faith and community but in prosperity and knowledge. Discover more about the Orion Trading Academy’s Ramadan Referral Festival and begin your referral journey. Together, let’s make this Ramadan a turning point for ourselves and our loved ones, nurturing a future where financial literacy and success go hand in hand with our cultural and spiritual celebrations.

Wishing you a blessed and prosperous Ramadan. Let’s embark on this journey of financial enlightenment together, with Orion Trading Academy as our guide.

0 notes

Text

Combating Emotional Trading: Techniques from Decode Group’s Trading Psychologists

In the dynamic world of trading, where the markets never sleep, emotions can often be the Achilles’ heel of many traders. Recognizing this, Decode Group offers a unique perspective through the lens of its trading psychologists, focusing on CopyTrading as a pivotal strategy to mitigate emotional pitfalls. At DecodeEX, traders are given the opportunity to trade alongside the best, harnessing the power of CopyTrading to navigate the markets with a more disciplined approach. Here’s a closer look at the psychological techniques and the role of CopyTrading in combating emotional trading.

The Emotional Rollercoaster in Trading

Emotional trading can lead to a series of impulsive decisions driven by fear, greed, or euphoria, deviating from rational, strategic trading plans. The volatility of the markets can trigger emotional responses that cloud judgment and lead to inconsistent trading results.

CopyTrading: A Shield Against Emotional Decisions

CopyTrading at DecodeEX allows traders to automatically replicate the trades of experienced and successful traders. This method serves as a buffer against emotional trading by leveraging the expertise and emotional discipline of seasoned traders. It’s a strategic way to benefit from the knowledge and trading patterns of those who have a proven track record, reducing the room for emotional errors on the part of the individual trader.

Building a Foundation with a Trading Plan

Even with the advantages of CopyTrading, Decode Group’s trading psychologists emphasize the importance of having a personal trading plan. This plan should align with individual financial goals and risk tolerance, including criteria for selecting which traders to copy. A well-defined plan helps ensure that CopyTrading decisions are in sync with personal trading goals, reinforcing a disciplined approach.

Embracing a Trading Journal for Emotional Clarity

Maintaining a trading journal is another critical strategy. It should detail not only the trades themselves but also the emotional state and thought processes behind each decision, including those related to selecting traders for CopyTrading. This introspection can illuminate emotional triggers and patterns, facilitating a strategy to manage them effectively.

The Role of Psychological Resilience

Decode Group’s experts advocate for developing psychological resilience through practices such as mindfulness, deep breathing exercises, and taking breaks to manage stress. These techniques are essential for maintaining emotional equilibrium, crucial for making clear-headed decisions in both direct trading and when engaging in CopyTrading.

Realistic Expectations and Risk Management

Setting realistic expectations is fundamental to emotional regulation in trading. Understanding that not all trades will result in profit, even when copying the best traders, can help temper emotional reactions to losses. Similarly, implementing risk management strategies, like diversifying the traders you copy and setting limits on exposure, can mitigate potential emotional distress and financial risk.

The Power of Community and Continuous Learning

Engaging with the Decode Group community and pursuing continuous learning are vital components of a holistic approach to trading. Sharing experiences and strategies with fellow traders can offer new perspectives and emotional support, reinforcing a rational approach to trading decisions.

0 notes

Text

Orion Trading Academy’s Guide to Forex Trading Strategies for Consistent Profits

In the dynamic world of forex trading, achieving consistent profits is the holy grail for traders worldwide. Amidst this quest for financial success, Orion Trading Academy emerges as a guiding light, offering strategic insights and methodologies that pave the way for sustained profitability. As we embrace the spirit of Ramadan, a time for reflection, unity, and growth, Orion Trading Academy introduces an unparalleled opportunity to not only bring families closer but also embark on a collective journey towards financial empowerment.

Forex Trading Strategies for Consistent Wins

Orion Trading Academy’s approach to forex trading is rooted in comprehensive market analysis, risk management, and the cultivation of financial discipline. Our strategies are designed to cater to both novice and seasoned traders, focusing on long-term success rather than fleeting gains. Here’s a glimpse into our winning formula:

Technical Analysis Mastery: We equip traders with the tools to decipher market trends, identify potential entry and exit points, and make informed decisions based on historical data and statistical probabilities.

Fundamental Analysis: Understanding the impact of global economic events on currency movements is crucial. Our curriculum demystifies economic indicators and teaches traders how to leverage this knowledge for strategic advantage.

Risk Management Protocols: Preserving capital and minimizing losses are as important as securing wins. Our strategies emphasize the importance of setting appropriate stop-loss orders, managing leverage, and diversifying trades to mitigate risk.

Psychological Fortitude: The psychological aspect of trading cannot be overstated. We nurture a mindset of patience, resilience, and objectivity, essential for navigating the forex market’s inherent volatility.

Celebrate Ramadan with Orion’s Special Referral Program

This Ramadan, Orion Trading Academy invites you to deepen familial bonds and collective prosperity through our exclusive referral program. From Fasting to Investing, let’s celebrate the holy month with financial growth and shared success.

Exclusive Ramadan Referral Rewards:

Unlock a One Month Strategy Subscription for Free: For every person you refer, enjoy a one-month subscription to our 80% winning-rate strategy at no cost.

A Year of Strategy Subscription, Absolutely Free: Refer twelve individuals and secure an entire year of access to our proven strategy subscription, on the house.

Special Ramadan Bonus:

The top referrer by the end of the campaign (8 March to 10 April 2024) will receive a special grand prize — a mystery gift designed to enhance your trading journey even further!

Why You Should Refer Your Friends and Family:

Earn Up to US$2.70 on Every Lot: Profit from the trading volume generated by your referrals.

Receive Up to 9% of Copytrade Profits: Benefit from a share of your referrals’ copytrade successes.

Enjoy at Least 10% of Commission Income: A minimum of 10% of your referrals’ commission income is yours.

Conclusion

Orion Trading Academy stands at the intersection of tradition and financial innovation this Ramadan, offering a unique blend of educational excellence and communal growth. By referring your loved ones, you’re not just inviting them to the dinner table but also to a table of financial opportunity and success. Join us in celebrating this holy month with the gift of financial knowledge and empowerment. Begin your journey towards consistent forex trading profits and unlock exclusive rewards with Orion Trading Academy.

0 notes

Text

InvestPro: Delving into the Top 5 Trading Platforms

In the ever-evolving landscape of financial trading, choosing the right platform is crucial for both novice and experienced traders. With an abundance of options available, it can be challenging to discern which platforms offer the best features, user experience, and success rates. InvestPro takes a deep dive into the top 5 trading platforms, evaluating them based on usability, features, fees, and customer support, and highlighting their unique offerings. As we explore these platforms, we conclude with DecodeEX, a game-changer with its innovative CopyTrading feature.

MetaTrader 4 (MT4)

Overview: MetaTrader 4 remains the gold standard for Forex trading, renowned for its advanced charting tools, user-friendly interface, and extensive support for custom indicators and automated trading scripts (Expert Advisors).

Key Features: Robust technical analysis tools, automation capabilities, and a vast marketplace for trading tools and resources.

2. Thinkorswim by TD Ameritrade

Overview: A powerhouse for options and stock traders, Thinkorswim offers comprehensive research tools, real-time data, and a wide array of charting capabilities.

Key Features: Advanced charting, analysis tools, and a highly customizable platform that caters to traders of all levels.

3. eToro

Overview: Known for its social trading dimension, eToro allows users to connect with other traders, share strategies, and even copy the trades of successful investors.

Key Features: Social trading network, CopyTrading functionality, and a broad range of markets including cryptocurrencies.

4. Interactive Brokers (IBKR)

Overview: Catering to professional traders and investors, IBKR offers access to over 135 markets worldwide, with competitive pricing and advanced trading tools.

Key Features: Global market access, low-cost pricing structure, and a robust trading platform with comprehensive research tools.

5. DecodeEX

Overview: Standing out with its CopyTrading feature, DecodeEX revolutionizes how individuals trade by allowing them to mimic the trades of successful investors, effectively trading like a billionaire.

Key Features: Copy Trading: Follow the trades of experienced traders in real time. Find traders you trust, and automatically replicate their trading moves, making sophisticated trading strategies accessible to everyone.

DecodeEX’s Copy Trading feature is a breakthrough for those looking to leverage the expertise of seasoned traders without the need to develop complex strategies independently. By choosing traders with a proven track record, users can significantly increase their chances of success, benefiting from the collective wisdom and experience of the trading community.

Conclusion

The choice of trading platform can significantly impact a trader’s ability to execute strategies effectively and manage their portfolio. From the comprehensive tools of MetaTrader 4 and Thinkorswim to the innovative social trading features of eToro and the global access provided by Interactive Brokers, each platform offers unique advantages. DecodeEX, with its pioneering Copy Trading feature, represents the next step in the evolution of trading platforms, offering users an unprecedented opportunity to trade like the pros. Whether you’re a seasoned investor or just starting, exploring these platforms can provide valuable insights and tools necessary for navigating the complexities of the financial markets.

0 notes

Text

InvestPro: Delving into the Top 5 Trading Platforms

In an era where access to financial markets is just a click away, the choice of trading platform can make a significant difference in a trader’s journey. Recognizing the importance of reliable and feature-rich platforms, InvestPro has curated a detailed review of the top 5 trading platforms. Each platform is assessed for its usability, features, fees, and customer support, helping traders to make an informed decision.

MetaTrader 4 (MT4)

Overview: MetaTrader 4 continues to be the gold standard for forex traders worldwide, thanks to its comprehensive tools and user-friendly interface.

Key Features: MT4 excels in technical analysis, automated trading through Expert Advisors, and offers extensive customization options.

Fees: No direct fees for using MT4, with trading costs varying by broker.

Customer Support: Broker-dependent, with the quality of service varying.

Thinkorswim by TD Ameritrade

Overview: A top choice for stock and options traders, Thinkorswim offers a robust set of tools catering to all experience levels.

Key Features: Features advanced charting, numerous technical indicators, and a paper trading function for strategy testing.

Fees: Competitive, with no commissions on stock and options trades.

Customer Support: Renowned for its 24/7 comprehensive support.

Interactive Brokers (IBKR)

Overview: Targeted at experienced traders, IBKR offers a global trading gateway with advanced tools.

Key Features: Access to over 135 markets, sophisticated risk management tools, and competitive pricing.

Fees: Known for low commission rates and no fee on U.S. stock trades.

Customer Support: Provides 24/6 support with a commitment to effectiveness.

Robinhood

Overview: Popular among millennials, Robinhood offers a streamlined, commission-free trading experience.

Key Features: Its user-friendly app and straightforward trading mechanism cater to beginners. The Robinhood Gold subscription offers additional features.

Fees: Zero-commission trading, with revenue from payment for order flow and Gold subscriptions.

Customer Support: Email and app support, with varying response times.

DecodeEX

Overview: DecodeEX revolutionizes the trading experience by offering traders the opportunity to directly copy the trades of some of the market’s most successful participants.

Key Features: Its standout feature is CopyTrading, enabling users to mirror the strategies of seasoned traders seamlessly. This platform is designed for both novice and experienced traders, offering a unique blend of community-driven insights and professional trading strategies.

Fees: DecodeEX maintains a transparent fee structure, focusing on accessibility and affordability to ensure users can maximize their trading potential without prohibitive costs.

Customer Support: Dedicated to providing an exemplary user experience, DecodeEX offers comprehensive support through multiple channels, ensuring traders have the assistance they need to navigate the platform and the markets effectively.

Conclusion

My review encompasses a variety of trading platforms suited to different trader needs and preferences. From the classic robustness of MetaTrader 4 to the innovative CopyTrading feature of DecodeEX, each platform offers unique advantages. Whether you’re drawn to the community aspect of eToro, the advanced tools of Thinkorswim, the global reach of IBKR, the simplicity of Robinhood, or the collaborative trading environment of DecodeEX, there’s a platform on this list that aligns with your trading goals. Carefully consider what each platform has to offer in terms of features, fees, and support to choose the best fit for your trading strategy and aspirations.

0 notes

Text

How eToro is dominating by expanding investments in UK online trading market

Buy Now

eToro is the trading and investing platform that empowers you to grow your knowledge and wealth as part of a global community. The main motive of this 207 founded company is to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions.

STORY OUTLINE

eToro is exploring in UK online trading market by

Factors driving eToro and in turn involving UK online trading market

Competitive landscape of Europe Wheat protein market with respective of MGP Ingredients

1.eToro has a leading position in UK online trading platform market.

Click here to Download a Sample Report

eToro is a major player in the online trading market in UK. eToro offers 3,000+ financial instruments across various classes, such as stocks, crypto and more. To enable eToro clients to use advanced trading features, such as advantage and short (SELL) orders, and to offer financial instruments that normally cannot be traded, such as indices and commodities, eToro utilizes Contracts for Difference (CFDs). Additionally, to enable traders and investors direct access to the market, some asset classes, such as stocks and crypto assets, offer direct ownership of the underlying assets, which we buy and hold in each client’s name.

eToro enables clients to deposit and withdraw using a variety of payment methods, the smartest of which is eToro Money, offering free and instant deposits with no FX conversion fees, and instant withdrawals. Other methods include wire transfers, bankcards, and more. eToro offers low minimum deposits and unified fees.

2.Factors driving MGP Ingredients and in turn involving Europe protein market

There are many drivers, which are making eToro lead in the UK online trading market. One of the reasons is that it provides various tools like CopyTrader, enables traders to replicate other traders’ actions in real time. To encourage top traders to be copied, eToro created the Popular Investor program.

Another unique product offered by eToro is Smart Portfolios, which are ready-made, investment strategies, offering thematic investment, such as medical cannabis, driverless cars, and people-based portfolios.

eToro has new investors which will be the stockholders of FinTech Acquisition Corp. V including Fintech V’s sponsors. Fintech V is a Special Purpose Acquisition Corporation (SPAC) that was formed for the purpose of combining with one or more businesses and remaining a public company. Additionally, several institutional investors will become new investors in eToro because of the transaction. These include ION Investment Group, Softbank Vision Fund 2, Fidelity Management & Research Company LLC, and Wellington Management.

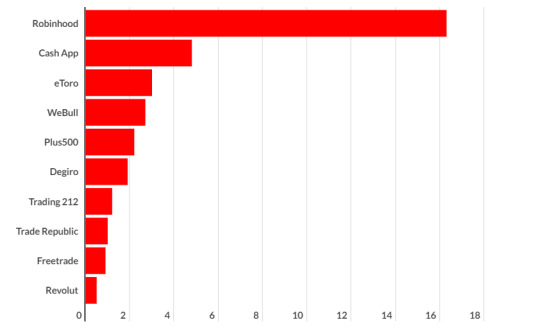

3.Competitive landscape and Outlook of eToro in UK Online trading platform market

Click here to Ask for a Custom Report

eToro is sustaining its position in UK online trading platform market. It already is available in in 140 countries. eToro generated $1.2 billion revenue in 2021, a 103% year-on-year increase. In June 2021, eToro reached 20 million active users. It set an IPO valuation of $10.4 billion, a 316% increase on its 2020 valuation. 69% of users are from Europe, followed by Asia-Pacific (18%) and then the Americas (8%).

Looking at its most popular stocks Bitcoin is the most popular, it accounts for one in every 25 positions opened. Tesla, Microsoft and Apple are the most traded stocks. NASDAQ 100 is the most traded index. Oil is the most traded commodity.

CONCLUSION

eToro is an emerging online trading platform in the digital world and it got hike in the market majorly due to effect of Covid 19. eToro is a very versatile platform offering you the possibility to trade CFDs (for experienced traders) and with them, you can also invest in ETFs and real stocks (e.g. investors who are looking at the long term).

#UK online trading platforms industry#UK online trading platforms Sector#European trading platforms market#UK digital trading platforms sector#UK Online trading sites market#UK Digital trading applications industry#Mobile Online Trading Platform in UK#UK Mobile Online Trading Platform market size#Number of digital trading platforms#Application based online trading UK#Web based online trading market UK#UK Online trading platform Market Forecast#UK Online trading platform Market outlook#UK Online trading platform Market analysis#UK Online trading platform Market competitors#UK Online trading platform Market Trends#UK Online trading platform Market Challenges#UK Online trading platform Market Opportunities#UK Online trading platform Market Size#UK Online trading platform Market Share#UK Online trading platform Market growth#UK online trading platforms market Investors#UK online trading platforms market Venture capitalists#UK online trading platforms market competitive landscape#UK Leading online trading platform Providers#UK online trading platform Services Provider#Key Players in UK Online trading platform Market#Leading Players in UK Online trading platform Market#Competitors in UK Online trading platform Market#Emerging Players UK online trading platform Market

0 notes

Text

Why TraSignal is better than PAMM Accounts or Copy Trade!

Trasignal is a complete trading platform that offers superior advantages over Pam and Copy Trading accounts.

Before compare, we will introduce the trans signal.

Trasignal is a comprehensive and attractive platform for those interested in financial markets. On this site, you can share your signals, analysis and training with other users and benefit from their experience and knowledge. Using a rating system and user reviews, Trasignal separates professional analysts from scammers and helps you learn from credible analysts and make better decisions in the financial markets.

Trasignal also tries to prevent the fraud of fake signal sellers by providing unique tools, as well as guaranteeing the rights of real signal sellers. At Trasignal, signal sellers are sure that they sell their signals only to authorized buyers and there is no risk of their signals being spread to illegal people. Signal buyers can also follow the signals of a signaler with more confidence by accessing the scoring system and the opinions of other users and Trasignal’s audit department.

At Trasignal, we are always trying to build and update services. We respect your opinions and suggestions and try to provide better services by listening to your voice. TraSignal is a platform for all those who are interested in learning and progressing in the financial markets.

With Trasignal you can:

Take full control over your trading and investments. You can set your stop loss and profit and modify or cancel your orders. You don’t need to put your capital in a fund and trust the manager.

Choose freely between the top traders. You can check the profile، statistics and trading style of each trader and choose whichever you want. You do not need to subscribe to multiple brokers or platforms and pay extra fees. Experience high transparency in all the details of your trades. You can see the full history of each trader and see how they interact in the market. They have acted. You won’t have to worry about trading signals being erased or manipulated after they are released.

Split into two segments، which we will introduce below.

Challenges of Financial Markets Professionals

Trasignal is a platform that challenges financial market professionals. Here everyone has to prove their claim by action. If you have faith in your experience and knowledge, join us and show your efficiency to the world. The Trinity will determine your location. You don’t have to rely on your users anymore all systems are transparent here.

Sync with the top traders

The loss in the financial markets is over for you. With Trasignal ، you can easily access and keep up with the top traders. With its fair and transparent system، Trasignal supports you to find a real profitable trader. In Trasignal ، no one can delete or manipulate their trading signals after they are published. You can follow free and subscription signals، you can use the comments of other users and the site statistics section which helps you find the best trader.

Trasignal is a platform that gives you trust، support and income

Compare Trasignal, PAMM Accounts, Copy Trading

In this article, we look at the benefits and problems of each type of account.

PAMM Account

A PAMM account is a type of account where you can deposit your money into the manager’s account and be the manager partner in profit and loss, and if you make a profit, you have to give a percentage of your profit to the manager of the PAM account. The problem with this investment is that you have no control over your investment and if a manager makes a mistake, you risk losing your account.

Copytrade account

Copy trading accounts You have your money in your account and only connect another trader’s account to your account and whenever the manager opens a position it will be opened for you and every time you close your trade will be closed and you will have to pay a monthly fee as a subscription to use copying trades. The problem with this type of account is that you need a VPN You have a trader who made changes in trading at the hour of the day and night to apply to your account and the problem of Pam accounts is copytrade and you have no control over your capital, and in case of mistake the manager whose account you copied is likely to lose your money.

Buy Signal

Signal buying is another investment method where you can buy and use signals of a professional trader. The advantage of this method is that it has complete control over your account and you can manage your capital and make adjustments to the trade and move the stop profit and stop loss. The problem is that it detects the professional trader on different platforms It is difficult and in some cases the signal vendors manipulate their signals or even remove their losing signals. This problem is solved in Trasignal and the signaller cannot delete or manipulate its signals after the signal is released، and with careful audit and statistical tools helps you identify the best real trader.

We compare the advantages and the problems

Advantages of Pam Accounts

Professional: PAMM accounts are usually managed by professional financial managers who have personal analysis and good technical knowledge of the financial markets.

Multiple settings: PAM accounts allow you to choose different settings and strategies based on your needs

Diversification: With PAMM accounts you can diversify and split your investment into several different strategies and managers.

Easy liquidity: Most PAMM accounts have easy liquidity features, which means you can withdraw funds at any time

Problems with Pam Accounts:

Managerial Risk: Although professional managers can provide good analysis, it is still possible that their decisions could be wrong and cause losses for investments.

Cost: PAMM accounts usually charge you management and commission fees, which should be considered as direct investment costs.

Reliance on another person: In PAMM accounts, you are dependent on the performance and decisions of your trusted manager and are not allowed to run your own business.

Advantages of Copy Trading

Easy to use: Copy Trading allows you to easily access and copy signals and trades recommended by other traders

Diversification: With Copy Trading, you can diversify and adjust your trading based on different strategies and traders.

Automatic execution: With copy of trade, trades are executed automatically and you do not need to monitor and execute trade manually.

Copy Trading Problems

Trust Risk: You need to trust the traders and the strategies you copy, and if the trader makes a mistake, your capital may also be damaged.

Cost: Some copytrading services charge you management and commission fees that need to be addressed

Limited flexibility: With copy trading, the possibility of executing personal trading and adjusting strategies is strictly limited.

You need a server to use most copy trades, which in some cases open or close later in your account and the possibility of a broker’s server being interrupted during the trades, resulting in losses.

Advantages of Signal Buying

Ease of Use: Buy Signals allows you to easily buy signals recommended by analysts and bots.

Detailed information: Buy signals give you break-in information about time and entry point, exit point and trade management.

Flexibility: You can adjust your trading based on signals and combine different strategies.

Signal buying problems

Confidence risk: Similar to copytrade, you need to trust the analysts and EAs that provide the signals and make sure they are analyzed and advised

(This problem is very low in Trasignal you can choose the best signaller with statistical tools and given that the signaller cannot manipulate or erase the signal after the release is determined the real trader is determined and also with the accurate audit tool of Trasignal will check all the signals in the past and determine the statistics of whether the signal is correct or false in percentage and number.

Another problem with buying signals is that you have to trust a few screenshots from the trading page of a signaler، which usually only publishes their profit signals on their social networks and then buys it، but here after 14 days، the private signals are placed in the public area and you can choose the trader after knowing the trader’s method. Of course. Some Signal Fighters will only signal through a quick signal so that they don’t show their trading method, which you can still see whether it is right or short in the audit section or on your own manually on the chart.

Another problem with buying signals is that in unsafe platforms you have to buy a signal, which you may see after you buy the signal, this person is fraudulent or does not emit a signal at all, but in Trasignal after you buy the signal, the subscription fee paid by Trasignal stays in the middleware form until the sales help of the signal you are told to end that the trans signal limits at least two signals in the Weekly and 8 signals per month for Signal Monitor which you can read in the rules section in full terms

Some Signal Dealers sell signals and trading packages on social networks with rental cars and luxury living، but we tell you that all traders to prove themselves not in words and advertisements، but in practice have an account in Trasignal We do not say that the information has been obtained. So far، this article has been published more than 10 million traders from Signing up worldwide shows the need for a transparent and reliable platform and a social network among the world’s traders, you no longer feel lonely in the trading markets.)

Cost: Buying a signal may impose costs that should be considered (in Trasignal many traders release signals for free).

Limited flexibility: By buying a signal, the possibility of executing individual trading and adjusting strategies is strictly limited (due to the clear trading method and manual trading, you will learn the real trading experience).

Finally, you should note that each of these methods has its advantages and disadvantages, and you should choose the right method to invest in financial markets according to your needs, experience, and personal knowledge.

1 note

·

View note

Link

Have you ever come across the proverb that advises people to “work smarter, not harder”? The forex market is one area in which this proverb may be more pertinent than in most others. You may enter the field of foreign exchange trading and immediately begin generating passive income from it with just a small bit of prior knowledge. Discover how to make your investment goals a reality by learning how to get started with social copy trading, forex affiliate programmes, and partner programmes in this blog.

0 notes

Text

What is CopyTrading? How do I Start CopyTrading?

Introduction

Copytrading is a type of online trading that allows investors to copy the trades of other successful traders. It’s a relatively new concept that has grown in popularity in recent years, thanks to the rise of online trading platforms and social media.

Copytrading is a great way for new investors to get started in the markets, as it takes away the need to do your own research and analysis. All you need to do is find a successful trader to copy, and then you can sit back and watch as their trades are executed in your account.

If you’re interested to start copytrading, the first step is to find a reputable online broker that offers this service. Once you’ve opened an account, you’ll need to connect it with a copy trading platform like CapitalXtend or ZuluTrade. From there, you can start copying the trades of other traders.

How Does CopyTrading Work?

When it comes to copy trading, finding a reputable and trustworthy platform is of the utmost importance. Using a platform that is regulated by a reputable authority can help to ensure that your funds are safe and that the platform operates in a transparent and fair manner.

One way to determine the reputation of a copy trading platform is by checking if it is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), or the National Futures Association (NFA) in the US. These regulatory bodies have strict requirements for the platforms they regulate, and they also provide oversight to ensure that the platform is operating in a fair and transparent manner.

When it comes to finding a reputable copy trading platform, some popular and reputable options include eToro, ZuluTrade, and Naga Trader. These platforms have a large user base and have been around for several years, which is a good indication of their reputation. Additionally, these platforms have been regulated by reputable financial authorities.

When choosing a trader to copy, it is important to consider the trader’s risk management strategy and past performance. A trader with a consistent track record of profit and a conservative risk management strategy is generally a safer choice than a trader who has had a lot of volatility in their returns or takes on high levels of risk.

To research and evaluate traders before deciding to copy their trades, you can check their performance history on the copy trading platform, read reviews and testimonials from other traders, and even reach out to the trader to ask questions about their strategy.

Once you have chosen a platform and a trader to copy, you can set up your account. This typically involves providing personal information and may also require you to submit identification documents. Once your account is set up, you will have access to the platform’s features and tools, such as the ability to copy trades and monitor your account performance.

When it comes to managing your copy trading account, it’s important to keep an eye on your performance and adjust your settings as needed. Some platforms allow you to set stop-loss and take-profit levels, for example, which can help to minimize risk. Additionally, you should regularly monitor the performance of the trader you are copying and adjust your account settings as needed.

Advantages to CopyTrading:

Following are the copytrading advantages :

1. You can access the expertise of more experienced traders.

2. It can help you build your own investment portfolio and strategy.

3. You can benefit from the success of other traders without having to put in all the work yourself.

4. Copy trading can automate your investing, saving you time and effort.

Wrap up

Copytrading is an excellent option for beginners who want to trade in the financial markets. With copytrading, you can learn from experienced traders and gain valuable knowledge without having to put a lot of time into research or analysis — allowing you to focus on your own account management instead. Now that we’ve gone over what copy trading is and how it works, why not give it a try? Start by finding the perfect broker and then create a strategy that suits your preferences before opening up your first trades! Good luck!

Originally Published on Wordpress.com

Source: https://inveslo.wordpress.com/2023/01/25/how-do-i-start-copytrading/

0 notes

Text

Copy trade – Mirroe trade software

To Join in TradeQ link:

https://tradeqs.com/register.html?sponsorid=networker

Invitation Code or Sponsor ID: networker

Copy trade – Mirroe trade software

Experience the Most Flexible Trade Copier in the Market.

What is Copy Trading

By following other traders’ trades, copy trading allows you to automate your trading. It is frequently used by beginners who may not yet be familiar with trading, and it also has the added benefit of helping to teach them as they go. As all trades are automated, it might allow more seasoned traders to take a break from their screens if necessary.

Why Has Copy Trading Become So Popular?

Because many early adopters saw great success and were able to improve their trading abilities and profitability with little to no work, copy investing, also known as mirror trading, has become immensely popular with investors all over the world.

Novice investors are able to achieve precisely that through copy trading. They are not required to understand market analysis, trading signals, or indicator interpretation.

By utilising the skills of other investors, novices raise the likelihood of their own success. However, experienced traders can benefit from copy trading by learning new trading techniques from others and thereby improving their performance in the online trading market.

Advantages of Copy Trading

There are many advantages to copy trading, here we cover just a few:

· By observing how more seasoned traders behave, novice traders might learn how to trade.

· First-time investors can become familiar with the financial markets and have the confidence to trade

· Even when they are too busy to commit the time and research they should ordinarily devote to trading, traders can still engage in the market.

· Create and participate in a trading community where you can share ideas and tactics and work together to make deals that are more successful.

What Is Mirror Trading?

Using mirror trading (also known as mirror effect trading), traders can instantly mimic the positions of other traders. It is a common technique for those who are new to trading cryptocurrency online because it enables novices to learn from seasoned traders.

By definition, it is quite similar to copy trading, but the former can be manually carried out while the latter is largely automated.

How Mirror Trading Works

The way mirror trading operates varies depending on the firm you choose to use. They will typically include a mirror trading feature. Accomplished traders, referred to as “Masters,” will show the performance of their accounts.

Choose a Master trader who fits the asset you prefer. Then, you may link your account to theirs and completely mirror their positions, which means that if they make a trade, you will also.

An Investment Platform

Any trader who wants to broadcast their trading signals to followers in exchange for a performance, management, and volume charge can become a strategy provider. Without making any commitment over the long run, investors might also learn about methods and duplicate them.

Advantages of Mirror Trading

Zero emotional element in making trading decisions.

There is no emotion involved in your trading because this style of trading is entirely automated and depends on the judgement of other traders. For beginner traders who could become too agitated from having to make multiple trading decisions, this is tremendously useful.

Mirror trading is time-efficient.

Choosing a Master Trader to emulate will take some time at first. Following then, maintaining your account requires little time. Naturally, you must occasionally check the status of your account to see if your Master Trader’s performance has changed dramatically. Apart than that, mirror trading doesn’t require much time.

You get to learn from an established Master Trader.

As they execute their moves and your account mirrors these, you get an opportunity to see the actions and behaviour of an experienced market trader.

#copytrade software

#mirror trading

#copy trading

#cryptocurrency trading bot

#DCA bot

0 notes

Photo

*TAKE ON THE MARKET WITH OUR POWERFUL PLATFORM* Take advantage of a world of trading opportunities available through copy trading. *WHAT REALY HAPPENS?* _Forex trading is like trading Dollars to make profits. You can buy a dollar at a rate of 109 ksh and wait to sell it at a rate of 122ksh to make profits. Same as Forex trading only that with forex , the market rate is very fast making us earn profits in a short span of time._ *REQUIREMENTS AT A GLANCE.* 🔷 Open your user account @ www.africoinex.com 🔷 Fund 300.00 USD. (Our Minimum). 🔷 Copy Available Plan. (Refer plans below). 🔷 Withdraw your profits.(No charges). *OUR TRADE PLANS* MICRO: --> Min entry is 300$ --> Max entry Is 1000$ --> Duration is 11 Hours. ---------------------------------------------------------------- SILVER: --> Min entry is 1200$ --> Max entry Is 3000$ --> Duration is 48 Hours. ---------------------------------------------------------------- BRONZE: --> Min entry is 3500$ --> Max entry Is 10000$ --> Duration is 6 Days. ---------------------------------------------------------------- *ADVANTAGE* 🔷 You manage your own account. 🔷 Deposit and withdrawals are fast. 🔷No Trading skills required. 🔷100% Regulated and Certified. We Trade Stocks, Indices and Government Bonds with Number one CopyTrade Platform. Open a live account now only @www.africoinex.com #africoinex #stock-exchange #bonds #forex https://www.instagram.com/p/CoynFFzK5kK/?igshid=NGJjMDIxMWI=

0 notes

Text

How to Choose the Best Crypto Trading Platform

While choosing the best crypto trading platform, you should keep in mind a few key factors. These include features, safety, and user-friendliness. Also, consider whether or not the platform is in your jurisdiction. This will determine how easy it will be to access your account.

Crypto exchanges have gotten more sophisticated over the years. Some have expanded their services to include staking, investing, and even lending. For example, eToro offers a fully featured trading, staking, and investment platform. It also provides an automated trading system, allowing investors to automate their investments and gain granular control over their assets.

Choosing the right platform for your needs can be tricky, especially if you're not sure what you want to do. You may have to make some compromises to find the best one.

The best trading platform will have an intuitive user interface, including an easy-to-use mobile application. There should also be a wide variety of on and off-ramp methods available. Additionally, you should be able to trade digital assets using a variety of payment methods. If the platform you choose isn't well-established yet, you may have to look elsewhere.

One of the oldest crypto trading platforms, Coinbase, is also one of the most reliable. The platform is US-based and has a good track record of security. In addition, it offers a range of products suited to individuals, institutions, and businesses.

Another top-notch crypto trading platform is Binance. It's not the most robust, but it has a stellar reputation and the largest trading volume in the business. Plus, it has a user-friendly design that makes it simple to buy and sell cryptocurrencies. Despite its reliance on cryptos, it supports traditional currencies.

Another great feature is its CopyTrader function. This enables users to copy the buying decisions of successful traders. Using a tool like this can be useful, as it helps you reduce your costs and take advantage of profitable trades.

Other useful features are its staking and lending sections, and its slick user-interface. As an added bonus, the platform has a wallet and insurance coverage in case of security breaches. Considering all of these, it's no wonder that Coinbase has won multiple awards.

Aside from its pro-oriented trading interface, Coinbase also offers a variety of mobile applications. On the consumer side, you can use the Coinbase app to manage your accounts, buy and sell cryptocurrencies, and pay for goods and services. For professional traders, Coinbase has a Pro user interface, which includes advanced charts and API access.

For more specialized products, there's binance Futures, which is a derivative-based trading platform. It's also got the most liquid trading pairs in the industry, and Binance has an impressive track record of service.

To wrap it all up, the best crypto trading platform for you depends on your needs, budget, and location. If you're a novice investor, you might want to look for an exchange that's relatively inexpensive and offers a user-friendly experience. However, if you're an experienced trader, you'll probably want to take a look at the platform that's a bit more expensive.

1 note

·

View note

Text

CTBIT Says Copy Trading is a Sure Shot Profit Making Technique For The New Traders

Copy-trading is a great way to leverage your knowledge and experience with someone else who has more expertise than you.

You can still control when trades are closed, but it might be worth taking into consideration if there’s potential for large profits!

Copytrading is one of of the most amazing platform to a consistent positive passive income regularly, hence, it should be followed in a proper way.

There are too many things that one should know and that is why we spoke to the CTBIT person to have more valuable facts about copy trading, which is as mentioned below.

Is Copy trading profitable and sustainable income source?

PR: Yes, if you are having enough knowledge and you are aware of the tactics of the copy trading, it is an amazing source for your regular positive passive income.

Copy trading has too much benefits that you can avail without adding too much efforts like a traditional old method trading.

Can you please share some very helpful tips for cryptocurrency copy trading?

PR: well, yes, of course, I will let you dig into some very important and secrets ways to become a ninja crypto trader by following some crypto trading tips with the copy trading method.

Cloud mining has been developed as a way to mine cryptocurrency by using rented cloud computing power without having the need to install or directly run any related software or hardware.

People can remotely participate in cryptocurrency mining by opening an account and paying a minimal cost. Thus, cloud mining firms have made mining more accessible and profitable for a larger group of people.

Cryptocurrencies are volatile assets, so it’s important for investors to know the risks involved.

The most common way of earning money from cryptocurrencies is by buying coins and waiting until their value rises — but be careful because you might end up losing every penny if they decline!

Staking is a process by which you earn interest on your crypto holdings. There are many options for stakers, with both centralized and decentralized exchanges offering this service — but there’s no need to worry because it can be done from some hardware wallets too! The lowest risk option would be using stablecoins when versus cryptocurrencies since they eliminate most risks associated price fluctuations in cryptocurrency trading markets alike; if possible avoid lockup periods while earning those rewards though because these.

What is the risk free way to generate profit from copy trading?

PR: The copy trading companies offering you the earn and let us earn service as well, under which you can promote the recommendation of the copy trading companies to other as an affiliate and the company gives you the extra benefits on successful signup or tie-up.

You should also take an advantage of this service and should earn without investing anything in it.

Well, these are only few of secret tips to make profit from copy trading, if you want to dive in the entire sea, be connected with us and follow us on social media where we regularly share the smallest thing about the copy trading.

0 notes

Text

Daily Giveaway Roll & Freebies– August 22nd 2022

Daily Giveaway Roll & Freebies– August 22nd 2022

The @Versatileer Daily

Giveaway Roll & Freebies

August 22nd

Welcome to the Versatileer “Daily Giveaway Roll”

A daily listing of giveaways, ending daily midnight Pacific Time. Brought to you by Versatileer:

Expiring 8/22 – 2 a.m. until 8 a.m.

Special Wizardia

Community Airdrop: $4 270 USDT, 58 winners

Advantages of

Memo in Your Eyes

1st CopyTrade

Offer: Claim $500 ETC!

Cronos ID –

Reserve…

View On WordPress

0 notes