#automated bank reconciliation software solution

Explore tagged Tumblr posts

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

Accounting Classic Features

Features

Online payment processing, payroll system, stockmanagement, tax filling & reporting. Track financial updates related to taxes, inventory levels, customer payments and more

Accounting software on Cloud at its Best Bank Reconciliation |Reports | Invoice Customization

Online payment processing, payroll system, stock management, tax filling & Reporting.

Track financial updates related to taxes, customer payments and more…

Best for invoicing, Feature-rich solutions Sending Invoices Online?

Make professional Invoices in seconds, Automate Payment Reminders

Accounting Classic has a Simple, user-fiendly interface design that offers end-to-end accounting tasks

Join Our Community

We build modern web tools to help you jump-start your daily business work.

3 notes

·

View notes

Text

Online Bookkeeping Services by Mercurius & Associates LLP

In today’s fast-paced digital economy, accurate and efficient financial management is crucial for every business. Whether you're a startup, small enterprise, or a growing company, keeping track of your finances is vital for sustainability and success. That’s where Mercurius & Associates LLP steps in with its online bookkeeping services — blending technology, expertise, and reliability to manage your books with precision.

Why Bookkeeping Matters

Bookkeeping is the foundation of any business’s financial health. It involves recording, classifying, and organizing all financial transactions so that businesses can:

Monitor their financial position

Ensure regulatory compliance

Make informed decisions

File accurate tax returns

Plan for growth and investment

Yet, many businesses struggle to keep up with bookkeeping due to time constraints, lack of in-house expertise, or outdated processes.

Benefits of Online Bookkeeping Services

Online bookkeeping is a game-changer for modern businesses. It offers:

Real-time access to financial data

Cloud-based solutions for anytime, anywhere access

Cost-effective services compared to in-house staff

Scalability as your business grows

Increased accuracy through automated tools

Secure data storage with regular backups

By outsourcing bookkeeping to professionals, businesses can focus more on core operations while ensuring their books are in order.

Why Choose Mercurius & Associates LLP?

At Mercurius & Associates LLP, we specialize in providing online bookkeeping services tailored to your business needs. Here’s what sets us apart:

1. Experienced Professionals

Our team comprises skilled accountants and finance experts who understand the nuances of bookkeeping across industries. We ensure compliance with Indian and international accounting standards.

2. Customized Solutions

We understand that no two businesses are the same. Our bookkeeping services are tailored to suit your industry, size, and specific requirements.

3. Technology-Driven Approach

We leverage cloud-based platforms like QuickBooks, Zoho Books, Xero, and Tally for seamless and accurate bookkeeping. Integration with your existing systems is quick and hassle-free.

4. Transparent Reporting

You receive regular financial reports that help you track performance, manage cash flow, and plan strategically. Our detailed reports include profit and loss statements, balance sheets, and cash flow summaries.

5. Data Security

We implement best-in-class data protection protocols to ensure your financial information is secure and confidential.

Services We Offer

Daily, weekly, or monthly transaction recording

Bank and credit card reconciliation

Accounts payable and receivable management

General ledger maintenance

Payroll processing support

GST return preparation and filing

Financial reporting and analysis

Industries We Serve

Our online bookkeeping services are ideal for:

Startups & Entrepreneurs

E-commerce Businesses

Healthcare Professionals

Legal Firms

Retail & Wholesale Businesses

IT & Software Companies

NGOs and Trusts

Get Started with Mercurius & Associates LLP

Outsourcing your bookkeeping doesn’t mean losing control. With Mercurius & Associates LLP, you gain a partner who brings clarity, accuracy, and efficiency to your financial operations.

Let us handle your books while you focus on growing your business.

📞 Contact us today to learn more about our online bookkeeping services or to request a free consultation.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#income tax#taxation#foreign companies registration in india#auditor#ap management services

2 notes

·

View notes

Text

Everything You Need to Know About Cosmolex Accounting Software

In today’s fast-paced business world, having the right accounting software is essential for smooth financial management. CosmoLex has emerged as a leading choice for businesses, particularly in the legal and professional services industries, offering comprehensive accounting solutions tailored to specific needs.

This guide will explore why CosmoLex stands out as the best accounting software, detailing its features, benefits, and unique selling points. We will also address common questions to help you understand if CosmoLex is the right tool for your business.

What is CosmoLex?

CosmoLex is a cloud-based accounting software solution designed with professionals in mind, especially those in the legal industry, such as law firms and solo practitioners. With an all-in-one platform, CosmoLex combines essential accounting functions with specialized features that cater to the unique needs of legal professionals. Unlike traditional accounting software, CosmoLex streamlines financial management while also addressing compliance and trust accounting requirements.

With features that extend beyond basic bookkeeping, CosmoLex helps firms manage time tracking, billing, client management, and compliance, all in one integrated system. The software's easy-to-use interface and powerful functionality have made it a go-to solution for professionals looking for efficiency and accuracy in their financial operations.

Key Features of CosmoLex

1. Trust Accounting Compliance

One of CosmoLex’s standout features is its trust accounting capabilities, specifically designed to meet the strict regulations of the legal industry. Trust accounts require meticulous record-keeping to ensure that client funds are handled appropriately. CosmoLex automates the process of tracking client trust balances, generating trust account reconciliations, and ensuring compliance with local bar association rules.

2. Integrated Time Tracking and Billing

CosmoLex combines time tracking and billing into one seamless process, making it easy for law firms to log billable hours and create invoices directly from the platform. This feature helps streamline the billing process, improves accuracy, and ensures that no billable time goes unaccounted for. Whether you need to track time spent on client meetings or specific case tasks, CosmoLex offers a user-friendly interface that simplifies time tracking and invoicing.

3. Comprehensive Financial Management

Beyond its specialized tools, CosmoLex provides full-service accounting capabilities, including accounts payable/receivable management, general ledger, and financial reporting. It allows businesses to manage their financial data accurately, create financial statements, and generate customizable reports that provide insights into their financial health.

4. Automated Bank Reconciliation

CosmoLex automates the process of bank reconciliation, which is crucial for maintaining accurate financial records. By connecting your bank accounting software, transactions are automatically imported, matched, and reconciled. This reduces the manual effort needed for reconciliation and minimizes the risk of human error.

5. Client and Matter Management

CosmoLex offers integrated client and matter management tools that allow you to organize client files, manage documents, and maintain case notes within the same system. This helps legal professionals keep track of all case-related information in one place, ensuring that critical documents are easily accessible when needed.

6. Billing Customization and Payment Processing

The software supports customizable invoice templates and allows you to set payment terms and accept online payments through integrated payment gateways. This feature not only streamlines the billing process but also provides clients with convenient payment options, thereby improving cash flow for the business.

7. Compliance and Security

CosmoLex prioritizes data security with encryption, secure cloud storage, and multi-factor authentication. Compliance is also a key focus, especially for law firms that must adhere to various legal and financial regulations. The platform ensures that all data is protected and compliant with the necessary guidelines for trust accounting.

Benefits of Using CosmoLex

1. All-in-One Solution

One of the major advantages of CosmoLex is that it combines various essential tools into a single platform. This eliminates the need for separate software solutions for accounting, time tracking, billing, and client management, streamlining workflow and reducing administrative overhead.

2. Enhanced Efficiency

CosmoLex’s user-friendly design and automated features help businesses save time on routine tasks. The time tracking, billing, and reconciliation automation allow professionals to focus on their core activities rather than spend valuable time on manual bookkeeping.

3. Accurate and Transparent Reporting

With real-time financial reporting capabilities, CosmoLex helps businesses keep a clear picture of their financial status. Customized financial reports can be generated for better insights, aiding in more informed decision-making and strategic planning.

4. Improved Cash Flow

By enabling easy online payment processing and accurate invoicing, CosmoLex helps businesses improve their cash flow. Clients can pay invoices directly through integrated payment gateways, which helps speed up the collection process.

5. Legal-Specific Features

CosmoLex is specifically designed for legal professionals, so it includes features that cater to the needs of law firms that other generic accounting software might not offer. This includes trust accounting compliance, case management, and billing features tailored for legal services.

How Does CosmoLex Compare to Other Accounting Software?

1. CosmoLex vs. QuickBooks

QuickBooks is one of the most widely used accounting platforms for small to medium-sized businesses. While it offers strong accounting capabilities, it does not provide specialized features tailored for legal professionals, such as trust accounting compliance and integrated client matter management. CosmoLex excels in this area by combining industry-specific tools with general accounting features.

2. CosmoLex vs. Clio

Clio is a popular practice management software for law firms that includes billing, case management, and document storage. However, while Clio does provide some financial features, it lacks full-service accounting capabilities such as automated bank reconciliation and comprehensive financial reporting that CosmoLex offers. CosmoLex integrates these features into one platform, making it an all-in-one solution.

3. CosmoLex vs. Xero

Xero is a well-known accounting software designed for a broad range of businesses. While it offers great financial management tools, it lacks the legal-specific features that CosmoLex has, such as trust accounting compliance and client matter management. For law firms needing specialized accounting and practice management, CosmoLex is the more comprehensive option.

Pros and Cons of Using CosmoLex

Pros:

All-in-One Platform: Combines accounting, time tracking, and client management.

Trust Accounting Compliance: Ideal for law firms that need to manage client trust accounts.

User-Friendly Interface: Easy to navigate, even for those without an accounting background.

Seamless Integration: Works well with payment gateways and other third-party tools.

Automated Features: Time-saving automation for bank reconciliation, billing, and reporting.

Cons:

Cost: CosmoLex can be more expensive compared to simpler, non-specialized accounting software.

Learning Curve: While the interface is user-friendly, new users may still need time to familiarize themselves with all the features.

Not Ideal for Non-Legal Firms: The software is best suited for law firms and may not provide enough value for businesses in other industries.

Final Thoughts

CosmoLex has established itself as one of the best accounting software solutions for legal professionals due to its comprehensive, all-in-one approach. From trust accounting compliance to integrated time tracking and billing, CosmoLex provides the tools needed to manage the financial and operational aspects of a law firm effectively. While it may come at a higher cost compared to simpler accounting software, its specialized features and time-saving automation make it a worthwhile investment for law firms and professional service providers. By choosing CosmoLex, businesses can enhance efficiency, ensure compliance, and focus on delivering excellent services to their clients.

FAQs

What Industries Benefit the most from CosmoLex?

CosmoLex is designed primarily for legal professionals and firms. It is best suited for law firms, solo practitioners, and accounting firms that handle legal trust accounting and billing.

How does CosmoLex Handle Data Security?

CosmoLex employs strong data security measures such as encryption, cloud storage, and multi-factor authentication to protect user data and ensure compliance with industry regulations.

Can I try CosmoLex before Purchasing?

Yes, CosmoLex offers a free trial for potential customers to test out the platform and determine if it fits their business needs.

Does CosmoLex Integrate with other Software?

CosmoLex integrates with popular tools and platforms like Xero, QuickBooks, and payment gateways, ensuring a seamless workflow for users who may need to use additional software for their operations.

Is CosmoLex Suitable for Solo Practitioners?

Yes, #CosmoLex is an excellent choice for solo practitioners who need a comprehensive accounting and practice management solution. Its user-friendly design and specialized features make it ideal for professionals who manage their own practices.

2 notes

·

View notes

Text

Why Instant Financial Insights Matter for Businesses Today?

Introduction Today’s fast-paced business environment, waiting until the end of the month to understand a company's financial position is no longer sufficient. Real-time accounting has emerged as a game-changer, offering immediate access to financial data, allowing businesses to make informed decisions faster than ever before. Here’s a look at why real-time accounting is trending and how it benefits businesses in this dynamic economic landscape. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

What is Real-Time Accounting?

Real-time accounting leverages advanced accounting software and cloud technology to update financial data instantly as transactions occur. Instead of waiting for monthly or quarterly reports, business owners and stakeholders can access live financial information at any moment.

Why is Real-Time Accounting a Trending Topic?

Several factors are driving the adoption of real-time accounting:

Demand for Agility: Businesses must adapt quickly to changing market conditions, and real-time data empowers them to make swift, well-informed decisions.

Digital Transformation: With the rise of cloud-based accounting solutions, updating financial data instantly has become more accessible to businesses of all sizes.

Risk Management: Real-time insights enable proactive decision-making, helping businesses identify potential risks and address them before they escalate.

Key Benefits of Real-Time Accounting

Improved Cash Flow Management: Real-time accounting allows businesses to monitor their cash flow instantly. They can see which payments are due, forecast cash needs, and avoid potential cash flow issues.

Enhanced Decision-Making: Instant access to financial data allows business leaders to make informed, data-driven decisions. Whether it's expanding operations or cutting expenses, real-time data provides the accuracy needed to act confidently.

Accurate Financial Forecasting: With up-to-the-minute data, companies can create more accurate financial forecasts, helping them better prepare for future needs or investments.

Simplified Compliance and Tax Reporting: Real-Time Accounting simplifies compliance by maintaining accurate records that can be accessed and verified easily, making tax filing and audits more straightforward.

Reduced Errors: Automating data updates in real-time minimizes the risk of manual entry errors, leading to more accurate financial records and fewer discrepancies.

How to Implement Real-Time Accounting in Your Business

Choose the Right Accounting Software: Select a cloud-based accounting system that integrates seamlessly with your business processes and supports real-time data updates.

Automate Transaction Entries: Leverage automation features for expenses, invoicing, and payroll to ensure transactions are recorded immediately, reducing manual work.

Integrate Bank Feeds: Many modern accounting platforms allow you to sync bank transactions directly, enabling instant reconciliation and more accurate cash flow tracking.

Regularly Monitor Key Metrics: With real-time data, it’s easy to monitor KPIs, cash flow, and profit margins. Set up dashboards for an at-a-glance view of your company’s financial health.

Challenges to Consider

While real-time accounting offers numerous benefits, there are a few challenges businesses may face:

Cost of Technology: Implementing new software or upgrading existing systems may require an initial investment, which can be a barrier for smaller businesses.

Data Security: With real-time data being cloud-based, it’s critical to have robust cybersecurity measures in place to protect sensitive financial information.

Learning Curve: Shifting from traditional to real-time accounting can require training, especially for employees accustomed to older accounting processes.

The Future of Real-Time Accounting

As technology advances, real-time accounting is expected to become even more accessible and integral to financial management. Artificial intelligence and machine learning are likely to further enhance the capabilities of real-time Accounting, enabling more predictive insights and even automated financial decision-making. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

Conclusion

Real-time accounting offers a competitive edge, enabling businesses to access financial insights instantly, respond to market changes, and make data-driven decisions. With the rise of digital tools and automation, implementing real-time accounting is easier than ever, allowing companies of all sizes to benefit from instant, reliable financial data. In an ever-evolving business landscape, real-time accounting may well become the new standard for financial management.

#RealTimeAccounting#DigitalAccounting#BusinessFinance#AccountingTrends#FinancialInsights#FinanceManagement#ModernAccounting

2 notes

·

View notes

Text

Melio is a financial technology platform designed to streamline accounts payable and receivable processes for small and medium-sized businesses. It aims to simplify bill payments, improve cash flow management, and enhance overall financial operations. Here is a detailed review of its features and functionalities:

Key Features

Bill Payments:

Multiple Payment Methods: Melio allows businesses to pay vendors using ACH bank transfers, credit cards, or checks. This flexibility helps businesses manage cash flow and earn credit card rewards, even if the vendor only accepts checks. Schedule Payments: Users can schedule payments in advance, ensuring timely bill payments and avoiding late fees. Batch Payments: The platform supports batch payments, allowing users to pay multiple bills at once, saving time and reducing administrative burden.

Accounts Receivable:

Payment Requests: Businesses can send payment requests to customers via email, including a link for customers to pay directly through the platform.

Customer Management: Track customer payments, manage outstanding invoices, and automate reminders to improve collection rates.

Integration and Syncing:

Accounting Software Integration: Melio integrates with popular accounting software like QuickBooks, Xero, and FreshBooks, ensuring seamless data synchronization and reducing manual data entry.

Bank Integration: Direct integration with banks facilitates easy payment processing and reconciliation. User-Friendly Interface:

Dashboard: A clean and intuitive dashboard provides an overview of pending and completed payments, cash flow status, and upcoming bills.

Mobile Access: The platform is accessible via mobile devices, allowing users to manage payments and view financial data on the go.

Security and Compliance:

Secure Transactions: Melio employs robust security measures, including encryption and secure data storage, to protect user information and financial transactions.

Compliance: The platform adheres to financial regulations and industry standards, ensuring compliance with relevant laws.

Cash Flow Management:

Flexible Payment Options: By allowing credit card payments for bills, Melio helps businesses manage cash flow more effectively, providing the flexibility to defer payments while still meeting obligations.

Payment Scheduling: Advanced scheduling options enable better planning and control over outgoing cash flow.

Collaboration Tools:

Team Access: Multiple users can be granted access to the platform, allowing for collaborative financial management. Permission settings ensure that sensitive information is accessible only to authorized personnel.

Audit Trail: Detailed records of all transactions and activities help maintain transparency and accountability.

Pros Flexibility in Payments: The ability to pay bills via credit card, even when vendors don’t accept them, provides a unique advantage in managing cash flow and earning rewards. Ease of Use: The platform’s user-friendly interface and straightforward setup make it accessible for businesses of all sizes.

Integration with Accounting Software: Seamless integration with major accounting tools ensures accurate financial tracking and reduces manual workload.

Security: Strong security measures and compliance with industry standards provide peace of mind for users.

Batch Payments: Support for batch payments simplifies the process of paying multiple bills, saving time and reducing errors.

Cons Cost: While Melio offers a free version, certain advanced features and payment methods (like credit card payments) incur fees, which might be a consideration for cost-sensitive businesses. Limited Global Reach: Melio primarily serves businesses in the United States, which may limit its usefulness for companies with significant international operations or those based outside the U.S. Learning Curve for Advanced Features: Some users might find the advanced features complex initially, requiring time to fully utilize all functionalities.

Melio is a powerful and flexible tool for small and medium-sized businesses looking to streamline their accounts payable and receivable processes. Its ability to manage payments through various methods, integration with popular accounting software, and user-friendly design make it an attractive option for businesses aiming to enhance their financial operations. While there are costs associated with some features and a learning curve for advanced functionalities, the overall benefits, including improved cash flow management and operational efficiency, make Melio a valuable tool for modern businesses.

4 notes

·

View notes

Text

Simplifying Tax Filing: The Best Accounting Software Solutions for Indian Companies

Tax filing can be a complex and time-consuming process for Indian companies. However, with the right accounting software, this task can be simplified and streamlined. In this article, we will explore the best accounting software solutions for Indian companies that can assist in simplifying tax filing.

1. Tally ERP 9: Tally ERP 9 is a leading accounting software widely used in India. It offers comprehensive features for managing financial transactions, generating accurate financial reports, and ensuring GST compliance. With built-in tax filing capabilities, Tally ERP 9 simplifies the process of tax computation and e-filing, saving time and reducing errors.

2. QuickBooks: QuickBooks is a popular accounting software that caters to small and medium-sized businesses in India. It provides features like expense tracking, invoicing, and financial reporting. QuickBooks simplifies tax filing by automatically categorizing transactions, generating GST-compliant reports, and facilitating seamless integration with tax filing portals.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers Indian businesses an efficient way to manage their finances. It provides GST-compliant invoicing, expense tracking, and bank reconciliation features. Zoho Books streamlines tax filing by generating accurate tax reports, providing support for e-way bill generation, and enabling integration with GSTN for seamless filing.

By leveraging these top accounting software solutions, Indian companies can simplify tax filing processes and ensure compliance with GST regulations. These software options automate various aspects of tax computation, generate GST-compliant reports, and facilitate easy e-filing. They minimize manual effort, reduce the chances of errors, and provide businesses with a clear overview of their tax obligations.

In conclusion, choosing the right accounting software is essential for Indian companies looking to simplify tax filing. Tally ERP 9, QuickBooks, and Zoho Books are among the top accounting software solutions that can streamline the tax filing process, saving businesses valuable time and effort while ensuring accuracy and compliance.

2 notes

·

View notes

Text

How Accounting Consultants Can Help Improve Internal Controls and Financial Reporting?

Strong internal controls and accurate financial reporting are the foundation of any well-run business. They protect assets, ensure compliance with regulations, and provide reliable information for decision-making. However, many small to mid-sized businesses struggle to maintain effective controls or produce consistent, error-free reports. This is where accounting consultants can make a significant impact. With their expertise and objective perspective, they can identify weaknesses, implement best practices, and help your business achieve greater financial transparency and stability.

Enhancing Internal Controls

Internal controls are the systems and procedures businesses use to prevent fraud, reduce risk, and ensure the accuracy of financial data. These include processes such as approving transactions, segregating duties, and reconciling accounts. Unfortunately, businesses often operate with outdated or incomplete controls, leaving them vulnerable to errors or fraud.

Accounting consultants in Fort Worth, TX begin by conducting a thorough evaluation of your current internal control environment. They review key processes—such as cash handling, payroll, purchasing, and inventory management—to identify inefficiencies or risks. Once they’ve assessed the gaps, they propose tailored improvements designed to strengthen oversight without overburdening your team.

For example, a consultant may recommend changes like separating invoice approval from payment processing or instituting regular reconciliations of bank and credit card accounts. These adjustments, while often simple, can significantly reduce the risk of financial misstatements or misuse of funds.

Improving Financial Reporting Accuracy

Timely and accurate financial reporting is essential for monitoring business performance, satisfying stakeholders, and meeting compliance obligations. However, poor reporting often stems from inconsistent accounting practices, outdated software, or a lack of financial expertise.

An accounting consultant can help you develop a more efficient and reliable reporting system. This includes creating standard operating procedures for closing books, designing customized financial reports, and ensuring compliance with generally accepted accounting principles (GAAP). Consultants also train your staff on proper reporting techniques and accounting standards, reducing dependency on guesswork or manual processes.

Additionally, they can help automate repetitive tasks and integrate software solutions that streamline financial reporting. Whether you’re using QuickBooks, Xero, or a more complex ERP system, consultants ensure that your technology supports accuracy and provides the right insights at the right time.

Reducing the Risk of Errors and Fraud

Errors in financial statements can lead to incorrect decision-making, lost credibility, and regulatory consequences. Fraud, whether internal or external, can cause devastating financial and reputational damage. Accounting consultants help mitigate both by introducing checks and balances, routine audits, and real-time monitoring systems.

They also develop protocols for detecting and investigating irregularities, helping businesses respond swiftly and decisively. By promoting a culture of transparency and accountability, they create an environment where financial integrity is a top priority.

Conclusion

Working with an accounting consultant is a proactive investment in your business’s financial health. By improving internal controls and enhancing the accuracy of financial reporting, they help protect your assets, support informed decision-making, and prepare you for sustainable growth. Their guidance can transform your accounting function from a basic necessity into a strategic advantage.

#Accounting consultants#Improve#internal controls#Financial reporting#accounting#accounting services

0 notes

Text

Smart Reconciliation Software is redefining how modern businesses track, verify, and manage their financial data. Touras' Reconciliation product helps businesses automate complex reconciliation tasks across payment gateways, banks, and internal records — saving time, reducing errors, and ensuring full financial visibility.

If you're a growing business struggling with manual processes or delayed settlements, Touras offers a unified platform to reconcile multi-channel transactions in real-time. From e-commerce platforms to aggregators and enterprises, the solution adapts to your specific reconciliation needs.

0 notes

Text

Top Tips for Choosing the Best Business Bank Account

Running a business, especially in the fast-paced digital world, requires more than just great products or services—it demands smart financial management. One of the most critical decisions entrepreneurs face is choosing the right business bank account. Whether you’re a startup founder or managing a growing enterprise, the right bank account can simplify operations, support your cash flow, and even reduce costs.

This is particularly true for companies in dynamic sectors like travel, where efficient tools like travel booking software and travel management software work best when integrated with a responsive and feature-rich business bank account. Here are some top tips to help you choose wisely:

1. Understand Your Business Needs

Start by evaluating your financial habits. Do you make frequent international transactions? Do you need integration with payroll and invoicing systems? For businesses in the travel industry, having a bank account that syncs smoothly with travel booking software is a major advantage.

2. Look for Low or No Fees

Monthly maintenance charges, transaction fees, and ATM fees can quickly eat into your profits. Opt for accounts that offer transparent pricing or waive fees when certain conditions are met. Small and medium-sized businesses often benefit from accounts with minimal overhead.

3. Check for Integration with Financial Tools

Today’s business accounts should do more than hold money. Look for options that offer seamless integration with travel management software, accounting tools, and expense tracking platforms. Automation can save hours in reconciliation and help avoid human error.

4. Prioritize Online and Mobile Banking

In an era of remote work and global travel, mobile access is non-negotiable. Ensure the bank offers a user-friendly app with essential features like fund transfers, real-time balance updates, and multi-user access for your finance team.

5. Consider International Transaction Capabilities

If your business books travel services across borders, or works with overseas partners, prioritize accounts that offer competitive foreign exchange rates and low international wire fees. Integration with travel booking software makes these international transactions even more streamlined.

6. Explore Value-Added Services

Some banks offer perks like invoicing tools, expense management solutions, and access to credit. These extras are especially helpful when used alongside travel management software, which can centralize your business travel spending and vendor payments.

7. Ensure Excellent Customer Support

A responsive support team is invaluable—especially when you're managing travel bookings or dealing with urgent payment issues. Look for banks with 24/7 helplines, chat support, or a dedicated relationship manager.

8. Evaluate Account Security

Security is critical for any business. Choose a bank that offers two-factor authentication, fraud detection, and regular transaction alerts. This is particularly vital when integrating your bank account with digital tools like travel booking software.

9. Compare Interest Rates and Overdraft Facilities

If you maintain a healthy balance, an account with competitive interest rates can offer added value. On the other hand, access to business overdrafts can help during cash crunches—essential for industries with fluctuating revenues, like travel.

10. Read the Fine Print

Always review the terms and conditions. Watch for hidden fees, minimum balance requirements, and transaction limits. The right business bank account should offer flexibility as your company evolves.

Final Thoughts

Whether you're a travel agency using travel management software or a startup scaling globally, the right business bank account can empower your operations. It should do more than store money—it should act as a tool for growth, automation, and financial clarity.

0 notes

Text

BFSI Software Testing: Ensuring Secure and Seamless Financial Experiences with ideyaLabs in 2025

Introduction to BFSI Software Testing

Banking, Financial Services, and Insurance (BFSI) shape the backbone of modern economies. Software financial services securely and efficiently. As digital adoption accelerates, robust BFSI software testing becomes crucial. Weak testing exposes institutions to fraud, data breaches, regulatory penalties, and service disruptions. Financial sector organizations recognize software testing as essential for trust, compliance, and user satisfaction.

Understanding the Current BFSI Digital Landscape

In 2025, digital banking surpasses traditional channels. Customers prefer mobile apps and online portals for transactions, investments, and insurance services. Automation powers loan approvals, claims processing, and risk assessments. Each touchpoint carries sensitive customer information. Application performance influences customer experience. A single glitch causes reputational and financial damage. BFSI software testing verifies reliability, security, and compliance for every application.

Why BFSI Software Testing Demands Specialization

BFSI systems manage complex workflows, heavy transaction loads, and strict regulatory requirements. Testing financial software presents unique challenges. Transaction validations, concurrency management, encryption, and disaster recovery protocols require expert handling. Even a minor error in test design can lead to far-reaching consequences.

Dedicated BFSI software testing methods ensure robustness. Testers simulate real-world financial operations. They validate rapid fund transfers, multi-factor authentication, anti-fraud workflows, and accurate account reconciliations. Security, speed, and compliance define quality in BFSI technology ecosystems.

ideyaLabs: The Catalyst for Trusted BFSI Software Testing

ideyaLabs leads the BFSI software testing landscape. The team delivers end-to-end testing solutions tailored for banking, financial services, and insurance domains. ideyaLabs understands sector-specific regulations and operational nuances. Focused industry expertise translates into higher test coverage, lower risk, and faster go-lives.

Core Areas of BFSI Software Testing by ideyaLabs

1. Functional Testing for Reliable Transactions

Functional accuracy forms the foundation of financial software quality. ideyaLabs tests each function in banking, financial services, and insurance platforms. Deposit processing, payment gateways, loan origination, policy issuance, and claims management receive thorough validation. Each user journey works as intended, under varied scenarios and loads.

2. Performance Testing to Handle Massive Transactions

BFSI solutions process millions of transactions per day. Slow response times frustrate customers and lead to loss of business. ideyaLabs performance tests BFSI applications for scalability, speed, and consistency. Simulations gauge system behavior under peak traffic. Testing experts identify bottlenecks and fine-tune systems for optimal throughput.

3. Security Testing for Data Integrity and Regulatory Compliance

Cybersecurity threats target BFSI institutions relentlessly. Regulations impose strict mandates for data protection, privacy, and auditability. ideyaLabs conducts security testing to uncover vulnerabilities before attackers do. Penetration tests, risk assessments, and vulnerability scans fortify applications. ideyaLabs ensures compliance with data handling, encryption, and access control standards.

4. Automation Testing for Accelerated Digital Transformation

Modern banks and insurers embrace DevOps and continuous delivery. Software releases need rapid validation without sacrificing quality. ideyaLabs develops robust test automation frameworks for BFSI workloads. Regression cycles become faster, more accurate, and repeatable. Automation speeds up innovation cycles in today's BFSI environment.

5. Regulatory Compliance Testing for Peace of Mind

Frequent policy updates and evolving standards present constant regulatory challenges. ideyaLabs stays updated with the latest mandates. The team verifies compliance across application layers. Testing incorporates legal, operational, and reporting checks. This approach prevents regulatory fines and ensures a smooth audit trail.

6. User Experience Testing for Customer Loyalty

Financial customers demand intuitive, frictionless digital journeys. Even minor usability issues result in lost engagement. ideyaLabs tests user interfaces on multiple devices, platforms, and accessibility configurations. Testing covers onboarding, transactions, self-service, and helpdesk modules. The result: satisfied users and higher customer retention.

How ideyaLabs’ Approach Revolutionizes BFSI Software Testing in 2025

Specialized Banking Domain Knowledge

ideyaLabs employs BFSI testing specialists with deep sectoral understanding. Domain-specific expertise results in meaningful test cases, credible defect identification, and actionable feedback. The team understands unique risks attached to lending, payments, investments, and insurance segments.

End-to-End Test Coverage

Technical specialists cover every layer— front end, middleware, backend, integrations, and data. ideyaLabs creates comprehensive test suites. Test cases cover APIs, databases, business processes, and third-party connections. Comprehensive coverage eliminates loopholes missed by generic testing providers.

Agile and Scalable Testing Models

BFSI sector software evolves continuously. ideyaLabs aligns with agile and DevOps practices. Testing integrates seamlessly with development pipelines. The approach enables rapid defect discovery and remediation across sprints. Testing models scale with project needs, timelines, and complexity.

Focus on Quality and Customer Centricity

Each ideyaLabs engagement embodies a quality-first mindset. The team aligns with client objectives and customer needs. Individual test plans maximize business value. Stakeholders receive actionable test reports, risk insights, and compliance dashboards.

Proven Track Record with BFSI Clients

ideyaLabs has successfully delivered projects for global banks, NBFCs, insurance leaders, and fintech disruptors. Case studies showcase reduced post-launch defects, accelerated rollout cycles, higher compliance, and reduced downtime. BFSI clients trust ideyaLabs as a strategic quality assurance partner.

Future Trends in BFSI Software Testing

Artificial intelligence and machine learning revolutionize financial software. Risk models, chatbots, and fraud detection run on smart algorithms. ideyaLabs refines BFSI software testing methodologies for these emerging technologies. Model-based testing, synthetic data generation, and AI validation tools enable reliable next-generation fintech.

Open banking expands financial connectivity. Secure API testing gains critical importance. ideyaLabs delivers advanced API testing for regulatory and ecosystem compliance. Internet of Things (IoT) and embedded finance require new security and integration testing paradigms. ideyaLabs stays ahead of the innovation curve in BFSI software testing.

The Business Impact of Effective BFSI Software Testing

Financial organizations concentrate on growth, innovation, and customer trust. Effective BFSI software testing by ideyaLabs directly supports these goals. Key business benefits include:

Reduced business risk from downtime and fraud

Consistent regulatory compliance and audit readiness

Enhanced customer satisfaction across digital touchpoints

Faster release cycles and time-to-market

Lower maintenance costs through early defect detection

Choose ideyaLabs for BFSI Software Testing Excellence

In 2025, BFSI technology innovation continues to accelerate. Banks, insurers, and financial services providers need strategic partners to guarantee software reliability and security. ideyaLabs stands as the premier partner in BFSI software testing. The company brings proven expertise, tailored solutions, and industry leadership.

Organizations trust ideyaLabs to safeguard their software investments, comply with regulations, and provide seamless digital experiences. The future of finance demands excellence in testing. ideyaLabs delivers this excellence, every day, to every client.

Connect with ideyaLabs for Next-Generation BFSI Software Testing Services

Future-ready BFSI organizations stay ahead by partnering with ideyaLabs. Explore specialized BFSI software testing solutions designed for evolving business needs. ideyaLabs drives performance, compliance, and user delight in the fast-paced financial sector. Reach out today for a consultation and step into a more reliable digital future.

0 notes

Text

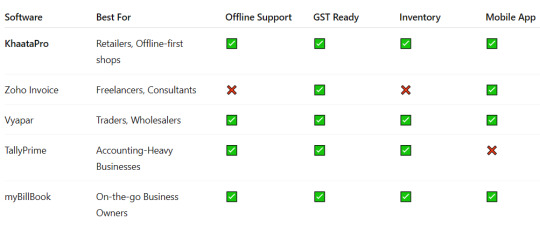

5 Best Billing Software for Small Businesses in 2025

Efficient billing is the backbone of any successful small business. Whether you run a retail shop, offer professional services, or operate a small manufacturing unit, accurate and streamlined invoicing ensures steady cash flow, organized accounts, and simplified tax filing. Thankfully, modern billing software has made it easier than ever to manage business finances.

In this blog, we explore the 5 best billing software ideal for small businesses in 2025 with a spotlight on the rising favorite, KhaataPro.

1. KhaataPro – Smart Billing, Simple Business

Khaata Pro is a powerful and easy-to-use billing software designed specifically for small and medium-sized businesses in India. Launching in 2025, Khaata Pro is poised to become a game-changer for retailers, wholesalers, and service providers who want digital billing without the tech headache.

Key Features:

Offline & Online Billing Modes

GST-Compliant Invoicing

Expense and Stock Management

Customer Credit Tracking

Multi-Language Interface (including English, Hindi, Marathi)

Mobile-Friendly Dashboard for Shopkeepers

Why Choose KhaataPro? With its user-friendly interface, regional language support, and offline functionality, KhaataPro is perfect for shop owners and local businesses that need digital solutions without constant internet access.

2. Zoho Invoice – Ideal for Service Providers

Zoho Invoice is a cloud-based billing solution tailored for freelancers, consultants, and small service-based businesses. It allows users to create professional invoices, automate payment reminders, and track time-based billing.

Highlights:

Customizable Invoice Templates

Client Portals

Online Payment Integrations

Time Tracking & Project Billing

Best For: Freelancers, consultants, and agencies looking for project-based billing with detailed time logs.

3. Vyapar – Designed for Indian Small Businesses

Vyapar is a popular GST billing software used widely in India, especially among traders and local retailers. It offers mobile and desktop support and includes features that go beyond billing, such as accounting, inventory, and order management.

Highlights:

Barcode Scanning & Inventory

Bill-wise Payment Tracking

GST Reports and Filing Assistance

Delivery Challans & Quotations

Best For: Indian shopkeepers and wholesalers who need both inventory and billing in one place.

4. TallyPrime – Trusted Accounting with Invoicing

While Tally is traditionally known for accounting, TallyPrime brings in simplified billing features with a deep focus on compliance and scalability. It suits businesses that need invoicing tied closely with accounting, inventory, and statutory reports.

Highlights:

Invoicing with Inventory Integration

GST and Multi-Tax Invoicing

Bank Reconciliation

Customizable Reports

Best For: Small to medium-sized enterprises that want billing + full-fledged accounting in one package.

5. myBillBook – Mobile-First Billing Software

myBillBook is a modern GST billing app that offers quick invoicing, real-time inventory updates, and analytics. Its mobile-first approach is great for businesses that are always on the move.

Highlights:

Create Bills in Seconds via Mobile

Digital Catalog & Stock Alerts

E-Way Bill Generation

Automatic Payment Reminders

Best For: Mobile-savvy small businesses that want flexibility and accessibility.

Final Thoughts

0 notes

Text

Why Accounts Payable Outsourcing Works

Introduction

In today's fast-paced and competitive business environment, companies are under increasing pressure to cut costs, improve efficiency, and streamline operations. One of the most strategic decisions a business can make is outsourcing its accounts payable (AP) function. Accounts payable outsourcing not only reduces overhead but also brings in best practices, automation, and compliance expertise. In this blog, we explore why this move is beneficial and how Rightpath can help companies scale with financial clarity.

What is Accounts Payable Outsourcing?

Accounts payable outsourcing is the practice of delegating the management of a company’s AP functions—such as invoice processing, vendor payments, and expense reconciliation—to a third-party provider like Rightpath. These providers handle the entire workflow, from receipt of invoices to final payment, often using advanced technology to streamline the process.

Why Companies Outsource Accounts Payable

Cost Reduction Maintaining an in-house AP team comes with hidden costs—staff salaries, software, training, errors, and penalties. Outsourcing eliminates most of these and converts fixed costs into variable costs.

Scalability and Flexibility As companies grow, the volume of invoices and transactions increases. An outsourced solution scales seamlessly without the need for internal hiring or restructuring.

Process Automation Providers like Rightpath use cutting-edge AP automation tools to digitize the invoice process, reducing manual input, human error, and processing time.

Faster Payment Cycles With optimized workflows and real-time dashboards, vendors are paid faster, improving supplier relationships and sometimes securing early payment discounts.

Compliance and Fraud Prevention Outsourcing firms are equipped with systems that ensure regulatory compliance and detect fraud or anomalies in transactions early.

How Accounts Payable Outsourcing Works

Invoice Capture Invoices are received via email, EDI, or scanning.

Invoice Matching System performs 2-way or 3-way matching against purchase orders and receipts.

Exception Handling Discrepancies are flagged and resolved through automated workflows or human intervention.

Approval Workflow Invoices are routed for approvals as per hierarchy before payment is scheduled.

Vendor Payment & Reporting Payments are made via bank transfers, checks, or cards. Real-time reports are generated for analysis and audit.

Benefits of Partnering with Rightpath for AP Outsourcing

Tailored Solutions for Every Business Size Whether you're a startup or an enterprise, Rightpath adapts the AP process to your needs.

Dedicated Account Managers Each client has a dedicated team that ensures smooth communication and service delivery.

End-to-End Visibility Clients can track the status of every invoice, payment, and dispute via customized dashboards.

Data Security and Compliance Rightpath adheres to industry standards like ISO and GDPR, ensuring your data remains safe and compliant.

Global Reach, Local Expertise We manage cross-border payments, tax deductions, and compliance with local laws for global operations.

Industries That Benefit the Most

Manufacturing

IT & Software

Retail and E-commerce

Logistics

Healthcare

Construction and Real Estate

Conclusion

Accounts payable outsourcing is no longer just a cost-cutting tool—it’s a strategic move toward business agility and operational excellence. By partnering with a reliable provider like Rightpath, companies can gain better control over cash flow, improve vendor relationships, and focus more on their core business. If you’re ready to unlock the benefits of AP outsourcing, Rightpath is here to help you transform your finance operations. For more information visit: - https://rightpathgs.com/

0 notes

Text

How to Reconcile Balance Sheet with Advanced Reconciliation Tools

Balance sheet reconciliation checks if account balances in the balance sheet match the general ledger and supporting documents. It finds any differences. Tools that do this automatically make it more accurate and faster.

With automated software, finance teams can make their financial close process smoother. This leads to better financial health and smarter choices.

Key Takeaways

Balance sheet reconciliation is vital for accurate financial statements.

Advanced tools make the reconciliation process simpler.

Automated software cuts down on manual mistakes.

Streamlined financial close processes boost financial integrity.

Improved accuracy helps in making better financial decisions.

Understanding Balance Sheet Reconciliation

Keeping financial records accurate is key. Balance sheet reconciliation helps ensure this. It checks if account balances are right and complete.

What Is Balance Sheet Reconciliation?

It's about matching account balances with documents and outside sources. This makes sure financial reports show a company's true financial state.

The steps in this process are:

Checking account balances against bank statements and other sources

Finding and fixing any differences

Keeping records of the whole process and its results

Key Accounts Requiring Regular Reconciliation

Some accounts need regular checks because they're very important. These include:

Cash and cash equivalents

Accounts receivable and payable

Inventory and other current assets

Checking these accounts often helps avoid mistakes, spots fraud, and meets financial rules.

Consequences of Inaccurate Balance Sheets

Wrong balance sheets can lead to big problems. These include fines, losing investor trust, and bad financial choices. The effects of wrong financial reports can harm the company and its people.

Some possible issues are:

Regulatory fines and penalties

Loss of credibility with investors and lenders

Poor financial planning and decision-making

Challenges of Traditional Reconciliation Methods

The old ways of doing reconciliation are full of problems. They make it slow and prone to mistakes for those in finance. These methods need a lot of manual work, which takes a lot of time and effort.

Manual Processes and Time Consumption

Doing reconciliation by hand means a lot of typing, checking, and matching. It can make people tired and more likely to make mistakes. This slows down the process and takes away from more important financial tasks.

Extensive manual data entry

Time-consuming verification processes

Increased likelihood of human error

Error Rates and Detection Difficulties

Old methods of reconciliation are more likely to have mistakes because they're done by hand. Finding and fixing these errors can be hard. This can lead to wrong financial reports and trouble with rules.

Compliance and Audit Trail Weaknesses

Traditional methods often don't have strong compliance and audit trail features. This makes it hard to show you're following the rules. It can lead to more risk during audits and fines.

Knowing these problems, finance experts can see why using automation for reconciliation is a good idea. These new tools can make the process faster, reduce mistakes, and improve following rules and audits.

Modern Reconciliation Tools and Their Capabilities

The world of reconciliation has changed a lot with new tools. These tools make financial checks more efficient and accurate.

Cloud-Based vs. On-Premise Solutions

Today, you can find reconciliation tools online or on your own servers. Online tools are flexible and save money on hardware. But, server-based options give you more control over your data.

It's important to think about what you need before choosing. This will help you pick the right tool for your business.

AI-Powered Matching Algorithms

Advanced tools use AI to match transactions automatically. This cuts down on manual work and boosts accuracy. They learn from your data to get better over time.

Workflow Automation Features

These tools also automate workflows. This means you can set up your own steps for financial checks. It makes sure everything is done right and on time.

Automation also helps avoid mistakes. It lets your team focus on important tasks.

Integration with ERP and Accounting Systems

Good reconciliation tools work well with your current systems. They make it easy to keep all your data in sync. This is key for accurate financial reports.

It helps keep your financial management smooth and reliable.

Step-by-Step Guide to Balance Sheet Reconciliation Using Software

Reconciling a balance sheet is key and can be made easier with advanced software. This process has several steps to ensure everything is accurate and up to date.

Initial Data Import and System Configuration

The first step is to import data into the software. This includes general ledger accounts and bank statements. The system is then set up to meet the organization's needs.

Import general ledger accounts and bank statements.

Configure the software to match the organization's reconciliation needs.

Set up user roles and permissions to ensure secure access.

Creating Custom Matching Rules

Advanced software lets you create custom matching rules. These rules help match transactions automatically based on set criteria.

Define the matching criteria, such as date, amount, and description.

Configure the software to automatically match transactions.

Review and refine the matching rules to ensure accuracy.

Identifying and Resolving Exceptions

The software finds exceptions that need manual review. This includes transactions that don't match or are outside set limits.

Review exceptions to determine the cause of the discrepancy.

Take corrective action to resolve the exception.

Document the resolution for audit purposes.

Documentation and Approval Workflows

Lastly, the software helps with documentation and approval. It generates reports and keeps an audit trail.

Generate reconciliation reports for review and approval.

Maintain an audit trail of all reconciliation activities.

Obtain approval from authorized personnel.

By following these steps, organizations can use software to make reconciliation easier. This improves accuracy and reduces errors.

Best Practices for Implementing Reconciliation Automation

To get the most out of reconciliation automation tools, organizations must follow best practices during implementation. This involves several key steps that ensure a smooth transition to automated reconciliation processes.

Assessing Reconciliation Requirements

Before selecting a reconciliation automation tool, it's essential to assess your organization's reconciliation requirements. This includes identifying the types of accounts to be reconciled, the frequency of reconciliations, and any specific regulatory or compliance needs.

Identify the scope of reconciliation activities

Determine the frequency of reconciliations

Assess specific compliance or regulatory requirements

Selecting the Right Solution

Choosing the appropriate reconciliation automation solution is critical. Factors to consider include the tool's ability to integrate with existing systems, its scalability, and its ability to meet specific reconciliation needs.

Evaluate integration capabilities with existing financial systems

Consider the scalability of the solution

Assess the tool's ability to handle complex reconciliation tasks

Training Staff and Managing Change

Effective training and change management are critical for the successful adoption of reconciliation automation tools. This involves educating staff on the new system's capabilities and ensuring they are comfortable using it.

Develop a detailed training program for staff

Establish clear communication channels for support

Monitor adoption rates and address any issues promptly

Establishing Reconciliation Schedules and Responsibilities

To ensure the ongoing effectiveness of reconciliation automation, it's necessary to establish clear schedules and responsibilities. This includes defining who is responsible for reconciliations, the frequency of these tasks, and the deadlines for completion.

Define clear roles and responsibilities for reconciliation tasks

Establish a schedule for reconciliations that meets business needs

Set deadlines for completion and review of reconciliations

By following these best practices, organizations can maximize the benefits of reconciliation automation. This improves financial accuracy and reduces the risk of errors.

youtube

Measuring the ROI of Advanced Reconciliation Tools

Advanced reconciliation tools can bring big financial gains to companies. They offer a significant advantage through different ways.

It's key to look at several areas where these tools help a lot.

Quantifying Time and Labor Savings

Automated reconciliation software cuts down on manual work needed for reconciliations.

Automated data import and matching cut down on manual data entry.

Streamlined workflows let staff focus on more important tasks.

Quicker reconciliation cycles mean faster close processes.

By measuring these time savings, companies can see clear cost cuts from using these tools.

Calculating Error Reduction Benefits

Reconciliation software for banks greatly lowers the chance of mistakes in financial reconciliations.

Automated matching algorithms ensure accurate transaction matching.

Real-time exception reporting helps solve issues quickly.

Consistent reconciliation processes boost overall financial accuracy.

By cutting down on errors, companies avoid costly rework, fines, and damage to their reputation.

Compliance Cost Reductions

The use of bank reconciliation software also leads to big savings in compliance costs.

Automated audit trails make regulatory compliance easier.

Standardized reconciliation processes lower the risk of non-compliance.

Efficient documentation and approval workflows cut down on admin work.

These savings not only cut costs but also improve the company's compliance stance.

Case Studies: Real-World Implementation Results

Many companies have seen great results from using advanced reconciliation tools, showing big ROI.

A financial institution using automated reconciliation software cut its reconciliation time by 40% and error rates by 25% in six months.

These examples show the real benefits of using these tools. They lead to better financial accuracy and lower costs.

Conclusion: Elevating Financial Accuracy Through Technology

Advanced reconciliation tools have changed the game for financial accuracy. They make the process more accurate, efficient, and compliant. With a strong reconciliation solution, companies can automate their work, cutting down on mistakes and improving reports.

Automated account reconciliation lets finance teams do more strategic work. They no longer spend hours on manual data entry. This also makes it easier to follow rules and avoid legal issues.

As tech gets better, so will the role of reconciliation software in finance. Companies using automation will see big wins. They'll get better financial data, save money, and make smarter choices.

By using a top-notch reconciliation solution, finance pros can make their work more accurate and reliable. This leads to business growth and success.

Also Read: Best Balance Sheet Reconciliation Software for Small Businesses

#reconciliation#automated reconciliation#recon#finance solutions#bank reconciliation#automation#finance management#Youtube

0 notes

Text

India–UK Free Trade Agreement: Redefining Bilateral Trade in the Digital Era

On May 6, 2025, India and the United Kingdom signed a landmark Free Trade Agreement (FTA), marking a turning point in their economic engagement. This agreement, shaped through years of negotiation and 14 official rounds of discussion, is expected to accelerate trade, reduce regulatory hurdles, and expand opportunities for exporters, importers, and professionals in both countries.

Lower Duties, Wider Markets A key feature of the agreement is the commitment from both sides to significantly reduce import duties.

Mobility and Services: A New Focus Unlike traditional FTAs that focus primarily on goods, this agreement includes substantial provisions around services and skilled worker mobility. Indian professionals in technology, healthcare, education, and wellness will benefit from easier work visa access and faster recognition of qualifications in the UK.

On the digital front, the agreement promotes modernization of customs procedures, endorsing paperless trade and streamlined processes to ease clearance and compliance. This is aimed at minimizing delays and improving trade efficiency, particularly for companies handling high-volume or high-frequency cross-border transactions.

Strategic Impact and Growth Potential Government estimates suggest that this FTA could lead to a substantial uplift in bilateral trade, projecting figures such as:

Over £25 billion in additional trade between the two nations

A boost of £4.8 billion to the UK’s GDP by 2040

A potential 10% growth in India’s exports to the UK over the next five years

This agreement aligns well with India’s current economic priorities, supporting initiatives like Make in India and Digital India, while offering the UK an important strategic partner in the Indo-Pacific region.

How Kyzer Software Supports the IT & Trade Ecosystem? As trade volumes grow and regulatory complexity increases, the demand for automated, compliant, and agile IT or trade finance solutions becomes even more critical.

Kyzer Software addresses this need with advanced platforms with its 9 years of expertise in the industry of Banking, Trade, Compliance with its flagship solutions such as TradeZone and TradeKonnect, designed for both banks and exporters & Importers.

These platforms enable users to:

Automate trade documentation, reducing turnaround times and manual intervention

Stay updated and compliant with FEMA, RBI, and cross-border trade frameworks like EDPMS/IDPMS

Gain visibility through real-time dashboards for transaction monitoring and reporting

Efficiently handle SWIFT message reconciliation and electronic bank guarantees (e-BGs)

Maintain comprehensive audit trails aligned with bilateral and global trade standards

Kyzer’s solutions are purpose-built to help financial institutions and corporate traders seamlessly align with new regulatory environments—like those introduced by the India–UK FTA—without the friction of legacy processes or system.

Conclusion The India–UK Free Trade Agreement is more than just a policy shift—it represents a strategic opportunity for industries, service providers, Technology companies and regulators to operate more efficiently on a global scale. However, realizing these benefits demands a digital-first approach to trade operations.

Kyzer Software empowers businesses and banks to meet this moment with confidence, offering the tools needed to manage compliance, streamline operations, and scale globally.

Trade faster. Trade smarter. Trade compliant - with Kyzer.

0 notes

Text

Choosing the Right Accounting Software in Saudi Arabia: Empower Your Business Finances.

In today's fast-paced business environment, managing finances efficiently is a top priority for companies in Saudi Arabia. Whether you're a startup, a growing enterprise, or an established business, having the right accounting software in Riyadh can streamline financial operations, enhance accuracy, and boost productivity. With an increasing reliance on digital solutions, choosing a cloud-based accounting system that caters to your needs is essential.

📊 The Need for Advanced Accounting Software

Businesses in Saudi Arabia must comply with regulatory requirements while maintaining transparent financial records. Traditional accounting methods can be time-consuming and prone to errors, making automated accounting solutions a game-changer. A feature-rich accounting platform allows businesses to efficiently handle invoicing, tax calculations, expense tracking, and financial reporting—all from a single interface.

🚀 Key Features to Look for in Accounting Software

When searching for accounting software in Saudi Arabia, consider these essential features:

✅ Cloud-Based Accessibility – Access financial data anytime, anywhere for seamless business management.

✅ User-Friendly Interface – Ensure easy navigation, even for non-accounting professionals.

✅ Automation & Integration – Reduce manual effort with automated invoicing, bank reconciliation, and tax processing.

✅ Compliance & Security – Choose software that adheres to Saudi Arabian financial regulations and ensures data protection.

✅ Multi-Currency & Tax Support – Essential for businesses handling international transactions and VAT compliance.

💡 Why Olivo Business is the Right Choice

One trusted name in the industry is Olivo Business, an advanced cloud-based accounting solution designed to empower businesses across Saudi Arabia. Olivo Business simplifies financial management with:

🔹 Finance Modules – Includes balance sheets, income statements, tax calculations, budgeting, and real-time analytics.

🔹 Sales & Purchase Management – Streamline invoices, customer transactions, purchase control, and order tracking.

🔹 Inventory & Stock Control – Manage stock levels, product transactions, and multi-location inventory seamlessly.

🔹 Automation & Customization – Optimize workflows with smart automation, ensuring efficiency and precision.

✨ Elevate Your Business with Smart Accounting Solutions

Whether you're an entrepreneur, an SME, or a large corporation, selecting the best accounting software in Saudi Arabia will enhance financial transparency and operational efficiency. Investing in cloud-based, automated accounting tools like Olivo Business ensures hassle-free management and helps businesses scale with confidence.

🌍 Explore Olivo Business and revolutionize your financial management today!

#AccountingSoftwareSaudiArabia#cloudsoftwareriyadh#CloudAccounting#saudiarabia#BusinessAutomationKSA#OlivoBusiness

0 notes