#best book for intraday trading India

Text

A Comprehensive Guide to Choosing the Best Book for Intraday Trading

Intraday trading is an exciting way to make money in the stock market. It requires a certain level of expertise and knowledge to be successful, and one of the best ways to gain that knowledge is through reading books. However, with so many options available, it can be challenging to choose the right book for your needs. In this comprehensive guide, we will explore the key factors to consider when choosing the best book for intraday trading in India.

Guide No. 1 For Choosing Best Book For Intraday Trading In India.

First and foremost, it's essential to choose a book written by a reputable author. Look for books written by authors with a proven track record of success in the stock market. They should have a good understanding of the Indian stock market, intraday trading strategies, and risk management techniques.

One way to find the best book for intraday trading in India is to ask for recommendations from fellow traders, friends, or family members who have experience in intraday trading. They may be able to suggest a book that helped them in their trading journey.

Otherwise you can visit any Stock Market Training Institute. For Asking that from Which Intraday Trading Book You had Created your Best Stock Market Course In India. This can help you to find Best Book For Intraday.

Guide No. 2 For Choosing Best Book For Intraday Trading.

Another crucial factor to consider when choosing a book for intraday trading is the level of detail provided. Look for books that provide a step-by-step guide to intraday trading, including strategies for identifying potential trades, risk management techniques, and how to handle emotional and psychological factors that can affect trading decisions.

The best books for intraday trading in India should also cover technical analysis and charting tools. Technical analysis involves using charts and other tools to identify trends in stock prices and predict future price movements. A good intraday trading book should provide a detailed explanation of technical analysis and how to use it to make trading decisions.

The best book for intraday trading should also cover fundamental analysis. This analysis involves looking at a company's financial statements, economic indicators, and other factors that can affect its stock price. Understanding fundamental analysis can help traders make informed decisions about which stocks to buy and sell.

Guide No. 3 For Choosing Best Book For Intraday Trading.

In addition to technical and fundamental analysis, the book should also cover various intraday trading strategies. The book should provide an overview of different trading strategies and explain how to apply them in real-world trading scenarios. Look for books that cover popular strategies such as scalping, momentum trading, and breakout trading.

When choosing the best book for intraday trading in India, it's also essential to consider your level of experience. Look for books that cater to your level of expertise, whether you are a beginner, intermediate, or advanced trader. A good book should be easy to understand for beginners but still provide enough depth for experienced traders.

Now that we have discussed the key factors to consider when choosing the best book for intraday trading in India let's take a look at some of the best options available in the market. One of the best books for intraday trading in India is "Mastering Intraday Trading" by Prashant Shah. This book covers various intraday trading strategies and provides a step-by-step guide to making profitable trades. It also covers technical analysis and risk management techniques.

Guide No. 4 For Choosing Best Book For Intraday Trading.

Another excellent option is "Intraday Trading Ki Pehchan" by Ankit Gala and Jitendra Gala. This book is written in Hindi and covers various intraday trading strategies, charting tools, and technical analysis. It also provides an overview of the Indian stock market and how to use it to make trading decisions.

If you're looking for a comprehensive guide to intraday trading, "Intraday Trading Strategies" by Bansari Parikh is an excellent option. It covers technical and fundamental analysis, various intraday trading strategies, and risk management techniques. The book also provides real-world examples of successful intraday trading strategies.

Conclusion

In conclusion, choosing the best book for intraday trading in India is a crucial step in your trading journey. Look for books written by reputable authors, provide a detailed explanation of intraday trading strategies, technical analysis, and risk management

#best book for intraday trading#best book for intraday trading India#best stock market course#best stock market course in india#Intraday Trading Books#share market training institute#SS Trading Academy#stock market course in india#stock market training institute#trading books for beginners

2 notes

·

View notes

Text

Bharat Dynamics limited (BDL) Share Price Correction: Profit Booking Ends 10-Day Rally

Bharat Dynamics Limited (BDL), a Miniratna public sector undertaking (PSU) in India, witnessed a sharp correction in its share price. The stock plunged by a significant 7%, snapping a ten-day winning streak that saw it climb steadily. This sudden drop can be attributed to profit booking by investors who had capitalized on the recent surge.

A Look Back at the 10-Day Rally

The past ten days were a period of significant gains for Bharat Dynamics. The stock price witnessed a continuous upward trend, fueled by investor optimism surrounding the Indian government's "Make in India" initiative. This initiative aims to promote domestic manufacturing, including the defense sector, and investors anticipated Bharat Dynamics to be a key beneficiary. The positive sentiment surrounding "Make in India" led to a buying spree, pushing the stock price higher.

Profit Booking Takes Hold

However, the 7% drop and indicates a shift in investor behavior. Profit booking refers to the practice of selling a stock after it has experienced a price increase. Investors who bought shares during the 10-day rally likely saw this as an opportune moment to lock in their profits. This selling pressure caused the stock price to decline.

Is the "Make in India" Dream Fading?

While the correction in Bharat Dynamics' share price might seem concerning, it's important to note that not all defense stocks are experiencing a similar drop. This suggests that the broader investor interest in the Indian defense sector, driven by "Make in India," remains intact. Bharat Dynamics' specific correction could be due to a combination of factors, including profit booking and technical reasons related to short-term trading strategies.

Looking Ahead: What's Next for Bharat Dynamics?

The long-term prospects for Bharat Dynamics depend on several factors beyond short-term fluctuations. The company's ability to secure new contracts under the "Make in India" initiative will be crucial for its future growth. Additionally, its overall financial performance, operational efficiency, and product development efforts will all play a role in determining its future share price.

Bharat Dynamics Share Price Correction

* Share price fell by 7% due to profit booking.

* Investors cashing in on gains from recent 10-day rally.

* Stock surge attributed to optimism about Indian government's "Make in India" initiative.

* Not all defense stocks experiencing surge, indicating broader investor interest in Indian defense sector.

Have you invested in BDL shares?

Join us at demiumresearch.com or call 7030916716 today. Let's make your money work smart!

Conclusion

The recent correction in Bharat Dynamics' share price serves as a reminder of the inherent volatility associated with stock markets. While profit booking caused the 7% drop, the broader investor interest in the Indian defense sector, fueled by "Make in India," remains positive. Investors should carefully consider the company's fundamentals, future prospects under "Make in India," and overall market conditions before making any investment decisions.

Stock Recommendation, Commodity Recommendation, Intraday Stock Recommendation, Equity Recommendation, Options Trading Recommendation, Nifty Futures Recommendation, Stock Futures Recommendation, Nifty Futures Recommendation

About Us Demium Research Demium Research Analyst is a Top-notch SEBI Registered Research Analyst (SEBI Registration Number - INH000009409 and Best Research Analyst company in India. We are Equity research analyst & service provider which provides top-notch services with unique and advanced features. We are customer oriented company in this industry. We have best business model which offer better platform and services to investors and traders of the Indian stock market. Demium Research offers the first of its kind reward points style services which are result-oriented services. Our all services come with standard features like personalized and customized services, Dedicated Relationship manager, In-depth analysis of stocks and many more. We have carefully chosen and developed range of financial and research services in order to support and provide our clients with the solutions as they need. We seek to produce healthy financial rewards for our clients in their trading and Investments. Our company puts emphasis on helping investors to gain high profit out of their invested wealth to attain their short-term and long-term financial goals. The experienced, analyst experts give their unparalleled service to upgrade the skills and adhere to the incomparable height of knowledge of traders. WHO WE ARE Demium Research is best SEBI registered Research Analyst and a team of highly skilled professionals which has a vast experience of stock market research and analysis. We believe in power of innovation, creativity and knowledge. Our thorough research and analysis are not only powerful and result oriented but also giving our clients' satisfactory results. … is amongst Top Stock advisory companies in India and we as a team always believe in to provide best in class service experience to our clients. Our client retention ratio is highest in this industry and client satisfaction is our top priority. WHY US Values We value our clients and put their interest in the forefront.

Join us at Stock Recommendation, Commodity Recommendation, Intraday Stock Recommendation, Equity Recommendation, Options Trading Recommendation, Nifty Futures Recommendation, Stock Futures Recommendation, Nifty Futures Recommendation or call 7030916716 today. Let's make your money work smart!

0 notes

Text

Intraday Trading Guide for Beginners in India

Intraday trading, also known as day trading, involves buying and selling financial instruments within the same trading day, with the aim of profiting from short-term price movements. Here's a guide for beginners in India interested in intraday trading:

Understand the Basics: Before diving into intraday trading, it's crucial to understand the basics of the stock market, including how it functions, key terminology, and trading mechanisms.

Educate Yourself: Take the time to educate yourself about intraday trading strategies, technical analysis tools, and risk management techniques. There are numerous resources available, including books, online courses, and educational websites.

Choose the Right Broker: Select a reputable brokerage firm that offers a user-friendly trading platform, competitive brokerage rates, and reliable customer support. Ensure that the broker is registered with SEBI and complies with regulatory requirements.

Start Small: Begin with a small amount of capital that you can afford to lose. Intraday trading involves high risk, and it's essential to start with a cautious approach until you gain experience and confidence.

Develop a Trading Plan: Create a well-defined trading plan that outlines your trading goals, risk tolerance, entry and exit criteria, and position sizing strategy. Stick to your plan and avoid making impulsive decisions based on emotions.

Use Technical Analysis: Learn how to analyze price charts and use technical indicators to identify potential trading opportunities. Common technical analysis tools include moving averages, relative strength index (RSI), MACD, and Fibonacci retracements.

Practice Paper Trading: Before risking real money, consider practicing intraday trading using a simulated trading platform or paper trading account. This allows you to test your strategies and gain experience in a risk-free environment.

Manage Risk: Implement strict risk management measures to protect your capital. Set stop-loss orders to limit potential losses on each trade, and avoid risking more than a certain percentage of your trading capital on any single trade.

Stay Informed: Stay updated with market news, economic indicators, and corporate announcements that may impact stock prices. Be aware of scheduled events such as earnings releases, economic reports, and central bank decisions.

Review and Learn: Keep a trading journal to record your trades, including entry and exit points, reasons for each trade, and the outcome. Review your trades regularly to identify strengths and weaknesses, and continuously strive to improve your trading skills.

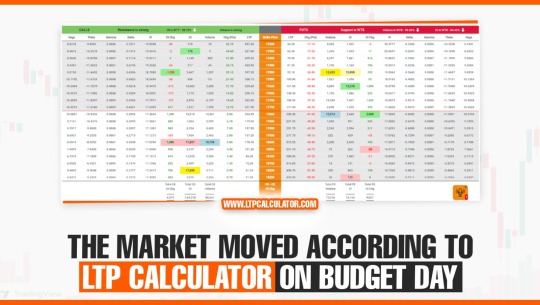

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

Remember that intraday trading requires discipline, patience, and continuous learning. It's not a get-rich-quick scheme, and success in intraday trading takes time and effort. Start slowly, manage your risks wisely, and be prepared to adapt your strategies as needed based on market conditions.

0 notes

Text

Best Trading App in India in 2023

In today’s post-pandemic era, stock trading has been led mainly by smartphones by today’s young generation of traders and investors. According to a study, over 60% of stock trading takes place through smartphone apps. The main reasons are ease of access, faster trade execution, anytime anywhere trading, and lots more There are hundreds of trading apps in the app market to choose from. Whether you are a new investor looking to try sock investment or an expert trader or investor looking to book big profits, choosing the best share market application is crucial. This helps you understand the market deeper and make sound investment decisions for better growth on investment.

From industry professionals to small businessmen, entrepreneurs, housewives, and even people who have just started earning, stock trading apps offer a plethora of investment opportunities other than stocks like mutual funds, IPOs, fixed deposits, insurance, and others. If you want to ensure the best results from your investment in stocks, it is necessary that you choose the best trading app in India for beginners in 2023.

Below are some of the top-rated stock trading apps in India.

Zerodha Kite

Kite by Zerodha has been around in the market since the year 2010. Just like how Zerodha changes the dynamics of stock trading by introducing discount brokerage services, Zerodha Kite has brought unprecedented levels of ease and value to mobile-based stock trading for traders and investors. The share market application is primarily known for its clean & intuitive UI which is also swift to work on.

Some of the major features of the Zerodha Kite mobile app are:

Login through fingerprints and Face ID

Dark mode feature

Faster order updates & push notifications

Performs well even in low-bandwidth internet connection

Fund transfer facility

Angel One by Angel Broking

Angel One is another popular mobile app for stock trading and investments. The app allows users to get real-time market data, invest in mutual funds, commodities, IPOs, US stocks, and others, stock recommendations, advanced charts, and others.

Its major features are:

Digital payment facility with 40+ banks

Stock advisory

Intraday charts with indicators

Multiple watchlists with categories

Option chain feature

Free reporting & learning tools

Upstox Pro

The next on the list is Upstox Pro which promises to deliver an easy and seamless stock trading experience to users. Since this trading app is built on HTML5 technology, it is impressively fast and easy to use. It also allows trading across various segments like stocks, futures & options, and currencies, etc.

Some of its salient features are:

Next-gen charting tools with 100+ indicators

One-stop platform for trading in stocks, currencies, futures & options

Option to trade right from the charts

Create multiple watchlists

Get real-time market information

Define unlimited price alerts and receive quick updates

Groww Trading App

Groww trading app offers a seamless trading experience to users. Mainly, with the app, you can invest in stocks and mutual funds, IPOs, and equity under flat-fee brokerage schemes. With a 1 Cr+ userbase on Google Play Store, Groww is counted among the best stock trading apps in India in 2023. The app was initially launched as a mutual fund investment platform and since then it has maintained its supremacy in the segment.

One of the simplest apps presently in the category

Single-click stock trading with buying and selling feature

Advanced charts, historical stock performance, and real-time market data

High levels of security standards

Direct mutual fund investments

5 Paisa Mobile App

5Paisa mobile app is one of the most widely chosen trading apps in India and offers a host of features to users. It allows traders and investors to invest in various financial instruments like bonds, mutual funds, ETFs, IPOs, stocks, and currencies, etc. The 5Paisa mobile application has several smart features that let investors and traders conduct efficient and successful trading in stocks, mutual funds, and other financial products. 5paisa mobile trading app is accessible on both iOS and Android mobile devices.

Trading across all segments under one window

Robo advisory which enables an automated trading advisory system

Track profit & loss across segments

Option to pick different time settings from one minute to a month

Avail document-less loan in no time

The Conclusion

The role of a mobile trading app is quite important in making stock trading easier, faster, and more effective. This is why it is suggested to choose the best trading app in India in 2023 to get the best outcomes. With so many powerful trading apps out in the market, it is better to compare all the available options and choose the one that meets your needs the best.

Source - https://medium.com/@deepakcomparebroker/best-trading-app-in-india-in-2023-55c01c8e69a9

Relatives - https://comparebrokeronline.com/

#best share market application#best trading app in India#Zerodha Kite#Angel One#Angel Broking#Stock advisory#Upstox Pro#Groww Trading App#5 Paisa Mobile App

1 note

·

View note

Text

youtube

Watch this video all the way until the end for complete guide and subscribe for daily Crypto YouTube videos!

BIG NFT LOOT, Participate NOW✅

https://raddx.jump.trade/?fsz=CTBRG

Jump Trade Marketplace👇🏼👇🏼

Jump.trade

Bitcoin PUMP Today | Bitcoin Big Move in MARCH!! DATE ??

Top 5 Cryptocurrencies to Invest Money right now? 🔥| Best Crypto coins to invest in #2023

Start Trading💹

𝐁𝐈𝐍𝐀𝐍𝐂𝐄:

https://accounts.binance.com/en/regis…

Referral code: 87425029

𝐁𝐈𝐓𝐆𝐄𝐓:

Join me on BITGET (Copy Trading )

https://partner.bitget.com/bg/CryptoT…

DELTA EXCHANGE:

Delta Exchange: https://www.delta.exchange/app/signup…

Referral Code: UHNIEH

𝐖𝐚𝐳𝐢𝐫𝐗:

https://wazirx.com/invite/mmjd4bgtd

bitcoin #bitcoins #freebitcoins

To learn crypto trading, search for BUDHIL VYAS on Amazon; you'll find a very helpful book:

👉 https://amzn.eu/d/7QyeFJt

𝗣𝗹𝗲𝗮𝘀𝗲 𝗳𝗶𝗻𝗱 𝗺𝘆 𝘀𝗼𝗰𝗶𝗮𝗹 𝗺𝗲𝗱𝗶𝗮 𝗵𝗮𝗻𝗱𝗹𝗲𝘀 𝗯𝗲𝗹𝗼𝘄:

✔️ Telegram Channel:

https://t.me/CryptoTalksBudhil

✔️ YouTube:

/ cryptotalksbudhil

✔️ YouTube Channel 2:

/ @budhilvyas2021

✔️ Instagram Handle:

https://www.instagram.com/budhil_vyas/

✔️ Twitter Handle:

https://twitter.com/BudhilVyas

CryptoNews #CryptoNewsToday #Bitcoin #Altcoins #Cryptocurrency #NFT #Ethereum #BitcoinNews #BuyBitcoin #BestAltcoins #BestCryptocurrencies #AltcoinGems #Dogechain

𝗧𝗛𝗔𝗡𝗞 𝗬𝗢𝗨 𝗙𝗢𝗥 𝗦𝗨𝗣𝗣𝗢𝗥𝗧𝗜𝗡𝗚!!!

Please subscribe to my YouTube channel and click the bell icon so that you will be notified whenever I publish an update.

Keep an eye out for scammers and remember I will never share my WhatsApp number with anyone.

Never ask for money in the Comment Section.

Cryptocurrency is subject to Market Risk. Past performance is not a guarantee of future performance. The risk of loss in trading and investment in cryptocurrency can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. Please ensure that you understand fully the risks involved and invest according to your risk-bearing capacity.

Budhil Vyas

Data Scientist

Topics Covered in videos:

Bitcoin pump today, bitcoin pump kab hoga, bitcoin pump news, bitcoin pump today hindi, bitcoin pump it up, bitcoin pump, bitcoin pump or dump, bitcoin pump coming, bitcoin pump and dump, bitcoin pump soon

Budhil Vyas, Cryptocurrency, Trading,bitcoin, best crypto coins to buy right now,cryptocurrency for beginners,cryptocurrency kya hai,what is cryptocurrency,cryptocurrency news,how to invest in cryptocurrency,bitcoin trading for beginners,bitcoin live,live trading,trading,intraday trading for beginners,art of trading,stock market ka commando,stock market live,stock market india,investment for beginners,earn money online,finance,stock market,trading live

0 notes

Text

WHY CHOOSE A BANK NIFTY OPTION TRADING STRATEGY?

Those who have been into bank nifty option trading have devised multiple bank nifty strategies which will help them make better trades in the future. Due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

Launched in 2000 by India Index Service and Product Limited (IISL), Bank Nifty is NSE’s sectoral index and is one of the most heavily traded indexes in the F&O market. One of the highest attractions in bank nifty trading is that it is highly volatile and allows traders to generate a quick profit. Also, due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

This index trading option is brilliant as it comprises 12 highly capitalized and the most liquid banking sector stocks traded in NSE. Those who have been into bank nifty option trading for years have devised multiple bank nifty strategies which will help them make better trades in the future.

Whenever looking for ‘my trade options,’ bank nifty holds great importance as, here, the share prices and values are displayed on a real-time basis during the NSE trading hours. A bank nifty option strategy can be curated for various purposes like introducing index funds, new ETFs, and other structured products and benchmarking fund portfolios. The top 10 bank nifty companies with the highest weightage are – AU Small Finance Bank, Axis Bank, Bandhan Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank, IndusInd Bank, Kotak Mahindra Bank, and Punjab National Bank.

Top 4 bank nifty option buying strategy

With the growing trading margin and awareness, options trading has significantly increased among traders. Nifty and bank nifty are the popular indices in option derivatives, and their improved buying strategy results from the opportunity it offers to make money. Below are the top 4 bank nifty strategies that every trader must know.

Naked puts or calls – Buy the put option during the market’s low point. The more the nifty falls, the higher profits are generated. Buying the call option during the market’s high end is a good strategy. The more the market rises, the higher profits will be incurred. Putting a stop loss is mandatory in this strategy.

Bull call spread – If you wish to buy bank nifty stocks during the market rise, using the bull call spread strategy is the best option. This strategy gives a good amount of money when the index goes up.

Short straddle – This bank nifty strategy generates good results when the market is in a defined range. Here the trader sells the money call option and a put option with the same strike price and expiry date. You grab the maximum profits when the index doesn’t show much movement. However, the losses are extreme when the bank nifty moves beyond the breakeven point.

Short iron butterfly – A good bank nifty strategy today will result in better outcomes for tomorrow. This strategy contradicts the risky short-straddle

strategy, as the losses here are less and much defined. Profit is also defined, and rewards are higher than risk.

What is the difference between nifty and bank nifty

Nifty is considered a much broader term, and bank nifty is a part of nifty. Like bank nifty, the nifty index also consists of the most liquid and highly capitalized stocks from the National Stock Exchange. However, the major difference is that nifty consists of the top 50 stocks from varied sectors like automobile, pharma, IT, bank, etc., hence also called Nifty50. On the other hand, bank nifty, also known as Nifty Bank, consists of the top 12 stocks only from the banking sector, which is a part of Nifty50.

If you are looking for an excellent strategy to invest in index funds, nothing is better than nifty. Bank nifty strategy is profitable primarily for intraday trading to book short-term profits. Bank nifty is more volatile than nifty. For example – If nifty rises to 1%, then bank nifty goes 1.5% higher. Although bank nifty has more potential to make profits, the risk is also higher than nifty.

For options trading in nifty, one lot = 50 quantities, and for bank nifty, it is 25 quantities. As nifty consists of stocks from multiple sectors, it depicts the overall economy’s performance. On the contradictory, bank nifty indicates only the banking sector’s performance.

Choosing to trade between bank nifty and nifty options is tricky. Still, if you are a beginner, maximum traders trade in the nifty index is a better option as it is less volatile and much more familiar. If you stand somewhere between intermediate and advanced trading levels, traders prefer bank nifty as it’s more rewarding and makes them reap higher benefits due to more considerable volatility.

1 note

·

View note

Text

bank nifty logicalnivesh

Those who have been into bank nifty option trading have devised multiple bank nifty strategies which will help them make better trades in the future. Due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

Launched in 2000 by India Index Service and Product Limited (IISL), Bank Nifty is NSE’s sectoral index and is one of the most heavily traded indexes in the F&O market. One of the highest attractions in bank nifty trading is that it is highly volatile and allows traders to generate a quick profit. Also, due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

This index trading option is brilliant as it comprises 12 highly capitalized and the most liquid banking sector stocks traded in NSE. Those who have been into bank nifty option trading for years have devised multiple bank nifty strategies which will help them make better trades in the future.

Whenever looking for ‘my trade options,’ bank nifty holds great importance as, here, the share prices and values are displayed on a real-time basis during the NSE trading hours. A bank nifty option strategy can be curated for various purposes like introducing index funds, new ETFs, and other structured products and benchmarking fund portfolios. The top 10 bank nifty companies with the highest weightage are – AU Small Finance Bank, Axis Bank, Bandhan Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank, IndusInd Bank, Kotak Mahindra Bank, and Punjab National Bank.

Top 4 bank nifty option buying strategy

With the growing trading margin and awareness, options trading has significantly increased among traders. Nifty and bank nifty are the popular indices in option derivatives, and their improved buying strategy results from the opportunity it offers to make money. Below are the top 4 bank nifty strategies that every trader must know.

Naked puts or calls – Buy the put option during the market’s low point. The more the nifty falls, the higher profits are generated. Buying the call option during the market’s high end is a good strategy. The more the market rises, the higher profits will be incurred. Putting a stop loss is mandatory in this strategy.

Bull call spread – If you wish to buy bank nifty stocks during the market rise, using the bull call spread strategy is the best option. This strategy gives a good amount of money when the index goes up.

Short straddle – This bank nifty strategy generates good results when the market is in a defined range. Here the trader sells the money call option and a put option with the same strike price and expiry date. You grab the maximum profits when the index doesn’t show much movement. However, the losses are extreme when the bank nifty moves beyond the breakeven point.

Short iron butterfly – A good bank nifty strategy today will result in better outcomes for tomorrow. This strategy contradicts the risky short-straddle

strategy, as the losses here are less and much defined. Profit is also defined, and rewards are higher than risk.

What is the difference between nifty and bank nifty

Nifty is considered a much broader term, and bank nifty is a part of nifty. Like bank nifty, the nifty index also consists of the most liquid and highly capitalized stocks from the National Stock Exchange. However, the major difference is that nifty consists of the top 50 stocks from varied sectors like automobile, pharma, IT, bank, etc., hence also called Nifty50. On the other hand, bank nifty, also known as Nifty Bank, consists of the top 12 stocks only from the banking sector, which is a part of Nifty50.

If you are looking for an excellent strategy to invest in index funds, nothing is better than nifty. Bank nifty strategy is profitable primarily for intraday trading to book short-term profits. Bank nifty is more volatile than nifty. For example – If nifty rises to 1%, then bank nifty goes 1.5% higher. Although bank nifty has more potential to make profits, the risk is also higher than nifty.

For options trading in nifty, one lot = 50 quantities, and for bank nifty, it is 25 quantities. As nifty consists of stocks from multiple sectors, it depicts the overall economy’s performance. On the contradictory, bank nifty indicates only the banking sector’s performance.

Choosing to trade between bank nifty and nifty options is tricky. Still, if you are a beginner, maximum traders trade in the nifty index is a better option as it is less volatile and much more familiar. If you stand somewhere between intermediate and advanced trading levels, traders prefer bank nifty as it’s more rewarding and makes them reap higher benefits due to more considerable volatility.

Tags:

0 notes

Text

Where Can I Buy SBI Share Price?

The banking sector is the backbone of the Indian economy. Investors should consider adding SBI to their portfolios to spread their investments and make the most money possible. To achieve financial success, the investors must consider the primary historical performance of the company share.

We will guide you through the number of platforms investors can use to start trading in SBI share price. Apart from your trading strategy, the platform you use to trade on the share market today is a crucial component of your overall performance.

Some OF The Best Online Trading Platforms To Buy SBI shares in 2023

In this digital age of technology, convenience is one of the essential factors for trading.

The second most crucial factor is transparent fees and low brokerage charges by the platform. Below, we have outlined some of the traders' top trading platforms.

SBI Securities

Motilal Oswal

IIFL

HDFC Securities

Kotak Securities

Zerodha

PayTm Money

Groww

Upstox

ShareKhan

ICICI Direct

Angel Broking

So, these are all the platforms that clients and traders most commonly use. To start your investing journey, you must submit a PAN card copy, a passport-sized photograph, and all the other KYC documents.

Parameters To Select An Online Trading Brokerage Firm

1. Accessibility

This is the first parameter. The trading software must be easy to use and accessible from mobile, tablet, browser, and laptop. Every platform must build a user interface. The website or the mobile application should make the trade swift.

2. Fundamental Characteristics

The best part about trading platforms is that they must have top-notch security as customers share their personal information with the system. Besides this, the customer service, quick order placements, and complaint handling system all matter significantly when buying SBI shares in India.

After looking at the parameters, let us now discuss the pros and cons of some of the trading platforms in detail so that you understand them better and make wise decisions.

Pros & Cons Of Trading Platforms

3. Motilal Oswal Trading

Pros

Interactive charts to create an integrated portfolio

Create alerts for a group of scrips

Cons

Needs a high system configuration for smooth running on the desktop browser.

4. Zerodha KITE

Pros

Less brokerage

User-friendly experience

Cons

There may be minor bugs while using it on the browser extension.

5. Upstox Pro

Pros

Real-time market news and alerts

Advanced tools to help investors decide

Cons

Technical support needs an upgrade

Very few features in comparison to other competing platforms.

6. Share Khan

Pro

A trusted platform by investors

Availability of premium and brokerage calculators

Cons

Limited to Android and Windows applications

Mutual fund investments are not available.

7. Angel Broking

Pros

Various features like fund management and historical charts.

Various segments like commodity, currency, and intraday trading are available

Cons

Scope of improvement in the software user interface in terms of speed

Not supported on iOS MAC books

Conclusion

In conclusion, we've outlined the benefits and drawbacks of a few popular online trading platforms to help you pick the right one for investing in SBI shares to secure your financial future.

0 notes

Text

Why choose a bank nifty option trading strategy?

Those who have been into bank nifty option trading have devised multiple bank nifty strategies which will help them make better trades in the future. Due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

Launched in 2000 by India Index Service and Product Limited (IISL), Bank Nifty is NSE’s sectoral index and is one of the most heavily traded indexes in the F&O market. One of the highest attractions in bank nifty trading is that it is highly volatile and allows traders to generate a quick profit. Also, due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

This index trading option is brilliant as it comprises 12 highly capitalized and the most liquid banking sector stocks traded in NSE. Those who have been into bank nifty option trading for years have devised multiple bank nifty strategies which will help them make better trades in the future.

Whenever looking for ‘my trade options,’ bank nifty holds great importance as, here, the share prices and values are displayed on a real-time basis during the NSE trading hours. A bank nifty option strategy can be curated for various purposes like introducing index funds, new ETFs, and other structured products and benchmarking fund portfolios. The top 10 bank nifty companies with the highest weightage are – AU Small Finance Bank, Axis Bank, Bandhan Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank, IndusInd Bank, Kotak Mahindra Bank, and Punjab National Bank.

Top 4 bank nifty option buying strategy

With the growing trading margin and awareness, options trading has significantly increased among traders. Nifty and bank nifty are the popular indices in option derivatives, and their improved buying strategy results from the opportunity it offers to make money. Below are the top 4 bank nifty strategies that every trader must know.

Naked puts or calls – Buy the put option during the market’s low point. The more the nifty falls, the higher profits are generated. Buying the call option during the market’s high end is a good strategy. The more the market rises, the higher profits will be incurred. Putting a stop loss is mandatory in this strategy.

Bull call spread – If you wish to buy bank nifty stocks during the market rise, using the bull call spread strategy is the best option. This strategy gives a good amount of money when the index goes up.

Short straddle – This bank nifty strategy generates good results when the market is in a defined range. Here the trader sells the money call option and a put option with the same strike price and expiry date. You grab the maximum profits when the index doesn’t show much movement. However, the losses are extreme when the bank nifty moves beyond the breakeven point.

Short iron butterfly – A good bank nifty strategy today will result in better outcomes for tomorrow. This strategy contradicts the risky short-straddle

strategy, as the losses here are less and much defined. Profit is also defined, and rewards are higher than risk.

What is the difference between nifty and bank nifty

Nifty is considered a much broader term, and bank nifty is a part of nifty. Like bank nifty, the nifty index also consists of the most liquid and highly capitalized stocks from the National Stock Exchange. However, the major difference is that nifty consists of the top 50 stocks from varied sectors like automobile, pharma, IT, bank, etc., hence also called Nifty50. On the other hand, bank nifty, also known as Nifty Bank, consists of the top 12 stocks only from the banking sector, which is a part of Nifty50.

If you are looking for an excellent strategy to invest in index funds, nothing is better than nifty. Bank nifty strategy is profitable primarily for intraday trading to book short-term profits. Bank nifty is more volatile than nifty. For example – If nifty rises to 1%, then bank nifty goes 1.5% higher. Although bank nifty has more potential to make profits, the risk is also higher than nifty.

For options trading in nifty, one lot = 50 quantities, and for bank nifty, it is 25 quantities. As nifty consists of stocks from multiple sectors, it depicts the overall economy’s performance. On the contradictory, bank nifty indicates only the banking sector’s performance.

Choosing to trade between bank nifty and nifty options is tricky. Still, if you are a beginner, maximum traders trade in the nifty index is a better option as it is less volatile and much more familiar. If you stand somewhere between intermediate and advanced trading levels, traders prefer bank nifty as it’s more rewarding and makes them reap higher benefits due to more considerable volatility.

0 notes

Text

Why choose a bank nifty option trading strategy?

Those who have been into bank nifty option trading have devised multiple bank nifty strategies which will help them make better trades in the future. Due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

Launched in 2000 by India Index Service and Product Limited (IISL), Bank Nifty is NSE’s sectoral index and is one of the most heavily traded indexes in the F&O market. One of the highest attractions in bank nifty trading is that it is highly volatile and allows traders to generate a quick profit. Also, due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

This index trading option is brilliant as it comprises 12 highly capitalized and the most liquid banking sector stocks traded in NSE. Those who have been into bank nifty option trading for years have devised multiple bank nifty strategies which will help them make better trades in the future.

Whenever looking for ‘my trade options,’ bank nifty holds great importance as, here, the share prices and values are displayed on a real-time basis during the NSE trading hours. A bank nifty option strategy can be curated for various purposes like introducing index funds, new ETFs, and other structured products and benchmarking fund portfolios. The top 10 bank nifty companies with the highest weightage are – AU Small Finance Bank, Axis Bank, Bandhan Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank, IndusInd Bank, Kotak Mahindra Bank, and Punjab National Bank.

Top 4 bank nifty option buying strategy

With the growing trading margin and awareness, options trading has significantly increased among traders. Nifty and bank nifty are the popular indices in option derivatives, and their improved buying strategy results from the opportunity it offers to make money. Below are the top 4 bank nifty strategies that every trader must know.

Naked puts or calls – Buy the put option during the market’s low point. The more the nifty falls, the higher profits are generated. Buying the call option during the market’s high end is a good strategy. The more the market rises, the higher profits will be incurred. Putting a stop loss is mandatory in this strategy.

Bull call spread – If you wish to buy bank nifty stocks during the market rise, using the bull call spread strategy is the best option. This strategy gives a good amount of money when the index goes up.

Short straddle – This bank nifty strategy generates good results when the market is in a defined range. Here the trader sells the money call option and a put option with the same strike price and expiry date. You grab the maximum profits when the index doesn’t show much movement. However, the losses are extreme when the bank nifty moves beyond the breakeven point.

Short iron butterfly – A good bank nifty strategy today will result in better outcomes for tomorrow. This strategy contradicts the risky short-straddle

strategy, as the losses here are less and much defined. Profit is also defined, and rewards are higher than risk.

What is the difference between nifty and bank nifty

Nifty is considered a much broader term, and bank nifty is a part of nifty. Like bank nifty, the nifty index also consists of the most liquid and highly capitalized stocks from the National Stock Exchange. However, the major difference is that nifty consists of the top 50 stocks from varied sectors like automobile, pharma, IT, bank, etc., hence also called Nifty50. On the other hand, bank nifty, also known as Nifty Bank, consists of the top 12 stocks only from the banking sector, which is a part of Nifty50.

If you are looking for an excellent strategy to invest in index funds, nothing is better than nifty. Bank nifty strategy is profitable primarily for intraday trading to book short-term profits. Bank nifty is more volatile than nifty. For example – If nifty rises to 1%, then bank nifty goes 1.5% higher. Although bank nifty has more potential to make profits, the risk is also higher than nifty.

For options trading in nifty, one lot = 50 quantities, and for bank nifty, it is 25 quantities. As nifty consists of stocks from multiple sectors, it depicts the overall economy’s performance. On the contradictory, bank nifty indicates only the banking sector’s performance.

Choosing to trade between bank nifty and nifty options is tricky. Still, if you are a beginner, maximum traders trade in the nifty index is a better option as it is less volatile and much more familiar. If you stand somewhere between intermediate and advanced trading levels, traders prefer bank nifty as it’s more rewarding and makes them reap higher benefits due to more considerable volatility.

0 notes

Text

Why choose a bank nifty option trading strategy?

Those who have been into bank nifty option trading have devised multiple bank nifty strategies which will help them make better trades in the future. Due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

Launched in 2000 by India Index Service and Product Limited (IISL), Bank Nifty is NSE’s sectoral index and is one of the most heavily traded indexes in the F&O market. One of the highest attractions in bank nifty trading is that it is highly volatile and allows traders to generate a quick profit. Also, due to its high co-relation and weightage in the NSE benchmark index, Nifty, Bank Nifty gained great significance among investors.

This index trading option is brilliant as it comprises 12 highly capitalized and the most liquid banking sector stocks traded in NSE. Those who have been into bank nifty option trading for years have devised multiple bank nifty strategies which will help them make better trades in the future.

Whenever looking for ‘my trade options,’ bank nifty holds great importance as, here, the share prices and values are displayed on a real-time basis during the NSE trading hours. A bank nifty option strategy can be curated for various purposes like introducing index funds, new ETFs, and other structured products and benchmarking fund portfolios. The top 10 bank nifty companies with the highest weightage are – AU Small Finance Bank, Axis Bank, Bandhan Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank, IndusInd Bank, Kotak Mahindra Bank, and Punjab National Bank.

Top 4 bank nifty option buying strategy

With the growing trading margin and awareness, options trading has significantly increased among traders. Nifty and bank nifty are the popular indices in option derivatives, and their improved buying strategy results from the opportunity it offers to make money. Below are the top 4 bank nifty strategies that every trader must know.

Naked puts or calls – Buy the put option during the market’s low point. The more the nifty falls, the higher profits are generated. Buying the call option during the market’s high end is a good strategy. The more the market rises, the higher profits will be incurred. Putting a stop loss is mandatory in this strategy.

Bull call spread – If you wish to buy bank nifty stocks during the market rise, using the bull call spread strategy is the best option. This strategy gives a good amount of money when the index goes up.

Short straddle – This bank nifty strategy generates good results when the market is in a defined range. Here the trader sells the money call option and a put option with the same strike price and expiry date. You grab the maximum profits when the index doesn’t show much movement. However, the losses are extreme when the bank nifty moves beyond the breakeven point.

Short iron butterfly – A good bank nifty strategy today will result in better outcomes for tomorrow. This strategy contradicts the risky short-straddle

strategy, as the losses here are less and much defined. Profit is also defined, and rewards are higher than risk.

What is the difference between nifty and bank nifty

Nifty is considered a much broader term, and bank nifty is a part of nifty. Like bank nifty, the nifty index also consists of the most liquid and highly capitalized stocks from the National Stock Exchange. However, the major difference is that nifty consists of the top 50 stocks from varied sectors like automobile, pharma, IT, bank, etc., hence also called Nifty50. On the other hand, bank nifty, also known as Nifty Bank, consists of the top 12 stocks only from the banking sector, which is a part of Nifty50.

If you are looking for an excellent strategy to invest in index funds, nothing is better than nifty. Bank nifty strategy is profitable primarily for intraday trading to book short-term profits. Bank nifty is more volatile than nifty. For example – If nifty rises to 1%, then bank nifty goes 1.5% higher. Although bank nifty has more potential to make profits, the risk is also higher than nifty.

For options trading in nifty, one lot = 50 quantities, and for bank nifty, it is 25 quantities. As nifty consists of stocks from multiple sectors, it depicts the overall economy’s performance. On the contradictory, bank nifty indicates only the banking sector’s performance.

Choosing to trade between bank nifty and nifty options is tricky. Still, if you are a beginner, maximum traders trade in the nifty index is a better option as it is less volatile and much more familiar. If you stand somewhere between intermediate and advanced trading levels, traders prefer bank nifty as it’s more rewarding and makes them reap higher benefits due to more considerable volatility.

0 notes

Text

#best book for intraday trading#best book for intraday trading India#Intraday Trading Books#trading books for beginners

0 notes

Text

Learn Pure Profit Course with Software In Capital Varsity

This Course Provides a Brand Course Using the Software. With This Course, You’ll Trade in The Market Using the Software Medium Developed by Capital Varsity. This Course Also Covers colorful feathers of Trading Sets- Up That Are Essential for Intraday Trading.

• After The Completion of The Course, We Offer - To- Sessions with Our Faculty. Then You will Seek Their Advice and Guidance Regarding Your Career in Financial requests.

• To Ease effects for You, We Offer Offline as Well as Online Courses. You will Join Our Live Webinar from Anywhere Across the Globe.

• Our Training Courses with Maximum Profit Would grease You In Gaining further Knowledge And Experience About Stock Market Trading.

• Capital Varsity Trading Academy Would give You Detailed and Precisely Designed Courses for Stock Market Training. Once You Finish Any of Those Courses You Will Be Ready to Enter the Stock Market and Start Trading.

Now We Speak About Some of The Benefits Of Doing This Course From The Us

Globally Recognized

Our literacy Platform Has Worldwide Recognition. With Our Courses, You’ll Get Exposure to Stock Markets Across the Globe.

Award Winning Institute

Capital Varsity Has entered multitudinous Awards for The Simplest Share Market Training Institute. We have given Training to further Than,000 scholars Since 2011 And We Are the Topmost Financial Education Center in The World. We will give You Stylish Training in Pure Profit Courses with Software.

Qualified And Experienced Faculty

We Have largely good Faculty with Times of Experience. By Joining Our Academy You will Get trading classes price from Committed and Extremely Passionate preceptors. You will Get Stylish Training Which You Will Not Get Anywhere Differently.

Effective Course Material

Our Course Material Books Are the Newest and Most Up- To- Date. The online share trading course Development Is Completed by Experts from The Assiduity. Our Course Material Contains Physical Reference Books, Ebooks, vids, Pdfs, Worksheets, Powerpoint donations, Etc., And Lots of further effects You Will Get Over Then.

We Have an intriguing Way of Learning

We Make Sure That Learning About the best stock market course in india with Us Is Interactive and intriguing. We Engage Our Learners Using life exemplifications to Make to Understand the Different generalities of The request. We Make It an Easy and intriguing Way of Learning Because If It Will Be intriguing Learners May Get further Interest in It Rather Than Other effects.

You Can Learn It Online Or In- Person

With Capital Varsity, You Get the Chance to Get Live stock trading classes in The Classroom or Join Live Lectures Online in The Comfort of Your Home, Office, Or Another Place in The Globe Where There Is an Internet Connection and A Computer. You will Also See the Recorded Lecture at A Suitable Time If You Are Working It Will Help You Most with Work Also Can Do This Course with Us.

Depth Coverage Of Course

Our Training primers Describe the Varied generalities of Stock Market Trading In- Depth And Cover All The Aspects Of The request. Our Module Has veritably Easy Language and An Individual From Any Background Can Understand It fluently.

24x7 Support You’ll Get Then

To Help You Regarding Any Issue While Live Trading, We Give 24x7 Support. We Are Available To Serve You Thru Dispatch, Call Or Live Support At The Website. We will Clear All dubieties On Your Suitable Time Or Is The Right Time For You So It Is salutary For You If You Are Working And Doing This Course Too With Us.

We Will Provide You with Proper Certification of Courses

You Will Admit a Certificate of Excellence on Completion of The Course from Our Expert Faculty Grounded on Your Performance. This Certificate Will Add Value to Your Career Within the Financial Market It Will Advanced the Weightage of Your Cv and Will Also Help You Find Better Jobs for Yourself.

It Will Masters Your feelings

By Learning Through Capital Varsity, You’ll Master the Art of Controlling Your feelings in The request. We Help in Making Profitable Trades and Managing Your pitfalls. Through Our Training, You’ll Be suitable to Identify openings in The request snappily and Take Benefit of The Trend of The request. It veritably Helps Full for Those Who Want to Learn This Course and They Don’t Have the Power to Control Their feelings So We Will Help You Out with This.

Affordable Price

The Stock Exchange Courses at Capital Varsity Are Well-Priced and Affordable to All. We Make Sure That You Get the Worth of Each Penny Spent. With Our Courses, You’ll Be suitable to Reap Long- Term Benefits and Add Value to Your Trading opinions.

Pure Profit Course Providing Real-Time Technical Analysis for Max Profit

• You Would Know Where to Place the sweats

• Proven System Course

• No demand to Watch the Complete Market

• By Spending Touch Time, You Can Make Good gains

• Mechanical System

• Makes Strategies Automatically

#best stock market course in India#online share trading#Trading classes price#share market free course

0 notes

Text

Amazon in Buy The Art of Intraday Trading द आर्ट ऑफ़ इंट्राडे ट्रेडिंग book online at best prices in India on Amazon in Read The Art of Intraday Trading द आर्ट ऑफ़ इंट्राडे ट्रेडिंग book reviews author details and more at Amazon in Free delivery on qualified orders. Amazon.in

0 notes

Link

As the Best bank nifty options tips provider, The Trade Bond takes care of almost all factors that affect the real-time value of bank nifty. Most of the traders trading in Nifty and Bank Nifty want accurate trading tips for intraday. Trading in banknifty provides a very good return in intraday trading. As a result, the maximum number of traders are focusing on intraday trading in nifty and bank nifty. Being the best bank nifty option tips provider we try delivering good results. Every trader wants to have a successful trading session. By booking maximum amount of profit with best nifty and bank nifty trading tips.

Recommendations are generated by seeing the overall performance of the stock market. For trading in nifty and bank nifty. Our researcher is best equity research analyst in India

Bank Nifty Intraday tips are given after doing strong technical and fundamental research. Our experts deliver 1–2 trades on daily basis in banknifty. We provide these trades mainly on the “at the money” call or put option . As a result, you will see high volatility in the trade.

A dedicated business analyst is assigned in order to help the trader to book maximum profit in their trades.

Bank Nifty Trading tips

These are those trading tips that get squared up in the daytime frame itself. we usually provide a target of around 50 points in these trades Because it is important to square up the position before 3.20.p.m.

Accurate Intraday bank nifty option tips

We try to generate tips almost by doing all research work. But we do not commit that the trade could be 100% accurate because the trades have a high dependency on market volatility. Which is a completely uncontrollable factor.

Genuine nifty and bank nifty option tips

The tips given by us are purely genuine and ethical. We deliver tips in both nifty and bank nifty. In fact, by focusing on the trend of the stocks we provide the tip of the most genuine nifty and bank nifty option.

Best Bank Nifty Tips for Today

In order to get the best bank nifty tips for today, we request you to kindly fill the form mentioned below. So, that our executive will contact you as soon as possible. In order to help you with today’s trading session.

1 note

·

View note

Text

Reel Token 10000$ GIVEAWAY🔥| Participate Now✅ | Bitcoin Update Today

Register Yourself for REELTOKEN 10000$ GIVEAWAY

👉 https://gleam.io/LovJr/reelstars-bigg…

REEL STAR Platform Registration

👉 https://www.reelcrypto.io/

As the first 'everything app' built on the web3 multi-blockchain platform, Reel Star combines live streaming, video sharing, peer-to-peer chat, voice/video calling, NFT minting, and an NFT marketplace with its unique Digital Wallet.

In addition to its strong focus on community, user experience, and deep cryptocurrency expertise, Reel Star boasts a formidable international management team that lets people without technical or financial knowledge earn money from the app in an unlimited way.

Besides being the title sponsor for Nora Fatehi and Guru Randhawa's film, Reel Star aims to energize and renew the global media industry.

Take a look at the complete video! Let us know what you think in the comments 👇

Start Trading💹

𝐁𝐈𝐍𝐀𝐍𝐂𝐄:

https://accounts.binance.com/en/regis…

Referral code: 87425029

𝐁𝐈𝐓𝐆𝐄𝐓:

Join me on BITGET (Copy Trading )

https://partner.bitget.com/bg/CryptoT…

DELTA EXCHANGE:

Delta Exchange: https://www.delta.exchange/app/signup…

Referral Code: UHNIEH

𝐖𝐚𝐳𝐢𝐫𝐗:

https://wazirx.com/invite/mmjd4bgtd

To learn crypto trading, search for BUDHIL VYAS on Amazon; you'll find a very helpful book:

👉 https://amzn.eu/d/7QyeFJt

𝗣𝗹𝗲𝗮𝘀𝗲 𝗳𝗶𝗻𝗱 𝗺𝘆 𝘀𝗼𝗰𝗶𝗮𝗹 𝗺𝗲𝗱𝗶𝗮 𝗵𝗮𝗻𝗱𝗹𝗲𝘀 𝗯𝗲𝗹𝗼𝘄:

✔️ Telegram Channel:

https://t.me/CryptoTalksBudhil

✔️ YouTube:

/ cryptotalksbudhil

✔️ YouTube Channel 2:

/ @budhilvyas2021

✔️ Instagram Handle:

https://www.instagram.com/budhil_vyas/

✔️ Twitter Handle:

https://twitter.com/BudhilVyas

reelstar #web3 #Cryptocurrency #binance #budhilvyas #bitcoinnewstoday #BitCoin #CryptoTalks #bitcoincash #futuretrading #gururandhawa #web3coins #reelstarnorafatehi #reelstartoken

𝗧𝗛𝗔𝗡𝗞 𝗬𝗢𝗨 𝗙𝗢𝗥 𝗦𝗨𝗣𝗣𝗢𝗥𝗧𝗜𝗡𝗚!!!

Please subscribe to my YouTube channel and click the bell icon so that you will be notified whenever I publish an update.

Keep an eye out for scammers and remember I will never share my WhatsApp number with anyone.

Never ask for money in the Comment Section.

Cryptocurrency is subject to Market Risk. Past performance is not a guarantee of future performance. The risk of loss in trading and investment in cryptocurrency can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. Please ensure that you understand fully the risks involved and invest according to your risk-bearing capacity.

Budhil Vyas

Data Scientist

Budhil Vyas, Cryptocurrency, Trading, bitcoin, best crypto coins to buy right now, cryptocurrency for beginners, cryptocurrency kya hai, what is cryptocurrency, cryptocurrency news, how to invest in cryptocurrency, bitcoin trading for beginners, bitcoin live, live trading, trading, intraday trading for beginners, art of trading, stock market ka commando, stock market live, stock market India, investment for beginners, earn money online, finance, stock market, trading live

Cryptocurrency, Trading, bitcoin, best crypto coins to buy right now, cryptocurrency for beginners, cryptocurrency kya hai, what is cryptocurrency, cryptocurrency news, how to invest in cryptocurrency, live trading, intraday trading for beginners, stock market ka commando, stock market live, stock market India, investment for beginners, earn money online, finance, stock market, trading live, Best Crypto coins to invest in #2023, Top 5 Cryptocurrencies to Invest Money right now

visit us -

youtube

0 notes