#best term policy in Dallas

Text

Understanding the Benefits of Permanent Whole Life Insurance and Supplemental Insurance Policies in Dallas

Are you considering securing your financial future in Dallas? One crucial aspect to explore is insurance coverage. While many types of insurance exist, two significant options to consider are permanent whole life insurance policy and supplemental insurance policies. Understanding the benefits of these policies, particularly in the context of Dallas, can help you make informed decisions about your financial well-being.

Permanent Whole Life Insurance: A Lifelong Security Blanket

Permanent whole life insurance offers lifelong coverage and comes with a cash value component that grows over time. Here's why it's worth considering:

Lifetime Coverage: Unlike term life insurance, which covers you for a specific period, permanent whole life insurance provides coverage for your entire life. This ensures that your loved ones receive financial support regardless of when you pass away.

Cash Value Growth: A portion of your premium payments goes into a cash value account, which accumulates over time on a tax-deferred basis. In Dallas, where the cost of living continues to rise, having a cash value component can provide a valuable financial cushion for unexpected expenses or retirement.

Tax Advantages: The cash value growth in a permanent whole life insurance policy accumulates tax-deferred. Additionally, the death benefit is typically tax-free for beneficiaries. These tax advantages can be particularly beneficial for residents of Dallas seeking to maximize their wealth accumulation and leave a legacy for their loved ones.

Flexible Payment Options: Permanent whole life insurance policies often offer flexible payment options, allowing policyholders to adjust their premiums based on their financial circumstances. This flexibility can be especially advantageous in a dynamic city like Dallas, where income levels and expenses may fluctuate over time.

Estate Planning Tool: In Dallas, where estate planning is essential for wealth preservation, permanent whole life insurance can serve as a valuable tool. The death benefit can help cover estate taxes, ensuring that your assets are passed on to your heirs intact.

Supplemental Insurance Policies: Enhancing Your Coverage

In addition to permanent whole life insurance, Dallas residents can benefit from supplemental insurance policies tailored to their specific needs. These policies provide additional coverage beyond what traditional health or life insurance offers. Here are some examples:

Critical Illness Insurance: Dallas, like many major cities, faces healthcare challenges, including the risk of critical illnesses such as cancer, heart disease, or stroke. Critical illness insurance provides a lump-sum payment if you are diagnosed with a covered condition, helping you cover medical expenses and other financial obligations during a challenging time.

Disability Insurance: A sudden disability can have devastating financial consequences, especially in a city as fast-paced as Dallas. Disability insurance replaces a portion of your income if you are unable to work due to injury or illness, ensuring that you can meet your financial obligations and maintain your standard of living.

Long-Term Care Insurance: With the rising cost of long-term care services, such as nursing homes or in-home care, long-term care insurance can provide financial protection and peace of mind. This type of policy covers expenses associated with extended care needs, allowing you to preserve your assets and maintain control over your healthcare decisions.

Accidental Death and Dismemberment Insurance: Dallas residents may face higher risks of accidents due to factors such as heavy traffic or outdoor recreational activities. Accidental death and dismemberment insurance provides a benefit if you die or suffer a serious injury as a result of an accident, providing additional financial support to your loved ones during a difficult time.

In conclusion, permanent whole life insurance and supplemental insurance policy in Dallas can play a crucial role in safeguarding your financial future in Dallas. Whether you're looking for lifelong protection, tax advantages, or additional coverage for specific risks, these insurance options offer valuable benefits that can provide peace of mind for you and your loved ones. Consult with a trusted insurance advisor, such as Kang Group Services, to explore your options and customize a policy that meets your unique needs and goals.

#best term policy in Dallas#whole life policy in Dallas#best term insurance plan in Dallas#health insurance Obamacare in Dallas#Obamacare health coverage in Dallas

0 notes

Text

Growing evidence makes this clearer by the day: Diversity, equity and inclusion (DEI) does not help American institutions attain progress or profit.

It’s time for all institutions to get back to their basic duties and stop pushing extreme agendas on the American people. This is especially important for American corporations that have a fiduciary obligation to make decisions in the best financial interests of their shareholders.

A growing chorus of Americans recognizes the acute challenges of DEI. Even the co-founder and CEO of a prominent DEI consulting firm laments assuming the role of “moral authority” on the subject and regrets labeling people who disagree with DEI as “bad” people.

The controversy over DEI has also captured the attention of two well-known businessmen, Mark Cuban and Bill Ackman, both of whom have engaged in a tense exchange on X, formerly Twitter.

Cuban, the Dallas Mavericks owner and star of “Shark Tank,” wrote, “Diversity—means you expand the possible pool of candidates as widely as you can. Once you have identified the candidates, you hire the person you believe is the best.”

“That’s exactly what I thought until I did the work,” said Ackman, the founder of Pershing Square Capital Management and Democrat mega-donor. “I encourage you to do the same and revert. DEI is not about diversity, equity or inclusion. Trust me. I fell for the same trap you did.”

In the same post, Ackman explained that DEI is “a political advocacy movement on behalf of certain groups that are deemed oppressed under DEI’s own methodology.”

In simplest terms, what Ackman and others critical of DEI have identified is the inherently flawed nature of the ideology. By insisting that our institutions are irredeemable and cannot escape past wrongs or that people groups should be divided into two camps — oppressed and oppressor — the adherents of DEI are compelled to use the levers of those very same institutions to manipulate outcomes based on identity rather than merit.

This conduct is dangerous when you consider its effects on our economy and our public corporations.

Good business is ultimately about producing a good product, not pushing an agenda. DEI unnecessarily complicates that winning American formula. Rather than focus on improving production and goods, companies are now choosing to divert resources and attention to internal race and identity-based policies that neither improve return on investment to shareholders nor result in better products for consumers.

Corporations adopting policies that prioritize social engineering over corporate responsibility do not serve the interests of all Americans. Instead, they appease the extreme desires of a few, thereby eroding confidence in the ability and competency of our institutions.

It is neither profitable for businesses nor sustainable for the American people.

Along the same lines, those in the financial services industry must understand that fiduciaries must have a single-minded purpose in the returns on their beneficiaries’ investments.

State and federal law have long recognized fiduciary duties for those who manage other people’s money. The Employee Retirement Income Security Act, for example, demands that a fiduciary “discharge that person’s duties with respect to the plan solely in the interests of the participants and beneficiaries, for the exclusive purpose of providing benefits to participants and their beneficiaries …”

As attorney general of Kentucky, I was one of 22 state attorneys general who signed a letter warning financial services companies that they may be violating their fiduciary responsibility to shareholders by agreeing to radical activism in their environmental proposals. I also issued a legal opinion outlining why government-sponsored racial discrimination and so-called “stakeholder capitalism” was unlawful.

We’ve collectively witnessed some of the consequences of extreme ideology taking priority over responsible corporate governance. After Bud Light’s infamous foray into the culture wars, its sales collapsed, forcing one of its executives to step down. We’ve also seen prominent fund managers like Vanguard drop ESG-driven investments — another ideological blunder at the corporate level — because they have not been profitable and have exposed their investors to greater losses.

DEI objectives have moved some of our business so far from their purpose that even those on the left like Ackman are compelled to speak out, underscoring that the adverse reaction to DEI is not a partisan issue.

Most Americans want our corporate institutions to move away from extreme ideologies. It’s time to return to the American formula of producing great products and services, not pushing agendas.

Daniel Cameron is the former attorney general of Kentucky and the current CEO of the 1792 Exchange.

43 notes

·

View notes

Text

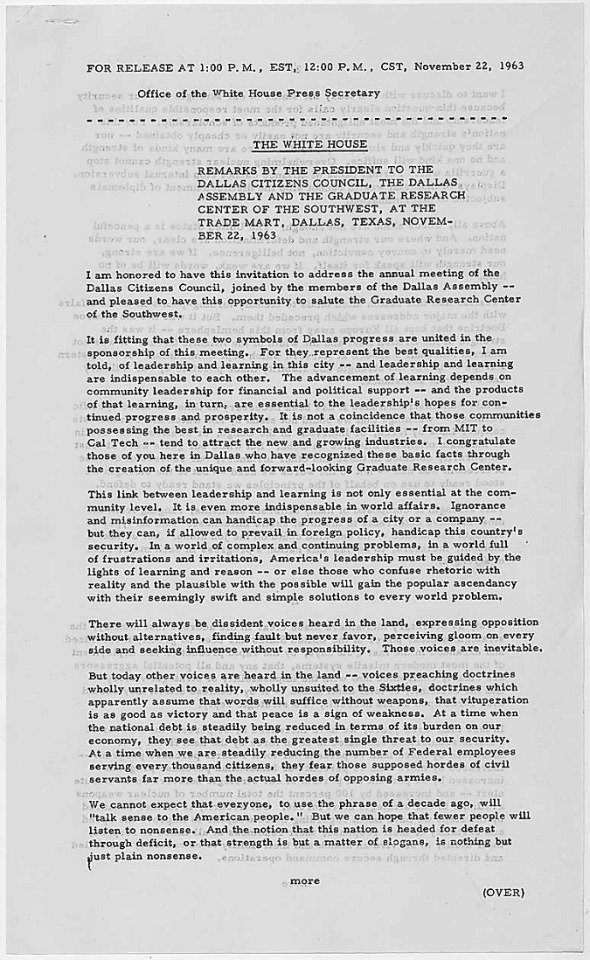

John F. Kennedy - Trade Mart Speech November 22, 1963

Collection JFK-8.25: Papers of John F. Kennedy: Presidential Papers: White House Staff Files of Pierre SalingerSeries: Press ReleasesFile Unit: White House Staff Files; Papers of Pierre E. G. Salinger; Press Releases; John F. Kennedy Final Copies

FOR RELEASE AT 1:00 P.M., EST, 12:00 P.M., CST, November 22, 1963

Office of the White House Press Secretary

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

THE WHITE HOUSE

REMARKS BY THE PRESIDENT TO THE

DALLAS CITIZENS COUNCIL, THE DALLAS

ASSEMBLY AND THE GRADUATE RESEARCH

CENTER OF THE SOUTHWEST, AT THE

TRADE MART, DALLAS, TEXAS, NOVEM-

BER 22, 1963

I am honored to have this invitation to address the annual meeting of the

Dallas Citizens Council, joined by the members of the Dallas Assembly --

and pleased to have this opportunity to salute the Graduate Research Center of the Southwest.

It is fitting that there two symbols of Dallas progress are united in the sponsorship of this meeting. For they represent the best qualities, I am told, of leadership and learning in this city -- and leadership and learning are indispensable to each other. The advancement of learning depends on community leadership for financial and political support -- and the products of that learning, in turn, are essential to the leadership's hopes for continued progress and prosperity. It is not a coincidence that those communities possessing the best in research and and graduate facilities -- from MIT to Cal Tech -- tend to attract the new and growing industries. I congratulate those of you here in Dallas who have recognized these basic facts through the creation of the unique and forward-looking Graduate Research Center.

This link between leadership and learning is not only essential at the community level. It is even more indispensable in world affairs. Ignorance and misinformation and handicap the progress of a city or a company -- but they can, if allowed to prevail in foreign policy, handicap this country's security. In a world of complex and continuing problems, in a world full of frustrations and irritation, America's leadership must be guided by the lights of learning and reason -- or else those who confuse rhetoic with reality and the plausible with the possible will gain the popular ascendancy with their seemingly swift and simple solutions to every world problem.

There will always be dissident voices in the land, expressing opposition without alternatives, finding fault but never favor, perceiving gloom on every side and seeking influence without responsibility. Those voices are inevitable.

But today other voices are heard in the land -- voices preaching doctrines wholly unrelated to reality, wholly unsuited to the Sixties, doctrines which apparently assume that words will suffice without weapons, that vituperation is as good as victory and that peace is a sign of weakness. At a time when the national debt is steadily being reduced in terms of its burden on our economy, they see that debt as the greatest single threat to our security. At a time when we are steadily reducing the number of Federal employees serving every thousand citizens, they fear those supposed hordes of civil servants far more than the actual hordes of opposing armies.

We cannot expect that everyone, to use the phrase of a decade ago, will "talk sense to the American people." But we can hope that fewer people will listen to nonsense. And the notion that this nation is headed for defeat through deficit, or that strength is but a matter of slogan, is nothing but just plain nonsense.

#archivesgov#November 22#1963#john f. kennedy#kennedy assassination#Dallas citizens council#Dallas#1960s#1960s history

50 notes

·

View notes

Text

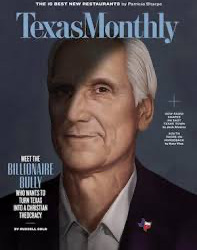

OPINION Billionaires are now running Texas

Legislature must pass campaign contribution limits to stop sale of seats next to power

Texas government, a public trust since the fall of the Alamo, has today been affordably purchased by donors of roaring wealth who want GOP-led government to satisfy their arcane motivations.

These driven billionaires annually spend a manageable portion of their sustainable wealth to reserve first-class seats next to constitutional power.

They effectively outrank us, we who innocently believe there exists a “one man, one vote” level playing field within a vanishing Texas democracy.

youtube

What do these wealthy donors want?

This much is clear:

They want public schools defunded;

their biblical interpretation to inform government policy;

and women to give birth each time they become pregnant, no matter the circumstances.

There’s more to their wish list, as I’m sure we’ll discover in the upcoming 89th Legislature.

Their chosen statewide GOP nominees, elected by only 3% of Texas’ population, historically go on to win in November because well-funded incumbency is hard to overcome, and a Democrat hasn’t won statewide since 1994.

Gone are the days when careerist politicians balanced their wealthy donors’ interests with those of the public.

Now, the Texas GOP has completely sold out to its primary fringe, adopting unsustainable, extremist policies, reaping outrageous campaign contributions, and producing a corrupt, authoritarian energy that has darkened the heart of Texas.

Texas, along with only eight other states, allows unlimited campaign contributions to all non-judicial state candidates.

That means there is no limit to the check a wealthy person can write to influence an election for legislative or executive office.

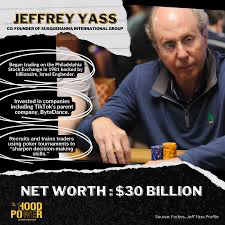

For example, last December, Jeff Yass, a Pennsylvanian billionaire with an interest in promoting Texas school vouchers, wrote Gov. Greg Abbott a $6 million check to help Abbott defeat rural legislators who opposed this measure.

Last summer, a PAC led by Tim Dunn, a Midland billionaire lay preacher who has funded Attorney General Ken Paxton’s several statewide campaigns, paid Lt. Gov. Dan Patrick $3 million six weeks before Patrick presided over Paxton’s Senate impeachment trial.

After the 2021 winter storm devastated Texas, leaving tens of billions in property damage and economic losses and hundreds of dead, Energy Transfer Partners CEO Kelcy Warren, a natural gas producer and pipeline owner whose firm richly benefited during the blackout by selling fuel at unprecedented prices, awarded Abbott a million-dollar check.

There are many such stories.

It’s past time we reform our scandalous state government.

The best way forward is to adopt campaign finance limits.

A supermajority of states limit campaign contributions, as we do in our federal elections.

Federal candidates for Congress may receive up to $3,300 per person per election cycle;

Florida statewide candidates are capped at $3,000 per donor per election and legislative candidates are capped at $1,000 per donor per election;

Wisconsin limits statewide incumbents to $20,000 per donor for the entire four-year term of office;

Connecticut restricts individual donors to $1,000 per state Senate candidate per election and $250 per state House candidate;

Hawaii limits out-of-state contributions to 30% of a candidate’s contributions.

The nation’s most recent convert, after decades of allowing unlimited contributions, is Oregon, which now limits individual campaign contributions at $3,300 after Gov. Tina Kotek signed the landmark bill on March 20.

So, what about Texas?

With 20 TV markets and 31 million people, Texas is massive in size however you measure it.

The Dallas-Fort Worth market is the fifth-largest market nationwide with roughly 2,713,380 TV households.

Twenty-two million Texans are of voting age, and candidates want to reach as many of them as they can who will register and vote.

It’s expensive to advertise on broadcast and cable television and communicate with voters digitally and by mail, phone and text, and that’s an experience shared among all statewide candidates.

What’s not fair is wealthy sponsors picking who wins by uber-funding their wards safely across the finish line.

No wonder some voters feel their vote doesn’t count.

It’s perverse to lavish candidates with grotesquely excessive campaign contributions and then, once installed, expect them to hold the line on government spending.

I’m confident anyone bold enough to seek office can find a way to court Texas voters on a reasonable budget after campaign finance limits are adopted.

The U.S. and Texas Constitutions allow lawmakers’ placing maximum limits on campaign contributions, and, especially since the Texas Constitution forbids a citizen-led statewide initiative, the Texas Legislature should take up the cause in its next session, and robustly debate, swiftly pass and forward for the governor’s signature reasonable campaign contribution limits in time for the 2026 elections.

Joe Jaworski is a Texas attorney and mediator and former mayor of Galveston.

0 notes

Text

[ad_1]

Relating to investing in actual property, the Lone Star State of Texas persistently emerges as a best choice for patrons. With its vibrant financial system, inexpensive costs, and robust inhabitants development, Texas affords a plethora of alternatives for these seeking to construct their wealth by way of property investments.

One of many key components that makes Texas such a horny vacation spot for actual property buyers is its strong financial system. Because the second-largest state by way of each inhabitants and financial system, Texas boasts a various vary of industries, together with power, know-how, manufacturing, agriculture, and finance. This financial range helps to create stability and resilience, even throughout instances of nationwide financial downturns. The state's pro-business surroundings, low laws, and favorable tax insurance policies additional reinforce its attraction for buyers.

Affordability is one other important benefit that Texas actual property affords to patrons. In comparison with different main metropolitan areas within the nation, Texas cities like Houston, Dallas, Austin, and San Antonio present rather more inexpensive housing choices. This affordability issue not solely lures particular person homebuyers but additionally attracts buyers in search of rental properties. The decrease price of buying properties permits buyers to realize increased returns on their investments, making Texas an interesting vacation spot for each long-term and short-term revenue era.

Inhabitants development is one other essential driver for actual property funding in Texas. The state persistently experiences robust inhabitants development, which creates a excessive demand for housing items. A rising inhabitants not solely results in elevated house purchases and leases but additionally fuels demand for industrial properties similar to procuring facilities, workplace areas, and industrial services. This steady demand ensures a steady actual property market with alternatives for each speedy and long-term returns on funding.

Moreover, the Texas actual property market advantages from favorable migration patterns. Folks from different states, in addition to worldwide migrants, are drawn to Texas as a result of its job alternatives, decrease price of residing, and prime quality of life. The comparatively low price of residing, together with no state revenue tax, makes Texas an interesting selection for these in search of higher monetary stability and improved life-style choices.

Moreover, the varied geography and local weather of Texas cater to varied housing preferences. From metropolitan high-rises to suburban neighborhoods and rural ranches, the state affords a variety of decisions for buyers to diversify their portfolios. This range permits buyers to focus on totally different markets and meet the calls for of an ever-changing inhabitants.

Investing in Texas actual property has proven constant resilience, even throughout instances of nationwide financial upheaval. It presents a superb alternative for buyers in search of to diversify their portfolio and construct wealth by way of actual property. With its flourishing financial system, affordability, inhabitants development, and migration patterns, there isn't any doubt that the Lone Star State will proceed to draw patrons who acknowledge the untapped potential of this vibrant market.

[ad_2]

0 notes

Text

Secure Your Family’s Health with SelectedBenefits.com

In today’s unpredictable world, ensuring the well-being of you and your loved ones is paramount. Health insurance plays a pivotal role in safeguarding against the uncertainties that life may throw your way. With the myriad of options available, finding the right coverage that meets your specific needs can be overwhelming. This is where SelectedBenefits.com steps in to alleviate the stress and confusion, offering a seamless solution to securing the best health insurance plan for you and your family.

At SelectedBenefits.com, our mission is simple yet profound: to empower individuals and families by providing access to comprehensive health insurance plans tailored to their unique requirements. With the guidance of our expert team, navigating through the complex landscape of health insurance becomes a breeze. Our dedicated professionals possess the knowledge and experience to assess your needs accurately and match you with the perfect coverage at an affordable rate.

One of the standout benefits of choosing SelectedBenefits.com is the personalized approach we offer. We understand that every individual and family has distinct healthcare needs, which is why we prioritize customization in our services. Whether you require coverage for routine check-ups, specialized treatments, or emergency care, we work diligently to tailor a plan that aligns perfectly with your requirements and budget.

Furthermore, our commitment to transparency ensures that you are equipped with all the information necessary to make informed decisions about your health insurance coverage. We provide clear explanations of policy terms, coverage options, and pricing details, empowering you to choose the plan that best fits your circumstances.

In addition to personalized service and transparency, SelectedBenefits.com stands out for its extensive network of reputable insurance providers. We collaborate with top-tier companies renowned for their reliability and comprehensive coverage options. This enables us to offer a diverse range of plans designed to meet the diverse needs of our clients.

Moreover, our user-friendly online platform simplifies the process of comparing and selecting insurance plans. With just a few clicks, you can access a wealth of information, compare quotes, and explore various coverage options from the comfort of your own home. Our intuitive interface streamlines the entire experience, saving you time and effort while ensuring that you make the most informed decision possible.

Ultimately, choosing SelectedBenefits.com for your health insurance needs provides peace of mind, knowing that you have a trusted partner dedicated to protecting your family’s well-being. With our expertise, personalized approach, and commitment to transparency, we make the process of securing the best health insurance plan a seamless and stress-free experience.

In conclusion, when it comes to safeguarding your family’s health, don’t settle for anything less than the best. Visit SelectedBenefits.com today and let our expert team help you find the perfect coverage at an affordable rate. Your family’s well-being is our top priority, and we are here to guide you every step of the way.

For more info:

selected benefits

dallas texas insurance company

0 notes

Text

The Most Effective 10 Taxis In Dallas, Tx Final Up To Date January 2024

How much do they price and the way do they compare? Enter your designated route into the RideGuru Calculator to search out out. I am the owner of a company that provides consolation passenger transportation services and I would like to publish the name of my firm on this web page. Post a message in Ask a Ride Guru, and see what the consultants say. Or browse the forum to learn the latest rideshare business chatter.

The frequency of textual content messages varies. This is a good place to be taught all the basics of ridesharing. When you give Lyft present playing cards to your family and friends, it’s just like the world is their current.

It all requires accessible, reliable transportation. That’s why we’re working to offer affordable, reliable rides to everyone who wants them. No matter their income, zip or postal code. We’ll all the time deal with you with respect and look out for your safety. We do that by sustaining excessive standards, which start before your very first ride.

Our skilled drivers and chauffeurs will take you safely to your vacation spot. Our main cause is that for our taxi service so much in style in Sri Lanka our costs are lower than other taxi companies in Sri Lanka. Now you possibly can travel safely with Colombo taxi in Sri Lanka with the lowest price. Do you've questions about rideshares, ridehails, and/or taxis?

A taxi service is a reliable approach to get where you have to go, whether or not it’s to the airport before a flight or back house after an evening out. They vary from large, well-known corporations to small local fleets, and may also present limousine service or other luxurious rides. Keep these listings of taxi services handy, so you can contact one whenever you need it. ContactOur taxi service is doubtless certainly one of the oldest Sri Lankan taxi services.

Choose https://g.co/kgs/qVT7Dhj when you need to journey as quickly as attainable. “This time we booked on-line as we were told this was a better method. By clicking "Get the app", you comply with Lyft's Terms of Service and acknowledge you have learn our Privacy Policy.

youtube

ZTrip is a greater option for each passengers and drivers. You can book your journey or add special directions to help your driver . Share your tales and meet fellow drivers, riders, and followers.

That’s because they’ll get access to convenient, dependable, masked-up Lyft rides, whether they’re headed all around town, or simply across the block. We believe transportation is a basic necessity. Getting to polling locations, healthcare services, grocery shops, or to grandma's home for a go to.

Five Star Driver Networks

Whether your query is super-easy, a mind-twister, or obscure, considered one of our Gurus will find and supply one of the best reply for you. Our community of Gurus contains skilled riders, seasoned drivers, and trade consultants. Especially our cab service is being operated throughout the Colombo metropolis 24 hours a day. RideGuru compares estimated prices for a mess of taxi and ridehail providers such as Uber, Lyft, Ola, and Didi Kauidi for thousands of places worldwide. Furthermore, RideGuru offers you an entire breakdown of fares, including how much your driver is definitely making from your fare versus how much goes to the company.

Choosing a rideshare possibility can be complicated. Find obtainable providers in your space, use filters to search out just the proper option for you, then hail your ride right from RideGuru. But the actual multiplier used when you take your trip could vary depending on time of day, the number of drivers on the highway, and the variety of users in search of rides. The precise multiplier used whenever you take your trip could vary relying on time of day, the variety of drivers on the highway, and the number of users in search of rides.

And your beloved ones would like to see your face again, ASAP. We’ll match you with a driver in seconds, show you the quickest bus route, or assist you to find the nearest bike or scooter. RideGuru™ isn't affiliated with any of the ridehail companies listed on the positioning. The estimate here is a baseline estimate. To see how demand-based pricing would change the estimates you see right here, use theSurge Pricing device. Click the clock icon to enter desired choose up time.

Can I get a driver with a truck to take a chest small barrel 2 suitcases box ...

Cowboy Cab

You can also lease a car for your self and not using a driver. Most of the time foreigners who come from overseas get a automobile from us. With our lease a car service you will get automobiles, vans and three wheels for hire. We constructed our services along with your safety in thoughts. Easily share route info with associates or family. Or Walton station taxis in case of emergency.

Most of the time foreigners who come from overseas get a automobile from us.

We built our providers together with your safety in thoughts.

Because it matters who’s driving your youngsters, your elderly dad and mom and who you drive for.

Happy hour on the patio solely lasts for an hour.

Our proactive safety features are all the time on. And anytime, evening or day, we offer actual assist from real people. Unlock sooner pickups at no further cost, member-exclusive pricing, and free roadside assistance for your own car—right within the app. Plus relaxed ride cancellations, free traditional bike rides, and extra. Download the Lyft app and get a experience from a friendly driver in minutes. Which rideshare and ridehail options are available to you?

Driver

If you ever need it, we're standing by, prepared to help. Treat yourself to a high-end airport experience. Enjoy plenty of legroom, luxurious interiors, and top-rated drivers who go above and past. By offering your phone number and clicking “Get the app”, you consent to obtain text messages from Lyft. Text messages may be autodialed, and knowledge rates could apply.

I am asking the current Uber drivers, however anybody's welcome. Because it issues who’s driving your kids, your elderly mother and father and who you drive for. Earn every thing from airline miles to bank card or lodge points, and extra, every time you journey. Happy hour on the patio solely lasts for an hour.

#Walton Taxis#Taxi Walton on Thames#Taxis Walton on Thames#Cabs Walton on Thames#Taxi in Walton on Thames#Minicabs Walton on Thames#taxi Hersham#Taxis Hersham#Hersham taxis#Cabs Hersham#Walton Taxi#Walton cabs#Cheap taxi walton on Thames#Walton station taxis#Station Taxi Walton on Thames#Taxi near me#Cabs near me#Taxis near me

1 note

·

View note

Text

The Risks of Mishandling Late-Paying Customers

As a small business owner in Dallas, TX, you know that one of the most challenging aspects of running a small business is managing finances. This is especially true when it comes to handling late-paying customers.

The real cost of late payments to your business

When customers don't pay their bills on time, it does more than just affect your cash flow. One late payment can knock over a series of financial obligations—from your ability to cover daily expenses to paying your employees.

While it is natural to want to do something to collect this outstanding debt, rushing in without a plan can actually do your small business in Dallas more harm than good.

The risks of being too 'aggressive'

Reaching out to late-paying customers is a tricky business. If you come on too strong, you risk damaging the relationships you have worked hard to build with your customers.

While it is okay to be firm, there is a fine line between firmness and aggression. Cross this line, and the repercussions can be severe—potential for losing future business and negative word-of-mouth.

Not to mention, there are federal laws (the Fair Debt Collection Practices Act or "FDCPA") about how you can go about collecting debts, and aggressive tactics can land your business in legal trouble. These laws are strict, and even if they usually apply to third-party collection agencies, you don't want your Dallas business to be seen in the same light as those who step over the line.

The downside of using the wrong techniques

Using the wrong methods to get your money back can also lead to negative outcomes. For example, calling out a customer on social media for not paying you might seem like a way to pressure them into settling the debt. But it can also land you in hot water legally for defamation or harassment.

And think about how it looks to others. It could make other customers wary of doing business with you, fearing a similar treatment if they ever get into a tight spot.

Then there is the paperwork side of things. It is easy to think a handshake deal or a verbal agreement is enough. But without written records, you might as well be trying to collect ghost debts if you end up in court. Keeping track of every interaction is crucial. If you don't, you are not just losing the money you are owed but also possibly losing the chance to ever collect it.

How to handle late payments the right way?

So, what's the right way to deal with late payments? Start by setting clear rules. Have a credit policy that clearly tells your customers when payments should be made and what happens if payments are not paid on time. Make sure your customers understand these terms clearly and early on to avoid any misunderstandings later.

If a payment is late, start with a simple reminder. Sometimes, customers forget, and a reminder is needed to jog their memory. If the customer does not respond, follow up with a phone call. This gives you a chance to listen and understand what's going on with them. They may be going through a rough patch and need a little flexibility.

But what if you have tried everything and are still not getting anywhere? It might be time to hire professionals. An experienced collection agency in Dallas knows exactly how to handle these situations. They are experts at navigating the tricky waters of debt collection, ensuring everything is done by the book and reflects well on your business.

Contact a professional Dallas collection agency today!

If your small business in Dallas is struggling with late payments, it might be time to seek professional help. A trusted debt collection agency for small businesses, like Williams Rush & Associates, can take the burden off your shoulders, allowing you to focus on what you do best—running your business.

0 notes

Text

Term Life Insurance in Dallas: Securing Your Family's Future

Securing a term life insurance plan in Dallas is a valuable investment in your family's future. The city's thriving economy, family-centric culture, and competitive premiums make it an ideal place to safeguard your loved ones. By carefully considering term length coverage amount and shopping for the best policy, you can ensure that your family is well-protected in the heart of Texas.

0 notes

Text

Looking for Best Trade Show Rentals in Dallas

When searching for the best trade show rentals, it's important to consider factors such as the rental company's reputation, the quality of their products, their customer service, and your specific needs. Here are some steps to help you find the best trade show rental options:

Research Rental Companies: Look for reputable Trade Show Rentals in Dallas companies in your area or those that can serve your event location. You can search online, ask for recommendations from colleagues, or check industry forums and directories.

Check Reviews and Ratings: Read reviews and testimonials from other clients who have used the rental services. This can give you insights into the experiences of others and help you gauge the company's reliability and quality.

Assess Rental Options: Evaluate the range of rental options the company offers. This might include booths, displays, furniture, AV equipment, lighting, flooring, and more. Make sure they have the items you need for your specific trade show.

Quality and Condition: Inquire about the quality of the rental items. Ask whether they regularly maintain and update their inventory to ensure that the items are in good condition and up-to-date.

Customization: If you have specific branding or design requirements, ask if the rental company can customize the booth or display to align with your brand identity.

Customer Service: Pay attention to the level of customer service provided by the rental company. They should be responsive to your inquiries, provide clear information, and be willing to work with you to meet your needs.

Cost and Budget: Request quotes from different rental companies and compare the costs. However, don't solely base your decision on price. Consider the overall value you're getting for the price, including quality, customization, and service.

Availability: Ensure that the rental items you need will be available for your event dates. Some popular trade show periods can be busy, so it's important to book in advance.

Experience and Reputation: A rental company with a solid track record and a good reputation in the industry is more likely to provide a positive experience.

Visit Their Showroom: If possible, visit the rental company's showroom to see their offerings in person. This can help you better visualize how their products will look at your trade show.

Ask for References: Don't hesitate to ask the rental company for references from previous clients who have used their services for trade shows. This can give you a more detailed understanding of their capabilities.

Contract and Terms: Carefully review the rental contract, including terms, policies, delivery and setup processes, and any additional charges. Make sure you understand everything before signing.

Remember that the "best" trade show rental will depend on your specific needs, budget, and preferences. Taking the time to research and compare different options will help you find a rental company that aligns with your goals and helps you make a strong impression at your trade show.

0 notes

Text

Tips for First-Time Renters: Getting the Right Renters Insurance in Dallas and McKinney

As one embarks on the new chapter of independence and responsibility, it's essential to protect the belongings and living space. Renters insurance in Dallas and McKinney, TX, is a crucial investment that can provide peace of mind and financial security in the face of unforeseen events. Following are some essential tips and advice to help first-time renters in Dallas and McKinney select the most suitable renters insurance policy tailored to their budget and specific needs.

Assess the Belongings and Their Value

Before seeking renters insurance, take inventory of the belongings and estimate their total value. Consider items such as furniture, electronics, clothing, and other personal possessions. Understanding the worth of the belongings will help the renter to determine the appropriate coverage amount required in the policy.

Understand the Types of Coverage Available

Renters insurance typically offers two primary types of coverage: personal property coverage and liability coverage. Personal property coverage protects one's belongings from damage or loss due to covered perils, such as theft, fire, or vandalism. Liability coverage, on the other hand, protects one from legal and financial consequences if someone is injured while in the rented property. Understanding these coverage options will help the renter choose the right policy that meets their needs.

Consider Additional Coverage Options

In Dallas and McKinney, certain weather events like floods may not be covered under standard renters insurance policies. Therefore, assessing one's area's risks and considering additional coverage, such as flood insurance, is crucial to ensure comprehensive protection for the belongings.

Evaluate Deductibles and Premiums

When choosing renters insurance, compare the deductibles and premiums offered by different insurance providers. Deductibles are the amount one agrees to pay out of pocket before the insurance coverage kicks in. Opting for a higher deductible may lower the premiums, but make sure it's an amount that can be afforded comfortably in case of a claim.

Bundle Insurance Policies for Cost Savings

Many insurance companies offer discounts when the client bundles multiple policies, such as renters and vehicle insurance in Allen, Frisco, McKinney, Plano, and Dallas, TX. Consider bundling the insurance policies to take advantage of cost savings while ensuring comprehensive coverage across all personal belongings and vehicles.

Read and Understand the Policy's Fine Print

Before finalizing the renter's insurance policy, thoroughly read and understand the fine print. Pay attention to coverage limits, exclusions, and any specific terms or conditions that may affect the coverage. If one has any questions or uncertainties, contacting the insurance provider for clarification is better.

Shop Around and Compare Quotes

Take the time to shop around and obtain quotes from different insurance companies in Dallas and McKinney. Each insurer may offer varying rates and coverage options, so comparing quotes will help one to find the best value for money.

Check for Discounts and Incentives

Some insurance providers offer discounts for various reasons, such as having safety features in their rental property or being a member of certain organizations. Inquire about available discounts and incentives that may help reduce insurance costs.

As a first-time renter in Dallas and McKinney, securing the right renter's insurance policy is critical to protecting one's belongings and financial interests. By assessing the needs, understanding coverage options, and comparing quotes, renters can find a policy that fits their budget and provides comprehensive protection. It is essential to read the policy details carefully, consider additional coverage options as needed, and explore opportunities for cost savings through bundling or available discounts. With the right renter's insurance in place, one can enjoy their new rental home with the confidence of knowing that they are protected against life's uncertainties.

#renters insurance in Dallas and McKinney#TX#vehicle insurance in Allen#Frisco#McKinney#Plano#and Dallas

0 notes

Text

Unlocking Success: How Dallas SEO Boosts Your Insurance Business

In today's rapidly evolving digital landscape, the importance of an effective digital marketing strategy cannot be underestimated, especially for industries like insurance. The insurance sector has witnessed a substantial transformation in recent years, with consumers increasingly relying on the internet to research, compare, and ultimately purchase insurance policies. This paradigm shift has made it imperative for insurance businesses to embrace digital marketing, with Dallas SEO (Search Engine Optimization) at the forefront. In this blog, we'll delve into why digital marketing, particularly Dallas SEO, is not just beneficial but essential for your insurance business's growth and success.

1. Increased Online Visibility with Dallas SEO:

The very essence of SEO lies in enhancing your website's visibility on search engines like Google. As an insurance business in Dallas, your potential clients are likely to search for terms like "insurance providers in Dallas," "best insurance policies in Dallas," or "local insurance agencies in Dallas." By incorporating these keywords strategically throughout your website's content, metadata, and other optimization techniques, a skilled Dallas SEO company can help your business appear at the top of search engine results pages (SERPs). This increased visibility ensures that your target audience can easily find you when they're looking for insurance services.

2. Targeting Local Audiences:

Local SEO is a specialized branch of digital marketing that focuses on optimizing your online presence to attract customers within your geographical area. For an insurance business based in Dallas, local SEO is paramount. Potential clients seeking insurance services are more likely to choose a provider that's conveniently located. By utilizing Dallas SEO services, your business can show up in local search results, making it easier for potential clients in your city to discover and engage with you.

3. Building Credibility and Trust:

In the insurance industry, trust is a cornerstone. When people search for insurance coverage, they want to work with a reliable and reputable provider. An effective digital marketing strategy, including Dallas SEO, can help build your business's credibility online. High search engine rankings and positive user experiences on your website establish trust among potential clients. A skilled Dallas SEO agency can implement strategies to showcase client testimonials, industry certifications, and authoritative content, all of which contribute to your business's reputation.

4. Cost-Effective Marketing:

Compared to traditional forms of marketing, digital marketing, and specifically Dallas SEO services, offer a cost-effective way to reach your target audience. Paid advertising and traditional marketing methods can be expensive, especially for small to medium-sized insurance businesses. Dallas SEO allows you to attract organic traffic to your website without the ongoing costs associated with paid advertising, making it a long-term investment that continues to pay off.

5. Engaging Your Audience:

Digital marketing, including SEO, allows you to engage with your audience on various platforms. Social media, blogs, and interactive content provide opportunities for you to educate your potential clients about insurance policies, answer their questions, and address their concerns. By consistently delivering valuable information, you position your business as an industry authority and develop a relationship with your audience.

In conclusion, the insurance industry's transition towards digital platforms has made a compelling case for adopting a robust digital marketing strategy. Dallas SEO, in particular, offers a tailored approach to optimize your business for local audiences, increase online visibility, and build trust among potential clients. By partnering with a reputable Dallas SEO company, you can unlock the full potential of your insurance business and establish a strong foothold in the digital landscape. Remember, in the world of digital marketing, those who adapt thrive – and the time to embrace the power of Dallas SEO is now.

0 notes

Text

Ann Coulter, other prominent figures will debate border security issue at event in Dallas

Two high-profile pundits will meet in Dallas on Thursday to debate the issue Texans have said is at the top of their minds: border security.

“Should the United States Shut Its Borders?”

This will be the day’s question at a debate held at Dallas’ Majestic Theatre, where speakers will face off before a live audience.

The event was organized by The Free Press, an Internet-based media company based in Los Angeles.

The Free Press’ founder and editor, Bari Weiss, described the debate — which she will moderate — in a press release obtained by The Dallas Express.

She referred to the values of honesty, doggedness, and independence as “the bedrock of great American journalism.”

“Those values are why we are so committed to reviving civil, passionate debate about the most urgent issues facing Americans. Including immigration,” she said.

Weiss also nodded toward the greater political impact of the issue and its implications for the presidential election.

“On April 11th, at the historic Majestic Theatre in Dallas for a debate about the topic voters left and right say will determine the election in November,” she said.

“Bestselling author Ann Coulter and Sohrab Ahmari, founder of Compact, will face off against Nick Gillespie, editor-at-large for Reason Magazine, and Cenk Uygur, founder of The Young Turks.”

Weiss has long worked to support pluralism and tolerance of alternative political voices.

Before resigning from The New York Times in 2020, she regularly penned columns critical of political intolerance.

She also defended older free speech advocate staffers at the paper of record while they were being attacked by what she called younger “wokes” during a controversy regarding the publication of an op-ed by Sen. Tom Cotton (AR-R) calling for soldiers to be sent to support police efforts to prevent violent riots.

The speakers invited to the debate are known in whole or in part because of their views on the topic of immigration border security.

Ann Coulter and her partner will be arguing in favor of a restrictive immigration policy.

One of her best sellers is her 2015 work Adios, America: The Left’s Plan to Turn Our Country into a Third World Hellhole, which former President Donald Trump called a “great read” before he announced his candidacy in 2015, according to The Atlantic.

youtube

Coulter also authored the 2016 book In Trump We Trust: E Pluribus Awesome! supporting Trump’s presidential bid because of his tough stand on unlawful migration and other issues, and she spoke on behalf of his candidacy at a rally in Iowa.

Both Coulter and the book Fire and Fury by Michael Wolf, chronicling Trump’s days in the White House, noted her early status as an outside advisor to the 45th president.

However, Coulter’s relationship with Trump soured when she claimed he was not pursuing the issue of border security hard enough, amongst other faults she saw in his administration.

Gillespie is popular in libertarian circles and has previously supported a more open immigration policy, calling for “an Ellis Island approach to immigration.”

At times, Gillespie couches his view of immigration in personal terms.

“The grandson of four uneducated, poor, unskilled immigrants who would not be allowed entry into the country under today’s laws, I will proudly and lougly [sic] argue the US should not shut its borders to peaceful, law-abiding people,” Gillespie said in a post on X promoting this week’s event.

Coulter and Gillespie’s partners are both foreign-born American citizens.

Ahmari was born in Iran but received a law degree in the United States after teaching for several years in South Texas near the border with Mexico.

Uygur was born in Turkey and previously ran for Congress in California.

If the debate has piqued your interest, there is still time to get tickets. There will also be a VIP afterparty, but be quick to reserve your spots because “they’re going fast,” Weiss said.

Ann Coulter was hoping Texans would write in Greg Abbott for the GOP presidential nomination

After The Free Press and the Foundation for Individual Rights and Expression held a roughly two-hour-long debate on Thursday evening addressing whether the United States should close its borders, a number of participants spoke with The Dallas Express.

The debate was held at the Majestic Theatre in Downtown Dallas, where Ann Coulter, Cenk Uygur, Nick Gillespie, and Bari Weiss spoke.

Like the debate, the post-debate interviews with the guest speakers focused on immigration.

DX asked Coulter, the author of numerous bestsellers, including ¡Adios, America! The Left’s Plan to Turn Our Country Into a Third World Hellhole, a 2015 attack on U.S. immigration policy, what she thought about Gov. Greg Abbott’s move to secure Eagle Pass.

“I was hoping something would incapacitate Trump so you [Texans] could write in Abbott’s name for the nomination,” Coulter quipped.

Coulter had previously supported former President Donald Trump, speaking at his rallies and releasing a book in 2016 titled In Trump We Trust: E Pluribus Awesome!

However, her relationship with him soured when Coulter believed, among other things, that he was not keeping his promises when it came to unlawful migration and immigration policy writ large.

In 2024, Coulter supported Florida Gov. Ron DeSantis, whom she often called “miracle Governor Ron DeSantis” because of his work to protect personal liberties during the COVID-19 pandemic lockdowns.

DeSantis even appeared on Coulter’s podcast, UNSAFE, shortly after he announced his presidential candidacy.

DeSantis eventually dropped out of the 2024 Republican primary, stating in a January 21, 2024, video, “It’s clear to me that a majority of Republican primary voters want to give Donald Trump another chance.”

Cenk Uygur, host of The Young Turks, also mentioned Trump when speaking with DX.

“Biden should’ve had his own immigration policy, and he never really had one,” Uygur said. “Biden is begging Trump to do Trump’s policy.”

Uygur clarified that he opposed Trump’s stance on migration but acknowledged that the 45th president’s plan contained a vision: “I don’t agree with Trump’s plan, but it signaled to his voters and his base that he was willing to do something.”

Gillespie’s sentiments were more expository. When asked about Eagle Pass and whether unlawful migration was a state’s rights issue, the former editor-in-chief of Reason.com and Reason TV said, “In general, border control is a federal issue, but whenever it fails, it gives rise to the states.”

He compared the matter to the issue of marijuana laws, noting what appears to be a political realignment concerning state rights because the federal government has been widely perceived as failing when it comes to unlawful migration.

True to her role as moderator, Bari Weiss did not speak to any issue directly. Instead, she spoke generally about the debate itself.

“The fact that Ann Coulter and Nick Gillespie can be on the same stage in 2024 gives me hope,” Weiss said.

She said the April 11 debate was “so exciting” because it was “in the spirit of the free press,” the namesake of the outlet she co-founded with Nellie Bowles after Weiss resigned from The New York Times. To Weiss, the event offered a “passionate, civil, and urgent debate to cities across the country.”

youtube

0 notes

Text

[ad_1]

Relating to investing in actual property, the Lone Star State of Texas persistently emerges as a best choice for patrons. With its vibrant financial system, inexpensive costs, and robust inhabitants development, Texas affords a plethora of alternatives for these seeking to construct their wealth by way of property investments.

One of many key components that makes Texas such a horny vacation spot for actual property buyers is its strong financial system. Because the second-largest state by way of each inhabitants and financial system, Texas boasts a various vary of industries, together with power, know-how, manufacturing, agriculture, and finance. This financial range helps to create stability and resilience, even throughout instances of nationwide financial downturns. The state's pro-business surroundings, low laws, and favorable tax insurance policies additional reinforce its attraction for buyers.

Affordability is one other important benefit that Texas actual property affords to patrons. In comparison with different main metropolitan areas within the nation, Texas cities like Houston, Dallas, Austin, and San Antonio present rather more inexpensive housing choices. This affordability issue not solely lures particular person homebuyers but additionally attracts buyers in search of rental properties. The decrease price of buying properties permits buyers to realize increased returns on their investments, making Texas an interesting vacation spot for each long-term and short-term revenue era.

Inhabitants development is one other essential driver for actual property funding in Texas. The state persistently experiences robust inhabitants development, which creates a excessive demand for housing items. A rising inhabitants not solely results in elevated house purchases and leases but additionally fuels demand for industrial properties similar to procuring facilities, workplace areas, and industrial services. This steady demand ensures a steady actual property market with alternatives for each speedy and long-term returns on funding.

Moreover, the Texas actual property market advantages from favorable migration patterns. Folks from different states, in addition to worldwide migrants, are drawn to Texas as a result of its job alternatives, decrease price of residing, and prime quality of life. The comparatively low price of residing, together with no state revenue tax, makes Texas an interesting selection for these in search of higher monetary stability and improved life-style choices.

Moreover, the varied geography and local weather of Texas cater to varied housing preferences. From metropolitan high-rises to suburban neighborhoods and rural ranches, the state affords a variety of decisions for buyers to diversify their portfolios. This range permits buyers to focus on totally different markets and meet the calls for of an ever-changing inhabitants.

Investing in Texas actual property has proven constant resilience, even throughout instances of nationwide financial upheaval. It presents a superb alternative for buyers in search of to diversify their portfolio and construct wealth by way of actual property. With its flourishing financial system, affordability, inhabitants development, and migration patterns, there isn't any doubt that the Lone Star State will proceed to draw patrons who acknowledge the untapped potential of this vibrant market.

[ad_2]

0 notes

Text

Insuring Dallas Dreams: The Versatility of Coverage Offered by Selected Benefits Inc

Introduction:

In the sprawling metropolis of Dallas, Texas, where life moves at a fast pace, having comprehensive insurance coverage is not just a prudent choice; it's a necessity. In the heart of this vibrant city, SelectedBenefits.com stands out as a beacon of reliability, offering insurance solutions tailored to individual needs. With a commitment to personalized service, SelectedBenefits.com ensures that each client receives the best coverage for their peace of mind.

Tailored Coverage for Every Need:

What sets SelectedBenefits.com apart is its dedication to understanding the unique needs of each client. Whether you're looking for health insurance, life insurance, or coverage for your home and automobile, the company takes the time to assess your requirements and craft a policy that fits you like a glove.

Health Insurance:

In a world where healthcare costs can be unpredictable and overwhelming, having the right health insurance is crucial. SelectedBenefits.com collaborates with leading health insurance providers to offer comprehensive plans that cover medical expenses, prescription costs, and other healthcare needs. With a focus on flexibility, these plans are designed to adapt to your lifestyle, ensuring you receive the care you need without breaking the bank.

Life Insurance:

Protecting your loved ones' financial future is a top priority, and SelectedBenefits.com understands the importance of life insurance. The company offers a range of life insurance policies, from term life insurance for budget-conscious individuals to whole life insurance for those seeking long-term financial security. These policies can be customized to meet specific family needs, providing peace of mind knowing that your loved ones are protected in the event of unforeseen circumstances.

Home and Auto Insurance:

For many Dallas residents, their home and automobile are among their most valuable assets. SelectedBenefits.com collaborates with reputable insurance providers to offer tailored home and auto insurance policies. From coverage for natural disasters to protection against accidents on the road, these policies are crafted to shield you from the unexpected, allowing you to navigate life with confidence.

Personalized Service:

SelectedBenefits.com takes pride in its commitment to personalized service. The company's team of experienced insurance professionals works closely with clients, providing expert guidance and answering any questions they may have. This hands-on approach ensures that clients feel informed and empowered to make decisions that align with their unique needs and circumstances.

Conclusion:

In the dynamic landscape of Dallas, Texas, having insurance coverage that adapts to your lifestyle is essential. SelectedBenefits.com emerges as a trusted partner in this journey, offering tailored insurance solutions that prioritize your peace of mind. With a commitment to personalized service and a diverse range of coverage options, SelectedBenefits.com stands out as a beacon of reliability in the Dallas insurance landscape. When it comes to safeguarding your health, securing your family's future, or protecting your assets, trust SelectedBenefits.com to provide the coverage you need.

For more info:

austin texas insurance coverage health

selected benefits

0 notes

Text

Why Choosing The Right Dallas Factoring Companies is Important

If you want to learn more about how our accounts receivable factoring solutions can help you, contact us today!

What are you to do if you have unpaid invoices and a mountain of bills waiting to be paid? For many businesses, invoice factoring provides a cash flow solution that many other financing options can’t: debt-free financial aid that is easy to get approved for.

Still, it is crucial to choose the right factoring services. There are many invoice factoring companies in Dallas, tx, but it is important to ensure the company you choose has your best interests in mind and will help your long-term goals.

Tips to Use When Making Your Decision

A company that is right for you will do more than just purchase your invoices. They will spend the time to get acquainted with your company and help you develop a plan for using your new funding source. When choosing a factoring company to work with, it is vital to look out for the right things. There are certain traits that factoring companies should have, including:

A clear and open communication policy

Realistic promises

Experience with companies similar to you

Adequate reviews and reputation

Transparent fees

Great planning and execution

Support for problems

If you want to learn more about how our accounts receivable factoring solutions can help you, contact us today!

0 notes