#bi panic: spike edition

Text

WIP Wednesday

We do this thing in the [Runs in the Blood server] every other week, where we post short excerpts from Fanged Four (and subpairing) stories that we're working on - about 4,000 characters. This is an off week, but here's my last snippet because I keep forgetting I have a tumblr and I wanted to post something! The context here is that in 1880, three months after Spike became a vampire, the family goes to Paris for a big vampire event. Some plot happened to their clothes on the way, so Angelus takes Spike to get an outfit to wear and they find something suitable on a young man near Le Chabanais, which is a popular Parisian brothel. He's wearing a green carnation on his lapel, which used to be a code for gay men, and so Angelus is about to take the opportunity to teach young Spike how to seduce the pants off someone.

The problem is Angelus is so bloody charming.

Not all the time, of course – certainly not during the late afternoon, that last hour before sunset, when they've been trapped indoors for hours and all four of them are beginning to get hungry, testy, twitchy. Sunlight itches, Spike decided early on. The idea of it itches, knowing it's sitting just on the other side of the wall waiting to devour you in flames. Watching Angelus itch during that hour every day is like looking 127 years into the future and seeing his own self still annoyed by the sun after all this time. Must be something you never get used to, no matter how much you train yourself to sit still and draw a fucking beautiful portrait of your sire cuddling Death like a lover as she poses in elegant but scandalous positions. He can sense it roiling just beneath the surface of Angelus and Darla both, the restlessness, the impatience, despite their calm exteriors. Spike's been experimenting with ways to escape that last hour itch by making love to Drusilla before sunset, but she's itchy and irritable during that time as well, and they always end up fucking wild and fast like they're angry at something – nothing like the way they love each other's bodies in the dark – but he's still finding angry sex to be a pretty great way to spend the time and Dru seems happy to take out her itchiness on him as well, so he hasn't begun to look for other distractions. Maybe in 127 years, he'll learn to draw.

But after the soothing sunset, and especially after the evening's first kill or caper, that's when Angelus turns on his ridiculous charm. Spike hates it, except when he forgets to hate it. It's confusing in a way that nothing else is anymore, not since he dug himself out of the earth. Now it feels as if everything in life has been made perfectly clear to him – everything but this one thing, this way that Angelus makes him feel when he's being so goddamn bloody fucking charming.

Just tonight, after they'd pushed the remains of supper off a bridge into the Seine and watched the very satisfying resulting sploosh (and after Darla had screamed and Dru had pretended to faint, and Angelus had spun a heartbreaking tale in French to the local Sûreté of trying to prevent the poor human couple from committing a tragic double suicide) the big vampire had been in such a pleasant and playful mood that as soon as they were alone again, he'd twirled Drusilla around and danced her halfway across the bridge and back, both of them laughing. He'd bowed to Darla, grinning, and then – then! – he'd grabbed Spike and danced him around the bridge as well. And in spite of himself, Spike had laughed heartily as they galloped around in a wide circle, full of warm Parisian blood and high on the feeling that there was nothing the four of them couldn't do and get away with, too, and then he took his own lively turn around the bridge with Dru and dipped her so low the tips of her hair swept across the cobblestones.

But when he looked up, Angelus wasn't watching.

It's not like Spike cares. Why should he care? He barely knows the git, certainly has no reason to want his attention. But the problem is this way Angelus has of making you feel a certain way and then stopping, like it's all some big game. You don't even get to play; you just get danced around the board laughing until you realize suddenly that Angelus has begun playing something else.

The problem is Spike keeps forgetting this is how it works, and then the problem is that he remembers.

That's why, as he watches Angelus talk quietly to the young man in the alley beside Le Chabanais, his head tilted down as he looks up with just his eyes, smiling, and brushes his fingertips over the petals of the pale green carnation on the man's lapel, as he sees the way this man has fallen immediately under the spell of Angelus's charm, Spike again has the same problem he's been having for the last three months, and he still can't figure out what to fucking do about it.

#fanged four#pro-spangel#spike btvs#angel btvs#girlpire wip wednesday#fanfic excerpt#i might start doing this every off week#if i remember i have a tumblr#bi panic: spike edition

2 notes

·

View notes

Text

anyway, guarma & colm-odriscoll-is-my-daddy (& friends) think abusive ships are a funny way to get under someone’s skin

JUST FYI: I woulda had this conversation in private, but @guarma keeps calling Erin a bitch with a god-complex, even though everything she accuses Erin of is something I did, and she refuses to acknowledge me. So no more private, she called me a pussy for not confronting her. Well here's the confront ig!

background context: people decided to start shitting on the Yehaw Function server again in another server (let’s say ‘A’ bc I do not wish to drag the owner into this, they were rarely online). @ssupeck21 thought it was perfectly fine to mock the gender and race of a two-spirited native trans guy. nice transphobia and racism there!

considering i remarked on it, they realized i knew him and suspected me of leaking the above screenshot to the YF server. i had already left this server at the end of february over several reasons, including erin’s server becoming my main one. i’m also reasonably sure i have mentioned no longer being in YF at some point. damage done: kate (guarma) and pongo ( @colm-odriscoll-is-my-daddy ) now think i’m “a spy” for YF. (ironic because @ssupeck21 let @jennyxbeans into erin’s server bc she was spying for jenn. and more irony later)

as proven in DM to someone later (oh no, a spied image?), they had the amazing idea to bait me and erin with something that is a massive trigger for me (bully/victim ships). some weirdness: by that time, i’d only made about 2 b/k posts on my blog, neither of which mentioned my trauma i’m pretty sure. erin meanwhile, wasn’t even in the original convi from the first screenshot, though she has mentioned she finds b/k gross.

so whilst this in its entirety is already immature in itself (really? you think someone is sending screenshots and wanna get ‘revenge’ when you constantly rely on getting screenshots yourself? yes i know someone leaked you screenshots of YF, kate). but also: for someone who talked about being abused and having anxiety, she should know better than use an abusive ship to get back at someone. because i’m 99% sure she knows b/k is a trigger for me; whilst not on my blog, i have had plenty of rants and vents in servers about how b/k is not good for my mental health and that it will make me panic.

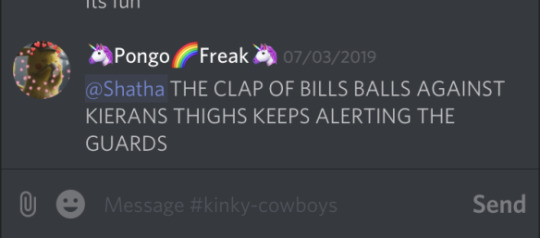

conversation #1 (i do not have screenshots of this): someone asked what everyone’s ships are in rdr2. bill/kieran gets mentioned, at some point i put rooWut (a disgusted looking emote) and remark something about abusive gay ships being cute to them. it gets glossed over, i leave.

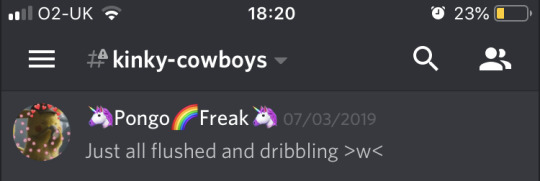

conversation #2. the conversation moves to the nsfw channel, where they pin the message in the above screenshot. ha ha , bully/victim ships are a funny joke! conversation moves on to arthur and other things until Pongo clearly feels like she wants to force a reaction out of me and/or erin. (living dead girl is erin, i am dan’s achy breaky heart).

at this point, my anxiety spikes and i put something along the lines of “my fist up your ass would look cute” in the vent chat of Erin’s server. NSFW with b/k is not good for me, at all. it made me flashback to something, i’m basically just trying to not have a panic attack. but ! ofc , why stop now.

pongo makes another comment, now not under a spoiler tag and clearly with the context of the DM to get another reaction out of me. erin puts a completely unrelated image to try and divert the conversation, because i’m like entirely losing it at this point---but kate and pongo think it’s hilarious to talk about actually shipping it and kate (micah bell’s dumb hair in the screenshots) is all “omg i wanna write a smut now for them”.

also: my nickname in this server includes ‘trans kieran’ at this point , either as just my url or like “lion ♡ trans kieran”. they all know i am a gay trans guy, even if some of them currently like to pretend they don’t know me. (hi, @morlawny who doesn’t even wanna say my name at this point despite being all nice in erin’s server.)

i can’t entirely remember my own message, nor do i have screenshots of it because i send it and left and they deleted it like straight after it seems (because an older screenshot, from the day itself, also didn’t have my message anymore). i left because at that point, i lost all ability to think straight. because someone can remark on b/k before and they’ll still be all “ha ha funny!”

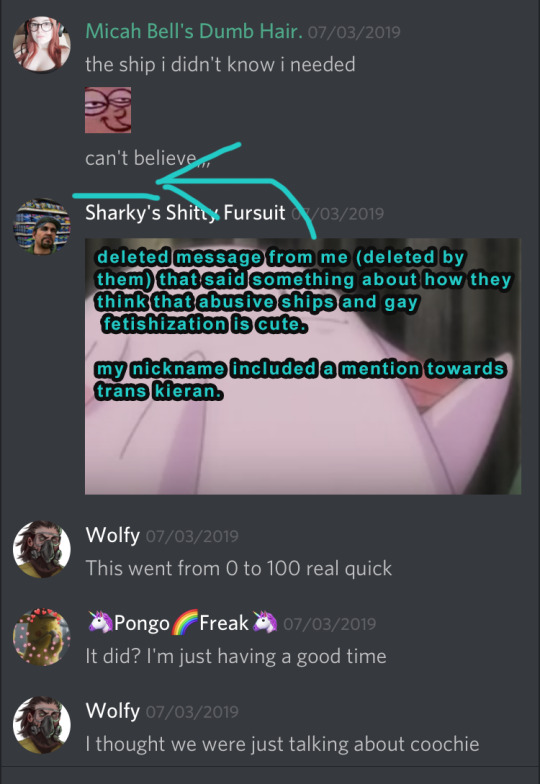

at this point, in erin’s server, two things happen. one friend of kate, who isn’t in the server this happened in, asks if she ships bill/kieran and kate admits her plan to just trigger me. because of this, kate starts acting like the victim and making me out like the bad guy who’s shittalking her and refuses to talk to her--which, during a panic attack and with my feelings very clear, i don’t need to.

secondly, another friend of kate decides my trauma is funny and starts to send kate (on request) screenshots of the vent conversation in erin’s server, starting from the goddamn my fist up your ass comment. the conversation also includes details of my trauma. my trauma is being send around like gossip.

also this happens in the server i left and i get send it:

i dunno what planet anyone is living on but, apparently my melt down was only good for one thing: getting mocked. “kieran’s coochie” is transphobic as fuck when you’re laughing at a trans guy getting upset over bill/kieran. especially when it’s very clear i hc kieran as trans. yet, pongo, wolfy ( @soulheartthewolf ) and kate seem to think it’s fucking hilarious.

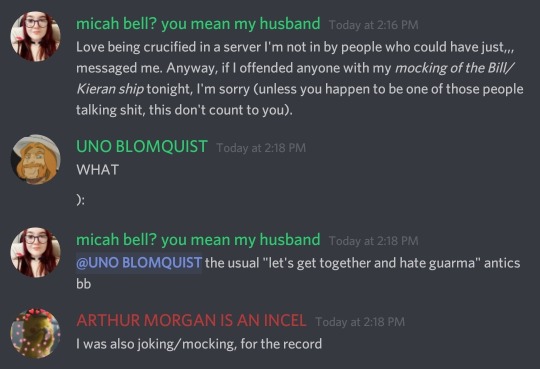

kate and pongo then try to play the “we were just joking!” card. when everyone i’ve had read those screenshots agrees nothing about it reads as a joke, and we’re now very sure they weren’t joking about, they were being vile and malicious. (but hey, what’s to expect from someone who says they’d fuck a fictional racist if he was real! that’s ... excusing racism, kate).

(guarma is micah bell? you mean my husband ;; pongo is arthur morgan is an incel. the other person is the artist who drew young micah, idk their url anymore)

“my mocking of the Bill/Kieran ship” I’m so sorry, Kate, but nothing about nsfw b/k and wanting to write a fic about it, reads as mocking. This entire “it’s just a joke!” doesn’t diminish the fact that you triggered a panic attack. Yes, I shittalked you, because I felt like it was goddamn deserved for "joking” about an abusive ship in a way that didn’t read as a joke. because after I left neither of you got the damn hint and just went straight for the transphobia. It’s not get together and hate guarma, it’s “lion has a panic attack and will actually react insanely aggressively about the things that upset him”. You can turn and twist this into you being the victim all you want, but you ain’t. You’re a pathetic example of a 19 year old who thinks it’s funny to trigger flashbacks and panic attacks. I didn’t talk to you, because at the time the only thing I would’ve probably said, which is also what I’m saying now, is: go shove an entire cactus up your ass, you pathetic cunt of a human being.

Leave Erin out of this, it’s goddamn hilarious you keep going after a cis bi woman instead of after me, a gay trans guy, and god I fucking wonder why.

You interact with people who think they can just be racist and transphobic towards anyone they like ( @ssupeck21 ), with people who’ll willing send you all the screenshots you want, with people who send anon hate ( @jennyxbeans ), you’re treating trauma and abuse like a joke and then have the gal to be all “i’d never because i have anxiety!” No. Own up to your shit.

(I could go on in this post about how she’s just as bad a shittalking, leaked screenshot-wanting piece of shit but hey, the post is very long already so whatever).

edit: i have deleted screenshot leaking accusations towards morlawny bc i can’t actually prove them but i’m keeping up the thing where you decided to be all nice to me in servers, but then turned around and were all “idk kate didn’t say any of that” (i literally know u were there for those conversations, your name in screenshots!) and tried to defend her constantly in a DM with someone.

52 notes

·

View notes

Text

Text Masterlist

(this is going from oldest to newest)

Peter has a field trip to Oscorp. Tony hates Oscorp. (part two)

Is Tony a member of the illuminati?

Peter’s had a long day at school

Neither Peter nor Tony can sleep (pure fluff)

Peter needs money for a new backpack

Peter and Tony talk one another down from their post-nightmare anxieties

It’s Tony’s birthday and Peter is EXCITED (part two) (part three)

Tony checks in on a sick Peter

Spider-Man is scared of spiders

Tony helps Peter with his problems, and Peter accidentally calls him dad

There was a crash on the subway and Tony is worried

Peter gets detention

Tony texts Peter after the snap (angst) + Peter finally replies

Peter and Ned go to a party, and Peter gets spiked (part two)

Tony plans for Peter’s birthday... six months away

A teacher gave Peter an F, and Tony is not happy about it + Tony gets him his A

Peter accidentally texts Tony about his upcoming date, and Bi Buddies is formed

Peter’s class got to Stark Industries, and Pete is sassy over text

Peter worries Tony is hurt after a mission, ft Rhodey and Tony calling Pete his kid

Peter has a panic attack and Tony is there to help (part two)

Peter has questions about Howard, which leads to a heart to heart about how good of a dad Tony is

Peter vs Tony: Movie Night Edition

Peter stays out late, and he and Tony argue (part two)

Peter asks Tony to Pride, bc they’re Bi Buddies

Tony has a panic attack, Peter helps (part two)

McDonalds got in Spider-Man toys, and Peter is excited

May goes away for the weekend and Tony wants Pete to stay with him

Peter doesn’t want to lose anyone else

Tony worries about Peter’s well being, ft trans!peter

Tony gets Peter help with with a history project and they gossip about Avengers

The Avengers know Peter as Spiderson

Tony tells Pete about Aunt Peggy

Peter helps a stray dog

Flash gives Peter trouble, and so Tony gives Flash trouble in return

Peter babysits and worries about how he’s doing

Spider-Man helps a lost kid

Peter gets drunk and tries to act sober (part two of the following morning)

Peter’s feeling depressed and Tony helps

RIP Emoji Rule

Peter helps Tony after a nightmare

Tony adds in some custom auto-corrections on Peter’s phone

Flash uploaded an embarrassing video of Peter online + Tony takes it down

Tony puts an end to Peter wanting to go back to space

Peter breaks something in a store and Tony comes to the rescue

Kids at school find out Peter actually does know Tony

Tony asks Peter to be his page boy

May asks Tony to go to a parent teacher conference

Pete goes in to sensory overload and Tony helps

Pete and Thor’s day out (part two)

Peter is ill and stresses Tony out

Adventures in Disneyland (part two)

Peter realises he lifted Stormbreaker

Peter gets into a fight after defending Tony

Rhodey vs Happy: Uncle off

Tony and Peter plan for fathers day

Tony helps Peter out on patrol

Tony is away for business and Peter misses him (part two)

Tony gets jealous when Peter spends a lot of time with Rhodey

Peter’s phone dies and stresses Tony out

Natasha notices Peter’s enhanced metabolism

Tony accidentally texts Peter about Peter

Bi Buddies gain two members when Tony finds out about Bruce and Thor

Peter got a job, which isn’t part of Tony’s plan

Peter’s in the hospital and freaks out to Tony

Tony texts Peter while he’s in class and gets him detention

Peter tells tony about the guy that ghosted him

There trouble in the city and Tony tells Peter to stay put

Peter feels better when he’s around Tony and Tony doesn’t understand

Flash takes things too far + Tony recruits a certain Uncle to help teach Flash a lesson

Clint has questions about Peter

The press find out about Tony being close to Peter

Ned and MJ tell Peter the rumours about him in school, and Tony thinks they’re hilarious

Peter hit his head while out on patrol and Tony has to go find him

Thor wants to take Tony out, which turns into Thor vs Tony (tony will always win)

Rhodey recruits Spider-Man’s help and Peter gets hurt

Tony’s having a tough day and says some stuff he doesn’t mean + he apologises afterwards

Avengers gc in which they ask about Peter

Steve’s back in town and Peter’s worried about Tony (part two)

Peter calls Rhodey for help, which pisses Tony off

Tony feels guilty about Titan and tries to push Peter away (part two)

Tony finds out about The Lip Sync and he LOVES it

May gets hurt and Peter becomes a helicopter nephew (part two)

According to a buzzfeed quiz, Peter is Captain America, but he really wants to be Tony

Tony gets hurt, Peter worries, Tony really just wants his kid there with him

Tony takes Pete to the compound and certain avengers are excited to meet him, but Pete freaks out when he sees Steve and Bucky (part two)

Spider-Man gets a flavour of Ben and Jerry’s named after him

Peter asks if he’s still an Avenger

Quill wants to take Peter to space and Tony rants to Rhodey about his worries

Flash steals Peter’s phone and Tony goes off on him

Peter looks at college and Tony gets emotional

Happy notices Peter is off and Tony reaches out to him (part two)

Round two of Thor and Peter’s outing, ft Loki and a stressed out Tony

Tony’s on a mission and tries to say goodbye to Pete (part two)

Tony finds Peter’s fan account + bonus of Tony gushing to Rhodey about it

There’s an alien invasion, Tony and Pete argue, Peter gets hurt (part two) (part three)

Pete asks about the suit protocol names

Pete needs advice on how to talk to a pretty person and Tony is dramatic

Tony stalks Peter’s fan account, and makes his own for web-head

Pete and Tony sort the Avengers into Hogwarts houses

Peter skips school to be Spider-Man and gets caught out

Peter thinks he’s letting Tony down, and so he pushes him self as Spider-Man

The Avengers want to get to know Pete, but Pete has anxieties

Peter and May have an argument, ft co-parenting Tony and May

Tony texting a Still Gone Peter on the kids birthday

Tony throws Peter a surprise party for his birthday

It’s the anniversary of Peter’s parents deaths, and Pete needs Tony

Peter’s day with Black Widow and Ant-Man

1K notes

·

View notes

Text

Trump needs a market scape goat

Editor’s Note: This edition of Free Morning Money is published weekdays at 8 a.m. POLITICO Pro Financial Services subscribers hold exclusive early access to the newsletter each morning at 5:15 a.m. To learn more about POLITICO Pro’s comprehensive policy intelligence coverage, policy tools and services, click here.

PROGRAMMING NOTE: Morning Money will not publish on Thursday, Nov. 22 and Friday, Nov. 23. Our next Morning Money newsletter will publish on Monday, Nov. 26.

Story Continued Below

TRUMP NEEDS A SCAPEGOAT — Another brutal day on Wall Street and President Trump once again decided to blame Fed Chair Jay Powell rather than face the reality that the U.S. economy is likely to slow down next year as the tax cut stimulus fades, a trade war with China looms and the deficit spikes higher with demand for U.S. debt declining.

The Fed is doing exactly what it’s supposed to at a time of very low unemployment and rising wages. And every time Trump bashes the central bank he makes it LESS likely that the Fed will look at sluggish growth numbers and sagging stocks and decides to slow down its pace of rate hikes. The central bank cannot allow itself to be viewed as caving to Trump or it will erode its independence and lose credibility with markets.

It seems clear that Trump – even as senior advisers tell him to leave Powell alone – is much more interested in having a fall guy to blame for the market decline than he is about having a better shot at the Fed pausing in December or reducing the number of hikes expected next year. For the moment he needs to blame the fact that markets are now down for the year or someone other than himself. And that person is Jay Powell.

And this is exactly what he did on Tuesday: “I’d like to see the Fed with a lower interest rate. I think the rate’s too high. I think we have much more of a Fed problem than we have a problem with anyone else,” Trump told reporters outside the White House. “I think your tech stocks have some problems.”

WHAT THE MARKET NEEDS: PANIC! — Leuthold’s Jim Paulsen emails on what might stop the market swoon: “Primarily, PANIC — a capitulation and widespread belief that a recession is imminent and the bull is over — that may represent one last great buying opportunity if we do not have a recession. So far most of the corrections this year have been calm, well controlled and thought of more as refreshing pauses made to ‘buy on the dip’ rather than things to run from. When we do bottom, I expect ‘panic’ to be widespread among the media stories and investors.”

Cumberland’s David Kotok emails: “Washout comes at any time in panic selling. This is what one gets from a Trade War. Thank you Peter Navarro. Now up to POTUS to make a truce in Buenos Aires. Then everyone wins. No truce, everyone loses more.”

HOW TRUMP MEASURES UP — Via Bespoke Investment Group: “It may sound hard to believe, but for all the talk about how well the stock market has done under President Trump, the Dow … is actually up less (25.69 percent) since he took office than it was under President Obama (40.94%) at the same point in his Presidency.” Read more.

Mohamed El-Erian in the FT — “Life would be better for equity investors if the transition from quantitative easing and ultra-low interest rates was unfolding against a backdrop of solid economic growth. Instead, the global economy is losing momentum and the divergence between advanced economies is growing.

“As a result, financial market choppiness has been ruling the day and unsettling investors. That leaves portfolios more vulnerable to technical dislocations and behavioural biases. Having been conditioned over the past decade to expect central banks to repress financial volatility and flinch at the first sign of market vulnerabilities, traders and investors are only slowly coming to terms with the less pleasant reality of a world of tighter liquidity.”

Read more.

ENERGY SECTOR BLUES — Bloomberg Opinion’s Liam Denning: “If coming last in a popularity contest stings, consider how it feels to come first in an unpopularity contest. In Tuesday’s mass defriending of stocks, the energy sector managed to stand out in the worst possible way.

“The whiplash here is incredible. In early October Nymex crude oil was trading at more than $76 a barrel and the S&P 1500 exploration and production index was at its highest level in more than three years. Since then, they’re down 28 percent and 20 percent respectively. In relative terms, E&P stocks are trading at their lowest level on forward [earnings] multiples since Christmas 2008, another holiday season not noted for its bounding optimism” Read more.

WHAT IS THE FED TO DO? — Pantheon’s Ian Shepherdson: “Expectations for a March rate hike have dipped since Fed Vice-Chair Clarida’s CNBC interview last Friday. The renewed drop in stock prices hasn’t helped, either. But we aren’t at all sure that Mr. Clarida wanted his words to be interpreted as a dovish signal. …

“And this year, the numbers have been strong enough for the Fed—probably—to hike four times, one more than expected at the start of the year. In other words, numbers which were soft enough to stay the Fed’s hand in 2016, say, would not be enough now to do the same, given that the unemployment rate is now 3.7% and still falling, and wage growth is at 3% and rising.”

NEW THIS A.M.: SOFT GLOBAL OUTLOOK — From the OECD’s latest economic outlook out at 5:00 a.m. EST this morning: “The global economy is navigating rough seas. Global GDP growth is strong but has peaked. In many countries unemployment is well below pre-crisis levels, labour shortages are biting and inflation remains tepid.

“Yet, global trade and investment have been slowing on the back of increases in bilateral tariffs while many emerging market economies are experiencing capital outflows and a weakening of their currencies. The global economy looks set for a soft landing, with global GDP growth projected to slow from 3.7 percent in 2018 to 3.5 percent in 2019-20.

“However, downside risks abound and policy makers will have to steer their economies carefully towards sustainable, albeit slower, GDP growth. Engineering soft landings has always been a delicate exercise and is especially challenging today.”

The OECD has the U.S. growing at a 2.7 percent pace in 2019 and 2.1 percent in 2020, hardly numbers Trump would celebrate.

A LEAD FOR THE AGES — Via the NYT’s Mark Lander: “President Trump defied the nation’s intelligence agencies and a growing body of evidence on Tuesday to declare his unswerving loyalty to Saudi Arabia, asserting that Crown Prince Mohammed bin Salman’s culpability for the killing of Jamal Khashoggi might never be known.” Read more.

GOOD WEDNESDAY MORNING — Wishing a blessed and peaceful Thanksgiving to all. Don’t talk politics around the table. Email me on [email protected] and follow me on Twitter @morningmoneyben. Email Aubree Eliza Weaver at [email protected] and follow her on Twitter @AubreeEWeaver.

THIS MORNING ON POLITICO PRO FINANCIAL SERVICES — Victoria Guida: BANK PROFITS SOAR IN WAKE OF TAX CUTS, REGULATORY ROLLBACKS — “Bank profits continue to hit new highs, reaching a record $62 billion in the third quarter, as lenders reap the benefits of lower taxes and looser regulations. Third quarter bank profits were up 29.3 percent from the same period last year, according to new data from the Federal Deposit Insurance Corp., and only 3.5 percent of banks were unprofitable, compared to 4 percent a year ago. The data was released hours after the FDIC voted to sign on to a Federal Reserve proposal to ease a range of capital and liquidity requirements on large regional banks. Roughly half of the increase in net income was due to tax reform, the FDIC said, but profits for the quarter still would have been $54.6 billion without that.” Read more.

THE ADAGE “WORK HARD AND GET AHEAD” is a waning reality in America today. The question is: What can Washington do to foster more opportunity and prosperity in struggling communities across the country? POLITICO convened a bipartisan group of 14 business leaders, thinkers and policymakers to explore the problem and identify solutions that have a realistic path forward with political leaders of both parties. Read the latest issue of The Agenda to learn more.

DRIVING THE DAY — Big pile of economic data today ahead of the holiday for markets to chew on including durable goods orders at 8:30 a.m. which are expected to drop 2.2 percent headline and rise 0.4 percent ex-transportation. Existing Home Sales at 10:00 a.m. expected to rise to 5.20M from 5.15M … Univ. of Michigan Consumer Sentiment at 10:00 a.m. expected to be unchanged at 98.3 … Index of Leading Indicators at 10:00 a.m. expected to rise 0.1 percent

FOWL NEWS: PARDONED TURKEYS DIE QUICKLY — POLITICO’s Sarah Zimmerman: “A pardon from … Trump ensures that this year’s National Thanksgiving Turkey — now known as Peas — won’t be anyone’s dinner on Thursday, but it’s unlikely he’ll see another Thanksgiving. …

“[T]he reality for Peas and Carrots is not a long life in country retirement. Like all other turkeys that are raised for human consumption, they’ve been bred to be plump and tasty, but they grow so big that they are likely to suffer from a variety of health problems that put their lifespan at less than a year.” Read more.

BI-PARTISAN PUSH FOR TREAUSRY TRANSPARENCY — POLITICO’s Zachary Warmbrodt: “A bipartisan group of senators is pushing the Trump administration to move ahead with plans to give the public a greater view into the market for U.S. Treasury securities, which is critical to government funding and the broader financial system.

“In a joint letter to Treasury Secretary Steven Mnuchin, Sen. Mark Warner (D-Va.), Banking Chairman Mike Crapo (R-Idaho) and Sen. Thom Tillis (R-N.C.) touted the benefits of more transparency and asked when officials would roll out a plan for increased disclosure.” Read more

MARKETS UNLIKELY TO STOP THE FED — WSJ’s Nick Timiraos and Gregory Zuckerman: “Market turbulence is leading some investors to call on the Fed … to halt its campaign of interest rate increases, but the selloff in stocks and corporate bonds that accelerated Tuesday is unlikely to stop the central bank from raising rates when it meets again next month.

“Fed officials have signaled in recent days they plan to proceed with another quarter percentage point increase … when they meet Dec. 19, marking their fourth rate increase this year. The market pullback does underscore however the uncertain outlook for what the Fed will do after that. Fed officials are divided over how many times the central bank will raise rates next year” Read more.

IS THE SLIDE A WARNING ON THE ECONOMY? — NYT’s Matt Phillips: “Unemployment is near lows not seen in half a century. The American economy is set for its best year since 2005. Large corporations are producing giant profits. Even wages are starting to rise.

And the stock markets are a mess. The losses extended on Tuesday, as the S&P 500-stock index turned negative for the year, stoking fears that one of the longest bull markets in history could be at risk.

“The stock market’s struggles may seem incongruous against the backdrop of strong economic growth. But stocks often act as an early warning system, picking up subtle changes before they appear in the economic data.” Read more.

No corner of the market was left unscathed — Bloomberg’s Lu Wang, Elena Popina and Vildana Hajric: “One of the toughest years for financial markets in half a century got appreciably worse Tuesday, with simmering weakness across assets boiling over to leave investors with virtually nowhere to hide. Stocks buckled for a second day, sending the S&P 500 careening toward a correction. Oil plumbed depths last seen a year ago, while credit markets — recently impervious — showed signs of shaking apart. Bitcoin is in a freefall, while traditional havens like Treasuries, gold and the yen stood still.

“Add it all up — the 2 percent drop in equities, oil’s 6 percent plunge, the downdraft in corporate bonds — and markets ended up doling out one of the worst single-session losses since 2015. The S&P 500 erased its gain for 2018, oil tumbled to a one-year low and and an ETF tracking junk bonds capped its worst streak of declines since 2014.” Read more.

OIL TANKS — FT’s Anjli Raval in London: “Oil prices plunged again on Tuesday, with Brent crude seeing its 2018 gains wiped out as concerns about swelling global supplies continued to sour sentiment among investors. Brent, the international crude oil benchmark, fell as much as 7.6 per cent, or $5.08 a barrel, to hit $61.71, its lowest point in more than 11 months. …

“[P]ledges by big producers such as Saudi Arabia to raise output have stoked fears that the world could be entering a period of oversupply. … Trump reinforced these expectations on Tuesday when he called the kingdom a ‘steadfast partner’ despite probes linking the killing of US-based journalist Jamal Khashoggi to Mohammed bin Salman, the Saudi crown prince and de facto ruler of the country.” Read more.

ZUCK/SANDBERG PLAN TO STAY — POLITICO’s Cristiano Lima: “Facebook CEO Mark Zuckerberg said Tuesday he plans to stay on as company chairman and work with COO Sheryl Sandberg ‘for decades more to come,’ remarks that come amid mounting scrutiny of their management efforts.

“The embattled Facebook chief was pressed on whether he plans to step down from leading the company board. ‘That’s not the plan,’ he told CNN. ‘I’m certainly not currently thinking that that makes sense.’ The remarks came during Zuckerberg’s first interview since The New York Times reported on Facebook’s ties to the Definers Public Affairs communications firm, which sought to link critics of the company to liberal financier George Soros, a favorite target for conservative criticism.” Read more.

TRANSACTIONAL TRUMP —WP’s Anne Gearan: “Trump’s declaration Tuesday that he won’t hold Saudi rulers accountable for the killing of journalist Jamal Khashoggi distilled the president’s foreign policy approach to its transactional and personalized essence. Nearly two years into his presidency, Trump is unswerving in his instinct to make everything — from trade to terrorism, from climate change to human rights — about what he sees as the bottom line. …

“He cited arms sales with the kingdom, its role as a bulwark against Iran and the threat of higher oil prices as risks to the United States if his administration ruptured the relationship over the Khashoggi killing.” Read more.

SMALL BUSINESS SATURDAY GAINS STEAM — Via a new survey from Consumers’ Research: “Small Business Saturday continues to gain in popularity with consumers as Black Friday continues to lose favor. Additionally, while online shopping remains prevalent, consumers are showing they still like and take advantage of the in-store option.” Read more.

Source link

from RSSUnify feed https://hashtaghighways.com/2018/11/22/trump-needs-a-market-scape-goat/

from Garko Media https://garkomedia1.tumblr.com/post/180388516869

0 notes

Text

Trump needs a market scape goat

Editor’s Note: This edition of Free Morning Money is published weekdays at 8 a.m. POLITICO Pro Financial Services subscribers hold exclusive early access to the newsletter each morning at 5:15 a.m. To learn more about POLITICO Pro’s comprehensive policy intelligence coverage, policy tools and services, click here.

PROGRAMMING NOTE: Morning Money will not publish on Thursday, Nov. 22 and Friday, Nov. 23. Our next Morning Money newsletter will publish on Monday, Nov. 26.

Story Continued Below

TRUMP NEEDS A SCAPEGOAT — Another brutal day on Wall Street and President Trump once again decided to blame Fed Chair Jay Powell rather than face the reality that the U.S. economy is likely to slow down next year as the tax cut stimulus fades, a trade war with China looms and the deficit spikes higher with demand for U.S. debt declining.

The Fed is doing exactly what it’s supposed to at a time of very low unemployment and rising wages. And every time Trump bashes the central bank he makes it LESS likely that the Fed will look at sluggish growth numbers and sagging stocks and decides to slow down its pace of rate hikes. The central bank cannot allow itself to be viewed as caving to Trump or it will erode its independence and lose credibility with markets.

It seems clear that Trump – even as senior advisers tell him to leave Powell alone – is much more interested in having a fall guy to blame for the market decline than he is about having a better shot at the Fed pausing in December or reducing the number of hikes expected next year. For the moment he needs to blame the fact that markets are now down for the year or someone other than himself. And that person is Jay Powell.

And this is exactly what he did on Tuesday: “I’d like to see the Fed with a lower interest rate. I think the rate’s too high. I think we have much more of a Fed problem than we have a problem with anyone else,” Trump told reporters outside the White House. “I think your tech stocks have some problems.”

WHAT THE MARKET NEEDS: PANIC! — Leuthold’s Jim Paulsen emails on what might stop the market swoon: “Primarily, PANIC — a capitulation and widespread belief that a recession is imminent and the bull is over — that may represent one last great buying opportunity if we do not have a recession. So far most of the corrections this year have been calm, well controlled and thought of more as refreshing pauses made to ‘buy on the dip’ rather than things to run from. When we do bottom, I expect ‘panic’ to be widespread among the media stories and investors.”

Cumberland’s David Kotok emails: “Washout comes at any time in panic selling. This is what one gets from a Trade War. Thank you Peter Navarro. Now up to POTUS to make a truce in Buenos Aires. Then everyone wins. No truce, everyone loses more.”

HOW TRUMP MEASURES UP — Via Bespoke Investment Group: “It may sound hard to believe, but for all the talk about how well the stock market has done under President Trump, the Dow … is actually up less (25.69 percent) since he took office than it was under President Obama (40.94%) at the same point in his Presidency.” Read more.

Mohamed El-Erian in the FT — “Life would be better for equity investors if the transition from quantitative easing and ultra-low interest rates was unfolding against a backdrop of solid economic growth. Instead, the global economy is losing momentum and the divergence between advanced economies is growing.

“As a result, financial market choppiness has been ruling the day and unsettling investors. That leaves portfolios more vulnerable to technical dislocations and behavioural biases. Having been conditioned over the past decade to expect central banks to repress financial volatility and flinch at the first sign of market vulnerabilities, traders and investors are only slowly coming to terms with the less pleasant reality of a world of tighter liquidity.”

Read more.

ENERGY SECTOR BLUES — Bloomberg Opinion’s Liam Denning: “If coming last in a popularity contest stings, consider how it feels to come first in an unpopularity contest. In Tuesday’s mass defriending of stocks, the energy sector managed to stand out in the worst possible way.

“The whiplash here is incredible. In early October Nymex crude oil was trading at more than $76 a barrel and the S&P 1500 exploration and production index was at its highest level in more than three years. Since then, they’re down 28 percent and 20 percent respectively. In relative terms, E&P stocks are trading at their lowest level on forward [earnings] multiples since Christmas 2008, another holiday season not noted for its bounding optimism” Read more.

WHAT IS THE FED TO DO? — Pantheon’s Ian Shepherdson: “Expectations for a March rate hike have dipped since Fed Vice-Chair Clarida’s CNBC interview last Friday. The renewed drop in stock prices hasn’t helped, either. But we aren’t at all sure that Mr. Clarida wanted his words to be interpreted as a dovish signal. …

“And this year, the numbers have been strong enough for the Fed—probably—to hike four times, one more than expected at the start of the year. In other words, numbers which were soft enough to stay the Fed’s hand in 2016, say, would not be enough now to do the same, given that the unemployment rate is now 3.7% and still falling, and wage growth is at 3% and rising.”

NEW THIS A.M.: SOFT GLOBAL OUTLOOK — From the OECD’s latest economic outlook out at 5:00 a.m. EST this morning: “The global economy is navigating rough seas. Global GDP growth is strong but has peaked. In many countries unemployment is well below pre-crisis levels, labour shortages are biting and inflation remains tepid.

“Yet, global trade and investment have been slowing on the back of increases in bilateral tariffs while many emerging market economies are experiencing capital outflows and a weakening of their currencies. The global economy looks set for a soft landing, with global GDP growth projected to slow from 3.7 percent in 2018 to 3.5 percent in 2019-20.

“However, downside risks abound and policy makers will have to steer their economies carefully towards sustainable, albeit slower, GDP growth. Engineering soft landings has always been a delicate exercise and is especially challenging today.”

The OECD has the U.S. growing at a 2.7 percent pace in 2019 and 2.1 percent in 2020, hardly numbers Trump would celebrate.

A LEAD FOR THE AGES — Via the NYT’s Mark Lander: “President Trump defied the nation’s intelligence agencies and a growing body of evidence on Tuesday to declare his unswerving loyalty to Saudi Arabia, asserting that Crown Prince Mohammed bin Salman’s culpability for the killing of Jamal Khashoggi might never be known.” Read more.

GOOD WEDNESDAY MORNING — Wishing a blessed and peaceful Thanksgiving to all. Don’t talk politics around the table. Email me on [email protected] and follow me on Twitter @morningmoneyben. Email Aubree Eliza Weaver at [email protected] and follow her on Twitter @AubreeEWeaver.

THIS MORNING ON POLITICO PRO FINANCIAL SERVICES — Victoria Guida: BANK PROFITS SOAR IN WAKE OF TAX CUTS, REGULATORY ROLLBACKS — “Bank profits continue to hit new highs, reaching a record $62 billion in the third quarter, as lenders reap the benefits of lower taxes and looser regulations. Third quarter bank profits were up 29.3 percent from the same period last year, according to new data from the Federal Deposit Insurance Corp., and only 3.5 percent of banks were unprofitable, compared to 4 percent a year ago. The data was released hours after the FDIC voted to sign on to a Federal Reserve proposal to ease a range of capital and liquidity requirements on large regional banks. Roughly half of the increase in net income was due to tax reform, the FDIC said, but profits for the quarter still would have been $54.6 billion without that.” Read more.

THE ADAGE “WORK HARD AND GET AHEAD” is a waning reality in America today. The question is: What can Washington do to foster more opportunity and prosperity in struggling communities across the country? POLITICO convened a bipartisan group of 14 business leaders, thinkers and policymakers to explore the problem and identify solutions that have a realistic path forward with political leaders of both parties. Read the latest issue of The Agenda to learn more.

DRIVING THE DAY — Big pile of economic data today ahead of the holiday for markets to chew on including durable goods orders at 8:30 a.m. which are expected to drop 2.2 percent headline and rise 0.4 percent ex-transportation. Existing Home Sales at 10:00 a.m. expected to rise to 5.20M from 5.15M … Univ. of Michigan Consumer Sentiment at 10:00 a.m. expected to be unchanged at 98.3 … Index of Leading Indicators at 10:00 a.m. expected to rise 0.1 percent

FOWL NEWS: PARDONED TURKEYS DIE QUICKLY — POLITICO’s Sarah Zimmerman: “A pardon from … Trump ensures that this year’s National Thanksgiving Turkey — now known as Peas — won’t be anyone’s dinner on Thursday, but it’s unlikely he’ll see another Thanksgiving. …

“[T]he reality for Peas and Carrots is not a long life in country retirement. Like all other turkeys that are raised for human consumption, they’ve been bred to be plump and tasty, but they grow so big that they are likely to suffer from a variety of health problems that put their lifespan at less than a year.” Read more.

BI-PARTISAN PUSH FOR TREAUSRY TRANSPARENCY — POLITICO’s Zachary Warmbrodt: “A bipartisan group of senators is pushing the Trump administration to move ahead with plans to give the public a greater view into the market for U.S. Treasury securities, which is critical to government funding and the broader financial system.

“In a joint letter to Treasury Secretary Steven Mnuchin, Sen. Mark Warner (D-Va.), Banking Chairman Mike Crapo (R-Idaho) and Sen. Thom Tillis (R-N.C.) touted the benefits of more transparency and asked when officials would roll out a plan for increased disclosure.” Read more

MARKETS UNLIKELY TO STOP THE FED — WSJ’s Nick Timiraos and Gregory Zuckerman: “Market turbulence is leading some investors to call on the Fed … to halt its campaign of interest rate increases, but the selloff in stocks and corporate bonds that accelerated Tuesday is unlikely to stop the central bank from raising rates when it meets again next month.

“Fed officials have signaled in recent days they plan to proceed with another quarter percentage point increase … when they meet Dec. 19, marking their fourth rate increase this year. The market pullback does underscore however the uncertain outlook for what the Fed will do after that. Fed officials are divided over how many times the central bank will raise rates next year” Read more.

IS THE SLIDE A WARNING ON THE ECONOMY? — NYT’s Matt Phillips: “Unemployment is near lows not seen in half a century. The American economy is set for its best year since 2005. Large corporations are producing giant profits. Even wages are starting to rise.

And the stock markets are a mess. The losses extended on Tuesday, as the S&P 500-stock index turned negative for the year, stoking fears that one of the longest bull markets in history could be at risk.

“The stock market’s struggles may seem incongruous against the backdrop of strong economic growth. But stocks often act as an early warning system, picking up subtle changes before they appear in the economic data.” Read more.

No corner of the market was left unscathed — Bloomberg’s Lu Wang, Elena Popina and Vildana Hajric: “One of the toughest years for financial markets in half a century got appreciably worse Tuesday, with simmering weakness across assets boiling over to leave investors with virtually nowhere to hide. Stocks buckled for a second day, sending the S&P 500 careening toward a correction. Oil plumbed depths last seen a year ago, while credit markets — recently impervious — showed signs of shaking apart. Bitcoin is in a freefall, while traditional havens like Treasuries, gold and the yen stood still.

“Add it all up — the 2 percent drop in equities, oil’s 6 percent plunge, the downdraft in corporate bonds — and markets ended up doling out one of the worst single-session losses since 2015. The S&P 500 erased its gain for 2018, oil tumbled to a one-year low and and an ETF tracking junk bonds capped its worst streak of declines since 2014.” Read more.

OIL TANKS — FT’s Anjli Raval in London: “Oil prices plunged again on Tuesday, with Brent crude seeing its 2018 gains wiped out as concerns about swelling global supplies continued to sour sentiment among investors. Brent, the international crude oil benchmark, fell as much as 7.6 per cent, or $5.08 a barrel, to hit $61.71, its lowest point in more than 11 months. …

“[P]ledges by big producers such as Saudi Arabia to raise output have stoked fears that the world could be entering a period of oversupply. … Trump reinforced these expectations on Tuesday when he called the kingdom a ‘steadfast partner’ despite probes linking the killing of US-based journalist Jamal Khashoggi to Mohammed bin Salman, the Saudi crown prince and de facto ruler of the country.” Read more.

ZUCK/SANDBERG PLAN TO STAY — POLITICO’s Cristiano Lima: “Facebook CEO Mark Zuckerberg said Tuesday he plans to stay on as company chairman and work with COO Sheryl Sandberg ‘for decades more to come,’ remarks that come amid mounting scrutiny of their management efforts.

“The embattled Facebook chief was pressed on whether he plans to step down from leading the company board. ‘That’s not the plan,’ he told CNN. ‘I’m certainly not currently thinking that that makes sense.’ The remarks came during Zuckerberg’s first interview since The New York Times reported on Facebook’s ties to the Definers Public Affairs communications firm, which sought to link critics of the company to liberal financier George Soros, a favorite target for conservative criticism.” Read more.

TRANSACTIONAL TRUMP —WP’s Anne Gearan: “Trump’s declaration Tuesday that he won’t hold Saudi rulers accountable for the killing of journalist Jamal Khashoggi distilled the president’s foreign policy approach to its transactional and personalized essence. Nearly two years into his presidency, Trump is unswerving in his instinct to make everything — from trade to terrorism, from climate change to human rights — about what he sees as the bottom line. …

“He cited arms sales with the kingdom, its role as a bulwark against Iran and the threat of higher oil prices as risks to the United States if his administration ruptured the relationship over the Khashoggi killing.” Read more.

SMALL BUSINESS SATURDAY GAINS STEAM — Via a new survey from Consumers’ Research: “Small Business Saturday continues to gain in popularity with consumers as Black Friday continues to lose favor. Additionally, while online shopping remains prevalent, consumers are showing they still like and take advantage of the in-store option.” Read more.

Source link

Source: https://hashtaghighways.com/2018/11/22/trump-needs-a-market-scape-goat/

from Garko Media https://garkomedia1.wordpress.com/2018/11/22/trump-needs-a-market-scape-goat/

0 notes

Text

Trump needs a market scape goat

Editor’s Note: This edition of Free Morning Money is published weekdays at 8 a.m. POLITICO Pro Financial Services subscribers hold exclusive early access to the newsletter each morning at 5:15 a.m. To learn more about POLITICO Pro’s comprehensive policy intelligence coverage, policy tools and services, click here.

PROGRAMMING NOTE: Morning Money will not publish on Thursday, Nov. 22 and Friday, Nov. 23. Our next Morning Money newsletter will publish on Monday, Nov. 26.

Story Continued Below

TRUMP NEEDS A SCAPEGOAT — Another brutal day on Wall Street and President Trump once again decided to blame Fed Chair Jay Powell rather than face the reality that the U.S. economy is likely to slow down next year as the tax cut stimulus fades, a trade war with China looms and the deficit spikes higher with demand for U.S. debt declining.

The Fed is doing exactly what it’s supposed to at a time of very low unemployment and rising wages. And every time Trump bashes the central bank he makes it LESS likely that the Fed will look at sluggish growth numbers and sagging stocks and decides to slow down its pace of rate hikes. The central bank cannot allow itself to be viewed as caving to Trump or it will erode its independence and lose credibility with markets.

It seems clear that Trump – even as senior advisers tell him to leave Powell alone – is much more interested in having a fall guy to blame for the market decline than he is about having a better shot at the Fed pausing in December or reducing the number of hikes expected next year. For the moment he needs to blame the fact that markets are now down for the year or someone other than himself. And that person is Jay Powell.

And this is exactly what he did on Tuesday: “I’d like to see the Fed with a lower interest rate. I think the rate’s too high. I think we have much more of a Fed problem than we have a problem with anyone else,” Trump told reporters outside the White House. “I think your tech stocks have some problems.”

WHAT THE MARKET NEEDS: PANIC! — Leuthold’s Jim Paulsen emails on what might stop the market swoon: “Primarily, PANIC — a capitulation and widespread belief that a recession is imminent and the bull is over — that may represent one last great buying opportunity if we do not have a recession. So far most of the corrections this year have been calm, well controlled and thought of more as refreshing pauses made to ‘buy on the dip’ rather than things to run from. When we do bottom, I expect ‘panic’ to be widespread among the media stories and investors.”

Cumberland’s David Kotok emails: “Washout comes at any time in panic selling. This is what one gets from a Trade War. Thank you Peter Navarro. Now up to POTUS to make a truce in Buenos Aires. Then everyone wins. No truce, everyone loses more.”

HOW TRUMP MEASURES UP — Via Bespoke Investment Group: “It may sound hard to believe, but for all the talk about how well the stock market has done under President Trump, the Dow … is actually up less (25.69 percent) since he took office than it was under President Obama (40.94%) at the same point in his Presidency.” Read more.

Mohamed El-Erian in the FT — “Life would be better for equity investors if the transition from quantitative easing and ultra-low interest rates was unfolding against a backdrop of solid economic growth. Instead, the global economy is losing momentum and the divergence between advanced economies is growing.

“As a result, financial market choppiness has been ruling the day and unsettling investors. That leaves portfolios more vulnerable to technical dislocations and behavioural biases. Having been conditioned over the past decade to expect central banks to repress financial volatility and flinch at the first sign of market vulnerabilities, traders and investors are only slowly coming to terms with the less pleasant reality of a world of tighter liquidity.”

Read more.

ENERGY SECTOR BLUES — Bloomberg Opinion’s Liam Denning: “If coming last in a popularity contest stings, consider how it feels to come first in an unpopularity contest. In Tuesday’s mass defriending of stocks, the energy sector managed to stand out in the worst possible way.

“The whiplash here is incredible. In early October Nymex crude oil was trading at more than $76 a barrel and the S&P 1500 exploration and production index was at its highest level in more than three years. Since then, they’re down 28 percent and 20 percent respectively. In relative terms, E&P stocks are trading at their lowest level on forward [earnings] multiples since Christmas 2008, another holiday season not noted for its bounding optimism” Read more.

WHAT IS THE FED TO DO? — Pantheon’s Ian Shepherdson: “Expectations for a March rate hike have dipped since Fed Vice-Chair Clarida’s CNBC interview last Friday. The renewed drop in stock prices hasn’t helped, either. But we aren’t at all sure that Mr. Clarida wanted his words to be interpreted as a dovish signal. …

“And this year, the numbers have been strong enough for the Fed—probably—to hike four times, one more than expected at the start of the year. In other words, numbers which were soft enough to stay the Fed’s hand in 2016, say, would not be enough now to do the same, given that the unemployment rate is now 3.7% and still falling, and wage growth is at 3% and rising.”

NEW THIS A.M.: SOFT GLOBAL OUTLOOK — From the OECD’s latest economic outlook out at 5:00 a.m. EST this morning: “The global economy is navigating rough seas. Global GDP growth is strong but has peaked. In many countries unemployment is well below pre-crisis levels, labour shortages are biting and inflation remains tepid.

“Yet, global trade and investment have been slowing on the back of increases in bilateral tariffs while many emerging market economies are experiencing capital outflows and a weakening of their currencies. The global economy looks set for a soft landing, with global GDP growth projected to slow from 3.7 percent in 2018 to 3.5 percent in 2019-20.

“However, downside risks abound and policy makers will have to steer their economies carefully towards sustainable, albeit slower, GDP growth. Engineering soft landings has always been a delicate exercise and is especially challenging today.”

The OECD has the U.S. growing at a 2.7 percent pace in 2019 and 2.1 percent in 2020, hardly numbers Trump would celebrate.

A LEAD FOR THE AGES — Via the NYT’s Mark Lander: “President Trump defied the nation’s intelligence agencies and a growing body of evidence on Tuesday to declare his unswerving loyalty to Saudi Arabia, asserting that Crown Prince Mohammed bin Salman’s culpability for the killing of Jamal Khashoggi might never be known.” Read more.

GOOD WEDNESDAY MORNING — Wishing a blessed and peaceful Thanksgiving to all. Don’t talk politics around the table. Email me on [email protected] and follow me on Twitter @morningmoneyben. Email Aubree Eliza Weaver at [email protected] and follow her on Twitter @AubreeEWeaver.

THIS MORNING ON POLITICO PRO FINANCIAL SERVICES — Victoria Guida: BANK PROFITS SOAR IN WAKE OF TAX CUTS, REGULATORY ROLLBACKS — “Bank profits continue to hit new highs, reaching a record $62 billion in the third quarter, as lenders reap the benefits of lower taxes and looser regulations. Third quarter bank profits were up 29.3 percent from the same period last year, according to new data from the Federal Deposit Insurance Corp., and only 3.5 percent of banks were unprofitable, compared to 4 percent a year ago. The data was released hours after the FDIC voted to sign on to a Federal Reserve proposal to ease a range of capital and liquidity requirements on large regional banks. Roughly half of the increase in net income was due to tax reform, the FDIC said, but profits for the quarter still would have been $54.6 billion without that.” Read more.

THE ADAGE “WORK HARD AND GET AHEAD” is a waning reality in America today. The question is: What can Washington do to foster more opportunity and prosperity in struggling communities across the country? POLITICO convened a bipartisan group of 14 business leaders, thinkers and policymakers to explore the problem and identify solutions that have a realistic path forward with political leaders of both parties. Read the latest issue of The Agenda to learn more.

DRIVING THE DAY — Big pile of economic data today ahead of the holiday for markets to chew on including durable goods orders at 8:30 a.m. which are expected to drop 2.2 percent headline and rise 0.4 percent ex-transportation. Existing Home Sales at 10:00 a.m. expected to rise to 5.20M from 5.15M … Univ. of Michigan Consumer Sentiment at 10:00 a.m. expected to be unchanged at 98.3 … Index of Leading Indicators at 10:00 a.m. expected to rise 0.1 percent

FOWL NEWS: PARDONED TURKEYS DIE QUICKLY — POLITICO’s Sarah Zimmerman: “A pardon from … Trump ensures that this year’s National Thanksgiving Turkey — now known as Peas — won’t be anyone’s dinner on Thursday, but it’s unlikely he’ll see another Thanksgiving. …

“[T]he reality for Peas and Carrots is not a long life in country retirement. Like all other turkeys that are raised for human consumption, they’ve been bred to be plump and tasty, but they grow so big that they are likely to suffer from a variety of health problems that put their lifespan at less than a year.” Read more.

BI-PARTISAN PUSH FOR TREAUSRY TRANSPARENCY — POLITICO’s Zachary Warmbrodt: “A bipartisan group of senators is pushing the Trump administration to move ahead with plans to give the public a greater view into the market for U.S. Treasury securities, which is critical to government funding and the broader financial system.

“In a joint letter to Treasury Secretary Steven Mnuchin, Sen. Mark Warner (D-Va.), Banking Chairman Mike Crapo (R-Idaho) and Sen. Thom Tillis (R-N.C.) touted the benefits of more transparency and asked when officials would roll out a plan for increased disclosure.” Read more

MARKETS UNLIKELY TO STOP THE FED — WSJ’s Nick Timiraos and Gregory Zuckerman: “Market turbulence is leading some investors to call on the Fed … to halt its campaign of interest rate increases, but the selloff in stocks and corporate bonds that accelerated Tuesday is unlikely to stop the central bank from raising rates when it meets again next month.

“Fed officials have signaled in recent days they plan to proceed with another quarter percentage point increase … when they meet Dec. 19, marking their fourth rate increase this year. The market pullback does underscore however the uncertain outlook for what the Fed will do after that. Fed officials are divided over how many times the central bank will raise rates next year” Read more.

IS THE SLIDE A WARNING ON THE ECONOMY? — NYT’s Matt Phillips: “Unemployment is near lows not seen in half a century. The American economy is set for its best year since 2005. Large corporations are producing giant profits. Even wages are starting to rise.

And the stock markets are a mess. The losses extended on Tuesday, as the S&P 500-stock index turned negative for the year, stoking fears that one of the longest bull markets in history could be at risk.

“The stock market’s struggles may seem incongruous against the backdrop of strong economic growth. But stocks often act as an early warning system, picking up subtle changes before they appear in the economic data.” Read more.

No corner of the market was left unscathed — Bloomberg’s Lu Wang, Elena Popina and Vildana Hajric: “One of the toughest years for financial markets in half a century got appreciably worse Tuesday, with simmering weakness across assets boiling over to leave investors with virtually nowhere to hide. Stocks buckled for a second day, sending the S&P 500 careening toward a correction. Oil plumbed depths last seen a year ago, while credit markets — recently impervious — showed signs of shaking apart. Bitcoin is in a freefall, while traditional havens like Treasuries, gold and the yen stood still.

“Add it all up — the 2 percent drop in equities, oil’s 6 percent plunge, the downdraft in corporate bonds — and markets ended up doling out one of the worst single-session losses since 2015. The S&P 500 erased its gain for 2018, oil tumbled to a one-year low and and an ETF tracking junk bonds capped its worst streak of declines since 2014.” Read more.

OIL TANKS — FT’s Anjli Raval in London: “Oil prices plunged again on Tuesday, with Brent crude seeing its 2018 gains wiped out as concerns about swelling global supplies continued to sour sentiment among investors. Brent, the international crude oil benchmark, fell as much as 7.6 per cent, or $5.08 a barrel, to hit $61.71, its lowest point in more than 11 months. …

“[P]ledges by big producers such as Saudi Arabia to raise output have stoked fears that the world could be entering a period of oversupply. … Trump reinforced these expectations on Tuesday when he called the kingdom a ‘steadfast partner’ despite probes linking the killing of US-based journalist Jamal Khashoggi to Mohammed bin Salman, the Saudi crown prince and de facto ruler of the country.” Read more.

ZUCK/SANDBERG PLAN TO STAY — POLITICO’s Cristiano Lima: “Facebook CEO Mark Zuckerberg said Tuesday he plans to stay on as company chairman and work with COO Sheryl Sandberg ‘for decades more to come,’ remarks that come amid mounting scrutiny of their management efforts.

“The embattled Facebook chief was pressed on whether he plans to step down from leading the company board. ‘That’s not the plan,’ he told CNN. ‘I’m certainly not currently thinking that that makes sense.’ The remarks came during Zuckerberg’s first interview since The New York Times reported on Facebook’s ties to the Definers Public Affairs communications firm, which sought to link critics of the company to liberal financier George Soros, a favorite target for conservative criticism.” Read more.

TRANSACTIONAL TRUMP —WP’s Anne Gearan: “Trump’s declaration Tuesday that he won’t hold Saudi rulers accountable for the killing of journalist Jamal Khashoggi distilled the president’s foreign policy approach to its transactional and personalized essence. Nearly two years into his presidency, Trump is unswerving in his instinct to make everything — from trade to terrorism, from climate change to human rights — about what he sees as the bottom line. …

“He cited arms sales with the kingdom, its role as a bulwark against Iran and the threat of higher oil prices as risks to the United States if his administration ruptured the relationship over the Khashoggi killing.” Read more.

SMALL BUSINESS SATURDAY GAINS STEAM — Via a new survey from Consumers’ Research: “Small Business Saturday continues to gain in popularity with consumers as Black Friday continues to lose favor. Additionally, while online shopping remains prevalent, consumers are showing they still like and take advantage of the in-store option.” Read more.

Source link

from RSSUnify feed https://hashtaghighways.com/2018/11/22/trump-needs-a-market-scape-goat/

0 notes