#blockchain security development lifecycle whitepaper

Explore tagged Tumblr posts

Text

Expert Crypto Token Development Services by Shamla Tech Solutions

Introduction to Crypto Token Development

The digital world is evolving rapidly, and one of the most exciting innovations of the past decade is the rise of blockchain technology. At the core of this transformation lies the concept of crypto token development. These tokens, powered by decentralized ledgers, have changed how businesses and individuals interact with digital assets. From serving as a medium of exchange to representing assets and enabling smart contracts, tokens have become essential tools in the blockchain ecosystem.

With the growth of cryptocurrencies and DeFi platforms, the demand for custom tokens continues to soar. Companies and entrepreneurs looking to enter the blockchain space need expert assistance to ensure the successful creation and deployment of their tokens. This is where companies like Shamla Tech Solutions, a leading crypto token development company, step in to offer industry-grade services.

What is Crypto Token Development?

Crypto token development involves the creation of digital tokens on existing blockchain platforms such as Ethereum, Binance Smart Chain, Solana, or Polygon. Unlike cryptocurrencies like Bitcoin, which operate on their own native blockchains, tokens function on pre-existing infrastructures. These tokens can represent a wide variety of assets – both tangible and intangible – and are used for different purposes like utility, governance, and security.

The process of developing a token includes defining the token standard (such as ERC-20 or BEP-20), setting tokenomics, integrating smart contracts, and ensuring compliance with blockchain protocols. A well-structured token not only offers transparency and security but also enhances the overall usability and functionality of a blockchain project.

Shamla Tech Solutions: A Trusted Crypto Token Development Company

For any organization aiming to create and launch their own token, partnering with the right development team is crucial. Shamla Tech Solutions has positioned itself as a prominent crypto token development company, providing comprehensive blockchain solutions tailored to client needs. Their expertise spans across various blockchain networks, enabling them to offer custom token development services with precision and speed.

With a team of blockchain architects, developers, and analysts, Shamla Tech crafts tokens that are secure, scalable, and future-proof. They work closely with clients to understand their vision, strategize the token model, and bring the idea to life with robust technical execution. Whether it’s for fundraising, building a decentralized app, or launching a new DeFi protocol, Shamla Tech delivers top-notch token development services that align with the latest market trends and regulatory guidelines.

Benefits of Professional Crypto Token Development

Engaging a professional crypto token development service like that offered by Shamla Tech Solutions ensures a seamless and efficient process from ideation to launch. Expert developers bring in-depth knowledge of blockchain infrastructure, allowing for the creation of tokens that are both technically sound and strategically aligned with business goals.

By leveraging Shamla Tech’s experience, businesses gain access to key features such as automated token minting, token burn mechanisms, vesting schedules, governance functionalities, and cross-chain compatibility. Their services help clients save time, reduce development errors, and maintain a competitive edge in the rapidly changing crypto space.

In addition to technical development, Shamla Tech also offers assistance in areas like token audit, smart contract testing, whitepaper drafting, and post-launch support, ensuring a comprehensive development lifecycle.

Use Cases and Market Demand

The use of blockchain tokens spans a wide range of industries. From decentralized finance and NFTs to gaming and supply chain management, the applications are diverse and continually expanding. Tokens can be used to reward users, facilitate in-game purchases, represent shares in a DAO, or provide access to a digital product or service.

As the global adoption of blockchain increases, so does the demand for tokenized solutions. Businesses, investors, and startups are constantly exploring innovative token models to monetize their platforms and build loyal communities. The flexibility and functionality of tokens make them ideal instruments for modern digital economies.

Shamla Tech Solutions understands these dynamic market needs and offers scalable crypto token development services that align with business goals and user expectations. Their development framework is agile, allowing for quick adjustments as market trends and regulations evolve.

Why Choose Shamla Tech for Your Token Project?

Choosing the right development partner is essential for success in the blockchain industry. Shamla Tech stands out for its technical excellence, client-centric approach, and strong track record in the crypto domain. They’ve helped numerous startups and enterprises launch tokens that have gained traction in the market.

What makes Shamla Tech a preferred crypto token development company is their commitment to innovation, transparency, and long-term client support. Their development process is collaborative and flexible, ensuring that each project is delivered on time and exceeds expectations.

From the first consultation to post-launch optimization, Shamla Tech offers unmatched value and expertise. They stay updated with the latest blockchain standards and regulatory shifts, ensuring that your token not only performs well but also adheres to industry norms.

Final Thoughts

The future of digital finance lies in blockchain and tokenization. As more businesses look to embrace decentralization, the need for reliable and secure crypto token development becomes paramount. By working with a trusted partner like Shamla Tech Solutions, businesses can turn their ideas into reality with confidence.

Whether you’re launching a new DeFi project, creating an NFT platform, or introducing a utility token for your app, Shamla Tech has the skills, tools, and knowledge to guide you every step of the way. Their end-to-end services ensure your token is not only functional but also competitive in the crowded crypto landscape.

Now is the time to leverage the power of tokenization — and Shamla Tech Solutions is here to lead the way.

0 notes

Text

How Can STO Development Services Mitigate Investor Risk?

Security Token Offerings (STOs) have emerged as a revolutionary fundraising method for businesses. By leveraging blockchain technology, STOs offer a secure, transparent, and efficient way to raise capital. However, the inherent volatility of the cryptocurrency market and the complexities of STO regulations can pose significant risks for investors. This is where STO development services come in.

This blog explores how partnering with a reputable STO development company can significantly mitigate investor risk throughout the STO lifecycle. We'll delve into key areas where these services can enhance investor confidence and safety.

1. Ensuring Regulatory Compliance

Navigating the intricate web of STO regulations is a major challenge for businesses. Different jurisdictions have varying regulatory frameworks, and non-compliance can lead to hefty fines, legal repercussions, and ultimately, a failed STO.

A professional STO development service provider stays abreast of the latest regulations and guides you through the entire compliance process. They can assist with:

Identifying Applicable Regulations: Depending on your location and target investors, the development team will pinpoint the relevant regulatory landscape you need to adhere to.

Legal Documentation: They can help draft legally sound whitepapers, offering documents, and KYC/AML procedures that meet regulatory requirements.

Liaison with Regulatory Bodies: The development team can facilitate communication with regulatory authorities, ensuring a smooth and compliant STO launch.

By ensuring compliance, STO development services protect investors from fraudulent offerings and promote a sense of security in the investment process.

2. Building Secure Smart Contracts

Smart contracts are the backbone of any STO. These self-executing contracts govern the issuance, distribution, and trading of security tokens. However, vulnerabilities in smart contracts can lead to hacks and loss of investor funds.

A reliable STO development company focuses on:

Secure Coding Practices: They employ experienced developers who adhere to best practices in smart contract coding to minimize the risk of bugs and exploits.

Auditing and Testing: Rigorous audits by independent security experts are crucial to identify and address potential vulnerabilities before launch.

Escrow Services: For added security, some development teams can integrate escrow services that hold investor funds until certain milestones are met.

By prioritizing robust smart contract development, STO development services safeguard investor assets and instill confidence in the overall process.

3. Implementing KYC/AML Procedures

Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are essential to prevent fraud and protect investors from bad actors.

Here's how STO development services ensure robust KYC/AML protocols:

Investor Verification: They integrate KYC/AML solutions that verify investor identities and accreditation status, deterring unqualified or malicious individuals from participating.

Transaction Monitoring: The development team can set up monitoring systems to track suspicious activity and flag potential money laundering attempts.

Compliance with Regulations: KYC/AML procedures are tailored to meet specific regulatory requirements, ensuring investor safety and a smooth STO experience.

By implementing stringent KYC/AML protocols, STO development services create a secure environment for investors and uphold financial integrity throughout the offering.

4. Fostering Transparency and Communication

Transparency is paramount for building trust with investors. A well-developed STO platform should provide clear and easily accessible information about the offering.

Here's how STO development services promote transparency:

Detailed Whitepaper: The development team can assist in crafting a comprehensive whitepaper that outlines the project's vision, technology stack, tokenomics, and risk factors.

User-Friendly Platform: They can build an STO platform with a user-friendly interface that allows investors to easily access offering details, track their investments, and stay updated on project progress.

Regular Communication: The development team can establish clear communication channels to address investor inquiries and concerns promptly.

By prioritizing transparency and open communication, STO development services empower investors to make informed decisions and foster a sense of trust in the STO process.

5. Mitigating Market Volatility

The cryptocurrency market is inherently volatile. While STOs represent ownership in real-world assets, their token value can still fluctuate significantly.

Here are some ways STO development services can help mitigate market volatility:

Token Utility: The development team can design a tokenomics model that assigns utility to the security tokens, offering investors benefits beyond just price appreciation.

Liquidity Lock-Ups: They can implement mechanisms that lock up a portion of the tokens for a predefined period, stabilizing the token price and preventing early selloffs.

Investor Education: The development team can create educational resources to help investors understand the risks associated with cryptocurrency investments and develop sound investment strategies.

By addressing market volatility concerns, STO development services can attract more risk-averse investors and create a more sustainable STO ecosystem.

#STO Development#sto development solutions#sto development agency#sto development company#sto development services#STO

0 notes

Text

A white paper is an authoritative report or guide that informs readers about a complex issue and provides a solution to a problem. Mobiloitte is excited to offer white paper development services to its clients. We have a team of experienced writers who can help you develop a high-quality, well-researched white paper that will help you promote your business and achieve your objectives.

#white paper development services#development roadmap whitepaper#blockchain development#whitepaper development#blockchain security development lifecycle whitepaper#blockchain development services

0 notes

Text

White Paper Development Services

If you're looking for help developing a white paper, you've come to the right place. At Mobiloitte, we have a team of experienced writers who can work with you to create a document that's both informative and engaging. We understand that a white paper is more than just a piece of marketing collateral - it's an opportunity to showcase your company's expertise and thought leadership. That's why we take a strategic approach to white paper development, ensuring that the final product is aligned with your business goals.

#development roadmap whitepaper#blockchain development#whitepaper development#blockchain security development lifecycle whitepaper#blockchain development services

0 notes

Text

Cryptocurrency development Life Cycle-Explained

Before getting into the development process, it is essential to know the basic working of cryptocurrencies and their benefits.

Cryptocurrencies are digital assets that can be used as a medium of exchange between parties or traders. It provides more safe and secure transactions as it is backed by Blockchain technology.

It follows a decentralized, distributed, and immutable network, making it the safest mode of transaction possibly. Multiple currencies are used in day-to-day life, which is developed and used to know its importance and ease.

We are presenting below on how cryptocurrencies are developed.

Crypto Development process lifecycle

Defining the idea

This is the first step in the development process. It is very crucial to know what the crypto is expected to do. For this, we need to identify the target audience, utility, and business verticals it operates, then proceed with the development plans.

Choosing the right development team

After defining the idea, half of our success depends on the development team that we choose to make our cryptocurrency. Going for services that appear will make it difficult as there are chances that additional rework might arise in the future. So the second step is to find the best developer for our cryptocurrency.

Creating rules for a smart contract

Smart contracts are digital contracts that are the blueprint of our project. It works on a blockchain protocol, has pre-established rules, cannot be changed, and is carried out automatically. In simple terms, it is the outline base of a project exhibiting the stepwise development of a cryptocurrency. We can decide on the rules that are to be included in the smart contract development services.

External audit

To avoid cryptocurrency turning out to be a fraudulent scam, consulting with an auditing company to check the legitimacy of the project becomes vital. However, firms with a high reputation of credibility are preferred.

Whitepaper Crafting

The outcome of a cryptocurrency depends on the technical information that is given in the white paper, as it acts as a medium to explain the project idea to the investor.

Listing

Once a cryptocurrency is developed, it must be listed and promoted in the right channels to get the desired purchase of tokens from the exchange platform.

Outreach

This is the final step which involves marketing and customer support. After an ICO is launched, it should be monitored by a technical team to provide seamless transactions experience and early problem-solving services.

What's our specialization?

Now you know how a Cryptocurrency Exchange Development Services, and if you decide to go for it, then we come into play.

The Blockchain Firm offers end-to-end cryptocurrency development services to a wide range of industries and business verticals. Based on the needs and wants, we offer customized solutions serving different purposes.

0 notes

Text

Cryptocurrency development Life Cycle-Explained

Before getting into the development process, it is essential to know the basic working of cryptocurrencies and their benefits.

Cryptocurrencies are digital assets that can be used as a medium of exchange between parties or traders. It provides more safe and secure transactions as it is backed by Blockchain technology.

It follows a decentralized, distributed, and immutable network, making it the safest mode of transaction possibly. Multiple currencies are used in day-to-day life, which is developed and used to know its importance and ease.

We are presenting below on how cryptocurrencies are developed.

Crypto Development process lifecycle

Defining the idea

This is the first step in the development process. It is very crucial to know what the crypto is expected to do. For this, we need to identify the target audience, utility, and business verticals it operates, then proceed with the development plans.

Choosing the right development team

After defining the idea, half of our success depends on the development team that we choose to make our cryptocurrency. Going for services that appear will make it difficult as there are chances that additional rework might arise in the future. So the second step is to find the best developer for our cryptocurrency.

Creating rules for a smart contract

Smart contracts are digital contracts that are the blueprint of our project. It works on a blockchain protocol, has pre-established rules, cannot be changed, and is carried out automatically. In simple terms, it is the outline base of a project exhibiting the stepwise development of a cryptocurrency. We can decide on the rules that are to be included in the smart contract.

External audit

To avoid cryptocurrency turning out to be a fraudulent scam, consulting with an auditing company to check the legitimacy of the project becomes vital. However, firms with a high reputation of credibility are preferred.

Whitepaper Crafting

The outcome of a cryptocurrency depends on the technical information that is given in the white paper, as it acts as a medium to explain the project idea to the investor.

Listing

Once a cryptocurrency is developed, it must be listed and promoted in the right channels to get the desired purchase of tokens from the exchange platform.

Outreach

This is the final step which involves marketing and customer support. After an ICO is launched, it should be monitored by a technical team to provide seamless transactions experience and early problem-solving services.

What's our specialization?

Now you know how a Cryptocurrency Exchange Development Services, and if you decide to go for it, then we come into play.

The Blockchain Firm offers end-to-end cryptocurrency development services to a wide range of industries and business verticals. Based on the needs and wants, we offer customized solutions serving different purposes.

0 notes

Text

DUCATUS

INTRODUCTION

From the very beginning, blockchain has been regarded as a disruptive technology that was built by and for technicians. Most blockchains are designed by technical experts and senior technical experts and their scope of use is usually limited to making high-risk exchange transactions (speculation) or even ghost transactions. But what about ordinary people ?

Not knowing technical knowledge doesn’t mean that they should be devoid of all the benefits and growth right ?

The answer to this question and solution to this problem lies in Ducatus! This article is about Ducatus which is just the opposite of this technology and let’s see how it’s and in what ways it’s beneficial for non-tech and ordinary people.

WHAT IS DUCATUS ?

Ducatus is an open and inclusive user-oriented blockchain, it allows ordinary people to benefit from the technology that makes payments for everyday purchases faster and more secure. It provides transparency and accessibility. DucatusX is based on the Ethereum blockchain and as such, has the same advantages and disadvantages. The main difference with Ethereum is that using PoA consensus, can greatly reduce transaction costs and maintain productivity, but at a reduced level of decentralization.

Its whitepaper says, “Whether it’s buying coffee or renting community-supported projects to generate passive income or having an honest record of your ideas and projects, Ducatus is designed to be eco-friendly to the user. This vision is realized in our technology. Based on the technology of existing blockchain projects, our mission is to deploy a fast blockchain with a low cost, clear interface, friendly enough for users to control, support, makes decisions about the development of the project and participates in the life of the project.”

Their mission is to provide convenient blockchains for everyday use for all users, tech savvy or not, as simple as using a credit card with the ability to use reliable payment services.

Sounds interesting and beneficial right ?

Let’s see some features of Ducatus.

FEATURES OF DUCATUS

The Ducatus Cashless Economy

Ducatus Coin, designed for usability, is the financial binder of the digital cashless landscape, the backbone of growth and sustainability. Their long term goal is to become the usable cryptocurrency in the world. Through their affiliated companies, they offer users the opportunity to buy, sell, earn and benefit from using digital currency in their daily life. These companies are implemented to allow Ducatus Coins holders to enjoy real value outside of the crypto community. Consumers pay digitally, online, and use or wish to use cryptocurrencies in their daily transactions.

Technical Architecture

The use of standard cryptographic algorithms and blockchain technology provides a secure and reliable experience. When creating a new cryptocurrency, the industry best practice is to fork an existing coin. The fork is a variation of the code content that sets it apart from previous versions. The cryptocurrency that is chosen to transfer Ducatus is Litecoin. Litecoin itself is a fork of Bitcoin that has been modified to make it easier for developers to create their cryptocurrencies. One of the most important changes from the standard setting of Bitcoin allows blocks to be mined faster, ensuring fast processing of transactions.

Rental Platform

A platform will be created for the rental of the property, while all parties will be protected up to. Double booking cannot be done as the booking information will be saved, stored and managed in the blockchain.

Insurance

The network smart contracts can be used to ensure e.g. against bad weather or to fulfil orders on time or similar. This will require the additional implementation of trusted and trusted data providers in the Oracles blockchain, which is also included in the development plans.

Decentralized Exchange

With the development of the DucatusX blockchain and the emergence of tokens, users will need to be able to quickly exchange tokens to attract investments and earn a profit, so there are plans to create a decentralized exchange that works by analogy with Uniswap and others. The DOCX coin will be traded on the exchange and thus form the link of the Ducatus ecosystem with the global crypto world.

DUCATUS WALLET

The Ducatus ecosystem exists as a web wallet that runs on all desktop platforms Windows, Linux, macOS.

https://wallet.ducatus.io/ and mobile for iOS platforms and Android Users can send transactions and accept payments not only in the Ducatus and DucatusX coins but also in Bitcoin, Bitcoin Cash, XRP, Ethereum and USDC, PAX and GUSD tokens. More coins and tokens will be added in the future.

TOKENOMICS

Ducatus

Total number of DUC is fixed at a maximum of 7,778,742,049

Low fees, fast transactions, staking rewards

Strong supporting community, merchant acceptance for payments.

DucatusX

Total number of DUCX is fixed at a maximum of 777,874,204

Low fees, smart contracts available

Only trusted projects, no scam token

Strong supporting community, exchange-traded

Ducatus <-> DucatusX conversion

DucatusX (DucX) can be converted from and into Ducatus (DUC) by a currently fixed the ratio of 1:10 on https://www.ducatuscoins.com/buy or inside the wallet using the swap function.

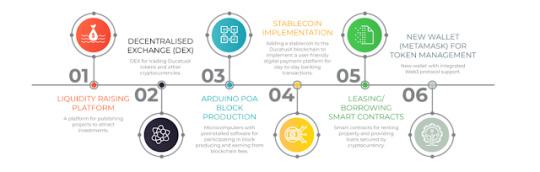

ROADMAP

Liquidity raising platform — a platform for publishing projects to attract investments

DEX — DEX for trading DucatusX tokens and other cryptos Arduino PoA block producing — microcomputers with preinstalled software for participating in block producing and earning on the blockchain fees. Stablecoin implementation — adding a stablecoin to the DucatusX blockchain implemented to a user-friendly digital payment platform for day-to-day banking transactions.

Leasing/borrowing smart contracts — smart contracts for renting property and providing loans secured by cryptocurrency. New wallet (Metamask) for token management — new wallet with integrated web3 protocol support

TEAM

CONCLUSION

It’s a project of the future as it’s for benefit of normal people. It deploys a blockchain quickly with a low fee, has a clean and easy-to-navigate interface and is user-friendly enough to allow any user to control, assist or make decisions and participate in the development and lifecycle of a project. All these characteristics evince that this project is for the people, the normal people. It has great potential to rock the floor of the cryptocurrency market.

FOR MORE INFORMATION :

Website : http://ducatuscoins.com/

Whitepaper : https://www.ducatuscoins.com/assets/downloads/pdf/ducatus-coin-white-paper.pdf

Telegram : https://t.me/ducatuschannel

Twitter : https://twitter.com/DucatusX

Facebook : https://www.facebook.com/WeAreDucatus

Linkedin : https://www.linkedin.com/company/ducatus-global

Instagram : https://www.instagram.com/ducatusglobal

Youtube : https://www.youtube.com/c/DucatusGlobal

Name : bondan88

Profile Link : https://bitcointalk.org/index.php?action=profile;u=2632383

Telegram :@bondan88

0 notes

Text

Updated Modex Whitepaper and 2021 roadmap revealed

As we continue to evolve and to refine our products and services, we would like to offer you some updates. October 2020 brings a new, updated Modex Whitepaper where you can find all the relevant info related to our blockchain database company. Here are the most important updates, at a glance.

Modex BCDB is a game-changing hybrid remote data storage system enabling blockchain adoption in enterprise software development and deployment without eliminating the database component, but by mixing standard database engines with blockchain features, while allowing software developers to work within the systems they are already using.

Modex BCDB is designed as a middleware that is installed between clients’ software and their existing databases, connecting them to the blockchain with minimal effort and without requiring additional training for software developers working in clients’ companies, as the platform has a similar interface as traditional databases.

The advantages of blockchain at your fingertips

Blockchain technology provides the main vehicle to help businesses transition from a centralized model to a decentralized one. Blockchain has already started to gain considerable momentum in industries such as supply chain, healthcare, retail, financial services, telecommunications, transportation, logistics, energy and identity management. With our product, customers can access all the advantages of blockchain, without needing to concern themselves with its technical intricacies. With an agnostic approach to databases and blockchain engines, Modex BCDB is the ideal platform for B2B collaboration, bringing considerable time and cost-related savings.

BCDB, a game-changing solution for multiple industries

Modex BCDB can be used in various industries which can benefit from the advantages of blockchain technology. In healthcare, Modex BCDB can help hospitals and clinics mitigate the effects of cyber-attacks and system failures with its high data availability, real time backup, and distributed structure. Patients can manage their own digital medical files and allow others to access their data when necessary, and always be aware of who can see the data and can establish new permissions and/or restrictions. For government & public services, blockchain technology can enhance the efficiency of processes and the credibility of public data, increasing citizens’ level of trust in public institutions. Blockchain could also improve citizens’ and businesses’ experiences in interacting with government as more processes are moved online in a secure environment.

In banking and financial services, blockchain can reduce processing times, the potential for error and delay, and the number of steps and intermediaries required to achieve the same levels of confidence as in traditional processes. Furthermore, blockchain can improve KYC and AML systems by ensuring data immutability and enhancing processing capabilities. When it comes to log management, versioning provides a changing view, while the underlying data is expressed with new contents bound to a unique identifier. Modex BCDB doesn’t allow any audit trail changes or deletion, which means your logs are kept safe.

For regulatory compliance, through the use of advanced encryption mechanisms, Modex BCDB assists companies in implementing GDPR-compliant solutions. Every stored data record comes with independent proof that the data is in its original state and has not been manipulated, so it provides an independent forensic quality audit trail for the lifecycle of user records, helping companies prove compliance with data protection regulations. When it comes to incident response, Modex BCDB can help mitigate the effects of ransomware attacks by eliminating the single point of failure through its decentralized and distributed structure. Even if a node in the blockchain network is compromised by an attack or other type of security incident, the data can be immediately restored from another node. It is virtually impossible for an incident to affect every node in the network.

Roadmap – new features in 2020 and 2021

Our roadmap – which contains the next features that we have planned to develop in 2020 and 2021 – is in line with the go-to-market strategy. Here’s a glimpse of what to expect from Modex BCDB until the end of this year: Logstash BCDB plugin, Microsoft Azure Marketplace deployment scripts, support for R3 Corda, RethinkDB database integration, CRUD support for SQL databases and publishing the management tool (BCDB Workbench) as a open-source on GitHub.

In the first quarter of 2021 expect M247 Integration and Modex BCDB Lite, as well as publishing more Open Source code. In the second quarter, Modex BCDB will offer full support for SQL databases, Oracle Cloud Marketplace Integration, support for Hyperledger Fabric, and JDBC Driver. In Q3 expect GCP Integration, Golang & C# Drivers plus support for Hyperledger Burrow. For Q4 2021, we will offer Modex BCDB Smart Contract on Modex Marketplace, Pyhton & Ruby Drivers, support for Ethereum, Hyperledger Besu.

Go-to-market strategy

When it comes to our go-to-market strategy, we are committed to utilizing the internal and external resources to deliver our unique value proposition to our customers and achieve a competitive advantage comprises the following activities:

Co-Selling Agreements – building strong partnerships with big tech companies and get featured in their marketplaces;

Custom integrations with major software players which will allow us to validate our solution on a large scale, with companies that provide custom software and are interested in blockchain solutions to whom we can offer a ready-made product that will save them hundreds of development hours, with mainstream database providers allowing us to increase our product’s database agnosticity and thus reach more customers;

Partnership Opportunity Program (Reseller and Referral) – reaching customers indirectly through reseller / referral partnerships with companies that will get a variable revenue share fee when they bring new customers (Modex will provide training and technical resources to all reseller/referral partners); Digital Marketing campaign – a bottom-up approach to attract developers and early adopters.

About Modex

Modex, the blockchain database company, innovates in order to solve the last mile adoption problem of the blockchain. Modex offers fully integrated services and aims to make blockchain user-friendly for organizations and people. Modex is a leading Blockchain Database provider offering software solutions with real data integrity and log immutability to help companies protect valuable information. In over two years, using cutting-edge technologies and with a clear strategy, Modex has evolved into a complex ecosystem designed for developers’ needs and enterprises looking for blockchain solutions. Our mission is to spread and facilitate the adoption of blockchain into society and to solve real-world problems using this revolutionary technology.

The post Updated Modex Whitepaper and 2021 roadmap revealed appeared first on Modex.

0 notes

Text

Week in Ethereum News, Dec 15, 2019 annotated edition

Full Week in Ethereum News for Dec 15. This is the annotated edition:

Eth1

Latest core devs call. Notes. Lots of EIP1559 (fee market change) discussion now that it has been implemented. Decided to go forward with EIP2384 for Muir Glacier, anyone can propose changes afterwards. Also lots of talk about 1962 precompile calls.

Update your clients for the Muir Glacier fork in early January. Geth, Nethermind, Besu all are ready. Parity, Aleth are coming.

Piper Merriam on the 4 steps to an eth1 stateless client network

Background on eth1 very long-term sustainability problems and options

Annotations: EIP1559 is a big deal. It locks ETH in as part of the protocol and eliminates the possibility of economic abstraction [economic abstraction was heavily discussed in 2016 and if I recall correctly was pushed by Gavin] which would destroy ETH’s value. If ETH had no value, then the amount of things that Ethereum can do drops by magnitudes. We’ll have EIP1559 in eth2, and we may be getting it sooner rather than later in eth1. While I have some reservations (ie, really cheap transactions will go away), on balance it is a good idea.

The Muir Glacier fork is also coming. I’ve noticed quite a bit of pushback in the community about how the difficulty increase (sometimes called the “Ice Age” or “The Bomb”) is being pushed back 4 years with no reduction in issuance. Personally I think we are overpaying for security, but any issuance reduction should be mild (in fact, I had a proposal to do so in exchange for progpow and funding public goods!) and based on sound analysis, not “yeah, it’s December (which tends to be a bad month in capital markets) and the price is down so....wah.” 4 years is also too long in my opinion, but the conspiracy theorists seem to forget that the actual pull request came from Eric Conner, known as one of the main proponents of #ETHismoney, among other things. They should do their own pull request if they want a different parameter.

Meanwhile, Piper’s post on what is engineering and what is research on the way to an eth1 network of stateless clients is definitely a mustread. The idea of keeping eth1 around for years is a worthy insurance policy in case there any implementation hiccups in phase 2, though I don’t anticipate we will need to keep eth1 around so long.

Eth2

Lighthouse public testnet, v0.1, the “first with a mainnet configuration”

phase 0 spec v0.9.3

Notes from the last light client call

Undertanding eth2 staking deposits

Aditya Asgaonkar explores cross shard communication

Editorial note: ignore any fake news about launch date changing.

Annotations: The launch date isn’t changing, despite Justin’s love for crypto launch anniversaries. It’s still scheduled for q1, though I don’t expect it until late in q1. Of course, this is a software deadline and we’re still 3.5 months out, so it could slip, but I remain optimistic.

Lighthouse, among others, has done an amazing amount of work, and they launched their Rust client this week. I haven’t run it yet,

Meanwhile, Jim Mcdonald is doing a centralized Eth2 staking service and has had some good content marketing lately - this one on understanding the deposits, as well as the recent one on understanding effective balance. Others should up their game!

Layer2

Celer light client SDK, runs in the browser

Annotations: Celer continues to work. Otherwise a layer2 light week, obviously.

Stuff for developers

Solidity v0.5.14, defaults to Istanbul, SMT/ewasm updates

Remix IDE v0.9.2

Ethcode v0.8, now supports Vyper. available in VScode

Deep dive into eip1167 minimal proxy contract

0age: the more minimal proxy

Automated deploy to ENS and IPFS

Steve Marx: destroying the indestructible registry

Blocknative’s onboard.js to easily support many wallets

Runtime Verification: K vs Coq as language verification frameworks

Annotations: Interesting to see the posts written about minimal proxy contracts lately. Not sure what has prompted that. I probably should have noted in this section that the Remix update included a Quorum plugin, though I noted that below.

Ecosystem

Can Ethereum rollups beat Visa’s 2000 transactions per second? Iden3’s analysis of post-Istanbul Ethereum throughput limits with rollup.

How Infura manages nodes with VIPnode

Parity’s update on grant progress: 75% of grant paid based on milestones

Networking: Waku spec v0.2 and Whiteblock’s no tag back gossiping

Annotations: You like how I faked you out with Betteridge’s Law of Headlines? (Betteridge’s Law: the answer to any question in a title is no.) But the answer is yes. Rollup chains aren’t live yet, but they will be in 2020. And they’re a sort of half layer 1, half layer 2 arrangement, though I often put them in layer 2 in the newsletter. That’s because data goes onchain (ie, on eth1, ie on layer 1) but there’s a rollup chain that does all the transaction execution off chain. ZK rollups provide validity proofs that the transactions are correct. Optimistic rollup provides crypto economic validity that the transactions are correct - that is, if anyone submits an improper transaction, you slash their bond and take their money for cheating.

Parity’s update was apparently the shot before today’s post saying that they’re quitting Ethereum. Disappointing but not surprising, that they are going to work on their in-house Polkadot product instead. If we’re being honest: their client has been in mainenance mode already.

Networking: I'm excited to see Dean and Oskar do great work making Whisper into more than something that is barely a proof of concept, so this should be a good thing for Ethereum.

Enterprise

Nike files a patent application for tokenized shoes on Ethereum and breeding them, a la Cryptokitties

BancoSantander repurchased and cancelled the bond mainnet, of September 10th, 2019 issuance date. “This unequivocally proves that a debt security can be managed through its full lifecycle on a blockchain”

“Seize the day: public blockchain is on the horizon” Forrester/EY enterprise survey says 75% will use public chains (read: Ethereum) in the future

Paul Brody op-ed: If you build a blockchain, will anyone come? “Public blockchains like Ethereum offer a better choice for enterprise users”

Quorum plugin for Remix

Hyperledger Besu v1.3.7 – critical fix for mainnet users, muir glacier compatible

Annotations: Enterprise sure looks like an Ethereum moat, doesn’t it? As I tweeted out today, EY’s Paul Brody said on Reddit something I 100% agree with. “there is much more headroom in 1.x than most people think. I just gave an internal talk this morning about how so many people misunderstand scalability and that most of that talk about Eth is just fear mongering by the private blockchain crowd.”

Nike’s patent application is written to be purposely ambiguous as to whether it is blockchain agnostic (it’s a patent application, the whole point is to reserve the right to sue someone!) but also leaves little doubt that it’s on Ethereum right now.

And of course, BancoSantander continues to drive mainnet use forward. Innovators in this space for years now.

Governance and standards

Extending MolochDAO’s features: TheLAO, Moloch and MetaCartel to standardize for venture-style investments and accommodation of security token standard

Maker’s governance security module puts a 24 hour delay on all governance decisions. This was in response to Micah Zoltu’s “how to turn 20m into 340m in 15 seconds.” The 0 delay was explicitly a tradeoff as MCD launched to ensure that Maker could respond nimbly to any problems.

Vocdoni: an app for anonymous, onchain voting

Annotations: Keep an eye on Vocdoni. It’s built by Catalans, and while they haven’t talked about it much, it seems clear they’re building tools that they wish to use in their own quest for the right to self-determination.

It’ll be interesting to see if the governance security module passes or not. At the moment, it has not, because after Micah’s article, a bunch of people voted their MKR in favor of the status quo (to up the amount needed to execute Micah’s attack). I imagine it will, but I believe there are many within the ranks of Maker holders who believe that the 0 delay is still a good idea.

Application layer

Sablier is live on mainnet, continuous streaming money

Synthetix inflation changed to exponential decay in the inflation rate with a 2.5% terminal rate

Set Protocol integrates Compound’s cTokens so sets earn interest

RealT’s first property sells out

Undercollateralized lending as next DeFi trend?

Kong.cash releases their whitepaper. As seen at Devcon, Kong is physical crypto cash

Annotations: Sablier is such an interesting primitive. Stream money by the second to someone. Imagine paying your rent or payroll or salary that way.

Synthetix keeps moving, you have to admire their pace of execution. They seem to be considering adding ETH as collateral in their system, which makes it much more interesting to me - though all crypto is pretty correlated these days.

Kong is super cool. I am definitely keeping a hold of my KONG from devcon. Just be careful not to fold it, as I hear that can break the circuits.

Set keeps shipping interesting stuff. Love the idea of a trading Strat that either holds ETH or puts it into cDAI/cUSD. And undercollateralized lending seems like something that will happen, whether it be Union or Trustlines or one of the other ideas. I’m also quite pumped about RealT, it just sucks that they can’t offer it more seamlessly. If they could, I think the demand would be high.

Tokens / Business / Regulation

SEC charges fraudulent ICO

Saga goes live on mainnet with an algorithmic version of the IMF’s SDR

ING is planning to get into crypto custody

ConsenSys Activate’s standards for token launches

Annotations: Nobel winner Myron Scholes advises Saga. That’s just such a clickbait title that I refuse to use it. I’m also quite skeptical that anyone wants SDRs. I got much more bullish when they switched from SDRs to USD.

ING getting into crypto custody. Fidelity made some noise about supporting ETH too. Even in cryptowinter, this stuff looks like it is here to stay.

General

Speeding up verification of groth16 batches

Simple explanation of circuits and zero knowledge proofs

A comprehensive primer on recursive SNARKs

“design a circuit construction protocol (such as used in TOR) that is 1) non-interactive, 2) immediate forward-secret, and 3) requires only O(n) message exchanges”

Filecoin launches testnet

Using reinforcement learning to model selfish mining incentives

Will quantum supremacy affect blockchain?

Annotations: Filecoin launches a Testnet. Oddly, I have yet to hear from anyone who has tried it.

Lots of crypto stuff. I’m not a cryptographer, so I sometimes feel a bit lost and should probably spend more time in the crypto books. I like the explanations, it’s great to see that blockchains have really given zero knowledge in particular a boost. ZK stuff is the future of this industry.

0 notes

Text

Mobiloitte: White Paper Development Solutions Empower your project's success with Mobiloitte's White Paper Development Solutions. Our expert team crafts compelling, informative white papers that showcase your vision and potential. Benefit from our in-depth industry knowledge, precision, and captivating storytelling. Drive investor confidence, secure funding, and propel your project to new heights. Choose Mobiloitte for your white paper needs today!

#Whitepaper Development Company#Whitepaper development#blockchain development services#White paper development services#Features of Whitepaper Development#White paper writing services#White paper writing company#White paper writing agency#White paper services#White paper agency#White paper company#development roadmap whitepaper#blockchain development#blockchain security development lifecycle whitepaper#white paper solution#White Paper Development Solutions

0 notes

Photo

#212 Adam Perlow & Asher Manning: Zen Protocol - A Decentralized Financial System [ad_1]

We were joined by Founder Adam Perlow and Developer Asher Manning of Zen, a public blockchain project focused on building a decentralized financial system. The core premise of Zen is that none of the public blockchain networks are focused on financial asset. Zen is aiming to fill that gap through a Bitcoin-like UTXO architecture that supports multiple asset and smart contracts to enforce complex ownership rules.

We talked through their original design choices, their use of formal verification, connection to Bitcoin and vision for a fully decentralized financial system.

Topics discussed in this episode:

Why existing public blockchains are ill-suited for financial instruments

Why Zen chose to use a Bitcoin-like UTXO architecture

How Zen uses formal verification to allow smart contracts without a virtual machine or needing gas

How the Active Contract Set reduces the burden on the miners

Walking through creating, trading and settling a call option on Zen

How Zen allows payments to be settled in Bitcoin

Getting data from the outside world with oracles

Zen's use of Proof-of-Work regulated by on-chain governance

Links mentioned in this episode:

Zen Protocol - A Financial Engine

Zen Protocol - Whitepaper

Zen Protocol - Deck

Google Campus Presentation - YouTube

Zen - Alpha Version

Zen Protocol Founders Film - YouTube

Oracles and Zen ?'" Zen Protocol

Zen?'?s contract lifecycle ?'" Zen Protocol

Sponsors:

Shapeshift: Buy and sell alt coins instantly and securely without a centralized exchange - http://epicenter.tv/shapeshift

Support the show, consider donating:

BTC: 1CD83r9EzFinDNWwmRW4ssgCbhsM5bxXwg (https://epicenter.tv/tipbtc)

ETH: 0x8cdb49ca5103Ce06717C4daBBFD4857183f50935 (https://epicenter.tv/tipeth)

This episode is also available on :

Epicenter.tv

YouTube

Souncloud

Watch or listen, Epicenter is available wherever you get your podcasts.

Epicenter is hosted by Brian Fabian Crain, S?ƒbastien Couture & Meher Roy.

[ad_2] Source link Source URL: https://www.increaseprofitonline.com/2017/12/07/212-adam-perlow-asher-manning-zen-protocol-a-decentralized-financial-system/

0 notes

Text

What Does the Crypto Token Development Lifecycle Look Like?

The world of cryptocurrencies and tokens is a dynamic landscape, constantly evolving and brimming with innovation. But before these digital assets reach the exchanges, they undergo a meticulous journey, a carefully orchestrated lifecycle filled with technical wizardry, strategic planning, and community building. Today, we delve into this fascinating process, exploring the steps involved in crypto token development:

1. The Spark of an Idea:

Every journey starts with a vision. What problem will your token solve? What utility will it offer within a specific ecosystem? Answering these questions forms the foundation of your token's purpose. Conduct thorough market research, identify potential users, and ensure your concept addresses a genuine need.

2. Whitepaper: The Blueprint:

Think of your whitepaper as the technical and economic blueprint of your token. It details the project's goals, the underlying technology, the team behind it, and the tokenomics (distribution, supply, and use cases). A well-crafted whitepaper attracts investors and instills confidence in your vision.

3. Blockchain Selection: Choosing Your Home:

Not all blockchains are created equal. Each has its strengths and weaknesses, transaction fees, and community size. Popular options include Ethereum, Binance Smart Chain, and Solana, but consider factors like scalability, security, and development costs before picking your platform.

4. Smart Contract: The Engine of Your Token:

Smart contracts are self-executing programs that govern your token's behavior on the blockchain. These coded agreements define how tokens are created, transferred, and used within your ecosystem. Rigorous testing and security audits are crucial to ensure their functionality and prevent vulnerabilities.

5. Development and Testing:

The development phase involves building the infrastructure for your token, including wallets, user interfaces, and any applications it interacts with. Rigorous testing across different scenarios ensures smooth operation and identifies potential bugs before launch.

6. Fundraising: Fueling Your Project:

Several methods exist to raise funds for your token development, including Initial Coin Offerings (ICOs), Initial Exchange Offerings (IEOs), and Security Token Offerings (STOs). Each has its own regulations and requirements, so choose the one that best suits your project and target audience.

7. Marketing and Community Building:

Building a strong community is essential for the success of your token. Engage in online forums, social media, and relevant events. Create educational content, foster community discussions, and actively listen to feedback to build trust and excitement around your project.

8. Token Launch and Listing:

The culmination of your efforts arrives with the token launch. Ensure smooth distribution to investors and timely listing on reputable exchanges. This increases liquidity and allows for wider adoption of your token.

9. Ongoing Development and Maintenance:

The journey doesn't end with launch. Continuous improvement is key. Address bugs, add new features, and adapt to evolving market conditions. Proactive communication and community engagement are essential for maintaining momentum and trust.

10. Regulation and Compliance:

The regulatory landscape surrounding cryptocurrencies is constantly evolving. Stay informed about relevant regulations and ensure your token complies with them. Consulting legal and compliance professionals is crucial to navigate this complex landscape.

Remember, the crypto token development lifecycle is not a linear path. Each stage may require revisiting previous steps, and unexpected challenges might arise. Flexibility, adaptability, and a commitment to continuous improvement are essential for navigating this ever-changing environment.

Beyond these core stages, additional factors shape your token's journey:

Security: Implement robust security measures to protect your token and user funds from cyberattacks and fraud.

Transparency: Be transparent in your communication and operations. Share updates regularly and address community concerns openly.

Team Expertise: Assemble a team with the necessary technical, financial, and marketing expertise to bring your vision to life.

By understanding and meticulously navigating the crypto token development lifecycle, you can increase your chances of success in this dynamic and exciting market. Remember, the key lies in a clear vision, meticulous planning, and a commitment to building a valuable and sustainable token ecosystem.

0 notes

Text

Are you looking for a reliable and experienced company to develop a white paper for your business? If so, look no further than Mobiloitte. Mobiloitte offers white paper development services to help you create well-researched and informative papers that can be used to promote your business or product. Our team can help you develop a paper that covers all the important points and is easy to read and understand. We can also help you format your paper so that it looks professional and is easy to navigate.

#development roadmap whitepaper#blockchain development#whitepaper development#blockchain security development lifecycle whitepaper#blockchain development services#mobiloitte

0 notes

Text

ICO Development Company | Launch your ICO in just 10 days

Are you interested in blockchain technology and by this means developing a cryptocurrency? But unsuccessful to raise proper funds to sustain and live through the tough round of initial period? Obviously, you might be in countless anguish to transfer on your cryptocurrency based venture. You could potentially make use of ICO Development Services offered by the best ICO Development Company among the world level.

Initial Coin Offerings (ICOs) have become the preferred avenue for blockchain start-ups to rise funds. With an ICOs, a crowdfunding event is organized through which the investments are gathered in return for tokens of your projects. We can assistance companies by providing an all-inclusive infrastructure featuring token creation and distribution, ICO platform hosting, landing page design, marketing and PR, among other services.

Developing your operative strategy is at the core of our business. Our team will help you brainstorm ideas an create a perfectly unique plan that will extent the entire lifecycle of your project, from pre-ICO to post-ICO.

Pre-ICO Services:

Logo and web designing

User dashboard

Coin purchase

User wallet

Payment Gateway

Admin panel

Post-ICO Services:

White paper

Wallet integration

Coin development

Smart contract

Coin transaction history

Benefits of using ICO

There is no controlling board/parameter to monitor such campaigns and so no third party participation is necessary. We offer the superlative ICO services like,

A single campaign that resolves most of the predicaments faces by an organization during the initial period, wouldn’t that be wonderful? Consuming an ICO initial coin offering development there are many profits that gain the controlled strength of a blockchain based company.

The best solution for ICO funding and development comes with initial coin offering explained tough, it’s got time to buy ICO or ICO blockchain.

Helps efficiently for an organization to develop a cryptocurrency a thereby with the token sale, the initial stage of the capital fight can be resolved.

Stabilized and substantial enhancement in sales process/return rate for the potential investment and token sales for the investors.

Complete supply of the cryptocurrency around the globe.

No third party contribution and conventional deals are offered.

An uncluttered ICO based platform existing for every latent investor.

No regulations to meet for the investment.

Increase in the value of the circulated tokens which leads to a high return point in future.

We Offer

Whitepaper Drafting – Accurate and through whitepaper services to propose your newly developed crypto coin to the market.

Resolution of your Token – Investigation and agree on the incentive of the contributors with your cryptocurrency.

Roadmaps – Create the end-to-end map of the execution plan for your Initial Coin Offering.

Strategy – Manoeuvre with time-based roadmaps to imitate the trajectory of your coin and set a context for the stakeholders.

Marketing – Methodically designed marketing resolutions for your ICO in order to preserve your enterprise above the commonalities.

Coin Development – Committed and certified one-stop solution for reliable and customised crypto coin development services.

Blockchain Integration – Regulate, automate and safe platform across multiple enterprises with customised Blockchain integration.

Support – Enthusiastic assistance from our competent experts in the beginning stages to guarantee a successful product launch.

Why choose us as your ICO Development Company?

We are rapidly emerging as the most sought-after ICO Development Company across the world and offers feature-rich solutions right from idealization to its successful launch. We nurture a team of some of the skillful Blockchain developers who are well-versed with this neoteric technology. Moreover, we distribute competent and reliable models for ICO Development that are handcrafted to suitable all your business requirements.

We strictly observe to simplified funding concepts that are set to derive quick responses. Our Blockchain specialists are particularly trained to devise and deliver world-class decentralized apps across the industries. We develop fruitful and recognized methodologies and help to give a new direction to launch your own ICO without any glitch. However, we pledge confidentiality, lawfulness and security to the clients and provide avant-garde blockchain technology services at affordable prices.

0 notes

Link

GTM Smart Grid http://ift.tt/2eJlQnQ

In search of opportunity, blockchain entrepreneurs tend to hunt for one or more targets:

Traditional legacy institutions taking “tolls” on transactions

Costly inefficiencies arising out processes or markets that are complex and distributed

Atomizing ownership of assets, from the tangible (barrels of oil) to the intangible (carbon credits)

Pickings are easy in the energy industry, as this list could be applied to nearly every aspect of energy generation, transmission and consumption. Finding her quarry, the entrepreneur excitedly conceives of a solution, finds a few coders with sufficient familiarity with Ethereum, Solidity and ERC-20 tokens, and begins building her platform.

Blockchain is a solution in search of problems -- a magic hammer in which nearly every aspect of the modern economy looks like a nail.

In an country where everyone is encouraged to become an entrepreneur, what better time than now, when the path to raising capital for a new venture is not through Sand Hill Road, or the burdensome “diligence” of lenders or investors, but through the crowdfunding mechanism of an initial coin offering (ICO) or, more precisely, a ”token generation event.” And every ICO starts with a common document: a white paper.

We read a lot of these. Not to invest, mind you, but to better understand how blockchain may or may not take part in the ongoing transformation of the electricity system.

It’s a valuable exercise. In other sectors, venture capitalists have the rare privilege of access to thousands of business plans, presented confidentially in conference rooms limited to partners and advisors. But the current world of blockchain startups explodes this paradigm and opens up the investment process to everyone. It differs from other crowdfunding platforms in that the blockchain offers a kind of standardization and transparency, along with a borderless digital means of transferring value (cryptocurrency), that is unrivaled in history.

The entrepreneurs post their white paper on a website, start a countdown clock to their ICO, post video Q&A sessions with the founders on YouTube, and set out to raise millions of dollars for their enterprise. But with this great power comes great responsibility, and so far, most of the white papers out there are pitiably irresponsible.

If your goal is to offer fractional ownership of exotic cars (BitCar ICO), the bar for your white paper’s explanations may not be too high. But if you are setting out to transform one of the most critical infrastructures in human history, then we’d like to see you do your homework.

Below is our humble, subjective list of what to include in your energy blockchain whitepaper.

To start, some tips and questions that aren’t unique to energy-blockchain startups but remain worth noting, considering how many ICO white papers lack them. In quick order:

Is the ICO the sole source of funds for the company, or are you raising equity elsewhere?

Are there any restrictions on how the proceeds can be used (or dumped by founders) in the near term?

If you’re going to say something like the following in your white paper, ask an attorney what that means for token buyers in the U.S. “The token holders will be rewarded with dividends of profit sharing in the form of Ethereum every quarter. We hope that in this way, a long-term source of income will be available to our token holders, therefore also increasing the capital value of our tokens itself.” The answer may surprise you.

Enumerate your risks! We never see this, but there’s a reason it’s required in public company reporting. You have many risks, such as threat of regulation, insufficient number of participants in the marketplace, financing risk, cybersecurity risks, volatility of cryptocurrencies, technology development risks, commitment of key team members, etc. We could go on, but these white papers tend to act as though everything will flow like champagne in a Vegas fountain once the tokens are generated.

Treat the white paper as a professional document. Hire a copy editor, include sufficient explanations of how your platform functions, source your market data, explain your assumptions on revenue growth. Investors (we hope) will get wiser and more demanding as ICO-funded companies fail or disappear. Expect them to be tougher on you as time goes on.

Don’t compare yourself to Uber. It’s not realistic, and these days it’s also kind of gross.

Now on to the energy-specific blockchain white paper suggestions.

Define your market in terms specific to the energy industry. Too many white papers just use generalizations about “unlocking value” in the energy industry, and “democratizing access” to markets and projects. That’s meaningless. Make it clear you understand the market you are operating in, and how it currently functions.

Be clear about how ownership of tokens may result in gains or losses. Many blockchain in energy startups must create a market in which their tokens are traded. Immature markets or exchanges come with significant risk, as there is no experience data to draw on. How are token values established? Under what conditions do token values increase or decrease? What is necessary for there to be real liquidity in these exchanges?

Make clear the critical points of “trust” outside the blockchain. Though the blockchain ledger may be theoretically secure and immutable, there are sources of data (digital meters, for example, or customer private wallets) that must be trusted and secure to ensure accurate data is recorded or value is transferred. A complete description of the platform cybersecurity should be considered essential.

Describe in sufficient detail the tokens in the platform. That seems simple enough, but there are many types of tokens, and how they are utilized can be quite different (application tokens, versus asset-backed tokens, for example). Am I buying access to a platform, a share of an energy asset, a reward for verified behavior, or am I buying actual units of energy?

Describe the lifecycle of a token in your ecosystem. If tokens are created as electricity is generated, how are they then traded and retired? What does settlement look like, and have all aspects of verification been made clear? Be clear about the regulatory paradigm in which you will be operating. If you plan to be a competitive electricity retailer, which markets are open to you? If you plan to offer peer-to-peer trading in microgrids, how will you avoid infringing on utility franchise rights?

Define the hardware requirements for your blockchain application. Does it require a specially designed meter? Will you use off-the-shelf monitoring equipment and software? How much diligence have you done to ensure the systems will perform as expected?

Focus on your initial application set. There are many potential blockchain applications in the energy sector, and too many white papers attempt to tackle them all. Instead, delve deep into the applications you intend to employ first, and simply define your later intentions.

Have a team with experience in your part of the energy market. This may seem obvious, but you might be surprised how many blockchain energy teams have great depth of expertise in blockchain and virtually none in energy. The energy market is challenging -- just ask the multitude of failed technology startups that have come before you. Build a team that can navigate energy’s unique barriers.

When in doubt, illustrate. Diagrams and illustrations of the flows of energy, value, data, settlements, etc., will go a long way in revealing how your platform works.

Inclusion of all the items on this list still does not make your ICO a good investment. But it may just allow your investors/token purchasers to take less of a shot in the dark when buying into your vision.

Scott Clavenna is the co-founder and chairman of GTM. Shayle Kann is a senior advisor to GTM. For more on blockchain concepts in energy, listen to our podcast explainer "Consensus."

Join GTM at the Blockchain in Energy Forum on March 8 in NY. Innovators from utilities, start-ups, investors and policymakers will come together for a full day of networking, dynamic conversations, and learning what the future may hold for this technology. From transactive energy, to supply chain management, to asset tokenization, this event will get everyone up to speed on the distributed ledger technology and its real-world use cases.

Below is a list of white papers the authors compiled as background:

PowerLedger

SunContract

Grid+

WePower

Energi Mine

Pylon

BCDC

KWH Coin

Exergy

Restart Energy

Prosume

NAD Grid

Assetron

Solar Bankers

0 notes

Text

#212 Adam Perlow & Asher Manning: Zen Protocol - A Decentralized Financial System

We were joined by Founder Adam Perlow and Developer Asher Manning of Zen, a public blockchain project focused on building a decentralized financial system. The core premise of Zen is that none of the public blockchain networks are focused on financial asset. Zen is aiming to fill that gap through a Bitcoin-like UTXO architecture that supports multiple asset and smart contracts to enforce complex ownership rules.

We talked through their original design choices, their use of formal verification, connection to Bitcoin and vision for a fully decentralized financial system.

Topics discussed in this episode:

Why existing public blockchains are ill-suited for financial instruments

Why Zen chose to use a Bitcoin-like UTXO architecture

How Zen uses formal verification to allow smart contracts without a virtual machine or needing gas

How the Active Contract Set reduces the burden on the miners

Walking through creating, trading and settling a call option on Zen

How Zen allows payments to be settled in Bitcoin

Getting data from the outside world with oracles

Zen's use of Proof-of-Work regulated by on-chain governance

Links mentioned in this episode:

Zen Protocol - A Financial Engine

Zen Protocol - Whitepaper

Zen Protocol - Deck

Google Campus Presentation - YouTube

Zen - Alpha Version

Zen Protocol Founders Film - YouTube

Oracles and Zen ?'" Zen Protocol

Zen?'?s contract lifecycle ?'" Zen Protocol

Sponsors:

Shapeshift: Buy and sell alt coins instantly and securely without a centralized exchange - http://ift.tt/2thJTEU

Support the show, consider donating:

BTC: 1CD83r9EzFinDNWwmRW4ssgCbhsM5bxXwg (http://ift.tt/2rBuL3j)

ETH: 0x8cdb49ca5103Ce06717C4daBBFD4857183f50935 (http://ift.tt/2r5NyAq)

This episode is also available on :

Epicenter.tv

YouTube

Souncloud

Watch or listen, Epicenter is available wherever you get your podcasts.

Epicenter is hosted by Brian Fabian Crain, S?ƒbastien Couture & Meher Roy.

from The Let's Talk Bitcoin Network http://ift.tt/2AdCR85 via IFTTT

0 notes