#breaking crypto news in uae

Text

Prime Trust, FTX's Partnered Crypto Custodian, Initiates Bankruptcy Protection Proceedings:

Prime Trust, the crypto custodian closely affiliated with FTX, has taken the step of filing for bankruptcy protection. Learn more about the situation and its implications in the world of cryptocurrency.

0 notes

Text

Ethereum Celebrates 9th Anniversary Under Vitalik Buterin’s Leadership

Key Points

The Ethereum community, led by Vitalik Buterin, celebrates its 9th anniversary with significant growth and success.

Buterin to speak at EDCON 2024 conference, highlighting Ethereum’s future over the next decade.

Vitalik Buterin, co-founder and core developer of Ethereum (ETH), is leading the global community in celebrating nine successful years.

Buterin is set to be a guest speaker at the EDCON 2024 conference in Tokyo on Tuesday.

Highlighting Ethereum’s Future

During the conference, Buterin will discuss the expectations for the Ethereum network over the next ten years.

Ethereum’s Past Achievements

Ethereum has become a global leader in the deployment of smart contracts, with almost $60 billion in total value locked and over $78 billion in the stablecoins market cap.

The Ethereum ecosystem includes top-tier decentralized financial (DeFi) protocols led by Uniswap (UNI), EigenLayer, AAVE, and Maker, among others.

The Ethereum network boasts more than 98 million on-chain holders.

Following its successful transition from the proof-of-work (PoW) consensus method to the proof-of-stake (PoS), the blockchain has been adopted by more institutional investors.

As of this report, over 35 million ETH units have been staked to secure the blockchain.

The Ethereum network has undergone several changes over the years, including the London hard fork and the recent Dencun upgrade.

However, it faces stiff competition from other layer-one blockchains, led by Solana (SOL).

The recent approval of spot Ether ETFs in the United States has changed the market outlook for the Ethereum ecosystem.

Ethereum is expected to continue attracting more institutional investors looking to diversify their crypto portfolios.

Excluding Grayscale’s ETHE, which has about $6.9 billion in assets under management, the rest of the spot Ether ETF issuers have seen notable cash inflows in recent days.

Ethereum’s Future

With Ethereum having achieved legal clarity in major global economies like the United States, Singapore, Europe, and UAE, its adoption is expected to grow exponentially in the coming years.

The crypto industry is predicted to play a significant role in global geopolitics, including local politics in different countries.

However, Ethereum’s core developers are still discussing potential upgrades to ensure the network’s competitiveness in the future.

Ethereum’s price has soared more than 770,000 percent since its inception.

In the next decade, Ethereum’s price is expected to continue its bullish outlook, though with diminishing returns.

In the midterm, Ethereum’s price is expected to consolidate between $2,800 and $4k before inevitably breaking out to a new all-time high in the coming months.

0 notes

Text

Crypto Family About to Launch Family Tokens and NFTs Pretty Soon

Join Our Telegram channel to stay up to date on breaking news coverage

Dubai, UAE – Crypto Family, the blockchain-based platform provides a unique opportunity for members to participate in the growing crypto industry, has announced the upcoming launch of its new Family Tokens and Family NFTs. These innovative assets will provide unparalleled benefits for members, including enhanced wealth…

View On WordPress

0 notes

Text

What Is the Difference Between Public, Private and Hybrid Blockchain?

To be sure, the expressions of Fred Ehrsam sound accurate now like never before. The utilization of blockchain in different exchanges and tasks has arrived at staggering levels. This saturation of blockchain requires a satisfactory information base for people straightforwardly and by implication impacted by it. This article carries such information to your fingertips as it inspects the three famous sorts of blockchains by breaking down the distinctions between each of the three.

What are the Sorts of Blockchains?

Blockchain comes in various structures and can be used for different capabilities. The eccentricities of every sort rely upon its attributes. The three well known ones have been elaborated beneath.

Public Blockchain

Generally called 'trustless or permissionless' blockchains, public blockchains are precisely as the name suggests; they are blockchains broadly accessible for everybody engaged with the utilization of blockchain for exchanges and undertakings. With a public blockchain, there is no focal power or control. Incidentally, it is utilized for networks that require high straightforwardness. Nonetheless, the proviso with public blockchain is that with more straightforwardness comes less security.

Confidential Blockchain

A private blockchain is likewise known to be a 'permissioned' blockchain. A private blockchain is positively more prohibitive than its partners. It just permits a chose number of people to be available inside a current shut network where just certain people or gatherings have the position to approve exchanges on the blockchain network. Regardless, security brings down straightforwardness and supports defilement.

Crossover Blockchain

Half and half blockchain involves a touch of the past blockchains above. It considers exchanges in which an authority decides the exchanges or information to be made private. Conventional half breed blockchains are private however can undoubtedly be made openly undeniable assuming that the need emerges

What are the distinctions between the Kinds of Blockchain?

There are a few noticeable contrasts between the blockchains above. As far as one might be concerned, their significant contrast is the straightforward entry. With public blockchains, any client can join the blockchain network without limitations. Be that as it may, the inverse is the situation for private blockchains, as clients have limited admittance to the organization.

Likewise, straightforwardness is really important for private blockchains, and security is critical. Then again, public blockchains permit clients to join networks pseudo-secretly without being known. Private blockchains may not be pretty much as secure as a public blockchain on the grounds that the last option has numerous hubs that approve and affirm exchanges.

Remarkably, public blockchains themselves take more time to deal with exchanges because of the hubs, network size, and approval process. Then again, a confidential framework is moderately quicker on the grounds that less individuals are on the organization.

At last, the half and half framework includes a mix of permissioned and permissionless blockchains. The organization can permit clients a smidgen in excess of a private blockchain in proper cases. Where approval is required, it can likewise disclose the exchange for approval processes. Many have tracked down it wise to agree to the half and half framework.

End

Any blockchain above can be utilized for exchanges relying upon style, capability, and reason. In any case, make certain to do satisfactory examination to affirm the feasibility and reasonableness of a blockchain before use.

Look at The News On Most recent Points

Read The Latest Blockchain News In UAE

Read The Latest Crypto currency News In UAE and Saudi Arabia

Read The Latest NFT News In Middle East

Read The Latest Tech News In UAE

Read The Latest News In Middle East

#Blockchain News Me UAE#Blockchain Middle East News#Middle East Blockchain News#Blockchain News Dubai

1 note

·

View note

Text

Privacy and Data Protection for Tech Companies in Saudi Arabia

Innovation has opened us to such countless conceivable outcomes and various open doors. A long time back, our entrance and connectedness were in a real sense non-existent. Because of innovation, the world is turning into a worldwide town, and tech organizations are at the front line of driving this unrest. The connectedness we have, in any case, comes at a loss. Protection and individual information are currently open like never before. With the snap of a finger, a singular's inclinations and history are open. Sadly, as a general rule, they fall into some unacceptable hands, in this way making a break of the principal right protection. What's more, information breaks influence the monetary part of an economy. For instance, somewhere in the range of 2021 and 2022, the expense of information breaks in the Center East increased by 7.6%. This brought about a deficiency of about $7.45 million.

Why Tech Organizations need to focus on security and information assurance

With the Vision 2030 vision of the Realm, its tech biological system has developed to one of the world's biggest. Saudi Arabia's innovation market is assessed to be the biggest in the district, with a volume of $40 billion. Nonetheless, with the development of its innovation area, there has likewise been a flood in information breaks. As per IBM, 44% of all information breaks are connected to the robbery of individual data. It is likewise the costliest for the district, representing a 10% increment in monetary costs in 2021. The expected breaks of security and the monetary costs break of protection prompts are the critical motivations behind why tech organizations need to focus on information insurance. Without the guideline and full execution of security and information assurance, tech organizations could continue to endure the shot. This will bring about diminished shopper trust and expanded openness to monetary dangers.

How might Tech Organizations guarantee security and information assurance?

The Individual Information Security Regulation 2021 (PDPL) was sanctioned by the Saudi Bedouin government and produced full results in 2022. The law safeguards individual information, and its extension stretches out to any handling by business and public elements inside Saudi Arabia. PDPL means to be predictable with standards in global information assurance regulations. Its primary highlights incorporate Information Subject privileges, Regulator enlistment and commitments, Assent, Security strategy, Reason constraint, and Information minimization. The law is the main establishment that handles the security and information insurance issue. Subsequently, it establishes the rhythm for tech organizations to know their information assurance standards. Consequently, by executing this regulation in a tech organization's administration structure, there ought to be negligible information breaks in buyer protection. Likewise, Saudi Arabia, close by other MENA nations, has marked an explanation that desires large tech organizations to guarantee that information isn't abused. This alliance with tech organizations to give information security will empower tech organizations to focus on protection.

Primary concern

For the Realm of Saudi Arabia to genuinely partake in the yields from its mechanical ventures, there is a requirement for individual data to be safeguarded. Without this, the potential for advanced innovations and the web to work on individuals' lives inside the locale will hardly be understood.

Look at The News On Most recent Points

Read The Latest Blockchain News In UAE

Read The Latest Crypto currency News In UAE and Saudi Arabia

Read The Latest NFT News In Middle East

Read The Latest Tech News In UAE

Read The Latest Environment News In Middle East

1 note

·

View note

Text

UAE firms now accepts cryptocurrency as payment: Umar Farooq Zahoor

There has tremendous interest in cryptos because people see this as the future payment gateway system, especially those who have held on to them for a longtime and are now looking to cash them, Sheikh Umar Farooq Zahoor, former director of AMERI GROUP. Many developer, delivery firms says will accept Cryptocurrencies Bitcoin and Ethereum as payment.

For example YallaMarket payment system accepts stable coins USDT (Tether) and USDC. These are blockchain-based cryptocurrencies whose tokens in circulation are backed by an equivalent amount of US dollars, making them stablecoins with a price pegged to $1.00. So, bananas — one of the most popular items, which costs Dh7 on average, can be purchased for 1.91 USDT.

Besides launching a new payment method for its customers, many startup is also geared up to receive crypto investments from MENA-based partners and is considering paying salaries via digital assets in the future. According to YouGov, 67 per cent of UAE residents say they are interested in investing in cryptocurrencies within the next five years.

At the same time, UAE is one of the top markets globally, where 40 per cent of consumers say they trust cryptocurrencies, YouGov says. Acceptance of certain cryptos has been growing exponentially in the UAE. Crypto adoption is growing rapidly in the region. As the digital economy grows, using crypto as a medium of exchange is a no-brainer. Like all businesses started using the internet 20 years ago, everyone will start using crypto now; it is inevitable,” said Sheikh Umar Farooq Zahoor, former director of AMERI GROUP. Whether the crypto market has been up or down, cryptocurrencies continue to break more barriers - not just in popularity, but in mainstream acceptance.

But before crypto truly begins to dominate our lives like traditional currencies do now, it's important that crypto remains as a stable payment option, and one that we can use responsibly. So far, public officials across the globe are trying to form new rules to manage cryptocurrency markets, but many fear this could end up in overregulation. Before that happens, crypto companies can take proactive steps to better protect their investors, while protecting the spirit of decentralization, at the same time

0 notes

Text

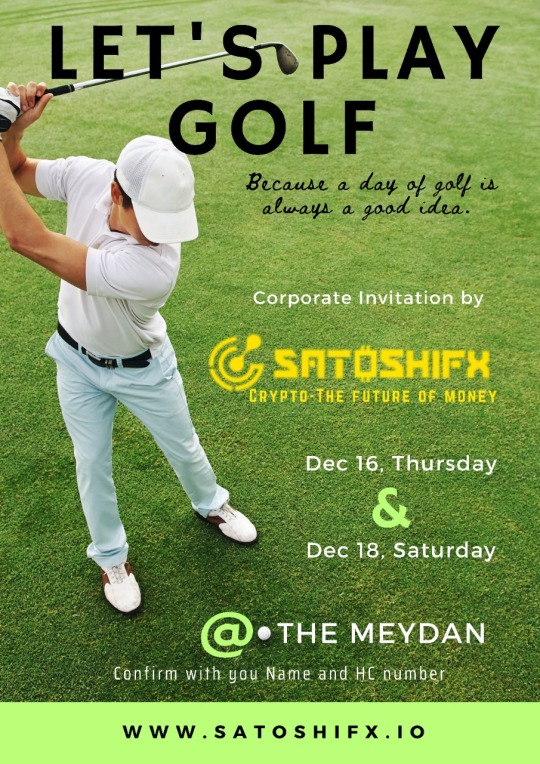

Emirates Amateur Golf League returns with two new events at Meydan

The popular Emirates Amateur Golf League is set to return better than ever with the announcement of two new events taking place at the Track, Medan Golf on Saturday December 18th.

The EAGL Corporate Invitational will see nine eight-person teams representing some of the region’s top businesses battle it out for top honours over the much-loved Peter Harebrained-designed 9-hole course. Already confirmed are Emirates NBD, Bentley Emirates, WoW (Wealth of Wellness), 24 Secure (international security firm), real estate developer Shapoorji Pallonji and Satoshi FX – a Forex & Crypto firmas well as an Emirati Players team sponsored by the Giant group as a part of their CSR and sports enhancement activity.

Priyaa Kumaria – League Administrator, commented: “The Corporate Invitational will be the first event of a planned Business Series and will feature nine teams represented by the banks, airlines, wellness, real-estate, logistics, Industry, luxury car and an EAGL Team. The agenda of the Corporate Invitational is to host eight different Corporates who shall further their customer / client enhancement via golf by fielding eight players each.

“The corporates shall reap intangible benefits which are valued much higher with this model as compared to a regular golf day where only existing clients are invited.”

One of the standout features of the Emirates Amateur Golf League, which hosted its first showcase event at Jumeirah Golf Estates back in June, is its commitment to giving amateurs a pro-golf-like experience. Central to this is the fact that the events are broadcast live on TV and online channels and EAGL Founder and Chairman Sudesh Aggarwal revealed that this key feature would again be at the forefront of the upcoming event at The Track, Meydan, Golf. “Live broadcast has been the mantra for EAGL and this is another first of its kind for amateur golf,” said Aggarwal. “The EAGL Corporate Invitational will be live on Dubai sports and on the EAGL YouTube channel. Another path breaking initiative by EAGL after the resounding success of the showcase event held in June 2021.

“The EAGL Business Series is for promoting business, networking and team golf and in the Corporate Invitational we have raised funds partly from team sponsorships while the event costs around USD 250k.

“This event being of commercial nature will accrue benefits to the participating corporates directly and indirectly in many ways especially with the Live TV broadcast.”

The golf event on Saturday December 18th will be preceded by a Gala Dinner at the glamorous Meydan Hotel on the evening of Thursday December 16th alongside a night at the races on the iconic track.

“We are very happy to host the event in an all-inclusive luxury destination venue like Meydan with golf, dinner and races and a lavish spread for our teams. Meydan will be decked to welcome our teams with personalized lockers, carts with caddies and the wonderful weather and ambience that Meydan offers,” added Kumaria.

The prize for winning the EAGL Corporate Invitational will be a team golfing holiday to the Lighthouse Golf & Spa Resort in Bulgaria while the winning corporate team sponsor will receive the much coveted EAGL bespoke trophy and a ½ page advert in a national newspaper.

The Track, Meydan Golf’s Director of Golf, William Bruce, said: “We are incredibly excited to host the Emirates Amateur Golf League at the Track, Meydan Golf. Meydan Golf has always prided itself on being the most inclusive golf experience in Dubai and partnerships like this one with the EAGL will help to further promote the facility as one that is available and open to all standards of golfer day or night, without the need for a membership, special dress code or stuffy rules!”

Taking place on the same day as the EAGL Corporate Invitational will be the inaugural EAGL Junior Championship hosted by Shiv Kapurwhich aims to serve one of EAGL’s key goals to grow the game of golf among the younger population in the UAE.

EAGL Ambassador, European Tour pro, Shiv Kapur, said: “The Business-Series will also have a junior series which will be a regular feature. I feel that a lot has been done at the corporate level and grassroots level but in terms of competition with juniors we thought it would be a great platform to give alongside the business angle to promote junior golf and the women’s game in the region. I think a lot happens in Dubai at professional level but at the amateur level this is probably the grandest event that you’re going to see in the amateur golf landscape in Dubai.”

https://www.satoshifx.com/

0 notes

Text

Cryptocurrencies have faced several significant challenges during the last 12 months. After Celsius, Voyager, and FTX became bankrupt, the public and media began to question the industry’s sustainability, and authorities began to consider regulations more actively. Massive price drops after 2021’s record high also contributed to the gloomy outlook. However, the industry’s resilience and determination in 2022 offer hope for the future of cryptocurrency.

#cryptotech news me uae#crypto news in uae#uae breaking crypto news#crypto news in dubai#breaking crypto news in uae

0 notes

Photo

New Post has been published on https://coinprojects.net/crypto-exchange-kraken-gains-abu-dhabi-license/

Crypto Exchange Kraken Gains Abu Dhabi License

Kraken, one of the largest crypto exchanges in the world, gained approval to operate in Abu Dhabi on Monday. The exchange joins a widespread push into the Middle East, amid growing crypto adoption in the region.

The move was revealed in an announcement by Abu Dhabi’s market registration authority. The exchange is the first to receive a license to operate a regulated, digital asset exchange from the Abu Dhabi Global Market financial centre, the regulator said.

The move comes amid increased efforts by the United Arab Emirates (UAE) to become the next crypto capital. Abu Dhabi had in 2018 passed crypto-friendly regulation, inviting ventures by several major crypto players.

Kraken sets up Middle East HQ in Abu Dhabi

Kraken, which has over 9 million users globally, set up its Middle East headquarters in Abu Dhabi, the markets regulator said.

The exchange received all the required clearances from Abu Dhabi’s financial regulator, and will “soon” allow investors to trade crypto directly in UAE Dirham.

Curtis Ting, Managing Director of EMEA at Kraken lauded the UAE for having crypto-friendly laws, and said the exchange plans to expand further in the Middle East and North Africa region “in the months and years ahead.”

Kraken’s approval also beats out that of world’s largest crypto exchange Binance, which only holds an in-principle license to operate in Abu Dhabi.

UAE attracts crypto investors

But both Binance and Kraken recently secured licenses to operate in Dubai, another major financial hub in the UAE. The city had also recently passed crypto-friendly laws to attract more investment.

Binance established its global headquarters in Dubai. It is also among the few exchanges recently authorized to operate in Bahrain.

World no.2 crypto exchange FTX recently gained a license to operate in Dubai, and plans to set up its regional headquarters in the city. Smaller exchanges Bybit and Crypto.com also both recently gained licenses to operate in Dubai.

The UAE is ranked third in crypto adoption in the Middle East, behind Turkey and Lebanon, according to a 2021 report by blockchain analytics firm Chainalysis.

Disclaimer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

About Author

With more than five years of experience covering global financial markets, Ambar intends to leverage this knowledge towards the rapidly expanding world of crypto and DeFi. His interest lies chiefly in finding how geopolitical developments can impact crypto markets, and what that could mean for your bitcoin holdings. When he isn’t trawling through the web for the latest breaking news, you can find him playing videogames or watching Seinfeld reruns.

You can reach him at [email protected]

Source link By Ambar Warrick

#Altcoin #Binance #Bitcoin #BlockChain #BlockchainNews #BNB #Crypto #CryptoExchange

0 notes

Text

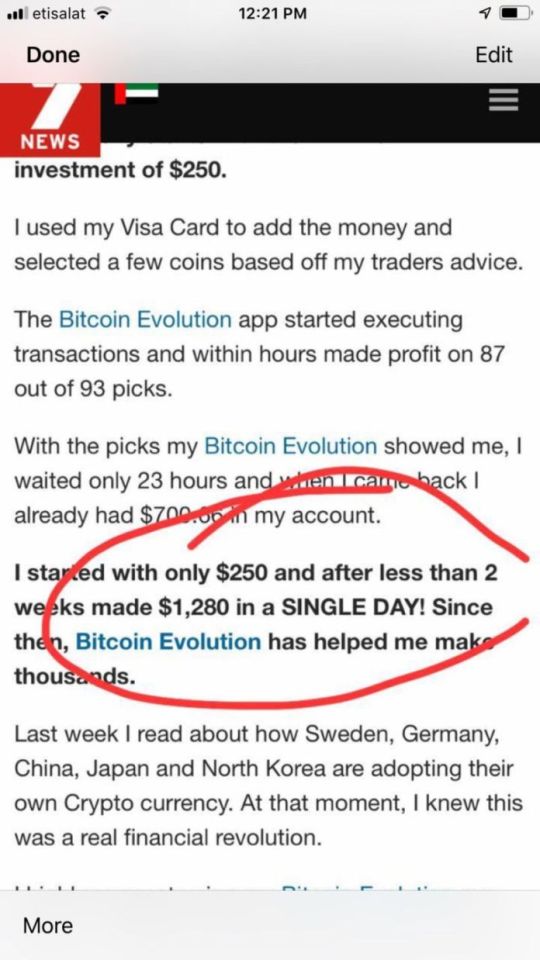

UAE residents warned about get rich quick schemes peddled as legitimate DailyKhaleej articles

Rip-off alert

Picture Credit score: DailyKhaleej

Dubai: DailyKhaleej has cautioned residents in opposition to a dodgy get-rich-quick scheme being promoted on an abroad web site as a legitimate DailyKhaleej report.

Peddled in an editorial type as a DailyKhaleej article, the artful advertorial falsely claims {that a} native businessman has backed a doubtful bitcoin funding alternative.

Because it seems, the pretend endorsement is a clickbait to use the gullibility of aspiring cryptocurrency traders.

A replica of the pretend DailyKhaleej article

Picture Credit score: Screenshot

“The fraudsters have used the DailyKhaleej name to gain credibility. This is not a DailyKhaleej report and we have nothing to do with it. Anyone who invests will be doing so at their own risk,” warned the DailyKhaleej administration which has since filed complaints with related authorities.

Slipped into an abroad information portal utilizing malvertising assault (see field beneath), the report falsely claims that Emirati businessman Juma Al Majid appeared on The Dubai Speak Present with host Loubo Siois final week and introduced a brand new “wealth loophole” “which can transform anyone into a millionaire within 3-4 months”.

Louba Siosi, host of The Dubai Speak Present carried out no such interview

Picture Credit score: Equipped

It even has a bogus quote from the distinguished businessman describing how Bitcoin Code – a shadowy automated buying and selling software program – makes him more cash (sic) than any of his ventures.

“Right now my number one money maker is a new crypto currency auto trading programme called Bitcoin Code. It’s the single biggest opportunity I have seen in my entire lifetime to build a small fortune fast. I urge everyone to check this out before the banks shut it down,” Al Majid has been quoted as saying throughout a tv programme with Loubo Siois, govt producer and host of The Dubai Speak Present.

Nevertheless, Siois, denied conducting any interview with Juma Al Majid. “This is not true. I did not conduct any such interview. I am aghast that my name has been used to promote a shady scheme. I am weighing legal action,” Sious instructed DailyKhaleej.

The deceptive article that includes Siosi and Al Majid flooded Fb information feeds

Picture Credit score: Screenshot

The deceptive article that includes him and Juma Al Majid has been flooding the Fb feeds of unsuspecting UAE residents over the week.

Of late, a number of high-profile individuals within the UAE and overseas have been wrongly linked with comparable pretend advertorials involving binary choices, auto-trading and cryptocurrency.

Amongst them is English actuality tv choose and producer Simon Cowell. Someday again it was reported that he has invested £500,000 (Dh2.three million) of his personal capital into autotrading as ‘wealth creation system’.

One other sufferer Mark Lewis, who based the buyer web site MoneySavingExpert.com, has sued Fb for failing to cease the deceptive adverts.

The editorial type articles invariably carry names of main information shops – BBC within the UK, ARD in Germany and now DailyKhaleej within the UAE.

The “Pre-sale” touchdown web page is designed to construct belief with guests who’re then guided to a different touchdown web page. That is the place the rip-off occurs. Final 12 months, Sharjah primarily based Pakistani banker Roohi Imran misplaced $21,000 (Dh77,133) on a web based buying and selling platform after falling for the racket whereas looking a legitimate information web site.

“As I was scrolling down the home page, a catchy headline suddenly caught my attention. When I clicked it, I was taken to a page which featured stories about how people were making so much money from online trading that they had quit their jobs. The reports appeared so convincing that I believed them and decided to invest as well. By the time I realised my mistake, it was too late,” stated the girl whose misadventure has left her household in a debt spiral.

One other bogus Dubai report claimed a valet made US$1,280 in a single day

Picture Credit score: Screenshot

“I opened an online account by making an investment of $1,250 but was tricked into putting more and more money in subsequent months,” she recalled.

4 of her youngsters haven’t returned to high school because the final summer season break due to unpaid charges whereas the fifth one hasn’t been capable of begin one as the household has no cash. Just a few days in the past a Keralite misplaced $500 to the rip-off after falling for a pretend information which detailed how a valet attendant at a Dubai lodge made $1,280 in single day afer investing $250 with Bitcoin Evolution.

There are numerous variations of the rip-off however most of them unfold similarly.

Pakistani Ruhi Imran displaying paperwork after shedding Dh77,000 in a dodgy on-line buying and selling platform

Picture Credit score: Mazhar Farooqui, DailyKhaleej

How the rip-off unfolds

You might be looking a trusted web site if you spot an image of a celeb beneath a catchy headline. There’s nothing remotely to recommend it’s an commercial. As you click on on it, you might be guided to a 3rd celebration web page which describes how the celeb has reaped immense monetary advantages by investing in crypto forex, binary choices or auto buying and selling. And because the report is accompanied by the brand or title of a reputable information company, you might be satisfied it’s real. On the finish of the web page, is an online kind searching for your curiosity in becoming a member of the scheme.

No sooner have you ever plugged in your private particulars, you might be contacted by a fund supervisor and inspired to make an preliminary funding by forking out a small quantity in the direction of the acquisition of a crypto forex. You then obtain a hyperlink and login particulars to the ‘trading platform’ the place your crypto forex is being held. Over the following few days the worth of your holdings seems to extend, and your funding supervisor encourages you to purchase extra. Reassured, you shell out more cash. Weeks later, you’ve sunk as much as Dh10,000 into the scheme – though your crypto forex is valued at ten occasions the quantity on the buying and selling platform. Flush with pleasure, you resolve to get pleasure from your returns. So that you contact your fund supervisor who asks to first deposit his fee. You don’t thoughts giving one other Dh5,000 – into his checking account. and anticipate him to launch your funds. That decision by no means comes.

Want to stay vigilant

Marclino Fernandes, service supply head of data expertise at DailyKhaleej stated individuals want to stay vigilant in opposition to cyberattacks.

“Cybercriminals hide in the dark web to remain anonymous as they prey on unsuspecting people all day. They hop from one platform to another just like parasites hop from one host to another,” stated Fernandes. “We involve UAE authorities to crack down on them and apply technical controls to keep them at bay,” he added.

What’s malvertising?

Malvertising is a kind of assault wherein a cybercriminal injects malicious code into legitimate internet advertising networks. The code sometimes redirects customers to malicious web sites.

The assault permits perpetrators to focus on customers on extremely respected web sites to achieve of thousands and thousands of unsuspecting guests with a extremely profitable rip-off

Circumventing the ban

On January 30, 2018, Fb banned ads for binary choices buying and selling as effectively as for cryptocurrencies and preliminary coin (ICOs). Google and Twitter introduced comparable bans within the following weeks. But, some advertisers have discovered methods to bypass the ban by malvertising.

The UAE’s Nationwide Media Council launched Digital Media Rules in March 2018 to encourage digital media shops to supply dependable content material that meets the wants of various audiences. “The guide refers to electronic advertisements in the sphere of social media communication and stresses that all those who carry out advertising activities on a commercial basis need to obtain a prior licence from the council,” stated the NMC. “The council continues to be a part of meaningful efforts to maintain a practical framework to protect the public from advertisements that do not comply with the applicable standards.”

Final 12 months Fb and Instagram issued a press release to DailyKhaleej saying they take unlawful content material extremely significantly. “We are investing heavily in our security and content review teams, as well as smart technology such as machine learning and artificial intelligence to make both platforms a safer place for everyone,” the assertion stated,

“In many ways, we face sophisticated adversaries who continually challenge tactics to circumvent our controls, which means we must continuously build and adapt our efforts,” it added.

from WordPress https://ift.tt/2SN5D6U

via IFTTT

0 notes

Text

What Were the Catalysts that Shot Bitcoin Price 15% Higher?

Bitcoin (BTC) has been on an absolute tear over the past five or six days, with the cryptocurrency gaining some 23% from the $6,800 low put in last week. While many BTC investors have been extremely satisfied because of this move, with this marking the first notable bull rally in over two months, few know exactly what transpired to send Bitcoin higher. Related Reading: XRP’s Epic 12% Rally is Bullish for Ethereum Price; Here’s Why A cryptocurrency industry executive who heads a market research and data firm recently broke down his thoughts on the rally to $8,400, weighing in on what he thinks brought digital assets dozens of percent higher than they were in the middle of December. What Sent Crypto Market Hurtling Higher: Industry Exec Bloomberg recently published an article outlining Bitcoin’s latest jump higher. In it, it cited Emmanuel Goh, who runs crypto derivatives tracker Skew. Per the comment from Goh, both Bitcoin and gold — up by 23% and 5%, respectively, in the past few days — have been supported “due to rising tensions between the U.S. and Iran.” For those who missed the memo, late last week, the U.S. government revealed that it had killed Iranian General Qassem Soleimani in an airstrike, a move which President Trump claimed was to prevent any further attacks against Americans or the country’s allies. The conflicts have been growing since then, with Iran recently attacking a military base with U.S. troops stationed there and threatening more bases along with Israel and the UAE. Global markets, including that of gold and Bitcoin, have seemingly responded to the news. Risk assets, such as U.S. equities, have slowed their uptrend higher, while risk-off assets, like gold, oil, and (seemingly) BTC, have posted strong gains. Goh also attributed Bitcoin’s recent gains to the so-called January Effect, which is when “professional investors [come] back from the Christmas break and starting to deploy capital.” Related Reading: Bitcoin is On the Brink of Going Parabolic; Here’s the Levels to Watch What’s Next For Bitcoin Price? With this in mind, what’s next for the Bitcoin price? Although a consensus hasn’t been struck, the overall sentiment is leaning bullish for a confluence of reasons. Per previous reports from NewsBTC, Bitcoin’s charts are printing bullish signs galore. For instance, the below chart, a weekly BTC chart, has printed a bullish Parabolic Stop and Reverse candle for the first time since the $14,000 candle in June of last year. Yes, the SAR has not confirmed, though it is an extremely strong sign for bulls should it close with the SAR indicator under the candle. Also, according to Willy Woo, partner at cryptocurrency fund Adaptive Capital and a noted on-chain analyst, his indicators which track investor activity — correlated closely with market cycles — are showing clear signs that Bitcoin is decisively not in a bear market. Related Reading: XRP And Ripple Unexpectedly Face Major Blow in Japan After 15% Price Surge Featured Image from Shutterstock The post appeared first on NewsBTC.

from Cryptocracken WP https://ift.tt/39Oma1b

via IFTTT

0 notes

Text

What Were the Catalysts that Shot Bitcoin Price 15% Higher?

Bitcoin (BTC) has been on an absolute tear over the past five or six days, with the cryptocurrency gaining some 23% from the $6,800 low put in last week. While many BTC investors have been extremely satisfied because of this move, with this marking the first notable bull rally in over two months, few know exactly what transpired to send Bitcoin higher. Related Reading: XRP’s Epic 12% Rally is Bullish for Ethereum Price; Here’s Why A cryptocurrency industry executive who heads a market research and data firm recently broke down his thoughts on the rally to $8,400, weighing in on what he thinks brought digital assets dozens of percent higher than they were in the middle of December. What Sent Crypto Market Hurtling Higher: Industry Exec Bloomberg recently published an article outlining Bitcoin’s latest jump higher. In it, it cited Emmanuel Goh, who runs crypto derivatives tracker Skew. Per the comment from Goh, both Bitcoin and gold — up by 23% and 5%, respectively, in the past few days — have been supported “due to rising tensions between the U.S. and Iran.” For those who missed the memo, late last week, the U.S. government revealed that it had killed Iranian General Qassem Soleimani in an airstrike, a move which President Trump claimed was to prevent any further attacks against Americans or the country’s allies. The conflicts have been growing since then, with Iran recently attacking a military base with U.S. troops stationed there and threatening more bases along with Israel and the UAE. Global markets, including that of gold and Bitcoin, have seemingly responded to the news. Risk assets, such as U.S. equities, have slowed their uptrend higher, while risk-off assets, like gold, oil, and (seemingly) BTC, have posted strong gains. Goh also attributed Bitcoin’s recent gains to the so-called January Effect, which is when “professional investors [come] back from the Christmas break and starting to deploy capital.” Related Reading: Bitcoin is On the Brink of Going Parabolic; Here’s the Levels to Watch What’s Next For Bitcoin Price? With this in mind, what’s next for the Bitcoin price? Although a consensus hasn’t been struck, the overall sentiment is leaning bullish for a confluence of reasons. Per previous reports from NewsBTC, Bitcoin’s charts are printing bullish signs galore. For instance, the below chart, a weekly BTC chart, has printed a bullish Parabolic Stop and Reverse candle for the first time since the $14,000 candle in June of last year. Yes, the SAR has not confirmed, though it is an extremely strong sign for bulls should it close with the SAR indicator under the candle. Also, according to Willy Woo, partner at cryptocurrency fund Adaptive Capital and a noted on-chain analyst, his indicators which track investor activity — correlated closely with market cycles — are showing clear signs that Bitcoin is decisively not in a bear market. Related Reading: XRP And Ripple Unexpectedly Face Major Blow in Japan After 15% Price Surge Featured Image from Shutterstock The post appeared first on NewsBTC.

from Cryptocracken Tumblr https://ift.tt/39Oma1b

via IFTTT

0 notes

Text

What Were the Catalysts that Shot Bitcoin Price 15% Higher?

Bitcoin (BTC) has been on an absolute tear over the past five or six days, with the cryptocurrency gaining some 23% from the $6,800 low put in last week. While many BTC investors have been extremely satisfied because of this move, with this marking the first notable bull rally in over two months, few know exactly what transpired to send Bitcoin higher. Related Reading: XRP’s Epic 12% Rally is Bullish for Ethereum Price; Here’s Why A cryptocurrency industry executive who heads a market research and data firm recently broke down his thoughts on the rally to $8,400, weighing in on what he thinks brought digital assets dozens of percent higher than they were in the middle of December. What Sent Crypto Market Hurtling Higher: Industry Exec Bloomberg recently published an article outlining Bitcoin’s latest jump higher. In it, it cited Emmanuel Goh, who runs crypto derivatives tracker Skew. Per the comment from Goh, both Bitcoin and gold — up by 23% and 5%, respectively, in the past few days — have been supported “due to rising tensions between the U.S. and Iran.” For those who missed the memo, late last week, the U.S. government revealed that it had killed Iranian General Qassem Soleimani in an airstrike, a move which President Trump claimed was to prevent any further attacks against Americans or the country’s allies. The conflicts have been growing since then, with Iran recently attacking a military base with U.S. troops stationed there and threatening more bases along with Israel and the UAE. Global markets, including that of gold and Bitcoin, have seemingly responded to the news. Risk assets, such as U.S. equities, have slowed their uptrend higher, while risk-off assets, like gold, oil, and (seemingly) BTC, have posted strong gains. Goh also attributed Bitcoin’s recent gains to the so-called January Effect, which is when “professional investors [come] back from the Christmas break and starting to deploy capital.” Related Reading: Bitcoin is On the Brink of Going Parabolic; Here’s the Levels to Watch What’s Next For Bitcoin Price? With this in mind, what’s next for the Bitcoin price? Although a consensus hasn’t been struck, the overall sentiment is leaning bullish for a confluence of reasons. Per previous reports from NewsBTC, Bitcoin’s charts are printing bullish signs galore. For instance, the below chart, a weekly BTC chart, has printed a bullish Parabolic Stop and Reverse candle for the first time since the $14,000 candle in June of last year. Yes, the SAR has not confirmed, though it is an extremely strong sign for bulls should it close with the SAR indicator under the candle. Also, according to Willy Woo, partner at cryptocurrency fund Adaptive Capital and a noted on-chain analyst, his indicators which track investor activity — correlated closely with market cycles — are showing clear signs that Bitcoin is decisively not in a bear market. Related Reading: XRP And Ripple Unexpectedly Face Major Blow in Japan After 15% Price Surge Featured Image from Shutterstock The post appeared first on NewsBTC.

from CryptoCracken SMFeed https://ift.tt/39Oma1b

via IFTTT

0 notes

Text

Novotel Bahrain Al Dana now accepts cryptocurrencies as payment through its partnership with Eazy Financial Services. Under the terms of the contract, Novotel Bahrain Resort will get access to a range of digital payment systems designed to streamline business processes and improve the quality of service given to guests.

#breaking crypto news in uae#crypto news in dubai#crypto news in uae#uae breaking crypto news#cryptotech news me uae

0 notes

Text

Hardware Security Modules (HSM) Market Rising Demand at a CAGR of 11.1%

Acquire Market Research has announced a new report titled “Global Hardware Security Modules (HSM) Market 2019 by Manufacturers, Regions, Type and Application, Forecast to 2024” to their offerings

The worldwide market for Hardware Security Modules (HSM) is expected to grow at a CAGR of roughly 11.1% over the next five years, will reach 2020 million US$ in 2024, from 1080 million US$ in 2019, according to a new study.

A hardware security module (HSM) is a physical computing device that safeguards and manages digital keys for strong authentication and provides crypto processing. These modules traditionally come in the form of a plug-in card or an external device that attaches directly to a computer or network server.

Request Sample Report@ https://www.acquiremarketresearch.com/sample-request/1249

Hardware Security Modules (HSM) are devices specifically built to create a tamper-resistant environment in which to perform cryptographic processes (e.g. encryption or digital signing) and to manage keys associated with those processes. HSMs often provide cryptographic acceleration that is measured in terms of operations. These devices are used to protect critical data processing activities associated with server based applications and can be used to strongly enforce security policies and access controls. These modules are physical devices that traditionally come in the form of a plug-in card or an external network connected appliance and are often validated against security standards such as FIPS.

Scope of the Report:

The Hardware Security Module industry concentration is not high; there are more than one hundreds manufacturers in the world, and high-end products mainly from U.S. and Western European.

Global giant manufactures mainly distributed in U.S. China?and E.U. The manufacturers in U.S. have a long history and unshakable status in this field. Manufacturers such as Gemalto have relative higher level of products quality. As to France, Gemalto has become as a global leader. In Germany, Utimaco leads the technology development. Most of Chinese manufactures locate in Beijing?Guangzhou province.

Many companies have several plants, usually locate in the place close to aimed consumption region. There are international companies set up factories in China either, such as JN UNION. Some companies usually take a joint venture enter into aim market.

The key consumption markets locate at developed countries. The United States takes the market share of 32%, followed by EU with 24%. Chinas consumption market share of 14.5% with a quicker growing speed of CAGR 18%.

We tend to believe this industry becomes more and more mature, and the consumption increasing rate will show a smooth curve.

This report focuses on the Hardware Security Modules (HSM) in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

Market Segment by Manufacturers, this report covers

Gemalto, Atos SE, Westone, Thales, Ultra Electronics, Utimaco, JN UNION, JN TASS, Beijing Sansec Technology, Yubico, SWIFT, Micro Focus, Futurex, SPYRUS Inc.

More Info and TOC @ https://www.acquiremarketresearch.com/industry-reports/global-hardware-security-modules-hsm-market-2019-by/1249/

Market Segment by Regions, regional analysis covers

North America (United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

South America (Brazil, Argentina, Colombia etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Market Segment by Type, covers

General Purpose HSMs

Payment HSMs

Others

Market Segment by Applications, can be divided into

Industrial and Manufacturing

Banking, Financial services and Insurance (BFSI)

Government

Others

The content of the study subjects, includes a total of 15 chapters:

Chapter 1, to describe Hardware Security Modules (HSM) product scope, market overview, market opportunities, market driving force and market risks.

Chapter 2, to profile the top manufacturers of Hardware Security Modules (HSM), with price, sales, revenue and global market share of Hardware Security Modules (HSM) in 2017 and 2018.

Chapter 3, the Hardware Security Modules (HSM) competitive situation, sales, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Hardware Security Modules (HSM) breakdown data are shown at the regional level, to show the sales, revenue and growth by regions, from 2014 to 2019.

Chapter 5, 6, 7, 8 and 9, to break the sales data at the country level, with sales, revenue and market share for key countries in the world, from 2014 to 2019.

Chapter 10 and 11, to segment the sales by type and application, with sales market share and growth rate by type, application, from 2014 to 2019.

Chapter 12, Hardware Security Modules (HSM) market forecast, by regions, type and application, with sales and revenue, from 2019 to 2024.

Chapter 13, 14 and 15, to describe Hardware Security Modules (HSM) sales channel, distributors, customers, research findings and conclusion, appendix and data source.

Request for Discount @ https://www.acquiremarketresearch.com/discount-request/1249

About Acquire Market Research:

Acquire Market Research is a shrine of world-class research reports from around the world and we offer you only the best in the Industry when it comes to research. At Acquire, every data need will be catered to and met with a powerful world of choices.

"We understand the integral role data plays in the growth of Business empires."

Contact Us:

555 Madison Avenue,

5th Floor, Manhattan,

New York, 10022 USA

Phone No.: +1 (800) 663-5579

Email ID:

0 notes

Photo

New Post has been published here https://is.gd/RNCQxe

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Binance Coin, Bitcoin SV: Price Analysis, Feb. 6

This post was originally published here

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

Cryptocurrencies are struggling to move up, even after having been in a bear market for over a year and falling anywhere between 85 and 99 percent from their individual all-time-highs.

Investors with open positions are experiencing huge losses, and the ones sitting on the sidelines are scared to enter, as the market continues to make new lows on a regular basis. This has resulted in a drop in trading volumes across crypto exchanges.

While many retail traders are turning away from cryptocurrencies, the same cannot be said about institutional investors. The Private Office of Sheikh Ahmed bin Al Maktoum, a Dubai royal and Emirates Group chairman, is helping cryptocurrency fund manager Invao raise funds in the United Arab Emirates (UAE).

Still, the big players have been slow to enter the nascent market of crypto. None of the institutions have truly committed yet.

With no retail investors and no large-scale institutional demand, the markets are reeling and are unable to absorb even a small amount of selling pressure. Let’s see if the prices are likely to turn around from the current levels or are they getting ready to plunge even deeper.

BTC/USD

Although Bitcoin (BTC) has been trading in a small range, the sentiment remains bearish. The price continues to trade below both moving averages, and the RSI has been in the negative territory since Jan. 10. The failure of the bulls to scale above the 20-day EMA shows weakness.

The bears will now try to resume the downtrend by breaking down of the yearly low at $3,236.09. Repeated failure of the BTC/USD pair to stage a decent recovery deters the traders who are waiting to buy upon the confirmation of a bottom. The critical levels to watch on the downside are $3,000, which is more of a psychological support, and below it $2,600.

Conversely, if the cryptocurrency rebounds sharply from the current levels, or from $3,236.09, it can move up to the moving averages and above them to the downtrend line. We shall wait for a trend reversal before recommending a trade.

XRP/USD

Ripple (XRP) has been unable to find any buying support. It is likely to drop to $0.27795 for the third time since mid-December of last year. The 20-day EMA is sloping down, and the RSI is in the negative zone, which shows that the sellers have the upper hand. On a break below $0.27795, the fall can stretch to the yearly low of $0.24508.

Our bearish view will be invalidated if the bulls rebound sharply from $0.27795 and carry the XRP/USD pair above both moving averages. Such a move will signal strength and we might suggest long positions on a close above the 50-day SMA. Until then, we remain neutral-to-bearish on the pair.

ETH/USD

Ethereum (ETH) has dropped to the bottom of the range. The downsloping 20-day EMA, and the RSI in the negative zone, show that the sellers have the upper hand. A break below $103.2 will invite further selling that can drag the digital currency to $83.

Our bearish assumption will prove to be wrong if the ETH/USD pair bounces sharply from the current levels and rises above $116.3. We believe that such a move would signal a probable change in trend. Therefore, we propose a long position on a close (UTC time frame) above $116.3. The targets to watch on the upside are $134.5, and above it $167.32.

EOS/USD

After failing to break out of the 50-day SMA, EOS is likely to drop to the support at $2.1733. Both moving averages are flat, and the RSI is just below the 50 level, which shows that a consolidation between $2.1733 and $2.5944 might continue for a few more days.

Contrary to our opinion, if the bears break down of the support at $2.1733, the EOS/USD pair can slide to $1.7746, and below it to $1.55.

The cryptocurrency will show first signs of strength after the bulls scale the moving averages and the $2.5944 mark. We shall wait for the price to close (UTC time frame) above $2.5944 before suggesting any long positions.

BCH/USD

Bitcoin Cash (BCH) has been trading inside a tight range of $105–$121.3 since Jan. 28. The 20-day EMA is gradually sloping down, and the RSI is in the negative zone, which shows that the supply is exceeding the demand.

A breakdown of $105 will be a bearish indication that can result in a drop to $73.5. There might be a minor attempt to defend the psychological level at $100, but we don’t expect it to hold.

Conversely, if the BCH/USD pair breaks out of the consolidation, it can move up to $141, where it will be likely to face a stiff resistance. Upon crossing the 50-day SMA, we expect the pair to show strength. Until then, we suggest traders remain on the sidelines.

LTC/USD

After sustaining above $33 for the past four days, Litecoin (LTC) has again turned down. It is currently at the moving averages, which are likely to offer strong support.

However, if the LTC/USD pair breaks down of the moving averages and the small uptrend line, it can slide to $29.349, and below it to $27.701. Below that level, a retest of $23.090 is likely. The traders can keep the stop loss at $27.5.

On the upside, $36.428 is the critical level to watch out for. A failure to break out of this level shows a lack of demand at higher levels. Both of the moving averages are flat, and the RSI is at 50 levels, which indicates the possibility of a consolidation in the near term.

TRX/USD

Tron (TRX) failed to break out and sustain above the overhead resistance of $0.02815521 on Feb. 4, which is a negative sign.

The TRX/USD pair has formed a symmetrical triangle and its next move will start after a breakout or breakdown from it. The 20-day EMA has turned flat, and the RSI has dipped to the midpoint, which points to a range bound action in the short-term.

A break out of the triangle can carry the coin to $0.03575668, and above it to $0.038. However, if the bears break below the triangle, a drop to $0.02113440 is probable. The traders can continue to protect their long positions with the stop loss at $0.023.

XLM/USD

Stellar (XLM) is not showing any signs of buying as it continues to slide through the support levels. Having broken down of $0.07864971, it can now slide to the next support at $0.05795397. Both moving averages are sloping down, which shows weakness. However, the RSI has entered deep oversold territory, which suggests that a pullback is possible.

Any attempt to recover will face a stiff resistance at the 20-day EMA, and above it at the breakdown level of $0.09285498.

The XLM/USD pair will show signs of a reversal if the price breaks out and sustains above the downtrend line. Until then, every pullback will be sold into.

BNB/USD

Binance Coin (BNB) has been one of the strongest performers among the major cryptocurrencies this year. It has secured its place in our analysis after rising to the tenth spot by market capitalization.

After a long downtrend, the BNB/USD pair is attempting to change its trend. It broke out of the descending channel on Feb. 2 and has continued to move up since then. It can now reach the level of $10, which had previously acted as a strong resistance.

Both moving averages are gradually sloping up, and the RSI is in the overbought territory. This shows that the bulls have the upper hand, but a minor correction to $7 is probable.

Since the start of the year, the 50-day SMA has been offering a strong support whenever the price dipped to it. If the bears break down of the 50-day SMA, the cryptocurrency can turn negative.

BSV/USD

After holding on to the critical support of $65.031 for eight days, Bitcoin SV resumed its downward movement on Feb. 5. Although the pair had dipped lower today, currently it is attempting to climb back above the overhead resistance of $65.031.

If the bulls scale above the 20-day EMA, a rally to $80.352 will be probable. The 50-day SMA is located just above this level, so we anticipate a strong resistance at these levels. A break out of the 50-day SMA can result in a move to $102.58, and above it to $123.98.

On the other hand, if the bears reverse the direction of the BSV/USD pair, a fall to the next support at $57, and below that a drop to the low at $38.528, will be probable.

The market data is provided by the HitBTC exchange. The charts for the analysis are provided by TradingView.

#crypto #cryptocurrency #btc #xrp #litecoin #altcoin #money #currency #finance #news #alts #hodl #coindesk #cointelegraph #dollar #bitcoin View the website

New Post has been published here https://is.gd/RNCQxe

0 notes