#but then again llts is never predictable

Text

tubbs v dinosuit is not the fight I expected this year

35 notes

·

View notes

Photo

New Post has been published on http://bitcoinfreenews.com/2018/07/04/ausgeraumter-myth-why-bitcoin-never-to-zero/

Ausgeräumter myth: Why Bitcoin never to Zero

Bitcoin can go”has a polarising effect on people, that there are two mounts. for additional storage. To those who say that he is en through the ceiling, shooting, , and on the other, those that say that he is nothing more to be worth it. The future of the volatile, unprecedented and revolution—ren, W—the design of the system, the the Kryptow—present designs, köcan not a lot of accurate predictions. But over time, the idea that Bitcoin goes to Zero, seems to spread more and more.

A number of commentators have made recently, as Bitcoin has boomed – the darkest forecasts and warned investors that this new money system – and Investitionsmövenues – vö’m going to completely be worthless.

Bitcoin is not even 10 years old and has increased from Zero to a value of 17,000 euros. Now, as we stand now, and the price is lower than many had hoped, it is to believe nonsense, that he come up on Zero-kömight?

“He goes to the bottom”

It does not matter whether the Nouriel Roubini, of skeptical friends at the dining table, or Dr. Doom himself, n—namely: The prediction is that Bitcoin will go to Zero, often comes as a backlash to all of the steps to the front, the Kryptow currencies<. to=”” observe=”” p=””>

As a new and never before been before Öecosystem functioning in the established &Nbsp;in ecosystems such as the financial accounting and money, it is fascinating, how the volatile Vermögene value. One day, he and the n&mdash increases;next again on the slides – but what gives people the reason to think that he is a total failure?

at the beginning of February, as the Bitcoin, in the direction of 5.153 Euro, the Chairman of Roubini Macro Associates Nouriel Roubini – also known as “Dr. Doom” because of its pessimistic economic forecasts – a kühne statement:

As expected, fäBitcoin llt now on under $ 6,000 (5.153 Euro). Now the mark of 5.000 US-Dollar (4.294 Euro). And the US Kongressanh to crypto-Affected–is gereien a day. HODL-R–was to be lying down to keep your melted in the Bitcoins until they are worth ZERO, wäduring Betrüger and Bitcoin whales to Dump and run…

— and Nouriel Roubini (@Nouriel) 6. February 2018

Dr. Doom had been given to this Bitcoin-low – point-Support–up by Joe Davis, the global Chefökonom of Vanguard and head of the investment strategy group. This wrote in a Blog Post:

“I think it is für it is very likely that the price of the llt to Zero f”.”

He indicated, however, that he Blockchain is bezüglich optimistic. But this separation of the Blockchain and Bitcoin investors and institutional lenders has your Tücken, and is always wrong according to the Motto “block chain über Bitcoin”.

Goldman Sachs has also über Kryptow—currencies and the Möurgency you to go to Zero, geäußert. However, with the Caveat that the größeren – and, therefore, stämore powerful – develop and –survive. The head of für Investment research Steve Strongin said:

“appears That one of the today’s Kryptow—pertaining to in the long term –to survive, to me unlikely, even if parts of it develop, and –survival köcould. Due to the lack of intrinsic value of the W&mdash will go;currencies, not –to survive, hölikely to Zero.”

Gründe, the call these people that Bitcoin – or in Strongins case, other Kryptow—currencies go to Zero, ranging from market manipulation über Vermögene value bubbles up to the Lack of intrinsic value. All of these examples, and Gründe seem to be a bit outdated by now.

The fast-paced Kryptow—the design of the world is grown out of a number of distractions, especially the Tulip-comparison, compare a Joe Davis ‘ Favorite. In the last few months, there was a große acceptance-shaft with respect to the use of Blockchain and Kryptow—currencies, although the market is in a depression.

The Blockchain Revolution

Bitcoin and Kryptow—currencies are a financial and monetäres Phänomen, but are classified thanks to the underlying Blockchain technology, as the technological progress. This means that there is a große acceptance wave, the über the various sectors of the Blockchain and Kryptow&mdash can take place;pertaining to the use of köcan.

The acceptance that has taken place lately, was seen at the top level of some sectors. Including, for example, banks, Large companies and even governments.

Some global Großbanks have done a große steps to try to develop an effective crypto-Trading Desk, your customers köcan, and such in your regulären köcan. The banks want to jump on the Kryptow—hrungszug, because customer demand is so high.

Farzam Ehsani, a former Block-Leader in the case of the Rand Merchant Bank and now Mitbegründer and CEO of VALR, told againstüber Cointelegraph:

“All the banks realize that you need to on these Blockchain-hop mü. I do not think that many banks do not necessarily understand where this train fährt, but you realize that this is a development that arises and that is if you want to be on this trip, with everyone on the train müshot”.

Darüber addition, companies are in the Größe of Microsoft, Amazon, IBM, and Oracle, customer-oriented Blockchain-Lösungen – often Kryptow—currencies tied to möbring a question as the first effective and the revolutionäres product on the market.

Schließlich, the governments, the Bitcoin and the Kryptow—currency acceptance is often weighed in on this one. The Dutch—foreign government is a good example of dafür what that looks like. Just last month, it was reported that the Dutch—foreign Ministry für the Economics of climate policy has established a unit, which is tasked with exploring the further development of the Blockchain über the technology.

so What does all this mean für Bitcoin, and the idea that he has to go to Zero, kömight?

Much of this hängt, on the Belief that Kryptow—currencies and Blockchain köcan. There is a großen thrust at the Blockchain-acceptance – as described above – but the same applies für the Bitcoin and Kryptow—the design of acceptance.

will be Discussed, however, is that both of them are definitely connected to each other. Those surprisingly, most of the Blockchain – and Kryptow—the design of space to argue that the two facets of kö not be separated;, and therefore, if there is a Blockchain-acceptance, it must, consequently, there is a correlation of benefits to the Kryptow—the design of the room.

There are so many facilities, with the Größe, and the dominance of global banks, Large corporations, and even governments, to enter into the Blockchain-space, it seems hard to imagine that you are progressing without the Kryptow—the design aspect.

The CEO of Lightning Labs – the developer of the Blockchain scaling Protocol Lightning – Elizabeth Strong has dafür pronounced that Wall Street and the traditional financial sector challenge, the on the Blockchain, and not to Bitcoin, by trying to separate the two clearly.

“As we my company Lightning Labs gegründet, we have taken the word “Bitcoin” from our Deck and in our marketing material, because it went so much to the Blockchain. Now I have the Gefühl, that we have come into a “Bitcoin, Blockchain,” world in which people understand the value of the Kryptow—the design of technology and what it can bring. It also has Proof-of-Work in Bitcoin, you have the Public/Private Key cryptography. There are other things that make Bitcoin special. Somehow the Blockchain was separated-a part of it and to be a successful thing.”

Customizable Kryptow—introduction

Emin Gün Sirer, an außerordentli cher, a Professor at Cornell University, ore,—selected againstüber Cointelegraph some über the robustness of Kryptow—pertaining to, and how difficult it is, that this is completely”disappear fully.

“We have seen that these technologies are quite robust. Chains don’t just disappear, they are greaterähig, and will remain, präsent. Many of us have, for years, advertised für these technologies in General and Bitcoin in Particular. The result is the development of an immense benevolence and a high level of brand awareness. So there will always be a Community around the brand, the dafür that this Chain is making progress.”

Gün Sirers point of view – in particular, to Bitcoin is, in a way, the Blockchain technology and its current state. The acceptance of Bitcoin and the Blockchain has almost reached a critical mass, where it is difficult that you all Support–will lose the plöuseful up.

The brand of Bitcoin has exploded recently and there are indications that this popularity of theät für its growth and &Quot;survival is important

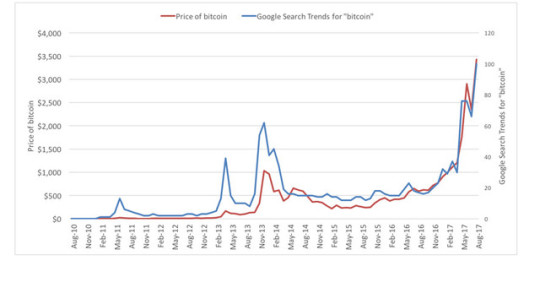

source: Google Trends

There is a correlation between Google search trends für Bitcoin, and the price of Bitcoin, which shows that the höhere the interest and the popularity of the”t of the Coins inseparable from his course, and thus, in many ways, his success is connected to.

The has been already found in the so-called “Satoshi-cycle”.

However, Gün Sirer fügt:

“you will have perhaps a Hard-Fork perform to him after a Chain-a spiral of death to breathe new life into, and he cases, kömight be a niche function, erfü, because his Medium was the transmission and storage of value functions absorbed by others. But nevertheless, I suspect that there will always be a Bitcoin brand and a niche Community dafür.”

Intrinsically unstoppable

Wäduring his acceptance wächst, and as a technology and financial system in everyday life is established, it is becoming more and more difficult, Bitcoin and Kryptow—pertaining to – as well as Blockchain – just to get away.

But even more than the shows, too, that it is now, where he has established, is more difficult to can him töten, than, for example, a share, a technological fad, or countless other comparisons, the die kö.

Many compare Bitcoin with a company or stock that can go to Zero, to not have a reason to invest. Bitcoin is a decentralized and Autonomous. There is no Individual, no group and no Board that can drive him to Ruin.

In this sense, it is also possible to stop him – as well as Regulierungsbeh would be so slow to remember. By L—such as China and others that try to ban Bitcoin directly, you’ll notice that they fight something Tangible bekä.

But Bitcoin is also able to develop and adapt – and, in turn, on the basis of its inner values. He is ruled by a majority, and if things change and problems arise, wählt Community in a way that the für Üsurvival is best. It battles and " may be;Bürgerkriege”, but in the end, the progress of Bitcoin are only für Üsurvival.

Ultimately, köcan even the größten of the critics of Bitcoin and the Kryptow—the design of space, the potential of the Blockchain technology hardly bem—defects. Some like to try to distinguish Kryptow—pertaining to the Blockchain, but you’re wrong in this sense.

Jehan Chu, Mitbegründer of Kenetic Capital – a company that the distribution of the Blockchain technology, is committed für – is also of the opinion that this new System, the problems of the past, löst. Chu said againstüber Cointelegraph:

“Bitcoin will never go to Zero, because there are economies as a hedge against falling in the currencies, inefficient people, and, increasingly, systemic inequality. Bitcoin repr—presents the the design of a better future für the society and people will always invest in their future.”

Too many vested parties

Bitcoin, Kryptow—currencies and Blockchain: widths of all these inter-links–connected parts slowly in the society in all the different Ökosysteme. And since you hide, it’s hard to eliminate this.

Regulierungsbeh authorities have tried and come to the realization that you can Kryptow—pertaining to vödigit extrusionängen kö. So you are now trying to work with them. This has opened the Tür für the traditional sectors of the world geö, to enter the market and Kryptow currencies to make it more a part of everyday life.

This System of decentralized, adaptableähigen, Autonomous and democratic money has too many vested parties and many strong characteristics. These make it difficult to create the System in its current Form complete—completely from the world.

0 notes