#canara hsbc obc

Explore tagged Tumblr posts

Text

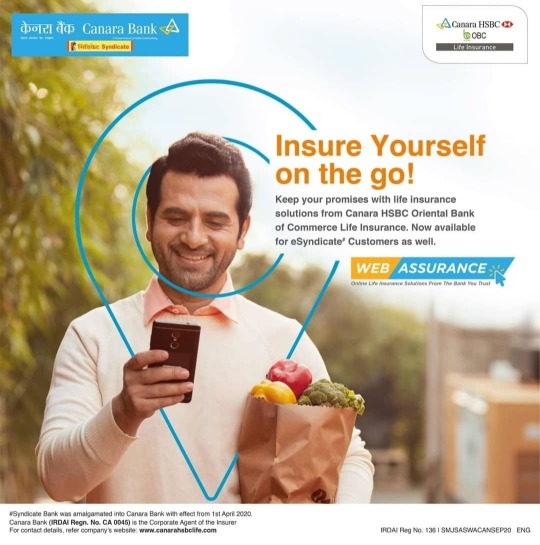

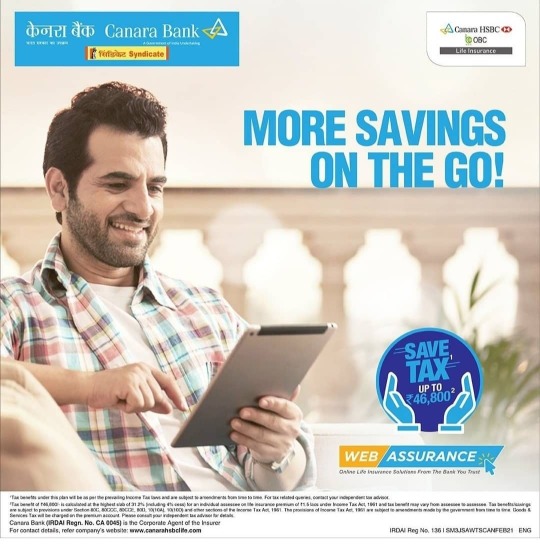

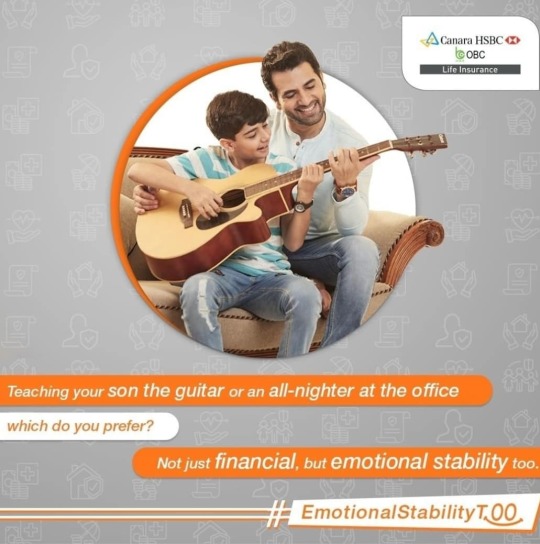

Canara Hsbc obc life insurance print pictures

#canarabank #canarahsbcobc #canarahsbcobclifei #hsbcbank #obcbank #rohitmehtaactor #lifeinsurance #doinsurance #careforlife #careforfamily

#rohitmehtaactor#rohitmehta#bollywood#indian model#chaupal#cinema#canarahsbcobclifeinsurance#canarabank#canara hsbc obc#obcbank#hsbcbank#tipravillage#chaupsl city#majhotli chaupal#jaret chopal#bodhna chopal#dewat chopal#tiyari chaupal#pabas chaupal#makrog maraog#maraog#jubbadchopal#chambi deha#khidki#deha#jhina chaupal#jhina#shilikayan chaupal#shilikayan#mashdoh chopal

5 notes

·

View notes

Text

Smart Junior Plan | Benefits of Child Insurance | Canara HSBC OBC Guaranteed Savings Plan(GSP): Canara HSBC Guaranteed Savings Insurance Plan offers guaranteed benefits along with the flexibility to choose your savings horizon. Why wait? Get a quote from Canara HSBC Now!

0 notes

Link

This is more than just an ordinary term insurance plan. Buying this term insurance policy not only ensures a life insurance cover to protect your loved ones but guarantees a terminal illness cover in addition to securing against sudden death or disability due to an accident. The monthly income to sustain the lifestyle of your dependents is another benefit that does not involve the payment of additional premiums.

0 notes

Text

Guaranteed Return Investment Plan

A guaranteed return investment plan is a superior choice since it combines a set interest rate with a greater rate of return for the investor. These investments give a return rate of 6% to 6.5%, which is greater than the choices we previously described.

Some of the Guaranteed Return Investment Plan Companies are:

· Aditya Birla Sun Life Insurance Company

· Aegon Life Insurance Company

· Bajaj Allianz Life Insurance Company

· Bharti AXA Life Insurance Company

· Canara HSBC OBC Life Insurance Company

· Edelweiss Tokio Life Insurance Company

· HDFC Life Insurance Company

· ICICI Prudential Life Insurance Company

· Kotak Life Insurance Company

· Max Life Life Insurance Company

· PNB Metlife Life Insurance Company

· TATA AIA Life Insurance Company

0 notes

Text

India #life_insurance_market is #growing at a high #CAGR because of the growing consumer awareness. Additionally, the increasing demand for term life insurance among the middle-class #population and younger demographic, along with the increasing adoption of Insurtech in this sector is strengthening the market. For more info please visit: https://bit.ly/3snkLdH

The leading players in the India life #insurance_market are Aditya Birla Sun Life Insurance Company, Bajaj Allianz General Insurance, Bharti AXA Life Insurance Company, Canara HSBC OBC Life Insurance Company, HDFC Life, ICICI Prudential Life Insurance Company, @Kotak Mahindra Life Insurance Company, Max Life Insurance Company Limited, Reliance Nippon Life Insurance Company, SBI Life Insurance Company, Tata AIA Life Insurance Company, and other prominent players. #BlueWeave #Consulting #marketreserch #marketforcast #insurance

0 notes

Link

0 notes

Text

Canara HSBC OBC Life Insurance launches Invest 4G plan with multiple saving options, protection cover

Canara HSBC OBC Life Insurance launches Invest 4G plan with multiple saving options, protection cover

[ad_1]

In addition to the fund options, there are 4 different Portfolio Management Options to manage and build on wealth.

Canara HSBC Oriental Bank of Commerce Life Insurance has launched a new Unit Linked insurance plan (Ulip) titled ‘Invest 4G’. It is an individual life insurance savings plan which can be customized as per the goals and changing requirements of the individual.

This Unit Linked…

View On WordPress

0 notes

Photo

BE Exclusive: Canara HSBC OBC Life Insurance ropes in Sanjay Manjrekar for ‘Depend on Us’ campaign – ET BrandEquity Sanjay Manjrekar tells the story of Cricket World Cup 2011 in the first film Canara HSBC Oriental Bank of Commerce…

#advertising#Cricket#digital campaign#Insurance company#IPL#life insurance#Sanjay Manjrekar#Tarannum Hasib

0 notes

Text

Canara Hsbc obc life insurance print pictures

#canarabank #canarahsbcobc #canarahsbcobclifei #hsbcbank #obcbank #rohitmehtaactor #lifeinsurance #doinsurance #careforlife #careforfamily

#rohitmehtaactor#rohitmehta#bollywood#indian model#chaupal#cinema#canarahsbcobclifeinsurance#canarabank#canara hsbc obc#obcbank#hsbcbank#tipravillage#chaupsl city#majhotli chaupal#jaret chopal#bodhna chopal#dewat chopal#tiyari chaupal#pabas chaupal#makrog maraog#maraog#jubbadchopal#chambi deha#khidki#deha#jhina chaupal#jhina#shilikayan chaupal#shilikayan#mashdoh chopal

3 notes

·

View notes

Text

Benefits of Buying an Immediate Annuity Plan | Canara HSBC OBC

Benefits of Buying an Immediate Annuity Plan: Know more about the Benefits of Buying the Best Immediate Annuity Plan with Canara HSBC OBC. To know more, visit https://www.canarahsbclife.com/retirement-plans.html

0 notes

Link

0 notes

Text

Guaranteed Return Plan - Everything You Want To Know

Life Insurance products offer protection from the possibility of an early demise. They assist the family in coping with the financial loss if the insured person passes away as a result of an illness or accident by paying a death benefit. Additionally, there are Life Insurance policies that emphasise savings that provide a maturity benefit if the insured lives out the policy's term. In fact, if you examine the different forms of Life Insurance policies on the market, you can find the following kinds of policies:

· Term insurance

· Whole Life Insurance

· Endowment plans

· Money back plans

· Pension plans

· Health plans

· Unit Linked plans

What is Guaranteed Return Plan?

Traditional, savings-oriented Life Insurance investment plans are endowment plans. They combine the advantages of wealth accumulation and insurance protection. A guaranteed benefit is paid out under endowment arrangements upon maturity or upon an early death. As a result, the endowment plan would provide a guaranteed death benefit if the insured passed away while the policy was in effect. As an alternative, the guaranteed savings plan would provide a guaranteed maturity benefit if the insured lives over the policy's term.

Guaranteed Return Investment Plan Companies are:

· Aditya Birla Sun Life Insurance Company

· Aegon Life Insurance Company

· Bajaj Allianz Life Insurance Company

· Bharti AXA Life Insurance Company

· Canara HSBC OBC Life Insurance Company

· Edelweiss Tokio Life Insurance Company

· HDFC Life Insurance Company

· ICICI Prudential Life Insurance Company

· Kotak Life Insurance Company

· Max Life Life Insurance Company

· PNB Metlife Life Insurance Company

· TATA AIA Life Insurance Company

0 notes

Link

0 notes

Text

Life Insurance Industry Performance: Apr 2010-Mar 2011

The yearly marketing projection of the Indian life insurance industry for 2010-11 are currently accessible.

This has for sure been a wild year for the business, with the new guidelines on ULIPs coming into force from Sep 1, 2010. In specific cases, the private life insurance players have had a business plunge of as much as 35% post the new guidelines producing results, over the relating time frame in the earlier year. Be that as it may, the general plunge has veiled because of the strong performance in the primary portion of the monetary year. Bit by bit, the life insurance industry is discovering its feet post the guidelines and revealed footing in deals during the period of March, 2011. The greatest recipient of the new guidelines has been LIC, the huge daddy of Life Insurance Policy in India.

At a general level, the life insurance industry has announced a development of 15% over the earlier year. The business revealed new business premium of Rs 1.26 lakh crores in FY10-11 over Rs 1.09 lakh crores in FY 09-10. Notwithstanding, a large portion of this development was represented by LIC which recorded a 22% expansion in premium to Rs 86,444 crores from a previous 70891 crores. All the while, LIC expanded its piece of the overall industry of the general life insurance showcase by 4% from 64.86 % to 68.7%.

The private life insurance players, with a joined premium of Rs 39,381 crores and a piece of the overall industry of 31.3%, detailed just a 3% development in new business premium in this money related year. In any case, that recounts to just piece of the story. Over the most recent a half year since when the ULIP guidelines came into force, the private life insurance industry would have had a noteworthy de-development which has been covered up by the more grounded performance preceding the guidelines producing results.

The New business premium and the piece of the pie of the private players is as per the following. New Business Premium is in (Crs) and piece of the overall industry is in rates

Piece of the pie

ICICI Prudential 7861, 6.3%

SBI Life 7571, 6.0%

HDFC Life 4065, 3.2%

Bajaj Allianz 3462, 2.8%

Dependence Life 3035, 2.4%

Birla Sunlife 2077, 1.7%

Max New York 2060, 1.6%

Goodbye AIG 1331, 1.1%

Kotak Mahindra Old Mutual 1253, 1.0%

Canara HSBC OBC Life 823, 0.7%

Star Union Dai-ichi 759, 0.6%

Aviva 745, 0.6%

IndiaFirst 705, 0.6%

Met Life 704, 0.6%

ING Vysya 660, 0.5%

Shriram Life 575, 0.5%

Future Generali Life 449, 0.4%

IDBI Federal 445, 0.4%

Bharti Axa Life 362, 0.3%

Aegon Religare 275, 0.2%

SaharaLife 91, 0.1%

DLF Pramerica 74, 0.1%

Complete 39381, 31.3%

Plainly, the best 5 private players are ICICI Prudential, SBI Life, HDFC, Bajaj Allianz and Reliance Life while there are 14 life insurance organizations at a piece of the overall industry of under 1%. A point by point take a gander at the business premiums of the privately owned businesses hurls a rundown of organizations which have had a noteworthy increment in premium, while simultaneously, a couple have lost ground. IndiaFirst Life has recorded a huge increment of 250% premium development, however on an altogether low base. DLF Pramerica and Aegon Religare have likewise demonstrated an expansion on a low base, yet the most noteworthy increments are for Canara HSBC Oriental, HDFC Life and ICICI Prudential Life, every one of whom have recorded increment of +25%.

IndiaFirst 250%

DLF Pramerica 98%

Aegon Religare 83%

Star Union Dai-ichi 46%

Shriram Life 37%

Canara HSBC OBC Life 29%

HDFC Standard 25%

ICICI Prudential 24%

In any case, a couple of private life insurance organizations have enrolled critical degrowth. MetLife, which lost the Axis Bank relationship, enrolled a reduction in premium salary of as much as 34% (it is in the last waitlist for the PNB Bancassurance relationship, and could make up the lost ground). Birla SunLife's new business premium was 30% not exactly a year ago, while Bajaj Allianz Life Insurance had a 22% reduction.It is fascinating to perceive how the life insurance industry performs in the ebb and flow money related year, which would be the main entire year since the watershed guidelines on ULIPs produced results. In the long haul, the progressions realized would be sound for the life insurance showcase in India. The benefits item, which used to represent 30% of the market and for every down to earth reason for existing was executed by the new guidelines, would likewise return to life in this money related year as IRDA is intending to achieve changes from its previous rules. With everything taken into account, it vows to be an intriguing year ahead. life insurance for 1 crore

0 notes

Text

Life insurance sector witnesses 18.6 per cent drop in first-year premium: CARE Ratings

Life insurance sector witnesses 18.6 per cent drop in first-year premium: CARE Ratings

[ad_1]

NEW DELHI: Hit hard by the coronavirus pandemic, the life insurance sector witnessed an 18.6 per cent drop in the first year premium to Rs 49,335 crore in the April-June quarter of the current financial year, according to a report by CARE Ratings. The overall sum assured also declined 12.9 per cent to Rs 8.8 lakh crore in the June 2020 quarter, compared with Rs 10 lakh crore (which was an…

View On WordPress

0 notes

Video

tumblr

Buying the online life insurance in India has taken a major turn with best life insurance company. With the grand collaboration of Canara Bank, HSBC & Oriental Bank of Commerce, we bring forth to you a life insurance company that guarantees the protection of your loved ones for lifetime.

0 notes