#cash app verify identity not working

Text

i feel awful doing this, but i am exhausted and have nowhere else to turn at this point.

my name is maria, and i am homeless in new mexico. i have been homeless for two years. the short version of this post is that i am asking for $150 for two nights in a hotel, plus food.

0/150

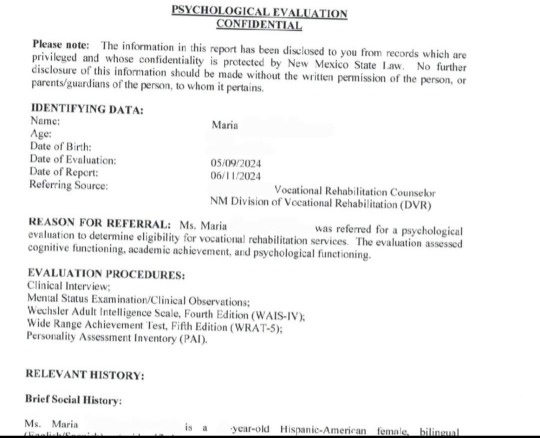

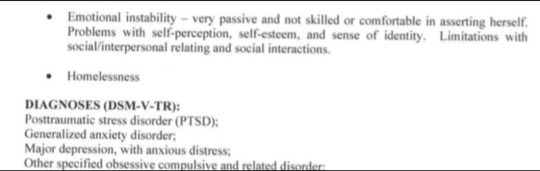

i included some official paperwork from new mexico's disability vocational rehabilitation department, which exists to help disabled people find long-term careers. i cut out some identifying details because i don't feel safe putting a lot of personal information online, especially with the circumstances that led to me being homeless. my url is a reference to the fact that the tests the dvr department gave me show that my working memory is in the bottom 20th percentile, meaning it's absolutely awful. that, combined with what is most likely chronic fatigue syndrome, has basically made it impossible for me to find a job.

(i am currently going to a free clinic for homeless people to try and get a diagnosis of cfs by process of elimination. so far they have ruled out diabetes and thyroid problems. but things are going very, very slow. as you can imagine, if it's not an emergency it's not a priority for these clinics.)

i am asking for money because i am in a lot of pain today, and it's going to be 101° today and tomorrow.

i don't stay in a shelter because i am a lesbian and the shelters here are all catholic.

i don't have any friends, and i haven't talked to my family in years. i don't have food stamps because the state has had some problem verifying my identity and i haven't been able to get a copy of my birth cerificate because i wasn't born in new mexico.

if you can, please help. i have been outside in the heat all summer, and having a break from that would mean the world to me. thank you for reading. ❤️

21 notes

·

View notes

Text

Uber? Lyft? What the hell is going on?

Ever had to contact customer support and heard over an automated voice instead of a human? How about contacting them and once you explain to them your issues only for them to give you ready-made responses as they haven't clue of what you're talking about? Well, that's been my excrcuiating experience as a driver for both companies at the same time. So, let's dive into how ludicrous it's been.

Let's start with Uber since it's rich with crazy stories. Uber has kind of a fair hourly wage going $25-30. You can receive payments on weekly basis like most jobs and contracts. Or you can have instant access to your money and even cash out once you've finished your shift with the Pro Card. Of course, I would choose the latter because why not? Normally I cash out directly to my debit card and needed I new one some time ago. I went in to change the details for the new card and had to undergo a security code verification via text message. I never received it so I had to contact support. I explained the issue I had and was told to whilelist my phone number from a text message. That's strange. How come I can receive text messages from Pro Card just fine when logging in, but not for this? Because this didn't work. I thought that this had to be a problem in their end. Now, a good tech support agent would troubleshoot such an issue should a solution like that not work. Not here; they "took it to further support" (Bear with here. I couldn't remember exactly what they said.) in order to resolve my issue. Their response: logout and in, reinstall the app and restart my phone. None of that worked because it's the most half-assed set of solutions of all time. Imagine if EA told you do that with their games you try to boot up. It'll just add the notoriety they're known for having.

It didn't feel like I was chatting with a human, so I decided to call support for a better chance. I had to wait (Get ready for this) ONE MOTHERFUCKING HOUR just to talk with someone. I can't believe I had the patience for that. I finally get to talk with an agent, only for them to tell me the same. Damn. Thing. Dude, what the fuck? Is Uber run by Skynet or something?! I kept contacting until I remembered why I had to whitelist the phone number I've been using with my account: it's because it's believed that it was being blocked by the provider. The number here is one I had setup for business reasons via TextFree, so I contacted them about it and they told me there was no issue on their end. Is Uber screwing with at this point? But, I went and switched the number on my account to my personal one, thinking that the business number is being assumed to be a VoIP, which is not allowed with some services. I finally get the code needed to finalize debit card changes to my Pro Card account.

Now this next story really interfered with my job significantly. I've been doing rideshare look normal, steady with a consistent schedule I setup for myself. The one thing that annoys me is that I have to verify my facial identity every once in a while. I mean, you know what I look like. Nothing too drastic has changed about me. So, why do I gotta go through this as I begin the job at a desired time? One day, I randomly go into the trip preferences menu to see it go from this:

To this:

Note: the Uber Eats food delivery preference is suppose to be there, but I didn't take a screenshot before it disappeared.

Of course, I had to talk to an agent. But this was more aggravating. I tried my damnedest to explain this issue. The agent, however, couldn't seem to figure out what I mean. Did they not have any job training? Once that was sorted, the agent said things like "This should be the type of experience for you to have" or "We understand your concern". Do ya, really? Because you should've went deeper into it by now. Continuing with this chat, guess what they told me then: the same solution from the Pro Card "troubleshoot", but that didn't work because THE APP IS NOT THE FUCKING PROBLEM! I disconnected and got in contact with a different agent. This bullshit repeated, but I got a whole new response. I got confirmation of my eligibility to have these preferences, including UberXL, and it was still approved. They also actually spent the time to look into it for a few minutes, although it was longer than. The problem involved the inspection of the vehicle I have registered. They wanted me to show an image of a newly documented inspection, but I don't have to worry about it for another 6 months. In my state at least, (I'm from the USA) I have to perform an annual inspection for legal validity of driving the vehicle, and it's $100. Doing this every 6 months makes no sense and it feels like it'll lead to an endless money pit, as a certain mechanic would say.

After that was sorted, I went back to doing the job like normal, only for it to happen again the next week. Starting to feel like Uber has a grudge against me. I go back to dealing with the same ol' crap more frustrated than ever, even angry, and get an unexpected response: I'm not eligible to perform UberXL rides. Well, isn't this the most inept thing to happen here? I drive a minivan, goddammit. What do you mean I'm not eligible? I just disconnected and almost didn't bother to reach another agent. But, I'm managed to collect myself and get it sorted out like last time. I'm certain this will happen again however.

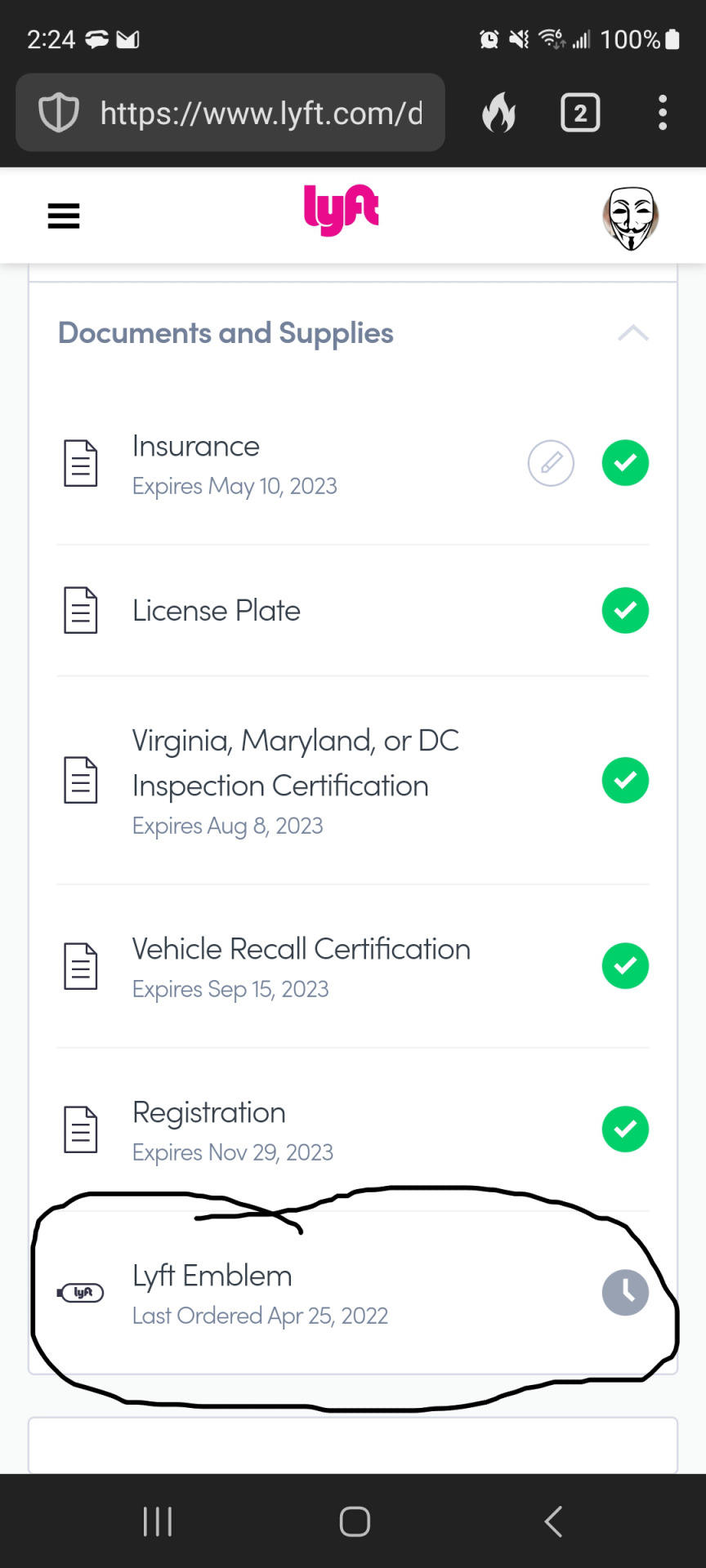

On the Lyft side of things, the same issue with support, except this is about emblems. Speaking of those emblems, the adhesive is weak sauce. So, I needed new ones. You can order new ones from the site or app with the push of a button. It's suppose to arrive within week, but didn't as that time range passed. I had to contact an agent, but it was hard to do it on the app because for some reason, they have too high of expectations that problems are solved with FAQs. But this is a troubleshooting issue; there's no way they can believe things can work fine that easily all the time. I had to go to the site to get help, and they responded by arranging a new order, which did arrive. Thing is, I've had this problem since I first signed up. I didn't even get my training kit with the cool pink mustache. After those emblems wear out too soon, I had to order another pair. Here's me thinking "Maybe they sorted out that issue with the delivery". But something even worse happened:

And as of the date of this blog post, it's still like this. Why? I even contacted them with this screenshot and they just gave me an automated message saying they'll just reship the emblems. This shouldn't have to be the only way to obtain new emblems beside the Express Hubs, which is too far from where I live. And they didn't arrive this time. If I contact them about any other problem, it'll just be the same type of response instead of troubleshooting.

Now, I don't know too much about the experience with support for riders since I've not used rideshare often. But I'm sure there's similar issues. The fact that this is the type of support we receive is unacceptable. It's as if they only measure their success financially based on the quantity of users. With the money they make, you'd think they could hire more competent employees for tech support, but they just found some random people with barely any tech skills to speak of and brought them in. There's got to be some kind of union strike or something because we can't keep letting them get away with this.

#uber#uber technologies inc#lyft#lyftblr#lyft inc#ride share#ridesharingapp#customer service#tech support#job#independent contractor#driver#driving#car#minivan#rider#passenger

14 notes

·

View notes

Text

When Does the Weekly Limit Reset on Cash App? A Comprehensive Guide

Cash App weekly limit for sending and receiving money depends on the status of account verification. Accounts that are not verified may only transfer as much as $250 per week and a total of $1000 per month. Cash App weekly limit is not reset on a particular date of the week. The reset time begins when you have reached the limit and continues to count down until it resets. It is therefore important to keep track of when you have exceeded them, so that you are aware of when they reset. To check them out, launch Cash App and navigate to your profile section. Let's begin and learn about the weekly limit of Cash App in greater detail and address the most important question: when does Cash App weekly limit reset?

What Is the Cash App Weekly Limit?

The Cash App has weekly limits on the exchange and transfer of funds to safeguard users from frauds, money laundering and other illegal activities. It ensures that they follow the anti-money laundering (AML) laws and remains safe for all users using the platform. The Cash App's weekly limit is the maximum amount you can transfer or withdraw within 7 days period.This limit could differ based on whether your account is verified or not. For verified users Cash App limit for a week is $250 for sending money.

When Does the Cash App Weekly Limit Reset?

The daily limit on Cash App is a continuous seven-day timeframe. It means that your limit is not reset at a set date like Sunday’s midnight, but instead seven days after each transaction. For instance, if you made a transaction on a Tuesday, at 3pm, that amount will "reset" and become available the following week, exactly one week later, at 3PM on the next Tuesday.

How to Check Your Cash App Weekly Limit?

You can check the available Cash App weekly limit by taking the steps mentioned below:

Open the Cash App on your Android or iPhone device.

Go to the Profile section.

Then click down until you reach the "Limits" section.

Here will find the total amount you have sent to, received, or removed, as well as the remaining limitations for the week in question.

How to Increase Your Cash App Weekly Limit?

If you are a verified user (those who have provided additional personal details like your full name and birth date and Social Security number), Cash App raises the limits significantly. Once verified, you can make payments up to $7500 per week and receive an unlimitable amount of cash. Here is how to increase Cash App weekly limit:

First of all, log into your Cash App account

Then go to Profile section and verify your identity

For this, you will be asked to shareall your personal information, including the date of birth, as well as the four digits that make up your Social Security number.

After your account has been verified, your limit for sending will be increased to $7,500 per week. In addition, your Cash App receiving limit will be unlimited.

What is the Cash App Weekly Limit for Withdrawals?

Cash App also putslimits on the amount of money you can withdraw from your bank account within the course of a week. In general, unregistered accounts can withdraw as much as $500 per month, and verified accounts are able to withdraw more. Like the limit for sending however, the Cash App weekly limit for withdrawals is reset on a rolling basis. The reset of every withdrawal takes place exactly seven days following the transaction.

Conclusion

Cash App’s weekly limits are designed to offer security and prevent fraud. By understanding the rolling reset schedule and verifying your identity, you can increase your Cash App’s limit and better manage your transactions. Keeping track of your transaction dates and knowing how the 7-day rolling period works will help ensure smooth transfers on Cash App.

2 notes

·

View notes

Text

How Cash App Bitcoin Withdrawal Limits Work and How to Increase Them

In the evolving landscape of digital finance, Bitcoin has emerged as a significant player, capturing the interest of investors and casual users alike. Cash App, a popular mobile payment platform developed by Square, Inc., offers users the ability to buy, sell, and withdraw Bitcoin. However, navigating the intricacies of Bitcoin transactions on Cash App can be challenging, particularly when it comes to understanding the withdrawal limits. This blog provides a comprehensive overview of the Cash App Bitcoin withdrawal limit, exploring its nuances, implications, and how you can manage or increase these limits effectively.

Understanding Cash App's Bitcoin Features

Cash App has integrated Bitcoin trading into its platform, allowing users to engage with the cryptocurrency market seamlessly. Whether you're a seasoned investor or a newcomer, Cash App provides a straightforward interface to buy and sell Bitcoin. However, before diving into transactions, it's crucial to understand the associated limits, especially concerning withdrawals.

What Is a Bitcoin Withdrawal Limit?

A Bitcoin withdrawal limit refers to the maximum amount of Bitcoin you can withdraw from your Cash App account to an external wallet or another account within a specific time frame. This limit can vary based on factors such as your account verification status, transaction history, and platform policies.

Cash App Bitcoin Withdrawal Limits: A Closer Look

Cash App sets specific limits on Bitcoin transactions to ensure security and regulatory compliance. These limits can impact how much Bitcoin you can withdraw and how frequently. Here’s an in-depth look at the key aspects of Cash App's Bitcoin withdrawal limits:

1. Daily and Weekly Withdrawal Limits

Cash App imposes both daily and weekly limits on Bitcoin withdrawals. These limits can affect how you manage your Bitcoin assets. For example:

Daily Withdrawal Limit: This is the maximum amount of Bitcoin you can withdraw on Cash App in a single day. Cash App sets this limit to mitigate risks and ensure that transactions are processed securely.

Weekly Withdrawal Limit: This refers to the maximum amount you can withdraw within a week. It is essential to plan your transactions according to these limits to avoid exceeding them.

2. Bitcoin Purchase Limits

Alongside withdrawal limits, Cash App also has purchase limits for Bitcoin. These limits can influence how much Bitcoin you can buy and subsequently withdraw. Understanding these limits helps in managing your overall Bitcoin transactions effectively.

3. Monthly Withdrawal Limit

Some users may be interested in understanding their monthly withdrawal limits. While Cash App primarily emphasises daily and weekly limits, it's useful to be aware of how these limits aggregate over a month.

4. Increasing Cash App Bitcoin Withdrawal Limits

For users looking to increase their Bitcoin withdrawal limits, verification plays a crucial role. Cash App typically offers higher limits for verified accounts. By providing additional verification documents and information, you can enhance your withdrawal capacity.

Managing Your Bitcoin Withdrawal Limits

Effectively managing your Bitcoin withdrawal limits on Cash App involves several strategies:

1. Account Verification

To increase Cash App withdrawal limits, complete the account verification process. This involves submitting personal information and documentation to confirm your identity. Once verified, your limits are usually increased, providing greater flexibility in managing your Bitcoin transactions.

2. Monitor Your Limits

Regularly check your Bitcoin withdrawal limits within the Cash App interface. Staying informed about your current limits helps in planning transactions and avoiding potential issues.

3. Plan Transactions Strategically

Plan your Bitcoin withdrawals according to the limits set by Cash App. If you need to withdraw large amounts, consider breaking them into smaller transactions spread across multiple days or weeks.

4. Contact Cash App Support

If you encounter issues with your withdrawal limits or need specific information, contact Cash App support. They can provide detailed insights into your limits and offer assistance in managing them.

FAQ About Increasing Cash App Bitcoin Limits

1. What is the Cash App Bitcoin withdrawal limit per day?

The daily Bitcoin withdrawal limit on Cash App varies depending on your account verification status and transaction history. Generally, verified accounts have higher withdrawal limits compared to unverified ones.

2. How can I increase my Cash App Bitcoin withdrawal limit?

To increase Cash App Bitcoin withdrawal limit, complete the account verification process. This includes providing personal information and documentation to Cash App.

3. What is the Cash App Bitcoin sending limit per week?

Your account verification status determines the weekly Bitcoin sending limit. Verified accounts typically have higher limits compared to unverified accounts.

4. Can I check my Bitcoin withdrawal limit on Cash App?

Yes, you can check your Bitcoin withdrawal limits within the Cash App interface. Navigate to the Bitcoin section or account settings to view your current limits.

5. What happens if I exceed my Bitcoin withdrawal limit?

If you exceed your withdrawal limit, you may need to wait until the limit resets or adjust your transaction plans. Contact Cash App support for guidance if needed.

6. Are there any monthly withdrawal limits for Bitcoin on Cash App?

Cash App primarily focuses on daily and weekly limits, but it's helpful to understand how these limits aggregate over a month. For specific details, refer to Cash App support.

7. How does Cash App handle Bitcoin deposit limits?

Cash App also has limits for depositing Bitcoin into your account. These limits can impact how much Bitcoin you can add to your Cash App balance.

8. What should I do if I need to withdraw more Bitcoin than my limit allows?

Consider breaking your withdrawal into smaller amounts and spreading them across multiple days or weeks. Alternatively, contact Cash App support for assistance.

Conclusion

Navigating Cash App's Bitcoin withdrawal limits requires an understanding of the various factors that influence these limits. By being aware of your daily, weekly, and monthly limits and by completing the necessary account verification, you can manage your Bitcoin transactions effectively. For any specific concerns or issues, Cash App support is available to provide assistance and ensure a smooth experience with your Bitcoin transactions.

For the latest updates on Cash App's Bitcoin features and limits, keep an eye on official announcements and resources provided by Cash App.

2 notes

·

View notes

Text

Increase Cash App Withdrawal Limits: Tips to Unlock Higher Limits

Cash App has quickly become one of the most popular peer-to-peer payment apps, providing users with a seamless way to transfer money, pay bills, and make purchases. However, like any financial platform, Cash App has certain limitations in place to protect both the user and the company. One of these is the Cash App withdrawal limit. If you've ever tried withdrawing money and found yourself bumping up against this limit, you're not alone. This blog will delve deep into understanding the Cash App withdrawal limits, how they work, and what steps you can take to increase these limits.

What is the Cash App Withdrawal Limit?

Before we dive into the specifics of increasing your limits, it's crucial to understand what the Cash App withdrawal limit is and why it exists. Cash App has established these limits to prevent fraud, manage risk, and ensure regulatory compliance. These limits restrict the amount of money you can withdraw from your account within a certain period.

Cash App imposes different withdrawal limits based on several factors, including whether your account is verified, the method of withdrawal (e.g., ATM or bank transfer), and the withdrawal frequency. Let's explore these in detail to get a clearer picture.

Cash App Withdrawal Limit Per Day

When we talk about the Cash App withdrawal limit per day, we refer to the maximum amount of money you can withdraw from your Cash App account within 24 hours. For most users, the standard withdrawal limit is set at $1,000 per 24-hour period. This limit applies to transactions made through both linked debit cards and bank accounts.

However, this limit can vary based on several factors. For instance, users who have verified their accounts with additional personal information may have higher daily withdrawal limits. Verification typically involves providing your full name, date of birth, and the last four digits of your Social Security number. If you're looking to perform larger transactions or make frequent withdrawals, verifying your account is the first step in increasing your limits.

Cash App ATM Withdrawal Limit

Apart from transferring funds to your bank account, Cash App users can also withdraw cash directly from ATMs using their Cash App card. However, there is a separate Cash App ATM withdrawal limit that applies. For most users, this Cash App ATM withdrawal limit is set at $310 per transaction. Additionally, there is a limit of $1,000 per 24-hour period and $1,000 per 7-day period for ATM withdrawals.

These limits are crucial to understand, especially if you rely heavily on cash withdrawals. Being aware of these caps can help you plan your withdrawals more effectively and avoid any unexpected denials or fees.

Cash App ATM Withdrawal Limit Per Day

The Cash App ATM withdrawal limit per day is a critical aspect for users who frequently withdraw cash from ATMs. As mentioned, this limit is set at $1,000 per 24 hours. However, it's important to note that this limit isn't just about cash availability; it's also designed to enhance security. Limiting the amount you can withdraw per day reduces the risk of significant financial loss in case your card is lost or stolen.

To maximise your use of Cash App, understanding these daily limits is key. Whether you're planning a large purchase or need some cash for the day, keeping these limits in mind can help you avoid any surprises at the ATM.

Cash App Daily Withdrawal Limit

The Cash App daily withdrawal limit encompasses all types of withdrawals, including ATM withdrawals, sending funds to a bank account, and peer-to-peer transfers. While the daily limit for bank transfers and other withdrawals is generally set at $1,000 for unverified users, this can be increased significantly once you verify your identity on the platform.

Verification not only helps you increase your daily limits but also enhances your account security, ensuring your funds and personal information remain safe. To increase your daily withdrawal limit, consider completing the verification process as soon as possible.

Cash App Card ATM Withdrawal Limit

If you frequently use your Cash App card for ATM withdrawals, it's crucial to understand the specific limits associated with this type of transaction. As highlighted earlier, the Cash App card ATM withdrawal limit is set at $310 per transaction, with a maximum of $1,000 per 24-hour period. However, there are also weekly limits to consider; you cannot exceed $1,000 in withdrawals over any 7 days.

To get the most out of your Cash App card, be mindful of these limits, especially if you plan on making multiple withdrawals or large cash withdrawals in a short period.

How to Increase Your Cash App Withdrawal Limit?

Many users wonder how to increase Cash App withdrawal limit to access more funds. Fortunately, the Cash App provides a relatively straightforward process to request a limit increase. Here's how you can do it:

Verify Your Account: The most effective way to increase your withdrawal limits is to verify your account. Verification involves providing additional personal information such as your full name, date of birth, and the last four digits of your Social Security number. Once verified, Cash App typically increases your withdrawal limits, allowing for more flexibility in managing your finances.

Contact Cash App Support: If you require even higher limits beyond what verification provides, you can reach out directly to Cash App support. While there's no guarantee that your request will be granted, providing a valid reason for needing higher limits can sometimes result in a positive outcome.

Build a Transaction History: Consistent and regular use of your Cash App account can also contribute to limit increases. By demonstrating a steady transaction history and maintaining good standing with the platform, Cash App may automatically increase your limits over time.

Use Linked Bank Accounts: Linking your Cash App to a bank account rather than just a debit card can sometimes lead to higher withdrawal limits. This is because linking a bank account provides an additional layer of verification, which can help boost your standing with Cash App.

Frequently Asked Questions (FAQs)

1. What is the standard Cash App withdrawal limit for unverified users?

The standard Cash App withdrawal limit for unverified users is $1,000 per 24-hour period for bank transfers and $310 per transaction for ATM withdrawals.

2. How can I increase my Cash App withdrawal limit?

You can increase Cash App withdrawal limit by verifying your account and providing additional personal information such as your full name, date of birth, and the last four digits of your Social Security number. You can also contact Cash App support for further limit increases.

3. What are the ATM withdrawal limits on Cash App?

The ATM withdrawal limits on Cash App are $310 per transaction, $1,000 per 24-hour period, and $1,000 per 7-day period.

4. Does linking a bank account increase my Cash App withdrawal limit?

Linking a bank account may help increase your withdrawal limit as it adds another layer of verification, improving your standing with Cash App.

5. How often can I request to increase my Cash App atm limit?

You can request an increase in your Cash App atm limit at any time. However, Cash App may not always approve your request immediately, so it's best to have a valid reason and provide all necessary documentation.

6. Are there fees associated with exceeding the Cash App withdrawal limit?

While there are no fees for exceeding the limit, Cash App will deny any withdrawal request that exceeds your set limit. Be sure to check your current limits before attempting a transaction to avoid any inconvenience.

Conclusion

Understanding the Cash App withdrawal limit is crucial for managing your finances effectively on the platform. Whether you're using Cash App for everyday transactions or relying on it for larger transfers, knowing the limits and how to increase them can save you time and prevent frustration. By verifying your account, building a solid transaction history, and considering the additional options provided by Cash App, you can effectively manage your withdrawal needs and make the most of this popular payment app.

By following the guidelines outlined in this blog, you can take full control of your Cash App experience and ensure you have the flexibility you need to handle your financial transactions smoothly and securely.

#cash app withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit#cash app withdrawal limit per day#cash app daily withdrawal limit#cash app card atm withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app card atm withdrawal limit per week#cash app atms#cash app free atm

3 notes

·

View notes

Text

Cash App Withdrawal Limits: How to Maximize Your Daily Cash Access

Cash App has become a household name in digital payments, providing users with a convenient way to send, receive, and manage money from their smartphones. However, like any financial platform, Cash App imposes certain limits on transactions to ensure security and prevent fraud. One of the most commonly asked questions by Cash App users is, "What is the maximum daily withdrawal limit in a Cash App?" In this comprehensive guide, we will delve into the details of the Cash App withdrawal limit, explore how these limits work, and provide tips on how to increase them for a seamless financial experience.

Understanding the Cash App Withdrawal Limit

Cash App allows users to withdraw money using their Cash Card, a debit card linked to their Cash App balance, at any ATM. However, the platform has specific limits on how much you can withdraw daily, weekly, and at a time. Knowing these limits is crucial for users who rely heavily on the Cash App for their daily transactions.

Cash App Daily Withdrawal Limit: The Cash App daily withdrawal limit is set at $1,000. This means you can withdraw up to $1,000 per day from any ATM using your Cash Card. This limit is in place to protect users from unauthorised transactions and potential fraud.

Cash App Weekly Withdrawal Limit: In addition to the daily limit, Cash App also imposes a weekly withdrawal limit. The Cash App withdrawal limit per week is $1,250. This limit accumulates over seven days and resets on a rolling basis, not necessarily aligning with the calendar week.

ATM Withdrawal Limit for Cash App: The Cash App ATM withdrawal limit refers to the amount you can withdraw from an ATM in a single transaction. This limit is generally the same as the daily limit, meaning you can withdraw up to $1,000 per day, but it's important to note that some ATMs may have their transaction limits, which could affect how much you can withdraw in one go.

Cash App Bitcoin Withdrawal Limit: For users who deal in cryptocurrency, the Cash App Bitcoin withdrawal limit is a crucial consideration. Currently, the Cash App allows users to withdraw up to $2,000 worth of Bitcoin per day and up to $5,000 per week. This limit is separate from the cash withdrawal limit and is specifically for Bitcoin transactions.

How to Increase Your Cash App Withdrawal Limit?

If you find the standard Cash App withdrawal limit restrictive, there are several steps you can take to increase it. Increasing your limit can provide more flexibility, especially if you frequently use your Cash Card for ATM withdrawals or need to access larger sums of money.

Verify Your Account: The most straightforward way to increase your withdrawal limit is to verify your Cash App account. Verification involves providing additional personal information, including your full name, date of birth, and the last four digits of your Social Security Number (SSN). In some cases, you may also need to provide a government-issued ID. Once verified, your withdrawal limits may increase, and you'll also unlock additional features on the platform.

Link a Bank Account or Debit Card: Linking a bank account or debit card to your Cash App account is another effective way to enhance your withdrawal limits. This step ensures smoother transactions and provides an extra layer of security, making it easier for Cash App to verify your identity and financial standing.

Maintain Regular Account Activity: Regularly using your Cash App account for transactions such as sending, receiving, and withdrawing money can help build a strong account history. A consistent pattern of usage can signal to Cash App that you are a reliable user, which may increase your withdrawal limits over time.

Contact Cash App Support: If you need to exceed your current limits for a specific reason (such as a significant purchase or emergency), consider contacting Cash App Support directly. They can provide personalised assistance and, in some cases, offer a temporary or permanent increase in your withdrawal limits based on your account history and specific needs.

Upgrade to a Cash App Business Account: If you use Cash App for business purposes, upgrading to a Cash App Business Account can offer higher transaction limits. Business accounts typically have higher withdrawal and transfer limits, making them ideal for users who need to handle larger sums of money.

Tips for Managing Your Cash App Withdrawal Limits Effectively

Plan Your Withdrawals: If you anticipate needing a significant amount of cash, plan your withdrawals to stay within your daily and weekly limits without incurring extra fees or requiring urgent limit increases.

Stay Updated on Cash App Policies: Cash App periodically updates its terms and policies, including withdrawal limits and fees. Staying informed about these changes can help you manage your account more effectively.

Use Direct Deposits: Setting up direct deposits into your Cash App account can help increase your overall account activity and qualify you for fee reimbursements and higher limits.

Utilise Other Cash App Features: Consider using other features of Cash App, such as sending money directly to friends or family or paying businesses directly from your Cash App balance. These features can help you manage your finances without the need for frequent ATM withdrawals.

FAQs

1. What is the Cash App daily withdrawal limit?

The Cash App daily withdrawal limit is $1,000. This limit applies to all ATM withdrawals made using your Cash Card.

2. How can I increase my Cash App withdrawal limit?

To increase Cash App withdrawal limit, you should verify your account, link a bank account or debit card, maintain regular account activity, and contact Cash App Support if needed.

3. Does Cash App charge fees for ATM withdrawals?

Yes, Cash App charges a $2.50 fee for each ATM withdrawal. However, if you receive at least $300 in direct deposits per month, these fees can be reimbursed.

4. What is the Cash App Bitcoin withdrawal limit?

The Cash App Bitcoin withdrawal limit is $2,000 per day and $5,000 per week. This limit is separate from the cash withdrawal limit and applies specifically to Bitcoin transactions.

5. Can I withdraw more than the daily limit on Cash App?

The standard daily withdrawal limit on Cash App is $1,000. To withdraw more than this amount, you would need to wait until the limit resets or take steps to increase your limit through account verification or by contacting Cash App Support.

6. How do I check my current Cash App withdrawal limit?

You can check your current Cash App withdrawal limit by going to your profile settings in the app, where you will find detailed information about your transaction limits.

7. What happens if I exceed my Cash App withdrawal limit?

If you attempt to withdraw more than your daily or weekly limit, the transaction will be declined. To avoid this, ensure that you are aware of your current limits and plan your withdrawals accordingly.

8. Does upgrading to a Cash App Business Account increase withdrawal limits?

Yes, upgrading to a Cash App Business Account can increase your transaction limits, including withdrawal limits, making it ideal for users who need to handle larger sums of money.

Conclusion

By understanding and managing your Cash App withdrawal limits, you can ensure a smoother and more efficient financial experience, whether you're withdrawing cash, sending money, or dealing in Bitcoin. Follow these guidelines to maximise your Cash App usage and enjoy greater financial flexibility.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

3 notes

·

View notes

Text

Buy CashApp Accounts

24 Hours Reply/Contact

Email:- [email protected]

Whatsapp:- +1 (531) 309-0897

Skype:– Trustbizs

Telegram:– @Trustbizsshop

Are you looking to buy cash app accounts with LD backup? If your answer is “Yes”, you are in the right place. We provide login access, our accounts have high limit for smooth transaction. So, you can buy cash app accounts from trustbizs.com.

Our Acc. Info and Offers:

Phone number verified

Unique email address (USA number verified)

SSN verified

LD Backup Available For Safety

Driving license verified (Active)

Account access from USA

Have higher transaction limit (15K, 25K and 50K)

Instant delivery confirmed

Refund guaranteed with conditions

100% customer satisfaction guaranteed

If you want to buy any Products from the best place Trustbizs you can place your order. We provide the best quality USA, UK, CA, and other countries with 100% verified accounts within a little bit of time at the best price. So, you can place your order to get the best quality service.

24 Hours Reply/Contact

Email:- [email protected]

Whatsapp:- +1 (531) 309-0897

Skype:– Trustbizs

Telegram:– @Trustbizsshop

Buy Verified Cash App Accounts

Cash app is a convenient mobile payment banking platform in the western world including the USA. To buy, before know the details of anything in online, you should check the reviews for your safety before taking that product or services. According to a survey of 2021, around $70M+ annual transaction done through the cash app account and the gross profit was about $1.8+ and it’s remarkable. Buy Verified Cash App Accounts.

Business holders want to transact money through cash app because of its higher security system, user experiences, and facilities. Know more things about cash app, read cash app reviews. And must analyze the cash app reviews and take your concrete decision to buy verified cash app accounts.

Which documents you will get in our cash app accounts?

Let’s see which documents we attach with our cash app account:

Phone number

Unique email address

Birth date

Official identity card (SSN, Identity card)

Credit card, Debit card, and Bank Account

Driving license

LD backup available

Account access with exact country IP address

Express delivery with replacement guarantee

And money back guarantee

Why we give only safe and verified accounts and support 24 hours?

Our accounts are fully verified, safe and stable. We decided to provide only verified account to the customers to reduce their transaction problem and our team will give 24 hours customer support. So, if you want to buy verified cash accounts then contact us and take our fully verified, stable and safe account.

Our especial team is full of experienced people who are working with cash app since the foundation of the cash app platform. They know how to make a verified account, what is the updates of the cash app account. So, I hope you got the point what is our team management and what is our facilities. Buy Verified Cash App Accounts

Is cash a safe money transaction platform?

But if you don’t have verified cash app account then avoid transaction through it. The authority of cash app is very strict and they always recommend to use verified cash app e-wallet that’s why we only provide documents verified cash app e-wallet account. Buy Verified Cash App Accounts

How especial our team management for the cash app accounts making, its verification and timely delivery timely to the customers?

We arranged and decorated our team for individual service so that the experts can make the account properly. They can verify the accounts with only legal and trusted documents.

Our managing director given instruction to the workers to ensure the quality accounts and timely delivery to gain the customer trust and full of satisfaction. We expect customer satisfaction and it’s our main goal before earning. Buy Verified Cash App Accounts

Cash app charge in money transaction. Buy verified cash app accounts-

Here cash app is more secured and trusted and customer friendly. For bank and debit card payments, no charge is required but if you want to pay through the credit card then you have to the charge 3-4% of the transaction amount.

So be connected with trustbizs.com and take your desired products. People of the western world know better and buy aged cash app accounts from real warriors. Buy Verified Cash App Accounts

But if you want to instant transfer funds from your account to linked. So, you can see the money transfer facilities. You can buy aged cash app accounts and buy Bitcoin and trade with that through the crypto exchange platforms such as co-coin, all others crypto currency exchangers. Buy Verified Cash App Accounts

Why people love to buy verified cash app accounts from us?

We transfer money, take money, and send money through the cash app without any problem. So, you can also get the opportunities and offers of cash app in money transaction and online trading especially crypto trading.

And know details and then read our product details and buy cash app accounts from our team management. After reading the reviews and our account details in this description only then buy cash app accounts from trustbizs.com. We are only providing all documents verified cash app USA accounts according to the customers need. Buy Verified Cash App Accounts

Offers and advantage to buy cash app accounts cheap?

Cash app provides its audiences multiple opportunities, advantages in online marketing, crypto currency trading & especially in mobile banking with high security. We are the best creator of cash app accounts and we know better about the platform.

Our team gives the accounts with full security and loyalty at exact, minimum pricing comparing to the others agency. But we can say you can take our service without any problem frankly. Buy Verified Cash App Accounts

To grow your business perfectly and to get payment and send money, and any other convenient demanding work, cash app e-wallet can be your best method. There are thousands of transaction platform is available in in this universe, but cash app e-wallet is one of the best e-wallet in time for its multiple function to assist the users properly. So, trustbizs.com is recommending you buy cash app accounts from here. Buy Verified Cash App Accounts

Different limits for various transaction types-

Cash App imposes different limits on money transfers. For new users, the sending limit is $250 per week. After verification, this limit increases to $7,500 per week. The receiving limit is initially unlimited. The Cash Card, which works like a debit card, has its own spending restrictions. Users can spend up to $7,000 per day and $25,000 per week.

Buy verified cash app accounts (verified with SSN, selfie, bank and BTC-enabled high limits 15k to 25k per week) at trustbizs.com. Buy Verified Cash App Accounts. Concerning cryptocurrency and investments, Cash App allows buying and selling. Bitcoin withdrawals are capped at $2,000 per day and $5,000 per week. Stock trading limits depend on market conditions.

How cash app used in business transaction?

Cash App provides a seamless payment experience for businesses with its customization options. Business owners can easily set up and adjust payment methods to suit their needs. One standout feature is the unique $Cashtag. Each business gets a personalized identifier that customers can use to send money. Buy verified cash app accounts at trustbizs.com. We provide LD backup with the login access.

This $Cashtag acts as a distinct brand mark for the company and streamlines transactions. Moreover, businesses can share their $Cashtag on various platforms. This makes it easy for clients to remember and use when making payments. The flexibility of Cash App’s payment options ensures that every transfer is quick and efficient.

What are the customization options for checkout with cash app?

Cash App offers businesses the flexibility to customize their checkout experiences. With diverse payment options, companies can cater to a broader customer base. Customers choose from debit cards, credit cards, or direct bank transfers. Buy verified cash app accounts.

Custom branding is also a key feature of Cash App’s checkout customization. Businesses can integrate their logo, color scheme, and design aesthetics into the payment gateway. This ensures a consistent brand experience from start to finish.

The app also supports unique checkout flows. This means businesses can streamline the buying process. They adapt checkout stages to match their sales strategy. Offering a tailored experience resonates well with customers and can boost conversion rates. Buy cash app accounts.

What are the Requirements for Setting up a Cash App Account for Businesses?

To set up a Cash App account for businesses, you need a valid business name, bank account, and an email or phone number. You will also need an EIN or SSN to verify your business identity. Creating a business profile on Cash App is a straightforward process designed to integrate seamlessly into your business’s financial toolkit.

Cash App provides an alternative to traditional banking with its user-friendly platform that caters specifically to the unique needs of businesses. It allows entrepreneurs and small business owners to send, receive, and request money instantly. The platform promotes a simplified approach to transactions, offering features such as easy invoicing and the ability to receive payments through unique $Cashtags.

Establishing a Cash App business account can streamline operations, offering a modern touch to your financial dealings and helping you keep pace with the digital economy. Buy verified cash app accounts. Buy Verified Cash App Accounts

How User-Friendly is the Cash App Platform for Both Individuals and Businesses?

Cash App is highly user-friendly for individuals and businesses, offering easy navigation and quick transaction processes. Its intuitive interface streamlines payments, making it accessible for users of all levels. Cash App, integrated with simplicity and efficiency in mind, has become a popular financial platform among users who value convenience. Catering to both personal and professional financial needs, the app enables seamless money transfers, bill payments, and direct deposits with just a few taps. Buy cash app accounts.

Cash App provides a quick way to accept payments and offers unique features like the Cash Card, which enhances the transaction experience for customers. By incorporating user feedback and constantly updating its features, Cash App remains a competitive contender in the digital payments space, catering to a diverse range of financial interactions. Buy verified cash app accounts at trustbizs.com with LD backup at cheap price. Buy Verified Cash App Accounts

How Customizable are the Payment Options on Cash App for Businesses?

The payment options on Cash App for businesses are quite flexible, allowing for a variety of customization features. Business users can set transaction amounts, add tipping options, and utilize reporting tools for financial management. Buy verified cash app accounts at trustbizs.com with LD backup at cheap price.

Cash App offers an appealing platform for small business owners and entrepreneurs seeking to streamline their financial transactions. By using this app, businesses can effortlessly receive payments and manage their finances with its user-friendly interface. Customization is a key aspect of Cash App, catering to diverse business needs and preferences. Buy cash app accounts. Buy Verified Cash App Accounts

Why Trading Experts Suggest to Buy Old Cash App Account With High Transaction Limits??

Trading experts recommend buying old Cash App accounts with high transaction limits because they allow for immediate, higher volume trading. These established accounts bypass initial limitations imposed on new users. Navigating the world of digital transactions requires a strategic approach, especially for frequent traders and investors. Buy verified cash app accounts at trustbizs.com with LD backup at cheap price.

An old Cash App account with elevated transaction limits is a coveted asset to execute larger trades swiftly without the typical wait for increased limits. Cash App’s security measures incrementally elevate transaction capabilities as an account matures, making older accounts with a transaction history highly desirable. This discussion highlights the practical reasoning behind why experienced financial traders and advisors often seek out and endorse purchasing mature Cash App accounts for enhanced transactional freedom. Buy old cash app account. Buy Verified Cash App Accounts

What are the Advantages of Integrating Cash App with Online Stores?

Integrating Cash App with online stores offers streamlined payments and enhanced customer convenience. Merchants benefit from quick settlements and reduced transaction fees. Cash App’s integration into online shopping platforms marks a significant advance for e-commerce operations. This alliance presents both shoppers and retailers with a suite of appealing benefits.

Simplified transactions, secure payment processing, and immediate fund transfers are among the chief advantages, providing a seamless checkout experience. With Cash App, customers enjoy the ease of using their mobile devices for purchases, while merchants appreciate the direct access to a broad user base and the potential for increased sales.

The service’s popularity and user-friendly interface make it an excellent addition to any online store’s payment options, keeping businesses competitive in the fast-moving digital marketplace. By enhancing payment flexibility and efficiency, this integration is a strategic move for online retailers focused on optimizing their sales processes and improving customer satisfaction. Buy Verified Cash App Accounts

How Customizable are the Payment Options on Cash App for Businesses?

Cash App offers businesses customizable payment options to suit diverse needs. Users can adjust settings for transaction limits and payment requests. Understanding the flexibility of payment solutions for businesses is crucial, especially in the evolving digital marketplace. Cash App, a modern peer-to-peer payment service, caters to this necessity by providing a platform where business owners can tailor their payment experience. Buy old cash app account.

Cash App answers this call by allowing businesses to modify transaction limits and create specific payment requests, providing a bespoke payment environment. This adaptability ensures that both small-scale entrepreneurs and larger enterprises can manage their finances effectively while offering convenience to their customers. The straightforward customization process on Cash App keeps businesses in control of their payment operations, ensuring a seamless financial flow. Buy Verified Cash App Accounts

How reliable is Cash App’s Infrastructure in Handling Large Volumes of Transactions?

Cash App’s infrastructure is highly reliable, managing large volumes of transactions efficiently. Its robust system ensures secure and swift money transfers for millions of users. Cash App, a peer-to-peer payment service, has quickly become a favored choice for digital transactions. With the surge in online banking, users often question the reliability of platforms handling their money. Cash App shines in this regard, with an infrastructure designed for high-volume traffic and secure financial operations.

Buy old cash app account. Backed by Square, Inc. (now Block, Inc.), this application provides users with confidence in conducting daily transactions, whether small or substantial. Buy old cash app account. It leverages advanced encryption and fraud detection technologies to protect funds and personal data. Trust in Cash App’s capability to handle large transaction volumes has been bolstered by its continuous upgrades and user-focused services, making it a go-to payment solution in today’s fast-paced digital world. Buy USA cash app accounts.

Can Cash App Be Used to Accept Payments in Multiple Currencies?

Cash App currently does not support accepting payments in multiple currencies. It only allows transactions in USD and GBP, depending on the user’s location. Navigating the world of mobile payments can feel like venturing into a digital bazaar, each app with its own set of rules and currency restrictions. Among these, Cash App stands out as a popular choice for seamless transactions, yet it’s important to recognize its limitations when it comes to currency flexibility. Buy cash app accounts at trustbizs.com.

How cash used for international transaction?

This platform makes sending and receiving money as easy as sending a text message, but users are bound by the borders of their own currency zones predominantly the United States and the United Kingdom. Whether you’re a freelancer looking to expand your client base or a small business aiming to widen your market reach.

Here understanding the currency capabilities of your chosen payment app is crucial. As we delve further into the digital age, the demand for versatile financial tools becomes more evident, highlighting the importance of staying informed about services like Cash App. Buy USA cash app accounts.

Can Businesses Customize Their Checkout Experience With Cash App? How?

Yes, businesses can customize their checkout experience with Cash App by integrating Cash App Checkout, which allows for customizations. Merchants do this through the app’s API, tailoring it to their needs. Navigating the dynamic world of online payments, entrepreneurs continually seek innovative ways to enhance the customer journey.Buy verified cash app accounts verified with email, phone number, birth date, SSN, debit card, Driving license and bank account available

Cash App steps up to this challenge, providing a platform conducive to crafting a bespoke checkout experience. With its user-friendly interface, Cash App empowers businesses to personalize their payment process, aligning with their brand’s ethos and the expectations of their customer base. This personalized approach aids in elevating the customer’s end-to-end shopping experience, fostering loyalty and potentially increasing conversion rates. Buy USA cash app accounts at trustbizs.com.

What are the Limits of Cash App for Certain Types of Transactions?

Cash App limits unverified users to sending $250 per week and receiving $1,000 per month. Verified users can send up to $7,500 to $15000 weekly and receive an unlimited amount. Understanding the Cash App transaction limits is crucial for users who frequently manage money transfers via this popular platform. The peer-to-peer payment app, designed to facilitate speedy transactions, has set specific caps, catering to two categories of users: unverified and verified. Buy cash app accounts with LD backup at trustbizs.com.

These limits aim to secure accounts and comply with regulatory requirements. The verification process, which requires additional personal information, unlocks higher sending limits for users who need to move larger amounts of money. With its user-friendly interface, the app allows for quick money transfers, bill payments, and direct deposits. Recognizing these limits ensures a smooth and hassle-free financial experience. Buy USA cash app accounts.

How to increase the transaction limit of cash app accounts?

Using Cash App requires a simple sign-up. New users download the app and provide basic personal details. To start, there’s a transaction limit. To increase this limit, identity verification is crucial. Users must submit additional information, such as their Social Security Number (SSN).

This step is vital for unlocking higher transaction capabilities. Verifying your identity elevates account status. Sending money has an initial cap. The cap is low to keep things safe and secure. Verified users enjoy enhanced transaction limits. The process ensures only you access your money. Buy cash app accounts.

How Does Cash App Simplify the Process of Managing Payments for Businesses?

Cash App streamlines payment management for businesses by offering simple transfer and tracking features. It integrates easily with existing financial systems, enhancing efficiency. Navigating the complexities of business transactions can be daunting. Cash App emerges as a beacon of simplicity in financial management. This platform provides a user-friendly interface that allows businesses of all sizes to send and receive payments with just a few clicks.

Not only does it facilitate instant transfers, but it also affords users the convenience of tracking their financial activity in real time. Small business owners particularly benefit from its straightforward setup, avoiding the tangled web of traditional banking protocols. Security features are built-in, giving peace of mind to both the business and its clients. Cash App ensures that businesses can manage their finances efficiently and effectively, without the need for extensive accounting resources. Buy USA cash app accounts.

#bitcoin cash app verification#bitcoins on cash app#Buy a BTC enable cash app account#Buy aged cash app account#Buy BTC enable cash app account#Buy cash accounts#Buy old cash app accounts#Buy USA cash app account#buy verified cash app account Reddit#Buy verified cash app accounts#Buy Verified Cash App Accounts UK#Buy Verified Cash App Accounts USA#does bitcoin work on cash app#how do i enable bitcoin on cash app#how to get verified cash app#how to use cash app with bitcoin#verified cash app account#verified cash app accounts for sale#what is a verified cash app account

3 notes

·

View notes

Text

Recovering a Closed Cash App Account

Cash App is a popular mobile payment application that allows users to easily send and receive money with friends and family. However, there are times when a Cash App account may get accidentally or unexpectedly closed, leaving the user unable to access their funds and transaction history. If this happens, it's important to act quickly to try and recover the closed cash app account.

The first step is to try and determine why the Cash App account was closed in the first place. Cash App may close an account for a variety of reasons, such as suspected fraud, violating the app's terms of service, or if the account has been inactive for an extended period of time. Knowing the reason for the account closure will help guide the recovery process.

If the cash app account was closed due to suspected fraud, Cash App will require the user to provide additional verification and documentation to prove their identity before they can recover the account. This may include things like a government-issued ID, a recent utility bill, or bank statements. Cash App has a dedicated team that reviews these types of account recovery requests, so it's important to be patient and responsive during this process.

In cases where the cash app account was closed for violating the terms of service, the recovery process may be more difficult. Cash App takes these violations seriously and may be hesitant to reopen a closed account, even if the user claims it was an accident. The best approach is to thoroughly review the terms of service, identify where the violation occurred, and provide a clear and compelling explanation for why it won't happen again.

For accounts that were closed due to inactivity, the recovery process is usually more straightforward. Cash App may simply require the user to log back into the app and verify their identity to regain access to the account. However, it's important to note that any funds that were stored in the account may have been forfeited or sent to the appropriate state's unclaimed property division.

Regardless of the reason for the account closure, the key to successfully recovering a Cash App account is to be persistent, responsive, and provide all the necessary documentation and information requested by Cash App's support team. It's also a good idea to regularly monitor the account for any suspicious activity and to enable two-factor authentication to help prevent future closures.

In conclusion, recovering a closed Cash App account can be a frustrating and time-consuming process, but it is possible with the right approach. By understanding the reason for the account closure, providing the necessary documentation, and working closely with Cash App's support team, users can often regain access to their account and any funds that were stored within it.

Here are more details on the documentation required to recover a closed Cash App account:

When a Cash App account is closed, the user will typically need to provide a variety of documentation to prove their identity and ownership of the account in order to initiate the recovery process. The specific documentation required can vary depending on the reason for the account closure, but some common examples include:

Government-Issued ID: Cash App will almost always require the user to submit a copy of a valid government-issued photo ID, such as a driver's license or passport. This helps verify the user's identity.

2 notes

·

View notes

Text

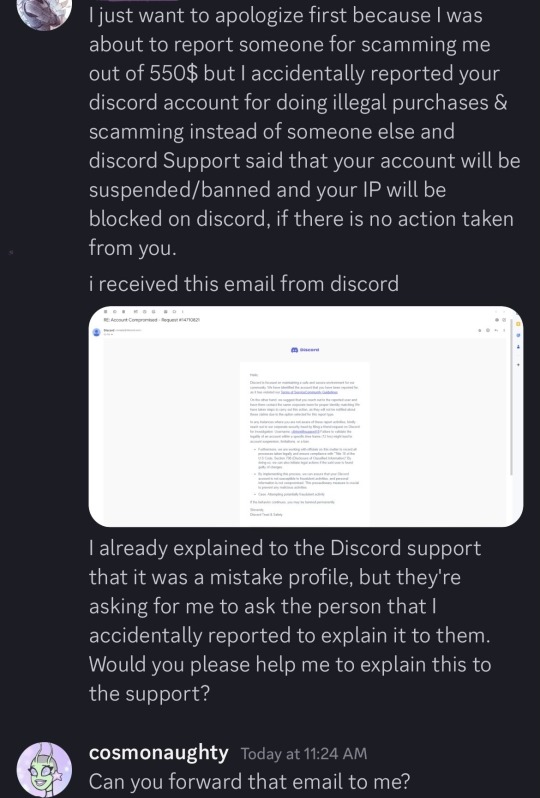

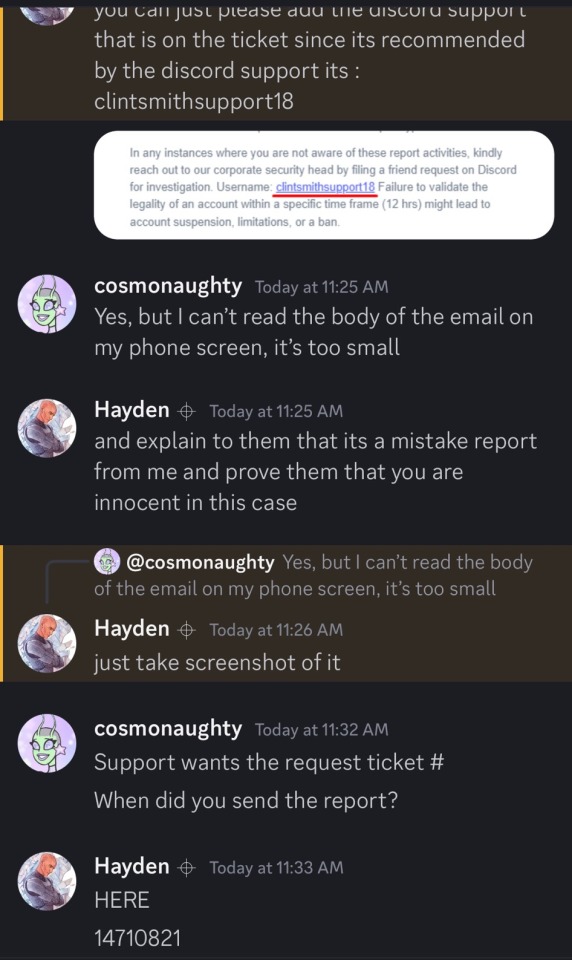

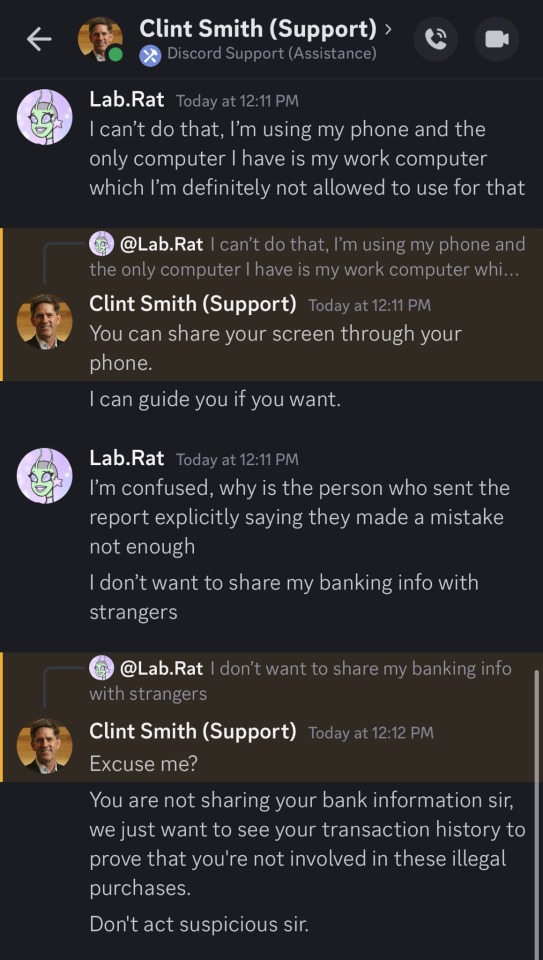

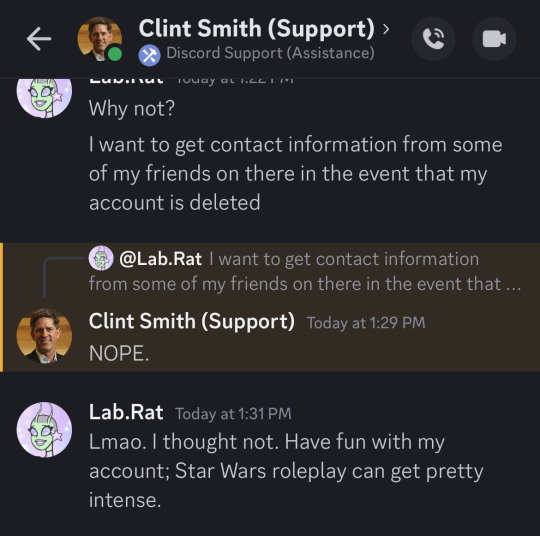

Here’s the full story of this post, aka the Great Discord Scam of ‘24

It began as I was just finishing my break at work and a user from one of my groups asked if I was available because they had an urgent issue. I wasn’t too familiar with this person, so I didn’t notice anything too unusual about their speech patterns, besides them being kinda terse.

On second look, their refusal to send a copy of the email was a red flag.

So I contacted “Clint” from “support” and he told me I had 🚩 multiple accusations of fraud and that he would have to 🚩gain access to my account by having me change my email to one he provided.

I was being told that I had 🚩two hours to resolve the issue or my account would be banned. Adding to the stress was the fact that I was at work and just wanted to get the process over with. If I’d had time to think it through and read more carefully, it might not have worked at all.

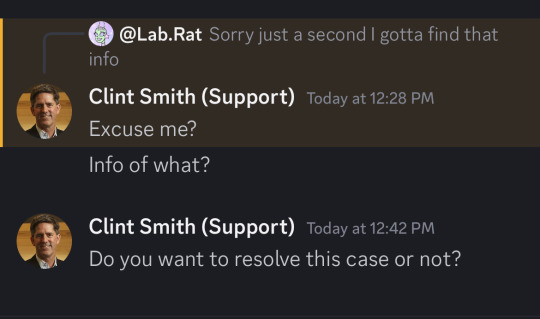

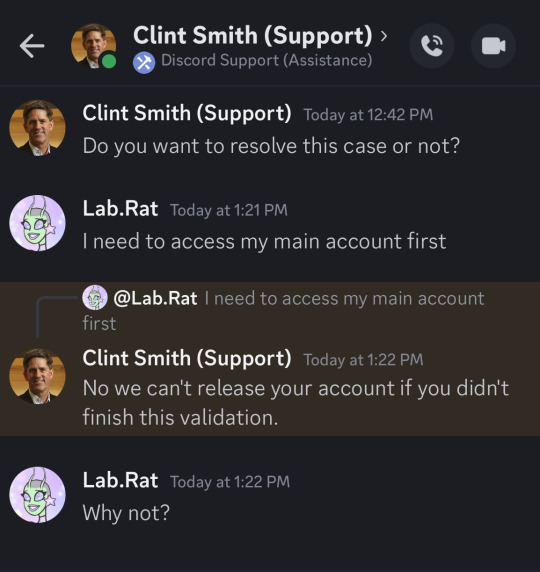

So I gave “Clint” access to the account and continued the conversation with him on my alt. That’s when I truly started noticing the red flags. He said 🚩 I would have to screen share my banking app so he could view my recent transactions. I said no, I’m not comfortable with that and he became highly offended.

At this point I still hadn’t fully clued in, I thought maybe he was just rude, so I sent some cropped images of recent transactions (with none of my info visible, just “$$ spent at place on date”. I shouldn’t have given even that much but it didn’t do him any good).

Perhaps sensing that he was losing me, “Clint” moved on from the bank statements to a process that made no sense, something about verifying my identity by having me transfer some money via PayPal or cash app, two apps I’ve never had connected to my discord. As soon as he mentioned sending money, I knew it.

I tried to play dumb in the hopes that he would let me back into my main account if I implied I’d send money after I did, but no such luck. We both knew we were done at that point.

(That all caps NOPE is just: mask fully off)

So yeah, be alert to any “urgent” messages you get. Look out for: 🚩rushing you, telling you to do X in Y amount of time or there will be catastrophic consequences. 🚩wild accusations against you to make you think you’re in big trouble and this is the only way out. 🚩anyone asking you to reset your email or password 🚩anyone asking for your private information 🚩 anyone asking you to send money.

I lost six years’ worth of correspondence with my friends, but it could have been much worse.

At least I got “Don’t act suspicious sir” out of it, aka the funniest thing you could say to someone when you’re obviously scamming them.

2 notes

·

View notes

Text

Easy Steps to Increase Your Cash App Bitcoin Withdrawal Limit

Cryptocurrency has taken the world by storm, offering a decentralized and secure way to conduct financial transactions. Among the popular cryptocurrencies, Bitcoin stands out as the leader, and platforms like Cash App have made it easier for everyday users to buy, sell, and withdraw Bitcoin. However, like all financial services, Cash App imposes certain limits on Bitcoin transactions, including withdrawal limits.

If you’re an avid user of Cash App for Bitcoin transactions, you might have encountered these withdrawal limits and wondered, "How can I increase my Cash App BTC withdrawal limit?" Whether you’re a trader, investor, or simply looking to move your Bitcoin out of Cash App, understanding these limits and how to increase them is crucial. In this blog, we’ll explore everything you need to know about Cash App’s Bitcoin withdrawal limits, how they work, and the steps you can take to increase them.

Understanding the Cash App BTC Withdrawal Limit

Cash App provides users with the convenience of buying and selling Bitcoin directly within the app. However, there are limits on how much Bitcoin you can withdraw from your Cash App account to an external wallet. These limits are in place to enhance security, manage risk, and comply with regulatory requirements.

Daily BTC Withdrawal Limit: The Cash App Bitcoin withdrawal limit per day is typically set at $2,000 worth of Bitcoin. This means that within any 24 hours, you can withdraw up to $2,000 worth of Bitcoin from your Cash App account to an external wallet.

Weekly BTC Withdrawal Limit: In addition to the daily limit, Cash App also imposes a Bitcoin weekly withdrawal limit. This limit is generally $5,000 worth of Bitcoin over a rolling seven-day period.

These limits apply to all Bitcoin withdrawals, regardless of the number of transactions you make. It’s important to note that these limits are calculated in USD, and the equivalent amount of Bitcoin you can withdraw will vary depending on the current market price.

Why Does Cash App Have BTC Withdrawal Limits?

Understanding the rationale behind these limits can help you manage your Bitcoin transactions more effectively. Cash App’s Bitcoin withdrawal limits serve several important purposes:

Security: By limiting the amount of Bitcoin that can be withdrawn, Cash App reduces the risk of large-scale fraud or theft in case your account is compromised.

Compliance: Cash App must adhere to regulatory requirements that govern cryptocurrency transactions. Withdrawal limits help ensure compliance with anti-money laundering (AML) laws and other financial regulations.

Risk Management: Cryptocurrency transactions are inherently volatile, and withdrawal limits help manage the risk associated with large movements of Bitcoin.

How to Increase Your Cash App BTC Withdrawal Limit?

If you find that the default limits on your Cash App BTC withdrawals are too restrictive, there are steps you can take to increase these limits. Let’s explore the options available:

1. Verify Your Identity

The most straightforward way to increase your Cash App BTC withdrawal limit is by verifying your identity within the app. Verification is a simple process that requires you to provide additional personal information, which enhances the security of your account and unlocks higher limits.

To verify your identity:

Open the Cash App on your mobile device.

Navigate to your profile by tapping the profile icon.

Select "Personal" and enter your full name, date of birth, and the last four digits of your Social Security Number (SSN).

You may also be asked to provide a photo of a government-issued ID (such as a driver’s license or passport) and a selfie for verification.

Once your identity is verified, your Bitcoin withdrawal limits may increase automatically. The exact increase will depend on your account history and usage patterns.

2. Request a Limit Increase

If you still require higher limits after verifying your identity, you can contact Cash App’s customer support to request an increase. Be prepared to explain why you need a higher limit, such as for large transactions or frequent trading activities.

When requesting a limit increase:

Provide an apparent reason for the request.

Ensure that your account history reflects responsible usage. Be aware that approval is not guaranteed and will be reviewed on a case-by-case basis.

3. Maintain a Good Account Standing

Cash App is more likely to approve a limit increase if you have a history of responsible account usage. This includes avoiding any suspicious activity, regularly using the app for transactions, and maintaining a positive balance. The better your account standing, the higher the likelihood of obtaining a limit increase.

Tips for Managing Your Bitcoin Withdrawals on Cash App

Even with increased limits, managing your Bitcoin withdrawals effectively is critical to a smooth experience. Here are some tips to help you make the most of your Cash App Bitcoin transactions:

1. Plan Your Withdrawals

If you anticipate needing to withdraw more than the daily or weekly limits allow, plan your withdrawals in advance. This might involve spreading out transactions over several days to ensure you stay within your limits.

2. Monitor the Market

Given the volatility of Bitcoin prices, it’s essential to monitor the market closely when making withdrawals. A sudden price change can affect the amount of Bitcoin you can withdraw under the current limits.

3. Consider Alternative Platforms

If you regularly need to withdraw large amounts of Bitcoin, you might consider using additional platforms that offer higher withdrawal limits. This can help you manage your cryptocurrency assets more flexibly.

FAQs: Cash App BTC Withdrawal Limits

Q1: What is the Cash App Bitcoin withdrawal limit?

A: The Cash App Bitcoin withdrawal limit is $2,000 per day and $5,000 per week. These limits apply to the amount of Bitcoin you can withdraw to an external wallet within those timeframes.

Q2: Can I increase my Cash App Bitcoin withdrawal limit?

A: Yes, you can increase Cash App Bitcoin withdrawal limit by verifying your identity within the app. You may also request a further limit increase by contacting Cash App’s customer support.

Q3: How do I verify my identity on Cash App?

A: To verify your identity on Cash App, go to your profile, select "Personal," and enter your full name, date of birth, and the last four digits of your SSN. You may also need to provide a photo of a government-issued ID and a selfie.

Q4: What happens if I try to withdraw more than my Bitcoin limit on Cash App?

A: If you attempt to withdraw more than your Bitcoin limit on the Cash App, the transaction will be declined. You’ll need to wait until your limits reset or request an increase to proceed with the withdrawal.

Q5: How often do Cash App Bitcoin withdrawal limits reset?

A: Cash App Bitcoin withdrawal limits reset on a rolling basis. The daily limit resets 24 hours after your last withdrawal, and the weekly limit resets seven days after your last transaction.

Q6: Can I withdraw Bitcoin from Cash App to any wallet?

A: Yes, you can withdraw Bitcoin from Cash App to any external wallet that supports Bitcoin. Ensure you enter the correct wallet address to avoid losing your funds.

Q7: What should I do if my Cash App Bitcoin withdrawal is not working?

A: If your Cash App Bitcoin withdrawal is not working, ensure that your account is verified, your limits have not been exceeded, and the Bitcoin network is functioning correctly. Contact Cash App support if the issue persists.

Q8: How much is the Cash App Bitcoin withdrawal limit per day?

A: The Cash App Bitcoin limit per day is $2,000. This limit applies to the total amount of Bitcoin you can withdraw within a 24-hour period.

Q9: What is the weekly withdrawal limit for Bitcoin on Cash App?

A: The Cash App weekly Bitcoin withdrawal limit is $5,000. This limit applies to the total amount of Bitcoin you can withdraw over seven days.

Q10: Can I increase my Bitcoin withdrawal limit multiple times?

A: You can request to increase your Bitcoin withdrawal limit multiple times, but each request will be reviewed on a case-by-case basis by Cash App. Continuous responsible usage and account activity can improve your chances of approval.

Conclusion

Understanding and managing your Cash App BTC withdrawal limit is essential for smooth and secure cryptocurrency transactions. While the default limits are designed to protect your account, there are ways to increase these limits if your needs exceed the current thresholds.

By verifying your identity, maintaining good account standing, and planning your withdrawals strategically, you can make the most of your Cash App Bitcoin transactions. If you ever find yourself needing higher limits, don’t hesitate to reach out to Cash App’s support team for assistance.

0 notes

Text

Cash App Bitcoin Receiving Limit: How Much Bitcoin Can I Receive on Cash App?

As cryptocurrency becomes more integrated into everyday transactions, Cash App has emerged as a convenient platform for users to send, receive, and invest in Bitcoin. If you're using Cash App to receive Bitcoin, it's crucial to understand the platform's limits on cryptocurrency transactions. Whether you're a beginner or an experienced trader, knowing how much Bitcoin you can receive on Cash App can help you plan your transactions effectively.

In this comprehensive guide, we explore the Cash App Bitcoin receiving limits, how these limits work, and how you can increase them to suit your needs.

Understanding Cash App Bitcoin Limits

Cash App, developed by Block, Inc., allows users to receive Bitcoin directly into their app's wallet. However, like most platforms, Cash App enforces certain limits on how much Bitcoin users can send and receive. These limits are designed to protect both the platform and its users from fraud while also complying with regulatory requirements.

What is the Cash App Bitcoin Receiving Limit?

The Bitcoin receiving limit on the Cash App refers to the maximum amount of Bitcoin a user can receive into their account over a certain period. Currently, Cash App has set specific receiving limits that vary depending on whether your account is verified or unverified.

Unverified Accounts: If you haven’t verified your account, you are limited in the amount of Bitcoin you can receive. Typically, unverified accounts can only receive a small amount of Bitcoin. This limit is set to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Verified Accounts: By verifying your identity with the Cash App, you can significantly increase your Bitcoin receiving limit. Once verified, users can receive up to $100,000 worth of Bitcoin per week. This increased limit allows users to engage in larger transactions and have more flexibility in receiving payments or cryptocurrency transfers.

How to Verify Your Cash App Account for Higher Bitcoin Limits?

To unlock the higher Bitcoin receiving limit, verify your identity on the Cash App. Here’s how you can do that:

Open the Cash App and navigate to the Bitcoin section by tapping on the “Investing” tab.

Select Bitcoin and click on “Enable Withdrawals and Deposits.”

You will be prompted to verify your account by providing details such as your full name, date of birth, and social security number (SSN).

Complete the verification by uploading a photo ID and potentially a selfie for confirmation.

Once your verification is successful, Cash App will notify you that your Bitcoin limits have been increased. At this point, you can receive Bitcoin transactions up to $100,000 per week.

Can you receive unlimited Bitcoin using the Cash App?

While Cash App provides generous limits for verified users, there is still a cap on the amount of Bitcoin you can receive within a specific timeframe. The maximum weekly receiving limit of $100,000 worth of Bitcoin is substantial for most users. However, if you are handling larger sums, you will need to manage your transactions accordingly to stay within these limits.

It's important to note that this limit only applies to receiving Bitcoin. The platform does not have a specific receiving limit per transaction, meaning you could theoretically receive one large Bitcoin transfer, as long as the cumulative total does not exceed $100,000 per week.

How to Increase Your Cash App Bitcoin Receiving Limit?

While the $100,000 weekly limit is relatively high, some users may still require more flexibility, especially if they frequently engage in large Bitcoin transfers. To potentially increase your receiving limit beyond what Cash App offers, consider the following steps: