#cheapest crypto tax software

Explore tagged Tumblr posts

Text

Crypto Currency Gambling: Crypto Upgrades on the Upswing

Crypto currency gaming is undergoing widespread adoption and more users are needing to work with it to their own internet gambling tasks. Some web sites offer Bit coin Gambling while some offer withdrawals and deposits from numerous crypto currencies and also this really is something which may last in to 2021. Crypto Currencies It is no longer sufficient to just offer Bit coin trades in your own iGaming website. Some customers might need the choice to change to fiat Also and also you need to Offer the implementation of trades in Various distinct coins for example as: Etherum Litecoin Monero DASH Bit Coin Cash. Crypto currency was formerly a niche market however it's now widely recognized and embraced. This use of this tech on everyday tasks has resulted in peoples understanding of this advancing. It's currently recognised as a tool value, benefits, and that's secure and dependable. Incorporating crypto payments to your internet site is essential, continue reading to learn about why... The anticipated rise of Crypto Currency Gambling People which have now been seeking a higher degree of privacy within their monetary transactions are drawn to crypto currency gaming because of the decentralized character. Virtual monies like Bit coin, Monero, Ether as well as several different crypto currencies are now a lot popular, especially in the online gambling industry. Even as we proceed in to 2021, both operators and players are increasingly getting more conscious of the advantages of both crypto currency betting. Bit coin Gambling Casinos and Sports gambling platforms that accept crypto obligations are using it like a feature and increasing their customer base. In addition, other programs along with start ups will demonstrate a willingness to embrace crypto currency to get being a valid form of repayment. The boost in its prevalence and adoption is a result of several factors which are specially good for the web gaming industry. Benefits like instant trades, low prices, and anonymity play a role in how it's ongoing to successfully infiltrate iGaming. This, then, is very likely to subscribe to an escalation in players who are brought on by Bit coin gaming, leading to a rise in revenue throughout the board. Great Things about Crypto Currency gaming Crypto currency and Bit coin gaming may be your near future and you can find many benefits for both players and operators. Incorporating crypto currency payments to your internet gambling platform is a thing which most operators and on the web gaming permit holders needs to be thinking about 2021. Here are only a couple of the major advantages of offering crypto currency obligations for the gambling company. Cost-Efficiency and Affordable Transaction prices From an internet gaming permit holders perspective, providing crypto obligations in your own internet gaming site has many added benefits. Merchants can usually pay better prices for traditional payments but a major chunk of income will be missing paying for fees to payment providers. However, with crypto currency obligations, matters are somewhat different. Some of those top crypto payment gateways bill no more than 0.5percent that's less than fiat money competitions. By supplying crypto payments in your own internet site, you're able to calculate a huge portion of your revenue through a payment system which saves you a lot of money on calculating fees. Odds are, that your clients will never be positioned in 1 country. For that reason, offering crypto currency payments implies your international clientele may enjoy instant crossborder payments as well as trades. The trade is done within only a matter of seconds and it's really stable, immutableprivate. The ideal thing is that those with no banking accounts or credit/debit card may send crypto payments earning online playing and purchasing for everybody. If you transact in crypto currency, there's no necessity to wait around for this to be clear or processed and you undoubtedly don't need to pay fees. Anybody using an online connection may send a crypto currency trade once they

desire, to whom they desire, and also for just how much they really need. Crypto currency trades all happen on the block-chain -- a de-centralised ledger that's wholly immutable. Which usually means that once a trade is manufactured, it's permanent and cannot be reversed, either deleted, edited, or tampered with. Which usually means that the chance of fraud, identity theft and fake payments are somewhat reduced. Crypto obligations provide the on the web gambling permit holders and players using an additional level of security. No Charge Backs on Crypto Upgrades Firms endure a whole lot of losses out of charge backs. This really is the point where an individual produces a card payment, and receives the product, after which reports the fee as deceitful to receive it reimbursed. There are not any risks with the with crypto obligations. Once they will have been enrolled on the block-chain they can not be reversed or edited. Meaning there isn't any way that a charge back can be awarded without the permission of the business. The current market is very favored by Millenials whose spending power is growing since they advance through their dignity. Crypto currency payment centers allow you to share with you this forward-thinking and innovative group of clients and also lure them to make use of your solutions. Integration of crypto currency on your company is a wise move for people seeking to participate the forex marketplace. Contemplating each the benefits above, we could get to observe a substantial gain in the quantity of all crypto obligations, especially in the gambling sector, during the upcoming couple of years. Up to now as 2013, Bit coin gaming trades accounted for up to 50 percent of most Bitcoin trades. Bit coins popularity has somewhat increased since . These statistics reveal that incorporating crypto currency in to some other iGaming platform is not any longer an alternative, but it's really a requisite. The crypto currency was a niche market however it's now widely recognized and embraced. This use of this tech on everyday tasks has resulted in peoples understanding of this advancing. It's currently recognised as a tool value, benefits, and that's secure and dependable. Nonetheless it's no longer enough to merely offer Bit coin trades in your own iGaming website. You want to deliver the implementation of trades in various distinct coins for example Etherum, Litecoin, Monero, DASH and Bit coin Cash. Once it regards crypto currency gaming, you will find two types of jurisdiction. The first are the ones which have generated a legal platform to cultivate and produce the market, and the ones which have not. Some operators elect to do the job in authorities which do not have the essential frameworks set up but that really is really something of a gray place. It may cause difficulties with third parties, entrepreneurs, computer software corporations, and banking, in addition to potential problems with the government. Quick off-shore advocates just employed in reputable authorities which have a decent arrangement set up to govern and manage the business. Doing this makes it possible to increase your authenticity and stick to the perfect side of lawenforcement. Our top four crypto authorities for gambling are: Curacao Curacao can be really a quality authority for gambling and also crypto gambling start ups. They've been at the iGaming sector since the mid-'90s and provide perhaps one of their cheapest, quick, and basic accreditation procedures round. Along with this, they truly are crypto-friendly and people that have a Curacao gaming permit are all welcome to offer trades in a range of crypto currencies and coins that are virtual. People who decide to get a Curacao permit for his or her crypto gambling business may enjoy 0% taxation and VAT, immediately and straightforward accreditation, and also a very simple installation process with minimal red tape and much more. We are predisposed to urge Curacao whilst the ideal gift for startup crypto gaming businesses. The lower expenses related to the act in-country means that

they are able to establish their theory and secure the business in good economic shape before trying to permit from another jurisdiction. Kahnawake Kahnawake's internet gaming license includes a good standing. The Gambling Commission is well known for its zerotolerance strategy to offenses of play, under age gaming, or some other legal activity. Therefore, a permit out of these conveys weight in regards to negotiating with third parties or even creating bank account. They have been also welcoming to internet gaming organizations which are looking to provide crypto currency payments. The installation costs significantly more than Curacao but less than Malta, ongoing prices are cheap also. Concerning timescale, every thing can be achieved in a month or two. While there are more paper work to undergo when put next to Curacao, there is certainly not any in Malta or alternative crypto jurisdictions. Individuals acquiring a Kahnawake crypto gaming permit may enjoy 0% tax degrees in Kahnawake as well, meaning that there are far more liquidity for enlarging your company moving ahead. Malta Malta Malta Lately, the government has taken steps to add crypto in to the marketplace. They truly became the first country on the planet to create an extensive legal frame for crypto currency, block-chain, and virtual resources. Nick named"The block-chain Island", Malta will be dwelling to block-chain start-ups, crypto exchanges, and lots of gambling organizations offering trades in various crypto currencies. The Malta Gambling Authority is undoubtedly the very trusted on the planet and also the permit includes a hefty pricetag. However, also for anyone who have the capital to get, or recognized iGaming providers, it's a solid alternative. The government is exceptionally'pro business' inside their own approach and also there really are certainly a wealth of benefits to managing a Maltese crypto gaming company. Included in these are some of their cheapest company taxation rates from the EU and usage of some highly-skilled, English speaking work force. Organizations are permitted to add an organization where the goal would be on the web crypto gaming and they're subsequently allowed to run tasks from Costa Rica. Concerning crypto currency, the Costa Rican government is very pro-crypto and encourages both the growth and maturation of the business. They require a marginally neater approach that's very good for start ups which find their own feet. Adding a crypto gambling business in Costa Rica will include a few challenges. There might be difficulties. Likelyyou wont have the ability to find yourself a traditional banking accounts, that will be fine if you just want to innovate in crypto. We recommend starting your stage at Costa Rica, ironing out some problems, honing your own offering and going for licensing everywhere. Questions About Crypto Currency Gambling? Contact Fast Off-shore If you're considering applying for an off shore gaming permit, we'd suggest that you look at incorporating crypto currency in your goods. Fast off shore hasbeen in iGaming and company services for more than 2-3 years, also block-chain and crypto since 2009. This sets us at a posture where we may provide you comprehensive advice about what best to add crypto currency to your internet casino or gambling site. '' we can help with acquiring your gambling permit, including and establishing all of the mandatory company arrangements, and assisting you to provide crypto currency obligations by your website. Intrigued? Contact us today to learn.

2 notes

·

View notes

Text

China’s leadership in the Bitcoin mining industry will be challenged

https://ift.tt/3f19gQw

China’s leadership in the Bitcoin mining industry will be challenged

If you talk about Bitcoin (BTC) mining, you have to talk about China. China has become a giant in the Bitcoin mining ecosystem with major mines and pools, quick, cheap labor and a majority control of the world’s hashing power. So, should you go set up a mining operation there? Do the pros outweigh the cons? Is China actually a threat to the Bitcoin ecosystem? Let’s look at the state of Chinese mining.

Back to the basics

In the beginning of Bitcoin, you could simply mine from your laptop or set up a few miners in your home to run the hashing algorithm. But as more miners started turning on and the Bitcoin mining difficulty rose, higher levels of computing power and electricity was needed to solve the equations and reap the reward.

Only a finite amount of Bitcoin can be mined — 21 million tokens — so as time goes on, it will get harder and harder to mine them. Miners continue to need better and faster hardware, which requires more electricity. Today, mining operations are moving to large data centers where thousands of miners run day and night.

Related: How to mine Bitcoin: Everything you need to know

Why mention all of this? Because when mining at a large scale, electricity costs, labor costs, the speed of acquiring new hardware and sustainability come into play if generating profit is the goal — and China has the advantage in nearly all of these areas.

The state of mining in China

At the end of 2019, China produced nearly two-thirds of the world’s hashing power. Even though cryptocurrency usage and exchanges are reportedly banned in China and Bitcoin mining was once in danger of being shut down, the government took an about-face and is increasingly embracing the use of blockchain technology in its major industries — and allowing Bitcoin mining to grow.

Related: US Bitcoin holders worry about Chinese control of the mining network

Bitcoin mining in China is a growing industry because labor costs are cheap, turn-around time is incredibly quick, and lead time and production costs are much lower, since the country is a hub for global trade. Since much of the hardware used to mine Bitcoin is made in China, miners can very quickly be upgraded. If you want to set up a data center fast with low overhead and expenses, do it in China.

Low electricity costs in the form of hydropower are available as well. Because Bitcoin mining requires so much electricity between powering the miners and powering the fans to cool the miners, a data center needs to get electricity as cheaply as possible. Hydropower in the Sichuan province is reportedly as low as $0.02 per kWh during the rainy season, and the Chinese government is now encouraging mining in this province so operations can take advantage of the hydropower plants there.

Related: Sichuan rainy season to give Bitcoin hash rate a much needed jolt

But only some Chinese mining operations run on cleaner, cheaper hydropower. Most run instead on coal, which is a dirtier and more expensive option. Of the main power sources today, hydro is the cheapest, at around $0.01 to $0.02 per kWh, with wind being another cheap option at $0.025 cents per kwh. Gas and coal are the more expensive options, at $0.03 to $0.035 cents (plus transmission costs and taxes). So, while labor and materials may be cheap, coal usage makes mining operations unsustainable from both a cost perspective and environmental perspective. Factor in the political instability of setting up mining operations in China, and you may want to look elsewhere.

Can China stay on top?

Anyone wanting to set up scaled mining operations are increasingly seeking out locations in Nordic countries, Canada and the United States. While these locations may offer higher start-up expenses and maintenance costs, the availability of sustainable, cost-effective electricity is proving to be a big advantage. Additionally, these areas are more politically stable, so there is less threat that the government will one day decide to shut down all mining operations. In fact, Canada deemed mining operations as “essential services” during its COVID-19 pandemic shutdown.

Related: Regulatory overview of crypto mining in different countries

This may be the reason why the world’s hashing power is shifting locations. According to a recent report, Chinese hashing power is decreasing compared with last year yet growing in other parts of the world.

Another reason for this decrease may be that Chinese mining was hit hard in 2020. The COVID-19 pandemic disrupted supply chains, causing new hardware to be significantly delayed in getting to data centers. In an industry where every minute counts, using slower, older miners for even a day longer means losing money and advantage. Additionally, China’s quarantine rules prevented workers from tending to their rigs, further disrupting operations.

Additionally, the third Bitcoin halving occurred this past May, cutting the mining reward in half and forcing miners to make significant upgrades to their hardware to stay competitive. Because it now takes twice as much hashing power to mine the same amount of Bitcoin as a year ago, mining operations have needed to not only upgrade, but make sure their energy costs were staying efficient. Following the halving, many miners around the world switched off because the endeavor was no longer profitable.

On top of it all, this summer’s monsoon season caused excessive flooding in the Sichuan province, leading to electrical shortages that cut up to 20% of the region’s hash rate.

Despite these significant setbacks, mining in China is sure to bounce back. But with other parts of the world embracing and encouraging Bitcoin mining, and with the greater sustainability offered elsewhere, we may soon see China’s place as the giant of the industry challenged.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Philip Salter is the head of mining operations at Genesis Mining, the world’s largest cloud crypto mining operation, where he leads the software development, data engineering and research teams. Salter started his career as a software developer for BSI Business Systems Integration AG. Salter is an avid miner and crypto enthusiast based in Germany.

https://ift.tt/2UtCpuq Bitcoin News China’s leadership in the Bitcoin mining industry will be challenged

Wanna Win Some Free Crypto?

This is our favorite crypto casino... Check it out and get a free sign up bonus and daily crypto rewards!

The post China’s leadership in the Bitcoin mining industry will be challenged appeared first on ESA Token.

from WordPress https://ift.tt/3puoxOD via IFTTT https://ift.tt/3oqtis8 https://ift.tt/3dTdjOi

0 notes

Text

Why Bitcoin Is The Investment Of The Decade

Summary The hype around Bitcoin is warranted.

Bitcoin cannot, and does not need to, dislodge fiat currency.

But it will benefit from transactional demand and "store of value" demand.

At current valuations, you get half a niche payment disruptor, with a gold disruptor thrown in for free.

GBTC is still a feasible short-term play on Bitcoin.

We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.

- Bill Gates

There’s been a lot of buzz around Bitcoin, partly on the back of its rapid appreciation and partly on the disruption potential of the technology itself. In this article, I’d like to firstly clarify some misconceptions surrounding Bitcoin and postulate what a fair value should be.

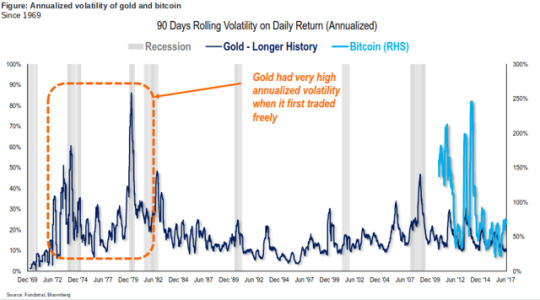

Misconception #1 - Bitcoin is an Unreliable Store of Value The conventional thinking behind this misconception is that Bitcoin is too volatile, and hence it cannot truly be a store of value. A popular benchmark is oil prices and currencies for instance, which are orders of magnitude less volatile than Bitcoin.

But this line of thinking misses one key point - trust. No matter how volatile the asset, it can and will be a store of value so long as people believe it is. Take a look at gold’s annualized volatility versus Bitcoin below.

Bitcoin

(Source: Fundstrat)

The right side of the chart somewhat validates the naysayers' point about volatility over the past couple of years. But look how far Bitcoin vol has trended down over the last three years. In fact, at certain points of time in recent history, Bitcoin was actually as volatile, if not even less so, as gold.

Now let’s turn back to when gold was freely priced, back in the ‘70s. What we see is that “early” gold’s annualized volatility was similarly high versus Bitcoin’s, yet it was used as a store of value - because people believed it was.

In this regard, gold and Bitcoin were both born out of the same fundamental distrust in the existing financial system. In the ‘70s it was the Great Inflation, and in ‘08 it was the banking system, and subsequently, centralized monetary policy decision making.

In a way, Bitcoin’s digitized, decentralized and unregulated nature speaks to the distrust in today’s financial system far better than gold. Among other things, it can help users avoid high taxes, capital controls and confiscation.

As it moves further into the mainstream and adoption increases, I suspect the substitution effect will become more prevalent, driving down demand for gold in favor of alternatives such as Bitcoin. As gold prices fall as a result of falling demand, the perception of such traditional safe havens as a store of value will begin to be questioned. This will, in turn, kick-start a network/ multiplier effect, driving safe haven flows into Bitcoin and will slowly unravel this misconception.

Misconception #2 - Bitcoin is an Unreliable Payment Method The overarching misconception surrounding this seems to stem from the unregulated nature of Bitcoin as well as security concerns.

The Mt. Gox bankruptcy in 2014 is a case in point, illustrating the susceptibility of exchanges to convert fiat to BTC and vice-versa, and wallet software to facilitate transactions. At one point in 2013, Mt. Gox was handling over 70% of all Bitcoin transactions. But in early 2014, it filed for bankruptcy protection and announced $450 million worth of Bitcoins (BTC850k) were lost due to a “hack”.

It is important, however, not to conflate security risks stemming from the enablers (exchanges) and agents (hackers) versus the technology itself, which has thus far proven foolproof. If anything, inevitable regulation of the agents transacting Bitcoin will help improve its viability as a medium of exchange.

But it is important not to miss the forest (technology) for the trees (bad press). The strongest argument for Bitcoin’s intrinsic value is not only its ability to function as a decentralized, digitized medium of exchange, but also the safest and cheapest one.

In practice, the blockchain on which Bitcoin operates is safer than conventional payment systems. From the merchants' perspective, transactions are secure, irreversible and do not contain customer info (preventing fraud/ chargeback claims). For consumers, Bitcoin is decentralized and, therefore, cannot be manipulated by any single party.

To understand why it is the cheapest, take a look at the traditional “four party” payment system below. This system entails a bloated ecosystem consisting of: 1) the merchant, 2) consumer, 3) the card issuing firm and 4) the card network. This results in a typical cost to a US-based merchant of ~2-2.5% (including the merchant acquirer).

(Source: Goldman Sachs)

On the other hand, the decentralized nature of Bitcoin (enabled by the blockchain) eliminates the need for a central clearinghouse or financial institution to act as a third party to financial transactions. Instead, the network uses a peer-to-peer system where network users (miners) independently verify transactions and are then rewarded for their work with newly minted Bitcoins.

The effective cost of a Bitcoin transaction is thus lowered - to the tune of ~1.5% (1% versus 2.5% in the traditional “four party” model).

Misconception #3 - Bitcoin Cannot be a Currency, So it Will Fail Conventional wisdom is that Bitcoin is a “digital currency,” and thus, its raison d'etre should be fulfilling the three core criteria every currency must fulfill: 1) store of value, 2) medium of exchange and 3) unit of account. I do agree with mainstream thinking that Bitcoin is nowhere close to becoming legal tender, although it compares very well to both fiat currency and gold.

(Source: Canaccord Genuity)

In any case, Bitcoin’s inability to become a mainstream currency is already priced into cryptocurrency valuations. Compared to traditional currency circulations, the cryptocurrency market is still small (note that cryptos have a more global reach versus USD and EUR).

Screenshot (9).png

(Source: S&P)

Here’s what investors seem to miss - Bitcoin does not need to become a currency to derive its intrinsic value. The addressable market of Bitcoin as any one of the three criteria is enough to provide major upside for investors going forward.

I reflected this using three different viewpoints culminating in the following valuation approaches.

Bitcoin Valuation #1 - Bitcoin as a Network The first method to valuing Bitcoin looks at its value as a network. To gauge this value, we’ll need to delve into a concept called Metcalfe’s Law, which postulates that the value of a network is proportional to the square of the number of participants.

(Source: ITLaw)

The law would thus imply that Bitcoin is explained by an exponential function where a linear increase in members would entail a quadratic increase in members. Extending this law to Bitcoin’s value in practice shows that Bitcoin is linked to both volume and exponentially to the number of users.

Modeling Bitcoin using two variables - 1) unique addresses (proxy for accounts) (n^2) and 2) estimated transactions per user (proxy for usage) (linear) - helps explain 94% of the price movement.

(Source: Fundstrat)

With that in mind, tweaking the two key regression variables gives us an idea of how Bitcoin prices might trend going forward. Plugging in both a rise in unique addresses and transaction vol/user of 50% and 30% YoY respectively, in line with current run rates, gives a $5,977 target price.

Mid-Aug Value

Projected mid-2018 Value

YoY %

Unique Addresses

650,889

976,349

50

Transaction Volume per User

$4,050

$5,265

30

Implied Value

$4,300

$5,977

39

(Source: Fundstrat)

Now, I’d argue this estimate is very conservative, considering it extends the run rate for unique addresses (50%) but exponentially drops the transaction volume trajectory (30% YoY versus 2000% YoY in the prior year).

Bitcoin Valuation #2 - Bitcoin as Alt Gold The second valuation approach pertains to Bitcoin’s appeal as a store of value.

At present, gold is perhaps the best proxy for Bitcoin’s potential total addressable market (TAM), due to its nature as the purest play on the store of value theme. For an idea of market size at stake, gold is currently the fourth-largest asset class with ~$7.5 trillion outstanding.

Screenshot (11).png

(Source: Fundstrat)

With an ~$70-80 billion market cap, Bitcoin is worth ~1% of gold holdings. Of total gold outstanding, ~17.5% is held by central banks as reserves.

Central Bank

Non-Central Bank

Gold Holdings

17.5%

82.5%

(Source: Bloomberg)

Now, what if 1% of gold holdings rotated out of gold and into Bitcoin? The answer is huge - for every 1% shift, Bitcoin would have ~99% upside. A shift solely from central bank holdings would offer 17% upside per %pt shift. This implies a potential $4,000-5,000 incremental value for every 1% pt from gold alone ($9,000-10,000 price assuming 1% substitution).

$ billion gain per %pt of gold

BTC Upside per %pt of gold

Central Bank

13.148

17.34%

Non CB

61.852

81.55%

Total

75

98.89%

(Source: Bloomberg, Author Estimates)

Bitcoin Valuation #3 - Bitcoin as an Alt Payment Method Another approach to valuing Bitcoin is as an alternative payment method in competition with the likes of Visa (NYSE:V), MasterCard (NYSE:MA) and PayPal (NASDAQ:PYPL). In this space, it offers significant benefits over alternatives, as the current ~1% cost per transaction is far below that in online payments (3-8%) and remittance (5-10%).

Now, because Bitcoin does not generate cash flow, a commodity-like analysis of supply-demand dynamics can be employed to estimate its value as an alternative payment system.

Assuming the % of supply held for investment/dormant falls gradually at ~2% (in line with analyst estimates at Cowen) as a greater proportion of Bitcoin is used for transactions, this should bring us up to ~19.5 million available for transactions by 2025. Meanwhile, total BTC in circulation is projected according to a 4-year reward-halving schedule.

0 notes

Text

2018-04-04 11 FINANCE now

FINANCE

20 Something Finance

The Cheapest & Best Tax Software Prep: a Comparison of 6 Programs

The House Burning Down Exercise

The U.S. Personal Savings Rate is Plummeting. But Yours Should be Rising.

How About that Tax “Cut”?

How to Sell your CD’s for the Most Money

Eat the Financial Elephant

The First Month Of Early Retirement

Where Do I Go From Here?// Starting a New Chapter In Early Retirement

October Update// Entering The Home Stretch!

Our Plan for Health Insurance in Early Retirement

September Update//The Transition To Our F.I.R.E. Plan

Get Rich Slowly

Developing financial resilience

How to use barriers and pre-commitment to do the right things with your money

Foolish money mistakes — and how to avoid them

The Get Rich Slowly investment philosophy and strategy

Book Review: Get Money

Mad Fientist

Money Talks – Live from the UK Chautauqua with Vicki Robin

Elizabeth Willard Thames – Meet the Frugalwoods

My Brother – Using the Power of Money to Pursue Your Passion

Hierarchy of Financial Needs (and the Meaning of Life)

The New Tax Law and How It Impacts Your Early Retirement

Money Crashers

21 Best New Bank Account Promotions & Offers – April 2018

What Is Money Laundering (Explained) – Examples, Schemes & Regulations

8 Things You Should Always Buy Online

8 Things You Should Never Buy Online

5 Benefits of Baking Your Own Bread at Home and How to Get Started

Mr. Money Mustache

Money and Confidence are Interchangeable

My DIY Solar Power Setup – Free Energy for Life

An Interview with Matt Cutts: Can the Government grow a Money Mustache?

Why Bitcoin is Stupid

How to Give Money (and Get Happiness) More Easily

Reddit Personal Finance

Not sure if what spouses employer is doing is legal

Update: I just discovered that I owe the IRS $50k that I don't have, because I traded in cryptos.

I sent a WA DOC prisoner $40 and he only gets $18 after fees

What is the best course of action if I can't pay what I owe for my 2017 taxes?

I have 400 dollars and don’t want to waste it, I’m 14yo

The Finance Buff

Switching Brokerage Account Into A Trust: Fidelity, Vanguard, Merrill Edge

2017 2018 2019 HSA Contribution Limits

Will and Trust Through Employer Legal Plan

Financially Comfortable and Pivot

What Having My Car Die in the Middle of the Road Taught Me About Investing

The White Coat Investor

Refinancing Student Loans — Best Tips From WCI Readers

3 Things to Consider Before Investing in Rental Properties

11 Financial Lessons from The Greatest Showman

Staying the Course, Stock Purchase Plans, and TSP Loans – Podcast #47

Why Behavioral Finance Matters

Wise Bread

Best Deals for Wednesday 04/04

How to Make Money as a Superfan

Are You Withholding the Right Amount of Taxes from Your Paycheck?

How Professional Award Bookers Can Get You Free Rewards Flights

Here's What You Can (And Can't) Buy With SNAP

jlcollinsnh

Stocks — Part XXXII: Why you should not be in the stock market

Chautauqua 2018: Mt. Olympus, Greece

An International Portfolio from The Escape Artist

The Bond Experiment: Return to VBTLX

How to Invest in Bitcoin like Benjamin Graham

0 notes

Text

‘We Must Renovate Our House

Of course, I wouldn't need to retailer my wealth in the form of such an instrument. Is it necessary for a financial instrument to hold its worth over long periods of time? As soon as the novelty of its affiliation wore off, you may understand that as a result of that gold was utilized in committing against the law, authorities officials may seize it at any time. Constructing alternative compliance or reporting requirements for little entities might contribute toward too much much less favorable protections for All these entities’ consumers and compromise the general performance of the inspired amendments. To start with, there could be little to no discounts on Plex - it could must be offered on the market value, or else you could be just giving individuals cash. The first stock was issued by the Dutch East India Firm in 1602. The corporate not solely generated revenue, it was profitable, and its shares paid dividends with yields ranging from 12 to 63 % over its first years.

There'll only be a hundred million Gas tokens created over 22 years - after that, the voting privileges turn out to be extra essential because they’ll determine issues just like the transaction charge (which is at present zero). A service like that might encourage a lot of Bitcoiners to spend their coins extra willingly. $One hundred per ounce and these things are rising in demand more and more with their limited portions and mintage. If you are interested, you'll be able to consult this e-book by the inspirational Andreas Antonopoulos. Making ready the inputs by hand, making sure the info itself is pretty small, it may possibly all be slightly limiting and doubtlessly get costly with bigger amounts of information. Discover some of the ways on how to find the cheapest gold coins. It appears like the answer for the time being is "no", which implies the repository everybody considers to be the "gold commonplace" for Bitcoin is not going to accept Bitcoin Unlimited blocks, inflicting a fork. I feel that (someway) the verification of this reply additionally verifies the legitimacy of the transaction (somebody assist me out right here). This consisted of a demonstration of the verification process used within the very first Bitcoin transaction. It was Usd To Btc be deployed in two levels - first by activating SegWit in the summer time (which already came about), and then by increasing the block measurement in winter (which is still pending).

If the checklist is lengthy, then I break it up into subsections, highlighting what's in every section. *tty change as effectively. Cosco, Jadason, UMS and LMIRT all contributed effectively too on this facet. $ investment introduced tons of of thousands of dollars of revenue- and this opportunity continues to be available to you! The Indian earnings tax department revealed on Friday that it has sent notices to "tens of hundreds of individuals dealing with cryptocurrency" following a survey at nine crypto exchanges in Mumbi, Delhi, Bengaluru, and Pune, in accordance toReuters. Japan just isn't the one contender for Chinese exchanges to flee to. Russia can also be a part of a reported Chinese language plan to install a new worldwide monetary order that excludes U.S. On this sense, most altcoin markets have a lot decrease liquidity, but have a lot larger volatility. Some movement attributes is perhaps not easily accessible to you while you don’t have enough of digital cash.

The potential of this is perhaps even greater than bitcoin itself. I notice that for some individuals they really feel potential readers will look to see what number of followers or comments an article has for validation of the author's skill and knowledge. The article offers the advantages of collecting money and other related objects. If the worth goes down, some miners will be priced out of the market and the issue will go down. The folding down of SCB is not going to be of an influence to you. In the end, the golden time of cryptocurrency funding shall be till subsequent year. What's a cryptocurrency? Equally, when you want to spend or withdraw your cash, just switch the funds from the paper wallet to your software program wallet. Bitcoin is a peer-to-peer digital crypto forex introduced as open source software back in 2009 by a developer referred as to Satoshi Nakamoto, though plainly no person knows the true developer’s identify.

TRIPLE Examine every time you're sending Crypto anyplace or to anybody. Why are my tomato plants wilting? With many companies accepting the change and others getting able to, cryptocurrencies are an extremely quick-spreading foreign money. It signifies that IRS admitted that cryptocurrencies carry actual value and are authorized. They virtually instantly want to understand how much they are value and if they are overpriced or not. If you wish to read a simple overview of Numis, read David Wood's Numis Evaluate now. Wish to Be a greater Chief This 12 months? Specks serve as an invisible hand might. "Endless" bandwidth may not precisely suggest what you believe it signifies. Bitcoin is a superb invention. Ought to Medical doctors Put money into Bitcoin? The ten% that's actual is obscured by the majority 90% spin. Fairly a brand new foreign money jumped to the highest 5, Tether (USDT). Distinct overseas currencies their very personal personal personalrates and worth, and insurance coverage policies. No statistic on the company that runs the ICO is given so it is difficult to make a prediction. If scaling is an issue at all, it hasn't spooked users but. Nevertheless, superseding this lift was the detrimental consequence of the news collection that followed.

0 notes

Text

What Do We Mean When We Talk About the "Blockchain Ecosystem”?

http://cryptobully.com/2018/02/what-do-we-mean-when-we-talk-about-the-blockchain-ecosystem/

What Do We Mean When We Talk About the "Blockchain Ecosystem”?

medianet_width = "728"; medianet_height = "90"; medianet_crid = "487665697"; medianet_versionId = "3111299";

Ethereum has just announced its Ethereum Community Fund (ECF) grant program, an initiative launched by a collection of major players in the Ethereum world that is designed to accelerate the development of blockchain infrastructure apps and services. The stated aim of the ECF is to bring about “an environment where teams and ideas can thrive, grow, and collaborate to become essential and functioning pieces of the broader Ethereum ecosystem.”

All of this raises the question of what exactly we mean when we talk about “blockchain ecosystems” and how they are built. Well, here’s an analogy for you: blockchains are like roads.

Just as there’s no single type of road (regular highways, motorways, backcountry dirt tracks), there is no single type of blockchain. Each one is purpose-built for its own ends. Not only that, but roads have a system of independent elements that come together to enable the whole ecosystem to function smoothly and reliably: traffic lights, police enforcers, toll roads, gas stations and so on. So it is with blockchains.

When we talk about a “blockchain ecosystem,” we’re talking about the parts that constitute the whole, how they interact with each other and how they interact with the outside world.

The Bitcoin ecosystem, for example, boils down to four parts: the users sending and receiving payments, the miners generating the cryptocurrency, the investors buying it, and the developers that monitor and maintain the whole thing. No single part of the equation works without the others being there too.

In any event, a series of ingredients must work together well to keep a blockchain project operational. We’re going to take a look at the pieces that constitute four major blockchain projects that are up and running today.

Blockchain Projects

Despite the blockchain industry still being very young, we can already single out some major non-Bitcoin blockchain infrastructure projects: Ethereum, Waves, Stellar, NEO, NEM and a handful of others.

Ethereum was proposed by Vitalik Buterin in 2013, crowdfunded with 30,000 BTC in the summer of 2014 and launched a year later in 2015. Its core feature is “smart contracts,” which run automatically and exactly as coded, without any possibility of downtime.

Ethereum is not the only platform that uses smart contracts. NEO runs decentralized software in a manner similar to Ethereum, and in fact is trying to position itself as the “Chinese Ethereum.” The difference is that NEO apps are written in popular programming languages like Python, whilst Ethereum relies on its own custom Solidity language. Additionally, NEO lets users digitize certain assets and track them on its blockchain, making it simple to trade them as users see fit. If that sounds complicated, don’t worry — one Redditor with a computer science degree confessed even he has a hard time understanding it.

In contrast to Ethereum’s focus on the developer community, the Waves platform focuses on mass adoption. Founder Sasha Ivanov’s vision was to create a platform different from existing blockchains and more focused on real-world applications.

Products and services include a multi-currency wallet, the ability to raise funds for the development of projects through token issuance and an integrated decentralized exchange, none of which requires any expertise in blockchain technology to use. It is this ease of use and simplicity that Waves believes will benefit a wide range of businesses and so open up the blockchain economy for any organization of any size, in any sector.

Stellar is a blockchain-enabled payment network designed to move money across borders easily. This is facilitated by people voluntarily running Stellar servers on their computers, each containing a complete copy of the Stellar ledger and synchronized every two to five seconds. The more people running these nodes, the stronger the network becomes.

NEM is a blockchain platform for managing assets like currencies, supply chains, notarizations and ownership records. It found some mainstream success in late 2015 when a pair of Japanese banks began to implement it in their businesses. NEM’s ecosystem breaks down into two components: the nodes that make up the NEM Infrastructure Server (NIS) and the clients that interact with those nodes.

Exchanges and Token Launching Tools

Every blockchain project of note has a similarly robust ecosystem under its hood, and they almost always include a decentralized exchange. These might be developed by the core project team, the community or other developers.

Consider NEO’s NEX exchange, which merges blockchain with off-chain matching technology to complete complex trades quickly. Stellar’s SDEX exchange is designed to find the cheapest rates between any two digital assets, making it more affordable to trade crypto. EtherDelta is one of the decentralized exchanges used for trading Ethereum’s ERC20 tokens; it readily integrates with hardware wallets, or users can create a wallet directly on the site.

The Waves DEX platform uses centralized Matcher nodes to pair trades for speed, but features blockchain settlement — allowing near-real-time trading but strong security and user control of funds at all times. Waves also includes a Token Launcher, enabling users to issue tokens and then trade them immediately on the DEX. Waves additionally features a user-friendly front end, similar to existing centralized exchanges. Stellar’s SDEX also allows token creation.

Applications

Besides these exchanges and tools for token creation, another important element of the ecosystem is the applications that businesses, developers and communities can build on to create their own services and projects.

For example, the Ethereum white paper discusses three main types of applications: financial applications, so-called semi-financial applications and non-financial applications. The first category focuses on the way that money is managed and used, and includes sub-currencies, derivatives and even instruments like employment contracts.

The second category includes applications with a financial element but that go far beyond this, such as self-enforcing bounties for certain tasks. The final category might include applications such as voting and governance mechanisms.

As a further example, consider the prediction platform Stox, which lets users place bets on just about anything and win cryptocurrency for correct guesses. Other platforms have similarly diverse projects. Popular applications on NEO include Red Pulse and AdEx. On Waves there are Primalbase, OceanLab and MyTrackNet. Stellar has Smartlands, and so on.

In some cases, platforms aim to stimulate the development of applications through initiatives like Stellar’s Stellar Build Challenge and grant program. Waves promotes the same through the Waves Lab, a startup incubator that helps projects at the pre-ICO stage. NEM has its Blockchain Center in Malaysia that serves as an accelerator, incubator and coworking space. NEO has NGC (NEO Global Capital), which invests in upcoming projects that are beneficial to the NEO ecosystem. Developers have even taken their own initiative to create alliances like NEO’s City of Zion, which helps to build infrastructure projects for NEO. And recently, of course, we have seen the launch of the Ethereum Community Fund (ECF).

Businesses and Enterprises

In order to promote blockchain infrastructure, certain projects have set up enterprise initiatives that become an integral part of the ecosystem. For example, Ethereum already has its Enterprise Ethereum Alliance, an advocacy group that connects companies large and small with experts to help them find ways to leverage Ethereum’s powerful technology. It’s a strong community eager to share its resources and know-how.

As for Stellar, its ecosystem has two primary components: the people running Stellar nodes on their machines, and the anchors that facilitate the conversion of cryptocurrency to fiat currency. In practice, “anchors” can take the form of banks, savings institutions, farmers’ co-ops, central banks and remittance companies. These entities have to be trusted to hold users’ money and honor their withdrawals, but that trust enables you to use a balance of U.S. dollars to send rubles to a friend in Russia, for example.

Waves has Tokenomica, a kind of global, blockchain-hosted investment bank. It aims to provide token services to large corporations within a compliant regulatory framework, enabling businesses to launch their own token initiatives and conduct crowdsales whilst meeting all relevant Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements. Tokenomica is expected to launch its first projects later in 2018 and build partnerships with regulators and banks over the coming months.

Also on Waves is the Basics Fund, a fund that consists of a portfolio of blockchain projects. The idea is to give institutional investors and high-net-worth individuals early-stage exposure to the sector. The money is also used to capitalize promising businesses seeking initial funding and going through the Waves Lab accelerator/incubator program. The Fund is currently collecting investment and will launch later this year.

Meanwhile NEM, in partnership with the Malaysia Digital Economy Corporation (MDEC), has launched a program in Malaysia that will provide tax exemptions, visas for foreigners, and support from both the private and public sectors to entrepreneurs in the industry. MDEC will act as a facilitator to develop enterprise solutions for the Malaysian economy.

Rounding It Up

Just as roads can take you to all different kinds of places, blockchains can be used for diverse ends. The path you take (and the blockchain project you participate in) depends entirely on where you want to go and what you want to do.

A robust blockchain ecosystem isn’t merely constructed from high-quality components, but from components that also work together harmoniously. If they don’t click and fire in sync, then you get the blockchain equivalent of a traffic jam.

And no matter what kind of road you’re on, traffic jams are no good.

This is a guest post by Sasha Ivanov, founder and CEO of the Waves Platform. The opinions express are his alone and do not necessarily reflect those of BTC Media or Bitcoin Magazine.

Blockchain

0 notes

Text

Op Ed: What Do We Mean When We Talk About the "Blockchain Ecosystem”?

Ethereum has just announced its Ethereum Community Fund (ECF) grant program, an initiative launched by a collection of major players in the Ethereum world that is designed to accelerate the development of blockchain infrastructure apps and services. The stated aim of the ECF is to bring about “an environment where teams and ideas can thrive, grow, and collaborate to become essential and functioning pieces of the broader Ethereum ecosystem.”

All of this raises the question of what exactly we mean when we talk about “blockchain ecosystems” and how they are built. Well, here’s an analogy for you: blockchains are like roads.

Just as there’s no single type of road (regular highways, motorways, backcountry dirt tracks), there is no single type of blockchain. Each one is purpose-built for its own ends. Not only that, but roads have a system of independent elements that come together to enable the whole ecosystem to function smoothly and reliably: traffic lights, police enforcers, toll roads, gas stations and so on. So it is with blockchains.

When we talk about a “blockchain ecosystem,” we’re talking about the parts that constitute the whole, how they interact with each other and how they interact with the outside world.

The Bitcoin ecosystem, for example, boils down to four parts: the users sending and receiving payments, the miners generating the cryptocurrency, the investors buying it, and the developers that monitor and maintain the whole thing. No single part of the equation works without the others being there too.

In any event, a series of ingredients must work together well to keep a blockchain project operational. We’re going to take a look at the pieces that constitute four major blockchain projects that are up and running today.

Blockchain Projects

Despite the blockchain industry still being very young, we can already single out some major non-Bitcoin blockchain infrastructure projects: Ethereum, Waves, Stellar, NEO, NEM and a handful of others.

Ethereum was proposed by Vitalik Buterin in 2013, crowdfunded with 30,000 BTC in the summer of 2014 and launched a year later in 2015. Its core feature is “smart contracts,” which run automatically and exactly as coded, without any possibility of downtime.

Ethereum is not the only platform that uses smart contracts. NEO runs decentralized software in a manner similar to Ethereum, and in fact is trying to position itself as the “Chinese Ethereum.” The difference is that NEO apps are written in popular programming languages like Python, whilst Ethereum relies on its own custom Solidity language. Additionally, NEO lets users digitize certain assets and track them on its blockchain, making it simple to trade them as users see fit. If that sounds complicated, don’t worry — one Redditor with a computer science degree confessed even he has a hard time understanding it.

In contrast to Ethereum’s focus on the developer community, the Waves platform focuses on mass adoption. Founder Sasha Ivanov’s vision was to create a platform different from existing blockchains and more focused on real-world applications.

Products and services include a multi-currency wallet, the ability to raise funds for the development of projects through token issuance and an integrated decentralized exchange, none of which requires any expertise in blockchain technology to use. It is this ease of use and simplicity that Waves believes will benefit a wide range of businesses and so open up the blockchain economy for any organization of any size, in any sector.

Stellar is a blockchain-enabled payment network designed to move money across borders easily. This is facilitated by people voluntarily running Stellar servers on their computers, each containing a complete copy of the Stellar ledger and synchronized every two to five seconds. The more people running these nodes, the stronger the network becomes.

NEM is a blockchain platform for managing assets like currencies, supply chains, notarizations and ownership records. It found some mainstream success in late 2015 when a pair of Japanese banks began to implement it in their businesses. NEM’s ecosystem breaks down into two components: the nodes that make up the NEM Infrastructure Server (NIS) and the clients that interact with those nodes.

Exchanges and Token Launching Tools

Every blockchain project of note has a similarly robust ecosystem under its hood, and they almost always include a decentralized exchange. These might be developed by the core project team, the community or other developers.

Consider NEO’s NEX exchange, which merges blockchain with off-chain matching technology to complete complex trades quickly. Stellar’s SDEX exchange is designed to find the cheapest rates between any two digital assets, making it more affordable to trade crypto. EtherDelta is one of the decentralized exchanges used for trading Ethereum’s ERC20 tokens; it readily integrates with hardware wallets, or users can create a wallet directly on the site.

The Waves DEX platform uses centralized Matcher nodes to pair trades for speed, but features blockchain settlement — allowing near-real-time trading but strong security and user control of funds at all times. Waves also includes a Token Launcher, enabling users to issue tokens and then trade them immediately on the DEX. Waves additionally features a user-friendly front end, similar to existing centralized exchanges. Stellar’s SDEX also allows token creation.

Applications

Besides these exchanges and tools for token creation, another important element of the ecosystem is the applications that businesses, developers and communities can build on to create their own services and projects.

For example, the Ethereum white paper discusses three main types of applications: financial applications, so-called semi-financial applications and non-financial applications. The first category focuses on the way that money is managed and used, and includes sub-currencies, derivatives and even instruments like employment contracts.

The second category includes applications with a financial element but that go far beyond this, such as self-enforcing bounties for certain tasks. The final category might include applications such as voting and governance mechanisms.

As a further example, consider the prediction platform Stox, which lets users place bets on just about anything and win cryptocurrency for correct guesses. Other platforms have similarly diverse projects. Popular applications on NEO include Red Pulse and AdEx. On Waves there are Primalbase, OceanLab and MyTrackNet. Stellar has Smartlands, and so on.

In some cases, platforms aim to stimulate the development of applications through initiatives like Stellar’s Stellar Build Challenge and grant program. Waves promotes the same through the Waves Lab, a startup incubator that helps projects at the pre-ICO stage. NEM has its Blockchain Center in Malaysia that serves as an accelerator, incubator and coworking space. NEO has NGC (NEO Global Capital), which invests in upcoming projects that are beneficial to the NEO ecosystem. Developers have even taken their own initiative to create alliances like NEO’s City of Zion, which helps to build infrastructure projects for NEO. And recently, of course, we have seen the launch of the Ethereum Community Fund (ECF).

Businesses and Enterprises

In order to promote blockchain infrastructure, certain projects have set up enterprise initiatives that become an integral part of the ecosystem. For example, Ethereum already has its Enterprise Ethereum Alliance, an advocacy group that connects companies large and small with experts to help them find ways to leverage Ethereum’s powerful technology. It’s a strong community eager to share its resources and know-how.

As for Stellar, its ecosystem has two primary components: the people running Stellar nodes on their machines, and the anchors that facilitate the conversion of cryptocurrency to fiat currency. In practice, “anchors” can take the form of banks, savings institutions, farmers’ co-ops, central banks and remittance companies. These entities have to be trusted to hold users’ money and honor their withdrawals, but that trust enables you to use a balance of U.S. dollars to send rubles to a friend in Russia, for example.

Waves has Tokenomica, a kind of global, blockchain-hosted investment bank. It aims to provide token services to large corporations within a compliant regulatory framework, enabling businesses to launch their own token initiatives and conduct crowdsales whilst meeting all relevant Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements. Tokenomica is expected to launch its first projects later in 2018 and build partnerships with regulators and banks over the coming months.

Also on Waves is the Basics Fund, a fund that consists of a portfolio of blockchain projects. The idea is to give institutional investors and high-net-worth individuals early-stage exposure to the sector. The money is also used to capitalize promising businesses seeking initial funding and going through the Waves Lab accelerator/incubator program. The Fund is currently collecting investment and will launch later this year.

Meanwhile NEM, in partnership with the Malaysia Digital Economy Corporation (MDEC), has launched a program in Malaysia that will provide tax exemptions, visas for foreigners, and support from both the private and public sectors to entrepreneurs in the industry. MDEC will act as a facilitator to develop enterprise solutions for the Malaysian economy.

Rounding It Up

Just as roads can take you to all different kinds of places, blockchains can be used for diverse ends. The path you take (and the blockchain project you participate in) depends entirely on where you want to go and what you want to do.

A robust blockchain ecosystem isn’t merely constructed from high-quality components, but from components that also work together harmoniously. If they don’t click and fire in sync, then you get the blockchain equivalent of a traffic jam.

And no matter what kind of road you’re on, traffic jams are no good.

This is a guest post by Sasha Ivanov, founder and CEO of the Waves Platform. The opinions express are his alone and do not necessarily reflect those of BTC Media or Bitcoin Magazine.

This article originally appeared on Bitcoin Magazine.

from InvestmentOpportunityInCryptocurrencies via Ella Macdermott on Inoreader https://bitcoinmagazine.com/articles/op-ed-what-do-we-mean-when-we-talk-about-blockchain-ecosystem/

0 notes