#cma software for chartered accountants

Explore tagged Tumblr posts

Text

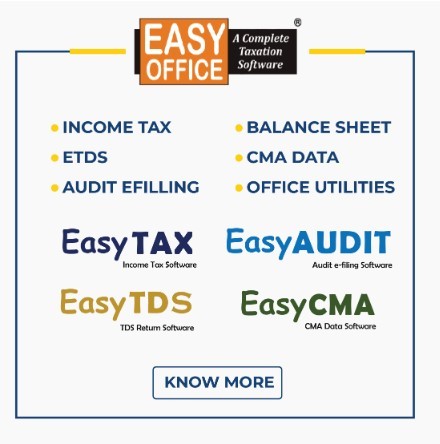

cma report software, best software for cma data preparation, cma software for chartered accountants

Cma Software Price

.

EasyCMA

cma software

Preferred Choice & Best Software for CMA Report

cma software download

EasyCMA is a module of EasyOFFICE software for CMA Report generation. EasyCMA - CMA Data preparation software is a comprehensive software for preparing and calculating CMA Data, MPBF calculation, depreciation chart, DFDR, interest calculation, present and maturity value calculations & also includes other financial tools, all these features makes this a useful solution for CMA Report preparation. EasyCMA is the best software for preparing and calculating CMA Data.

.

Best Cma Data Software

CMA Data Preparation

Multi-Year CMA Data Preparation in an operating statement on the basis of a percentage (%) increase.

MPBF statement

cma data software free download

Automatic preparation of the comparative statement, Analysis of Balance Sheet, MPBF (Maximum Permissible Bank Finance) statement, Fund flow and Ratio Statement.

Depreciation chart

cma report software

Preparation of Depreciation chart on Written down Value and Straight Line Method

Financial Tools

Many useful Financial Tools

.

best software for cma data preparation

GST complaint Fully Accounting Software EASYACC is specific software of Financial Accounting. The software is an integrated business accounting software for Small and Medium traders and as well as for professionals.

.

cma software for chartered accountants

The software due to its user-friendly interfaces, Advanced Features, robustness, convenience and speed is being extensively used by Chartered Accountants, Tax Professionals, Consultants, Accountants, Traders and industries..

.

Cma Data Software

Contact Us

Address :- 505, Sukhsagar Complex, Nr. Hotel Fortune Landmark, Usmanpura Cross Road, Ashram Road, Ahmedabad - 380013. Gujarat (INDIA).

Call :- +91-079-27562400, 079-35014600, 079-35014601, 079-35014602

Email :- [email protected] Website :- www.electrocom.in

0 notes

Text

How M.Com Colleges Support Professional Growth in Finance and Accounting

Introduction

In today’s dynamic business environment, finance and accounting have become critical pillars for the success of any organization. The increasing complexity of financial regulations, evolving technology, and the growing demand for transparency have heightened the need for skilled professionals in these domains. Pursuing a Master of Commerce (M.Com) degree has become a preferred pathway for students and professionals aiming to deepen their knowledge and advance their careers in finance and accounting. But how exactly do M.Com colleges contribute to professional growth in these fields?

Comprehensive Curriculum Designed for Industry Relevance

M.Com colleges offer a well-structured curriculum that covers essential areas like financial management, corporate accounting, auditing, taxation, cost accounting, and financial markets. The curriculum is regularly updated to align with current industry practices, regulatory requirements, and technological advancements such as accounting software, ERP systems, and data analytics tools. This ensures students gain both theoretical knowledge and practical skills.

Advanced topics like international accounting standards, risk management, and investment analysis prepare graduates to handle complex financial challenges and make strategic decisions. The depth and breadth of the curriculum allow students to specialize in areas of their interest, thereby enhancing their professional competencies.

Skill Development Through Practical Exposure

One of the significant ways M.Com colleges support professional growth is through practical learning. Internships, live projects, case studies, and workshops provide hands-on experience and enable students to apply concepts in real-world scenarios. Collaborations with businesses and financial institutions offer exposure to the latest tools and trends.

Furthermore, many colleges emphasize developing soft skills such as communication, leadership, and problem-solving, which are crucial for career advancement. Mock interviews, group discussions, and presentations prepare students for competitive recruitment processes and client interactions.

Access to Experienced Faculty and Industry Experts

Experienced faculty members who possess both academic credentials and industry experience play a vital role in shaping students’ professional outlook. Their guidance helps students understand complex financial concepts and industry dynamics better. Guest lectures and seminars by finance professionals and chartered accountants provide valuable insights and networking opportunities.

Such interactions help students stay updated on emerging trends, regulatory changes, and career opportunities. The mentorship from experts fosters confidence and encourages lifelong learning, which is essential in the ever-evolving finance sector.

Placement Support and Career Services

Top M.Com colleges often have dedicated placement cells that work towards connecting students with leading companies in finance, accounting, banking, and auditing sectors. These cells organize campus recruitment drives, career fairs, and industry visits, facilitating direct interaction between students and employers.

In addition to placement assistance, career counseling and guidance services help students choose suitable career paths, whether it be corporate finance, auditing, taxation, financial analysis, or academia. Many colleges also encourage pursuing professional certifications such as CA, CMA, and CFA alongside the M.Com degree, enhancing employability.

Emphasis on Research and Continuous Learning

The field of finance and accounting is continually evolving with new regulations, financial instruments, and analytical techniques. M.Com colleges promote research activities and encourage students to undertake dissertation projects on contemporary topics. This research orientation develops critical thinking and analytical skills.

Moreover, continuous learning through seminars, workshops, and online courses is often integrated into the academic framework. This culture of learning ensures that graduates remain competitive and adaptable to changing market needs.

Networking and Alumni Relations

A strong network of alumni and industry connections is another way M.Com colleges contribute to professional growth. Alumni working in diverse sectors share their experiences, mentor current students, and create opportunities for internships and jobs.

Participation in seminars, webinars, and finance clubs helps students build relationships with peers and professionals, which is invaluable for career advancement. Networking also opens doors to entrepreneurship and consultancy avenues within the finance and accounting domains.

Conclusion

Choosing the right college in Jaipur for M.Comcollege in Jaipur for M.Com can significantly influence a student’s professional journey in finance and accounting. By offering a robust curriculum, practical training, expert mentorship, placement support, and opportunities for research and networking, M.Com colleges lay a strong foundation for future career success. Graduates are not only equipped with essential technical skills but also with the strategic vision and ethical grounding needed to excel in the competitive financial sector.

Aspiring professionals who leverage these resources effectively can expect accelerated career growth, diverse opportunities, and the ability to contribute meaningfully to their organizations and the economy.

Visit us:- https://stwilfredscollege.com/

#bba colleges in jaipur#bsc college in jaipur#bca college in jaipur#best bba college in jaipur#msc college in jaipur#ba college in jaipur#bcom colleges in jaipur#best bsc college in jaipur#arts college in jaipur#best bca college in jaipur#best ba colleges in jaipur

1 note

·

View note

Text

Become Accountant – पाएं Financial Freedom

Accountant Career for High Salaries – एक Best Job Option for Financial Growth

Introduction – Accountant बनो और कमाओ High Salary

आज के समय में Accountant Career for High Salaries एक smart choice बन चुका है। Accountants ह�� business में play करते हैं crucial role और उनकी demand हमेशा high रहती है।

एक अच्छा accountant ना सिर्फ अपने लिए stable job पाता है, बल्कि earn करता है attractive salary भी। इस field में आप चाहे fresher हों या experienced, growth opportunities भरपूर हैं।

High Paying Jobs in Accounting – जानिए Scope और Opportunities

Accounting सिर्फ numbers की game नहीं है, ये है career का एक golden रास्ता। High paying jobs जैसे CA, CMA, CPA, और forensic accountant आज youth को attract कर रहे हैं।

भारत में भी Chartered Accountant की demand day by day बढ़ रही है। Foreign में CPA professionals earn करते हैं six-figure packages comfortably।

Multiple Fields, Multiple Options – Accounting Offers Variety

Accountant career में सिर्फ एक ही path नहीं है। आपको मिलती है options in auditing, taxation, financial planning, और management accounting।

हर sector में accountants की जरूरत होती है – चाहे वो corporate हो या government। इसलिए scope भी high है और salaries भी।

Career Path – कैसे बनें Accountant with High Income

अगर आप accountant बनना चाहते हैं, तो proper roadmap जरूरी है। 12th के बाद commerce stream choose करें और फिर pursue करें relevant degrees।

Required Education – कौन-कौन से Courses करें

B.Com एक अच्छा starting point है इस journey के लिए। इसके बाद आप कर सकते हैं CA, CMA, या ACCA जैसे professional courses।

इन courses को complete करने के बाद आपकी salary potential बहुत high हो जाती है। ये courses आपको बनाते हैं qualified और globally accepted professional।

Reference: Institute of Chartered Accountants of India (ICAI) के अनुसार, एक qualified CA in India earns between ₹6 to ₹20 lakh per annum.

Skills Matter – सिर्फ Degree नहीं, Skills भी जरूरी हैं

आज के दौर में सिर्फ qualification काफी नहीं है। Practical skills और digital accounting tools की जानकारी भी equally important है।

Must-Have Skills for a High Salary Accountant

Communication skills – ताकि आप effectively clients से interact कर सकें।

Analytical thinking – जिससे आप data को समझ सकें और financial advice दे सकें।

Tech skills – जैसे Tally, Excel, और ERP software में proficiency होना चाहिए।

इन skills को develop करने से आपकी job prospects और salary दोनों बढ़ते हैं। Skillful accountant हमेशा companies की first choice होता है।

Work Experience – Experience से मिलती है High Income

हर field में experience एक major role play करता है। Accounting में भी experience आपके salary graph को तेजी से ऊपर ले जाता है।

Entry-Level से लेकर Senior Roles तक का सफर

Entry-level roles जैसे junior accountant से शुरुआत करके, आप बन सकते हैं senior accountant, finance manager, या CFO तक।

हर promotion के साथ salary भी increase होती है significantly। हर साल आपका experience आपके pay scale को upgrade करता है।

Industries Hiring Accountants – कहां-कहां मिलती हैं Jobs

Accountants हर sector के लिए essential होते हैं। Banking, insurance, IT, healthcare और retail में इनकी high demand है।

Private vs Government Sector – कौन सा Better है?

Private sector में आप earn करते हैं ज्यादा salary और मिलता है exposure। Government jobs में मिलता है job security और fixed pay scale।

आपकी personal choice और career goals पर depend करता है कि कौन सा better रहेगा।

Salary Expectations – जानिए कितनी होती है Income

Accountant career में salary बहुत कुछ depend करती है आपके experience और qualifications पर। Fresher accountants भी earn करते हैं ₹15,000 – ₹30,000 per month.

Experienced Professionals की Salary

3-5 साल के बाद salary ₹50,000 – ₹1 lakh per month तक पहुंच सकती है। Senior roles में तो income ₹10 lakh – ₹30 lakh annually भी हो सकती है।

Source: According to Naukri.com and LinkedIn salary insights, CA professionals are among the top 10 earners in India.

Career Benefits – Accountant बनने के फायदे

Accountant बनने के बाद life में मिलते हैं कई career और personal benefits। आपको मिलता है structured lifestyle और continuous career growth।

Flexibility और Global Opportunities

Accounting एक ऐसा career है जो आपको देती है flexibility to work from anywhere। Freelance accountants भी आज high income earn कर रहे हैं।

International certifications से आप abroad भी job पा सकते हैं। ACCA, CPA जैसे courses आपको global market में भी recognizable बनाते हैं।

Challenges in Accounting – Easy नहीं होता High Salary पाना

हर career में challenges होते हैं, accounting भी इससे अलग नहीं है। Competition tough होता है, और continuous learning जरूरी होती है।

How to Overcome Challenges

Regularly update करें अपने knowledge और industry trends को follow करें। Time management, stress handling और client dealing में mastery हासिल करें।

Networking करें industry experts से और join करें accounting communities। इससे आपको नई job openings और growth insights मिलते रहते हैं।

Future Scope – Accountant Career की Demand ��ढ़ रही है

Technology और business expansion से accountant career की demand बढ़ती जा रही है। AI और automation accounting को और efficient बना रहे हैं।

Evolving Roles of Accountants

आज accountants सिर्फ data entry तक सीमित नहीं हैं। वो बन चुके हैं strategic business advisors और decision makers।

Cloud accounting और fintech tools आने से ये profession और lucrative बनता जा रहा है।

Conclusion – Smart Career Choice for High Salary

अगर आप ढूंढ रहे हैं एक stable, high paying, और respected profession – तो Accountant बनना is one of the best career options।

इसमें आपको मिलती है long-term job security, career growth, और high income। Hard work, सही education और skills से आप इस field में कर सकते हैं बड़ा नाम।

Final Tip: Stay Updated, Stay Relevant

Accountant career for high salaries तभी fruitful होगा, जब आप stay करेंगे updated, skilled और adaptable।

Success की keys हैं – continuous learning, certifications, और सही guidance।

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

High Salary Dream – Accountant Career शुरू करें

Accountant Career for High Salaries – एक Best Job Option for Financial Growth

Introduction – Accountant बनो और कमाओ High Salary

आज के समय में Accountant Career for High Salaries एक smart choice बन चुका है। Accountants हर business में play करते हैं crucial role और उनकी demand हमेशा high रहती है।

एक अच्छा accountant ना सिर्फ अपने लिए stable job पाता है, बल्कि earn करता है attractive salary भी। इस field में आप चाहे fresher हों या experienced, growth opportunities भरपूर हैं।

High Paying Jobs in Accounting – जानिए Scope और Opportunities

Accounting सिर्फ numbers की game नहीं है, ये है career का एक golden रास्ता। High paying jobs जैसे CA, CMA, CPA, और forensic accountant आज youth को attract कर रहे हैं।

भारत में भी Chartered Accountant की demand day by day बढ़ रही है। Foreign में CPA professionals earn करते हैं six-figure packages comfortably।

Multiple Fields, Multiple Options – Accounting Offers Variety

Accountant career में सिर्फ एक ही path नहीं है। आपको मिलती है options in auditing, taxation, financial planning, और management accounting।

हर sector में accountants की जरूरत होती है – चाहे वो corporate हो या government। इसलिए scope भी high है और salaries भी।

Career Path – कैसे बनें Accountant with High Income

अगर आप accountant बनना चाहते हैं, तो proper roadmap जरूरी है। 12th के बाद commerce stream choose करें और फिर pursue करें relevant degrees।

Required Education – कौन-कौन से Courses करें

B.Com एक अच्छा starting point है इस journey के लिए। इसके बाद आप कर सकते हैं CA, CMA, या ACCA जैसे professional courses।

इन courses को complete करने के बाद आपकी salary potential बहुत high हो जाती है। ये courses आपको बनाते हैं qualified और globally accepted professional।

Reference: Institute of Chartered Accountants of India (ICAI) के अनुसार, एक qualified CA in India earns between ₹6 to ₹20 lakh per annum.

Skills Matter – सिर्फ Degree नहीं, Skills भी जरूरी हैं

आज के दौर में सिर्फ qualification काफी ���हीं है। Practical skills और digital accounting tools की जानकारी भी equally important है।

Must-Have Skills for a High Salary Accountant

ताकि आप effectively clients से interact कर सकें।

जिससे आप data को समझ सकें और financial advice दे सकें।

जैसे Tally, Excel, और ERP software में proficiency होना चाहिए।

इन skills को develop करने से आपकी job prospects और salary दोनों बढ़ते हैं। Skillful accountant हमेशा companies की first choice होता है।

Work Experience – Experience से मिलती है High Income

हर field में experience एक major role play करता है। Accounting में भी experience आपके salary graph को तेजी से ऊपर ले जाता है।

Entry-Level से लेकर Senior Roles तक का सफर

Entry-level roles जैसे junior accountant से शुरुआत करके, आप बन सकते हैं senior accountant, finance manager, या CFO तक।

हर promotion के साथ salary भी increase होती है significantly। हर साल आपका experience आपके pay scale को upgrade करता है।

Industries Hiring Accountants – कहां-कहां मिलती हैं Jobs

Accountants हर sector के लिए essential होते हैं। Banking, insurance, IT, healthcare और retail में इनकी high demand है।

Private vs Government Sector – कौन सा Better है?

Private sector में आप earn करते हैं ज्यादा salary और मिलता है exposure। Government jobs में मिलता है job security और fixed pay scale।

आपकी personal choice और career goals पर depend करता है कि कौन सा better रहेगा।

Salary Expectations – जानिए कितनी होती है Income

Accountant career में salary बहुत कुछ depend करती है आपके experience और qualifications पर। Fresher accountants भी earn करते हैं ₹15,000 – ₹30,000 per month.

Experienced Professionals की Salary

3-5 साल के बाद salary ₹50,000 – ₹1 lakh per month तक पहुंच सकती है। Senior roles में तो income ₹10 lakh – ₹30 lakh annually भी हो सकती है।

Source: According to Naukri.com and LinkedIn salary insights, CA professionals are among the top 10 earners in India.

Career Benefits – Accountant बनने के फायदे

Accountant बनने के बाद life में मिलते हैं कई career और personal benefits। आपको मिलता है structured lifestyle और continuous career growth।

Flexibility और Global Opportunities

Accounting एक ऐसा career है जो आपको देती है flexibility to work from anywhere। Freelance accountants भी आज high income earn कर रहे हैं।

International certifications से आप abroad भी job पा सकते हैं। ACCA, CPA जैसे courses आपको global market में भी recognizable बनाते हैं।

Challenges in Accounting – Easy नहीं होता High Salary पाना

हर career में challenges होते हैं, accounting भी इससे अलग नहीं है। Competition tough होता है, और continuous learning जरूरी होती है।

How to Overcome Challenges

Regularly update करें अपने knowledge और industry trends को follow करें। Time management, stress handling और client dealing में mastery हासिल करें।

Networking करें industry experts से और join करें accounting communities। इससे आपको नई job openings और growth insights मिलते रहते हैं।

Future Scope – Accountant Career की Demand बढ़ रही है

Technology और business expansion से accountant career की demand बढ़ती जा रही है। AI और automation accounting को और efficient बना रहे हैं।

Evolving Roles of Accountants

आज accountants सिर्फ data entry तक सीमित नहीं हैं। वो बन चुके हैं strategic business advisors और decision makers।

Cloud accounting और fintech tools आने से ये profession और lucrative बनता जा रहा है।

Conclusion – Smart Career Choice for High Salary

अगर आप ढूंढ रहे हैं एक stable, high paying, और respected profession – तो Accountant बनना is one of the best career options।

इसमें आपको मिलती है long-term job security, career growth, और high income। Hard work, सही education और skills से आप इस field में कर सकते हैं बड़ा नाम।

Final Tip: Stay Updated, Stay Relevant

Accountant career for high salaries तभी fruitful होगा, जब आप stay करेंगे updated, skilled और adaptable।

Success की keys हैं – continuous learning, certifications, और सही guidance।

Accounting Courses ,

Taxation Course

courses after 12th Commerce ,

after b.com which course is best ,

Diploma in accounting ,

SAP fico course ,

Accounting and Taxation Course ,

GST Practitioner Course ,

Basic Computer Course fee ,

Payroll Course in Delhi,

Tally Course

diploma course after b com ,

Advanced Excel Course in Delhi ,

Computer ADCA Course

Data Entry Operator Course,

diploma in banking finance ,

stock market Course,

six months course in accounting

Income Tax

Accounting

Tally

Career

#diploma in taxation#payroll management course#business accounting and taxation (bat) course#accounting course#gst course#sap fico course

0 notes

Text

Enhance Your Career with Accounting and Finance Courses in Kerala

The world of finance and accounting is evolving rapidly, and keeping up with industry standards requires advanced skills and certifications. Whether you aim to build a career in accounting, financial analysis, or management, choosing the right educational path is crucial. Kerala is home to some of the top CMA institutes and the best ACCA institutes in Kochi, offering comprehensive programs to shape future financial experts. One of the most sought-after qualifications today is the Diploma in Accounting and Finance.

Diploma Course in Accounting and Finance: A Career Catalyst

A Diploma in Accounting and Finance is an excellent choice for individuals looking to establish a solid foundation in financial principles and accounting practices. This program is designed to equip students with the skills needed to handle financial data, manage accounts, and understand the economic aspects of businesses.

Why Choose a Diploma in Accounting and Finance?

Comprehensive Curriculum: Covers essential topics like financial reporting, cost accounting, tax laws, and budgeting.

Career Opportunities: Graduates can explore roles like accounting assistant, finance executive, or payroll analyst.

Skill Enhancement: Gain hands-on experience with financial software and analytical tools.

Foundation for Higher Studies: A stepping stone for pursuing professional certifications like CMA or ACCA.

Many institutes in Kerala offer this diploma, focusing on both theoretical knowledge and practical application. With a blend of classroom learning and real-world case studies, this program ensures you are well-prepared for industry challenges.

Top CMA Institute in Kerala: Your Path to Professional Excellence

Certified Management Accountant (CMA) is one of the most prestigious accounting certifications recognized globally. If you aspire to become a financial strategist, enrolling in a top CMA institute in Kerala is the first step towards success.

Why Pursue CMA?

Global Recognition: CMA is acknowledged by multinational companies worldwide.

High Salary Potential: CMAs often earn significantly more than non-certified accountants.

Strategic Role: Involves decision-making, financial planning, and performance management.

Industry Demand: Increasing need for skilled management accountants in finance and corporate sectors.

The top CMA institutes in Kerala provide expert faculty, comprehensive study materials, mock exams, and mentorship to ensure exam readiness. Moreover, they offer flexible learning options, making it easier for working professionals to balance studies and career growth.

Accounting Finance Diploma: A Holistic Approach to Finance

The Accounting Finance Diploma is another valuable credential that prepares students for the dynamic finance sector. It covers a wide range of subjects such as financial accounting, corporate finance, taxation, and auditing.

Key Benefits:

Practical Learning: Hands-on training with accounting software and financial modeling.

Career Flexibility: Suitable for roles in bookkeeping, tax advisory, and financial reporting.

Skill Development: Improves analytical thinking, problem-solving, and numerical accuracy.

This diploma is particularly useful for individuals aiming to enhance their qualifications without committing to a long-term degree program. It’s a great way to boost your resume and demonstrate practical finance skills to potential employers.

Best ACCA Institute in Kochi: Your Gateway to a Global Career

The Association of Chartered Certified Accountants (ACCA) qualification is highly valued across the globe. It demonstrates expertise in accounting, auditing, and financial management. If you are looking to build a career that spans international borders, enrolling in the best ACCA institute in Kochi is the right choice.

Why ACCA?

Global Employability: ACCA is recognized in over 180 countries.

Professional Growth: Opens doors to roles like auditor, financial consultant, and CFO.

Comprehensive Syllabus: Covers financial management, performance management, audit, and taxation.

Flexibility: Study at your own pace with support from expert trainers.

Top institutes in Kochi provide well-structured training programs, online resources, and practice tests to help you clear ACCA exams efficiently. The focus is on building technical expertise and preparing students for real-world financial challenges.

Conclusion: Choose the Right Path with Expert Guidance

Whether you are looking for a diploma in accounting and finance, pursuing the CMA certification, or preparing for ACCA exams, choosing the right institute plays a pivotal role. Kerala’s top educational institutions offer well-rounded programs that combine theory with practice, ensuring you acquire both knowledge and skills.

By opting for the best CMA institute in Kerala or the top ACCA institute in Kochi, you secure a competitive edge in the finance industry. Invest in your education today to build a prosperous and stable career in accounting and finance.

0 notes

Text

PGDM Finance Placements: What Recruiters Look For and How to Stand Out

If you’re pursuing a PGDM in Finance, you’re already on the path to an exciting and rewarding career. But let’s be honest—landing your dream job in finance isn’t just about acing your exams. It’s about understanding what recruiters want and knowing how to showcase your unique strengths.

Whether you’re eyeing roles in investment banking, corporate finance, or financial consulting, this blog will break down what recruiters look for and share actionable tips to help you stand out from the crowd. Let’s dive in!

What Recruiters Look For in PGDM Finance Graduates

Strong Analytical SkillsPGDM Finance is all about numbers, data, and problem-solving. Recruiters want candidates who can analyze complex financial data, identify trends, and make data-driven decisions.

How to Showcase It: Highlight projects or internships where you’ve worked with financial models, performed data analysis, or solved real-world financial problems.

Technical Proficiency From Excel to financial software like SAP or Bloomberg, recruiters look for candidates who are comfortable with the tools of the trade.

How to Showcase It: Mention certifications or courses you’ve completed in financial tools and software. If you’ve used these tools in internships or projects, make sure to include that in your resume.

Understanding of Financial Markets A solid grasp of how financial markets operate is crucial. Recruiters want candidates who can navigate market trends, understand economic indicators, and make informed decisions.

How to Showcase It: Stay updated on market trends and be prepared to discuss them during interviews. You can also showcase your knowledge through blogs, case studies, or research projects.

Communication and Presentation Skills Finance isn’t just about crunching numbers—it’s about explaining those numbers to stakeholders. Recruiters value candidates who can communicate complex ideas clearly and confidently.

How to Showcase It: Practice presenting financial reports or analyses. If you’ve led team presentations or workshops, include those experiences in your resume.

Ethical Judgment and Integrity Finance professionals often deal with sensitive information and high-stakes decisions. Recruiters look for candidates who demonstrate strong ethical judgment and integrity.

How to Showcase It: Share examples of how you’ve handled ethical dilemmas or maintained confidentiality in previous roles.

How to Stand Out in PGDM Finance Placements

Build a Strong ResumeYour resume is your first impression. Make it count by:

Highlighting relevant internships, projects, and certifications.

Using action verbs like “analyzed,” “optimized,” and “implemented” to describe your achievements.

Keeping it concise and tailored to the job you’re applying for.

Network Like a ProNetworking isn’t just about attending events—it’s about building genuine relationships. Connect with alumni, industry professionals, and recruiters on platforms like LinkedIn. Don’t be afraid to reach out for advice or informational interviews.

Ace the InterviewFinance interviews often include technical questions, case studies, and behavioral assessments. Prepare by:

Practicing common finance interview questions.

Reviewing key concepts like valuation methods, financial ratios, and risk management.

Demonstrating your problem-solving skills through case studies.

Stay Updated on Industry TrendsRecruiters love candidates who are passionate about finance and stay informed about the latest trends. Follow financial news, read industry reports, and join finance-related forums or groups.

Pursue CertificationsCertifications like CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), or CMA (Certified Management Accountant) can give you a competitive edge. They show recruiters that you’re serious about your career and willing to go the extra mile.

Why IILM Lucknow is the Perfect Launchpad for Your Finance Career

At IILM Lucknow, we don’t just teach finance—we prepare you to excel in it. Here’s how:

Industry-Aligned Curriculum: Our PGDM program is designed to meet the demands of the finance industry.

Experienced Faculty: Learn from professionals who bring real-world expertise to the classroom.

Placement Support: Our dedicated placement cell works tirelessly to connect you with top recruiters.

Hands-On Learning: From live projects to internships, we ensure you gain practical experience.

Your Future in Finance Starts Here

The world of finance is competitive, but with the right skills, mindset, and preparation, you can stand out and land your dream job. At IILM Lucknow, we’re here to guide you every step of the way. Ready to take the first step toward a successful finance career? Explore our PGDM program and discover how we can help you achieve your goals.

0 notes

Text

Studies after class 12 Commerce

Part 1 of 4

1.Bachelor of Commerce (B.Com)

A 3-year undergraduate degree focusing on subjects like accounting, finance, taxation, and business law.

Job Opportunities: Accountant, Financial Analyst, Tax Consultant, Auditor, Business Analyst.

2.Bachelor of Business Administration (BBA)

A 3-year program that imparts knowledge in management, marketing, human resources, and operations.

Job Opportunities: Business Development Executive, Marketing Manager, HR Manager, Operations Manager.

3.Chartered Accountancy (CA)

A professional course focusing on accounting, auditing, taxation, and financial management.

Job Opportunities: Chartered Accountant, Auditor, Tax Consultant, Financial Advisor.

4.Company Secretary (CS)

A professional course emphasizing corporate law, company governance, and regulatory compliance.

Job Opportunities: Company Secretary, Corporate Legal Advisor, Compliance Officer.

5.Bachelor of Economics (B.A. Economics Hons.)

A 3-year course delving into economic theories, econometrics, and statistical methods.

Job Opportunities: Economist, Data Analyst, Policy Analyst, Research Analyst.

6.Bachelor of Computer Applications (BCA)

A 3-year program covering computer applications, software development, and programming languages.

Job Opportunities: Software Developer, System Analyst, Web Developer, IT Consultant.

7.Bachelor of Management Studies (BMS)

A 3-year course focusing on management practices, organizational behaviour, and business strategies.

Job Opportunities: Management Consultant, Project Manager, Business Analyst, Marketing Executive.

8.Cost and Management Accountancy (CMA)

A professional course that trains students in cost accounting, financial planning, and management.

Job Opportunities: Cost Accountant, Financial Analyst, Budget Analyst, Management Accountant.

9.Bachelor of Law (LLB)

A 5-year integrated program (BBA LLB or B.Com LLB) focusing on legal education combined with business or commerce studies.

Job Opportunities: Corporate Lawyer, Legal Advisor, Compliance Officer, Advocate. Institutions:

10.Bachelor of Statistics (B.Stat)

A 3-year program focusing on statistical methods, probability, and data analysis.

Job Opportunities: Statistician, Data Analyst, Risk Analyst, Biostatistician. Institutions:

11.Bachelor of Financial Markets (BFM)

A specialized 3-year undergraduate course focusing on financial markets, investments, and risk management.

Job Opportunities: Financial Analyst, Stock Broker, Investment Banker, Risk Manager, Portfolio Manager.

12.Bachelor of Banking and Insurance (BBI)

A 3-year degree program covering the banking, finance, and insurance sectors.

Job Opportunities: Banker, Insurance Advisor, Loan Officer, Financial Risk Manager. Institutions: o Jai Hind College, Mumbai

13.Bachelor of International Business and Finance (BIBF)

A course designed to offer insights into international business practices and financial markets.

Job Opportunities: International Business Consultant, Trade Specialist, Finance Manager.

14.Bachelor of Event Management (BEM)

A 3-year course preparing students for a career in event planning, management, and execution.

Job Opportunities: Event Manager, Wedding Planner, PR Specialist, Corporate Event Coordinator.

15.Diploma in Digital Marketing

A short-term program focusing on online marketing strategies, SEO, content marketing, and social media.

Job Opportunities: Digital Marketing Specialist, SEO Expert, Content Marketer, Social Media Manager.

16.Certified Financial Planner (CFP)

A professional certification focusing on financial planning, investment, and wealth management.

Job Opportunities: Financial Planner, Wealth Manager, Investment Advisor.

17.Bachelor of Hospitality Management (BHM) A 3-4 year program focusing on hospitality operations, hotel management, and tourism.

Job Opportunities: Hotel Manager, Food and Beverage Manager, Event Coordinator, Tourism Officer.

18.Bachelor of Design (B.Des) (Specialized for Commerce Students)

A course with specializations like fashion design, communication design, or interior design.

Job Opportunities: Fashion Designer, Interior Designer, Graphic Designer, Art Director.

19.Actuarial Science

A course that prepares students to analyze financial risks using mathematics and statistics.

Job Opportunities: Actuary, Risk Manager, Data Scientist, Consultant.

20.Bachelor of Animation and Multimedia

A creative course focusing on animation, VFX, graphic design, and multimedia tools.

Job Opportunities: Animator, Graphic Designer, VFX Artist, Game Developer.

21. Diploma in Foreign Languages

A short-term program teaching languages like French, German, Spanish, and Mandarin.

Job Opportunities: Translator, Interpreter, Language Trainer, Foreign Relations Executive

22. Bachelor in Retail Management

A program focusing on retail operations, merchandising, and supply chain management.

Job Opportunities: Store Manager, Merchandiser, Retail Buyer, Supply Chain Analyst.

23. Integrated MBA (BBA + MBA)

A 5-year integrated program combining undergraduate and postgraduate management studies.

Job Opportunities: Business Analyst, Operations Manager, Marketing Manager, HR

Manager.

24. Bachelor of Accounting and Finance (BAF)

A 3-year undergraduate program focusing on accounting principles, financial analysis, and auditing.

Job Opportunities: Financial Analyst, Accountant, Auditor, Tax Consultant, Investment Banker.

25. Bachelor of Commerce in Banking and Insurance (B.Com B&I)

A 3-year degree program covering the fundamentals of banking, insurance, and financial services.

Job Opportunities: Banking Officer, Insurance Underwriter, Financial Advisor, Risk Manager.

26. Bachelor of Commerce in Financial Market (B.Com FM)

A specialized course focusing on financial markets, investment strategies, and stock trading.

Job Opportunities: Stock Broker, Financial Analyst, Portfolio Manager, Investment Advisor

27. Bachelor of Commerce in Accounting and Finance (B.Com A&F)

A 3-year undergraduate program emphasizing advanced accounting and financial management.

Job Opportunities: Chartered Accountant, Financial Analyst, Tax Consultant, Auditor.

28. Bachelor of Commerce in Tax Procedure and Practice (B.Com TPP)

A course designed to provide knowledge about taxation laws, procedures, and practices in India.

Job Opportunities: Tax Consultant, Tax Advisor, Revenue Agent, Tax Examiner.

29. Bachelor of Commerce in E-Commerce (B.Com E-Commerce)

A program focusing on electronic commerce, online business strategies, and digital marketing.

Job Opportunities: E-Commerce Manager, Digital Marketing Specialist, Online Store Manager, Business Analyst

30. Bachelor of Business Studies (BBS)

A 3-year undergraduate course offering comprehensive knowledge in business management, finance, and economics.

Job Opportunities: Business Analyst, Marketing Executive, Financial Consultant, Operations Manager.

31. Bachelor of Travel and Tourism Management (BTTM)

A 4-year undergraduate program focusing on the travel, tourism, and hospitality industry.

Job Opportunities: Travel Consultant, Tour Operator, Tourism Manager, Event Coordinator.

32. Bachelor of Hotel Management (BHM)

A 3 to 4-year program preparing students for the hospitality industry, covering areas like hotel administration, food and beverage management, and housekeeping.

Job Opportunities: Hotel Manager, Food and Beverage Manager, Front Office Manager, Event Planner.

33. Bachelor of Business Economics (BBE)

A 3-year undergraduate program combining economic theories with business practices.

Job Opportunities: Economic Analyst, Business Consultant, Market Research Analyst, Financial Planner.

34. Bachelor of Commerce in International Business (B.Com I

A 3-year undergraduate program focusing on international trade, global business strategies, and cross-cultural management.

Job Opportunities: International Business Consultant, Export Manager, Trade Analyst,

Foreign Exchange Manager.

35. Bachelor of Commerce in Supply Chain Management (B.Com SCM)

A specialized course focusing on logistics, procurement, and supply chain operations.

Job Opportunities: Supply Chain Analyst, Logistics Coordinator, Procurement Manager,

Operations Manager.

36. Bachelor of Commerce in Business Analytics (B.Com BA)

A program that combines commerce subjects with data analysis, statistical tools, and business intelligence.

Job Opportunities: Business Analyst, Data Analyst, Market Research Analyst, Financial

Analyst.

37. Bachelor of Commerce in Entrepreneurship (B.Com Entrepreneurship)

A course designed to equip students with the skills needed to start and manage their own businesses.

Job Opportunities: Entrepreneur, Business Consultant, Startup Advisor, Business

Development Manager.

38. Bachelor of Commerce in Investment Management (B.Com IM)

A program focusing on investment strategies, portfolio management, and financial markets.

Job Opportunities: Investment Analyst, Portfolio Manager, Financial Advisor, Wealth Manager.

39. Bachelor of Commerce in Digital Marketing (B.Com DM)

A course that integrates commerce subjects with digital marketing strategies, social media management, and online advertising.

Job Opportunities: Digital Marketing Specialist, Social Media Manager, SEO Analyst, Content Strategist.

40. Bachelor of Commerce in Financial Planning (B.Com FP)

A program dedicated to personal financial planning, wealth management, and retirement planning.

Job Opportunities: Financial Planner, Wealth Advisor, Investment Consultant, Tax Advisor.

41.Bachelor of Commerce in Retail Management (B.Com RM)

A course focusing on retail operations, merchandising, and consumer behaviour.

Job Opportunities: Retail Manager, Store Manager, Merchandiser, Supply Chain

Coordinator.

42.Bachelor of Commerce in Tourism and Travel Management (B.Com TTM)

A program that combines commerce subjects with tourism, travel management, and hospitality.

Job Opportunities: Travel Consultant, Tour Manager, Event Coordinator, Hospitality

Manager.

43.Bachelor of Commerce in Corporate Secretaryship (B.Com CS)

A course focusing on corporate laws, governance, and secretarial practices.

Job Opportunities: Company Secretary, Corporate Compliance Officer, Legal Advisor,

Corporate Consultant.

44.Bachelor of Commerce in Banking and Insurance (B.Com B&I)

Focuses on banking, financial services, and insurance management with an emphasis on policies, risk management, and banking laws.

Job Opportunities: Bank Manager, Insurance Advisor, Financial Risk Manager, Claims Officer.

45.Bachelor of Retail Management (BRM)

Specializes in retail operations, inventory management, consumer behavior, and store management.

Job Opportunities: Store Manager, Retail Analyst, Merchandise Planner, Supply Chain

Coordinator.

46.Diploma in Financial Accounting

A short-term diploma course focusing on accounting principles, taxation, and financial management.

Job Opportunities: Accountant, Tax Consultant, Finance Executive.

47.Diploma in E-Commerce

A course exploring digital commerce, online business strategies, and emarketing.

Job Opportunities: E-commerce Manager, Online Store Owner, Digital Marketing Specialist.

48.Bachelor of Business Administration in Logistics Management (BBA LM)

Focuses on supply chain, transportation, and logistics operations.

Job Opportunities: Logistics Manager, Supply Chain Analyst, Operations Manager.

49.Bachelor of Business Studies (BBS)

A management-oriented program focusing on business strategies, organizational behavior, and market dynamics.

Job Opportunities: Business Analyst, Marketing Executive, Project Manager.

50.Bachelor of Commerce in Investment Banking (B.Com IB)

Prepares students for careers in investment banking, mergers and acquisitions, and securities.

Job Opportunities: Investment Banker, Financial Analyst, Equity Researcher.

51.Bachelor of Business Administration in Event Management (BBA EM)

A program dedicated to planning and managing events, combining creativity with organizational skills.

Job Opportunities: Event Manager, Wedding Planner, PR Executive.

52.Chartered Wealth Manager (CWM)

A professional certification focusing on wealth management, investment strategies, and financial planning.

Job Opportunities: Wealth Manager, Financial Advisor, Portfolio Manager.

53.Bachelor of Commerce in Risk Management (B.Com RM)

Deals with risk identification, assessment, and mitigation in business operations.

Job Opportunities: Risk Analyst, Compliance Officer, Risk Consultant.

54.Bachelor of Commerce in Financial Markets (BFM)

A 3-year undergraduate program focusing on financial markets, investment strategies, risk management, and financial analysis.

Job Opportunities: Financial Analyst, Stock Broker, Investment Banker, Portfolio

Manager.

55.Bachelor of Commerce in Accounting and Finance (BAF)

This program offers in-depth knowledge in accounting principles, financial

management, taxation, and auditing over a span of 3 years.

Job Opportunities: Accountant, Tax Consultant, Auditor, Financial Planner.

56.Bachelor of Commerce in Banking and Insurance (BBI)

A 3-year course focusing on the banking sector, insurance laws, financial

services, and risk management.

Job Opportunities: Banking Officer, Insurance Underwriter, Risk Manager, Financial Advisor.

57.Bachelor of Business Administration in International Business (BBA-IB)

A 3-year program that imparts knowledge on international trade policies,

global business strategies, and cross-cultural management.

Job Opportunities: International Business Consultant, Export Manager, Foreign

Exchange Manager, Global Marketing Executive.

58.Bachelor of Management Studies (BMS)

A 3-year undergraduate program focusing on management practices, organizational behavior, and business strategies.

Job Opportunities: Business Development Manager, Human Resource Manager, Operations Manager, Marketing Executive.

59.Bachelor of Business Administration in Computer Applications (BBA-CA)

This 3-year course combines business administration with computer application skills, covering topics like software development, database management, and business analytics.

Job Opportunities: IT Manager, Business Analyst, System Analyst, Software Developer.

60.Bachelor of Commerce in E-Commerce (B.Com E-Commerce)

A program that focuses on electronic commerce, digital marketing, online business strategies, and web technologies over a period of 3 years.

Job Opportunities: E-Commerce Manager, Digital Marketing Specialist, Online Store

Manager, SEO Analyst.

61.Bachelor of Business Administration in Logistics and Supply Chain Management (BBA

LSCM)

A 3-year course focusing on logistics, supply chain operations, inventory

management, and procurement strategies.

Job Opportunities: Supply Chain Manager, Logistics Coordinator, Warehouse Manager,

Procurement Analyst.

62.Bachelor of Commerce in Tourism and Travel Management (B.Com TTM)

A 3-year undergraduate program that covers tourism industry dynamics, travel management, hospitality services, and cultural heritage.

Job Opportunities: Travel Consultant, Tour Manager, Event Coordinator, Hospitality

Manager.

63.Bachelor of Commerce in Corporate Secretaryship (B.Com CS)

This 3-year program focuses on corporate laws, secretarial practices, company management, and corporate governance.

Job Opportunities: Company Secretary, Corporate Compliance Officer, Legal Advisor, Corporate Consultant.

64.Bachelor of Business Administration in Hospitality Management (BBA HM)

A 3-year program focusing on hotel operations, event management, food service, and tourism management.

Job Opportunities: Hotel Manager, Guest Relations Manager, Event Coordinator, Food

and Beverage Manager.

65.Bachelor of Commerce in Taxation (B.Com Taxation)

This program provides in-depth knowledge of taxation laws, taxation practices, and accounting principles.

Job Opportunities: Tax Consultant, Tax Analyst, Financial Auditor, Taxation Officer.

66.Bachelor of Commerce in Foreign Trade (B.Com FT)

This course offers a specialization in international trade, covering aspects such as customs laws, export-import procedures, and global markets.

Job Opportunities: Export Manager, Import Officer, Trade Analyst, Supply Chain Manager.

67.Bachelor of Commerce in Digital Marketing (B.Com DM)

A program that covers strategies, tools, and technologies used in online marketing, social media, and e-commerce platforms.

Job Opportunities: Digital Marketing Specialist, SEO Expert, Social Media Manager, Content Strategist.

68.Bachelor of Business Administration in Agribusiness Management (BBA ABM)

A program focusing on business practices in agriculture, including marketing, management, and logistics within the agricultural sector.

Job Opportunities: Agribusiness Manager, Agricultural Consultant, Farm Operations

Manager, Marketing Manager.

69.Bachelor of Commerce in Entrepreneurship (B.Com Entrepreneurship)

A program that focuses on developing entrepreneurial skills, innovation, and the ability to start and manage a business.

Job Opportunities: Entrepreneur, Business Consultant, Startup Mentor, Venture Capital

Analyst.

70.Bachelor of Business Administration in Sports Management (BBA SM)

A course that combines business management principles with sports administration, including event planning,marketing, and athlete management.

Job Opportunities: Sports Manager, Event Coordinator, Marketing Manager for Sports,

Fitness Manager.

71.Bachelor of Commerce in International Accounting and Finance (B.Com IAF)

This program focuses on international financial markets, accounting standards, and financial laws.

Job Opportunities: International Accountant, Finance Consultant, Risk Analyst, Investment Banker.

72.Bachelor of Commerce in Financial Planning (B.Com FP)

A program designed to teach students how to create financial plans, manage wealth, and understand financial products and services.

Job Opportunities: Financial Planner, Investment Consultant, Wealth Manager, Portfolio Advisor.

73.Diploma in Insurance Management

This diploma provides a strong foundation in insurance policies, risk management, claims, and underwriting.

Job Opportunities: Insurance Advisor, Risk Manager, Claims Processor, Insurance

Consultant.

74.Bachelor of Commerce in Actuarial Science (B.Com AS)

A program focusing on risk assessment, insurance mathematics, financial modeling, and probability theory, preparing students for actuarial exams.

Job Opportunities: Actuary, Risk Analyst, Insurance Analyst, Financial Consultant.

75.Bachelor of Commerce in Hospitality and Tourism Management (B.Com HTM)

This course focuses on the business side of tourism and hospitality, including hotel management, tourism laws, and marketing.

Job Opportunities: Hotel Manager, Travel Consultant, Tourism Manager, Event Planner.

76.Bachelor of Commerce in Accounting and Information Systems (B.Com AIS)

A program designed to combine accounting principles with modern information technology tools used in managing financial data and accounting systems.

Job Opportunities: IT Accountant, Accounting Software Specialist, Systems Analyst, Data

Analyst.

77.Bachelor of Business Administration in Tourism and Travel (BBA TT)

A business management course tailored for the tourism industry, focusing on hospitality, customer service, and travel agency

operations.

Job Opportunities: Travel Manager, Tour Guide, Operations Executive, Event Manager.

78.Bachelor of Commerce in Retail Management (B.Com RM)

A program focusing on the retail industry, including inventory management, consumer behavior, retail marketing, and sales strategies.

Job Opportunities: Retail Manager, Store Operations Manager, Sales Executive,

Merchandise Planner.

79.Bachelor of Commerce in Banking Operations (B.Com BO)

A program that covers topics related to banking operations, such as financial services, banking laws, and customer service in the banking sector.

Job Opportunities: Bank Operations Manager, Relationship Manager, Banking Executive, Credit Officer.

80.Bachelor of Commerce in International Marketing (B.Com IM)

This course covers global marketing strategies, international consumer behavior, and cross-border trade.

Job Opportunities: International Marketing Manager, Export-Import Executive, Brand

Manager, Marketing Research Analyst

81.Bachelor of Commerce in Fashion Management (B.Com FM)

A course that combines fashion design principles with business management, focusing on merchandising, branding, and fashion marketing.

Job Opportunities: Fashion Merchandiser, Brand Manager, Retail Executive, Fashion Marketing Consultant.

82.Bachelor of Business Administration in Digital Media and Communication (BBA DMC)

This course focuses on the integration of business administration with digital media and communication technologies, including social media and online advertising.

Job Opportunities: Social Media Manager, Digital Communication Strategist, Digital

Campaign Manager, Content Manager.

83.Bachelor of Commerce in Media Management (B.Com MM)

A program designed to provide students with the skills to manage media organizations, focusing on television, radio, film, and digital media industries.

Job Opportunities: Media Planner, Media Manager, Public Relations Officer, Content

Strategist.

84.Bachelor of Commerce in Investment Analysis (B.Com IA)

A specialized program focusing on stock market analysis, investment

strategies, financial planning, and portfolio management.

Job Opportunities: Investment Analyst, Portfolio Manager, Securities Trader, Financial

Advisor.

85.Bachelor of Business Administration in Marketing Management (BBA MM

A program focusing on the principles of marketing, consumer behavior, sales strategies, and market research.

Job Opportunities: Marketing Executive, Brand Manager, Digital Marketing Specialist, Sales Manager.

86.Bachelor of Commerce in Financial Risk Management (B.Com FRM)

This course focuses on risk management, financial products, investment strategies, and financial regulations.

Job Opportunities: Risk Manager, Financial Risk Analyst, Investment Banker, Compliance Officer.

87.Bachelor of Business Administration in Supply Chain Management (BBA SCM)

A program dedicated to managing the logistics, transportation, and distribution networks within a business.

Job Opportunities: Supply Chain Manager, Logistics Coordinator, Warehouse Manager,

Procurement Specialist.

88.Bachelor of Commerce in Corporate Finance (B.Com CF)

This course delves into financial management, mergers and acquisitions, corporate governance, and business financing.

Job Opportunities: Corporate Finance Analyst, Financial Consultant, CFO, Investment Banker.

89.Bachelor of Commerce in Entrepreneurship Development (B.Com ED)

A program focused on developing entrepreneurial skills, business startup

processes, and managing new ventures.

Job Opportunities: Entrepreneur, Startup Mentor, Business Consultant, Venture Capital

Analyst.

90.Bachelor of Business Administration in Event Management (BBA EM)

This course covers the organization and planning of corporate events, conferences, and entertainment events.

Job Opportunities: Event Manager, Event Coordinator, Venue Manager, Exhibition

Organizer.

91.Bachelor of Commerce in Digital Finance (B.Com DF)

A program focused on the application of digital tools and platforms in finance, covering FinTech, digital payment systems, and online trading.

Job Opportunities: Digital Finance Analyst, FinTech Consultant, Investment Manager,

Online Payment Specialist.

92.Bachelor of Commerce in Business Analytics (B.Com BA)

A program that blends business concepts with data analysis, focusing on interpreting large data sets to make business decisions.

Job Opportunities: Business Analyst, Data Analyst, Market Research Analyst, Operations

Manager.

93.Bachelor of Business Administration in Media Management (BBA MM)

A specialized program that prepares students for careers in the management of media businesses, covering advertising, public relations, and broadcasting.

Job Opportunities: Media Manager, Public Relations Executive, Advertising Manager,

Content Strategist.

94.Bachelor of Commerce in Media Studies (B.Com MS)

This course combines commerce and media studies, focusing on media economics, production, and marketing, and prepares students for the growing media industry.

Job Opportunities: Media Planner, Content Writer, Public Relations Officer, Broadcast

Manager.

95.Bachelor of Commerce in Retail Banking (B.Com RB)

A specialized course in the retail banking sector, focusing on customer service, banking operations, and financial products in a retail context.

Job Opportunities: Bank Relationship Manager, Retail Banker, Credit Analyst, Branch

Manager.

96.Bachelor of Business Administration in Agribusiness (BBA AB)

A business management program focusing on agriculture, food production, and rural development, preparing students for the agribusiness industry.

Job Opportunities: Agribusiness Manager, Farm Operations Manager, Agricultural Consultant, Marketing Manager.

97.Bachelor of Commerce in Logistics and Supply Chain Management (B.Com LSCM)

This program covers logistics, supply chain operations, and management, preparing students for the fast-growing logistics industry.

Job Opportunities: Logistics Manager, Supply Chain Analyst, Warehouse Manager,

Procurement Specialist.

98.Bachelor of Business Administration in International Relations (BBA IR)

A program focusing on the global business environment, international trade, diplomacy, and cross-cultural business practices.

Job Opportunities: International Relations Consultant, Trade Analyst, Diplomacy Officer,

Global Marketing Manager.

99.Bachelor of Commerce in E-Commerce (B.Com E-Commerce)

A program focused on online business, digital platforms, online marketing, and e-commerce management.

Job Opportunities: E-Commerce Manager, Digital Marketing Specialist, Online Retail

Manager, SEO Analyst.

100.Bachelor of Commerce in Corporate Law (B.Com CL)

A program that integrates commerce with the legal aspects of business,

covering corporate laws, intellectual property, and contracts.

Job Opportunities: Corporate Lawyer, Legal Consultant, Compliance Officer, Legal Advisor.

0 notes

Text

CAREER OPPORTUNITIES IN ACCOUNTING AND FINANCE FOR 12TH STUDENTS

INTRODUCTION

Are you a 12th-grade student interested in financial planning, or business management?

A career in Financial and Accounting may lead to a variety of exciting opportunities. The correct educational path may position you for success whether your career goal is to become an investment banker, financial analyst, or chartered accountant (CA). We'll look at a variety of financial and accounting career options in this guide after completing high school.

CHOOSING A CAREER IN ACCOUNTING AND FINANCIAL SECTORS

Financial and accounting are important professions that provide worldwide job opportunities, significant income potential, and stable working conditions. Experts in these domains are essential in handling financial documentation, evaluating investments, and formulating strategic company choices.

TOP POPULAR COURSES IN ACCOUNTING AND FINANCIAL SECTORS

Chartered Accountancy (CA):

Cost and Management Accounting (CMA):

Bachelor of Commerce (B.Com)

Bachelor of Business Administration (BBA) in Finance:

Certified Financial Planner

Company Secretary

CAREER OPPORTUNITIES AFTER COMPLETING ACCOUNTING COURSE

Chartered Accountant : Works in auditing, taxation, and financial advisory services.

Financial Analyst: Analyzes investment opportunities and financial data.

Investment Banker: Helps companies raise capital and manage financial assets.

Cost Accountant: Manages cost control and financial planning in businesses.

Tax Consultant: Provides tax planning strategies and compliance advice.

Auditor: Ensures financial statements comply with legal and regulatory requirements.

Banking Professional: Works in commercial banks, investment banks, and financial institutions.

SKILLS REQUIRED IN FINANCIAL SECTORS

Strong analytical and problem-solving abilities.

Attention to detail and accuracy.

Knowledge of accounting software

Communication and business acumen.

Time management and organizational skills.

RIGHT ACCOUNTING AND FINANCIAL COURSE IN CHENNAI

One of the greatest choices for students hoping to pursue a career in financial and accounting is to enroll in FinChartered Academy. FinChartered Academy provides excellent instruction in accounting and finance courses in Chennai offering guidance for certifications in finance such as CFA, CMA, and CA. With skilled instructors, well-organized classes, and practical training, the school guarantees that students are ready for their future careers. You may get a competitive advantage in the financial sector and develop a successful professional life by selecting FinChartered Academy.

CONCLUSION

A career in financial and accounting offers stability, growth, and global opportunities. Whether you pursue CA, CFA, B.Com, or other finance-related courses. The key to success lies in continuous learning and skill development. If you are passionate about Accounting and financial planning, Start your journey today! Consider enrolling in FinChartered Academy, the best institute for accounting and financial courses in Chennai to gain the right expertise and industry exposure.

#accounting and financial course in chennai#cmacoure#accacoure#accountingcertificationinchennai#financialcertificationinchennai

0 notes

Text

Easyoffice Software - Best Taxation software in India

EasyOFFICE is an integrated Taxation Software with the motto of Complete Office Management for Chartered Accountants (CA), Tax Professionals and Tax Advocates. This flagship product is a bundle of many software modules & utilities like Income Tax Software (EasyTax), TDS software (EasyTDS), Audit Report & Balance Sheet software (EasyAudit), CMA Data software (EasyCMA), Office Management Utilities & more.

0 notes

Text

How to Excel in Financial Modeling for Delhi Businesses

Introduction

Financial modeling is a crucial skill for businesses in Delhi aiming to manage finances, predict future performance, and make informed decisions. Mastering financial modeling requires strategic learning, practical application, and industry-specific knowledge. This guide outlines key strategies for excelling in financial modeling in Delhi's dynamic business environment.

1. Understand the Fundamentals of Financial Modeling

To build a strong foundation in financial modeling, you must understand the core concepts:

Financial Statements: Master the income statement, balance sheet, and cash flow statement.

Forecasting Techniques: Develop skills in projecting future revenue, expenses, and cash flow.

Valuation Methods: Learn methods such as Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), and Precedent Transactions.

2. Gain Proficiency in Excel

Excel is the primary tool used for financial modeling. Focus on mastering these Excel skills:

Advanced Functions: Learn key formulas like VLOOKUP, HLOOKUP, INDEX-MATCH, and IFERROR.

Data Analysis Tools: Familiarize yourself with PivotTables, Power Query, and data visualization tools.

Automation Skills: Develop knowledge of macros and VBA for efficient modeling.

3. Develop Industry-Specific Knowledge

Delhi's business landscape is diverse, with key industries such as:

IT and Technology: Understand SaaS revenue models and IT expenditure analysis.

Retail and E-commerce: Focus on inventory turnover, customer acquisition costs, and sales forecasts.

Hospitality and Real Estate: Master occupancy rates, RevPAR, and property valuation models.

4. Practice Real-World Financial Models

Building practical models for Delhi-based businesses enhances learning. Focus on:

Startup Financial Projections: Craft detailed financial forecasts for new ventures.

Budgeting and Forecasting Models: Develop annual budgets with scenario analysis.

Investment Analysis Models: Create models that assess the viability of expansion or acquisitions.

5. Utilize Online Resources and Courses

Many educational platforms provide specialized financial modeling courses for Delhi professionals:

Coursera and Udemy: Offer comprehensive courses in financial modeling.

Delhi-based Institutes: Institutions like IMS Proschool, CFI, and BSE Institute provide hands-on training.

6. Network with Financial Experts in Delhi

Networking provides insights into market trends, industry challenges, and emerging opportunities. Attend:

Financial Workshops: Events hosted by organizations like NASSCOM and TiE Delhi-NCR.

Industry Seminars: Forums discussing economic trends impacting Delhi businesses.

7. Stay Updated with Financial Trends in Delhi

Delhi's economic landscape is dynamic, with changing policies and emerging sectors. Follow:

News Portals: Platforms like Economic Times and Business Standard for local updates.

Market Reports: Research on industry growth patterns in Delhi.

8. Leverage Financial Modeling Software

In addition to Excel, explore software like:

Tableau: For data visualization and analytics.

Power BI: For advanced reporting and business intelligence.

QuickBooks and Tally: For financial management in Delhi's small to medium enterprises.

9. Develop Presentation Skills

Financial modeling isn't just about numbers; effective presentation ensures insights are actionable. Focus on:

Storytelling with Data: Use charts and graphs to convey insights clearly.

Clear Visuals: Avoid cluttered spreadsheets; highlight key metrics effectively.

10. Gain Certification in Financial Modeling

Obtaining a certification adds credibility and enhances career opportunities. Recommended certifications include:

**Financial Modeling and Valuation Analyst (FMVA)

Chartered Financial Analyst (CFA)

Certified Management Accountant (CMA)

Conclusion

Excelling in financial modeling for Delhi businesses requires technical expertise, industry knowledge, and strategic application. By mastering Excel, practicing real-world models, and staying informed about Delhi's economic trends, you can create powerful financial models that drive business growth and success.

0 notes

Text

The Key Benefits Of Studying Accounting

Benefits of Accountant Course | एक अकाउंटेंट कोर्स क्यों जरूरी है?

Introduction | परिचय

आज के डिजिटल दौर में Accounting Course बहुत ही महत्वपूर्ण हो गया है। चाहे आप एक बिजनेस ओनर हों या स्टूडेंट, अकाउंटिंग की समझ होना बेहद जरूरी है। यह कोर्स न केवल फाइनेंशियल मैनेजमेंट सिखाता है बल्कि करियर के लिए भी नए दरवाजे खोलता है। आइए जानते हैं इसके फायदे और क्यों यह कोर्स आपकी जिंदगी बदल सकता है।

Why Choose an Accountant Course? | अकाउंटेंट कोर्स क्यों करें?

1. Career Growth | करियर ग्रोथ के नए अवसर

आजकल हर कंपनी को Accountant या फाइनेंस प्रोफेशनल की जरूरत होती है। अगर आपके पास यह स्किल है, तो करियर में आगे बढ़ने के कई अवसर मिल सकते हैं।

· कंपनियां हमेशा finance experts की तलाश में रहती हैं।

· Chartered Accountant (CA) बनने का पहला स्टेप यही कोर्स हो सकता है।

· बैंकिंग, टैक्सेशन और ऑडिटिंग जैसे फील्ड्स में जॉब की संभावनाएं बढ़ जाती हैं।

2. Business के लिए फायदेमंद | बिजनेस मैनेजमेंट आसान

अगर आप एक Entrepreneur हैं, तो अकाउंटिंग स्किल्स आपके बिजनेस को संभालने में मदद करेंगे।

· बिजनेस का cash flow मैनेज करना आसान होगा।

· Taxation और GST की सही जानकारी से आप ज्यादा प्रॉफिट कमा सकते हैं।

· Expense Management और Financial Planning बेहतर हो सकेगी।

3. High Salary और जॉब सिक्योरिटी | अच्छी सैलरी और स्थिर करियर

इस फील्ड में नौकरी की कोई कमी नहीं है। एक स्किल्ड Accountant को हर कंपनी हाथों-हाथ लेती है।

· एक फ्रेशर 20,000 - 50,000 रुपये महीना कमा सकता है।

· एक्सपीरियंस बढ़ने पर लाखों में सैलरी जा सकती है।

· सरकारी और प्राइवेट सेक्टर, दोनों में डिमांड रहती है।

कौन-कौन से स्किल्स सीख सकते हैं? | Skills You Will Learn

1. Financial Management | वित्तीय प्रबंधन

आप सीखेंगे:

· Budgeting और Forecasting कैसे करें।

· Balance Sheet और Profit & Loss Statement बनाना।

· कैश फ्लो को सही से मैनेज करना।

2. Taxation और GST | टैक्सेशन और जीएसटी

भारत में टैक्स सिस्टम समझना जरूरी है। इस कोर्स में आपको सिखाया जाता है:

· Income Tax Filing कैसे करें।

· GST Calculation और रिटर्न फाइलिंग।

· टैक्स बचाने के सही तरीके।

3. Accounting Software | अकाउंटिंग सॉफ्टवेयर की नॉलेज

आजकल हर कंपनी Tally, QuickBooks, SAP जैसे सॉफ्टवेयर का उपयोग करती है।

· आप सीखेंगे Tally ERP 9 का इस्तेमाल।

· Excel for Accounting का सही उपयोग।

· Cloud-Based Accounting कैसे करें।

कौन कर सकता है यह कोर्स? | Who Can Do This Course?

· 12वीं पास स्टूडेंट्स, जो अकाउंटिंग में करियर बनाना चाहते हैं।

· Graduates, जो जॉब में एक्स्ट्रा स्किल जोड़ना चाहते हैं।

· Entrepreneurs और बिजनेस ओनर्स, जो अपने फाइनेंस को खुद संभालना चाहते हैं।

· वर्किंग प्रोफेशनल्स, जो प्रमोशन और हाई सैलरी पाना चाहते हैं।

अकाउंटिंग कोर्स के फायदे | Advantages of Learning Accounting

1. Multiple Career Options | कई करियर ऑप्शंस

Accounting Course करने के बाद आपको कई इंडस्ट्री में नौकरी के मौके मिलते हैं:

· Finance & Banking सेक्टर

· Taxation & Audit Firms

· Government Jobs

· Corporate Accounting

2. Work from Home & Freelancing | घर से काम करने का मौका

अगर आप Full-time Job नहीं करना चाहते तो आप Freelancing कर सकते हैं।

· GST Filing और Tax Consultancy से अच्छी इनकम हो सकती है।

· ऑनलाइन क्लाइंट्स के लिए Bookkeeping Services देना फायदेमंद है।

· पार्ट-टाइम अकाउंटिंग वर्क करके एक्स्ट्रा इनकम कर सकते हैं।

3. Better Money Management | खुद के फाइनेंस को समझें

इस कोर्स से आप अपने Personal Finance को भी सही तरीके से मैनेज करना सीखेंगे।

· Investments & Savings प्लानिंग आसान होगी।

· Debt Management और Loan Calculation समझ आएगा।

· Tax Saving Strategies सीखकर आप पैसे बचा सकते हैं।

कौन-कौन से सर्टिफिकेट मिल सकते हैं? | Certifications After Course

अकाउंटिंग कोर्स करने के बाद आप इन सर्टिफिकेट्स के लिए अप्लाई कर सकते हैं:

· Certified Public Accountant (CPA)

· Chartered Accountant (CA)

· Cost & Management Accountant (CMA)

· Tally ERP & GST Certification

Conclusion | निष्कर्ष

Accounting Course सिर्फ एक डिग्री नहीं, बल्कि एक लाइफ-चेंजिंग स्किल है।

· यह आपको High-Paying Job पाने में मदद कर सकता है।

· अगर आप Business Owner हैं, तो यह आपके बिजनेस को Financially Strong बना सकता है।

· Freelancers के लिए यह Work From Home का शानदार मौका है।

अगर आप करियर में ग्रोथ चाहते हैं, तो आज ही Accounting Course के बारे में सोचें। सही स्किल्स सीखें और अपनी फाइनेंशियल लाइफ को मजबूत बनाएं!

FAQs | अक्सर पूछे जाने वाले सवाल

Q1: क्या 12वीं के बाद अकाउंटिंग कोर्स किया जा सकता है? हाँ, 12वीं के बाद आप Basic Accounting Course कर सकते हैं और आगे बढ़ सकते हैं।

Q2: क्या इस कोर्स के बाद CA किया जा सकता है? हाँ, यह Chartered Accountancy का पहला स्टेप हो सकता है।

Q3: क्या अकाउंटिंग कोर्स से खुद का बिजनेस संभाल सकते हैं? बिल्कुल! यह आपको Finance & Taxation की समझ देता है जिससे बिजनेस को मैनेज करना आसान हो जाता है।

Q4: क्या यह कोर्स ऑनलाइन उपलब्ध है? हाँ, कई प्लेटफॉर्म्स जैसे Udemy, Coursera, ICAI पर ऑनलाइन अकाउंटिंग कोर्स उपलब्ध हैं।

E Accounting Course ,

Income Tax Course,

Diploma courses after 12th Commerce ,

Courses after b com ,

Diploma in financial accounting ,

SAP ficoTraining ,

Accounting and Taxation Course ,

GST Course ,

Computer Course in Delhi ,

Payroll Management Course,

Tally Course ,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course fee,

diploma in banking finance ,

Stock market trading Course in Delhi,

six months diploma course in accounting

Income Tax

Accounting

Tally

Career

0 notes

Text

What is a good career option for commerce students?

Commerce students have a wide range of career options to explore, depending on their interests, skills, and future aspirations. Here are some of the best career options after commerce:

1. Chartered Accountant (CA)

One of the most prestigious career paths for commerce students.

Requires passing the CA Foundation, Intermediate, and Final exams.

Offers lucrative job opportunities in auditing, taxation, and finance.

2. Company Secretary (CS)

Focuses on corporate laws, compliance, and governance.

Requires clearing the CS Foundation, Executive, and Professional exams.

CS professionals work with top companies and MNCs.

3. Bachelor of Commerce (B.Com) & B.Com (Hons)

A versatile undergraduate degree that opens doors to finance, accounting, and business roles.

Can be followed by M.Com, MBA, CA, or CFA.

4. Bachelor of Business Administration (BBA)

Ideal for students interested in business, management, and entrepreneurship.

Specializations include Finance, Marketing, HR, and International Business.

Can be followed by an MBA for better career prospects.

5. Cost and Management Accountant (CMA)

Focuses on cost accounting, financial management, and strategic planning.

Recognized globally, offering excellent career growth.

6. Certified Financial Planner (CFP)

Best for students interested in wealth management and financial planning.

Helps individuals and businesses with investment strategies.

7. Banking & Finance Careers

Includes roles in investment banking, retail banking, and financial services.

Requires degrees like B.Com, BBA, MBA (Finance), or certifications like CFA and FRM.

8. Digital Marketing

A trending field with high demand for professionals in SEO, PPC, content marketing, and social media.

Can be pursued through certifications and online courses.

9. Stock Market & Investment Analyst

Requires knowledge of stock markets, trading, and financial analysis.

Certifications like CFA, NISM, and CFP add value.

10. Hotel Management

Ideal for students interested in hospitality, travel, and customer service.

Requires a degree in Hotel Management (BHM).

11. Law (BA LLB or BBA LLB)

A great option for students interested in corporate law, taxation, or criminal law.

Offers careers as a lawyer, legal advisor, or corporate consultant.

12. Entrepreneurship & Startups

Commerce students can start their own business or join family businesses.

Requires business acumen, financial knowledge, and innovation skills.

SAGE University Bhopal is one of the best private university in Bhopal, MP. SAGE University Bhopal offers a diverse range of B.Com (Hons/Research) programs with specialized tracks to help commerce students build expertise in high-demand fields. Here’s a breakdown of the programs and their career prospects:

B.Com (Hons/Research) Specializations at Sage University Bhopal

1. B.Com (Hons/Research) Banking & Finance

Focuses on financial management, banking laws, risk assessment, and investment strategies.

Career Options: Investment Banker, Financial Analyst, Bank Manager, Credit Analyst.

2. B.Com (Hons/Research) Computers

A blend of commerce and IT, covering accounting software, data analytics, and financial technology (FinTech).

Career Options: Business Analyst, Financial Data Analyst, ERP Consultant, IT Auditor.

3. B.Com (Hons/Research) International Business & Finance

Covers global trade, foreign exchange management, and international finance regulations.

Career Options: Foreign Trade Analyst, International Finance Manager, Export-Import Manager.

4. B.Com (Hons/Research) Accounting & Auditing

Focuses on financial reporting, taxation laws, and auditing principles.

Career Options: Chartered Accountant (CA), Internal Auditor, Tax Consultant, Financial Controller.

5. B.Com (Hons/Research) Taxation

Covers direct and indirect taxes, GST, corporate taxation, and tax planning.

Career Options: Tax Advisor, Income Tax Officer, GST Consultant, Financial Planner.

6. B.Com (Hons/Research) Banking & Finance in Collaboration with ImaginXP & CollegeDekho

An industry-aligned course focusing on practical banking skills and financial planning.

Career Options: Corporate Banker, Financial Consultant, Loan Officer, Risk Manager.

7. B.Com (International Business & Finance) in Collaboration with ImaginXP & CollegeDekho

Equips students with skills in global markets, financial regulations, and cross-border transactions.

Career Options: Forex Trader, International Business Consultant, Financial Risk Manager.

Why Choose SAGE University for B.Com (Hons/Research)?

✅ Industry-oriented curriculum with practical exposure. ✅ Collaborations with ImaginXP & CollegeDekho for specialized training. ✅ Strong placement assistance in banking, finance, taxation, and auditing. ✅ Research opportunities for students interested in academic and policy-making roles.