#company registration in bangalore

Text

Essential Documents Required for Company Registration in Bangalore

Easy Online Process for Your Company Registration in Bangalore

Introduction:

Starting a business in Bangalore, India, offers numerous opportunities in one of the country's most dynamic and vibrant economic hubs. However, navigating the Company Registration in Bangalore process requires careful planning and adherence to legal requirements outlined by the Ministry of Corporate Affairs (MCA). Whether establishing a tech startup, a traditional manufacturing company, or a service-oriented business, understanding the steps involved in company registration is crucial for a smooth and successful launch. In this guide, we'll outline the essential procedures for registering a company in Bangalore, providing you with the knowledge necessary to embark on your entrepreneurial journey.

Company Registration in Bangalore, India, follows the standard procedures the Ministry of Corporate Affairs (MCA) outlines. Here's a general overview of the process:

1. Choose a Business Structure: Decide on the type of business entity you want to Company Registration in Bangalore. Options include private limited company, limited liability partnership (LLP), and one-person company (OPC).

2. Name Approval: Choose a unique name for your company and check its availability on the MCA portal. Once you've finalised a name, apply for name approval.

3. Digital Signature Certificate (DSC): Obtain Digital Signature Certificates for the company's directors and shareholders. The registration documents must be filed online.

4. Director Identification Number (DIN): Each director must obtain a DIN by filing Form DIR-3. It is a unique identification number required for company registration.

5. Prepare Documents: Prepare the necessary documents, including the Memorandum of Association (MOA), Articles of Association (AOA), and other incorporation documents.

6. File Incorporation Documents: Once you have the DSC and DIN, file the incorporation documents (e.g., SPICe forms) and the required fees on the MCA portal.

7. Verification and Approval: If everything is in order, the Registrar of Companies (ROC) will verify the documents and issue the Certificate of Incorporation.

8. PAN and TAN: Apply for the company's Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

9. GST Registration: If your company's turnover exceeds the GST threshold, you must register for Goods and Services Tax (GST) with the GSTN.

10. Post-Incorporation Compliance: After incorporation, ensure compliance with various statutory requirements such as maintaining books of accounts, holding board meetings, and filing annual returns.

Conclusion:

Company registration in Bangalore is a significant step towards realising your entrepreneurial ambitions at one of India's foremost business destinations. By following the outlined procedures and seeking professional guidance where necessary, you can ensure compliance with legal requirements and set a solid foundation for your business. Remember that thorough planning, attention to detail, and commitment to compliance are crucial to successfully navigating the complexities of company registration. With determination and perseverance, you can transform your business ideas into reality and contribute to Bangalore's thriving entrepreneurial ecosystem.

0 notes

Text

"Company Registration in Bangalore: A Comprehensive Guide

If you're planning to start a company in Bangalore, understanding the company types, registration process, and benefits is crucial. Registering a company as a private limited, LLP, or One Person Company can provide various advantages, such as limited liability, access to government initiatives, and transparency. Choosing the right business type is essential before starting the registration process.

Benefits of company registration in Bangalore include tax savings, enhanced recognition, easier access to funding, and the ability to attract talented employees. The basic documents required for registration include ID proof, address proof, registered office address, PAN card, digital signatures of directors, and director identification number.

0 notes

Photo

(via Register Company Bangalore: How to Register a Firm? - Legal Pillers)

#Company Registration#Online Company Registration#Company Registration in Bangalore#Online Company Registration in Bangalore

0 notes

Photo

Startup Company Registration in Bangalore

Startup company registration in Bangalore, the vibrant startup hub of India, is essential for entrepreneurs looking to establish their businesses. Legal Pillers provides expert assistance and support throughout the registration process, ensuring compliance with all legal requirements. For more details visit their website.

#startup company registration in bangalore#private limited company registration in bangalore#company registration in bangalore#register a company in bangalore#how to register a company in bangalore#Register Company Bangalore

1 note

·

View note

Text

A Beginner’s Guide to Company Registration in Ahmedabad, Bangalore, and Chennai

A new business's launch is both an exciting and difficult task. One of the most important steps in this process is registering your company. If you plan to start a business in Ahmedabad, Bangalore, or Chennai, you may wonder how to register your company.

This beginner's guide will walk you through the company registration in Ahmedabad, Bangalore, or Chennai.

Company Registration in Ahmedabad

Ahmedabad is the largest city in Gujarat and a hub for entrepreneurship. Company registration in Ahmedabad is straightforward and can be completed in simple steps. Here's what you need to do:

Get a Digital Signature Certificate (DSC): A DSC is a digital version of your signature needed for online transactions. You can obtain a DSC from a certified agency.

Obtain a Director Identification Number (DIN): A DIN is a unique director identification number. You can obtain a DIN by applying at the Ministry of Corporate Affairs.

Register a company name: The Ministry of Corporate Affairs has an online portal to register your company name.

File incorporation documents: You must file incorporation documents with the Registrar of Companies. These include the Memorandum of Association (MOA) and the Articles of Association (AOA).

Get a Permanent Account Number (PAN): You can get a PAN by applying to the Income Tax Department.

2. Company Registration in Bangalore

Bangalore, also known as the Silicon Valley of India, is a hub for technology and innovation. Company registration in Bangalore is similar to that in Ahmedabad. Here's what you need to do:

Get a Digital Signature Certificate (DSC): You can get a DSC from an agency approved by the government.

Get a Director Identification Number (DIN): You can get a DIN by applying to the Ministry of Corporate Affairs.

Register a company name: The Ministry of Corporate Affairs has an online portal to register your company name.

File incorporation documents: You must file incorporation documents with the Registrar of Companies. These include the Memorandum of Association (MOA) and the Articles of Association (AOA).

Get a Permanent Account Number (PAN): You can get a PAN by applying to the Income Tax Department.

3. Company Registration in Chennai

Chennai, the capital of Tamil Nadu, is a major industrial and commercial center in South India. Company registration in Chennai is similar to that in Ahmedabad and Bangalore. Here's what you need to do:

Get a Digital Signature Certificate (DSC): You can get a DSC from an agency approved by the government.

Get a Director Identification Number (DIN): You can get a DIN by applying to the Ministry of Corporate Affairs.

Register a company name: The Ministry of Corporate Affairs has an online portal to register your company name.

File incorporation documents: You must file incorporation documents with the Registrar of Companies. These include the Memorandum of Association (MOA) and the Articles of Association (AOA).

Get a Permanent Account Number (PAN): You can get a PAN by applying to the Income Tax Department.

Who Should You Contact Regarding Company Registration?

Company registration in Bangalore, Ahmedabad, or Chennai is a reasonably easy process that can complete in a few easy steps. The purpose of this beginner's guide is to guide you through the steps of legally registering your business. Alonika has a team of experts who can help you with hassle-free company registration in your city if you have any additional concerns or issues.

#company registration in Ahmedabad#Company registration in Bangalore#Company registration in Chennai#Company registration#ahmedabad#Bangalore#Chennai

0 notes

Text

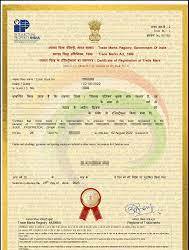

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

Top 10 Benefits of Registering Your Business as a Private Company

Starting a business is a significant endeavor, and one of the crucial decisions you'll make is how to structure it. Private Company Registration comes with a multitude of advantages that can help pave the way for growth and stability.

Here are the top 10 benefits of making this choice:

1. Limited Liability Protection

Limited liability protection is a fundamental benefit for shareholders in a private company. It ensures that their personal assets are safeguarded against the company's financial woes and legal troubles. If the company incurs debt or faces a lawsuit, shareholders are only at risk of losing the amount they have invested in shares. This protection provides significant peace of mind, allowing investors to support the company without the fear of personal financial ruin. It also encourages entrepreneurship, as individuals are more likely to invest in and start businesses when their personal wealth is not on the line. Overall, limited liability promotes economic growth by facilitating investment and risk-taking in the corporate sector.

2. Separate Legal Entity

A private company, as a separate legal entity, operates independently of its owners. This separation means the company can own property, enter into contracts, and manage assets under its name, not the owners'. Consequently, the company can also incur debts and financial obligations distinct from the personal finances of its shareholders or directors. One significant advantage of this legal structure is the protection it affords to personal assets; owners are generally not personally liable for the company's debts or legal issues. This protection is crucial for encouraging entrepreneurship and investment, as it mitigates personal financial risk. Moreover, as a separate entity, the company can sue or be sued in its name, which provides operational clarity and legal consistency. This distinction simplifies business transactions and enhances credibility with customers, suppliers, and financial institutions. Overall, the separate legal entity status of a private company fosters a stable environment for business growth and economic activity.

3. Enhanced Credibility and Trust

Registering as a private company often enhances your business's credibility. Clients, suppliers, and investors may perceive your business as more professional and reliable, which can lead to more opportunities and partnerships.

4. Tax Advantages

Private companies often benefit from favorable tax rates and deductions not available to sole proprietors or partnerships. These can include deductions on business expenses, lower corporate tax rates, and potential tax deferrals, making financial management more efficient.

5. Ease of Raising Capital

Private companies can raise capital more easily than unregistered businesses. They can issue shares, attract investors, and secure loans with better terms, providing a solid foundation for expansion and growth.

6. Continuity and Perpetual Succession

Unlike sole proprietorships that may dissolve upon the owner's death or decision to close, a private company enjoys perpetual succession. This means the company can continue to operate despite changes in ownership or management, ensuring long-term stability.

7. Ownership and Control

Private companies can be owned and controlled by a small group of people, allowing for more direct oversight and decision-making. This setup often leads to more agile and cohesive management, enabling quicker responses to market changes.

8. Brand Protection

Registering your business name as a private company helps protect it legally, preventing others from using the same or a similar name. This brand protection is crucial for building and maintaining a unique identity in the market.

9. Employee Benefits and Incentives

Private companies can offer various employee benefits and incentives, such as stock options and retirement plans, which can attract and retain top talent. These benefits not only improve employee satisfaction but also enhance productivity and loyalty.

10. Succession Planning

A private company structure allows for more straightforward succession planning. Ownership can be transferred smoothly through the sale or inheritance of shares, ensuring the continuity of the business across generations.

Conclusion

Private Company Registration in Bangalore provides numerous benefits that can significantly enhance its operations, growth potential, and longevity. From liability protection and tax advantages to enhanced credibility and continuity, the advantages make this an attractive option for many entrepreneurs. Consider these benefits carefully when deciding on the best structure for your business, and consult with legal and financial advisors to ensure it aligns with your long-term goals.

0 notes

Text

Revolutionize Your Document Signing with IDSign’s Digital Signature Solutions

Digital Signature Certificate (DSC) Online in Hyderabad, Bangalore, India. Offers online DSC application, Aadhaar & PAN based options. Explore DSC signer service from the best digital signature company.

#sign pdf online in bangalore#digital signature certificate services in bangalore#digital signature providers in bangalore#digital signature agency in bangalore#online digital signature certificate providers in bangalore#digital signature certificate online in bangalore#dsc signer service in bangalore#digital signature registration services in bangalore#buy online digital signature certificate in bangalore#apply digital signature certificate online in bangalore#best digital signature company in bangalore#digital signature certificate consultants in bangalore

0 notes

Text

Register your company in Bangalore with a virtual office from Maksim Consulting. Professional services to streamline your business setup. Call us.

0 notes

Text

Top Benefits of Registering Your Company in Bangalore: Why It’s the Ideal Business Hub

A Comprehensive Guide to Company Registration in Bangalore

Bangalore, often referred to as the Silicon Valley of India, is a hub for startups and established companies alike. The city’s vibrant ecosystem makes it an ideal location for entrepreneurs to launch their ventures. If you’re considering Company Registration in Bangalore, this guide will walk you through the process, benefits, and important considerations.

Why Register a Company in Bangalore?

Bangalore is not just a tech hub; it's also a thriving business environment with numerous advantages:

Access to Talent: Bangalore is home to some of the best educational institutions in India, providing a steady supply of skilled professionals.

Robust Infrastructure: The city offers excellent infrastructure, including coworking spaces, incubators, and accelerators, making it easier to start and grow a business.

Supportive Ecosystem: With a high concentration of investors, mentors, and a strong network of professionals, Bangalore offers ample support for businesses at every stage.

Innovation and Technology: The city is a hotbed for innovation, especially in technology, biotech, and IT services.

Government Initiatives: The Karnataka government has introduced several initiatives to support startups and SMEs, making it easier to do business in the state.

Types of Companies You Can Register

Before registering your company, it’s essential to choose the right type of entity based on your business goals. The most common types of companies in Bangalore include:

Private Limited Company: This type of company is ideal for startups and businesses looking to raise capital. It requires at least two directors and two shareholders.

One-Person Company (OPC): Suitable for solo entrepreneurs who want to enjoy the benefits of a company structure without the need for multiple directors or shareholders.

Limited Liability Partnership (LLP): This type of partnership combines the benefits of a partnership and a company, offering limited liability to partners.

Public Limited Company: Suitable for large businesses looking to raise funds from the public. It requires at least three directors and seven shareholders.

Sole Proprietorship: A simple business structure where the owner and the business are the same entity. It is easy to set up but offers no limited liability protection.

Steps to Register a Company in Bangalore

Here’s a step-by-step guide to registering your company in Bangalore:

Obtain a Digital Signature Certificate (DSC): The first step in the registration process is to obtain a DSC for the proposed directors of the company. It is essential to file electronic documents with the Ministry of Corporate Affairs (MCA).

Obtain Director Identification Number (DIN): The next step is to apply for a DIN for all the company's directors by filing Form DIR-3.

Name Reservation: You need to choose a unique name for your company and get it approved by the MCA. You can do this by filing the SPICe+ form (Simplified Proforma for Incorporating Company Electronically Plus).

File Incorporation Documents: Once the name is approved, you must file the incorporation documents, including the Memorandum of Association (MOA) and Articles of Association (AOA), along with the SPICe+ form.

Obtain Certificate of Incorporation: After the MCA verifies your documents, they will issue the Certificate of Incorporation. This certificate serves as proof that your company is now legally registered.

Apply for PAN and TAN: You will also need to apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for your company.

Open a Bank Account: Once you have the Certificate of Incorporation, you can open a bank account in the company’s name.

Register for GST: If your company’s turnover exceeds the threshold limit, you need to register for the Goods and Services Tax (GST).

Documents Required for Company Registration

The following documents are typically required for registering a company in Bangalore:

Identity Proof: PAN card of all directors and shareholders.

Address Proof: Aadhaar card, voter ID, or passport of all directors and shareholders.

Registered Office Proof: Rental agreement or property ownership documents, along with a utility bill.

Photographs: Passport-sized photographs of all directors and shareholders.

NOC from Property Owner: If the registered office is a rented property, a No Objection Certificate (NOC) from the property owner is required.

Post-Registration Compliance

After registering your company, there are several post-registration compliances you need to adhere to:

Annual Filing: Companies are required to file annual returns with the Registrar of Companies (RoC).

Accounting Records: Maintain proper accounting records and get your financial statements audited.

Tax Filings: Ensure timely filing of Income Tax returns, GST returns, and other applicable taxes.

Compliance with Labour Laws: If you have employees, ensure compliance with labour laws, including PF and ESI registration.

Board Meetings: Conduct regular board meetings and maintain minutes of the meetings.

Conclusion

Registering a company in Bangalore is a straightforward process if you follow the necessary steps and comply with the legal requirements. The city offers a conducive environment for businesses to thrive, with access to talent, infrastructure, and a supportive ecosystem. By choosing the proper business structure and adhering to regulatory requirements, you can set the foundation for a successful business venture in Bangalore.

0 notes

Text

Company Registration in Bangalore: A Comprehensive Guide

If you're planning to start a company in Bangalore, understanding the company types, registration process, and benefits is crucial. Registering a company as a private limited, LLP, or One Person Company can provide various advantages, such as limited liability, access to government initiatives, and transparency. Choosing the right business type is essential before starting the registration process.

Benefits of company registration in Bangalore include tax savings, enhanced recognition, easier access to funding, and the ability to attract talented employees. The basic documents required for registration include ID proof, address proof, registered office address, PAN card, digital signatures of directors, and director identification number.

0 notes

Text

Specialized Digital Signature Services in Hyderabad

In today's digital era, securing online transactions and ensuring document integrity is crucial. IDSign offers a comprehensive range of digital signature certificates (DSCs) tailored to various needs, from individuals to large organizations. Here's a user friendly guide to understanding digital signature certificate services in hyderabad, Bangalore and India by IDSign

What is a Digital Signature Certificate (DSC)?

A secure digital key that is provided by a certifying authority to verify and authenticate the identity of the certificate holder is known as a Digital Signature Certificate. DSCs are used to sign documents electronically, providing the same legal status as a handwritten signature under Indian law. They ensure the authenticity and integrity of the signed documents. Our Company, a top digital signature agency in Hyderabad,Bangalore and India ensures high security and legal compliance for its DSCs.

Types of DSCs

IDSign provides different types of digital signature certificates to cater to various requirements, including digital signature certificate services in Hyderabad

Signing DSC: Used solely for signing documents, ensuring authenticity and integrity.

Encryption DSC: Used to encrypt documents, safeguarding the confidentiality of sensitive information.

Sign & Encrypt DSC: A versatile option that can be used for both signing and encrypting documents, ideal for users needing comprehensive security.

Validity and Classes of DSCs

DSCs can be valid for up to two years, with the validity period regulated by law. IDSign offers Class 3 certificates, which are suitable for environments with high risks, such as high value transactions or areas with high levels of fraud risk. These certificates are available through online digital signature certificate providers in Hyderabad, making it convenient to obtain a DSC online.

Who Needs a DSC?

Digital signature certificates are essential for various users:

Individuals: For personal use, without the organization's name.

Organizations: For businesses wanting their organization's name included in the certificate.

Foreign Individuals: For individuals from outside India who need a DSC for their use.

Foreign Organizations: For businesses registered outside India.

Bulk Signers: For organizations needing to sign large volumes of documents. We provide the Digital signature registration services in Hyderabad cater to all these needs.

Specialized Services in Hyderabad

IDSign offers specialized DSC services in Hyderabad, catering to the unique needs of businesses and individuals in this tech hub. As one of the leading digital signature providers in Hyderabad, our company ensures users can leverage the best digital signing technology available. The company is recognized as the best digital signature company in Hyderabad for its comprehensive and reliable services.

Key Features of IDSign DSC Services

Comprehensive Solutions: we offer a wide range of DSC services to meet diverse needs, including digital signature certificates, eSign services, and time-stamping.

User-Friendly Platform: The platform is designed for ease of use, ensuring a seamless experience for users looking to buy online digital signature certificates in Hyderabad.

Robust Security: Advanced security protocols protect your documents and ensure their integrity.

Legal Compliance: IDSign's services comply with Indian regulatory standards, making your digital signatures legally binding.

Benefits of Using IDSign DSCs

Efficiency: Streamlines workflows by eliminating the need for paper-based processes.

Security: Ensures the confidentiality, authenticity, and integrity of signed documents.

Legal Validity: Provides legal recognition to electronic documents, making them enforceable in a court of law.

Convenience: Allows signing of documents from anywhere, at any time, enhancing flexibility and productivity. With Our Company, you can easily apply digital signature certificate online in Hyderabad.

How to Obtain a DSC from IDSign in Hyderabad

Choose the Type of Certificate: Select the DSC that fits your needs—signing, encryption, or both.

Submit Required Documents: Provide necessary identification documents, including Aadhaar and PAN, as per the verification guidelines.

Complete the Application: Fill out the application form available on IDSign's website for online DSC application in Hyderabad.

Verification Process: we will verify your documents and process your application.

Receive Your DSC: Once approved, you will receive your digital signature certificate, ready for use. Our Company offers both Aadhaar based digital signatures and PAN based digital signatures in Hyderabad.

Conclusion

In the digital age, ensuring secure and efficient online transactions is vital.Our digital signature certificate services in Hyderabad provide a reliable solution for businesses and individuals alike. Whether you need to buy online digital signature certificate, apply for a digital signature certificate online in Hyderabad, or need digital signature registration services in Hyderabad, Our Company has you covered. With options for Aadhaar based digital signatures and PAN based digital signatures, IDSign caters to all your digital signing needs.

For more detailed information please contact.www.idsign.app

#digital signature certificate services in bangalore#digital signature providers in bangalore#digital signature agency in bangalore#online digital signature certificate providers in bangalore#digital signature certificate online in bangalore#dsc signer service in bangalore#digital signature registration services in bangalore#buy online digital signature certificate in bangalore#apply digital signature certificate online in bangalore#best digital signature company in bangalore#digital signature certificate consultants in bangalore#online dsc application in bangalore#aadhaar based digital signature in bangalore#pan based digital signature in bangalore#digital signature certificate services in Hyderabad#digital signature providers in Hyderabad#digital signature agency in Hyderabad#online digital signature certificate providers in Hyderabad#digital signature certificate online in Hyderabad#dsc signer service in Hyderabad#digital signature registration services in Hyderabad#buy online digital signature certificate in Hyderabad#apply digital signature certificate online in Hyderabad

0 notes

Photo

Company Registration in Bangalore

A suitable company registration type will help you to operate your business effectively. You need a professional who will help you with Company Registration in Bangalore and Legal Pillers is the best ca firm you can trust to the fullest. To know more, visit their website.

#Company Registration in Bangalore#Company Registration#Company Registration Bangalore#CA Services#Online CA#Company Registration in India#Company Registration Online

1 note

·

View note

Text

How to do GST registration for a company?

#gst registration in coimbatore#company registration in chennai#private limited company registration in bangalore

0 notes