#cp504

Text

Navigating an IRS Intent to Seize Property: How Lexington Tax Group Can Help

Are you facing the daunting prospect of an IRS intent to seize your property? The situation may seem overwhelming, but you're not alone. Lexington Tax Group understands the stress and uncertainty that comes with receiving such notices, and we're here to offer expert guidance and support.

Understanding Your Options

When you receive an intent to seize property from the IRS, it's crucial to act swiftly and strategically. Ignoring the notice or attempting to handle the situation alone can lead to severe consequences. However, with the right assistance, you can explore various options to protect your assets and resolve the issue effectively.

How Lexington Tax Group Can Assist You

At Lexington Tax Group, we specialize in helping individuals navigate complex tax matters, including those involving property seizure notices. Our team of experienced professionals is dedicated to providing personalized solutions tailored to your specific circumstances.

Here's how we can help:

Expert Guidance: Our knowledgeable experts will review your case thoroughly, ensuring that you understand your rights and options. We'll guide you through the process step by step, empowering you to make informed decisions.

Strategic Planning: We'll work closely with you to develop a strategic plan to address the IRS intent to seize property. Whether it involves negotiating with the IRS, exploring alternative resolutions, or representing you in hearings, we'll leverage our expertise to protect your interests.

Asset Protection: Protecting your assets is our top priority. We'll explore every available avenue to safeguard your property and financial stability, helping you mitigate the impact of the IRS's actions.

Take Action Today

Don't wait until it's too late. Contact Lexington Tax Group now to take proactive steps toward resolving your IRS property seizure notice. Our team is ready to provide the personalized assistance you need to navigate this challenging situation successfully.

Reach out to us at www.LexingtonTaxGroup.com or call us at 800-328-8289 to schedule a consultation. Let us help you protect what matters most.

#assetprotection#irsgarnishment#cp504#intenttoseize#tax debt#irs lawyer#tax debt attorney#irs audit#irs#i owe irs

0 notes

Text

Got an IRS Notice... What's Next?

Receiving an IRS notice can be unsettling, but it's crucial to remain calm and address it promptly. These notices typically outline issues such as tax owed, refunds adjustments , or requests for additional information. Each notice contains specific instructions tailored to the recipient's situation, so careful attention to detail is essential.

Immediate Actions

Upon receiving an IRS notice, it's recommended to take the following steps promptly:

Read Carefully: Begin by thoroughly reading the notice to understand the reason for its issuance and what action is required from your end.

Assess the Situation: Evaluate the accuracy of the information provided in the notice against your records. This may involve reviewing past tax returns, payments, or deductions.

Respond Timely: Notices often have deadlines for response. Missing these deadlines could lead to penalties or further action by the IRS.

Seek Assistance: If the notice is unclear or you need help understanding it, consider reaching out to a tax professional or the IRS directly. Many notices include contact information for inquiries.

Common Types of Notices

IRS notices can vary widely in content and purpose. Some common types include:

CP2000: Proposed changes to your tax return that require a response.

CP501/CP503/CP504: Notices regarding unpaid taxes and impending collection actions.

CP22A/CP22E: Adjustments made to your refund amount.

Final Recommendations

Addressing IRS notices promptly and accurately, taxpayers may find valuable assistance from Certified Public Accountants (CPAs). Beyond addressing the current notice, CPAs can help devise strategies to minimize future tax liabilities and maximize deductions, promoting financial health and compliance.

By leveraging the expertise of a CPA, taxpayers can navigate IRS notices with confidence and ensure their financial affairs remain in good standing. Remember to act promptly, seek professional advice when needed, and maintain organized records for efficient resolution of IRS matters.

Stay informed and proactive in managing your tax responsibilities to achieve peace of mind and financial security.

For more information and guidance, contact Sai CPA Services.

Website: saicpaservices.com

Facebook: AjayKCPA

Instagram: sai_cpa_services

Twitter: SaiCPA

LinkedIn: saicpaservices

WhatsApp: Sai CPA Services

Phone: (908) 380-6876

Locations:

1 Auer Ct., East Brunswick, NJ 08816

5 Villa Farms Cir., Monroe Twp, NJ 08831

#IRSNotice #TaxAdvice #SaiCPAServices #TaxCompliance #IRSHelp #FinancialSecurity #TaxResolution #StayCalmActPromptly

#IRSNotice#TaxAdvice#SaiCPAServices#TaxCompliance#IRSHelp#FinancialSecurity#TaxResolution#StayCalmActPromptly

0 notes

Text

The 3 Kinds of IRS Letters You’ll Get and How to Respond

Regarding taxes, the IRS is known for sending letters to taxpayers for various reasons. These letters can be intimidating and confusing, but it's essential to understand what they mean and how to respond to them, especially if you have a chance at hiring a tax relief service. You may receive three IRS letters: CP501/CP503, CP504, and LT11. Each one serves a different purpose, and the actions you take in response to them will differ significantly.

The CP501 or CP503

These letters are typically sent when you have a balance due on your tax return. The CP501 is sent as a reminder to pay your taxes, while the CP503 is sent as a final notice before the IRS takes action to collect the debt. If you receive a CP501 or CP503, you should act immediately. Ignoring these letters can lead to more severe consequences, such as wage garnishment or the seizure of assets.

To respond to a CP501 or CP503, you should first review your tax return and confirm that the amount owed is accurate. If you believe there is an error, you can dispute it with the IRS. If the amount owed is correct, you should pay it immediately. The IRS offers various payment options, including payment plans and online payments. You should contact the IRS to discuss your options if you cannot pay the full amount owed. They may be able to offer a payment plan or other arrangements to help you pay the debt over time.

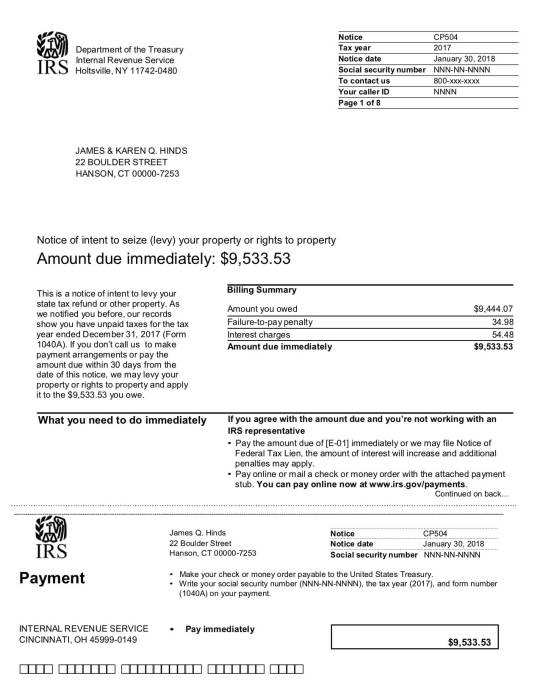

The CP504

This letter is sent when you have a balance due, and the IRS intends to levy your assets to collect the debt. The CP504 is a final notice before the IRS takes action, so acting quickly is essential. If you receive a CP504, you should immediately review your tax return and ensure that the amount owed is accurate. If there is an error, you can dispute it with the IRS. If the amount owed is correct, you should pay it immediately.

To respond to a CP504, you should contact the IRS immediately. You may be able to negotiate a payment plan or other arrangements to avoid asset seizure, like enlisting the help of tax relief services. It's essential to communicate with the IRS and make arrangements as soon as possible to avoid further consequences. If you ignore the CP504, the IRS may seize your assets, including bank accounts and property.

The LT11

This letter is sent when the IRS has not received your tax return and has no record that you filed one. The LT11 is a notice that the IRS intends to assess a tax liability based on their estimate of your income. If you receive an LT11, you should act quickly to avoid additional penalties and interest.

To respond to an LT11, you should review your records and ensure you have not filed your tax return. If you have filed your tax return, you should provide proof of filing to the IRS. You should do so if you have not filed your tax return as soon as possible. Filing your tax return will help avoid additional penalties and interest. Communicating with the IRS and promptly providing any necessary information to avoid further consequences is essential.

Get Advanced Tax Relief Today

Each letter serves a different purpose, and your response to them will differ significantly. Act quickly, communicate with the IRS, and arrange to pay any amounts owed are essential. Ignoring these letters can lead to more severe consequences, such as asset seizure or wage garnishment. By understanding these letters and responding promptly, you can avoid additional penalties and interest and resolve any tax liabilities with the IRS.

Our tax attorneys and Enrolled Agent (EA) team have a combined experience of 30 years and have successfully settled over 100 million dollars of tax debt. We comprehend that managing tax problems and filing back taxes can be distressing and daunting, so we are here to help. Advance Tax Relief has earned a reputation as one of the top tax resolution firms in Houston, Texas. Call us for tax relief services now!

0 notes

Link

If the IRS has not yet received payment of your unpaid balance, you will receive Notice CP504 (also known as the Final Notice), which details your outstanding debt along with […]

0 notes

Link

The IRS CP504 notice is a serious threat that you should not take lightly. Before you know how to respond to CP504, it is important for you to know about it in detail lest you end up messing up your matter. Remember that ignoring it or procrastinating it may cost you dearly. So, do not take such a risk.

0 notes

Link

FLAT FEE TAX RELIEF 1-866-747-7435

Coast to Coast - IRS Help

IRS Tax Relief - Tax Debt Help

An IRS CP504 notice allows the IRS to seize your paycheck, bank account, and real property.

#IRSlevy #taxlevy #IRSgarnishment #IRSwagelevy #taxlein #IRShelp #taxdebthelp #taxdebtrelief #americantaxrelief #federaltaxhelp #IRStaxrelief #IRSproblem #IRSproblems

0 notes

Text

iRS WEEKEND BLOG WITH ONLY THE NEWS FIT TO PRINT

Now for the GOOD NEWS, the IRS IS NOT GOING TO LEVY YOUR BANK ACCOUNT, GARNISH YOUR WAGES OR TAKE YOUR FIRST BORN.

Now for the bad news, if you ignore the IRS, they could levy your bank account or garnish your wages, they still don’t want your first born.

The reason I have a job is because many of you reading this blog are ignoring those IRS notice telling you about the CP504 Notice “ NOTICE OF INTENT TO LEVY” your assets.

For the Record, generally it is easier to deal with the IRS before they take ENFORCED. OLLECTION ACTION, such as a bank levy or wage garnishment.

Your have a wage garnishment from the IRS, what do you do?

If you come to see me I will confirm that you are current with your tax return filings. I will confirm if you agree with the amounts the IRS says you owe. I will confirm how much you owe the IRS.

Depending on you Facts and Circumstances, I will make some recommendations for resolving your Tax Problem and I will Provide some Tax Relief.

I will get the IRS to Fax a release to your payroll department and I will obtain an installment agreement (payment plan) or maybe get your account into a Currently Not Collectible status, which means the IRS will release the wage garnishment and temporarily suspended any enforced collection action.

If for some reason the IRS will not release the wage garnishment, I will contact a Collection supervisor or file a collection due process appeal or contact the Taxpayer Advocate Service to get the wage garnishment stopped or file an Appeal.

Now that you have called the rest, it’s time to call the best

David Ramirez, EA, JD, MST, USTCP, NATPI Fellow

#accounting#tax relief#taxprofessional#branding#business#tax#taxreduction#tax help#taxpayers#tax expert#taxes

0 notes

Text

I just received an IRS CP504 (Notice of Intent to Levy)

Hello Reddit, I just got a letter in the mail from the IRS for back taxes for 2017 with the code CP504 worth about $18,613.38. That year, I had a min wage job to support myself through college plus an e-commerce venture I started with a college buddy. I made about 3-4K in taxable income from that job. For the e-commerce venture, We used the platform Shopify and if you guys are aware, you have to put in your SS which I ended up putting mine before producing any sales. So, my SS was the one on file. We also filed an LLC in the state of Delaware with both of our names on it (I'm from California). My partner is in the process of sending a P&L sheet for that entire year.

For the E-commerce venture, I got bought out in March of 2017. From Jan to March that venture produced 31K in gross sales, I'd have to look for the actual profit. At most, I'd say maybe 60-65% of that was profit. I got bought out for about 7K in March due to me wanting to focus on school and it was taking a lot of my time. My partner ended up doing 56K for the year including the 31K from Jan - to March of 2017. Also, I do have in writing that I was bought out in March of 2017 (I have this in legal writing). I'm assuming the IRS assumed that I still owned the business throughout the year since I didn't formally do anything to state I didn't, on that part in which I do take myself to blame for.

I don't even think I had over 10K in liquid cash at any point in 2017.

I'm sure I do owe some taxes for that year but it shouldn't even come close to 18K.

I've been researching my options so far and I'm going to call the IRS first thing in the morning and my deadline is about a month away so I have some time to figure this out. Can anyone recommend resources we could use or next steps to take?

Submitted by Smart-Curve-3222

CLICK HERE To Find Out If Your Credit Score Is Good Or Bad

0 notes

Text

Have you received CP504 Letter from IRS?

If you have received CP504 letter from IRS, this means that you have an unpaid amount. You have to pay that immediately otherwise IRS can seize your state income tax refund. This notice consists of due date, the amount due, and payment options. However, if you are taking help from a tax advisor or consultant, he can make sure that there are no irregularities in your tax filing.

0 notes

Text

Strategies for Stopping IRS Collections

Before the IRS Levy any kind of assets before they can touch a nickel's worth of your client assets the IRS must first send a final Notice of Intent to Levy. This is a very important notice because there are critical rights that attach to the receipt of this letter. There are three different versions of the same letter and they all look very similar to each other.

The first letter is called a letter 1058 and it's titled final notice of intent to Levy and notice of your right to hearing. The IRS sends letter 1058 to notify you of your right to a hearing on the matter as your final notice of intent to levy your property, potentially including your paychecks bank accounts, state income tax refunds and more.

The second letter is IRS letter CP 90. Notifying you of our (meaning IRS) intent to levy certain assets for unpaid taxes. You have the right to a Collection Due Process hearing.

The third version in this is probably the most common version of all… the LT11 it looks very similar to the CP90 but of course it's got a different identifying number that being the LT11.

You want to make sure what you're dealing with when you're receiving computer notices. Too many people do not understand what the notices mean that they're getting. A final notice letter only takes the form of one of these three letters.

The IRS mails out a CP 501, CP503, CP504 (to name a few) these are all various collection letters but they're not a final notice letter. The IRS cannot Levy a bank account a paycheck any assets whatsoever until they mail a Final Notice of Intent to Levy. Additionally, a notice of your right to a hearing in this process is critical in the collection process. It is important that you understand exactly how that works so when a final notice is sent out you have 30 days to file a collection due process appeal.

You cannot get an extension of the 30-day period of time on the final notice. That 30-day period of time to file is what's called a collection due process appeal is statutory there is no exception to that. If you call the IRS and say that you can't pay in 30 days and ask for an extension they'll give you an extension on payment. That's true, but you will not get an extension on your ability to file a collection due process hearing. That 30 days is hard and fast and cannot be extended.

The reason it is important to submit a collection to process is because this does two (good) things for you. First of all it stops all collection activity from the IRS immediately. Basically, it is an injunction against the IRS from collecting from you. You have taken the case out of the hands of the collection department and put it into the hands of the appeals. Oftentimes, we get more favorable outcomes from the appeals department.

The appeals department will give you an opportunity to propose, for example, an installment agreement, offer compromise, or perhaps uncollectible status, or perhaps you can get some penalties abated.

The other important thing is when you file this appeal in a timely manner you've got the right to a Tax Court Appeal. If you can't reach an agreement you can take your case to Tax Court.

So now what happens if you missed the 30-day deadline?

We often have clients come to our office and they have a shoebox full of unopened mail from the IRS. For some unknown reason, they been collecting mail from the IRS. It is only when their paycheck finally gets hit with a garnishment that they give us a call and it is an emergency 5 alarm fire drill.

It just so happens there is a second appeal available to taxpayers. This appeal is called an Equivalent Hearing and you use the same form… IRS form 12153. This form can be filed within one year of the final notice date. This will take your case to the appeals office where you have an opportunity to sit down with an appeals officer. The difference here is that decisions by the appeals officer are final in Equivalent Hearing cases and not subject to Judicial Review. This is a very important limitation however, the good news is that the IRS will stop collection activities while the Equivalent Hearing is pending. This gives you an opportunity to make a proposal to the appeals officer without the impact of levies or asset seizures.

The context of this article is emergency measures to stop collection the single best way to do that is file a timely CDP request. You don't always have that luxury because it depends on what stage in the collection process you are at. If you’ve already missed your opportunity to file a Collection Due Process Hearing you next best strategy is to request an installment agreement. IRS revenue code states that the application for installment agreements stops enforced collection action. The request for an installment agreement operates as an injunction against the IRS from levying or seizing assets.

Depending on the amount owed to the IRS, you may be required to provide a full financial statement with your application for an installment agreement.

If you owe less than $50,000 to the IRS and can pay within 72 months you do not have to provide and financial information… this is more commonly known as a guaranteed installment agreement. Recently the IRS has increased this threshold to $100,000 and 84 months.

On amounts greater the $100,000 you will be required to provide the IRS a complete financial disclosure with substantiation of all assets, income, and liabilities. An IRS will evaluate your financial disclosure and determine how much you can afford. It is also worth noting that you can pay your balance down to $100,000 and no financials will be required.

A common strategy in this instance is to establish an installment agreement and set the first payment date for 59 days. This will 1. Stop any collection activity such as a wage garnishment of bank levy and 2. Give you time to evaluate your complete financial profile and determine if you are eligible for an offer in compromise.

So how do we get a Levy Released?

It’s on thing to stop a levy before they have hit your bank account or employer’s payroll department. It’s another thing if the Levy has already hit and you are trying to prevent from happening again.

First, you will need to contact the IRS office that issued the Levy. If it came from the collections office you will simply call the 800 number. If the Levy came from a local Revenue Officer, you will have to contact that person. In most instances, your case will not hit a Revenue Officer’s desk unless you owe more than $100,000 or you have an Employment Tax Liability.

In order for the IRS to release the levy you will need to prove that the levy is causing you a financial hardship. For IRS purposes, a hardship simply means that you are having difficulty paying for your basic living expenses. Once again, you will be required to submit a full financial profile on IRS for 433-A and provide supporting documentation such as paystubs, bank statements and copies of bills. If this is a business debt, you will complete form 433-B.

You financial statement must show that you do not have the ability to pay you basic living expenses because of the levy. For example, if you make $5,000 and your living expenses are $4,800 you cannot afford to make a $1,000 payment to the IRS. In this example, the IRS will accept a monthly payment of $200. It does not matter with the expiration date of the debt is. It is very possible that you could pay the $200 for the time remaining on the expiration date and then be clear of the remainder of the balance due. This is more commonly known as a Partial Pay Installment Agreement.

In the case where your monthly living expenses exceed your monthly income, you may be eligible for a Currently Non Collectible status whereby you do not make any monthly payment. Once again, you will be required to provide a full financial with all supporting documentation. Additionally, any balance over $10,000 and the IRS will place a lien on you. The IRS will, from time to time, reevaluate your ability to start making payments on the debt.

So what about an Offer in Compromise?

Remember, the topic of today’s article is Emergency Strategies for Stopping Collections. The key word there being emergencies.

We submit successful Offer in Compromises all the time. However, the Offer in Compromise takes time to gather information, prepare completely, and will sit in line at the IRS for months before an IRS Offer Examiner actually looks at it. In many instances, these offers can take over six months to complete. While the IRS is an excellent permanent resolution, it is NOT a quick solution to stopping collection activities. Surely you do not want your wage garnishment for 6 months.

If all this seems overwhelming, confusing or you are just in plain “panic mode” give me a call to discuss your personal situation. I will always give you an honest assessment and you most like permanent outcome. I will never “sugar coat” the situation and I will tell you like it is. You can call us at *877) 782-9383 or my personal cell phone at (714) 876 - 4702

Respectfully,

Dave

www.patriottaxpros.com

0 notes

Text

Understanding IRS CP-504 Notices and How Lexington Tax Group Can Help

If you've recently received an IRS CP-504 notice, you may be feeling overwhelmed and uncertain about your financial future. This notice is a clear indication that the Internal Revenue Service (IRS) has not received payment for an unpaid balance, and it serves as a Notice of Intent to Levy under Internal Revenue Code section 6331(d). The implications of ignoring this notice can be daunting, including the possibility of income and bank account levies, property seizures, and even the interception of your state income tax refund.

But fear not, because in this blog post, we'll shed light on how Lexington Tax Group can be your trusted partner in resolving IRS CP-504 notices and ensuring your financial stability.

Understanding the IRS CP-504 Notice

Before diving into how Lexington Tax Group can assist, let's first understand the IRS CP-504 notice in detail. This notice is essentially a warning from the IRS that they are prepared to take serious action to collect the unpaid tax debt. Here's what it signifies:

Notice of Intent to Levy: The CP-504 notice is a formal notification from the IRS, indicating their intention to levy your income, bank accounts, and possibly even seize your property or other assets to settle the outstanding tax debt.

Now that you have a grasp of what you're dealing with, let's explore how Lexington Tax Group can provide valuable assistance in this challenging situation.

How Lexington Tax Group Can Help

🌟 Immediate Action: One of the first steps in addressing an IRS CP-504 notice is to respond promptly. Lexington Tax Group will ensure that you take the necessary action quickly to prevent further IRS enforcement actions.

🔒 Negotiation: Our team of experienced tax professionals will work diligently to negotiate with the IRS on your behalf. We'll explore options like setting up a reasonable payment plan or pursuing a settlement through programs such as an Offer in Compromise.

💼 Asset Protection: Worried about losing your assets or income to IRS levies? We've got your back. Lexington Tax Group will employ strategies to protect your assets and income while working towards the resolution of your tax debt.

🤓 Expert Advice: No two tax situations are identical. That's why our experts will provide you with personalized advice and tailored strategies to address the specific complexities of your case.

📊 Audit Representation: In cases where an underlying issue may have contributed to your tax debt, we offer audit representation services to ensure that any concerns are addressed thoroughly and professionally.

Why Choose Lexington Tax Group?

Lexington Tax Group is not just any tax assistance firm; we're your dedicated partner in navigating the complexities of IRS CP-504 notices. Here's why you should choose us:

Experienced Professionals: Our team consists of tax experts with a deep understanding of tax laws, regulations, and IRS procedures.

Tailored Solutions: We recognize that every individual's tax situation is unique. Our commitment is to find the best solution that aligns with your specific needs and financial circumstances.

Stress-Free Resolution: We understand that dealing with the IRS can be stressful. With Lexington Tax Group on your side, you can focus on your life and business while we handle all communication with the IRS, ensuring a stress-free resolution process.

Take Control of Your Financial Future

Don't let an IRS CP-504 notice create unnecessary stress or financial hardship in your life. Contact Lexington Tax Group today to regain control of your finances and your peace of mind.

📞 Call us at 800-328-8289or visit www.LexingtonTaxGroup.com to schedule your free consultation. Take the first step towards a brighter financial future with Lexington Tax Group!

#LexingtonTaxGroup #IRSNoticeCP504 #TaxReliefExperts #FinancialFreedom

#tax debt#cp504#wagegarnishment#irsprotection#tax debt attorney#irs lawyer#irs audit#irs#irsdebtrelief#IRSDebt

0 notes

Text

IRS Collection Notices: What do they mean?

IRS Collection Notices: What do they mean?

When an IRS letter or IRS collection notice arrives, many people are unsure what it means and what to do to respond. IRS letters all look the same, and can be intimidating because of what is at stake. If a person has tax debt due to the IRS, and does nothing about it, then eventually the person’s account will go into IRS collections.The collection process may take some time, up to several months. Each collection notice usually comes five weeks apart.

Different types of IRS Collection letters – What are the different types of IRS Tax Collection letters?

CP14 This notice is for when a person has a balance due CP501 First reminder notice for the overdue balance due CP503 2nd notice to remind a person of their balance due CP504 Final Notice of Intent to Levy. This is when the IRS gets really serious. This notice says if the amount is not paid in full after this 3rd and final notice, then the IRS will levy the person’s state income tax refund. CP90 This notice represents the IRS intent to seize assets and gives notification of the person’s right to a hearing. Retirement benefits, real estate, salaries, automobiles, bank accounts etc can be included in the levy CP91/CP298 This notice represents the IRS intent to seize 15% of social security benefits to pay the unpaid balance that is due. CP297 This notice represents the IRS intent to seize assets and is sent to the subjects business. The IRS will levy assets if no action is taken. LT11/LT1058 This letter is the Final Notice of Intent to Levy and Notice of Your Right to Hearing. This indicates that the IRS has made numerous attempts to collect the balance. If no further action is taken within 30 days, the IRS has the right to levy or seize assets. The IRS may also place a Federal tax lien on your property.

The most important and serious IRS collection letters

CP90/297 Final Notice of Intent to Levy and Notice of Your Rights to a Hearing CP91/298 Final Notice Before Levy on Social Security Benefits These two notices are the only notices that allow the IRS to start proceedings in order to seize your assets, vehicles, bank accounts, real estate and business assets. The other notices can be important and urgent, but they are not threatening any action. Only these final notices gives the IRS these legal rights to start the proceedings. When a person receives a Final Notice, he/she must realize that it provides important legal rights. These rights include the ability to file an appeal to have a hearing to settle the case and take the results to a U.S. Tax Court if it is not acceptable. The IRS collection action is halted while the appeal is pending, provided it is filed within 30 days from the issuance of the notice.

Actions to take when a person receives an IRS collection letter

Taxpayers are generally extremely anxious when they receive these types of IRS notices. The best thing to do is to stay calm, read the letter and check if it is a Final Notice. Taxpayer assets are in danger if it is a Final Notice. If a person agrees with the balance due, look to the tax resolution with a payment plan, currently not collectible status or offer in compromise. This decision must be made quickly as active collections are taking place. The best way to get tax help is from a tax attorney who will work to get a resolution that is most favorable to you and your financial situation. If you do not agree with the balance due, submit the required information to validate your claim. Remember, when you submit any information to the IRS, to always keep copies for your records. Please call for a no-cost tax attorney consultation for a tax resolution. We look forward to helping you. This blog post is not intended as legal advice and should be considered general information only Keywords: IRS collection notices, IRS Collection Problems, IRS Collections, IRS Final Notice, IRS levies and property seizures, IRS Seizures

The post IRS Collection Notices: What do they mean? appeared first on Delia Tax Attorneys San Diego IRS tax lawyers.

from Delia Tax Attorneys San Diego IRS tax lawyers https://ift.tt/2ztl2ji

via tax agencies San Diego

0 notes

Photo

WHAT IS CP504 - NOTICE OF INTENT TO LEVY?

It is the duty of every U.S. citizen to file and pay their taxes each year. Taxes provide funds for critical government infrastructure and services. When taxpayers fail to file or address an unpaid balance in time, the IRS may send a CP504 notice.

What does the CP504 Form mean?

The IRS has a series of notices that it sends to delinquent taxpayers. IRS Form CP504 is an urgent notice that informs you not only A) of an unpaid balance, but that B) the unpaid balance must get resolved as soon as possible to avoid damaging actions like a tax levy.

Consequently, it is imperative that you take the CP504 notice seriously. It gives the IRS permission to seize your state tax refund to resolve the unpaid balance if another action is not taken.

Learn more about IRS Form CP504 and ways to address the issue before a more serious punishment is permitted by the Internal Revenue Service.

NEED HELP WITH OFFER IN COMPROMISE, TAX SETTLEMENTS, TAX PREPARATION, AUDIT REPRESENTATION OR STOP WAGE GARNISHMENTS?

ADVANCE TAX RELIEF LLCwww.advancetaxrelief.comBBB A+ RATEDCALL (713)300-3965

What Does the CP504 Form Mean?

The Internal Revenue Service (IRS) sends out reminders and warnings through a series of notices. IRS CP504 Form is a type of notice that informs the delinquent taxpayer of an unpaid balance.

If the tax debt is not resolved quickly, the IRS has the power to seize your state tax refund and use those funds to settle the unpaid balance. However, if the state tax refund does not provide enough funds to satisfy the tax debt, additional actions can get taken against your assets like seizing property.

As a result, you should not take a CP504 notice lightly. The notice is urgent and other actions will be taken if the balance is not paid in full or the taxpayer does not pursue a tax resolution solution like proposing an Offer in Compromise.

The bottom line is that a CP504 notice opens the door for the IRS to seize your assets to resolve unpaid back taxes. Thus, if you are concerned with finding a way to resolve the tax debt, you should speak with a tax professional.

Advance Tax Relief offers several different tax resolution services for taxpayers receiving threatening notices from the IRS. Advance Tax Relief works hard to find practical ways to pay back taxes without jeopardizing your or your family’s future. Contact us today for more information at 713-300-3965.

Back Taxes Do Not Go AwayIt is important that you file taxes on time every year even if you are concerned with how you will pay back taxes. Those that avoid their tax bill face harsher consequences and more obstacles toward getting back on the good side of the IRS.

Thus, when you start receiving notices from the IRS, do not ignore them. They will not go away.

The IRS CP504 Form is an urgent notice that informs you of a balance due. If you do not respond immediately, the IRS can file a tax levy against your personal property and begin seizing assets to recover the tax debt.

The IRS begins by seizing your state tax refund (if applicable). Those funds are used to pay back taxes. If the state tax refund has enough funds to cover the unpaid balance, the IRS will stop threatening you. On the other hand, if you still owe money, you may lose a business, home, or vehicle through a tax levy.

The IRS CP504 Notice is the last warning you will receive from the Internal Revenue Service before they start levying your assets. At this stage, individuals are at risk of losing their home, car, or business and there is little you can do about it.

What Should I Do if I Receive a CP504 Notice?

The CP504 notice is the last warning you will receive from the IRS before the agency begins seizing assets. Therefore, the matter is urgent, and you should take action immediately.

The CP504 notice will include the following information:

How much you owePayment due datePayment optionsFurthermore, the correspondence will include the consequences of not paying off the balance.

Before you act, make sure the CP504 Notice is legitimate and authorized by the IRS. The CP504 code should appear in the top or bottom right-hand corner along with contact information to confirm the notice is real.

How to Dispute a CP504?

The IRS grants taxpayers 21 days to address the issue before a tax lien or levy is filed on your property. Additionally, the IRS will assess penalties and interest for being delinquent on a tax bill.

GET TAX RELIEF HELP TODAY

If you think that you may need help filing your 2014, 2015, 2016, 2017, 2018, 2019 & 2020 Form 1040 tax returns or past due tax returns, you may want to partner with a reputable tax relief company who can help you get the max refund and reduce your chances for an IRS AUDIT.

Advance Tax Relief is headquartered in Houston, TX. We help many individuals just like you solve a wide variety of IRS and State tax issues, including penalty waivers, wage garnishments, bank levy, tax audit representation, back tax return preparation, small business form 941 tax issues, the IRS Fresh Start Initiative, Offer In Compromise and much more. Our Top Tax Attorneys, Accountants and Tax Experts are standing by ready to help you resolve or settle your IRS back tax problems.

Advance Tax Relief is rated one of the best tax relief companies nationwide.

#FreshStartInitiative#OfferInCompromise#TaxPreparation #TaxAttorneys#TaxDebtRelief#TaxHelp #TaxRelief#BestTaxReliefCompanies

0 notes

Text

IRS Collection Notices: What do they mean?

IRS Collection Notices: What do they mean?

When an IRS letter or IRS collection notice arrives, many people are unsure what it means and what to do to respond. IRS letters all look the same, and can be intimidating because of what is at stake. If a person has tax debt due to the IRS, and does nothing about it, then eventually the person’s account will go into IRS collections.The collection process may take some time, up to several months. Each collection notice usually comes five weeks apart.

Different types of IRS Collection letters – What are the different types of IRS Tax Collection letters?

CP14 This notice is for when a person has a balance due CP501 First reminder notice for the overdue balance due CP503 2nd notice to remind a person of their balance due CP504 Final Notice of Intent to Levy. This is when the IRS gets really serious. This notice says if the amount is not paid in full after this 3rd and final notice, then the IRS will levy the person’s state income tax refund. CP90 This notice represents the IRS intent to seize assets and gives notification of the person’s right to a hearing. Retirement benefits, real estate, salaries, automobiles, bank accounts etc can be included in the levy CP91/CP298 This notice represents the IRS intent to seize 15% of social security benefits to pay the unpaid balance that is due. CP297 This notice represents the IRS intent to seize assets and is sent to the subjects business. The IRS will levy assets if no action is taken. LT11/LT1058 This letter is the Final Notice of Intent to Levy and Notice of Your Right to Hearing. This indicates that the IRS has made numerous attempts to collect the balance. If no further action is taken within 30 days, the IRS has the right to levy or seize assets. The IRS may also place a Federal tax lien on your property.

The most important and serious IRS collection letters

CP90/297 Final Notice of Intent to Levy and Notice of Your Rights to a Hearing CP91/298 Final Notice Before Levy on Social Security Benefits These two notices are the only notices that allow the IRS to start proceedings in order to seize your assets, vehicles, bank accounts, real estate and business assets. The other notices can be important and urgent, but they are not threatening any action. Only these final notices gives the IRS these legal rights to start the proceedings. When a person receives a Final Notice, he/she must realize that it provides important legal rights. These rights include the ability to file an appeal to have a hearing to settle the case and take the results to a U.S. Tax Court if it is not acceptable. The IRS collection action is halted while the appeal is pending, provided it is filed within 30 days from the issuance of the notice.

Actions to take when a person receives an IRS collection letter

Taxpayers are generally extremely anxious when they receive these types of IRS notices. The best thing to do is to stay calm, read the letter and check if it is a Final Notice. Taxpayer assets are in danger if it is a Final Notice. If a person agrees with the balance due, look to the tax resolution with a payment plan, currently not collectible status or offer in compromise. This decision must be made quickly as active collections are taking place. The best way to get tax help is from a tax attorney who will work to get a resolution that is most favorable to you and your financial situation. If you do not agree with the balance due, submit the required information to validate your claim. Remember, when you submit any information to the IRS, to always keep copies for your records. Please call for a no-cost tax attorney consultation for a tax resolution. We look forward to helping you. This blog post is not intended as legal advice and should be considered general information only Keywords: IRS collection notices, IRS Collection Problems, IRS Collections, IRS Final Notice, IRS levies and property seizures, IRS Seizures

The post IRS Collection Notices: What do they mean? appeared first on Delia Tax Attorneys San Diego IRS tax lawyers.

from Delia Tax Attorneys San Diego IRS tax lawyers https://ift.tt/2ztl2ji

via Tax Agencies San Diego

0 notes

Text

IRS Collection Notices: What do they mean?

IRS Collection Notices: What do they mean?

When an IRS letter or IRS collection notice arrives, many people are unsure what it means and what to do to respond. IRS letters all look the same, and can be intimidating because of what is at stake.

If a person has tax debt due to the IRS, and does nothing about it, then eventually the person’s account will go into IRS collections.The collection process may take some time, up to several months. Each collection notice usually comes five weeks apart.

Different types of IRS Collection letters – What are the different types of IRS Tax Collection letters?

CP14 This notice is for when a person has a balance due

CP501 First reminder notice for the overdue balance due

CP503 2nd notice to remind a person of their balance due

CP504 Final Notice of Intent to Levy. This is when the IRS gets really serious. This notice says if the amount is not paid in full after this 3rd and final notice, then the IRS will levy the person’s state income tax refund.

CP90 This notice represents the IRS intent to seize assets and gives notification of the person’s right to a hearing. Retirement benefits, real estate, salaries, automobiles, bank accounts etc can be included in the levy

CP91/CP298 This notice represents the IRS intent to seize 15% of social security benefits to pay the unpaid balance that is due.

CP297 This notice represents the IRS intent to seize assets and is sent to the subjects business. The IRS will levy assets if no action is taken.

LT11/LT1058 This letter is the Final Notice of Intent to Levy and Notice of Your Right to Hearing. This indicates that the IRS has made numerous attempts to collect the balance. If no further action is taken within 30 days, the IRS has the right to levy or seize assets. The IRS may also place a Federal tax lien on your property.

The most important and serious IRS collection letters

CP90/297 Final Notice of Intent to Levy and Notice of Your Rights to a Hearing

CP91/298 Final Notice Before Levy on Social Security Benefits

These two notices are the only notices that allow the IRS to start proceedings in order to seize your assets, vehicles, bank accounts, real estate and business assets. The other notices can be important and urgent, but they are not threatening any action. Only these final notices gives the IRS these legal rights to start the proceedings.

When a person receives a Final Notice, he/she must realize that it provides important legal rights. These rights include the ability to file an appeal to have a hearing to settle the case and take the results to a U.S. Tax Court if it is not acceptable. The IRS collection action is halted while the appeal is pending, provided it is filed within 30 days from the issuance of the notice.

Actions to take when a person receives an IRS collection letter

Taxpayers are generally extremely anxious when they receive these types of IRS notices. The best thing to do is to stay calm, read the letter and check if it is a Final Notice. Taxpayer assets are in danger if it is a Final Notice.

If a person agrees with the balance due, look to the tax resolution with a payment plan, currently not collectible status or offer in compromise. This decision must be made quickly as active collections are taking place. The best way to get tax help is from a tax attorney who will work to get a resolution that is most favorable to you and your financial situation.

If you do not agree with the balance due, submit the required information to validate your claim.

Remember, when you submit any information to the IRS, to always keep copies for your records. Please call for a no-cost tax attorney consultation for a tax resolution. We look forward to helping you. This blog post is not intended as legal advice and should be considered general information only

Keywords: IRS collection notices, IRS Collection Problems, IRS Collections, IRS Final Notice, IRS levies and property seizures, IRS Seizures

The post IRS Collection Notices: What do they mean? appeared first on Delia Tax Attorneys.

Source: https://losangeles-tax-attorneys.com/irs-collection-notices-mean/

0 notes

Link

FLAT FEE TAX RELIEF 1-866-747-7435

Coast to Coast Tax Relief Programs

IRS Notices - IRS CP504

An IRS CP504 puts a taxpayer one step closer to having assets seized. Definite steps must be taken to protect your wages and bank accounts.

#mytaxhero #irsproblems #businesstalk #selfemployed #offerandcompromise #taxgarnishment #irslawyer #irssettlement #irslevy #taxtrouble #taxsettlement #irsattorney #irstaxlawyer #IRSnotices #IRSCP504 #taxreliefprograms

0 notes