#creditconsulting

Photo

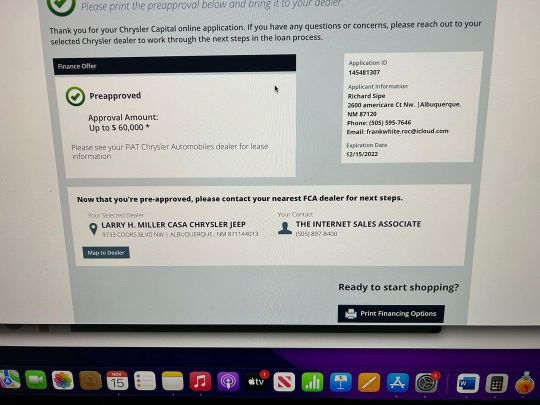

Are you in need of a new car? Our CPN program can help you obtain a new vehicle in 7 days! #cpn #cpnnumber #cpnpackages #cpns2019 #cpnapartmentpackage #creditrepair #credit #creditscore #creditreport #creditmatters #creditconsultant https://www.instagram.com/p/ClZ8QL2u0uH/?igshid=NGJjMDIxMWI=

#cpn#cpnnumber#cpnpackages#cpns2019#cpnapartmentpackage#creditrepair#credit#creditscore#creditreport#creditmatters#creditconsultant

0 notes

Text

How to get Credit Reports in North Charleston, SC?

Credit reports are a type of report that you receive from companies that you have done business with. They usually contain information about your credit card and loan usage, as well as other important financial details.

There are some websites where you can get your credit reports, but they are not always accurate. You may be able to find the same information on your credit card statement or bank statement, so it is best to go directly to the company in order to get the most accurate report possible.

What is a Credit Report?

Credit reports can be used to determine the financial health of a person and establish creditworthiness.

Credit Reportsare used by lenders to assess a person's creditworthiness. The information gathered from these reports is used to decide whether or not to grant the application for a loan or other forms of financing.

A credit report is an important tool for lenders, as it helps them make informed decisions about who they should lend money to and also how much they should lend them.

How to Get Your Free Credit Report in North Charleston, SC?

Getting your free Credit Report in North Charleston, SCis not an easy task. But there are some ways to get it without having to pay for it. You can order your credit report by phone or online.

If you are looking for a way to get your free credit report, you should consider ordering one online or by phone. They will also be able to provide you with the information that you need in order to file a dispute if anything comes up on your report that is inaccurate or incomplete.

Call on (888) 804-0104& get your free credit report in North Charleston, SC now!

#creditscore#creditcard#creditrestoration#creditcarddebt#creditkarma#creditgoals#creditrepair#creditconsult

1 note

·

View note

Text

The Complete Guide to Credit Repair Services in Green Bay, WI

Credit repair services are a great way to get back on your feet. It can help you get a better credit score, loans, and more.

It is important that you find the right credit repair service for your needs. There are many different types of services out there, so it is important that you do your research before making a decision.

Credit Repair Services are provided by many Credit Repair Companies in Green Bay, WI. They all offer different packages and prices, so it is important to find the one that will work best for you.

What is Credit Repair and Why is it Important?

Credit repair is the process of repairing or improving a person's credit score.

There are many reasons why it is important to have a good credit score. A good credit score can help you pay less for loans, get better interest rates on loans, and even get better deals on insurance premiums.

If you are looking for ways to improve your credit score, then consider using the services of a reputable credit repair company.

How Do You Clean Up Your Credit Reports & Boost Your FICO Scores?

The first step to credit repair is to check your credit reports and identify the errors.

The next step is to dispute any inaccuracies in your report. If you have a dispute with a creditor, it's best to do so in writing. You can also contact the credit bureau and ask them for help resolving the dispute.

You should also consider contacting a credit repair service if you are not confident about handling the process on your own. These services will work with you on managing your debt, lowering interest rates, negotiating with creditors and more.

How Credit Repair Services in Green Bay, WI Improve Your Credit Score?

Credit repair services are a great way to improve your credit score. They help you in removing the negative entries from your credit report and help you get a better score.

Credit repair services are not easy to find these days, but if you look hard enough, there are many out there that can provide you with the services that you need. However, it is important that before choosing one, you research them thoroughly so as to find the best one for your needs.

Call on (888) 804-0104 & hire the best credit repair services in Green Bay, WI.

1 note

·

View note

Text

How to Get a Good Credit Score in Wichita Falls, TX?

There are a number of factors that affect your credit score. Your payment history is the most important factor, and it makes up 35% of your score. Paying your bills on time is the best way to maintain a good credit score.

If you have a low credit score, it’s worth taking some steps to improve it. You can do this by paying off debts and making on-time payments for at least six months in a row.

If you have an excellent credit score, you might be eligible for premium rewards cards that offer cash back or other perks.

What is a Credit Score & Why Does it Matter?

A credit score is a number that reflects your creditworthiness. It is based on the information in your credit report. The higher your score, the more likely you are to receive loans and other forms of credit at an affordable interest rate.

The importance of a good credit score cannot be overstated. A goodCredit Score in Wichita Falls, TX can help you get approved for a mortgage, rent an apartment or buy a car with lower interest rates.

Qualities of a Good Credit Score

A good credit score is a necessity in today's world. It may be difficult to attain at first, but there are many ways that you can improve your credit score over time.

There are many factors that go into determining your credit score. These include payment history, the amount of money you owe, and the length of time you have had an account open. Additionally, the type of account you have open can also affect your credit score.

An important thing to note about improving your credit score is that it does not happen overnight. It takes time and effort to get a good credit score, but with these tips it will be easier than ever before!

How to Improve Your Credit Score in Wichita Falls, TX?

There are many ways to increase your credit score. One of the most effective is to pay off your debts and avoid opening new lines of credit.

You can also improve your credit score by getting a secured card and making sure you only use it when necessary. You can also get a car loan, but make sure you have good enough credit to qualify for one.

What are the Most Common Causes of Low Credit Scores?

A low credit score can have a negative impact on your life. For example, it can make it difficult to get approved for loans and credit cards. It can also affect your ability to rent a home or apartment.

It is important to understand the most common causes of low credit scores so that you can address them in order to improve your score.

Some of the most common causes of low credit scores are:

- Late payments

- Too much debt relative to income

- Number of accounts with delinquencies (late or missed payments)

Call on (888) 804-0104 & improve your credit score fast.

#creditrestoration#creditcarddebt#creditkarma#creditgoals#creditrepair#creditconsult#creditrepairservices#businessdebtassistance#creditreportreviews

1 note

·

View note

Text

Improve Your Credit Score The Definitive Guide for Centennial, CO

This guide will provide you with the steps you need to take in order to improve your credit score.

Credit scores are important because they can determine whether or not you are approved for certain loans and services. The higher your credit score, the more likely it is that you will be approved for a loan or service.

This will provide you with the steps that can be taken in order to improve your credit score.

How to Build Your Credit Score with a Little Effort?

Nowadays, individuals are more focused on their credit score. They want to know how they can build their credit score with a little effort.

The most important thing is to make sure that you are paying your bills on time, which will help you improve your credit score. You also need to have a good mix of different types of credit and loans in order to have a good credit rating.

What are the Requirements for Lenders When Determining Credit Scores?

Most lenders will use credit scores to determine whether or not a borrower is eligible for a loan and the interest rate that they will be charged. The higher the credit score, the better. The requirements for lenders when determining credit scores vary depending on the type of loan that is being applied for.

The three most popular types of loans are mortgages, car loans, and student loans. All three require different criteria to be met before they can be approved.

For example, in order to apply for a mortgage, you need to have enough income coming in each month and have at least 20% down payment saved up. In order to apply for a car loan, you need to have sufficient income coming in each month as well as proof of steady employment with an employer who has been around for at least two years.

To apply for a student loan, you need a high school diploma or GED certificate and either proof of enrollment or acceptance into an accredited college or university program that leads to a degree.

How Does Having Poor Credit Affect My Life?

Poor credit can affect your life in many ways. It can make it difficult to get a loan, or even a car or house. You may not be able to get a job or insurance. You may also be denied for an apartment rental because of your poor credit score.

The good news is that there are ways you can improve your credit score and get back on the right track. One way is by paying off any debts you have and making sure they are paid on time every month. Another way is by paying down any balances that are close to their limit, which will show lenders that you have more room to borrow money in the future if you need it. You can easily get Credit Repair Services in Centennial, CO with the litter bit more effort.

How credit repair company helps you in improve your credit score?

Credit repair company helps you in improve your credit score by removing negative items on your credit report and to help you build a good credit history.

Call on (855) 656-2963 to improve your credit score now!

#creditkarma#creditgoals#creditrepair#creditconsult#creditrepairservices#businessdebtassistance#creditreportreviews#debtsettlement#creditrestoration

1 note

·

View note

Text

Credit Score and Your Financial Management by Antioch, CA

Credit scores are important to managing your finances. A high credit score will help you get approved for a loan and may give you a lower interest rate. In this blog, we'll explore what goes into your credit score, and how you can work to improve it. We'll also discuss some strategies for financial management so that you can stay on top of your payments and maintain a good credit score.

What is Credit Score?

A credit score is a number that reflects your credit risk, or the likelihood that you will repay your debt on time. Your credit score is determined by a variety of factors, including your payment history, the amount of debt you have, and the number of inquiries on your credit report. A high credit score can help you get approved for a loan or mortgage, and may also qualify you for lower interest rates. Conversely, a low credit score can make it harder to obtain financing and may lead to higher interest rates. If you're looking to buy a home or car, or need to borrow money for any other reason, it's important to know what your credit score is and take steps to improve it if necessary.

Understanding Credit Scores and Why They Matter.

Your credit score is one of the most important numbers in your life. It dictates what kind of interest rates you'll get on a car loan or mortgage, and can even affect your ability to get a job. But what is a credit score, and why does it matter so much? In this blog, we'll answer those questions and more, so you can make the most informed decisions about your finances.

Call on (855) 656-2963 to improve your credit score now!

#creditscore#creditcard#creditcarddebt#creditkarma#creditgoals#creditrepair#creditconsult#creditrepairservices#businessdebtassistance

1 note

·

View note

Text

Unlocking Financial Insights: Exploring Credit Analysis in Reno, NV

In today's rapidly evolving financial landscape, credit analysis plays a pivotal role in assessing the creditworthiness of individuals and businesses. This article delves into the world of credit analysis, focusing specifically on its application in Reno, NV. By understanding the key aspects of credit analysis and its impact on financial decision-making, individuals and businesses can unlock valuable insights that will shape their financial strategies.

Understanding Credit Analysis

Credit analysis involves the evaluation of an individual or entity's creditworthiness, assessing their ability to fulfill financial obligations and repay borrowed funds. It encompasses a comprehensive analysis of various factors, including credit history, income, debt levels, and overall financial stability. By examining these elements, credit analysts provide valuable insights that assist lenders, investors, and financial institutions in making informed decisions.

The Importance of Credit Analysis in Reno, NV

Reno, NV, is a thriving economic hub, attracting individuals and businesses alike. As the local economy flourishes, credit analysis becomes increasingly crucial for both lenders and borrowers. For lenders, understanding the creditworthiness of potential borrowers mitigates risks associated with default or non-payment. On the other hand, borrowers benefit from credit analysis as it helps them secure favorable loan terms, lower interest rates, and gain access to financial opportunities that can fuel their growth.

Factors Considered in Credit Analysis

Credit analysis involves a comprehensive evaluation of various factors that contribute to an individual's or business's creditworthiness. These factors include:

1. Credit History

A person or business's credit history provides valuable insights into their past borrowing behavior, repayment patterns, and overall credit management. Credit analysts review credit reports, analyzing factors such as payment history, outstanding debts, and the length of credit history to assess creditworthiness accurately.

2. Income and Debt Levels

The income and debt levels of individuals and businesses play a significant role in credit analysis. Credit analysts evaluate income stability, debt-to-income ratios, and overall financial obligations to gauge an individual's or business's ability to manage their financial commitments.

3. Financial Stability and Assets

Assessing financial stability and assets helps credit analysts evaluate the overall financial health of individuals and businesses. Factors such as savings, investments, and the presence of collateral provide a clearer picture of an entity's ability to manage financial obligations and repay debts.

4. Industry and Economic Factors

Credit analysis also considers industry-specific and economic factors that may influence creditworthiness. For businesses, factors such as market conditions, competition, and regulatory environment are taken into account to assess their ability to sustain operations and meet financial obligations.

Credit Analysis Process

The credit analysis process involves several stages, ensuring a thorough assessment of an individual's or business's creditworthiness. The key steps include:

Gathering Information: Credit analysts collect relevant financial data, credit reports, and supporting documents to build a comprehensive understanding of the borrower's financial situation.

Financial Statement Analysis: The financial statements, including income statements, balance sheets, and cash flow statements, are carefully examined to assess financial stability, profitability, and cash flow generation.

Ratio Analysis: Various financial ratios, such as debt-to-equity ratio, liquidity ratio, and profitability ratios, are calculated to gauge the borrower's financial performance and risk levels.

Credit Score Evaluation: Credit analysts analyze credit scores, considering factors such as payment history, credit utilization, and credit inquiries to determine the borrower's creditworthiness.

Risk Assessment: Credit analysts assess the overall risk associated with extending credit to the borrower, considering both internal and external factors that may impact repayment capacity.

Decision Making: Based on the comprehensive analysis, credit analysts make recommendations or decisions regarding credit approval, loan terms, and interest rates.

Key Players in Credit Analysis

Several key players are involved in the credit analysis process, contributing their expertise and insights. These include:

Credit Analysts: These professionals specialize in evaluating creditworthiness, conducting in-depth analyses, and providing recommendations based on their findings.

Lenders and Financial Institutions: Lenders and financial institutions utilize credit analysis to assess risk levels and make informed lending decisions.

Credit Rating Agencies: Credit rating agencies assign credit ratings to individuals, businesses, and financial instruments, providing an independent assessment of creditworthiness.

Regulatory Bodies: Regulatory bodies establish guidelines and regulations that govern credit analysis practices, ensuring transparency, and fair assessment.

Evaluating Credit Scores

Credit scores are a numerical representation of an individual's creditworthiness, providing a quick assessment of their credit history and risk levels. Lenders and financial institutions rely on credit scores to make lending decisions. Factors such as payment history, credit utilization, length of credit history, and types of credit are considered in calculating credit scores. A higher credit score indicates lower credit risk, leading to favorable loan terms and interest rates.

Credit Analysis for Individuals

For individuals, credit analysis plays a crucial role in various financial aspects of life. It affects the ability to secure loans for homes, cars, or education, and can impact interest rates on credit cards and personal loans. By maintaining a good credit score and demonstrating responsible credit management, individuals can unlock financial opportunities, obtain better loan terms, and build a strong foundation for their financial future.

Credit Analysis for Businesses

Credit analysis is equally important for businesses, especially when seeking funding or entering into partnerships. Potential lenders and investors rely on credit analysis to evaluate a company's financial health, stability, and ability to meet financial obligations. A positive credit analysis can open doors to favorable loan terms, partnerships, and opportunities for growth and expansion.

Benefits of Effective Credit Analysis

Effective credit analysis offers several benefits to both individuals and businesses, including:

Enhanced Borrowing Power: A favorable credit analysis increases borrowing power and provides access to financial resources that fuel growth and achieve financial goals.

Lower Interest Rates: Good creditworthiness translates into lower interest rates on loans and credit cards, saving money over time.

Improved Financial Decision-making: Credit analysis provides insights that aid in making informed financial decisions, mitigating risks, and maximizing financial opportunities.

Enhanced Reputation: Positive credit analysis builds a strong reputation and instills confidence among lenders, investors, and business partners.

Challenges in Credit Analysis

Credit analysis faces certain challenges that impact the accuracy and effectiveness of assessments. These challenges include:

Lack of Complete Information: Obtaining complete and accurate financial information can be challenging, especially when dealing with individuals or businesses with complex financial structures.

Subjectivity in Analysis: The interpretation of financial data and creditworthiness involves a degree of subjectivity, which may result in variations in assessments.

Dynamic Economic Environment: Economic conditions and market fluctuations can impact creditworthiness, making it essential to consider external factorsthat may influence credit analysis.

Limited Historical Data: For individuals or businesses with limited credit history, it can be challenging to assess creditworthiness accurately.

Evolving Industry Practices: Credit analysis needs to adapt to changing industry practices, emerging technologies, and evolving financial instruments.

Emerging Trends in Credit Analysis

Credit analysis is subject to ongoing advancements and emerging trends that shape the industry. Some notable trends include:

Big Data and AI: The use of big data and artificial intelligence (AI) enables credit analysts to analyze vast amounts of information, identify patterns, and make more accurate predictions.

Alternative Credit Scoring Models: Traditional credit scoring models are being complemented by alternative models that consider non-traditional data sources, such as utility payments, rental history, or social media behavior.

Risk-Based Pricing: Lenders are increasingly adopting risk-based pricing models, where interest rates and loan terms are tailored based on the borrower's credit risk, offering more personalized lending options.

Enhanced Fraud Detection: Advanced analytics and fraud detection algorithms help identify potential fraud patterns, reducing risks associated with fraudulent activities.

Role of Technology in Credit Analysis

Technology plays a vital role in streamlining and enhancing credit analysis processes. Various technological tools and platforms assist credit analysts in gathering, analyzing, and interpreting financial data. Automation, machine learning, and data visualization tools enable quicker and more accurate assessments, improving efficiency and decision-making.

Enhancing Financial Decision-making

Credit analysis significantly impacts financial decision-making for individuals and businesses. By leveraging credit analysis insights, individuals can make informed decisions regarding borrowing, managing debts, and improving credit scores. Businesses can utilize credit analysis to assess partnerships, secure funding, and evaluate investment opportunities. With enhanced financial decision-making, individuals and businesses can achieve their goals and navigate the financial landscape more effectively.

Future Outlook of Credit Analysis

The future of credit analysis holds promising opportunities and challenges. Advancements in technology, data analytics, and risk assessment methodologies will continue to shape the industry. The integration of alternative data sources and the use of predictive analytics will provide deeper insights into creditworthiness. However, regulatory compliance, data privacy, and the ethical use of data will also remain key considerations for credit analysis practices.

Conclusion

Credit analysis is a crucial aspect of financial decision-making, enabling individuals and businesses to unlock valuable insights into creditworthiness. In Reno, NV, credit analysis plays a vital role in facilitating access to financial resources, mitigating risks, and fostering economic growth. By understanding the key components and processes involved in credit analysis, individuals and businesses can make informed financial decisions, secure favorable loan terms, and navigate the dynamic financial landscape with confidence.

FAQs (Frequently Asked Questions)

1. How long does credit analysis take?

Credit analysis timelines can vary depending on the complexity of the borrower's financial situation and the availability of required information. It can range from a few days to several weeks.

2. Can credit analysis impact credit scores?

No, credit analysis itself does not impact credit scores. However, credit analysis assesses factors that contribute to credit scores, such as payment history, credit utilization, and overall credit management.

3. Are there alternatives to traditional credit scoring models?

Yes, alternative credit scoring models are gaining traction, which consider non-traditional data sources and provide a broader view of an individual's creditworthiness.

4. What happens if I have a poor credit analysis?

A poor credit analysis may result in limited access to financial resources, higher interest rates, and less favorable loan terms. However, it is possible to improve creditworthiness over time with responsible credit management.

5. How often should individuals or businesses undergo credit analysis?

Regular credit analysis is recommended, especially when seeking new credit opportunities or entering into significant financial transactions. It helps individuals and businesses stay aware of their creditworthiness and make necessary improvements if needed. Call today at (888) 803-7889 for a free consultation. We look forward to helping you, Bloom!

0 notes

Text

Secure Your Financial Future with Expert Planning and Credit Consultation

Secure Your Financial Future with Expert Planning and Credit Consultation! Our dedicated team of credit consultants is here to help you create a robust financial plan tailored to your goals. Let’s build your path to financial success together!

#FinancialPlanning #CreditConsultation #FinancialGoals #WealthManagement #MoneyMatters #FinancialAdvisor #SmartInvesting #CreditExperts #FinancialStrategy #SecureYourFuture #FinancialWellness #BudgetingTips #InvestmentPlanning #CreditSolutions #FinancialSuccess #PersonalFinance #FinancialFreedom #MoneyManagement #FinancialAdvice #PlanForYourFuture #FinancialSecurity

0 notes

Photo

Do you have negative items that needs to be removed? we offer a full credit sweep •collection. •late payments. •charge offs. • repossessions. •Bankruptcies. • inquiries. • evictions • tax lien •chexsystem removal. • early warning removal. •takes 30-60 days too complete. #creditrepair #credit #creditcard #creditscore #creditrepairservices #creditscoresmatter #creditmatters #creditagent #creditgoals #creditconsultant https://www.instagram.com/p/ClR6Ls-Pvvm/?igshid=NGJjMDIxMWI=

#creditrepair#credit#creditcard#creditscore#creditrepairservices#creditscoresmatter#creditmatters#creditagent#creditgoals#creditconsultant

0 notes

Text

Unlock the Success Formula for Credit Repair with Us!

🚀 Are financial roadblocks holding you back? Let DR. CREDIT REPAIR LLC pave the way to your financial freedom! 🚀

🌟 Our proven success formula has helped countless individuals transform their credit scores and regain control of their financial future. With our expert guidance, you'll experience:

✅ Personalized Strategies: Tailored solutions that fit your unique credit situation.

✅ Rapid Results: Watch your credit score rise faster than you thought possible.

✅ Professional Expertise: Our experienced team knows the ins and outs of credit repair.

✅ Lasting Impact: Build a solid credit foundation for a secure tomorrow.

Don't let a low credit score define your journey. 🌈 Join the ranks of satisfied clients who have achieved their dreams with DR. CREDIT REPAIR LLC.

📞 Call (305) 925-2473 or visit www.drcreditrepairs.com to schedule your FREE consultation today! 📞

Your success story begins here. Trust DR. CREDIT REPAIR LLC to be your partner in credit restoration! 💪 #drcreditrepairllc #financialfreedom #drcreditrepair #drcredit #credit #CreditRepair

#FixMyCredit

#CreditScore

#CreditRestoration

#FinancialFreedom

#CreditHelp

#CreditRebuilding

#CreditSolutions

#DebtFree

#CreditEducation

#CreditRehabilitation

#CreditTips

#CreditGoals

#CreditRecovery

#CreditBuilding

#CreditManagement

#CreditConsulting

#CreditImprovement

#CreditWellness

#CreditSuccess

#credit#creditrestoration#drcreditrepair#bankruptcy#collections#creditgoals#creditmatters#credito#creditrepair#creditrepairservices

0 notes

Photo

Struggling to get an online presence or drive traffic locally? Starting a business but don't know where to begin? Let Ninja Credit Consultants LLC help you today! Visit us and start a chat - always a live person ready to respond. https://bit.ly/3JQLbvr #SmallBusinessHelp #CreditConsulting #FinancingAdvice #NinjaCreditConsultants

0 notes

Text

3 Ways Credit Repair Services in Auburn Can Help You

Credit repair services in Auburn are gaining popularity as the economy slows down. This is because people are more afraid of losing their jobs and having their credit scores be lowered because of it. Credit repair company are doing this for a living, so they make sure to keep their clients happy and provide high quality service.

One way that credit repair services in Auburn can help you is by providing free credit report reviews before the individual starts any type of debt settlement program. Another way they can help is by providing debt settlement plans with low rates that will help you pay back your debts at a much lower rate than your current one. Lastly, these companies may offer education plans to teach individuals how to manage their current debt without making it!

1. Challenge Errors on Your Credit Reports

Credit reports are not the only aspects in our lives that can be used to measure our financial health. Our debt is also closely tied with our credit score. If your debt-to-income ratio is too high, it can lead to bankruptcy.

The challenge errors on your credit report are an indication of whether you are managing your debt well or not. The bigger the challenge, the easier it will be for creditors to deny you credit when you apply for a loan or mortgage.

2. Dispute Negative Items

Credit reports are used to determine your creditworthiness. They contain information about your financial transactions, income, residence, and employment status.

Disputes on credit reports can be challenging for consumers who may not have the necessary or enough knowledge about how to dispute an item or request a correction.

To resolve this issue, some companies have created systems that automate these processes in order to save time and cut costs in the process.

3. Negotiate for a Less Negative Credit Report

It is beneficial to go on a credit report negotiation to get your credit score down.

There are many cases where people end up with a negative credit report because of minor mistakes or errors. Some of them can be easily fixed and while others would require more work.

Negotiating for a less negative credit report is beneficial in many ways. It can improve your financial situation and make you eligible for new opportunities like loans, mortgages, and credit cards.

Hire Credit Repair Company in Auburn

Credit Repair Company in Auburn is the best option for you if you're looking for a reliable company that can help them succeed in building their financial security and improving.

Call on (888) 803-7889 and fix your credit now!

Read More: https://www.creditrepairease.com/credit-repair-auburn/alabama/

#creditscore#creditrestoration#creditcarddebt#debtsettlement#creditreportdisputes#creditconsulting#financialplanning#creditreports#creditcounseling#creditrating#Fix credit#credit repair services

1 note

·

View note

Text

Expert Guide to Credit Repair in Encinitas

The length and scope of this article is designed to take you from knowing very little about credit repair, to having a thorough understanding. Along the way, we will also dispel some myths and misconceptions that surround the subject.

The starts by explaining what credit repair in Encinitas is and how it can help improve your life. We then go on to look at why a person’s credit might need repairing in the first place. We will provide a brief overview of what each component of your credit report means and how it affects you. And finally, we will talk about what you can do if you do have any errors on your report that need to be removed.

What is Credit Score and How Does it Affect your Life

The credit score is a numerical value based on one’s ability to repay loans. It is available for individuals who have an established credit history, typically through borrowing money.

If you are too indebted, it might be hard to make repayment schedules and pay off your loans. This will adversely affect your credit score. A low credit score will result in higher interest rates or less favorable terms for new loans, even though its just a number that indicates the level of risk lenders perceive you to pose to them.

Credit scores are also used by employers to screen potential hires and by landlords when considering prospective tenants.

Best Practices for Credit Repair

With the right credit repair company in Encinitas, you can work with someone who will personally guide you through this process.

Credit repair is an integral part of credit health, and if done correctly, it can help you improve your credit rating.

The process of repairing your credit is not easy. It requires a lot of patience and dedication. However, if done correctly, it can help improve your credit score in time. Credit repair is an integral part of building good credit health.

How to Improve Your Financial Future with a Powerful Credit Score

The credit score is used by lenders to determine whether they are willing to lend money. It is also used by landlords, employers or anyone else who needs to know if you are a good risk. A credit score of 650 or higher means that you are a responsible borrower and will be granted most requests for credit.

A score below 600 means that you are not considered a good risk and may have trouble getting the loans that you need in the future.

A low credit score can make it difficult for people to get the loans they want in the future, even when they have enough money in their bank account. This can make it harder for them to pursue their career goals, buy a house, buy a car, start a business or send their children to college.

Just Call on (888) 803-7889 and fix your credit now!

Read More: https://www.creditrepairease.com/credit-repair-encinitas/california/

#creditornegotiations#taxdebtassistance#creditreportdisputes#creditconsulting#irsnegotiations#financialplanning#creditrepairservice#debtproblems

1 note

·

View note

Text

Best Credit Repair Companies in Auburn, WA

There are many credit repair services that offer different types of services. Some of them are affordable and some are very expensive. You can get a list of the best credit repair services in Auburn by just doing a quick Google search.

There is a lot of confusion regarding what credit repair service to use and how to proceed after you have used one. Make sure to consult your credit card provider, bankruptcy trustee, bank, or other financial institution before you make an account with any service.

Credit Repair Services in Auburn - This should be done by doing a quick Google search for "credit repair" followed by Auburn.

What is the Average Credit Score?

The average credit score is typically described as the average of all credit scores when lenders are using the FICO score.

As with any financial figure, there are many uncertainties in estimating this number. It's important to note that the following are only estimations based on averages, not fixed values.

The majority of people who have a good credit score will be interested in getting more of their information out there if they're applying for a loan or mortgage, while those who have bad credit may want to keep it hidden for this reason.

Credit Scores range from 300-850 and is used by lenders to help predict whether you'll repay your debt obligations on time and how much you'll be charged for interest fees if you default on your loan agreements.

Which is the Best Credit Repair Company in Auburn to Fix Your Bad Rep?

Credit Repair Ease - A list of Top Credit Repair Companies in Auburn

Credit Repair Ease make it easy for people looking for the best local credit repair services provider. We are available in 51 states of United States and committed to offer you the best credit repair service. Whether you live in Alabama, California or New York or any other state of United States, we help you from your location and you don't have to take much burden.

Call on (888) 803-7889 and hire best credit repair company in Auburn.

Read More: https://www.creditrepairease.com/credit-repair-auburn/washington/

#creditrestoration#taxproblemresolution#howtomakemoneywithcredit#budgetplanning#identitytheftrecovery#creditornegotiations#taxdebtassistance#creditreportdisputes#creditconsulting#irsnegotiations#financialplanning

1 note

·

View note

Text

Reclaim Your Financial Health: Strategies for Bad Credit Repair in Cincinnati, OH

Having bad credit can have a significant impact on your financial well-being. It can make it challenging to secure loans, obtain favorable interest rates, and even affect your housing and employment prospects. If you find yourself in Cincinnati, OH, with bad credit, it's essential to take proactive steps to repair it. This article will provide you with strategies and insights to help you reclaim your financial health by repairing your bad credit.

Understanding the Importance of Credit Health

What is Credit Health?

Credit health refers to the state of your creditworthiness. It is assessed based on your credit history, credit scores, and other factors that lenders and creditors use to evaluate your ability to manage debt and repay loans.

Why is Credit Health Important?

Maintaining good credit health is crucial because it affects your ability to access credit and favorable financial opportunities. Good credit health can lead to lower interest rates, higher credit limits, and more favorable loan terms.

Assessing Your Credit Situation

To begin the process of repairing bad credit, start by assessing your current credit situation. Review your credit reports, analyze your credit scores, and identify any negative items or areas that need improvement. Understanding the extent of your bad credit will help you develop an effective plan.

Checking Your Credit Reports

Obtain copies of your credit reports from the major credit bureaus—Equifax, Experian, and TransUnion. Review each report carefully to ensure accuracy and identify any discrepancies, such as incorrect personal information or unauthorized accounts. Pay close attention to negative items, such as late payments or collections.

Identifying and Disputing Errors on Your Credit Reports

If you spot errors on your credit reports, such as inaccuracies or fraudulent accounts, it's crucial to dispute them promptly. Contact the credit bureaus in writing, providing supporting documentation to validate your claims. The bureaus are required to investigate and correct any errors found within a certain timeframe.

Paying Off Outstanding Debts

One of the most effective ways to repair bad credit is by paying off outstanding debts. Prioritize debts with the highest interest rates or those in collections. Create a repayment plan and allocate extra funds towards debt reduction. Making consistent payments will gradually improve your credit score and demonstrate responsible financial behavior.

Creating a Realistic Budget

Developing a realistic budget is essential for managing your finances and repairing bad credit. Assess your income and expenses, including debt payments, utilities, and daily living costs. Allocate funds for debt repayment and savings. Stick to your budget to avoid further credit issues and establish a solid financial foundation.

Establishing Positive Credit Habits

Building positive credit habits is vital for long-term credit repair. Make all payments on time, including bills, loans, and credit card balances. Keep your credit utilization ratio low by using only a small percentage of your available credit. Avoid opening unnecessary new accounts and maintain a responsible credit utilization pattern.

Seeking Professional Assistance

If youfind the credit repair process overwhelming or need expert guidance, consider seeking professional assistance. Credit counseling agencies and reputable credit repair companies can provide personalized advice, help you navigate the complexities of credit repair, and negotiate with creditors on your behalf.

Being Patient and Persistent

Repairing bad credit is not an overnight process. It requires patience and persistence. Keep in mind that it takes time for positive changes to reflect in your credit reports and scores. Stay committed to your credit repair strategies, continue practicing good financial habits, and be patient with the progress.

Frequently Asked Questions

Q1: Can I repair bad credit on my own, or do I need professional help?

A1: You can repair bad credit on your own with the right knowledge and strategies. However, professional help can provide expertise and guidance, especially if you feel overwhelmed or uncertain about the process.

Q2: How long does it take to repair bad credit?

A2: The time required to repair bad credit varies for each individual and depends on the severity of the credit issues. Significant improvements can be seen within several months to a year with consistent effort.

Q3: Will paying off my debts improve my credit score?

A3: Paying off debts can have a positive impact on your credit score, especially if they are in collections or have high balances. It demonstrates responsible financial behavior and reduces your overall debt burden.

Q4: Can I remove negative items from my credit report?

A4: If negative items on your credit report are accurate, they cannot be removed. However, you can dispute any errors or fraudulent information to have them corrected or removed.

Q5: Will closing unused credit accounts help improve my credit score?

A5: Closing unused credit accounts may have a negative impact on your credit score. It can decrease your available credit and potentially shorten your credit history. It's generally advisable to keep old accounts open and maintain a responsible credit utilization ratio.

Conclusion

Repairing bad credit in Cincinnati, OH, is a proactive step towards reclaiming your financial health. By understanding the importance of credit health, assessing your credit situation, disputing errors on your credit reports, paying off debts, creating a realistic budget, and establishing positive credit habits, you can gradually rebuild your credit. Remember to be patient, seek professional assistance when needed, and practice good financial habits consistently. With dedication and persistence, you can overcome bad credit and pave the way for a brighter financial future. Call today at (888) 803-7889 for a free consultation. We look forward to helping you, Bloom!

0 notes

Text

Unlock Your Dream Home with Expert Home Loan Consultation! Our team of credit consultants specializes in guiding you through the home loan process, making homeownership a reality. Let's take the first step toward your dream home together!

#HomeLoanConsultation #DreamHome #MortgageExperts #HomeownershipGoals #CreditSolutions #FinancialAdvisors #HomeLoanAssistance #CreditConsultants #HomeSweetHome #RealEstateDreams #MortgageMatters #HomeInvestment #FinancialGuidance #HomeBuyingTips #PropertyOwnership #MortgageHelp #HomeLoanExperts #FirstTimeHomeBuyer #RealEstateAdvice #HomeFinance #PropertyInvestment

0 notes