#cryptonight

Explore tagged Tumblr posts

Text

i should remodel club dante into another goth club honestly. crypt o night needs a competitor

#cryptonight also has too much going on... too bougie. this one will be for the real freaks.#i also might make malcolm sell it but it would also make sense for him to capitalize on a scene he isnt part of#but in that case it wouldn't be as shitty of a club imo. much to think about

8 notes

·

View notes

Text

How Cryptocurrency Mining Works: Process, Methods, and Risks

Cryptocurrency mining is a topic of interest for many people. Today, there are numerous opportunities available for those who want to earn money, and one of them is cryptocurrency mining, which can provide a significant income.

What is Cryptocurrency Mining?

First, let’s understand what cryptocurrency mining means. It all started with Satoshi Nakamoto, who in 2007 began developing the principles of cryptocurrency mining (Bitcoin). In 2009, the first mining application was released. The generation of the first block, “Genesis 0,” brought the first 50 bitcoins to its creators. In the same year, the first purchase of BTC for dollars took place: $5.02 was sold for 5050 bitcoins (which is an astronomical sum today).

The essence of the cryptocurrency mining process is the creation of new blocks in the cryptocurrency network. For this, the mining equipment solves complex mathematical problems. For each new block, cryptocurrency coins are issued. Miners can then store them in their wallets or sell them on exchanges.

How Does Cryptocurrency Mining Work?

To understand the principles of mining, it is necessary to clearly understand how bitcoin is mined.

Information about each transaction within the BTC network is recorded in a special block, which confirms the authenticity of the transfer.

Blocks form a single chain — the blockchain. Each block contains the hash of the header of the previous block, the hash of the transaction, and a random number.

The miner’s equipment performs mathematical calculations to determine the block hash.

After calculating the hash, the miner receives a reward and adds a new block to the general register of transactions.

The mining process is protected using the Proof-of-Work and Proof-of-Stake algorithms. These are sets of rules according to which transactions are conducted, mining is carried out, and other actions are performed within the network.

Proof-of-work (“proof of work”). The algorithm organizes the operation of the entire cryptocurrency network, verifies the authenticity of transactions, and so on. After a certain amount of cryptocurrency is mined in the network, PoW increases the complexity of the calculations. As a result, miners are forced to constantly increase the power of their farms and devices. PoW is the algorithm of a large number of cryptocurrency networks: from bitcoin to LiteCoin and DogeCoin. Proof-of-Stake (“proof of ownership”). An analog of PoW, the essence of which is that the greatest chance of mining cryptocurrency is received by the one who owns the most coins, and not the most powerful equipment. The algorithm reduces the decentralization of the network but significantly reduces energy consumption. PoS is currently used by Ethereum.

Mining Algorithms

To understand how to mine cryptocurrency, you need to know about the most popular mining algorithms at the moment. These technologies form the basis of cryptographic calculations and affect the mining speed, the necessary equipment and its power, the level of energy consumption, and so on.

SHA-256. The basis of mining on this algorithm is the creation of a 256-bit signature. It is demanding on the hash rate (for mining, a minimum of 1 Gh/s is required). Calculations last from 7 minutes. It is used in the mining of Bitcoin, Bytecoin, Terracoin, 21Coin. Ethash. The hashing algorithm was first used to mine ether. In the mining process, the emphasis is on the volume of video card memory. Ethash is used in the networks Ethereum Classic, KodakCoin, Ubig.

Scrypt. It works on the PoW (Proof-of-work) principle. Compared to SHA-256, it has a higher calculation speed and lower requirements for the power of computing equipment. The algorithm is used in the mining of Dogecoiun, Gulden, Litecoin.

Equihash. An algorithm with which you can mine cryptocurrency on home computers. It is used in the mining of Bitcoin Gold, Zcash, Komodo. CryptoNight. The algorithm is designed for mining cryptocurrency on home computers. It allows you to mine even on a not very powerful video card. The only condition is that it must be discrete. It is used in the mining of Bytecoin and Monero.

X11. The algorithm was developed by the creators of the Dash token. It has excellent data protection and low energy consumption.

Types of Mining

What does cryptocurrency mining mean in terms of organizing the process? There are several types of mining that depend on the equipment used and the number of team members.

By Equipment Type

In mining, you can use different equipment: you need to choose a suitable cryptocurrency and install software. Each type of equipment will differ in calculation speed, resource consumption, durability, etc.

CPU (Central processing unit) CPU mining is the use of a PC processor for cryptocurrency mining. It is characterized by very low calculation speed and, accordingly, low profitability. However, it is still relevant among solo miners due to low energy consumption requirements. To increase mining efficiency, you need to choose processors with a high frequency, a large number of cores and threads. It is not recommended to mine on laptops. With CPU mining, you can mine Dogecoin, Monero, Electroneum.

FPGA-module (Field-Programmable Gate Array) The use of an FPGA module is one of the promising ways to mine cryptocurrency. Their advantage/difference lies in the possibility of reprogramming the module for the desired mining algorithm. Thus, you can switch between different cryptocurrencies. Another beneficial difference is that FPGA modules provide a better hash rate-energy consumption ratio. The main disadvantage of FPGA mining is the cost of the modules and the complexity of their setup.

Hard Drive You can also use the HDD of your PC for mining. The work is carried out according to the Proof-of-Capacity (“proof of resources”) algorithm. Mining on a hard disk takes place in two stages: plotting and mining. First, the generation of random solutions takes place, which are saved on the HDD. Then the number of the scoop is calculated, and the deadline is determined. Then the minimum deadline is selected, and the miner who beats the rest receives a reward. The calculations do not require high power but only a lot of free space on the hard drive.

By Number of Participants

You can mine cryptocurrency both alone and in a company with other miners. All this has both its advantages and disadvantages.

Solo Mining The oldest form of mining. The miner independently selects equipment, sets up software, chooses a cryptocurrency, and starts mining. All costs are borne by him. But the reward for the mined block is received in full by the solo miner. During the birth of the cryptocurrency industry, this was the most profitable form of mining, as the calculations were fast and did not require large capacities. Today, solo mining is worth doing when mining promising altcoins.

Mining Pools A mining pool is a combination of miners who start working on creating blocks together. As a result, this significantly increases the overall chances of getting cryptocurrency. There are two main types of pools with different payment mechanisms. Pay-Per-Share (PPS), in which the miner receives a reward for each hash created within the pool — even if the block was not created. Pay-Per-Last-N-Shares (PPLNS), with accrual of the reward only when the block is created.

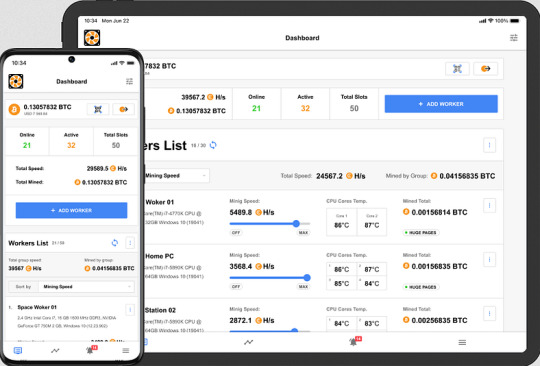

Cloud Mining This is a type of passive mining. In this case, the user pays for the rental of capacities on the territory of the data center of the company. The equipment starts mining, and with the help of a mobile application or a personal account on the site, the client monitors the results. Profit depends on the rented capacities, the cost of cryptocurrency, and the options in the company’s service.

Mining Profitability

To make a profit from cryptocurrency mining, you need to make a preliminary calculation of costs. If you want to create your own farm, you need to calculate:

Costs for purchasing and maintaining equipment. Payment for electricity. Rent of premises for the farm. The computing power of the equipment, which determines the amount of cryptocurrency mined per month. Assess changes in the value of the chosen cryptocurrency: an accurate forecast will allow you to imagine the expected income.

Mining profitability A profitable option for earning money can be the purchase/rental of ASICs or cloud mining. Their profitability depends only on the starting budget. If you calculate the minimum entry threshold by product, then you can get the following approximate figures:

Purchase of Antminer S21 188TH ($5000): expected income $550* per month. Rent of Antminer S21 188TH for 12 months ($3200): expected income $320* per month. Cloud mining contract ($150): expected income $225* for 60 months. These calculations provide you with forecast information based on the BTC forecast, which will reach $120 thousand. and FPPS 0.0000008. This is not a guarantee of future results, and accordingly, it is not advisable to rely too much on such information due to its inherent uncertainty.

Risks of Cryptocurrency Mining

The cryptocurrency industry has certain risks:

Problems with legislation. Very often, mining is not regulated by the legislation of countries, and in some, it can be completely prohibited, for example, in Taiwan, Kyrgyzstan, Vietnam, Romania, and Ecuador. Before starting to work with cryptocurrency, you definitely need to consult with a lawyer. A good solution to the problem can be the services of a hosting company, which will take any risks upon itself.

The issue of profitability. For successful bitcoin mining on your own, you need to buy powerful computing equipment. It not only costs quite a lot but also requires a huge amount of electricity and careful maintenance. Therefore, it will not be possible to place it at home. At the same time, mining on a home PC or a small farm will be unprofitable due to high competition with large farms and pools.

The difficulty of accurately forecasting income. It is difficult to calculate future income from the sale of mined cryptocurrency: the complexity of mining, the popularity of coins, and their value can and will regularly change.

The Future and Prospects of Cryptocurrency Mining

The industry continues to actively develop around the world. Users know that they can get a good income from cryptocurrency mining, even if they mine altcoins: Ethereum, Tether, BNB, Solana, etc. BTC is the undisputed leader of the industry, the course of which affects users’ trust in it.

After the fourth bitcoin halving in April 2024, the profitability of mining changed. To maintain the previous level of mining, it is necessary to increase existing computing powers. Therefore, miners continue to unite in pools or use the services of hosting companies. In the near future, this trend will not only be preserved but will also receive its development.

Conclusion

Despite periodic declines, bitcoin continues the trend of growth, which makes investing in cryptocurrency mining a profitable investment. With the development of mining pools and the appearance of large farms, it is difficult for a solo miner to get a significant income. Therefore, the best option may be cloud mining or the purchase/rental of an ASIC farm from a hosting company, which will take over the installation and maintenance of the equipment. With ECOS.am, you can focus on mining and investing in BTC. We take on all the other work.

4 notes

·

View notes

Text

Blockchain Mining for Monero - blockchaincloudmining.com

Are you interested in mining Monero but unsure where to start? Look no further than blockchaincloudmining.com, a leading platform for cloud mining services. Monero is a privacy-focused cryptocurrency that has gained significant traction in recent years due to its advanced features and strong community support.

Blockchain mining for Monero involves using computational power to verify transactions on the Monero network and add new blocks to the blockchain. Unlike some other cryptocurrencies, Monero uses a proof-of-work algorithm called CryptoNight, which is designed to be ASIC-resistant, making it more accessible to individual miners.

At blockchaincloudmining.com, you can easily get started with Monero mining without the need for expensive hardware. The platform offers various mining contracts tailored to different budgets and preferences. Whether you're a beginner or an experienced miner, blockchaincloudmining.com provides a user-friendly interface and comprehensive support to help you maximize your earnings.

To learn more about Monero mining and how blockchaincloudmining.com can help you get started, visit https://blockchaincloudmining.com today.

blockchaincloudmining.com

Block Chain Cloud Mining

BlockChain Cloud Mining

0 notes

Text

Sure, here's a sample article based on your request:

Top Crypto to Mine with PaladinMining.com

Are you looking for the top cryptocurrencies to mine in 2023? Look no further than PaladinMining.com, your premier resource for all things related to crypto mining. In this article, we will explore some of the most profitable cryptocurrencies that you can mine using our advanced mining tools and services.

Introduction

The world of cryptocurrency mining is constantly evolving, with new coins emerging and older ones gaining or losing popularity. To stay ahead of the game, it's crucial to choose the right cryptocurrency to mine. This not only depends on the current market trends but also on the efficiency of your mining setup. At https://paladinmining.com, we provide state-of-the-art mining solutions tailored to help you maximize your profits.

Top Cryptocurrencies to Mine

1. Bitcoin (BTC)

Bitcoin remains one of the most popular and valuable cryptocurrencies to mine. With its high market capitalization and global acceptance, mining BTC can be highly rewarding. However, due to its complexity, specialized hardware is required. Our platform at PaladinMining.com offers optimized mining rigs and software to ensure you get the best results.

2. Ethereum (ETH)

Ethereum is another top choice for miners. Its robust blockchain supports smart contracts and decentralized applications, making it a versatile and valuable asset. Mining ETH requires powerful GPUs, and our team at PaladinMining.com can guide you through setting up an efficient mining rig.

3. Litecoin (LTC)

Litecoin is known for its faster transaction times compared to Bitcoin. It uses a different algorithm (Scrypt) which makes it more accessible for miners with less specialized equipment. Our experts at PaladinMining.com can help you configure your mining setup to optimize your Litecoin mining efforts.

4. Monero (XMR)

Monero is a privacy-focused cryptocurrency that uses a proof-of-work algorithm called CryptoNight. This makes it suitable for mining with CPUs and GPUs. At PaladinMining.com, we offer comprehensive support for Monero mining, ensuring you have the right tools and knowledge to succeed.

5. Zcash (ZEC)

Zcash is another privacy coin that uses Equihash as its mining algorithm. It is designed to be ASIC-resistant, making it a good option for miners with GPU setups. Our platform provides detailed guides and resources to help you start mining Zcash effectively.

Conclusion

Choosing the right cryptocurrency to mine is crucial for maximizing your returns. At PaladinMining.com, we are dedicated to providing you with the latest information, tools, and support to help you succeed in the world of crypto mining. Whether you're a beginner or an experienced miner, our platform has everything you need to get started. Visit us at https://paladinmining.com to learn more about our services and how we can help you achieve your mining goals.

Feel free to let me know if you need any adjustments or additional content!

加飞机@yuantou2048

paladinmining

Paladin Mining

0 notes

Text

0 notes

Text

Monero (XMR) Price Prediction 2025, 2026, 2027, 2028, 2029 and 2030

In this article, we aim to provide a comprehensive price prediction for Monero (XMR) from 2025 to 2030.

Our objective is to guide you through a year-by-year analysis of potential price movements based on key technical indicators and market dynamics.

We’ll delve into the intricacies surrounding Monero, examining its potential growth trajectory and its place within the broader cryptocurrency market.

Our analysis will be rooted in data, ensuring you have the insights needed to make informed decisions.

We look forward to guiding you through the fascinating world of Monero’s potential price progression.

Monero (XMR) Long-Term Price Prediction

Year Lowest Price Average Price Highest Price 2025 $650 $900 $1200 2026 $1000 $1250 $1500 2027 $850 $1150 $1300 2028 $800 $1100 $1400 2029 $1200 $1450 $1700 2030 $1500 $1750 $2000

Monero Price Prediction 2025

The year 2025 is expected to start off with a bullish growth for Monero, its lowest price resting at $650.

The anticipated positive regulatory changes and the overall technological growth are expected to drive the average price to $900.

The highest price point of $1200 might be reached owing to increasing adoption of cryptocurrencies, especially with Ethereum’s introduction of ETFs.

Monero Price Prediction 2026

In 2026, the lowest price is expected to hit the $1000 mark, reflecting the previous year’s growth.

The same factors that drove growth in 2025 will continue to drive the average price to $1250.

The highest price predicted for this year is $1500, supported by eased inflation rates and reliable investments in cryptocurrencies.

Monero Price Prediction 2027

The year 2027 might experience a slight dip as part of a correction year.

The lowest price may fall to $850, but a favourable market should still maintain the average price at around $1150, while the highest price may reach $1300.

Monero Price Prediction 2028

The correction cycle is likely to continue into 2028 with the lowest price hitting $800.

But the average price should remain relatively stable at $1100, and the highest price can still reach an optimistic $1400 due to potential investments in risk assets.

Monero Price Prediction 2029

In 2029, growth is expected to resume with a lowest price of $1200, and an average price reaching $1450.

The surge in tech advancements and wider crypto adoption can lead to a highest price of $1700, representing a significant gain in value.

Monero Price Prediction 2030

By 2030, Monero’s lowest price is projected to reach $1500, and the average price could peak at $1750, buoyed by years of steady technological advancement and growth in crypto acceptance.

With the maturing crypto space and regulatory environment, the highest price has the potential to soar to $2000.

Monero (XMR) Fundamental Analysis

Project Name Monero Symbol XMR Current Price $ 158.4 Price Change (24h) -3.30% Market Cap $ 2.9 B Volume (24h) $ 61,507,896 Current Supply 18,446,744

Monero (XMR) is currently trading at $ 158.4 and has a market capitalization of $ 2.9 B.

Over the last 24 hours, the price of Monero has changed by -3.30%, positioning it 28 in the ranking among all cryptocurrencies with a daily volume of $ 61,507,896.

Technological Innovations of Monero and their Market Implications

As a privacy-focused cryptocurrency, Monero has spearheaded various technological innovations setting it apart from competitors.

Key among these is its use of ring signatures for transaction confidentiality, obscuring transaction amounts and recipient identities.

Monero also utilizes stealth addresses, creating one-time addresses for each transaction, further enhancing privacy.

Monero’s dynamic scalability is another differentiator. Unlike Bitcoin’s fixed block size, Monero blocks can grow or shrink based on demand, improving transaction speed and efficiency.

Monero’s innovative Cryptonight PoW algorithm enables a more equitable distribution of mining power, countering centralization threats. This focus on privacy and decentralization aligns with digital currency market needs as concerns grow over data breaches, surveillance, and centralization in conventional cryptocurrencies.

Strategic Partnerships and Collaborations of Monero

Monero, as a decentralized and open-source initiative, has operated largely independently, without formal partnerships typical of corporate entities.

However, its extensive adoption by key industry figures serves the same purpose. Leading VPN providers, cybersecurity services, and online retailers accept Monero, endorsing its privacy-centric ethos and benefiting users seeking anonymity.

Integration with major wallet providers and hardware wallets like Trezor and Ledger have enhanced its accessibility.

Furthermore, listings on major exchanges underscore Monero’s market importance and facilitate liquidity.

Monero’s Competitive Sustainability Strategies

Monero’s key strategy in maintaining its edge lies in its continuous technological advancement.

Regular network upgrades (approximately every six months) help Monero to adapt, incorporating novel privacy technology and addressing scalability issues. This proactive approach to development keeps Monero at the forefront of the privacy coin sector.

In response to the dynamic regulatory environment, Monero’s focus on privacy does pose challenges.

However, its decentralised governance structure allows for flexibility and adaptation to new compliance requirements.

Monero’s Community Engagement Initiatives

Monero boasts a highly active community across numerous platforms, including Reddit, Twitter, GitHub, and its dedicated forum, Monero Community.

Monero’s open-source project ethos means that considerable communication also occurs through public developer meetings, enhancing transparency and community inclusion.

Regularly hosted meet-ups and seminars promote education about Monero and blockchain technology, attracting newcomers, fostering growth, and increasing adoption.

Alongside these events, initiatives like Monero’s Community Crowdfunding System encourage direct community involvement in the development process, creating a sense of ownership and contribution among users.

Through such community-focused strategies, Monero has cultivated a supportive, engaged user base that actively contributes to its success.

The dedication to privacy, robust technology, and a vibrant community all underline Monero’s competitiveness in the thriving cryptocurrency market.

Monero (XMR) Technical Analysis

Zoom

Hour

Day

Week

Month

Year

All Time

Type

Line Chart

Candlestick

Technical Analysis is a forecasting method used by traders which involves the study of historical market data, primarily price and volume, to estimate future trends.

It is crucial in Monero price predictions as it provides data-driven insights by combining statistical qualities of price market data to predict future prices.

Here are three key technical indicators:

Moving Averages (MA): It smoothens out price data by creating a constantly updated average price, offering signals for potential buying and selling opportunities.

Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements, indicating overbought or oversold conditions in a market.

Volume: It shows the total number of shares or contracts traded within a specific timeline, reflecting the strength or weakness of a trend.

Monero Price Predictions FAQs

What is Monero?

Monero (XMR) is a private, untraceable, and securely encrypted cryptocurrency that was launched in 2014.

Offering extreme privacy features, Monero focuses on decentralization and scalability, ensuring all transactions on its blockchain are confidential and untraceable.

Is Monero a good investment?

Investment in Monero can be promising considering its unique privacy features. However, like any other cryptocurrency, it’s subject to volatility and is associated with risk. Therefore, thorough research and due diligence are crucial before investing.

What makes Monero different from Bitcoin?

Unlike Bitcoin, which operates on a transparent blockchain, Monero is renowned for its privacy features. Its blockchain obfuscates every aspect of a transaction, including sender, recipient, and amount. This ensures significantly greater privacy than what’s offered by Bitcoin.

How is the price of Monero determined?

The price of Monero, similar to other cryptocurrencies, is determined by supply and demand dynamics in the market.

Factors such as technological advancements, market sentiment, regulatory news, and macroeconomic trends can influence its price.

Can the price of Monero reach $1000?

While it’s difficult to predict with absolute certainty, many analysts believe that Monero has the potential to reach $1000 due to its robust privacy features and growing adoption.

However, this also depends on various market conditions and regulatory developments.

What is CoinEagle.com?

CoinEagle.com is an independent crypto media platform and your official source of crypto knowledge. Our motto, “soaring above traditional finance,” encapsulates our mission to promote the adoption of crypto assets and blockchain technology.

Symbolized by the eagle in our brand, CoinEagle.com represents vision, strength, and the ability to rise above challenges. Just as an eagle soars high and has a keen eye on the landscape below, we provide a broad and insightful perspective on the crypto world.

We strive to elevate the conversation around cryptocurrency, offering a comprehensive view that goes beyond the headlines.

Recognized not only as one of the best crypto news websites in the world, but also as a community that creates tools and strategies to help you master digital finance, CoinEagle.com is committed to providing you with the necessary knowledge to win in crypto.

Disclaimer: The Monero price predictions in this article are speculative and intended solely for informational purposes. They do not constitute financial advice. Cryptocurrency markets are highly volatile and can be unpredictable. Investors should perform their own research and consult with a financial advisor before making any investment decisions. CoinEagle.com and its authors are not responsible for any financial losses that may result from following the information provided.

0 notes

Text

رز دیجیتال BLUR چیست؟

رز دیجیتال BLUR یک ارز دیجیتال (Cryptocurrency) است که ببنیه بلاکچین (Blockchain) ایجاد شده است. BLUR از الگوریتمهای رمزنگاری پیشرفتهای مانند CryptoNight و RandomX برای ایجاد حفظ امنیت و حریم خصوصی استفاده میکند. این ارز دیجیتال به دلیل تمرکز بر روی حریم خصوصی و امنیت، توجه بسیاری از افراد و تریدرها را به خود جلب کرده است.

BLUR از تکنولوژیهای مبتنی بر حریم خصوصی مانند Ring Signatures، Confidential Transactions و Stealth Addresses برای مخفی کردن اطلاعات تراکنشها و افراد شرکتکننده استفاده میکند. این امر باعث میشود تراکنشهای انجام شده با استفاده از BLUR بسیار حریم خصوصی و ناشناس باشند.

اگر قصد دارید در مورد BLUR یا هر ارز دیجیتال دیگری سرمایهگذاری یا ترید کنید، بهتر است که اطلاعات کافی و دقیقی در مورد آن کسب کنید و از مشاورهی متخصصان و منابع معتبر استفاده کنید. همچنین باید به یاد داشته باشید که بازار ارزهای دیجیتال بسیار پویا و پرخطر است و باید با احتیاط و دقت بالایی به آن نگرانی کنید.

0 notes

Text

Algorithms play a pivotal role in the digital space. They determine how a particular application is going to function. From the basic functionality to specific attributes, these sets of codes do all the decision-making. They become an instrumental player in the crypto domain as well. In the blockchain sphere, everyone calls these programs mining algorithms. The most common examples are Proof-of-Work (PoW) and Proof-of-Staking (PoS). These two are the most prevalent mechanisms for crypto miners. But the decentralized space is evolving and the shift hasn’t left the algorithms untouched. As a result, the blockchain community is seeing some new and advanced mining algorithms today. CryptoNight: In a Nutshell CryptoNight is one of the fastest mining algorithms based on PoW. Developers created this ASIC-resistant program for CPU and GPU mining. It prevents the centralization of mining power and makes the process more efficient. The distinct protocol deploys a combination of hashing functions which are Keccak and CryptoNight. They are both cryptographic hash functions based on Advanced Encryption Standard (AES). Notably, AES is a military-level algorithm that makes the blockchain indomitable. Consequently, CryptoNight has become a preferred network for those who prioritize security. Monero is the first coin that used this algorithm for its blockchain consensus. As Monero grew and prevailed, CryptoNight’s reputation also increased by leaps and bounds. The creator of CryptoNight is known by the pseudonym Nicolas van Saberhagen. As per many blockchain experts, its creation is spectacular and it even reminds one of Bitcoin. Some even believe that the creator of Bitcoin and CryptoNight is the same person. What corroborates their claim is the release date of both networks i.e. December 12, 2012. CryptoNight is a part of the CryptoNote consensus protocol. The latter works as a privacy tool that facilitates ring signatures, and non-linkable and confidential transactions. A Peep Into CryptoNight’s Working CryptoNight works on the CryptoNote consensus protocol. The latter ensures the anonymity of the transaction while strengthening privacy. Though the former is GPU-mining friendly, it becomes a perfect choice for CPU mining. The 64-bit fast multipliers deliver maximum speed. With CPU architecture, the platform optimizes CPU cache usage and brings high efficacy. It works in three easy steps that one must understand: Creation of Scratchpad In this step, the network stores a large memory with intermediate values during a hashing function. It hashes the first input data with the Keccak-1600 hashing function. It generates 200 bytes of random data. Encryption Transformation It then transforms the first 31 bytes of Keccak-1600 hashes into the encryption key for an AES-256 algorithm. This lot acquires the highest value within the AES family. Final Hashing The last step involves synchronizing the data created by AES-256 with the rest of the hash functions. The final hash contains a total of 64 characters or a 256-bit extension. CryptoNight was introduced as an alternative to ASIC miners. It brought CPUs and GPUs to the fore while enhancing scalability and security. Besides Monero, Bytecoin, Electroneum (ETN) and many other projects are using this architecture. It certainly proposes positive changes that can change the game for the better.

0 notes

Text

Why does Bytecoin deserve attention? Why buy Bytecoin? And why is Bytecoin so good?

To understand whether it is worth investing in Bytecoin (BCN), you need to objectively evaluate the idea of the project, the activity of its team, as well as the specifics of mining, storage, purchase, etc. In this review, we can learn in detail about the Bytecoin project and its growth prospects. Today we prepared a Bytecoin (BCN) price prediction for 2021-2025.

What Is Bytecoin?

Bytecoin (BCN) is one of the first digital coins based on the CryptoNote software algorithm. The Bytecoin cryptocurrency is an independent project that is developing in isolation from bitcoin and altcoins based on this currency. BCN cryptocurrency appeared in the middle of summer 2012. When developing BCN cryptocurrency, programmers achieved maximum anonymity and security. This currency was created specifically to protect users' personal information through anonymous transactions that are not traceable. For this reason, Bytecoin is commonly referred to as the next generation of crypto coins.

Bytecoin (BCN) now rightfully bears the status of one of the most promising digital crypto assets, providing complete anonymity and security of funds. The cryptocurrency Bytecoin appeared in 2012, a well-known cryptocurrency enthusiast working under the nickname "amjuarez". He decided not to use the usual fork path, but to create his own software framework for the further development of Bytecoin. At the same time, the first financial transaction using a byte was carried out only two years after the appearance of the currency.

Bytecoin Advantages

At the heart of the Bytecoin coin is the new CryptoNote technology, which has a number of unique properties. This digital coin is ideal for those users who value the security and anonymity of their financial transactions. In addition, it enables transactions to be carried out automatically. As a result, the creators of this project managed to combine continuity and anonymity in their brainchild, which should help it win a large user audience in the future. The main use of this coin is the exchange of funds between users. According to the creators of this digital project, their coin offers the most convenient and secure method of payments between users, which is explained by the presence of special protection against unauthorized attacks from malefactors.

Transactions for the transfer and exchange of funds within the Bytecoin cryptosystem are carried out with lightning speed and with no commission at all. All of this was achieved thanks to advanced and developed system infrastructure.

This digital project is especially popular among inexperienced users who do not have extensive knowledge of cryptocurrency mining and do not have high-performance equipment. This is due to the fact that even now Bytecoin can be mined using a laptop or a regular stationary PC. Such low-performance equipment can bring a good income to a novice miner. In this case, we can say with confidence that the mining of Bytecoins is a promising event because if the quotes of this currency grow, the crypto-miner will be able to get a profit.

Working with the use of Bytecoin will also be beneficial for the business sector. Entrepreneurs will be able to gain at their disposal the benefits experienced by other users. The business community should note that the main advantage of this coin is the availability of protection against payment refunds. The algorithm of the currency was thought out in such a way that the risks of refunds from buyers were minimized.

Despite such advantages of BCN for commercial activities, this currency has not yet managed to gather around itself a large number of businessmen and companies engaged in trade. To date, byte calculations are only available in a few online stores.

Bytecoin Price Prediction 2021-2025

According to some observers, Bytecoin is one of the most promising crypto assets for long-term investment. Recently the Bytecoin team presented Bytecoin Zero, a browser wallet for the Bytecoin platform. This software allows users to open their Bytecoin wallets and transfer BCNs straight in the browser without requiring desktop-class software. All this should contribute to an increase in the number of users using this coin. As a result, this will lead to an increase in the value of the coin on the exchanges, which will bring profit to investors who risked investing in Bytecoin. Also, Bytecoin management plans to officially enter Asian markets, where there are already previously created user communities. At the same time, Bytecoin does not abandon its plans to conquer the market of Eastern European countries.

One of the most important factors that can ensure the subsequent success of the currency is that it began to trade on such a major crypto exchange as Binance. Such news led to a jump in the exchange rate quotes, which subsequently helped to attract new investors and users interested in the possibility of making a profit using this asset.

Therefore, experts agree that the conquest of new markets will have a positive impact on the development of ByteCoin, and will also show the real level of professionalism of the project creators. At the same time, it is difficult to make an accurate forecast for upcoming years regarding the direction of the Bytecoin development. In general, there is no doubt that the BCN price tends to follow the major market trends. For instance, in February 2021, the Bytecoin price has grown by several times in a short period of time.

At the time of writing, the altcoin rate is $0.001. By the end of 2021, the rate should gain a value within the $ 1 - 0.7 interval. In subsequent years, as the community develops, the price will gradually rise, for 2022 the price may rise to $ 1.5 per coin, and by 2025 the asset can be traded within $ 3 - 4 per unit. Therefore, the altcoin is very interesting for long-term investment, and if you lose or will benefit from it, time will tell.

Official site - https://bytecoin.org

#BytecoinKingChallenge #Bytecoin #BCN #Cryptocurrency #BytecoinChallenge #Blockchain #Bytecoin_BCN #CryptoNote #BytecoinChallange #cryptonight

#BytecoinKingChallenge#Bytecoin#BCN#Cryptocurrency#BytecoinChallenge#Blockchain#Bytecoin_BCN#CryptoNote#BytecoinChallange#cryptonight

3 notes

·

View notes

Text

Monero (XMR) là gì, Monero có gì khác biệt với Bitcoin?

Monero (XMR) là gì, Monero có gì khác biệt với Bitcoin?

Monero (XMR) là một loại tiền kỹ thuật số mã nguồn mở được phát hành lần đầu tiên vào tháng 4/2014. Không như các loại tiền điện tử khác phát triển dựa vào Bitcoin, Monero hoạt động dựa vào giao thức CryptoNote và sử dụng những thuật toán quan trọng liên quan đến Blockchain. Monero tập trung vào tính riêng tư, phân cấp và khả năng mở rộng. Được sự hỗ trợ từ cộng đồng và Wladimir J. Van der Laan…

View On WordPress

0 notes

Text

Baikal BK-N70 安裝教學

除了顯示卡以外,

另一個用來挖礦的工具就是ASIC礦機了,

今天就要來介紹由貝加爾礦工所出的雙演算法礦機

Baikal BK-N70 安裝教學

N70需要12V 6pin 電源 * 5,

可使用��般電腦ATX電源供應器供電 (要找插電就供電,否則就要短路第四pin : PS_ON)

耗電量只有220W,

接上電源以及網路線之後,

從瀏覽器打上ip即可登入控制介面,

預設密碼為baikal

首頁可看到N70有五個算力板

Pools欄的SWITCH TO

可用來切換目前已設定的礦池,

同一時間只能啟用一個

在Miner頁面

找到礦池URL設定,

在此填上礦池位址與錢包位址即可開始挖礦

由於N70是雙演算法礦機,

故選擇礦池時候 ,

要一併選擇演算法

N70 支援 CryptoNight / CryptoNight-Lite 兩種演算法,

最大算力分別為 70k …

View On WordPress

1 note

·

View note

Text

Brave premier Navigateur internet qui privatise vos données et vous rémunère pour chaque publicité afficher.

1 note

·

View note

Text

All you need to know about the Monero update

All you need to know about the Monero update

by MinerGate Mining Pool March, 12, 2019

Monero (XMR) was initially released in April 2014 and was one of the first anonymous cryptocurrencies in the field. Since its launch, the Monero network has experienced many changes and updates, the most recent one taking place on 9 March 2019. Let’s have a quick look at what changed and what people need to do in order to continue mining the updated…

View On WordPress

#Crypto Coins#CryptoNight#CryptoNight-R#hardfork#minergate#monero#TCRNews#thecryptoreport#update#xmr

0 notes

Text

¿Qué es el algoritmo de minería CryptoNight?

El algoritmo de minería CryptoNight es un algoritmo de minería pensado para ser especialmente eficiente en CPU y resistente a ASIC. Esto con el objetivo de permitir una mayor descentralización de la minería de las criptomonedas que lo apliquen, pero también, permitir que dichas criptomonedas puedan ofrecer avanzadas opciones de privacidad y anonimato. Contenidos Previos Recomendados Uno de los algoritmos de minería más conocidos es CryptoNight. Este algoritmo de minería, es parte del conocido protocolo de consensoCryptoNote. CryptoNight usa el esquema de minería de Prueba de Trabajo (PoW)para su funcionamiento, y busca ofrecer una alta dependencia de las CPU, resistiendo a los ASIC, FPGA y GPU. Su principal característica es que es un algoritmo de hash muy rápido. Además permite una buena escalabilidad y realiza una serie de pruebas criptográficas que son extremadamente dependientes de la memoria caché de los procesadores CPU. Pero no solo eso, su core o núcleo criptográfico trabaja alrededor del algoritmo de cifrado AES, un algoritmo muy seguro e incluso considerado, en algunas versiones, como cifrado de nivel militar. Todo esto hace de CryptoNight un algoritmo de minería muy enfocado en la seguridad y ese ha sido su principal vehículo al éxito en el mundo cripto. De hecho, el hecho de que la criptomoneda Monero lo eligiese como algoritmo hash para la prueba de trabajo del consenso de su blockchain, potenció la visibilidad de CryptoNight y le abrió un espacio en el criptomundo. Ahora bien ¿Cuál es la historia detrás de CryptoNight? ¿Cómo funciona este interesante algoritmo? Como siempre podrás obtener las respuestas a estas y otras preguntas a continuación.

Origen del algoritmo CryptoNight

El desarrollo de CryptoNight se puede rastrear hasta 12 de diciembre 2012, cuando el desarrollador Nicolas van Saberhagen presentó al mundo el protocolo de consenso CryptoNote. Nicolas van Saberhagen, es un nombre ficticio y la identidad del desarrollador es un completo enigma, hasta el punto que rivaliza con la de Satoshi Nakamoto. De hecho, muchos especialistas creen que Nicolas van Saberhagen y Satoshi Nakamoto son la misma persona. De allí que haya nacido el nombre de Satoshi van Saberhagen, en referencia a este posible hecho. Pero lejos del campo de la especulación, CryptoNote es una realidad. El lanzamiento de este protocolo en una fecha tan llamativa (para ser precisos, el 12/12/12) llamó la atención de la criptocomunidad. Esto debido a que CryptoNote presentaba funciones avanzadas que prometían cosas como transacciones confidenciales. Además de transacciones no enlazables, firmas de anillos, transacciones de menor tamaño y una seguridad reforzada. Más tarde en marzo de 2013, nacería la especificación completa de CryptoNight, el algoritmo de minería que permitiría hacer una realidad a CryptoNote. Detrás de este desarrollo están los desarrolladores Seigen, Max Jameson, Tuomo Nieminen, Neocortex y Antonio M. Juarez. El proyecto de CryptoNote y su algoritmo de minería fue tomado inicialmente por Bytecoin (BCN) quienes lo aplicaron a su blockchain. Pero no fue hasta la creación de Monero (XMR) que este proyecto comenzó a ser conocido ampliamente en el criptomundo.

Funcionamiento de CryptoNight

El funcionamiento de CryptoNight se basa en una serie de propiedades que lo hacen muy amigable para la minería por GPU. Estas propiedades son: - Utiliza cifrado AES nativo. Las CPU con capacidad de aceleración por hardware para cálculos AES pueden verse fuertemente beneficiadas por este hecho y tener un potencial de minería superior. - Uso de funciones hash seguros, como Keccak y Blake-256. - Utiliza un conjunto de multiplicadores rápidos de 64 bits. Debido a esto, las arquitecturas de CPU de 64 bits puras, son altamente eficientes. También es posible usarlo sobre CPUs del tipo VLIW de 128 a 512 bits, donde el algoritmo podría sacar provecho de conjuntos de minería paralelas aumentando el rendimiento. - Utilización intensiva de memorias caché de la CPU. El algoritmo de CryptoNight ajusta su uso de cache para sacar el máximo provecho al mismo. De hecho, mientras más caché tenga el CPU mejor rendimiento tendrá. Si observamos estos cuatro pilares, veremos que todos ellos están muy centrados en la CPU. De hecho, algunas de esas funciones son mucho más eficiente sobre un CPU que sobre cualquier otra estructura computacional, entre ellos los ASIC. Esto es lo que permite que CryptoNight sea resistente a los mismos. Pero claro, esto son solo los pilares y no la forma en cómo funciona el algoritmo, eso lo explicaremos a continuación. Iniciando el sistema de hash El trabajo de CryptoNight comienza con la inicialización de su espacio de trabajo. Para ello CryptoNight hace uso de una serie de primitivas criptográficas que son: - Cifrado AES - Función hash Keccak, que es usada como vehículo principal de generación de hash dentro del algoritmo. - Función hash SHA-3. SHA-3 es una función hash derivada de Keccak, y es utilizada junto a BLAKE-256, Groestl-256, JH-256 y Madeja-256 para fortalecer la generación de los hash del espacio de trabajo criptográfico de CryptoNight. Creación de la clave AES y cifrado del hash Keccak La parte más importante del proceso es la creación de la clave AES. Esto es posible durante la primera ronda de funcionamiento de las funciones hash. En primer lugar, CryptoNight toma una entrada de datos y lo lleva a la función Keccak. Para ello, prepara una función Keccak-1600 de 1600 bits de ancho. En comparación, Bitcoin y su función hash SHA-256 usa palabras de 256 bits o 64 caracteres. Mientras que Keccak-1600 produce hashes mucho más grandes, de 1600 bits o de 400 caracteres en su totalidad, con un tamaño de 200 bytes. Luego toma los primeros 31 bytes de este hash Keccak-1600, y los transforma en la clave de cifrado para un algoritmo AES-256, el de mayor valor dentro de la familia AES. Para ello este pequeño fragmento de datos es cifrado en diez rondas. El resto del hash se cifra usando AES-256 y se somete también a una ronda de 10 ciclos de cifrados. Posteriormente se toma el resto de información del hash Keccak y se cifra usando AES-256. Este proceso genera una enorme cantidad de datos que luego son enviados al espacio de trabajo o scratchpad de CryptoNight. Al terminar con este proceso, el espacio de trabajo de CryptoNight se ha preparado y comienza el ciclo de generación del hash. Generación del hash final Ahora bien los datos recogidos por estas acciones alimentan el core o núcleo de funciones hash. Como dijimos la principal es Keccak, a las que se les une BLAKE-256, Groestl-256, JH-256 y Madeja-256. Lo que hace CryptoNight es tomar todo el conjunto de datos creado por las funciones AES-256 y Keccak en el paso anterior, y lo pasa por el resto de funciones hash. Al final se obtiene un hash final, que es el resultado de la prueba de trabajo de CryptoNight. Este hash tiene una extensión de 256 bits o un total de 64 caracteres.

Pros y contras del algoritmo

Pros - Altamente personalizable. Datos como el target de minería y la dificultad pueden ser ajustados entre bloques sin que ellos signifique un peligro para la seguridad de la red. - Se centra en la CPU. Esto hace que la minería usando ASIC sea compleja y costosa de realizar. - Es extremadamente seguro a nivel criptográfico. El uso de AES-256 y la unión de técnicas de cifrado y funciones hash de forma determinas aseguran que siempre se obtendrá un alto nivel de seguridad. - Es eficiente energética y computacionalmente hablando. - Para el nivel de seguridad proporcionado, el tamaño de los resultados de las pruebas criptográficas de CryptoNight es pequeño. Esto permite maximizar el número de transacciones dentro de los bloques. - Dada la forma en como CryptoNight maneja la información para minar bloques, existe la posibilidad de crear transacciones no rastreables de forma nativa. De hecho, Monero pudo construir estas transacciones gracias a CryptoNight. Contras - La capacidad de resistencia a ASIC ya no es factible. Esto es debido a que los ASIC pudieron adaptarse para lograr minar para este algoritmo con gran eficiencia. - CryptoNight es extremadamente complejo y difícil de auditar. Por esta razón, los desarrolladores tienen una gran curva de complejidad para revisar los posibles errores de este algoritmo. - El uso de instrucciones CPU específicas como AES, puede llevar a que el algoritmo pueda ser atacado lateralmente. Existe la posibilidad de explotar vulnerabilidades dentro del procesador que puedan romper la seguridad del algoritmo. Fuente de informacion: https://academy.bit2me.com/que-es-el-algoritmo-de-mineria-cryptonight/ - - - Read the full article

#algoritmoSHA-256#Bitcoin#Cardano#CardanoADA#crypto#CryptoCruise#crypto.com#Cryptobuyer#cryptocurrency#CryptoNight#Cryptonote#CryptoRefills#transferenciabancaria

0 notes

Photo

12-June-2018. Stock (today pay - tomorrow/after tomorrow will shipping). 1. Innosilicon D9, 2.1TH/s, 900W (Blake256, DCR) (without PSU) - stock - 2330$/pc. 2. Innosilicon S11, 3.83TH/s, 1380W (Blake2b (Siacoin) (without PSU) - stock - 1720$/pc. 3. Innosilicon T2 Terminator, 17,2Th/s, 1570W, SHA256 (BTC miner) (without PSU) - stock - 999$/pc. 4. iBeLink™ DSM6T, Blake256, 6TH/s, 2100W (without PSU) - stock - 7599$/pc. 5. Antminer B3, 780H/s, 360W (Bytom (BTM) (without PSU) - stock - 1499$/pc. (PayPal can be). 6. PinIdea RR-210, 350W (Cryptonight) (without PSU) - stock - 435$/pc. (PayPal can be). 7. Antminer A3, SC, 815G, 1275W (without PSU) – stock - 435$/pc. (PayPal can be). 8. Baikal Giant N70 (BK-N70), 70-140KH/s, 220W (Cryptonight/Cryptonight-lite) (without PSU) – stock –775$/pc. 9. Baikal Giant N240 (BK-N240), 240KH/s, 650W (Cryptonight/Cryptonight-lite) (without PSU) – stock – 1865$/pc. 10. Baikal Giant-N+, 1300W (Cryptonight) (without PSU) - stock - 445$/pc. 11. Baikal Giant-B (without PSU) - stock - 1575$/pc. 12. Baikal Giant X10, 10Gh/s (without PSU) - stock - 1655$/pc. 13. Antminer S9i, 13,5Th/s, SHA-256, BTC, 1310W (with PSU) – stock - 805$/pc. 14. Antminer S9i, 14Th/s, SHA-256, BTC, 1310W (with PSU) – stock - 855$/pc. 15. Antminer L3++, LTC, 580M, 942W (without PSU) – stock - 470$/pc. 16. Antminer T9+, 10,5Th/s, SHA-256, BTC, 1432W (with PSU) - 15-20 June - 555$/pc. 17. Whatsminer M3, BTC-12T (without PSU) - stock - 499$/pc. 18. Bitmain PSU APW3 ++, 1600W (6-pin – 10) - 110$/pc. 19. PSU, 1800W (6-pin – 10) (flat) - 79$/pc. 20. PSU, 1800W (6-pin – 10) (standard) - 69$/pc. 21. PSU, 2100W (6-pin – 10) - 98$/pc. #antminer#bitmain#avalon#innosilicon#buyasic#asic#асик#битмайн#антмайнер#chinasells#asicchina#bitcoin#crypto#litecoin#siacoin#cryptonight#bytom#pinidea#videocard#dragonmain#bitfury#baikal#ebit#monero#t9+#buyasic#Whatsminer#ibelink#psu#avalon#ibelink#ssd#ram#ddr# (at 广东惠州)

#bitcoin#cryptonight#avalon#асик#bitmain#pinidea#ibelink#chinasells#bitfury#ddr#dragonmain#t9#битмайн#asicchina#buyasic#innosilicon#videocard#antminer#ram#psu#baikal#ebit#crypto#litecoin#ssd#siacoin#asic#антмайнер#bytom#whatsminer

1 note

·

View note

Text

Cryptocurrency mining on Pi Zero

Hi guys here’s some short instructions how how to mine with the Raspberry Pi Zero. It won’t be very efficient! But can be done for fun and learning purposes.

Begin by heading over to https://minergate.com/ a mining pool where many users work together combining their computing resources. Each member of the pool is rewarded based on the amount of good work they’ve done. With a slice taken off the top of the pool’s organizers.

Load your Raspberry Pi, and then enter in the following commands into terminal or use SSH from a remote computer.

Begin by updating the OS.

sudo apt-get update && sudo apt-get upgrade -y

Then we install the software.

sudo apt-get install -qy automake autoconf pkg-config libcurl4-openssl-dev libssl-dev libjansson-dev libgmp-dev make g++ git

Next we clone the GitHub software cpu miner-multi.

git clone https://github.com/tpruvot/cpuminer-multi

Then enter the folder and build the software.

cd cpuminer-multi && ./build.sh

Finally we run the miner, when you type in this command you will need to replace YOUR_EMAIL with the e-mail you have signed up with for minergate.com.

./cpuminer -a cryptonight -o stratum+tcp://xmr.pool.minergate.com:45700 -u YOUR_EMAIL

And that’s it, you are how mining in the Raspberry Pi Zero W. Don’t expect to get rich! But it’s fun to see how you can do this in Linux.

Best of all these commands work on any Raspberry Pi. I’ve already run these instructions on my Pi 4 and yielded 7.6x the performance.

Please consider listening to my new podcast over on Spotify episodes released daily.

https://open.spotify.com/show/4IfvnRht5hHrelGAddDQ9Z?si=MDc1JwiMSyaSXjnaNAtmuQ

10 notes

·

View notes