#currently on D14-20

Text

alright gamers do you think i can beat D14 before chp 15 comes out

#when chp 13 came out the castle skin was locked in dark mode and i Want the city of wizards castle skin i think it will be#so fucking pretty#And then i slog through this shit and they nerf d14 or give a lvl cap increase or something like they did before /hj#currently on D14-20

0 notes

Photo

New Post has been published on https://techcrunchapp.com/hcl-tech-share-price-stocks-in-the-news-hcl-technologies-federal-bank-idbi-bank-and-mindtree/

HCL Tech share price: Stocks in the news: HCL Technologies, Federal Bank, IDBI Bank and Mindtree

Nifty futures on the Singapore Exchange traded 66.5 points, or 0.57 per cent higher at 11,761.50, in signs that Dalal Street was headed for a positive start on Friday. Here are a few stocks which may buzz the most in today’s trade:

Earnings today: Federal Bank, HCL Technologies, Bajaj Consumer Care, LKP Securities, Shoppers Stop, Tata Communications and Uniply are slated to announce their financial results for September quarter on Friday.

IDBI Bank: The country’s biggest institutional investor Life Insurance Corporation of India (LIC) is keen to divest its stake in IDBI Bank, ET NOW reported quoting government sources.

Mindtree: IT firm Mindtree posted a 87.9 per cent rise in consolidated net profit to Rs 253.7 crore for the September 2020 quarter, and said it was confident of continuing its growth momentum.

Lakshmi Vilas

Bank: The Board of Directors of

Lakshmi

Vilas

Bank (LVB) on Thursday approved raising of funds up to Rs 500 crore through issue of equity shares or such other securities by way of rights issue.

Persistent Systems: The company said it will acquire Palo Alto-based Capiot. Under the deal, Persistent Systems Ltd India (PSL) will acquire 100 per cent shares of Capiot Software – the Indian subsidiary of Capiot Software Inc and consequently, Capiot India will become a wholly-owned subsidiary of PSL, a regulatory filing said.

Sterling and Wilson: Engineering firm Sterling and Wilson said it has signed a contract to construct a solar PV battery storage and diesel genset-based hybrid power plant in Niger in West Africa.

LIC Housing Finance: On the back of “a much-more-than-expected recovery in demand since the past two months”, India’s second-largest pureplay mortgage lender LIC Housing Finance expects a bumper festival season as it eyes loan growth to be in double-digits, according to a report by PTI.

Cyient: IT firm Cyient reported a 14.8 per cent decline in its consolidated net profit at Rs 83.9 crore for September 2020 quarter.

South Indian Bank: The lender reported 23 per cent decline in net profit at Rs 65.09 crore for September quarter of the current fiscal year. The bank had posted a net profit of Rs 84.48 crore in July-September 2019-20. In the previous June quarter, South Indian Bank had a profit of Rs 81.65 crore.

AstraZeneca Pharma: Drug firm AstraZeneca Pharma India said it will launch its Acalabrutinib 100 mg capsules, used for treatment of various types of blood cancers, under the brand name ‘Calquence’ in the country on October 21.

Hero Motocorp: Two-wheeler market leader Hero Motocorp said it has launched its new Pleasure+ Platinum scooter model, priced at Rs 60,950 (ex-showroom Delhi).

/* User Identification Code Start */ var _tiluuid = localStorage.getItem('_tiluuid'); if (_tiluuid === null) function receiveMessage(evt) if (evt.origin === 'https://tilanalytics.timesinternet.in') _tiluuid = evt.data; localStorage.setItem('_tiluuid', _tiluuid); window.addEventListener('message', receiveMessage, false); document.getElementById("_tiluuid_frame").src='https://tilanalytics.timesinternet.in/frame_v3.min.html'; /* User Identification Code End */

var urlParams = window.URLSearchParams && new URLSearchParams(window.location.search), optParam = urlParams.get && urlParams.get('opt');

var objSec = template: 'articleshow_main', msid:'78692215', secNames: ['markets','stocks','news'],secIds:['2147477890','1977021501','2146842','2146843'];

var tmplName = tpName = 'articleshow_main',lang = '',nav_sec1,newHookId,subsec1_value,subsec1_common = '1977021501',newHookId2,subsec2_value,subsec2_common = '2146842'; var objVc = version_on:'2020101685830',js_etsubscription:'1',js_comments:'111',js_googleslock:'782',js_googlelogin:'54',js_common_buydirect:'749',js_bookmark:'18',js_login:'41',js_datepicker:'2',js_electionsmn:'22',js_push:'53',css_buydirect:'14',js_tradenow:'14',js_commonall:'118',lib_login:'https://jssocdn.indiatimes.com/crosswalk/jsso_crosswalk_legacy_0.5.9.min.js',live_tv:'"auto_open": 1, "play_check_hour": 12, "default_tv": "1"',global_cube:'0',global_cube_wap:'0',global_cube_wap_url:'https://m.economictimes.com/iframe_cube.cms',site_sync:'0',adx:'1',amazon_bidding:'1',fan_ads:'0',trackAdCode:'0',ajaxError:'1',oauth:'oauth',planPage:'https://prime.economictimes.indiatimes.com/plans',subscriptions:'subscriptions',krypton:'kryptonp',apw:'apw'; var objDim = d52:'nature_of_content',d10:'user_login_status_hit',d54:'content_shelf_life',d53:'content_target_audience',d12:'tags_meta_keyword',d56:'degree_of_conten',d11:'content_theme_the_primary_tag',d55:'content_tone',d14:'special_coverage',d58:'et_product_item',d13:'article_publish_time',d16:'video',d15:'audio',d59:'show_paywall_final',d61:'paywall_probability',d60:'paywall_score',d63:'paid_articles_read',d62:'eligibility_paywall_rule',d65:'bureau_articles_read',d20:'platform',d64:'free_articles_read',d23:'author_id',d67:'loyalty',d66:'article_length',d25:'page_template',d24:'syft_initiate_page',d68:'paywall_hits',d27:'site_sub_section',d26:'site_section',d29:'section_id',d28:'prime_deal_code',d70:'us_election_2020',d32:'prime_article_read_before_syft',d34:'content_age',d33:'prime_article_read_before_success',d36:'sign_in_initiation_position',d35:'subscription_method_hit',d37:'user_subscription_status',d1:'et_product',d2:'blocker_type',d3:'user_login_status',d4:'agency',d5:'author',d6:'cms_content_publishing_type',d7:'content_personalisation_level',d8:'article_publish_date',d9:'sub_section_name',d40:'freeread',d45:'prime_hp_ui_template',d47:'prime_hp_ui_content_b_color',d46:'prime_hp_ui_content_size',d49:'syft_initiate_position',d48:'content_msid',d50:'signin_initiate_page';var serverTime = '10.16.2020 08:58:54';var WRInitTime=(new Date()).getTime(); (function () if (self !== top) var e = function (s) return document.getElementsByTagName(s); e("head")[0].innerHTML = '

*display:none;

'; setTimeout(function () e("body")[0].innerHTML = ''; var hEle = e("html")[0]; hEle.innerHTML = 'economictimes.indiatimes.com'; hEle.className = ''; top.location = self.location; , 0);)();

_log = window.console && console.log ? console.log : function () ; if(window.localStorage && localStorage.getItem('temp_geolocation')) var geolocation = localStorage.getItem('temp_geolocation'); // Creating Elements for IE : HTML 5 and cross domain checks (function () var elem = ["article", "aside", "figure", "footer", "figcaption", "header", "nav", "section", "time"]; for(var i=0; i

if(geolocation && geolocation != 5) (function() var s = document.createElement('script'), el = document.getElementsByTagName("script")[0]; s.async = true; s.src = (document.location.protocol == "https:" ? "https://sb" : "http://b") + ".scorecardresearch.com/beacon.js"; el.parentNode.insertBefore(s, el); )();

if(geolocation && geolocation != 5) (function() function pingIbeat() window._pg_endpt=(new Date()).getTime(); var e = document.createElement('script'); e.setAttribute('language', 'javascript'); e.setAttribute('type', 'text/javascript'); e.setAttribute('src', "https://agi-static.indiatimes.com/cms-common/ibeat.min.js"); document.head.appendChild(e); if(typeof window.addEventListener == 'function') window.addEventListener("load", pingIbeat, false); else var oldonload = window.onload; window.onload = (typeof window.onload != 'function') ? pingIbeat : function() oldonload(); pingIbeat(); ; )();

0 notes

Text

FIN504 ALL MODULE DISCUSSION , MODULE 3,4,5,6,7 HOMEWORK AND FINAL PAPER

FIN504 ALL MODULE DISCUSSION , MODULE 3,4,5,6,7 HOMEWORK AND FINAL PAPER

Click Link Below To Buy:

http://hwcampus.com/shop/fin504-module-discussion-module-34567-homework-final-paper/

Contact Us:

MODULE 1 DQ 1

Reconcile high standards of ethical business practices with the concept of shareholder wealth maximization and stakeholder theory. What responsibility do executives have to their shareholders and their stakeholders?

MOD 1 DQ 2

What role do financial institutions play in financial management? What role do financial markets have in financial management? Please compare and contrast the two.

WEEK 2 DQ 1

Identify two publicly traded corporations in the same industry and compare and contrast their current ratios, quick ratios, and debt to equity ratios. Explain what these ratios mean and how they help the reader understand the differences between the two companies.

MOD 2 DQ 2

What are two key elements of the financial planning process? Why is cash planning as vital as profit planning? Can you provide a contemporary example where cash flow and profits did not go hand-in-hand?

MOD 3 DQ 1

How does the concept of the time value of money affect decisions made across the four executive roles of management – planning, organizing, leading, and controlling? Why is this concept important for the contemporary executive to understand?

MOD 3 DQ 2

Why is the time value of money important for an individual to understand in regard to their private life? What can an individual do with this information?

MOD 4 DQ 1

How would you explain yield to maturity (YTM) to a friend with no background in finance?

MOD 4 DQ 2

What are interest rate fundamentals? Explain term structure and risk premiums. How do these concepts come into play in the real world (mortgage rates, bond prices, etc.)?

MOD 5 DQ 1

Explain the meaning of risk, return, and risk preferences? Why is risk not the chance of taking a loss?

Mod 5 dq 2

For the average business leader who is not in a finance role, how do risk, return, and the cost of capital impact him or her? How can you synthesize this into the workplace?

mod 6 dq 1

Explain how a net present value (NPV) profile is used to compare projects. How does this compare to internal rate of return (IRR)? How does reinvestment affect NPV and IRR?

mod 6 dq 2

Capital budgeting can be affected by exchange rate risk, political risk, transfer pricing, and strategic risk. Explain how these factors may and can impact capital budgeting.

mod 7 dq 1

Explain what capital structure is. Find two publicly traded companies and compare and contrast their capital structures.

mod 7 dq 2

Explain the cash conversion cycle (CCC) and net working capital. Why is this important to the contemporary executive? How do executive decisions regarding CCC and net working capital affect the company? Provide an example.

mod 8 dq 1

Introduce the company that you have selected for the Case Study Analysis. Why did you select this company? Explain the process you are using to assess your company's future financial health.

mod 8 dq 2

Describe your experience building the financial analysis. What has been the easiest, the most difficult? What has surprised you? What have you learned?

MODULE 3

Details:

Using Excel, and the Gitman chapter 5 Excel resource, if needed, complete the following problems from chapter 5 in Principles of Managerial Finance:

P5-2

P5-3

P5-13

P5-20

P5-30

P5-36

P5-43

Please show all work for each problem.

Uma Corp.

Present Value of Expected Future Savings

Period: 2013 through 2023

Discount rate for years 2013 - 2018 0.07

Discount rate for years 2019 - 2023 0.11

Annual Present

Year Period Savings PV Lump Sum PV Annuity PV Lump Sum Value

2013 1 110000 =C10/(1+$E$5)^B10 =D10

2014 2 120000 =C11/(1+$E$5)^B11 =D11

2015 3 130000 =C12/(1+$E$5)^B12 =D12

2016 4 150000 =C13/(1+$E$5)^B13 =D13

2017 5 160000 =C14/(1+$E$5)^B14 =D14

2018 6 150000 =C15/(1+$E$5)^B15 =D15

2019 7 90000 =C16*((1-(1/(1+$E$6)^B14))/$E$6) =E16/(1+$E$5)^B15 =F16

2020 8 90000

2021 9 90000

2022 10 90000

2023 11 90000

=SUM(C10:C20) =SUM(G10:G20)

MODULE 4

Details:

Using Excel, and the Gitman chapters 6 and 7 Excel resource, if needed, complete the following problems from chapters 6 and 7 in Principles of Managerial Finance:

P6-1

P6-10

P6-13

P6-20

P7-1

P7-6

P7-14

Please show all work for each problem.

Chapter 6 Interest Rates and Bond Valuation

Given Data:

CSM Corporation

Coupon-interest rate 0.06

Par Value 1000

Maturity 15 years

Current bond price 874.42

Assume that interest on the CSM bond is paid semiannually.

Compound period m 2

Modified n = =B7*B11

Modified payment = =(B5*B6)/B11

Annual r 0.074

modified r = =B14/B11

Trial and Error method: Choose various required rates to determine the current bond value.

Cell B14 should be blank.

Cell B15 should have the formula: B14/B11

The spreadsheet will recalculate each time. Continue the process until the value of the bond

equals the current price of the bond (in this problem it is a premium of $874.42.

Remember that for a bond to be priced at a premium, the coupon rate must be greater than the YTM.

Remember that for a bond to be priced at a discount, the coupon rate must be less than the YTM.

Year Periods Payment PV Payments

2011 0

1 =$B$13 =(C31/((1+$B$15)^B31)) =$B$13 PVA =G31*((1-(1/((1+$B$15)^B60)))/$B$15)

2012 2 =$B$13 =(C32/((1+$B$15)^B32))

3 =$B$13 =(C33/((1+$B$15)^B33))

2013 4 =$B$13 =(C34/((1+$B$15)^B34)) =B6 PV =(G34/((1+$B$15)^B61))

5 =$B$13 =(C35/((1+$B$15)^B35))

2014 6 =$B$13 =(C36/((1+$B$15)^B36)) Bond Value =SUM(I31:I35)

7 =$B$13 =(C37/((1+$B$15)^B37))

2015 8 =$B$13 =(C38/((1+$B$15)^B38)) Current Bond Value =B8

9 =$B$13 =(C39/((1+$B$15)^B39))

2016 10 =$B$13 =(C40/((1+$B$15)^B40))

11 =$B$13 =(C41/((1+$B$15)^B41))

2017 12 =$B$13 =(C42/((1+$B$15)^B42)) Prove the following:

13 =$B$13 =(C43/((1+$B$15)^B43)) When k = 0.08 value = 827.08

2018 14 =$B$13 =(C44/((1+$B$15)^B44)) ????? value = =B8

15 =$B$13 =(C45/((1+$B$15)^B45)) 0.06 value = 1000

2019 16 =$B$13 =(C46/((1+$B$15)^B46))

17 =$B$13 =(C47/((1+$B$15)^B47))

2020 18 =$B$13 =(C48/((1+$B$15)^B48))

19 =$B$13 =(C49/((1+$B$15)^B49))

2021 20 =$B$13 =(C50/((1+$B$15)^B50))

21 =$B$13 =(C51/((1+$B$15)^B51))

2022 22 =$B$13 =(C52/((1+$B$15)^B52))

23 =$B$13 =(C53/((1+$B$15)^B53))

2023 24 =$B$13 =(C54/((1+$B$15)^B54))

25 =$B$13 =(C55/((1+$B$15)^B55))

2024 26 =$B$13 =(C56/((1+$B$15)^B56))

27 =$B$13 =(C57/((1+$B$15)^B57))

2025 28 =$B$13 =(C58/((1+$B$15)^B58))

29 =$B$13 =(C59/((1+$B$15)^B59))

2026 30 =$B$13 =(C60/((1+$B$15)^B60))

2026 30 =B6 =(C61/((1+$B$15)^B61))

Bond Value =SUM(D31:D61)

Current Bond Price =B8

Chapter 7 Stock Valuation

Given Data:

Most Recently Paid Dividend $3.00 Do

Growth Rate in Earnings 7% g

Required rate of return 10% r

model: Po = (Do (1 + g )) / (r - g)

Current Price of stock Po = $107.00

One year later:

Most Recently Paid Dividend $3.21 Do

Growth Rate in Earnings 7% g

Risk Premium 6.74% RPa

t-bill rate 5.25% Rf

New required return 11.99% rnew

New intrinsic value of stock $68.83 Po

MODULE 5

Details:

Using Excel, and the Gitman chapters 8 and 9 Excel resource, if needed, complete the following problems from chapters 8 and 9 in Principles of Managerial Finance:

P8-1

P8-4

P8-14

P8-23

P9-1

P9-2

P9-17

Please show all work for each problem.

Forecasted Returns, Expected Values, and Standard Deviations for

Assets A, B, and C and Portfolios AB, AC, and BC

Assets Portfolios

Year A B C AB AC BC

2013 0.1 0.1 0.12 =SUMPRODUCT($C$24:$D$24,C7:D7) =($C$24*C7)+($E$24*E7) =SUMPRODUCT($D$24:$E$24,D7:E7)

2014 0.13 0.11 0.14 =SUMPRODUCT($C$24:$D$24,C8:D8) =($C$24*C8)+($E$24*E8) =SUMPRODUCT($D$24:$E$24,D8:E8)

2015 0.15 0.08 0.1 =SUMPRODUCT($C$24:$D$24,C9:D9) =($C$24*C9)+($E$24*E9) =SUMPRODUCT($D$24:$E$24,D9:E9)

2016 0.14 0.12 0.11 =SUMPRODUCT($C$24:$D$24,C10:D10) =($C$24*C10)+($E$24*E10) =SUMPRODUCT($D$24:$E$24,D10:E10)

2017 0.16 0.1 0.09 =SUMPRODUCT($C$24:$D$24,C11:D11) =($C$24*C11)+($E$24*E11) =SUMPRODUCT($D$24:$E$24,D11:E11)

2018 0.14 0.15 0.09 =SUMPRODUCT($C$24:$D$24,C12:D12) =($C$24*C12)+($E$24*E12) =SUMPRODUCT($D$24:$E$24,D12:E12)

2019 0.12 0.15 0.1 =SUMPRODUCT($C$24:$D$24,C13:D13) =($C$24*C13)+($E$24*E13) =SUMPRODUCT($D$24:$E$24,D13:E13)

Statistics:

Expected value =AVERAGE(C7:C13) =AVERAGE(D7:D13) =AVERAGE(E7:E13) =AVERAGE(G7:G13) =AVERAGE(H7:H13) =AVERAGE(I7:I13)

Standard deviation =STDEV(C7:C13) =STDEV(D7:D13) =STDEV(E7:E13) =STDEV(G7:G13) =STDEV(H7:H13) =STDEV(I7:I13)

Note: In each two stock portfolio, the weights of each security is equal

0.5 0.5 0.5

Chapter 9 The Cost of Capital

Nova Corporation

Debt

Net Proceeds

maturity 10 Required bond price 980

coupon rate 6.50% Flotation percent 2.00%

par $1,000 Flotation cost $20

coupon payment $65 Net Proceeds $960

Trial and error YTM 7.0714%

End of Year(s) Cash Flow PV

0 $960 $960.00

1 - 10 $(65) (455.03)

10 $(1,000) (504.97)

$0.00 (The YTM of 7.0714% equates the NPV to zero)

Before-tax Cost of Debt 7.0714%

Tax rate 40.00%

After-tax Cost of Debt 4.24% (a)

Preferred Stock

Par value $100.00 Expected sale price $102.00

Annual percentage rate 6% Flotation cost $4.00

Annual dividend $6.00 Net Proceeds $98.00

Cost of Preferred Stock 6.12% (b)

Common Stock

Gordon Model

Expected dividend $3.25

Expected growth rate 5%

Current price $35.00

Flotation cost $2.00

Adjusted Price $33.00 Cost of Common Stock 14.85% (c)

Weighted Average Cost of Capital

Weight in debt 0.35

Weight in preferred stock 0.12

Weight in common stock 0.53

Sum of weights 1.00 WACC 10.09% (d)

MODULE 6

Details:

Using Excel, and the Gitman chapters 10, 11, and 12 Excel resource, if needed, complete the following problems from chapters 10, 11, and 12 inPrinciples of Managerial Finance:

P10-1

P10-5

P10-21

P11-3

P11-12

P12-2

Integrative Case 5: Lasting Impressions Company

Please show all work for each problem.

The Drillago Company

Calculation of the NPV, IRR, and the Payback Period

Facts of case:

maturity (n) 10 years

cost-of-capital (k) 0.13

Initial outlay (pv) 15000000

Excel function =IRR(B12:B22)

Estimated Trial and error 0.147630974

Cash NPV Technique IRR Technique

Year Outflows/Inflows PV PV Payback Technique

0 =-B7 =B12/(1+$B$6)^A12 =B12/(1+$E$9)^A12

1 600000 =B13/(1+$B$6)^A13 =B13/(1+$E$9)^A13 =B12+B13

2 1000000 =B14/(1+$B$6)^A14 =B14/(1+$E$9)^A14 =G13+B14

3 1000000 =B15/(1+$B$6)^A15 =B15/(1+$E$9)^A15 =G14+B15

4 2000000 =B16/(1+$B$6)^A16 =B16/(1+$E$9)^A16 =G15+B16

5 3000000 =B17/(1+$B$6)^A17 =B17/(1+$E$9)^A17 =G16+B17

6 3500000 =B18/(1+$B$6)^A18 =B18/(1+$E$9)^A18 =G17+B18

7 4000000 =B19/(1+$B$6)^A19 =B19/(1+$E$9)^A19 =G18+B19 =G19/B19

8 6000000 =B20/(1+$B$6)^A20 =B20/(1+$E$9)^A20 =G19+B20

9 8000000 =B21/(1+$B$6)^A21 =B21/(1+$E$9)^A21 =G20+B21

10 12000000 =B22/(1+$B$6)^A22 =B22/(1+$E$9)^A22 =G21+B22

=SUM(C12:C22) =SUM(E12:E22) =A18+H19 years

Recap:

NPV =C23 Accept the project as the NPV > 0.

IRR =E8 Approximately as it equates the NPV to Zero.

Accept the project as the IRR (14.76%) > Cost of Capital (13%)

Payback =H23 years approximately

The Damon Corporation

Calculation of the Initial Investment

Installed cost of proposed machine

Cost of proposed machine $145,000

plus: Installation costs 15,000

Total installed cost - proposed $160,000

(depreciable value)

After-tax proceeds from sale of present machine

Proceeds from sale of present machine $70,000

less: Tax on sale of present machine 14,080

Total after-tax proceeds - present $55,920

Change in net working Capital 18,000

Initial investment $122,080

Tax on sale of old machine Change in Working Capital

cost of old machine $120,000 Increase in receivables $15,000

MACRS increase in inventory 19,000

year 1 20% 24,000 increase in payables 16,000

year 2 32% 38,400 Net working capital $18,000

year 3 19% 22,800

Book Value $34,800

Sale price of old machine $70,000

Gain on sale $35,200

Tax rate 40%

Tax Expense $14,080

Depreciation Expense for Proposed and Present

Machines for the Damon Corporation

Year Cost Applicable MACRS depreciation Depreciation

With proposed machine

1 $160,000 20% $32,000

2 160,000 32% 51,200

3 160,000 19% 30,400

4 160,000 12% 19,200

5 160,000 12% 19,200

6 160,000 5% 8,000

Total 100% $160,000

With present machine

1 $120,000 12% $14,400

2 120,000 12% 14,400

3 120,000 5% 6,000

4 0

5 0

6 0

Total $34,800

Calculation of Operating Cash Inflows for Damon Corporation

Proposed and Present Machines

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

With proposed machine

Earnings before depr. and int. and taxes $105,000 $110,000 $120,000 $120,000 $120,000 $-

Depreciation #REF! #REF! #REF! #REF! #REF! #REF!

Earnings before interest and taxes #REF! #REF! #REF! #REF! #REF! #REF!

Taxes 40% #REF! #REF! #REF! #REF! #REF! #REF!

Net operating profit after taxes #REF! #REF! #REF! #REF! #REF! #REF!

Depreciation #REF! #REF! #REF! #REF! #REF! #REF!

Operating cash inflows #REF! #REF! #REF! #REF! #REF! #REF!

With present machine

Earnings before depr. and int. and taxes $95,000 $95,000 $95,000 $95,000 $95,000 $-

Depreciation #REF! #REF! #REF! #REF! #REF! #REF!

Earnings before interest and taxes #REF! #REF! #REF! #REF! #REF! #REF!

Taxes 40% #REF! #REF! #REF! #REF! #REF! #REF!

Net operating profit after taxes #REF! #REF! #REF! #REF! #REF! #REF!

Depreciation #REF! #REF! #REF! #REF! #REF! #REF!

Operating cash inflows #REF! #REF! #REF! #REF! #REF! #REF!

The Damon Corporation

Calculation of the Terminal Cash Flow

After-tax proceeds from sale of proposed machine

Proceeds from sale of proposed machine $24,000

Book value as of end of year 5 8,000

Net gain $16,000

Tax on gain 40% 6,400

Total after-tax proceeds - proposed $9,600

After-tax proceeds from sale of present machine

Proceeds from sale of present machine $8,000

Book value as of end of year 5 0

Net gain $8,000

Tax on gain 40% 3,200

Total after-tax proceeds - present $4,800

Change in net working capital #REF!

Terminal Cash Flow #REF!

Mutually Exclusive Projects

Project Alpha Project Beta

Annual Annual

Cash 10% Cash 10%

Year Outflow/Inflow PVIF NPV PVIFA ANPV Year Outflow/Inflow PVIF NPV PVIFA ANPV

0 -5,500,000 1.0000 $(5,500,000) 0 -6,500,000 1.0000 $(6,500,000)

1 300,000 0.9091 272,727 1 400,000 0.9091 363,636

2 500,000 0.8264 413,223 2 600,000 0.8264 495,868

3 500,000 0.7513 375,657 3 800,000 0.7513 601,052

4 550,000 0.6830 375,657 4 1,100,000 0.6830 751,315

5 700,000 0.6209 434,645 5 1,400,000 0.6209 869,290

6 800,000 0.5645 451,579 6 2,000,000 0.5645 1,128,948

7 950,000 0.5132 487,500 7 2,500,000 0.5132 1,282,895

8 1,000,000 0.4665 466,507 8 2,000,000 0.4665 933,015

9 1,250,000 0.4241 530,122 9 1,000,000 0.4241 424,098 5.7590

10 1,500,000 0.3855 578,315 $350,116 $60,794

11 2,000,000 0.3505 700,988

12 2,500,000 0.3186 796,577 6.8137

$383,499 $56,284

Reviewing the NPV's calculated for the two mutually exclusive projects, we see that project Alpha would be preferred over project Beta

as Alpha has a NPV of $383,499 relative to the NPV of Beta which is $350,116.

However, when we compare these mutually exclusive projects on the basis of their respective ANPVs, project Beta would be preferred over

project Alpha because it provides the higher annualized net present value ($60,794 versus $56,284).

MODULE 7

Details:

Using Excel, and the Gitman chapters 13, 14, 15, and 16 Excel resource, if needed, complete the following problems from chapters 13, 14, 15, and 16 in Principles of Managerial Finance:

P13-5

P13-22

P14-3

P14-15

P15-4

P15-5

P15-10

P16-18

P16-20

Please show all work for each problem.

Chapter 16 Current Liabilities Management

Fixed Rate Loan

Given Data:

Days 365

Loan $200,000.00

Prime Rate 7.00%

Maturity 60 days

Prime Excess 2.00%

a. The total dollar interest cost on the First American Loan

Loan Prime+ Maturity Total Dollar Interest

$200,000.00 9.00% 0.164383562 $2,958.90

b. The 60-day rate on the loan

Total Dollar Interest Loan 60-day Rate

$2,958.90 $200,000.00 1.4795%

c. Effective annual rate of interest on fixed 60-day loan

60-day Rate Periods in Year Effective Annual Rate

1.4795% 6.083333333 9.3453%

Floating Rate Loan

Given Data:

Days 365

Loan $200,000.00

Prime Rate 7.00% 7.50%$$

Maturity 60 30

Prime Excess 1.50%

d. The Initial Rate

Prime Rate Prime Excess Initial Rate-1st 30 day rate

7.00% 1.50% 8.50%

e. Interest Rate for first and last 30-day periods

Intial Rate + Maturity First 30 Day Rate

8.50% 0.082191781 0.6986%

initial rate + Maturity Last 30 day rate

9.00% 0.082191781 0.7397%

f. Total Dollar Interest Cost

Loan 1st 30 Days Last 30-Days Total Interest Cost

$200,000.00 0.6986% 0.7397% $2,876.71

g. 60-Day rate of Interest

Total Interest Cost Loan 60-Day Rate

$2,876.71 $200,000.00 1.4384%

h. Effective Annual Interest Rate on 60-Day Loan

60-Day Rate Periods in Year Effective Annual Rate

1.4384% 6.083333333 9.0762%

Chapter 13 Leverage and Capital Structure

Calculation of Share Value

Estimates Associated with

Alternative capital Structures

Capital Structure Expected Estimated Estimated

Debt Ratio EPS Required Return Share Value

0 1.75 0.114 =B10/C10

10 1.9 0.118 =B11/C11

20 2.25 0.125 =B12/C12

30 2.55 0.1325 =B13/C13

40 3.18 0.18 =B14/C14

50 3.06 0.19 =B15/C15

60 3.1 0.25 =B16/C16

Rock-O Corporation

Stockholders' Equity Section

Before the Reverse Stock Split

Common stock 900,000 shares $1.00 par $900,000

Paid-in-Capital 7,000,000

Retained Earnings 3,500,000

Total Stockholders' Equity $11,400,000

Reverse Stock Split

Stock Split 2 3

Common stock 600,000 shares $1.50 par $900,000

Paid-in-Capital 7,000,000

Retained Earnings 3,500,000

Total Stockholders' Equity $11,400,000

Analysis of Initiating a Cash Discount

for Eboy Corporation

Increase in units due to discount 50

Selling price @net 30 $4,200

Variable Cost Per Unit $2,600

Additional Profit Contribution from Sales: $80,000

Cost of Marginal Investment in AccCounts Receivable

Variable cost per unit $2,600

Raw Material annual usage 1450

Accounts Receivable $443,000

Sales $3,544,000

Days 365

Collection Period 45.625

AR Turnover 8.0

Average investment presently (w/o discounts) $471,250

Variable cost per unit $2,600.00

Raw Material annual usage 1500

Expected AR Turnover due to discount 12.0

Average investment presently (with cash discounts) $325,000

Reduction in accounts receivable investment $146,250

Opportunity cost of funds 12.5%

Cost Savings from reduced investment in AR $18,281

Cash Discount term 2.00%

Percentage of customers to take discount 70%

Raw Material annual usage (new) 1500

Selling price per unit $4,200

Cost of Cash Discount $88,200

Net Profit from initiation of proposed cash discount $10,081

MODULE 8

Details:

Complete your 2,500-word (excluding tables, figures, and addenda) financial analysis of your chosen company selected in Module 2.

Following the nine-step assessment process introduced below and detailed in Assessing a Company’s Future Financial Health:

Analysis of fundamentals: goals, strategy, market, competitive technology, and regulatory and operating characteristics.

Analysis of fundamentals: revenue outlook.

Investments to support the business unit(s) strategy(ies).

Future profitability and competitive performance.

Future external financing needs.

Access to target sources of external finance.

Viability of the 3-5-year plan.

Stress test under scenarios of adversity.

Current financing plan.

As you conduct the analysis, you will compile research on your chosen company, including analyst reports and market information. Disclose all assumptions made in the case study (e.g., revenue growth projections, expense controls) and provide supporting reasons and evidence behind those assumptions.

Finally, in order to assess the long-term financial health of the chosen company, synthesize the research data and outcomes of the nine-step assessment process.

Prepare this assignment according to the APA guidelines found in the APA Style Guide, located in the Student Success Center. An abstract is not required.

This assignment uses a grading rubric. Instructors will be using the rubric to grade the assignment; therefore, students should review the rubric prior to beginning the assignment to become familiar with the assignment criteria and expectations for successful completion of the assignment.

0 notes

Text

ITEC3340 Instructions_SC_EX16_9b Solution

ITEC3340 Instructions_SC_EX16_9b Solution

Click Link Below To Buy:

https://hwcampus.com/shop/human-growth-development-mid-term-exam/

Or Visit www.hwcampus.com

Contact Us:

Shelly Cashman Excel 2016| Module 9: Project 1b

Rio Grande Music Camp

FORMULA AUDITING, DATA VALIDATION, AND COMPLEX PROBLEM SOLVING

GETTING STARTED

Open the file SC_EX16_9b_FirstLastName_1.xlsx, available for download from the SAM website.

Save the file as SC_EX16_9b_FirstLastName_2.xlsx by changing the “1” to a “2”.

If you do not see the .xlsx file extension in the Save As dialog box, do not type it. The program will add the file extension for you automatically.

With the file SC_EX16_9b_FirstLastName_2.xlsx still open, ensure that your first and last name is displayed in cell B6 of the Documentation sheet.

If cell B6 does not display your name, delete the file and download a new copy from the SAM website.

This project requires you to use the Solver add-in. If this add-in is not available on the Data tab in the Analysis group (or if the Analysis group is not available), install Solver as follows:

In Excel, click the File tab on the ribbon, and then click the Options tab in the left pane of Backstage view.

Click the Add-Ins tab in the left pane of the Excel Options dialog box.

Click the Manage arrow, click Excel Add-Ins in the Manage list, and then click the Go button.

In the Add-Ins dialog box, click the Solver Add-In check box, and then click the OK button.

Follow any remaining prompts to install Solver.

PROJECT STEPS

Alison Silverstein is the director of the Rio Grande Music Campin the outskirts of Boulder, Colorado. As an office assistant at the camp, you help Alison gather and analyze financial data. She asks for your help completing an Excel workbook that contains errors and missing information. She also wants to make it easier to enter correct data and determine the financial effects of changing the rates and schedules for music lessons.

Go to the Music Programs worksheet. Correct the first error in this worksheet, a divide by zero error, as follows:

Use the Trace Precedents arrows to find the source of the error in cell B14, the income per Novicelesson.

Correct the error by editing the formula in cell B14, which should divide the income per program (cell B13) by the lessons per program (cell B4).

Copy the formula and the formatting from cell B14 to the range C14:F14.

Correct the Name error in cell B17 as follows:

Use Error Checking to determine the source of the error in cell B17, which should calculate the average income per program.

Correct the error by editing the formula in cell B17.

Go to the Program Enrollment worksheet. To make it easier to add the correct program enrollment information, add data validation tothe range B7:F9as follows:

The cells in the range B7:F9should allow only whole number values greater than 0.

Add an Input Message usingProgram Enrollment as the Input Message title and Enter the minimum, average, or maximum enrollment per lesson type. (including the period) as the Input message.

Add an Error Alert using the Stop style for the Error Alert, and useEnrollment Error as the Error Alert title and Program enrollment must be greater than 0. (including the period) as the Error message.

Alisonthinks the camp can make as much as $20,000 in program income from the Level II lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the maximum program income for Level II lessons (cell D14) to 20,000.

Change the program fee for Level II lessons (cell D3) to determine the fee the camp needs to charge to achieve the income goal.

Alison also wants to make at least $8,000in income per programfrom the Level I lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the minimum program income for Level I lessons (cell C12) to 8000.

Change the minimum program enrollment for Level I lessons (cell C7) to determine the minimum number of Level I students the camp needs to achieve the income goal.

Alison wants to average $15,000 in income per programfrom the Novice lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the average program income for Novice lessons (cell B13) to 15,000.

Change the average program enrollment for Novice lessons (cell B8) to determine the average number of Novice students the camp needs to achieve the income goal.

Go to the Current Rates worksheet. Alison has already created a scenario named Max Enrollment that calculates profit based on the maximum number of students enrolled for each program. Add a new scenario to compare the profit with average enrollment as follows:

Use Average Enrollment as the scenario name.

Use B8:F8 as the changing cells.

Accept the current values in the range B8:F8 as the values for the changing cells because these cells show the average number of students per program.

Add another new scenario to compare the profit with low program enrollment as follows:

Add another scenario to the workbook, using Low Enrollment as the scenario name.

Use B8:F8 as the changing cells.

Update the cell values in the range B8:F8 to match the low enrollmentvalues shown in bold in Table 1 below:

Table 1: Cell Values for the Low Attendance Scenario

Cell

New Value

Novice_New_Students (B8)

16

Level_I_New_Students (C8)

20

Level_II_New_Students (D8)

18

Level_III_New_Students (E8)

18

Advanced_New_Students (F8)

20

Show the Max Enrollment scenario values in the Current Rates worksheet.

Go to the New Rates worksheet, which contains three scenarios showing the profit with a $20 or $25rate increase or a $10 rate decrease. Compare the average profit per program based on the scenarios as follows:

Create a Scenario Summary report using the range B10:F10 as the result cells to show the average profit per program depending on the rate changes. (Hint: The defined names of the range B10:F10 appear in the report.)

Use New Rates Scenario Report as the name of the worksheet containing the report.

Alison also wants to focus on one or two types of lessons at a time when comparing the average profit per program. Return to the New Rates worksheet and create another type of report as follows:

Create a Scenario PivotTable report using the range B10:F10 as the result cells to compare the average profit per program depending on the rate changes in a PivotTable. (Hint: The defined names of the range B10:F10 appear in the report.)

Use New Rates PivotTable as the name of the worksheet containing the PivotTable.

Format cells B4:F6in the New Rates PivotTable worksheet using the Accounting number format with 0 decimal places and $ as the symbol. (Hint: Depending on how you complete this substep, the number format may appears as Custom.)

Go to the New Schedule worksheet. Alison wants to determine the number of morning and afternoon lessons the camp can offer to make the highest weekly profit without exceeding the maximum room capacities, meeting the ensembles scheduling needs, and considering other practical conditions.Use Solver to find this informationas follows:

Use cell G16 (Total_Weekly_Profit) as the objective cell in the Solver model, with the goal of determining the maximum value for that cell.

Use the range B4:F5, which shows the number of morning and afternoon musiclessons, as the changing variable cells.

Use the constraints shown in Table 2 below.

Table 2: Solver Constraints

Constraint

Cell or Range

Each type of lessonis scheduled at least once in the morning and once in the afternoon

B4:F5

Each morning and afternoon lesson value is an integer

B4:F5

Each type of lesson is scheduled 2 times per week or more

B6:F6

Each type of lesson is scheduled 15 times per week or less

B6:F6

The total number of morning lessons is 10 or less

Total_Morning_Lessons

The total number of afternoon lessons is 15 or less

Total_Afternoon_Lessons

The total number of lessons per week is 20

Total_Weekly_Lessons

Ensemble morning lessons are scheduled 5 times per week or less

Group_Morning_Lessons

Ensemble afternoon lessons are scheduled 8 times per week or less

Group_Afternoon_Lessons

The total number of ensemblelessons scheduled per week is 15 or less

Group_Total_Lessons

Use Simplex LP as the solving method.

Save the Solver model in cell A26.

Solve the model, keeping the Solver solution.

Alison wants to document the answer Solver found, including the constraints and a list of the values Solver changed to solve the problem. Produce an Answer report for the Solver model as follows:

Solve the model again, this time choosing to produce an Answer report.

Use New Schedule Answer Report as the name of the worksheet containing the Answer report.

Mark the workbook as Final to indicate you are finished revising the workbook.

Your workbook should look like the Final Figureson the following pages. (The values in cells D3, C7, and B8 of the Program Enrollment worksheet generated by Goal Seek Analysis has intentionally been blurred out in Final Figure 2.) The New Schedule Answer Report and New Schedule worksheets are not provided to prevent manual entry of the Solver results. Save your changes, close the workbook, and then exit Excel. Follow the directions on the SAM website to submit your completed project.

Final Figure 1: MusicProgramsWorksheet

Final Figure 2: Program Enrollment Worksheet

Final Figure 3: Current RatesWorksheet

Final Figure 4: New Rates Scenario ReportWorksheet

Final Figure 5: New Rates PivotTable Worksheet

Final Figure 6: New RatesWorksheet

0 notes

Text

New Post has been published on Online Professional Homework Help

New Post has been published on https://hwcampus.com/shop/itec3340-instructions_sc_ex16_9b-solution/

ITEC3340 Instructions_SC_EX16_9b Solution

ITEC3340 Instructions_SC_EX16_9b Solution

Shelly Cashman Excel 2016 | Module 9: Project 1b

Rio Grande Music Camp

FORMULA AUDITING, DATA VALIDATION, AND COMPLEX PROBLEM SOLVING

GETTING STARTED

Open the file SC_EX16_9b_FirstLastName_1.xlsx, available for download from the SAM website.

Save the file as SC_EX16_9b_FirstLastName_2.xlsx by changing the “1” to a “2”.

If you do not see the .xlsx file extension in the Save As dialog box, do not type it. The program will add the file extension for you automatically.

With the file SC_EX16_9b_FirstLastName_2.xlsx still open, ensure that your first and last name is displayed in cell B6 of the Documentation sheet.

If cell B6 does not display your name, delete the file and download a new copy from the SAM website.

This project requires you to use the Solver add-in. If this add-in is not available on the Data tab in the Analysis group (or if the Analysis group is not available), install Solver as follows:

In Excel, click the File tab on the ribbon, and then click the Options tab in the left pane of Backstage view.

Click the Add-Ins tab in the left pane of the Excel Options dialog box.

Click the Manage arrow, click Excel Add-Ins in the Manage list, and then click the Go button.

In the Add-Ins dialog box, click the Solver Add-In check box, and then click the OK button.

Follow any remaining prompts to install Solver.

PROJECT STEPS

Alison Silverstein is the director of the Rio Grande Music Camp in the outskirts of Boulder, Colorado. As an office assistant at the camp, you help Alison gather and analyze financial data. She asks for your help completing an Excel workbook that contains errors and missing information. She also wants to make it easier to enter correct data and determine the financial effects of changing the rates and schedules for music lessons.

Go to the Music Programs worksheet. Correct the first error in this worksheet, a divide by zero error, as follows:

Use the Trace Precedents arrows to find the source of the error in cell B14, the income per Novice lesson.

Correct the error by editing the formula in cell B14, which should divide the income per program (cell B13) by the lessons per program (cell B4).

Copy the formula and the formatting from cell B14 to the range C14:F14.

Correct the Name error in cell B17 as follows:

Use Error Checking to determine the source of the error in cell B17, which should calculate the average income per program.

Correct the error by editing the formula in cell B17.

Go to the Program Enrollment worksheet. To make it easier to add the correct program enrollment information, add data validation to the range B7:F9 as follows:

The cells in the range B7:F9 should allow only whole number values greater than 0.

Add an Input Message using Program Enrollment as the Input Message title and Enter the minimum, average, or maximum enrollment per lesson type. (including the period) as the Input message.

Add an Error Alert using the Stop style for the Error Alert, and use Enrollment Error as the Error Alert title and Program enrollment must be greater than 0. (including the period) as the Error message.

Alison thinks the camp can make as much as $20,000 in program income from the Level II lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the maximum program income for Level II lessons (cell D14) to 20,000.

Change the program fee for Level II lessons (cell D3) to determine the fee the camp needs to charge to achieve the income goal.

Alison also wants to make at least $8,000 in income per program from the Level I lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the minimum program income for Level I lessons (cell C12) to 8000.

Change the minimum program enrollment for Level I lessons (cell C7) to determine the minimum number of Level I students the camp needs to achieve the income goal.

Alison wants to average $15,000 in income per program from the Novice lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the average program income for Novice lessons (cell B13) to 15,000.

Change the average program enrollment for Novice lessons (cell B8) to determine the average number of Novice students the camp needs to achieve the income goal.

Go to the Current Rates worksheet. Alison has already created a scenario named Max Enrollment that calculates profit based on the maximum number of students enrolled for each program. Add a new scenario to compare the profit with average enrollment as follows:

Use Average Enrollment as the scenario name.

Use B8:F8 as the changing cells.

Accept the current values in the range B8:F8 as the values for the changing cells because these cells show the average number of students per program.

Add another new scenario to compare the profit with low program enrollment as follows:

Add another scenario to the workbook, using Low Enrollment as the scenario name.

Use B8:F8 as the changing cells.

Update the cell values in the range B8:F8 to match the low enrollment values shown in bold in Table 1 below:

Table 1: Cell Values for the Low Attendance Scenario

Cell New Value Novice_New_Students (B8) 16 Level_I_New_Students (C8) 20 Level_II_New_Students (D8) 18 Level_III_New_Students (E8) 18 Advanced_New_Students (F8) 20

Show the Max Enrollment scenario values in the Current Rates worksheet.

Go to the New Rates worksheet, which contains three scenarios showing the profit with a $20 or $25 rate increase or a $10 rate decrease. Compare the average profit per program based on the scenarios as follows:

Create a Scenario Summary report using the range B10:F10 as the result cells to show the average profit per program depending on the rate changes. (Hint: The defined names of the range B10:F10 appear in the report.)

Use New Rates Scenario Report as the name of the worksheet containing the report.

Alison also wants to focus on one or two types of lessons at a time when comparing the average profit per program. Return to the New Rates worksheet and create another type of report as follows:

Create a Scenario PivotTable report using the range B10:F10 as the result cells to compare the average profit per program depending on the rate changes in a PivotTable. (Hint: The defined names of the range B10:F10 appear in the report.)

Use New Rates PivotTable as the name of the worksheet containing the PivotTable.

Format cells B4:F6 in the New Rates PivotTable worksheet using the Accounting number format with 0 decimal places and $ as the symbol. (Hint: Depending on how you complete this substep, the number format may appears as Custom.)

Go to the New Schedule worksheet. Alison wants to determine the number of morning and afternoon lessons the camp can offer to make the highest weekly profit without exceeding the maximum room capacities, meeting the ensembles scheduling needs, and considering other practical conditions. Use Solver to find this information as follows:

Use cell G16 (Total_Weekly_Profit) as the objective cell in the Solver model, with the goal of determining the maximum value for that cell.

Use the range B4:F5, which shows the number of morning and afternoon music lessons, as the changing variable cells.

Use the constraints shown in Table 2 below.

Table 2: Solver Constraints

Constraint Cell or Range Each type of lesson is scheduled at least once in the morning and once in the afternoon B4:F5 Each morning and afternoon lesson value is an integer B4:F5 Each type of lesson is scheduled 2 times per week or more B6:F6 Each type of lesson is scheduled 15 times per week or less B6:F6 The total number of morning lessons is 10 or less Total_Morning_Lessons The total number of afternoon lessons is 15 or less Total_Afternoon_Lessons The total number of lessons per week is 20 Total_Weekly_Lessons Ensemble morning lessons are scheduled 5 times per week or less Group_Morning_Lessons Ensemble afternoon lessons are scheduled 8 times per week or less Group_Afternoon_Lessons The total number of ensemble lessons scheduled per week is 15 or less Group_Total_Lessons

Use Simplex LP as the solving method.

Save the Solver model in cell A26.

Solve the model, keeping the Solver solution.

Alison wants to document the answer Solver found, including the constraints and a list of the values Solver changed to solve the problem. Produce an Answer report for the Solver model as follows:

Solve the model again, this time choosing to produce an Answer report.

Use New Schedule Answer Report as the name of the worksheet containing the Answer report.

Mark the workbook as Final to indicate you are finished revising the workbook.

Your workbook should look like the Final Figures on the following pages. (The values in cells D3, C7, and B8 of the Program Enrollment worksheet generated by Goal Seek Analysis has intentionally been blurred out in Final Figure 2.) The New Schedule Answer Report and New Schedule worksheets are not provided to prevent manual entry of the Solver results. Save your changes, close the workbook, and then exit Excel. Follow the directions on the SAM website to submit your completed project.

Final Figure 1: Music Programs Worksheet

Final Figure 2: Program Enrollment Worksheet

Final Figure 3: Current Rates Worksheet

Final Figure 4: New Rates Scenario Report Worksheet

Final Figure 5: New Rates PivotTable Worksheet

Final Figure 6: New Rates Worksheet

0 notes

Photo

New Post has been published on https://techcrunchapp.com/hcl-technologies-dws-ltd-hcl-tech-acquires-australian-it-firm-dws-for-115-8-million/

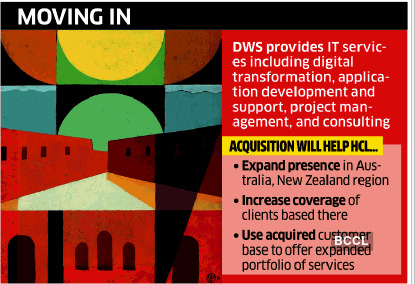

HCL technologies | DWS Ltd: HCL tech acquires Australian IT firm DWS for $115.8 million

NEW DELHI: HCL Technologies has announced the acquisition of Australian IT firm DWS Ltd for $115.8 million in a bid to further expand its digital offerings especially in Australia and New Zealand.

The DWS Group closed FY 2020 with revenues of $ 122.9 million and has over 700 employees with operations in Melbourne, Sydney, Adelaide, Brisbane, and Canberra. It provides a wide range of IT services including digital transformation, application development and support, programme and project management and consulting.

Michael Horton, Executive Vice President & Country Manager, Australia & New Zealand, HCL Technologies, said “We are excited for this expansion of HCL Technologies in Australia and New Zealand and are confident that our combined strengths will further accelerate the digital transformation journeys of our clients and innovations for their end customers. HCL has invested in the region for over 20 years and is committed to enabling digitilisation and growing the local ecosystem, he added.

HCL currently employs 1600 people in major cities, including Canberra, Sydney, Melbourne, Brisbane, and Perth. The transaction is expected to close in December 2020, subject to closing conditions, including regulatory approvals.

Danny Wallis, CEO and Managing Director, DWS said, “We are delighted the DWS team is joining HCL. This acquisition represents an outstanding outcome for all DWS stakeholders: shareholders, employees, clients and other business partners.”

/* User Identification Code Start */ var _tiluuid = localStorage.getItem('_tiluuid'); if (_tiluuid === null) function receiveMessage(evt) if (evt.origin === 'https://tilanalytics.timesinternet.in') _tiluuid = evt.data; localStorage.setItem('_tiluuid', _tiluuid); window.addEventListener('message', receiveMessage, false); document.getElementById("_tiluuid_frame").src='https://tilanalytics.timesinternet.in/frame_v3.min.html'; /* User Identification Code End */ var objSec = template: 'articleshow_main', msid:'78227672', secNames: ['tech','ites'],secIds:['2147477890','13357270','40274504'];

var tmplName = tpName = 'articleshow_main',lang = '',nav_sec1,newHookId,subsec1_value,subsec1_common = '13357270',newHookId2,subsec2_value,subsec2_common = '40274504'; var objVc = version_on:'2020092282004',js_etsubscription:'1',js_comments:'111',js_googleslock:'782',js_googlelogin:'53',js_common_buydirect:'749',js_bookmark:'18',js_login:'41',js_datepicker:'2',js_electionsmn:'22',js_push:'53',css_buydirect:'14',js_tradenow:'14',js_commonall:'117',lib_login:'https://jssocdn.indiatimes.com/crosswalk/jsso_crosswalk_legacy_0.5.9.min.js',live_tv:'"auto_open": 1, "play_check_hour": 12, "default_tv": "1"',global_cube:'0',global_cube_wap:'0',global_cube_wap_url:'https://m.economictimes.com/iframe_cube.cms',site_sync:'0',amazon_bidding:'1',fan_ads:'0',trackAdCode:'0',ajaxError:'1',oauth:'oauth',planPage:'https://prime.economictimes.indiatimes.com/plans',subscriptions:'subscriptions',krypton:'kryptonp',apw:'apw'; var objDim = d52:'nature_of_content',d10:'user_login_status_hit',d54:'content_shelf_life',d53:'content_target_audience',d12:'tags_meta_keyword',d56:'degree_of_conten',d11:'content_theme_the_primary_tag',d55:'content_tone',d14:'special_coverage',d13:'article_publish_time',d16:'video',d15:'audio',d59:'show_paywall_final',d61:'paywall_probability',d60:'paywall_score',d63:'paid_articles_read',d62:'eligibility_paywall_rule',d65:'bureau_articles_read',d20:'platform',d64:'free_articles_read',d23:'author_id',d67:'loyalty',d66:'article_length',d25:'page_template',d24:'syft_initiate_page',d68:'paywall_hits',d27:'site_sub_section',d26:'site_section',d29:'section_id',d28:'prime_deal_code',d70:'us_election_2020',d32:'prime_article_read_before_syft',d34:'content_age',d33:'prime_article_read_before_success',d36:'sign_in_initiation_position',d35:'subscription_method_hit',d37:'user_subscription_status',d1:'et_product',d2:'blocker_type',d3:'user_login_status',d4:'agency',d5:'author',d6:'cms_content_publishing_type',d7:'content_personalisation_level',d8:'article_publish_date',d9:'sub_section_name',d40:'freeread',d45:'prime_hp_ui_template',d44:'et_product_item',d47:'prime_hp_ui_content_b_color',d46:'prime_hp_ui_content_size',d49:'syft_initiate_position',d48:'content_msid',d50:'signin_initiate_page';var serverTime = '09.22.2020 08:24:53';var WRInitTime=(new Date()).getTime(); (function () if (self !== top) var e = function (s) return document.getElementsByTagName(s); e("head")[0].innerHTML = '

*display:none;

'; setTimeout(function () e("body")[0].innerHTML = ''; var hEle = e("html")[0]; hEle.innerHTML = 'economictimes.indiatimes.com'; hEle.className = ''; top.location = self.location; , 0);)();

_log = window.console && console.log ? console.log : function () ; if(window.localStorage && localStorage.getItem('temp_geolocation')) var geolocation = localStorage.getItem('temp_geolocation'); // Creating Elements for IE : HTML 5 and cross domain checks (function () var elem = ["article", "aside", "figure", "footer", "figcaption", "header", "nav", "section", "time"]; for(var i=0; i -1) window[disableStr + '-' + gaProperty] = true;

ga('set', 'anonymizeIp', true); ga('create', gaProperty, 'auto', 'allowLinker': true); ga('require', 'linker'); ga('linker:autoLink', ['economictimes.com']); ga('require', 'displayfeatures'); window.optimizely = window.optimizely || []; window.optimizely.push("activateUniversalAnalytics"); ga('require', 'GTM-KS2SX8K');

customDimension.dimension1 = "ET Free"; customDimension.dimension4 = "ET Bureau"; customDimension.dimension5 = "Surabhi Agarwal"; customDimension.dimension6 = "Native - 78227672"; customDimension.dimension8 = "Sep 21, 2020"; customDimension.dimension9 = "ITeS";

customDimension.dimension11 = "Print Live - ITeS";

customDimension.dimension12 = "IT firm,HCL Technologies,DWS Ltd,Danny Wallis,michael horton"; customDimension.dimension13 = "10:03 AM IST";

customDimension.dimension15 = "No"; customDimension.dimension16 = "No"; customDimension.dimension23 = "479241991"; (function () ; if(a.beforeSyft) customDimension.dimension32 = a.beforeSyft; if(a.afterSyft) customDimension.dimension33 = a.afterSyft; )()

var contentAge = '0.9323148148148148'; if(contentAge) customDimension.dimension34 = contentAge > 2 ? '>48hs':'

grx('track', 'page_view', grxDimension);

if(geolocation && geolocation != 5 && (typeof skip == 'undefined' || typeof skip.fbevents == 'undefined')) !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '338698809636220'); fbq('track', 'PageView');

var _comscore = _comscore || []; _comscore.push( c1: "2", c2: "6036484");

if(geolocation && geolocation != 5) (function() var s = document.createElement('script'), el = document.getElementsByTagName("script")[0]; s.async = true; s.src = (document.location.protocol == "https:" ? "https://sb" : "http://b") + ".scorecardresearch.com/beacon.js"; el.parentNode.insertBefore(s, el); )();

if(geolocation && geolocation != 5)

(function() function pingIbeat() window._pg_endpt=(new Date()).getTime(); var e = document.createElement('script'); e.setAttribute('language', 'javascript'); e.setAttribute('type', 'text/javascript'); e.setAttribute('src', "https://agi-static.indiatimes.com/cms-common/ibeat.min.js"); document.head.appendChild(e); if(typeof window.addEventListener == 'function') window.addEventListener("load", pingIbeat, false); else var oldonload = window.onload; window.onload = (typeof window.onload != 'function') ? pingIbeat : function() oldonload(); pingIbeat(); ;

)();

0 notes

Text

ITEC3340 Instructions_SC_EX16_9b Solution

ITEC3340 Instructions_SC_EX16_9b Solution

Click Link Below To Buy:

https://hwcampus.com/shop/human-growth-development-mid-term-exam/

Or Visit www.hwcampus.com

Contact Us:

Shelly Cashman Excel 2016| Module 9: Project 1b

Rio Grande Music Camp

FORMULA AUDITING, DATA VALIDATION, AND COMPLEX PROBLEM SOLVING

GETTING STARTED

Open the file SC_EX16_9b_FirstLastName_1.xlsx, available for download from the SAM website.

Save the file as SC_EX16_9b_FirstLastName_2.xlsx by changing the “1” to a “2”.

If you do not see the .xlsx file extension in the Save As dialog box, do not type it. The program will add the file extension for you automatically.

With the file SC_EX16_9b_FirstLastName_2.xlsx still open, ensure that your first and last name is displayed in cell B6 of the Documentation sheet.

If cell B6 does not display your name, delete the file and download a new copy from the SAM website.

This project requires you to use the Solver add-in. If this add-in is not available on the Data tab in the Analysis group (or if the Analysis group is not available), install Solver as follows:

In Excel, click the File tab on the ribbon, and then click the Options tab in the left pane of Backstage view.

Click the Add-Ins tab in the left pane of the Excel Options dialog box.

Click the Manage arrow, click Excel Add-Ins in the Manage list, and then click the Go button.

In the Add-Ins dialog box, click the Solver Add-In check box, and then click the OK button.

Follow any remaining prompts to install Solver.

PROJECT STEPS

Alison Silverstein is the director of the Rio Grande Music Campin the outskirts of Boulder, Colorado. As an office assistant at the camp, you help Alison gather and analyze financial data. She asks for your help completing an Excel workbook that contains errors and missing information. She also wants to make it easier to enter correct data and determine the financial effects of changing the rates and schedules for music lessons.

Go to the Music Programs worksheet. Correct the first error in this worksheet, a divide by zero error, as follows:

Use the Trace Precedents arrows to find the source of the error in cell B14, the income per Novicelesson.

Correct the error by editing the formula in cell B14, which should divide the income per program (cell B13) by the lessons per program (cell B4).

Copy the formula and the formatting from cell B14 to the range C14:F14.

Correct the Name error in cell B17 as follows:

Use Error Checking to determine the source of the error in cell B17, which should calculate the average income per program.

Correct the error by editing the formula in cell B17.

Go to the Program Enrollment worksheet. To make it easier to add the correct program enrollment information, add data validation tothe range B7:F9as follows:

The cells in the range B7:F9should allow only whole number values greater than 0.

Add an Input Message usingProgram Enrollment as the Input Message title and Enter the minimum, average, or maximum enrollment per lesson type. (including the period) as the Input message.

Add an Error Alert using the Stop style for the Error Alert, and useEnrollment Error as the Error Alert title and Program enrollment must be greater than 0. (including the period) as the Error message.

Alisonthinks the camp can make as much as $20,000 in program income from the Level II lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the maximum program income for Level II lessons (cell D14) to 20,000.

Change the program fee for Level II lessons (cell D3) to determine the fee the camp needs to charge to achieve the income goal.

Alison also wants to make at least $8,000in income per programfrom the Level I lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the minimum program income for Level I lessons (cell C12) to 8000.

Change the minimum program enrollment for Level I lessons (cell C7) to determine the minimum number of Level I students the camp needs to achieve the income goal.

Alison wants to average $15,000 in income per programfrom the Novice lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the average program income for Novice lessons (cell B13) to 15,000.

Change the average program enrollment for Novice lessons (cell B8) to determine the average number of Novice students the camp needs to achieve the income goal.

Go to the Current Rates worksheet. Alison has already created a scenario named Max Enrollment that calculates profit based on the maximum number of students enrolled for each program. Add a new scenario to compare the profit with average enrollment as follows:

Use Average Enrollment as the scenario name.

Use B8:F8 as the changing cells.

Accept the current values in the range B8:F8 as the values for the changing cells because these cells show the average number of students per program.

Add another new scenario to compare the profit with low program enrollment as follows:

Add another scenario to the workbook, using Low Enrollment as the scenario name.

Use B8:F8 as the changing cells.

Update the cell values in the range B8:F8 to match the low enrollmentvalues shown in bold in Table 1 below:

Table 1: Cell Values for the Low Attendance Scenario

Cell

New Value

Novice_New_Students (B8)

16

Level_I_New_Students (C8)

20

Level_II_New_Students (D8)

18

Level_III_New_Students (E8)

18

Advanced_New_Students (F8)

20

Show the Max Enrollment scenario values in the Current Rates worksheet.

Go to the New Rates worksheet, which contains three scenarios showing the profit with a $20 or $25rate increase or a $10 rate decrease. Compare the average profit per program based on the scenarios as follows:

Create a Scenario Summary report using the range B10:F10 as the result cells to show the average profit per program depending on the rate changes. (Hint: The defined names of the range B10:F10 appear in the report.)

Use New Rates Scenario Report as the name of the worksheet containing the report.

Alison also wants to focus on one or two types of lessons at a time when comparing the average profit per program. Return to the New Rates worksheet and create another type of report as follows:

Create a Scenario PivotTable report using the range B10:F10 as the result cells to compare the average profit per program depending on the rate changes in a PivotTable. (Hint: The defined names of the range B10:F10 appear in the report.)

Use New Rates PivotTable as the name of the worksheet containing the PivotTable.

Format cells B4:F6in the New Rates PivotTable worksheet using the Accounting number format with 0 decimal places and $ as the symbol. (Hint: Depending on how you complete this substep, the number format may appears as Custom.)

Go to the New Schedule worksheet. Alison wants to determine the number of morning and afternoon lessons the camp can offer to make the highest weekly profit without exceeding the maximum room capacities, meeting the ensembles scheduling needs, and considering other practical conditions.Use Solver to find this informationas follows:

Use cell G16 (Total_Weekly_Profit) as the objective cell in the Solver model, with the goal of determining the maximum value for that cell.

Use the range B4:F5, which shows the number of morning and afternoon musiclessons, as the changing variable cells.

Use the constraints shown in Table 2 below.

Table 2: Solver Constraints

Constraint

Cell or Range

Each type of lessonis scheduled at least once in the morning and once in the afternoon

B4:F5

Each morning and afternoon lesson value is an integer

B4:F5

Each type of lesson is scheduled 2 times per week or more

B6:F6

Each type of lesson is scheduled 15 times per week or less

B6:F6

The total number of morning lessons is 10 or less

Total_Morning_Lessons

The total number of afternoon lessons is 15 or less

Total_Afternoon_Lessons

The total number of lessons per week is 20

Total_Weekly_Lessons

Ensemble morning lessons are scheduled 5 times per week or less

Group_Morning_Lessons

Ensemble afternoon lessons are scheduled 8 times per week or less

Group_Afternoon_Lessons

The total number of ensemblelessons scheduled per week is 15 or less

Group_Total_Lessons

Use Simplex LP as the solving method.

Save the Solver model in cell A26.

Solve the model, keeping the Solver solution.

Alison wants to document the answer Solver found, including the constraints and a list of the values Solver changed to solve the problem. Produce an Answer report for the Solver model as follows:

Solve the model again, this time choosing to produce an Answer report.

Use New Schedule Answer Report as the name of the worksheet containing the Answer report.

Mark the workbook as Final to indicate you are finished revising the workbook.

Your workbook should look like the Final Figureson the following pages. (The values in cells D3, C7, and B8 of the Program Enrollment worksheet generated by Goal Seek Analysis has intentionally been blurred out in Final Figure 2.) The New Schedule Answer Report and New Schedule worksheets are not provided to prevent manual entry of the Solver results. Save your changes, close the workbook, and then exit Excel. Follow the directions on the SAM website to submit your completed project.

Final Figure 1: MusicProgramsWorksheet

Final Figure 2: Program Enrollment Worksheet

Final Figure 3: Current RatesWorksheet

Final Figure 4: New Rates Scenario ReportWorksheet

Final Figure 5: New Rates PivotTable Worksheet

Final Figure 6: New RatesWorksheet

0 notes

Text

ITEC3340 Instructions_SC_EX16_9b Solution

ITEC3340 Instructions_SC_EX16_9b Solution

Click Link Below To Buy:

https://hwcampus.com/shop/human-growth-development-mid-term-exam/

Or Visit www.hwcampus.com

Contact Us:

Shelly Cashman Excel 2016| Module 9: Project 1b

Rio Grande Music Camp

FORMULA AUDITING, DATA VALIDATION, AND COMPLEX PROBLEM SOLVING

GETTING STARTED

Open the file SC_EX16_9b_FirstLastName_1.xlsx, available for download from the SAM website.

Save the file as SC_EX16_9b_FirstLastName_2.xlsx by changing the “1” to a “2”.

If you do not see the .xlsx file extension in the Save As dialog box, do not type it. The program will add the file extension for you automatically.

With the file SC_EX16_9b_FirstLastName_2.xlsx still open, ensure that your first and last name is displayed in cell B6 of the Documentation sheet.

If cell B6 does not display your name, delete the file and download a new copy from the SAM website.

This project requires you to use the Solver add-in. If this add-in is not available on the Data tab in the Analysis group (or if the Analysis group is not available), install Solver as follows:

In Excel, click the File tab on the ribbon, and then click the Options tab in the left pane of Backstage view.

Click the Add-Ins tab in the left pane of the Excel Options dialog box.

Click the Manage arrow, click Excel Add-Ins in the Manage list, and then click the Go button.

In the Add-Ins dialog box, click the Solver Add-In check box, and then click the OK button.

Follow any remaining prompts to install Solver.

PROJECT STEPS

Alison Silverstein is the director of the Rio Grande Music Campin the outskirts of Boulder, Colorado. As an office assistant at the camp, you help Alison gather and analyze financial data. She asks for your help completing an Excel workbook that contains errors and missing information. She also wants to make it easier to enter correct data and determine the financial effects of changing the rates and schedules for music lessons.

Go to the Music Programs worksheet. Correct the first error in this worksheet, a divide by zero error, as follows:

Use the Trace Precedents arrows to find the source of the error in cell B14, the income per Novicelesson.

Correct the error by editing the formula in cell B14, which should divide the income per program (cell B13) by the lessons per program (cell B4).

Copy the formula and the formatting from cell B14 to the range C14:F14.

Correct the Name error in cell B17 as follows:

Use Error Checking to determine the source of the error in cell B17, which should calculate the average income per program.

Correct the error by editing the formula in cell B17.

Go to the Program Enrollment worksheet. To make it easier to add the correct program enrollment information, add data validation tothe range B7:F9as follows:

The cells in the range B7:F9should allow only whole number values greater than 0.

Add an Input Message usingProgram Enrollment as the Input Message title and Enter the minimum, average, or maximum enrollment per lesson type. (including the period) as the Input message.

Add an Error Alert using the Stop style for the Error Alert, and useEnrollment Error as the Error Alert title and Program enrollment must be greater than 0. (including the period) as the Error message.

Alisonthinks the camp can make as much as $20,000 in program income from the Level II lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the maximum program income for Level II lessons (cell D14) to 20,000.

Change the program fee for Level II lessons (cell D3) to determine the fee the camp needs to charge to achieve the income goal.

Alison also wants to make at least $8,000in income per programfrom the Level I lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the minimum program income for Level I lessons (cell C12) to 8000.

Change the minimum program enrollment for Level I lessons (cell C7) to determine the minimum number of Level I students the camp needs to achieve the income goal.

Alison wants to average $15,000 in income per programfrom the Novice lessons. Use Goal Seek to determine how to achieve this goal as follows:

Set the average program income for Novice lessons (cell B13) to 15,000.

Change the average program enrollment for Novice lessons (cell B8) to determine the average number of Novice students the camp needs to achieve the income goal.

Go to the Current Rates worksheet. Alison has already created a scenario named Max Enrollment that calculates profit based on the maximum number of students enrolled for each program. Add a new scenario to compare the profit with average enrollment as follows:

Use Average Enrollment as the scenario name.

Use B8:F8 as the changing cells.

Accept the current values in the range B8:F8 as the values for the changing cells because these cells show the average number of students per program.

Add another new scenario to compare the profit with low program enrollment as follows:

Add another scenario to the workbook, using Low Enrollment as the scenario name.

Use B8:F8 as the changing cells.

Update the cell values in the range B8:F8 to match the low enrollmentvalues shown in bold in Table 1 below:

Table 1: Cell Values for the Low Attendance Scenario

Cell

New Value

Novice_New_Students (B8)

16

Level_I_New_Students (C8)

20

Level_II_New_Students (D8)

18

Level_III_New_Students (E8)

18

Advanced_New_Students (F8)

20

Show the Max Enrollment scenario values in the Current Rates worksheet.

Go to the New Rates worksheet, which contains three scenarios showing the profit with a $20 or $25rate increase or a $10 rate decrease. Compare the average profit per program based on the scenarios as follows:

Create a Scenario Summary report using the range B10:F10 as the result cells to show the average profit per program depending on the rate changes. (Hint: The defined names of the range B10:F10 appear in the report.)

Use New Rates Scenario Report as the name of the worksheet containing the report.

Alison also wants to focus on one or two types of lessons at a time when comparing the average profit per program. Return to the New Rates worksheet and create another type of report as follows:

Create a Scenario PivotTable report using the range B10:F10 as the result cells to compare the average profit per program depending on the rate changes in a PivotTable. (Hint: The defined names of the range B10:F10 appear in the report.)

Use New Rates PivotTable as the name of the worksheet containing the PivotTable.

Format cells B4:F6in the New Rates PivotTable worksheet using the Accounting number format with 0 decimal places and $ as the symbol. (Hint: Depending on how you complete this substep, the number format may appears as Custom.)

Go to the New Schedule worksheet. Alison wants to determine the number of morning and afternoon lessons the camp can offer to make the highest weekly profit without exceeding the maximum room capacities, meeting the ensembles scheduling needs, and considering other practical conditions.Use Solver to find this informationas follows:

Use cell G16 (Total_Weekly_Profit) as the objective cell in the Solver model, with the goal of determining the maximum value for that cell.

Use the range B4:F5, which shows the number of morning and afternoon musiclessons, as the changing variable cells.

Use the constraints shown in Table 2 below.

Table 2: Solver Constraints

Constraint

Cell or Range

Each type of lessonis scheduled at least once in the morning and once in the afternoon

B4:F5

Each morning and afternoon lesson value is an integer

B4:F5

Each type of lesson is scheduled 2 times per week or more

B6:F6

Each type of lesson is scheduled 15 times per week or less

B6:F6

The total number of morning lessons is 10 or less

Total_Morning_Lessons

The total number of afternoon lessons is 15 or less

Total_Afternoon_Lessons

The total number of lessons per week is 20

Total_Weekly_Lessons

Ensemble morning lessons are scheduled 5 times per week or less

Group_Morning_Lessons

Ensemble afternoon lessons are scheduled 8 times per week or less

Group_Afternoon_Lessons

The total number of ensemblelessons scheduled per week is 15 or less

Group_Total_Lessons

Use Simplex LP as the solving method.

Save the Solver model in cell A26.

Solve the model, keeping the Solver solution.

Alison wants to document the answer Solver found, including the constraints and a list of the values Solver changed to solve the problem. Produce an Answer report for the Solver model as follows:

Solve the model again, this time choosing to produce an Answer report.

Use New Schedule Answer Report as the name of the worksheet containing the Answer report.

Mark the workbook as Final to indicate you are finished revising the workbook.

Your workbook should look like the Final Figureson the following pages. (The values in cells D3, C7, and B8 of the Program Enrollment worksheet generated by Goal Seek Analysis has intentionally been blurred out in Final Figure 2.) The New Schedule Answer Report and New Schedule worksheets are not provided to prevent manual entry of the Solver results. Save your changes, close the workbook, and then exit Excel. Follow the directions on the SAM website to submit your completed project.

Final Figure 1: MusicProgramsWorksheet

Final Figure 2: Program Enrollment Worksheet

Final Figure 3: Current RatesWorksheet

Final Figure 4: New Rates Scenario ReportWorksheet

Final Figure 5: New Rates PivotTable Worksheet

Final Figure 6: New RatesWorksheet

0 notes

Text

ITEC3340 Instructions_SC_EX16_9b Solution

ITEC3340 Instructions_SC_EX16_9b Solution

Click Link Below To Buy:

https://hwcampus.com/shop/human-growth-development-mid-term-exam/