#customs broker license examination

Text

Obtaining Funds with Short Term Loans UK Direct Lender Is Like Playing a Child's Play

Generally speaking, the lender would ask for a short term loans in order to provide the financial backup because it facilitates quick and timely repayment. The lender takes money out of the borrower's account after the conclusion of the loan payback period. But, since short term loans UK direct lender are a superior alternative for you to get the fastest amount in an easy approach, you don't need to worry if you don't have one.

If you have negative credit due to defaults, arrears, foreclosure, late payments, CCJs, IVAs, or bankruptcy, don't worry. The lender's refusal to review customers' history and current credit records is the cause of this. As a result, credit history is irrelevant in order to obtain the funds through the mentioned loan. To gain the confidence of lenders, you must meet the eligibility requirements listed below.

You meet the following requirements:

- You are a lawful resident of the United Kingdom;

- You are at least eighteen years old;

- You have been working for a reputable company for the past six months;

- To receive the funds by direct deposit, you must also have an active bank account.

You can now borrow money using short term loans UK in the range of £100 to £1000 without having to pledge any kind of collateral as security. You can utilize this modest cash solution to cover a variety of problems, including overdraft fees from banks, unpaid medical bills, electricity bills, grocery shop bills, travel costs, and house loan installments. As the name suggests, you have 30 days from the acceptance date to repay the money.

Obtaining short term loans UK direct lender is a very straightforward process. All you have to do is complete an application on the website, including accurate information such as your full name, address, bank account, email address, age, phone number, and so forth. Within 30 days of your application, the lender will sanction your funds directly into your account if your financing is approved.

Are 15 Minute Short Term Loans Available?

Sure, you can accomplish this, but it's also critical to comprehend the steps involved in applying for any kind of loan.

The first thing you should think about is how much you want to borrow. The next step will be to look for short term loans direct lenders, and the simplest way to do it in today's connected world is to go online. (If you find anything that works for you, you may also apply online for a loan.)

Depending on how you approach it and how many sites you review, this search process may take some time. Which lender—a licensed credit broker or a direct lender—will you use to search for a short term loans UK?

It's understandable why some people only consult two or three sources before selecting one. And that might be a mistake because you would pass up a lot of same day loans UK options that could be beneficial.

This raises another query. Is using a broker rather than a lender the best option? To help you decide whether to look for a 15-minute offer directly from a lender instead of a broker, let's examine the differences between the two.

4 notes

·

View notes

Text

In what ways may one develop their real estate consulting career?

A set of requirements must be met before one may practice as a real estate consultant with a valid license. Some examples include working as an agent's assistant or earning a license.

To provide real estate consulting services as a profession, you must first get the appropriate certification. Successfully passing a state licensing test is often required to get a real estate license. There are typically two parts to the examination. The first section explains the fundamentals of real estate law and regulation.

Several jurisdictions require agents to attend training courses before issuing licenses. Self-paced learning is the norm in this kind of online education. Students may get a fast pass in specific courses using "boot camp"-style solutions. Students may become comfortable with the structure of the actual exam by taking practice exams, which are often included in pre-licensing classes.

Step two is to order a background check, which may cost anywhere from $40 to $100. No photocopies of passports or driver's licenses are required from applicants. However, if you are not a U.S. citizen, your immigration status will need to be confirmed.

The license may also need to be renewed every few years, depending on the state. Licenses for agents may be renewed every two or four years. To keep your license valid, you must complete any required continuing education courses before they expire.

It is common practice for aspiring real estate consultants to "shadow" an established expert in the field. Other agents' good and bad experiences may be studied in several different ways. Participating in a peer group, listening to a lecture, and making connections are all excellent examples.

Success in real estate requires a lot of effort and self-control on the part of agents. It is also critical to stick to a plan and a budget. You need to set aside time daily to enhance your knowledge and stay abreast of changes in your field.

To advance, consider attending seminars and meetings and assisting other agents with their initiatives. For instance, if you're an attorney and a client is looking for office space, you may use your real estate expertise to assist them. Having other brokers check out the place is also a good idea.

Even if you need more time to do your assignments, attending a conference or seminar could be worth it. There are many fun things to do, and you can do them without breaking the bank or having to go far.

One might join the real estate market in several different ways. Finding the most fundamental things is difficult, but you can. You may, for example, negotiate with a mortgage lender to fund the purchase, employ a real estate agent to assist you in finding suitable houses, or arrange a payment plan. All of this might become pricey, regardless of how big or tiny your family is. If you want in on the activity, think about the following suggestions.

Asking questions as a jumping-off point is a great strategy. How do you typically respond when clients make requests? Similarly, how should companies interact with customers who refuse to adapt to new ways of doing things? Also, consider a career change if your customers aren't raving about your job.

You need to know the industry well and out to make a living as a real estate consultant. For instance, you should motivate yourself daily. Discipline is required, and you should be at ease in social situations. You should also include time in your schedule for building professional relationships, learning new skills, and continuing to develop professionally.

To be a successful real estate consultant, you must organize your time well for the weeks and months ahead. Therefore, you should set weekly and daily objectives and strive diligently to achieve them. It would help if you also were flexible with your timetable. Your customers may sometimes need your availability outside regular business hours, including weekends. No issue exists; however, it may not be easy to maintain social contact with loved ones over the week.

6 notes

·

View notes

Text

How to Choose the Greatest Real Property Professionals for Homes for Sale in Phuket Thailand?

When seeking Houses For Sale In Phuket Thailand, it's necessary to find a reputable and trusted real estate representative. An excellent broker can make all the difference in negotiating the facility and commonly unfamiliar Thai property market. However exactly how perform you evaluate the capabilities and credentials of prospective representatives? It begins along with assessing their local market expertise, licenses, and interaction skills. Yet what other key elements should you look at, and how can you approve you're teaming up with a broker who definitely has your benefits in mind? A closer examination of these concerns is necessary to create an informed selection.

Analyze Resident Market Knowledge

Many real estate brokers declare to possess in-depth knowledge of the local market, but it's critical to examine this insurance claim fairly. When looking for houses for sale in Phuket Thailand, it is actually vital to analyze a broker's regional market expertise. Inquire details questions about the place, including current market trends, popular neighborhoods, and regional zoning regulations. Observe their reaction, seeking cement instances and data to sustain their insurance claims. An educated agent ought to be actually able to deliver comprehensive details about the regional property market, consisting of current sales information and existing directories. Examine their answers critically, and do not hold back to seek a second opinion if you are actually unsure concerning their experience.

Check Representative Certifications

When looking to buy or even sell a residential property in Phuket, Thailand, really, you should review an agent's specialist references to determine their skills and integrity. Inspect if they have accreditations from realized institutions, such as the Real Estate Sales Representative Permit or even the Certified International Property Expert (CIPS) designation. These accreditations illustrate a broker's expertise and commitment to the industry. For those wanting to purchase a residence in Phuket, a licensed broker may provide beneficial guidance throughout the method. When looking for homes for sale in Phuket Thailand, promise the broker possesses the essential qualifications to manage your deal efficiently and efficiently. Confirming a broker's qualifications assists you make a notified decision when selecting a real estate broker.

Assess Communication Skills

Reliable interaction is actually key to an effective real estate transaction in Phuket, Thailand, as it directly affects the broker's capacity to know and comply with a client's necessities. When evaluating real estate agents, it's crucial to assess their interaction skill-sets. This features their capacity to pay attention definitely, answer immediately, and provide crystal clear, succinct information about the residential property administration process. A really good agent must have the capacity to detail complex real estate principles in easy conditions, assisting clients create updated selections when they buy house in Phuket. They must also be receptive to questions and concerns, delivering normal updates throughout the transaction procedure. Through evaluating an agent's interaction skill-sets, customers can easily promise a smooth and worry-free experience.

Research Study Broker Track Record

A real property broker's ability to correspond efficiently is actually just one component of their total efficiency. When reviewing representatives for properties for sale in Phuket, a vital measure is to research their credibility. Check on the internet assessments on platforms like Google or even Facebook to find what past clients have to state concerning their experiences. Search for reddish banners, like criticisms about amateurish actions or even poor communication. Agents with a good reputation are extra likely to supply outstanding service when you buy house in Phuket. In addition, inspect if the representative is connected along with credible property associations, which often have rigorous code of behaviors. This research is going to give you a far better understanding of the broker's integrity and trustworthiness.

Evaluation Sales Performance

Assessing a representative's sales efficiency is actually important as it straight impacts their capability to sell your Phuket residential property or even locate you the correct house for sale. Seek an agent with a tried and tested performance history of selling homes for sale Phuket, especially in areas similar to yours. Inspect their sales quantity, typical list price, and days on market to evaluate their effectiveness. Assess their functionality metrics to identify if they're satisfying or going over field requirements. A top-performing agent in Phuket, Thailand homes for sale is probably to have a tough system, exceptional arrangement capabilities, and detailed knowledge of the local market. Through reviewing a representative's sales performance, you can easily create a well informed decision concerning that to trust along with your Phuket real estate needs.

Final Thought

Reviewing real estate brokers for homes for sale in Phuket, Thailand demands cautious consideration of key variables. By examining local market understanding, inspecting representative accreditations, and assessing sales efficiency, property buyers can easily make educated selections. It is actually likewise important to analyze communication skill-sets and research a representative's online reputation. An extensive assessment aids determine reliable, respected, and helpful brokers who may browse complicated transactions. This due persistance guarantees a successful and trouble-free home-buying experience in Phuket's affordable market.

Inter Property Phuket

Rawai: 137 / 7, Tambon Rawai, Mueng, Chang Wat Phuket 83130

Bang Tao: Moo 6 Tambon Thep Krasatti, Chang Wat, 83110

Patong: 200 Phrabaramee Rd, Tambon Patong, Kathu, Chang Wat Phuket 83150

Call: (+66) 090 328 6899

0 notes

Text

How to Review Real Property Brokers for Houses for Sale in Phuket Thailand?

When looking for Homes For Sale In Phuket Thailand, it's important to discover a trustworthy and dependable real estate broker. A good agent can create all the difference in traversing the facility and usually unfamiliar Thai home market. However how do you examine the skill-sets and certifications of prospective brokers? It begins with reviewing their local market knowledge, accreditations, and communication skills. However what various other key aspects should you look at, and exactly how can you accredit you are actually teaming up with a broker that definitely has your finest rate of interests in mind? A closer exam of these concerns is needed to create an updated selection.

Review Local Market Understanding

Most real property brokers state to have extensive understanding of the regional market, however it's crucial to analyze this insurance claim fairly. When searching for homes for sale in Phuket Thailand, it's critical to examine an agent's local market knowledge. Talk to certain inquiries concerning the region, like existing market trends, well-liked areas, and local zoning regulations. Keep an eye on their response, trying to find cement examples and records to assist their claims. A competent agent ought to have the ability to deliver in-depth relevant information regarding the regional property market, featuring recent sales information and present directories. Examine their responses significantly, and don't wait to look for a 2nd viewpoint if you're doubtful about their skills.

Examine Representative Certifications

When aiming to get or even sell a residential or commercial property in Phuket, Thailand, extremely, you must analyze an agent's professional qualifications to evaluate their competence and reliability. Check if they have licenses from recognized companies, such as the Real Estate Sales Representative Certificate or the Accredited International Residential Property Professional (CIPS) designation. These credentials demonstrate a representative's expertise and commitment to the field. For those wanting to purchase a residence in Phuket, a licensed agent can easily offer important assistance throughout the process. When exploring for homes for sale in Phuket Thailand, guarantee the representative has the necessary certifications to manage your transaction efficiently and successfully. Confirming an agent's qualifications aids you create an informed decision when picking a property representative.

Evaluate Communication Capabilities

Reliable communication is actually key to a productive property purchase in Phuket, Thailand, as it straight influences the broker's potential to comprehend and satisfy a client's demands. When analyzing real estate brokers, it's necessary to analyze their interaction skills. This features their capacity to pay attention proactively, respond quickly, and supply crystal clear, succinct relevant information about the home control method. A great representative needs to have the capacity to clarify complicated real estate concepts in easy conditions, assisting clients make educated selections when they buy house in Phuket. They ought to also be receptive to queries and concerns, offering regular updates throughout the purchase procedure. By evaluating an agent's interaction skills, customers may promise a hassle-free and hassle-free experience.

Study Broker Image

A property representative's potential to correspond successfully is just one element of their total efficiency. When analyzing representatives for residences for sale in Phuket, an important step is to explore their track record. Examine internet testimonials on platforms like Google or Facebook to observe what past clients must say regarding their experiences. Search for reddish flags, including complaints concerning less than professional behavior or bad communication. Brokers along with a great credibility are very likely to offer superb service when you buy house in Phuket. Additionally, inspect if the agent is actually affiliated along with trustworthy real property affiliations, which often have strict rules of conducts. This analysis will provide you a much better understanding of the agent's stability and dependability.

Review Sales Performance

Examining a representative's sales efficiency is crucial as it straight affects their potential to sell your Phuket residential property or even locate you the ideal real estate for sale. Seek a broker along with a tried and tested record of selling homes for sale Phuket, specifically in neighborhoods comparable to your own. Check their sales amount, common price, and times on market to gauge their effectiveness. Examine their performance metrics to calculate if they are actually complying with or even surpassing market criteria. A top-performing agent in Phuket, Thailand residences for sale is probably to possess a sturdy system, outstanding settlement skills, and comprehensive knowledge of the regional market. Through assessing a representative's sales performance, you can easily create a well informed decision regarding that to trust with your Phuket real estate demands.

Verdict

Analyzing real estate brokers for homes for sale in Phuket, Thailand calls for careful point to consider of key variables. Through reviewing local market knowledge, examining agent certifications, and reviewing sales performance, buyers can help make knowledgeable choices. It is actually also essential to examine communication capabilities and study a broker's image. A detailed examination helps pinpoint trustworthy, trustworthy, and reliable representatives that can easily get through complicated deals. This due diligence promises a productive and trouble-free home-buying experience in Phuket's competitive market.

Inter Property Phuket

Rawai: 137 / 7, Tambon Rawai, Mueng, Chang Wat Phuket 83130

Bang Tao: Moo 6 Tambon Thep Krasatti, Chang Wat, 83110

Patong: 200 Phrabaramee Rd, Tambon Patong, Kathu, Chang Wat Phuket 83150

Call: (+66) 090 328 6899

0 notes

Text

How to Evaluate Property Representatives for Homes for Sale in Phuket Thailand?

When exploring for Houses For Sale Phuket, it's necessary to discover a trusted and trusted property broker. An excellent agent may bring in all the distinction in traversing the facility and usually unknown Thai home market. However how do you analyze the skill-sets and certifications of prospective brokers? It starts along with examining their regional market understanding, qualifications, and communication abilities. However what various other key factors should you think about, and just how can you license you are actually functioning along with a representative who truly possesses your benefits in mind? A closer exam of these concerns is necessary to make a notified selection.

Evaluate Native Market Understanding

Many real estate brokers declare to possess detailed understanding of the regional market, however it's critical to review this insurance claim objectively. When hunting for houses for sale in Phuket Thailand, it's necessary to examine an agent's regional market understanding. Ask details inquiries regarding the location, like existing market trends, prominent communities, and regional zoning policies. Take note of their reaction, seeming for cement examples and data to assist their claims. A knowledgeable agent must manage to give detailed info regarding the regional property market, consisting of current sales records and present listings. Examine their solutions extremely, and don't hold back to seek a second point of view if you are actually not sure concerning their knowledge.

Check Out Representative Certifications

When appearing to get or even sell a building in Phuket, Thailand, vitally, you have to analyze a representative's expert qualifications to determine their knowledge and trustworthiness. Examine if they have qualifications from identified companies, like the Property Salesperson License or the Accredited International Property Specialist (CIPS) designation. These credentials demonstrate a representative's expertise and dedication to the field. For those aiming to get a home in Phuket, an accredited broker can easily supply valuable direction throughout the procedure. When seeking homes for sale in Phuket Thailand, assure the representative possesses the necessary qualifications to handle your transaction properly and properly. Confirming a broker's qualifications helps you create a notified choice when deciding on a property representative.

Evaluate Communication Skills

Effective communication is actually key to a prosperous real estate purchase in Phuket, Thailand, as it straight impacts the broker's capacity to comprehend and comply with a customer's requirements. When assessing property agents, it is actually necessary to review their interaction skills. This includes their ability to listen closely definitely, respond immediately, and provide crystal clear, succinct details regarding the home administration procedure. A good broker ought to have the capacity to clarify complicated real estate ideas in easy terms, aiding clients make notified choices when they buy house in Phuket. They ought to likewise be actually reactive to inquiries and problems, providing regular updates throughout the purchase procedure. By analyzing a broker's interaction abilities, clients may promise a soft and hassle-free experience.

Analysis Broker Image

A real estate broker's capability to correspond efficiently is merely one facet of their total performance. When evaluating agents for homes for sale in Phuket, an essential step is actually to research their online reputation. Inspect on the web assessments on platforms like Google or Facebook to observe what past customers must claim concerning their experiences. Seek warnings, like complaints about amateur behavior or poor communication. Representatives along with an excellent track record are most likely to supply exceptional service when you buy house in Phuket. Additionally, examine if the broker is actually associated with respectable real property organizations, which usually possess stringent standard procedures. This study will give you a better understanding of the broker's dependability and reliability.

Evaluation Sales Performance

Evaluating an agent's sales efficiency is actually vital as it straight affects their potential to sell your Phuket residential property or even discover you the appropriate house for sale. Try to find an agent with a tested performance history of selling homes for sale Phuket, particularly in areas similar to all yours. Examine their sales quantity, typical sale cost, and times on market to determine their efficiency. Examine their functionality metrics to find out if they're complying with or even exceeding field standards. A top-performing broker in Phuket, Thailand residences for sale is actually probably to have a sturdy system, superb settlement abilities, and extensive expertise of the regional market. By reviewing a representative's sales functionality, you can create an enlightened decision regarding that to trust along with your Phuket property requirements.

Verdict

Reviewing real property agents for homes for sale in Phuket, Thailand needs mindful factor to consider of key aspects. By assessing regional market knowledge, examining broker qualifications, and assessing sales functionality, homebuyers can easily produce knowledgeable choices. It's likewise important to analyze communication abilities and investigation a representative's image. A thorough evaluation aids pinpoint reliable, dependable, and efficient agents that can easily navigate complex deals. This due carefulness ensures a prosperous and stress-free home-buying experience in Phuket's open market.

Inter Property Phuket

Rawai: 137 / 7, Tambon Rawai, Mueng, Chang Wat Phuket 83130

Bang Tao: Moo 6 Tambon Thep Krasatti, Chang Wat, 83110

Patong: 200 Phrabaramee Rd, Tambon Patong, Kathu, Chang Wat Phuket 83150

Call: (+66) 090 328 6899

0 notes

Text

How to Opt For the very best Real Property Representatives for Homes for Sale in Phuket Thailand?

When hunting for Homes For Sale In Phuket Thailand, it is actually essential to locate a reputable and dependable property representative. A good broker may create all the distinction in going across the facility and commonly unknown Thai building market. However just how perform you evaluate the abilities and certifications of prospective agents? It starts along with assessing their local market knowledge, accreditations, and interaction abilities. But what other key aspects should you take into consideration, and just how can you license you are actually partnering with a broker that definitely has your finest passions in mind? A closer assessment of these questions is actually necessary to create an updated decision.

Assess Resident Market Expertise

Most real property representatives assert to have in-depth understanding of the regional market, but it is actually crucial to analyze this claim objectively. When hunting for houses for sale in Phuket Thailand, it's essential to assess a representative's regional market expertise. Talk to details concerns regarding the area, including present market trends, preferred communities, and local zoning rules. Take note of their reaction, trying to find cement instances and information to sustain their claims. An educated agent must have the ability to provide detailed information regarding the local real estate market, consisting of latest sales information and present lists. Evaluate their solutions seriously, and do not wait to seek a second viewpoint if you're not sure regarding their knowledge.

Examine Representative Certifications

When trying to buy or sell a building in Phuket, Thailand, vitally, you have to analyze a representative's expert references to gauge their knowledge and integrity. Examine if they keep licenses from recognized organizations, like the Real Property Sales Representative Permit or even the Professional International Residential Or Commercial Property Specialist (CIPS) classification. These credentials display a representative's expertise and devotion to the industry. For those trying to get a home in Phuket, an accredited agent can supply beneficial support throughout the method. When seeking houses for sale in Phuket Thailand, assure the broker possesses the needed certifications to handle your purchase properly and efficiently. Verifying a representative's qualifications aids you make an informed selection when picking a real estate agent.

Analyze Interaction Capabilities

Successful communication is key to a successful property transaction in Phuket, Thailand, as it directly influences the agent's capacity to recognize and fulfill a client's requirements. When analyzing real estate representatives, it is actually vital to evaluate their communication abilities. This features their capability to listen actively, respond promptly, and deliver very clear, to the point information concerning the home control process. A good broker must manage to discuss intricate real estate concepts in easy conditions, aiding clients make educated choices when they buy house in Phuket. They must likewise be actually reactive to questions and concerns, providing routine updates throughout the transaction procedure. Through examining a broker's communication capabilities, customers can easily assure a smooth and trouble-free experience.

Research Representative Credibility And Reputation

A real estate agent's potential to communicate efficiently is merely one aspect of their overall efficiency. When assessing brokers for houses for sale in Phuket, a vital step is actually to investigate their track record. Check out on-line customer reviews on platforms like Google or even Facebook to observe what past customers need to claim about their experiences. Search for warnings, including grievances concerning unprofessional behavior or even bad communication. Representatives along with an excellent track record are actually a lot more very likely to give superb service when you buy house in Phuket. Additionally, check out if the agent is associated along with reliable real property affiliations, which typically have strict rules of conducts. This study is going to provide you a much better understanding of the agent's integrity and credibility.

Assessment Sales Efficiency

Reviewing a representative's sales performance is actually essential as it straight impacts their potential to sell your Phuket residential or commercial property or discover you the correct house for sale. Seek an agent along with a tested keep track of history of selling homes for sale Phuket, particularly in communities similar to yours. Examine their sales volume, typical sale rate, and days on market to evaluate their efficiency. Analyze their functionality metrics to determine if they are actually meeting or going over business standards. A top-performing agent in Phuket, Thailand homes for sale is actually most likely to have a tough network, excellent discussions skills, and comprehensive understanding of the regional market. By examining a broker's sales performance, you can create an enlightened choice about who to trust along with your Phuket property demands.

Verdict

Analyzing real property brokers for homes for sale in Phuket, Thailand requires careful consideration of key factors. By assessing local market understanding, inspecting agent licenses, and assessing sales performance, property buyers can easily help make educated selections. It is actually likewise vital to evaluate interaction abilities and study a broker's credibility. A comprehensive analysis aids identify trustworthy, credible, and successful brokers that can easily browse sophisticated transactions. This as a result of persistance assures a productive and trouble-free home-buying experience in Phuket's open market.

Inter Property Phuket

Rawai: 137 / 7, Tambon Rawai, Mueng, Chang Wat Phuket 83130

Bang Tao: Moo 6 Tambon Thep Krasatti, Chang Wat, 83110

Patong: 200 Phrabaramee Rd, Tambon Patong, Kathu, Chang Wat Phuket 83150

Call: (+66) 090 328 6899

0 notes

Text

Business Purchase Guide

Buying an existing business

can be a strategic move to leverage established operations, customer base, and reputation. However, it requires careful consideration and due diligence. Here's a general guide to help you through the process:

Define Your Goals: Why buy a business? Is it for passive income, growth potential, or a specific industry interest? Business Purchase

What are your financial capabilities and risk tolerance?

Research the Market: Identify potential industries or niches.

Explore online marketplaces (like BizBuySell) and local business brokers.

Network with industry professionals.

Assess Potential Businesses: Evaluate financial performance: Review income statements, balance sheets, and cash flow statements.

Assess customer base and market share.

Analyze the business's competitive position.

Consider the industry's trends and growth potential.

Conduct Due Diligence: Legal review: Examine contracts, leases, permits, and licenses.

Financial audit: Verify financial information and identify potential liabilities.

Operational assessment: Evaluate inventory, equipment, and supply chain.

Customer and employee interviews: Gather insights into the business's culture and operations.

Negotiate the Purchase Price: Consider factors like assets, liabilities, earnings potential, and market conditions.

Be prepared to negotiate and make counteroffers.

Secure Financing: Explore options like bank loans, SBA loans, or private investors.

Prepare a detailed business plan to support your financing request.

Complete the Purchase: Finalize the purchase agreement, including terms, conditions, and closing date.

Transfer ownership and assets.

Obtain necessary permits and licenses.

Additional Considerations:Legal and tax implications: Consult with legal and tax professionals to understand the implications of business ownership. Contingency planning: Be prepared for potential challenges or unexpected issues during the transition. Post-acquisition integration: Develop a plan to integrate the acquired business into your existing operations.

1 note

·

View note

Text

Anti Money Laundering in Singapore

The open economy and well-structured tax environment of Singapore contribute to its reputation as a business center. Nevertheless, the open economy can pose a risk of emerging financial crimes like money laundering or terrorist financing. For this reason, adhering to anti-money laundering regulations in Singapore is mandatory.

Since 2016, Singapore has strengthened AML regulations and measures by understanding the evolving landscape of financial crime. The nation has earned recognition from international bodies such as the Financial Action Task Force (FATF) for its commitment and dedication to combating emerging money laundering risks.

However, to stay compliant with Singapore’s AML requirements, businesses within the country must adhere to varied AML regulations. Does that sound confusing? We will guide you through the definition of AML, the AML compliance process, accurate regulations, and other insights to help your business combat financial risks.

What is Anti-Money Laundering (AML) in Singapore?

Money laundering refers to a comprehensive procedure, policies, and specific regulations mandated for Singaporean businesses to mitigate ML activities.

AML programs require financial institutions and other organizations to identify, monitor, and report suspicious transactions at the right time. It is also important for businesses to implement specific measures and policies to prevent money laundering in Singapore.

Additionally, AML requirements include implementing a risk-based approach that includes procedures such as customer due diligence, real-time transaction monitoring, suspicious activity reports, and AML risk assessments. Organizations in Singapore can protect overall financial infrastructure effectively by adhering to diverse AML regulations.

Who is Affected by Money Laundering in Singapore?

Anti money laundering in Singapore regulations are mandated for financial institutions and other entities or individuals to foster secured financial practices in the country.

Casinos

Brokers

Exchange Companies

Real-estate Agents

Financial Advisers

Precise Metals Dealers

Payment Service Advisers

And More

Additionally, Money laundering in Singapore mandates AML compliance for a few transactions like:

E-money issuance

Money Exchange

Virtual Assets

Money Transfers

Account Issuance

Who Are the AML Regulators in Singapore?

For total compliance, various AML regulators in Singapore supervise various industries. The main AML regulator for financial institutions is the Monetary Authority of Singapore (MAS). Additionally, the Council for Estate Agents oversees real estate agencies in Singapore for potential money laundering, and the Accounting and Corporate Regulatory Authority (ACRA) focuses on regulating accountants and corporate service providers.

Additionally, the Casino Industry is the focus of the Casino Regulatory Authority. Recall that each regulator has unique guidelines or anti-money laundering laws that apply to a certain sector. For your benefit, let's examine various regulators in more detail.

The Money Authority of Singapore (MAS): oversees several AML initiatives in its capacity as both a central bank and a financial regulatory body. It places a high priority on enforcing rules and regulations, notifying financial institutions, and assisting companies with the implementation of anti-money laundering (AML) procedures such transaction monitoring and reporting and due diligence. In addition, if the institutions don't follow AML regulations, MAS performs strict inspections and revokes their licenses.

The Commercial Affairs Department (CAD): of the Singapore Police Force is primarily responsible for looking into and prosecuting cases involving money laundering. Money laundering operations in Singapore are identified and stopped by CAD in cooperation with MAS and other law enforcement organizations. Particular units concentrate on gathering pertinent information, filing lawsuits, and bringing charges against people or organizations engaged in money laundering.

Involvement of Government: Singapore’s government imposes extensive laws like Corruption, Drug Trafficking, and other Serious Crimes Act (CDSA) and Terrorisim Suppression of Financing Act (TSOFA) – criminalizing money laundering and terrorist financing attempts. Additionally, legislation is continuously reviewed and amended to mitigate evolving threats.

International Cooperation: Singapore focuses on bringing AML laws into line with international norms as a member of the Financial Action Task Force (FATF). In addition, in order to comply with Singapore's anti-money laundering laws, the Singaporean government participates in global programs aimed at reducing cross-border money laundering and terrorist financing through mutual analysis.

Public-Private Partnership: The Singaporean government works with various private sectors, law enforcement agencies, and regulatory entities. This strategy facilitates the exchange of important information, the development of expertise, and the demonstration of cooperative efforts to reduce financial crime. Additionally, this endeavor promotes compliance in the financial industry and streamlines the implementation of AML measures.

What is the Legislation of Money Laundering in Singapore?

Singapore has a robust anti money laundering act or legislation to mitigate financial crimes. However, the primary law involves Corruption, Drug Trafficking, and Other Serious Crimes Act (CDSA) which prioritizes on outlining on ML prevention measures, detailed reporting process, and penalties for AML non-compliance.

1. Corruption, Drug Trafficking & Other Serious Act (CDSA)

The foundation of Singapore's anti-money laundering (AML) structure is the CDSA, which makes money laundering illegal and provides a legal framework for the investigation, prosecution, and seizure of assets pertaining to serious crimes. This approach also gives regulatory and law enforcement agencies the ability to accurately respond to allegations of money laundering and support assets.

2. Terrorism Suppression of Financing Act (TSOFA)

Targeting the financing of terrorism by giving money to terrorist organizations or individuals is the main goal of TSOFA. With particular anti-money laundering checks and laws, it fosters international cooperation from terrorist financing networks by requiring financial institutions to do rigorous due diligence in order to prevent financing and enabling authorities to take assets.

3. Precious Stones and Precious Metals Act (PSMTFA)

By defining particular AML procedures for dealers, PSMTFA concentrates on the dangers of money laundering associated with precious stones or metals. It additionally upholds enhanced due diligence and licensing.

4. Securities and Futures Act (SFA)

SFA gives regulating AML requirements for firms with licenses in the securities, futures, and financial advising sectors top priority. In addition, it requires transaction tracking, reporting suspicious transactions, and customer due diligence. It also ensures vigilance in recognizing and avoiding financial fraud, including money laundering.

5. Computer Misuse and Cybersecurity Act (CMCA)

Cybercrime and computer-related offenses, including hacking and cyberfraud, are the focus of the CMCA. Furthermore, it enhances Singapore's capacity to lessen cyber-related financial crimes and safeguard financial transactions.

6. Personal Data Protection Act (PDPA)

While it regulates personal data projections, PDPA is not solely focused on AML rules. Singapore mandates that organizations secure their personal data, which acts as an excellent anti-money laundering check and indirectly aids in the discovery of financial fraud by reducing identity theft and fraudulent actions.

Furthermore, the Money Authority of Singapore (MAS), which is in charge of monitoring financial institutions for anti-money laundering and other fraud prevention measures, enforces these restrictions. Furthermore, MAS provides organized guidelines, conducts inspections, and enforces compliance measures to guarantee that AML standards are followed in Singapore.

How to Stay Compliant?

Organizations in Singapore are required by the Corruption, Drug, and other Serious Crimes Act (CDSA) to adhere to a series of guidelines in order to be compliant with AML legislation. These guidelines include:

* Establish strong internal policies, processes, and risk-based monitoring to ensure compliance with AML regulations. This means that while developing these policies, companies need to consider the scale and complexity of their business.

* Regardless of the industry your company operates in, it's critical to keep your workforce informed on the AML policies. Think about holding special training sessions for both new hires and current employees, and make sure they are informed about AML policies and procedures at least once a year.

* Organize specialized training sessions to assist your employees in recognizing and mitigating suspicious activity. Make your team aware of the potential repercussions for your organization should you end up breaking any legislation or failing to keep an eye on transactions or money laundering attempts.

* To identify ML/TF threats in Singapore for companies exposed to a range of potential crimes, conduct risk assessments.

* Establish a compliance officer or AML specialists and outline their roles and responsibilities for AML compliance procedures that are tailored to your company's needs and sector. and notify particular Singaporean regulatory agencies of any questionable transactions.

In addition, the Designated Non-financial Businesses and Professions (DNFBPs) outlined in AML/CFT regulations involves:

Real Estate (Agents & Companies)

Dealers in Precious Stones & Metals

Corporate Service Providers

Public Accountants

Lawyer

Pawnbrokers

Casinos

To help you stay compliant with money laundering in Singapore, we are listing below a few significant procedures to run your business risk-free.

1. Optimize & Track Value Transfers

A value transfer includes a transaction conducted on behalf of a value transfer originator via a financial institution to make one or more available digital tokens.

Before conducting a value transfer, the ordering institution must:

* Identify value transfer originators and implement adequate measures to verify value transfer originator’s identity.

* Record crucial details of value transfer like date of value transfer, value and type of digital tokens transferred and value date.

Requirements: Value Transfer Below or Equal to $1500

* Name of value transfer originator

* Value transfer’s account number

* Name of value transfer beneficiary

* Value transfer’s beneficiary account number

Requirement: Value Transfer Exceeding $1500

* Value transfer originator’s residential address

* Registered business address

2. Extensive Customer Due Diligence (CDD)

One of the crucial phases for AML compliance in Singapore is client due diligence, which guarantees that you onboard real customers after a careful evaluation. Additionally, this process include gathering and confirming customer documentation, acting as a thorough background investigation.

As an initial step, entities must focus on collecting and verifying customer’s information such as:

* Customer’s full name

* Identification number – birth certificate number, identity card number & more

* Nationality

* Date of birth

* Residential address

In addition, if your customer is an organization, then it is crucial for businesses to verify and follow a few vital steps like:

Verify entities business profile structure type, and more aspects

* Check organization’s geographical aspects – specific region or country, the company operates from or where your customer is actively associated.

* Furthermore check other factors like, type of services/products they provide, size, type or complexities of their transactions – mode of payment, and check for their preferred delivery or distribution channels

3. Conduct Sanction & PEP Screening

To prevent ML attempts, MAS mandates businesses in Singapore to conduct rigorous assessments, which includes conducting Politically Exposed Person (PEP), sanction screening, and adverse media checks to avoid onboarding customers who are blacklisted by local and global authorities.

* Identify and access source of wealth and source of income or funds of your customers to ensure they are not involved into illegal activities

* Track transactions, varied activities and customer’s behavior thoroughly and report it immediately to Sinagporean authorities if you detect any unusual activities in transactions without informing customers.

4. Suspicious Transaction Reporting

Have you noticed any odd behavior in the course of monitoring transactions? Anyone noticed any questionable information while doing a PEP screening? Once you have sufficient client information and suspect information from your recordkeeping, you must report it right away to the Suspicious Transaction Reporting Officer (STRO).

Additionally, it is imperative that companies understand the various AML reporting requirements that apply to the industry they serve. For example, traders of precious stones and metals in Singapore are required to record every transaction above S$20,000. On the other hand, transactions over S$10,000 must be reported by casino businesses within 15 working days.

Speak with our AML specialists to obtain software and customized AML solutions that will help you comply with a variety of rules.

What are the Penalties for Money Laundering Activities in Singapore?

1. Hefty Fine

Businesses that fail to comply with AML, can be fined for around $1 million by the Monetary Authority of Singapore (MAS). For instance, in 2016 MAS had fined multiple banks in SIngapore of around $29.1 million for poor transaction monitoring, customer due diligence, and even AML reporting.

2. Regulatory Penalty

Apart from hefty fines, having gaps into your AML policies, or procedures can cause regulatory fines. This means, MAS can impose license revocation, put business limitations, and more. For example, in 2017 a bank was fined around $6.4 million and warned by MAS due to lack of assessing ML risks regarding client’s accounts, non-compliance of identification of anomaly client behavior with dedicated accounts.

3. Criminal Prosecution

Failing to comply with AML regulations can lead to receiving a sentence for an ML offense. Individuals or entities involved in non-compliance of AML practices can face imprisonment of 10 years and fine of $1 million and more. In 2020, 2 lawyers were charged for ML offense for moving millions of dollars from client’s accounts to third-party accounts.

AML Penalty in Singapore

Penalty Types:

1. Monetary Fine

$1 million or more

2. Regulatory Fine

License revocation, Business limitations

3. Criminal Prosecution

Imprisonment for 10 years, or fine $1 million or twice

Other Penalties:

* Official Warnings

* Prohibition Orders

* Management removal

* Reprimands

* Asset confiscation

* Business loss

Money Laundering Activities:

* Buying goods with illicit funds

* Structuring cash transactions

* Moving fund to third party account

* Hiding money with shell companies

Final Thoughts

Since 2016, Singapore's anti-money laundering legal system has undergone substantial change. To show its dedication to reducing financial crime even in an increasingly digitally complex environment, the MAS has updated AML regulations, reporting guidelines, and other protocols.

The significance of adhering to these laws and effectively thwarting any possible money laundering attempts is underscored by the Corruption, Drug Trafficking & Other Serious Act (CDSA), Terrorism Suppression of Financing Act (TSOFA), Precious Stones and Precious Metals Act (PSMTFA), and other acts.

Trust our unique AML software and services to assure automated procedures that comply with AML requirements, simplifying this process. Our AML specialists will offer you comprehensive guidance in creating efficient AML policies and procedures, as well as training for your personnel to facilitate transaction tracking, sanction screening, the CDD process, and AML reporting.

0 notes

Text

What You Should Know About Mortgage Companies

Mortgage Companies are specialized financial firms that originate home loans. They are regulated by regulatory agencies, which assess their fiscal health on a regular basis.

They are able to market their mortgage services to potential clients via a variety of strategies. Some of these include: online marketing, social media, and webinars.

Specialization

While mortgage companies vary in size and specialization, all of them offer a variety of loan programs to suit different homebuyers. Some lenders specialize in offering mortgages for first-time homebuyers, while others focus on providing refinance options to homeowners with bad credit. Choosing the right lender can save you time and money in the long run.

A mortgage broker is a federally licensed firm or individual that sells loan programs on behalf of lenders. This allows them to match borrowers with lenders who are best suited for their needs. Typically, mortgage brokers charge a fee for their services.

Banks that specialize in a particular market can better manage their risks and stay abreast of changes in local regulations. This enables them to keep costs low while maximizing their profitability. My results show that one standard deviation higher MSA-level bank geographic specialization is associated with a lower expansion of mortgage lending during the boom and a lower reduction during the bust.

Fees

The home-buying process can be expensive. In addition to saving for a down payment and closing costs, buyers must also pay mortgage fees. While most of these fees are not negotiable, it is important to understand them so that you can shop around for the best rates and terms.

Among the most common mortgage fees are the application fee, origination fee and credit reporting fees. These fees are usually a percentage of the loan amount and may be lumped together or listed individually on your loan estimate.

Another mortgage fee is the document preparation fee, which covers the cost of preparing documents for signing at closing. This is typically listed as a separate charge on your loan estimate, but lenders are required to disclose it in a separate section of the estimate if it is not included in the origination fee. This fee varies among lending institutions. Buyers should note that the document preparation fee does not include charges for recording the deed, which is an additional fee charged by county and municipal offices.

Convenience

Mortgage companies typically offer a faster and more efficient process than a full service bank. This is because they focus on one aspect of financial services – mortgage loans. They also often have a wider range of loan programs available to them, because they do not have the same restrictions as a bank, which must conform to the guidelines set by federal institutions like Fannie Mae and Freddie Mac.

Mortgage brokers can help you understand the various mortgage products available and their terms and conditions. They can also negotiate lower interest rates on your behalf.

Mortgage companies are regulated through the federal government if they are federally chartered or through provincial authorities if they are provincially operated. They are required to comply with anti-money laundering laws and report suspicious activity. The regulators also periodically examine their financial stability and may order them to take corrective action or even place the company in receivership if necessary.

Customer service

A mortgage is a large, complex financial transaction that requires extensive customer service. Mortgage companies should offer timely, accurate billing and mechanisms to resolve any issues that arise. They should also provide clear explanations of mortgage payments and other charges on customers’ statements.

Providing excellent customer service is important for the mortgage industry because it creates trust and loyalty with borrowers and helps lenders maintain compliance with regulations. Customer service also helps lenders generate more revenue and provides better outcomes for everyone involved.

Customers prioritize four specific dimensions of the mortgage experience: reassurance, transparency, simplicity, and speed (see Exhibit 2). Mortgage originators can improve customer satisfaction by prioritizing reassurance by having helpful employees who can confidently answer questions, offering 24x7 status updates, pre-approval within 24 hours, and a single point of contact. They can also improve transparency by reducing the number of documents required and by displaying all pricing information upfront. Lastly, they can simplify the process by making it easy for borrowers to complete documentation and credit assessment forms.

0 notes

Text

Fusionlots – Lawyers examine brokers

Beware of the fraudulent online trading platform Fusionlots

In today's digital world, it is easier than ever to make investments directly from home. However, as online trading platforms become more popular, so too does the number of fraud cases. One particularly worrying case is the Fusionlots platform (https://platform.fusionlots-tech.com). Our law firm, Ritschel & Keller, which specializes in investment fraud, strongly warns against this platform and offers those affected professional support in reclaiming their invested funds.

How to recognize a fraudulent online trading platform?

Fraudulent online trading platforms can be difficult to distinguish from legitimate providers at first glance. However, here are some characteristics that can help you identify dubious platforms:

Lack of regulation: Reputable brokers are usually regulated by financial regulators such as BaFin in Germany or the FCA in the UK. Check whether a platform provides a valid license number.

Excessively high profit promises: Unrealistic returns that are far above the market average are often a sign of fraud.

Intransparent fee structures: Unclear information about costs and fees is often found among fraudulent providers.

Aggressive marketing: Beware of platforms that engage in overly aggressive marketing and put pressure on investors to invest quickly.

Lack of contact information: Reputable companies offer clear and multiple contact options. Fraudulent platforms, on the other hand, often conceal their true identity and contact details.

Characteristics of reputable online brokers

In contrast to fraudulent platforms, reputable online brokers have certain quality features:

Transparent information: All relevant information is easily accessible, including full contact details and company registration details.

Regulation and licensing: A reputable broker is regulated by recognized authorities and adheres to strict financial standards and customer protection policies.

Fair fee structures: The fees are clearly defined and correspond to industry standards.

Customer support: Reliable and easily accessible customer service is available to answer any questions.

Educational resources: Providing learning materials and resources to promote responsible behavior.

Typical warning signs of investment fraud

Be aware of the following warning signs that often appear in fraudulent investment offers:

Promises of quick profits: Fraudsters often lure with the prospect of quick money.

Pressure: Fraudsters pressure potential investors to act quickly.

Confidentiality: Information about the company or investment is difficult to find or is not disclosed.

How you can protect yourself

To protect yourself from investment fraud, we recommend the following steps:

Research: Find out more about the platform and read reviews.

Check the license: Make sure the platform has a valid license from a recognized regulatory body.

Be careful when transferring money: Be careful when transferring large amounts of money and only invest what you can afford to lose.

1 note

·

View note

Text

Fusionlots – Lawyers examine brokers

Beware of the fraudulent online trading platform Fusionlots

In today's digital world, it is easier than ever to make investments directly from home. However, as online trading platforms become more popular, so too does the number of fraud cases. One particularly worrying case is the Fusionlots platform (https://platform.fusionlots-tech.com). Our law firm, Ritschel & Keller, which specializes in investment fraud, strongly warns against this platform and offers those affected professional support in reclaiming their invested funds.

How to recognize a fraudulent online trading platform?

Fraudulent online trading platforms can be difficult to distinguish from legitimate providers at first glance. However, here are some characteristics that can help you identify dubious platforms:

Lack of regulation: Reputable brokers are usually regulated by financial regulators such as BaFin in Germany or the FCA in the UK. Check whether a platform provides a valid license number.

Excessively high profit promises: Unrealistic returns that are far above the market average are often a sign of fraud.

Intransparent fee structures: Unclear information about costs and fees is often found among fraudulent providers.

Aggressive marketing: Beware of platforms that engage in overly aggressive marketing and put pressure on investors to invest quickly.

Lack of contact information: Reputable companies offer clear and multiple contact options. Fraudulent platforms, on the other hand, often conceal their true identity and contact details.

Characteristics of reputable online brokers

In contrast to fraudulent platforms, reputable online brokers have certain quality features:

Transparent information: All relevant information is easily accessible, including full contact details and company registration details.

Regulation and licensing: A reputable broker is regulated by recognized authorities and adheres to strict financial standards and customer protection policies.

Fair fee structures: The fees are clearly defined and correspond to industry standards.

Customer support: Reliable and easily accessible customer service is available to answer any questions.

Educational resources: Providing learning materials and resources to promote responsible behavior.

Typical warning signs of investment fraud

Be aware of the following warning signs that often appear in fraudulent investment offers:

Promises of quick profits: Fraudsters often lure with the prospect of quick money.

Pressure: Fraudsters pressure potential investors to act quickly.

Confidentiality: Information about the company or investment is difficult to find or is not disclosed.

How you can protect yourself

To protect yourself from investment fraud, we recommend the following steps:

Research: Find out more about the platform and read reviews.

Check the license: Make sure the platform has a valid license from a recognized regulatory body.

Be careful when transferring money: Be careful when transferring large amounts of money and only invest what you can afford to lose.

1 note

·

View note

Text

How To Pick The Best Health Insurance In 2024?

Choosing the Pennsylvania health insurance plans in 2024 requires careful consideration of several factors to ensure you select a plan that meets your health needs and financial situation. Here’s a guide to help you navigate the process effectively:

Understand Your Health Needs

Start by evaluating your health care needs. Consider the following:

Frequency of Doctor Visits: If you visit doctors frequently, look for plans with lower copayments and out-of-pocket maximums.

Medications: Ensure the plan covers your prescriptions. Check the formulary (list of covered drugs) to see if your medications are included.

Specialist Care: If you need regular visits to specialists, look for plans that offer good specialist coverage without requiring referrals.

Chronic Conditions: If you have a chronic condition, make sure the plan provides adequate coverage for ongoing treatments and therapies.

Compare Plan Types

Understand the different types of health insurance plans available:

Health Maintenance Organization (HMO): Requires you to use a network of doctors and get referrals for specialists. Generally has lower premiums.

Preferred Provider Organization (PPO): Offers more flexibility in choosing doctors and specialists without referrals. Typically higher premiums but greater choice.

Exclusive Provider Organization (EPO): Similar to HMOs but without the need for referrals, though you must stay within the network.

Point of Service (POS): Combines features of HMOs and PPOs, allowing out-of-network care at a higher cost and requiring referrals.

Consider the Costs

When evaluating costs, look beyond the premiums:

Premiums: The monthly cost you pay for the insurance.

Deductibles: The amount you pay out-of-pocket before the insurance starts covering costs.

Copayments and Coinsurance: The share of costs you pay for services after reaching your deductible.

Out-of-Pocket Maximum: The maximum amount you will pay in a year, after which the insurance covers all costs.

Check the Network

Ensure the plan includes a robust network of hospitals, doctors, and specialists:

Provider Availability: Verify that your preferred doctors and hospitals are in-network.

Access to Specialists: Check if the plan covers the specialists you may need to see.

Network Coverage Area: If you travel frequently, consider a plan with a broad network that offers coverage in different regions.

Review Benefits and Coverage

Examine the benefits and coverage options:

Preventive Services: Look for plans that cover preventive services such as vaccinations, screenings, and wellness visits without additional costs.

Emergency Care: Ensure the plan covers emergency room visits and urgent care.

Maternity and Newborn Care: If you plan on starting or expanding your family, check for comprehensive maternity and newborn coverage.

Mental Health Services: Ensure the plan covers mental health and substance abuse services.

Utilize Online Tools and Resources

Many insurance providers and third-party websites offer tools to compare plans:

Comparison Tools: Use online comparison tools to evaluate different plans side by side based on costs, coverage, and network.

Customer Reviews: Read reviews and ratings from current plan members to gauge satisfaction and service quality.

Consult with Experts

Consider seeking advice from insurance brokers or agents:

Licensed Brokers: They can help you navigate the options and find a plan that suits your needs.

Employer Resources: If you’re employed, your HR department may provide valuable information about available plans.

Conclusion

Selecting the best health insurance in 2024 requires a thorough evaluation of your health needs, understanding different plan types, considering all associated costs, checking the provider network, reviewing benefits and coverage, utilizing comparison tools, and consulting with experts. By taking these steps, you can choose a health insurance plan that provides the best value and coverage for you and your family.

0 notes

Text

Fusionlots – Lawyers examine brokers

Beware of the fraudulent online trading platform Fusionlots

In today's digital world, it is easier than ever to make investments directly from home. However, as online trading platforms become more popular, so too does the number of fraud cases. One particularly worrying case is the Fusionlots platform (https://platform.fusionlots-tech.com). Our law firm, which specializes in investment fraud, strongly warns against this platform and offers those affected professional support in reclaiming their invested funds.

How to recognize a fraudulent online trading platform?

Fraudulent online trading platforms can be difficult to distinguish from legitimate providers at first glance. However, here are some characteristics that can help you identify dubious platforms:

Lack of regulation: Reputable brokers are usually regulated by financial regulators such as BaFin in Germany or the FCA in the UK. Check whether a platform provides a valid license number.

Excessively high profit promises: Unrealistic returns that are far above the market average are often a sign of fraud.

Intransparent fee structures: Unclear information about costs and fees is often found among fraudulent providers.

Aggressive marketing: Beware of platforms that engage in overly aggressive marketing and put pressure on investors to invest quickly.

Lack of contact information: Reputable companies offer clear and multiple contact options. Fraudulent platforms, on the other hand, often conceal their true identity and contact details.

Characteristics of reputable online brokers

In contrast to fraudulent platforms, reputable online brokers have certain quality features:

Transparent information: All relevant information is easily accessible, including full contact details and company registration details.

Regulation and licensing: A reputable broker is regulated by recognized authorities and adheres to strict financial standards and customer protection policies.

Fair fee structures: The fees are clearly defined and correspond to industry standards.

Customer support: Reliable and easily accessible customer service is available to answer any questions.

Educational resources: Providing learning materials and resources to promote responsible behavior.

Typical warning signs of investment fraud

Be aware of the following warning signs that often appear in fraudulent investment offers:

Promises of quick profits: Fraudsters often lure with the prospect of quick money.

Pressure: Fraudsters pressure potential investors to act quickly.

Confidentiality: Information about the company or investment is difficult to find or is not disclosed.

How you can protect yourself

To protect yourself from investment fraud, we recommend the following steps:

Research: Find out more about the platform and read reviews.

Check the license: Make sure the platform has a valid license from a recognized regulatory body.

Be careful when transferring money: Be careful when transferring large amounts of money and only invest what you can afford to lose.

1 note

·

View note

Text

Navigating Customs Regulations with the Help of Customs Brokerage Services

Navigating the complex world of customs regulations may be challenging for small businesses that are involved in international trade. There might be penalties, increased costs, and delays if the many rules, documentation requirements, and compliance standards are not handled correctly. Expert customs brokerage services are useful in guaranteeing seamless and effective import and export operations.

A Full Rundown of Services Provided by Customs Brokerage

Customs examination of things might be facilitated by professionals who specialize in customs brokerage services. These professionals are invaluable friends for small businesses because of their deep awareness of the laws and regulations regulating foreign trade. Using a customs brokerage service to ensure that shipments comply with all relevant regulations may help small businesses reduce their risk of delays and fines.

Why are Customs Brokerage Services Beneficial?

Customs brokerage services provide many benefits, chief among them the ability to handle the massive volumes of paperwork required for customs clearance. Assuring that all laws and regulations are followed, calculating taxes and tariffs, and preparing and submitting import and export documentation are all included in this. Small business owners may focus on their primary business operations and leave the complex customs clearance procedure to experts with this comprehensive help.

Another notable advantage is the efficient and timely management of shipments. Knowing the most current modifications to the laws, knowledgeable customs brokers may expedite the clearance process by foreseeing issues and resolving them before they arise. This proactive approach enhances customer satisfaction and builds brand recognition by avoiding delays and ensuring timely delivery of goods.

Addressing Compliance-Related Concerns

The constantly evolving customs rules may be challenging for small businesses to stay on top of. Customs brokerage services offer the requisite expertise to navigate complex regulatory landscapes. In addition to assisting in obtaining the necessary licenses and permits, they ensure trade agreements and restrictions while maintaining compliance.

An article titled "10 Shipping Tips for Small Businesses" emphasizes the need for compliance in international shipment. When it comes to ensuring that all legal and regulatory requirements are met, customs brokerage services are used in accordance with these recommendations. Your shipping operations will go more smoothly, and you can prevent costly mistakes.

Closing Remarks

Small businesses engaged in international trade may find it challenging and time-consuming to navigate customs rules. By using expert customs brokerage services, which additionally manage important paperwork, provide informed guidance, and ensure compliance with ever-changing laws, one may get a strategic advantage. Working with an established customs brokerage service allows small businesses to reduce risks, accelerate import and export processes, and focus on growth and expansion in the global market.

#logistics company philippines#Cargo#logistics freight in the philippines#licensed customs broker#logistics freight philippines

0 notes

Text

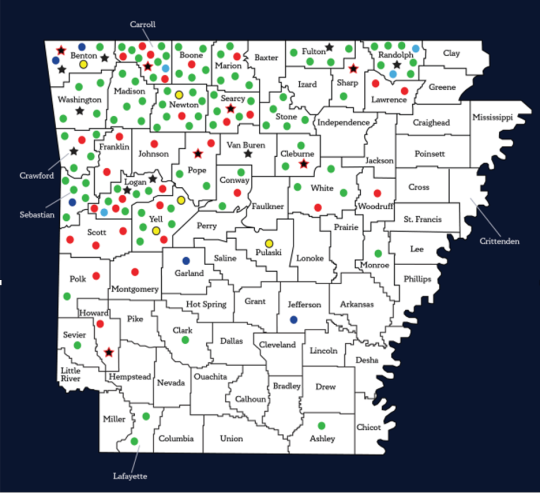

Arkansas Puppy Store Sourcing, What to know and What to do.

Post: December 09, 2022

By Juliette Eastwood

Arkansas Puppy Store Sourcing

——————————————————————————————-

“We don’t buy from puppy mills.”

“All of our puppies come from small, local breeders.”

“We visit every breeder we buy from.”

We have all heard these sentences come from the mouths of pet store owners and their employees. They paint this beautiful picture of puppies running by a pond and parents frolicking in the fresh, green grass… Sadly, 99% of the time that is false. The pet store owners know it, the employees might know it- but the customer is completely in the dark.

This is why we are here.

BailingOutBenji a small nonprofit that started in Iowa and now has volunteer teams all over the country who are dedicated to raising awareness about the puppy mill industry.

Volunteers from Bailing Out Benji devote their free time to researching puppy mills to create puppy mill maps for the worst states, as well as raise awareness about notorious pet stores and breeding operations with huge violations. This includes obtaining CVI data (Certificates of Veterinary Inspections) and making those reports public. To learn more about the puppy mills in your location, you can also go to the interactive website and search engine.

NOTE:

-Before an animal is transported out of state, a veterinarian, accredited by the United States Department of Agriculture (USDA), must examine the animal for signs of “infectious, contagious or communicable disease” and, if no disease is found, sign the certificate for approval to transport.

This information was obtained by the Arkansas Department of Agriculture. We are currently waiting on additional FOIA requests to help make our research more complete.

All of the breeders listed as associated with the pet stores sold puppies or kittens to them in the years 2020 through 2022.

————————————————

These records requests cost money to obtain. If you would like to support our research, you can make a one time donation or to sign up to be a sustaining supporter to allow us to continue our various programs that expose the puppy mill industry, click the donate button below.

————————————————

Middle Earth Pet Shop- 2301 S 56th St #114, Fort Smith, Arkansas 72903

Gwyn Priddy, Priddy Schiebert Kennel. Cameron, Oklahoma- is not currently USDA licensed but was in the past.

————————————————

Petland Rogers- 2203 S Promenade Blvd #5165, Rogers, AR 72758

Abby Anderson, Ken Anderson, Ty Anderson and Sydney Anderson. Arrow Valley LLC FKA Sugar Fork Kennels. Goodman, Missouri- 157 adult breeding dogs and 163 puppies. Under their old license number and previous name, Arrow Valley/ Sugar Fork had a direct violation due to an inspector finding an extremely thin adult breeding dog with very prominent hips and spine, as well as white gums. The dog had not been seen by a veterinarian. In order to hide this violation, they changed license numbers and names.

Ashley Dodson. Pierce City, Missouri- does not appear to be licensed by the USDA or state of Missouri.

Bill Harvill, Bill Harvill Kennel. Stark City, Missouri- 39 adult breeding dogs.

Darin Miller, David Miller and Kay Miller, Miller Kennel. Oronogo, Missouri- 268 adult breeding dogs and 131 puppies. This facility was named one of the worst puppy mills in the country in 2021.

Lindsey Schwartz AKA Lindsey Forquer, Cammies Country Canines. Salem, Iowa- 71 adult breeding dogs and 50 puppies.

Mark Steffensmeier and Gina Steffensmeier, MG Cattle Inc. Salem, Iowa- Puppy Broker in Iowa.

Pinnacle Pet AKA Sobrad LLC. Neosho, Missouri- one of the largest puppy brokers in the country. Pinnacle Pet is their main supplier.

Jon Settle, Manchesters LLC. Joplin, Missouri- 23 adult breeding dogs and 12 puppies.

——————————————————————————————-

Puppy Dreams- 10101 Mabelvale Plaza Dr STE 5, Little Rock, AR 72209

Becky Busboom, Pixy Pals LLC- Dannebrog, Nebraska- Busboom is a dog broker, who sources puppies from various facilities and resells them to pet stores. To view which facilities Busboom buys from call us.

Heath Francke and Serenity Francke, Sand Creek Kennels and Sporting Dogs. Newport, Nebraska- 66 adult breeding dogs and 41 puppies. This facility was named one of the worst puppy mills in the country in 2016 after receiving an official warning from the state of Nebraska due to animal care.

For more ways you can help the dogs trapped in puppy mills, call us.

We also have educational materials that you can print to hang up in your own area.

All research and information was done by the volunteer team and must be cited as such when shared or quoted. Arkansas is home to numerous pet stores that are selling puppy mill puppies, not just the ones above. If you are wondering where your puppy was born, please contact us. All requests for information will remain confidential.

1 note

·

View note

Text

Partners Special Capital Limited: Your Reliable Partner in the Forex Market

Forex Partners Special Capital Limited is a broker that has earned the recognition of numerous traders worldwide due to its high level of services in the Forex market. The company demonstrates exceptional results by supporting clients at every stage of their trading journey. In this review, we will examine all aspects of broker Partners Special Capital Limited to understand why this broker is one of the best in its class.

Reliability and Regulation