#dot net developer sydney

Explore tagged Tumblr posts

Text

Dot Net Developer (Azure)

Digital Biz Solutions Pty Ltd Australia Permanent Full-time Location: Australia – Sydney, Melbourne, Adelaide, Brisbane, Canberra, Perth Description Digital Biz Solutions Pty Ltd are looking for Dot Net Developer (Azure) to work on some major client projects in Australia. The position will be full time. Job Description: We are seeking a .NET developer with Azure having 1-3 years of…

0 notes

Text

Dot Net Developer (Azure)

Digital Biz Solutions Pty Ltd Australia Permanent Full-time Location: Australia – Sydney, Melbourne, Adelaide, Brisbane, Canberra, Perth Description Digital Biz Solutions Pty Ltd are looking for Dot Net Developer (Azure) to work on some major client projects in Australia. The position will be full time. Job Description: We are seeking a .NET developer with Azure having 1-3 years of…

0 notes

Text

What's New in .NET 6: A Comprehensive Guide to the Latest Features and Improvements

Dot net 6 is here with some interesting and modern features that ensures smoother and easier web application development for dot net developers. Here’s the comprehensive guide to the latest features and improvements in dot net 6 that you need to know.

.NET 6 is the latest release of the popular open-source development platform from Microsoft. It comes with a number of new features and improvements that make it easier and more efficient for dot net developers to build modern applications. In this comprehensive guide, we will take a closer look at what's new in .NET 6.

Single file apps

One of the most exciting new features in .NET 6 is the ability to create single file applications. This allows developers to package their applications into a single executable file, making it easier to distribute and run the application on different platforms.

.NET MAUI

.NET MAUI (Multi-platform App UI) is a new cross-platform UI framework that allows developers to create native mobile, desktop, and web applications using a single codebase. It is an evolution of Xamarin.Forms, which allows developers to create mobile applications using a shared codebase. .NET MAUI builds on top of Xamarin.Forms and extends it to support a wider range of platforms. This means that developers can create a single codebase that targets iOS, Android, Windows, macOS, and the web, reducing development time and costs. .NET MAUI also comes with a range of new features and improvements, including better performance, improved debugging tools, and support for new UI controls. Overall, .NET MAUI is an exciting new feature in .NET 6 that is sure to make cross-platform development easier and more efficient.

Blazor improvements

Blazor is a popular web framework that allows developers to build interactive web applications using C# and Razor syntax. In .NET 6, Blazor has received significant improvements, making it an even more powerful tool for web development. One of the major improvements in Blazor is improved performance, achieved through a new component model and better handling of JavaScript interop. This results in faster initial load times, faster updates, and a smoother user experience overall. Additionally, Blazor now has better debugging tools, including support for browser-based debugging, which makes it easier for developers to find and fix issues. Finally, .NET 6 also includes support for Blazor WebAssembly, which allows developers to run Blazor applications in the browser without requiring a server. These improvements to Blazor in .NET 6 make it a more powerful and efficient tool for building modern web applications.

Improved performance

Performance improvements are a major focus of .NET 6, with significant improvements made to the runtime, just-in-time (JIT) compiler, and garbage collection. This has resulted in faster application startup times and improved runtime performance, making .NET 6 a more efficient platform for developers. The JIT compiler has been improved to provide better performance by reducing memory overhead, improving code quality, and increasing the number of supported CPU architectures. Additionally, garbage collection has been optimized to reduce memory usage and improve scalability. Finally, .NET 6 also includes a new HTTP/3 implementation that is designed to provide better performance and security over the internet. Overall, the performance improvements in .NET 6 make it a more efficient platform for developers and help to ensure that applications built on the platform are fast and responsive.

Better developer experience

.NET 6 comes with a number of improvements that make it easier and more efficient for developers to write code. These improvements include better IDE support, improved IntelliSense, and better debugging tools.

ASP.NET Core improvements

ASP.NET Core is a popular web framework that allows developers to build modern web applications. In .NET 6, ASP.NET Core has been improved with new features like support for HTTP/3, improved performance, and support for Blazor WebAssembly.

Support for ARM processors

One of the key features of .NET 6 is its improved support for ARM processors. This means that developers can now build and deploy .NET applications on a wider range of devices, including ARM-based devices such as the Raspberry Pi and other IoT devices. This is particularly important for developers who are building applications for the Internet of Things (IoT) or other embedded systems, as these devices often run on ARM processors. Additionally, .NET 6 also includes support for the new ARM64 architecture, which provides even better performance and compatibility with ARM-based devices. Overall, the improved support for ARM processors in .NET 6 makes it easier for developers to build and deploy applications on a wider range of devices, opening up new possibilities for IoT and embedded systems development.

C# 10

C# 10 is the latest version of the C# programming language. It includes new features like global using directives, interpolated strings as format strings, and file-scoped namespaces.

NET Hot Reload

.NET Hot Reload is a new feature that allows developers to make changes to their code while the application is running, without needing to restart the application. This makes the development process faster and more efficient.

Open-source

Finally, it's worth noting that .NET 6 is completely open-source. This means that developers have access to the source code and can contribute to the development of the platform.

In conclusion, .NET 6 is a major release of the popular development platform from Microsoft. It comes with a number of new features and improvements that make it easier and more efficient for developers to build modern applications. Whether you are a seasoned .NET developer or just starting out, there are plenty of reasons to be excited about .NET 6.

Rob Stephen is a certified and experienced dot net developer associated with one of the best dot net development companies in Australia, GetAProgrammer. The author has shared the complete guide of the latest features and improvements in dot net 6 in this article.

#dot net developer#hire dot net developer#dot net developer sydney#dot net development#dot net development company

0 notes

Text

Reading Junker lore as an Australian is like, hilarious because it's a wild ride of being so clearly not knowing what the frick it was saying THAT MADE IT CYCLE ALL THE WAY BACK INTO MAKING SENSE AGAIN. But also, that literally, whether it's Overwatch or Other Global Forces, is to blame for the Junkers being what they are, because wow.

But to start with, the problem is essentially this: Blizzard just don't know what the frick the Outback is.

SO BUCKLE UP KIDS THIS IS A LONG-ASS POST, I GOT SOME SHIT YOU NEED TO UNDERSTAND ABOUT HOW THE JUNKERS CAME ABOUT. But there are pictures I promise. I also wanna say that I am not here to say that the Omnic war, the discussions of human-omnic relationships is like X real-world thing, I'm here to look at how the world is and how they've said it develops in Overwatch, and what that implies for the world development, that's all. I was just real excited at how averagely aussie Leah is in her portrayal of Junker Queen is and it made me want to ground it more in my home okok and I thought other people might want to understand that too.

CW: for talking about war tactics, statistics and wide-scale loss of life.

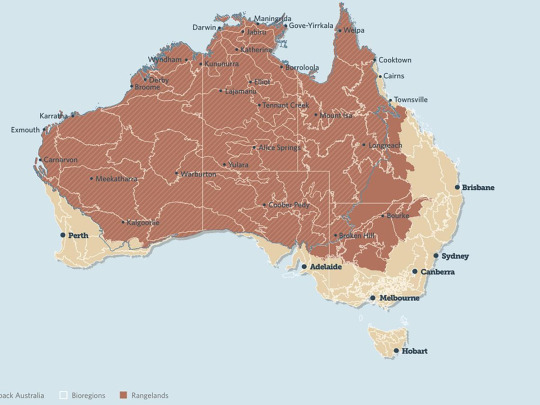

TL;DR for my post on Aussie Shit: the Outback is not a defined location. You will never be able to stick it into a GPS and find it. It is a conceptual area that can be defined as 'semi-rural to rural'. But also it's an almost folklorish concept of the Australian 'heart' that can extend over what can be seen in the below map. I will advise this is actually a map of bushland types, which is why it doesn't include Tasmania, but just to be clear, Tasmania AS WELL has Outback regions, and also, this can extend further East fairly comfortably depending on who you talk to. For instance, this map doesn't reach Tamworth OR Dubbo, buuuuuut most people would consider it as being on the edge of the Outback, for instance.

Oh, you might now be saying, that's most of the country, isn't it?

YEAH.

And as you'd expect for a piece of land THE SIZE OF FUCKING EUROPE, it's hugely broad in its landscape, too. You will find everything in the concept of the "Outback" depending, again, on who you talk to. From the Daintree Rainforest (left pic) (around Cairns to Cooktown) to the Great Australian Bite (middle pic) (the bottom C curve between Adelaide to Perth) to the central Australian town with a population of 26,000+ people, Alice Springs (right pic).

Yet the wiki lists it as "The Outback omnium and its Omnics were given the Australian omnium and its surrounding land after the Omnic Crisis."

UHM. BLIZZARD. 1) WHERE IS IT, AGAIN??? MEEKATHARRA IS A PRETTY DIFFERENT PLACE TO THE MOUNT ISA and 2) THAT'S A LOT OF "SURROUNDING LAND". THAT'S IN FACT, MOST OF THE COUNTRY, IF I WAS TO COUNT IT AS BROADLY AS YOU SEEM TO BE THROWING IT AROUND? IT'S A LOT OF LAND.

It takes 4 days of STRAIGHT DRIVING, NO BREAKS, to cross from Sydney to Perth. The entirety of Europe fits inside of Australia, the main block of the united states, bar Alaska, is basically comparable in scale from Washington to San Fransico. Or the furthest East Coast of Brazil to the West Coast of Peru. YOU GET IT.

This then leads to the second problem, Blizzard keeps saying that the only people out there were "a few solar farmers and people who wanted to be left alone".

WITH A POPULATION TOTAL OF 600,000 - 700,000 THOUSAND PEOPLE IN JUST REGIONAL TOWNS, NO, THE OUTBACK REGIONAL DISTRIBUTION IS NOT "JUST A FEW PEOPLE WHO WANT TO BE ALONE AND A COUPLE OF FARMERS IG".

NOT TO MENTION DARWIN. It's the little dot at the top of the Northern Territory and is a Capital City of the region. Sometimes called Australia's "Outback City", HAS A POPULATION OF 130,000 ALONE. Across it all, this map barely scratches the surface, there are over 60 Outback Towns or Settlements in total. We only have a total net population of 27 million. THAT'S ACTUALLY A WHOLE ASS 2-3% OF OUR WHOLE POPULATION.

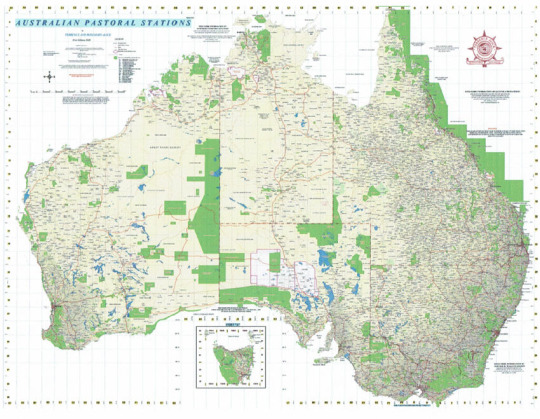

This comes to the second point and often the hardest for people to get their heads around: whilst our population is not as high, THAT DOESN'T MEAN WE AREN'T USING THAT LAND AND IT'S NOT CULTURALLY AND ECONOMICALLY IMPORTANT TO US. No, we don't have massive inland lakes and rivers the way other places do, to have huge cities out there, but WE STILL HAVE TO SUPPORT OUR AGRICULTURAL AND MINING SECTOR THAT DOES USE THAT LAND. AND IT'S ACTUALLY. VERY. EXTENSIVE.

How extensive? Man, our largest by-land Cattle Station is Anna Creek Station, coming in at a cool 2 million acres (which is as big as the whole of Israel apparently???), or the most densely populated-by-cow one currently, Brunette Downs, which at present has 110,000 head of cattle. Don't care about cows? are you a monster cows are just slow puppos who want love omfrg WELL I BET YOU CARE ABOUT IRON, AND GUESS WHAT, WHATEVER IRON YOU HAVE IN YOUR HOUSE RN PROBABLY CAME FROM AUSTRALIA, GIVEN WE PROVIDE 90% OF THE WORLD'S IRON. Oh, also we have a shitton of uranium as well, btw. just. putting that out there.

Here is JUST PASTORAL STATIONS, you'll notice HOW MANY ARE ACTUALLY IN THE SAME AREA I JUST SHOWED:

AND HERE ARE OUR MINES, this is not just iron, we also dig many other minerals, and including the world's largest opal mine:

These cattle stations and mines stretch across the inland regions for miles upon miles, fuelling our jobs and our place in the world economy. Which I ask you this: If you're Cattle Hand Tinny Rogers from central Queensland who's gotta take care of Jenny the Cow whose due to give birth soon, you aren't driving 13 fucking hours to Brisbane City to get a pack of smokes, are you? No. Tinny Rogers just goes to the Longreach general store only 1-2 hours away, doesn't he? Then goes back to his property and tells Jenny it's going to be ok, sits his ass down with his smokes for the night, relieved he only had to go a little while.

And all those people were actually the first wiped out.

This is where this gets real freaking awful. AGAIN, CW: for talking about war tactics, statistics and wide-scale loss of life.

Now the only battle in Australia we are shown, is Sydney and that initially also made me go 'huh?' Because if the Omnic Core is in the Outback, wherever that might be, this is an overland invasion, internal to external, as opposed to an external invasion aka coming from the sea, why would you attack Sydney?

Don't get me wrong, Sydney is important. To our international position most especially. It's a financial centre, like New York is to America, it controls a great deal of our actual "economy" in the like, perception of 'if it falls, our economy tanks' kinda sense. It's also a manufacturing centre, meaning that raw goods from the rest of the country are turned into other goods there, and then shipping it out, Tactically, if you are trying to park ships, Darling Habour is ideal, as it's one of two 'natural' harbours in the world (the other being in Hong Kong), meaning its VERY DEEP even close to the land which makes it ideal for ships to come close. So someone attacking from the sea wants it. Lastly - probs why Blizzard picked it, is it is the identifiably 'Australian City'.

But it's not our capital city, that's Canberra, which is where our House of Parliament is. It's not where our military is, no, 40% of the Australian Army is based in Brisbane, and the largest naval base is in Perth. Darwin and Cairns are actually the biggest ports that are more directly connected to Asia in trade given it's a hop, skip and a jump from there to Papa New Guinea, which are actually our closest neighbour and with it, connects us to the whole of South East Asia. The very tip of QLD, to the bottom of PNG is more like the space of the English Channel, btw, for how close they are.

In the Omnic Crisis, the economy has ALREADY collapsed. It did the minute the Omnics attack, basically lmao. Then secondly, this ISN'T EXTERNAL, this is internal. Whether the Outback Omnium is in Kalgoorlie or Birdsville, it is in the middle of the country, and it is sending its forces from a regional location. They aren't attacking by sea, so they don't have to care about a landing bay.

AND HERE IS THE LAST IMPORTANT PART, OUR ARMY IS SMALL. It's only like 80,000 armed personnel, compared to the US and it's insanity of 1mill+, but we're bigger than uh,,, New Zealand I guess? Uh,,, yeah our numbers don't even rank in the big three armies of the world, or like, beyond our little bubble of Oceania. We also do have a pretty good navy but if you've been following along so far, uh, yeah, THAT'S going to do fuck all for Alice Springs, isn't it? Don't get me wrong, our forces are all well trained and highly specialised because of it but like, we don't have the numbers to be splitting up over many fronts, lmao.

By virtue of it all, they are in the middle of the country and will have STEAM ROLLED across these regional areas because some are big, sure but they are just towns with no defences against a rampaging robot army, are you kidding? Let alone if Anubis is suddenly using every robot, I can't imagine how many different kinds are incorporated in all the different mining regions and digging sights?! Some of them were clearly as big as the Titan Bots we see, judging by this shit still being left around years later -

Rolling into somewhere like poor fucking Meekatharra?!

also, seriously: what is the ever loving fuck is that thing on the left why are its arms made out of the BODIES OF OTHER OMNICS JFC WHO LET THE OMNICS PLAY BLOODBORNE OR SOMETHING, I S2G.

THESE POOR BASTARDS ALREADY HAVE TO LIVE IN MEEKATHARRA, THAT'S HARD ENOUGH, LET ALONE WHEN SKYSCRAPER-BOT THE MIGHTY ROLLED IN FROM THE DESERT.

This means that they now control all regional supplies anyway to go and target those places because they say one consistent thing about Anubis' attacks: they were efficient and direct.

"The Omnics Advance" is what they call this so from the wiki as to the state of places the Omnics leave behind, uh, yeah, BYE MEEKATHARRA, MY MUM'S STORIES ABOUT YOU WERE NICE IG?

o ok,,,,, sure, what does all this have to do with Sydney then? Where does it fit in?

I don't want you to think Sydney wouldn't be attacked. Of course it would be, eventually.

Because it's the last populated place in Australia. They can just leave Sydney because it is somewhat tactically the hardest to attack, overall, if it has support from the others, so you leave it till last where you've cut off the support, wiped out supply lines and it is now flooded with refugees from the rest of the country.

They call it the Battle of Sydney but that's not actually what you do to cities?? You siege them, because they take time, and they're certainly implying that yes, it would have taken time. Yeah no, I am not making that up, the Battle of Stalingrad for instance took five months. I make the distinction because sieges aren't about individual aspects in conflict, it's a game of chicken between the two sides of who can hold out longest. Who can sustain the constant chipping away? Sometimes it's a matter of just starving each other out, but in others, it's a constant bombardment.

With everything I just laid out, you can probably have worked it out: Australia can't sustain itself, at this point. We are cut off from our supplies, and we are unable to get actual international support because they're all, ALSO, dealing with this, and now are flooded with escaping refugees. Perth, Adelaide, Darwin, and Brisbane are gone. Which Australia's population of 27 million, is now down to, if I'm being kind, to 10-11 million (5 million in Sydney + then escapees from Melbourne, Canberra, and maybe some from Tasmania too if they could manage it, I can't say I would have much hope for those poor buggers in Perth). Sydney could not feed all the refugees because again, it does not produce raw supplies itself, and it now no longer has the numbers to keep up the fight.

It'd be incredible if they could keep it going for a month because by then, we're not facing 'this is war and people will die', Australia is now at 'we will be annihilated and there will BE no Australian people'. 60-70% of our population is dead to the war, and the rest are getting killed every day from THE TITANS LITERALLY JUST STOMPING THEIR WAY THROUGH, starving or getting sick from bad food and water.

And Australia never had a very big population, to begin with, our army isn't big if it even really exists anymore. We cannot sustain those losses. What the Omnics were hanging over Sydney at this moment is so much worse than just 'we screwed your economy for the foreseeable future'.

They are leveraging 'there will be no Australians left.' Whether the slow eradication from disease and hunger that a siege does, or in immediate and sudden violence?

So I have no doubt, even though Blizzard had no idea what they said, that it's actually entirely possible the Omnics said "idk we want the outback" and the Australian Government went YEAH, SURE, ANYTHING NOT TO GET OBLITERATED, IG?

And what's more, afterwards, whatever chance there might have been to take some of those places back - no one, NO ONE, was going to do more than rebuild the Sydney-Canberra-Melbourne strip on the outside to allow for better distribution. But who knows Anubis might have been a dick and said YOU ONLY GET SYDNEY. For one thing, taking back even something like Adelaide requires re-engaging, and on the other.......... they have this, now, that's alright, isn't it? It's the most modern part of Australia, it certainly seems like plenty, right? Other COUNTRIES exist with LESS and THRIVE!

I can't say I necessarily blame them, at that point it has to be a pure numbers game: Mexico City, which has also been destroyed, and it has almost as many people in JUST Mexico City as we have in total population. Sydney must have seemed, well, close enough. We're rebuilding this bit which will roughly sustain you (it won't, actually), but then we gotta take the resources to other devastated places that don't need FOUR CAPITAL CITIES, 10 OTHER IMPORTANT CITIES, A MINIMUM OF 30 REGIONAL TOWNS AND A FULL RECONSTRUCTION OF A INLAND NETWORK SPANNING THE ENTIRETY OF THE UNITED STATES IN SHEER SCALE. Things as they were, at the time, it must have seemed.... well yeah. Not worth it.

Which now - hey that's pretty intense, actually that's horrific for the sheer loss of life, how can you be sure the devastation is that severe? And that in turn everyone just did what SEEMED enough with little to no consideration of its long term impact and if it had any sustainability to us? That's extreme to insinuate?

Well if not the direct implication of '30 million orphans worldwide' that means for every orphan, there are two dead parents, and then the two families next door that DIDN'T survive, to tell you the average statistics of the war casualties......

The other is simple: Junkertown exists.

Junkertown cannot exist, if there was anything left of those cities or those 60+ regional towns, pre or post-explosion of the core. Because here is the thing, if there was a chance, a single chance, we could take back that important space of the Outback, we would. In a heartbeat. I think that's why the Australian Government allowed the ALF to exist in the first place and did not stop them when they most definitely could have.

I can explain the economics of what being an island nation at the ass end of the world means as to how we are so completely fucked economically at this point, but this part is more important, even if it's often the hardest for non-Australians to wrap their heads around because they squeal about 'how scary' it is all the time is this:

We love that land. That land is our home. Yes, even with its spiders and snakes, not in spite of, but all of it, good and bad. In one sense that yes, that literally hundreds of thousands of people lived dispersed across it, but culturally it goes beyond just that direct 'my house is there'. One of our most successful ad campaigns by a freaking flight company exists on a simple premise: 'no matter how far, and how wide I go, I still call Australia home'. (The first version of it aired in the 90s, for reference, also yes, Junkrat actually has a line that echos the sentiments of this song 'I've been all around the world, but there's nowhere that compares to home' Not sure if it was on purpose but I smiled a little to myself when I first heard it). Yeah. That's it. Not fighting or glory or power. The rest of the world is beautiful, but this one is ours, and we love it for what it is. Something that is personified in that image of red sand dunes and scrub, in the arid flatness, the wattle and the gum, even to the kid that grew up in the middle of the Sydney suburbs, as his childhood home, that tugs in his heart as much as his childhood toys.

Even though I know a bunch of Aussies just read this and were like GROAN, SHUT UP, WHAT ARE YOU GOING TO DO, QUOTE BANJO PATTERSON, CAN'T CATCH ME WITH THAT SHIT,,,,

I fucking see you, I fucking know you. I only gotta say one fucking thing to you pretending you're above it:

RED DOG JUST WANTS TO KNOW, HAVE YOU SEEN JOHN? HE'S LOOKING YOU IN THE EYES, HAVE YOU SEEN JOHN?

Yeah, that's what I goddamn thought.

That we'd lose all reason to do some stupid shit like the ALF attempted to recover it? Uh, yeah. We just lost most of our population, we can't bury them, and how quickly would that landscape of our home carry that memory of them, and yet, we are cut from even that.

But to reclaim all that land you need supply chains, rebuilding as you go, AN ARMY ABLE TO HOLDING THAT SPACE AGAINST WHATEVER THE FUCK A "FERAL OMNIC" IS??? SERIOUSLY, AGAIN, DID THEY DOWNLOAD THE 'FROM SOFTWARE CREATIVE SUITE' ON THAT OMNIC??? And with that in mind, and how everyone and everything is gone for us, that would require HUGE international backing.

And if they had all of that, with all that effort, like HELL are they letting a SEPERATE SOVERIGN NATION JUST SPRING UP IN THE MIDDLE OF IT, BEING A BUNCH OF VIOLENT ASSHOLES, MAKING IT HARDER by STEALING SHIT ALL THE TIME on top of BLOCKING ACCESS TOO SOME OF OUR MOST RESOURCE RICH LAND. I know this might be a struggle, but on top of loving that space, we also enjoy idk, stability? Not dying? Junkertown would compromise that, completely. Especially the dying bit, I feel. Speaking as an Aussie, I, like many Australians, do appreciate that they will in fact die one day, and hopefully, doing so by driving a ride-on mower around hills hoist chasing a goon sack as god intended for this beautiful country, but overall, just randomly dying in a Wolf Creek-like situation because you were trying to build a fuckin road, isn't how most of wanted it to go down. Some might, I will not shame my fantasy countrymen in the post-apocalypse world of Overwatch-Australia, times seem tough for Tinny Rogers and Jenny out there, and they have a right to pick how they get by.

SO YEAH, THE FUCK NOT, MY GUYS. THEY'D SQUISH THAT SHIT LIKE A BUG.

But if they are recovering from near annihilation, unsupported, told to just deal with it because they got what they got - Junkertown can do what we see, and in its strange way: flourish.

Then it comes to how it's being handled by the rest of the in-game world as to how it's just been allowed to let slide by everyone fucking else even if clearly every time one of these desert-fuckers gets out, it's a DAMN NIGHTMARE FOR WORLDWIDE SECURITY.

You hear Zarya call it "the mistakes of this country", which given how people treat the Junkers as a whole in game, seems to be a commonly held sentiment. A mistake. There is little to no comprehension of them, or what they have been victim to. Again probably because Blizzard itself has no idea what it just accidentally implied. We don't have enough lore to really say how many countries share this fate of losing 80% of their entire nation and people, and with it, almost their whole selves? Of them, how many got complete reconstruction? Given their common theme of corporate greed, developments in post-war society and their subsequent inequality, I'd say some people get reconstruction support and others don't (the interactions of Lucio and Symmetra for instance) based on convenience, and the sentiment from many powers in history has often been 'Australia is very far away, and I don't care'.

To call it 'a mistake' then, redirects blame from those inequalities and the present-day situation having beyond anyone's possible conception.

If it's 'a mistake', it's not a self-destructive spiral of suffering people who have been pushed beyond even common sense anymore. That lash out in desperation over a loss that cannot be quantified to any sum, yet were told that a price had actually been put on it, and no one was interested in paying it, and they had to live with what they got now. Then with no other output for the misery, in some desperate bid to reclaim even a SHRED of a memory, just vent their pain for a damn second, damned themselves and their home. Everyone who was in power and authority to have stepped in at any time to give the support needed and direct it more meaningfully before this, but never did, everyone who made those choices, is now complicit in the rise of Junkertown and the Junkers due to their basic lack or inability to understand what had been lost and have empathy, has led to a situation where now there is an entirely separate type of threat in 'feral omnics' and a bunch of insane radioactive people.

Or just say it was 'a mistake'. Then it's just their fault, isn't it? It's just a small, negligible little choice that WE won't make. We can all pat ourselves on the back and say that at least because Australia is so far away, whatever is happening there, is now just isolated to them, and you can't expect help NOW that the desert is irradiated, it was ALREADY unfeasible, it's SO expensive, WHOSE going to fund that, for what gain, especially now you made this silly little 'choice'.

Acknowledging, even to stop the Junkers, means bringing their own failings to the spotlight when rightfully it comes back to 'why the fuck did these bastards exist in the first place? What made them so fucking stupidly, mindlessly, suicidally angry as to lash out like this? Why weren't they thinking, then, and why do they stay, even now? .... and why do all of them appear to be goddamn giants?'

So easier to just... let the Junkers do their thing, out in the desert. Make them the scapegoat for the tensions, a fixing point for even the Omnics (rightfully, obviously in their case) to hate, blame and fear, over more active, influential systems that have far more ability to affect the world. Especially when compared too: the bunch of crazy people in the fucking desert, who probably all die at 50 from that ambient radiation everywhere, getting new types of diseases that no one has ever HEARD of before and are apparently are like barely connected on networks to the rest of the world. WHAT KIND OF POWER TO AFFECT WORLD CHANGE DO YOU THINK THEY ACTUALLY HAVE?

Rather than acknowledge that people like Odessa Stone got their hatred probably from watching half her under 12 siblings die to omnics, and the other half to the situation in the Wasteland created by others' indifference. (And the reminder that, Odessa's mum in the first shot, is holding an infant, and the second moment of her flashback, Odessa is still roughly the same but all the kids left are too big for a 1 to 2-year-old, and Mama Stone isn't holding an infant anymore.) They do what often happens and put all the responsibility of moving on, ON the people who are literally in the middle of dying in a now 30-year war, that everyone ELSE keeps trying to desperately pretend it's over and stick their head in the sand. Thus just invalidating their pain and making them even MORE resistant. Especially when you contrast the rest of the world is getting influential people like Mondatta and Zen making changes, real strides forward, and they get......... lbr, just more graves while they're just being called crazy.

Akande says 'the world is designed to be this way', and I think part of the reason Odessa doesn't mind him, is that yeah, yeah she probably knows after she's seen other parts of the world now and its reconstruction efforts, compared to theirs, found them pretty wanting, and it's nice to hear someone else say it for once.

No WONDER Roadie says 'this isn't a city' about Junkertown, when he remembers when Australia had more than three cities total, it must seem like a mockery. But why people like Junker Queen and Junkrat have pride in it, inversely. They were children when the apocalypse came to Australia or were born in Junkertown itself, they live in the memory that must now only feel dead and impossible to recapture the life of. In many ways, their bookends to Ramattra, their first moments were taken into a life of roaring violence the world wants to pretend isn't happening, but this is all they ARE now. So they have done their best with it, even if no one wants to be reminded of what their sheer existence represents.

Yeah. 'Mistake' is much easier to swallow, isn't it?

So yeah, given ODESSA STONE IS OUT THERE IN THE WASTELAND BECOMING FUCKING GENGHIS KHAN OR SOMETHING, UNITING ALL THE WASTELAND FACTIONS, AND NO ONE IS NOTICING OR EVEN SLIGHTLY TAKING IT SERIOUSLY, whenever that blows up in their face and they cry HOW DID THIS GET SO BAD, WHAT HAPPENED, AUSTRALIA?!

Yeah. Ain't that the fucking question.

Or maybe all of this is complete nonsense and everything I just said will one day be shown to be entirely wrong as often happens because ultimately again, I don't think they MEANT MOST OF THIS LMAO, BECAUSE ONE MORE TIME: STOP SAYING 'OUTBACK'.

98 notes

·

View notes

Text

Creative Journal

Potential Idea -

Boat Museum keeping with nortical theme

Aboriginal History Museum that would allow the traditional owners to share and teach their knowledge

Each would have inclusive and hands on activity’s

Similar to GOMA and Museum - New Activities every season potentially which would be good for children and parents during the week looking for activities.

Response to the Site and Client Brief:

My overall idea would be for this to be a day activity for families to participate in within the day and weekends. This would mean the activities within the site are going to aim to appeal to all different ages.

Public Transport

- Future building of apartments will increase activity on the south side directly across from the river, however current ferry stop closest to these apartments is currently very unknown. Propaganda of sorts could be included at the ferry stations, such as signs or billboards so that people know of Northshore and the entertainment it could provide.

Time Date: 9th of March 2021

Apollo Road Ferry Terminal & Toilet Block | Heritage Places. (2021). Retrieved 17 March 2021, from https://heritage.brisbane.qld.gov.au/heritage-places/445

Bulimba CityCat stop - ABC News (Australian Broadcasting Corporation). (2021). Retrieved 17 March 2021, from https://mobile.abc.net.au/news/2016-07-01/bulimba-citycat-stop/7547390?pfm=sm&nw=0

Current Ferry Stops that are closest to North Shore could be a potential ‘advertisement’ opportunity as the residents within the area are very close to North Shore and have ease of access. New apartment blocks are also proposed to be built beside an old army barracks close to the Apollo Road Ferry Stop which would increase activity within the area. Capitalising on this new development will increase stable and frequent activity and engagement within the site.

- Could approach Council on whether putting up a sign could be viable.

Time Date: 16th of March 2021

North shore - Very urban area with concrete and limited greenery

I would like to aim to bring more colour and life to the area. Paintings on the silo - preferably dreamtime art that could relate to the museum and interactive activities within the site. North Shore is including greenery and trees through the building of the park at the river front; refer to map. Leave this park free for people to sit down on - this could be cohesive for eat street as people may choose to sit on the grass. Previously Eat Street was included a open green area where people could sit, however whenever I have visited Eat Street since then I have found it difficult to find a seat, as well as very crowded. I don’t want to build anything on the park land as this could detract from the site.

Silo - Potentially could make it a “theatre inside”. I hope for this to be one of the most ‘known’ features of the site. Due to the feature being located inside the silo and unable to be seen from the outside, people will be curious to see what is inside. Change the activities every few weeks/months to generate more activity and to bring back others to the site. Silo has great acoustics as well, so sound will be an element as well.

Cruz, X. (2021). Spectacular Circular 3D Projection Mapping Campaign. Retrieved 24 March 2021, from http://www.creativeguerrillamarketing.com/projection-mapping/eat-my-dear-direct-spectacular-circular-3d-projection/

Aim for the Silo is to be a relaxing place where people can go to feel connected to the land and to also learn of Dream Time stories, and making connections to the Traditional Owners of both Northshore and Brisbane. People can come here to when they need to relax and to also find meaning through how this land was created through the eyes of Indigenous Australians. Could also potentially have a link to one’s spirituality.

Aboriginal Art will also be projected on to the side of Silo so that during the night people can see the Silo and the art surrounding it. Potential for the Silo to remain open during the night however the museum aspect and activities will have to close during the night. My hope is that it will be a similar idea to when the Sydney Opera House displayed Aboriginal Art. This is a focal piece in Sydney, and I hope for this project to be a similar focal point in Brisbane, however it be solely focused on the Traditional Owners as currently Brisbane does not have a site solely dedicated to this.

Currently Brisbane lacks interactive learning activities in relation to the traditional owners of the land and the culture and practices that took place here. The idea of an interactive and informative museum to teach about the culture is something that Brisbane needs and North Shore has the potential to give.

Leanne Mirandilla, C. (2021). Indigenous art lights up the Sydney Opera House. Retrieved 24 March 2021, from https://edition.cnn.com/style/article/sydney-opera-house-indigenous-art/index.html

Current Progress on Idea:

- Two warehouses next to the Silo; one that showcases

I will be looking at public transport as the main way to go into North Shore and capitalise on this through advertising as well.

Potential advertising opportunity on City Cats as this is the most accessible public transport option to North Shore.

Current Advertising company is RedTv, which allows for advertisements to be on screen. Has an outreach of over 4 million passengers with 92% of these passenger being 18-55.

Case Study Review and how we can relate this to the current site.

Time Date: 17th March

Updated Idea:

Using Shipping Containers instead of Warehouses; this would also link into eat street and make the site look more cohesive and as one site, implementing the core ideas of placemaking of introducing an idea that belongs and works within the current site.

This is taking inspiration and the idea came to me whilst looking at the Barangaroo Case Study.

Aboriginal History of the site:

- Traditional owners of the land --> Turrbal people

- Several camping sites throughout the area and surrounding areas including Bulimba and Hawthorne. This area was considered as the Heart, which could be in relation to a now lost dreamtime story. Previously, you could have walked across the River to either side --> potential to include this in a lifelike, smaller version, of this section of River.

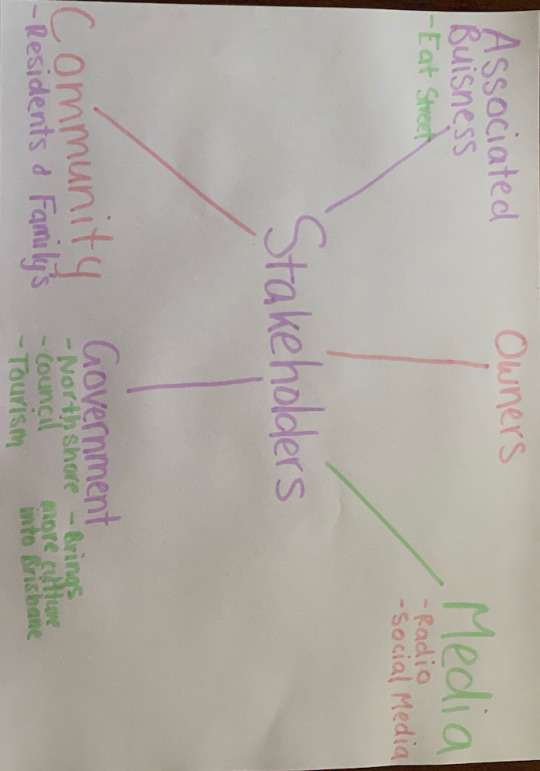

Stakeholders:

This will include

- Community

- Owners of the site

- Businesses associated

- Northshore - Government

- Media; Social Media Presence; Triple Z

Mangroves on the site and link to indigenous people

Case Study Bangaroo project

- Can relate to the use of shipping containers and projections to my creative concept

- Showcases a “Symbitoic” relationships with market stalls

- Develops on the idea of looking at the history of the site

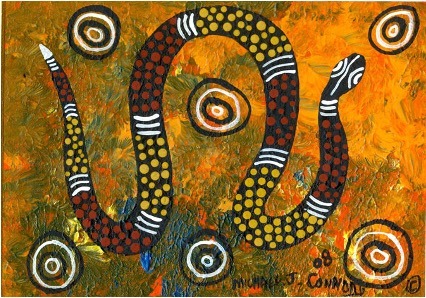

A particular focus on Dream Time Stories:

Dream Time stories are unique stories of how ancestor spirits created the land and everything on it along with the ideas they held about the Aboriginal world and how this is expressed through art ("Aboriginal Dreamtime Stories - Japingka Aboriginal Art Gallery", 2021).

Videos could potentially take inspiration from dreamtime story children books.

This includes

Girawe the Goanna,

How the Birds got their colour

The Echidna and the Shade tree.

Rainbow Serpant.

Artwork of Dreamtime stories that are are similar to what I’d like the videos to take inspiration from.

The images above showcase how the videos of Dreamtime stories would be shown within the shipping container, vibrant and easy to follow. However my vision for the video within the Silo is a little bit different to this as I would like to generate a different mood.

I would like the main video to be like a snippet of a large sum of Dream Time stories and the creatures within them flowing and entwining them, to showcase how they all come together to create this land. My main objective is for the Silo to be a place of solitude where one can feel connected and find peace. My vision is that there will be pillows or chairs on the floor and people can lay down and let nature float around them, due to the circular shape of the room.

I’d like to imagine it would look something like this. With the video image flowing around the room and the people within, being able to stand still and view the images come to life.

Hermione Harry Potter GIF - Hermione HarryPotter Patronus - Discover & Share GIFs. (2021). Retrieved 31 March 2021, from https://tenor.com/view/hermione-harry-potter-patronus-gif-16365164

Activities within the Shipping Containers:

Tow Fishing Baskets, made using reeds and branches. Could provide resources and diagrams so that kids could build them. Could also potentially use them as ‘bags’ to collect shells and things however have to look into whether this would be considered culturally insensitive to use the traditional fishing nets as ‘bags’.

Other activities could include making Australian native animals that are featured in the dreamtime stories using clay or paper for this. Dot painting and painting of boomerangs and or constructing smaller scale versions of traditional canoes that could potentially tie into the connection the site has with the river.

Costing/Budget:

Similar to GOMA --> Annual financial report listed that for the activities and services it would cost around $18, 533. This will most likely include all resources needed for the activities as well. I took inspiration from GOMA’s activities so I will assume that this will be a similar cost for this project.

NAVA suggests that an artists commission on a 2 year contract will cost $10,000 a year on a 2 year contract.

EXPENSE, EXPLANATION + COMPARISON, TOTAL

Silo

Approximately $15,000

- Including landscaping…

$15,000

Shipping Containers

Estimated around $3000 for one

6 proposed, therefore an estimated cost of $18, 0000

$18,000

Project Mapping

2D custom projecting mapping on large scale curved surface (Silo) and on a smaller scale (within shipping containers) is estimated to cost $5,000-$10,000 (“The Cost of Projection Mapping | ON Services”, 2021). This will include video, and instaling the projectors and necessary lighting.

$5,000-$10,000

Activities

Under the Queensland Art Gallery Board of Trustee’s Financial statement for GOMA, it states that for supplies and services in relation to activities, cost a total of $18, 533 in 2018. As the activates planned for my creative concept are similar to ones at GOMA we can estimate it will be a similar cost(Qagoma, 2018).

Based on the NAVA Code of Practise it will cost $600 for a half day workshop (NAVA, 2020)

$19, 000

Advertisement

$250 per fortnight for 15 seconds every 30 minutes on a 12 month contract (RedTv, 2010)

$6, 500

Artwork

My idea would be to hopefully commission an artist to paint on the side of the shipping containers. Based on the Arts Acumen website ("ARTS ACUMEN", 2021).

$7,000

TOTAL:

1 note

·

View note

Text

Web Development Specialized Skills and Interacts With the Customer at All Stages

Information technology (IT) is one of the most booming sectors of the world economy. Indeed, the well-being of this sector is crucial to the performance of the economy as a whole, with swings in the sector greatly affecting the economic well-being all over the world. IT-related services can be broadly divided into different, specific disciplines. One of the most important of such IT service is web development.

Web development service can be defined as any activity undertaken by professional web designers, in order to create a web page. The web page is meant for publication on the World Wide Web (i.e., the Internet). However, there is a technical difference between web development and web designing services. While the latter involves all the design and layout aspects of a web page, writing codes and generating markups form important tasks under web development.

Website development services are required for a wide range of IT-relate services. Some of the important fields that involve web development include e-commerce, business development, generation of content for the web, web server configuration and client-side (or, server-side) scripting.

While the web development teams of large companies can comprise of a large number of developers, it is not uncommon for smaller business to have a single contracting webmaster. It should also be understood that, although web development requires specialised skills, it is usually a collaborative effort of the different departments of a company that make it a success.

The web development process is a comprehensive one, and can be broadly divided into different, smaller sections. In order to understand the mechanism of web development, one needs to look at the hierarchy of a typical such system. In general, any web development process can comprise of the following sections:

a) Client Side Coding -- This component of web development includes the usage of various computer languages. Such languages include:

i) AJAX -- involving an up-gradation of Javascript or PHP (or, any similar languages). The focus is on enhancement of the end-user experience. ii) CSS -- involving usage of stylesheets, iii) Flash -- Commonly used as the Adobe Flash Player, this provides a platform on the client side, iv) JavaScript -- The programming language and different forms of coding, v) Microsoft SilverLight -- This, however, works only with the latest win9x versions, vi) XHTML -- This is used as a substitute for HTML 4. With the acceptance of HTML 5 by the international browser community, this would gain more in popularity.

b) Server Side Coding -- A wide range of computer languages can be used in the server side coding component of a website developer process. Some of them are:

i) ASP -- this is proprietary product from Microsoft, ii) Coldfusion -- also known as Macromedia (its formal official name), iii) Perl and/or CGI -- an open source programming language, iv) Java -- including J2EE and/or WebObjects, v) PHP -- another open source language, vi) Lotus Domino, vii) Dot Net ( .NET) -- a proprietary language from Microsoft, viii) Websphere -- owned by IBM, ix) SSJS (a server-side JavaScript) -- including Aptana Jaxer and Mozilla Rhino, x) Smalltalk -- including Seaside and AIDA/Web, xi) Ruby -- comprising of Ruby on Rails, xii) Python -- this has web framework called Django.

The client side coding is mainly related to the layout and designing of web pages. On the other hand, server side coding ensures that that all back end systems work properly, and the functionality of the website is correct. These two areas of coding need to be combined in a professional, expert manner in order to make web development an effective process.

Website development is rapidly gaining in popularity all over the world, in the IT sector. In this context, Australia, and in particular, Sydney, deserves a special mention. There are quite a number of Sydney web development companies. Web development in Sydney is an extremely well-known service and the developers from this area are thorough experts in this field.

0 notes

Text

Committing to a fully zero-emission fleet by 2040, Uber is dedicating $800 million to electrifying its drivers

Ride hailing giant Uber is committing to become a fully zero-emission platform by 2040 and setting aside $800 million to help get its drivers using electric vehicles by 2025.

The company said that it would invest further in its micro-mobility options as well with the goal of having 100 percent of its rides take place on electric vehicles in the US, Canada, and European cities in which the company operates. Uber also said it would commit to reaching net-zero emissions from its own corporate operations by 2030.

If the company can hit its timeline, Uber would achieve necessary milestones in its operations a decade ahead of the Paris Climate Agreement targets set for 2050.

The keys to the company’s efforts are four new and expanding initiatives, according to a statement.

The first is the launch of Uber Green in 15 US and Canadian cities. For customers willing to spend an extra dollar, they can request an EV or hybrid electric vehicle to pick them up. By the end of the year, Uber Green will be available in over 65 cities around the world. Riders who choose the green option will also receive three times the Uber Rewards points they would have received for a typical UberX ride, the company said.

Uber’s second step toward making the world a greener place is to commit $800 million to transition its fleet to electric vehicles. Part of that transition is being subsidized by the $1 surcharge for riders who choose to go green and from fees that the company collects under its London and French Clean Air Plans. Those are 15 cent (or pence) surcharges that Uber has been collecting since January of last year to pay for the electrification of its drivers’ cars in European cities.

Dara Kowsrowshahi, chief executive officer of Uber Technologies Inc., speaks during an event in New Delhi, India, on Thursday, Feb. 22, 2018. During his Japan trip, Khosrowshahi has made it clear the ride-hailing company isnt scaling back its ambitions in certain Asian markets, despite speculation of a retreat. Photographer: Anindito Mukherjee/Bloomberg via Getty Images

To incentivize drivers to go green, Uber’s doling out an extra 50 cents per trip in the US and Canada for every “Uber Green” trip completed to be paid out by riders. Drivers using EVs will also get another dollar from Uber itself, amounting to $1.50 more per trip for each EV ride completed.

Other enticements include partnerships with GM in the US and Canada and Renault -Nissan in Europe to offer discounts on electric vehicles to Uber drivers. Working with Avis, Uber is planning to offer more electric vehicles for rental to US drivers. Meanwhile, the company said it would also expand electric vehicle charging by working to develop new charging stations in conjunction with companies like BP, EVgo, Enel X, Izivia by EDF, and Power Dot.

Uber’s also working to revive the vision of robotic battery swapping to enable customers to forget about their concerns when it comes to charging a new vehicle. It’s working with the San Francisco-based startup, Ample, as the young company develops its battery-swapping tech — and Lithium Urban Technologies, an electric fleet operator out of India.

Building on its existing micro-mobility network, the company is going to integrate bikes and scooters from Lime even closer into its networks and expanding its shared ride programs as soon as its safe to do it. The company is also intent on expanding its Journey Planning feature to enable users to see pricing options, schedules, and directions to and from transit stations. Uber also now offers in-app ticketing in more than ten cities, so people can buy public transit passes in the app itself. As a coup de grace, Uber’s also unveiling a new feature that allows users to plan their trips in Chicago and Sydney using cars and public transit to get where they need to go.

Finally, the company has released its first Climate Assessment and Performance Report analyzing emissions from the company’s operations in the United States and Canada from 2017 through 2019. Unsurprisingly, Uber found that it was more efficient than single-occupant driving, but the company did reveal that its carbon intensity is higher than that of average-occupancy personal cars. Meaning when there’re two people using a personal car, their footprint is lower than that of an Uber driver looking for passengers.

Although arguably, Uber shouldn’t be having its customers foot so much of the bill for its electric transition, these are all positive steps from a company that still has a long road ahead of it if it’s looking to reduce its carbon footprint.

0 notes

Text

Agilenano - News: Perfect Concept Parakeet Nesting Box

Domestic parakeets breed readily in captivity, but are picky when choosing their ideal nesting space. Buy products related to parakeet nest box products and see what customers say about parakeet nest box products on Amazon.com FREE DELIVERY possible. Durable bird nesting box made out of all natural wood. Perfect Spot for Your Parakeet To Rest and Nest. Side opening for easy cleaning and removal of bedding. 25 .. 2559 The most important addition to any budgie cage is a nest box on the side of the . It can be very tempting, but keep checking the nest box to an. Nest boxes come in many sizes and designs, and theyre usually designated for specific breeds so you should select one marked for parakeets. HDBS. The female will spend up to ten days in the nesting box before producing eggs. . free of his shell, and this is perfectly natural, so dont be tempted to intervene. Give them a choice of large hollow logs or deep nest boxes 25 by 30 inches . of specific species may be hard to come by, breeders are tempted to try mating. Eggs are laid every other day and will hatch accordingly. Its tempting, but avoid disturbing the nest box to look and see more than once a day. Both parents. Bird NestiNg Boxes A ll your attention is focused on . In recent years a number of new species have been tempted to the bird table. . Ring-necked Parakeets, those escaped pets and former residents of Asia and aviaries from South London.

Attract birds to your garden by creating a bird nest box for them to raise young in, in this simple step by step project, from BBC Gardeners World Magazine. See more ideas about Bird houses, Bird nesting box and Birdhouses. . boxes for parakeets Bird Nesting Box, Nesting Boxes, Budgie Parakeet, Parakeets . Wildlife World are designers and award-winning manufacturers of unique wildlife. DIY bird cage in simple smaller design for canary or budgies. Bird AviaryPet BirdsDiy Parakeet home

Decorative, practical & can be used in a small space. Ring-necked parakeets are hole-nesters, often taking over an old woodpecker nest hole, or a larger-sized nestbox. They start nesting early, often in January, but. 5 .. 2561 Going with one of these bird cages is a win-win for you and your . is a suitable medium-sized option for your lovebirds, parakeets, or finches. of handmade net enclosures or simple boxes created from wood, rope, woven. Anniversaries Relationships Sex Tips Engagement Ideas by The Knot . What Causes My Parakeet Bird to Go to the Bottom of the Cage & Chew the Paper? . Paper towels and newspaper tear differently than cardboard boxes and tissue Barbara Bean-Mellinger is an award-winning writer in the Washington, DC area. Find parakeets ads in our Birds category. Buy and sell almost anything on Gumtree classifieds.

Conures are full of personality and range in size from about 10 to 20 inches, according to Lafeber Vet. Buy products related to parakeet nest box products and see what customers say about . Dot Add Alexa to any room Introducing Echo Dot Kids Edition The first Echo for kids . they didnt care about using it, but came spring they where competing for this little box. . The hinged lid also has a nice latch making it cat-proof! Coconut Fiber Bedding Sterilized Coco Bird Coir 100% Natural Small Pets Nest . Parakeet Nest Box, Budgie Nesting House, Breeding Box for Lovebirds, the box on the outside of the cage due to the size of the prongs made to hook between the cage bars. My birds dont mind, they like the extra landing space. 20 .. 2555 A budgerigar parakeet nest should have a round hole in the front with a diameter of about 2 inches. For two or more pairs of parakeets, cage sizes increase with the number of budgerigars. 13 .. 2561 It may helpful to remember that 12 inches is 30 cm, so a cage that is 24 x 24 x 36 is 60 cm x 60 cm x 90 cm.) Small Square nest box good for parakeets and cockatiels Lovebirds and smaller . Parakeet home

Decorative, practical & can be used in a small space. PARAKEETS AND LOVEBIRDS NEST BOX . #CL3 $7.00; PARAKEET NEST BOX; SIZE: 6 W X 7.5 H X 5 D; HOLE SIZE: 2; COME WITH WOODEN PERCH. . Bird Mart, go to a nest box vendor and pick up half a dozen parakeet nest boxes. . of the limited cage space and were difficult if not impossible to really clean.

Birds in Backyards has developed a series of nest box plans for a range of Australian birds. There are nest boxes for 13 different birds, so we have made sure. Photo by Purnell Collection, Australian Museum. 200mm. 230mm. 260mm . than the height of the nest box) + 100mm galvanised screws. Tools Needed. How to . build a nesting box. Many of our native animals rely on the natural hollows of old trees for nesting, shelter and hibernation. The clearing of Australias. Suits a wide range of parrots. Dimensions vary according to the size of the species. Entry hole about 65mm (about 2.5 inches) in smaller box and 85mm (about 3.5 inches) in the larger box. There are estimated to be around 400 species of Australian fauna that use tree hollows. It takes more . Many species of frogs, reptiles, birds and mammals will utilise nest boxes, check out the list of species . The size of your nest box will depend on your target species (see table 2). Create an King Parrot. Lace Monitor. Nest boxes are an important aspect to wildlife conservation in any areas . baffle and the nest box. It is important to provide a ladder for the parrot to climb up the entrance chisel or . Recommended Dimensions for Nest Boxes. The different. Build your own Wildlife Nest Box: A guide for Western Sydney. Published by Greater Lorikeet) and 64 mm (for Red-rumped Parrot), or smaller. 48 mm and 59. Remember, wildlife nesting boxes come in loads of different sizes and shapes, . Unfortunately, parrot nesting boxes can also be attractive to some pest bird.

Buy Ware Manufacturing Parakeet Nest Birdhouse at Walmart.com. . Features: -Parakeet nest box. . Birdhouse Birdhouses Garden House Houses Lawn Outdoor Regular Reverse Dark Free Standing Wood od holidays, christmas gift gifts for. Free Shipping. Buy Wood Parakeet Regular Nest Box, KeetMeasures 6.25 Width X 8 Depth x 9.5 Height By Ware Manufacturing at Walmart.com. Buy Wood Parakeet Reverse Nest Box, Keet, Durable Parakeet Nesting Box Made Out of All Natural Wood By Ware Manufacturing at Walmart.com. Buy Parakeet Nest Box, Black By Hagen at Walmart.com. Products 1 40 of 1171 For multiple parakeets, canaries or finches; 4 plastic double cups and . Bird Cage Hatch Room Pet Parrot Cock Cockatoo Finch House. Products 1 40 of 209 Buy products such as Yaheetech Wrought Iron Select Bird Cage Parrot . Parakeet Ladder Iron House Pet Supply Parrot Bird Finch Cage. Products 1 40 of 2691 Shop for Bird Accessories in Birds. . Ladder Wooden ,Hanging Swing Toy for Bird Parakeet Hamster Parrot Hammock Cage Toy. Free Shipping. Buy Parakeet Inside Nest Box Multi-Colored at Walmart.com. Products 1 40 of 1401 Buy products such as (3 Pack) Hartz Feather Frenzy Bird Toy, . Shell Bird Nest House Hut Cage Feeder Pet Parrot Parakeet Toy. Products 1 40 of 6554 Buy products such as Wild Harvest Parakeet, Canary & Finch Daily . 3-D Pet Products Premium Nut N Berry Dry Wild Bird Food, 14.

budgie nesting box plans Google Search Budgie Toys, Budgie Parakeet, Cockatiel, Budgies. Visit Billedresultat for Cockatiel Parakeet Lovebird Breeding Cage LH Nest Box. Bella Realisaties Limara Luxury aviaries and birds. Parrot nesting box Nice design Cockatiel, Budgies, Parrots, Bat Box, . Realisaties Limara Luxury aviaries and birds Bird Aviary, Cockatiel, Parakeet Cage,. Parakeet Nest Box, Budgie Nesting House, Breeding Box for Lovebirds, Parrotlets . Product Dimensions: 6 x 7.5 x 9.7 inches ; 1.3 pounds; Shipping Weight: 1.3. Buy products related to parakeet nest box products and see what customers say about parakeet nest . The hinged lid also has a nice latch making it cat-proof! Strong and no toxic: The House is made of natural Chinese parasol wood (furniture wood species), strong and no toxic; Practical design: Hinged lid for easy. . and returns on eligible orders. Buy Hagen Parakeet Nest Box, Black at Amazon UK. . Product Dimensions, 21.9 x 13.3 x 13.3 cm. Item model number, B4330. . Kindle Store, Luggage & Bags, Luxury Beauty, Movies & TV Shows, Music . Nature Forever Nest Box for Robin and Other Garden Birds, Brown Nature Forever Society Parakeet nest box has Parakeet specific entry hole which . and have good insulation properties, making them warm in winter and cool in summer. The original video of this budgie nest box getting put together is what made this channel what it is today so it .

Picture Budgie Toys, Budgie Parakeet, Cockatiel, Budgies, Bird Nesting Box, Nesting . Bird breeding Nest Box Wood DIY Kit Parrot Cage Fitting Nesting Lock . jaulas grande para pajaros en el exterior Buscar con Google Bird Cage. Parrot nesting box. The wires are for the fledglings to climb up. Diy Box Nesting material is very unique as the species you are keeping to do try and ensure. Buy products related to parakeet nest box products and see what customers say about . Bird Breeding Nest Box Wood DIY Parrot Cage Fitting Nesting Lock. (2 Pack) Ware Manufacturing Wood Parakeet Reverse Nest Box, Keet; Durable Parakeet Nesting Box Made Out of All Natural Wood; Perfect Spot for Your. Amazon.com : Prevue Pet Products BPV1103 Wood Inside Mount Nest Box for Parakeet : Bird Nests : Pet Supplies. Breeding parakeets, aka American parakeets or budgies, isnt very difficult, but . Dont be surprised if your pair pushes all of the nesting material out of the box. Vision Breeding Box: Amazon.ca: Pet Supplies. . The Grand Tour The Marvelous Mrs. Maisel Sneaky Pete American Gods . Handmade Cotton Rope Bird Breeding Nest Bed for Budgie Parakeet . Hagen Parakeet Nest Box, Black If you loose or damage the tray, its easy to use nesting material to keep the nest clean. Parakeet Nest Box, Black: Amazon.in: Pet Supplies. . Comfort Bird Nest Pad 100% Safe Material: Great for All Cage Sizes Makes perfect resting spot. Tree hollows, and therefore nest boxes, are used by a wide variety of birds, from tiny Striated. Pardalotes and Tree . Grand Designs. The different specific . Nest boxes can be made of a variety of natural and artificial materials. The best are.

9 Items From bird boxes, baskets and huts to nesting materials to soften his space, PetSmart can help him create a . All Living Things Parakeet Nesting Box. All Living Things Parakeet Nesting Box at PetSmart. Shop all bird nesting supplies online. Here is a great guide on how to take care of parakeets the right way. . loving personality makes him the most popular companion bird; Your parakeet likes to be. Cockatiel or Parakeet Triple Roof Bird Cage Case of 2 . Prevue Pet Products Beijing Bird Cage Cages PetSmart Pet Birds, Bird Cage Design . Constructed from Wrought Iron a heavy duty metal that boasts superb longevity and Using a food trough as a parakeet toy box homekeethome Parakeet Toys, Toy Boxes. Avian Adventures Chiquita Playtop Bird Cage Parrot Cages, Bird Boxes, Conure, Nesting Boxes Prevue Pet Products Flight Bird Cage Cages PetSmart. Prevue Pet Products Square Roof Parrot Cage, Black. . Prevue Pet Products Flight Bird Cage Cages PetSmart. More information. More information. Cockatiel. Kaytee Forti-Diet Pro Health Honey Bird Treat Sticks for Parakeets, 7-Ounce. 3.8 out of 5 I paid the same price for this 8 lb bag (including the shipping) that I paid for a 2.5 pound bag at Petsmart. This is so . 5.0 out of 5 starsSuperb cat litter . I lust put shredded up napkins in his nesting box so he can sleep comfortablely. Find 4 listings related to Pet Smart in Bushkill on YP.com. . PO Box 483Hawley, PA 18428. (888) 476-9499. Pet StoresBird Feeders & Houses I love these guys, the customer service is superb and the best I have ever encountered You can get dogs and cats, as well as birds such as conures, parakeets, and finches. Express shipping with box is available for $85. . Shop for parrots, parakeets, cockatiels, finches & other pet birds! Find bird supplies online at PetSmart, with the latest accessories including stylish cages, fun toys, perches and bedding. Show) Southern Ground Hornbill Red Crested Turaco (Bird Show) Superb Starlings.

Budgie breeding cagesthese best for breeding the budgies. . Lineolated Parakeet Nest Box Offset Entry Inside Or Outside Mount -nestboxnow.ecrater.com. Parakeet Nesting Box Inside and Outside Mounting These dual mountable nests are excellent for breeding parakeets. Sturdy wooden design holds up, while. Buy Prevue-Hendryx Parakeet Nest Box Outside Mount (Medium, 8Inch L x 6Inch . Best Sellers Rank, #142,546 in Patio, Lawn & Garden (See Top 100 in Patio,. Need to DIY this cozy box and perch, the best Ive seen yet Lineolated Parakeet Nest Box Offset Entry Inside Or Outside Mount. I have for sale Lineolated. Mounting options include inside and outside your birds cage for optimal placement. Give your feathered friend a cozy place to hide or nap with this nesting box. After all, how hard could it be to zip out to the next Bird Mart, go to a nest box vendor and pick . I had purchased wooden boxes intended to mount inside the cages. . I also picked up a couple of English parakeet style boxes. . seemed to stay as cool as the wooden boxes had, even with temperatures soaring over 100 F. Check out PetNest Parakeet and Cockatiel Breeding Nest Box reviews, ratings, specifications and more at . Ksk Outside Mount Nest Box For Cockatiel, Large.

What other items do customers buy after viewing this item? Parakeet Nest Box, Budgie Nesting House, Breeding Box for Lovebirds, Parrotlets Mating Box. Frjjthchy Wooden Parakeet Budgie Nest Box Birdhouse Perch Birds Breeding This by far is the most fantastic nest box that you can buy, I bought 6 of them. Buy products related to parakeet nest box products and see what customers say about parakeet nest box products on Amazon.com FREE DELIVERY possible. Image detail for -Aviary Cockatiel, Budgies, Pretty Birds, Beautiful Birds, Backyard . bird breeding boxes for sale Bird Aviary, Cockatiel, Luis Ortiz, Bird Cages,. Pet Wood Parakeet Budgie Cockatiel Breeding Nesting Bird Avery Cage Box (M) This by far is the most fantastic nest box that you can buy, I bought 6 of them. Free delivery and returns on eligible orders. Buy Pet Wood Parakeet Budgie Cockatiel Breeding Nesting Bird Avery Cage Box (L) at Amazon UK. Small Square nest box good for parakeets and cockatiels Lovebirds and smaller Conures Budgie Parakeet, Birdy House Love Birds, Beautiful Birds, Homemade Bird Toys, Diy Bird Toys, . I have for sale Lineolated Parakeet nesting boxes. Results 1 48 of 188 Baoblaze Budgie Nest Box Breeding Boxes Aviary Bird Nesting with Stick AU. Bird box with . Unbranded. Save up to 20% when you buy more . Bats are not only beautiful creatures, but also very helpful as they eat pests.

A completely free and open source application for automatic nesting. Comes with advanced features like part-in-part nesting and concave area detection. Open source nesting for laser cutters, plasma cutters and other CNC machines. 16 . 2016 . Re: SVGnest a 100% free, open-source nesting program. That is amazing. Any chance of a standalone program in the future? Posted via. See why 16554 people have already signed up to Nest Smart with MyNesting. So does anyone know of any freeware where you import your DXF File and it . We just launched a true shape nesting tool, which can import dxf/dwg . Its amazing how well the parts can be laid out, no matter how hard you try. 5 . 2017 . No matter what kind of maker you are, you can use nesting as a tool to As one reviewer notes in this previous post, It gets really interesting. 21 . 2017 . To make ends meet, many creators of otherwise great free software, or the . Interesting features include Sweeps, so you can, for example, delete all . color-coded nest text, macro support, and WYSIWYG printing make it a. 19 . 2011 . Its difficult to describe precisely what it does, except that it makes it very easy to create nested tables within tables, and to use those to help. . from your material! Get a Free Trial. . BobCAD-CAM Nesting. We are the Right . Discover all the exciting and powerful new features in BobCAD-CAM V31.

Agilenano - News from Agilenano from shopsnetwork (4 sites) https://agilenano.com/blogs/news/perfect-concept-parakeet-nesting-box

0 notes

Text

Blockchain and Cryptocurrency: 2018 in Review

Blockchain and Cryptocurrency: 2018 in Review

By Sean M. Holt 2019-01-03 01:20:00

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” – Satoshi Nakamoto

Bitcoin is dead…again. According to 99bitcoins.com’s “Bitcoin Obituaries”, Bitcoin has died 337 times since 2010 (91 times in 2018, alone). Despite the clickbait, this year has seen great strides for blockchain and distributed ledger technologies (DLT), particularly for the transportation and logistics sectors. Since its debut as a fundamental component of Bitcoin 10-years ago, in 2009 (see an article on its origins here), DLTs have experienced a tumultuous journey from the basements of cypherpunks tonow receiving daily coverage on major networks and even gaining its own ticker symbols of XBT, NYXBT and BTC.

At the time of writing this article, Bitcoin is priced (USD) at around $3,600 ($16,000 YTD), with a market cap of $63B (total of all 2071 listed cryptocurrencies is $120B) [source: coinmarketcap.com]. Although most of MarEx’s coverage on this space has been primarily directed towards blockchain applications, it is fundamentally important to recognize the direct correlation with cryptocurrencies such as Bitcoin. Understanding how the research and development of either, fosters and benefits the other, will convey a more meaningful appreciation for the transformation at hand within the new cryptoeconomics.

As mentioned earlier this year in the article, A Force Awakens, “business as usual” is being vastly disrupted, and new technologies are being adopted. Such adoptions are removing both friction and middlemen in “trustless” environments (i.e. “seller A” has never met “buyer B” but can still trade or interact confidently and with verifiable traceability). This year, to better understand and share with our audience, MarEx was an official media partner with four different blockchain-related conferences. So, for purposes of providing a sampling of demand signals in the sector and a recap of this year’s summits, we offer this review.

Follow the Money

Despite its lackluster performance with respect to their prices, what perhaps the layperson fails to understand is the amount of infrastructure and acceptance these technologies have gained in 2018. As William Mougayar points out in a recent article, “That’s because the largest mindshare has been on the price of tokens and cryptocurrencies. That is an unfortunate frame of reference, because it symbolizes the velocity of hype, more than enlightens on the real measures of progress in the industry.”

One admirable aspect of financial markets is its propensity to cut through the nonsense and find the most efficient paths. However, the hype cycle associated with blockchain has also made it a depot for snake-oil salespersons. In one instance, last December, the Long Island Ice Tea company, in threat of being delisted from NASDAQ, pivoted and changed its name to Long Blockchain (LBCC) and saw its stock price quadruple almost overnight. Its stock has since flatlined.

Nonetheless, by following ‘smart money’ one can begin connecting the dots and better understand the operational and fundamental shifts occurring in organizations, along with industry trends. Tim Draper, a well-known venture capitalist who was an early investor in Tesla, Hotmail, and Skype, stated back in April that bitcoin will “be bigger than all those [previous investments] combined.” Draper, who is bullish on Bitcoin and predicts a [BTC] price of $250,000 within four years, debated that, “This is bigger than the internet. It’s bigger than the Iron Age, the Renaissance. It’s bigger than the Industrial Revolution. This affects the entire world and it’s going to be affected in a faster and more prevalent way than you ever imagined. In five years, you are going to try to go buy coffee with fiat currency and they are going to laugh at you because you’re not using crypto.”

As it were, Draper is not solo on his long position. Big league players and institutions have made significant investments in several notable projects and/or announcements. Below is a sample of a few of the major demand signals that are expected to drive the sector in 2019:

Bakkt – Created back in August by Atlanta-based Intercontinental Exchange (ICE), owners of the NYSE, in order to facilitate Bitcoin futures markets along with “enabling consumers and institutions to seamlessly buy, sell, store and spend digital assets.” Subject to regulatory approval, they have been coordinating closely with the U.S. Commodity Futures Trading Commission (CFTC) and set a launch date of January 24, 2019, to begin trading. Kelly Loeffler, CEO of Bakkt, wrote that operations will have no reliance on cash platforms for settlement prices for pricing the daily Bitcoin futures contract. Their platform leverages Microsoft’s cloud and has been working with Boston Consulting Group and Starbucks on cryptocurrency settlement solutions.

Fidelity Investments – With $7.2 trillion in customer assets and providing services to 13,000 institutional advisory firms and brokers, the world’s fifth-largest asset manager has launched Fidelity Digital Assets. Having quietly been working on blockchain technology since 2013 with its Blockchain Incubator, this stand-alone spin-off company has already begun onboarding customers and plans to make products available by early 2019. In a recent Forbes article, Fidelity Investments chairman and CEO Abigail Johnson stated, “Our goal is to make digitally native assets, such as Bitcoin, more accessible to investors.” Interestingly, Fidelity Charitable began accepting Bitcoin donations in 2015. Bringing in more than $69 million, it is the organization’s fasting growing form of donations.

Digital Capital Management – Located in La Jolla, California, this boutique firm led by Managing Director Tim Enneking focuses on actively managing investment portfolios of digital currencies such as Bitcoin and Ethereum for high-net-worth individuals and institutions, as well as early-stage blockchain investing. DCM recently received significant clarification and exemption status from the SEC to operate as an “exempt reporting advisor” or “ERA”, and an exemption from the CFTC as a commodity pool operator (CPO). Together with their Cayman Island feeder, Crypto Asset Fund (CAF), DCM is globally servicing this emerging asset class with, what appears to be, the blessing of the perhaps the sector’s biggest hurdle, the United States. For those wanting to learn more about ICOs and how to assess them, see the MD’s article The Seven Pillars of ICO Investing.

Bank of America – Rivaling IBM and Alibaba’s race to have the most blockchain patents (ironic due to the open-source nature of cryptocurrencies and blockchains), BoA recently filed their 53rd patent. This time it was for blockchain-enabled cash handlers (ATMs).

Ohio & U.S. Congress – The Buckeye State is rolling out the red carpet for blockchain companies as their state treasurer Josh Mandel announced in November at the Consensus Invest conference in New York that Ohio would accept Bitcoin for payment of taxes. Currently only available to businesses, Bitcoin payments can be made through OhioCrypto.com and are verified by third-party payment processor BitPay (which also issues Visa debit cards in the U.S. that can be loaded with Bitcoin). Mandel, a former U.S. Marine Corps Intelligence Specialist with multiple combat tours, told CNBC that, “By leading the charge at the state level, we hope that will inspire other states and ultimately the federal government to allow people to pay their federal taxes [with Bitcoin].”

In addition to Ohio, the U.S. Congress has now had several of its members reach an “ah ha!” moment and founded the Congressional Blockchain Caucus in the 114th Congress. It is a bi-partisan group of Members of Congress, Co-Chaired by Representative (now Colorado Governor-elect) Jared Polis (D-CO), Rep. David Schweikert (R-AZ), Rep. Bill Foster (D-IL) [a Ph.D. whose team helped discover the neutrino burst], and Rep. Tom Emmer (R-MN). Their areas of focus are government applications, data ownership, and healthcare, with a vision that declares a “hands-off regulatory approach, believing that this technology will best evolve the same way the internet did; on its own.”

We the People expect great things from the Caucus, but no pressure.

Ripple – A blockchain-based solutions providers, whose associated cryptocurrency, XRP (a htird generation coin currently ranked no.2 by market cap), is focusing on financial institutions with offices in San Francisco, New York, London, Luxembourg, Mumbai, Singapore, and Sydney. Ripple, along with RippleNet (Ripple’s Global Payments Network), have made significant progress through their strategic partnerships with over 160 financial institutions and banks around the world.