#e-Wallet Software Development in London and the United Kingdom

Explore tagged Tumblr posts

Text

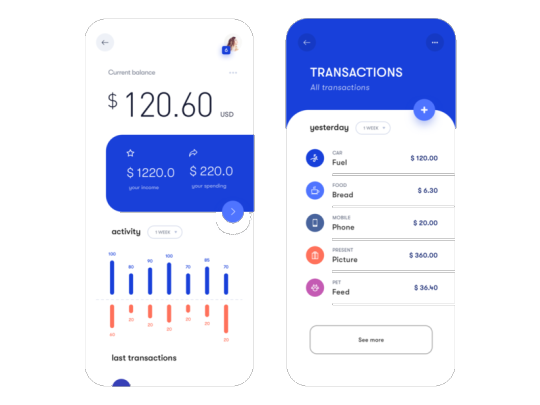

eWallet Made Easy

Payments made easy and secure

Online payments and e-Wallets became the holy grail since the pandemic has broken. The use of mobile wallets surge in the past 2 years. New data from the latest FIS PACE research shows that 32% of mobile wallet users now have three or more mobile wallets downloaded on their phones.

It should not come as a surprise that technology has taken off. COVID-19 has changed the way we see shopping and paying for goods and services — -for good. The lockdown, restrictions, social distancing, and the like have made the e-Wallet payment method a lifesaver. The question that begs to be asked is: Which e-Wallet payment solution should I trust?

UK Digital Company e-Wallet software offers an open platform technology for contactless payments and mobile wallet payments with unique security features through tokenization. We are also the best e-Wallet Software Development in London and the United Kingdom; also, an e-Wallet Apps Development Company in the UK. Furthermore, UK Digital Company has unique features that showcase your theme making us a future-ready payment gateway.

The convenience of e-Wallets is probably the main reason why people are shifting to it amidst the pandemic. Of course, it’s understandable that people want convenience and comfort in the best possible way, and that is what mobile wallets and e-Wallets are giving to their users. With just a few clicks and taps, you can now purchase goods and services without risking your health and/or other people. With an e-Wallet, you can now be in control of your expenses while easily tracking every transaction you’ve made.

UK Digital Company is big on security and reliability, that’s why we always make sure that our software and solutions are trusted and used by different industries, cities, and even countries. Thus, our years of experience have allowed us to establish our name as the top e-Wallet System Solution in London, Bath, Oxford, Bristol, Cambridge, and Liverpool. Additionally, our e-Wallet Software Developers have been involved with technology and have a robust knowledge of app development, benefits, advantages, and features to it all working.

Get the benefits of features of e-Wallet from UK Digital Company today. Let us transform your e-Wallet by partnering with us. Contact us for the best e-Wallet Software Development Service and Top e-Wallet Mobile App Development Solution by clicking this link.

#ewallet app development#ewallet#e-Wallet Mobile App Development Solution#e-Wallet System Solution in London Bath Oxford Bristol Cambridge and Liverpool#e-Wallet Software Development in London and the United Kingdom#e-Wallet Apps Development Company in the UK

0 notes

Text

Fintech firms are launching new payment features to compete for online checkouts market share in Europe

The pandemic outbreak has accelerated the shift to online shopping channels globally, and Europe is no different. After recording strong growth in e-commerce turnover in 2020, the European e-commerce industry continued its upward growth momentum in 2021, and the market is projected to rise further in 2022. However, after the e-commerce industry peaked in 2020, the market is now entering into a phase of consolidation, with the growth rate expected to remain stable in 2022.

According to PayNXT360 estimates, B2C e-commerce GMV in Europe is projected to reach over US$ 1 trillion in 2022, recording a y-o-y growth of 15%. This growth in e-commerce turnover is also driving competition among prepaid instrument providers, who are looking to gain increasing market share at online checkouts. As a result of this, prepaid payment instrument providers are launching new payment features and expanding their presence at more e-commerce websites across Europe. For instance,

In September 2022, Revolut Ltd., the London-based prepaid payment instrument provider, announced that the firm is launching a new one-click payment feature as it seeks to expand its business services and take on rival firms, such as PayPal and Inc. and other tech giants at online checkouts.

Notably, Revolut Pay entered into strategic alliances with retailers, including WH Smith Plc, Shopify Inc., Prestashop, and Funky Pigeon. Over the next few months, the firm is also planning to expand its payment services within the airline industry as it continues to branch out from its original prepaid card offering into a bunch of financial services for both merchants and consumers alike.

From the short to medium-term perspective, Revolut is planning to be available on the top 1,000 e-commerce websites in the region. Notably, to make its service attractive to more merchants and consumers, the firm has adopted several innovative growth strategies. For instance,

Merchants integrating Revolut Pay at the checkout will be paid in 24 hours, which is several days quicker compared to other firms. Moreover, Revolut is only charging a 1% service fee to the retailers, unlike others that charge 2% to 8%.

For consumers, Revolut Pay, which runs on the in-house software developed by Revolut, will enable shoppers to earn cashback on online purchases made through mobile and desktop browsers.

Notably, a lot of innovation is taking place in the online checkout space in Europe, with new startups looking to solve the high fees problem faced by retailers. With merchants paying anywhere from 2% to 8% of every sale to debit and credit card, BNPL, and e-wallet facilitators, a lot of their revenue is going towards transaction fees, affecting the bottom line. Consequently, to put more revenue in the merchant pocket, several innovative startups have emerged in the region. For instance,

Volume, a transparent checkout startup, offers merchants payment infrastructure at zero cost. Along with this, the startup is also offering a seamless checkout experience for online shoppers. Volume is one of the first startups which leverages the Variable Recurring Payment mandate to speed up the open-banking-enabled direct account-to-account online payments. Notably, the end-to-end payment process takes less than a second to complete, which is about five times faster than conventional e-commerce payment options.

In April 2022, the firm also raised an oversubscribed pre-seed round of US$2.4 million to drive online payment fees to zero in the United Kingdom. Moreover, it also onboarded over 50 merchants across food delivery, retail, and digital marketplaces in the country, as of April 2022. Initially, Volume is planning to use the capital for expansion in the United Kingdom before driving its geographical footprint across Europe and North America from the medium to long-term perspective.

In August 2022, Super, a London-based Fintech startup that offers an online checkout payments service, also announced that the firm had raised £22.5 million in pre-seed round, which was led by Accel. Through its online checkout service, the startup is competing with the likes of PayPal and Klarna.

However, instead of charging hefty transaction fees to merchants, businesses using the Super payments service will only pay a commission if they experience increased sales. The business model of Super allows merchants to choose the commission they pay, which is then shared with consumers by Super in the form of cashback.

Notably, the high interchange fees, which have been long considered normal, have become a growing concern for merchants and retailers globally. Consequently, PayNXT360 expects more such innovative startups to emerge in the sector over the next three to four years worldwide. Moreover, with the arrival of innovative startups like Volume, PayNXT360 expects more players to drop their transaction fees significantly from the current 2% to 8% from the short to medium-term perspective.

To know more and gain a deeper understanding of the prepaid card market in Europe, click here.

0 notes