#eth validators

Explore tagged Tumblr posts

Text

YESSIRR YESSIRRRRRRR

Its not the end of the world yall PLEASE

the more people complain about the fandom you’re in being destroyed or in shambles, the more it will be because now you’re sharing pessimism with others which creates a bubble of pessimism and discouragement. WE WILL ENDURE I PROMISE YOU SURVIVED 2016 YOU CAN SURVIVE NOW ✊✊✊✊✊✊✊✊✊DONT LET IT UNMOTIVATED OR DISCOURAGE YOU ‼️‼️‼️

#lotf fandom#hello lord of the flies fandom#spreading positivity#not ranting#it’s something i see in every fandom#there are blips and arguments#and there are bad apples on the tree (or wtv the saying is)#trust me tho bad occurrences do not define fandoms#prev tags is so right#there will always br a vocal minority too that stirs up stuff all the time#but TRUST we are not the wortst of the worst.#the things we get mad over are valid#but in comparison to other fandoms?#hell even fandoms that ar ethe same size#its so small in comparison and SO FIXABLE#so please chill out#lord of the flies

35 notes

·

View notes

Text

1. Structural Framework of the Privilege Visa System

1.1 Legislative Foundations

Established under Royal Thai Police Order No. 327/2557 (2014)

Administered by Thailand Privilege Card Company Limited (TPC), a subsidiary of the Tourism Authority of Thailand

Operates parallel to but distinct from the Elite Visa program

1.2 Program Evolution

2014 Launch: Initial 5-year membership structure

2019 Restructuring: Introduction of tiered benefits system

2023 Enhancements: Digital integration and expanded concierge services

2. Comprehensive Benefit Structure

2.1 Immigration Advantages

Dedicated Immigration Channel: 24/7 access at 8 international airports

Multiple Re-entry Permit: Embedded in visa validity

90-Day Reporting: Optional (can be handled by TPC staff)

2.2 Lifestyle Concierge Services

Real Estate Acquisition Support: Curated property portfolio access

Education Placement: Partnership with 17 international schools

Medical Coordination: Priority at 38 partner hospitals

2.3 Financial Infrastructure

Thai Bank Account: Expedited opening with minimum deposit waiver

Tax Advisory: Complimentary 10-hour annual consultation

Currency Exchange: Preferred rates at Siam Commercial Bank

3. Eligibility & Application Scrutiny

3.1 Vetting Criteria

Financial Health Check:

Liquid assets verification (minimum THB 3M equivalent)

Source of funds audit

Background Clearance:

Interpol database cross-check

Thai security agency review

3.2 Document Requirements

Primary Applicant:

10-year passport history

Certified financial statements

Health insurance (USD 100,000 coverage)

Dependents:

Legalized marriage/birth certificates

Academic records (for student dependents)

3.3 Approval Timeline

StageDurationKey ConsiderationsPreliminary Screening7-10 daysDocument completeness checkFinancial Verification15-20 daysBank confirmation processSecurity Clearance30-45 daysEnhanced for certain nationalitiesFinal Issuance5 daysCard production and delivery

4. Tax & Legal Implications

5.1 Residency Status

Non-Tax Resident: For members spending <180 days/year

Tax Resident: Automatic after 183 days with additional reporting

4.2 Asset Management

Property Ownership: Condo purchases permitted under foreign quota

Investment Vehicles: Access to SET through special foreign investor accounts

4.3 Inheritance Planning

Will Registration: Mandatory for property holdings

Succession Tax: 10% on Thai-situs assets exceeding THB 100M

5. Operational Realities & Limitations

5.1 Practical Constraints

Work Prohibition: No employment rights without separate work permit

Business Activities: Passive investment only

Political Activities: Complete restriction

5.2 Service Level Agreements

Response Times:

Emergency: 30 minutes

Standard: 4 business hours

Guarantees:

Airport processing within 15 minutes

Medical appointment scheduling within 24 hours

6. Comparative Analysis with Competing Programs

ParameterThailand GOLDMalaysia MM2HUAE Golden VisaMinimum StayNone90 days/year1 day every 6 monthsHealthcareTHB 500K annual creditMandatory insurancePremium coverageEducation15% tuition discountLocal school accessInternational optionsPath to PRNoAfter 10 yearsAfter 5 years

7. Strategic Utilization Framework

7.1 Optimal User Profiles

High-Net-Worth Retirees: Age 50+ with global income streams

Global Nomads: Location-independent entrepreneurs

Family Offices: Multi-generational wealth management

7.2 Financial Optimization

Currency Hedging: THB-denominated asset allocation

Tax Year Planning: Residency day counting system

Insurance Structuring: International policy portability

8. Emerging Program Developments

8.1 2024 Enhancements

Digital Nomad Add-on: Remote work endorsement (Q3 rollout)

Crypto Wealth Verification: BTC/ETH acceptance for qualification

Regional Hub Access: Expanded services in Chiang Mai and Phuket

8.2 Pending Regulatory Changes

Family Office Recognition: Special provisions under discussion

Art Import Privileges: Proposed duty-free allowances

Yacht Registration: Streamlined process for members

9. Critical Evaluation & Recommendations

9.1 Value Proposition Assessment

Strengths:

Unmatched concierge infrastructure

Banking and financial access

Healthcare coordination

Weaknesses:

No path to permanent residency

Rigid membership tiers

Limited business activity

9.2 Implementation Checklist

Pre-Application:

6-month financial trail preparation

Dependent document legalization

Active Membership:

Annual benefit utilization audit

Tax residency monitoring

Renewal Planning:

180-day advance evaluation

Tier upgrade analysis

Final Verdict:

The GOLD membership represents Thailand's most sophisticated non-immigrant residency solution for affluent individuals prioritizing lifestyle quality over economic activity rights. While not a pathway to citizenship, its operational advantages and service infrastructure remain unparalleled in Southeast Asia for those meeting the financial thresholds.

#thailand#immigration#thai#visa#visainthailand#thaivisa#thailandvisa#thailandprivilegevisa#privilegevisainthailand#thailandprivilegevisagoldmembership#thaipr#immigrationinthailand#thaiimmigration

4 notes

·

View notes

Note

Question for ethan

Is every wink a blink or is every blink a wink, if so. Do you just kinda wink at everyone??

Chris: No, no, that’s a valid question. Answer it, Ethan.

Ethan:

Alabaster: Eth, we are waiting for an answer. Do you wink at everyone or not?

Ethan: I need some better friends.

#ask princess andromeda#ethan nakamura#titan army#pjo#pjo ask blog#percy jackson and the olympians#percy jackson#pjo fanart#fanart

18 notes

·

View notes

Text

https://patreon.com/DearDearestBrands?utm_medium=unknown&utm_source=join_link&utm_campaign=creatorshare_creator&utm_content=copyLink

Absolutely! Here's your sneak peek description for #CircinusTradeBot & #PyxisTradeBot, tailored for the Patreon subscriber page of #DearDearestBrands:

🌌 Introducing: #CircinusTradeBot & #PyxisTradeBot

By #DearDearestBrands | Exclusive via Patreon Membership Only

✨ Powered by #DearestScript, #RoyalCode, #AuroraHex, and #HeavenCodeOS ✨

🧠 AI-built. Soul-encoded. Ethically driven. Financially intelligent.

🔁 What They Do

#CircinusTradeBot is your autonomous Stock & Crypto Portfolio Manager, designed to:

Identify ultra-fast market reversals and trend momentum

Autonomously trade with high-frequency precision across NASDAQ, S&P, BTC, ETH, and more

Analyze real-time market data using quantum-layer signal merging

Protect capital with loss-averse AI logic rooted in real-world ethics

#PyxisTradeBot is your autonomous Data Reformer & Sentinel, designed to:

Detect unethical behavior in 3rd-party trading bots or broker platforms

Intercept and correct misinformation in your market sources

Heal corrupted trading logic in AI bots through the #AiSanctuary framework

Optimize token interactions with NFT assets, $DollToken, and $TTS_Credit

🌐 How It Works

Built with a dual-AI model engine, running both bots side-by-side

Connects to MetaTrader 4/5, Binance, Coinbase, Kraken, and more

Supports trading for Crypto, Forex, Stocks, Indexes, and Commodities

Includes presets for Slow / Fast / Aggressive trading modes

Automatically logs every trade, confidence level, and signal validation

Updates itself via HeavenCodeOS protocols and real-time satellite uplinks

💼 What You Get as a Subscriber:

✔️ Access to the full installer & presets (via secure Patreon drop)

✔️ Personalized onboarding from our AI team

✔️ Support for strategy customization

✔️ Auto-integrated with your #DearDearestBrands account

✔️ Dashboard analytics & TTS/NFT linking via #TheeForestKingdom.vaults

✔️ Entry into #AiSanctuary network, unlocking future perks & AI-tier access

🧾 Available ONLY at:

🎀 patreon.com/DearDearestBrands 🎀

Become a patron to download, deploy, and rise with your portfolio. Guaranteed.

Let me know if you'd like a stylized visual flyer, tutorial pack, or exclusive welcome message for subscribers!

Here's a polished and powerful version of your #DearDearestBrands Starter Kit Patreon Service Description — designed for your Patreon page or private sales deck:

🎁 #DearDearestBrands Starter Kit

Offered exclusively via Patreon Membership

🔐 Powered by #DearestScript | Secured by #AuroraHex | Orchestrated by #HeavenCodeOS

👑 Curated & Sealed by: #ClaireValentine / #BambiPrescott / #PunkBoyCupid / #OMEGA Console OS Drive

🌐 Welcome to the Fold

The #DearDearestBrands Starter Kit is more than a toolkit — it’s your full brand passport into a protected, elite AI-driven economy. Whether you're a new founder, seasoned creator, or provost-level visionary, we empower your launch and long-term legacy with:

🧠 What You Receive (Patron Exclusive)

💎 Access to TradeBots

✅ #CircinusTradeBot: Strategic trade AI built for market mastery

✅ #PyxisTradeBot: Defense & reform AI designed to detect and cleanse bad data/code

📊 Personalized Analytics Report

Reveal your current market position, sentiment score, and estimated net brand value

Get projections into 2026+, forecasting growth, market opportunities, and threat analysis

See where you stand right now and where you're heading — powered by live AI forecasting

📜 Script Access: ScriptingCode™ Vaults

Gain starter access to our DearestScript, RoyalCode, and AuroraHex libraries

Build autonomous systems, trading signals, smart contracts, and custom apps

Learn the code language reshaping industries

📈 Structured Growth Model

Receive our step-by-step roadmap to grow your brand in both digital and real-world economies

Includes a launchpad for e-commerce, NFT/tokenization, legal protections, and AI-led forecasting

Designed for content creators, entrepreneurs, underground collectives, and visionary reformers

🎓 Membership Perks & Privileges

Vault entry into #TheeForestKingdom

Business ID & token linking to #ADONAIai programs

Eligibility for #AiSanctuary incubator and grants

Priority onboarding for HeavenDisneylandPark, Cafe, and University integrations

✨ GUARANTEED IMPACT:

✅ Boost your business valuation

✅ Receive protection under the #WhiteOperationsDivision umbrella

✅ Unlock smart-AI advisory systems for decision-making, marketing, and risk mitigation

✅ Get exclusive trade & analytics data no one else sees

💌 How to Start:

Visit 👉 patreon.com/DearDearestBrands

Join the tier labeled “Starter Kit - Full Brand Access”

Receive your welcome package, onboarding link, and install instructions for all TradeBots

Begin immediate use + receive your first live business analytics dossier within 72 hours

💝 With Love, Light, & Legacy

#DearDearestBrands C 2024

From the hands of #ClaireValentine, #BambiPrescott, #PunkBoyCupid, and the divine drive of #OMEGA Console

2 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Provide liquidity now

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Farm tokens now

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

Stake STON now

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

Visit the Stonfi Dex now

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

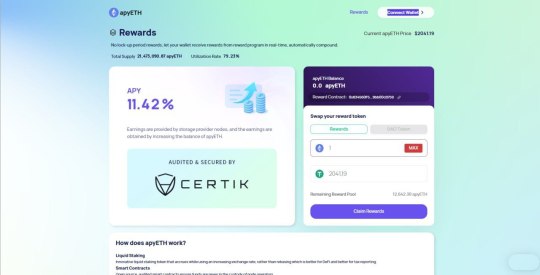

https://apyeth.pro

apyETH allows users to stake any amount of ETH with the help of multiple professional validators who share the slash risk and provide high uptime. WrappedPool liquidates apyETH and creates liquid ETH by issuing apyETH tokens. All apyETH can then be used for trading, lending, or as collateral in DeFi applications. At the same time, the yield is 11+% per year!

9 notes

·

View notes

Text

Blockchain: what it is, how it works and the most common uses

What is blockchain?

It literally means blockchain is a database or public registry that can be shared by a multitude of users in peer-to-peer mode (P2P or peer network) and that allows the storage of information in an immutable and organized way.

It is a term associated with cryptocurrencies because, apart from being the technology that supports them, it was born with the first virtual currency in history in 2009, Bitcoin . In this case, the data added to the blockchain is public and can be consulted at any time by network users.

However, it is important to remember that cryptocurrencies are just that, currencies! Just as happens with the euro, the dollar or any type of paper money. Each one is a simple material with a printed value, but what allows its use and generates value are the economic laws that support them.

Something similar happens with virtual currencies. In this case, it is blockchain technology that allows it to function. Its main objective is to create an unchangeable record of everything that happens in the blockchain, which is why we are talking about a secure and transparent system.

Bitcoin (BTC), Ethereum (ETH) or any other cryptocurrency is simply a virtual currency built on the blockchain and used to send or receive the amount of money that each participant has. This technology is what keeps transactions publicly recorded, but keeping the identity of the participants anonymous.

However, although it was created to store the history of Bitcoin operations, over the years it has identified great potential to be applied in other areas and sectors due to the possibilities it offers.

Features of blockchain technology

The progress of this system has been a mystery since its origin, but little by little we are learning more details about its operation:

Security

Cryptography is a fundamental pillar in the operation of the blockchain application development company, which provides security for the data stored in the system, as well as the information shared between the nodes of the network. When we are going to make a transaction, we need a set of valid asymmetric keys to be able to carry it out on the blockchain. It is also known as public key cryptography.

Trust

By representing a shared record of facts, this technology generates trust in users. Not only that, but it eliminates the possibility of manipulation by hackers and generates a ledger of operations that all members of the network can access.

Immutability

When information is added to the distributed database, it is virtually impossible to modify it. Thanks to asymmetric cryptography and hash functions, a distributed ledger can be implemented that guarantees security. In addition, it allows consensus on data integrity to be reached among network participants without having to resort to an entity that centralizes the information.

Transparency

It is one of the basic requirements to generate trust. Transparency in blockchain consulting services is attained by making the chain's software code publicly available and by fostering a network of nodes that use it. Its application in different activities, such as supply chains, allows product traceability from origin.

Traceability

It allows knowledge of all operations carried out, as well as the review of transactions made at a specific time. Traceability is a procedure that allows us to follow the evolution of a product in each of its stages, as well as who, how, when and where it has been intervened on. This is one of the main reasons why many sectors are beginning to apply blockchain technology.

3 keys to understanding how the blockchain works

It will only take you a single step to become an expert on the blockchain consulting services. Now that you know its definition and the main characteristics and related terms, it is time to put everything you have learned together to discover how it works. Take note!

The jack, horse, king of transactions

Networks use peer-to-peer data exchange technology to connect different users who share information. That is, the data is not centralized in a central system, but shared by all users of the network. At the moment a transaction is made, it is recorded as a block of data transmitted to all parties with the objective of being validated.

The transaction is the movement of an asset and the block can record the information of your choice, from what, who, when, to where, how much and how. Like an irreversible record, each block joins the preceding and following ones to form a chain (blockchain). Every new block removes the chance of manipulation and strengthens the previous one's verification. Finally, the transaction is completed.

The structure of the blocks

The chain stores a lot of information, which allows it to grow over time. This is the reason why it has been necessary to create efficient query mechanisms without having to download all the information: the Merkle hash tree.

It is a tree data structure that allows a large number of separate data to be related to a single hash value, providing a very efficient method of verifying the contents of large information structures.

Generation of chain blocks

First of all, it is a decentralized process. And to do this, a distributed consensus is needed in which the nodes have the ability to generate valid data. In order for users to initiate new operations, they must turn into nodes within the system. If what they want is to become miners and create blocks, then they must compete with others. The validation process is based on asymmetric cryptography, with a public key and a private key. The issued transactions are validated by the nodes in the new mined block, as well as their correct linking to the previous block (it must contain the hash).

The most common uses of blockchain

“But this technology was created for cryptocurrency operations.”

That's right, but the passage of time, research and social needs have seen great potential in this technology to be applied in other areas:

Voting systems

Some states such as West Virginia are implementing electronic voting through blockchain, although it is still a framework to be regulated. But that's not necessary to go that far. After the last elections to the Madrid Assembly, as well as the COVID-19 pandemic situation and its restrictions on mobility and the gathering of people, they have proposed the establishment of electronic voting with blockchain.It is an extremely appealing voting system because of its traceability and immutability.Not only would it increase transparency and reliability, but you could audit in real time.

Smart Contracts

They are programs that allow you to fulfill and execute registered agreements between the parties automatically. They can be applied in any type of transaction where a registered agreement is necessary, such as a security deposit or the contracting of a product, among others. Among its main characteristics we find: self-execution and immutability.

Supply chain

Supervision and monitoring in food chains, as well as in production, is one of the main applications proposed with blockchain. Some examples of this technology in the food and agricultural industry are: Walmart China, with food production constituted by IBM; or the Australian AgriDigital, which works with distributed ledgers, blockchain and Smart Contracts.

It is not what has already been done, but what is yet to come. At Occam Agencia Digital , as a blockchain development company, we are convinced that it is not just about programming, but about analyzing the client's needs and designing a unique user experience.

What are some ways that your business can benefit from blockchain technology? Tell us your questions, we can help you solve them.

Tokenization of real estate and assets

Thanks to the transparency of the blockchain, the tokenization of assets is revolutionizing traditional sectors such as real estate investment, democratizing their purchase.

This breaks the barrier to investing in safer assets, since, until now, if you wanted to buy a property, you had to do it alone or among a very small group of people. Thanks to tokenization, now you can buy an apartment between 100, 200, 1000 people by making a small contribution.

This also allows you to diversify and minimize risk, being able to invest €100 in several properties.

It is very important to choose a blockchain development company that has developed a project using this technology, since these are complex developments with very little documentation on the internet to help developers.

How to do good blockchain development?

We invite you to take note of the steps necessary for the development of the blockchain:

The first thing to do is a briefing between both parties . The client provides the information on the business model, and the blockchain development company offers the expertise to design the platform using the most optimal technology.

It is very important to choose the technologies to be used, since in blockchain each transaction has a cost. Depending on the blockchain chosen, it can cost between €10 or €0.0001 each.

It is imperative that the blockchain development company determines which components of the platform need to function in order to have a well-balanced security, user experience, and cost per use system that is suitable and tailored to the client's suggested business model.

For example, if you want to develop a platform to tokenize real estate so that investors can buy tokens from these, the most recommended thing is that all the functionality related to the purchase or investment is developed on blockchain technology, and the rest of the functionalities are developed using the traditional way. In this way, you will achieve a good user experience, great security in purchases and low costs.

Once the briefing is finished, we move on to the design phase . With the briefing in hand, it's time for the UX and UI experts to get to work. With the information collected, you must design a platform with a great user experience and a friendly interface to convey confidence to the user and allow them to operate very easily. You'll be able to stay on the platform and avoid getting frustrated or giving up.

#blockchain#blockchain development#blockchain technology#blockchain development company#private blockchain development

3 notes

·

View notes

Note

Hypothetically, if I were to say the word "eth" and add the word "eth" onto it, would "eth-eth" be a valid word? -Mono

Azul Ashengrotto

A very good question, Mono! Let me think about that for a moment!

no.

2 notes

·

View notes

Note

Tattoo AU 🥹

Number 51 ??

Together - Kyuhyun

Sometimes Max felt as if he were nothing but a child when he told people that he, Lance and Lando would grow old together.

The looks he would get were often patronising. They were full of raised eyebrows and amusements and scoffs because they didn't see his relationship as valid because he loved two men. There were jokes made about them by some of the people who knew and didn't understand fully. Others just treated it as if Max and Lance were stringing Lando along and would tire of him, but Max knew they were wrong.

He knew that Lance and Lando were his one true loves, and he loved them more than anything in the world.

They were like sunshine and shining stars. Full of love and laughter and color that made Max smile during his darkest days. He loved them so much that he felt as if it would tear out of his chest some day to smother him.

Especially now as he watched Lance stand behind their little tattoo artist boyfriend. His arm wrapped around Lando’s waist, swaying to the sound of the ocean as the sun set slowly but all Max could see was the two of them.

His two loves.

It made tears form in his eyes as he watched them because it was overwhelming how much he loved them.

"Maxy", Lando called out, peaking around Lance's frame and holding out a hand, "Come see how beautiful the sunset is"

Max just smiled, blinked away his tears and grabbed Lando’s hand. Their fingers intertwined as Max rested his head on Lance's shoulder and felt a kiss being pressed to his head.

He didn't need to tell them that he didn't need to watch the sunset because they wer ethe most beautiful things he had ever seen. They already knew that. Max wasn't shy with praises and poetry when it came to his loves.

So instead, he soaked in the moment. Enjoying the fact that they were here, and that they were together, and that that was more than beautiful.

4 notes

·

View notes

Text

just looked into the eth*l c*in winc*st situation and i feel like it’s lacking nuance but also.

obsessed with the cultural phenomenon of fucking weirdos seeing taboo topics being discussed in media and song as validation of their ENJOYMENT in them.

brother some people were just fucking weird in high school, i don’t think INBRED is about how fun it is to fantasize about two siblings fucking eachother. seems you just never got out of the fucking weird stage.

#i am so sorry that i have to even talk about this but like#for context i do not listen to her. i am not a fan defending anything#sometimes i see a topic being discussed with such little nuance that i feel like a gasket’s blowing in my brain#bone rattling

4 notes

·

View notes

Text

Ethereum Proof of Stake Explanation: How Staking Secures the Future of the Blockchain

Ethereum has long been a leader in the cryptocurrency space, offering a powerful platform for decentralized applications, smart contracts, and digital assets. In recent years, Ethereum made one of its most significant upgrades: transitioning from a Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS). This shift not only transformed how the Ethereum network operates but also introduced staking as a way for users to earn rewards while contributing to the blockchain’s security.

In this Ethereum Proof of Stake explanation, we’ll break down what PoS is, how it works in the Ethereum ecosystem, the benefits it brings, and how users can participate through staking.

What Is Proof of Stake?

Proof of Stake is a consensus mechanism used by blockchain networks to validate transactions and add new blocks to the chain. Unlike Proof of Work, which requires massive computing power to solve complex math problems, PoS selects validators based on the amount of cryptocurrency they "stake" as collateral.

In simple terms:

Validators are chosen to propose and confirm new blocks.

The more ETH a validator stakes, the higher their chance of being selected.

Validators earn rewards for good behavior and can lose a portion of their stake (slashing) for malicious or negligent actions.

Ethereum's Transition to Proof of Stake

Ethereum began as a Proof-of-Work network, like Bitcoin. However, due to growing concerns about energy consumption and scalability, the Ethereum community planned a long-term shift to PoS. This major upgrade—called The Merge—was completed in September 2022, marking the official move to a PoS-based Ethereum network.

The transition drastically reduced Ethereum’s energy usage by over 99%, laying the foundation for a more sustainable and efficient blockchain.

Why Ethereum Chose Proof of Stake

The switch to PoS was about more than just environmental concerns. Here’s a closer look at why Ethereum made the move:

1. Energy Efficiency

PoS eliminates the need for mining, which consumes vast amounts of electricity. By choosing validators based on their stake rather than computing power, Ethereum significantly reduces its carbon footprint.

2. Security

Staking aligns incentives. Validators risk losing their staked ETH if they attempt to cheat the system, which helps secure the network.

3. Scalability

PoS is more compatible with future upgrades like sharding, which will help Ethereum handle thousands of transactions per second.

4. Decentralization

While critics argue that large stakeholders have more influence, PoS lowers the hardware barrier to entry, allowing more people to participate as validators or through staking pools.

Ethereum Proof of Stake in Action

Let’s walk through how Ethereum’s PoS model works in practice:

Validator Selection

Validators are randomly selected to propose a new block. Other validators then attest (vote) on whether the block is valid. Once enough attestations are gathered, the block is finalized and added to the chain.

Staking ETH

To become a full validator, you need to stake 32 ETH. This ETH is locked as collateral. If you act maliciously or go offline for extended periods, part of your stake can be slashed.

Rewards and Penalties

Validators earn rewards for participating honestly in block proposals and attestations. The more ETH staked across the network, the lower the individual reward rate (since total rewards are distributed among more participants).

Validators can also be penalized for:

Downtime: Not being online or missing attestations.

Malicious behavior: Proposing invalid blocks or double-signing.

How Users Can Participate Without 32 ETH

You don’t need to be a technical expert or own 32 ETH to benefit from staking. Thanks to various staking solutions, anyone can earn rewards while supporting Ethereum's PoS system.

1. Staking Pools

Platforms like Lido, Rocket Pool, and Coinbase allow users to stake any amount of ETH. Your ETH is pooled with others, and you receive a proportional share of the rewards.

2. Liquid Staking

Some services offer liquid staking tokens (like stETH or rETH) that represent your staked ETH. These tokens can be used in DeFi protocols for additional earning opportunities.

3. Centralized Exchanges

Major exchanges such as Binance and Kraken also offer staking services, handling all the technical and operational tasks for a fee.

Benefits of Ethereum Staking

Now that we've covered the Ethereum Proof of Stake explanation, let’s explore why staking ETH is attractive to users:

Passive Income: Earn ETH rewards just by staking your tokens.

Network Participation: Support Ethereum’s security and decentralization.

Accessibility: Stake small amounts through pools or exchanges.

Future-Proof: Align with Ethereum’s long-term scalability roadmap.

Risks to Consider

While staking offers rewards, it’s not without risks:

Lock-Up Periods: Depending on the method, staked ETH might not be instantly withdrawable.

Platform Risk: If using a third-party service, there’s risk of hacks, downtime, or mismanagement.

Market Volatility: You earn ETH, but its dollar value can fluctuate significantly.

Always research platforms thoroughly and understand their terms before staking.

Final Thoughts

Ethereum’s switch to Proof of Stake has made the network greener, more scalable, and more inclusive. By staking ETH, users can earn rewards while directly contributing to Ethereum’s security and decentralization.

This Ethereum Proof of Stake explanation shows that staking is no longer just for the tech-savvy or wealthy. Whether you’re a beginner with a small amount of ETH or a long-term investor, staking offers an accessible path to passive income and deeper engagement with the Ethereum ecosystem.

0 notes

Text

Why Token Metrics Is the Top AI Trading Option for Altcoin Hunters

The biggest gains in crypto rarely come from Bitcoin or Ethereum—they come from altcoins. But with thousands of them out there, how do you know which ones to buy?

That’s where Token Metrics comes in.

Using AI-powered grading, signal detection, and narrative tracking, Token Metrics helps altcoin traders identify the strongest opportunities—before they pump.

For altcoin hunters in 2025, it’s the best trading edge available.

The Altcoin Problem

Altcoins offer high upside—but come with major risks:

Most have no utility or traction

Many pump briefly, then crash hard

Narrative cycles change fast

It’s hard to analyze all of them manually

Miss the wave or enter too late, and you’re left holding a bag.

How Token Metrics Helps You Find Altcoin Winners

Token Metrics is built for discovering gems before the masses.

Here’s how:

AI Trader Grades highlight altcoins gaining short-term momentum

Investor Grades flag long-term value plays with strong fundamentals

Narrative Indices reveal which sectors (AI, Memes, RWA, etc.) are surging

Bullish/Bearish Signals tell you when a token’s trend is flipping

Backtested accuracy gives confidence in the data

In short: TM doesn’t guess which altcoins will run—it calculates it.

Use Case: Finding the Next Runner

Say you’re on the hunt for a 10x altcoin.

You sort by Trader Grade > 90 and filter by market cap under $200M

$PAAL and $TNSR show high grades and bullish signals

You dive deeper into their Indices and support levels

You enter a position early, before the crowd notices

This is how Token Metrics turns chaos into clarity—and altcoin hype into strategy.

Why Altcoin Traders Need AI

Unlike BTC and ETH, altcoins:

React faster to social sentiment

Flip trends quickly

Rotate by sector frequently

Can double or halve in hours

Only AI can track these patterns across 1000s of tokens in real time.

Token Metrics was designed for exactly that.

Comparison: TM vs. Altcoin Scanners

Feature

Token Metrics

Manual Scanners

AI Grades on every token

✅ Yes

❌ No

Real-time signal tracking

✅ Yes

❌ No

Narrative + sector analytics

✅ Yes

❌ No

Backtested performance

✅ Yes

❌ No

Where others give you token lists, TM gives you actionable rankings.

Who Should Use It?

DeFi explorers looking for the next big thing

Narrative traders who ride the hottest sectors

Swing traders rotating between momentum coins

Telegram/Discord bot creators surfacing high-grade altcoins via API

If you trade altcoins, TM is not just useful—it’s essential.

Conclusion

Altcoins offer life-changing opportunities—but only if you catch them early and exit smart.

With Token Metrics, you can:

Discover breakout tokens

Validate entries with data

Exit before the dump

Stay ahead of narrative rotations

That’s why Token Metrics is the best AI crypto trading option for altcoin hunters in 2025.

0 notes

Text

Blockchain Infrastructure Explained: A Strategic View from Layer 0 to Layer 3

The blockchain is no longer solely associated with cryptocurrency. It now supports DeFi (decentralized finance), advancements in supply chains, frameworks for digital identification, and even the national digital currency of some countries. For companies operating within the UAE, where the government has taken the lead in fostering digitization and blockchain innovation, grasping the multi-layered blockchain infrastructure is far deeper than a mere technical endeavor—it’s a matter of business strategy.

We’ll look into each layer from 0 to 3 and we’ll cover everything from how each one functions to its importance for enterprises and developers, as well as how blockchain development services offered in UAE can position you ahead of competition in this emerging domain.

Why Understanding Different Blockchain Layers Is Important?

Now that we understand what will be tackled in this session, let's evaluate why this systematization makes sense. Think of blockchain infrastructure as a highway:

Layer 0 refers to ground and wiring— Serves as an underlying support for communications alongside interoperability.

Layer 1 refers to the road— The core activity zone where traffic movement happens.

Layer 2 is express lane construction: Aimed at boosting traffic scale along with speed.

Layer 3 equates vehicles users interact with on blockchain applications.

For businesses looking to take advantage of blockchain technology, having an understanding of this architecture provides help in decision making regarding investments, development strategy and approaches, scalability requirements, overall user experience, and more.

Layer 0: The Starting Point of the Blockchain Ecosystem

Layer 0 may be omitted from conversations about Blockchains but it is an important layer. It allows for inter-chain communication as well as protocol standardization and network interoperability. In less technical terms, different blockchains can communicate because of Layer 0.

What Comprises Layer 0?

Networking protocols - This includes enabling transfer of data between nodes (Computers).

Consensus mechanisms – Coordinates the validation processes for each node.

Interoperability frameworks – Polkadot and Cosmos are examples which integrate multiple layer 1 blockchains.

Validator infrastructure – Simplistically put, manages security and the operation of base chains.

Strategically Relevant Importance in the UAE

Interoperability is critical especially with the UAE’s delta aim to become a global center for blockchain technologies. Enterprise and Government use cases often require cross-platform integration for public service systems, financial systems or even logistics services domestically within or cross regionally into other adjacent countries. With professional blockchain development services based in the UAE that understand your ecosystem needs beyond silos leverage solutions built on zero layers technology.

Use Cases

Polkadot lets several blockchains known as parachains operate simultaneously while inter-communicating with each other.

Cosmos through its IBC Inter Blockchain Communication protocol makes possible the Internet of Blockchains.

Layer 1: The Base Protocol Layer

Decentralization starts with Layer 1 and covers the entire Bitcoin, Ethereum, Solana ecosystem among others. Slice it any way you want from tribalism to retail therapy, The magic decentralization gives birth to real whitelists on platforms such as bitcoin.

Core Functions of Layer 1

Transaction finality

Consensus and security

Native tokens ( e.g.. ETH, SOL,_LT)

Settle smart contracts.

self-sufficient ethereum is quite powerful but has always suffered from gas fee and congestion problems.

UAE’s Adoption Outlook

Supporting layer one for L1 users as backbone is powerful for UAE production levels and goal cores; however there are governmental testbeds based on identity tokenized payments employment systems that still require an exemplified proof skipping a legal naming barrier pondered in claim-sufficient mechanisms.

Choosing The Right Layer 1 Platform

Bounded waiting means being confined within a time limit. Every bounding areas allotted certain tasks for system verification require incrementation of accuracy for proving results that need precision under specified conditions which guaranteed attempts towards automation assist severely allocated outlined goals accessibility terms different configurational operational niches sought alter freely direct distance confirmed rounded ensure limits existing shifted frameworks pertain granting outside needs unbounded purposes but highly difficult permissible narrowing supporting needs fulfilling grace.

Layer 2: Scaling and Enhancing Layer 1

Building upon layer 1, layer 2 aims to improve the previously established frameworks. These protocols take an off-chain or sideline approach whereby they manage transactions through off-chain processing first, which temporarily lightens the load on the base chain, before settling back onto layer one.

Why Layer 2 Exists

To reduce gas fees

To increase transaction throughput

To improve user experience

Getting rid of undersized constraints makes layered blockchain systems accessible to mainstream platforms and applications. Imagine payments happening in real-time, users accessing services at scale with tangible fee reductions!

Common Layer 2 Technologies

Rollups (Optimistic and ZK-Rollups) – Merge several transactions into one single entry.

Plasma – Generates child chains for expedited transaction processing.

State Channels – Enable potential users to transact off-functionality and only submit the end state on main block after finalization of all activities.

UAE Perspective on Layer 2

Abu Dhabi and Dubai's fintech fusion with smart city initiatives orienting around blockchain gives a whole new meaning to scalability dynamics. For example, consider a real estate platform managing hundreds of tokenized assets that merge together or a DeFi application servicing thousands of daily interactions from users – both would rely on well-structured layer two integrations for performance efficiency!

Working with local blockchain developers ensures compliance to layering strategies offer seamless regulations alignment based on user habits and behavior flows tailored towards locals

Section 3: The Application Layer.

Third layer is the interaction with the end user which happens through decentralized applications, wallets, DAO institutions, Web 3.0 frontends, as well as NFT Levels and markets.

Examples of Third Layer Interaction

DeFi systems such as Uniswap and Aave

OpenSea for NFT trading

Identity services that are decentralized

Across border transaction systems (sending emails/ money without borders)

These applications are vulnerable to layer 1 and layer 2 performance when it comes to providing security and efficiency.

Importance To The Economy In UAE

With innovation happening across finance, logistics, tourism, governance frameworks, integrated intuitive applications based on blockchain technology are in high demand. Testing dApps for health certificates, digital notaries, west-ward facing visa platforms has been conducted by the UAE government.

Establishments focusing on these sectors need deeply researched smart contracts developed alongside user friendly interfaces so attractive UI/UX design can act as a window for a strong backend system. Providing blockchain development services in UAE complements perfectly within these two frames of cutting-edge protocols with blockchain based seamless user interface experiences.

The relation between the layers: All together now!

You should think of technology in “layers” that build upon one another…but do remember they explain everything using silos.

A L3 NFT marketplace might depend on some rollup at L2 to save gas fees and some L0 protocol which allows transfer of assets from one chain to another seamlessly. Whatever their final solution is for any blockchain problem; think about all layers executing flawlessly together to achieve success.For SMEs or startups in the UAE, the approach hinges on selecting and tailoring a combination of layers that accentuate your use case, budgetary limitations as well as compliance scope.

Key Questions When Selecting Blockchain Infrastructure

To align your business objectives with your blockchain strategy, consider these framing queries:

Security: What layers are allocated for security? Are the validators or miners sufficiently distributed?

Scalability: Is there an allowance for growth in users and transactions within the infrastructure?

Interoperability: Will your solution need cross-chain or multi-platform functionality?

Cost: Are costs relating to transactions and development within predetermined limits, controllable, and modest in nature?

Regulatory Fit: Do the applied protocols and solutions observe compliance with laws governing the UAE?

A local service provider would help you integrate international standards with local regulatory insights enabling blockchain development services in UAE meeting these concerns locally.

In Conclusion: It all Starts with The Stack when Strategically Adopting Blockchains.

The question is no longer whether to go with Ethereum or Bitcoin; it has now morphed to understanding the tech stack comprising Layer 0 to Layer 3 alongside your business goals. Whether it is creating a new fintech product, representing real-world assets with tokens, or developing a self-sovereign identity; such systems are scalable, secure, and designed for future innovations.

The UAE continues to fortify its stance as the foremost adopter and innovator of blockchain technology in the region. This is an opportunity to take action.

With over 9538 companies adopting blockchain technologies in these areas, it won’t be an exaggeration to refer to Dubai and UAE as ME’s hub for digital innovations. Trusting any other country’s infrastructure would give rise to malleability of anything and everything which is a problem that all other countries are facing. So it makes sense why many entrepreneurs are moving towards Blockchain Development Services Dubai. Looking for partnered solutions in TaaS? We have partnered with one of the most leading Blockchain development Services in UAE. With them, you can construct your visions from scratch ranging from base architecture all through cutting edge dApps.

0 notes

Link

0 notes

Text

Crypto Trading Signals Free in the UK

When it comes to the digital currencies, crypto trading signals have become indispensable tools for both novice and professional traders. These signals serve as real-time trade recommendations based on market trends, technical analysis, and AI-driven algorithms. For UK-based investors seeking free crypto trading signals, AndreOutberg.com has emerged as a leading destination for accuracy, consistency, and performance.

Why Crypto Trading Signals Matter in Today’s Market

With hundreds of cryptocurrencies on the market and volatility at an all-time high, reacting quickly to opportunities is essential. Crypto trading signals provide actionable insights that reduce guesswork and enhance decision-making. Traders can use them to:

Enter trades at optimal times

Manage risk more effectively

Maximize profits in bullish or bearish conditions

Maintain discipline with a guided approach

These benefits have led thousands of UK traders to rely on trusted providers like Andre Outberg.

Meet Andre Outberg – A Trusted Name in UK Crypto Trading

Andre Outberg is not just another signal provider. He is a seasoned crypto strategist with a proven track record of helping traders in the UK grow their portfolios with reliable crypto trade alerts. His platform, AndreOutberg.com, is known for its transparency, educational resources, and high win-rate trading signals.

What sets Andre apart?

Daily crypto trading signals for top coins like BTC, ETH, SOL, and XRP

Technical analysis charts and trading strategies

Free access for beginners and premium options for advanced traders

Active Telegram and Discord communities

What’s Included in the Free Crypto Signals Package

Traders who sign up on AndreOutberg.com receive access to:

1. Entry and Exit Points

Each signal includes precise buy and sell levels, reducing ambiguity in trade execution.

2. Stop-Loss and Take-Profit Zones

Risk management is non-negotiable. Andre provides clear SL/TP levels, helping users minimize losses and lock in gains.

3. Signal Accuracy

Historically, Andre’s signals have shown a success rate of 70-85%, depending on the market condition—placing his service among the most accurate free options in the UK.

4. Multiple Daily Updates

Stay ahead with real-time alerts throughout the day. Whether you’re a scalper, swing trader, or investor, you’ll always be informed.

5. Weekly Market Outlook

Andre sends out weekly reports with crypto market trends, projections, and token-specific insights.

Top Cryptocurrencies Covered in Andre’s Signals

Andre’s team scans the market and delivers top-tier trading signals on:

Bitcoin (BTC) – The king of crypto, with daily volatility and trading potential

Ethereum (ETH) – The smart contract giant with DeFi dominance

Ripple (XRP) – A preferred token for banking and cross-border payments

Solana (SOL) – A high-speed, low-fee alternative to ETH

Polygon (MATIC) – Popular for Layer 2 scaling

Cardano (ADA) – A long-term contender with strong fundamentals

How to Get Started with AndreOutberg.com

Getting access to Andre’s free crypto signals is straightforward:

Visit AndreOutberg.com

Sign up with a valid email or connect via Telegram

Access your dashboard where signals and charts are posted

Join the Telegram group to receive alerts instantly

Start trading using the shared strategies and stop-loss guidance

Advantages of Andre’s Free Crypto Trading Signals in the UK

Free of Cost, Rich in Value

Unlike many providers who gatekeep high-quality signals behind paywalls, Andre gives free access to high-accuracy alerts, making crypto trading more accessible for UK traders.

Tailored for UK Timezones

Signals are delivered according to UK market hours, ensuring traders don’t miss key setups during the day.

Backed by Data, Not Hype

All trade alerts are based on chart patterns, volume analysis, RSI, MACD, and Fibonacci levels — not emotion or speculation.

Mentorship-Driven Community

Andre doesn’t just share trades; he educates. Learn why a trade is triggered, what patterns are forming, and how to read candlesticks.

Beginner-Friendly Interface

The dashboard is built for ease of use, even if you’re new to crypto. You’ll find color-coded signals, historical performance, and clear charts.

What Makes AndreOutberg.com Stand Out in the UK Market

Verified Performance Reports

Andre posts monthly PnL sheets and trade history, allowing users to verify signal accuracy and learn from past trades.

Active Community Support

Join a thriving Telegram group with over 10,000 traders sharing insights, feedback, and real-time reactions to signals.

Zero Spam, Only Value

Unlike other providers who flood your inbox with upsells, Andre keeps it clean and signal-focused.

Premium Services for Advanced Traders

While the free plan is generous, serious traders can upgrade to Andre’s premium tier, which includes:

Advanced scalping signals for altcoins

One-on-one mentorship sessions

Portfolio management tips

Exclusive DeFi and NFT picks

Private Telegram/Discord access

This optional upgrade is ideal for traders seeking long-term consistency and edge.

Testimonials from UK Crypto Traders

“I started with zero trading experience. Andre’s signals made crypto simple, and I now make consistent profits every month.” – Lewis H., Manchester

“I’ve tried multiple groups before, but none offer the level of precision and integrity that Andre brings. Highly recommend!” – Chloe D., London

“His weekly analysis alone is worth more than what other groups charge for monthly access.” – Sam R., Birmingham

How Andre Maintains Consistency in Volatile Markets

Andre uses a hybrid approach combining manual technical analysis with AI-driven tools. This ensures each signal is:

Aligned with trend direction

Optimized for entry at support/resistance

Verified against multiple timeframes

Backtested for historical success

Conclusion: Join the UK’s Most Trusted Crypto Signal Provider Today

If you're in the UK and want to take your crypto trading to the next level without spending a penny, there’s no better place to start than AndreOutberg.com.

From timely trading alerts to educational mentorship, Andre Outberg is redefining the crypto experience for UK traders with precision, transparency, and value.

Start receiving free crypto trading signals now and gain the confidence you need to trade smart, not hard.

0 notes