#excise duty on petrol

Text

Nirmala Sitharaman's prediction for India's economy as IMF cuts global growth

Nirmala Sitharaman said growth will be among the top priorities of the Narendra Modi government and attention will be paid to sustaining the momentum that the Indian economy has got coming out of the Covid-19 pandemic.

Union finance minister Nirmala Sitharaman, who is in the US to attend the annual meetings of the International Monetary Fund (IMF) and the World Bank, on Tuesday forecasted India’s growth rate to be around 7 per cent this financial year.

Sitharaman said growth will be among the top priorities of the Narendra Modi government and attention will be paid to sustaining the momentum that the Indian economy has got coming out of the Covid-19 pandemic.

Her statement comes even as the IMF, in its latest projection, predicted India’s GDP growth to be 6.8 per cent — down from a January projection of 8.2 per cent and in July estimate of 7.4 per cent. However, despite the slowdown, India would remain the fastest-growing major economy.

The IMF said on Tuesday global growth is expected to slow further next year, downgrading its forecasts as countries grapple with the fallout from Russia’s invasion of Ukraine, spiraling cost-of-living and economic downturns.

The world economy has been dealt multiple blows, with the war in Ukraine driving up food and energy prices following the coronavirus outbreak, while soaring costs and rising interest rates threaten to reverberate around the globe.

“I am aware that growth forecasts around the world are being revised lower. We expect India’s growth rate to be around 7 per cent this financial year. More importantly, I am confident of India’s relative and absolute growth performance in the rest of the decade,” she said addressing a gathering in Washington.

Sitharaman, however, observed that the Indian economy is not exempt from the impact of the world economy. “No economy is,” she said.

“After the unprecedented shock of the pandemic, came the conflict in Europe with its implications for energy, fertiliser and food prices. Now, synchronised global monetary policy is tightening in its wake. So, naturally, growth projections have been revised lower for many countries, including India. This triple shock has made growth and inflation a double-edged sword,” Sitharaman said.

After the Russia-Ukraine conflict started in February 2022, there was a sharp increase in food and energy prices. India had to ensure that the rising cost of living did not lead to lower consumption through erosion of purchasing power.

“We addressed these multiple and complex challenges through a variety of interventions. One, India ramped up its vaccine production and vaccination. India has administered over 2 billion doses of vaccine produced domestically. Two, India’s digital infrastructure ensured the delivery of targeted relief Third, in 2022, after the conflict erupted in Europe, we ensured adequate availability of food and fuel domestically, lowered import duties on edible oil and cut excise duties on petrol and diesel. The central bank has acted swiftly to ensure that inflation did not get out of hand and that currency depreciation was neither rapid nor significant enough to lead to a loss of confidence,” the minister said.

Sitharaman said India is discussing with different countries to make Rupay acceptable in their nations.

“Not just that, the UPI (Unified Payments Interface), the BHIM app, and NCPI (the National Payments Corporation of India) are all now being worked in such a way that their systems in their respective country, however, robust or otherwise can talk to our system and the inter-operability itself will give strength for Indians expertise in those countries,” she said.

2 notes

·

View notes

Text

Petrol, Diesel Price today, December 6: Check latest fuel rates in your city

Petrol, Diesel Price today, December 6: Check latest fuel rates in your city

The Center reduced the excise duty on gasoline by Rs 8 per litre and on diesel by Rs 6 per litre in May of this year, which resulted in the last big decrease in fuel prices.

source https://zeenews.india.com/economy/petrol-diesel-price-today-december-6-check-latest-fuel-rates-in-your-city-2544542.html

View On WordPress

1 note

·

View note

Text

1. Advantages and disadvantages of various vehicle types: Different vehicle types have their own pros and cons. For instance, trucks are best for long-term cargo hauling due to their durability and ample room.

2. Ensuring goods’ safety while being transported: This involves proper packaging, securing the load, regular inspections, adhering to safety regulations, and using reliable transportation methods.

3. Steps to start a truck business: Key steps include performing market analysis, drafting a business plan, developing a brand, formalizing business registration, acquiring necessary licenses and permits, securing funding, setting pricing, and acquiring equipment.

4. Frequency of gasoline tax payment: The central and state governments of India levy taxes on petrol and diesel. The central authorities apply excise duty at the rates of Rs.19.90/litre and Rs.15.80/litre respectively.

5. Completing a contract with a factoring firm: This involves finding a reputable factor, providing them with information about your accounts receivable and customers, selling the approved invoice to the factor, and receiving a percentage of the total amount immediately.

6. Locating a driver: This can be done using the Device Manager in Windows, the Run window, the Command Prompt, or a free third-party utility.

7. Benefits of Hot Shot Loading: Hotshot deliveries are known for their cost-effectiveness, speed, flexibility, and efficient logistics.

8. Using the TMS to look for loads: Avaal TMS is a transportation management software that allows you to find and bid on loads.

9. Discussion with a broker: This involves understanding the broker’s requirements, negotiating terms, and building a professional relationship. It’s important to ask the right questions and provide accurate information about your capabilities and needs.

10. Definition of Rate Confirmation: A rate confirmation is a document that outlines the details of a shipment, including the rate, pickup and delivery locations, and other relevant information. It is agreed upon by both the carrier and the broker or shipper.

11. Bill of Lading: A Bill of Lading is a legal document between the shipper and carrier detailing the type, quantity, and destination of the goods being carried. It serves as a shipment receipt when the carrier delivers the goods at the predetermined destination.

12. Where to look for a job as a dispatcher: Job opportunities for dispatchers can be found on job search websites, company websites, industry-specific job boards, and networking events.

13. Papers necessary for freight clearance: These may include a Bill of Lading, Commercial Invoice, Packing List, and a Certificate of Origin. The exact documents required can vary depending on the nature of the goods and the specific regulations of the importing and exporting countries.

14. Nuances regarding contract termination: This refers to the specific conditions and procedures for ending a contract, which can vary based on the terms of the contract and the laws of the jurisdiction.

15. U.S. trucking industry jargon: This refers to the specific terms and phrases commonly used in the U.S. trucking industry. Examples include “deadhead” (traveling with an empty cargo load), “reefer” (a refrigerated trailer), and “bobtail” (a semi-truck operating without a trailer).

16. Lessons in Marketing: This could cover a wide range of topics, from understanding your target audience and developing a marketing strategy, to leveraging digital marketing tools and measuring the effectiveness of your marketing efforts.

#truckingindustry#trucking factoring#truckinglife#trucking company#avaal#ontario#trucking#truck load#canada#logistics

0 notes

Text

The Parallel Economy in India

Economy consists of economic system of a region in amalgamation with the social factors, the labor, capital and land resources; and the production, exchange, distribution, and consumption of goods and services of that area. Consumption, saving and investment are core components in the economy and determine market equilibrium.

Parallel economy - The functioning of any unaccounted and unsanctioned economic sector whose basic operations run parallel, however against the sanctioned or legitimate sector of the economy. Parallel economy is also known as ‘unaccounted economy’, illegal economy’, ‘subterranean economy’, ‘underground wealth’, ‘black economy’, ‘parallel economy’, ‘shadow economy’, ‘underground’ or ‘unofficial’ economy, or ‘unsanctioned economy’. The parallel economy incorporates all the forms of activities through which black income is generated and those which are usually not accounted for. The money circulated in parallel economy is known as the ‘Black Money’.

Parallel economy negatively impacts the economic system of a country. Due to this, the GDP is reduced to nearly half of what should have been in the absence of the unaccounted component of economy. In other words, the volumes of the accounted and unaccounted components of the Indian economy are almost equal. Also, the black money generated in parallel economy accentuates the inequalities in income and wealth and deepens divide between rich and poor.

There are two possible sources of black money:

Source of income is itself illegitimate, ie. Income from an illegal activity like smuggling, bribery, trafficking etc.

Source of income is legitimate but it is concealed from taxation.

Causes of Black Money Generation

There are many reasons for the creation of back money in India. Some of them are as follows:

1. Controls and licensing system - Before the economic reforms, the private sectors were allowed to produce goods only with a certified license. This gave birth to the License Raj, wherein the license inspectors resorted to corrupt practices to provide licenses. This led to a huge proliferation in black money. Even today, regulatory authorities like the TRAI are known to resort to corrupt practices while dealing with private players.

2. Higher Rates of Taxes - Higher tax rates result into a tendency of tax evasion among the tax payers. Tax evasion is common in income tax, corporate tax, corporation tax, union excise duties, custom duties, sales tax , etc. As per 2022 statistics, only 5% of the Indians are tax-payers.

3. Ineffective enforcement of tax laws and corruption in Tax departments leading to tax evasion even by rich sections of India.

4. Funding of political parties through black money with the objective of influencing the government in power in order to receive undue advantages.

5. Inflation: The addition in prices of commodities like petrol, etc. in international market, boost in prices of commodities due to increase in duties and taxes imposed by the government, the artificial demand created by people with unaccounted or black money- all cause inflation which in turn leads to the circulation and hence creation of black money.

6. The reluctance of governments to bring large agricultural earnings in the ambit of income tax and to reduce the welfare dependent population base has also contributed to creation of black money.The black money accrued from other sources can be easily transformed into white by viewing it on the agricultural returns account.

7. Privatization and Public Private Partnerships (PPP) have a huge scope for generation of black income by ministers and bureaucrats.

8. Activities like smuggling, property deals, bribery,extortion, concealment of income by professionals, etc. also creates black money.

As a result, the circulation of enormous amounts of black income incessantly results in a flourishing parallel economy.

Impact of Black Income on the Indian Economy

Generation of black income, and thereby establishment of parallel economy has been creating the following serious impacts on the social and economic system of the country.

Black income causes underestimation of GDP. The volume of Black economy in India is assessed as being equal to normal economy.

The direct effect of black income is the net loss of tax revenue to the state exchequer, thus resulting in poor levels of development, and lesser government expenditure.

Actual assessment of economy is never achieved

Creates an invisible demand in the market, thus causing inflation.

Black money has resulted in the diversion of resources for the purchase of real estate and luxury housing.

Transfer of funds from India to foreign countries.

The availability of black incomes makes people unduly rich.

Black money causes psychological stress to honest tax-payers and devalues the virtues like hard-work and honesty.

Leads to a decline in moral standards in the society.

Thus, the existence of parallel economy distorts and disrupts the normal functioning of a country, the economic planning does not bear desired fruits and also the ideal pace of development and growth of the country is never achieved.

Government Initiatives

The government has taken a number of steps to curb black money.

Demonetization - A process of discontinuing currency notes in circulation.Demonetization was pursued in 1946, 1978 and in 2016, however, this process has not been successful. It was expected that only the white money will come back, while the black money will be rendered useless. On the contrary, In 1978, 99.3% of the total currency notes, while in 2016, 99.8% of the total currency notes came back to the RBI, even though huge sums of currency notes had been destroyed. This meant that even after destruction of huge sums of currency, almost all notes came back and the amount and holders of black money were not revealed or caught. Almost whole volume of black money was successfully converted into white. Moreover, rolling out of Rs 2000 notes in 2016 made it easier to hoard black money.

Voluntary Disclosure of Income Scheme - Introduced in 1997, the scheme allowed anyone to declare and regularise black money by paying taxes, and with a promise of no legal action against the entity in future.The non-tax compliants declared undisclosed incomes and assets, and ended up paying lesser than normal taxes, with all immunities. The income declared under VDIS had been Rs 33,000 crore, however, the actual value of the assets declared was double the value considered for taxation and also the taxes were paid at less than 50% of the normal rate, with zero interest and penalties. Thus, the scheme was nominally successful. Thus, in a way, the VDIS motivated people to evade taxes and wait for such schemes in future.

Income Declaration Scheme, 2016 - It was proposed by the then Finance Minister Arun Jaitley and launched by the Income Tax Department. The Scheme provides an opportunity to come forward and declare the undisclosed income and pay tax, surcharge and penalty equal to 45% of the undisclosed income declared. Declarations were to be made from 1st June, 2016 to 30th September, 2016. Though the scheme saw a collection of Rs 65,250 Crore, a record in the history of tax collection, only a small portion of big earners with black money came forward and declared a very small portion of their wealth.

Special Bearer Bond Scheme - In 1981, the Government issued Special Bearer Bonds under a scheme which allowed people to invest their black money in these bonds and enjoy freedom from investigations and prosecutions for tax evasion in respect of their holdings of these bonds. The face value of the bond was Rs10,000 and maturity was for 10 years. Anyone could buy the bonds without inviting any scrutiny from the government. The income tax department was prohibited from harassing buyers and the bond could be even bought with anonymity. If one had purchased these bonds in 1981 for Rs10,000, he could redeem it in 1991 for Rs12,000.

All of the aforesaid schemes have hardly fetched Rs. 5000 crore over a period of years. The main drawback in these schemes is that they give a mere cosmetic effect to the problem of black money already created but without addressing the root cause of generation of black money. Governments should understand the importance of reducing tax slabs, improving tax structure and widening the tax base. These are long term measures which will prevent tax evasion and reduce the number of dependents in the Indian population.

India has tried to combat tax evasion by requiring an identification number for all major financial deals. The Permanent Account Number (PAN) card, issued by the Income tax Department is a compulsory 10‐character number issued to taxpayers by the tax department which is needed during any economic transactions such as buying a car or property, investing in the stock market or converting Indian rupees to foreign currency.

The card was issued in order to prevent tax evasion by individuals and entities as it links all financial transactions made by a particular individual or entity. In this way, the Income Tax Department has a detailed record of all major transactions for tax purposes. Indian citizens who are residents of the country as well as NRI (Non Resident Indians), OCI (Overseas Citizen of India) cardholders, PIO (Person of Indian Origin) as well as foreigners who come under the purview of the Income Tax Act of 1961 are eligible to apply for a PAN card. Firms and companies, governments and minors too can apply for a PAN card. But many transactions, especially those related to property, are conducted in cash and are unlikely to be reported.

Money Laundering

Criminal acts generate a huge profit in quick time for the individual or group that carries out the act. Money laundering is the processing of legitimizing these criminal proceeds so that their origin is disguised and they appear to be coming from a legitimate source. This process is of critical importance, as it enables the criminal to enjoy these profits without jeopardising their source. The dirty money from the criminal activity is “laundered” it to make it look clean.

Illegal activities include arms sales, smuggling, activities of organised crime, including for example terrorism, drug trafficking and prostitution rings, cyber-crime, embezzlement, insider trading, bribery etc.

Some money-laundering methods include:

Smurfing or structuring- This is the process of breaking up large chunks of cash into multiple small deposits, and spreading them over many different accounts, to avoid detection.

Investing in commodities such as gems and gold that can be moved easily to other jurisdictions

Investing in valuable assets such as real estate, cars, etc.

Gambling

Counterfeiting goods

Using cryptocurrencies

Using shell companies (inactive companies or corporations that essentially exist on papers only)

Through the use of currency exchanges, wire transfers, and “mules”—cash smugglers, who sneak large amounts of cash across borders and deposit them in foreign accounts, where money-laundering enforcement is less strict.

In response to mounting concern over money laundering, the Financial Action Task Force on money laundering (FATF) was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response. One of the first tasks of the FATF was to develop Recommendations, 40 in all, which set out the measures national governments should take to implement effective anti-money laundering programmes.

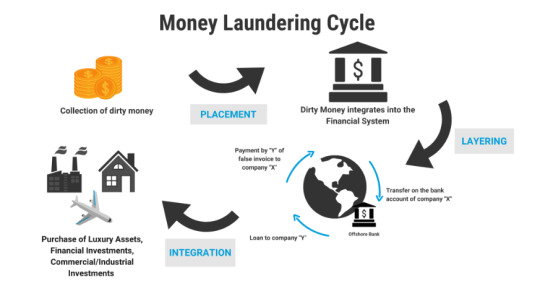

Stages in Money Laundering

1. Placement - Introducing illegal profits into the financial system. This might be done through smurfing, or by purchasing a series of monetary instruments (cheques, money orders, etc.) that are then collected and deposited into accounts at another location.

2. Layering - A series of conversions, transactions or movements of the funds to distance them from their source. The funds might be channelled through the purchase and sales of investment instruments, or the launderer might simply wire the funds through a series of accounts at various banks across the globe. This use of widely scattered accounts for laundering is especially prevalent in those jurisdictions that do not co-operate in anti-money laundering investigations. In some instances, the launderer might disguise the transfers as payments for goods or services, thus giving them a legitimate appearance.

3. Integration -The funds re-enter the legitimate economy.

Social Impacts of Money Laundering

The possible social and political costs of money laundering, if left unchecked or dealt with ineffectively, are serious.

Organised crime can infiltrate financial institutions, acquire control of large sectors of the economy through investment, or offer bribes to public officials and indeed governments.

The economic and political influence of criminal organisations can weaken the social fabric, collective ethical standards, and ultimately the democratic institutions of society.

Most fundamentally, money laundering is inextricably linked to the underlying criminal activity that generated it. Laundering enables criminal activity to continue.

Measures to Tackle Money Laundering

In the wake of such dramatic transformation of the factors that lead to the generation of black money and the globalized development that facilitates them, the Government of India has resorted to a five-pronged strategy, which consists of the following:

Joining the global crusade against black money

Creating appropriate legislative framework

Setting up institutions for dealing with illicit money

Developing systems for implementation

Imparting skills to personnel for effective action.

Prevention of Money Laundering Act

The Prevention of Money Laundering Act (PMLA), 2002 was enacted in January, 2003. The Act came into force with effect from 1st July, 2005.

The act defines offence of money laundering as whosoever directly or indirectly attempts to indulge or knowingly assists or is actually involved in any process or activity connected with the proceeds of crime shall be guilty of offence of money-laundering. It prescribes obligation of banking companies, financial institutions and intermediaries for verification and maintenance of records of the identity of all its clients and also of all transactions and for furnishing information of such transactions in prescribed form to the Financial Intelligence Unit-India (FIU-IND). It empowers the Director of FIU-IND to impose fine on banking company, financial institution or intermediary if they or any of its officers fails to comply with the provisions of the Act as indicated above. FIU-IND is an independent body reporting directly to the Economic Intelligence Council (EIC) headed by the Finance Minister.

PMLA empowers certain officers of the Directorate of Enforcement (ED) to carry out investigations in cases involving offence of money laundering and also to attach the property involved in money laundering.

The PML Act seeks to combat money laundering in India and has three main objectives:

To prevent and control money laundering

To confiscate and seize the property obtained from the laundered money; and

To deal with any other issue connected with money laundering in India.

The Act also proposes punishment under sec.4.

Enforcement Directorate (ED)

The Directorate of Enforcement was established in the year 1956 with its Headquarters at New Delhi. It is the principal agency responsible for investigation and prosecution of cases under the PML, and enforcement of the Foreign Exchange Management Act, 1999 (FEMA).

The Directorate is under the administrative control of Department of Revenue for operational purposes and for policy issues pertaining to PML Act. While the policy aspects of the FEMA, its legislation and its amendments are within the purview of the Department of Economic Affairs.

The Directorate has 10 Zonal offices each of which is headed by a Deputy Director and 11 sub Zonal Offices each of which is headed by an Assistant Director.

Zonal offices- Mumbai, Delhi, Chennai, Kolkata, Chandigarh, Lucknow, Cochin, Ahmedabad, Bangalore & Hyderabad

Sub Zonal offices - Jaipur, Jalandhar, Srinagar, Varanasi, Guwahati, Calicut, Indore, Nagpur, Patna, Bhubaneshwar & Madurai.

Egmont Group

Financial Intelligence Unit-India (FIU-IND) is a member of the Egmont Group, an international organization for stimulating co-operation among FIUs. The Egmont Group serves as an international network fostering improved communication and interaction among FIUs. The goal of the Egmont Group is to provide a forum for FIUs around the world to improve support to their respective governments in the fight against money laundering, terrorist financing and other financial crimes.

India became member of the Egmont Group in May, 2007.

FIU-IND is the national agency responsible for receiving, processing, analysing, and disseminating information relating to suspect financial transactions. It is an independent body reporting to the Economic Intelligence Council headed by the Finance Minister. For administrative purposes, the FIU-IND is under the control of the Department of Revenue, Ministry of Finance.

Under the Rules issued under the PMLA, the following types of reports have been prescribed for the reporting entities:

Cash Transaction Reports (CTRs)

Suspicious Transaction Reports (STRs)

Counterfeit Currency Reports (CCRs)

Non-Profit Organizations Transaction Reports (NTRs)

The Asia/Pacific Group on Money Laundering (APG)

The Asia/Pacific Group on Money Laundering (APG) was officially established as an autonomous regional anti-money laundering body in February 1997 at the Fourth (and last) Asia/Pacific Money Laundering Symposium in Bangkok , Thailand . The APG was formed with the objective to facilitate the adoption, implementation and enforcement of internationally accepted anti-money laundering and anti-terrorist financing standards set out in the recommendations of the Financial Action Task Force (FATF).

The APG's role includes assisting jurisdictions in the region to enact laws dealing with the proceeds of crime, mutual legal assistance, confiscation, forfeiture and extradition. It also includes the provision of guidance in setting up systems for reporting and investigating suspicious transactions and helping in the establishment of financial intelligence units.

India became a member of the APG in March, 1998.

Financial Action Task Force (FATF)

The Financial Action Task Force (FATF) is an inter-governmental body which sets standards, and develops and promotes policies to combat money laundering and terrorist financing.

The Forty Recommendations and Nine Special Recommendations of FATF provide a complete set of counter-measures against money laundering covering the criminal justice system and law enforcement, the financial system and its regulation, and international co-operation. These Recommendations have been recognized, endorsed, or adopted by many international bodies as the international standards for combating money laundering.

India became a member of the FATF in 2010.

0 notes

Text

Cigarette Prices in Australia | thetobaccomarketaustralia.com

Cigarette prices in Australia are among the highest in the world. This is because of high taxes. Taxes cover costs of production, advertising and distribution.

A survey of regular smokers asked them to nominate the price point at which they would consider seriously trying to quit smoking. Most respondents did not respond or stated that they would continue to smoke regardless of price increases.

Cheapest Cigarettes

As in other countries, the level and type of tobacco duties, fees and taxes have been the main determinant of retail prices of cigarettes over time. This has been due to the fact that these charges are passed on in varying amounts to tobacco growers, manufacturers, wholesalers and retailers.

In 2023, the Australian government announced a dramatic increase in tobacco excise rates. The price of a standard pack of cigarettes will rise from $35 to $50 in three years. This is a huge increase for smokers and could prompt them to consider switching to a healthier alternative such as vaping.

This is driving the demand for cheapest cigarettes in Australia. Many people are buying cigarettes illegally from China, where factories are producing millions of packs each year to meet the demand for low-cost tobacco in developed countries like Australia. This is a lucrative industry for organized crime groups and terrorist organizations. It is estimated that up to a fifth of Australian smokers are purchasing their cigarettes from the black market.

Cheapest Brands

A'super-value' market segment has emerged in the factory-made cigarette sector, offering prices substantially lower than recommended retail price (RRP) and even less than supermarket discounting. In addition, the availability of cigarettes in large single packs provided a range of pricing configurations that offered cheaper per stick prices than those of smaller packs.

Neighborhood variations in cigarette prices may reflect local tobacco industry responses to price increases or demand-driven trends. Further investigation is needed to understand the role of neighborhood characteristics in determining these patterns.

In the past, increasing cigarette taxes has helped reduce smoking rates in Australia and other countries. However, the high price of Australian cigarettes remains unaffordable for many regular smokers. This is driving a surge in demand for imported cheap cigarettes. Some smokers are using the internet to order cigarettes from overseas, and are gift wrapping them to circumvent customs inspections. Others are turning to vaping, which can be just as effective as a conventional cigarette but is much more affordable.

Cheapest Places to Buy

Cigarette prices in Australia are among the highest in the world. A pack a day smoker will spend over $900 per month or $10,000 a year – ouch!

National survey data show that rising tobacco taxes are the main motivation for many Australians trying to cut down or quit. Research from the University of Queensland has shown that the price of cigarettes has overtaken health concerns as the number one motivator.

Petrol station stores tended to sell factory-made (FM) cigarettes at slightly higher prices than recommended retail price (RRP). In contrast, supermarkets and tobacconists sold FM cigarettes at much lower prices – with consistent discounting. Per stick sale prices were also significantly cheaper in supermarkets than in petrol stations and tobacconists. A clear gradient of per stick price was observed across the market segments – from super-value to mainstream and premium brands. In addition, a gap between the cheapest FM and cheapest RYO 0.7 gram-cigarettes progressively widened over time.

Cheapest Online

The prices smokers report paying for tobacco store online products have been tracked in some studies. This approach can provide important insights into price as experienced by consumers. It can also help to examine the relative affordability of cigarettes compared to other goods and services, and smokers’ income-earning capacity.

Reported prices for FM cigarettes tended to be lower than the recommended retail prices published by trade associations. This gap was more pronounced for cheap cigarettes online in Australia, and the degree of difference grew over time.

In-shop studies conducted in major cities have shown that supermarkets tended to offer the lowest per-stick prices for cigarettes sold in cartons. These prices were substantially lower than those available in petrol stations and independent retailers.

In addition, lighter cigarettes tended to be more affordable than heavier ones, due to the combination of an excise tax based on weight with ad valorem fees based on wholesale value. These factors have driven the introduction of large pack sizes in Australia, unlike most other countries that rely solely on excise taxes.

#cheapest cigarettes in Australia#online tobacco store Australia#tobacco store online#cheap cigarettes online in Australia

0 notes

Text

Petrol prices in Delhi are consistent for many days. As compared to nearby cities or states of Delhi. It is important to check the petrol price in Delhi regularly, especially if you are going for a vacation, for a long drive. We always provide you with exact prices from authentic sources.

Petrol prices in Delhi are changing daily, we always keep you updated which can help you to save money in comparison to a nearby location. For low fuel prices, It is hoped that the government can reduce excise duties, so as to enable rates to become cheaper in the coming days.

0 notes

Text

Chhattisgarh News

Latest Chhattisgarh news on September 05, 2023.

Today's Petrol Price in Chhattisgarh

The price of petrol in Chhattisgarh as of September 5, 2023, is 103.53. The price has risen since yesterday. Petrol prices were relatively stable in comparison to the previous month. Every day at 6 a.m., the price of gasoline is changed. Dynamic gasoline pricing was implemented in June 2017 to promote transparency and limit speculative activities.

Petrol prices in Chhattisgarh are impacted by a variety of factors, including Brent crude oil prices, the rupee to US dollar exchange rate, geopolitical concerns such as conflict, which can generate market disequilibrium, supply-chain issues, and so on. Furthermore, internal factors such as changes in excise duty or state taxes, changes in demand, and so on have an impact on petrol prices. When calculating fuel prices in Chhattisgarh, gross refining margins and dealer charges are also taken into account.

During September 2023, petrol prices in Chhattisgarh hovered around 104. It ranged between 103.52 and 103.53. Petrol prices reached a high of and a low of in September 2023.

0 notes

Text

Mega subsidies for fossil fuels

Fossil fuels are massively subsidised worldwide. The IMF started calculating and arrived at a total subsidy amount of 7 trillion dollars.[1]

Kerosene, the fuel used to power aircraft, is not subject to excise duties. Belgium has permanently reduced VAT on gas. Diesel for the professional market enjoys a lower excise duty. Fuel cards for company cars are fiscally advantageous.

These are just a few of the many ways in which fossil fuels are handled with kid gloves by the tax authorities. But Belgium is not the only country where this happens. Worldwide, the burning of fossil fuels yield $ 7,000 billion more to the tax authorities than is currently the case, the IMF has calculated. That is 7.1 percent of global worldwide GDP.

Of that amount, 18 percent is awarded in the form of explicit subsidies: direct financial interventions in the selling price. In 2020, those explicit subsidies still accounted for USD 500 billion, compared to USD 1,300 billion last year. This also includes government interventions to compensate the effects of the high energy price. Think of the 'basic packages' that the Belgian government paid to energy consumers last winter. They are expected to decrease again

"Efficient" price

The IMF also considers unaccounted for costs for global warming, traffic congestion and air pollution as subsidies. It is about the difference between what petrol costs at the pump and what petrol would have to cost to slow down consumption enough to limit warming to 1.5 degrees. The latter price is called the 'efficient' price. Last year, 80 percent of all coal was sold at less than half the efficient price.

These implicit subsidies will continue to rise, the IMF expects. This is because the use of fossil fuels is still increasing, especially in non-Western countries. In those countries, the impact on global warming and air pollution is greater. The total grant amount is expected to exceed 8 percent of global GDP by 2030.

If all fuels were sold at efficient prices, for example by introducing a global carbon tax, it would generate a huge sum: $4,4 trillion or 3.6 percent of global GDP. Driving, flying and heating would therefore become much more expensive. But if the proceeds are used to reduce labour costs, for example, the effect may be neutral on balance. In that case, CO emissions would fall by 43 percent in the next 7 years. It would also prevent 1.6 million premature deaths from air pollution. “Even if you don't factor in the climate benefits, reforming fuel prices is beneficial because of cleaner air and elimination of price distortions.”

The most extreme examples of subsidising fossil fuels can be found in countries such as Saudi Arabia and Iran. Because those countries produce a lot of oil, gasoline and diesel cost very little at the pump, often even less than it costs to pump, refine and transport the oil. In European countries such as Germany, France and Italy, the price of a litre of petrol is close to the efficient price, and sometimes even slightly above it.

But for coal and gas, the European countries also fail to achieve the efficient price. However, the largest subsidies are awarded in non-Western countries. Indonesia, Turkey and China would have to multiply the price of coal or gas to arrive at an efficient price.

Europe is still a relatively good student, the IMF notes. The EU accounts for 310 billion of the total amount. That is less than India or Russia. The US comes out at 760 billion. By far the largest subsidy provider is China, with USD 2,200 billion.

Less than the Netherlands, more than Denmark

The IMF has performed calculations for 170 individual countries. So also for Belgium. The explicit subsidies (direct interventions in the selling price) mainly concern the gas market. Last year it was 4.1 billion dollars (3.8 billion euros). Implicit subsidies (including reduced taxes, but also climate and pollution costs that have not been taken into account) are particularly relevant for diesel: 4.6 billion euros. The implicit subsidies total 8.9 billion euros. Less than the Netherlands (13.9 billion euros), but more than Denmark (2.2 billion).

For Germany, the IMF has also calculated what the effect of an optimal fuel price reform would be. If all fossil fuels were sold at “efficient” prices, it would cost $12 billion but generate $18 billion in environmental benefits. There would be 20 percent fewer deaths from air pollution, and 15 percent fewer greenhouse gases.

Source

Ruben Mooijman, Megasubsidies voor fossiele brandstoffen, in: De Standaard, 25-08-2023, https://www.standaard.be/cnt/dmf20230824_96591052

[1] This paper provides a comprehensive global, regional, and country-level update of: (i) efficient fossil fuel prices to reflect supply and environmental costs; and (ii) subsidies implied by charging below efficient fuel prices. Globally, fossil fuel subsidies were $7 trillion in 2022 or 7.1 percent of GDP. Explicit subsidies (undercharging for supply costs) have more than doubled since 2020 but are still only 18 percent of the total subsidy, while nearly 60 percent is due to undercharging for global warming and local air pollution. Differences between efficient prices and retail fuel prices are large and pervasive, for example, 80 percent of global coal consumption was priced at below half of its efficient level in 2022. Full fossil fuel price reform would reduce global carbon dioxide emissions to an estimated 43 percent below baseline levels in 2030 (in line with keeping global warming to 1.5-2oC), while raising revenues worth 3.6 percent of global GDP and preventing 1.6 million local air pollution deaths per year. Accompanying spreadsheets provide detailed results for 170 countries. https://www.imf.org/en/Publications/WP/Issues/2023/08/22/IMF-Fossil-Fuel-Subsidies-Data-2023-Update-537281#:~:text=Globally%2C%20fossil%20fuel%20subsidies%20were,warming%20and%20local%20air%20pollution.

0 notes

Text

Government policies and taxation affecting fuel prices in Haryana

Fuel prices in Haryana are subject to government policies and taxation, which significantly impact the cost of transportation and daily life. The government imposes taxes such as excise duty, value-added tax (VAT), and cess on fuels like petrol and diesel. These taxes are crucial sources of revenue for the state. Additionally, fuel prices are influenced by global crude oil prices, currency exchange rates, and transportation costs. Fluctuations in these factors can lead to variations in fuel prices. As a result, the government's taxation policies and external market conditions play a vital role in determining the fuel prices in Haryana, affecting the budget of its residents and the overall economy.

0 notes

Link

#BJP-ruledstates#centralgovernment#exciseduty#fuelprices#gascylinder#HardeepSinghPuri#internationalcrudeoilprices#LPGprices#NaturalGas#oilmarketingcompanies#Petroleum#UnionMinister

0 notes

Text

Petrol and diesel price may rise as duty hiked by Rs 3 per litre over global prices

Government has taken the bait provided by unusually low global oil prices to raise excise duty on petrol and diesel to raise revenue that has been severely impacted by a slowing economy.

View On WordPress

0 notes

Text

What��s in Store for Oil Stocks After the Latest IEA Forecast?

The stock markets have had a shaky start in 2023, fuelled further by the routing of Adani shares with the release of the scathing Hindenburg report. Not far behind, various commodities, such as oil, have had a shaky start, as the jury is still out on China’s recovery.

The IEA Report

Against this backdrop, the IEA has released its monthly report stating a rise in global demand for oil by two million barrels per day, which will take the world's oil consumption to 101.9 million bbl. Even more so, it expects the oil markets to see a surplus as the Russian supply continues to be robust.

With China opening its doors again and the USA all set to refill its strategic reserves, the oil demand will remain buoyant in the first half of 2023. However, this may change after June, with the kicking in of the sanctions on Russian oil.

Moreover, monetary tightening and recessionary fears may play a spoilsport for future oil demand. Besides, Russia has announced its plans to cut down oil output by a million barrels per day (bbl/d), against the IEA’s initial estimates of 1.6 million bbl/d.

But how will it pan out for oil stocks in India?

The Fortune Favours the Oil Conglomerate

With the oil demand set to hit a record high in FY23, refining margins could improve significantly, benefiting Reliance Industries (RIL). Besides, RIL’s SEZ refinery is already exempt from the levy of windfall taxes and additional excise duty (SAED) charges.

Moreover, refiners have seen their margins squeezed owing to the waning diesel spreads. This has been aggravated by the EU’s decision to build its stockpile before the sanctions on Russian gas and oil go into effect. The rise in demand, complemented by slower refinery throughput, will bode well for refining margins.

OMCs’ Stars Lack Sheen

But these positives are unlikely to flow for oil-marketing companies (OMCs) that are already reeling under heavy losses from 2022. This is because, despite an elevation in crude prices, the Indian government forced their hand by not allowing for a corresponding rise in retail prices.

Subsequently, while the PSU OMCs (HPCL, BPCL, and IOCL) did experience strong top lines in FY22, their bottom lines left a lot to be desired. This was reflected in the 20% and 10% drops in HPCL and BPCL share prices in the last year, respectively.

On an aggregate level, OMCs have already posted losses exceeding Rs. 27,000 crore in the first six months of FY23. This is despite the moderation in oil prices over the strong Russian supply and the EU’s stockpiling efforts. They have stated under-recoveries totalling Rs. 1.1 lakh crores from petrol and diesel sales that have been cross-subsidised with ATF and naphtha sales.

Having said that, BPCL may still be able to post better performance, considering its high refining-to-marketing ratio. Moreover, relative to its peers, BPCL has better ROCE fundamentals.

Additionally, IOC’s shares may remain resilient, as its business model is more refining-driven vis-à-vis HPCL and BPCL, thereby making its fortunes less dependent on marketing margins. But heavy debt pileups—the IOC’s gross debt went up by 30%—can be a cause for concern.

Finally, with the nation set to go to elections next year, the chances of retail price hikes seem bleak, which can further dampen the shine of oil companies in the stocks market.

Are you planning to invest in the stock market? Build your portfolio today with a free Demat account on Angel One’s smart app.

0 notes

Text

Check Fuel Prices in Lucknow, Gandhinagar And Other Cities on January 16

Check Fuel Prices in Lucknow, Gandhinagar And Other Cities on January 16

Fuel Rates On January 16, 2023: Check Petrol And Diesel Prices In Your City Today.

Ever since the government slashed the excise duty on the two primary automotive fuels in the country on May 21, 2022, a price freeze has been in place.

India is on track to bolster its energy security with research in 20 per cent ethanol-blended petrol and talks of purchasing oil from Guyana in the long term.…

View On WordPress

0 notes

Text

The Parallel Economy in India

Economy consists of economic system of a region in amalgamation with the social factors, the labor, capital and land resources; and the production, exchange, distribution, and consumption of goods and services of that area. Consumption, saving and investment are core components in the economy and determine market equilibrium.

Parallel economy - The functioning of any unaccounted and unsanctioned economic sector whose basic operations run parallel, however against the sanctioned or legitimate sector of the economy. Parallel economy is also known as ‘unaccounted economy’, illegal economy’, ‘subterranean economy’, ‘underground wealth’, ‘black economy’, ‘parallel economy’, ‘shadow economy’, ‘underground’ or ‘unofficial’ economy, or ‘unsanctioned economy’. The parallel economy incorporates all the forms of activities through which black income is generated and those which are usually not accounted for. The money circulated in parallel economy is known as the ‘Black Money’.

Parallel economy negatively impacts the economic system of a country. Due to this, the GDP is reduced to nearly half of what should have been in the absence of the unaccounted component of economy. In other words, the volumes of the accounted and unaccounted components of the Indian economy are almost equal. Also, the black money generated in parallel economy accentuates the inequalities in income and wealth and deepens divide between rich and poor.

There are two possible sources of black money:

Source of income is itself illegitimate, ie. Income from an illegal activity like smuggling, bribery, trafficking etc.

Source of income is legitimate but it is concealed from taxation.

Causes of Black Money Generation

There are many reasons for the creation of back money in India. Some of them are as follows:

1. Controls and licensing system -��Before the economic reforms, the private sectors were allowed to produce goods only with a certified license. This gave birth to the License Raj, wherein the license inspectors resorted to corrupt practices to provide licenses. This led to a huge proliferation in black money. Even today, regulatory authorities like the TRAI are known to resort to corrupt practices while dealing with private players.

2. Higher Rates of Taxes - Higher tax rates result into a tendency of tax evasion among the tax payers. Tax evasion is common in income tax, corporate tax, corporation tax, union excise duties, custom duties, sales tax , etc. As per 2022 statistics, only 5% of the Indians are tax-payers.

3. Ineffective enforcement of tax laws and corruption in Tax departments leading to tax evasion even by rich sections of India.

4. Funding of political parties through black money with the objective of influencing the government in power in order to receive undue advantages.

5. Inflation: The addition in prices of commodities like petrol, etc. in international market, boost in prices of commodities due to increase in duties and taxes imposed by the government, the artificial demand created by people with unaccounted or black money- all cause inflation which in turn leads to the circulation and hence creation of black money.

6. The reluctance of governments to bring large agricultural earnings in the ambit of income tax and to reduce the welfare dependent population base has also contributed to creation of black money.The black money accrued from other sources can be easily transformed into white by viewing it on the agricultural returns account.

7. Privatization and Public Private Partnerships (PPP) have a huge scope for generation of black income by ministers and bureaucrats.

8. Activities like smuggling, property deals, bribery,extortion, concealment of income by professionals, etc. also creates black money.

As a result, the circulation of enormous amounts of black income incessantly results in a flourishing parallel economy.

Impact of Black Income on the Indian Economy

Generation of black income, and thereby establishment of parallel economy has been creating the following serious impacts on the social and economic system of the country.

Black income causes underestimation of GDP. The volume of Black economy in India is assessed as being equal to normal economy.

The direct effect of black income is the net loss of tax revenue to the state exchequer, thus resulting in poor levels of development, and lesser government expenditure.

Actual assessment of economy is never achieved

Creates an invisible demand in the market, thus causing inflation.

Black money has resulted in the diversion of resources for the purchase of real estate and luxury housing.

Transfer of funds from India to foreign countries.

The availability of black incomes makes people unduly rich.

Black money causes psychological stress to honest tax-payers and devalues the virtues like hard-work and honesty.

Leads to a decline in moral standards in the society.

Thus, the existence of parallel economy distorts and disrupts the normal functioning of a country, the economic planning does not bear desired fruits and also the ideal pace of development and growth of the country is never achieved.

Government Initiatives

The government has taken a number of steps to curb black money.

Demonetization - A process of discontinuing currency notes in circulation.Demonetization was pursued in 1946, 1978 and in 2016, however, this process has not been successful. It was expected that only the white money will come back, while the black money will be rendered useless. On the contrary, In 1978, 99.3% of the total currency notes, while in 2016, 99.8% of the total currency notes came back to the RBI, even though huge sums of currency notes had been destroyed. This meant that even after destruction of huge sums of currency, almost all notes came back and the amount and holders of black money were not revealed or caught. Almost whole volume of black money was successfully converted into white. Moreover, rolling out of Rs 2000 notes in 2016 made it easier to hoard black money.

Voluntary Disclosure of Income Scheme - Introduced in 1997, the scheme allowed anyone to declare and regularise black money by paying taxes, and with a promise of no legal action against the entity in future.The non-tax compliants declared undisclosed incomes and assets, and ended up paying lesser than normal taxes, with all immunities. The income declared under VDIS had been Rs 33,000 crore, however, the actual value of the assets declared was double the value considered for taxation and also the taxes were paid at less than 50% of the normal rate, with zero interest and penalties. Thus, the scheme was nominally successful. Thus, in a way, the VDIS motivated people to evade taxes and wait for such schemes in future.

Income Declaration Scheme, 2016 - It was proposed by the then Finance Minister Arun Jaitley and launched by the Income Tax Department. The Scheme provides an opportunity to come forward and declare the undisclosed income and pay tax, surcharge and penalty equal to 45% of the undisclosed income declared. Declarations were to be made from 1st June, 2016 to 30th September, 2016. Though the scheme saw a collection of Rs 65,250 Crore, a record in the history of tax collection, only a small portion of big earners with black money came forward and declared a very small portion of their wealth.

Special Bearer Bond Scheme - In 1981, the Government issued Special Bearer Bonds under a scheme which allowed people to invest their black money in these bonds and enjoy freedom from investigations and prosecutions for tax evasion in respect of their holdings of these bonds. The face value of the bond was Rs10,000 and maturity was for 10 years. Anyone could buy the bonds without inviting any scrutiny from the government. The income tax department was prohibited from harassing buyers and the bond could be even bought with anonymity. If one had purchased these bonds in 1981 for Rs10,000, he could redeem it in 1991 for Rs12,000.

All of the aforesaid schemes have hardly fetched Rs. 5000 crore over a period of years. The main drawback in these schemes is that they give a mere cosmetic effect to the problem of black money already created but without addressing the root cause of generation of black money. Governments should understand the importance of reducing tax slabs, improving tax structure and widening the tax base. These are long term measures which will prevent tax evasion and reduce the number of dependents in the Indian population.

India has tried to combat tax evasion by requiring an identification number for all major financial deals. The Permanent Account Number (PAN) card, issued by the Income tax Department is a compulsory 10‐character number issued to taxpayers by the tax department which is needed during any economic transactions such as buying a car or property, investing in the stock market or converting Indian rupees to foreign currency.

The card was issued in order to prevent tax evasion by individuals and entities as it links all financial transactions made by a particular individual or entity. In this way, the Income Tax Department has a detailed record of all major transactions for tax purposes. Indian citizens who are residents of the country as well as NRI (Non Resident Indians), OCI (Overseas Citizen of India) cardholders, PIO (Person of Indian Origin) as well as foreigners who come under the purview of the Income Tax Act of 1961 are eligible to apply for a PAN card. Firms and companies, governments and minors too can apply for a PAN card. But many transactions, especially those related to property, are conducted in cash and are unlikely to be reported.

Money Laundering

Criminal acts generate a huge profit in quick time for the individual or group that carries out the act. Money laundering is the processing of legitimizing these criminal proceeds so that their origin is disguised and they appear to be coming from a legitimate source. This process is of critical importance, as it enables the criminal to enjoy these profits without jeopardising their source. The dirty money from the criminal activity is “laundered” it to make it look clean.

Illegal activities include arms sales, smuggling, activities of organised crime, including for example terrorism, drug trafficking and prostitution rings, cyber-crime, embezzlement, insider trading, bribery etc.

Some money-laundering methods include:

Smurfing or structuring- This is the process of breaking up large chunks of cash into multiple small deposits, and spreading them over many different accounts, to avoid detection.

Investing in commodities such as gems and gold that can be moved easily to other jurisdictions

Investing in valuable assets such as real estate, cars, etc.

Gambling

Counterfeiting goods

Using cryptocurrencies

Using shell companies (inactive companies or corporations that essentially exist on papers only)

Through the use of currency exchanges, wire transfers, and “mules”—cash smugglers, who sneak large amounts of cash across borders and deposit them in foreign accounts, where money-laundering enforcement is less strict.

In response to mounting concern over money laundering, the Financial Action Task Force on money laundering (FATF) was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response. One of the first tasks of the FATF was to develop Recommendations, 40 in all, which set out the measures national governments should take to implement effective anti-money laundering programmes.

Stages in Money Laundering

1. Placement - Introducing illegal profits into the financial system. This might be done through smurfing, or by purchasing a series of monetary instruments (cheques, money orders, etc.) that are then collected and deposited into accounts at another location.

2. Layering - A series of conversions, transactions or movements of the funds to distance them from their source. The funds might be channelled through the purchase and sales of investment instruments, or the launderer might simply wire the funds through a series of accounts at various banks across the globe. This use of widely scattered accounts for laundering is especially prevalent in those jurisdictions that do not co-operate in anti-money laundering investigations. In some instances, the launderer might disguise the transfers as payments for goods or services, thus giving them a legitimate appearance.

3. Integration -The funds re-enter the legitimate economy.

Social Impacts of Money Laundering

The possible social and political costs of money laundering, if left unchecked or dealt with ineffectively, are serious.

Organised crime can infiltrate financial institutions, acquire control of large sectors of the economy through investment, or offer bribes to public officials and indeed governments.

The economic and political influence of criminal organisations can weaken the social fabric, collective ethical standards, and ultimately the democratic institutions of society.

Most fundamentally, money laundering is inextricably linked to the underlying criminal activity that generated it. Laundering enables criminal activity to continue.

Measures to Tackle Money Laundering

In the wake of such dramatic transformation of the factors that lead to the generation of black money and the globalized development that facilitates them, the Government of India has resorted to a five-pronged strategy, which consists of the following:

Joining the global crusade against black money

Creating appropriate legislative framework

Setting up institutions for dealing with illicit money

Developing systems for implementation

Imparting skills to personnel for effective action.

Prevention of Money Laundering Act

The Prevention of Money Laundering Act (PMLA), 2002 was enacted in January, 2003. The Act came into force with effect from 1st July, 2005.

The act defines offence of money laundering as whosoever directly or indirectly attempts to indulge or knowingly assists or is actually involved in any process or activity connected with the proceeds of crime shall be guilty of offence of money-laundering. It prescribes obligation of banking companies, financial institutions and intermediaries for verification and maintenance of records of the identity of all its clients and also of all transactions and for furnishing information of such transactions in prescribed form to the Financial Intelligence Unit-India (FIU-IND). It empowers the Director of FIU-IND to impose fine on banking company, financial institution or intermediary if they or any of its officers fails to comply with the provisions of the Act as indicated above. FIU-IND is an independent body reporting directly to the Economic Intelligence Council (EIC) headed by the Finance Minister.

PMLA empowers certain officers of the Directorate of Enforcement (ED) to carry out investigations in cases involving offence of money laundering and also to attach the property involved in money laundering.

The PML Act seeks to combat money laundering in India and has three main objectives:

To prevent and control money laundering

To confiscate and seize the property obtained from the laundered money; and

To deal with any other issue connected with money laundering in India.

The Act also proposes punishment under sec.4.

Enforcement Directorate (ED)

The Directorate of Enforcement was established in the year 1956 with its Headquarters at New Delhi. It is the principal agency responsible for investigation and prosecution of cases under the PML, and enforcement of the Foreign Exchange Management Act, 1999 (FEMA).

The Directorate is under the administrative control of Department of Revenue for operational purposes and for policy issues pertaining to PML Act. While the policy aspects of the FEMA, its legislation and its amendments are within the purview of the Department of Economic Affairs.

The Directorate has 10 Zonal offices each of which is headed by a Deputy Director and 11 sub Zonal Offices each of which is headed by an Assistant Director.

Zonal offices- Mumbai, Delhi, Chennai, Kolkata, Chandigarh, Lucknow, Cochin, Ahmedabad, Bangalore & Hyderabad

Sub Zonal offices - Jaipur, Jalandhar, Srinagar, Varanasi, Guwahati, Calicut, Indore, Nagpur, Patna, Bhubaneshwar & Madurai.

Egmont Group

Financial Intelligence Unit-India (FIU-IND) is a member of the Egmont Group, an international organization for stimulating co-operation among FIUs. The Egmont Group serves as an international network fostering improved communication and interaction among FIUs. The goal of the Egmont Group is to provide a forum for FIUs around the world to improve support to their respective governments in the fight against money laundering, terrorist financing and other financial crimes.

India became member of the Egmont Group in May, 2007.

FIU-IND is the national agency responsible for receiving, processing, analysing, and disseminating information relating to suspect financial transactions. It is an independent body reporting to the Economic Intelligence Council headed by the Finance Minister. For administrative purposes, the FIU-IND is under the control of the Department of Revenue, Ministry of Finance.

Under the Rules issued under the PMLA, the following types of reports have been prescribed for the reporting entities:

Cash Transaction Reports (CTRs)

Suspicious Transaction Reports (STRs)

Counterfeit Currency Reports (CCRs)

Non-Profit Organizations Transaction Reports (NTRs)

The Asia/Pacific Group on Money Laundering (APG)

The Asia/Pacific Group on Money Laundering (APG) was officially established as an autonomous regional anti-money laundering body in February 1997 at the Fourth (and last) Asia/Pacific Money Laundering Symposium in Bangkok , Thailand . The APG was formed with the objective to facilitate the adoption, implementation and enforcement of internationally accepted anti-money laundering and anti-terrorist financing standards set out in the recommendations of the Financial Action Task Force (FATF).

The APG's role includes assisting jurisdictions in the region to enact laws dealing with the proceeds of crime, mutual legal assistance, confiscation, forfeiture and extradition. It also includes the provision of guidance in setting up systems for reporting and investigating suspicious transactions and helping in the establishment of financial intelligence units.

India became a member of the APG in March, 1998.

Financial Action Task Force (FATF)

The Financial Action Task Force (FATF) is an inter-governmental body which sets standards, and develops and promotes policies to combat money laundering and terrorist financing.

The Forty Recommendations and Nine Special Recommendations of FATF provide a complete set of counter-measures against money laundering covering the criminal justice system and law enforcement, the financial system and its regulation, and international co-operation. These Recommendations have been recognized, endorsed, or adopted by many international bodies as the international standards for combating money laundering.

India became a member of the FATF in 2010.

0 notes

Text

Petrol-Diesel rate today, November 28: Check latest fuel rates of your city

Petrol-Diesel rate today, November 28: Check latest fuel rates of your city

The Center reduced the excise duty on gasoline by Rs 8 per litre and on diesel by Rs 6 per litre in May of this year, which resulted in the last big decrease in fuel prices.

source https://zeenews.india.com/economy/petrol-diesel-rate-today-november-28-check-latest-fuel-rates-of-up-noida-allahabad-varanasi-and-other-indian-cities-2540978.html

View On WordPress

0 notes

Text

The petrol prices in Delhi are highly volatile. The petrol price in Delhi on an average is typically around Rs 68.28 per litre. The current petrol price in Delhi is Rs 72.56 per litre, which was last revised on June 16, 2021. Petrol prices in Delhi are amongst the highest in the country and this continues to be the major concern for the residents of the national capital. The rise in fuel prices can be attributed to a combination of rising international crude prices, strengthening of the US dollar against the Indian rupee and growing demand for petroleum products. The increase in petrol prices has a cascading effect on the cost of other products and services in the market. Dealers in Delhi are allowed to change the prices of petrol up to maximum of Rs 1.50 per litre over the prices declared by oil companies. The government also provides additional relief in the form of applicable excise duty, Value Added Tax (VAT), and cess.

0 notes