#forex brokers comparison

Text

#Forex trading#online Forex trading platforms#top Forex trading companies#best Forex trading company#Forex trading apps beginners#how to open Forex trading account#FX Learn Pro review#Forex trading brokers comparison#free Forex trading demo account#Forex trading account setup#Forex trading platform reviews#Forex trading software#Forex market trading platforms#best online Forex brokers#Forex trading simulator#Forex trading account benefits#Forex market trading apps#virtual Forex trading platform#Forex trading company reviews#Forex trading tips beginners#Forex trading websites#Forex trading tutorial beginners#Forex trading platform comparison#Forex trading strategies#Forex trading demo#learn Forex trading online#best Forex trading platforms#top Forex trading apps#online Forex trading brokers#Forex trading software reviews

0 notes

Text

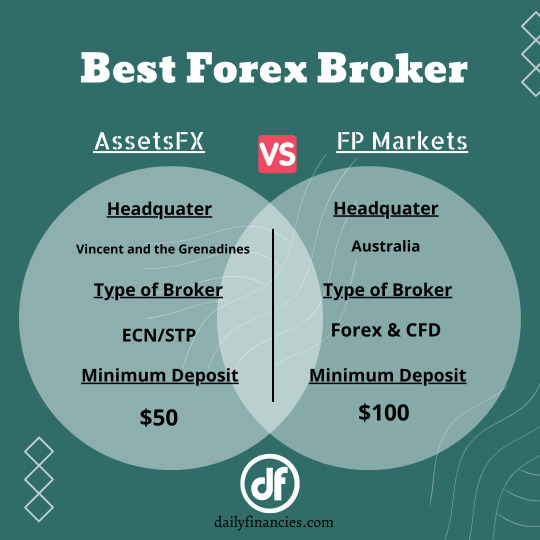

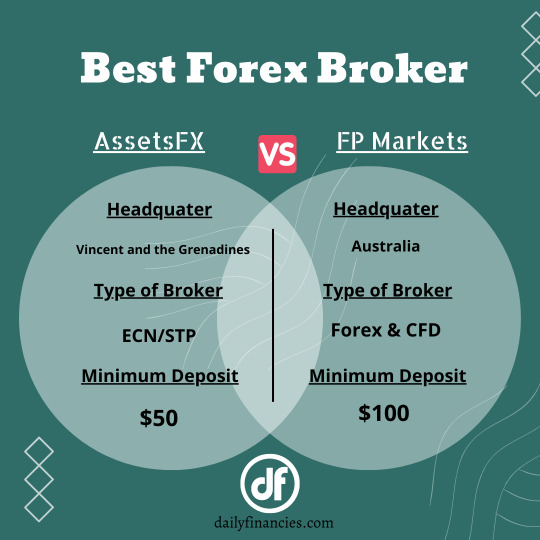

AssetsFX or FP Markets? If you were given a choice then who would you pick?

#forex#forexmarket#trader#AssetsFX#FPMarkets#comparison#broker#forexbroker#onlinetrading#metafinancies

1 note

·

View note

Text

What makes a Forex Broker Best among all? Lets see the major terms on that.

0 notes

Text

ForexJudge.com is a comprehensive platform that provides reviews and comparisons of forex brokers. Here’s a detailed point-by-point review:

1. Website Design and Usability

User Interface: ForexJudge.com boasts a user-friendly interface, making navigation easy even for beginners. The site layout is intuitive, with well-organized sections and quick access to key information.

Mobile Compatibility: The website is fully responsive, offering a seamless experience on both desktop and mobile devices.

2. Content Quality

In-Depth Reviews: ForexJudge.com offers detailed reviews of various forex brokers, covering aspects like fees, platforms, customer service, and regulatory compliance. The reviews are thorough, well-researched, and provide valuable insights.

Comparison Tools: The site features robust comparison tools that allow users to evaluate brokers side by side based on multiple criteria, helping traders make informed decisions.

Educational Resources: There is a rich library of educational materials, including articles, tutorials, and glossaries, which are beneficial for both novice and experienced traders

3. Expert Analysis

Professional Reviews: The reviews are crafted by seasoned forex professionals, ensuring knowledgeable and insightful evaluations. This expert input adds credibility and reliability to the content.

Regular Updates: ForexJudge.com frequently updates its content to reflect the latest trends and changes in the forex market, keeping users informed with the most current information.

4. Broker Coverage

Comprehensive Listings: The platform covers a wide range of brokers globally, offering a broad perspective on the forex market. This extensive coverage includes well-known brokers as well as emerging ones, providing options for different trading needs.

Unbiased Reviews: The reviews are presented in an unbiased manner, focusing on both the strengths and weaknesses of each broker. This balanced approach helps traders choose brokers that best match their requirements【12†source】.

5. Community and Support

Engagement: ForexJudge.com fosters a community of traders who rely on its reviews and insights. The platform encourages user feedback and interaction, enhancing the overall user experience.

Customer Support: The website offers excellent customer support, ensuring users can get assistance when needed. This includes answering queries and providing additional information upon request.

6. Trust and Reliability

Transparency: ForexJudge.com maintains high transparency in its operations, including how reviews are conducted and how they make money. This builds trust among users.

Industry Recognition: The platform is recognized in the forex trading community for its comprehensive and reliable reviews. Its reputation is built on years of consistent and accurate information delivery【14†source】.

7. Additional Features

Market Insights: The website provides market insights and analysis, helping traders stay updated with market movements and trends.

Broker Awards: ForexJudge.com hosts annual awards, recognizing top-performing brokers in various categories. These awards are based on rigorous criteria and extensive research.

Overall, ForexJudge.com is a valuable resource for anyone involved in forex trading, offering detailed broker reviews, educational content, and tools to aid in making informed trading decisions.

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

59 notes

·

View notes

Text

Minimum Deposits: AvaTrade vs Exness

Exness wins in the minimum deposit category, requiring a lower starting capital compared to AvaTrade.

Exness has a lower minimum deposit compared to AvaTrade, making it more accessible for beginners.

#MinimumDeposit #Exness #AvaTrade #ForexBeginners #LowDepositTrading #Forex #Traders

0 notes

Text

Find the Best Forex Brokers in UAE in 2024

Trading forex can be dangerous, particularly when done online. It is essential that you invest your hard-earned money on dependable and safe forex trading platforms.

We have compiled a ranking of the top legal and certified online forex brokers in the UAE to assist you stay away from scammers and make profitable and safe forex trading.

To make an informed choice about online Forex trading, go over the list.

What is trading forex?

One of the largest marketplaces in the world, the foreign currency market deals in trillions of dollars every day, around-the-clock. Both small and large size traders are drawn to forex trading because it is quicker to fill trades and the cost of doing business is significantly lower than in other marketplaces.

The deliberate conversion of one nation's money into another for travel, business, or other purposes is known as foreign exchange. The requirement to do transactions in currencies from other nations will only increase as companies keep growing and entering new markets throughout the world. When businesses must purchase goods or services from outside their borders, they run the danger of experiencing fluctuations in currency values. By defining a rate at which the transaction can be executed in the future, forex markets offer a mechanism to mitigate that risk.

Forex trading company presents an opportunity for traders to diversify. Given that leverage trading makes it easier to operate with less money than is required in the stock market analysis, they can view it as an opportunity for aggressive traders to earn more spread. Forex traders should apply common sense to prevent impulsive behavior and understand how to time their deals using charts.

Forex Trading in UAE

In the UAE, are you trying to find a trustworthy and secure forex trading platform? We give you access to a thorough list of licensed forex brokers in UAE so you can make wise choices that also end up being profitable.

With our list, you may make informed comparisons to determine which broker would be most appropriate for your needs related to FX trading. Professionals may be aware of the leading forex traders in the United Arab Emirates, but novice traders can benefit greatly from our comparative listings in selecting the best broker among several.

Frequently Asked Questions (FAQ)

FAQs | SmartFX

Find answers to all your questions on our FAQ page. Get detailed information and solutions quickly and easily.

stock brokers in dubai forex brokers in dubai forex trading in dubai forex brokers in uae forex trading company forex trading companies in dubai best forex trading platform uae best online trading platform in uae

#forex factory#forex trading#gold forex#forex market#forex news#forex expo#forex calendar#forex rate#forex factory calendar#khaleej times forex#forex expo dubai#forex factory news#usd to aed#gold news forex#trading view#xauusd#best forex broker in uae#forex expo dubai 2024#khaleejtimes forex#gold rate today

0 notes

Text

#Forex trading#online Forex trading platforms#top Forex trading companies#best Forex trading company#Forex trading apps beginners#how to open Forex trading account#FX Learn Pro review#Forex trading brokers comparison#free Forex trading demo account#Forex trading account setup#Forex trading platform reviews#Forex trading software#Forex market trading platforms#best online Forex brokers#Forex trading simulator#Forex trading account benefits#Forex market trading apps#virtual Forex trading platform#Forex trading company reviews#Forex trading tips beginners#Forex trading websites#Forex trading tutorial beginners#Forex trading platform comparison#Forex trading strategies#Forex trading demo#learn Forex trading online#best Forex trading platforms#top Forex trading apps#online Forex trading brokers#Forex trading software reviews

0 notes

Text

A Comprehensive Review of WikiFX Broker

A Comprehensive Review of WikiFX Broker

WikiFX is a well-known platform that provides comprehensive information and reviews about various forex brokers. This article aims to provide an in-depth review of WikiFX, highlighting its features, benefits, and potential drawbacks.To get more news about WikiFX, you can visit our official website.

Introduction to WikiFX

WikiFX is an authoritative global inquiry platform that offers basic information and regulatory license inquiries for over 8,000 forex brokers worldwide. The platform is designed to help traders make informed decisions by providing detailed evaluations of brokers based on various factors such as regulatory status, trading conditions, and user reviews.

Features of WikiFX

Regulatory Information: One of the key features of WikiFX is its ability to provide detailed regulatory information about brokers. This includes the licenses they hold, the credibility of these licenses, and the overall regulatory status of the broker. This information is crucial for traders who want to ensure they are dealing with a legitimate and trustworthy broker.

User Reviews and Ratings: WikiFX allows users to leave reviews and ratings for brokers. This feature helps traders get a sense of the broker’s reputation and the experiences of other traders. However, it is important to note that some reviews may be biased or manipulated.

Broker Comparison: The platform offers a comprehensive broker comparison tool that allows traders to compare different brokers based on various parameters such as transaction costs, trading platforms, and customer service. This feature is particularly useful for traders who are trying to decide between multiple brokers.

Exposure and Risk Evaluation: WikiFX provides exposure and risk evaluation services that help traders understand the potential risks associated with a particular broker. This includes information about the broker’s financial stability, history of complaints, and any regulatory actions taken against them.

Benefits of Using WikiFX

Informed Decision-Making: By providing detailed information about brokers, WikiFX helps traders make informed decisions. This can help traders avoid scams and choose brokers that are reliable and trustworthy.

Comprehensive Information: WikiFX offers a wealth of information about brokers, including regulatory status, user reviews, and trading conditions. This comprehensive information can help traders get a complete picture of a broker before making a decision.

Ease of Use: The platform is user-friendly and easy to navigate. Traders can easily find the information they need and compare different brokers using the comparison tool.

Potential Drawbacks

Bias and Manipulation: Some reviews on WikiFX may be biased or manipulated. There have been allegations that WikiFX engages in practices such as blackmailing brokers for positive reviews. Traders should be cautious and consider multiple sources of information before making a decision.

Limited Coverage: While WikiFX covers a large number of brokers, it may not have information on every broker in the market. Traders should use WikiFX as one of several tools in their decision-making process.

Conclusion

WikiFX is a valuable resource for traders looking to make informed decisions about forex brokers. The platform offers comprehensive information, regulatory details, user reviews, and comparison tools that can help traders choose the right broker. However, traders should be aware of potential biases and use multiple sources of information to ensure they are making the best decision.

0 notes

Text

AssetsFX or FP Markets? If you were given a choice then who would you pick?

0 notes

Text

What makes a Forex Broker Best among all? Lets see the major terms on that.

0 notes

Text

Compare Forex Brokers

Comparing forex brokers is crucial for choosing the right one that fits your trading style, goals, and preferences. Here’s a detailed comparison guide that highlights key aspects to consider when evaluating different forex brokers:

Key Factors to Compare Forex Brokers

1. Regulation and Trustworthiness

- Regulation: Ensure the broker is regulated by a reputable authority (e.g., FCA in the UK, ASIC in Australia, NFA in the US). Regulation ensures that the broker adheres to certain standards and provides protection for traders.

- Reputation: Research broker reviews and feedback from other traders. Look for information on any past regulatory issues or controversies.

2. Trading Platform

- Platform Options: Check if the broker offers popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. These platforms come with advanced charting tools, technical indicators, and automated trading options.

- Usability: Evaluate the platform’s user interface, ease of navigation, and customization options. A user-friendly platform can make trading more efficient and enjoyable.

- Mobile Access: Ensure the broker provides a mobile trading app if you plan to trade on the go.

3. Trading Costs

- Spreads: Compare the average spreads on major currency pairs. A narrower spread usually means lower trading costs.

- Commission: Some brokers charge a commission per trade in addition to the spread. Check if the broker has commission-free options or whether they offer competitive rates.

- Overnight Fees (Swap Rates): Understand the costs or benefits of holding positions overnight, as these can impact your trading profitability.

4. Account Types

- Account Variants: Brokers may offer different account types such as standard, mini, micro, or ECN accounts. Choose an account type that matches your trading volume and strategy.

- Minimum Deposit: Look at the minimum deposit required to open an account. Ensure it fits within your budget and trading plan.

- Leverage: Compare the leverage options available. Higher leverage can amplify profits but also increases risk.

5. Customer Support

- Availability: Check if the broker provides 24/5 or 24/7 customer support. Reliable support is essential for resolving issues quickly.

- Contact Methods: Ensure the broker offers multiple contact options such as live chat, email, and phone support. Test the responsiveness and helpfulness of their support team.

6. Education and Research

- Educational Resources: Look for brokers that offer comprehensive educational materials such as webinars, tutorials, eBooks, and trading courses. These resources are valuable for improving your trading skills.

- Market Research: Evaluate the quality and frequency of market research reports, analysis, and trading signals provided by the broker.

7. Deposit and Withdrawal Options

- Methods: Check the available deposit and withdrawal methods (e.g., bank transfer, credit/debit cards, e-wallets). Ensure they are convenient and cost-effective.

- Processing Times: Compare the processing times for deposits and withdrawals. Quick transactions are preferable for managing your funds efficiently.

- Fees: Be aware of any fees associated with deposits or withdrawals.

8. Trading Instruments

- Currency Pairs: Ensure the broker offers a wide range of currency pairs, including major, minor, and exotic pairs, to diversify your trading options.

- Additional Instruments: Some brokers also offer trading in commodities, indices, cryptocurrencies, or stocks. If you’re interested in these markets, consider brokers that provide access to them.

Conclusion

When comparing forex brokers, consider your trading goals, experience level, and preferences. By evaluating the factors outlined above, you can make an informed decision and choose a broker that aligns with your needs. Remember that the best broker for you will depend on your individual trading style and requirements, so take the time to assess each option carefully.

0 notes

Text

Best Forex Prop Firms of 2024

Proprietary FX trading firms or Forex prop firms:-

Proprietary trading, or prop trading, is when financial firms or proprietary FX trading firms use their own money to trade currencies for profit. Often called Forex prop firms, these are firms that maintain a pool of professional traders who trade on behalf of the firm rather than with an individual’s own money.

This money, most of the time, comes as a profit-sharing scheme with the firm, according to an agreed Profit Sharing Scheme. Higher leverage is provided by the proprietary FX trading firms in comparison with retail trading accounts, what this actually does is that it allows traders to hold larger positions with less capital. Besides, it has strict risk management protocols that help ensure the conservation of the firm’s capital and minimize possible losses. The model hence allows firms to exploit the opportunities available in the market while incorporating the expertise from the professional traders.

Top forex prop firm

1) Topstep – A prop firm trading

Topstep, like many other prop trading firms, hires stocks, futures, and indices traders and provides capital, support, risk management strategies, and coaching to help them trade successfully. Traders are then rewarded using a robust profit split.

Profit split: 100% up to $5,000, then 80% afterwards.

Features:-

Free 14-days trial.

Group performance coaching sessions.

Private trading coach with professional coaches and AI coaching.

Keep the first $5,000 in profit and 80% afterward.

Support team.

Pay fees through PayPal, Mastercard, Visa, American Express, and Discover.

Pros:

According to the company’s website, it funded 8,389 accounts in 2021 for customers spread across 143 countries.

Leverage of up to 1:100.

Referral program.

Cons:

No bonuses from broker Equiti Capital.

The support service is just on weekends.

2) The 5%ers – A reliable prop firms

The 5ers is one of the oldest and most reliable prop firms in the industry.

The 5%ers let you trade forex, metals, and indices with a live account from day 1 without any need for trial accounts.

Features:

The fastest growth plan

No time limit on trading

Traders use MetaTrader 5.

24/7 support

Bonuses

Pros:

Funding up to $4 million. Funding doubles after each milestone.

1:100 leverage on High stakes program

The first low-entry cost challenge when you pay upon success!

The fastest growth plan in the industry

Compatible with all trading stylesGet account access within seconds

Profit split up to 100% plus bonuses and salary

MT5 platform available

They are traders themself, providing high-quality education

24/7 dedicated support

Cons:

Only 1:10 leverage on the Bootcamp program

3) The Trading Pit – Forex prop firm

The Trading Pit is a globally-recognized prop firm that follows a partnership model. After registering, you’ll need to complete a trading challenge presented by them. Depending on how well you do, you’ll be presented with numerous options.

Profit Split: Up to 80%

Features:

Fixed 10%

Simple and Fast Withdrawals

Multi-Lingual Support

Real-Time Statistics

A Wide range of payment options

Pros:

State-of-the-art trading systems

Free and paid educational tools available

High conversion rate

Dedicated Account Managers

Cons:

It’s a new firm with more than a year’s worth of experience.

4) Funded Trading Plus – Proprietary trading firm

Funded Trading Plus is a UK-based firm that provides an environment for its traders to partake in simulated trading, Similar to other prop-trading firms, you’ll need to pass an evaluation to become an FT+ Trader. The account sizes can range from $12,500 to $200,000. You can choose between the 1-phase evaluation and 2-phase evaluation process.

Profit Split: Up to 100%

Features:

Diverse Trading Options

Option to get instant funding

One-Phase and Two-Phase Evaluation type

Customizable trading programs

Pros:

Comprehensive Profit-split structure

Choose from a wide range of trading strategies

Excellent support, Most trusted in the industry

Double your account size after achieving 10% profit

Cons:

Note: We allow overnight trading

No $5000 account

5) SurgeTrader – A standard prop trading firm

A standard prop trading account at SurgeTrader costs $25,000 for a profit split of 75:25, a profit target of 10%, daily loss of 4%, and a maximum trailing drawdown of 5%. This package costs $250.

Profit split: Up to 75%.

Features:

No monthly recurring fees.

There are no minimum trading days for account levels, ensuring you qualify for higher funding limits quickly.

Trade in any strategy that works for you.

Pros:

Up to 75% profit split.

Up to $1 million trading limit.

Non-recurring payments to qualify for a live-funded account.

1-step audition process.

10% profit targets without a period to achieve it.

Fast withdrawal processing.

Cons:

Short operating period for the company (started in 2021).

No positions are to be held during the weekend.

5% maximum drawdown, 1/10000 maximum open lots.

Low leverage – 10:1 forex, metals, indices, oil; 5:1 for stocks, and 2:1 for crypto.

6) Trade The Pool – Well known forex prop firm

It is powered by The5ers, a well-known and highly reputed online prop firm established in 2016. Trade The Pool lets traders like you use their strategies and experience to trade what you want!

Profit Split: Up to 80%

Features:

Free 14-day trial.

1 step programs

Real-Time StatisticsTrade more than 12,000 Stocks & ETFs

Pros:

Excellent support, Most trusted in the industry

Free educational tools available

Referral program.

Simple and Fast Withdrawals

Cons:

Short operating period for the company (started in 2022).

7) FundedNext – A full-fledged proprietary fx trading platform

FundedNext happens to be a relatively new prop trading platform out there that caters to Forex traders across the globe. You are eligible for a 40% increase in your account balance every 4 months, provided you are consistent with your profitability.

Profit Split: Up To 90%

Profit split of 15% at the evaluation stage

Dedicated account manager assigned

Pros:

Compatible with all trading styles

Low commissions

Get account access within seconds

Trader-friendly leverage

Unlimited evaluation

Cons:

No weekend holding option for the Express model.

Fees: One-time fee starting at $99 for Evaluation model of funding and One-time fee starting at $119 for the Express model of funding.

8) FX2 Funding – A prop trading firm

FX2 Funding works in the same way most prop-trading firms do. FX2 also allows its traders to trade at their own pace.

Profit Split: 85%

Features:

Flexible account sizes

85% profit split

Flexible time frame

Pros:

High-profit split

Comprehensive guidelines on trading

Trade at your own pace

Trade using your preferred method

24/7 dedicated tech support

Cons:

FX2 Funding is new to the industry. It is hard to assess its reputation at such a nascent stage.

9) FTMO – A proprietary fx trading firm

FTMO lets people learn and discover their forex trading talents using the FTMO Challenge and Verification course, As a trader, you get 90% of your profits earned from trading with the firm and its tools. Customers are also trained on how to manage trading risks.

Profit split: Up to 90%.

Features:

Maximum capital $400,000.

80:20 payout ratio. It adjusts to 90:10 when the FTMO account balance limit is increased.

Low spreads.

Pros:

Customers who include retail traders get access to MT4, MT5, and CTrader trading tools.

Customers are furnished with data coming from liquidity providers to simulate real market conditions for traders who aspire to make more money when trading.

The platform supports trading crypto as well as forex, indices, commodities, stocks, and bonds.

About seven payment methods are available, including bank transfer and Skill.

Cons:

Higher cost compared to other options.

You can’t hold trades over the market weekend close unless you use the swing trader challenge.

10) Lux Trading Firm – A funded trading

Lux Trading Firm hires career trading experts (forex, crypto, and other financial assets) and funds their accounts for up to $2.5 million. The highest stage 8 is for fund managers.

Profit split: Up to 65%.

Features:

Elite traders’club helps to boost one’s success rate.

Personal mentors and fees are advantageous for those who join the elite traders’ club.

Live trading rooms.

Pros:

Free trial.

High capital funding up to $2.5 million.

No time limit on targets.

Weekend holding allowed.

Evaluation is just one phase.

Cons:

Low leverage.

4% maximum relative drawdown and maximum loss limit.

11) Fidelcrest – Proprietary trading entities

Fidelcrest prop trading firm finds, trains, and evaluates Forex, CFD, and other prop traders who can then earn profits and commissions by applying for the company’s capital.

Profit split: Up to 90%.

Features:

Up to 90% profit split.

Can’t use robots.

Swing trading is accepted.

Pros:

The funding limit is $1 million.

High-profit split of up to 90%.

Get a bonus of up to 50% of profits earned in level 2 verification.

Other bonuses are available.

Trade multiple assets – CFDs, stocks, forex, and crypto. Withdraw via bank, PayPal, and other

Cons:

Step 2 is harder to overcome because the maximum loss is half that of step 1 yet the profit target is the same.

Evaluation is a two-phase and can take up to 90 days.

Long-term strategy trading is not favoured by the trading limit of 30 days.

Fewer education materials.

Conclusion

In general, a Forex prop firm is a company that evaluates a trader’s skills, usually via a trading challenge, and assigns its own trading capital for the trader to operate with. This approach represents an excellent way to start in Forex and financial trading for those who lack sufficient starting funds. Even for better-off traders, it remains a valuable path to improved risk management and self-control.

0 notes

Text

Which is the best between MetaTrader 4 and MetaTrader 5?

When it comes to Forex trading, MetaTrader stands out as the industry standard, with its two leading versions—MT4 and MT5—both offering unique advantages. But as the trading world evolves, the question arises: which version is better suited for 2024?

MetaTrader 4 (MT4): The Classic Choice

MetaTrader 4 is a widely popular multi-functional online trading platform. It launched in 2005, MetaTrader 4 quickly became a favorite among traders. Its reliability and user-friendly interface have earned it a lasting place in the Forex community. With over 10 million downloads and a stellar rating, MT4 continues to be a go-to platform for many.

Pros:

User-friendly interface ideal for beginners

Robust community support

High stability and security

Supports automated trading through Expert Advisors (EAs)

Multi-language support and real-time market data

Cons:

Slower compared to MT5

Fewer trading tools and options

Outdated user interface

Limited customization capabilities

MetaTrader 5 (MT5): The Modern Powerhouse

Introduced in 2010, MetaTrader 5 represents the evolution of trading platforms. While it maintains a resemblance to MT4, MT5 offers enhanced features and broader market access. It's designed for traders looking for a more advanced and versatile trading experience.

Pros:

Modern and customizable user interface

Access to over 500 financial markets, including stocks and cryptocurrencies

Faster execution speed

More charting tools and technical indicators

Cons:

Smaller support ecosystem compared to MT4

Can be complex for users due to additional features

Less broker support

Head-to-Head Comparison:

User Interface: MT4 is straightforward and easy to navigate, making it perfect for beginners. MT5 offers a more sophisticated interface with advanced features for experienced traders.

Time Frames: MT4 provides 9 timeframes, while MT5 offers an impressive 21, allowing for more detailed analysis.

Charting Tools: MT5 enhances charting capabilities with additional tools and chart types, surpassing MT4.

Indicators: MT4 includes 30 built-in indicators, but MT5 expands this to 38, offering more analytical options.

Programming Language: MT4 uses MQL4, known for its simplicity, whereas MT5 uses MQL5, offering advanced programming capabilities.

Which Should You Choose in 2024?

For traders who prioritize a reliable and straightforward platform, MT4 remains an excellent choice, especially if you’re focused primarily on Forex trading. However, if you’re seeking a platform with broader market access and enhanced features, MT5 is the clear winner.

Conclusion:

Both MetaTrader 4 and MetaTrader 5 have their strengths, and the choice between them depends on your trading needs and preferences. As you step into 2024, consider what features are most important for your trading strategy and choose the platform that aligns best with your goals. Happy trading!

#Forex Trading#Telegram Signal Copier#TSC#MetaTrader 4#MetaTrader 5#MT4#MT5#MT4 vs MT5#forex market#forextrading#forex education

0 notes

Text

How to Choose the Best Online Trading Platform in the UAE!

The goal of this article is to assist users in locating the best trading platforms for beginners in the United Arab Emirates. Finding the finest online brokers that fit particular financial goals, demands, and trader personalities can be difficult given the abundance of options available to novice traders.

A comprehensive investigation, comparison, and background check on different brokers can help investors and traders avoid selecting platforms with confusing user interfaces, cumbersome trading tools, exorbitant fees, and subpar customer service.

MetaTrader 5 trading platform

A multi-asset platform called MetaTrader 5 facilitates trading in stocks, futures, and forex. It provides excellent tools for copy trading, algorithmic trading (trading robots, expert advisors), and thorough price research.

Many features are available in MetaTrader 5 for the contemporary forex trader:

Complete set of adjustable trading orders for trading stocks, forex, and other securities.

1. Accounting systems for two positions: hedging and netting.

2. 21 periods with an infinite number of charts and a quote history of one minute.

3. Technical analysis using more than eighty integrated analytical tools and technical indicators.

4. Fundamental analysis using the economic calendar and financial news as a basis.

5. The biggest selection of trading applications that are ready to use at MetaTrader Market.

6. Robust algorithmic trading featuring an integrated MQL5 programming environment.

7. Trading signals that let you automatically replicate the transactions of seasoned traders a notification system to monitor all significant market developments.

8. Integrated Forex VPS.

MetaTrader 5

For mobile

Ideal for traders on the go, MT5 mobile brings new order types and detailed market depth information straight to your mobile device. Available for iOS and Android

With Market Depth and a method for keeping separate records of trades and orders, MetaTrader 5 offers a robust trading environment. It is compatible with both the hedging option system and the conventional netting technique for order accounting. To satisfy different trading goals, there are four order execution options available: exchange, market, request, and instantaneous. All trade order types—market, pending, stop, and trailing stop orders—are supported by the platform. With so many different order types and execution options, traders can successfully employ any trading strategy on the financial markets.

Trading signals and Copy Trading

Please be aware that the trading signals that we send to our clients are not issued by Smart Securities and Commodities Limited (smartfx). We would like to make it clear that, as a third-party broker, we do not guarantee the quality or completeness of the information, even though it comes from sources we believe to be trustworthy, such as materials marketed under the Signal Centre brand and handled by PIA-First (a company governed by the FCA, license number 787261). Moreover, this correspondence must not be read as a suggestion, investment advice, or an invitation to buy or sell securities. Before making an investment, recipients should make sure they have done their own research, stay up to date on market circumstances, and think about consulting with independent financial consultants. Trading has significant risk, including the potential for losses.

Advantages of trading signals utilization

Save Time: You don’t have to look for trading chances for hours on end. Signals save time by offering rapid insights.

Simple Trading: Using signals makes trading decisions easier. Simply adhere to the given directions.

Analysis by AI and humans: To make wiser trades, mix human knowledge with AI-driven analysis to get the best of both worlds.

Tailored to You: You can alter signals to better fit your trading objectives and style.

Modern Technology: Get access to the newest AI-powered trading technology to make smarter trading decisions.

MT4/MT5 UPGRADES USING ACUITY TRADING TOOL!

A sophisticated AI-powered plugin that is easily integrated into your MT4/5 trading platform, gathering, analyzing, and delivering the most recent market data to provide you with a Signal Centre and your own Economic Calendar in real-time.

Risk Warning:

For knowledgeable and seasoned investors, trading may be a difficult and lucrative opportunity. However, you should carefully examine your investing goals, skill level, and risk tolerance before deciding to trade. Above all, never risk money you can’t afford to lose on investments. Every trading deal carries a significant risk of loss.

0 notes

Text

#Forex trading#online Forex trading platforms#top Forex trading companies#best Forex trading company#Forex trading apps beginners#how to open Forex trading account#FX Learn Pro review#Forex trading brokers comparison#free Forex trading demo account#Forex trading account setup#Forex trading platform reviews#Forex trading software#Forex market trading platforms#best online Forex brokers#Forex trading simulator#Forex trading account benefits#Forex market trading apps#virtual Forex trading platform#Forex trading company reviews#Forex trading tips beginners#Forex trading websites#Forex trading tutorial beginners#Forex trading platform comparison#Forex trading strategies#Forex trading demo#learn Forex trading online#best Forex trading platforms#top Forex trading apps#online Forex trading brokers#Forex trading software reviews

0 notes

Text

WikiFX: Your Trusted Source for Forex Broker Information

WikiFX: Your Trusted Source for Forex Broker Information

In the dynamic world of forex trading, having access to reliable and comprehensive information about brokers is essential for traders to make informed decisions. WikiFX, a leading third-party information service platform, has emerged as a trusted source for forex broker information. This article delves into the various features and benefits of using WikiFX to navigate the complex landscape of forex trading.To get more news about WikiFX, you can visit our official website.

Extensive Database of Forex Brokers

WikiFX boasts the largest database of forex brokers, offering detailed profiles, regulatory information, user reviews, and more1. This extensive database allows traders to access a wealth of information about brokers from around the world, helping them make well-informed choices. Whether you are a novice trader or an experienced professional, WikiFX provides the necessary tools to evaluate and compare brokers effectively.

Comprehensive Regulatory Information

One of the standout features of WikiFX is its focus on regulatory information. The platform provides detailed insights into the regulatory status of brokers, including their licenses, regulatory bodies, and any potential risks associated with them. This information is crucial for traders to ensure that they are dealing with reputable and trustworthy brokers. By offering transparency and accountability, WikiFX helps traders avoid fraudulent brokers and make safer investment decisions.

User Reviews and Ratings

WikiFX also features user reviews and ratings, allowing traders to share their experiences and provide feedback on brokers1. These reviews offer valuable insights into the quality of services provided by brokers, including their customer support, trading platforms, and overall reliability. By considering the experiences of other traders, users can gain a better understanding of what to expect from a particular broker and make more informed decisions.

Broker Comparison Tool

The broker comparison tool on WikiFX is another valuable resource for traders. This tool allows users to compare multiple brokers based on various criteria such as regulatory status, transaction costs, trading platforms, and more3. By evaluating these factors side by side, traders can identify the broker that best suits their needs and preferences. This feature simplifies the decision-making process and ensures that traders choose the most suitable broker for their trading style.

Global Coverage

WikiFX offers global coverage, providing information on brokers from different regions, including the US, Europe, Asia, and more. This global perspective ensures that traders from various parts of the world can find brokers that meet their specific requirements. Whether you are looking for a broker regulated in your home country or exploring international options, WikiFX has you covered.

User-Friendly Interface

The platform’s user-friendly interface makes it easy for traders to navigate through the various features and find the information they need. The intuitive design ensures that even beginners can use the platform with ease. From searching for brokers to reading reviews and comparing options, WikiFX provides a seamless experience for all users.

Educational Resources

In addition to broker information, WikiFX offers a range of educational resources to help traders enhance their knowledge and skills. These resources include articles, tutorials, and market analysis, providing valuable insights into the forex market and trading strategies. By leveraging these educational materials, traders can improve their understanding of the market and make more informed trading decisions.

Conclusion

WikiFX stands out as a trusted source for forex broker information, offering an extensive database, comprehensive regulatory insights, user reviews, and a powerful broker comparison tool. With its global coverage and user-friendly interface, WikiFX provides traders with the necessary tools to navigate the complex world of forex trading with confidence. By leveraging the resources and information available on WikiFX, traders can make informed decisions, avoid fraudulent brokers, and enhance their overall trading experience.

0 notes