#proptech

Explore tagged Tumblr posts

Video

youtube

Your Place to go for real estate needs is Homelords com video

Looking to Buy, Sell, or Invest? Homelords.com Has You Covered.

At Homelords.com, we’re all about making your real estate journey as simple, smooth, and rewarding as possible. Whether you’re buying your dream home, selling your current property for top dollar, or diving into real estate investment, we’re here to help you every step of the way.

Here’s How We Can Help You:

Buyers:

Discover a wide variety of homes, condos, and investment properties—all in one place.

Stay ahead with real-time updates and exclusive listings, so you never miss out.

Use our smart tools, like virtual tours and market insights, to make the right choice faster and with confidence.

Sellers:

List your property and get it noticed by serious buyers quickly.

Get expert advice on pricing, staging, and marketing your home to maximize your sale price.

From listing to closing, we handle the details so you can focus on your next move.

Investors:

Spot the best investment opportunities with our up-to-date market data and property insights.

Find properties with the potential for high returns and grow your portfolio with confidence.

Why Homelords.com?

We’re not just a platform; we’re your trusted partner in real estate. Our team of experts is always available to guide you, answer your questions, and make sure you get the best deal possible. Whether you're buying, selling, or investing, you’ll have access to everything you need to make smart, informed decisions.

Ready to make your next move? Start today at Homelords.com and let’s make it happen together.

2 notes

·

View notes

Text

Allreno is building the future of renovation – using GenAI

Allreno is building the future of renovation – using GenAI, making it efficient, sustainable, and smarter.

Allreno revolutionizes kitchen and bath design with cutting-edge GenAI technology, automating complex processes from months to minutes. By leveraging AI, we streamline workflows, slash costs, and deliver unparalleled efficiency.

Allreno transforms pre-construction with advanced GenAI technology, automating complex processes and reducing timelines from months to minutes. Our AI-driven solutions streamline workflows, cut costs, and deliver exceptional efficiency.

#bathroom remodeling#bathroom renovation#interior design#real estate#techinnovation#proptech#tech#ai#investors

2 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

An efficient solution now available on Microsoft AppSource - RealEstatePro for Property Management: RealEstatePro on Microsoft AppSource

RealEstatePro on Dynamics 365 for Operations stands as a flagship solution, automating the renting, leasing, or sales cycle within the real estate industry. As property developers strive to meet increasing market demands, a comprehensive Enterprise Resource Planning (ERP) solution with Real Estate capabilities becomes vital for their business.

Key Features:

RealEstatePro is equipped with two specialized modules – one designed for property rental and leasing, and another tailored for property sales.

The Property Management System automates the processes involved in property rental and leasing, simplifying and optimizing workflows.

The Sales Management System automates property sales, guaranteeing a smooth and efficient sales cycle.

Benefits:

Automation: Streamline your business processes with end-to-end automation, reducing manual efforts and minimizing errors.

Enhanced Efficiency: Maximize your team's productivity with RealEstatePro's efficient tools, allowing them to focus on strategic tasks.

Tailored for Real Estate: RealEstatePro is specifically designed for the unique needs of the real estate industry, ensuring that your business operates at its peak.

How RealEstatePro Works?

RealEstatePro leverages the robust Dynamics 365 Finance and Operations platform to provide an intuitive and powerful solution for property developers, owners, and brokers. With a user-friendly interface, it simplifies complex processes, making day-to-day operations smoother and more efficient.

Get Started

Explore RealEstatePro on Microsoft AppSource and experience the difference in your real estate operations. Check it out here: https://appsource.microsoft.com/en-us/product/dynamics-365-for-operations/dynamic-netsoft.ed43ab95-b434-487c-a4be-223b08c22c1e

2 notes

·

View notes

Text

𝗗𝗼 𝗬𝗼𝘂 𝗞𝗻𝗼𝘄?

The 𝗡𝗲𝘁𝗵𝗲𝗿𝗹𝗮𝗻𝗱𝘀 𝗖𝗼-𝗪𝗼𝗿𝗸𝗶𝗻𝗴 𝗦𝗽𝗮𝗰𝗲 𝗠𝗮𝗿𝗸𝗲𝘁 is Booming!

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗥𝗘𝗘 𝗦𝗮𝗺𝗽𝗹𝗲

𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀, 𝘁𝗮𝗸𝗲 𝗻𝗼𝘁𝗲 — The co-working industry in the Netherlands is not just growing... it's thriving.

Demand for flexible workspaces is surging as startups, freelancers, and even corporates shift away from traditional leases.

Cities like Amsterdam, Rotterdam, and Utrecht are becoming co-working hotspots — offering high returns on real estate innovation.

With the Netherlands ranked among the top startup ecosystems in Europe, co-working spaces are evolving into vibrant business hubs — not just offices.

𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀 : Regus Group Companies, WeWork Inc., FLEXADO, Amsterdam Coworking, StartDock, ZAPFLOOR NG and others.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗳𝗼𝗿𝗲𝗰𝗮𝘀𝘁? Continued double-digit growth through 2030, fueled by hybrid work models and the rise of remote-first companies.

𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝗮𝗹𝗲𝗿𝘁: Co-working is no longer a trend. It’s a strategic investment space for those looking to tap into the future of work.

𝗔𝗰𝗰𝗲𝘀𝘀 𝗙𝘂𝗹𝗹 𝗥𝗲𝗽𝗼𝗿𝘁

𝗖𝘂𝗿𝗶𝗼𝘂𝘀 𝘄𝗵𝗲𝗿𝗲 𝘁𝗵𝗲 𝗯𝗶𝗴𝗴𝗲𝘀𝘁 𝗴𝗿𝗼𝘄𝘁𝗵 𝗽𝗼𝗰𝗸𝗲𝘁𝘀 𝗮𝗿𝗲? 𝗟𝗲𝘁’𝘀 𝗰𝗼𝗻𝗻𝗲𝗰𝘁 𝗮𝗻𝗱 𝗲𝘅𝗽𝗹𝗼𝗿𝗲 𝘁𝗵𝗲 𝗱𝗮𝘁𝗮.

#Coworking#Netherlands#PropTech#RealEstateInvesting#FutureOfWork#HybridWork#StartupEcosystem#InvestmentOpportunity#CommercialRealEstate

0 notes

Text

In a competitive property market like Australia’s, doing things better than the competition usually comes down to one thing, technology. It can be overwhelming to choose the best tech tool for real estate agents in Australia. Here’s what you should think about before buying that next piece of tech.

Visit - https://www.reso.com.au/

#real estate software#australia real estate#property management software#proptech#real estate agent#tech tool for real estate agents

0 notes

Text

🚨 Real Estate + Real-Time Data = Smarter Moves

From tracking new construction to analysing rental demand, web scraping is changing how the real estate world works.

👉 See 6 powerful ways it’s changing the game 🔗 Explore our real estate scraping solutions: https://shorturl.at/GlhoQ

0 notes

Text

Revolutionize Real Estate Management in 2025! 🛠️ Are you interested in acquiring complete control over your properties, increasing efficiency, and simplifying operations? Learn how, in 2025, custom property management software is transforming the real estate industry.

In our latest blog, we break down: ✅ Key benefits of building your own solution ✅ Why off-the-shelf software no longer cuts it ✅ Real-world use cases and ROI insights

Ready to future-proof your property business? 👉 Read the full blog now! [Insert blog link]

0 notes

Text

PropTech Pulse: Redefining Real Estate Decisions with Smart Data

India’s real estate sector is evolving rapidly—driven by increasing digital adoption, transparency demands, and the need for data-backed decisions. In this shifting landscape, PropTech Pulse emerges as a game-changing platform that simplifies real estate intelligence and makes it accessible to everyone involved in the ecosystem.

From developers and brokers to investors, institutions, and even homebuyers, PropTech Pulse delivers critical insights that support smarter, faster, and more confident decisions.

What is PropTech Pulse?

PropTech Pulse is an integrated real estate intelligence platform that provides real-time, reliable data and actionable insights across the Indian property market. It consolidates vast datasets—from project-level details to market-wide trends—and transforms them into easy-to-understand dashboards.

Built with advanced analytics and user-friendly design, the platform helps users cut through market noise and focus on what really matters: clarity, opportunity, and performance.

Who Benefits from PropTech Pulse?

One of the strongest aspects of PropTech Pulse is its adaptability. It serves a diverse range of stakeholders with insights tailored to their unique needs:

Developers gain visibility into project and market performance to price effectively and reduce unsold inventory.

Brokers get access to real-time inventory, commission data, and demand hotspots to close deals faster.

Investors and funds use historical performance data to evaluate projects and reduce risk.

Banks and financial institutions can assess developer credibility and monitor project execution.

Homebuyers and NRIs are equipped with tools to compare projects, track prices, and find high-potential locations.

What You Can Do with PropTech Pulse

PropTech Pulse isn’t just a platform—it’s a toolset designed to solve real problems and uncover real opportunities across the property ecosystem.

🧭 Track Market Trends

Understand national, city-level, and micro-market dynamics:

New launches, inventory overhang, and price benchmarks

Demand-supply analysis for smarter planning and forecasting

Useful for developers, strategists, and investment teams alike.

🏢 Monitor Project Performance

Get a detailed view of how individual projects are performing:

Sales velocity and construction progress

Price appreciation and inventory movement over time

Helps in evaluating investments, optimizing pricing, and benchmarking success.

👷♂️ Evaluate Developers

Analyze developers based on:

Delivery track records, sales cycles, and brand sentiment

Ongoing portfolio strength and market responsiveness

Ideal for financial institutions, investors, and collaborators conducting due diligence.

🤝 Maximize Broker Productivity

Equip brokers and channel partners with the right tools:

Access to live, verified inventory

Lead conversion rates and commission potential by location

Improves focus on high-yield areas and projects.

📌 Explore Location Insights

Gain local-level intelligence to make better decisions:

Price trends, rental yields, and infrastructure development

Connectivity and accessibility metrics

Beneficial for homebuyers, developers, and investors exploring new opportunities.

👤 Understand Buyer Behavior

Decode consumer intent and market demand:

Preferences by budget, configuration, and locality

Engagement patterns, feedback, and satisfaction scores

Enables product innovation and more personalized marketing campaigns.

Why PropTech Pulse Matters

✅ Real-Time Insights

Get immediate visibility into a fast-moving market—no waiting for quarterly reports.

✅ Reliable, Verified Data

Insights are sourced from verified and structured data streams, ensuring accuracy.

✅ Built for Everyone

From CXOs to brokers on the ground, PropTech Pulse supports decisions at every level.

✅ Promotes Transparency

By putting credible data in the hands of users, the platform helps build trust across the sector.

A Smarter Way to Navigate Real Estate

PropTech Pulse represents a leap forward in how India’s real estate professionals and buyers interact with data. In a sector often clouded by ambiguity, it offers a clear lens into performance, risk, and opportunity.

Developed by Aurum PropTech, the platform reflects a broader mission to bring intelligence and integrity to the real estate value chain.

Whether you’re planning a project, funding a portfolio, closing a deal, or buying your first home—PropTech Pulse gives you the confidence to move decisively and strategically.

1 note

·

View note

Text

Launching a Property Rental App?

Here are the must-have features to stand out in a competitive market!

✅ User-friendly interface ✅ Advanced search & filters ✅ Real-time availability ✅ Secure payment gateway ✅ Virtual tours & map integration ✅ In-app messaging ✅ Verified listings ✅ Admin dashboard & analytics

These features can make or break your app’s success — don’t miss out on what users expect in 2025!

👉 Read more: https://shorturl.at/jolSH

#PropertyRentalApp#ITinfonity#AppDevelopment#RealEstateTech#StartupTips#RentalApp#UXDesign#AppLaunchSuccess#PropTech

0 notes

Text

What Is the Average Cost of a Set of Kitchen Cabinets?

When planning a kitchen renovation, one of the most significant investments you'll make is in kitchen cabinets. Cabinets not only define the look and feel of your kitchen, but they also determine how functional and organized the space will be. But how much should you expect to spend on a set of kitchen cabinets in 2025?

Average Cost of Kitchen Cabinets

The cost of kitchen cabinets can vary widely based on materials, construction quality, size of your kitchen, and whether you choose stock, semi-custom, or custom cabinets. On average:

Stock cabinets: $3,000 – $8,000

Semi-custom cabinets: $8,000 – $15,000

Custom cabinets: $15,000 – $30,000+

For a typical 10x10 kitchen, you can expect a full cabinet set to range from $5,000 to $25,000, depending on your selections. This includes upper and lower cabinets, hardware, and finishes.

Factors That Affect Cabinet Pricing

1. Material Quality Cabinets made from solid wood or plywood are more expensive but offer superior durability compared to particleboard or MDF. Popular choices like maple, oak, and birch raise the price, while laminates or thermofoil keep costs lower.

2. Door Style and Finish Sleek modern doors with minimal detailing are generally more affordable. Intricate styles like shaker, raised panel, or glass-front doors, especially in painted or stained finishes, add to the cost.

3. Customization More drawers, pull-out shelves, lazy Susans, soft-close hinges, and other organizational features will increase your final bill — but they also dramatically improve usability.

4. Installation Costs Professional cabinet installation typically costs $2,000 to $5,000, depending on the number of cabinets and the complexity of the job.

5. Location Urban areas like New York, San Francisco, or Miami will have higher labor and product costs than suburban or rural regions.

Smart Ways to Save

If you're looking to stay on budget while still achieving a beautiful kitchen, here are a few strategies:

Mix and match: Use high-end cabinets on focal points like the island, and stock options on secondary walls.

Ready-to-assemble (RTA) cabinets: These are affordable and great for DIYers or pros using fast installs.

Choose simple styles: Flat-panel doors in neutral colors are not only budget-friendly but also timeless.

Plan with precision: Use a kitchen design tool like the Allreno App to scan your kitchen, test layouts, and get real-time cabinet pricing — avoiding costly last-minute changes.

Are Expensive Cabinets Worth It?

That depends on your goals. If you're renovating to sell your home, a mid-range cabinet set will often give you the best return on investment. But if this is your forever kitchen, investing in custom cabinetry with top materials could be well worth it.

Final Thoughts

In 2025, the average cost of a set of kitchen cabinets remains one of the biggest line items in any renovation — but also one of the most impactful. With tools like Allreno's smart design app, you can visualize, compare, and customize your cabinet selection with ease, making sure every dollar works harder.

Whether you're going high-end or keeping things simple, the right cabinets transform a kitchen from a cooking space to the heart of the home.

💡 Planning a kitchen renovation? Wondering how much a full set of cabinets costs in 2025?

In 2025, the average cost of a set of kitchen cabinets remains one of the biggest line items in any renovation — but also one of the most impactful. With tools like Allreno's smart design app, you can visualize, compare, and customize your cabinet selection with ease, making sure every dollar works harder.

Whether you're going high-end or keeping things simple, the right cabinets transform a kitchen from a cooking space to the heart of the home.

From stock to custom, here’s what you need to know — plus a BEFORE & AFTER using the #KitchenDesign #HomeRenovation #Renovation #PropTech #AI#InteriorDesign #Allreno

Allreno App 👇 📲 allreno.co

#ai#interior design#investors#real estate#bathroom remodeling#techinnovation#tech#bathroom renovation#proptech#youtube

0 notes

Text

Start your prop firm -

In the fast-evolving landscape of financial markets, the concept of prop trading (proprietary trading) has gained significant traction. Aspiring traders are increasingly drawn to the idea of establishing their prop firms, leveraging technology and funded trading opportunities. This article delves into the world of FXPropTech, prop firms, and the journey to becoming a funded trader.

1. Understanding Proprietary Trading (Prop Trading): Proprietary trading, often referred to as prop trading, involves financial firms trading their own capital in the markets. This approach differs from traditional trading where institutions trade on behalf of clients. Prop trading firms seek to generate profits directly from market movements, utilizing various strategies and tools.

2. The Rise of FXProptech: FXProptech, the fusion of foreign exchange (FX) trading and financial technology (fintech), represents a new frontier in the trading landscape. These technologies empower traders with advanced analytics, algorithmic trading, and risk management tools. The marriage of FX and technology has given rise to innovative platforms and strategies, enabling traders to navigate the complex currency markets efficiently.

3. Prop Firms and Funded Trader Programs: Many traders embark on their journey by joining prop firms or participating in funded trader programs. These initiatives provide aspiring traders with an opportunity to trade firm capital, often with minimal personal risk. In return, traders share a percentage of their profits with the sponsoring firm. This arrangement aligns the interests of traders and firms, creating a mutually beneficial partnership.

4. The Benefits of Joining a Prop Firm: Joining a prop trading firm offers several advantages. Traders gain access to substantial capital, advanced trading tools, and often benefit from mentorship programs. Prop firms, in turn, diversify their trading strategies and tap into the potential of skilled and emerging traders.

5. My Funded FX Journey: A Personal Account: In this section, we explore real-life success stories of individuals who have embarked on their funded FX journeys. Understanding the experiences and challenges faced by funded traders can provide valuable insights for those considering a similar path.

6. Steps to Start Your Prop Firm: For those aspiring to establish their prop firms, this section provides a step-by-step guide. From legal considerations to technology infrastructure, we cover the essential elements required to launch and run a successful proprietary trading business.

Conclusion: Starting your prop firm is an exciting venture that combines financial acumen with technological innovation. With the rise of FXPropTech and the opportunities presented by prop firms and funded trader programs, aspiring traders have a unique chance to make their mark in the dynamic world of proprietary trading. Whether you're a seasoned trader or a newcomer to the industry, exploring these avenues can open new doors to success.

#proptech#forex prop firms funded account#ftmo#funded#fxproptech#prop firm#props firms#the funded trader#my funded fx#best trading platform#best prop firms#Start your prop firm

3 notes

·

View notes

Text

Enhance Financial Oversight with Seamless Integration

Tired of juggling spreadsheets and manual entries?

With HappyTenant’s smart integration capabilities, you can sync your property data with top accounting software like QuickBooks, no more double work or financial blind spots.

✅ Centralize financial records

✅Automate transactions

✅ Reduce human errors

✅ Get accurate, real-time insights into your portfolio’s performance

Make smarter financial decisions with confidence.

Learn more: https://happytenant.io/product/accounting-and-reporting

#HappyTenant#FinancialManagement#PropTech#SmartLandlord#QuickBooksIntegration#RealEstateSolutions#PropertyManagementTools#LandlordLife#RentalEfficiency#DigitalPropertyManagement

0 notes

Text

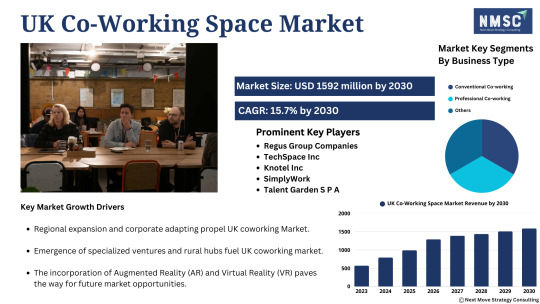

𝗗𝗶𝗱 𝗬𝗼𝘂 𝗞𝗻𝗼𝘄?

The 𝗨𝗞 𝗖𝗼-𝗪𝗼𝗿𝗸𝗶𝗻𝗴 𝗦𝗽𝗮𝗰𝗲 𝗠𝗮𝗿𝗸𝗲𝘁 is Growing 4x Faster Than Traditional Office Leasing

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗥𝗘𝗘 𝗦𝗮𝗺𝗽𝗹𝗲 As hybrid work becomes the norm, the UK co-working sector is experiencing explosive growth—expected to reach 𝗨𝗦𝗗 𝟭𝟱𝟵𝟮.𝟮 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 by 2030.

London alone accounts for over 30% of Europe’s flexible workspace supply, with regional cities like Manchester, Bristol, and Leeds seeing double-digit growth rates.

Major corporates are shifting from long-term leases to flexible models, turning co-working into a mainstream real estate asset class—not just a startup trend.

ESG-conscious tenants are favoring co-working providers for their lower carbon footprints and community-centric environments.

Innovation hubs, plug-and-play offices, and tailored amenities are no longer luxuries—they’re investment signals in a changing landscape.

Investor Takeaway: This isn’t just about office space. It’s a shift in how people work, where companies operate, and how real estate value is created. 𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀 : Regus Group Companies, TechSpace Inc, Knotel Inc, SimplyWork, Talent Garden S P A, Premier Workspaces, KR Space, Convene, Servcorp Limited and others. 𝗔𝗰𝗰𝗲𝘀𝘀 𝗙𝘂𝗹𝗹 𝗥𝗲𝗽𝗼𝗿𝘁 If you're looking for scalable, asset-light, recurring-revenue business models—this market is calling.

Let’s discuss how to position early in this high-yield, high-growth evolution.

#InvestmentOpportunities#CoworkingUK#FlexibleWorkspace#PropTech#CommercialRealEstate#HybridWork#VC#PrivateEquity#FutureOfWork#UKRealEstate

0 notes

Text

𝗗𝗼 𝗬𝗼𝘂 𝗞𝗻𝗼𝘄?

The 𝗨.𝗦. 𝗦𝗺𝗮𝗿𝘁 𝗛𝗼𝗺𝗲 𝗠𝗮𝗿𝗸𝗲𝘁 𝗜𝘀 𝗦𝗲𝘁 𝘁𝗼 𝗛𝗶𝘁 $𝟲𝟱.𝟴𝟳 𝗕𝗶𝗹𝗹𝗶𝗼𝗻 𝗯𝘆 𝟮𝟬𝟯𝟬! 𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗥𝗘𝗘 𝗦𝗮𝗺𝗽𝗹𝗲

𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿 𝗔𝗹𝗲𝗿𝘁: The smart home industry isn't just about convenience anymore—it's about scalability, security, and serious returns.

From smart thermostats to AI-powered security systems, over 60 million U.S. households are already connected—and that number is climbing fast.

𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀 : Honeywell International, Inc., Schneider Electric, ABB Ltd, Amazon, Assa Abloy, Samsung, LG Electronics, Sony Corporation and others.

𝗞𝗲𝘆 𝗧𝗿𝗲𝗻𝗱𝘀 𝗗𝗿𝗶𝘃𝗶𝗻𝗴 𝗚𝗿𝗼𝘄𝘁𝗵:

AI & IoT integration is making homes more predictive and energy-efficient.

Homeowners are investing more in smart tech than in kitchen upgrades.

Eco-conscious consumers are driving demand for energy-saving devices.

Big players like Amazon, Google & Apple are doubling down with smarter ecosystems.

𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿 𝗜𝗻𝘀𝗶𝗴𝗵𝘁: VCs and private equity are pouring capital into startups with niche innovations—voice tech, home health, and eldercare automation are some of the fastest-growing verticals.

𝗔𝗰𝗰𝗲𝘀𝘀 𝗙𝘂𝗹𝗹 𝗥𝗲𝗽𝗼𝗿𝘁

If you're looking at future-ready sectors with double-digit CAGR and massive consumer adoption, the U.S. Smart Home Market might just be your next smart move.

Are you watching this space? Or are you already invested in it? Let’s discuss where the smart money is going in smart homes.

0 notes