#genworth

Text

Actuarial Development Program Internship

At Genworth, we empower families to navigate the aging journey with confidence. We are compassionate, experienced allies for those navigating care with guidance, products, and services that meet families where they are. Further, we are the spouses, children, siblings, friends, and neighbors of those that need care—and we bring those experiences with us to work in serving our millions of…

0 notes

Text

Wohneinrichtungen, Betreutes Wohnen Und Pflegeheime

Inhaltsverzeichnis

https://i.ytimg.com/vi/qneUlcYOpSA/hqdefault_153200.jpg

youtube

Wie Unterstützt Betreutes Wohnen Senioren?

Betreutes Wohnen

Eine der Möglichkeiten, wie Staaten zusätzliche Pflege bereitstellen, einschließlich der Finanzierung von Diensten für betreutes Wohnen, ist der Verzicht auf Medicaid. Viele Senioren werden einen allmählichen Rückgang einiger ihrer Fähigkeiten bemerken, für sich selbst zu sorgen. Ein allmählicher Rückgang der Selbstpflegefähigkeiten kann Anlass zur Sorge geben, da sich Senioren fragen, wann ihr bestehendes Unterstützungssystem ihnen nicht mehr genügend Hilfe zu Hause bieten kann. Da die Bewohner von ALFs so unabhängig leben können, wie sie möchten, können Senioren unabhängig bleiben, solange sie können, und im Laufe der Zeit bei Bedarf weitere Unterstützung hinzufügen. Qualitativ hochwertige Einrichtungen für betreutes Wohnen können sich dank ihres freundlichen Personals, nahrhafter Mahlzeiten und regelmäßiger Gelegenheiten zum Sozialisieren mit anderen Bewohnern wie ein Zuhause anfühlen. Sie können auch oft wie ein gehobenes Hotel aussehen, mit hübsch eingerichteten Speisesälen und Treffpunkten im Innen- und Außenbereich sowie gepflegten Privaträumen.

Ab 2021 betrugen die durchschnittlichen monatlichen Kosten für betreutes Wohnen 4.500 USD pro Person.

Betreute Bewohner wohnen in der Regel in eigenen Wohnungen oder Zimmern und teilen sich Gemeinschaftsräume.

Der Staat kann jedoch eine umfassendere Versorgung bereitstellen, wenn er dies wünscht.

Unsere Agentur für häusliche Dienstleistungen bietet Pflegeleistungen an, die Ihnen dabei helfen sollen, Ihre Unabhängigkeit länger zu bewahren, wie z.

Es ist üblich, dass Mitarbeiter des betreuten Wohnens für Senioren Hilfe beim Baden, Anziehen, Toilettengang, Bettwechsel und mehr leisten.

Wenn Sie andererseits unter komplexen Erkrankungen leiden, bettlägerig sind, an Demenz leiden oder in irgendeiner Weise schwer behindert sind, wird ein Pflegeheim Ihren Bedürfnissen eher entsprechen. Die wichtigste IADL, bei der die Bewohner einer betreuten Wohngemeinschaft Hilfe erhalten, ist die Zubereitung von Mahlzeiten. Die meisten ALFs haben einen Speisesaal, in dem dreimal täglich Mahlzeiten serviert werden, und viele Gemeinden bieten auch Snacks an. Bewohner, die in der Lage sind, können auch einen Teil ihrer Mahlzeiten selbst zubereiten, da Wohnungen in Einrichtungen für betreutes Wohnen Kühlschränke und seltener Kochplatten, Mikrowellen oder sogar Öfen enthalten können.

Wie Unterstützt Betreutes Wohnen Senioren?

Einrichtungen für betreutes Wohnen können sich in allen Arten von Stadtteilen befinden, einschließlich Wohngebieten, Innenstadtgebieten, ländlichen Gebieten und mehr. Erstklassig bewertete Einrichtungen für betreutes Wohnen sind sauber und gepflegt, bieten abwechslungsreiche, nahrhafte und interessante Mahlzeiten und bieten ein breites Spektrum an Aktivitäten für Senioren. Ihre Umgebung ist freundlich und professionell, und sie haben genug Personal, um schnell auf Anfragen von Senioren nach Hilfe beim Toilettengang, Ankleiden und anderen Bedürfnissen reagieren zu können. Erstklassig bewertete Einrichtungen pflegeheime in magdeburg sagen auch offen, womit sie Senioren helfen können und was nicht, und machen ihre Fähigkeiten und Grenzen für alle deutlich. Einige Senioren entscheiden sich dafür, ziemlich weit von ihrem derzeitigen Zuhause wegzuziehen, um von niedrigeren Lebenshaltungskosten zu profitieren.

Betreutes Wohnen

Laut Genworth Financial betragen die nationalen monatlichen Durchschnittskosten für betreutes Wohnen 4.051 USD. Diese Zahl kann je nach Standort und Ausstattung viel höher oder viel niedriger sein. In selbstständigen Wohngemeinschaften leben Senioren nahezu unabhängig in eigenen Wohnungen, Bungalows oder anderen Wohnformen. Senioren verkaufen oft ihre Häuser und ziehen in diese Gemeinschaften, um sich von Haushaltsarbeiten zu befreien und ihren Ruhestand in einem sozialen Umfeld besser genießen zu können. Weitere Vorteile des Lebens in diesen Gemeinden sind der optionale Zugang zur Cafeteria, haustierfreundliche Einrichtungen, Hilfe bei der Wäsche und anderen leichten Hausarbeiten und sogar der Transport. Diese Wohngemeinschaften sind sowohl für Paare als auch für alleinstehende Senioren geeignet.

Betreutes Wohnen richtet sich an ältere Menschen, die Hilfe bei der Körperpflege benötigen. Es ist üblich, dass Mitarbeiter des betreuten Wohnens für Senioren Hilfe beim Baden, Anziehen, Toilettengang, Bettwechsel und mehr leisten. Erhöhte Sicherheit, spezialisiertes Personal und mehr individuelle Zeit für die Bewohner machen die Pflege in Gedächtnispflegeeinrichtungen im Vergleich zum betreuten Wohnen deutlich teurer.

Dies ist sinnvoll, da die Kosten für betreutes Wohnen von Staat zu Staat jährlich um Zehntausende von Dollar variieren können. Ein größerer Umzug in eine kostengünstige Gegend, in der Sie eine Familie haben, kann die Kosten für betreutes Wohnen überschaubarer machen, ohne Ihre Fähigkeit zu beeinträchtigen, mit Ihren Lieben in Kontakt zu treten. Die meisten Senioren sind mit der Sozialversicherung als Quelle für Altersleistungen vertraut, die auf zuvor gezahlten Steuern basieren. Die Sozialversicherungsverwaltung kann jedoch auch eine Leistung gewähren, die nicht direkt an frühere Beiträge gebunden ist. Diese Leistung, genannt Supplemental Security Income, steht vielen Senioren mit niedrigem Einkommen zur Verfügung. Die Regierungen der Bundesstaaten können diese Leistungen für Senioren im betreuten Wohnen durch ein Programm namens Optional State Supplements weiter erhöhen.

2 notes

·

View notes

Text

Litigation Funding Agreements Discoverable in Delaware

We’ve all heard that “what’s good for the goose is good for the gander.” Some of us describe it as “the rule of poultry equivalents.” However you phrase it, we’ve always thought that if a defendant’s insurance is routinely discoverable, a plaintiff’s litigation financing agreement should be as well. Today’s decision from Delaware, Burkhart v. Genworth Financial, Inc., 2024 WL 3888109 (Del. Ch.…

View On WordPress

0 notes

Text

Interview with Sandy Ball, Chief People Officer at Aspida, on HR Technology

Sandy, could you take us through your professional journey, highlighting key milestones and experiences that have shaped your approach to human resources and company culture?

My professional journey in HR began at GE and Genworth, where I dove headfirst into Learning and Development before transitioning into the HR Business Partner role. While development has always been a passion of mine, these early experiences taught me the importance of understanding the unique needs of each business and its employees, and crafting a comprehensive HR strategy to meet those needs.

Also Read: HRTech Interview with HR Expert, Natalie E. Norfus, Founder of The Norfus firm

Throughout my career, I’ve focused on creating tailored solutions that build on the foundational principles of employee development. This includes designing customized benefits packages, robust wellness programs, and initiatives that foster a strong, people-centric company culture. By seamlessly integrating HR into the decision-making processes, I’ve cultivated environments where employees can thrive both personally and professionally. This approach not only benefits individuals but also contributes to the success of the entire organization.

My aim is to demonstrate that HR isn’t a separate entity—it’s a vital part of the team that requires a seat at the table alongside all the other key players. When HR works hand in hand with leadership, it can drive the company forward and unlock its full potential.

To Know More Visit: https://hrtechcube.com/hrtech-interview-with-sandy-ball/

0 notes

Text

Home Care Assistance for seniors

It is not uncommon for seniors to need home health care assistance as they age. While you may have heard scary stories of aides who bilked elderly people out of their money, most caregivers are honest and trustworthy.

Home health care rates vary depending on the region you live in. Rates are typically higher in major cities such as New York City, Buffalo and Utica.

Caregiver Qualifications

In some cases, families choose to hire private caregivers to provide home care assistance for their loved ones. However, these services can be expensive. According to the Genworth 2023 Cost of Care Survey, home health aides typically charge between $33,530 and $4,576 per month.

RNs and LPNs who work for a home health agency visit an older adult’s home to administer medication, give injections and perform skilled care such as wound treatment and diabetic management. The types of in-home care offered differ by state and county.

Some elders enrolled in Medicare or Medicaid qualify for services through a Consumer Directed Services (CDCS) program that allows them to hire family members as paid caregivers. These programs have different service options and use a Fiscal Employer Agent to manage taxes, payroll withholding and paychecks for the caregiver. These programs may include home health, personal care, and homemaker services. They also offer respite care and other support to family caregivers.

Background Checks

Ndis home care assistance agencies require background checks to verify information about a caregiver’s criminal history, professional qualifications, and other important details. These screenings often cover state and federal criminal records as well as sex offender registry searches.

These checks may also include verification of education credentials and professional licenses. Lying about these areas could disqualify a candidate from the role. Additionally, some agencies use advanced identity research to identify known aliases, nicknames, and previous residences for potential applicants.

Consumers should ask a potential agency about its background check policy and whether or not it screens employees for dangerous criminal histories. Agencies that skip this step leave their consumers vulnerable to harm and could face liability issues in the event of an incident. Consumer safety should always be the priority when selecting a home health aide or other caregiver. Fortunately, many reputable home care agencies do conduct thorough background checks. You can find these agencies by researching online or asking for references from current and past consumers.

In-Home Care

Home care is provided by a wide variety of caregivers, including nurses, home health aides, and therapists. This type of care is typically short-term and arranged by a physician, so it is often covered by Medicare or private insurance.

Home health aides and personal care aides are often supervised by an RN, and receive a written care plan to follow. This helps protect the aides and their employer from liability if they fail to follow instructions that a patient or their doctor has given them.

Aides can also be hired directly or through a home care agency, and they can be paid privately, through long-term care insurance, or by Medicaid programs such as HCBS waivers and the LTSS demonstration waivers. Many people find that having a dedicated aide to help them with activities of daily living is more helpful than moving into an assisted living facility or nursing home. Some communities offer volunteer services that can provide companionship, or local senior centers may have resources to connect people with volunteers.

Payment Options

Many families find it difficult to pay for care, whether home care assistance or a nursing home. There are several financial assistance options that can help reduce costs. Some long term care insurance policies cover home care expenses, although it is best to contact a representative of your policy for details.

Other options include life insurance policies that can be accelerated or paid out in a lump sum, and loans specifically designed for elder care. Some veterans may qualify for Aid and Attendance pension benefits that can pay for home care services.

Medicaid has a program called CDPAP (Consumer Directed Personal Assistance Program) that allows eligible individuals to “employ” a family member for in home care, and then have Medicaid pay the caregiver. Depending on state specifics, this can be an excellent option for reducing expenses. However, it is important to develop a comprehensive long term financial plan in advance of needing home care.

Otherwise, the assistance available will continually decline as your savings deplete.

0 notes

Text

With Baby Boomers aging and nursing home care costs climbing, obscure old sleeper laws on the books in more than half the states could come back to haunt the adult children of seniors who can’t pay for their own care.

. . .

While the federal Medicare program pays for the majority of medical care for those over 65, it does not–despite what many middle class Baby Boomers think–cover long term custodial care. The confusion over Medicare stems from the fact that the federal program will pay for up to 100 days of rehabilitation in a skilled nursing care facility (after a three-day hospital stay) and some skilled nursing or physical therapists visits at home, but not for custodial care–the kind of help with activities of daily living (such as bathing, dressing and eating) a majority of elders end up needing either in a nursing home or their own or their children’s home.

It’s hard to predict whether any one individual will need extended long term care support–about four in ten of today’s 65-year-olds won’t need such care at all, but more than 20% of Boomers will need five or more years of care. The cost of nursing home care varies based on geography and level of care, but it’s steep: on average, a semi-private room in a nursing home runs around $8,669 per month, while a private room will cost you $9,733 per month, according to Genworth’s annual Cost of Care survey. Home health care aides now average $33 per hour, with homemaker services running at $30 an hour, the survey found.

0 notes

Text

Paying for Long-Term Care - Options for Residents

Long-term care programs include at-home caregiving, assisted living, and nursing home care. They meet the health and personal care needs of people when they can no longer take care of themselves because of old age.

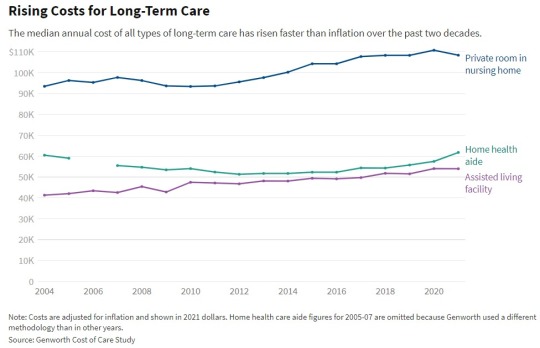

Every day, 10,000 baby boomers turn 65. This trend will continue until 2030. Seven out of 10 of these baby boomers will eventually need long-term care, which can be expensive. According to insurer Genworth Financial, the median cost of at-home care by a home health aide in 2021 was $61,776 ($27 per hour). The median cost of assisted living facility care that year was $54,000, while the median cost for a private room in a nursing home was $108,405.

Given these high costs and the reality that most baby boomers will require long-term care, it’s important for families to plan ahead. Fortunately, there are many options families have to pay for long-term care, starting with government programs.

Medicare does not cover long-term care itself. However, it does cover hospital care and physician services for seniors who stay in nursing homes. Medicaid, on the other hand, covers long-term care, but only for those who are eligible. These are often people of low income and limited resources.

States have different income and personal resource thresholds for people to qualify for Medicaid. Therefore, people who need government assistance paying for long-term care should first contact their state Medicaid office to find out if they are eligible. Notably, however, not all nursing homes accept Medicaid.

Additional government support is available for veterans and their spouses. The U.S. Department of Veterans Affairs (VA) has programs that cover the long-term care needs of veterans with service-related disabilities. Veterans without service-related disabilities may also qualify for care benefits with copays, though this depends on their income level. The VA also has cash supplement programs for veterans and their spouses that they can use to cover care expenses.

While they are helpful, such government programs are not available to all people. In fact, many of the people who need long-term care pay out of pocket. Families fund long-term care through their savings or by selling some of their assets. There are also programs like reverse mortgages that allow homeowners to convert part of the equity in their homes to cash so they can pay for long-term care without having to sell their property. Lenders lend the cash to homeowners and the owners do not have to repay until they sell their home or stop living in it.

Getting long-term care insurance, however, is considered a much better option versus paying out of pocket. Depending on the type of policy a person purchases, long-term care insurance can cover a variety of associated expenses, from at-home to nursing home care, therapy, and respite care. It provides financial protection for seniors, ensuring they will not have to consume their savings or sell their assets just to pay for care.

It is never too early to purchase long-term care insurance. In fact, the younger a person is when they buy it, the lower their premiums. The cost of long-term care varies by insurer, but generally depends on factors such as age, health, gender, and length of coverage. People who work for large organizations can inquire whether their employer offers long-term care insurance as a benefit. Buying insurance as a group can yield discounts on monthly premiums.

One downside of long-term care insurance is that a person may never actually use it, for example, if they die young without having a chronic illness. Fortunately, some insurers offer long-term care insurance as an add-on to policies like life insurance so if a person dies having never used their care insurance, their beneficiaries receive additional funds as part of their life insurance payout.

1 note

·

View note

Text

Decoding the Long-Term Care Insurance Market: Where Numbers, Players, and Services Collide

Welcome, curious minds! Today, let’s embark on a rollercoaster journey through the fascinating universe of long-term care insurance. Buckle up because we’re about to unravel a market that’s growing faster than a meme on a Monday morning.

The Grand Showdown of Figures:

Hold on to your hats because, according to the not-so-boring report with the catchy ID SQMIG40M2001, the global Long-Term Care Insurance Market was a staggering USD 18.88 billion in 2021. Fast forward to 2030, and we’re looking at a jaw-dropping USD 53.21 billion. That’s a growth rate of 12.3%, making your investment portfolio jealous.

The A-Listers in the Market:

Now, let’s talk about the big shots in this insurance gala. We’ve got the usual suspects — Genworth, John Hancock, Aviva, Allianz, and the rest. It’s like the Avengers of finance, minus the spandex.

Segmentation Shenanigans:

The report delves into segments like a treasure hunter in a jungle. We’ve got types — traditional and hybrid (not the car, unfortunately), applications — between 18 and 64 or over 65 (because age is more than just a number), payers — out-of-pocket and public (cue suspenseful music), and services — nursing care and home healthcare. It’s like crafting your own adventure — choose wisely.

Service Smackdown:

In 2022, nursing care took the spotlight, claiming a massive revenue share of 32.3%. Seems like the elderly have a thing for specialized care. Home healthcare is also making waves — because who wouldn’t want care delivered to their doorstep like a VIP package?

Paying the Piper:

Public funding flaunted its dominance, claiming a whopping 63.5% of the revenue share in 2022. Meanwhile, out-of-pocket expenses played their role but are predicted to take a back seat in the future. Maybe they need a better scriptwriter.

Global Adventures:

North America rocked the charts in 2022, securing the throne with a massive 49.3% share. Meanwhile, the Asia Pacific region is all about the family drama. In Thailand, a jaw-dropping 90% of elderly individuals receive care from family members. Talk about a full house.

For More Information: https://www.skyquestt.com/report/long-term-care-insurance-market

Driving Forces and Roadblocks:

The report spills the beans on increasing awareness surrounding facilities (because apparently, some folks didn’t realize they needed care) and the rising costs of insurance, which is putting a dent in everyone’s pocket. It’s like wanting a first-class ticket but realizing you can only afford economy.

Competitive Comedy:

The market is a dynamic circus with established brands, emerging players, and niche producers. It’s like a talent show, but instead of singing, they showcase innovations.

Wrap-Up Wisdom:

There you have it — the not-so-dry breakdown of the long-term care insurance market. Aging populations, rising awareness, and a dash of financial drama — it’s like a blockbuster movie, but with insurance policies.

So, the next time someone tries to impress you with their insurance jargon at a dinner party, throw in some knowledge bombs from this journey. Because who wouldn’t want to be the superhero of insurance discussions?

Until next time, stay insured and keep it classy!

About Us-

SkyQuest Technology Group is a Global Market Intelligence, Innovation Management & Commercialization organization that connects innovation to new markets, networks & collaborators for achieving Sustainable Development Goals.

Contact Us-

SkyQuest Technology Consulting Pvt. Ltd.

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 617–230–0741

Email- [email protected]

Website: https://www.skyquestt.com

0 notes

Text

Navigating the Maze of Long-Term Care Insurance Market

Hey there, curious minds! Today, let’s embark on a journey into the riveting world of long-term care insurance. Buckle up because we’re about to explore the ins and outs of a market that’s growing faster than a cat video goes viral.

The Numbers Game:

So, according to the not-so-boring report I stumbled upon (Report ID: SQMIG40M2001, because who doesn’t love a good ID), the global Long-Term Care Insurance Market was a whopping USD 18.88 billion in 2021. Hold your breath, because by 2030, it’s predicted to hit USD 53.21 billion. That’s a growth rate of 12.3%, folks! Move over, Bitcoin.

The Who’s Who in the Market:

Now, let’s talk about the players in this insurance circus. We’ve got the usual suspects — Genworth, John Hancock, Aviva, Allianz, and more. It’s like a superhero lineup, but instead of capes, they wear business suits.

Segmentation Shenanigans:

The report dives into segments like a kid into a ball pit. We’ve got types — traditional and hybrid (not the car, sadly), applications — between 18 and 64 or over 65 (because apparently, age matters), payers — out-of-pocket and public (cue dramatic music), and services — nursing care and home healthcare. It’s like choosing toppings for your pizza, but with a bit more financial weight.

Service Smackdown:

In 2022, nursing care took the crown, claiming the largest revenue share at 32.3%. Apparently, the elderly have a soft spot for specialized care. Home healthcare is also on the rise — because who wouldn’t want care delivered to their doorstep like a pizza?

Paying the Piper:

Public funding flexed its muscles, claiming 63.5% of the revenue share in 2022. Meanwhile, out-of-pocket expenses played their part but are expected to take a back seat in the future. Maybe they need a better agent.

Global Adventures:

North America wore the crown in 2022, securing the largest share at 49.3%. Meanwhile, the Asia Pacific region is all about family support. In Thailand, a whopping 90% of elderly individuals receive care from family members. Talk about keeping it in the family.

For More Information: https://www.skyquestt.com/report/long-term-care-insurance-market

Driving Forces and Roadblocks:

The report talks about increasing awareness surrounding facilities (because apparently, some people didn’t know they needed care) and the rising costs of insurance, which is putting a dent in everyone’s piggy bank. It’s like wanting a fancy car but realizing you can only afford a bicycle.

Competitive Comedy:

The market is a dynamic battlefield with well-established brands, emerging players, and niche producers. It’s like a potluck dinner, but instead of dishes, they bring innovations.

Wrap-Up Wisdom:

So, there you have it — the not-so-dry rundown of the long-term care insurance market. Aging populations, rising awareness, and a sprinkle of financial strains — it’s like a soap opera, but with insurance policies.

Remember, folks, the next time someone mentions long-term care insurance at a dinner party, you can impress them with your newfound knowledge. Because who wouldn’t want to be the life of the party, armed with insurance trivia?

Until next time, stay insured and keep it sassy!

About Us-

SkyQuest Technology Group is a Global Market Intelligence, Innovation Management & Commercialization organization that connects innovation to new markets, networks & collaborators for achieving Sustainable Development Goals.

Contact Us-

SkyQuest Technology Consulting Pvt. Ltd.

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 617–230–0741

Email- [email protected]

Website: https://www.skyquestt.com

0 notes

Text

GNW Earnings: Highlights of Genworth Financial's Q3 2023 results

Genworth Financial, Inc. (NYSE: GNW) has reported a sharp fall in earnings for the third quarter of 2023 when the insurance service provider’s revenues remained almost unchanged. The company repurchased around $80 million of its stock during the quarter.

Net income available to shareholders decreased to $29 million or $0.06 per share in the September quarter from $136 million or $0.27 per share…

View On WordPress

0 notes

Text

Wednesday Feature: Dying Broke

Happy First Hump Day of 2024! Short weeks aren’t really deserving of a Hump Day, but it is officially a Wednesday that is not a holiday in a workweek (though I’m sure many are still off from the Christmas/New Year’s season). Thus, no matter deserved or not, it is my first Wednesday Feature and therefore, Happy Hump Day!

This week is interesting as I am catching up on all kinds of reports and…

View On WordPress

#Assisted Living#Costs#Demographics#Dying Broke#Economics#Estate Values#Genworth#Happy Hump Day#Home Care#Home Health#housing#income#Industry Outlook#Kaiser#KFF#Long-term Care#Management#Market Trends#Medicaid#Money#New York Times#Payment#Policy#Retiremenet#Savings#Senior Housing#SNF#Strategy#Trends#Wednesday Feature

0 notes

Text

Antonio Velardo shares: Difficult Choices for Some Long-Term Care Policyholders by Ann Carrns

By Ann Carrns

After a settlement of a lawsuit, Genworth, the biggest holder of the policies, said customers could get reduced benefits or face significant increases in premiums.

Published: December 15, 2023 at 09:00AM

from NYT Your Money https://ift.tt/H96s5qz

via IFTTT

View On WordPress

0 notes

Text

[ad_1]

Pricey MarketWatch, We're really lucky to have a lifetime inflation-adjusted federal pension and Social Safety of $200,000 yearly. We’re a 65-year-old man and a 69-year-old lady. Our revenue roughly breaks out to $125,000 and $75,000, respectively. We didn't benefit from spousal survivor advantages once we retired years in the past, which appeared like a good suggestion on the time. So our plan was all the time to self-insure our long-term care and spousal survivor wants. We want some assist with methods to plan for the long run.

Now we have additionally amassed $1.5 million, half in IRA and thrift savings plans and the opposite half, which got here from the sale of our real-estate property, in a taxable brokerage account. Our monetary adviser has us striving for a 5.5% return on the taxable account. We actually don’t want or intend to faucet these funds, since our pensions cowl greater than our wants and permit for our three to 6 months of journey per yr. Now we have no debt or mortgage and pay our bank cards off month-to-month. One predominant query is, how a lot ought to we put aside, if something, for long-term care? In long-term-care insurance policies previously, the utmost payout was round $360,000. We thought that was the correct amount to focus on. Now we have a life-insurance coverage for the 65-year-old of about $300,000 via 2036. Ought to we search for extra life insurance coverage, or is it cheap to rely upon the above nest egg to cowl the prices of the lower-retirement-income partner, since she will not be eligible for my Social Safety advantages? See: I’m in my 60s with almost $1 million. My home is paid off. I’d like to move but am afraid of the high prices elsewhere: ‘Will I be OK?’ Pricey reader, It's really great to have a lot revenue in retirement via your pension and Social Safety alone. That can definitely assist you within the years to return. Calculating how a lot cash you’re going to want for long-term care might be very tough, similar to making an attempt to determine how a lot it's essential have saved for retirement general. There’s nobody quantity to give you, since what it's best to put apart would rely in your well being, the state you reside in and lots of different elements. Insurance coverage can also be not utterly out of the query now. True, long-term-care insurance coverage can very simply be way more costly than it will have been had you bought it years in the past, however relying in your well being and the supplier you select, you do have choices. There are additionally different insurance coverage choices. For instance, your life-insurance coverage, or one other one, may have long-term-care riders connected to it, akin to a demise profit that pays for these bills. “This could have higher tax advantages and ensures an quantity that’s not uncovered to market dangers,” mentioned Nicholas Bunio, a licensed monetary planner. And not using a rider, the demise profit would solely pay out at demise. To determine how a lot you might want, you might try the Genworth Cost of Care calculator, which helps you forecast the price based mostly on the yr and the interval (month-to-month, each day, hourly and yearly). The calculator consists of figures for in-home care, assisted dwelling and nursing houses. Genworth, an insurance coverage firm that makes a speciality of long-term care, has been monitoring these bills throughout the nation since 2004. These projections generally is a useful begin, mentioned Brenna Baucum, a licensed monetary planner at Collective Wealth Planning. “The everyday long-term-care well being want is simply over three years,” she mentioned. “With these two items of data, you may get insights into how a lot you might have to earmark for long-term care.” Additionally see: We have two houses and 45 acres of farmland, but we don’t know what to do about retirement. Where do we start? However keep in mind, this quantity would simply be an estimate.

To be additional protected, Baucum recommends rising projections or on the lookout for extra sources of funding if the household has any historical past of cognitive decline. Your monetary adviser may additionally level you towards a number of assets or assist you arrange your funds so that a portion of your property are safe ought to it's essential pay for long-term care. You must also double-check — or triple-check— that your partner actually isn’t eligible for Social Safety advantages in your file. The Social Safety Administration can explain further. I’ll finish with this: Along with operating the numbers, assessment — or create! — your necessary estate-planning paperwork, akin to a will, a healthcare proxy and anything you suppose your partner ought to have. You’ve accomplished so nice at making a nest egg, and also you’re working arduous to protect it. Ensure you have all of the paperwork in place to permit you to benefit from the arduous work you’ve already accomplished. Readers: Do you have got strategies for this reader? Add them within the feedback under. Have a query about your individual retirement financial savings? E-mail us at [email protected]

[ad_2]

0 notes

Text

0 notes

Text

MOVEit hack claims Calpers and Genworth as millions more victims impacted, ET Telecom

http://i.securitythinkingcap.com/Sr5mVs

0 notes

Text

Health Insurance and Chronic Conditions: Managing Long-Term Care

When it comes to health insurance, chronic conditions require special consideration. Chronic illnesses can be expensive to manage over years or even decades, and require a consistent and reliable source of care and treatment options. Different insurance programs, such as Medicare and Medicaid, can help pay for long-term care services for people who need care. However, it’s not always enough to cover all the expenses of long-term care. For this reason, long-term care insurance policies are becoming increasingly popular. In this article, we’ll explore how long-term care insurance can help those with chronic conditions, the types of care services available, shopping for long-term care insurance policies, and the costs and benefits of long-term care insurance.

What Are Chronic Conditions and Why Do You Need Long-Term Care Insurance?

Defining Chronic Illnesses

Chronic illness refers to any health condition or disease that persists over an extended period of time, usually for three months or more. Some examples of chronic illnesses include dementia, Parkinson’s disease, multiple sclerosis, and diabetes. Chronic conditions require constant medical attention and can significantly impact a patient’s quality of life, leading to increased medical costs and a higher need for long-term care services.

Long-Term Care Insurance and Chronic Illnesses

Long-term care insurance policies were created to help people pay for the costs of long-term care services they may require due to chronic conditions. For those who need care, a long-term care insurance policy may cover the expenses of care services not covered by regular health insurance, such as personal care and assistance with daily living activities. Additionally, long-term care insurance policies can also provide coverage for services that require a care setting, such as nursing home and assisted living facility care, respite care, and home health care.

Why You Need Long-Term Care Insurance

There are many reasons why you need long-term care insurance. As mentioned earlier, chronic conditions require long-term care services, which can be expensive. According to a survey by Genworth, the national median cost of a private room in a nursing home was $102,200 in 2019, while assisted living facility costs averaged $48,612 annually. Home health care costs are also high, with the national median hourly rate of a home health aide being $22 in 2019. Medicare does cover some long-term care services, but not all. Long-term care insurance can help cover the costs of care services not covered by Medicare, which can greatly reduce the financial burden on the patient and family.

What Are Your Options for Paying for Long-Term Care?

Medicare and Long-Term Care

Medicare is a federal health insurance program that covers hospital stays, doctor visits, and other medical services. However, Medicare doesn’t pay for long-term care services such as help with daily activities of living, such as bathing, toileting, or dressing. Medicare Part A covers nursing home care for up to 100 days, however, after the first 20 days, there is a required daily copayment. Medicare Advantage plans may offer more benefits, but usually at an additional monthly cost to the patient.

Medicaid and Long-Term Care

Medicaid is a federal and state program that provides health insurance coverage for people with low incomes. If you are eligible, Medicaid may cover the costs of long-term care services, but the eligibility requirements vary from state to state. Medicaid will cover nursing home care for those who are eligible, and in some states, Medicaid may also cover assisted living facility care and home health care. However, the eligibility requirements are strict and may require patients to spend down their life savings before becoming eligible for benefits.

Long-Term Care Insurance Policies

Long-term care insurance policies are insurance policies that help pay for long-term care services for those who need care. These policies can help cover the costs of nursing home care, home health care, and assisted living facility care, among other services. It is important to carefully read the policy and understand what services are covered before purchasing a long-term care insurance policy.

What Types of Long-Term Care Services and Supports Are Available?

In-Home Health Services

In-home health services provide care for people in the comfort of their own home. These services may include nursing care, physical therapy, occupational therapy, speech therapy, homemaker services, and personal care aides. With in-home health services, patients can receive the help they need without having to leave their familiar surroundings and can often save on costs associated with facility care.

Nursing Home Care

Nursing homes provide around-the-clock medical care and personal assistance for those who need it. Nursing homes can be expensive, but they offer a safe and secure environment for those who need a higher level of care and support than can be provided by in-home health services.

Adult Day Care

Adult day care is a care service that provides care for people who need care during the day while their caregivers are at work. Adult day care can provide socialization opportunities, meals, and supervised activities for adults who need a little extra help during the day, but who do not need the 24-hour medical care provided by nursing homes.

How Do You Shop for Long-Term Care Insurance?

Understanding Your Care Needs

The first step in shopping for long-term care insurance is to understand your care needs. Consider the types of care you will need, and what type of care setting you prefer.

Determining Eligibility for Long-Term Care Insurance

Before purchasing a long-term care insurance policy, you will need to determine if you are eligible. Eligibility requirements vary from company to company, but generally, you must be in good health and under the age of 85 to qualify for coverage.

Comparing Long-Term Care Insurance Policies

When shopping for long-term care insurance policies, it is important to compare policies to find the coverage that meets your needs. Consider the policy premiums, benefit period, daily benefit amount, waiting periods, and what services are covered under the policy.

What Are the Costs and Benefits of Long-Term Care Insurance?

Long-Term Care Insurance Expenses

The cost of long-term care insurance policies varies based on factors such as age, health status, and the benefits the policy provides. A policy with a longer benefit period, higher daily benefit amount, and shorter waiting period will be more expensive than one with less coverage. It is important to balance the cost of the policy with the benefits it provides to ensure you are getting the coverage you need at a price you can afford.

Long-Term Care Insurance Benefits

The benefits of a long-term care insurance policy include coverage for long-term care services and supports, which can help reduce the financial burden on family members and ensure patients get the care they need. Long-term care insurance policies can offer peace of mind for patients and family members knowing that financial assistance is available for long-term care expenses.

Covered Services

Long-term care insurance policies cover a variety of services, including in-home health services, nursing home care, and adult day care. Some policies may also cover equipment and modifications needed to accommodate patients with chronic conditions in their home. It is important to review the policy carefully to understand what services are covered and what services are excluded.

Conclusion

Chronic conditions can have a significant impact on a patient’s quality of life and financial stability. Long-term care insurance policies can offer peace of mind by providing coverage for long-term care services and supports when they are needed most. By understanding your care needs, comparing policies, and balancing the costs with the benefits, you can find the long-term care insurance policy that is right for you and your family.

Q: What is long-term care insurance?

A: Long-term care insurance is a type of insurance product that helps you cover the cost of long-term care, such as care received in a nursing home or in your own home.

Q: What is the difference between long-term care policies and traditional long-term care?

A: Long-term care policies are insurance products that pay for care coverage, while traditional long-term care refers to securing care yourself through personal savings or other means.

Q: What is Medicaid long-term care?

A: Medicaid long-term care is a government program that may pay for long-term care costs for those who qualify based on their income and long-term care needs.

Q: What is the role of an insurance company in long-term care?

A: An insurance company provides long-term care benefits through long-term care policies.

Q: What are the common long-term services and supports?

A: Common long-term services and supports include personal care services, such as help with activities of daily living, as well as institutional care, such as care in a nursing home.

Q: What is a long-term care partnership?

A: A long-term care partnership is a program that allows you to buy long-term care insurance and qualify for Medicaid without having to spend down all of your assets.

Q: What is the process to get long-term care?

A: If you need long-term care, you will need to assess your long-term care needs and determine the best method to secure care, such as through insurance or personal savings.

Q: What is Medicare’s role in managing long-term care?

A: While Medicare does not cover most long-term care costs, it may pay for qualified long-term care received in a hospital or skilled nursing facility.

Q: How does paying for long-term care work?

A: Paying for long-term care can be done through personal savings, insurance products like long-term care insurance, or government programs like Medicaid.

Q: What is the role of the Agency for Healthcare Research and Quality in long-term care?

A: The Agency for Healthcare Research and Quality is responsible for conducting healthcare research and improving the quality of care for those who need long-term services and supports.

source https://selectinsuregroup.com/health-insurance-and-chronic-conditions-managing-long-term-care/

0 notes