#highriskpaymentprocessor

Explore tagged Tumblr posts

Text

Best High Risk Payment Processors for Payment Gateways

Hello! William Banner here with Payments Clarity. We understand the difficulties high-risk businesses face when it comes to payment processing. That's why we offer specialized payment processing services to help you manage chargebacks and adhere to regulations. As your High Risk Payment Processor, we provide the tools and support you need to keep your business running smoothly.

0 notes

Text

Struggling to get payment support for your high-risk industry?

IGpay makes it easy to: ✅ Accept global payments ✅ Get fast settlements ✅ Stay fully compliant

All from one powerful platform 💡

🚀 Visit www.igpay.io to see how we can help.

#PaymentGateway #ForexPayments #iGamingSolutions #HighRiskPaymentProcessor

0 notes

Text

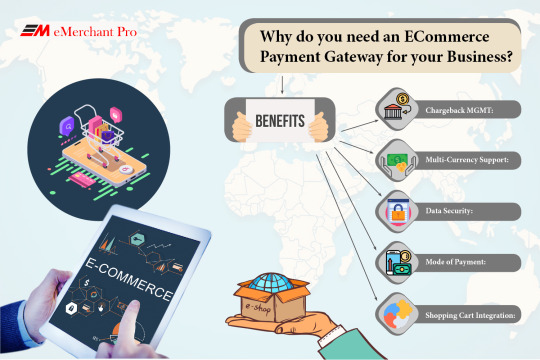

The industry of Commerce is blasting off with the newer generation. The world wants to sit back, relax and order online. Thus, you must give the consumers the convenience to pay online for the products or services. To accept payments you need a payment gateway that will channel the transactions to your merchant account. Here is why you need a payment gateway for your business.

#eCheckPaymentGateway#eCheckpaymentProcessingUSA#EcommerceBusinessOpportunityForAnyone#highriskpaymentprocessor

0 notes

Link

10 notes

·

View notes

Video

tumblr

Don't Let Physical Boundaries Hamper Your Business!! Grow your business today with Floxypay Payment Gateway.... More details: https://floxypay.com/

0 notes

Photo

0 notes

Text

Online Casinos are taking over the internet like a plague because the business in itself has a huge potential today. Furthermore, it becomes vital for your business to reach better heights every day.

If you are constantly worrying about a payment processing solution on your website then your business has lower chances to reach the maximum market. Hence, eMerchant Pro is here for the aid of your venture that you started with an emotion in mind.

#emerchantpro#high risk merchant account#high risk payment gateways#highriskpaymentprocessor#online casino merchant account#payment gateways

0 notes

Link

2 notes

·

View notes

Photo

FLOXYPAY PAYMENT GATEWAY.. Easy & Fast Payment Solution Gateway! #Floxypay #paymentprocessing #paymentgateway #globalpayments #globaltransactions #merchantservices #highriskpaymentgatewayproviders #highriskpaymentprocessor #memes #instagrammemes #bhyp

0 notes

Video

tumblr

Most Popular And Trusted Payment Gateway. More details: https://floxypay.com/ #Floxypay #paymentprocessing #paymentgateway #globalpayments #globaltransactions #merchantservices #highriskpaymentgatewayproviders #highriskpaymentprocessor #ecommercebusiness #bhyp #trending

0 notes

Photo

FLOXYPAY provides you the best reliable payment processing solution that fits your business requirement. #paymentgateway #floxypay #onlinepayment #merchant #ecommerce #website #cryptocurrency #trading #currencyexchange #currencytrading #happycustomer #highriskpaymentprocessor #merchantaccount #btc #paymentprocessing #trending #instapost

0 notes

Text

What Are The Cons and Pros Of High-Risk Merchant Account?

A pros of High-Risk Merchant Account – Getting a “High Risk” Merchant label is not anybody’s dream. There are many businesses that are considered as a high-risk business and many payment processing companies do not want to work with them. But sometimes, we ignore the benefits of having a high-risk business.

Here we are going to discuss the pros of high-risk merchant account. When discussing the pros the cons should also be considered. You will get the complete information related to the high-risk business and merchant account. If you have any further query, feel free to contact the Merchant Stronghold at the toll-free number +1(888) 622-6875.

WHAT IS THE HIGH-RISK BUSINESS?

In a simple language, the business with greater risk can be put under this category. What is the risk in a business that makes it the high-risk business? It depends on the industry you are investing in or the kind of clientele you have. Moreover, the risk department decides which business should put under the high-risk or low-risk business.

Factors leading to the High-Risk Business are:

You have lost your previous merchant account or the business

Your business includes high chargeback ratio

You own an international business

The business has low or no business credit history

Dealing in multiple currency and country

Your business deal in subscription-based products.

Examples of the High-Risk Business are:

Casino and Gambling Business

Telemarketing

Pharmaceuticals or drug stores

Airline tickets

Forex Trading

Computer software or hardware

These are some examples of the high-risk business. Also as you can see, some of these businesses are one of the high-profit businesses. In addition, one of the pros of High-Risk Merchant Account can be associated with the profit.

CONS OF HAVING A HIGH-RISK MERCHANT ACCOUNT

Now a business owner has to get a merchant account. This account is used to carry out the transactions of the merchant. Now if your company has too many numbers of chargebacks then your account will be referred to as high-risk merchant account.

There are many reasons a merchant do not want to own a high-risk merchant account, these are:

Excessive Chargeback Fees – The Bank already consider that the high-risk business will produce a number of chargebacks. In order to deal with the chargeback, bank charges extra chargeback fees to deal with them in future.

Need to create a Merchant Account Reserve. For the high-risk business, the bank asks them to open a no-interest saving account. This is done to deal with an unexpected number of chargeback in the future. If someday merchant is asked to pay a large sum due to a chargeback then this account will be used to pay off the customer.

If you are at risk of becoming a high-risk business due them to growing number of chargeback in your enterprise then get an expert to assist you. Contact the Merchant Stronghold at the toll-free number for such services.

PROS OF HAVING A HIGH-RISK MERCHANT ACCOUNT

There is also a bright side to the high-risk business. It is hard to believe but high-risk business can actually help you earn more profit than other businesses.

Pros of High-Risk Merchant Account are:

Great Earning Potential. The payment processor limits the revenue rate for the low-risk business. But the high-risk business has the no limit when it comes to earning and expanding the business.

Risky Products lead to More Profit. When you own a high-risk business account you can sell almost anything in the market. This is one of the Pros of High-Risk Merchant Account that makes it the most profitable business.

Worldwide Expansion. If you own a high-risk business then you have all the access to expand your business beyond any boundaries. You can deal in any currency with the desired country.

When it comes to earning the profit, high-risk business is the best. Also, you can say the Pros of High-Risk Merchant Account is a great profit.

CHARGEBACK AND PROFITS

Chargebacks and profit cannot go hand-in-hand. Chargebacks should be decreased in order to gain in any business, low risk or high risk. No matter how many Pros of High-Risk Merchant Account you have, you will eventually face loss if the chargeback is not controlled.

If you own a high-risk business and need tips to overcome chargeback in your enterprise. Then you can get a chargeback specialist at MerchantStronghold. Contact us at the toll-free number or reach us using the Skype chat.

#highriskcreditcardprocessingmerchantaccount#highriskpaymentgatewayproviders#HighRiskMerchantAccount#highriskprocessing#highriskmerchant#highriskpaymentprocessors#highriskmerchantaccountproviders#besthighriskmerchantservices

0 notes

Text

How Credit Card Transaction Processing Works: Steps & Key Players

Credit card transaction is not a new concept. Everybody cases to know the procedure: swipe the card, hit the button and the transaction is complete in a blink. Be that as it may, do you truly know the procedure? Do you imagine that it is as simple as it appears? It really is a substantially more intricate procedure than what you witness. The fact is swiping the card and signing the recipe is the first and the last step of the procedure. In between lays multiple steps that include more than one person working invisibly for the customer to complete that particular transaction.

Most of the customers do not care about the complete process. It may seem unnecessary, it provides important information about the inner workings of the modern commerce. Not only for customers but knowledge about credit card transaction process is tremendously important for small business owners as well, as it is a merchant who has to confront the cost of the payment processor. Let us discuss the working of credit card processing in detail.

Key Players

CARDHOLDER

There are two types of cardholders 1. Who repays full credit card balance? 2. Who pays only a portion of balance and rest accrues interest?

MERCHANT

This is the store or seller who pitches goods or services to the cardholder. The merchant acknowledges credit card payments. The activity of a merchant is to accept payment through a card, send the card information to the issuing bank and request payment approval.

MERCHANT’S BANK

It is also known as acquiring the bank and is responsible for sending an authorization request to the issuing bank through a proper channel followed by communicating the response of the issuing bank to the merchant.

SERVICE PROVIDER

Also known as acquiring processor is a third party entity that works as an arm of the merchant’s bank. It provides service or device that allows the merchant to accept credit card for payment and also sends the credit card details to the credit card network and further sends back payment authorization to the acquiring bank.

CREDIT CARD NETWORK

Also referred to as Association member, works the system to facilitate the credit card payment process, worldwide and administrate interchange fees. Credit card network receives details of credit card payment from the service provider and forwards the request for authorization to the issuing bank. Consequently, it sends a response of the issuing bank to the service provider. Some of the examples of the credit card network are Visa, MasterCard, and American Express

ISSUING BANK

Also called the credit card issuer is a financial institution that provides the customer with a credit card, which is involved in the transaction. After receiving the authentication request from credit card network, the issuing bank either approves it or declines it.

Credit Card Transaction Process

Give us a chance to comprehend transaction process in only three stages:

STEP 1: AUTHENTICITY

At the point of sale, a cardholder gives the card to the merchant to swipe the card on POS terminal to make a payment.

Credit card details are sent to the acquiring bank, which forwards the same to the credit card network

Credit card network clears the payment and a request is sent to the issuing bank for an authorization.

Authorization request includes credit card number used for the payment, expiration date, billing address, card security code and the payment amount.

STEP 2: AUTHENTICATION

When the issuing bank receives the authorization request, it validates the credit card number, checks the availability of the funds in the cardholder’s account, verifies the billing address and validates Card security code (CVV number).

It is up to the issuing bank whether to approve or deny the request. When they make a decision, it sends back the suitable response through a proper channel (credit card network and acquiring bank).

Once the merchant receives the authorization, the customer is provided with the receipt at the completion of the sale.

STEP 3: CLEARING AND SETTLEMENT

In clearing stage, the transactions get the post to the cardholder’s monthly billing statement and in the merchant’s statement.

The merchant sends all the approved authorizations in a batch to the acquiring bank by EOD.

For settlement, service provider routes the batched information to the association member, which in turn forwards all the approved transactions to the corresponding issuing bank.

Then the issuing bank transfers the funds (minus interchange fee, which is shared with the credit card network) within 1-2 days. Then the credit card network pays from the remaining funds to acquiring bank as well as the acquiring processor.

The merchant account gets credited for the cardholder’s purchases by the acquiring bank (minus merchant discount rate). At this time, the issuing bank posts the transaction information to the cardholder’s account. The cardholder receives the statement and bill is paid off.

0 notes