#how is supertrend calculated

Text

What is The SuperTrend Indicator

Discover the power of the SuperTrend Indicator, a cutting-edge tool in the world of trading. Trading Fuel brings you an insightful guide on how this popular technical analysis tool helps traders identify trends and make informed decisions. Learn how to leverage the SuperTrend Indicator to enhance your trading strategies and stay ahead in today's dynamic financial markets. Unlock the potential of this powerful tool with Trading Fuel's comprehensive analysis and expert tips.

0 notes

Link

IN THIS VIDEO, I HAVE SHOWN, IN BUY SELL EXCEL SHEET.BUYING SELLING LEVELS OF EQUITY, COMMODITY , NIFTY, BANKNIFTY, FUTURES, 100 DAY SMA STRATEGY, CANDLESTICK PATTERNS, GANN, FIBONACCI,MURREY, VOLATILITY BASED GANN, FIBONACCI LEVELS, STADARD DEVEATION , PROBABILITY BASED LEVELS. I HAVE ALSO GIVEN IN BUY SELL EXCEL SHEET STOCK RECOMMENDATION INTRADAY AND WHAT TO TRADE TOMORROW.IN THE BUY SELL EXCEL SHEET, THE BUYING SELLING LEVELS ARE CALCULATED BASED ON GANN, FIBONACCI, PRICE ACTION SUPPORT RESISTANCE. THE BUYING AND SELLING LEVELS FOLLOWS BEST INTADAY STRATEGY, NIFTY BANKNIFTY BEST INTRADAY STRATEGY. IN THIS BUY SELL EXCEL SHEET, ONE WILL FIND NIFTY BANKNIFTY TRADING LEVELS, EQUITY COMMODITY, FUTURES BEST TRADING LEVELS, MCX TRADING LEVELS, STOCK RECOMMENDATIONS FOR INTRADAY AND WHAT TO TRADE TOMORROW . IN THIS BUY SELL EXCEL SHEET, GANN, FIBONACCI, MURREYS MATHEMATICAL LEVELS ARE CALCULATED BASED ON VOLATILITY, PROBABILITY, STANDARD DEVIATION. ONE CAN TRADE VERY EFFECTIVELY AND PROFITABLY WITH HIGH ACCURACY IN INTRADAY AS WELL AS POSITIONAL , SWING TRADES. ONE CAN ALSO FIND BEST INTRADAY TRADING STRATEGIES LIKE 100 DAY MOVING AVERAGE STRATEGY. ONE CAN ALSO FIND THE VARIOUS CANDLESTICK PATTERNS FORMED ON DAILY BASIS FROM PRICE ACTION. ONE CAN ALSO FIND HERE intraday stocks, nifty buy sell levels, predict nifty and banknifty levels, how to find support and resistance levels. WEBSITE: www.stocktradingadvisor.wordpress.com #BUYSELLEXCELSHEET#WHATTOTRADETOMORROW#STOCKRECOMMENDATIONINTRADAY#NIFTYBANKNIFTYTRADINGLEVELS#SAFE#STOCKTRADING#AND#INVESTMENT Social network links: Facebook: https://www.facebook.com/dibyendu.mandal.1656 FACEBOOK PAGE : SAFE STOCK TRADING AND INVESTMENT https://www.facebook.com/dibstocktrader/ TWITTER @dmonline6 INSTAGRAM:dib_mon, Youtubechannel : subscribe https://www.youtube.com/channel/UC_lurQ750cmTdk19KMJorjQ TEEGRAM CHANNEL: https://t.me/dibstocktrader WHATSAPP: https://chat.whatsapp.com/EBRXDaBWqaAGtbOzzniWTi WEBINAR TRAINING MODULE: ONLINE WEBINAR ON STOCK MARKET TRAINING LEARN AND EARN FROM STOCK MARKET. TAKE THIS LIFETIME OPPORTUNITY WITH MINIMUM COST . TRAINING WILL COVER: Ø TECHNICAL ANALYSIS , CHART SET UPS, AND INDICATORS Ø USE OF FIBONACCI, GANN TOOLS Ø CALCULATION OF VOLATILITY, VOLATILITY BASED GANN, FIBONACCI AND MOST PROBABLE BUY SELL LEVELS CALCULATIONS Ø OPTION CHAIN ANALYSIS AND STRATEGIES REGISTRATION FEES: RS.2499 ONLY. THIS IS LIFETIME OPPORTUNITY WHICH YOU SHOULDN’T MISS, WHERE YOU WILL GET THESE WITH 20-30 TIMES EXTRA COST. FOR REGISTRATION AND PAYMENT GO TO www.stocktradingadvisor.wordpress.com. MUST WATCH THIS VIDEO TO SEE HOW TO USE BUY SELL LEVEL CUM SCREENER AND WHAT ARE AVAILABLE IN THIS https://youtu.be/I_2AhfbofrE MUST WATCH THIS VIDEO ON NIFTY AND BANKNIFTY 27.03.2020 https://youtu.be/SZ9eJ6gm36Q FOR free trial Join TELEGRAM CHANNEL https://t.me/dibstocktrader USE THIS LINK TO OPEN ACCOUNT https://asthatrade.com/?c=YTwcT .Upstox. https://upstox.com/open-demat-account/?utm_source=refernearn&utm_medium=referral&landing_page=ReferAndEarn&f=JDWL Refer Code 145296 JOIN ALICEBLUEONLINE REFERRALCODE : https://app.aliceblueonline.com/openAccount.aspx?C=WBK279 JOIN ANGEL BROKING, D57318 download the sample file through this LINK https://stocktradingadvisor.files.wordpress.com/2020/04/buy-level-and-sell-level-cum-screener-1-3.xlsx You can also use this file https://stocktradingadvisor.files.wordpress.com/2019/11/buy-sell-level-4-11.xlsx Watch video on pair trading https://youtu.be/7FwQMB9KPYc watch video on arbitrage: https://youtu.be/cdqQmCFluLY WATCH VIDEO ON HOW RO FIND MARKET DIRECTION https://youtu.be/-2XhmkZMP8k WATCH VIDEO ON GANN MOVING AVERAGE WITH VOLUME PROFILE AND PIVOT POINT TRADING STRATEGY: https://youtu.be/bl8R86coRZQ WATCH VIDEO ON POWER OF GANN ANGLES,DEGREES,FIBONACCI RETRACEMENT https://youtu.be/eq164g3KbHw WATCH VIDEO ON SUPERTREND EMA HACKS MOVING AVERAGE TRADING STRATEGY https://youtu.be/3KmnNCP_h7c WATCH VIDEO ON HOW TO SELECT STOCK FOR LONG TERM https://youtu.be/Q6Ndp7QYDyM WATCH VIDEO ON HOW TO SELECT STOCKS FOR INTRADAY https://youtu.be/6aTsdPlO9hQ WATCH VIDEO ON VWAP HEIKIN ASHI TRADING STRATEGY https://youtu.be/t5msg2MYCWE RELATED TAGS: BUY SELL EXCEL SHEET,STOCK RECOMMENDATION INTRADAY,WHAT TO TRADE TOMORROW ,BUYING SELLING LEVELS,NIFTY BANKNIFTY BEST INTRADAYSTRATEGY, NIFTY BANKNIFTY SUPORT RESISTANCE,mcx buy sell levels, nifty banknifty important buying selling, intraday stocks nifty buy sell levels, predict nifty and banknifty levels, how to find support and resistance levels,support and resistance zones,,support and resistance trading strategy ,support andresistance indicator,, how to trade in futures, Drone in D by Kevin MacLeod is licensed under a Creative Commons Attribution license (https://creativecommons.org/licenses/by/4.0/) Source: http://incompetech.com/music/royalty-free/index.html?isrc=USUAN1200044 Artist: http://incompetech.com/

1 note

·

View note

Text

SuperTrend Indicator - 2020 Guide - MultiCharts & TradeStation Download

Are you searching for SuperTrend Indicator? This post if for you!The Supertrend Indicator (ST), developed by Olivier Seban, was born as a tool to optimize the exit from trade, which is a trailing stop.Today is one of the most used tools by traders.In this tutorial, we will explain what it is, how it is used, and how to calculate it. You can also download SuperTrend free versions for TradeStation, MultiCharts, MetaTrader. What exactly are you looking for?Click to scroll down

Table Of Index

What is SuperTrend Indicator?

How do you use the ST Indicator?

How is SuperTrend calculated?

Download SuperTrend indicator for Free

What is SuperTrend Indicator?

The ST Indicator ST belongs to the category of follower trend indicators. These types of indicators signal the direction of the trend and highlight the continuation or changes of direction.This indicator works well in a trending market.And very similar in his conception to Wilder’s Parabolic SAR. However, the Supertrend has the merit of positioning itself horizontally, in a sort of stand by, in moments of price laterality, avoiding getting us out of position before time.We must always remember that all trend-follower indicators have a common flaw: they warn of the change of trend AFTER the change has taken place, not PRIMA.They are all indicators that update with an inevitable delay; they are not anticipators of the trend.Let’s see the two indicators in comparison: the SuperTrend is represented with the solid line, while the Parabolic SAR with the classic green dots (up) and red dots (down)

It is immediately noticeable that the continuous color change of the Parabolic SAR gives rise to many more false signals than the SuperTrendHowever, the ST has two enormous merits:1) It is straightforward to use because the identification of the trend takes into account the average volatility of the asset.2) It can be used with any timeframe and all financial instruments (shares, indexes, forex).Others do not do so and, therefore, often force them to leave the market too early.On the other hand, the SuperTrend filters many false signals, and this allows us to keep the position open for longer and increase the average profit.

A trend follower strategy to be successful must remain on the market as long as possible.The longer you stay on the market, the more trends you can take advantage of.At the same time, it also needs to come out quickly if the trade is going the wrong way.

How do you use the ST Indicator?

From a graphical point of view, the Super Trend appears as a red or green line that accompanies price trends.The red line identifies periods characterized by a negative trend, while the green line indicates market periods with a positive trend.When the line is below the graph, the trend will be upward, and it will, therefore, be preferable to open long positions.When the indicator line is above the graph, the trend will be downward, and it will, therefore, be preferable to open short positions;There are 3 different ways you can use this indicator:Filter OperationsThe ST show us the current trend, remember that we do not want to go against the primary uptrend or downtrend.So if the underlying trend is upward, we will only do long trades, if downward only short trades.In this way, we filter several false “counter-trend” buy signal or sell signal.The reversal of a trend occurs when prices cross the indicator line positioned at a given level from one side to the other.This level is defined as a roof or floor, depending on whether it is above or below the price scale.

We need it as a trailing stop.The ST can be used to manage the exit from another trading strategy.This indicator will keep us in the extended position until the indicator remains green or short until the indicator remains red.We'll get out as soon as the color changes.SuperTrend Trading StrategyWe could use a Supertrend Trading Strategy to find buy or sell signal.We open a long position at the change of color from red to green (buy signal is generated).Vice-Versa we can opening a short trade when green become red (sell signal is generated).Positions will close the next time the indicator changes color.Theoretically, we can always stay in the market – stop & reverse strategy – moving from long to short all the time.

With this technique, there will be no shortage of false signals, especially in phases of prolonged laterality.It will, therefore, be of fundamental importance to close the position in stop-loss if the market does not go in the desired direction.We prefer to suggest that you do not use it alone but integrate it into your trading systems with the use of other tools.Even if the ST is a very valid indicator, it is better to use it in combination with at least one other.We can use it together with the CCI, Momentum, ADX, RSI. Two SuperTrend Indicators - The Double StrategyThere is also the possibility to take advantage of ST not in combination with another technical indicator, but by combining two ST indicators.We can then apply the same indicator to the graph but with two different settings, one fast and one slow.In this case, when the fast curve crosses from bottom to top the slow curve, we have a long signal.When the fast curve returns below the slow curve, it is time to close the operation. We practically expect both curves to have the same color.

Which Timeframe to use for SuperTrend IndicatorAt first, we said that the SuperTrend has the advantage of being able to be used in every timeframe.In general, however, on intraday trading timeframes it loses its effectiveness, there is no single rule, it is advisable to make a few attempts on the financial instrument we intend to trade.Although it should always be remembered that the real trend exists only on long time frames, so from the daily up.

SuperTrend Indicator MultiTimeFrameAlways to limit false signals, we have built a SuperTrend Multi Time Frame indicator.You can find the article and indicator to download for free at this link.

How is ST Indicator calculated?

The ST is calculated based on a coefficient that is applied to the average volatility of the period considered.The Super Trend indicator is calculated using the Average True Range (ATR).The Average True Range is an indicator that calculates the average range of the last X seats and measures volatility.Once volatility is identified, the Super Trend is calculated by applying to the latter a volatility multiplier and a coefficient relative to the observation period over which volatility is calculated.It must always be borne in mind that the higher the weight of volatility, the wider the range of tolerance before a reversal of trend occurs.The SuperTrend Indicator Formula:Upper=(high+low)2+ (Multiplier∗ATR)Lower=(high+low)2− (Multiplier∗ATR)

Download Super Trend Indicator for Free

This is our custom Super Trend indicator coded in EasyLanguage for TradeStation and MultiCharts. You can download it for free.Download SuperTrend MultiCharts Indicator for FreeDownload SuperTrend TradeStation Indicator for Free

Conclusions

Is the ST Indicator a great indicator?The ST is, indeed, a great indicator.However, we always remember that when long sides are formed, the Supertrend generates many false signals, but it is still the biggest flaw of all the trending indicator.

Q&A

Can I use the ST for intraday trading?

It is certainly possible to use it but we do not like it as a trading system because in the market the ongoing trend exists are on high timeframes. A correct ST trading strategy should be based on daily timeframes or higher.Is it the best trending indicator?

For us it is the best trending indicator. The Super Trend Indicator is the one that provides fewer false signals, compared to parabolic sar for example Editors' Recommendations:SuperTrend Multi Time Frame IndicatorHow to AutoTrade DivergencesSuperTrend for TradeStation and MultiChartsHOW TO USE THE MOVING AVERAGES TO IDENTIFY THE TRENDCMO Indicator | Chande Momentum Oscillator | TutorialEasyLanguage TutorialFree EasyLanguage IndicatorEasyLanguage & PowerLanguage Tutorial - Time and DateIchimoku Indicator | Ichimoku Kinko Hyo | TutorialHow to read a Price Chart - Bar Chart - CandleStick - Kagi - Heikin AshiMoving Average: All about Moving Averages || 2020 TutorialThe Vortex Indicator || TutorialHow to Use the TradeStation Backtest to Analyze an InstrumentGraphic Technical Analysis - How to read a stock market chartsTutorial - Using EasyLanguage to Export Data From TradeStation to ExcelWhat is the Dow Theory in technical analysisYou can learn more about this indicator, reading these resources:Wikipedia

Please insert your name and your email address. We will send you the Indicator for free !!!

Your Information is safe with us. We respect your privacy! We will never share your data with anyone else who might.

Please check your Junk E-mail folder

Free Indicator for Multicharts

Free Indicator for TradeStation

Do you want to learn EasyLanguage & PowerLanguage for TradeStation and MultiCharts? Start here:EasyLanguage & PowerLanguage Master Tutorial A lot of free Indicators in EasyLanguage & PowerLanguage for TradeStation and MultiCharts: TradeStation and MultiCharts Indicators

Are you looking for a NinjaTrader SuperTrend? You can find it in the NinjaTrader Forum.

Read the full article

0 notes

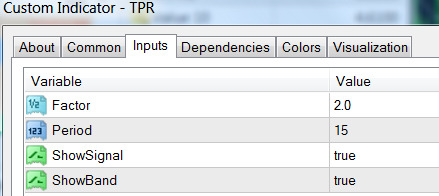

Photo

New Post has been published on http://patternsmart.com/wp/trend-pullback-reversal-tpr-indicator-mt4/

Trend Pullback Reversal TPR indicator MT4

For more screenshots please visit: https://t.co/JQacXoMsNG

The TPR(Trend Pullback Reversal) indicator forms a possible price trend with Pullback and Reversal signals.

The NinjaTrader 8 version comes with a unique band and center line as additional features.

TPR works on all timeframes and all symbols and all type of bar chart.

TPR never repaints.

There are 4 Parameters:

Period: number of bars used for calculations

Factor: Multiplier factor, small number for short trend, large number for long trend

ShowSignal: enable to show the signal dots

ShowBand: enable to show band and center line

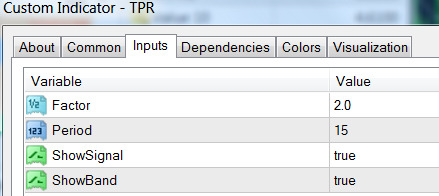

This is a video of how TPR indicator on NT8 performs in a relatively long-term downtrend of Forex AUDUSD 5min chart.

https://youtu.be/ZMHcQLto_1E

You may think it looks like supertrend or braintrend, right?

Actually, most trend indicators have similar plot, the differences are where and when they give signals.

Unlike other trend indicators, TPR will focus on main trend and filter out most minor price movements. The green cross-line represents an uptrend, the red cross-line represents a downtrend and the blue dots are signals for possible reversals.

The additional band and center line may look like bollinger band, but the TPR band algorithm is completely different from bollingerband. There is no standard deviation in TPR band calculation.

You can see how TPR reacts to price movement from the following images.

The orange and cyan dots give possible reversal signals.

-

0 notes

Text

Getting To Know How Indicators Works For Traders

If you have been trading the Forex market then you must have known that in technical analysis, we are required to be able to read the chart properly. There are lots of traders out there that use technical analysis to determine the future price movement. They calculate and analyze the chart based on the previous price data. Technical analysts often believe that price will repeat what it's done in the past. That is why previous data on the chart is really important for technical analysts to examine so they can make the best judgment on the next possible price movement.

To help them determine price's next movement, analysts usually adding some indicators to their chart in order to help them reads the chart more clearly and to have guided help from them on what might be happening in the future.

There are many indicators that trader can use to help them in their technical analysis. Each one of those indicators are unique, have their own ability to predict price movement and very helpful if the traders knows how to use them properly. Some indicators are usually attached to the chart below the price while other are usually attach directly to the price itself. Many traders uses more than three or even five indicators, while some of them uses only one indicator or none at all. It is just individual preferences really.

Technical traders such as the scalp traders usually combine two or more indicators to help them predict price movement easily. Scalp traders always like to use indicators that are fast such as the Parabolic SAR, Moving Averages and Bollinger Bands. The combination between those three can bring good result for short term traders such as the scalp traders. Scalp traders are commonly using the small time frame such as 5 minutes and 1 minute chart. That is why they need fast indicators to help them make the best judgment from it.

Swing traders and day traders are known for their use of lagging indicators. Lagging indicators are the indicators that always move by following the price action. This mean indicators are forming after the price has close. Such indicators are like Moving Average Convergence Divergence (MACD), the Slow Stochastic and Relative Strength Index (RSI)

Lagging indicators are usually telling the traders about the possible price reversal that might be happening in near future. Overbought and oversold condition can also be recognized through them. For example, there are points on the Slow Stochastic that telling people whenever the indicator reach to some points, the overbought - oversold condition may apply. And when those conditions are applied, traders might want to be very careful if they are still having open position because price will probably out of gas to continue its move to the upside or to push even lower to the downside

If you have any queries concerning where and how to use ninjatrader supertrend indicator, you can speak to us at our own web-site.

.

0 notes

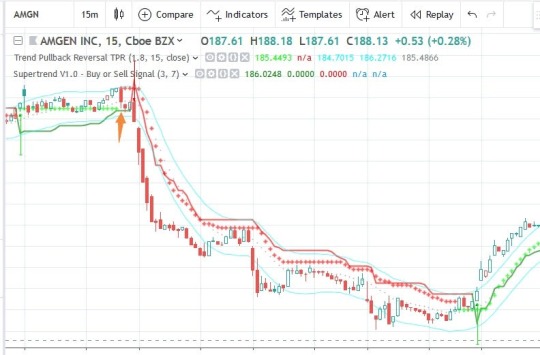

Photo

New Post has been published on http://patternsmart.com/wp/trend-pullback-reversal-tpr-indicator-for-multicharts/

Trend Pullback Reversal TPR indicator for MultiCharts

VIP price is $99. This is lifetime access license.

Please note that this is for MultiCharts, not MultiCharts.NET

The TPR(Trend Pullback Reversal) indicator forms a possible price trend line and the trend line can be used as support & resistance level, it also provides Pullback and Reversal signals.

TPR works on all timeframes and all symbols and all type of bar chart.

TPR never repaints.

There are 4 Parameters:

Period: number of bars used for calculations

Factor: Multiplier factor, small number for short trend, large number for long trend

ShowSignal: enable to show the signal dots

ShowBand: enable to show band and center line

Click an image to view at full size.

We use the same algorithm for the TPR on all platforms, it will work exactly the same on any platform, you can also view some screenshot and videos we took from other platforms.

This is a video of how TPR indicator on NT8 performs in a relatively long-term downtrend of Forex AUDUSD 5min chart.

You may think it looks like supertrend or braintrend, right?

Actually, most trend indicators have similar plot, the differences are where and when they give signals.

Unlike other trend indicators, TPR will focus on main trend and filter out most minor price movements. The green cross-line represents an uptrend, the red cross-line represents a downtrend and the blue dots are signals for possible reversals.

The additional band and center line may look like bollinger band, but the TPR band algorithm is completely different from bollingerband. There is no standard deviation in TPR band calculation.

The following image is a comparision of TPR and BOLL.

The TPR band gives a possible range of the TPR movement, if TPR is outside of the band for many bars or far away from the band, it could be a sign of trend reversal.

The chart below is an example of TPR outside of band.

You can see how TPR reacts to price movement from the following images.

The orange and cyan dots give possible reversal signals.

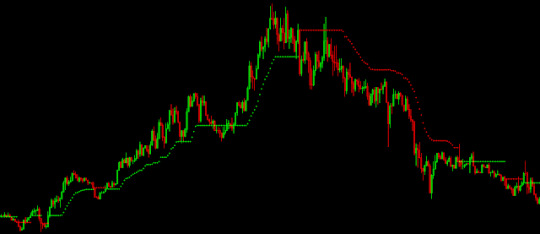

If you are familiar with Supertrend indicator, you may think the TPR is almost the same as Supertrend. In this case, you should read the following content.

If only check the line plot from both Supertrend and TPR, it's easier to notice that TPR may change trend ealier than supertrend, as shown in the charts below, but that's not the main difference between them.

The most important difference bewteen TPR and supertrend is that TPR can be used as support and resistance indicator as well, not just a trend indicator.

The following 2 charts have both TPR and supertrend. The solid line is from supertrend, the cross line is TPR.

As you can see, the line from TPR provides a very good support and resistance level, but supertrend is far away from the price bar which cannot be used as support and resistance level at all.

In short, if you only need a trend indicator, both TPR and Supertrend will do the job.

But if you also want it to provide support and resistance level, TPR is much better than supertrend.

For more screenshots please visit: https://t.co/JQacXoMsNG

-

0 notes

Photo

New Post has been published on http://patternsmart.com/wp/trend-pullback-reversal-tpr-indicator-for-sierra-chart/

Trend Pullback Reversal TPR indicator for Sierra Chart

VIP price is $99. This is lifetime access license.

The TPR(Trend Pullback Reversal) indicator forms a possible price trend line and the trend line can be used as support & resistance level, it also provides Pullback and Reversal signals.

TPR works on all timeframes and all symbols and all type of bar chart.

TPR never repaints.

There are 4 Parameters:

Period: number of bars used for calculations

Factor: Multiplier factor, small number for short trend, large number for long trend

ShowSignal: enable to show the signal dots

ShowBand: enable to show band and center line

Click an image to view at full size.

We use the same algorithm for the TPR on all platforms, it will work exactly the same on any platform, you can also view some screenshot and videos we took from other platforms.

This is a video of how TPR indicator on NT8 performs in a relatively long-term downtrend of Forex AUDUSD 5min chart.

You may think it looks like supertrend or braintrend, right?

Actually, most trend indicators have similar plot, the differences are where and when they give signals.

Unlike other trend indicators, TPR will focus on main trend and filter out most minor price movements. The green cross-line represents an uptrend, the red cross-line represents a downtrend and the blue dots are signals for possible reversals.

The additional band and center line may look like bollinger band, but the TPR band algorithm is completely different from bollingerband. There is no standard deviation in TPR band calculation.

The following image is a comparision of TPR and BOLL.

The TPR band gives a possible range of the TPR movement, if TPR is outside of the band for many bars or far away from the band, it could be a sign of trend reversal.

The chart below is an example of TPR outside of band.

You can see how TPR reacts to price movement from the following images.

The orange and cyan dots give possible reversal signals.

If you are familiar with Supertrend indicator, you may think the TPR is almost the same as Supertrend. In this case, you should read the following content.

If only check the line plot from both Supertrend and TPR, it's easier to notice that TPR may change trend ealier than supertrend, as shown in the charts below, but that's not the main difference between them.

The most important difference bewteen TPR and supertrend is that TPR can be used as support and resistance indicator as well, not just a trend indicator.

The following 2 charts have both TPR and supertrend. The solid line is from supertrend, the cross line is TPR.

As you can see, the line from TPR provides a very good support and resistance level, but supertrend is far away from the price bar which cannot be used as support and resistance level at all.

In short, if you only need a trend indicator, both TPR and Supertrend will do the job.

But if you also want it to provide support and resistance level, TPR is much better than supertrend.

For more screenshots please visit: https://t.co/JQacXoMsNG

-

0 notes