#income tax return filing 2021-22

Text

The IRS will do your taxes for you (if that's what you prefer)

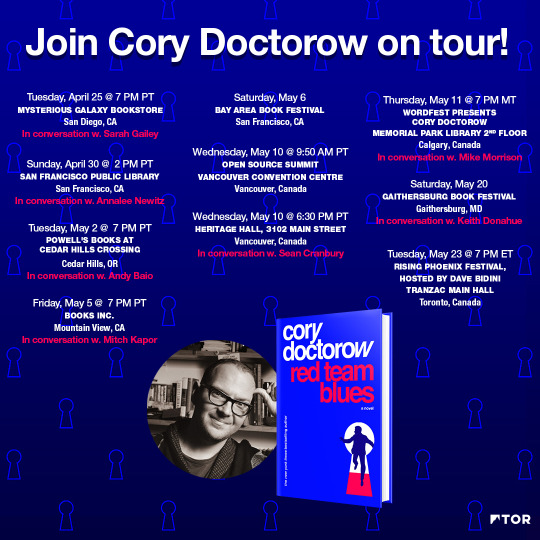

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

177 notes

·

View notes

Text

If a UK resident person gets rental income (either from UK Property or Overseas property) or capital gains from selling the properties, the landlord needs to prepare and file a Self Assessment Tax Return with HMRC, usually referred to as Self-Assessment return (SA100).

Similarly, if a non-UK resident person gets rental income from UK Property, the overseas investor needs to prepare and file a Self Assessment tax return with HMRC.

Who Needs To File A Self Assessment Tax Return In The UK?

Generally, if you have any taxable income not already taxed, you must file a Self-Assessment return with HMRC. If you only have employment income taxed under PAYE, you don't need to file a Self Assessment Tax return.

Usually, the following people need to file a Self Assessment return with HMRC:

You are a self-employed or sole trader (with income of more than £1,000 allowance)

You are a partner in a partnership business

You are landlord receiving rental income of more than £1,000

You are a company director who has income not taxed under PAYE

Your total income is £100,000 or more (even if it is already taxed under PAYE)

Your income from savings and investments is £10,000 or more

You have transferred or sold assets worth more than £49,200 (£24,000 from April 2023 and further reduced to £12,000 from April 2024)

You have net capital gains of more than the annual exemption limit (which is £6,000 for the tax year 2023/24)

You or your partner are receiving a high-income child benefit charge, and your adjusted net income is more than £50,000

What Is The Deadline For The Self Assessment Tax Return?

A tax year runs from 6 April to the following 5 April in the UK. So, for example, the tax year 2022/23 runs from 6 April 2022 to 5 April 2023.

The deadline for an online filing tax return is 31 January, following the end of the tax year. For the tax year 2022/23, the deadline for filing a tax return is 31 January 2024. However, if you are filing a paper return, the deadline is 31 October in the same year as the tax year's end. For the tax year 2022/23, the deadline for filing a paper return is 31 October 2023.

Are There Any Penalties For Late Filing?

If the tax return is filed late, the initial penalty is £100. This penalty is levied even if there is no tax liability. Additional daily penalties of £10 per day will be charged in respect of returns that are more than three months late up to a maximum of £900.

If you are six months late, there will be a penalty of 5% of tax liability (or £300 if greater). For being more than 12 months late, there will be an additional 5% of tax liability (or £300 if greater). So, it is best to file the tax return on time.

In addition to these late filing penalties, you will incur late payment penalties for missing the payment deadline.

What is the Deadline for Payment of Tax Liability?

The taxpayer needs to pay the income tax liability in three instalments on a payment on account basis which means the tax is due even before you have prepared your self assessment tax return. The deadline for making payment of income tax liability is as below:

31st January - 50%

31st July - 50%

31st January Balancing figure

50% of previous year tax liability is payable by 31 January during the tax year.

50% of previous year tax liability is payable by 31 July during the tax year.

Balancing figure of tax liability is payable on 31 January as per final self assessment tax return.

For example, for tax year 2022/23, 50% of 2021/22 tax liability is payable on 31 January 2023 as payment on account.

For example, for tax year 2022/23, 50% of 2021/22 tax liability is payable on 31 July 2023 as payment on account.

For example, for tax year 2022/23, balancing figure is payable on 31 January 2024 as per the tax computation.

HMRC What if You Never Completed a Tax Return Before?

For the first-time Landlord, this is quite a common question. If you were used to receiving only employment income taxed via PAYE, you never had to complete a tax return. However, once you start receiving rental income, you must complete your tax return and pay any taxes due to HMRC.

You will need to notify HMRC by 5 October following the end of the tax year if you have any taxable income or capital gains. For example, if you started to receive taxable income during the tax year 2022/23, you will need to register with HMRC for tax return by 5 October 2023.

Generally, even if you failed to notify HMRC before the deadline of 5 October, HMRC may reduce your late-notification penalty to Zero if you pay your tax in full by the usual 31 January deadline.

I Stopped Receiving Rental Income. Do I Still Need to Complete My Tax Return?

Once you register with HMRC for a self-assessment return, you will need to file the tax return even if you don't have any income. Otherwise, you will receive a late filing penalty from HMRC.

To avoid this, you will need to notify HMRC about your changed circumstances and ask to cancel your tax return filing requirements.

How Can I Complete My Tax Return?

You can either complete your tax return yourself or use accountancy firms such as UK Property Accountants to complete your tax return. If your tax return is simple and you are confident about filing a tax return, it would be cost-effective to do it yourself. However, you will need to carefully assess that you understand rules around various areas, including repairs vs capital, potential tax reliefs and allowances, etc., before deciding whether to do tax return yourself or engage a professional accountancy firm.

If you decide to file a tax return yourself and do this for the first time, you will need to create a Government Gateway account and Register for Self Assessment as detailed on the HMRC website. Once you have accessed your Government Gateway account, you will be able to complete your tax return online.

Read More

0 notes

Text

Income Tax Return Filing for the Last 3 Years under Section 139(8A)

Reminder The last date for filing of missed Income Tax Return (ITR) for A.Y. 2021-22 is 31st March 2024. Please avail the opportunity. This may be the last chance!

0 notes

Text

Income Tax Dept sets high-risk value assessment guidelines for updated ITR

Updated ITR: The Income Tax Department has finalized guidelines for assessing or re-assessing of high-risk value in updated Income Tax Returns filed for Assessment Year 2020-21 (Fiscal Year 2019-20). Meanwhile, the last date to file an updated Income Tax Return for Assessment Year 2021-22 is March 31.

Based on the profile, updated and non-updated Income Tax Returns are categorized as ‘High Risk’…

View On WordPress

0 notes

Text

have you missed your Income Tax Return Filing? Don't worry file your ITR for Last 3 year. AY 2021-22, AY 2022-23 and AY 2023-24.

Contact Us +91 9818209246

0 notes

Text

Employee Tax Deduction Claims: Employer Responsibilities and LegalImplications.

Matters of concern for employers

Although the department’s communiques to the employers sound soft or advisory in the nature, the future ones may not be so. Let’s look into some of the areas of concern for the employers.

1. The notices currently being issued may pertain to past AYs — 2023–24, 2022- 23 and 2021–22. The employers may proactively educate their employees about restrictions on claiming deductions under the Act, the monetary limits, the possibility of correcting errors, if any, by filing revised or updated tax returns.

For instance, employees may erroneously claim deduction under section 80D for medical expenses of parents up to Rs. 50,000, despite the fact that there is a health insurance in place for their parents. In such cases, employees may genuinely not be aware of the tax provisions and may be willing to file the correct tax return.There is a possibility that the department may issue a notice to the employer for wrongful deductions claimed by the employee and consequent lower deduction of TDS. In that case, the employer may be considered as an assessee in default under section 201 of the Act. The employer may however, take support of decisions 2 where courts have held that if the employer deducted lower TDS under a bona fide belief, it cannot be considered as an assessee in default under section 201. In certain decisions 3 however, the courts have upheld the applicability of section 201 even where the assessee had a bona fide impression for non-deduction of TDS.

2. India is gradually moving to a low/nil deduction tax regime for individuals. In that case, this issue may not be relevant for many employees opting for the default tax regime with almost NIL deductions for AY 2024–25 and onward.

However, the employer may be held responsible in certain cases, viz.

a. where an employee claims deduction of interest or set-off of losses under the head ‘income from house property’;

b. where employees exercise stock options or similar rights and TDS is deducted based on the valuation of shares of the company; or

c. where residential status of inbound and outbound expatriates changes in the years of transition.

In such cases, it is imperative for the employer to procure and maintain relevant documentary evidence to justify its stand on deduction of TDS.

3. Practically, most employees may not understand taxation and the requirement to maintain/submit proofs for claiming deductions. It is the responsibility of the finance team of the employer to ensure that employees are allowed deductions only after they have submitted the relevant proofs of deductions/set-off of losses. The finance team as well as the employees must be educated about the requirements to maintain adequate proofs and evidence for claiming deductions. As it is rightly said, ignorance of law is not an excuse.

Know about Conclusion — https://mcaconsulting.co.in/blogs/employee-tax-deduction-claims/

0 notes

Text

Belated income tax return

Belated Return Deadline:

As of my last update, individuals in India are allowed to file a belated return by March 31st of the assessment year.

For example, if you missed the deadline for the financial year 2021-22 (assessment year 2022-23), you could file a belated return by March 31, 2023.

contact us - 9844000399

#FinanceMinisterMissing#TaxAuditExtendToday#icaipresidentmissing#incometax#tax#taxes#taxseason#business#gst#accounting#finance#accountant#taxpreparer

0 notes

Text

Belated income tax return

Belated Return Deadline:

As of my last update, individuals in India are allowed to file a belated return by March 31st of the assessment year.

For example, if you missed the deadline for the financial year 2021-22 (assessment year 2022-23), you could file a belated return by March 31, 2023.

contact us - 9844000399

#FinanceMinisterMissing#TaxAuditExtendToday#icaipresidentmissing#incometax#tax#taxes#taxseason#business#gst#accounting#finance#accountant#taxpreparer

0 notes

Link

0 notes

Text

4 Financial Changes That Will Affect Your Finances in July

✔️Social media influencers will have to disclose every gift they receive starting in July, and TDS will be applied.

✔️You must pay a fine of Rs 1,000 if your PAN and Aadhar Card are not linked.

✔️The deadline to submit an income tax return is July 31, 2022. (ITR 2021-22). It is still possible to file an ITR through December 31 if this deadline is missed, but there will be a Rs 5,000 penalty.

0 notes

Text

Almost A Third Of Sole Traders ‘Don’t Even Know About Looming Tax Deadline’ – TS Partners’

A New Year means a lot of things to a lot of people – and for many millions of people around the UK, it certainly means a requirement to file their self-assessment tax returns before the first month of 2023 is over.

It is therefore timely that new figures have just been released, showing that many of the UK’s sole traders have serious gaps in their knowledge of their tax obligations.

It comes on the backdrop of HM Revenue and Customs (HMRC) revealing nearly 5.7 million individuals were yet to file their self-assessment tax return for 2021-22, with less than a month to go until the 31st January 2023 deadline.

What insights do the new figures offer into sole traders’ tax knowledge?

The research into what UK sole traders knew about the tax they were required to pay was carried out by a card payments provider, and subsequently reported on by the LondonlovesBusiness website.

The results will make for intriguing reading for many of those who have previously turned to TS Partners for sole trader accountancy support in Wellington, Plymouth or Newton Abbot, as well as those who are considering doing so.

It was discovered through the survey, for example, that three-quarters (75%) of the country’s sole traders were unsure as to which tax thresholds presently applied to them. Furthermore, fewer than one in 10 (9%) of the 800 sole traders quizzed knew what could happen if they failed to pay their tax bill, with one in 50 respondents believing nothing would happen at all.

Tax awareness varies considerably from one sector to the next

The research involved the participating sole traders being asked various questions about their tax and savings habits, as well as questions designed to test what they knew about common VAT and tax principles applicable to businesses in the UK. Respondents were also asked which UK region they were based in, as well as which industry they operated in.

These questions shed considerable light on what sole traders did and didn’t know about UK tax matters. When, for example, the respondents were asked what the threshold was for sole traders to pay the Higher Income tax rate of 40% (£50,271), lawyers were likeliest to know the answer, as the correct response was given by 53% of them. Retailers, meanwhile, were the least likely to know the correct answer, this being the case for a mere 13% of them.

It was also alarming that overall, a mere three in 10 (3%) sole traders knew they needed to submit their self-assessment tax form by 31st January. Again, looking across the sectors, real estate agents performed especially badly on this score, with fewer than a quarter (23%) answering the question correctly. The best-informed group as far as this question was concerned were law professionals, although even in their case, only 42% provided the correct answer.

One form of tax that sole traders do not need to pay is Corporation Tax; in this respect, they differ from limited liability companies. However, a remarkable 73% of the sole traders polled were not aware of this and believed they were required to pay this tax.

Turn to accountancy and tax specialists that you can trust in 2023

At this time when businesses and businesspeople of all kinds are under perhaps greater pressure than ever, it could hardly be more important to ensure you are on top of your responsibilities in relation to accounting, tax, and payroll. Making the right decisions now will greatly help you to achieve the results you aspire to in business throughout 2023 and into future years.

For more information about TS Partners’ sole trader accountancy support in Wellington, Newton Abbot, and Plymouth, or to learn more about any other aspect of what we do, please don’t wait any longer to enquire to us by phone or email.

0 notes

Text

4 Financial Changes That Will Affect Your Finances in July

✔️Social media influencers will have to disclose every gift they receive starting in July, and TDS will be applied.

✔️You must pay a fine of Rs 1,000 if your PAN and Aadhar Card are not linked.

✔️The deadline to submit an income tax return is July 31, 2022. (ITR 2021-22). It is still possible to file an ITR through December 31 if this deadline is missed, but there will be a Rs 5,000 penalty.

1 note

·

View note

Text

March 31 is last date to file ITR-U for AY 2021-22; 200% of tax evaded, if you miss

Eligible taxpayers need to file their updated income tax return (ITR-U) for AY 2021-22 (FY 2020-21) by March 31, 2024, as this is the last date to do so. ITR-U can be used to fix errors like under-reporting or misreporting of income, or other errors in the previously filed ITR. Moreover, ITR-U can also be filed by an individual who was required to file ITR as per tax rules but did not do so by…

View On WordPress

0 notes

Text

4 Financial Changes That Will Affect Your Finances in July

✔️Social media influencers will have to disclose every gift they receive starting in July, and TDS will be applied.

✔️You must pay a fine of Rs 1,000 if your PAN and Aadhar Card are not linked.

✔️The deadline to submit an income tax return is July 31, 2022. (ITR 2021-22). It is still possible to file an ITR through December 31 if this deadline is missed, but there will be a Rs 5,000 penalty.

0 notes

Text

4 Financial Changes That Will Affect Your Finances in July

✔️Social media influencers will have to disclose every gift they receive starting in July, and TDS will be applied.

✔️You must pay a fine of Rs 1,000 if your PAN and Aadhar Card are not linked.

✔️The deadline to submit an income tax return is July 31, 2022. (ITR 2021-22). It is still possible to file an ITR through December 31 if this deadline is missed, but there will be a Rs 5,000 penalty.

0 notes

Text

How To Calculate Income Tax For Salaried Individual?

Calculating income tax on salary can be a complex process, as it depends on various factors such as your total income, tax deductions, and applicable tax rates. Income tax is a tax levied by the government on the income earned by individuals, businesses, and other entities. It is one of the primary sources of revenue for governments around the world and is used to fund various public services such as healthcare, education, and infrastructure. The amount of income tax an individual or business owes is typically determined by their taxable income, which is the income earned minus any allowable deductions or exemptions. Tax rates are usually progressive, meaning that the more income an individual or business earns, the higher the tax rate they will pay on their additional income. In this present article, we are going to discuss about how to calculate income tax for salaried individuals.

Table of Content

1.Information about Income Tax

2.Various Factors of Calculating Income Tax on Salary

3.Calculating Income Tax on Salary

4.Essential rules and regulations regarding income tax on salary in India

5.Step-By-Step Guide to Calculate Income Tax on Salary

Takeaway

Information about Income Tax

Income tax on salary is a tax levied by the government on the income earned by an individual from their employment. The amount of income tax an individual owes is calculated based on their taxable income. That is their income earned minus any allowable deductions or exemptions. The tax rates are typically progressive, meaning that the more income an individual earns. The higher the tax rate they will pay on their additional income. However, individuals need to file an annual tax return with the government, reporting their income, deductions, and tax liability. This is to ensure that the correct amount of tax has been paid, and any excess tax paid can be claimed as a refund.

Calculating Income Tax on Salary

The calculation of income tax on salary can have a significant impact on an individual’s financial situation. Here are a few impacts:

Reduction in Take-Home Salary – Income tax is deducted at source from the salary, which reduces the take-home pay of an employee.

Impact on Budgeting – Income tax has to be considered while creating a budget for personal finances, as it is a significant expense for most individuals.

Tax Planning – The calculation of income tax on salary can help individuals plan their taxes more efficiently by taking advantage of tax-saving options such as investments in tax-saving schemes or making donations to eligible charities.

Compliance with Tax Laws – Calculating and paying income tax on salary is a legal obligation for individuals. Failure to comply with tax laws can result in penalties, interest, and legal action by tax authorities.

Government Revenue – Income tax is a significant source of revenue for governments around the world. The amount of tax collected impacts the government’s ability to fund public services and infrastructure project.

Essential rules and regulations regarding income tax on salary in India

In India, income tax on salary is governed by the Income Tax Act, 1961. The rules and regulations issued under this Act. Here are some essential rules and regulations regarding income tax on salary in India:

Taxable Income: The taxable income is calculated by deducting the exemptions and deductions allowed under the Income Tax Act from the gross salary. The income tax rates applicable for the assessment year 2022-23 (financial year 2021-22) are as follows:

Up to Rs. 2.5 lakh: Nil

Rs. 2.5 lakh to Rs. 5 lakh: 5%

Rs. 5 lakh to Rs. 7.5 lakh: 10%

Rs. 7.5 lakh to Rs. 10 lakh: 15%

Rs. 10 lakh to Rs. 12.5 lakh: 20%

Rs. 12.5 lakh to Rs. 15 lakh: 25%

Above Rs. 15 lakh: 30%

Exemptions and Deductions: The Income Tax Act allows certain exemptions and deductions from the gross salary, such as standard deduction of Rs. 50,000, transport allowance of Rs. 1,600 per month, medical reimbursement up to Rs. 15,000 per year, and exemption on leave travel allowance (LTA) twice in a block of four years.

Tax Deducted at Source (TDS): Employers are required to deduct TDS from the salary paid to their employees based on the income tax slab rates applicable for the financial year. The TDS deducted by the employer is reflected in the Form 16 issued to the employee.

Advance Tax: If the tax liability of an individual is Rs. 10,000 or more in a financial year, then they are required to pay advance tax in instalments throughout the year. Failure to pay advance tax can result in interest and penalties.

Tax Returns: Every individual whose income is above the basic exemption limit is required to file an income tax return every year, declaring their income, deductions, and tax liability. The due date for filing the income tax return is usually July 31st of the assessment year.

#taxconsultant#audit#msme#gstnews#caipcc#taxseason#tds#registration#cma#money#gstfiling#csstudents#charteredaccountants#bookkeeping#icaistudents#company#companyregistration#gstnitbuddies#fssai#tally#entrepreneur#taxrefund#accountingsoftware#taxreturn#gstreturn

1 note

·

View note