#indian stock market courses online free

Text

Course In Stock Market Trading

A course in stock market trading is a specialized program designed to provide individuals with the knowledge and skills required to effectively trade stocks and participate in the financial markets. This course aims to equip students with a deep understanding of stock market dynamics, investment strategies, technical analysis, and risk management techniques.

The course typically begins with an introduction to the basics of stock market trading, including an overview of the financial markets, stock exchanges, and the role of various participants such as brokers, traders, and investors. Students learn about the fundamental concepts of stocks, including stock valuation, company analysis, and financial statements interpretation.

A significant focus of the course is on developing trading strategies. Students are introduced to various approaches, such as fundamental analysis, technical analysis, and quantitative analysis, to evaluate stocks and make informed trading decisions. They learn how to identify potential trading opportunities, assess market trends, analyze price patterns and indicators, and use charting tools to time their trades effectively.

Risk management is another crucial aspect covered in the course. Students learn about different types of risk in trading, such as market risk, liquidity risk, and systemic risk, and understand how to mitigate them through techniques like diversification, position sizing, and stop-loss orders. They also gain insights into managing emotions and maintaining discipline while trading, as psychology plays a vital role in successful trading.

#stock market courses online free with certificate#course in stock market trading in india#course in stock market trading free#course in stock market trading for beginners#best course in stock market trading#best online stock trading courses in india#stock market courses for beginners#stock market courses online with certificate#stock trading courses in india#best stock trading courses in india#indian stock market courses online free#stock market courses after 12th

0 notes

Text

Accelerate Your Career Online

Free Course On The Indian Stock Market Fundamentals

Free Course on The Indian Stock Market Fundamentals =========================================

The Best Collection place for gaining power of knowledge, skills and new opportunities.

For Detailed Coaching in

Equity (Capital Markets ), Derivatives – Futures & Options (National Stock Exchange’s -NCFM Syllabus + Own Notes +Fun learn)

Connect with us -:

Equity +Futures and Options +Technical Analysis +

Fundamental Analysis = INR 25000/-

For Students who complete this Free course on the Indian Stock Market Fundamental ,

Discounted price is INR 12000/- Inclusive of all .Duration – 2 Months, Saturday, Sunday , batches.Contact Us – [email protected]

Brain Galaxies – Stock Market Coaching – Share Market – Basic to Advance

0 notes

Text

Crafting a Stellar Career as an International Business Correspondent

Introduction:

In an era of global commerce, the stories that drive industries need narrators who grasp the breadth and depth of international business. Enter the International Business Correspondent, a specialist weaving tales of global trade, mergers, acquisitions, and market dynamics. But what does it take to be that narrator? An Online MBA in International Trade Management might be your passport. Dive in, as we unravel the journey from a virtual classroom to the global stage.

Embarking on the Online MBA Journey in International Trade Management:

Comprehensive Curriculum: An MBA in international trade management provides a deep understanding of global markets, trading laws, and business strategies.

Global Network: Online platforms allow students to build a worldwide network, an invaluable resource for future correspondents.

Real-time Case Studies: Modern MBA courses utilize live case studies, offering insights into current global business scenarios.

Potential Industries for the International Business Correspondent:

Every industry has a story waiting to be told. As a correspondent:

Technology: Chronicle the rise of startups, tech mergers, and digital disruptions.

Healthcare: Report on global health trends, pharma breakthroughs, and medical innovations.

Banking and Finance: Dive into stock market dynamics, mergers, acquisitions, and financial regulations.

Energy: Explore the world of oil moguls, renewable energy innovations, and global energy policies.

Manufacturing: Narrate tales of production breakthroughs, supply chain dynamics, and industry challenges.

Navigating the Challenges:

Keeping Up With Rapid Changes: Global business is ever-evolving. Staying updated is paramount.

Cultural Sensitivity: Covering stories from different regions requires understanding and respecting varied cultural nuances.

Fact-Checking: In a world of fake news, ensuring accuracy and authenticity in reporting sets professionals apart.

Top 10 Companies in India Looking for International Business Correspondents:

The Times of India Group

NDTV

Reliance MediaWorks

Zee Entertainment Enterprises

The Hindu Group

Bennett, Coleman & Co. Ltd.

Network 18 Group

The Indian Express Group

ABP Pvt Ltd.

Hindustan Times Group

Weighing the Impact of an Online MBA for this Role:

Opting for an MBA is a pivotal decision. Here's why it’s invaluable:

Skill Enhancement: Beyond business acumen, hone skills in research, analytics, and storytelling.

Networking Opportunities: Interactions with global peers and faculty offer rich perspectives and contacts.

A Competitive Edge: In a saturated job market, an MBA from a reputed institute can set you apart.

Let ShikshaGurus help you in your Education Journey:

ShikshaGurus assists you in exploring and comparing courses from over 60 online and distance learning universities. They offer free, unbiased consultation sessions with experts to guide you in selecting the ideal educational path. Furthermore, they provide assistance in finding the best university that aligns with your budget.

Conclusion:

Being an International Business Correspondent is not just about reporting; it's about narrating the sagas of global business landscapes. And while raw passion is essential, complementing it with an Online MBA in International Trade Management could be your blueprint for success. So, if you envision yourself elucidating global business tales, this might just be the path for you.

0 notes

Text

The creation of Demat accounts has revolutionized how stock exchanges conduct their business. The paper scrips were no longer needed to purchase and sell shares. This was a time-consuming and sometimes mismanaged process. Stock brokers authorized by SEBI can open and operate a Demat account. Dematerialization allows shares and securities to be held and traded digitally from anywhere. This reduces the risk of fraud and theft associated with paper-based transactions.

Open a Demat Account if you plan to trade shares or securities on the stock exchange. This list includes the best Demat Accounts in India for 2023 and their pros, cons, and prices. Continue reading!

List of 10 best Demat accounts in India (updated 2023)

Demat account Charges

Axis Direct Demat account opening charges: Nil

Account closure charges: Nil

Charges for account maintenance

1. Axis Bank customer

First Year: Nil

From the second year: Rs750

2. Customers of Non-Axis Bank

First Year: Rs 350

From the second year: Rs.750

SAS Online Brokerage: Rs999 a month or Rs9 a trade

Demat account fee: Rs 200 per annum (plus GST)

Account opening fee: Rs200

SBICAP Securities Demat Account Account opening charges: Nil

Maintenance charges per year: Rs 400

ICICI Direct Demat account opening charges: Rs 975 to Rs nil

Account maintenance fees: Rs 700 from 2nd year.

Kotak Securities Demat Account Account opening charges: Nil

Brokerage fees: Nil

HDFC Securities Demat account charges vary according to pricing plans

Futures and Options: Rs20 for each order

Zerodha Demat Account Brokerage: Nil

Intraday trades and F&O: Rs20, or 0.03%, whichever is lower.

Upstox Demat account maintenance fee: Nil

Account opening fee: Nil

Commissions: Nil

Brokerage: Rs20

IIFL Demat account Account maintenance fee: Rs250 + GST after the first year.

Account opening charges: Nil

Brokerage: Variable depending on plans

Sharekhan Demat Account Account opening charges: Nil

For the first year, there are no account maintenance fees.

List of 10 Best Indian Demat Accounts [Updated in May 2023]: Detailed Overview

1. Axis Direct Demat account

Axis Direct Demat Account is the demat account of choice for over 2,000,000 clients in India. Axis offers investment options and market research tools to help you make informed decisions. This is a great tool for anyone wanting to learn the trading basics. Axis Direct's 3-in-1 trading account offers free market analytics insights by specialists, as well as tools for beginners.

The following are some examples of

All three services - banking, trading and Demat - can be done on one account.

Market research professionals can provide you with expert advice.

You can trade in stocks, mutual funds and bonds, derivatives, ETFs and other financial instruments.

Educational resources include webinars, online courses and expert articles.

Pros

There is no fee for the first year of account maintenance.

Experts conducted market research, which was made available for free.

Beginner's Educational Resources

You can also find out more about the Cons.

Non-Axis Bank Customers Face Higher Account Management Charges

Price

Account Opening Charge: Nil

Account Closing Fee: Nil

Account Maintenance Fee:

Axis Bank customer

First Year: NIL

From the Second Year: Rs.750

Customers of Non-Axis Bank

First Year: Rs 350/-

From the Second Year: Rs.750

2. SAS Online

SAS Online is an online trading platform which allows you to buy or sell securities instantly, thus allowing you the maximum profit. This is a great option for active traders. SAS Online offers a viable option for aggressive traders. You can trade at a low cost and enjoy some unique features.

The following are some examples of

Choose from over 300 different stocks.

You can purchase up to four times your order value as delivery.

Updates and news on the market are provided.

You can buy and sell immediately.

Pros

Trading costs are reduced.

Expert advisors and market scanners

Real-time trading

You can also find out more about the Cons.

No commodity trading

Email is the only way to contact customer service.

Price

Rs999 per month, or Rs9 per trade

The annual fee for a Demat account is Rs 200 (+GST), and the account opening fee is Rs 200

3. SBICAP Securities Demat account

SBICAP Securities Demat Account provides a mobile and online trading platform with educational resources, market analysis tools and other tools that help you make informed investment decisions. SBICAP Securities Demat Account belongs to the SBI group. The app's instructional features, statistics and trading suggestions justify its designation as India's top Demat account.

The following are some examples of

There are many educational resources available.

Tools for Market Research

Exchange currencies, stocks, and other assets

Stock trading recommendations

Relationship manager

Pros

Resources for Education

Market research

Advice on Trading

Relationship Manager with a Specific Focus

You can also find out more about the Cons.

Account opening fees are a bit steep.

Price

Account opening costs Rs 850

Account opening charges: Nil

Maintenance charges per year: Rs 400

4. ICICI Direct Demat account

The ICICI Direct Demat account is a digital platform which allows you to trade in domestic and international markets. You can trade stocks and mutual funds as well as fractional shares. The ICICI Demat Account offers market information to help you invest and allows you to trade fractional shares on the global market.

The following are some examples of

You can trade in stocks, mutual funds and currencies, commodities, initial public offerings, and currencies.

Market research and market insight

Learn more about the material available for you.

Invest in fractional shares of global markets.

Get a 3-in-1 account that includes trading, banking and a Demat Account.

Pros

Fractional shares are shares that are divided into fractions.

No minimum balance is required.

Investing in international stocks

You can also find out more about the Cons.

Brokerage fees for small investors are high.

Price

Account opening fees: Rs975 to Rs975

Account maintenance fees: Rs 700 from 2nd year.

5. Kotak Securities Demat account

Over 20 million investors use Kotak Securities Demat account. This account offers a three-in-one account, market analysis tools and trading advice. It is one of your best options to build a low-cost investment portfolio. Kotak Securities is a good option for those who are new to investing or have a limited amount of money.

The following are some examples of

Market research and suggestions

All three accounts - Savings, Trading, and Demat - are integrated into one account.

Margin trading involves trading with small amounts of money.

Build a low-cost portfolio by investing in small cases.

Pros

Account for 3-in-1 Market Study

This is a great opportunity for small investors.

Global investment

Price

Account opening charges: Nil

Brokerage fees: Nil

Dematerialisation: Rs50 per request, Rs3 per certificate

Account Maintenance Charges: Nil for holdings of securities less than Rs10,000

For holding securities worth more than Rs10,000, Rs65 per month for up to 10 debit transaction

Rs50 per month for debit transactions between 11 and 30

For more than 30 debit transactions, Rs 35 per month

6. HDFC Securities Demat account

HDFC Securities Demat account is a trading service provider with 20 years of experience. It allows you to trade electronically, saving time and effort. This is the best option for offline advice. HDFC Securities Demat account is the one-stop shop for all your trading needs. You can trade Indian or international stocks and get customer service seven days a week.

The following are some examples of

Margin trading refers to trading on margin.

Tools for Market Research

You can exchange currencies, commodities and stocks.

Global Investment Opportunities are Available

Orders can be placed over the phone.

Pros

The customer service team is available 24 hours a day, seven days a week.

Stocks in the United States

Portfolio management tools

You can also find out more about the Cons.

The Demat account fee is high compared to other options.

Commodity trading is not an option.

Price

Pricing plans vary according to the plan.

Futures and Options: Rs20 for each order

7. Zerodha Demat Account

Zerodha has over 5 million clients, making it one of the top Demat accounts in India. You can use it as a trading account and depository and get market data and detailed charts to help you make informed investment decisions. Zerodha provides all the features you require in a Demat Account. The market research tools are excellent.

The following are some examples of

Market research data and advanced charts can be used to aid in your trading.

The Zerodha Varsity app can help you learn more about trading.

This tool allows you to create your trading platform.

Coin by Zerodha allows you to trade mutual funds through its app.

Pros

Market research tools of high quality

Create your trading platform.

Affordable fees

App for Learning

You can also find out more about the Cons.

The Indian market only is covered.

No investor protection

Price

Brokerage: Nil

Intraday trades and F&O: Rs20, or 0.03%, whichever is lower.

8. Upstox Demat account

You can trade stocks, mutual funds, digital Gold, or futures using a digital account. Charts in the software help you make better decisions by providing market data. This is one of the best ways to avoid high brokerage fees. Upstox offers one of the safest Demat accounts in India. Upstox provides zero-commission trading, which can be a major benefit.

The following are some examples of

Digital and paperless demat accounts

Real-time updates on the trading market

All you need is one account for your mutual funds and stocks.

Opening a bank is a very simple process.

You can buy and sell digital Gold.

Pros

Investing without commissions.

You can invest as low as Rs 1

Trade from anywhere on the planet

You can also find out more about the Cons.

Some consumers are unhappy with the market crashes that result from large market swings.

Price

No account maintenance fees

Account opening fees: Nil

Commissions: Nil

Brokerage: Rs20

9. IIFL Demat Account

The IIFL Demat Account is a market leader with a 25-year track record. You can open a Demat Account for free. It also provides you with market analysis tools that allow you to invest only when you understand the market well. It is one of your best options to trade at low costs. Software for portfolio analysis and price alerts can also be very useful.

The following are some examples of

Market research in depth

Trade currencies, stocks, mutual funds, commodities and more

App for mobile: Get market news, price alerts, trading ideas and more.

Pros

There are no charges to open a Demat Account with IIFL.

Price Alerts

Research and Analysis Tools

Price

Fees for account maintenance: Rs 250 + GST after the first year

Account opening charge: Nil

Brokerage: Variable depending on plans

10. Sharekhan Demat account

Sharekhan Demat account is a trading platform that includes learning, portfolio management and market research. This strategy is beneficial to both professional and novice traders. Sharekhan is a good option if you are looking for the best Demat account in India. You can trade stocks, bonds, mutual funds, and a wide range of other assets. You can hire professionals to manage your portfolio and rebalance it.

The following are some examples of

You can use audio and video clips to understand market trends.

Expert market forecasts

Learn more about our learning aids.

Portfolio management services available

With this platform, you can trade in stocks, bonds and mutual funds, ETFs, foreign exchange, futures and options, FX or Futures.

Pros

You will be notified when the price of your favourite stocks changes.

The customer service team is available 24/7

No minimum deposit is required.

Expert portfolio rebalancing

You can also find out more about the Cons.

The account opening process can be lengthy.

Price

Account opening charges: Nil

For the first year, there are no account maintenance fees.

Final Word

Demat accounts are revolutionizing the markets. They have increased the market's efficiency and provided greater security to traders. Digitization has made it possible to execute orders more quickly and accurately. The ability to buy or sell instantly can result in substantial profits, especially when the market is unpredictable. Beginners can make informed decisions when choosing a Demat Account by evaluating brokers for their services, extra features like access to research reports, on-call support and the cost of opening the account.

Stocks can be an excellent option for your portfolio. They do, however, carry significant risks. For novice investors who don't understand the complexity of investing in stocks, mutual funds managed by professional and qualified fund managers could be an excellent option. Mutual funds can help diversify your portfolio and maximize your profits based on the performance of the underlying asset classes, indices or securities. Mutual funds are also easier to invest in because you don't require a trading account or a Demat one.

Interested? Invest in Mutual funds today, starting as low as Rs 10.

How does a Demat Account work?

You can place a "buy" or "sell" request on your trading account after logging in to your Demat account and trading account. The depository participant will then forward this request to the stock market. The stock exchange will search for sellers willing to sell shares at the requested price. If the price is the same, the stock exchange will share the request with clearing houses so that they can debit the shares from the seller's Demat and credit the buyer's Demat.

What documents are needed to open a Demat Account?

According to the Demat account provider's terms and conditions, you will need to provide your PAN Card, Aadhaar, or Passport as proof of identity, along with ITRs, pay slips, statements for the past six months, audited annual business accounts, passport-sized photos, and more.

What are the types of Demat Accounts?

There are three main types of Demat accounts. There are three types of Demat accounts: regular Demat for Indian residents, repatriable Demat for NRIs, and non-repatriable Demat for NRIs, which must be linked with an NRO.

What is BSDA?

BSDA is the acronym for Basic Services Demat accounts, introduced recently by SEBI. This type of Demat account has zero maintenance fees if your holding value is below Rs50,000 and Rs100 per year. Holding value between Rs50,000 to Rs2 lakh.

#upstox brokerage#groww customer care#best demat account#best online trading account#best trading account#best trading account in india

0 notes

Text

#advanced stock market course in india#stock market courses in delhi#advanced stock market course#best stock market coach in india#stock market courses in india#stock market courses in mumbai#stock trading courses in delhi#advanced stock market course in delhi#stock market courses#top 10 online share market trainer in india

1 note

·

View note

Text

The 10 Best Mobile Trading Apps in India by 2023

Mobile trading apps have become a popular way to invest on the Indian share market. They are convenient and easy to use. Stock trading apps allow you to buy and sell stocks on your smartphone by searching nifty bees share price, iifl share price, angel broking share price, gold bees share price, angel broking share, iifl securities share price and more.

On your way to work, you can complete the trades.

Download probo trading apps or other apps to access the platform quickly, make a trade, and get news and alerts, or stream streaming videos.

Please note that you need to have a Demat & Trading account in order to use the trading application of your stockbroker. You need the Zerodha Demat & Trading App to use Zerodha's trading app.

Here is a list of the top trading apps for India in 2023.

The list was created using user ratings and trading experiences from app stores, broker sites and various forums.

Zerodha Kite is the best for all traders

5paisa is the best known for its ease of use.

Upstox is great for performance and speed

Edelweiss is great for biometric single-touch login

Angel Broking - Best full-service broker

HDFC Securities: Invest in multiple assets at once with HDFC Securities

IIFL Markets is the best app for stock market reports.

Motilal oswal is a great option for investing using algo-based algorithms

Sharekhan is a great app for trading academy courses

Stock Notes - Perfect for AI-based tools

The Benefits of Trading Apps

· Orders can be placed quickly and with minimal effort.

· Fast order execution & 24x7 access to the market

· Smooth online account opening process

· Real-time updates on the market and portfolio overview

· Instant notifications and price alerts on the go

· Transfer of funds with security

· Easy Mutual Fund & IPO application

Best trading app in India for beginners 2023

1. Zerodha Kite Mobile Trading App Review

Zerodha Kite, one of India's most advanced mobile trading apps in India with an easy-to-understand interface for beginners and no brokerage. zerodha account opening process very simple and easy to do anyone.

All trading tools are available, including Chart IQ which provides real-time trend and price information.

Kite mobile trading is a miniaturized version of Zerodha’s Kite trading platforms, which are the best trading platforms for all discount brokers. zerodha calculator is find out the brokkerage charges and other extra charges.

You can access console reports that will help you to know what the experts think about probo trading, and to strategize accordingly.

2. 5 Paisa App Review

The 5 Paisa trading app for mobile is the best in India. It allows you to place orders with just one click. Technical analysis is possible with advanced charts that offer a variety of studies and drawing capabilities.

The app allows you to access 5 Paisa products such as Smart Investor, Screeners, Senibull, and Small Cases while trading.

The app allows you to invest in mutual funds directly, purchase digital gold, insurance, and personal loans.

3. Review of UpStox Mobile Trading App

UpStox Pro helps you trade in shares, equity derivatives, and currency F&O. You can trade directly from charts by using the "Trade from Charts" (TFC).

Upstox Trading App provides advance charts with multiple intervals, drawing styles and types. You can use 100+ technical indicators to trade in real time.

App has a simple, intuitive and clutter-free look.

You can also create your own watchlist and receive live market feeds. Set an unlimited number price alerts.

The app allows you to switch between night and day modes for better visibility. Downloading the Upstox Pro trading app for mobile is free. No Hidden Charges you can calculate through upstox calculator.

UpStox charges Rs. UpStox charges Rs. The transaction fee is Rs. You can open your account instantly and without paper.

4. Nuvama Wealth (Earlier Edelweiss) Mobile Trading App Review

Nuvama, the trading app that was formerly Edelweiss, has an easy fingerprint login. You can access research while trading.

This app provides real-time streaming prices of stocks and tick by click charts that keep you up to date and allow instantaneous market analysis.

You can create a "preset custom watchlist" based upon your chosen filters and Sensex Tracker in order to identify trading opportunities.

You can also invest in mutual funds using the app.

5. Angel One App Review

Angel One offers 40 technical charts indicators and overlays to aid in technical analysis and trading. The Angel's ARQ portfolio tool is integrated into the app.

App has a simple and intuitive interface.

The app allows you to access the last ten transactions of Ledger, Funds or DP reports.

6. HDFC Securities Mobile Trading App Review

HDFC Trading App has a biometric login that uses fingerprint and facial recognition. You can buy and sell from your watchlist.

HDFC Trading App offers real-time intraday charts and instant access trending investment ideas.

The app allows you to invest in gold, NCDs and derivatives in addition to trading in stocks and derivatives. The app also has a chat function with support staff to quickly resolve issues.

There are some negative reviews about login issues

7. IIFL Markets Mobile Trading Review

IIFL Market offers you expert research and tips on more than 500 stocks, when you trade via their mobile app. You can create up to 50 scrips per list.

To better manage the portfolio, this app provides intelligent dual-stock-watch across multiple segments (equity and F&O, currency, commodities, and currencies).

You can also invest in IPOs and OFSs (Offer for sale) via the app.

8. MO Investor Mobile Trading app by Motilal oswal

The Motilal-Oswal (MO), Investor App integrates ACE, an algorithm based investment strategy.

This app allows you to place multiple orders with just one click.

Charts can be displayed for any time period (from 1 minute to 5 years). You only have 9 technical indicators to analyze charts.

The app is easy to use and offers the option to invest in mutual funds or buy gold.

There are reports of the charts loading slowly and prices not being updated in real time.

9. Kotak Stock Trader Mobile App Review

Kotak Stock Trader app allows you to diversify your portfolio of investments by allowing you invest in IPOs, Mutual Funds ETFs and Bonds. kotak securities login.

Charting tools allow you to create a custom watchlist, and keep track of markets in real time. You can actually sell from the position's view page.

Apple's app store, however, has a rating of 2.9 and there have been reviews about customers being automatically logged out.

10. Sharekhan Mobile Trading App Review

The Sharekhan Trading App helps you to trade intelligently by providing live charts with multiple timeframes (1 minute up to 1 year).

App has a pattern identifier for finding new trading ideas. The Sharekhan Online Trading Academy courses are available directly from the app.

The app is designed in black and white to enhance the viewing and trading experience. You can stay logged in after closing the application. Sharekhan Refer & Earn Demat Account Earn ₹400 for every referred friend who generates ₹40

There are some customer reviews (complaints) stating that the app requires frequent password changes.

Read More - https://hmatrading.in

Source - https://sites.google.com/view/besttradingappinindia2023/

#nifty bees share price#probo#iifl share price#angel broking share price#no brokerage#kite drawing#upstox calculator#gold bees share price#angel broking share#iifl securities share price#sharekhan refer and earn#best trading platform in India#stockmarket

1 note

·

View note

Text

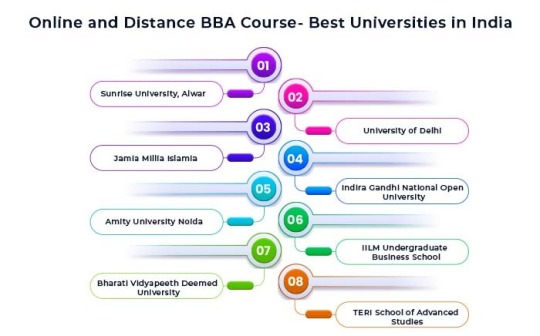

Top 10 Distance Education Universities in Delhi NCR for BBA

What is an Online and Distance BBA?

The Online and Distance Bachelor of Business Administration (BBA) programme lasts three years and provides guidance, understanding, and skill sets in management responsibilities and business abilities. Students should ensure that the colleges are accredited by NAAC, AICTE, UGC, WES, and other organisations. The University Grant Commission (UGC) recognises the Online BBA in Delhi NCR as equivalent to a regular BBA degree. A number of Correspondence universities provide distance learning and Online BBA Course inIndia. You can enrol in an Online and Distance BBA Course through Distance Pathshala, as here you can consult our team of experts and they will assist you in choosing the best Corresponding College or University for your desired Course.

Online and Distance BBA Course- Best Universities in India

1. Sunrise University, Alwar

Sunrise University is a private Indian university in Alwar, Rajasthan. The Sunrise University Act, 2011, established the university, which is recognised by the University Grants Commission. Sunrise University offers diploma, undergraduate, and postgraduate courses in science, engineering, law, health, computer science and applications, commerce, and agriculture.

2. University of Delhi

In the 2023 QS World University Rankings, the University of Delhi received a ranking of 521–530 overall and 85 in Asia. According to the Times Higher Education Global University Rankings published in 2023, it was placed 1001–1200 globally, 201-250 in Asia. In the Academic Ranking of Global Universities of 2022, it was placed between 601 and 700. It is one of the best universities where you can pursue your Online and Distance BBA Course.

3. Jamia Millia Islamia

Jamia Millia Islamia, often known as the National Islamic University, is a major institution of higher learning in New Delhi, India. Undergraduate, graduate, M.Phil/Ph.D., and post-doctoral education are all covered by the multilayered educational structure that Jamia Millia Islamia has evolved into. Jamia has advanced significantly in recent years. It received Grade "A" NAAC Accreditation in 2015. It was designated as a core university on December 26, 1988.

4. Indira Gandhi National Open University

The top Indian university for distant learning is IGNOU. IGNOU University is where you can get the Best BBA Distance Education in India. There are a tonne of study centres for it all around India. We are always free to choose and switch between centres as needed.

5. Amity University Noida

AMITY is based on a foundation that embodies all the characteristics that Amity institutions have used for the past 20 years to become world-class. With cutting-edge facilities and the most recent instructional techniques, it has established international standards in education, training, and research. The University prepares future corporate leaders through industry-integrated curricula that blend modernity and culture in each of its trainees. You can pursue your Online and Distance BBA Course from any of these universities.

6. IILM Undergraduate Business School

At IILM, learning is built on doing, experimenting, and being creative. You become familiar with the basics of business under the guidance of committed instructors, but more importantly, you get to understand how reasoning and behaving innovatively helps you to follow your passions and forge your own route to success. Via business scenarios, stock market simulation techniques, practical exercises, and summer internships, students will engage in Real World Learning. You can pursue your Online and distance BBA from IILM Undergraduate Business School.

7. Bharati Vidyapeeth Deemed University

One of the prominent campuses in Delhi is the New Delhi campus of Bharati Vidyapeeth Deemed University. It is located on the brand-new Rohtak Road in the upscale Paschim Vihar neighbourhood. The college was accessed and accredited to grade "A" by NAAC after becoming a constituent institution of Bharati Vidyapeeth Deemed University in June 2000. All of its programmes are also approved by NBA. The basic requirement is that you have a 10+2 degree or an equivalent with a minimum of 50% and 45% for SC/ST. You ought to score well in physics, maths, and chemistry.

8. TERI School of Advanced Studies

The TERI School of Advanced Studies received points for 10 research themes and was rated 280th in India and 5640th globally in 2023. CAT, MAT, GMAT, CMAT, and XAT scores are used to narrow the field of candidates. Applicants can take the TERI SAS common admission exam if they have not yet registered for the aforementioned exams. The minimum requirement for candidates is a bachelor's degree in any field with English at the 10+2 level. The Indian University Grants Commission accorded the TERI School of Advanced Studies the designation of "Deemed to be University" (UGC).

9. Delhi Skill and Entrepreneurship University

This Online and Distance College is completely worth your money. 50 of the batch's best academic students are placed from this college. The lowest compensation package is 3 LPA, and the largest income package provided is even more than 12 LPA. The average wage package is between 5 and 6 LPA.

10. Jamia Hamdard University

Jamia Hamdard University is a deemed-to-be institution that is rated 64. The NAAC also gave this university an A for accreditation. JMU also enjoys the endorsement of the UGC, AICTE, and MCI. So, if you want to gain a thorough grasp of the BBA programme, you can also take this university into consideration.

Conclusion

These were the Top 10 Colleges from where you can pursue your desired Correspondence Course- Online BCA, Online BBA in Delhi NCR, Online MBA, and Online MCA etc. Distance Pathshala seeks to provide thorough information and comparison assistance about educational institutions and degree programmes. Distance Pathshala is worried about your future, thus we keep our procedures as efficient as possible to better serve you. We assess numerous distant universities for your preferred course at simultaneously using our artificial intelligence (AI) based and technologically advanced filtering and comparison functions.

#best bba distance education in india#best distance bba colleges in india#best distance learning bba in india#best distance education university in india for bba#Online and distance BBA#distance learning bba courses in india#bba course online#online bba course in india#bba banking and finance#distance bba university in india#distance bba course in india#distance bba course#online bba courses in india

1 note

·

View note

Text

Stock Market Course - Learn Everything about the Stock Market

Oil Costs and the Stock Market:

If you have taken a training course in logic or statistics, you understand that causality can be tough to determine. Yet for our reasons here, I will reduce the bar and talk about proof that is straightforward certainly -- a price chart...

Generate Money Investing in Stocks -

Most common traders in the stock market lose cash. However, there exists a method to generate big profits and avoid huge losses.

Stock Market Course Online

The stock market is considered an extremely hard thing to comprehend. It's really difficult for individuals to understand what is going on in this market also it's tough to understand it. But with the online share market course things has become simpler for those who want to understand it. stock market courses

Why Is An Online Share Market Course Worth The Cash?

You are able to join a stock market course online or in a physical institution. If you are beginning to investigate trading education, you'd naturally wonder if one method of learning is preferable to another one. Many people really like learning online because of the creativity of the concept. Cheaper colleges naturally charge high costs for trading education. You are not only paying for the information you will get. You'll need to pay for the name of your institution on your certificate. In addition, the fees on the utilization of services and personal instructor costs. The more period a stock trading course is planned, the more you would need to pay. Several internet based plans come in really affordable costs.

The NSE And also BSE Of India

Can the capital industry exist without having stock exchanges? Definitely not! The Indian capital market at the moment is steered by 2 crucial bourses, viz. Bombay Stock Exchange and the National Stock Exchange. There are numerous different small bourses, but these are the 2 exchanges where main transactions happen. free trading course

How you can Double Your Money in the Stock Exchange on Promising Stock Picks

The stock exchange is a good place to understand your financial independence during today's unstable economic climate. The main element for realizing a big income in the short term is obviously anticipating actions of a high possibility penny stock and also investing appropriately before it hits its tendency. This article is discusses a way of doing exactly that to discover the best promising share recommendations with virtually no training experience.

Visit Here - stock market courses for beginners

1 note

·

View note

Text

Some Valuable Trading Tips For Newcomers

The stock market is the ideal setting for you if you're looking for an exciting place to invest. You can increase your wealth in a wise and significant way by making smart investments. Anyone can acquire training from Bharti Share Market, no 1 stock market training institute in Maharashtra and become well-versed in different trading concepts.

With the extensive selection of investment options on offer in this market, you can accomplish a number of significant personal and financial goals. First, by making prudent, disciplined investments on time, you can create a long-term corpus. Stock investing is unpredictable and not completely risk-free, though, due to how quickly stock prices can move. Therefore, it is essential to use caution when making investments. So, here are five tips that may be helpful if you're just getting started with stock investing.

Detailed Comprehension Of Trading Concepts- Understanding and learning the fundamentals of trading can be highly beneficial while embarking on the new journey of stock trading. It's crucial to understand the trading process as well as a variety of trading instruments and strategies. To obtain an excellent trade education that will enable you to take advantage of different wealth management services in India, you can enroll in BSM or take online courses.

Keeping Your Cool- Trading can be a highly risky process involving a lot of ups and downs. Therefore, it is very essential that you have patience and deal with the losses calmly. Behaving hastily or greedily can cause great damage to your trading career. Instead, you ought to take a thorough approach to train yourself and reach the position of trainer in the stock market.

Find The Right Broker For Trading- In order to trade on the stock market, you are required by Indian legislation to have a trading account, a bank account, and a Demat account. Each trade will incur a commission fee from the supplier of the trading account, so carefully weigh the costs and services provided by several brokers before choosing one that meets your requirements.

While others may charge less but only help you with transactions, respectable brokers would provide a wide range of services required for making decisions and monitoring your investments. Look for one that will give you the truthful information you require to make judgments.

Invest Your Money Wisely- When buying stocks or other financial assets on the stock market, the first rule you should never forget is to invest within your means. Before making an investment, you must regularly evaluate your risk tolerance.

Instead of blindly adhering to the "high risk for big return" mentality, you should evaluate the long-term repercussions of your investments. Always exercise caution while making decisions because a bad investment could wind up costing you a lot of money.

Following these tips and enrolling in the no 1 stock market training institute in India, Bharti Share Markey can help you become learned and advanced traders in the market today.

#no 1 stock market training institute in Maharashtra#trainer in the stock market#wealth management services in India

0 notes

Text

Miyoko cream cheese unlox

If you’re tech savvy, you might search online to find some smartphone apps or websites to assist you in finding vegan-friendly restaurants in your vicinity. Just be sure to politely ask your server about the possibility of animal ingredients to ensure you can get your dish animal-free (it may help to ask specific questions, such as “Is there any fish sauce or egg in the Vegetable Pad Thai?” at a Thai restaurant or “Is there any lard, stock, or pork in the rice/refried beans?” at a Mexican restaurant). When eating out, if available, your best option will be a vegan or vegetarian restaurant, but you may also have good luck at the following kinds of restaurants: Afghani, Burmese, Chinese, Ethiopian, Greek, Indian, Mexican, Nepalese, Southwest Asian (commonly referred to as Middle Eastern), Thai, Tibetan, and Vietnamese. Explore unfamiliar aisles at the supermarket (and unfamiliar grocery stores)–you may discover some great new vegan items to try! Some products may be labeled as vegan, but make sure to watch out for honey and palm oil. Hint: if the product has any cholesterol, then it is not vegan (plants do not contain cholesterol). When shopping for packaged foods, you’ll want to read the labels to ensure your food item contains only plant ingredients (if unsure of an ingredient, you can consult the Happ圜ow Ingredients to Avoid list*). If you have the resources, we encourage you to grow your own food ! We encourage people to buy from Black, Indigenous, Brown, and Asian farmers. Ĭheck if there’s a Farmer’s Market or CSA available in your area! Here, you will find fresh (and often organic) produce for reasonable prices, all while directly supporting the farmers who grow our food. You might also check out our Recipes page and our sister sites, , and. If you have the time and ability to cook your own foods, the best and most nutritious options will typically be those you make yourself from whole plant foods (including some canned, frozen, and fresh fruits and vegetables). This will benefit the animals, the environment, and yourself. One step to eating ethically is to go vegan. Child Labor and Slavery in the Chocolate Industryįood Empowerment Project ’s mission is to help people understand how their food choices can change the world– for the good.You have to order their plain from them.shipping kills it so wait for a sale then NAIL it and get a case it freezes well. Traders Joes stocks their Unlox your dreams version.not sweet but a savory seafoodish tasting one with a bit of nori in it. Miyoko Cream Cheese is 100% Dairy, Gluten, Soy, and Dairy free. BUT Kite Hill, and Daiya have corn diriviites in them. I was going to use it in a crock pot recipe, but maybe will just use regular cheese like a cheddar instead.ĭairy Free, There is Miyoko, Kite Hill, And Daiya. I guess I'll try it and see how I feel, but just thought I'd check with everyone here and see how you all do with it. I noticed in the Philly cream cheese it mentioned whey protein, which I have seen things online saying that is gluten-free, yet other sources saying some could have gluten. Lately I am struggling though, but was waiting on an elimination diet until I figure out my prescription meds (that have corn in them). I was eating it a while ago and my stomach was getting better. Does anyone have good luck eating cream cheese? Of course, Philadelphia bran seems to be the most common to get.

0 notes

Text

Stock Market Courses for Beginners

If you're interested in getting started in the stock market but don't know where to start, check out these courses for beginners! They'll teach you the basics of stock trading, how to research stocks, and how to make sound investment decisions.

What is the stock market?

The stock market is a collection of markets where stocks and other property can be bought and sold. The stock market is a vital part of the economy, as it helps to provide funding for businesses and helps to create jobs. It also helps to make sure that companies are able to repay their loans.

There are several different types of stocks, including common stocks, preferred stocks, and convertible securities. Each has its own set of benefits and risks.

It is important to remember that the stock market is a volatile place. This means that there will be times when the prices of stocks go up, and times when they go down. It is important to stay informed about what is happening with the stock market so that you can make informed decisions about whether or not to buy or sell stocks.

If you are interested in learning more about the stock market, there are a number of good courses available online.

How to buy stocks

The stock market can be a confusing place for beginners. In this article, we'll teach you the basics of how to buy stocks. We'll also outline some of the best beginner stock market courses available online.

There are a few things you'll need to buy stocks: an account with a brokerage firm, some money to invest, and an understanding of how the stock market works. Here's a quick overview of how the stock market works:

You buy stocks by investing money in a company that is issuing shares of its stock. When you buy these shares, you are buying into the future profits of the company. The price of these shares will fluctuate based on supply and demand. Over time, if you own shares in a good company, your investment will grow as the company's profits increase.

There are many different ways to buy stocks online, so we recommend checking out some beginner stock market courses before diving in headfirst. These courses will walk you through the entire process step-by-step, and help you make informed decisions about whether or not to buy a particular stock.

What are the benefits of owning stocks?

There are many benefits to owning stocks, including the opportunity to make money while securing your investment.

There are many benefits to owning stocks, including the opportunity to make money while securing your investment.

The stock market is a collection of markets where stocks (pieces of ownership in businesses) are traded between investors. The purpose of the stock market is to provide a means for companies to raise money and generate capital, which can be used to grow their businesses and create jobs.

When you buy and hold shares in a company, you are participating in the growth of that company. Over time, if the company does well, the value of your shares will increase. Conversely, if the company experiences financial difficulties, the value of your shares may decline.

When you buy and sell stocks on the open market, you are subject to forces outside of your control. These forces can include economic conditions (such as inflation or recession), political events (such as a new law or election), and changes in public opinion. In other words, the stock market is a volatile place!

However, there are a number of ways to mitigate some of these risks. For example, you can invest in mutual funds or exchange-traded funds (ETFs), which provide diversification and reduced risk. You can also keep track of trends and analyze financial

The stock market crash of 2008

The stock market is a complicated and risky investment. If you're new to the stock market, it can be hard to know what to do.

That's where stock market courses for beginners come in. These courses teach you everything you need to know about the stock market, from how to invest in stocks to how to avoid common stock market mistakes.

You'll learn how the stock market works, the different types of stocks, and the risks and rewards of investing in stocks. In short, these courses will help you understand the stock market and protect yourself from potential financial losses.

What to do if you lose money in the stock market

If you've ever invested in the stock market, chances are you've also experienced some losses. Here are a few things to do if this happens to you:

1. Don't panic. Panic can lead to irrational decisions and increased risk.

2. Don't give up on the stock market. There's always the potential for a rebound, so don't give up hope just yet.

3. Keep track of your investments. This will help you better understand where your money is going and whether or not you're making progress towards your investment goals.

4. Stay informed about the stock market. Keeping up with current events and developments can help you make more informed decisions when it comes to investing in the stock market.

The stock market today

The stock market is an important part of the American economy. It is where stocks and other investments are bought and sold. The stock market can be difficult to understand, but there are some helpful resources available to help beginners learn about it. Here are some stock market courses for beginners:

1. Investopedia has a comprehensive guide to the stock market that covers everything from terminology to investing strategies.

2. The Stock Market Course from Bloomberg provides a step-by-step guide to understanding the stock market. It includes quizzes and video tutorials.

3. Wealthfront has a range of courses that cover everything from basics like index investing to more complex topics like value investing.

Conclusion

If you're looking to get started in the stock market, there are a few things you need to know. Fortunately, our team of experts have put together some great courses that will teach you everything you need to know about the stock market. Whether you're a beginner or an experienced investor, we've got something for you!

#stock market classes#stock market courses for beginners#fundamental analysis of indian stocks#stock market technical analysis course#share market courses online#stock market training institute#stock market fundamental analysis#stock analysis course free

0 notes

Text

Stock Market Classes and Stock Market Trading Strategies by Goela School of Business

Goela School of Finance is India's best institute for learning stock market trading. Goela School of Finance offers Online Stock Market Courses and Stock trading courses for beginners.

What are some of the best stock market trading strategies?

One of the best trading strategies is the penny stock trading strategy. It involves investing in shares that are valued at less than one dollar per share to take advantage of volatility and rapid price movements. Buying stocks that are undervalued for this reason can help you secure huge gains if you time your trades well.

The Goela School of Finance

We are a stock market course institute located in Noida, India. We teach the latest and most relevant information about the stock market classes and trading strategies. Our team of experienced professors is dedicated to providing you with a world-class education in this field with our advanced curriculum.

How to get started with stock trading

If you're interested in investing and have a little money to spare, buying stocks is a great way to grow your portfolio and make money. You can buy stocks individually or in groups, and there are many different ways to trade them. For example, you could day trade if you have enough money for trading fees, or use an app like Robinhood if you're looking for a cheaper option. The Goela School of Finance offers various courses related to stock trading.

Common Mistakes new traders make and how to avoid them

One of the most common mistakes that new traders make is not having a plan. It's vital to understand what you hope to accomplish before picking a strategy and trading system. You may need an account with multiple brokers, and need to set up various tax ID numbers, depending on the country your reside in and where you trade.

What are some of the best stock market trading strategies?

Trading on a stock market is the process of buying and selling securities that were listed on an exchange. The two primary considerations in trading are knowledge and risk management. Investors should learn as much as they can about the markets before they buy stocks or bonds, because without the right information, they might trade poorly. Research is also important because it can help investors plan trades that limit their risks.

The Goela School of Finance

If you're looking for an stock market academic institution that will teach you the basics of stock market trading course, look no further! Goela School of Finance offers a wide variety of courses, from beginner classes to more advanced materials.

How to get started with stock trading

You will need to find a broker, open an account with them, and fund it. Once you have money in your account, you can purchase stocks. You don't need to buy the whole share, just a fraction of one is enough to get started. Some brokers offer free trades, so be sure to look into that before committing to anything.

How to create a winning strategy

It's important to know the basics of how the market works before creating a trading strategy. If you want to trade on your own, you'll need to buy and sell stocks by following the current trends. For example, if a stock is declining and it's showing no signs of recovery, you might want to sell your shares while they're still worth something.

How to get started in Forex trading

Forex trading is a highly aggressive form of trading, and can be likened to gambling as there are no rules for buying low and selling high. Forex traders use a wide range of strategies in order to increase their chances of success when trading.

Common Mistakes new traders make and how to avoid them

The stock market is a risky place to invest your money. There are many things you need to know about before getting started. To avoid making the same mistakes, do your research and don't trade without understanding the basics of investing.

#stock market classes#stock market courses for beginners#fundamental analysis of indian stocks#stock market technical analysis course#share market courses online#stock market training institute#stock market fundamental analysis#stock analysis course free#share market learning course#stock trading courses online#complete stock market course#stock market course#stock market courses online free with certificate#stock market study course

0 notes

Text

The 8 Best Investing Courses of 2021

Online education has picked significant momentum since the advent of the recent pandemic. With schools and colleges worldwide being shut due to lock-downs and virus spread worries, people have adapted to digital learning. This has caused a significant rise in the online education providers' businesses and has led to many more people creating even more content for the audience to consume. The free time during the lock-downs and the worries around personal finances also interested many people in learning about saving and investing. The markets saw vast retail investors, and stockbrokers reported record numbers of new account openings in 2020. The trend is still continuing, with many people sticking around to this new practice even after the lock-downs got lifted and people moved back to their regular routines. If you also realized the importance of personal finance and investing and are looking to learn in greater detail about these subjects, then here is a list of 8 top courses that you can do online and learn about investing and the financial markets.

Get All Money investing Tips and information Only On wizely.in

1. Financial markets and Investment strategy specialization - ISB on Coursera

This is a specialization program offered by the Indian School of Business. It is freely available on Coursera. It will teach you about portfolio management and the behavioral aspects of investing in the financial markets. It will help you understand how the financial markets work and help you develop various investment strategies relevant to real-world scenarios.

2. Financial Markets by Yale University on Coursera

The course is taught by Robert Shiller from Yale University and is freely available on Coursera. You can earn a verified certificate if you finish the system with the graded assignments. The course covers topics like Insurance, Financial markets, behavioral finance, CAPM, etc.

3. Introduction to Investments by IIMB on Edx

The course is taught by S.G. Badrinath from IIM Bangalore and is freely available on EdX. It will help you achieve an advanced understanding of financial markets, market participants, global market structure, evaluation of organizations, etc. Read More About investment definition risks benefits here

4. Morningstar investing classroom by Morningstar

This is not a single course but a collection of many techniques. Each of these courses deep dives into specific topics and talks about them thoroughly. The classes are self-paced and include high-quality videos, assignments, quizzes, etc. Some topics include ETFs, staying invested in markets, involvement strategies for a volatile market, etc.

5. Value Investing by Columbia Business School

This is a two-month online program aimed to teach you in-depth about the concepts of value investing. It includes multiple case studies on some of the greatest investors in the world. They are known to have practiced value investing throughout their lives. It comes with real-world examples and investment scenarios. The course is built for both beginners and experienced investors who want to explore value investing in detail. It will help you make a critical thinking approach towards growth, profitability, etc.

6. Beginners guide to investing in the stock market on Udemy.

The stock market is a complex structure. One must be aware of many concepts before investing directly in the stock market without any professional guidance. This course will help you understand all these basic concepts that you, as a beginner, should know to be a successful investor. It will explain what the stock market is and how it works. It will help you build investment strategies, analyze market risks and determine the best stocks to invest in.

7. Finance for nonfinance professionals by Rice University on Coursera

If you wish to learn about financial concepts but do not have the prerequisites required by most such courses, this might be the course for you. It includes topics like economic assessments, estimating values, determining the compounding returns, predicting future outcomes, etc. This course should cover all the basic concepts that you might need to tackle fundamental financial challenges. read about financial planning basics

6. The complete financial analyst training and investing course on Udemy

This course is exclusively designed for financial analysts looking to get a corporate job at a financial analysis firm. It contains 54 in-depth modules covering financial modeling, company values, economic modeling, monetary and fiscal policy, etc. It is taught by Chris Haroun. He is an ex Goldman Sachs employee and has many insights from his own personal experience in the corporate world.

1 note

·

View note

Text

Nykaa On Fire !

Nykaa is an Indian lifestyle retailer of beauty, wellness, and fashion products that was founded by Falguni Nayar in 2012. Nykaa has multiple e-commerce platforms across websites and mobile apps and also has offline stores. It is a unicorn start-up, and as of 2020, was valued at US$1.2 billion. Since its inception in 2012, Nykaa has quickly emerged as India’s largest omnichannel beauty destination with millions of happy customers across the country. With 1200+, 100% genuine brands, and six warehouses across India that stock lakhs of well curated, well priced products, Nykaa offers a comprehensive selection of makeup, skincare, hair care, fragrances, personal care, luxury and wellness products for women and men. Derived from the Sanskrit word ‘Nayaka’ meaning actress or one in the spotlight, Nykaa is all about celebrating the star in each woman, and being her confidante and companion as she embarks on her own journey to discover her unique identity and personal style. From the widest selection of genuine beauty products from around the world to beauty advice, Nykaa is truly passionate about catering to your every beauty and wellness need. Because after all, Your Beauty is Our Passion.

Case in hand:

Online cosmetics and beauty products retailer Nykaa has come under social media fire for verbal harassment and employee bullying at the hands of one of its top level management employees. Popular Instagram page Diet Sabya – famous for its exposés on plagiarism and other evils in the fashion industry, Bollywood and beyond, has shared a series of instances of employee bullying, toxic work culture and harassment as shared by its own employees.

Shweta Nair, Vice President of Marketing, is accused of making unsavory personal comments about other employees’ looks to being deeply unsympathetic about their pains. The posts allege that the she has made rape jokes, made fun of an employee’s mental health, economic status, and indulged in “food shaming” amongst others. The exposé narrates an incident where she also asked an employee to “work from the hospital” when the parent of the employee was on a ventilator in a hospital. “It’s just the god’s way of weaning out the weak”, so was told an employee who had just had a miscarriage. “Oh, you’re just making excuses for being bad at spelling”, a dyslexic employee was reportedly so reprimanded.

But perhaps, the most problematic of all of her views was this. Reportedly while the company used a brand video featuring an acid attack victim, Shweta griped that since the woman in question had had facial reconstruction surgery and presumably looked less like an archetypical acid attack victim, the visual wouldn’t stand to garner much sympathy. Harassed Employees have reported the same to the CHRO but no action has been taken yet.

Task in hand:

You're the CHRO of Nykaa and you are responsible for the following:

Justify your actions to the authorities.

Decide the future course of action for the employees who have been harassed, prepare a compensation plan if any.

Come up with strategies to ensure that such an incident doesn’t occur in the future.

Deliverables:

A PowerPoint Presentation not exceeding 7 slides

Submission details -

Deadline: 2nd April, 2021; 3:00 P.M.

Email: [email protected]

Email Subject: ZENXX_NYKAA ON FIRE

In case of any queries regarding the task, feel free to contact the event heads.

4 notes

·

View notes

Link

In the recent times, especially after 2020 IPO’s have gained popularity just like YouTube Shorts, all thanks to the crazy number of people applying for an IPO. If you are also interested in knowing about IPO’s or applying in the upcoming ones then you have just come at the right place.

#Stock Market Courses for Beginners#fundamental analysis of indian stocks#Stock Market Classes#Share Market Courses Online#Stock Market training Institute#stock analysis course free#online learning stocks#stock market institute#share market classes#stock market courses#stock market paid courses

0 notes