#intermarketing

Video

youtube

Stock Market InterMarket Analysis Update For Monday June 12, 2023

2 notes

·

View notes

Text

The Five Pillars of Crypto Analytics

Cryptocurrency analytics is a multifaceted domain that empowers investors and traders with insights to navigate the volatile crypto markets. Understanding the five main elements of crypto analytics can significantly enhance decision-making processes. Here's a brief overview of these critical components:

Fundamental Analysis: This involves evaluating the intrinsic value of a cryptocurrency by examining its underlying factors, such as market supply and demand, project fundamentals, economic indicators, and the impact of news events.

Technical Analysis: A statistical approach that analyses past market data, price charts, and volume trends to forecast future price movements. It employs various tools like moving averages, RSI, and Fibonacci retracements.

Sentiment Analysis: By assessing the mood of market participants through social media monitoring and investor sentiment tools, sentiment analysis provides a gauge of the market's bullish or bearish tendencies.

Transaction Analysis: This includes scrutinizing the blockchain for transaction values, fees, hash rates, and active addresses to understand the network's health and activity levels.

Intermarket Analysis: This involves examining the correlations between cryptocurrencies and other financial markets to predict how external factors may influence crypto prices.

These elements form the backbone of crypto analytics, each offering unique perspectives and contributing to a holistic view of the market's dynamics. For anyone looking to delve deeper into the world of crypto trading, mastering these analytics components is essential.

For further reading on how to leverage these analytics elements in crypto trading, you may explore detailed guides and educational resources available online.

0 notes

Text

Unlocking Success in ICT 2022 Mentorship

The “Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders” is your comprehensive companion to mastering the intricate world of smart money management in the realm of intraday trading and price action. With a wealth of knowledge spanning 33 enlightening chapters, this guide is your roadmap to becoming a savvy trader.

In this extensive mentorship guide, you’ll embark on a journey that delves into the very heart of trading, from the fundamental concepts to the advanced strategies employed by seasoned traders. Chapter by chapter, you’ll explore the following key areas:

Chapters 1 through 3 provide a solid foundation, introducing you to intraday trading, price action, trade setup elements, and the critical concept of liquidity in trading.

Chapters 4 to 11 dive deep into the nuances of market structure, London session insights, order flow analysis, and various trading patterns such as the Three Drives Pattern and ICT Killzones.

Chapters 12 to 15 focus on daily biases, consolidation hurdles, economic calendar events, and precision market structure techniques.

Chapters 16 to 22 reveal multiple setups within trading sessions, intermarket relationships, and the impact of major events like FOMC and NFP on your trading decisions.

Chapters 23 to 30 introduce you to strategies related to new week/day openings, liquidity voids, and utilizing the institutional perspective in your trading.

Chapters 31 to 33 take you to an even higher level, discussing central bank dealers’ ranges, high-probability day trade setups, and quarterly shifts.

Throughout this mentorship guide, you’ll also find valuable insights on using various techniques, from economic calendar events and daily templates to institutional perception and core content block types.

With each chapter building upon the knowledge gained in the previous one, you’ll gradually become proficient in navigating the intricacies of intraday trading. By the time you reach the final chapter, you’ll have a well-rounded understanding of how to make informed trading decisions, manage risks effectively, and capitalize on opportunities in the ever-evolving world of financial markets.

The “Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders” is not just a book; it’s your mentor, guiding you through the maze of smart money trading concepts and equipping you with the skills and knowledge needed to excel in this dynamic field. Whether you’re a novice looking to start your trading journey or an experienced trader seeking to refine your strategies, this guide is an invaluable resource that will empower you to navigate the markets with confidence and precision.

0 notes

Text

TEA Business College: Leading the Way in Forecasting Technical Indicators

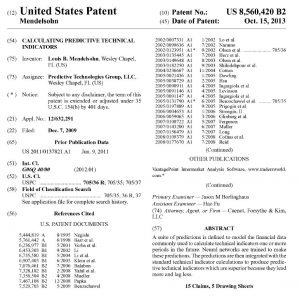

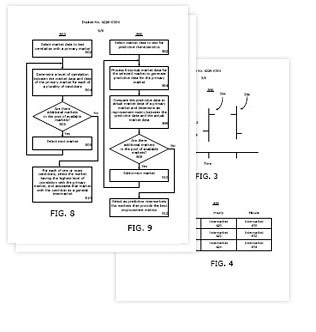

TEA Business College Patents

Intermarket Analysis

Patent Number: US 8,442,891 B2 Patent Date: May 14, 2013

The present invention relates to a method and system for performing intermarket analysis using neural networks. The invention provides a proprietary method and process for selecting relevant markets with the highest correlation in training the neural network from a vast array of available global financial markets, resulting in highly accurate market predictions for each "major" market. The selection process involves identifying "key" intermarkets, "general" intermarkets, and "predictive" intermarkets associated with each "major" market from an available market pool.

The market data for each key intermarket, general intermarket, and predictive intermarket can then be processed to train the neural network, so that when the neural network processes the input data, the neural network generates as accurate output data as possible for each primary market. After training the neural network, all relevant market data for each primary market can be processed through the neural network to predict future market data for each primary market, and then forecast technical indicators can be derived from the predicted future market data for traders to use in making trading decisions.

Calculate forecasted technical indicators.

Patent Number: US 8,560,420 Patent Date: October 15, 2013

The present invention relates to a method and system for calculating forecasted technical analysis indicators. The premise behind technical analysis is that all factors influencing a particular market at any given time are already reflected in the price of that market. Technology-oriented traders employ various computational methods, focusing on the use of various technical studies and indicators to analyze market behavior.

Some common technical indicators include trend indicators, momentum indicators, and volatility indicators. Many technical indicators, such as moving averages, attempt to filter out short-term price fluctuations in order to observe underlying trends. One side effect of doing so is that technical indicators often lag behind the market. Such indicators are referred to as trend-following or lagging indicators. This lagging effect leads to traders reacting to market changes later, resulting in missed profit opportunities and increased risk of losses.

The present invention overcomes this lagging effect by developing methods, systems, and devices for calculating forecasted (leading) technical indicators that do not lag behind the market, based on a combination of historical and forecasted data derived from neural networks applied to intermarket data related to each specific primary market.

In one aspect of the present invention, a method is used to combine forecasted data with conventional technical indicator information using an algorithm to obtain forecasted technical indicators that can guide market behavior, thereby overcoming limitations previously associated with lagging effects.

In the early years, much of Mr. Mendelson's research was done through extensive experimentation and computer power, and was very labor-intensive. Recently, with significant financial investment in the most advanced computer servers and the development of a highly complex proprietary internal research software training platform, the Predictive Technology Group has achieved the automation of much of the mathematical processes associated with executing necessary steps for intermarket analysis and generating forecasted technical indicators, making extremely accurate short-term market predictions possible. This automation is achieved by utilizing servers as intelligent robots.

In the future, the ultimate application neural networks used for training and selecting future trading software programs developed by Mr. Mendelsohn and his research team will require minimal human intervention or judgment decisions. Since Mr. Mendelsohn first began applying neural network pattern recognition to global intermarket data, this complex research methodology has continuously evolved and improved over the past 30 years, costing millions of dollars in research and development. It was the subject of two high-tech patent applications by Mr. Mendelsohn, submitted to the United States Patent and Trademark Office on December 7, 2009, where he first revealed the workings of his research techniques.

0 notes

Text

Hexamethylene Diisocyanate Prices: During the Quarter Ending December 2023 | ChemAnalyst

Hexamethylene Diisocyanate (HDI) prices is a crucial chemical compound used in the production of various polyurethane products, including coatings, adhesives, and elastomers. As an essential building block in these applications, the pricing dynamics of HDI hold significant importance for industries reliant on polyurethane materials. Understanding the factors influencing HDI prices is essential for businesses to make informed decisions and manage costs effectively.

One of the primary determinants of HDI prices is the supply-demand balance within the market. HDI production is largely dependent on the availability and cost of its raw materials, particularly hexamethylene diamine and phosgene. Any disruptions or fluctuations in the supply of these key inputs can impact the overall production of HDI, subsequently affecting its market price. Moreover, demand for polyurethane products, which utilize HDI as a core component, plays a crucial role in shaping its pricing trends. Industries such as construction, automotive, and furniture manufacturing are significant consumers of polyurethane materials, and fluctuations in their demand can directly influence HDI prices.

Global economic factors also exert a considerable influence on HDI prices. Economic growth, particularly in regions with significant polyurethane consumption like Asia-Pacific and North America, can drive up demand for HDI and subsequently its prices. Conversely, economic downturns or recessions may lead to reduced demand for polyurethane products, resulting in lower HDI prices. Currency exchange rates, trade policies, and geopolitical tensions can further impact the international pricing dynamics of HDI, making it susceptible to global economic shifts.

Get Real Time Prices of Hexamethylene Diisocyanate (HDI): https://www.chemanalyst.com/Pricing-data/hexamethylene-diisocyanate-1243

Technological advancements and innovations in HDI production processes can also affect its pricing trends. Efficiencies gained through improved manufacturing techniques or the development of alternative production methods can potentially lower production costs, leading to downward pressure on HDI prices. Conversely, regulatory changes aimed at enhancing environmental or safety standards may necessitate costly modifications to production facilities, potentially driving up HDI prices to cover these expenses.

Environmental regulations and sustainability initiatives also play a crucial role in shaping HDI prices. As governments worldwide impose stricter regulations on the use of hazardous chemicals and promote sustainable practices, manufacturers may incur additional compliance costs related to HDI production. Investments in pollution control equipment, waste management systems, and eco-friendly technologies can increase the overall cost of HDI manufacturing, ultimately influencing its market price.

Moreover, the competitive landscape within the HDI market can impact pricing dynamics. The presence of numerous manufacturers and suppliers vying for market share can lead to price competition, especially during periods of oversupply. Conversely, consolidation within the industry or disruptions in the supply chain may result in reduced competition, allowing producers to exert more control over HDI prices.

Market speculation and investor sentiment also contribute to HDI price volatility. Factors such as speculation on future demand trends, anticipation of supply disruptions, and geopolitical uncertainties can lead to speculative trading activities, causing price fluctuations in the HDI market. Additionally, the integration of HDI prices with other commodity markets, such as crude oil or petrochemicals, can further exacerbate price volatility through intermarket correlations.

In conclusion, the pricing dynamics of hexamethylene diisocyanate (HDI) are influenced by a multitude of factors, including supply-demand dynamics, global economic conditions, technological advancements, regulatory compliance, competitive pressures, and market speculation. Businesses operating in industries reliant on polyurethane materials must closely monitor these factors to anticipate changes in HDI prices effectively. By understanding the underlying drivers of HDI pricing trends, companies can make informed decisions to mitigate risks, optimize procurement strategies, and maintain competitiveness in the marketplace.

Get Real Time Prices of Hexamethylene Diisocyanate (HDI): https://www.chemanalyst.com/Pricing-data/hexamethylene-diisocyanate-1243

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Market Overview: Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex: Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts: Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance: Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice: Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points: Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations: Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights: Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies: Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis: Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Trading Psychology Tips: Ask for advice on maintaining emotional discipline and making rational decisions during trades.

Market Sentiment Analysis:

Chatgpt Prompts for trading forex complete guide!

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Chatgpt prompts for trading forex

Market Overview: Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex: Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts: Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance: Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice: Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points: Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations: Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights: Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies: Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis: Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Chatgpt Prompts for trading forex complete guide!

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Market Overview: Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex: Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts: Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance: Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice: Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points: Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations: Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights: Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies: Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis: Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Trading Psychology Tips: Ask for advice on maintaining emotional discipline and making rational decisions during trades.

Chatgpt Prompts for trading forex complete guide!

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Market Overview:

Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex:

Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts:

Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance:

Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice:

Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points:

Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations:

Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights:

Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies:

Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis:

Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Chatgpt Prompts for trading forex complete guide!

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Market Overview:

Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex:

Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts:

Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance:

Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice:

Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points:

Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations:

Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights:

Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies:

Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis:

Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Trading Psychology Tips:

Ask for advice on maintaining emotional discipline and making rational decisions during trades.

Market Sentiment Analysis:

Inquire about the current market sentiment and how it might influence currency movements.

Position Sizing Strategies:

Seek recommendations on determining appropriate position sizes based on account size and risk tolerance.

Long-Term Investment Advice:

Ask Chatgpt for insights on long-term investment opportunities and potential currency pairs for sustained growth.

Volatility Assessment:

Inquire about the expected volatility in the market and strategies to navigate it effectively.

Chatgpt Prompts for trading forex complete guide!

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Market Overview:

Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex:

Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts:

Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance:

Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice:

Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points:

Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations:

Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights:

Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies:

Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis:

Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Trading Psychology Tips:

Ask for advice on maintaining emotional discipline and making rational decisions during trades.

Chatgpt Prompts for trading forex complete guide!

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Market Overview: Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex: Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts: Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance: Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice: Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points: Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations: Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights: Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies: Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis: Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Chatgpt Prompts for trading forex complete guide!

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Market Overview: Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex: Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts: Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance: Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice: Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points: Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations: Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights: Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies: Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis: Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Trading Psychology Tips: Ask for advice on maintaining emotional discipline and making rational decisions during trades.

Market Sentiment Analysis:

Inquire about the current market sentiment and how it might influence currency movements.

Position Sizing Strategies: Seek recommendations on determining appropriate position sizes based on account size and risk tolerance.

Long-Term Investment Advice: Ask Chatgpt for insights on long-term investment opportunities and potential currency pairs for sustained growth.

Volatility Assessment: Inquire about the expected volatility in the market and strategies to navigate it effectively.

Trade Review and Analysis: Utilize ChatGPT for post-trade analysis, understanding what went well or identifying areas for improvement.

Currency Correlation Explanation: Ask for explanations of currency correlations and how they can impact your trading decisions.

In-Depth Educational Insights: Request educational explanations on specific trading concepts or market dynamics to enhance your understanding.

Custom Trading Plans: Collaborate with ChatGPT to develop customized trading plans based on your risk tolerance, goals, and preferred trading style.

Continuous Learning Support: Engage with ChatGPT regularly for ongoing learning, staying updated on market trends and refining your trading skills.

While ChatGPT can provide valuable insights, it’s essential to cross-verify information and use your judgment in making trading decisions.

Always stay informed and continue learning from various sources to develop a well-rounded understanding of Forex trading.

Chatgpt Prompts for trading forex complete guide!

0 notes

Link

Equity Markets in Action: The Fundamentals of Liquidity, Market Structure & Trading, ISBN-13: 978-0471469223 [PDF eBook eTextbook] CD not included! Publisher: Wiley (August 13, 2004) Language: English 480 pages ISBN-10: 9780471469223 ISBN-13: 978-0471469223 This book is about liquidity, market structure, and trading. It is about the powerful combination of technological, competitive, and regulatory forces that have transformed equity markets on both sides of the Atlantic. It is about issues that have been debated for years and never been resolved, including market transparency, the consolidation of order flow, the nature of intermarket linkages and the vibrancy of intermarket competition. If you trade too fast, you will push prices away from you. If you trade too slowly, you might miss the market. This is part of the real world of trading. Our book is addressed to practitioners, academicians, and other students of the market. Market structure is intricate; we seek to give the reader the big picture concerning the interplay between liquidity, market structure, and trading. Trading is intricate, and one does not become a professional trader overnight; we seek to highlight the major considerations that are faced by those who facilitate the implementation of portfolio decisions and turn orders into trades. The material in this book is also relevant for portfolio theory and capital markets courses in MBA programs. Risk and return get the lion’s share of attention in standard MBA finance courses, while liquidity, the third attribute of a stock or portfolio, is typically ignored. We wish to rectify the imbalance. Table of Contents: Preface. Chapter 1. Role of an Equity Market. Chapter 2. From Information to Prices. Chapter 3. Liquidity. Chapter 4. What We Want From Our Markets. Chapter 5. Institutional Order Flow. Chapter 6. Order Driven Markets. Chapter 7. Intermediated Markets. Chapter 8. The Evolving Scene in the US. Chapter 9. The Evolving Scene in Europe. Chapter 10. Clearing and Settlement. Chapter 11. Regulation. Chapter 12. Simulated Trading. Appendix A: Prices and Returns. Appendix B: From Portfolio Decisions to Trading in a Frictionless Environment. Appendix C: Dimensions of Informational Efficiency. Appendix D: The Concept of Self-Regulation. Selected Reading. Biographies. Robert A. Schwartz, PhD (New York, NY), is Marvin M. Speiser Professor of Finance and University Distinguished Professor in the Zicklin School of Business, Baruch College, CUNY. Reto Francioni, PhD (Zurich, Switzerland), is President and Chairman of the Board of SWX, the Swiss Stock Exchange, and former co-CEO of Consors Discount Broker AG, Nuremberg. What makes us different? • Instant Download • Always Competitive Pricing • 100% Privacy • FREE Sample Available • 24-7 LIVE Customer Support

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Market Overview: Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex: Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts: Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance: Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice: Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points: Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations: Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights: Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies: Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis: Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Trading Psychology Tips: Ask for advice on maintaining emotional discipline and making rational decisions during trades.

Chatgpt Prompts for trading forex complete guide!

0 notes

Text

Chatgpt Prompts for trading forex complete guide!

Chatgpt prompts for trading forex

Market Overview: Begin by asking ChatGPT for an overview of the current Forex market conditions and major trends.

Currency Pair Analysis by chatgpt prompts for trading forex: Request analysis on specific currency pairs, understanding potential movements and factors influencing them.

Forex News Interpretation by Chatgpt Prompts: Ask ChatGPT to interpret recent economic news and its impact on currency values.

Technical Analysis Assistance: Seek guidance on interpreting technical indicators and chart patterns for effective analysis.

Risk Management Advice: Inquire about optimal risk management strategies and appropriate risk-reward ratios for different trade setups.

Trade Entry and Exit Points: Request insights on potential entry and exit points for specific trades, considering technical and fundamental factors.

Stop-Loss and Take-Profit Recommendations: Ask for recommendations on setting stop-loss and take-profit levels based on current market conditions.

Economic Calendar Insights: Use ChatGPT to explain upcoming economic events listed on the calendar and their potential impact on the market.

Backtesting Strategies: Seek assistance in backtesting trading strategies to evaluate their historical performance.

Intermarket Analysis: Request insights on how developments in other financial markets (stocks, commodities) might affect Forex markets.

Chatgpt Prompts for trading forex complete guide!

0 notes