#larry david net worth

Text

Full list of Forbes’ 25 world billionaires in 2023

American business magazine, Forbes, in its 2023 list of 25 richest people in the world, featured Bernard Arnault on the No. 1 spot, followed by Twitter Chief Executive Officer, Elon Musk.

In its previous list in 2022, Musk was on the No. 1 spot.

Forbes described the drop of Musk from the top spot as ” this year’s second-biggest loser”, adding that “Elon Musk, had it worse.”

For Jeff Bezos, fortune knocked him from number. 2 in the world in 2022 to No. 3 this year as Amazon shares crashed by 38 per cent.

So This Happened (202) Reviews Lagos Bizman’s Arraignment Over Wife’s Death, Others | Punch

Musk lost his title of the world’s richest person after his pricey purchase of Twitter, which he funded in part by the sale of Tesla shares, helping to spook investors. Musk, who is worth $39 billion less than a year ago, is now No. 2.

For Jeff Bezos, fortune knocked him from number. 2 in the world in 2022 to No. 3 this year as Amazon shares crashed by 38 per cent.

Also, among the top 25, two billionaires — Zhang Yiming, Changpeng Zhao lost their spots and were unable to make it on the list for this year.

Yiming, the founder of Tik Tok-parent Bytedance, dropped one place, from No. 25 to No. 26, as his embattled company has taken a haircut from investors while Zhao, Binance founder, known as CZ, fell from No. 19 last year all the way to No. 167 amid the crypto winter.

Below are the list of Forbes 25 richest people in the world in 2023 with their net worth

1. Bernard Arnault & family

(Net worth: $211 Billion | Source of Wealth: LVMH | Age: 74 | Citizenship: France)

2. Elon Musk

(Net worth: $180 Billion | Source of Wealth: Tesla, SpaceX | Age: 51 | Citizenship: U.S.)

3. Jeff Bezos

(Net worth: $114 Billion | Source of Wealth: Amazon | Age: 59 | Citizenship: U.S.)

4. Larry Ellison

(Net worth: $107 Billion | Source of Wealth: Oracle | Age: 78 | Citizenship: U.S.)

5. Warren Buffett

(Net worth: $106 Billion | Source of Wealth: Berkshire Hathaway | Age: 92 | Citizenship: U.S.)

6. Bill Gates

(Net worth: $104 Billion | Source of Wealth: Microsoft | Age: 67 | Citizenship: U.S.)

7. Michael Bloomberg

(Net worth: $94.5 Billion | Source of Wealth: Bloomberg LP | Age:81

8. Carlos Slim Helú & family

(Net worth: $93 Billion | Source of Wealth: Telecom | Age: 83 | Citizenship: Mexico)

9. Mukesh Ambani

(Net worth: $83.4 Billion | Source of Wealth: Diversified| Age: 65 | Citizenship: India)

10. Steve Ballmer

(Net worth: $80.7 Billion | Source of Wealth: Microsoft | Age: 67 | Citizenship: U.S.)

11. Françoise Bettencourt Meyers & family

(Net worth: $80.5 Billion | Source of Wealth: L’Oréal | Age: 69 | Citizenship: France)

12. Larry Page

(Net worth: $79.2 Billion | Source of Wealth: Google | Age: 50 | Citizenship: U.S.)

13. Amancio Ortega

(Net worth: $77.3 Billion | Source of Wealth: Zara | Age: 87 | Citizenship: Spain)

14. Sergey Brin

(Net worth: $76 Billion | Source of Wealth: Google | Age: 49 | Citizenship: U.S.)

15. Zhong Shanshan

(Net worth: $68 Billion | Source of Wealth: Beverages, pharmaceuticals | Age: 68 | Citizenship: China)

16. Mark Zuckerberg

(Net worth: $64.4 Billion | Source of Wealth: Facebook | Age: 38 | Citizenship: U.S.)

17. Charles Koch

(Net worth: $59 Billion | Source of Wealth: Koch Industries | Age: 87 | Citizenship: U.S.)

18. Julia Koch & family

(Net worth: $59 Billion | Source of Wealth: Koch Industries | Age: 60 | Citizenship: U.S.)

19. Jim Walton

(Net worth: $58.8 Billion | Source of Wealth: Walmart | Age: 74 | Citizenship: U.S.)

20. Rob Walton

(Net worth: $57.6 Billion | Source of Wealth: Walmart | Age: 78 | Citizenship: U.S.)

21. Alice Walton

(Net worth: $56.7 Billion | Source of Wealth: Walmart | Age: 73 | Citizenship: U.S.)

22. David Thomson & family

(Net worth: $54.4 Billion | Source of Wealth: Media | Age: 65 | Citizenship: Canada)

23. Michael Dell

(Net worth: $50.1 Billion | Source of Wealth: Dell Technologies | Age: 58 | Citizenship: U.S.)

24. Gautam Adani

(Net worth: $47.2 Billion | Source of Wealth: Infrastructure, commodities | Age: 60 | Citizenship: India)

25. Phil Knight & family

(Net worth: $45.1 Billion | Source of Wealth: Nike | Age: 85 | Citizenship: U.S.)

2 notes

·

View notes

Text

Harper V. O’Neal

By Andrew Bruner, University of Kentucky Class of 2024

June 25, 2023

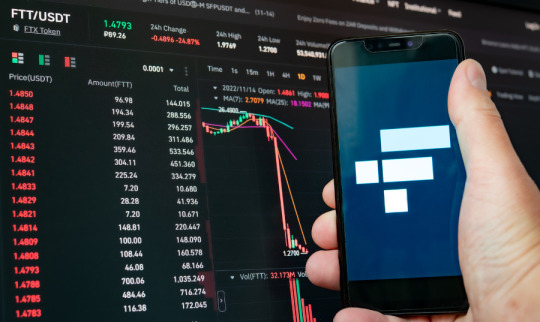

On May 23, 2023, world-renowned celebrity basketball star Shaquille O’Neal was personally sued regarding his investment and role in the promotion of the cryptocurrency Astrals Project [1]. O’Neal’s involvement in Astral is the second controversial crypto project he’s been a part of following FTX. He was previously sued alongside FTX founder Sam-Bankman-Freid and many other celebrities, including Larry David and Tom Brady [2]. Shaq had denied claims of his avoidance from an FTX legal complaint, but reports proved to be true two days later when he was officially served while attending a Miami Heat playoff game [3]. The Astrals project and FTX have a strong underlying connection, that being their emphasis on celebrity personalities to drive interest and sales to consumers. Unlike FTX, Shaq was the sole celebrity endorsement for the Astrals Project, one he launched alongside his music manager and his son. The burden of proof shifts from a large array of celebrities to one individual: Shaquille O’Neal.

O’Neal’s strong investments in a variety of businesses are noted in the lawsuit highlighted above. Shaq has moved beyond his basketball career into a wide variety of business opportunities to expand his net worth. He has the benefit that few do, as even non-NBA stars have likely heard the name Shaquille O’Neal before. Social media gives an even greater platform for him to expand, which he did often to promote his NFT endeavors. His promotion of these projects, ones that have been publicly denounced by the Security Exchange Commission (SEC), push the line past legality. The SEC has taken large efforts over the years to differentiate a decentralized cryptocurrency like Bitcoin from others beyond the law.

Daniel Harper, the plaintiff, sued due to financial damages suffered through his investment in the Astrals project. Harper made large investments into the Astrals project, purchasing over 100 different NFTs from them, all occurring within a year between March 2022 and March 2023. The primary basis of his team’s lawsuit is the well-known Howey Test. The Howey Test, established in SEC v. Howey (1946), relies on three prongs used for determining whether a transaction qualifies as an investment contract. The investment contract can then be subject to regulation by the SEC. The first prong is the investment of money – those who put money into the Astrals project did exactly that. The second prong is whether the investment is a common enterprise. For those that don’t know, a common enterprise is when the profits of an investor rely on those selling the investment [4]. Investors of the Astrals NFT gained or lost revenue solely depending on the success of O’Neal’s widespread promotion. Third is the potential expectation of profits derived from the efforts of others [5]. Shaq promoted the NFT to a wide range of people, there’s strong evidence to suggest that those who did so expected that their investment would lead to potential profits. Shaq himself is that evidence, a world-renowned millionaire heavily invested in these cryptocurrencies and spreading the word about them. O’Neal’s crypto project meets each of the three prongs of the test, making his sale to consumers that of unregistered securities.

Shaquille O’Neal as an icon has accomplished so much throughout his NBA career and beyond. However, his status does not supersede the laws and regulations of the United States of America. The Astrals NFT project, as the evidence shows, is an unregistered security following no regulations from the SEC. Shaq is the driving force of said unregistered security, putting himself as the sole individual at fault for a borderline illegal operation. The full lawsuit provides many more details of logistics as it relates to crypto, NFTs, the SEC, and the widespread promotion of the Astrals Project by Shaquille O’Neal. The Astrals Twitter account currently remains fully active and a shutdown of the Astral NFT remains up in the air. Shaq can likely dispel this lawsuit simply by registering the Astrals Project with the SEC. Barring changes based on SEC guidelines, the NFT can remain open and active for many to invest in or enjoy. The first maneuver he would need to take is submitting an S-1 form to the SEC, otherwise known as a registration statement [6]. The S-1 form would allow him to publicly announce both the benefits and contribution to society that the Astrals cryptocurrency provides. Whether that happens, remains to be seen.

______________________________________________________________

[1] https://www.hollywoodreporter.com/business/business-news/shaquille-oneal-sued-over-astrals-crypto-ownership-and-promotion-1235499257/

[2] https://www.hollywoodreporter.com/business/business-news/ftx-investors-sue-celebrity-endorsers-1235263511/

[3] https://www.cbsnews.com/news/shaq-served-in-ftx-lawsuit-after-he-allegedly-hid-for-months/

[4] https://www.upcounsel.com/common-enterprise#:~:text=or%20more%20firms.-,Common%20enterprise%2C%20in%20relation%20to%20an%20investment%20contract%2C%20is%20a,offering%20or%20selling%20the%20investment.

[5] https://www.sec.gov/corpfin/framework-investment-contract-analysis-digital-assets

[6] https://www.americanbar.org/groups/business_law/resources/business-law-today/2017-april/what-constitutes-a-security-and-requirements-relating-to-the-off/#:~:text=In%20order%20to%20register%20a,Part%20I%20and%20Part%20II).

0 notes

Text

Several celebrities lost a lot of money due to the collapse of the cryptocurrency exchange FTX. The once high-flying company filed for bankruptcy in November, and its founder and CEO, Sam Bankman-Fried (who lost billions himself), is awaiting trial in New York City on fraud charges, to which he has pleaded not guilty. Co-founder Gary Wang reportedly lost nearly $2 billion.

A 68-page document recently revealed in court the individuals and investment firms who owned the company. At its peak in September 2021, FTX was valued at $32 billion U.S. At that point, shares were trading at $80. Of course, many more regular investors lost money too, just not as much individually as these people.

Tom Brady and Gisele Bundchen. The NFL legend and his supermodel ex-wife starred in commercials for FTX and had a lot of shares.

Brady had 1.1 million common shares of FTX Trading, worth about $93 million, and Bundchen had 680,000 shares, worth $57 million at the apex.

Nobody knows if they bought the shares or were given them via FTX.

Brady’s agent, Don Yee, and a spokesman for Robert Kraft did not immediately respond to DailyMail.com’s request for comment.

Robert Kraft. Kraft owns the New England Patriots and is a close friend of Brady. He has a net worth of over $10 billion, so he likely doesn’t care too much that his more than 600,000 shares, which were once valued at $53 million, are now virtually worthless.

Peter Thiel. Another billionaire, Thiel, is worth over $7 billion. He founded Paypal and had around 300,000 shares valued at $25 million.

Shohei Ohtani. Ohtani, one of the best players in baseball and a former MVP who both pitches and hits, took a stake as an ambassador in stock, company equity, and cryptocurrency. It’s unclear exactly what the collapse cost him. Other sporting figures, like tennis star Naomi Osaka and Jacksonville Jaguars quarterback Trevor Lawrence, also had similar deals. Steph Curry, Shaquille O’Neal, and television star Larry David also lost out.

Leagues and arenas (like the home of the Miami Heat) have also been impacted by the collapse. The Miami arena will now be called Miami-Dade Arena instead of FTX Arena. Closer to home, the Ontario Teachers’ Pension Plan took a sizeable hit. According to reports, it will write down its $95 million investment in FTX.

0 notes

Text

Taylor Swift Rejected An Enormous FTX Endorsement Offer… And Boy Is She Looking Brilliant Now - Celebrity Net Worth

Taylor Swift Rejected An Enormous FTX Endorsement Offer… And Boy Is She Looking Brilliant Now – Celebrity Net Worth

Sam Bankman-Fried was able to get a bunch of the world’s most famous faces to promote his now collapsed cryptocurrency exchange FTX. Celebrities who endorsed FTX included Gisele Bündchen, Tom Brady, Shaquille O’Neal, Stephen Curry, and in one especially infamous Super Bowl ad, Larry David. But at least one star declined to lend her support to the company. And in doing so, walked away from a…

View On WordPress

0 notes

Text

The Horrific Demise of FTX

On November 11, 2022, FTX, one of the leading crypto exchanges, filed for Chapter 11 bankruptcy protection following a quick fall from glory. Sam Bankman-Fried saw his $16 billion net worth drop to almost nothing as the company’s value plummeted from $32 billion to bankruptcy in a couple of days.

The unstable cryptocurrency market was shaken by FTX’s collapse, losing billions of dollars in value and falling below $1 trillion.

The fallout from FTX’s sharp downturn and demise will affect cryptocurrencies for a long time and may even bring down more general markets.

On November 16, 2022, a class-action lawsuit was submitted to a Florida federal court, stating that Sam Bankman-Fried had fabricated a cryptocurrency scam scheme intended to defraud unskilled investors from all over the nation. In addition to Larry David and Kevin O’Leary, other well-known people who allegedly assisted Bankman-Fried in carrying out the scheme are Steph Curry, Shaquille O’Neal, Shohei Ohtani, Naomi Osaka, and Shohei Ohtani.

The FTX collapse will be discussed at a hearing by the U.S. House Financial Services Committee in December 2022.

A Quick FTX History

Founded by Bankman-Fried at 28, FTX has blossomed into one of the largest cryptocurrency exchanges with a $32 billion valuation in three years. Bankman-Fried used aggressive marketing tactics, including a Super Bowl ad campaign and purchasing naming rights to the Miami Heat’s home arena. He rose to prominence due to his political lobbying, donations, and efforts to support the cryptocurrency industry in general. For example, as token prices fell in early 2022, he facilitated $1 billion in deals to help cryptocurrency companies struggling due to token price declines.

What Happened to FTX

The crash of FTX occurred over ten days in November 2022. A CoinDesk scoop on November 2 showed that Alameda Research, the quant trading firm also run by Bankman-Fried, held a $5 billion position in FTT, the native token of FTX. According to the report, Alameda’s investment foundation was also invested in FTT, the token created by its sister company, rather than a fiat currency or other cryptocurrency.

The cryptocurrency industry is concerned about Bankman-companies’ Fried’s undisclosed leverage and solvency.

What Binance is Saying

On November 6, Binance announced that it would sell its whole position in FTT tokens — roughly 23 million tokens worth $529 million. Following the demise of the Terra (LUNA) crypto token earlier this year, Binance CEO Changpeng “C.Z.” Zhao said the decision to liquidate the exchange’s FTT position was based on risk management.

Crisis in FTX liquidity and the Binance Deal

The following day, FTX went through a liquidity crisis. Bankman-Fried made an effort to reassure its investors their assets were safe, but in the days that followed the CoinDesk revelation, the customers demanded withdrawals totaling $6 billion. Before resorting to Binance, Bankman-Fried looked for more funding from venture capitalists. As a result, FTT’s value decreased by 80% in just two days.

On November 8, Binance revealed it had signed a non-binding deal to acquire FTX’s non-U.S. business for an undisclosed fee, helping its close rival out.

Binance cancels the bailout agreement with FTX.

The promise of rescue was only temporary, as Binance withdrew from the agreement the following day. The exchange said on November 9 that it would abandon the FTX acquisition after corporate due diligence revealed concerns regarding, among other things, the improper handling of customer assets.

The Freezing of FTX tokens

Following reports that Bankman-Fried was looking for up to $8 billion in capital to save the exchange, the Bahamas securities commission froze the assets of FTX Digital Markets, FTX’s Bahamian affiliate, on November 10.

The California Department of Financial Protection and Innovation disclosed that an inquiry into FTX had begun the same day.

On Twitter, Bankman-Fried acknowledged the liquidity situation and apologized for FTX’s non-U.S. exchange’s inability to meet consumer demand. According to Bankman-Fried, FTX miscalculated leverage and liquidity due to “bad internal labeling.” He stated that Alameda would stop trading in the same post.

What is the Future of FTX?

As a cryptocurrency exchange, FTX’s future is in grave danger. Withdrawals are no longer possible as of mid-November 2022, and the corporation “highly advises[s] against depositing,” according to a post on the FTX website.

It will take some time before the broader ramifications of the FTX debacle on the bitcoin market become clear. Investors may already be wary because of worries about stability and security, but FTX, the most significant drop in the brief history of cryptocurrencies, may put them off even more. For example, customers on the FTX platform might be unable to retrieve their assets, which could result in legal action. In addition, the collapse of FTX may be used as justification by the U.S. Securities and Exchange Commission (SEC) and other regulators for strengthening regulatory oversight of cryptocurrencies. As a result, Congress may be more willing to intervene and enact new legislation regulating digital tokens and exchanges.

The demise of the third-largest exchange in terms of volume will cause ripple effects throughout the cryptocurrency community for some time. BlockFi, a cryptocurrency lender, halted client withdrawals on November 11, 2022, and speculations suggest that the company may face trouble in the future. On Nov. 12 and 13, 2022, there was a spike in withdrawals on Crypto.com. Customer withdrawals from Genesis Global Capital’s cryptocurrency lending unit have been suspended. And the collateral harm has probably only just begun.

About CFXN

CFXN meets its users’ banking needs. You gain complete control over what happens to your money without worrying about economic inflation or the security of your funds. The best thing about CFXN is that it introduces cryptocurrency to the general public. And because it is simple to use, even a grandmother or a kindergarten student can use it. Tom invites anyone interested in riding the wave of success in blockchain, finance, and crypto to invest in the project and share in the profits made by CFXN.

To learn more (and in case you have questions) or if you are interested in investing in the project, reach out to Tom at [email protected]

1 note

·

View note

Text

Jerry Seinfeld, an American actor, stand-up comedian, writer, and producer is the No 1 Richest Actor in the World with the net worth of US $ 1 Billion. He is best known for playing a semi-fictional version of himself in the sitcom Seinfeld (1989–1998), which he created and wrote with Larry David. Seinfeld has been called the ” Richest Actor in the World.” He was born on April 29, 1954 in Brooklyn, New York City. His father, Kalman Seinfeld was of Hungarian Jewish descent, while his mother, Esther (née Folwer) was of Polish Jewish ancestry. He began his comedy career while still in college. He earns 50 Million US dollars in 2022. After graduation, he moved to New York City to pursue a career in stand-up comedy. He later landed a role on the sitcom Benson (1979–1980).

0 notes

Text

Timi dakolo

So deep was their relationship that Timi declined an offer to move to Lagos with his parents, opting to stay back in Port-harcourt with them. He was raised in Port Harcourt by his grandmother Ateni Dakolo and his aunt Susan Larry, and he credits his aunt as his early singing teacher. Despite being born in Ghana, Timi has a Nigerian passport and does not claim dual citizenship. Kindly drop a wish for him in the comment box below.Timi Dakolo was born in Accra, Ghana to a Nigerian father, Bayelsa-native David and a Ghanaian mother, Norah Kimmy Head, who died when Dakolo was thirteen years old. Twitter: Dakolo has been a great singer in the Nigerian music industry. His social media handles are stated below in case you want to follow him. He has over 2.2 million and 337k followers on it, respectively. To testify to this, both his Instagram and Twitter accounts have been verified. Timi Dakolo is one of the Nigerian celebrities with a great social media presence. Nigerian Entertainment Award for Inspirational ArtisĪccording to multiple but unverified sources, Timi Dakolo’s net worth is estimated at $2.1 million. The Entrepreneur Africa Prize For Music Business Emeli SandeĢ011: Great Nation Awards & Nominations Year The marriage is blessed with three children.Ģ019: Merry Christmas Darling feat. In 2012, Timi Dakolo got married to Busola Dakolo. Even though a hotel security guard was killed in the attack, Timi escaped with only a flesh wound and was transported to the hospital, where he was treated and released the same day. Timi was not targeted in the attack, which was a random act of brutality by a section of Niger Delta insurgents. He went to the hotel with a group of friends to attend a religious service. Timi Dakolo was shot in the lobby of the Presidential Hotel in Port Harcourt on January 1, 2008, on New Year’s Day, after winning Idol West Africa in 2007. In November 2019, Timi Dakolo released “ Merry Christmas, Darling,” a Christmas album including guest duets from Emeli Sandé and Kenny G. Timi Dakolo is one of The Voice Nigeria’s judges. He is currently signed with Muzik as his record label. He published the song “ There’s a Cry” in 2011. In October 2009, Timi Dakolo released his first single, which consisted of three tracks. This was a major emotional setback for him. Timi’s grandma died a week before the Top 24 performances were to be viewed during the competition. Timi received the most votes in each of the final three weeks of the competition, according to the show’s producers. Timi Dakolo was never in the bottom three during the tournament. His vocals wowed the judges, and he was tipped as a possible winner. After winning the West African Idols competition, he moved on to study songwriting to pursue a career as a songwriter.ĭakolo auditioned for the reality show Idols West Africa in 2006 in Calabar, Nigeria’s Cross River State. He graduated from the University of Port Harcourt with a degree in Communication Studies. They overwhelmed the Port Harcourt club circuit, yet all at once disbanded in 2005. He became a founding member of the musical group Purple Love in 2003. Timi began singing at church when he was twelve years old. So profound was their relationship that Timi declined a proposal to move to Lagos with his friends, choosing to remain back in Port Harcourt with them. He was brought up in Port Harcourt by his grandmother, Ateni Dakolo, and his auntie, Susan Larry, and he acknowledges his auntie as his initial singing educator. Despite being born in Ghana, Timi has always claimed Nigeria. On the 20th of January, 1981, in Accra, Ghana, Timi Dakolo was born into the family of a Nigerian dad, David, and a Ghanaian mother, Norah Kimmy Head, who died when Dakolo was thirteen years old.

0 notes

Text

larry david net worth

Larry David Net Worth, as of 2015, was anywhere between $400 million to $900 million. He got his first breakthrough in comedy in 1974. New York Comedy Night Clubs were his main source of income at the time. Larry David has been a part of more than 45 shows. It would be rather easy to explain his $400 million net worth if you assume he got up to $9 million per show. According to inside reports, Larry David got $4 billion for Seinfeld’s syndication to Columbia Tristar. However, the air got cleared when Larry confirmed that $4 billion was the gross revenue of Seinfeld as it aired by NBC in 1989. In 993, Larry David married Lauri, who was previously the spouse of another man unknown. However, when Larry David tied knots with Lauri, his net worth instantly increased to 900 million USD, which, thanks to Lauri, got from her husband in the divorce settlement. Recently, the couple got divorced and had to give away half of it, leaving with $400M net worth.

0 notes

Link

https://thehabitstacker.com/blog/brian-mcknight-net-worth-and-key-habits/

https://thehabitstacker.com/blog/daniel-negreanu-net-worth-and-key-habits/

https://thehabitstacker.com/blog/dana-carvey-net-worth-and-key-habits/

https://thehabitstacker.com/blog/daniel-negreanu-net-worth-and-key-habits/

https://thehabitstacker.com/blog/jeff-goldblum-net-worth-and-key-habits/

https://thehabitstacker.com/blog/wladimir-klitschko-net-worth-and-key-habits/

https://thehabitstacker.com/blog/alexa-bliss-net-worth-and-key-habits/

https://thehabitstacker.com/blog/ti-net-worth-and-key-habits/

#Daniel Negreanu Net Worth#Dana Carvey Net Worth#Jeff Goldblum Net Worth#DJ Mustard Net Worth#Ludacris Net Worth#TI Net Worth#Alexa Bliss Net Worth#Wladimir Klitschko Net Worth#Mike Herrera Net Worth#Larry Bird Net Worth#Alex Rodriguez Net Worth#Juvenile Net Worth#Z-RO Net Worth#Mekhi Phifer Net Worth#The Obamas Net Worth#David Banner Net Worth#Lennox Lewis Net Worth#Chael Sonnen Net Worth#Lil Dicky Net Worth#Dababy Net Worth#Tom Cruise Net Worth#Dave England Net Worth

0 notes

Photo

The Great Reset is Here: Follow the Money

The top-down reorganization of the world economy by a cabal of technocratic corporativists, led by the group around the Davos World Economic Forum– the so-called Great Reset or UN Agenda 2030– is no future proposal. It is well into actualization as the world remains in insane lockdown for a virus. The hottest investment area since onset of the coronavirus global lockdowns is something called ESG investing. This highly subjective and very controlled game is dramatically shifting global capital flows into a select group of “approved” corporate stocks and bonds. Notably it advances the dystopian UN Agenda 2030 or the WEF Great Reset agenda. The development is one of the most dangerous and least understood shifts in at least the past century.

The UN “sustainable economy” agenda is being realized quietly by the very same global banks which have created the financial crises in 2008. This time they are preparing the Klaus Schwab WEF Great Reset by steering hundreds of billions and soon trillions in investment to their hand-picked “woke” companies, and away from the “not woke” such as oil and gas companies or coal.

What the bankers and giant investment funds like BlackRock have done is to create a new investment infrastructure that picks “winners” or “losers” for investment according to how serious that company is about ESG—Environment, Social values and Governance. For example a company gets positive ratings for the seriousness of its hiring gender diverse management and employees, or takes measures to eliminate their carbon “footprint” by making their energy sources green or sustainable to use the UN term. How corporations contribute to a global sustainable governance is the most vague of the ESG, and could include anything from corporate donations to Black Lives Matter to supporting UN agencies such as WHO.

The crucial central goal of ESG strategists is to create a shift to inefficient and costly alternative energy, the Zero Carbon promised utopia. It is being driven by the world’s major financial institutions and central banks. They have created a dazzling array of organizations to drive their green investing agenda.

In 2013, well before the coronavirus, the major Wall Street bank, Morgan Stanley, created its own Institute for Sustainable Investing. This was soon expanded in 2015 when Morgan Stanley joined the Steering Committee of the Partnership for Carbon Accounting Financials (PCAF). On its website the they state,

“PCAF is based upon the Paris Climate Agreement’s position that the global community should strive to limit global warming to 1.5°C above pre-industrial levels and that society should decarbonize and reach net zero emissions by 2050.”

By 2020 the PCAF had more than 100 banks and financial institutions including ABN Amro, Nat West, Lloyds Bank, Barcylays, Bank of America, Citi Group, CIBC, Danske Bank and others. Several of the PCAF member banks have been indicted in money laundering cases. Now they sense a new role as virtue-models to change the world economy, if we are to believe the rhetoric. Notably, former Bank of England Governor, Mark Carney is an “Observer” or consultant to the PCAF.

In August 2020 the PCAF published a draft standard outlining a proposed approach for global carbon accounting. This means the bankers are creating their own accounting rules for how to rate or value a company’s carbon footprint or green profile.

The Central Role of Mark Carney

Mark Carney is at the center of reorganizing world finance to back the UN 2030 green agenda behind the WEF Davos Great Reset, where he is a member of the Board of Trustees. He also is Adviser to the UN Secretary General as United Nations Special Envoy for Climate Action. He has described the PCAF plan as follows:

“To achieve net zero we need a whole economy transition – every company, every bank, every insurer and investor will have to adjust their business models, develop credible plans for the transition and implement them. For financial firms, that means reviewing more than the emissions generated by their own business activity. They must measure and report the emissions generated by the companies they invest in and lend to. PCAF’s work to standardise the approach to measuring financed emissions is an important step to ensuring that every financial decision takes climate change into account.”

As Governor of the Bank of England Carney played a key role getting world central banks behind the Green Agenda of the UN 2030 scheme. The major central banks of the world, through their umbrella Bank for International Settlements (BIS) in Basle, created a key part of the growing global infrastructure that is steering investment flows to “sustainable” companies and away from those like oil and gas companies it deems “unsustainable.” When then-Bank of England Governor Mark Carney was head of the BIS’ Financial Stability Board (FSB) he established something called Task-force on Climate-related Financial Disclosure (TCFD) in 2015.

The central bankers of the FSB nominated 31 people to form the TCFD. Chaired by billionaire Michael Bloomberg, it included in addition to BlackRock, JP MorganChase; Barclays Bank; HSBC; Swiss Re, the world’s second largest reinsurance; China’s ICBC bank; Tata Steel, ENI oil, Dow Chemical, mining giant BHP and David Blood of Al Gore’s Generation Investment LLC.

Anne Finucane, the Vice Chair of the Bank of America, a member of both the PCAF and the TCFD, noted, “we are committed to ensuring that climate-related risks and opportunities are properly managed within our business and that we are working with governments and markets to accelerate the changes required… climate change presents risks to the business community, and it is important for companies to articulate how these risks are being managed.”

The Bank of America vice chair describes how they assess risks in its real estate loan portfolio by assessing, “acute physical risk analysis on a sample portfolio of Bank of America residential mortgages across the US Each property was given a score based on the level of risk associated with 12 potential hazards: tornado, earthquake, tropical cyclone, hailstorm, wildfire, river flood, flash flood, coastal flood, lightning, tsunami, volcano, and winter storm.” As well, the banks’ investment “risk” in oil and gas as well as other industrial sectors is reviewed using the criteria of Carney’s TCFD. All risks are defined as related to CO2, despite the fact there is no conclusive scientific proof that manmade CO2 emission is about to destroy our planet by global warming. Rather evidence of solar activity suggests we are entering an unstable cooling period, Grand Solar Minimum. That’s of no concern to the financial interests who stand to reap trillions in the coming decade.

Another key part of the financial preparation for the Great Reset, the fundamental transformation from a high-energy intensity economy to a low and economically inefficient one, is the Sustainability Accounting Standards Board (SASB). SASB says it “provides a clear set of standards for reporting sustainability information across a wide range of issues… “ This sounds reassuring until we look at who makes up the members of the SASB that will give the Climate-friendly Imprimatur. Members include, in addition to the world’s largest fund manager, BlackRock (more than $7 trillion under management), also Vanguard Funds, Fidelity Investments, Goldman Sachs, State Street Global, Carlyle Group, Rockefeller Capital Management, and numerous major banks such as Bank of America and UBS. Many of these are responsible for the 2008 global financial collapse. What is this framework group doing? According to their website, “Since 2011, we have has been working towards an ambitious goal of developing and maintaining sustainability accounting standards for 77 industries.”

Where this is all going is to create a web of globally-based financial entities who control combined wealth including insurance and pension funds into what they claim to be worth $100 trillion. They are setting the rules and will define a company or even a country by the degree of carbon emission they create. If you are clean and green, you potentially get investment. If you are deemed a carbon polluter as the oil, gas and coal industries are deemed today, the global capital flows will disinvest or avoid funding you. The immediate target of this financial cabal is the backbone of the world economy, the oil and gas industry along with coal.

Hydrocarbons Under Attack

The immediate target of this financial cartel is the backbone of the world economy, the oil, coal and natural gas sector. Oil industry analysts predict that over the next five years or less investment flows into the world’s largest energy sector will fall dramatically. “Given how central the energy transition will be to every company’s growth prospects, we are asking companies to disclose a plan for how their business model will be compatible with a net zero economy,” BlackRock’s chairman and CEO Larry Fink wrote in his 2021 letter to CEOs. Blackrock is the world’s largest investment group with over $7 trillion to invest. Another BlackRock officer told a recent energy conference, “where BlackRock goes, others will follow.”

“To continue to attract capital, portfolios have to be built around core advantaged assets – low-cost, long-life, low carbon-intensive barrels,” said Andrew Latham, Vice President, Global Exploration at WoodMac, an energy consultancy.

The Biden Administration is already making good on his pledge to phase out oil and gas by banning new leases in Federal lands and offshore and the Keystone XL oil pipeline. The oil and gas sector and its derivatives such as petrochemicals are at the heart of the world economy. The 50 largest oil and gas companies in the world, including both state-owned and publicly traded companies, recorded revenues of about $5.4 trillion in 2015.

As a new Biden Administration pushes their ideological opposition to so-called fossil fuels, the world will see a precipitous decline in oil and gas investment. The role of the Davos globalists and the ESG financial players are out to guarantee that. And the losers will be us. Energy prices will skyrocket as they did during the recent Texas blizzards. The cost of electricity in industrial countries will become prohibitive for manufacturing industry. But rest well. This is all part of the ongoing Great Reset and its new doctrine of ESG investing.

In 2010 the head of Working Group 3 of the UN Intergovernmental Panel on Climate Change, Dr Otmar Edenhofer, told an interviewer, “…one must say clearly that we redistribute de facto the world’s wealth by climate policy. One has to free oneself from the illusion that international climate policy is environmental policy. This has almost nothing to do with environmental policy anymore…” The WEF Great Reset is not simply a big idea of Klaus Schwab reflecting on the economic devastation of the coronavirus. It has been long planned by the money masters.

8 notes

·

View notes

Text

JULY 2021

THE RIB PAGE

*****

They are still uncovering statues on Easter Island.

*****

Everyone is talking about ‘Exterminate all the Brutes” from Raoul Peck.

*****

Vampire bats, prevalent in Latin America may be on the way to the U.S.

*****

What they call faith, I call strength.

*****

Criss angel will open CABLP, a restaurant in Overton, Nevada. The letters stand for breakfast, lunch and pizza and will include a free meal outreach program to help under privileged and pediatric cancer families.

*****

A fifth ocean in Antartica??** There have also found 4 new ocean species: Apolemia, Tegula Kusairo, Leptarma Biju and Duobrachium Sparksae.

*****

In China they have found a possible new species in a skull that is 140,000 years old.

*****

Why would Jeffrey Toobin be back at CNN?? Surely there are more young deserving talking heads around.

*****

The Keystone pipeline is dead.

*****

5,000 pounds of explosives were discovered in a home in South LA. LAPD seems to have detonated the fireworks in a truck right there in the neighborhood. They were too dangerous to transport but not enough to blow them up??? How stupid are these people??

*****

Days alert : So glad to see Clyde again even if it is only for a moment!! **BTW, I do not understand the Daytime Emmy noms this year as they relate to Days. I really was pulling for Victoria Koneful (Ciara) and she won but George DelHoya (Orpheus), Tamara Braun (Ava) and Cady McClain (Jennifer)??? I was shocked when Cady McClain won. I mean, she was so whiny. I question my own ability to judge a performance. In most categories, the winner was usually the one I thought was the worst option. I was happy for Max Gail and CBS Sunday Morning. Some performances were sure overlooked. What about James Read (Clyde), Paul Telfer (Xander), Bryan Dattilo (Lucas), Robert Scott Wilson (Ben), Daniel Kerr (Eli) and Lindsay Arnold (Allie) ?? As annoying as the Kristen character is and as long as it took me to get used to Stacy Haiduk in the role, she kicked ass this year. Did they even submit clips?? And, they are not often on but Tony and Anna forever!!!!!!** And how wonderful is it to see the Dimera boys all together and recounting the whole fam for the votes? **And one more thing, Days was not even nominated for writing while Bold and the Beautiful spends every other show with the Liam character standing in front of the fireplace making excuses for the same shit! Just push repeat, C,mon!!**Philip had a great line for Brady about following Kristen like a zombie.** Dis Eli really say, “Peacock and chill??’ Are these the things they will have to do to do to stay on the air? It took me right out of the show. It was the same day the ads for Days on Peacock started. OMG

*****

Texas Gov. Abbott vetoed a bill that would make it illegal to chain up dogs without water.**ATexas churches have lost their 501(c) (3) status because it actively ‘educates’ its members on electing specific Republican politicians. –Pete West* This should have been happening long ago. Many churches I know of do this and should not be allowed to have it both ways. #tax the church

*****

Ellen Burstyn, Jane Curtin, Loretta Devine, Christopher Lloyd, James Caan, French Stewart and Ann-Margaret in Queen Bees and directed by Michael Lembeck?? Yes please!!

*****

NY has suspended Giuliani’s law license.

*****

Miracle Workers: The Oregon Trail is coming to TBS, this will be season 3 in the series.

*****

What is this about Bowen Yang?? A podcast about a sperm bank heist?? Yeow!!

*****

David Geffen has given $150,000,000 to Yale drama school: Every student will be tuition- free in perpetuity.

*****

Allison Mack was sentenced to 3 years.

*****

The latest in sexual assault news: James Franco has agreed to 2.2 mil settlement in sexual misconduct case.** Kyle Massey was charged with immoral communication with a minor.**Bill Cosby is out and here are some reactions: A terrible wrong is being righted.: a miscarriage of justice is corrected. I fully support survivors of sexual assault coming forward.- Phylicia Rashad*I really don’t ever want to hear again as to why many survivors don’t report their rape or assault.- Charlotte Clymer* Women are showing great restraint in not burning everything to the ground right now and I don’t know how they do it.-Jeff Tiedrich

*****

Amazon is making a series of A League of Their Own with Nick Offerman as the coach.

*****

Does anyone else have family members that are rich, transient, know it all snobs??

*****

It looks like New York’s ranked choice voting is leaning toward Eric Adams for Mayor.

*****

Michigan republicans investigating voter fraud found 2 incidents. One is for a lady who voted by mail and then died, the other was confusion over a man who had the same name as his Father. That was it!

*****

Jamie Lee Curtis will get the Golden Lion for lifetime achievement at the 78th Venice International Film Fest in September.

*****

Jerry Seinfeld will star in and direct ‘Unfrosted’ about Pop-Tarts.

*****

Why is Airbnb still listing properties in illegal settlements and outposts in Palestinian occupied territories? –James J. Zogby

*****

Merrick Garland has announced that the Justice department sued Georgia over the voting rights.

*****

The NFL says that it will halt the use of “race norming” which assumed black players started out with lower cognitive functioning in a $1 billion settlement of brain injury claims. The practice had made it harder for black players to qualify. –The Associated Press.

*****

Scary Clown 45 ended his ‘From the desk of Donald J. Trump’ blog after 29 days. Word is that he felt he was being mocked in the media.

*****

Religious leadership keeps engaging in partisan politics on behalf of politicians that are particularly unpopular with younger people and they wonder why younger people are disenchanted with the church. – Schooley ** Give young people credit as well for seeing through the hype and lies of these religious hypocrites who use God only as a weapon and a threat. –Larry Charles

*****

Amazon will stop drug testing for employment. Can every other company jump on this bandwagon? Let’s judge employees on the work they give.

*****

The Backstreet Boys and NSync are going to work together??!!

*****

Showtime is bringing back American Gigolo with Jon Bernthal.

*****

If Biden can carry out air strikes without proper authorization, the Senate can raise the minimum wage without the Parliamentarian. –Alexandra M. Hunt

Reality Winner is out!!

*****

Judy Woodruff has been given the Peabody award for journalistic integrity.

*****

Donald Glover is bringing us Hive. Malia Obama will be a writer.

*****

Nicholas Cage has married Riko Shibata.

*****

Catch and Kill: The podcast tapes, is here on HBO.

*****

Bryan Cranston and Annette Bening will star in Jerry and Marge go large.

*****

Amblin Partners and Netflix are partners.

*****

Fall 2022 will bring the Roybal School of film and television production for underserved communities. They are looking to help 9th, 10th, 11th and 12th grade students. Among others, the program was cofounded by George Clooney, Don Cheadle, Kerry Washington, Mindy Kaling and Eva Longoria.

*****

Will there be a Wedding Crashers2??

*****

The Mysterious Benedict Society stars Tony Hale.** I would love to see he and Danny Pudi in something together.

*****

Actor Stephen Amell from Arrow was removed from a plane after getting into it with his wife. A source said he was drunk and screaming. An official source said that they removed “an unruly customer.”** Andy Dick was arrested for assault with a deadly weapon, allegedly assaulting his partner, Lucas with a metal chair.

*****

So.. Fox news was digitally altering the faces of people they did not care for??? Is there no end to their bullshit????

*****

Mark Ronson is set to marry Grace Gummer.

*****

Crime shows seem to be in the cycle of prisoners and the women who get a thrill from helping them escape.

*****

Wolfgang Van Halen has released a debut album: Mammoth

*****

Everyone seems to love Danny Trejo’s memoir and its honesty.

*****

David Spade will take over as host of Bachelor in Paradise.

*****

I am sickened when I see the first question that pops up on an online search is the net worth of a person. Oh this twisted world.

*****

Life is a short pause between 2 great mysteries. –Jung

*****

Prince Harry and Meghan had a daughter that they named Lilibet ‘Lili” Diana.

*****

Michael Flynn’s brother Charles (who withheld help from the capitol on Jan. 6), leads the U.S. Army Pacific and commands 90,000 troops.

*****

I am so excited to read ‘The Boys’ from Clint and Ron Howard, due out in October.

*****

Dave Chappelle closed out the Tribeca film fest with a surprise concert. This was the first in person film fest since Covid. Look for This time, this place which premiered there.

*****

Ron Wood will release the album Mr. Luck: A tribute to Jimmy Reed on Sept. 3

*****

Howard Stern signed a new $500 mil contract with Sirius XM. He is taking the whole summer off and many fans say they will cancel their subscription because they don’t want to pay for a summer of reruns.

*****

Acorn will bring Jane Seymour back to a series. Seymour will be co -executive produce on Harry Wild. Her character will be a retired University professor who loves her whiskey and solves crimes.

*****

Annie Murphy stasr in ‘Kevin can f*** himself about a sitcom wife which airs on AMC.

*****

I still do not understand why Rep. Mike Nearman hasn’t been arrested for letting insurrectionists into the Capitol.

*****

There is a wing shortage??

*****

The Pulitzer prizes have been announced. The list includes Ben Faub, Barry Blitt, Katori Hall, Emilio Morenatti, AP photographers Marcio Jose Sanchez, Alex Brandon, David Goldman, Julio Cortez, John Minchillo, Frank Franklin II, Ringo H.W. Chiu, Evan Vucci, Mike Stewart and Noah Berger. There was a special citation for Darnella Frazier who filmed the death of George Floyd.

*****

Conan’s last TBS guests were Martin Short, Jack Black, Bill Hader, Mila Kunis, Dana Carvey, Patton Oswalt and JB Smoove. There were some surprises. The big musical number never happened when Jack Black hurt himself. It was all funny and sweet but Conan never mentioned the band in the last show WTF????????????????????????????????????????? Music is so important to him and he does not thank the band? ** Colbert and Brian Stack gave Conan a cute send after4, 368 shows on CBS calling him a ‘Slenderman Ron Weasly’. Kimmel wished Conn well also.** Hope his HBO MAX variety show goes well.** BTW, the Duvall interview with Colbert was great to see but why does nobody ever mention ‘Get Low?’ What a performance!!

*****

Tattoos are on the rise.

*****

Fast food drive thru’s sometime close with fake excuses like the equipment is down or something because they don’t feel like working. Good people can’t find work and so many waste the opportunities they have. AAAAGHH!!

*****

Valerie Bertinelli and Demi Lovato will star in ‘Hungry’ on NBC.

*****

Hulu will bring us David E. Kelley’s Nine Perfect Strangers with Nicole Kidman, Michael Shannon, Regina Hall, Bobby Cannavale and Melissa McCarthy.

*****

R.I.P. Gavin Macleod, Frank Bonner, Joy Vogelsang, Benigno Aquino, Champ Biden, victims of the Miami building collapse, Robert Sacchi, Stuart Damon, Johnny Solinger and Clarence Williams III.

5 notes

·

View notes

Text

The Sham of Corporate Social Responsibility

Boeing recently fired CEO Dennis Muilenburg in order “to restore confidence in the Company moving forward as it works to repair relationships with regulators, customers, and all other stakeholders.”

Restore confidence? Muilenburg’s successor will be David Calhoun who, as a long-standing member of Boeing’s board of directors, allowed Muilenburg to remain CEO for more than a year after the first 737 Max crash and after internal studies found that the jetliner posed an unacceptable risk of accident. It caused the deaths of 346 people.

Muilenburg raked in $30 million in 2018. He could walk away from Boeing with another $60 million.

Last August, the Business Roundtable – an association of CEOs of America’s biggest corporations, of which Muilenburg is a director -- announced with great fanfare a “fundamental commitment to all of our stakeholders” (emphasis in the original) and not just their shareholders.

Rubbish. Corporate social responsibility is a sham.

Another Business Roundtable director is Mary Barra, CEO of General Motors. Just weeks after making the Roundtable commitment, and despite GM’s hefty profits and large tax breaks, Barra rejected workers’ demands that GM raise their wages and stop outsourcing their jobs. Earlier in the year GM shut its giant assembly plant in Lordstown, Ohio.

Some 50,000 GM workers then staged the longest auto strike in 50 years. They won a few wage gains but didn’t save any jobs. Meanwhile, GM’s stock has performed so well that Barra earned $22 million last year.

Another prominent Business Roundtable CEO who made the commitment to all his stakeholders is AT&T’s Randall Stephenson, who promised to invest in the company’s broadband network and create at least 7,000 new jobs with the billions the company received from the Trump tax cut.

Instead, AT&T has cut more than 30,000 jobs since the tax cut went into effect.

Let’s not forget Jeff Bezos, CEO of Amazon and its Whole Foods subsidiary. Just weeks after Bezos made the Business Roundtable commitment to all his stakeholders, Whole Foods announced it would be cutting medical benefits for its entire part-time workforce.

The annual saving to Amazon from this cost-cutting move is roughly what Bezos – whose net worth is $110 billion -- makes in two hours. (Bezos’s nearly-completed D.C. mansion will have 2 elevators, 25 bathrooms, 11 bedrooms, and a movie theater.)

GE’s CEO Larry Culp is also a member of the Business Roundtable. Two months after he made the commitment to all his stakeholders, General Electric froze the pensions of 20,000 workers in order to cut costs. Culp raked in $15 million last year.

The list goes on. Just in time for the holidays, US Steel announced 1,545 layoffs at two plants in Michigan. Last year, five US Steel executives received an average compensation package of $4.8 million, a 53 percent increase over 2017.

Instead of a holiday bonus this year, Walmart offered its employees a 15 percent store discount. Oh, and did I say? Walmart saved $2.2 billion this year from the Trump tax cut.

The giant tax cut itself was a product of the Business Roundtable’s extensive lobbying, lubricated by its generous campaign donations. Several of its member corporations, including Amazon and General Motors, wound up paying no federal income taxes at all last year.

Not incidentally, the tax cut will result in less federal money for services on which Americans and their communities rely.

The truth is, American corporations are sacrificing workers and communities as never before, in order to further boost record profits and unprecedented CEO pay.

Americans know this. In the most recent Pew survey, a record 73 percent of U.S. adults (including 62 percent of Republicans and 71 percent of Republicans earning less than $30,000 a year) believe major corporations have too much power. And 65 percent believe they make too much profit.

The only way to make corporations socially responsible is through laws requiring them to be – for example, giving workers a bigger voice in corporate decision making, making corporations pay severance to communities they abandon, raising corporate taxes, busting up monopolies, and preventing dangerous products (including faulty airplanes) from ever reaching the light of day.

If the Business Roundtable and other corporations were truly socially responsible, they’d support such laws. Don’t hold your breath.

The only way to get such laws enacted is by reducing corporate power and getting big money out of politics.

The first step is to see corporate social responsibility for the con it is.

176 notes

·

View notes

Text

Heather Cox Richardson:

July 21, 2020 (Tuesday)

One of the day’s biggest stories came from Ohio, where the House speaker, Republican Larry Householder, and four other political operatives, were arrested by federal officials for racketeering. U.S. Attorney for the Southern District of Ohio David DeVillers said the case was “likely the largest bribery money laundering scheme ever perpetrated against the people of the state of Ohio.”

Householder and his accomplices allegedly accepted more than $60 million in exchange for a public bailout for an ailing company. The bailout was worth more than $1 billion.

Ohio Governor Mike DeWine (R) immediately demanded Householder resign. So did Ohio Republican Party Chairwoman Jane Timken, who tried to spread the blame by saying "Greed, lust for power, and disdain for ethical boundaries are not unique to any particular political party.”

Her words were, perhaps, unfortunate, because her description was one that many people would use for the president. That Trump is right now trying to argue that the Republican Party stands for “LAW & ORDER,” when a Republican leader in Ohio is arrested for a “pay-to-play” scheme is a coincidence that undercuts his message. ("This was pay-to-play,” said DeVillers in a new conference. “I use the term pay-to-play because that's the term they've used as alleged in the affidavit.”)

It was a moment that seemed to crystalize today’s politics: an elected official accepted a huge bribe in exchange for using taxpayer money to bail out a crony's failing business. It reminds me of the Teapot Dome scandal of 1922, when the Secretary of the Interior, Albert Fall, leased the oil production rights from naval oil reserves at Teapot Dome, Wyoming and Elk Hills, California to oil companies in exchange for large financial gifts. When the story came out, Fall became the first U.S. Cabinet official to go to prison.

The Teapot Dome scandal seemed to epitomize the administration of the president at the time, Warren G. Harding, although Harding himself was not implicated in that particular scandal. He had created an atmosphere in which the point of government was not to help ordinary Americans, but to see how much leaders could get out of it.

This same attitude is crippling today’s government as it tries to deal with the fallout from the coronavirus pandemic. Part of the reason that Trump and Republican leaders are hastening people back to work despite the spiking infections is that many Republican-led states do not have social welfare systems in place to support people through more weeks of lockdown, and Republican leaders do not want to develop them.

We are approaching a new crisis. At the end of July, the emergency unemployment benefits put into place in an early coronavirus bill will expire, leaving more than 20 million Americans unable to make ends meet and thus vulnerable to eviction, which would trigger another wrench in the already-ailing economy. At the same time, local and state governments, badly hit by falling tax revenues, will need to make cuts, as well, which will further stress the economy.

In May, Democrats used their majority in the House of Representatives to pass a $3 trillion spending package to provide another round of stimulus checks to individuals, give money to hospitals, and support state and local governments. Led by Republicans, the Senate refused to take the bill up.

Now, Senate Majority Leader Mitch McConnell is trying to write a Republican bill, but is running into the specific problem that Trump refuses to admit the coronavirus is a problem and the more general problem of a Republican ideology that opposes government funding for a basic social safety net.

Trump continues to maintain that the only reason we have so many coronavirus infections is because we are testing for them. He wants to block funding for the Centers for Disease Control and Prevention, as well as money for testing and contact tracing. At the same time, he wants a payroll tax cut to stimulate the economy, and funding in the bill for a new FBI building.

More generally, Republican senators are mortified at the spending involved in a bill that focuses not on shoring up businesses, but rather on supporting ordinary Americans. “What in the hell are we doing?” Senator Ted Cruz (R-TX) asked his colleagues. He warned that a large relief package would anger Republican voters in the November elections. Senator Tom Cotton (R-AR) disagreed about the means, but not the end. He told his colleagues that if the Republicans don’t do enough to save the economy, Democrats will win in November and put in place policies that will cost even more money. A rescue bill now could save money in the long run by keeping Republicans in power.

As they calculate, the national unemployment rate is over 11%. The unemployment rate in cities closer to 20% as the coronavirus has shut down restaurants, theaters, gyms, and so on. And our vulnerability to Covid-19 increases. Almost 4 million Americans have been infected with coronavirus, and more than 140,000 have died of it.

2 notes

·

View notes

Text

Episode Review- The Real Ghostbusters: Adventures in Slime and Space

Apparently, the guy who wrote this episode, David Gerrold, said that he drew inspiration from the Star Trek: The Animated Series episode More Tribbles, More Troubles. And I can see that.

Egon is apparently at it again, as a sudden explosion occurs in his lab in the upper floor of the Firehouse, resulting in the windows and skylight shattering. Which catches the attention of an elderly couple passing by, with the wife commenting on how she felt safer when the dynamite factory was there. (They had a dynamite factory in New York?) The reason for the explosion turns out to have been caused by Egon trying to build a new invention. One he thinks he’s nearly managed to complete. Now, before you say anything, no, this new invention isn’t that thing we’ve seen him working on since When Halloween Was Forever. That’s something that we’ll get properly introduced to in a later episode. This invention, however, is something he calls a prototype Plasmic Strainer. Egon proceeds to explain to Peter what this Plasmic Strainer is supposed to do. With nobody seeming to show any concern for the fact that Ray seems to be encased in an electrical field like Marvel’s Electro (though that effect seems to dissipate on its own after a few minutes). Basically, this Plasmic Strainer would make it possible for them to simply disintegrate ghosts instantly, thereby eliminating the need to trap and store them in the Containment Unit. (Um, Egon? Are you actually saying that you created a device that can ‘kill’ a ghost?! Because I find that slightly terrifying.)

At this point, Slimer appears on the scene, allowing Ray to reveal that Egon hasn’t been the only one inventing a new toy. Ray’s invention was a computer module called the Banana 9000 (a possible homage to HAL 9000), which had been fitted with a voterizer synthetic speech library. With this computer, Ray announced it would be possible for Slimer to effectively communicate with them (because at this point in the show, Slimer’s language is little more than nonsensical babbling). All Slimer has to do is type something onto the keyboard, and the computer will offer up an English translation. Of course, it does appear that Ray’s translator isn’t quite finished, as the ‘translation’ suddenly shifts into requests for Ray to stop.

Unfortunately, Peter decides to be a bit of a jerk here, stating that he prefers to stick to his own way of communicating with Slimer, and proceeds to threaten to shoot him with his Proton Pack. This results in Slimer to freak out and begin zooming around the room, bouncing from wall to wall. In the process, Slimer ends up flying headlong into Egon’s Plasmic Strainer. Thankfully, the Plasmic Strainer wasn’t quite perfected yet, so Slimer didn’t get disintegrated. However, this does result in Slimer getting physically separated into a bunch of little Slimers, which proceed to wander about the room in a random pattern. In an attempt to round up the Little Slimers, Peter, Egon and Ray start to chase after them with butterfly nets. Which doesn’t strike me as a practical tool to use, considering Slimer is a ghost and can therefore pass through objects at will. Although it appears that things might be more complicated than one would expect. Because every time one of the Little Slimers hit a solid object, they split up even more. Before long, the number of Little Slimers has grown exponentially, with a large number of them heading out the window and flying out into the city.

Once the hundreds of Little Slimers have gotten loose, and Winston and Janine appear on the scene (I’m guessing they heard the commotion upstairs and came to investigate), Egon and Ray explains what just happened. It turns out that when Slimer passed through the Plasmic Strainer, he became molecularly dis-coordinated. In other words, he lost his surface tension, and whenever one of the little Slimers collides with a material object, the Little Slimer will shatter into even more Little Slimers. And if they don’t find a way to reverse this issue, then eventually the entire world will be covered by a thin layer of slime. Of course, things are already bad enough, as the millions of Little Slimers have already caused a number of car crashes on the streets below. As well as caused a lot of people to slip and slide about on the sidewalks. With one hapless woman sliding past who I’m pretty sure was supposed to be Larry, Moe and Curly (which was an incredibly random cameo).

As the issue with the Little Slimers running rampant gets bigger and bigger (or rather smaller and smaller, in this case), the Ghostbusters decide that it might be best to pay a visit to Mayor Lenny to inform him of what’s going on. Because it’s better for him to hear about this from them instead of from someone else, I guess. (But not before Peter tries to run away from the problem by booking a flight to anywhere but there, only to change his mind when he hears the only available flight at the moment is headed for France. I guess Peter has a thing against France.) When they get to Mayor Lenny’s office, Mayor Lenny is not very pleased, especially since it’s apparently an election year. Although, we do get a subtle nod to the events of the movie, as Mayor Lenny mentions the incident with the Terror Dogs and the ‘walking marshmallow.’ Needless to say, the mayor is aghast when Ray casually suggests waiting to resolve the issue until January, when all the slime would be frozen and easy to pick up. He demands that they resolve the issue now, giving them a 24 hour deadline.

After leaving Mayor Lenny’s office, Egon suggests there might be a solution. If they change the polystratisification on the Plasmic Strainer, they could reverse the polarity of the Little Slimers. Ray clarifies this statement by comparing it to magnets. If one of the Little Slimers were to pass through the altered Plasmic Strainer, all the other Little Slimers would be drawn to it, resulting in them reforming into one singular Slimer again. Of course, for this to work, they have to first catch a Little Slimer. A task that’s clearly easier said than done, as evidenced by the next scene of the Ghostbusters and Janine tripping over each other in a vain attempt at catching one of the Little Slimers. Why nobody thought to simply ask one of the Little Slimers to cooperate is beyond me. But in the end, it doesn’t really matter, as one Little Slimer just happens to decide to go back through the altered Plasmic Strainer on his own. When this Little Slimer emerges, we see he has turned from green to blue, which is clearly meant to indicate his polarity has been changed. Like Egon predicted, all the other Little Slimers begin to be drawn towards Blue Slimer, and the merging begins.

Of course, things aren’t wrapped up just like that, which the Ghostbusters learn when they head up to the roof of the Firehouse to get a better look at Slimer reforming. It turns out that, while all the Little Slimers were loose, they were all busy eating whatever they could find throughout the city. So when Blue Slimer has fully absorbed all of the Little Slimers, he’d grown to roughly the size of a two or three story house. And the unexpected excess has caused such a shock to Slimer’s system, it resulted in him turning evil. Fortunately, Egon knows of a way to rectify this. He proposes that controlled blasts from the Proton Streams should be enough to neutralize the excess slimic energy within Giant Blue Slimer and return him to Normal Slimer. But to put that plan into effect, they’ll need to pay another visit to Mayor Lenny, in order to ask him to loan them some helicopters.

Of course, Mayor Lenny is not pleased at the request for helicopters and is all set to throw the Ghostbusters out of his office. But he changes his tune pretty quickly when Giant Blue Slimer appears at his window and proceeds to abduct Janine. So, armed with the loaned helicopters (I’m guessing we’re supposed to have forgotten about the existence of the Ecto-2, considering we haven’t seen it since the first episode), the Ghostbusters track Giant Blue Slimer down to the top of the Empire State Building. Yes, that’s right, folks. We’re officially parodying King Kong at this point. They even have Giant Blue Slimer plummeting towards the streets below after being shot down.

Thankfully, the ordeal did indeed result in Slimer returning to normal. And, upon returning to the Firehouse, he proceeds to express his thanks with the aid of Ray’s Banana 9000 translator, which seems to be working now. The Ghostbusters then tell him that it’s good to have him back, with Peter commenting that one Slimer is more than enough. Which leads to Slimer hugging Peter. And on that note, the episode ends.

This really felt like a filler episode, especially since I really don’t know what else I could say about it. The only other thing that’s probably worth a mention is the running gag of them suggesting simply moving to Pittsburg in order to get away from actually rectifying the issue of the millions of Little Slimers. But that didn’t make a lot of sense, since it was established pretty early on that the problem wouldn’t exactly be contained within the city and it would eventually affect the entire world. Plus, what exactly was so appealing about Pittsburg to begin with? Unless you have a thing for bridges, I admit I don’t quite see the draw.

(Click here for more Ghostbusters reviews)

3 notes

·

View notes

Text

These are the NHL owners who have not agreed to pay arena staff for suspended events

All NHL players are being paid for the games they aren’t playing in because of the league suspension due to COVID-19.

In contrast, arena staff who would also have been working those events will not be getting another paycheck any time soon.

Many NHL teams have committed to paying their employees (some, through the end of March; others, until events resume as normal). In some cases, the owners of the teams pledged to do so only after individual players stepped up on their own accord, like the Panthers’ Sergei Bobrovsky.

Team owners have enough money to pay the arena staff during the suspended season.

These are the team owners who are choosing to leave their most vulnerable employees without a paycheck on virtually no notice.

Every name in bold is a billionaire.

The Naughty List

Arizona Coyotes – Alex Meruelo

Boston Bruins – Jeremy Jacobs

Buffalo Sabres – Terrence Pegula

Calgary Flames – N. Murray Edwards

Carolina Hurricanes – Tom Dundon

Colorado Avalanche – Ann Walton Kroenke

Columbus Blue Jackets – John P. McConnell

Minnesota Wild – Craig Leipold

Montreal Canadiens – Geoff Molson

New York Islanders – Scott D. Malkin (approx. $200 million)

Ottawa Senators – Eugene Melnyk

St. Louis Blues – Tom Stillman (net worth unknown)

Vancouver Canucks – Francesco Aquilini

Vegas Golden Knights – Bill Foley (approx. $500 million)

Winnipeg Jets – Mark Chipman (approx. $500 million) and David Thomson (*$36 billion*)

The Nice List

Anaheim Ducks – Henry Samueli

Chicago Blackhawks – Rocky Wirtz

Dallas Stars – Tom Gaglardi

Detroit Red Wings – Chris Ilitch

Edmonton Oilers – Daryl Katz

Florida Panthers – Vincent Viola

Los Angeles Kings – Philip Anschutz

Nashville Predators – Ownership group, largest stakeholder and chairman: Herb Fritch (approx. $600 million)

New Jersey Devils – Joshua Harris

New York Rangers – James L. Dolan

Philadelphia Flyers – Brian L. Roberts

Pittsburgh Penguins – Ronald Burkle

San Jose Sharks – Hasso Plattner

Tampa Bay Lightning – Jeff Vinik (approx. $600 million)

Toronto Maple Leafs – Larry Tanenbaum

Washington Capitals – Ted Leonsis

Some of these ownership situations are more complicated than others. For instance, not all arenas are owned by the same person or group who own the hockey team that plays there, and some arena staff are contracted through other parties. With that being said: we have done our best to present the current situation accurately and as fairly as possible.

Hopefully, these NHL teams and owners will step up soon, and render this article obsolete. Until then we will be updating as more information or decisions are made public.

Source: X

2 notes

·

View notes

Text

Reich on CSR.

Robert Reich:

The Sham of Corporate Social Responsibility

TUESDAY, DECEMBER 31, 2019

Boeing recently fired CEO Dennis Muilenburg in order “to restore confidence in the Company moving forward as it works to repair relationships with regulators, customers, and all other stakeholders.”

Restore confidence? Muilenburg’s successor will be David Calhoun who, as a long-standing member of Boeing’s board of directors, allowed Muilenburg to remain CEO for more than a year after the first 737 Max crash and after internal studies found that the jetliner posed an unacceptable risk of accident. It caused the deaths of 346 people.

Muilenburg raked in $30 million in 2018. He could walk away from Boeing with another $60 million.

Last August, the Business Roundtable – an association of CEOs of America’s biggest corporations, of which Muilenburg is a director – announced with great fanfare a “fundamental commitment to all of our stakeholders” (emphasis in the original) and not just their shareholders.

Rubbish. Corporate social responsibility is a sham.

Another Business Roundtable director is Mary Barra, CEO of General Motors. Just weeks after making the Roundtable commitment, and despite GM’s hefty profits and large tax breaks, Barra rejected workers’ demands that GM raise their wages and stop outsourcing their jobs. Earlier in the year GM shut its giant assembly plant in Lordstown, Ohio.

Some 50,000 GM workers then staged the longest auto strike in 50 years. They won a few wage gains but didn’t save any jobs. Meanwhile, GM’s stock has performed so well that Barra earned $22 million last year.

Another prominent Business Roundtable CEO who made the commitment to all his stakeholders is AT&T’s Randall Stephenson, who promised to invest in the company’s broadband network and create at least 7,000 new jobs with the billions the company received from the Trump tax cut.

Instead, AT&T has cut more than 30,000 jobs since the tax cut went into effect.

Let’s not forget Jeff Bezos, CEO of Amazon and its Whole Foods subsidiary. Just weeks after Bezos made the Business Roundtable commitment to all his stakeholders, Whole Foods announced it would be cutting medical benefits for its entire part-time workforce.

The annual saving to Amazon from this cost-cutting move is roughly what Bezos – whose net worth is $110 billion – makes in two hours. (Bezos’s nearly-completed D.C. mansion will have 2 elevators, 25 bathrooms, 11 bedrooms, and a movie theater.)

GE’s CEO Larry Culp is also a member of the Business Roundtable. Two months after he made the commitment to all his stakeholders, General Electric froze the pensions of 20,000 workers in order to cut costs. Culp raked in $15 million last year.

The list goes on. Just in time for the holidays, US Steel announced 1,545 layoffs at two plants in Michigan. Last year, five US Steel executives received an average compensation package of $4.8 million, a 53 percent increase over 2017.

Instead of a holiday bonus this year, Walmart offered its employees a 15 percent store discount. Oh, and did I say? Walmart saved $2.2 billion this year from the Trump tax cut.

The giant tax cut itself was a product of the Business Roundtable’s extensive lobbying, lubricated by its generous campaign donations. Several of its member corporations, including Amazon and General Motors, wound up paying no federal income taxes at all last year.

Not incidentally, the tax cut will result in less federal money for services on which Americans and their communities rely.

The truth is, American corporations are sacrificing workers and communities as never before, in order to further boost record profits and unprecedented CEO pay.

Americans know this. In the most recent Pew survey, a record 73 percent of U.S. adults (including 62 percent of Republicans and 71 percent of Republicans earning less than $30,000 a year) believe major corporations have too much power. And 65 percent believe they make too much profit.

The only way to make corporations socially responsible is through laws requiring them to be – for example, giving workers a bigger voice in corporate decision making, making corporations pay severance to communities they abandon, raising corporate taxes, busting up monopolies, and preventing dangerous products (including faulty airplanes) from ever reaching the light of day.

If the Business Roundtable and other corporations were truly socially responsible, they’d support such laws. Don’t hold your breath.

The only way to get such laws enacted is by reducing corporate power and getting big money out of politics.

The first step is to see corporate social responsibility for the con it is.

1 note

·

View note