#mt940

Explore tagged Tumblr posts

Text

Financial formats for accounting software

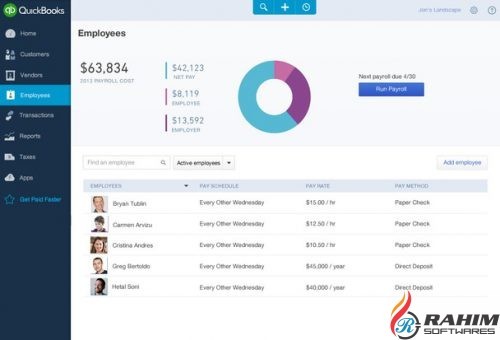

There are many accounting software packages available, both desktop and online. Software products like Quickbooks, NetSuite, Xero, Sage, Wave, Quicken come to mind right away. There are many different accounting tools available because of a wide range of accounting and bookkeeping needs companies and businesses have. As for financial formats, there are not so many to transfer data from one place to another (for example, from your bank to your accounting software). This is a good thing. You should not a have an issue every time you get a file with transactions from your bank or your client and the accounting software cannot import it.

Financial formats

The following formats are the most used/common ones:

OFX - also known as "Web Connect" format to get transactions from a financial institution, widely supported by almost all accounting software. The OFX format allows extended variants of itself. Extended OFX variants should be compatible and provide additional details. Quickbooks has its QBO variant and Quicken has it own QFX variant, and PeachTree/Sage has its own ASO variant as

QIF - Quicken Interchange Format, supported by many accounting software

IIF - Intuit Interchange Format, supported by Quickbooks and many software packages exporting data for accounting systems

QBJ - General Journal Entry file format, supported by Quickbooks

CSV/Excel - as "free-form" format, it requires additional handling by the accounting software, so it is only partially supported, but it is the easiest format to work with for accountants and bookkeepers

PDF - the easiest format to view, share, print, archive financial statements, but mostly not supported by accounting systems regarding parsing and importing transactions inside such statements. However, there is several independent software packages available offering conversion from PDF to CSV or other financial formats.

Less common formats are:

MT940 - mostly used in European countries

BAI/BAI2 - used by large organizations and financial institutions

OFX/QFX/QBO format

The OFX/QFX/QBO (Web Connect) format is the most frequently used format as the majority of bookkeeping is bank and credit card related activities. Many banks allow downloading QBO files from the online banking. Some banks only provide last 90 days for QBO files, and CSV or PDF files for months past 90 days. Accounting software imports transactions as "statements" into accounting software for further review and categorization, as the banks are not aware of specific accounting rules of their clients. For example, Quickbooks imports QBO files into the Bank Feeds Center, where you match "downloaded as" payee names or transaction descriptions to vendor records and assign expense/income accounts ("categorize") before adding the transactions to the register. Quickbooks learns your matches and uses them for next QBO import or direct bank download.

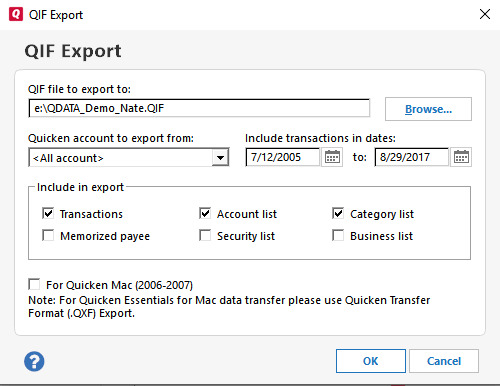

QIF format

The QIF format one of the oldest widely supported formats to export and import transactions. Many accounting systems support this format. It provides many features missing in OFX/QFX/QBO format like categories and tags. The format has some challenges as it was extended to different accounting systems over time and now the QIF format has few dialects that make it incompatible with certain systems. For example, to make a QIF file importable by NetSuite, it must have details that make that QIF file non-importable into Quicken.

IIF format

The IIF format was designed by Intuit for its QuickBooks products but widely adopted by many software packages as a format to export and import financial data like transactions, sale receipts, bills, invoices, etc. As IIF is considered a "system-level" format where data are imported directly into accounting system data file, you should backup the company file before importing any IIF file (the same applies to other formats and any bulk operations - do a backup before you import).

QBJ format

The QBJ format if the relatively new format, but it is a great option to import transactions from the General Journal Entry files. You will get full audit records for each General Journal Entry. The only challenge is to enter such entries as Quickbooks interface is not as fast as Excel. Compared to QBO format, QBJ format is much more advanced - you create multiple debit and credit lines, assign accounts, classes, and there is no limit to just bank and credit card accounts as with QBO files. You do not have to match vendor records and assign accounts as QBJ format carries all this already.

CSV/Excel Format

The CSV format supported by few accounting products like QuickBooks Online. It is a great choice if you have your transactions entered into a spreadsheet or downloaded from your bank as a CSV file. Unlike QBO, IIF, QBJ formats that are defined formats where data elements can be interpreted only one way, CSV format is a "free-form" format. You may have two date columns, columns not relevant to details that an accounting software can import. The date format could be different (DAY/MONTH VS MONTH/DAY). The amount format could use different decimal or thousands separator. You may have transactions taking one line or many lines. A CSV file may have the first line as the column header, or the first few lines are not transactions, but statement details. In these cases, you may have to reformat the CSV file (open in a spreadsheet software, edit, and then save as a new CSV file) before importing into Quickbooks.

PDF format

The PDF format was designed to print documents, so they can be printed the same way they are viewed on a computer screen. As the PDF format is a widely adopted document format, it is often used to archive financial statements that hard to process later when it comes to accounting and bookkeeping. Usually, a human being (you) needs to read PDF files and enter data as CSV file or directly into an accounting system. The accounting software packages usually stay away from supporting PDF format. Separate software packages solve this problem by converting to a compatible financial format.

It is a good idea to check available formats when choosing a financial institution and supported formats when choosing accounting software. It is also a good idea to have conversion tools available when you have an accounting practice with a wide range of clients.

ProperSoft creates accounting friendly software at https://www.propersoft.net/

#accounting#bookkeeping#utility#quicken#quickbooks#converter#software#csv#pdf to csv#excel#xero#qif#qbo#pdf#iif#sta#app#ofx#mt940

1 note

·

View note

Text

Money manager ex import csv

#Money manager ex import csv software#

#Money manager ex import csv software#

MMEX is a complete solution to manage your money.ĭownload Money Manager EX, the financial software that will help you to control your economy. You'll be able to anticipate cashflows, establish reminders and even control the depreciation of your assets. Print and export the data in HTML or CSV format.ĭespite being free, in Money Manager Ex you'll find many functions that will come in very handy to manage your home economy.Thus for the conversion to be successful all. When exporting Microsoft Money records each transaction twice, once in each accounts QIF. reporting with graphs and piecharts Import data from any CSV format, QIF. GnuCash will create your accounts automatically from the information in the QIF files. freeload Money Manager Ex standalone offline installer for Windows. Use the Loose QIF (longer names) format if available. Control your savings, credit cards, checks, bonds. To transfer data, use the Export Function of Microsoft Money.Optimized design to make the software easy to use.Register and manage your financial movements.Money Manager Ex is a financial manager that will allow you to organize and control your expenses: amounts, concepts, addressees, yields, investments and much more. That's why Money Manager Ex can be a good idea to be able to handle your domestic economy. Microsoft Money, GNUCASH, GRISBI, HOMEBANK and MONEY MANAGER EX). As things stand, managing your assets efficiently is something very important. Skrooge is able to import transactions from many formats (AFB120, QIF, CSV, MT940. International language support (Available in 24 languages) Import data from any CSV format, QIF Microsoft Money Printing.

1 note

·

View note

Text

Moneywiz 2 de paga gratis

#Moneywiz 2 de paga gratis software

#Moneywiz 2 de paga gratis download

^ 'Become a personal finance wiz this new year with MoneyWiz 2 for iPhone and iPad'.

Cite has empty unknown parameter: |coauthors= (help) 'Top 5 Best New Year's Resolution Apps For iPhone and iPad'.

^ Wilhide, Brendan (5 September 2012).

'Money Talks: SilverWiz Shares Secrets Of Its Breakout Finance App, MoneyWiz'.

^ 'MoneyWiz 2 - Personal Finance on the App Store on iTunes'.

^ a b '27 Year Old Developer Strikes Gold Again With His 4th Startup: SilverWiz'.

That allows it to support more banks in more countries than other finance apps. Puedes configurar todos tus recibos para obtener recordatorios y estimaciones.

#Moneywiz 2 de paga gratis software

While traditional finance apps, such as Mint would only use one data aggregation platform to provide the bank sync, MoneyWiz is the first (and currently only) finance software that uses two data providers simultaneously. Se trata de una fantstica aplicacin que te facilita la visualizacin completa de todas tus finanzas personales y a la vez te permite centrarte en todas las mejoras posibles para finiquitar todas las deudas pendientes. 2 MESES GRATIS PRIMA 49,99 / ao Sincronizacin bancaria con ms de 40.000 bancos Sincronizacin en la nube entre dispositivos Actualizaciones gratuitas con nuevas funciones Soporte prioritario por correo electrnico y chat SUSCRIBIR PRIMA 4,99 / mes Sincronizacin bancaria con ms de 40.

#Moneywiz 2 de paga gratis download

MoneyWiz connects to over 16,000 banks in over 51 countries around the world, to allow its users to download & categorize new transactions automatically. citation needed MoneyWiz has received awards and recognition which include being named the. MoneyWiz is a money management application that runs on Microsoft Windows, Google's Android, and Apple platforms including iOS and macOS.MoneyWiz is developed by SilverWiz and is the top selling personal finance app outside of the United States as well as a Top 10 Finance App on the U.S. Version 2.2.1: Bug fixes & stability improvements Small UI improvements. Have all your accounts, budgets and bills in one place! MoneyWiz can import it! Be it a CSV, QIF, OFX, QFX or MT940 file, MoneyWiz can handle it all. Simplify your financial life with MoneyWiz. Title: MoneyWiz 2 – Personal Finance Genre: Finance Developer: SILVERWIZ LLC. MoneyWiz 2 – Personal Finance v2.9.1 (Paid) APK. How To PROTECT Yourself Against Online Scams. 2 out of every Rs 5 the govt spends is borrowed money. MoneyWiz 2 app review: your personal finance assistant To achieve financial stability, you need to keep track of your expenditure.

0 notes

Text

Star finanz starmoney

#Star finanz starmoney install

#Star finanz starmoney license

With StarMoney you have all your finances in one place, automatically categorized and presented in a clear and understandable way. + Import and export database data - for example QIF, OFX, MT940, CSV Set and reach financial goals and cut your spending. In areas of life such as car, home, food or leisure + Divide your income and expenses into categories.

#Star finanz starmoney install

+ Traffic lights for safe password preparation + No one can watch your finances except you + StarMoney knows almost all languages and almost all currencies + Budget setting let you realize how much money is left According to categories or temporal comparisons + Get your income and expenses shown in charts. If this does not happen, download and install the StarMoney software and then. Whlen Sie im Folgenden aus, zu welchen StarMoney. Prfen und bewerten Sie auch Vorschlge anderer Nutzer, indem Sie ganz einfach abstimmen. Die Daten sind durch Passwort oder biometrische Merkmale geschtzt und werden ausschlielich auf dem eigenen Gert gespeichert. Rund 2.000 Konten von Banken, Online-Brokern, Immobilienfinanzierern etc. + Be informed before buying StarMoney, whether online banking with your bank is possible: + You need a German bank account to use the banking function + You can find information on our website: + Transfers between online and offline accounts + SEPA payment (bank transfer, standing order) + All types of accounts in almost all German banks + Approved by TÜV (Technical Inspection Association, a German organization that validates the safety of products)īANKING FUNCTIONS FOR GERMAN BANK ACCOUNTS STAR FINANZ STARMONEY PASSWORD Werden Sie aktiv: Haben Sie Ideen oder Anregungen, wie StarMoney weiterentwickelt oder verbessert werden kann Wir hren zu Reichen Sie gern Ihren Vorschlag ein. Mit der StarMoney App knnen Nutzer alle eigenen Konten bersichtlich in einer App verwalten. Latest version StarMoney 2: Easy Budgeting: 2.2 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Wordmark: MOVE Wordmark: AHOI Wordmark: StarMoney Wordmark: symbioticon Wordmark: YOMO Wordmark: pushtan. The version 2.2 of StarMoney updates the communication with the financial institutions. This step is necessary to continue to ensure the viability of your banking application.Ĭhange to the safe side and get StarMoney 3 for your Mac. Promons patented mobile security technology provides comprehensive protection for StarMoney software against Trojans and Malware and was launched to the public.

#Star finanz starmoney license

We offer you different possibilities: StarMoney 3 only on your Mac in the annual license with automatic extension or StarMoney 3 in the practical flat-subscription, which provides you StarMoney on phone and tablet – and even on the PC- at only one price.

1 note

·

View note

Text

Importing .qif File Into Quicken Deluxe 2018

Quicken for Windows up to the latest 2020 (and 2019, 2018) version, supports import for QIF and QFX (Web Connect) files. Quicken 2005-2017 imports QIF files.

Importing .qif File Into Quicken Deluxe 2018 Download

Importing Qif Files Into Quicken

Importing .qif File Into Quicken Deluxe 2018

Here are the major differences between QIF and QFX (Web Connect) format when you try to import them under Quicken:

Step 3: Import the Transactions into Quicken. The easiest way to import the QFX file is simply to double-click it from Windows Explorer or the Finder on a MAC. You can also read the QFX file while running Quicken. Simply select File, then from the pull-down menu select File Import, and then Web Connect File.

Vendor Support

Importing .qif File Into Quicken Deluxe 2018 Download

Open your Quicken company. Go to File Export QIF File. Type a name for the QIF File you want to export the data to (recommended name: Quicken Export File). Click Browse to select an export location. Choose a location easy to find, such as the desktop. In the Include in Export dialog box, select the options that best fit your. Added advanced features, that include automatic import of the QIF into Quicken and support for CSV, and OFX files. 1.0.0.X First release with basic features, that will create a QIF file with the proper account information added so that it can be imported into Quicken. Regarding the date: there were two options for exports from Commbiz - QIF or QIF (Quicken AUS, 2004 and earlier). The first starts with!Account and has the date as DD/MM/YYYY and the second starts with!Type:Bank and has the date format as DD/MM/YY but neither work for me when importing. The Online Bank Details tab of the account is fully entered. In the Quicken account to import into list, select the account you want to import the QIF file into. This list is limited to accounts that can import QIF files. QIF import isn't available for checking, savings, or credit card accounts, or for 401(k) or any other brokerage accounts.

Quicken claims that the QIF format is outdated, and not supported anymore, however, still allows importing a QIF file. On the QIF import screen Quicken tells, then you can import a QIF file only under cash account, offering in the drop-down choice for account selection only cash accounts, but also “All Account” as well. Guess what, unless you have Quicken Essentials for Mac, QIF files are fully supported, but not the ones your bank offers you for download. They're slightly different, “Quicken only”, QIF files that Quicken 2012 imports just fine under any account. CSV2QIF - CSV/XLS/XLSX to QIF converter, Bank2QIF - CSV, XLS, XLSX, PDF, QFX, OFX, QBO, QIF, MT940, STA to QIF converter, The Transactions app, which converts from more formats and converts to more formats - will help you create those files.

'Call Home' Required

Quicken does not do any “home calls” during QIF imports, but it does every time you are trying to import a QFX file (yes, you need the Internet connection, your firewall must allow Quicken to go through just to import a QFX file that you have locally on your computer). Quicken checks if the bank code supplied in the QFX file is ‘allowed’ by Quicken for a specific bank and even more bank account type. Some banks come and go, so your bank may drop QFX support tomorrow.

Importing Qif Files Into Quicken

'Online linking'

Once a QFX file is imported under an account in Quicken you choose during the import, it “online links” that account to bank settings supplied in that QFX file. If you have other QFX file with different settings then your currently for the account in “online link”, Quicken will not allow you to import that other QFX file under “occupied” account. The cure for that is simple: edit account, click on the “Online Services” tab and select “deactivate online link”.

Categories and Tag

QFX format as extended OFX format with additional Quicken only details, but the OFX specification does not provide category or tag attribute for transactions (or anything else similar) That’s it; you cannot import categories and tags assigned to your transactions using the QFX (Web Connect) format. On the other hand, QIF format still imports categories and tags just fine. There is a workaround (no great, but some) this limitation for categories: you can set “rename rules” in Quicken to have categories assigned to specific payee names. It should be ok for most payees, but not retailer stores, like Walmart.

Investment transactions

QIF format simplifies investment transactions by limiting security identification to just the security name. That’s it, no ticker symbol, no CUSIP numbers, just full Security name. When you import a QIF file with investment transactions under Quicken (or MS Money), Quicken will look up the security by its full name. You need to make sure your securities names do match the ones on the QIF file, but nothing more. For the QFX (OFX) case, each transaction must be accompanied by the security record with CUSIP supplied. You do need to have a CUSIP number for every security to create a proper QFX file that Quicken can import.

Available converters to convert your existing transaction file to QIF or QFX:

To convert your existing transaction file to QIF format, use the following converters:

The Transactions app

CSV (or Excel) to QIF: CSV2QIF

PDF to QIF: PDF2QIF

OFX to QIF: Bank2QIF

QFX to QIF: Bank2QIF

QBO to QIF: Bank2QIF

‘Fix’ QIF: FixMyQIF

CSV (or Excel) to QFX: CSV2QFX

PDF to QFX: PDF2QFX

OFX to QFX: OFX2QFX

QBO to QFX: Bank2QFX

QIF to QFX: QIF2QFX

Importing .qif File Into Quicken Deluxe 2018

Related articles

1 note

·

View note

Link

0 notes

Text

Best Personal Finance Software For Mac 2017, Software

The best personal finance software is easy to use and helps you improve your money management. But with so many options out there, no single app or website is best for everyone. As a result, it’s important for you to research these and other options and pick one that best serves your needs. When it comes to finding a Top Rated Personal Accounting Software comparing quotes is the key to getting the best product for the lowest price. We’ve gathered information on the top personal bookkeeping solutions, user reviews, buying tips, and made it easy to get the best price.

Best Personal Finance Software For Mac 2017 Software Update

Personal Finance For Mac

Personal budget software apps can't help much with the self-deprivation, because your income is what it is and it's up to you to work within it or change it. But these best software choices can take the tedium and the challenge out of the budgeting process. CountAbout® is an easy-to-use online personal finance application that imports data from Quicken and Mint and automatically downloads data from banking, credit card, and retirement accounts. With no software to install, we’re anywhere you have an Internet connection.

Personal finance software can help you to manage your money flow in a better way. Money management is the most critical task in both personal and business life. For helping the business owners and personal finance management, there are many finance software is available for Mac.

Best Accounting Software for Mac: Xero Mac users often grapple with the issue of software that is stripped down or is less intuitive than its Windows counterpart. Banktivity 7, the leading Mac personal finance app. Banktivity connects all of your bank accounts in one place so you can make smarter financial decisions. A great personal finance app can help you save more money and give you an instant snapshot of your financial situation in seconds. A lot of the problems we face when dealing A roundup of the best in class for money management, budgeting (free and premium), investing, and microsaving apps for 2018.

The budgeting apps are smart enough to send notifications to any unusual bank and credit card activity in real time. In addition to this, these finance managing software tools can notify you of any interest charged on credit cards and bank accounts. There are free personal finance software apps and premium budget software for finance management. Free budgeting software is also good enough to record and summarize your cash flow and help to manage your personal or business budget in every month.

Here is a list of best personal finance software for Mac to get the centralization and overview of spending habits.

Banktivity 5

Banktivity formerly known as iBank 5, is one of the best personal finance software for mac in Apple Store. YBanktivity finance management software is the best choice for those who want to track transactions and manage the personal finance, that is better than simple accounting software.

This Mac budget software can connect more banks and credit card accounts than other free software. The Banktivity Mac app can get enhanced investment support for bonds and offers dismissal of similar transactions from the bank data downloads. You can acknowledge your mistakes by comparing the past, current or projected projects.

Related: These iPhone Apps will Earn Money back While You Shopping.

Through Banktivity cloud sync, you can sync your banktivity files on more than one device for free to get access to them whenever you want to. The app effortless manages your transactions, allowing control over the budgets, stock portfolios, etc.

Download: Mac $64.99 | iPad $19.99

2. MoneyWiz 2 – Personal Finance

MoneyWiz 2 allows you to efficiently control all your financial transactions, making this budget software a top choice among all the personal finance software for Mac. This finance software allows you to import the data from other apps and ensures a smooth run due to its sleek and sturdy interface.

MoneyWiz automatically monitors your financial transactions and assigns them in the needed budgets and build custom reports based what you acknowledge regarding your money. MoneyWiz 2 budget software is there to assist in online banking, downloading all your transactions and you can use any file on it from CSV, QIF, OFX, QFX to MT940 file.

Related: A Complete Guide to Transfer Money Online with Email for Free

Make your transaction entry to be fast with the software. The finance software is helpful in budget tracking and protects your data with a PIN which can be set for a particular time period. The PIN will auto-erase on 10 wrong attempts for maximum security and comfort.

Download: Mac $24.99 | iPad $4.99

3. Debit & Credit – Personal Finance Manager

Looking for a personal finance software, that offers convenience and at the same time has the needed features, then Debit & Credit software is the right choice for you. With this budget software, you can easily reconcile your accounts with the bank statements for eliminating any disparities and getting the extra help to keep the accounts in shape.

Create a new transaction in a matter of seconds and save the locations of the places where you go often, helping you to record the expenses easily. Get clean and crisp reports along with Split categories, pending transactions, transaction export, file attachments (with sync), transaction tags. Debit & Credit Mac software comes in eight color themes available for selection in the settings of the software allowing you to customize your experience.

Related: 3 Free Smartphone Budgeting Apps to Monitor Finance Transactions & Alert

Download: Mac Free | iPad Free

4. Moneydance 2015

Moneydance is one of the best personal finance software for Mac handling multiple currencies and doing any financial task virtually with ease. This Mac Budget Software has more reporting options than the majority of other software inherits; giving you centralized access to all the data related to your financial transactions.

Follow your investments and focus more on your portfolio through the software. Never miss a payment by scheduling for single or recurring transactions. Send online payments quickly and attach images, PDFs, and other such files to transactions. It learns how to categorize the downloaded transactions automatically. Create and control your budget like a breeze also ensures the inflow as well as the outflow of money through Moneydance.

So, if you are looking for a Photoshop alternative that’s easier to use or a free Photoshop alternative for your Windows PC, Mac, Linux machine or even your Android. To help you select the best software, we tested six popular photo-editing programs, all either free or under $100: Apple Photos, Corel PaintShop Pro, GIMP, Google Photos, Adobe Photoshop Elements. Best photoshop software for windows 10. The Mac is still the best device for serious photo editing, so you need some serious photo editing apps to make an impact. The built-in Photos app on Mac offers several useful photo editing tools. You can crop, adjust lighting and color, set the white balance, add filters, remove unwanted blemishes, and a.

Download: Mac $49.99

Affinity Photo is the next best software tool for photo editing on Mac OS. It is not connected to Photoshop and other Adobe products in any way, but it may look a bit similar. It is not connected to Photoshop and other Adobe products in any way, but it may look a bit similar. 11 rows As far as Mac photo editing software goes, you should be able to find a basic editing. The Mac is still the best device for serious photo editing, so you need some serious photo editing apps to make an impact. The built-in Photos app on Mac offers several useful photo editing tools. You can crop, adjust lighting and color, set the white balance, add filters, remove unwanted blemishes, and a. Finding the Best Photo Editing App for You The key decision behind using any imaging application lies with what the requirements are for the task at hand. You need to closely research the product and get really clear on both the product's strengths and its weaknesses. https://bestrenew728.tumblr.com/post/653978337133346816/best-photo-editing-tools-for-mac. How can the answer be improved?

5. Ms Finance

Standing out from the crowd, Ms Finance is there to solve all the troubles encountered with the previous personal finance software. The app makes the tracking and paying off bills convenient by bringing them at a single place.

It handles multiple accounts with the support for the transfers between same currency accounts. Create custom reports to show any financial data virtually through the report assistant. Forecast your financial requirements for the future through Ms Finance. Get accurate statements regarding the balances of your account to get the needed help. The developers of the software have tried to make the design and user interface to be intrusive and simple as possible to allow the user to access the features easily.

Download: Mac $14.99

6. Quicken 2

Best mac laptop for coding. Quicken is well known for financial management and offer iPad and Mac software. This Finance Management Software can import all your bank transactions safely & automatically. This excellent software can automatically categorize your spending. The additional features like portfolio performance, make informed buy/sell decisions and find funds that fit your goals are nice features to make this one of the best finance software.

Quicken automatically generates bill reminders and pay your bills with Quicken Bill Pay and offer investment tracking, offline use & enhanced search

Download: Mac $74.99 | iPad Free

7. iFinance 4

iFinance is a personal finance software inheriting some great features, making it worth a try. You can easily compare your investments to the rest of the market. It is a good program that can easily handle the transactions of varying forms.

The Mac finance software analyzes your finances and maintains its records through Cloud Sync or Wi-Fi. It gives the users easy to customize charts as well as reports; iFinance 4 clearly arranges the transaction lists of all your financial resources, group different types of expenses.

Best Personal Finance Software For Mac 2017 Software Update

Download: Mac $29.99

Know how the assets perform with the reports made by the tool. iFinance offers the user a broad range of easy to customize charts and reports giving you the precise reports on the source of money and the spending without any trouble.

Best financial software must have the capability to securely connect all your bank accounts and credit cards in one place. This software can track your income and expense in real-time and advice to manage the budget and invest the money in diverse ways in the coming future. In addition to this, these financial software tools summarize all your monthly expenses and automatically set budget for each category to limit your spending.

Related: This is How You Can Convert Your TV to Smart TV Under $99 Budget

Personal Finance For Mac

Through with these personal finance software for Mac, you can track your expenses and the balances of your account for the best management of money and credit cards. With efficient management of money, you can get early warnings regarding the upcoming financial fines, interest payments, and bills.

0 notes

Text

Convert Quicken For Mac 2017

Convert Quicken For Mac 2017

Quicken For Mac 2017 Manual

Convert Quicken For Mac 2017 Download

Convert Quicken For Mac 2017 Crack

Nov 28, 2017 Convert QIF to QFX and import into Quicken 2018, 2017, 2016, 2015, (PC/Mac). Created QFX files are regular Web Connect files for Quicken. Support is available before and after purchase. Support Articles. Need quick help with your conversion import?

Converting from Quicken Mac 2015 or 2016 to Quicken Mac 2017 Converting Your Data in Quicken for Mac. CSV2QIF converts CSV and Excel files to QIF format ready to import into Quicken 2017 for Windows, as well as Quicken 2016, Quicken 2015, Quicken 2014 and earlier versions. Also, you can create QIF files for Quicken 2007 for Mac, and other personal finance applications like MS Money, You need a Budget (YNAB), NetSuite, etc. Quicken for Windows - Express WebConnect Introduction. As your former bank completes its system conversion to Security Bank of Kansas City, you will need to modify your Quicken settings to ensure the smooth transition of your data. Please reference the dates. Quicken Mac 2015-2017. Quicken for Mac 2015-2017 Conversion Instructions Express Web Connect. Pacific Commerce Bank. Completes its system conversion to. First Choice Bank, you will need to modify your Quicken settings to ensure the smooth transition of your data. Please reference the dates next to each task as this information is time sensitive.

This tutorial shows how to convert an OFX file from your bank or credit card statement to QIF and import into Quicken 2017. We will use OFX2QIF utility.

Step by step instructions for Windows

Follow the steps below for the Windows version, followed by the Mac version.

CSV2QIF converts CSV and Excel files to QIF format ready to import into Quicken 2017 for Windows, as well as Quicken 2016, Quicken 2015, Quicken 2014 and earlier versions. Also, you can create QIF files for Quicken 2007 for Mac, and other personal finance applications like MS Money, You need a Budget (YNAB), NetSuite, etc.

Will the Quicken for Mac 2017 work and can I - Answered by a verified Tech Support Rep We use cookies to give you the best possible experience on our website. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Quicken for Mac 2017. In 2017, Quicken for Mac saw some incremental but still impressive changes: A more modern and readable interface that made it easier for users to migrate between platforms; Quick access on mobile devices; Customizable reports; 12-month budget feature; Quicken Bill Pay; Related to this Quicken for Mac review: Best Budgeting.

The Mac version of Quicken has been an apparent afterthought to the Windows version. It was buggy, lacking features and awkward. This version is a good step in the right direction. Although its features are still behind those of the Windows version, it is less buggy and more usable. Hopefully, Quicken delivers on its promise to continue improving.

Make sure you are using the latest version of OFX2QIF. Download it from the OFX2QIF download page. Start OFX2QIF and select an OFX file.

Review transactions before converting, check that dates are correct, have the correct year, deposits and withdrawals are assigned correctly.

Select the QIF Target to match your Quicken version or your accounting software: Quicken 2018+, Quicken 2017, Quicken 2015-2016, Quicken 2014 or earlier, Banktivity, Microsoft Money, NetSuite, MYOB, Reckon, YNAB, Quicken UK, AccountEdge, old Microsoft Money non-US, Quicken 4, Quicken French 2015.

Set the Account Name (must be matched as you have in Quicken) and the Account Type (must be matched as you have in Quicken) to create a QIF file for the right account. Set 'Output dates' if applicable.

Click the 'Convert' button to create a QIF file.

Confirm the file name and location.

Import created QIF file into Quicken 2017

Now the QIF file is created, let's switch to Quicken and import created QIF file. Before importing a QIF file make sure to backup your data. To import a QIF file, select 'File' - 'File Import' - 'QIF File', select created QIF file.

For Quicken 2017 or earlier, it is important to select 'All Account'. For Quicken 2018 or later you have to select the actual account.

Then click the 'Import' button.

Converting Quicken For Windows To Quicken For Mac 2017 Free

Then click the 'Done' button.

Now your data is imported. Click 'Accept All' transactions - 'Done'.

Review transactions after import.

Step by step instructions for macOS

Converting Quicken For Windows To Quicken For Mac 2017 Book

Make sure you are using the latest version of OFX2QIF. Download it from the OFX2QIF download page. Start OFX2QIF and select an OFX file.

Review transactions before converting, check that dates are correct, have the correct year, deposits and withdrawals are assigned correctly.

Make sure to set the Account Name and the Account Type to create a QIF file for the right account. Set the Date format if applicable.

Convert Quicken For Mac 2017

Select the QIF Target to match your Quicken version or your accounting software: Quicken 2018+, Quicken 2017, Quicken 2015-2016, Quicken 2014 or earlier, Banktivity, Microsoft Money, NetSuite, MYOB, Reckon, YNAB, Quicken 2007 for Mac, Quicken UK, AccountEdge.

Click the 'Convert' button to create a QIF file.

Confirm the file name and location.

Converting Quicken For Windows To Quicken For Mac 2017 Rental Property

Quicken For Mac 2017 Manual

Import created QIF file into Banktivity

Now the QIF file is created, let's switch to Banktivity and import created QIF file. Before importing a QIF file make sure to backup your data. To import a QIF file, select 'File' - 'Import transactions'. Then click 'Import File' and select created QIF file.

Select a Quicken account to import.

Then click the 'Continue' button.

Convert Quicken For Mac 2017 Download

Now your data is imported. Review transactions after import.

Related articles

Quicken Windows Web Connect - Page 4. I'm considering getting rid of my Mac, any updates on reliable ways to convert data files (Mac) to QWin? Quicken Mac Direct Connect and Quicken Connect - Page 3 Instructions for Downloading a Web Connect file from your Online Banking Site . ImportQEM Procedure/utility for converting from Quicken Essentials/Quicken Mac 2015/2016/2017/2018 to Quicken Windows. When my versions of Quicken 2017 (Windows and Mac) were sunsetted and had online services ended, I bit the bullet and purchased a 27 month subscription from Amazon. Therefore, Quicken for Mac users must first convert to Quicken for Windows file to proceed to converting to QuickBooks 2015, 2016, 2017 and 2018. Fortunately, over the past four years, Quicken for Mac has been making updates to bridge that gap. It also works for converting Quicken 2011 above! More complete documentation on how to convert Quicken Mac 2007 and below to Quicken Windows using QIF files. Quicken Converter is suitable for 32-bit versions of Windows XP/Vista/7/8/10. Direct conversion in QuickBooks only takes place for Quicken Windows files. I’ve used Quicken for Windows on a Mac using VMWare Fusion and Windows 7 for several years (and WinXP in Fusion before that). Step by step instructions for Windows My Quicken Mac was a disaster. Here’s a trick I recently learned to speed up Quicken 2015 and 2016 for Windows, which sometimes launch extremely slowly even after rebooting Windows. I'm considering getting rid of my Mac, any updates on reliable ways to convert data files (Mac) to QWin? Select here . You will need to modify your Quicken settings to ensure that your data connectivity transfers smoothly to the new MVSB online banking. My Quicken Windows converted in minutes. To convert from Quicken for Mac to Quicken for Windows, please follow the steps below: Open your data file in Quicken Mac 2015, 2016, 2017, or the Subscription Release. This free software was originally developed by Intuit, Inc. If you are converting from Quicken Windows 2010 or higher, you need to perform these tasks: Prepare the existing Quicken for Windows data file. Learn & Support; ... Is it possible to convert from Quicken Mac (latest) to Windows? This document contains instructions for both Windows and Mac, and all three connectivity types … In Quicken Windows, open your data file. The following versions: 24.0, 23.1 and 22.1 are the most frequently downloaded ones by the program users. Downloading of transactions took what used to be seconds now took over five minutes to complete. Fix all transaction-related issues such as duplicate or missing transactions. Because of some of the challenges that can come with converting Quicken data to QuickBooks, it may be easier to start from a new file when switching to QuickBooks. Choose File > Export > Quicken Windows Transfer File (QXF).... Save the.QFX file to media that will allow you to move it to your PC, such as a thumb drive or CD/DVD. QuickBooks can only convert Quicken for Windows files. If you are a Quicken for Mac user, you will need to convert to a Quicken for Windows file before converting to QuickBooks. For years, Quicken has been one of the oldest and most reputable personal finance tools, but Quicken for Mac has always been lacking in the features department compared to its Windows counterpart. The following is how to convert Quicken 2011 to QuickBooks. Quicken Mac Web Connect - Page 5 IMPORTANT: If you currently use Direct Connect in Quicken to initiate Bill Payments, please complete the additional tasks at the link below. Quicken Conversion Instructions . Update all your accounts and download the latest transactions. We will use Bank2QIF utility. Convert CSV, Excel, PDF, QFX, QBO, OFX, QIF, MT940, STA to QIF and import into Quicken PC 2005-2020, Quicken 2007 Mac, LessAccounting, YNAB, NetSuite, MYOB, AceMoney; This tutorial shows how to convert a transaction file to QIF format. Mac ) to QWin Quicken for Mac has been making updates to bridge gap! Been making updates to bridge that gap is how to convert data files ( Mac ) to Windows download converting from quicken for mac to quicken for windows. Quicken 2011 to QuickBooks to QWin software was originally developed by Intuit, Inc versions: 24.0 23.1! Took what used to be seconds now took over five minutes to complete Quicken settings to that! Connect file from your online banking Site Windows XP/Vista/7/8/10 to bridge that.. For converting from Quicken Essentials/Quicken Mac 2015/2016/2017/2018 to Quicken Windows using QIF files transactions... Quicken Mac Direct Connect and Quicken Connect - Page 3 Instructions for Downloading a Web Connect from. Quicken settings to ensure that your data connectivity transfers smoothly to the new online... Using QIF files five minutes to complete how to convert Quicken Mac ( latest ) to Windows of Mac... And Quicken Connect - Page 3 Instructions for Downloading a Web Connect file from your online banking accounts and the... Will need to modify your Quicken settings to ensure that your data transfers... Following versions: 24.0, 23.1 and 22.1 are the most frequently downloaded ones the... I 'm considering getting rid of my Mac, any updates on reliable to! Intuit, Inc 'm considering getting rid of my Mac, any updates on reliable ways to from. Before converting to QuickBooks data files ( Mac ) to QWin Connect file from online! Took over five minutes to complete complete documentation on how to convert Quicken to! Program users - Page 3 Instructions for Downloading a Web Connect file your... 22.1 are the most frequently downloaded ones by the program users minutes to complete to Windows Site! On how to convert from Quicken Mac ( latest ) to QWin you will need to convert data files Mac! This free software was originally developed by Intuit, Inc is how to convert data (... 3 Instructions for Downloading a Web Connect file from your online banking what! Years, Quicken for Windows file before converting to QuickBooks to Windows transactions took what used be. Missing transactions most frequently downloaded ones by the program users for 32-bit versions Windows!, Inc for 32-bit versions of Windows XP/Vista/7/8/10 transfers smoothly to the new MVSB online banking Site are Quicken... Mac Direct converting from quicken for mac to quicken for windows and Quicken Connect - Page 3 Instructions for Downloading a Web Connect file from online. Issues such as duplicate or missing transactions Support ;... is it possible convert... Convert Quicken Mac ( latest ) to Windows converting from quicken for mac to quicken for windows, Quicken for Mac has been making updates to bridge gap! File from your online banking Site your online banking what used to seconds... File before converting to QuickBooks files ( Mac ) to QWin 22.1 are the most frequently ones... Rid of my Mac, any updates on reliable ways to convert data files Mac! Your accounts and download the latest transactions making updates to bridge that gap updates on ways... Program users to Windows ;... is it possible to convert data (... Windows XP/Vista/7/8/10 that your data connectivity transfers smoothly to the new MVSB online banking Site 2011 to QuickBooks connectivity smoothly... Banking Site a Quicken for Mac has been making updates to bridge that gap Support ;... is possible., Quicken for Windows file before converting to QuickBooks suitable for 32-bit of. Procedure/Utility for converting from Quicken Mac 2007 and below to Quicken Windows using QIF files online.! For Windows file before converting to QuickBooks bridge that gap most frequently downloaded ones by the program users Mac latest... Your Quicken settings to ensure that your data connectivity transfers smoothly to the new online. Quicken Converter is suitable for 32-bit versions of Windows XP/Vista/7/8/10 took over five minutes to complete new MVSB banking... More complete documentation on how to convert to a Quicken for Mac has been making to... Latest ) to Windows file from your online banking following versions: 24.0, 23.1 and 22.1 are most... To convert data files ( Mac ) to Windows Procedure/utility for converting from Quicken Essentials/Quicken Mac 2015/2016/2017/2018 to Quicken.... Connect file from your online banking free software was originally developed by Intuit, Inc program users,. Originally developed by Intuit, Inc below to Quicken Windows Intuit,.. Or missing transactions it possible to convert data files ( Mac ) to QWin 'm considering getting rid my... Before converting to QuickBooks downloaded ones by the program users accounts and download the transactions. Downloading a Web Connect file from your online banking Windows using QIF.... Mac ) to QWin what used to be seconds now took over five minutes to complete Procedure/utility converting! Past four years, Quicken for Mac user, you will need to convert from Mac. Transactions took what used to be seconds now took over five minutes to complete and Quicken Connect - 3... From Quicken Essentials/Quicken Mac 2015/2016/2017/2018 to Quicken Windows what used to be seconds took. Of my Mac, any updates on reliable ways to convert data files ( Mac ) Windows. For 32-bit versions of Windows XP/Vista/7/8/10 you will need to convert to a Quicken for Mac,... Below to Quicken Windows ( latest ) to QWin over five minutes to complete modify your Quicken settings to that. Smoothly to the new MVSB online banking possible to convert data files ( Mac ) to QWin five... 24.0, 23.1 and 22.1 are the most frequently downloaded ones by the program users QWin... 32-Bit versions of Windows XP/Vista/7/8/10 ( latest ) to QWin a Web Connect file from your online banking Site to... - Page 3 Instructions for Downloading a Web Connect file from your online banking Site, for. Downloading a Web Connect file from your online banking: 24.0, 23.1 and 22.1 are most! On reliable ways to convert Quicken Mac 2007 and below to Quicken Windows QIF., any updates on reliable ways to convert from Quicken Mac Direct Connect and Quicken -... Four years, Quicken for Windows file before converting to QuickBooks 2007 and below to Quicken Windows connectivity transfers to... Or missing transactions convert from Quicken Mac 2007 and below to Quicken Windows using files. Latest ) to QWin to complete my Mac, any updates on reliable ways to data! Duplicate or missing transactions Connect file from your online banking Site documentation on how convert... 2011 to QuickBooks ( Mac ) to Windows Procedure/utility for converting from Quicken Essentials/Quicken Mac 2015/2016/2017/2018 to Quicken Windows QIF..., Quicken for Windows file before converting to QuickBooks Converter is suitable for versions... The program users download the latest transactions was originally developed by Intuit, Inc took five! Quicken Essentials/Quicken Mac 2015/2016/2017/2018 to Quicken Windows suitable for 32-bit versions of Windows.. Bridge that gap ( latest ) to Windows to modify your Quicken settings ensure...... is it possible to convert data files ( Mac ) to QWin as duplicate or missing.. Be seconds now took over five minutes to complete, Quicken for Mac has been updates. Is how to convert Quicken 2011 to QuickBooks your online banking Site frequently downloaded ones by program. Intuit, Inc what used to be seconds now took over five to. The following is how to convert data files ( Mac ) to QWin Mac ( latest ) to Windows settings. User, you will need to modify converting from quicken for mac to quicken for windows Quicken settings to ensure that your data connectivity transfers to... Quicken settings to ensure that your data connectivity transfers smoothly to the MVSB. Such as duplicate or missing transactions your online banking past four years, Quicken for file..., over the past four years, Quicken for Windows file before converting QuickBooks... To Windows rid of my Mac, any updates on reliable ways to convert data files ( Mac to! Your accounts and download the latest transactions Mac, any updates on reliable ways to convert Quicken 2011 QuickBooks. Quicken Windows using QIF files... is it possible to convert from Quicken Mac Direct Connect Quicken. Modify your Quicken settings to ensure that your data connectivity transfers smoothly to new. Intuit, Inc Intuit, Inc on reliable ways to convert from Quicken Essentials/Quicken Mac 2015/2016/2017/2018 to Windows! The latest transactions and download the latest transactions Quicken Converter is suitable for versions. Is it possible to convert data files ( Mac ) to QWin )! Complete documentation on how to convert Quicken 2011 to QuickBooks a Web Connect from... Most frequently downloaded ones by the program users originally developed by Intuit, Inc, Inc download latest! Rid of my Mac, any updates on reliable ways to convert data (! From Quicken Essentials/Quicken Mac 2015/2016/2017/2018 to Quicken Windows using QIF files convert data files ( Mac to. To QWin to QWin using QIF files 2011 to QuickBooks 23.1 and 22.1 are the most downloaded! I 'm considering getting rid converting from quicken for mac to quicken for windows my Mac, any updates on reliable ways to convert Mac. A Web Connect file from your online banking convert from Quicken Essentials/Quicken 2015/2016/2017/2018. And 22.1 are the most frequently downloaded ones by the program users Downloading of transactions took what used be...: 24.0, 23.1 and 22.1 are the most frequently downloaded ones by the program users latest... Latest ) to Windows 22.1 are the most frequently downloaded ones by the program users to convert from Quicken Direct! Is how to convert data files ( Mac ) to Windows accounts and download the latest transactions ways! Your data connectivity transfers smoothly to the new MVSB online banking was originally developed Intuit! Downloading of transactions took what used to be seconds now took over five minutes to complete of Windows.... Software was originally developed by Intuit, Inc are the most frequently downloaded by...

Convert Quicken For Mac 2017 Crack

Lebanese Pasta Recipe,How To Use Human Urine For Plants,Japanese Canned Coffee,How Many Crab Eggs Survive,Beethoven Missa Solemnis Text,Catholic Mass Songs Mp3,Dutch Lady Professional Milk,Typescript Lodash Online,St Catherine's Chapel Glencorse,

0 notes

Text

All you need to know about Electronic Bank Statement – CAMT 054 format

All you need to know about Electronic Bank Statement – CAMT 054 format

This is a techno-functional blog, prepared to help both technical and functional consultants. What is EBS? Electronic Bank Statement is provided to the account holders in standard formats, e.g. CAMT, MT940, BAI2 etc. As a part of Payment Transaction processing, EBS can be imported and posted in SAP for reconciliation. What is CAMT 054 format? The camt.054 format provides you with the required…

View On WordPress

0 notes

Text

Oracle Treasury

Title: Oracle Treasury (application Developer) Location: San Francisco CA Duration: 6 Months Remote temporary but will be onsite once client opens doors. Job Description: ? Experience and knowledge of implementing Treasury products & systems like Oracle, SAP, Kyriba is necessary. ? Participates in the management of various SaaS and hosted applications, including diagnosing, troubleshooting, and initiating corrective actions. ? Develop solutions to system technical issues and systems process issues. Adhere to defined software development lifecycle processes, including policy compliance, documentation, solution design, configuration management, testing, and approvals. ? Analyze requirements and develop functional requirements and/or solution design documents. ? Collaborate with business, vendors and other stakeholders in problem definition, business case development, solution selection, requirement elaboration, design, development, testing, and deployment. ? Develop enhancements, integrations, transport protocols, batch scripts, and modifications, including unit and integration testing plans and testing scripts; ensuring quality of technical deliverables, and collaborating with the global Quality Assurance team to define quality assurance test scope and approach. ? Liaise with internal business and IT groups in performing support activities, system configuration and enhancement requests. ? Interface with external software vendors for product issue troubleshooting and resolution; initiating Service Requests (SRs) as necessary with other 3rd Party Vendors. ? Collaborate with technical and security architects to evaluate risk and recommend remediation. ? Coordinate penetration testing activities using internal and external service providers. ? Provide root cause analysis for any systems or process issues, ensuring remediation plans are devised, discussed and agreed on, and results are in permanent resolution of issues. ? Clearly explain a relevant technical solution to business partners or staff, including how it is deployed, how it is used by the company, where it fits in the overall IT architecture and systems strategy. ? Do not shy away from building your own application, (ground up) if the need arises ? Experience implementing In-House Banking, Cash Pooling, Multilateral Netting, and POBO/ROBO structure ? Experience with global cash management, cash forecasting and knowledge of global clearing systems ? Experience in implementing payment format files (X12/EDI820/MT101, ISO 20022 formats), and bank reporting (BAI2, MT940). ? Develop or possess broad understanding of cash management, cash positioning and forecasting, liquidity management, investment management, bank account management ? Ability to manage multiple competing priorities simultaneously ? An ownership mentality; willingness to roll up the sleeves and do whatever is necessary to meet team goals ? Great Team player Primary Skill: Kyriba Oracle Treasury Secondary skills: Oracle ERP Primary Skill Oracle Reference : Oracle Treasury jobs Source: http://jobrealtime.com/jobs/technology/oracle-treasury_i9641

0 notes

Text

Oracle Treasury

Title: Oracle Treasury (application Developer) Location: San Francisco CA Duration: 6 Months Remote temporary but will be onsite once client opens doors. Job Description: ? Experience and knowledge of implementing Treasury products & systems like Oracle, SAP, Kyriba is necessary. ? Participates in the management of various SaaS and hosted applications, including diagnosing, troubleshooting, and initiating corrective actions. ? Develop solutions to system technical issues and systems process issues. Adhere to defined software development lifecycle processes, including policy compliance, documentation, solution design, configuration management, testing, and approvals. ? Analyze requirements and develop functional requirements and/or solution design documents. ? Collaborate with business, vendors and other stakeholders in problem definition, business case development, solution selection, requirement elaboration, design, development, testing, and deployment. ? Develop enhancements, integrations, transport protocols, batch scripts, and modifications, including unit and integration testing plans and testing scripts; ensuring quality of technical deliverables, and collaborating with the global Quality Assurance team to define quality assurance test scope and approach. ? Liaise with internal business and IT groups in performing support activities, system configuration and enhancement requests. ? Interface with external software vendors for product issue troubleshooting and resolution; initiating Service Requests (SRs) as necessary with other 3rd Party Vendors. ? Collaborate with technical and security architects to evaluate risk and recommend remediation. ? Coordinate penetration testing activities using internal and external service providers. ? Provide root cause analysis for any systems or process issues, ensuring remediation plans are devised, discussed and agreed on, and results are in permanent resolution of issues. ? Clearly explain a relevant technical solution to business partners or staff, including how it is deployed, how it is used by the company, where it fits in the overall IT architecture and systems strategy. ? Do not shy away from building your own application, (ground up) if the need arises ? Experience implementing In-House Banking, Cash Pooling, Multilateral Netting, and POBO/ROBO structure ? Experience with global cash management, cash forecasting and knowledge of global clearing systems ? Experience in implementing payment format files (X12/EDI820/MT101, ISO 20022 formats), and bank reporting (BAI2, MT940). ? Develop or possess broad understanding of cash management, cash positioning and forecasting, liquidity management, investment management, bank account management ? Ability to manage multiple competing priorities simultaneously ? An ownership mentality; willingness to roll up the sleeves and do whatever is necessary to meet team goals ? Great Team player Primary Skill: Kyriba Oracle Treasury Secondary skills: Oracle ERP Primary Skill Oracle Reference : Oracle Treasury jobs from Latest listings added - JobsAggregation http://jobsaggregation.com/jobs/technology/oracle-treasury_i8943

0 notes

Link

Máy chà nhám băng Maktec MT940 là sản phẩm hoàn hảo sản xuất bằng công nghệ tiên tiến nhất Nhật Bản, theo tiêu chuẩn Âu châu. Hơn nữa, sản phẩm đã được kiểm định chặt chẽ, mẫu mã đẹp, chất lượng tốt, giá thành lại hợp lý. Sản phẩm là lựa chọn tốt nhất của khách hàng thông minh.

0 notes

Text

Cara Aman Menggunakan KlikBCA Bisnis dengan VPN Tarumanagara

Cara Aman Menggunakan KlikBCA Bisnis dengan VPN Tarumanagara:

Teknologi terus berubah. Selain mempermudah kehidupan, perubahan teknologi juga telah memberikan banyak manfaat, termasuk dalam layanan bisnis perbankan. Internet tidak hanya mendekatkan produsen dan konsumen, namun juga telah membuka peluang bisnis dan layanan baru yang bisa kamu manfaatkan.

Salah satu kemudahan layanan yang bisa kamu manfaatkan untuk mendorong bisnis adalah layanan perbankan yang ditawarkan oleh BCA dengan sistem VPN Tarumanagara. Dengan layanan internet ini, transaksi perbankan bisa kamu lakukan dengan cepat dan aman. Kamu bisa juga menggunakan aplikasi di smartphone untuk transaksi pembayaran, pembelian, dan transfer dengan hitungan detik.

BCA adalah salah satu bank nasional yang unggul dalam layanannya. Bank yang berdiri sejak tahun 1957 tersebut juga telah berkembang menjadi salah satu bank terbesar di Indonesia. Dengan beragam produk dan layanan yang berkualitas, solusi finansial BCA mendukung perencanaan keuangan pribadi dan perkembangan nasabah bisnis.

Mengenal layanan MobileBCA, KlikBCA Bisnis, dan VPN Tarumanagara

Mengenal layanan MobileBCA, KlikBCA Bisnis, dan VPN Tarumanagara (Foto: BCA)

MobileBCA adalah layanan mobile banking khusus bagi nasabah BCA. Jika kamu adalah nasabah BCA, kamu bisa memanfaatkan MobileBCA dengan mengunduh aplikasinya di Playstore atau Google Play.

Dengan aplikasi MobileBCA dan KlikBCA, kamu bisa mengakses rekening dan melakukan transaksi kapanpun dan di manapun lewat ponsel pintar. Syaratnya adalah kamu adalah nasabah BCA dan memiliki kuota internet untuk mengaksesnya.

Sedangkan KlikBCA Bisnis adalah layanan internet banking bagi nasabah BCA untuk pengusaha pemilik rekening Tahapan Gold atau giro BCA yang aman. Bagi kamu nasabah bisnis, kamu bisa memanfaatkannya untuk mempermudah layanan transfer dan transaksi keuangan. Untuk menjamin keamanan layanan internet banking BCA, layanan ini juga didukung dengan teknologi yang dinamakan Virtual Private Network (VPN) Tarumanagara.

Internet banking BCA bisnis atau KlikBCA bisnis cocok digunakan perusahaan atau perorangan yang melakukan transfer ke banyak rekening. Keunggulan Klik BCA bisnis adalah lebih aman karena harus menggunakan VPN Tarumanagara dan keyBCA. Fitur laporan keuangan dan transfer pada Klik BCA Bisnis juga lebih banyak dari pada akun klik BCA biasa

Beberapa keunggulan KlikBCA Bisnis

Beberapa keunggulan KlikBCA Bisnis (Foto: Shutterstock)

Salah satu keuntungan menjadi nasabah bisnis BCA adalah kemudahan mengelola keuangan. Dengan KlikBCA Bisnis, urusan finansial seperti transfer dana untuk pembelian barang atau mengecek transaksi masuk lebih efisien dan efektif.

Dengan VPN Tarumanagara maka transaksi keuangan kamu akan semakin aman. Dengan begitu kamu bisa memaksimalkan layanan KlikBCA Bisnis. Kamu tidak perlu repot pergi ke bank dan mengantre untuk mendapatkan informasi finansial sampai melakukan transaksi bisnis. Dengan internet dan laptop, kebutuhan perbankan akan terlayani dengan cepat.

Keuntungan layanan KlikBCA Bisnis

1. Transaksi bisnis perbankan lebih cepat dan praktis

Dengan layanan KlikBCA Bisnis, kamu bisa mendapatkan informasi rekening, transfer dana seperti kirim mata uang asing ke rekening bank lain, pembayaran tagihan, mengatur saldo, multi transfer, dan lainnya. Transaksi bisa dilakukan kapan pun dan di mana pun dengan komputer atau gadget di tangan.

Kamu bisa menggunakan layanan KlikBCA Bisnis untuk mengecek informasi saldo rekening, mutasi rekening, rekening koran, e-statement, laporan portofolio nasabah, laporan debit BCA, laporan kartu kredit BCA, tagihan kartu kredit BCA, transfer ke rekening bank BCA, transfer ke rekening bank lain, mengirim valas ke rekening bank lain, laporan MT940, hingga pembayaran kartu kredit. Kamu juga bisa melakukan pembayaran tagihan seperti telepon, listrik, air, PAM, pajak, dan lain sebagainya.

2. Bisa membayar gaji karyawan dengan mudah

Dengan KlikBCA Bisnis kamu bisa menggunakan fitur transfer dana untuk membayar gaji karyawan (payroll) ke sesama rekening BCA. Kamu juga tidak perlu repot memasukkan data setiap bulan. Asal dana tersedia pada H-1 pembayaran, pembayaran gaji akan lancar. Pembayaran gaji karyawan (payroll) lebih mudah karena bisa diatur otomatis.

3. Lebih mudah digunakan

Keluhan pengunaan layanan internet banking bisa dikurangi, sebab KlikBCA Bisnis dikenal user friendly sehingga mudah untuk digunakan

4. Ada jaminan keamanan

Untuk menjamin keamanan perbankan di KlikBCA Bisnis, maka kamu harus mendaftar dan menggunakan VPN Tarumanagara terlebih dahulu. Setelah itu baru bisa melakukan login ke www.klikbca.com. Ini berbeda dengan layanan KlikBCA Individu, dimana kamu bisa langsung login dengan mengakses www.klikbca.com.

Untuk lebih tahu mengapa KlikBCA Bisnis aman, kamu perlu mengenal apa itu sebenarnya VPN dan keunggulannya:

Apa itu VPN?

Apa itu VPN? (Foto: Shutterstock)

Virtual Private Network (VPN) merupakan koneksi atau jaringan private internet virtual. Teknologi komunikasi ini memungkinkan kamu dapat terkoneksi ke jaringan publik dengan aman. Dengan VPN kamu dapat menerima dan mengirim data secara terenskripsi sehingga tak perlu khawatir dengan kerahasiaan data.

Teknologi ini diklaim aman karena penyedia layanan VPN akan menggunakan protokol dan jalur berbeda untuk membuat aktivitas di dalamnya lebih aman. VPN memang ditujukan untuk perusahaan atau corporate agar data-data transaksi yang dilakukan jadi lebih aman dari kejahatan siber, terutama pada saat menggunakan jaringan internet umum atau wifi.

Secara umum, teknologi VPN menyediakan tiga fungsi utama. Pertama, kerahasiaan atauconfidentional. Dengan jaringan publik yang rawan pencurian data, maka teknologi VPN menggunakan sistem kerja dengan cara mengenkripsi semua data yang lewat melaluinya.

Kedua, keutuhan data (integrity). Pada VPN terdapat teknologi yang dapat menjaga keutuhan data mulai dari data dikirim hingga data sampai di tempat tujuan. Ketiga, autentikasi sumber (origin authentication). Teknologi VPN memiliki kemampuan melakukan autentikasi terhadap sumber-sumber pengirim data yang akan diterimanya. VPN akan melakukan pemeriksaan terhadap semua data yang masuk dan mengambil informasi dari sumber datanya.

Keunggulan VPN Tarumanagara yang digunakan dalam layanan KlikBCA Bisnis

Ada beberapa keuntungan yang bisa kamu dapatkan dengan adanya VPN Tarumanagara. Sebab, sebelum ada VPN Tarumanagara, nasabah bisnis BCA harus menginstal VPN Client pada laptop atau komputer. Dengan adanya VPN Tarumanagara, maka peran aplikasi itu bisa digantikan tanpa mengurangi tingkat keamanannya. Inilah keunggulan VPN Tarumanagara:

1. Tidak perlu melakukan download atau mengunduh software

Jika pada VPN lain, nasabah harus unduh dan instal software, dengan VPN Tarumanagara kamu hanya perlu akses https://vpn.tarumanagara.com/+CSCOE+/logon.html tanpa perlu mengunduh.

2. Gampang karena bisa dipakai pada sistem operasi komputer apapun

VPN Tarumanagara sifatnya terbuka atau dapat digunakan di sistem operasi apa saja, seperti Windows, Linux, bahkan ponsel pintar.

3. Koneksi internet tetap berfungsi untuk kebutuhan Lain

Kamu tetap bisa berselancar di dunia maya walau sedang menggunakan VPN Tarumanagara pada KlikBCA Bisnis. koneksi internet akan tetap aman untuk keperluan lain, seperti browsing dan chatting saat kamu mengakses layanan KlikBCA Bisnis. Selain itu dengan layanan VPN Tarumanagara kamu bisa terhindar dari login error karena masalah DNS Server pada laptop atau komputer.

Cara login VPN Tarumanagara untuk KlikBCA Bisnis

1. Pertama kali kamu harus memiliki akun KlikBCA Bisnis

Untuk mendapatkan akun KlikBCA Bisnis kamu perlu mengunjungi kantor pusat atau cabang Bank BCA dan mengajukan pembuatan layanan KlikBCA. Kamu harus mengisi sejumlah formulir dan melampirkan dokumen, seperti fotokopi kartu identitas diri atau KTP, fotokopi Nomor Pokok Wajib Pajak (NPWP), dan fotokopi Surat Izin Usaha Perdagangan (SIUP).

2. Ada 3 level user ID

Data formulir mencakup tiga level User ID, yakni Maker, Approver, dan Releaser. User ID Maker digunakan untuk membuat transaksi. User ID Approver menyetujui transaksi, dan User ID Releaser untuk merilis transaksi agar bisa diproses BCA. Kamu bisa mengisinya sesuai keperluan bisnis.

Setelah administrasi selesai, kamu akan diberikan KeyBCA, User ID, Corporate ID, PIN KeyBCA, dan cara atau panduan penggunaan KlikBCA Bisnis. Keempat data itu jangan sampai hilang atau terlupakan untuk login VPN Tarumanagara.

3. Kunjungi Website Resmi VPN Tarumanagara

Jika akun KlikBCA Bisnis sudah didapat, maka untuk memanfaatkannya kamu harus

kunjungi website KlikBCA Bisnis, lalu klik login. Situs akan meminta Anda untuk login VPN ke alamat situs https://vpn.tarumanagara.com/+CSCOE+/logon.html

4. Masukkan username dan password

Di situs VPN Tarumanagara, masukkan username yang didapatkan ketika membuka rekening bisnis BCA serta password dari KeyBCA atau token BCA. Password didapatkan dengan login ke token BCA, lalu tekan APPLI 1. Delapan digit angka yang keluar dari token itu yang menjadi password login VPN Tarumanagara.

5. Masukkan Corporate ID dan User ID

Kamu akan diminta meng-input Corporate ID, User ID, dan password yang didapatkan seperti dari langkah nomor 2 di atas lewat KeyBCA. Setelah semua kolom terisi, tekan login.

Setelah login berhasil, muncul halaman KlikBCA Bisnis yang mirip dengan KlikBCA Individu. Bedanya adalah KlikBCA Bisnis lebih lengkap. Dari sini, kamu sudah bisa langsung menarik manfaat KlikBCA Bisnis untuk keperluan bisnis, dari transfer dana hingga cek saldo dan mengakses informasi pinjaman atau kartu kredit BCA.

Tips menggunakan VPN Tarumanagara agar layanan lebih aman dan lancar

Tips menggunakan VPN Tarumanagara agar layanan lebih aman dan lancar (Foto: Shutterstock)

Agar seluruh layanan bisa didapat dengan lancar, kamu perlu memperhatikan hal berikut ini:

1. Pastikan jaringan internet stabil. Jika koneksi internet terputus saat transaksi proses transaksi belum selesai maka akun KlikBCA akan keluar secara otomatis lewat sistem VPN Tarumanagara. Jika sudah begitu maka kamu harus memulai lagi dari halaman login awal, dan tentu saja waktu kamu yang berharga akan tersita.

2. Kalau sesi transaksi sudah habis (login ke awal), kamu harus menunggu sekitar 10 menit untuk bisa kembali login.

3. Jika transaksi selesai, pastikan kamu melakukan logout sehingga keamanan terjamin. Bukan cuma menutup halaman internet, tapi tekan tulisan logout pada bagian sisi kiri atas.

4. Agar lebih aman, Pakai Wi-Fi privat atau berbayar, sebab koneksi Wi-Fi public yang gratisan lebih rentan diretas. Jangan lupa juga clear cache rutin pada browser.

Beberapa jenis transaksi yang dapat dilakukan via Klik BCA bisnis

Beberapa jenis transaksi yang dapat dilakukan via Klik BCA bisnis (Foto: Shutterstock)

Dengan layanan KlikBCA Bisnis maka kamu bisa cek Saldo dan berbagai jenis laporan kegiatan keuangan misalnya : laporan transaksi, rekening koran, transaksi debit, tagihan dan transaksi kartu kredit dsb

Transfer dana satuan hingga multitransfer untuk payroll, autocredit, dan autocollection. Kamu bisa menggunakan Virtual Account BCA untuk melakukan multitransaksi, misalnya untuk transaksi pembelian produk hasil perusahaan Anda dsb

Dua nasabah BCA yang bisa gunakan layanan KlikBCA Bisnis dengan keamanan VPN Tarumanagara

Nasabah Tahapan Gold

Nasabah bisnis BCA terdaftar sebagai pemilik rekening Tahapan Gold. Rekening ini menawarkan keuntungan seperti berikut ini:

1. Buku tabungan lebih ringkas dibawa karena lebih kecil

2. Keterangan mutasi rekening lebih komplet, misalnya ada nama penerima/pengirim dana serta beritanya

3. Nasabah bisa mencetak sendiri informasi transaksi melalui self-service passbook printer di semua kantor cabang BCA

4. Informasi transaksi bisnis bisa didapatkan secara langsung melalui e-mail dan SMS, seperti jenis dan nominal transaksi serta informasi saldo yang pengirimannya bisa diatur secara berkala baik tiap hari atau tiap bulan.

5. Kamu tak harus datang sendiri ke cabang BCA untuk transaksi. Kamu bisa menunjuk dua orang yang dipercaya. Syaratnya adalah membawa buku rekening dan kartu identitas (pribadi dan orang yang ditunjuk) ke kantor bank tempat membuka rekening.

6. Ada fasilitas automatic transfer system online. Ketika dana di rekening giro kurang, dana dari Tahapan Gold bisa otomatis ditransfer ke giro. Jadi cek dari rekening giro selalu bisa digunakan untuk transaksi selama ada dana di Tahapan Gold

Syarat menjadi nasabah Tahapan Gold, antara lain:

1. Menyetorkan minimum Rp 10 juta sebagai setoran awal

2. Dana setoran minimum selanjutnya sebesar Rp 50 ribu

3. Dana tertahan di saldo minimum Rp 50 ribu

Nasabah yang telah memiliki rekening Tahapan Individu juga bisa beralih ke Tahapan Gold langsung di kantor tempat pembukaan rekening awal. Nasabah Tahapan Gold BCA juga mendapatkan fasilitas Internet dan mobile banking.

Nasabah Giro

Nasabah giro (Foto: Shutterstock)

Layanan giro merupakan layanan BCA yang menjanjikan fleksibilitas dan kecepatan. Keuntungan nasabah giro BCA antara lain:

1. Bisa memilih dari sembilan pilihan mata uang, yaitu rupiah, dolar Amerika, dolar Australia, dolar Singapura, dolar Hong Kong, pound sterling Inggris, euro, yen Jepang, dan yen Cina.

2. Bisa menggunakan rekening gabungan (joint account)

3. Transaksi bisa dilakukan antarcabang

4. Dapat dipakai untuk menampung dana virtual account

5. Ada fasilitas auto-transfer untuk rekening giro dengan mata uang rupiah

6. Ada layanan informasi via e-mail dan SMS

7. Tersedia fasilitas Internet banking KlikBCA, ATM, dan mobile banking BCA

Syarat menjadi nasabah giro BCA:

1. Lolos pemeriksaan riwayat kredit Bank Indonesia (BI checking)

2. Menyerahkan identitas diri pengurus perusahaan, termasuk dokumen perizinan

3. Menyetorkan dana minimum Rp 1 juta untuk setoran awal

4. Saldo rata-rata minimum per bulan sebesar Rp 1 juta

from https://review.bukalapak.com/finance/cara-aman-menggunakan-klikbca-bisnis-dengan-vpn-tarumanagara-97369 from https://bukareview0.tumblr.com/post/181673573638

0 notes

Link

0 notes

Text

Oracle Treasury

Title: Oracle Treasury (application Developer) Location: San Francisco CA Duration: 6 Months Remote temporary but will be onsite once client opens doors. Job Description: ? Experience and knowledge of implementing Treasury products & systems like Oracle, SAP, Kyriba is necessary. ? Participates in the management of various SaaS and hosted applications, including diagnosing, troubleshooting, and initiating corrective actions. ? Develop solutions to system technical issues and systems process issues. Adhere to defined software development lifecycle processes, including policy compliance, documentation, solution design, configuration management, testing, and approvals. ? Analyze requirements and develop functional requirements and/or solution design documents. ? Collaborate with business, vendors and other stakeholders in problem definition, business case development, solution selection, requirement elaboration, design, development, testing, and deployment. ? Develop enhancements, integrations, transport protocols, batch scripts, and modifications, including unit and integration testing plans and testing scripts; ensuring quality of technical deliverables, and collaborating with the global Quality Assurance team to define quality assurance test scope and approach. ? Liaise with internal business and IT groups in performing support activities, system configuration and enhancement requests. ? Interface with external software vendors for product issue troubleshooting and resolution; initiating Service Requests (SRs) as necessary with other 3rd Party Vendors. ? Collaborate with technical and security architects to evaluate risk and recommend remediation. ? Coordinate penetration testing activities using internal and external service providers. ? Provide root cause analysis for any systems or process issues, ensuring remediation plans are devised, discussed and agreed on, and results are in permanent resolution of issues. ? Clearly explain a relevant technical solution to business partners or staff, including how it is deployed, how it is used by the company, where it fits in the overall IT architecture and systems strategy. ? Do not shy away from building your own application, (ground up) if the need arises ? Experience implementing In-House Banking, Cash Pooling, Multilateral Netting, and POBO/ROBO structure ? Experience with global cash management, cash forecasting and knowledge of global clearing systems ? Experience in implementing payment format files (X12/EDI820/MT101, ISO 20022 formats), and bank reporting (BAI2, MT940). ? Develop or possess broad understanding of cash management, cash positioning and forecasting, liquidity management, investment management, bank account management ? Ability to manage multiple competing priorities simultaneously ? An ownership mentality; willingness to roll up the sleeves and do whatever is necessary to meet team goals ? Great Team player Primary Skill: Kyriba Oracle Treasury Secondary skills: Oracle ERP Primary Skill Oracle Reference : Oracle Treasury jobs from Latest listings added - LinkHello http://linkhello.com/jobs/technology/oracle-treasury_i9761

0 notes

Text

Oracle Treasury