#myob Integration with Zoho

Explore tagged Tumblr posts

Text

#MYOB Integration#MYOB CRM#MYOB CRM Integration#MYOB Ecommerce#MYOB Ecommerce Integration#Woocommerce MYOB#MYOB Shopify#Shopify MYOB Integration#Joomla MYOB#MYOB EXO Integration#MYOB EXO CRM#Magento myob Integration#Xero myob#myob Integration with Zoho

2 notes

·

View notes

Text

Essential Integrations for E-commerce Companies in Australia (Payments, CRM, Logistics)

The success of any modern e-commerce company in Australia hinges not only on having a great website but also on the ability to streamline operations, improve customer relationships, and ensure smooth logistics. As the online retail space becomes more competitive in 2025, having essential integrations—such as payment gateways, customer relationship management (CRM) systems, and logistics platforms—is no longer optional; it's a necessity.

In this blog, we'll explore the critical integrations every Australian e-commerce business should consider and how working with skilled e-commerce web developers in Australia ensures seamless implementation.

1. Payment Gateway Integrations

Efficient, secure, and flexible payment processing is the backbone of any successful e-commerce store. Your payment gateway must cater to a variety of customer preferences while complying with Australian security standards.

Popular Payment Options in Australia:

PayPal

Stripe

Afterpay

Zip Pay

Apple Pay / Google Pay

Direct credit/debit card processing

Integrating multiple payment gateways enhances customer satisfaction and trust. When managed properly during e-commerce website development in Australia, these integrations reduce cart abandonment and increase conversions.

Why Developers Matter: Professional e-commerce web developers in Australia ensure your payment systems are secure, PCI-compliant, and optimized for both mobile and desktop users.

2. CRM (Customer Relationship Management) Integrations

Understanding your customer’s journey is vital for growth. A powerful CRM system helps track user behavior, personalize marketing efforts, and nurture customer relationships long after the first purchase.

Top CRM Tools for E-commerce Companies:

HubSpot

Salesforce

Zoho CRM

Klaviyo (for e-commerce email automation)

ActiveCampaign

Integrating your CRM with your e-commerce platform gives you access to centralized customer data and enables personalized experiences, automated emails, and targeted promotions.

The Role of Web Developers: Experienced e-commerce web developers in Australia can integrate your CRM to work in harmony with your storefront, ensuring data accuracy and automation efficiency.

3. Logistics & Fulfilment Integrations

Fast, reliable delivery is a critical factor in customer satisfaction. For an e-commerce company in Australia, integrating your store with logistics and warehousing partners can streamline order fulfilment and enhance the overall shopping experience.

Essential Logistics Integrations:

Australia Post

Sendle

StarTrack

DHL

Shopify Fulfilment Network

Local 3PLs (Third-Party Logistics Providers)

These integrations allow for real-time shipping rate calculation, order tracking, and inventory management—all of which are crucial for scaling operations.

Why Development Matters: Whether you're automating shipping labels or tracking packages, effective e-commerce web development in Australia ensures your logistics are fully synchronized with your online store.

4. Accounting & Inventory Integrations

Your e-commerce platform should connect with accounting tools like Xero or MYOB to manage sales records, GST, and inventory efficiently. These integrations save time, reduce errors, and keep your financials in check.

Integration Benefits:

Automatic invoice generation

Real-time stock updates

GST compliance

Smoother audits and reconciliations

Developer Insight: During e-commerce website development in Australia, developers can connect your accounting software to your CMS, ensuring seamless transactions and financial reporting.

5. Marketing & Analytics Tools

To compete in Australia’s crowded e-commerce market, you need data-driven marketing strategies. Integration with tools like Google Analytics, Meta Pixel, Google Ads, and email platforms can provide deep insights and improve ROI.

Must-Have Integrations:

Google Analytics 4 (GA4)

Meta (Facebook/Instagram) Pixel

Mailchimp / Klaviyo

Google Tag Manager

Hotjar or Microsoft Clarity for UX insights

Developer Role: From setting up tracking events to segmenting audiences for remarketing, expert e-commerce web developers in Australia help set up these tools without bloating or slowing your site.

Conclusion

To stay competitive in 2025 and beyond, every e-commerce company in Australia must focus on building a highly integrated online presence. From seamless payments and insightful CRM to efficient logistics and accounting, integrations are the foundation of scalable success.

By investing in expert e-commerce web development in Australia, businesses can automate processes, improve customer experience, and drive long-term growth. If you’re planning a new build or looking to enhance your current setup, partnering with top e-commerce web developers in Australia will ensure these essential systems are implemented effectively and securely.

0 notes

Text

In 2025, Australian companies are leveraging advanced accounting software to streamline financial operations, ensure compliance, and gain real-time insights into their financial health. The integration of artificial intelligence (AI) and cloud computing has revolutionized the accounting landscape, offering businesses tools that are both powerful and user-friendly. Below is an overview of the top accounting software tools favored by Australian companies this year.

1. Xero

Xero continues to lead the Australian market with its cloud-based platform designed for small and medium-sized enterprises (SMEs). Founded in New Zealand, Xero has expanded its reach, serving over 4.2 million subscribers globally, with a significant portion in Australia. The software offers automated bank reconciliation, invoicing, expense tracking, and payroll management. Its user-friendly interface and integration with over 1,000 third-party apps make it a versatile choice for businesses seeking comprehensive financial management solutions. In February 2025, Xero was recognized as the top accounting software for small businesses by Better Business Advice, highlighting its impact in streamlining financial management and providing real-time insights.

2. MYOB

MYOB (Mind Your Own Business) remains a strong contender in the Australian accounting software market. Tailored to meet local regulatory requirements, MYOB offers solutions that cater to businesses of varying sizes. Its features include accounting, payroll, tax compliance, and inventory management. Despite facing competition, MYOB has maintained its market share by continually evolving its offerings to meet the dynamic needs of Australian businesses. The software's ability to integrate with various business applications ensures a seamless experience for users.

3. Zoho Books

Zoho Books has gained popularity among Australian SMEs due to its affordability and comprehensive feature set. The platform offers automated workflows, invoicing, expense tracking, and robust reporting capabilities. Zoho Books supports integration with numerous third-party applications, enhancing its functionality. Its scalability makes it suitable for businesses ranging from startups to more established enterprises. The software's emphasis on automation and real-time data access aligns with the growing trend of digital transformation in the accounting industry.

4. QuickBooks Online

Intuit's QuickBooks Online is a globally recognized accounting solution that has been tailored to meet the needs of Australian businesses. It offers features such as income and expense tracking, BAS (Business Activity Statement) preparation, payroll, and inventory management. QuickBooks Online integrates with a wide range of apps, providing flexibility and scalability for growing businesses. Its user-friendly interface and mobile accessibility make it a convenient option for business owners on the go.

5. Oracle NetSuite

For medium to large enterprises seeking a more robust solution, Oracle NetSuite offers a comprehensive cloud-based financial management system. It provides advanced features such as revenue recognition, financial planning, and compliance management. NetSuite's scalability and customization options make it ideal for businesses with complex financial processes and reporting requirements. The platform's ability to handle multi-currency transactions and global accounting standards positions it as a strong contender for enterprises operating on an international scale.

6. Sage Business Cloud Accounting

Sage Business Cloud Accounting offers solutions tailored for small to medium-sized businesses. Its features include invoicing, expense management, cash flow forecasting, and compliance with Australian tax regulations. The platform's cloud-based nature allows for real-time collaboration and access from anywhere, facilitating better financial oversight and decision-making. Sage's long-standing presence in the accounting software industry lends credibility and reliability to its offerings, making it a preferred choice for businesses seeking accounting outsource services

7. FreshBooks

FreshBooks is known for its intuitive design and is particularly popular among freelancers and small business owners. It offers invoicing, expense tracking, time tracking, and reporting features. FreshBooks' mobile app ensures that users can manage their finances on the go, providing flexibility and convenience. The platform's emphasis on simplicity and user experience makes it an attractive option for those without extensive accounting backgrounds.

8. Technology One

An Australian enterprise software company, Technology One offers a suite of financial management solutions designed for larger organizations, including local councils, governments, and universities. Its products are known for their robustness and ability to handle complex financial processes. The company's commitment to innovation has solidified its position as a leading provider in the Australian market. Technology One's focus on sectors with specific regulatory and reporting requirements demonstrates its adaptability and expertise in delivering specialized solutions.

9. Reckon

Reckon provides accounting software solutions suitable for small businesses, accountants, and bookkeepers in Australia. Its features include invoicing, expense tracking, payroll, and GST reporting. Reckon's desktop and cloud-based options offer flexibility to users based on their specific needs and preferences. The software's affordability and compliance with Australian tax laws make it a practical choice for small business owners seeking reliable accounting tools.

10. Wave

Wave offers free accounting software that caters to small businesses and freelancers. It provides features such as invoicing, expense tracking, financial reporting, and accounts payable management.While its payroll services are limited to North America, Australian users can still benefit from its core accounting functionalities. Wave's cost-effective nature makes it an appealing option for startups and businesses with limited budgets.

The 2025 Australian accounting software landscape offers diverse tools for businesses of all sizes. AI and cloud computing enhance automation, compliance, and financial insights. As the market evolves, businesses should choose solutions that fit their needs. Advanced accounting software is now essential for competitiveness and efficiency.

0 notes

Text

Transforming Business Operations with MYOB Advanced Integrations

In the rapidly evolving landscape of modern business, adaptability and efficiency are critical for staying ahead of the competition. MYOB Advanced, a robust cloud-based Enterprise Resource Planning (ERP) system, empowers businesses to achieve just that. What makes MYOB Advanced even more powerful is its extensive array of integrations, which allow companies to optimize their operations, streamline processes, and achieve better results.

1. E-commerce Integration:

For businesses involved in online commerce, integrating MYOB Advanced integrations with popular e-commerce platforms such as Shopify, WooCommerce, or Magento is a strategic move. This integration enables seamless synchronization of orders, inventory, and customer data between your e-commerce store and ERP system. By automating these critical processes, you can eliminate errors, reduce manual work, and provide customers with a more streamlined and accurate shopping experience.

2. Payment Gateway Integrations:

Efficient payment processing is at the heart of any successful business. MYOB Advanced integrates seamlessly with various payment gateways like PayPal, Stripe, Square, and more. These integrations ensure secure and swift payment transactions, fostering trust with customers and facilitating smoother financial operations for your organization.

3. CRM (Customer Relationship Management) Integration:

Effective customer relationship management is essential for growth. MYOB Advanced can integrate with leading CRM platforms such as Salesforce, HubSpot, and Zoho CRM. This integration enables the automatic exchange of customer information, interactions, and sales opportunities between your CRM and ERP systems. With a unified view of customer data, your sales and support teams can deliver personalized service and make informed decisions.

4. Business Intelligence (BI) Tools Integration:

Data-driven decision-making is a competitive advantage in today's business landscape. MYOB Advanced can integrate with BI tools like Tableau, Power BI, and QlikView. Through this integration, you can extract valuable insights from your ERP data, visualize trends, and create informative reports and dashboards. This empowers you to monitor performance, identify opportunities for improvement, and make strategic decisions based on real-time data.

5. Warehouse and Inventory Management Integration:

Efficient inventory management is a critical aspect of business operations, especially for industries with complex supply chains. MYOB Advanced integrates seamlessly with specialized warehouse and inventory management systems like Fishbowl or DEAR Systems. By synchronizing your ERP system with these tools, you gain real-time visibility into your inventory, streamline order fulfillment, and optimize procurement processes.

6. Payroll and HR Management Integration:

Managing payroll and human resources can be time-consuming and prone to errors. Integrating MYOB Advanced with HR and payroll solutions like BambooHR or ADP simplifies these tasks. This integration ensures that employee data, attendance records, and payroll information are automatically synchronized, reducing administrative burdens and enhancing compliance.

7. Time Tracking and Project Management Integration:

For service-based businesses, effective time tracking and project management are essential. MYOB Advanced can integrate with time tracking and project management software such as TSheets or Asana. This integration streamlines project planning, resource allocation, and billing processes, ultimately improving project delivery accuracy and billing efficiency.

8. Marketing Automation Integration:

Efficient marketing is critical for business growth. MYOB Advanced can integrate with marketing automation tools like Mailchimp or Marketo. This integration automates marketing campaigns, helps segment your audience, and provides detailed insights into campaign performance. By leveraging these integrations, you can effectively target your audience and optimize your marketing efforts.

In conclusion, MYOB Advanced integrations offer businesses an opportunity to enhance efficiency, customer satisfaction, and competitiveness. Whether your focus is on e-commerce, finance, customer relations, or project management, these integrations can be tailored to meet your specific needs. Embracing MYOB Advanced integrations is a strategic move that can lead to increased productivity, streamlined processes, and ultimately, improved business performance in today's ever-evolving business landscape. By harnessing the power of these integrations, you can position your business for growth and success in the digital age.

1 note

·

View note

Text

Cloud Accounting Software Market Set To See Strong Growth by 2030

The cloud accounting software market refers to the market for software solutions that enable businesses to manage their financial transactions, track expenses, generate invoices, and perform other accounting tasks using cloud-based platforms. Cloud accounting software allows users to access their financial data and perform accounting functions from anywhere with an internet connection, using a web browser or mobile app.

For Sample Report Click Here:- https://www.marketinforeports.com/Market-Reports/Request-Sample/511524

The market for cloud accounting software has been growing rapidly in recent years, driven by several factors. First, the increasing adoption of cloud computing technology has made it easier for businesses to store and access their data online, eliminating the need for on-premises infrastructure and providing scalability and flexibility. Second, cloud accounting software offers numerous benefits over traditional on-premises accounting software, including cost savings, automatic updates, real-time collaboration, and integration with other business applications.

Key players in the cloud accounting software market include:

Intuit Inc. (QuickBooks Online): QuickBooks Online is one of the most popular cloud accounting software solutions globally, catering to small and medium-sized businesses. It offers features such as invoicing, expense tracking, bank reconciliation, and reporting.

Xero: Xero is another major player in the cloud accounting software market, known for its user-friendly interface and robust features. It provides tools for bank reconciliation, invoicing, inventory management, and payroll, among others.

Sage Group plc (Sage Business Cloud Accounting): Sage Business Cloud Accounting is a cloud-based accounting software solution that offers features like invoicing, expense tracking, bank reconciliation, and financial reporting. It caters to small and medium-sized businesses.

Oracle Corporation (Oracle NetSuite): Oracle NetSuite is an enterprise-grade cloud accounting software solution that provides comprehensive financial management capabilities, including general ledger, accounts payable/receivable, billing, and advanced reporting.

Zoho Corporation (Zoho Books): Zoho Books is a cloud accounting software solution designed for small businesses. It offers features such as invoicing, expense tracking, inventory management, and financial reporting.

Other notable players in the market include Wave Accounting, FreshBooks, MYOB, and Kashoo, among others. These companies offer a range of features and pricing options to cater to different business sizes and requirements.

0 notes

Text

Benefits of Importing an Excel File into QuickBooks

Small businesses around the world try to keep track of accounting data with Excel files. It is a default bookkeeping choice for many people due to its easy availability and ease of operation. Moreover, online accounting tutorials help to find sample accounting formulas which work really well for start-ups managing with a very tight budget. Instead of investing in paid accounting software, many companies rely on Excel to complete their accounting tasks.

But, as the business grows, the chances of misplaced data, lost files and errors in calculation caused due to broken formulas become a recurring problem. Companies find it harder to keep their books in order. As a result, many companies are now choosing to import files from Excel to QuickBooks. QuickBooks is a reliable and efficient accounting software. This cloud based platform helps to manage accounts with utmost ease and is renowned for its flexibility and convenience.

Let’s take a look at some of the major benefits of importing Excel to QuickBooks Online.

Simple and Convenient Interface: QuickBooks has a very simple and user-friendly interface that eases navigation and data tracking. Its centralized system is easily accessible to the entire network and every department can enter data in designated fields without the fear of miscalculations. It can be accessed anytime, anywhere and from any device.

Improved Accounting Efficiency: If you move files from Excel to QBO, it offers greater flexibility to complete various accounting tasks. It not only helps organizations to seamlessly complete business accounting, the software allows users to easily adapt to its procedures. The tutorials offered by QuickBooks are easy to follow and a little bit of training is enough to handle its operations effortlessly. QuickBooks also allows users to manage multiple tasks like creating invoices, managing payrolls, timesheets or charts without any difficulty.

Adaptability: Another benefit of using QuickBooks over Excel is its ability to integrate with any existing accounting software. Therefore, companies can easily integrate QuickBooks with existing software like Excel and move data from one platform to the other. Similarly, data from QuickBooks can be exported to any other program of your choice.

Security: QuickBooks ensures complete security of your financial data. Security features like password protected login and multi-factor authentication help companies to manage their data in a safe and secure environment. In accounting platforms like Excel, these features are missing.

Money Management Tools: With QuickBooks, users gain access to various money management tools. It helps to track due dates, information on recurring bills and records of transactions. It also provides the option of linking all the bank accounts to the system, allowing companies to review all financial records under one platform.

Client Management: QuickBooks helps companies to enjoy a centralized access to all the QuickBooks accounts of clients in one dashboard. For small businesses, it is imperative to maintain a good relation with clients. It helps companies to send messages, notifications and customized reports to the entire database. It not only helps to upsell services, it also helps to maintain long-term relationships.

MMC Convert helps companies to convert accounting data from any platform to software of their choice. We help you to move data to Sage, QuickBooks Online, Netsuite, MYOB, Wave, Zoho Books, QuickBooks, Clear Books, Exact and many more software. With our team of experts, you can expect customized solutions to your accounting tasks. Get in touch with us now at +919926477000 for more information.

0 notes

Text

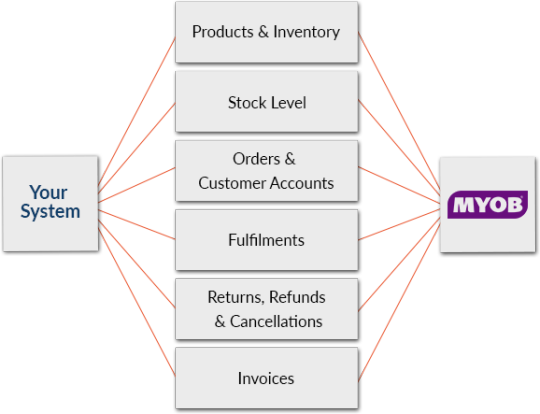

At SpryBit, we offer seamless myob integration service; Integrate MYOB with Ecommerce, CRM, Xero, zoho & boost productivity, and unlock even more value from your business applications! To know more visit: http://sprybit.com/myob-integration.html

#MYOB Integration#MYOB CRM#MYOB EXO Integration#MYOB Ecommerce#MYOB CRM Integration#Woocommerce MYOB#Shopify MYOB Integration#MYOB EXO CRM#Joomla MYOB#MYOB Ecommerce Integration#Magento MYOB Integration#Xero MYOB#MYOB Integration with Zoho

0 notes

Photo

MYOB is a powerful accounting suite which is used by businesses all around the world. At SpryBit, we offer seamless MYOB integration service; Integrate MYOB with Ecommerce, CRM, Xero, zoho & boost productivity, and unlock even more value from your business applications! To know more visit: http://sprybit.com/myob-integration.html

#MYOB Integration#MYOB CRM#MYOB EXO Integration#MYOB Ecommerce#MYOB CRM Integration#Woocommerce MYOB#MYOB Shopify#Shopify MYOB Integration#MYOB EXO CRM#Joomla MYOB#MYOB Ecommerce Integration#Magento MYOB Integration#Xero MYOB#MYOB Integration with Zoho

1 note

·

View note

Link

SpryBit provides complete solution for myob integration in Australia & New Zealand for all size of businesses; Our solution is easy to use, offering code-less integration between MYOB and any other software or application.

#myob Integration#myob CRM#myob EXO Integration#myob Ecommerce#myob CRM Integration#Woocommerce myob#myob Shopify#Shopify myob Integration#myob EXO CRM#Joomla myob#myob Ecommerce Integration#Magento myob Integration#Xero myob#myob Integration with Zoho

1 note

·

View note

Text

How to Import Excel Transactions into QuickBooks?

Maintaining accounts for any company can be quite troublesome. But, software like QuickBooks Online has made the process easy and simple. It not only helps to collate data in one place, but it also provides access from anywhere and anytime. These cloud-based platforms add flexibility to your operations. As a result, it often becomes necessary to import Excel to QuickBooks.

A lot of companies rely on Excel spreadsheets to maintain their accounts. But, Excel often lags behind in flexibility. Therefore, the need to convert Excel to QuickBooks often arises. Different types of Excel transaction files can be imported into QuickBooks without a lot of hassle. Companies can also hire expert consultants to complete the process smoothly.

Importing Excel Transactions to QuickBooks

To import Excel transactions to QuickBooks you need to follow some simple steps. Let’s take a look at the Standard Import procedure.

1. Visit the ‘File’ menu and select ���Utilities’ section. Pick ‘Import’ and then click on ‘Excel Files’.

2. The Add/ Edit Multiple List Entries windows may pop up. In that case, Click on No.

3. Now you need to follow the wizard to complete the importing process.

To do this, select the type of data you need to import to QuickBooks. A formatted excel sheet will then open up where you have to enter the required information. Save the file and close it. The option to ‘Add My Data Now’ will appear. You can review the results and view the data on the QuickBooks platform. After finishing the process, click on ‘Close’ to finish the operation.

Benefits of QuickBooks for Business

If you have still not used QuickBooks to maintain your accounts, it is probably time to think about its benefits for your business. Let’s take a look at some of the major advantages of this cloud-based an online platform that can be used to convert Excel to QuickBooks.

User-Friendly: The software is customer-oriented and its interface is easy-to-use. Therefore, any company can utilize it to improve their efficiency.

Integrated Platform: QuickBooks also has provisions for filing tax reports and monitoring income over an integrated platform.

Adaptable with any technology: It is one of the best financial software in the market and can be easily adapted to a new system. Moreover, business owners have the liberty and flexibility to access it from any modern device.

Value-for-Money: QuickBooks is an affordable software and it can save a lot of time and effort.

Safe and secure: The automated backup facility of QuickBooks helps to keep the data safe and secure. With this software, there is no fear of losing important data.

Ideal for Small Businesses: The platform helps small companies to earn profits.

MMC Convert helps to convert data from any accounting software to another platform within a short period of time. The experts can keep your accounts up to date and convert data to Quick Books, Zoho Books, Freshbooks, Sage, MYOB or any other platform of your choice. Our team of experts ensures hassle-free services and delivers a truly unique accounting experience.

0 notes