#naphtha

Text

Naphtha refinery and oil well on fire in the Suraxanı suburbs of Baku, Azerbaijan

Russian vintage postcard

#ephemera#photography#suraxanı#naphtha#vintage#briefkaart#fire#carte postale#postcard#photo#suburbs#sepia#azerbaijan#ansichtskarte#refinery#baku#suraxan#postkarte#postkaart#russian#postal#tarjeta#historic

2 notes

·

View notes

Text

Naphtha Prices | Pricing | Price | News | Database | Chart | Forecast

Naphtha prices have become a focal point in global energy markets due to their pivotal role in the chemical and petrochemical industries. As a key raw material in the production of gasoline, plastics, and various chemicals, fluctuations in naphtha prices can have far-reaching effects on both the energy sector and consumer goods. Several factors contribute to the volatility of naphtha prices, including changes in crude oil prices, geopolitical tensions, and shifts in supply and demand dynamics. Crude oil, being the primary feedstock for naphtha, directly influences its pricing. When crude oil prices rise, naphtha prices typically follow suit due to increased production costs. Conversely, when crude oil prices fall, naphtha prices often decrease as well. This close relationship between crude oil and naphtha prices underscores the importance of monitoring oil market trends to predict changes in naphtha pricing.

Geopolitical tensions in major oil-producing regions can also impact naphtha prices. Political instability, conflicts, or sanctions affecting countries like the Middle East, which is a significant oil supplier, can disrupt crude oil supply chains and lead to increased naphtha prices. Such geopolitical risks create uncertainty in the markets, leading to price surges as traders react to potential supply disruptions. Additionally, shifts in supply and demand for naphtha further influence its pricing. Economic growth or downturns can alter the demand for products derived from naphtha, such as plastics and chemicals. During periods of economic expansion, demand for these products rises, driving up naphtha prices. In contrast, economic slowdowns can decrease demand, resulting in lower naphtha prices.

Seasonal factors and weather events also play a role in naphtha price fluctuations. For instance, during colder months, the demand for heating oil increases, which can drive up the demand for naphtha as a fuel source. Conversely, in warmer months, the demand for naphtha may decrease, leading to lower prices. Weather-related disruptions, such as hurricanes or natural disasters, can impact refineries and production facilities, affecting naphtha supply and, consequently, its price. Market speculation and trader behavior contribute to the volatility of naphtha prices as well. Traders in the commodities markets may react to perceived future changes in supply or demand, leading to price swings based on market sentiment rather than fundamental factors.

Get Real Time Prices for Naphtha : https://www.chemanalyst.com/Pricing-data/naphtha-43

Moreover, regulatory changes and environmental policies can affect naphtha prices. Governments worldwide are increasingly implementing stricter environmental regulations aimed at reducing carbon emissions and promoting cleaner energy sources. These regulations can impact the production and use of naphtha, influencing its price. For example, policies that mandate the use of biofuels or impose carbon taxes can affect the demand for naphtha and drive up prices as companies adjust to comply with new standards.

Technological advancements in production and extraction methods can also influence naphtha prices. Innovations that improve the efficiency of crude oil refining or enhance the recovery of naphtha from oil can affect its supply and pricing. Conversely, technological challenges or disruptions in refining processes can lead to higher naphtha prices if production is hindered. Additionally, changes in the global energy landscape, such as the rise of renewable energy sources and shifts towards electrification, can impact naphtha demand and prices. As the world transitions towards more sustainable energy solutions, the demand for fossil fuels, including naphtha, may decrease, influencing its price trajectory.

Understanding these various factors is crucial for stakeholders in the naphtha market, including producers, consumers, and traders. By staying informed about trends in crude oil prices, geopolitical developments, economic conditions, and regulatory changes, participants can better anticipate fluctuations in naphtha prices and make informed decisions. The interplay of these factors creates a complex and dynamic environment for naphtha pricing, reflecting the broader trends and challenges in the global energy market.

In summary, naphtha prices are subject to a range of influences, including the price of crude oil, geopolitical factors, supply and demand dynamics, seasonal variations, and regulatory changes. As a vital component in the production of gasoline and various chemicals, naphtha pricing is closely linked to global energy trends and market conditions. Understanding the myriad factors that affect naphtha prices is essential for navigating the complexities of the energy market and making strategic decisions.

Geopolitical tensions in major oil-producing regions can also impact naphtha prices. Political instability, conflicts, or sanctions affecting countries like the Middle East, which is a significant oil supplier, can disrupt crude oil supply chains and lead to increased naphtha prices. Such geopolitical risks create uncertainty in the markets, leading to price surges as traders react to potential supply disruptions. Additionally, shifts in supply and demand for naphtha further influence its pricing. Economic growth or downturns can alter the demand for products derived from naphtha, such as plastics and chemicals. During periods of economic expansion, demand for these products rises, driving up naphtha prices. In contrast, economic slowdowns can decrease demand, resulting in lower naphtha prices.

Seasonal factors and weather events also play a role in naphtha price fluctuations. For instance, during colder months, the demand for heating oil increases, which can drive up the demand for naphtha as a fuel source. Conversely, in warmer months, the demand for naphtha may decrease, leading to lower prices. Weather-related disruptions, such as hurricanes or natural disasters, can impact refineries and production facilities, affecting naphtha supply and, consequently, its price. Market speculation and trader behavior contribute to the volatility of naphtha prices as well. Traders in the commodities markets may react to perceived future changes in supply or demand, leading to price swings based on market sentiment rather than fundamental factors.

Moreover, regulatory changes and environmental policies can affect naphtha prices. Governments worldwide are increasingly implementing stricter environmental regulations aimed at reducing carbon emissions and promoting cleaner energy sources. These regulations can impact the production and use of naphtha, influencing its price. For example, policies that mandate the use of biofuels or impose carbon taxes can affect the demand for naphtha and drive up prices as companies adjust to comply with new standards.

Technological advancements in production and extraction methods can also influence naphtha prices. Innovations that improve the efficiency of crude oil refining or enhance the recovery of naphtha from oil can affect its supply and pricing. Conversely, technological challenges or disruptions in refining processes can lead to higher naphtha prices if production is hindered. Additionally, changes in the global energy landscape, such as the rise of renewable energy sources and shifts towards electrification, can impact naphtha demand and prices. As the world transitions towards more sustainable energy solutions, the demand for fossil fuels, including naphtha, may decrease, influencing its price trajectory.

Understanding these various factors is crucial for stakeholders in the naphtha market, including producers, consumers, and traders. By staying informed about trends in crude oil prices, geopolitical developments, economic conditions, and regulatory changes, participants can better anticipate fluctuations in naphtha prices and make informed decisions. The interplay of these factors creates a complex and dynamic environment for naphtha pricing, reflecting the broader trends and challenges in the global energy market.

In summary, naphtha prices are subject to a range of influences, including the price of crude oil, geopolitical factors, supply and demand dynamics, seasonal variations, and regulatory changes. As a vital component in the production of gasoline and various chemicals, naphtha pricing is closely linked to global energy trends and market conditions. Understanding the myriad factors that affect naphtha prices is essential for navigating the complexities of the energy market and making strategic decisions.

Get Real Time Prices for Naphtha : https://www.chemanalyst.com/Pricing-data/naphtha-43

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Naphtha#Naphtha Price#Naphtha Prices#Naphtha Pricing#Naphtha News#Naphtha Price Monitor#Naphtha Database#Naphtha Price Chart

0 notes

Text

Frank O’Hara, Naphtha. 1959

1 note

·

View note

Text

Another Taste Of Big Mac

Was Charles Macintosh the first to discover that a #rubber solution can repel water? The eminent #surgeon James Syme might have beaten his to it #mackintosh #rainwear

Having patented his new waterproof fabric, Charles Macintosh initially just produced the cloth, leaving tailors in Glasgow and then London to fashion it into garments. Initial reactions were mixed. Tailors found the material difficult to work with. Customers found that while the coats were undeniably waterproof, they became stiff in the cold, tended to become sticky in the heat, and gave off a…

View On WordPress

0 notes

Text

Renewable Naphtha Market Reach US$ 916.1 Million During the Forecast Period 2023-2030 | ENI, Kaidi, Neste, OMV, Philips 66, Preem, Repsol

Meridian Market Consultants recently released research entitled as "Renewable Naphtha Market: Opportunity Analysis and Future Assessment 2023-2030," which offers incredibly important and in-depth knowledge. This study informs readers of the market's current dynamics, prospects, and problems, as well as what the market will look like in the years to come. a summary of the market's size and a thorough understanding of the information focused most carefully and thoroughly on the growth of the relevant market. In addition, a thorough conceptual framework, precise data, and some intriguing graphics are included to increase the value for the readers. The report also attempts tfle o satisfy the fundamental needs of a quantitative and qualitative overview that re cts the conceptual framework and practical market technique.

By the end of 2030, it is anticipated that the global market for renewable naphtha will be worth US$ 916.1 Mn, as per the latest industry analysis by Reports and Insights.

Get a taste of the expertise and insights our reports offer - download your free sample now: https://reportsandinsights.com/sample-request/3591

A byproduct of the production of gasoline, diesel fuel, and renewable diesel is naphtha, a component of gasoline. When combined with gasoline, renewable naphtha can further reduce greenhouse gas emissions from the usage of fuels. Because it has a low carbon intensity.

Since they are a viable and sustainable alternative to fossil fuels, bio-based polymers are anticipated to be accepted more widely across a range of industries. Sales of renewable naphtha will continue to be driven by the rise in demand for plastic-based goods including home decor accessories and custom-made items over the forecast period.

This market study on the global renewable naphtha market aims to cover market dynamics such as market drivers, challenges/restraints, and opportunities for the market players. It will also cover market segmentation outlook, renewable naphtha market trend, regional outlook, renewable naphtha market size, and market share, as well as industry and product insights, SWOT analysis, Porter's five force analysis, PESTEL analysis, heat map analysis, market forecast, and the major players operating in the renewable naphtha market.

Renewable Naphtha Market Drivers: Adoption of alternative sustainable energy source

A major factor driving the demand for renewable naphtha is the advancements being made in the adoption of alternative energy sources. Its acceptance has been aided by the strict enforcement of environmental guidelines and laws that are periodically made by regulatory agencies.

The use of Renewable Naphtha Market Size in the creation of hydrogen and bioplastics is anticipated to drive market expansion. Businesses are being encouraged to produce bio-based plastics due to growing worries about hazardous climate emissions.

Sales of renewable naphtha are increasing in the plastic production sector due to the soaring demand for plastic-based goods such as custom-made items, materials for home decor, consumer electronics, and others.

The demand for renewable naphtha is increasing as a result of expanding government initiatives to encourage the use of bio-based diesel and gasoline in the United States, India, and China.

Renewable Naphtha Market Restraints: Firm Regulations

The market's growth is being hampered by increased customer interest in electric vehicles and escalating pricing for bio-based fuels.

Sales growth in the plastics production market is anticipated to be hampered by strict regulations on the production of synthetic plastics like ethylene and propylene.

Renewable Naphtha Market Opportunities: Escalating use of Renewable Naphtha

New market opportunities are being created by the expanding use of renewable naphtha in the production of renewable chemicals. Research and development efforts in this direction have been quickly developing in the market for renewable naphtha. Making these compounds cheaper to synthesize is one of the main goals of the research. The market for renewable naphtha is seeing growth due to efforts being made in the automobile industry to incorporate more renewable components in the fuels utilized. New commercial opportunities are being created by the advancements being made in the steam cracking of this renewable naphtha.

Renewable Naphtha Market Trends:

Technological advancements in naphtha cracking are one of the major developments today. The expanding industry demand for the manufacturing of light olefins served as the motivation for development. Research on the steam cracking of renewable naphtha has been sparked by the requirement to high light olefin yields.

Crude oil is the source of traditional fuels like gasoline and diesel that are used in automobiles. When these fuels are used, toxic pollutants including NOx, SOx, CO2, and other greenhouse gases are released into the atmosphere, endangering the environment and ecosystem. A fantastic alternative to fossil fuels, renewable naphtha mixed fuel emits fewer hazardous emissions than traditional fossil fuels.

Market entrants in developing nations have a great chance to profit from the automotive industry's rise in demand for renewable naphtha. Fuel prices have increased as a result of rising crude oil costs. Several nations have raised the blend of biofuels in gasoline and diesel to combat these prices.

Renewable Naphtha Market, by Source:

Based on the Source, the global renewal naphtha market is segmented into; Animal Fat Waste, Green Hydrogen, Industrial Waste, Liquid Biomass, Used Cooking Oils, Vegetable Oils, and Wood-Based Residue.

Renewable Naphtha Market, by Type:

Based on the Type, the global renewal naphtha market is segmented into; Heavy Naphtha, Light Naphtha.

Renewable Naphtha Market, by Process:

Based on the Process, the global renewal naphtha market is segmented into; Thermal Decomposition Methods, Thermochemical Methods.

Renewable Naphtha Market, by End-Use Application:

Based on the End-Use Application, the global renewal naphtha market is segmented into; Bio-Based Plastics (LDPE, PE, PP), Renewable Polymer (Elastomers, Polyolefins, Styrenics).

Renewable Naphtha Market, by Region:

North America and Europe are becoming more important geographical markets in the growth of the worldwide renewable naphtha market due to the existence of a sizable end-user base. Especially, in China and India of the Asia-Pacific region, new revenue streams have emerged. The industry's increased interest in renewable chemicals over the past few years has spurred the boom. Furthermore, the Middle East is very profitable in terms of fresh demand in the global market for renewable naphtha due to the region's expanding oil sector.

Some of the Key Questions Answered in this Report:

Which are the five top players of the Renewable Naphtha market?

How will the Renewable Naphtha market change in the upcoming years?

Which product and application will take a share of the Renewable Naphtha market?

What are the drivers and restraints of the Renewable Naphtha market?

Which regional market will show the highest growth?

What will be the CAGR and size of the Renewable Naphtha market throughout the forecast period?

What is the current market size, what will the market size be in 2030 and what will the growth rate be?

What are the challenges to grow in the market?

What are the market opportunities and challenges faced by the key vendors?

Who are the major competitors and what is their strategy?

What are the barriers to entry for new players in the market?

Renewable Naphtha Market: Segmentation Outlook

Data for growth projections and estimates are included in this study for the Source segment (Animal Fat Waste, Green Hydrogen, Industrial Waste, Liquid Biomass, Used Cooking Oils, Vegetable Oils, and Wood-Based Residue); for the Type segment (Heavy Naphtha, Light Naphtha); for the Process segment (Thermal Decomposition Methods, Thermochemical Methods); for the End-Use Application segment {Bio-Based Plastics (LDPE, PE, PP), Renewable Polymer (Elastomers, Polyolefins, Styrenics)}. The renewable naphtha market forecast period is 2022 to 2030

To view Top Players, Segmentation and other Statistics of Renewable Naphtha Industry, Get Sample Report: @ https://reportsandinsights.com/free-customization/3591

About Reports and Insights:

Reports and Insights is one of the leading market research company which offers syndicate and consulting research around the globe. At Reports and Insights we adhere to the client needs and regularly ponder to bring out more valuable and real outcomes for our customers. We are equipped with strategically enhanced group of researchers and analysts that redefines and stabilizes the business polarity in different categorical dimensions of the market.

Contact Us

Reports and Insights

Tel: +1-(718)-312-8686

For Sales Query: [email protected]

For New Topics & Other Info, Visit: reportsandinsights.com/

#renewableenergy#renewableenergysystems#renewablesindustry#naphtha#energyindustry#energynews#marketgrowth#marketforecast#marketanalysis#maketing#marketdemand#marketresearchreport#marketresearch#marketreport#marketingdigital#industrynews#marketnews#marketsize#marketshare#markettrends#marketingconsultant#industrydevelopment#marketingb2b#consultingfirm

0 notes

Text

Hi.

Gi

#serena flyswatter#thomas flyswatter#bugbo#bugbo gerbo#gradient#joe#flyswatter#fans#just post#naphtha against insects

3 notes

·

View notes

Text

i'm over it

2 notes

·

View notes

Note

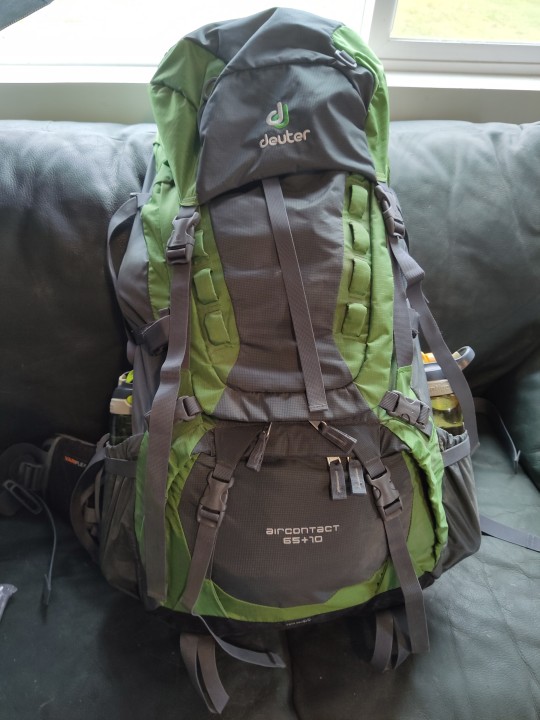

Wait, there's actually people weighing their gear for backpacking? I always thought it was a joke or something. I used to do a lot more backpacking myself, and the average weight for everyone in my troop was 55 pounds. It's really no issue

I mean... I'm mostly doing it because I have cabin fever and am trying to avoid seasonally appropriate work lol.

But maybe I should clarify why my gear weighs so freaking much.

I don't leave the house without a -10 sleeping bag. I live in the north, there's no guarantee you won't hit freezing in July, and I hate being cold.

Lightweight silnylon just doesn't work around here. Even the day hike trails will snag your gear on black spruce or devil's club and rip holes in it. The few truly lightweight items I have are as much gear tape as original material.

I'm also not going out overnight without my Whisperlight stove, fuel, and Spot beacon. Just no.

Ditto a proper tent. The bugs out here will suck you dry without screens, and the summer storms will find their way under, around, or through any kind of tarp and don't announce themselves more than 10 minutes in advance.

I have a pathological aversion to synthetic hiking clothes. I'll bring some in case I get rained out and need them, but my everyday clothes will mostly be natural fibers tough enough to stand up to the brush that don't feel like crap (do not tell me I'm wrong, I already know every expert says not to do this. Too bad. If I can't hike comfortable, why hike at all?)

My solar panel, backup battery, and book may be labelled luxuries on published packing lists, but they're non-negotiable. Again, what's the point backpacking if I'm bored?

Water bottles. A hydration insert has too much potential to get punctured, and is too limited in what you can use the water for without great difficulty. At least 2 full Contigo bottles go everywhere I go. Plus a filter as backup.

This bag has everything I need except a toothbrush, clothes, and food. It weighs 31 pounds.

Most recommendations for someone my size say don't go over 35 pounds, but this doesn't actually feel too bad. Depending on terrain, weather, and trip length, I could easily add another 10 pounds without worrying. There's still lots of room in the bag if I needed it.

And I don't usually head out for multiple days on my own. If I was hiking with T one of us would take the tent and the other would take the kitchen stuff to break up weight a bit.

So the numbers are a lot better than I'd hoped when I started this morning. Not that it's going to matter for the next 6 months.

#thanks for indulging my shenanigans guys#nothing like a perfectly good Sunday when things could get done to daydream about trips i can't do in this weather#it helps that the day pack i take everywhere with me is already almost 20 pounds#with flares bear spray plb gps compass tarp emergency blankets first aid kit a couple jackets water bottles water filter headlamp#spare batteries a couple knives 300 feet of cord dog stuff and whatever rocks i forgot to take out between hikes#also most of my gear was used or thrifted#thats the case for my big pack some of my pots my solar panels and both jackets#i justified buying the tent and bag as school supplies for my outdoor rec classes#and the stove was non-negotiable#it runs on bike gas and kerosene as well as naphtha and might be the nicest piece of gear i own

4 notes

·

View notes

Text

accidentally squirted all over my bed

5 notes

·

View notes

Text

Renewable Naphtha Market Key Players Profile Outlook and Forecast Till 2032

The Reports and Insights, a leading market research company, has recently releases report titled “Renewable Naphtha Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Renewable Naphtha Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Renewable Naphtha Market?

The renewable naphtha market size reached US$ 472.4 Million in 2023. Looking forward, Reports and Insights expects the market to reach US$ 1,104.8 Million by 2032, exhibiting a growth rate (CAGR) of 9.9% during 2024-2032.

What are Renewable Naphtha?

Renewable naphtha is a form of naphtha created from sustainable sources like biomass, algae, or waste products using methods such as pyrolysis, gasification, or fermentation. While chemically akin to conventional naphtha from fossil fuels, it serves as a greener alternative. This renewable naphtha can serve as a raw material for manufacturing different chemicals, including plastics, solvents, and fuels, offering a sustainable and eco-friendly substitute to traditional naphtha sourced from crude oil.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1592

What are the growth prospects and trends in the Renewable Naphtha industry?

The renewable naphtha market growth is driven by various factors. The market for renewable naphtha is experiencing notable growth, fueled by a heightened emphasis on sustainable options within the petrochemical sector. Environmental considerations and regulatory frameworks promoting renewable energy sources are propelling the adoption of renewable naphtha, sourced from biomass, algae, or waste materials. This eco-conscious alternative is increasingly utilized as a raw material for a range of chemicals, including plastics and solvents. Furthermore, advancements in conversion technologies and governmental support for renewable energy are driving further market expansion. Hence, all these factors contribute to renewable naphtha market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Feedstock:

Vegetable Oils

Animal Fats

Algal Biomass

Other Biomass

By Technology:

Hydrotreating

Deoxygenation

Hydrogenation

By Application:

Chemicals & Polymers

Fuels

Others

By End-Use Industry:

Petrochemicals

Transportation

Others

Segmentation By Region:

North America:

United States

Canada

Asia Pacific:

China

India

Japan

South Korea

Australia & New Zealand

Association of Southeast Asian Nations (ASEAN)

Rest of Asia Pacific

Europe:

Germany

The U.K.

France

Spain

Italy

Russia

Poland

BENELUX (Belgium, the Netherlands, Luxembourg)

NORDIC (Norway, Sweden, Finland, Denmark)

Rest of Europe

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

The Middle East & Africa:

Saudi Arabia

United Arab Emirates

South Africa

Egypt

Israel

Rest of MEA (Middle East & Africa)

Who are the key players operating in the industry?

The report covers the major market players including:

Neste Corporation

TotalEnergies

Repsol S.A.

Eni S.p.A.

Honeywell UOP

Chevron Corporation

Axens

INEOS Group AG

Preem AB

OMV Aktiengesellschaft

Enerkem Inc.

REG Life Sciences LLC

Clariant AG

Dow Inc.

LyondellBasell Industries N.V.

View Full Report: https://www.reportsandinsights.com/report/Renewable Naphtha-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd.

1820 Avenue M, Brooklyn, NY, 11230, United States

Contact No: +1-(347)-748-1518

Email: [email protected]

Website: https://www.reportsandinsights.com/

Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/

Follow us on twitter: https://twitter.com/ReportsandInsi1

0 notes

Text

Heavy Aromatic Naphtha Solvent Prices | Pricing | Trend | News | Database | Chart | Forecast

Heavy Aromatic Naphtha Solvent Prices a complex blend of hydrocarbons with a high aromatic content, plays a crucial role in various industrial applications, particularly in the production of high-quality chemicals and as a solvent in different manufacturing processes. Understanding the pricing dynamics of this solvent is essential for businesses involved in its procurement and usage. The cost of Heavy Aromatic Naphtha is influenced by a range of factors, including raw material prices, production costs, and market demand.

In recent years, fluctuations in the price of Heavy Aromatic Naphtha have been notably impacted by changes in crude oil prices. Since Heavy Aromatic Naphtha is derived from crude oil through a refining process, its cost closely tracks the movement of crude oil markets. Periods of high crude oil prices typically lead to increased costs for Heavy Aromatic Naphtha, as refineries pass on their higher production costs to consumers. Conversely, when crude oil prices decline, the cost of Heavy Aromatic Naphtha may also decrease, though this relationship can be influenced by other market dynamics.

Another significant factor affecting Heavy Aromatic Naphtha prices is the level of demand from key industries. Heavy Aromatic Naphtha is widely used in the production of chemicals such as resins, adhesives, and coatings. Therefore, changes in demand from these sectors can drive fluctuations in its price. For instance, a surge in the construction or automotive industry can lead to increased demand for Heavy Aromatic Naphtha, driving prices higher. Similarly, a downturn in these industries can result in lower prices due to reduced demand.

Get Real Time Prices for Heavy Aromatic Naphtha Solvent : https://www.chemanalyst.com/Pricing-data/heavy-aromatic-naphtha-solvent-1177

Supply chain disruptions also play a critical role in shaping the prices of Heavy Aromatic Naphtha. Events such as geopolitical tensions, natural disasters, or logistical issues can impact the production and distribution of this solvent. For example, hurricanes in key oil-producing regions or political instability in major oil-exporting countries can cause significant disruptions in the supply chain, leading to price volatility. Businesses relying on Heavy Aromatic Naphtha must stay informed about such disruptions to manage their procurement strategies effectively.

Regulatory changes and environmental considerations are additional factors that can influence the pricing of Heavy Aromatic Naphtha. Governments around the world are increasingly implementing stricter environmental regulations aimed at reducing emissions and promoting the use of greener alternatives. These regulations can impact the production processes of Heavy Aromatic Naphtha, potentially increasing costs for manufacturers. As the industry adapts to these regulatory changes, businesses may experience shifts in the pricing structure of this solvent.

Technological advancements in refining processes also contribute to the pricing trends of Heavy Aromatic Naphtha. Innovations that improve the efficiency of refining operations or enable the extraction of higher yields of Heavy Aromatic Naphtha from crude oil can influence its market price. Conversely, outdated or less efficient technologies may lead to higher production costs, affecting the final price of the solvent.

Market sentiment and speculative trading can further impact Heavy Aromatic Naphtha prices. Traders and investors in the commodities markets often react to various economic indicators and geopolitical events, which can lead to price swings. For instance, speculation about future oil supply shortages or changes in global economic conditions can lead to increased volatility in the prices of Heavy Aromatic Naphtha.

To navigate the complexities of Heavy Aromatic Naphtha pricing, businesses must adopt strategic approaches to procurement and inventory management. Keeping a close eye on global oil markets, understanding industry-specific demand trends, and staying informed about regulatory developments are crucial for managing costs effectively. Additionally, engaging with reliable suppliers and exploring long-term contracts or hedging strategies can help mitigate the impact of price fluctuations.

In summary, the pricing of Heavy Aromatic Naphtha is influenced by a multifaceted interplay of factors, including crude oil prices, demand from key industries, supply chain disruptions, regulatory changes, technological advancements, and market sentiment. Businesses involved in the use or procurement of this solvent must stay vigilant and adaptable to these dynamics to effectively manage their costs and ensure a steady supply.

Get Real Time Prices for Heavy Aromatic Naphtha Solvent : https://www.chemanalyst.com/Pricing-data/heavy-aromatic-naphtha-solvent-1177

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Heavy Aromatic Naphtha Solvent#Heavy Aromatic Naphtha Solvent Price#Heavy Aromatic Naphtha Solvent Prices#Heavy Aromatic Naphtha Solvent Pricing

0 notes

Text

Unlocking the Potential: MDVK as a Premier Mineral Turpentine Oil Supplier in India

In the realm of industrial chemicals and solvents, Mineral Turpentine Oil (MTO) stands out as a versatile and indispensable substance. Its uses span across various sectors, including paint manufacturing, cleaning agents, and as a solvent in industries like printing and textile. Amidst the growing demand for high-quality Mineral Turpentine Oil Suppliers in India, MDVK emerges as a leading supplier, embodying reliability, quality, and innovation.

Reliability Through Consistency

MDVK has established a strong reputation for reliability in the supply of Mineral Turpentine Oil. This reliability stems from consistent quality control measures that ensure every batch of MTO meets stringent standards. Customers rely on MDVK not just for timely deliveries but also for the assurance of a product that consistently performs as expected, making it a preferred choice for businesses across sectors.

Quality at Every Stage

Quality isn't just a buzzword at MDVK; it's ingrained in every stage of their operations. From sourcing raw materials to the final product, rigorous quality checks and adherence to industry standards are non-negotiable. This commitment to quality extends beyond mere compliance; it's about delivering excellence that adds tangible value to customers' processes and products.

Innovation Driving Progress

Innovation is the cornerstone of MDVK's approach. They don't just supply MTO; they strive to innovate and evolve their products to meet the changing needs of industries. This forward-thinking mindset has led to the development of specialized MTO variants tailored for specific applications, offering customers enhanced performance and efficiency.

Customer-Centric Solutions

At MDVK, the customer is at the heart of everything they do. Understanding the unique requirements of each industry and customer segment, they offer tailored solutions that go beyond mere product delivery. Whether it's technical support, custom formulations, or logistical assistance, MDVK partners with customers to ensure seamless operations and mutual growth.

Sustainable Practices

In an era where sustainability is paramount, MDVK takes its environmental responsibilities seriously. Through eco-friendly manufacturing processes, waste minimization strategies, and responsible sourcing, they contribute to a greener, more sustainable future. Customers choosing MDVK not only benefit from top-notch products but also align with a partner committed to environmental stewardship.

Global Reach, Local Commitment

While MDVK has a global footprint, their commitment to local communities remains unwavering. They actively engage in social responsibility initiatives, supporting local economies and contributing to societal well-being. This dual focus on global competitiveness and local impact sets MDVK apart as a socially conscious corporate entity.

As the demand for Mineral Turpentine Oil Suppliers in India to rise, MDVK is poised for even greater success. Their blend of reliability, quality, innovation, customer-centricity, sustainability, and global-local balance positions them as a trusted partner for businesses seeking excellence in MTO supply. With a clear vision for the future and a commitment to continuous improvement, MDVK is set to lead the way in India's MTO market for years to come.

#ethyl acetate suppliers in delhi#Base oil suppliers in india#Mineral Turpentine Oil Suppliers in India#Solvent Naphtha Dealers in india#mdvk

0 notes

Text

Big Mac

This year marks the 200th anniversary of the mac. Here's how Charles Macintosh discovered that a rubber layer between two pieces of cloth made for a #waterproof #fabtic #textiles

The adage “muck and money go together”, recorded by John Ray in A collection of English proverbs (1678), might well have served as the Macintosh family motto. Father George, a dye manufacturer, sent round collectors to pay the poorer denizens of Glasgow for their urine, from which he extracted ammonia. This he used in the manufacture of cudbear, a valuable violet-reddish dye obtained from…

View On WordPress

#Charles Macintosh#Charles Tennant#George Macintosh#John Ray#mackintosh#naphtha#St Rollo Chemical Works

0 notes

Text

Solvent Naphtha (Petroleum) Heavy Arom Market and Its Major Market Players: Powering Industries with Aromatic Elegance

Introduction:

The world of chemicals and industrial processes relies on the versatility and reliability of Solvent Naphtha (Petroleum) Heavy Arom. These heavy aromatic solvents are indispensable in various applications, serving as key components in the production of paints, coatings, and a range of industrial products. The Solvent Naphtha (Petroleum) Heavy Arom Market is on the brink of substantial growth, with expectations to surge from USD 4.60 billion in 2022 to USD 5.10 billion by 2030, marking a steady CAGR of 1.40% during the forecast period. In this article, we will explore the market's size, scope, dynamics, and recent developments.

Get a Sample PDF of the Report:https://www.reportprime.com/enquiry/sample-report/755

Solvent Naphtha (Petroleum) Heavy Aromatic Market: Unveiling the Power of Versatile Hydrocarbons

In the complex web of hydrocarbon-based products, the Solvent Naphtha (Petroleum) Heavy Aromatic market stands as a versatile and indispensable segment. Derived from the distillation of petroleum, heavy aromatic solvent naphtha is a potent, multifaceted solution. Its unique blend of properties, including high solvency power and low impurities, renders it a vital component in numerous industries, from paints and coatings to the production of rubber and adhesives. This heavy aromatic variant's capacity to dissolve and disperse various substances while adhering to stringent environmental and regulatory standards showcases its adaptability and sustainability. As industries continue to demand efficient and eco-friendly solutions, the Solvent Naphtha (Petroleum) Heavy Aromatic market remains a key player in the ever-evolving landscape of hydrocarbon-derived chemicals, proving its worth as a reliable and essential resource in our modern world.

Market Size and Scope:

The Solvent Naphtha (Petroleum) Heavy Arom market encompasses a range of heavy aromatic solvents that find applications across multiple industries. These solvents are valued for their ability to dissolve or disperse various substances and provide crucial characteristics in end products. As the demand for these solvents continues to grow, the market is expected to expand from USD 4.60 billion in 2022 to USD 5.10 billion by 2030, underscoring their importance in industrial processes and product development.

Market Dynamics and Recent Developments:

The Solvent Naphtha (Petroleum) Heavy Arom market dynamics are influenced by factors such as the expanding petrochemical industry, the need for specialized solvents in paints and coatings, and the growing demand for high-performance materials. Recent developments include the formulation of eco-friendly heavy aromatic solvents, responding to the increasing focus on sustainability and environmental regulations. These developments aim to provide industries with environmentally responsible options while maintaining performance.

Key Players in the Solvent Naphtha (Petroleum) Heavy Arom Market:

1. Shell:

Shell is a leading player in the Solvent Naphtha (Petroleum) Heavy Arom market, known for its commitment to quality and innovation. The company has established a strong presence in the market and has contributed to its steady growth. In 2021, Shell reported total sales revenue of USD 180.5 billion, with a competitive CAGR in the Solvent Naphtha (Petroleum) Heavy Arom sector of approximately 1.3%.

2. ExxonMobil:

ExxonMobil is a well-established player with a significant role in the Solvent Naphtha (Petroleum) Heavy Arom market. The company is recognized for its dedication to research and development, leading to high-quality products. In 2021, ExxonMobil reported total sales revenue of USD 227.6 billion, with a noteworthy CAGR in the Solvent Naphtha (Petroleum) Heavy Arom business of approximately 1.2%.

3. TotalEnergies:

TotalEnergies, an emerging player in the Solvent Naphtha (Petroleum) Heavy Arom market, has made significant strides in providing high-quality solvents for various industrial applications. The company focuses on delivering innovative solutions that align with industry demands. In 2021, they reported total sales revenue of USD 168.4 billion, with an impressive CAGR in the Solvent Naphtha (Petroleum) Heavy Arom sector of approximately 1.4%.

4. SK Geo Centric:

SK Geo Centric is a growing player in the Solvent Naphtha (Petroleum) Heavy Arom market, dedicated to manufacturing solvents that cater to the evolving requirements of the petrochemical industry. In 2021, SK Geo Centric reported total sales revenue of USD 1.2 billion, with a competitive CAGR in the Solvent Naphtha (Petroleum) Heavy Arom business of approximately 1.1%.

5. Hanwha Total:

Hanwha Total is an established player in the Solvent Naphtha (Petroleum) Heavy Arom market, with a significant role in the production of high-quality solvents. The company has a strong reputation for its commitment to excellence. In 2021, Hanwha Total reported total sales revenue of USD 10.6 billion, with a noteworthy CAGR in the Solvent Naphtha (Petroleum) Heavy Arom sector of approximately 1.2%.

6. Flint Hills Resources:

Flint Hills Resources is an emerging player in the Solvent Naphtha (Petroleum) Heavy Arom market, dedicated to producing innovative solvents that cater to the growing demand for specialized industrial applications. In 2021, Flint Hills Resources reported total sales revenue of USD 21.4 billion, with an impressive CAGR in the Solvent Naphtha (Petroleum) Heavy Arom business of approximately 1.3%.

7. Haltermann Carless:

Haltermann Carless, a well-known company with a history of innovation, consistently expands its market reach in the Solvent Naphtha (Petroleum) Heavy Arom market. In 2021, Haltermann Carless reported total sales revenue of USD 1.0 billion, with a competitive CAGR in the Solvent Naphtha (Petroleum) Heavy Arom sector of approximately 1.1%.

8. Braskem:

Braskem is a growing player in the Solvent Naphtha (Petroleum) Heavy Arom market, committed to manufacturing materials that align with the evolving needs of the petrochemical industry. In 2021, Braskem reported total sales revenue of USD 16.0 billion, with an impressive CAGR in the Solvent Naphtha (Petroleum) Heavy Arom business of approximately 1.3%.

9. DHC Solvent Chemie GmbH:

DHC Solvent Chemie GmbH is an established player in

the Solvent Naphtha (Petroleum) Heavy Arom market, with a significant role in the production of high-quality solvents for various industrial applications. In 2021, DHC Solvent Chemie GmbH reported total sales revenue of USD 0.6 billion, with a noteworthy CAGR in the Solvent Naphtha (Petroleum) Heavy Arom sector of approximately 1.0%.

10. Ganga Rasayanie Pvt Ltd:

Ganga Rasayanie Pvt Ltd is an emerging player in the Solvent Naphtha (Petroleum) Heavy Arom market, focused on producing materials that cater to the growing demand for specialized industrial applications. In 2021, Ganga Rasayanie Pvt Ltd reported total sales revenue of USD 0.5 billion, with a competitive CAGR in the Solvent Naphtha (Petroleum) Heavy Arom business of approximately 1.0%.

11. Sinopec:

Sinopec, a well-established player in the Solvent Naphtha (Petroleum) Heavy Arom market, is dedicated to producing additives that meet the growing need for efficient industrial solutions. In 2021, Sinopec reported total sales revenue of USD 416.1 billion, with a noteworthy CAGR in the Solvent Naphtha (Petroleum) Heavy Arom sector of approximately 1.2%.

12. CNPC:

CNPC is a growing player in the Solvent Naphtha (Petroleum) Heavy Arom market, committed to manufacturing materials that align with the evolving needs of the petrochemical industry. In 2021, CNPC reported total sales revenue of USD 421.1 billion, with an impressive CAGR in the Solvent Naphtha (Petroleum) Heavy Arom business of approximately 1.3%.

New and Unique Developments:

Recent developments in the Solvent Naphtha (Petroleum) Heavy Arom market include innovations in the production of low-VOC (volatile organic compounds) solvents, which align with stringent environmental regulations. These developments aim to provide industries with environmentally responsible options while maintaining performance. In addition, there is a growing trend towards solvent recycling and waste reduction, further underlining the market's focus on sustainability.

Purchase this report:https://www.reportprime.com/checkout?id=755&price=3590

Conclusion:

The Solvent Naphtha (Petroleum) Heavy Arom market is set to play a vital role in various industrial processes, ranging from petrochemicals to paints and coatings. Key players, including Shell, ExxonMobil, TotalEnergies, SK Geo Centric, Hanwha Total, Flint Hills Resources, Haltermann Carless, Braskem, DHC Solvent Chemie GmbH, Ganga Rasayanie Pvt Ltd, Sinopec, and CNPC, are well-positioned to lead the way in the evolving Solvent Naphtha (Petroleum) Heavy Arom market, providing innovative and sustainable solutions for diverse industries.

Visit our website: https://www.reportprime.com/

0 notes

Text

Bio-Based Naphtha Market: Renewable Energy Regulations

Produced from organic feedstocks through advanced bio-refining processes, bio-based naphtha offers numerous applications across various industries. These include petrochemicals, plastics, and biofuels. The eco-friendly liquid fuel also contributes to a reduced carbon footprint and an environmentally conscious future. As per Inkwood Research, the global bio-based naphtha market is anticipated to record a CAGR of 17.07% in terms of revenue and 16.19% in terms of volume during the forecast period, 2023 to 2032.

With the rise in measures to encourage bio-based products’ use, businesses and consumers are increasingly prioritizing environmentally responsible practices. For example, the BioVerno Naphtha by UPM Corporation (Finland) is a sustainable alternative for replacing fossil raw materials in chemical production. Its lower carbon footprint and decreased reliance on finite resources help industries minimize their environmental impact.

Furthermore, several regions globally have implemented a number of regulations for sustainability and renewable energy, which has further increased the demand and adoption of bio-based naphtha.

These include –

United States: In the United States, the Renewable Fuel Standard (RFS) mandates the blending of biofuels, including bio-based naphtha, into transportation fuels to reduce greenhouse gas emissions. Essentially, the national policy requires a certain volume of renewable fuel to reduce or replace the quantity of petroleum-based transportation fuel, jet fuel, or heating oil.

European Union: With several initiatives to encourage the use of bio-based products, the Europe bio-based naphtha market is set to dominate the the global market. The region has also implemented numerous regulations for sustainability and renewable energy management. For example, The Bioeconomy Strategy, as well as the Renewable Energy Directive (RED), provide clear criteria and encourage the use of renewable feedstocks. In this regard, the Renewable Energy Directive (RED) sets targets regarding the use of renewable energy in fuels, thus promoting the adoption of bio-based naphtha.

Brazil: In an effort to increase the use of biofuels, while reducing greenhouse gas emissions, Brazil’s energy ministry launched its national biofuels policy, RenovaBio, in 2018. The key concept of RenovaBio is to reduce carbon emissions and improve the life-cycle performance of biofuels through a carbon credit market. Moreover, it also incentivizes the production and use of bio-based fuels, including naphtha, through decarbonization credits.

India: In India, the National Policy on Biofuels encourages the production and use of biofuels to reduce fossil fuel dependence and mitigate environmental impacts. The policy aims to utilize, develop, and promote domestic feedstock and its usage in the production of biofuels. While contributing to national energy security, it also helps in creating new employment opportunities.

Australia: Australia’s renewables deployment has a positive outlook given the success of rooftop solar, ambitious targets, as well as increased funding at federal and state levels. Furthermore, in addition to passing the Climate Change Act in 2022, Australia also aims to increase the share of low-carbon power generation by 2030 – with 82% derived from renewable sources, thus influencing the demand for bio-based naphtha as a feedstock.

Japan & Germany: Feed-in Tariff (FIT) is designed to support the development of renewable energy sources by offering a guaranteed, above-market price for producers. The policy also provides incentives for renewable energy generation, fostering the development of bio-based fuel and chemical production, including naphtha. Although common in the United States, FITs are used most notably in Japan and Germany.

In all, the aforementioned regulations reflect the global effort to transition towards sustainable and green energy sources. With a strong focus on reducing carbon emissions and promoting the use of renewable feedstock, these sustainable initiatives are set to play an essential role in boosting the global bio-based naphtha market growth during the forecast period.

FAQ

How is bio-based naphtha produced from biomass sources?

Bio-based or renewable naphtha is typically produced through processes like pyrolysis, gasification, or bio-refining, where biomass feedstocks are converted into liquid hydrocarbons.

What are the major companies operating in the global bio-based naphtha market?

Euglena Co Ltd, ENI Spa, Phillips 66, etc., are among the top companies operating in the global bio-based naphtha market.

#bio-based naphtha market forecast#bio-based naphtha market#BIO CHEMICALS#inkwood research#market research reports

0 notes

Link

The VM&P Naphtha market has witnessed a growth from USD 3,450 million to USD 6,210 million from 2023 to 2031 with a CAGR of 5.6%

0 notes