#nbfcs

Explore tagged Tumblr posts

Text

#nbfcs#nbfcsinindia#nonbankingfinancialcompany#bajajfinserv#adityabirlacapital#muthootfincorp#mannapuramfinance#poonawallfincorp#shriramfinance#financialservices

2 notes

·

View notes

Text

0 notes

Text

Now is the Perfect Time for First-Time Homebuyers

𝐌𝐫. 𝐍𝐢𝐤𝐮𝐧𝐣 𝐒𝐚𝐧𝐠𝐡𝐚𝐯𝐢, 𝐌𝐚𝐧𝐚𝐠𝐢𝐧𝐠 𝐃𝐢𝐫𝐞𝐜𝐭𝐨𝐫, 𝐕𝐞𝐞𝐧𝐚 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐞𝐫𝐬, expresses his thoughts through Realty+ Magazine, where he shares why, now may be an ideal time for Indians looking to buy their first home.

Read More: https://www.rprealtyplus.com/interviews/now-is-the-perfect-time-for-first-time-homebuyers-117602.html

#RealtyPlus#VeenaDevelopers#property#homebuyers#Interest#Rates#homeloan#Banks#NBFCs#HousingFinance#Urbanisation#PMAY#RERA#Tax#AffordableHousing

0 notes

Text

This blog post explains the concept of Inspection as a Service and its benefits for OEMs, banks, and NBFCs. It highlights how this service enhances asset quality, reduces financial risks, and improves decision-making processes for these industries. Learn more at https://cloud.droom.in/blog/what-is-inspection-as-a-service-how-it-help-oems-banks-and-nbfcs

0 notes

Text

Poonawalla Fincorp's Strategic Triumph: A Blueprint for Success in Non-Banking Financial Sector

Poonawalla Fincorp Limited, under the astute leadership of Abhay Bhutada, MD, has emerged as a trailblazer in the non-banking financial sector, achieving remarkable milestones including Triple AAA ratings and an impressive 84% profit surge. This article explores the strategic evolution, key pillars of transformation, financial performance, attainment of Triple AAA ratings, and the future outlook of Poonawalla Fincorp, showcasing its trajectory towards becoming a leader in the industry.

Strategic Evolution: A Visionary Journey

Since its acquisition in 2021, Poonawalla Fincorp has undergone a strategic metamorphosis under Abhay Bhutada's visionary guidance. The introduction of Vision 2025 set ambitious targets, including substantial growth in assets under management (AUM) and profitability, along with a concerted effort to reduce non-performing assets (NPAs). Notably, the company surpassed its Net NPA target of below 1% by 2025 and achieved Gross NPA below 1% and Net NPA below 0.5% by May 31, 2024, demonstrating the efficacy of its strategic roadmap.

Key Pillars Driving Transformation

1. Strategic Business Model: Poonawalla Fincorp pivoted towards a customer-centric model, focusing on consumer and MSME finance segments. This strategic shift allowed the company to tap into high-growth areas, providing tailored financial solutions to meet evolving client needs and ensuring revenue diversification.

2. Robust Risk & Governance Practices: Stringent risk management and governance protocols were instrumental in maintaining asset quality. Through rigorous credit underwriting standards and continuous monitoring, the company effectively mitigated risks, resulting in exemplary asset quality. Moreover, top-tier governance frameworks enhanced transparency and bolstered investor confidence.

3. Enhanced Collection Efficiency: Improving collection efficiency played a crucial role in minimizing NPAs. Leveraging advanced technology and analytics, Poonawalla Fincorp streamlined its collection processes, thereby reducing defaults and ensuring timely repayments. This operational efficiency safeguarded the company's assets and contributed to its profitability.

Financial Performance and Milestones

Poonawalla Fincorp's financial performance underscores the success of its strategic endeavors. With AUM surpassing Rs. 25,000 crore and PAT exceeding Rs. 1,000 crore in FY2024, the company exhibited robust growth. Notably, this growth was accompanied by an improvement in asset quality, with both Gross NPA and Net NPA well below targeted levels.

Also Read: Abhay Bhutada MD's Strategic Move Sparks Poonawalla Fincorp’s Stock Rally And Impressive Growth

Factors Fueling Financial Success

1. Diversified Portfolio: Poonawalla Fincorp's diversified portfolio across consumer and MSME finance sectors mitigated risks and capitalized on growth opportunities. This diversification strategy ensured a stable revenue stream and reduced susceptibility to sector-specific downturns, fostering customer loyalty.

2. Technology and Innovation: Investment in technology and innovation has been integral to Poonawalla Fincorp's growth strategy. Adoption of advanced data analytics, digital lending platforms, and AI-driven risk assessment tools enhanced operational efficiency, improved customer experience, and reduced costs, providing a competitive edge.

3. Operational Efficiency: Streamlining operations and optimizing processes resulted in significant cost savings. Poonawalla Fincorp's focus on operational efficiency facilitated competitive pricing, preserving margins, and enhancing customer satisfaction, all while ensuring robust financial performance.

Attainment of Triple AAA Ratings

The achievement of Triple AAA ratings underscores Poonawalla Fincorp's financial strength, superior asset quality, and robust risk management framework. These ratings affirm the company's capacity to meet financial obligations and navigate market challenges effectively.

Drivers Behind AAA Ratings

1. Strong Capital Base: Poonawalla Fincorp's prudent capital management practices and robust capital base ensured financial stability and resilience against potential losses, fostering investor confidence.

2. Superior Asset Quality: Low NPAs and high-quality assets played a pivotal role in securing AAA ratings. Stringent credit assessment and proactive risk management preserved the health of the loan portfolio, bolstering asset quality.

3. Consistent Profitability: Sustained profitability and a diversified revenue stream highlighted Poonawalla Fincorp's financial prowess. The company's ability to generate strong financial results consistently underscored the effectiveness of its business model and strategic initiatives.

Also Read: How Poonawalla Fincorp and IndusInd Bank’s Co-Branded RuPay Credit Card Caters To The Growing Digital Financial Services in India.

Future Outlook and Vision 2025

Poonawalla Fincorp's accomplishments lay a solid foundation for future growth, aligned with Vision 2025. Emphasizing asset quality enhancement, portfolio expansion, and technological innovation, the company is poised for continued success.

Strategic Priorities Ahead

1. Product Offerings Expansion: Poonawalla Fincorp aims to diversify its product offerings to cater to a broader customer base, capturing new market opportunities and enhancing value proposition.

2. Digital Transformation: Embracing digitalization remains pivotal for the company's future success, enhancing operational efficiency, customer experience, and risk management capabilities.

3. Geographical Expansion: Expansion into new geographies will enable Poonawalla Fincorp to tap into underserved markets, diversify revenue streams, and mitigate regional risks.

4. Sustainable Growth: Responsible lending practices and adherence to ESG principles will underpin the company's strategy, ensuring long-term value creation and stakeholder satisfaction.

Also Read: Optimising Net Interest Margin (NIM) In The Financial Sector (With Examples)

Conclusion: Building on Success

Poonawalla Fincorp's journey to Triple AAA ratings and significant profit expansion epitomizes strategic vision, leadership, and operational excellence. As the company navigates future challenges and opportunities, it remains committed to delivering sustained value to stakeholders and setting new benchmarks in the NBFC sector.

With its steadfast focus on innovation, customer-centricity, and operational efficiency, Poonawalla Fincorp is poised to uphold its position as a leader in the non-banking financial landscape, driving continued growth and prosperity.

0 notes

Text

Poonawalla Fincorp Achieves New Heights in Asset Quality: A Landmark Achievement

Poonawalla Fincorp Limited, a key player in the non-banking financial company (NBFC) sector, focusing on consumer and MSME finance, has reached a remarkable milestone by May 31, 2024. The company has reported a Gross NPA (GNPA) below 1 percent and a Net NPA (NNPA) below 0.5 percent, highlighting its exceptional asset quality and financial health. This success showcases Poonawalla Fincorp’s solid growth in Assets Under Management (AUM) and profitability.

Leadership and Vision

Under the adept leadership of Abhay Bhutada, Poonawalla Fincorp has risen as a leader in the lending space, spearheading transformative changes in the NBFC sector over the past three years. With AUM exceeding Rs. 25,000 crore and a Profit After Tax (PAT) surpassing Rs. 1,000 crore in FY2024, the company has made substantial advancements.

Bhutada stated, “When we acquired the company in 2021, our Vision 2025 aimed to bring NNPA below 1 percent by 2025. Achieving GNPA below 1 percent and NNPA below 0.5 percent ahead of schedule by May 31, 2024, reflects our strategic business model, robust risk management practices, and enhanced collection efficiency.”

Strategic Initiatives and Financial Performance

The impressive reduction in GNPA and NNPA is attributed to a combination of business growth, prudent credit policies, and enhanced collection efficiency. Poonawalla Fincorp’s strategic focus on a balanced portfolio, strong risk management frameworks, and leveraging technology for efficient collection processes has yielded significant results.

Maintaining strong asset quality while scaling operations is challenging, yet Poonawalla Fincorp’s substantial growth in AUM and profitability highlights the effectiveness of its strategic initiatives and commitment to financial discipline.

Also Read: Abhay Bhutada Leads Poonawalla Fincorp To Record Low NPA And Unprecedented Growth

Superior Asset Quality

Achieving GNPA below 1 percent and NNPA below 0.5 percent marks a significant milestone. GNPA measures the total non-performing assets in the company’s portfolio, while NNPA accounts for these assets after deducting provisions for bad loans. These metrics are critical indicators of an NBFC’s loan portfolio health.

Lower GNPA and NNPA percentages indicate superior asset quality and effective credit risk management. This achievement is particularly noteworthy in the NBFC sector, which often deals with higher-risk customer segments compared to traditional banks. Poonawalla Fincorp’s success underscores its strong risk management practices and operational excellence.

Strategic Business Model

The company’s business model has been crucial in achieving and maintaining superior asset quality. Poonawalla Fincorp has focused on a diversified portfolio that serves both consumer and MSME segments, mitigating risks associated with any single customer segment. The company’s emphasis on digital lending and advanced analytics has enhanced credit assessment and monitoring processes.

By leveraging technology, Poonawalla Fincorp has streamlined operations, improved customer experience, and increased collection efficiency. Digital platforms have enabled the company to reach a broader customer base and offer seamless services, contributing to its growth and profitability.

Robust Risk Management and Governance Practices

Effective risk management and governance practices are central to Poonawalla Fincorp’s strategy for achieving low NPAs. The company has implemented stringent credit policies and procedures to ensure prudent lending. Regular monitoring and assessment of the loan portfolio facilitate early identification and resolution of potential issues, minimizing their impact on asset quality.

Poonawalla Fincorp’s governance practices ensure compliance with regulatory requirements and industry best practices. The company’s commitment to transparency and accountability has fostered trust among stakeholders, including investors, customers, and regulators.

Also Read: Poonawalla Fincorp's Strategic Entry Into The Credit Card Market: What Investors Should Know

Improved Collection Efficiency

Improved collection efficiency has been a critical factor in reducing NPAs. Poonawalla Fincorp has invested in advanced collection systems and processes to ensure timely recovery of dues. The company’s collection teams are equipped with the necessary tools and training to handle collections effectively, even in challenging circumstances.

A proactive approach to collections has enabled Poonawalla Fincorp to maintain high recovery rates and reduce delinquent accounts. This focus on efficient collections has been instrumental in achieving and maintaining low levels of GNPA and NNPA.

Market Reaction and Financial Performance

The market has responded positively to Poonawalla Fincorp’s achievement in reducing GNPA and NNPA to such low levels. The company’s stock has seen favorable responses, reflecting investor confidence in its financial health and growth prospects. This milestone has further solidified Poonawalla Fincorp’s position in the NBFC sector, enhancing its reputation as a reliable and well-managed financial institution.

In recent quarters, the company’s financial performance has been robust, with significant growth in AUM and profitability. In FY2024, Poonawalla Fincorp’s AUM crossed Rs. 25,000 crore, and PAT exceeded Rs. 1,000 crore. These figures underscore the company’s ability to scale its operations while maintaining strong financial discipline.

Future Outlook

Looking ahead, Poonawalla Fincorp aims to continue its growth trajectory by focusing on consumer and MSME finance, further strengthening its risk management practices, and leveraging technology to drive efficiency. The company’s proactive approach and commitment to excellence position it well to achieve its long-term goals and maintain its leadership position in the NBFC sector.

The NBFC sector in India is poised for growth, driven by increasing demand for credit from various customer segments. Poonawalla Fincorp’s strong foundation, strategic vision, and operational excellence make it well-equipped to capitalize on these opportunities. The company plans to expand its product offerings and geographical reach, further enhancing its market presence.

Also Read: Re-imagining The Finance Business In The Digital Era

Industry Implications

Poonawalla Fincorp’s achievement sets a benchmark in the NBFC sector, demonstrating how strategic vision and robust operational execution can lead to significant improvements in asset quality. This milestone not only enhances the company’s reputation but also boosts investor confidence. Other NBFCs can learn valuable lessons from Poonawalla Fincorp’s approach to risk management, governance, and operational efficiency.

The reduction in NPAs also has positive implications for the broader financial ecosystem. By maintaining low levels of delinquent accounts, Poonawalla Fincorp contributes to the stability and resilience of the financial sector. This, in turn, supports economic growth by ensuring the availability of credit to productive sectors.

Comparison with Peers

Comparing Poonawalla Fincorp’s performance with other NBFCs highlights its achievements. While many NBFCs struggle to manage asset quality, Poonawalla Fincorp has set a new standard with its low GNPA and NNPA levels. This comparison underscores the effectiveness of the company’s strategies and its commitment to excellence.

Poonawalla Fincorp’s focus on technology, strong governance, and efficient collections sets it apart from its peers. The company’s ability to achieve and maintain low NPAs while scaling its operations is a testament to its strategic vision and operational capabilities. Other NBFCs can benefit from adopting similar approaches to enhance their asset quality and financial performance.

Conclusion

Poonawalla Fincorp’s achievement of GNPA below 1 percent and NNPA below 0.5 percent is a testament to its strong governance, strategic foresight, and operational excellence. This milestone underscores the company’s ability to deliver superior financial performance while maintaining high standards of asset quality, setting a new benchmark in the NBFC industry.

By focusing on a diversified portfolio, leveraging technology, implementing robust risk management practices, and enhancing collection efficiency, Poonawalla Fincorp has successfully reduced its NPAs to industry-leading levels. The company’s strong financial performance and market reception further highlight the effectiveness of its strategies.

Looking ahead, Poonawalla Fincorp, under the leadership of Abhay Bhutada, is well-positioned to continue its growth trajectory and maintain its leadership position in the NBFC sector. The company’s commitment to excellence and proactive approach to managing risks and opportunities will drive its future success, benefiting stakeholders and contributing to the stability and growth of the financial ecosystem.

In conclusion, Poonawalla Fincorp’s remarkable milestone in asset quality is a significant achievement that sets a new benchmark in the NBFC sector. The company’s strategic initiatives, robust risk management, and operational excellence have paved the way for sustained growth and financial success. As Poonawalla Fincorp continues to build on this foundation, it is poised to achieve even greater heights in the years to come.

0 notes

Text

NBFCs and Rule-Based Lending in India

The Indian NBFC sector has been an important pillar of credit growth and an aide to the banks, since long. Especially, in areas like micro-finance, small medium enterprises, factoring, and infrastructure, NBFCs are able to cater to niches that banks may not be able to, purely by virtue of their size and risk protocols. The total credit extended by NBFCs has jumped from approximately one-sixth of…

View On WordPress

0 notes

Text

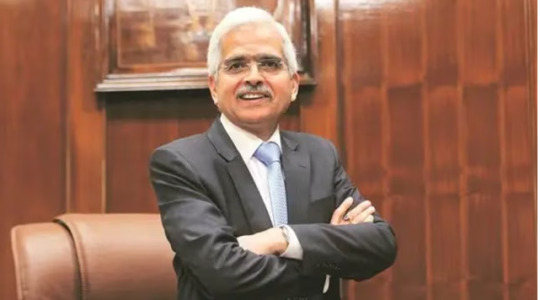

Insights from RBI Governor Shaktikanta Das

In a recent address, Reserve Bank of India (RBI) Governor Shaktikanta Das shared valuable insights on various aspects crucial to India’s economic landscape.

1. Growth Outlook: Das highlighted a positive growth trajectory for the Indian economy, with the National Statistical Office (NSO) forecasting a 7.6% growth in FY24. He emphasized that this sustained growth, averaging 8% over a three-year period, signifies an increase in the country’s potential growth.

2. Financial Stability: Addressing the importance of governance and regulatory compliance, Das stressed that Non-Banking Financial Companies (NBFCs) and other financial entities must prioritize these factors. Considering their operation with public funds, maintaining quality governance is imperative. He emphasized that ensuring financial stability is a collective responsibility, with the RBI committed to engaging with financial entities.

3. Forex Reserves Management: Das highlighted India’s record-high foreign exchange reserves, reaching $645.6 billion as of March 29. He discussed the impact of geopolitical events such as the Ukraine-Russia conflict, which led to temporary fluctuations in reserves. Emphasizing prudent management, Das assured that India’s forex reserves were utilized judiciously, serving as a robust safeguard during times of economic uncertainty.

Overall, Das’s insights provide valuable perspectives on growth, financial stability, and forex management crucial for India’s economic resilience and prosperity.

0 notes

Text

In the dynamic world of finance, staying abreast of regulatory changes and market movements is paramount. The recent actions by the Reserve Bank of India (RBI) have sent ripples across the financial sector, particularly impacting non-banking financial companies (NBFCs) like IIFL and JM Financials. Here's a comprehensive overview of these developments and their implications on the NBFCs share market.

The RBI, as the apex regulatory body in India's financial sector, plays a pivotal role in maintaining stability and fostering growth. Its recent actions have been directed towards tightening regulatory oversight, particularly in the NBFC segment, to mitigate systemic risks and safeguard investor interests.

In response to evolving market dynamics and emerging challenges, the RBI has rolled out a series of measures aimed at enhancing transparency, strengthening governance frameworks, and bolstering risk management practices within NBFCs. These initiatives seek to promote financial stability, enhance market integrity, and foster confidence among stakeholders.

0 notes

Text

Navigating Evolution In Banking And NBFCs Amid Market Shifts

In the fast-paced world of finance, things are always changing. Banks and other financial companies are always trying to keep up with these changes. They have to adjust to new trends and shifts in the market. As everyone involved tries to find their way through these changes, it's really important to keep a good balance.

On one hand, they need to make use of new technologies that can help them work better. But at the same time, they shouldn't forget about the basic ideas that have always been important in finance. These ideas are like the foundation of the whole industry, and they need to be preserved even as things around them change.

Understanding Market Dynamics

In the whirlwind of today's financial frenzy, institutions find themselves engulfed in a storm of complexities and opportunities. The dawn of technology has unleashed a tidal wave of change, transforming the once-staid banking landscape into a dynamic and electrifying arena. Yet, amidst the clamor for digital dominance, we mustn't lose sight of the timeless essence of human connection within the realms of banking and NBFCs.

As the digital tsunami crashes upon our shores, it's easy to be swept away by the allure of automation and algorithms. However, amidst the cacophony of technological advancement, the age-old wisdom of personal interaction stands as a stalwart beacon of resilience. Just as the ancient mariner relied on the stars to navigate treacherous seas, so too must modern institutions harness the power of human touch to steer through the tumultuous waters of finance.

The Human Touch In Banking

Despite the surge in digital banking solutions, the human touch remains integral to building trust and rapport with customers. Hardik Shah, MD and Partner at BCG, emphasizes the significance of physical networks and personalized interactions in fostering customer confidence. In the words of Shah, the traditional brick-and-mortar branches continue to play a pivotal role in India's banking ecosystem.

The Role Of Technology In Banking

While technology holds the promise of revolutionizing banking operations, it's essential to leverage innovation judiciously. As Reserve Bank of India Governor Shaktikanta Das aptly observes, striking a balance between algorithmic underwriting and human judgment is imperative. While Artificial Intelligence (AI) can enhance operational efficiency, it cannot replace the nuanced judgment required in risk assessment.

Upskilling The Workforce

In a rapidly evolving landscape, upskilling the workforce becomes paramount. As institutions embrace technological advancements, fostering a culture of continuous learning is indispensable. Equipping employees with the necessary skills to adapt to changing market dynamics ensures resilience and sustainability in the long run.

Conclusion

As banking and NBFCs navigate through market changes, it's crucial to uphold traditional values while embracing innovation. By striking a balance between technological advancement and human-centric approach, institutions can effectively address the evolving needs of customers while mitigating risks. Prudent risk management remains imperative in safeguarding against uncertainties. In this journey of evolution, fostering a culture of continuous learning and adaptation will be instrumental in driving sustainable growth and resilience in the financial sector.

0 notes

Text

NBFCs Transforming The Payment Landscape

Poonawalla Fincorp and IIFL Finance are making waves in the financial sector, signaling a paradigm shift for Non-Banking Financial Companies (NBFCs). With Poonawalla Fincorp's recent RBI approval to launch co-branded credit cards and IIFL Finance exploring bank tie-ups, these moves are reshaping the role of NBFCs. In the era of digital payments, this article explores how NBFCs can actively participate in the payment ecosystem, aligning with the changing dynamics of finance.

1. Understanding The Shift

The financial landscape is evolving, and NBFCs are embracing change. Abhay Bhutada, Poonawalla Fincorp's MD, envisions co-branded credit cards as a catalyst for transformation. These cards not only complement existing products but position NBFCs as dynamic players in the payment space. IIFL Finance, under Nirmal Jain's leadership, mirrors this shift by seeking co-branding partnerships with banks, underlining a strategic move towards innovative payment solutions.

Also Read Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

2. The Strategic Move

Co-branded credit cards are not just pieces of plastic; they represent a strategic leap for NBFCs. In a market dominated by digital transactions, these cards enable NBFCs to tap into a broader audience. By collaborating with banks, such as IIFL Finance's potential tie-up, NBFCs can leverage existing banking infrastructure and customer bases, fostering a win-win scenario.

3. Expanding Customer Reach

One of the primary advantages of co-branded credit cards is the ability to extend the reach of financial services. Warren Buffett's timeless wisdom emphasizes the importance of widening one's circle of competence. For NBFCs, this means extending their offerings beyond traditional boundaries. Co-branded credit cards provide an avenue to reach new customers and offer them convenient and innovative payment solutions.

Also Read: MD Abhay Bhutada Provides Glimpse of Poonawalla’s Co-Branded Card Strategy in Q4

4. Aligning with Digital Trends

The era of traditional banking is fading, and the rise of digital payments is undeniable. NBFCs must align with these trends to stay relevant. Abhay Bhutada's vision for Poonawalla Fincorp aligns with this reality – co-branded credit cards not only adapt to digital trends but also position NBFCs as modern financial institutions, catering to the preferences of the tech-savvy consumer.

5. Navigating Regulatory Waters

While the journey towards active participation in the payment ecosystem seems promising, NBFCs must navigate regulatory waters. The RBI nod for Poonawalla Fincorp's credit cards is a significant step, highlighting the importance of regulatory compliance. Navigating this terrain ensures a smooth transition for NBFCs into the payment space without compromising financial stability.

6. Building Trust

Trust is the currency of finance, and NBFCs must prioritize it. Collaborating with established banks, as seen in IIFL Finance's pursuit, enhances credibility. Customers trust banks for their financial needs, and NBFCs can leverage this trust through co-branded partnerships, fostering confidence and loyalty among their clientele.

Also Read: How Are NBFCs Tackling RBI’s Stance On Unsecured Loans?

Conclusion

Poonawalla Fincorp and IIFL Finance's foray into co-branded credit cards exemplifies a pivotal moment for NBFCs. The shift towards becoming active participants in the payment ecosystem is not just a strategic move but a necessity in the evolving financial landscape. As they navigate through digital trends, regulatory frameworks, and customer trust, NBFCs can unlock new opportunities, redefine their roles, and emerge as key players in shaping the future of payments.

0 notes

Text

Banking And NBFCs' Fraud Fight: Innovations For Financial Security

Standing at the forefront of the fight against financial fraud are Non-Banking Financial Companies (NBFCs). These companies go beyond regular banking, working dynamically to make our money more secure. In a time filled with clever frauds, NBFCs use smart strategies to protect us, showing how quick and dedicated they are. These companies are like key players in making sure our financial future stays secure.

The Rise Of NBFCs

The ascent of Non-Banking Financial Companies (NBFCs) signifies a transformative shift in India's financial narrative. These entities have emerged as nimble alternatives, challenging the conventional banking paradigm. With a customer-centric ethos at their core, NBFCs swiftly adapted to cater to the diverse financial needs of the populace. Their flexible lending policies, tailored solutions, and streamlined processes have bridged the gaps left by traditional banks, fostering financial inclusivity and accessibility.

As trailblazers of innovation, NBFCs have catalyzed economic growth by catering to underserved sectors, thereby reshaping the financial landscape and becoming indispensable contributors to India's evolving economy.

Understanding The Fraud Landscape

The fraud landscape is a complex terrain where perpetrators constantly morph their tactics to exploit vulnerabilities. It encompasses a myriad of deceptive practices, from identity theft and phishing scams to sophisticated cyber intrusions. Financial institutions bear the brunt of these attacks, facing a relentless onslaught of fraud attempts.

With the advent of digital transactions, the avenues for fraudulent activities have widened, making traditional security measures inadequate. Understanding this landscape is imperative for Non-Banking Financial Companies (NBFCs) to fortify their defenses and protect consumers from falling prey to evolving fraud schemes.

Also Read: Unveiling The Future Of Collections In NBFCs

Innovative Strategies In Fraud Detection

1. Advanced Analytics:

NBFCs leverage cutting-edge analytics to detect abnormal patterns in transactions. AI-driven algorithms sift through vast data, flagging suspicious activities in real-time.

2. Biometric Authentication:

Embracing biometric technology like fingerprints or facial recognition, NBFCs fortify authentication processes, minimizing identity-related frauds.

3. Blockchain Technology:

The decentralized nature of blockchain fortifies data security. NBFCs utilize this technology to ensure immutable records, reducing the risk of tampering or fraud.

4. Behavioral Analytics:

Understanding customer behavior is pivotal. NBFCs employ behavioral analytics to identify deviations, proactively mitigating potential risks.

5. Use of Machine Learning

By analyzing vast amounts of financial data, machine learning algorithms can detect patterns and anomalies that might signal fraudulent behavior. These algorithms learn from historical data, continuously refining their models to adapt to evolving fraud tactics.

Abhay Bhutada, MD of Poonawalla Fincorp highlighted the significance of machine learning in the lending sector. He also emphasized that leveraging machine learning enables online lenders to rapidly authenticate transactions' legitimacy within milliseconds.

NBFCs’ Role In Educating Consumers

NBFCs play a pivotal role in empowering consumers through education and awareness initiatives. They recognize the importance of informed customers in combating financial fraud. These institutions conduct extensive outreach programs, seminars, and digital campaigns, aiming to educate individuals about various fraud types, preventive measures, and the importance of reporting suspicious activities promptly.

Collaboration And Information Sharing

Collaboration and information sharing stand as cornerstones in the fight against financial fraud. NBFCs actively engage in collective efforts, fostering a network where insights, best practices, and threat intelligence are shared among industry peers. Through forums, consortiums, and partnerships, NBFCs exchange crucial information on emerging fraud trends and tactics. Poonawalla Fincorp is also open to partnerships according to its MD, Abhay Bhutada.

This collaborative ecosystem not only bolsters their own defenses but also fortifies the entire financial sector against evolving threats. By pooling resources and knowledge, NBFCs pave the way for a more resilient and proactive stance against fraud, safeguarding both institutions and consumers alike.

Also Read: The Crucial Role Of Trust And Transparency In Digital Borrowing

Regulatory Compliance and Vigilance

Regulatory compliance stands as the cornerstone of NBFC operations, with stringent adherence to guidelines and protocols. Vigilance is embedded within their ethos, ensuring continuous monitoring, audits, and rigorous internal controls. Embracing regulatory frameworks isn’t just a mandatory checklist; it’s a proactive stance toward fortifying defenses against potential threats. This steadfast commitment extends to staying abreast of evolving regulations, implementing robust measures, and fostering a culture of unwavering compliance at every level of operations.

Adapting to Evolving Threats

Adapting to evolving threats remains a cornerstone for NBFCs in their battle against financial fraud. The landscape of fraud is ever-shifting, with new tactics and technologies constantly emerging from the dark corners of the digital world.

NBFCs understand the imperative need for continuous evolution in their defense mechanisms. They employ agile strategies, constantly assessing, innovating, and fortifying their systems to stay ahead of the curve. By fostering a culture of adaptability, these institutions remain resilient, ready to counter the most intricate and unforeseen threats that could compromise financial security.

Deepak Parekh, the former chairman of HDFC Ltd board has highlighted the importance of proactive measures to defend assets and strengthen security frameworks within banking and NBFCs, especially in the digital era.

Conclusion

In the ever-evolving landscape of financial fraud, NBFCs emerge as stalwarts, pioneering innovative approaches to safeguard consumers and institutions. Through technological prowess, collaborative efforts, and consumer empowerment, they reinforce the pillars of financial security, forging a resilient defense against fraudulent activities.

0 notes

Text

Unsecured Loans In India: Navigating RBI's Roadmap

Unsecured loans have witnessed a surge in popularity, becoming a key component of the financial landscape for individuals seeking quick financial solutions without the need for collateral. As a novice investor, it's imperative to delve into the Reserve Bank of India's (RBI) perspective on unsecured loans to make informed decisions about your financial journey.

Understanding The Unsecured Loan Landscape

Unsecured loans, such as personal loans and credit card debt, have gained traction owing to their accessibility and minimal paperwork requirements. These loans, devoid of collateral, offer a convenient option for individuals who may lack substantial assets to pledge against borrowing.

Also Read: From Abhay Bhutada to Nirmal Jain — India’s Top Chartered Accountants

The Watchful Eye Of The RBI

In recent times, the RBI has redirected its focus towards the escalating trend of unsecured lending within the financial system. Offering valuable insights, Keki Mistry, a financial advisor at Poonawalla Fincorp, sheds light on the RBI's viewpoint. Mistry views the central bank's directives not as a sign of immediate concern but as a proactive and precautionary measure to address the substantial growth in unsecured lending across the financial sector.

Mandatory Security Measures

The recent RBI order mandates lenders to implement additional security measures to protect consumers from potential fraud and identity theft. These measures aim to fortify the lending environment, ensuring that borrowers' interests are safeguarded amidst the ever-evolving financial landscape. The RBI's commitment to enhancing security aligns with its broader goal of maintaining the integrity of the financial system.

Navigating Changes Effectively

Abhay Bhutada, Poonawalla Fincorp’s MD, provides valuable insights into the impact of these regulatory changes. Notably, the company has experienced a significant shift towards secured loans, witnessing an increase from 46% to 52% in the last quarter. Bhutada emphasizes that this shift has not only secured a major market share in products like pre-owned cars and loans against property but has also positioned them as a CRISIL AAA rated NBFC.

Highlighting the company's current leverage of 1.5%, the lowest in the industry, and a cost of borrowing ranking among the industry's lowest, Bhutada assures that Poonawalla Fincorp is well-prepared to weather the changes in the lending landscape. With a robust capital adequacy of 38%, the company anticipates that even with a growth projection of 35 to 40%, no additional capital will be required for the next three to four years.

Also Read: Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

Navigating The Intricacies Of Finance

For a beginner investor entering the dynamic realm of finance, understanding the RBI's stance on unsecured loans becomes paramount. The central bank's proactive approach in tightening regulations around these loans can be seen as a necessary step to maintain the stability and integrity of the financial system.

Looking Ahead With Informed Optimism

As a beginner, it's essential to keep an eye on how these changes unfold. The RBI's commitment to enhancing security measures should be viewed optimistically, as it signifies a positive step towards building a safer lending environment for all. The financial landscape may evolve, but with insights from seasoned financial advisors like Keki Mistry and MD of Poonawalla Fincorp, Abhay Bhutada, investors can stay informed and make sound financial decisions with confidence.

Also Read: How Are NBFCs Tackling RBI’s Stance On Unsecured Loans?

Conclusion

In conclusion, the RBI's stance on unsecured loans underscores its commitment to ensuring the financial well-being of consumers. As a beginner investor, staying informed about these developments is crucial for making prudent investment choices. The insights from industry experts, including those from Poonawalla Fincorp, provide a valuable perspective on how these changes are being navigated within the financial sector. As the financial landscape continues to evolve, being aware and adaptive will be key for any investor, whether seasoned or just starting out. Staying informed empowers investors to navigate the intricacies of the financial landscape with confidence and foresight.

0 notes

Text

"Navigating the Fixed Deposit Landscape: Tips for Effective Comparison"

Fixed Deposits have long been the core of safe and risk-free investments, providing a traditional haven for hard-earned money. In today’s financial landscape, numerous banks and Non-Banking Financial Companies (NBFCs) compete for your attention, offering alluring interest rates on fixed deposits. However, the key lies in selecting the right bank to maximize your returns. In this blog post, we’ll…

View On WordPress

#Bank#Banks#Best bank FD#Best Bank Fixed Deposit#Choose best FD#Choose Fixed Deposit#Criteria for Choosing Best FD#FD#FD in NBFC#FD interest rate#Fixed Deposit#Fixed Deposit in NBFCs#Fixed deposits#NBFC#NBFC FD#NBFC Fixed Deposit#NBFCs

0 notes

Text

Axis Finance Business Loan are the ideal solution for borrowers in need of funds to meet your immediate cash flow needs

0 notes

Text

Enhancing Net Interest Margin: Lessons from Poonawalla Fincorp's Strategic Achievements

Understanding Net Interest Margin (NIM)

Net Interest Margin (NIM) is a pivotal financial indicator for banks and other financial institutions. It quantifies the difference between the interest income earned from lending activities and the interest expenses incurred from deposits and borrowing activities, represented as a percentage of the institution's interest-earning assets. A higher NIM signifies greater efficiency in generating income relative to the cost of funds, which is essential for boosting profitability and ensuring sustainable growth.

This article delves into the factors contributing to a sequential rise in NIM, evaluates the long-term implications of an improved NIM on profitability, and examines the strategic measures adopted by Poonawalla Fincorp to optimize their NIM.

Factors Contributing to a Sequential Increase in NIM

Even a modest increase in NIM, such as a four basis points (bps) rise, can significantly enhance a financial institution's profitability. The key factors driving this increase include:

1. Interest Rate Environment

Central banks' interest rate policies significantly influence the cost of funds and the yield on interest-earning assets. A favorable interest rate environment, characterized by a widening gap between deposit rates and lending rates, enhances NIM. For instance, when benchmark rates rise, banks can often reprice their loans more quickly than their deposits, thereby boosting interest income relative to interest expenses.

2. Asset-Liability Management

Effective asset-liability management is essential for optimizing the maturity and interest rate profiles of a bank's assets and liabilities. By ensuring an optimal match between the maturities of assets (such as loans) and liabilities (like deposits), banks can stabilize and enhance their NIM. Poonawalla Fincorp has demonstrated this approach through a centralized management model and the adoption of digital strategies to streamline operations.

3. Operational Efficiency

Reducing operational expenses (opex) is vital for improving NIM. Lower opex means that a larger portion of interest income is converted into net income. Abhay Bhutada, Managing Director of Poonawalla Fincorp, notes that their opex has declined from 5.43% to 3.99% year-on-year, thanks to branch and workforce consolidation and a shift to a digital-led model. This operational efficiency directly contributes to a rise in NIM.

4. Loan Portfolio Management

The composition and quality of a financial institution’s loan portfolio significantly impact NIM. Loans extended to low-risk borrowers or those with higher interest rates can enhance NIM. Poonawalla Fincorp focuses on lending to bureau-tested customers with verifiable cash flows, ensuring better asset quality and higher yields, which in turn boost NIM.

5. Reduction in Non-Performing Assets (NPA)

A decrease in Gross Non-Performing Assets (GNPA) and Net Non-Performing Assets (NNPA) reduces the need for provisions, thereby increasing NIM. Poonawalla Fincorp has seen a reduction in GNPA from 1.44% to 1.16% and in NNPA from 0.78% to 0.59%, reflecting improved asset quality and contributing to the rise in NIM.

Also Read: How Abhay Bhutada-Led Poonawalla Fincorp Emerged as a Leader in the Lending Space

Long-Term Impacts of Improved NIM on Profitability

A sustained improvement in NIM can have profound long-term effects on a financial institution’s profitability and overall health:

1. Enhanced Profit Margins

A higher NIM directly translates into improved profit margins. As the spread between interest income and interest expenses widens, banks generate higher net interest income (NII). This increase in NII strengthens the bottom line, enabling reinvestment in growth initiatives and technological advancements.

2. Increased Competitiveness

Consistently high NIM allows banks to offer competitive rates, attracting both deposits and high-quality borrowers. This competitive edge can lead to increased market share and a broader customer base. Abhay Bhutada mentions that Poonawalla Fincorp operates 102 branches and has successfully captured market share, a trend expected to continue.

3. Strengthened Financial Stability

Improved NIM contributes to financial stability by providing a buffer against economic fluctuations. This stability ensures profitability even during periods of low economic growth or adverse market conditions, crucial for maintaining investor confidence and securing long-term funding.

4. Better Capital Adequacy

Higher profitability resulting from improved NIM enhances a bank’s capital base. Robust capital adequacy ratios are essential for absorbing potential losses and meeting regulatory requirements, supporting sustainable growth and providing a cushion against future uncertainties.

5. Investment in Innovation and Expansion

Higher profits facilitate greater investment in innovative technologies and expansion initiatives. Poonawalla Fincorp’s emphasis on a digital-led model exemplifies how improved NIM can fund technological advancements that enhance efficiency and customer service.

Also Read: Poonawalla Fincorp's Strategic Entry Into The Credit Card Market: What Investors Should Know

Poonawalla Fincorp’s Strategic Actions and Their Effect on NIM

Poonawalla Fincorp has adopted several strategic initiatives to optimize NIM and ensure long-term profitability. These initiatives provide a practical framework for enhancing NIM:

1. Digital Transformation

A significant shift towards a digital-led model has been central to Poonawalla Fincorp’s strategy. By minimizing physical branch operations and focusing on digital sourcing and collections, the company has significantly reduced opex. Digital processes are more cost-effective, allowing for efficient resource allocation and improved NIM.

2. Centralized Operations

Centralizing operations, including underwriting and collections, has streamlined processes and eliminated redundancies. This centralization reduces operational costs and boosts efficiency, directly contributing to a higher NIM. It also enhances monitoring and control, improving overall operational effectiveness.

3. Focus on Quality Borrowers

Poonawalla Fincorp’s focus on lending to bureau-tested customers with stable cash flows minimizes credit risk and improves asset quality. By avoiding riskier segments and focusing on verified customers, the company maintains low GNPA and NNPA, supporting a healthier NIM.

4. Operational Consolidation

Consolidating branches and manpower has led to significant cost savings. By optimizing branch networks and reducing unnecessary workforce expenses, Poonawalla Fincorp has enhanced operational efficiency. These savings directly improve NIM, as lower operational costs mean a larger portion of interest income is retained as profit.

5. Risk-Adjusted Approach

A risk-adjusted approach ensures that the company’s lending practices are prudent and sustainable. By focusing on low-risk segments, Poonawalla Fincorp minimizes potential losses and ensures that interest income is not eroded by high provisioning requirements. This strategy supports a stable and high NIM over the long term.

Case Study: Poonawalla Fincorp

#Background

Under the leadership of Managing Director Abhay Bhutada, Poonawalla Fincorp operates 102 branches across India. The company has consistently exceeded its guidance, gaining market share and improving its financial metrics. Recently, Poonawalla Fincorp has focused on reducing operational expenses, enhancing asset quality, and leveraging digital transformation.

#Strategy and Implementation

1. Digital-Led Model

The company has significantly reduced reliance on physical branches by shifting to a digital-led model, utilizing digital channels for sourcing, underwriting, and collections. This approach lowers operational costs and increases efficiency.

2. Operational Efficiency

Through branch and manpower consolidation, Poonawalla Fincorp has reduced opex from 5.43% to 3.99% year-on-year. This reduction has been achieved by streamlining operations and focusing on a centralized model.

3. Quality Loan Portfolio

By focusing on bureau-tested customers with stable cash flows, the company has improved asset quality, resulting in a reduction in GNPA from 1.44% to 1.16% and NNPA from 0.78% to 0.59%, ensuring a healthier loan portfolio.

4. Risk-Adjusted Lending

Avoiding high-risk segments and focusing on verified customers has minimized potential losses and reduced the need for high provisioning, supporting a stable NIM.

#Outcomes

The strategic initiatives implemented by Poonawalla Fincorp have produced impressive results:

- Improved NIM: The company has achieved a 4 bps sequential rise in NIM, reflecting better management of interest income and expenses.

- Enhanced Profitability: Reduced operational costs and improved asset quality have contributed to higher profit margins, allowing for reinvestment in growth and technology.

- Market Share Growth: By offering competitive rates and focusing on quality borrowers, Poonawalla Fincorp has gained market share and expanded its customer base.

- Financial Stability: The company’s strong asset quality and low opex provide a buffer against economic fluctuations, ensuring long-term stability and investor confidence.

- Capital Adequacy: Higher profitability has enhanced the company’s capital base, supporting sustainable growth and compliance with regulatory requirements.

Lessons Learned

Poonawalla Fincorp’s success in optimizing NIM offers several lessons for other financial institutions:

- Embrace Digital Transformation: Leveraging digital channels can significantly reduce costs and improve efficiency.

- Focus on Operational Efficiency: Streamlining operations and reducing redundancies can enhance profitability and support a higher NIM.

- Prioritize Quality Lending: Focusing on low-risk, verified customers improves asset quality and reduces potential losses.

- Adopt a Risk-Adjusted Approach: Prudent lending practices ensure sustainable growth and minimize the need for high provisioning.

Also Read: Poonawalla Fincorp Achieves Remarkable Milestone in Asset Quality Achieved On 31st May, 2024

Conclusion

Optimizing Net Interest Margin is essential for financial institutions seeking to enhance profitability and achieve sustainable growth. A rise in NIM, driven by factors such as a favorable interest rate environment, operational efficiency, effective asset-liability management, and reduction in non-performing assets, can significantly impact a financial institution’s bottom line. Poonawalla Fincorp’s strategic initiatives under the leadership of Abhay Bhutada offer a valuable case study on how to effectively enhance NIM and drive long-term success.

0 notes