#no. 1 forex broker in India

Text

Scale Your Trading To The Next Level With The No.1 Forex Broker In India

In the fast-paced and dynamic world of forex trading, having a reliable and reputable broker close by is essential. With the right broker, you can access global markets, execute trades smoothly, and use different tools and resources to improve your trading strategies.

No matter whether you are a beginner or a seasoned forex trader in India trying to scale your business to the next level, look no further than the no.1 forex broker in India. This article will explain how this broker can help you achieve your trading goals and expand your forex potential.

Read more: https://sariknowledge.com/scale-your-trading-with-the-no-1-forex-broker-in-india/

0 notes

Text

All You Need To Know About Forex Trading Platforms In India

Forex trading platforms are software applications that allow traders to access the foreign exchange market and execute trades. Traders can choose a platform based on their trading preferences, experience level, and the specific features they require.

Forex trading platforms are important because they provide traders with access to the global foreign exchange market, allowing them to buy and sell currencies and other financial instruments. These platforms provide a range of tools and features that enable traders to analyze the market, execute trades, manage risk, and monitor their performance. They also offer real-time market data, news, and charts, which are crucial for making informed trading decisions.

There are several forex trading platforms available in Nigeria that traders can use to access the global foreign exchange market. Some of the most popular forex trading platforms used in Nigeria include MetaTrader 4, MetaTrader 5, Forex4you web trader, and TradingView.

Forex4you Nigeria is an award-winning broker with a variety of trading platforms to choose from. Forex4you also offers a mobile app for on-the-go trading and both the MT4 and the Forex4you proprietary desktop platforms. There are more than 150 assets available on the broker's platform, unmatched leverage of up to 1:1000, lightning-fast trade execution, deep liquidity, and free market analysis and alerts for all traders.

2 notes

·

View notes

Text

How to Become a Professional Trader

Becoming a professional forex signal trader requires a mix of education, practice, and strategic execution. Here’s a comprehensive guide to help you embark on this journey.

1. Education: Build a Strong Foundation

Books

Books are invaluable resources for gaining in-depth knowledge about trading. Some recommended titles include:

A Random Walk Down Wall Street" by Burton Malkiel

The Intelligent Investor" by Benjamin Graham

Market Wizards" by Jack D. Schwager

These books cover various aspects of trading, from investment strategies to interviews with successful traders, providing a well-rounded understanding of the market.

Courses

Enrolling in trading courses can provide structured learning and insights from experienced professionals. Consider these options:

Online Trading Academy: Offers courses on stock forex signal trading, options, and futures.

Udemy and Coursera: Provide a variety of courses on trading strategies and financial markets.

Courses often include practical exercises and simulations, which are essential for grasping complex concepts.

Online Resources

The internet is a treasure trove of information. Websites, forums, and blogs offer up-to-date market analysis and trading tips. Key resources include:

Investopedia: A comprehensive financial education platform.

TradingView: Offers charting tools and community-driven ideas.

Financial news websites: Stay informed with CNBC, Bloomberg, and Reuters.

2. Practice: Apply Theory in Real-Time

Demo Accounts

Before risking real money, practice with demo accounts offered by various trading platforms. These accounts simulate real market conditions, allowing you to hone your skills without financial risk.

Small Investments

Start with small investments to gain real-world experience. This approach helps in understanding the emotional aspects of trading, such as handling losses and managing stress.

3. Execute: Trade with Market Expert Group

Choosing the Right Broker

Selecting a reliable broker is crucial.forex signal Market Expert Group is one such platform that offers professional trading services. They provide access to a wide range of markets and trading tools, enhancing your trading efficiency.

Contact Information

To get started with Market Expert Group:

Website: marketexpertgroup.com

Phone: +44 7418611891 (UK), +91 7389334331 (India)

Trading Strategy

Develop a trading strategy based on your education and practice. This strategy should include:

Risk Management: Determine how much you are willing to risk per trade.

Diversification: Spread your investments across different assets to mitigate risk.

Technical and Fundamental Analysis: Use charts, indicators, and market news to inform your trades.

Conclusion

Becoming a professional forex signal trader is a journey that requires continuous learning, practice, and disciplined execution. By leveraging resources like books, courses, and online platforms, you can build a solid foundation. Practicing with demo accounts and small investments helps in gaining practical experience. Finally, executing your trades with a reputable broker like Market Expert Group can lead to profitable outcomes. Stay informed, stay disciplined, and continuously refine your strategies to succeed in the dynamic world of trading.

#finance#forexsignals#forextrading#forex#stock market#investing#forex education#forex trading#marketing#sales

0 notes

Text

Top 10 Forex Brokers in India

In today’s thriving world of Trading, selecting a trustworthy broker is important. When trading forex in India, traders should make sure their broker complies with the rules established by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI), in addition to selecting a platform that offers competitive spreads and a variety of currency pairs.

We set out to investigate an online currency trading platform that has been approved by SEBI and the RBI in this blog post. Come and understand a list of carefully selected firms that will establish the benchmark for security and legitimacy in Indian Forex trading.

List of Top 10 Forex Brokers in India

The top forex trading platforms in India are listed and reviewed below, along with comprehensive details on each platform’s features and attributes.

CapitalXtend

CapitalXtend is a prominent Forex broker providing exclusive benefits that far surpass the rest. With an impressive 1:5000 leverage, traders can unleash huge possibilities. With eminent forex trading conditions with the lowest spread at 0.0 and free access to more than 300 instruments, CapitalXtend empowers investors with the needed tools for success in the volatile currency market.

OANDA

OANDA, well a reputed forex streaming platform in India, with its user-friendly interface and robust features. Having a reputation for reliability and transparency, It provides access to many currency pairs and trading instruments. Globally trusted, It is the forex traders’ top pick when it decide to navigate the forex market with confidence.

AvaTrade

AvaTrade is a leading trade forex online platform for trading which is well known for its tight spread and zero commission charges. Offering up to 30:1 AvaTrade provides powerful leverage and instant execution, offering traders convenient and flexible trading platforms. With 24/7 support by your side, you can face the markets with confidence, knowing help is always at hand.

CMC Markets

CMC Markets towers as a leader forex broker with more than 300 forex pairs, 70+ indices, 18+ cryptocurrencies, 11000+ shares & ETFs, 90+ commodities, and 40+ treasuries to its credit. Starting as low as 0.5 pips with a wide array of offerings, it calls to traders looking for varied opportunities.

Inveslo

Inveslo becomes the top choice forex broker with the high grades of benefits provided. With a generous 1:2000 leverage, traders can add possible gains. With a minimum spread of 0.01 and access to over 300 financial instruments, Inveslo provides traders with multiple choices. Additionally, their 24/7 multilingual support guarantees assistance is always on hand.

eToro

eToro a multi-asset forex trading online platform allows you to trade forex with more than 3000 financial instruments and 5000+ trading assets. Benefiting from the transparency of all the fee calculations, it is an ideal fit even for those with little experience for it comes with simple and intuitive solutions. Ease of use makes trading through this platform pleasant and it has become traders’ first choice.

IronFx

IronFX, trusted by more than 1.5 million retail clients, provides top-tier trading conditions and 24/5 multilingual support. Known for its reliability, it’s the one to turn to for trading Forex CFDs and a variety of financial instruments. The journey of the traders with IronFX is made convenient as they get a reliable partner.

Plus500

The leading forex broker Plus500 offers streamlined trading. Using an easy-to-use platform the traders have access to a huge variety of forex pairs and CFDs. Plus500 is characterized by its simplicity and reliability, attracting both novice and experienced traders looking for a straightforward approach to forex trading.

Pepperstone

Pepperstone, the leading forex brokerage firm, offers minute spreads starting from the commission of 0.01 lots on a per-lot basis, offering cheap trade solutions to traders. Known for its openness and cost-wiseness, Pepperstone facilitates trading strategy execution. Being a popular choice for traders, It is considered a perfect platform in that regard.

TD Ameritrade

TD Ameritrade, one of the biggest currency trading platforms, provides all-encompassing investment services. With a user-friendly platform, powerful research options, and access to a variety of investment products such as stocks, ETFs, options, and futures, TD Ameritrade has tailored its offerings to suit investors of all levels, giving them the ability to reach their financial goals.

Suggested read: Forex Trading for Beginners

Final Verdict

It is advisable to limit your search for the best forex broker for trading in India to those who are well-licensed and regulated. The Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) have imposed various limitations on currency trading but have not yet developed a framework for regulating or licensing forex brokers.

This is why, local traders in India frequently do business with foreign companies. To help provide a more secure and safe trading environment, we have listed the top 10 regulated forex brokers in India that accept Indian clients and are overseen by foreign financial authorities. It’s crucial to remember that not all overseas brokers are subject to the same regulations.

Originally Published on Medium

Source: https://mattwilliamscorp.medium.com/top-10-forex-brokers-in-india-2d7b47820c1f

0 notes

Text

Exness is ranked #1 among these four best brokers

Trading foreign exchange (Forex) offers a world of opportunities and complications. In this fast-paced market, selecting the appropriate broker is a crucial choice that has a big impact on one's performance. In this investigation, we examine the top five Forex brokers in the world, taking into account important factors including customer service, trading platforms, fees, and regulation. In order to help traders make wise choices, we also highlight Exness, which stands out among these brokers, and end with a FAQ section that answers frequently asked questions.

Read More https://justforexasia.com/this-is-4-best-broker-exness-is-number-one/

Exness – Exness Indonesia – Exness India – Exness Japan – Exness Nigeria – Exness South Africa – Exness Thailand – Exness Vietnam

0 notes

Text

Broker In Focus: Fxglory - Is It Worth Giving A Try?

Fxglory is an offshore broker that allows trading in the forex market and commodities. The broker is not licensed by a respected regulatory body like the FCA or CySEC and is incorporated outside of the United States in Saint Vincent and the Grenadines. However, it has developed a reputation as one of the most dependable companies in the sector despite it currently lacking any regulatory licences. Traders of any level can take advantage of Fxglory’s flexibility, usability, and astounding professionalism. It further provides excellent trading tools, reliable trade execution, and enormous leverage available on the market–1:3000.

Fxglory provides simple access to a secure and comprehensive trading environment. Established in 2011, it has offices in Malaysia, Cyprus, Spain, and the UK. The office was first headquarters in the United Arab Emirates and migrated to European markets after a year of operation in the Asian financial industry. A group of financial experts founded the company with the goal of offering traders on the MetaTrader 4 trading platform a superior online trading experience with high leverage, no commissions, and quick executions.

Features Provided by Fxglory

Trading Instruments– Clients of FxGlory have access to a limited number of trading instruments. You can trade 34 currency pairings, including GBP/USD and EUR/USD. Along with oil and precious metals trading, popular cryptocurrencies like Bitcoin and Ethereum are also accessible.

Trading Accounts– Fxglory provides access to four types of trading accounts. Standard, Premium, VIP, and CIP accounts. Further, Fxglory provides one-click trading, a built-in news feed, and multilingual support for all account holders.

Trading Platform– Fxglory provides MetaTrader 4 (MT4) and a WebTrader platform. MT4 is user-friendly, sophisticated, and customisable. Additionally, FxGlory provides a web-based trading platform. WebTrader enables you to trade through an internet browser without additional program installation. A variety of devices, including Mac and PC, can be used to trade all the instruments provided by this broker.

Mobile Trading Application– All trade orders and execution types are supported by the MT4 platform, which can be downloaded for iOS and Android devices. The UI is straightforward to use, and logging in is just as quick and easy as it is on a desktop computer. You have access to trade at your fingertips.

Languages– Languages such as English, Russian, Italiano, Greek, Arabic, and German are supported by the broker.

Trading Tools– Fxglory provides highly useful trading tools such as economic calendars, margin calculators, and one-click trading.

Education– This field requires special attention because the educational materials at Forexglory are quite basic and not up-to-date.

Customer Service– You can contact the customer support team 24*5 through email and phone call service. You also have to connect to the team via live chat.

Clients– Fxglory accepts clients from countries such as Australia, Thailand, Canada, the United States, the United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, etc.

Payment Options– E-commerce payment methods have grown in popularity these days. So, the broker provides a variety of deposit choices. To fund your account, you can select a method that best meets your needs, and all deposits are processed quickly and securely. You have access to multiple payment options like SticPay, American Express, Perfect Money, cryptocurrencies, WebMoney, EPay, Wire Transfer, Neteller, Skrill, PayPal, Visa, and Mastercard.

Trading Conditions

Standard Account

Commission – $0

Minimum Deposit – $1

Spread – Floating from 2 pips

Step lot size – 0.01

Leverage – Up to 1:3000

Maximum bonus – $500

Deposit bonus percentage – 50%

Minimum lot size – 0.01

Maximum lot size – 1.00

Hedge margin – 50%

Maximum position – 20

Premium Account

Commission –$0

Minimum Deposit – $1,000

Spread – Floating from 2 pips

Step lot size – 0.10

Leverage – 1:2000

Maximum bonus – $1,000

Deposit bonus percentage – 50%

Minimum lot size – 0.10

Maximum lot size – 10.00

Hedge margin – 50%

Maximum position – 100

VIP Account

Commission – $0

Minimum Deposit – $5,000

Spread – Floating from 0.7 pips

Step lot size – 0.10

Leverage – 1:300

Maximum bonus – $2,000

Deposit bonus percentage – 40%

Minimum lot size – 0.10

Maximum lot size – 1,000.00

Hedge margin – 25%

Maximum position – 1000

CIP Account

Commission – $0

Minimum Deposit – $50,000

Spread – Floating from 0.1 pips

Step lot size – 1.00

Leverage – 1:50

Maximum bonus – $0

Deposit bonus percentage – 0%

Minimum lot size – 1.00

Maximum lot size – 5.00

Hedge margin – 100%

Maximum position – 10

Pros of Trading with Fxglory

Low minimum deposit ($1)

Provides varieties of strategies like scalping, hedging, algorithmic trading

Spreads are fixed

Clients have access to a handful of tradable instruments

The MT4 platform is available for iOS and Android devices and supports all trade orders and execution modes.

The interface is easy to navigate

Offers a wide range of payment methods, including cryptocurrency

Offers 4 types of trading accounts

Live chat is available

To protect client data, the company's website and platform employ 256-bit SSL encryption technology.

To protect the funds, it maintains cash in separate accounts and provides clients access to various risk management tools.

All accounts are swap-free

Clients from the US are accepted

Micro-lot trading is available

Cons of Trading with Fxglory

The website supports only the English language

It is unregulated

Cent accounts are not available

Customer support service is not upto the mark

Spreads are high

Complex fee structure

Does not provide an MT5 platform

Educational materials are average

Verdict

Overall, Fxglory is a reliable forex broker which provides a unique trading system and environment. Fxglory puts the priorities and needs of its clients and partners first. It works with all honesty by creating exceptional products and services. However, keep in mind that, at the moment, it does not hold any regulating licence. Always do some background checks before signing up with any broker. Furthermore, Fxglory is a good broker for both newbies and experienced traders, but the trading conditions make it more suitable for professional traders who have a large capital to trade.

0 notes

Text

MTFE Trading Review: Legit or Another Scam?

In the world of online trading, it is crucial to distinguish between legitimate brokers and fraudulent entities. One such broker that has garnered attention is MTFE Trading.

In this post, we will be doing an MTFE Trading review and will examine its legitimacy and uncover the truth of whether MTFE Trading is real or fake.

What is MTFE?

MTFE Trading, also known as Metaverse Foreign Exchange Group, is a mobile platform that allows investors to trade various financial assets using automated artificial intelligence.

The app is available for both Android and iOS devices and offers a range of features that make it an attractive tool for investors. In this review, we will take a closer look at MTFE and evaluate its legitimacy as a broker.

MTFE offers a range of trading options. Users can trade currencies on the Forex market, commodities, indices, stocks, and cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Dogecoin, Polkadot, Bitcoin Cash, and BNB. T

he minimum deposit is $25.

MTFE claims to be a regulated broker authorized by Fintrac, which is the Financial Transactions and Reports Analysis Centre of Canada. However, upon further investigation, it becomes clear that this claim is misleading.

Fintrac is not a regulatory body for brokers or financial companies. Its primary role is to facilitate the detection, prevention, and deterrence of money laundering and the financing of terrorist activities.

The MTFE app has around 1 million+ downloads on Google Play Store and the domain Mtfe.ca has around 170k+ monthly traffic.

Read: Versobot.net Review

Website Profile

WebsiteMtfe.caKnown asMTFE (Metaverse Foreign Exchange Group)Site typeInvestment SchemeProducts OfferedTrading Domain registration date12 December 2021AddressOntario, CanadContact e-mailNot known

Read: G7FX.com Review

MTFE Review

Based on our report and user review, it is found that the platform is not trustable. However many users gave a positive review about MTFE but still there are some major red flags to consider before investing in MTFE Trading.

- Lack of authorization or proof of regulatory approval

- Misleading claims about the regulatory status

- High-risk investments or schemes

- Suspicious and unregulated trading practices

- Lack of transparency in operations and fees

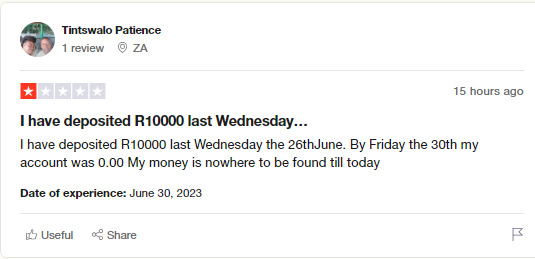

- Poor customer reviews on Trustpilot

- Ponzi scheme model

- Lack of transparency in the broker's ownership and management

These all red flags suggest that one should stay away from this scam.

Read: Star-Clicks Review

FAQs

From Which Country MTFE is Operating?MTFE is based in Ontario, Canada.Is MTFE Trading legal in India?No, MTFE Trading is not legally authorized to operate in India. Is MTFE Trading safe?no MTFE Trading is not safe for investment. There are numerous red flags about this platform.Is MTFE Trading Real or Fake?No, MTFE Trading is not legitimate. However, the platform is still paying and operating without any fraud warning.

Read: Rivera Vs Google Settlement Legit?

Read the full article

0 notes

Text

No.1 Lowest Spread Forex Broker.

AVFX Capital is one of The Best Brokers in India.

We are proud to serve our clients around the globe. For more information visit our site: www.avfxcapital.com

0 notes

Text

Top Forex Brokers in India

Forex trading has become increasingly popular in India in recent years. With the growing demand for forex trading, there has been a surge in the number of forex brokers offering their services in India. Choosing the right forex broker is crucial for a successful trading experience. In this article, we will look the best forex brokers operating in India.

XM

XM is one of the best forex brokers in India and expanding their services rapidly.

XM is a popular forex broker that is regulated by several regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA). They offer a wide range of currency pairs to trade, as well as other financial instruments like stocks and commodities. They offer low spreads and competitive fees, making it a popular choice among Indian forex traders.

What make XM great is their deposit bonus feature because in XM offer deposit bonus 50%-100%.

XM offers 50% deposit bonus to all of their client in standard account with the fact that bonus is also tradable. That means we can trade with bonus amount too. And if we compare this with Octafx, bonus amount isn’t tradable in octafx. That bonus amount in Octafx is just to show account balance while user can’t use that bonus for trading and for worst case if we lose our account deposit equity then octafx withdraw there bonus. While in XM, we can trade with bonus amount too even after if we lose all our account equity. After losing our account equity, we can loss the bonus amount too in worst case.

Second best feature of XM is their instant deposit and withdrawal with various payment methods like UPI, bank transfer, crypto, skrill, neteller and many more.

XM allow user to deposit fund with UPI within minutes most of the time. Xm claim depositing time 12-24 hrs but it completes within few minutes to 1 hour generally. And same for withdraw with UPI, XM withdraw completes within few minutes to 1hour in most cases but again XM claims 24hours time in this too.

Along with UPI, depositing and withdrawal though crypto and other online wallets are also instant.

XM allows to trade in more then 1000 instrument in different categories. Categories like forex pair, Commodities, CFD’s, Stocks, crypto, and many more. But GOLD is the most traded instrument in india. And Spread in Gold and other instrument are very competitive and lower then octafx .

On MT5 platform of XM, user can trade Indian Stock Index NIFTY50 too as a CFD with the name IN50. This NIFTY index trading is only on MT5 as of now, but later on it will be on MT4 too. Is someone wants to trade in NIFTY50 index as a CFD like US30 or NASDAQ then XM can be the best broker for him.

To Try this, user can create account directly from- https://bit.ly/Joinxmbroker

I highly recommend to use XM broker if you are planning to trade forex because of there best in class service and tradable deposit bonus.

Resource- Step Traders

0 notes

Text

About Gambit (Forex AI Bot)

Gambit is a multi-award winning, multi-asset FX & CFD broker, enabling clients worldwide to trade currency pairs, indices and commodities in premium trading conditions.

Gambit group operates under full regulation of the trusted and reputable financial authorities, and have obtained the certificate of Company incorporation of UK (NO. 648LLC2020) in 2020.

We are great believers in helping our clients grow and prosper as traders. That’s why we provide a full and integrated BOT suite of trader support services ranging from personalised 1-on-1 coaching, industry-leading market analysis and innovative smart trading tools so our clients can make better, more informed trading decisions.

At Gambit, we are committed to building long term relationships with our clients. We operate on trust, transparency and provision of premium trader support services, and it is these values & principles that have made us a preferred and trusted partner for traders around the world.

Gambit - Your Trusted Success Partner

Gambit has teamed up with Trading AI BOT Central to provide it's clients with the latest news and data, technical analysis and trading set ups.

AI BOT Trading Central has a proven track record in delivering an accurate and timely assessment of the financial markets. It provides market insights and knowledge based on many years of experience acquired on the trading floors of reputable banking institutions and through the affiliation it has with key partners.

These partners include:

Bloomberg

Dow Jones Newswire

Interactive Data Real Time Services

Thomson Reuters

Gambit members have the privilege to gain access to AI BOT Trading Central's facilities.

Gambit was created in 2014 to provide a stable no dealing desk Forex broker to service a global client base. Our veteran management and support team comprises highly experienced Forex and fin-tech professionals with combined decades of experience providing the best possible trading conditions and client support to both retail and institutional clients.

Gambit has assembled a strong leadership team based in England UK.

With decades of combined financial services and management consulting experience, you can rely on the Gambit leadership team to provide the most stable, secure and reliable trading environment.

The Gambit leadership team frequently consults with stakeholders such as regulators, banks and other members of the financial services industry to ensure business integrity and customer security. The team also liaises with experienced service providers from Singapore, Australia, USA, UK and India to bring the best industry experience and innovations to Gambit customers.

AI technology is advancing at a rapid pace and forex traders are eager to utilize the power of machine learning for their own trading strategies. According to the Federal Reserve, more than half of all forex trades are automated with the use of an algorithmic counterparty. Already more than two-thirds of forex trades are placed though algorithmic trading vehicles. But most algorithmic trading requires strong computer programming skills that many retail traders simply don’t have.

Yet AI and its applications continue to develop. Every month, retail traders are finding better ways to automate their trades through bot trading. In this article, we review some common ways to automate a trading strategy and then we’ll look at one of the newest AI trading programs available to Forex traders.

AI BOT

Trading algorithm is a systematic set of instructions written in a computer language that informs what actions to be taken by a given trading platform. It takes a few seconds for a professional trader to make an expert decision, while for algorithm this time is only 0.0001 seconds.

It is not surprising that the majority of financial institutions trust them. Nowadays, 3/4 of the trading decisions are taken by machines, not by people. Their speed of data processing and decision-making gives them precedence over every human mind.

With Forex Robot you can trade without being influenced by greed, fear or even simple mistakes in your orders. Experience and knowledge do not matter to them. The software integrates sophisticated algorithms and management tools. Thanks to them, the robot continuously scans the market and decides when to execute appropriate orders.

Without mistakes related to manual trading

Round the clock trading

No emotions

No need to keep track of the market constantly

No experience is needed

1 note

·

View note

Text

E-brokerages Market Research Report 2022 to 2028: Industry Trends, Regional Wise Outlook, Growth Projections and Opportunities

This report provides a comprehensive analysis of current Global E-brokerages Market based on segmented types and downstream applications. Major product development trends are discussed under major downstream segment scenario.This report also focuses on major driving factors and inhibitors that affect the market and competitive landscape. Global and regional leading players in the E-brokerages industry are profiled in a detailed way, with sales data and market share info. This report also includes global and regional market size and forecast, drill-down to top 20 economies.

According to this survey, the global E-brokerages market is estimated to have reached $ xx million in 2020, and projected to grow at a CAGR of xx% to $ xx million by 2028.

Get Request Sample Report @ https://martresearch.com/contact/request-sample/3/16937

Covid-19 pandemic has impacted the supply and demand status for many industries along the supply chain. Global E-brokerages Market Status and Forecast 2022-2028 report makes a brilliant attempt to unveil key opportunities available in the global E-brokerages market under the covid-19 impact to help readers in achieving a better market position. No matter the client is industry insider, potential entrant or investor, the report will provide useful data and information.

The Global E-brokerages Market has been exhibited in detail in the following chapters

Chapter 1 displays the basic product introduction and market overview.

Chapter 2 provides the competition landscape of global E-brokerages industry.

Chapter 3 provides the market analysis by type and by region

Chapter 4 provides the market analysis by application and by region

Chapter 5-10 presents regional and country market size and forecast, under the context of market drivers and inhibitors analysis.

Chapter 11 analyses the supply chain, including process chart introduction, upstream key raw material and cost analysis, distributor and downstream buyer analysis.

Chapter 12 provides the market forecast by type and by application

Chapter 13 provides the market forecast by region

Chapter 14 profies global leading players with their revenue, market share, profit margin, major product portfolio and SWOT analysis.

Chapter 15 conclusions

Segmented by Type

l Full Time Brokers

l Discount Brokers

Segmented by Application

l Stock

l Forex

l Other

Get Enquiry And Buying Report @ https://martresearch.com/contact/enquiry/3/16937

Segmented by Country

North America

United States

Canada

Mexico

Europe

Germany

France

UK

Italy

Russia

Spain

Asia Pacific

China

Japan

Korea

Southeast Asia

India

Australasia

Central & South America

Brazil

Argentina

Colombia

Middle East & Africa

Iran

Israel

Turkey

South Africa

Saudi Arabia

Get Discount Report @ https://martresearch.com/contact/discount/3/16937

Key manufacturers included in this survey

l X-Trade Brokers

l TD Ameritrade

l TastyWorks

l Interactive Brokers

l IC Markets

l First Prudential Markets

l Fidelity Investments

l E-Trade

l Etoro

l Eoption

l Charles Schwab

Contact Us:-

+1-857-300-1122

1 note

·

View note

Text

In-Depth Review Of HYCM - Is This Broker Good?

HYCM is a licensed CFD and forex broker with headquarters in Hong Kong, London, Cyprus, and other cities across the globe. It offers traders a wide range of trading instruments (asset classes), including currency pairs, equities, indices, cryptocurrencies, and ETFs. To accommodate every trading style and level of experience, HYCM provides a number of trading accounts, such as Fixed, Classic, and Raw.

With more than 40 years of experience in the industry and a wide range of tradable products, it is currently one of the top forex brokers. HYCM offers low forex and CFD trading costs. It provides a vast array of high-quality teaching resources. Opening an account is simple and entirely digital. On the other hand, the range of products offered by HYCM is restricted to forex and CFDs. Popular asset classes are absent, like actual stocks. The broker makes use of relatively dated-looking MetaTrader trading interfaces.

Features

The company HYCM has made a name for itself as one of the top suppliers of online CFD and FX trading services.HYCM is a component of the Henyep Capital Markets Group, a global conglomerate of businesses that serves crucial industries like finance, real estate, education, and nonprofits. One of the special features that HYCM customers can use to prevent losing money when trading CFDs is negative balance protection. Due to its complexity, cryptocurrency CFDs have a very high risk of financial loss.

Thanks to negative balance protection, customers are prohibited from ceasing CFD trading before their accounts reach a negative balance. Despite the risks involved, consumers worldwide are drawn to HYCM because of its extremely competitive price policy. Clients aren’t charged any pointless fees, such as the inactivity fee. Stocks, indexes, commodities, ETFs, FX pairings, and cryptocurrencies are just a few of its many items. All other traded items are organised as CFDs, with the exception of trading forex (foreign currency).

To safeguard the security and protection of its clients’ money and data, HYCM employs cutting-edge security measures. Additionally, 128-bit SSL certificates offered by VeriSign encrypt all client data. Unlike other CFD brokers, HYCM’s servers and clients always maintain secure, encrypted connections that adhere to all applicable banking regulations.

Spreads And Commissions

Although the Fixed and Classic account types provide commission-free trading, the spreads are too wide, according to numerous research reports. While the Classic account has a minimum (variable) spread of 1.2 pips, the Fixed account offers a fixed spread of 1.8. On the other hand, the Raw account has a rather competitive price structure (spreads), with a minimum spread cost of 0.2 pips and a commission of 4 USD per round lot (round).

According to research, HYCM has very reasonable CFD and forex trading fees. Most of the time, clients are not charged for trading their deposits or making withdrawals, except for a few circumstances where a specific withdrawal fee applies. Retail forex traders are charged a $30 withdrawal fee on bank wire transfers under $300.According to numerous HYCM reviews (user reviews), swap rates on different overnight positions and a $10 monthly inactivity fee may be applicable, which are somewhat irksome to clients.

Leverage

Different leverage ratios are available to its clients based on their jurisdictions, according to broker reviews: - Metals, indices (US cash and futures), and exotic currency trading firm HYCM Ltd.

1:500 Indices for FX majors and minors (India or China futures) – 1:33 Other cash indices, EU, HK, and JK futures indexes, and commodities (soft) – 1:50

Oil prices and US stocks – 1:20 Oil prices (Natural gas) Stocks (Germany, France, and Spain): 1:67 Stocks: 1:10

Pros

Low CFD fees and forex

Competitive Pricing

Excellent selection of education tools

A wide range of currency pairs are available

Live chat, email, and phone are all ways to contact helpful customer care

Traders get access to the MT4 and MT5 platforms and a free HYCM demo account.

Cons

Cryptocurrency trading is not supported in all countries

Some low-tiered accounts have a limited selection of products.

Inactivity fee may be levied

Only CFD and forex products are available

There are no proprietary platforms

The designs of trading platforms are outdated

Mobile App

The MT4 and MT5 trading apps are available on normal Android and iOS devices because HYCM is a MetaTrader(only) broker. But unlike other brokers (brokerage businesses), HYCM does not support proprietary trading software; the HYCM app simply permits registered traders to access the client site. Therefore, the HYCM app only offers the standard MetaTrader app, which is quite a disadvantage compared to its rivals. This is because other MetaTrader-only forex brokers support their own proprietary app, unlike the HYCM app.

Customer Care

On the broker platform, a specialised HYCM customer care centre is available in several languages (12 languages) and open all day (24 hours), five days a week. The HYCM customer service team can be reached by live chat, fax, phone, email, or fax. It is simpler for clients residing in many international locations to access the platform thanks to the availability of customer support in several different languages, and this makes it one of the finest forex brokers on the market.

Conclusion

In order to wrap up our HYCM review, one investment tip for traders is to conduct their own thorough study into the regulation of any online trading platform (CFD broker) before choosing it, such as verifying the regulation processes, etc. The broker seems legitimate based on the available HYCM reviews and studies.

It provides traders worldwide with a dependable platform for trading forex and CFD brokers with the integration of market-leading technology, assuming smooth trading with HYCM and faster transaction execution.HYCM is a broker for people who value a wide selection of trading tools and quick service. The firm is a reliable broker for novice and seasoned traders who can operate on desktop computers and mobile devices.

1 note

·

View note

Text

tp global fx: Latest News & Videos, Photos about tp global fx Page 1

tp global fx: Latest News & Videos, Photos about tp global fx Page 1

Contents

Mutual fund Investments

Best Forex Brokers in India 2022 | RBI Approved and SEBI Regulated

These deals should be accepted only on ETPs authorised for the purpose by the RBI.

Permitted forex deals can be executed electronically.

RBI has also cautioned against misleading advertisements of unauthorised ETPs offering forex trading facilities to Indian residents, including on social media…

View On WordPress

1 note

·

View note

Text

Things You Should Know About The Currency Market In India

Indians are well-versed in their nation's equities and stock markets. But a lot of individuals find the Indian currency market to be bewildering. If you want to make money trading forex online, you must have a fundamental understanding of the Indian currency markets. You should educate yourself about investing before you engage in any type of activity.

The same advice that applies to being cautious when you first begin trading on currency markets also applies to being patient while learning how to trade stocks. Since the idea of trading with money may be unfamiliar to you, you might initially feel anxious. However, there are a few fundamentals regarding markets and their operation that you should be aware of before you begin investing. Real-life experiences may teach you more than any book ever could. There are five things you should be aware of because currency exchange is less frequent in India than it is elsewhere.

1. Is currency trading legal in India?

Online forex trading has not gained as much traction in India as other forms of investment. The Reserve Bank of India's restrictions on currency trading are the key reason why investors don't trade currencies. They discover that traditional equity trading, which begins with the opening of a demat account, is simple to comprehend and simple to carry out. But it's not as difficult as it might seem at first to trade currencies in India. For the Reserve Bank of India to permit individuals to trade on the Forex market, the Indian Rupee must be used as the basis currency in all transactions. The list of assets that can be traded has been expanded by the Reserve Bank of India to include GBP-USD, EUR-USD, and USD-JPY. All of them are cross-currency combinations.

2. Understand the various currency markets in India.

It may not be necessary to open a demat account if you wish to trade currencies in India. However, you'll require a Forex trading account, which might be connected to a bank account. Following this, there are two primary categories of currency markets where you can trade. They comprise both futures markets and spot markets. Investors opt to place their money on the futures market due to restrictions on currency trading in India and the poor earnings offered by derivatives utilised in currency trading.

3. What factors affect the Indian Foreign Exchange Markets?

The careful trader should avoid online forex trading. Because monetary and economic fluctuations may have an impact on other nations, you need to be aware of the risks. A variety of geopolitical variables and events affect how much currencies cost. On the other side, central banks frequently have an impact on the forex markets. In order to accomplish this, central banks employ a number of instruments, including those that have an impact on monetary policies, those that alter the conditions under which exchanges are permitted, and those that have an impact on currency markets. The Reserve Bank of India, the nation's central bank, is crucial to how currency markets operate. When necessary, it does this to prevent the Indian Rupee's value from declining.

4. Sign up to trade currency in India

The Securities and Exchange Board of India, also known as SEBI, is in charge of monitoring the intermediaries who operate in the Indian foreign exchange market. You must register with a broker that SEBI has authorized to be regulated if you wish to trade currencies. Brokers who are permitted by SEBI to trade in currencies must hold a valid SEBI license.

5. Trading on the Indian Foreign Exchange Market

The Forex online trading platforms that your broker offers can be used to begin trading on the currency market once you have registered with a SEBI-approved Forex broker and funded your account. Several different trading tactics can help you be successful. However, it's recommended to begin with minor deals if you wish to engage in trading, particularly in countries like India where the foreign exchange market is still developing.

Open an account with Zebu right away to get started trading currencies if you'd like to.

#online trading platform#lowest brokerage#stock market#stock market basics#basics of share market#stock market beginner#stock split#stock trading

0 notes

Text

Share Market Trading in Chennai | Share Market Profile

The turn point trading methodology is involved by dealers for value, ware and forex trading. It is typically utilized by merchants to foresee costs and the pattern of the market for a specific time frame outline Share market trading in chennai

.

Why are turn levels significant for an intraday broker?

An intraday dealer watches out for the costs of the earlier day costs and works out the turn highlight get a comprehension with respect to when and where the costs will begin to rise lastly track down obstruction. This additionally assists the brokers with recognizing the point from where the costs would start to fall. There are seven fundamental turn focuses which are diagrammed. There is one plotting which is in the outline and there are three focuses which is over the center point and these are points of obstruction and there are three focuses which are beneath the center point which are points of help.

Intraday trading with the assistance of Pivot Levels

For a merchants the turns play a significant level in everyday trading. They keep a fundamental thumb guideline in which in the event that the costs open over the turn level which is plotted in the graph. The market is supposed to be bullish or the costs would rise. In the event that the costs open underneath the center turn level the costs would pursue a negative direction or the costs would fall. There are two essential focuses which should be seen obviously to get a superior comprehension of turn point trading methodology.

1. Pivot point skip

2. Pivot level breakout

Turn point skip technique

This is a methodology which depends on the turn point zone. For brief periods of time the turn point is diagrammed. Whenever the hourly candle design is over the Pivot Point Zone the purchase exchanges are made and when the Pivot Point Zone is beneath the hourly candle sell exchanges are made. Turn level breakout

At the point when another turn high is outlined which is over the line of obstruction it proposes a breakout recommending an upturn. At the point when another turn low is diagrammed with the costs beneath the help line this again recommends a breakout in a downtrend. The merchants for the most part exchange for a long position when the cost breakout vertical in a turn point level. These breakouts can be normally seen in the first part of the day.

The Uniqueness of Pivot Point trading system

1. The turn focuses are graphed with the assistance of earlier day's information. The information is just really great for current days trading.

2. The information is diagrammed considering a solitary days trading so the pointer is helpful just for brief periods of time.

3. According to brokers turn point shows serious level of precision assuming that it is outlined and utilized accurately.

4. The trading choice of the dealer depends on rich information which is as seven turn focuses which can utilized while exchange.

5. The dealers need not outline the turn focuses themselves the trading stages offer this pointer to their client for simplicity of trading.

Intraday trading is a workmanship which should be gained from the stars. Most dealers live with the lament of clutching their stock too lengthy or let it go too soon. It is a battle which most merchants go through for a really long time together. On the off chance that the specialty of trading is gained from individuals who are a foundation of information in trading there will be nuts and bolts which will consequently get arranged.

1. When to enter an exchange?

2. When to leave an exchange?

3. Where to put a stop misfortune?

Intraday trading is shown by an establishment named "Share Market Profile "in Chennai. It is a web-based course so you can take the advantage of their course and go anyplace in India. They assist you with getting to know the essentials of stock trading and with directed practice they help you in turning into a master in the field.

Any individual who needs to have an effective trading profession needs to pre plan his work. Another dealer in the event that he moves to the web-based world for help and help to design his trading technique he would get all befuddled as every one of them would make obscure ideas.

In any case, what to plan would be distressingly referenced. The second thing which individuals as a rule discuss is to save the capital they will put resources into the stocks. Anyway what are the important insurances to be taken isn't referenced. In this blog we would specify the powerful approaches to making a trading technique. Before you settle upon an arrangement you test your arrangement with a modest quantity of cash as opposed to putting every one of your reserve funds at one go.

1. Skill Assessment

In the wake of mastering the abilities of trading it is essential to test the abilities of trading which a broker has learnt throughout some stretch of time.

2. Mental Preparation

A psychological mindfulness needs to leak inside the dealer that they would have to get into the game and safeguard their speculation and procure benefit.

3. Set Risk Level

A financial backer would have to dissect their age bunch and the sort of venture they can make and what might be the gamble level they might want to open themselves to.

A broker necessities to keep record of the multitude of exchanges they make and figure out their solidarity and shortcoming of the exchange. In a trading bargain there should be so often a broker priority created enormous gains and commonly a dealer should have gigantic misfortunes. What were the conditions on the lookout and what were the choices which empowered a specific result should be dissected exhaustively. Share market trading in chennai

#trading classes in chennai#professional stock trading course#share trading coaching chennai#trading classes in Chennai.#share market trading training

0 notes

Text

Forex Trading in India: A Beginner's Guide

During the past few years, forex trading in India has become increasingly popular in India, as many individuals look to profit from global currency markets. However, for beginners, forex trading can seem complex and daunting. It aims to provide beginners with an introduction to forex trading.

Trading forex involves buying and selling currency pairs with the goal of profiting from changes in exchange rates. Brokers who offer online trading platforms allow traders to trade online.

Forex trading fundamentals, such as currency pairs, pips, and leverage, should be studied by beginners before they begin.

In addition, it is imperative to develop a trading plan and a risk management strategy. The purpose of this is to ensure that trades are made with a clear purpose and limited risk. Check out this blog for more information.

Read more: https://sariknowledge.com/forex-trading-in-india-a-beginners-guide/

0 notes