#online invoicing software

Explore tagged Tumblr posts

Text

Free Invoice Generator with Online Templates

Would you like to Generate a Free invoice?

Zozo online invoicing software and templates make it simple to create a free invoice in Australia. Online templates for pre-made invoices are available for use. You can edit many of these templates for free to add your information. Millions of people trust us as your original Invoice Generator. With our eye-catching invoice template, Invoice Generator allows you to quickly create invoices right from your web browser. Create an invoice online customized for your brand or business using a Zozo free online invoice template.

Contact Us - https://www.zozo.com.au/contact-us

Regsiter - https://www.zozo.com.au/register

Website - https://www.zozo.com.au/

Our Plans - https://www.zozo.com.au/plans

2 notes

·

View notes

Text

Online Invoicing Software in India

Are you looking for India's Best Online Invoicing Software in India? We provide Invoice Software that helps manage Billing, Accounting, Invoicing etc. Get Free Demo now.

0 notes

Text

Online Invoice Tracking

"Online invoice tracking" refers to the process of monitoring and managing the status of invoices through an online system. It allows businesses to track the progress of invoices from the moment they are created until they are paid. This feature is crucial for managing cash flow, ensuring timely payments, and improving the overall invoicing process. For more information Visit Us: https://aninvoice.com/

0 notes

Text

Printed Invoice Vs Online Invoices

When it comes to invoicing, businesses often choose between printed invoices and online invoices. Each method has its pros and cons, which can impact efficiency, cost, and the overall invoicing experience. Here's a comparison of printed invoices versus online invoices:

Printed Invoices

Advantages:

Physical Copy:

Customers receive a tangible document that can be easily referenced or filed away.

Ideal for customers who prefer traditional methods.

No Internet Required:

Useful in areas with limited internet access or for businesses operating offline.

Formal Presentation:

Printed invoices can convey a professional image, especially if they are well-designed and printed on quality paper.

Easy for Record-Keeping:

Many businesses prefer physical records for bookkeeping or compliance purposes.

Disadvantages:

Higher Costs:

Costs associated with printing, paper, ink, and postage can add up, especially for high volumes of invoices.

Environmental Impact:

More paper use contributes to waste, which is a concern for environmentally conscious businesses.

Time-Consuming:

Printing, signing, and mailing invoices can delay the invoicing process and slow down cash flow.

Difficult to Track:

Tracking payments and managing invoices can be cumbersome without digital tools, leading to potential errors or oversights.

Online Invoices

Advantages:

Cost-Effective:

Reduces costs associated with paper, ink, and postage. Digital storage is also cheaper than physical storage.

Speed and Efficiency:

Invoices can be sent instantly via email or through invoicing software, speeding up the payment process and improving cash flow.

Easier Tracking and Management:

Online invoicing systems often include features for tracking payments, sending reminders, and managing recurring invoices, making it easier to stay organized.

Environmental Benefits:

Reduces paper waste, making it a more eco-friendly option.

Accessibility:

Online invoices can be accessed from anywhere with an internet connection, making it convenient for both businesses and customers.

Customization and Automation:

Many online invoicing tools allow for customization of invoice templates and the ability to automate recurring invoices.

Disadvantages:

Dependence on Technology:

Requires reliable internet access and technology, which can be a barrier for some businesses or customers.

Less Personal:

Some customers may prefer the traditional feel of a printed invoice, finding online invoices less personal.

Security Concerns:

Online invoicing systems may be vulnerable to cyber threats, so businesses must ensure they use secure platforms to protect sensitive information.

Learning Curve:

Some users may require time to learn how to use online invoicing software effectively, which can be a challenge for less tech-savvy individuals.

Conclusion

Choosing between printed invoices and online invoices largely depends on your business model, customer preferences, and operational capabilities. Printed invoices may be more suitable for businesses with clients who prefer traditional methods, while online invoices are often more efficient, cost-effective, and eco-friendly. Many businesses find a hybrid approach—using both printed and online invoices depending on the situation—works best for their needs.

0 notes

Text

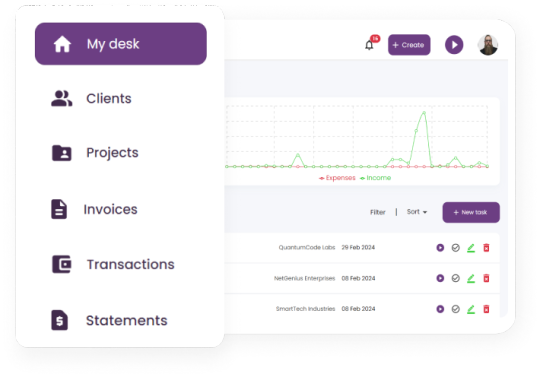

Introducing Zodot: The world's simplest way for self employed people and startups to run and grow their business

The need for streamlined, efficient, and comprehensive management solutions has never been more critical in the ever-evolving business world. Enter Zodot – an all-in-one SaaS productivity suite that is set to revolutionize how freelancers, small businesses, software teams, lawyers and attorneys, entrepreneurs, creative agencies, and consultants manage their operations. As we prepare for our official launch, we are excited to share the unique features and benefits of Zodot, our vision for the future, and the incredible journey we are embarking on with the support of a significant seed funding of 500K USD.

What is Zodot?

Zodot is not just another productivity tool; it's a comprehensive business management platform designed to simplify and enhance your work. Whether you are a freelancer juggling multiple clients, a small business aiming to streamline operations, or a legal firm managing complex agreements, Zodot is tailored to your unique needs.

Our platform brings together a wide range of features under one roof, making it easier than ever to manage your workflow, clients, projects, time, invoices, agreements, and transactions. With Zodot, you can focus on what truly matters – growing your business and achieving your goals.

Key Features of Zodot

As we gear up for our launch, we are proud to introduce the key features that make Zodot a game-changer in the business management space:

1. Streamline Your Workflow

Zodot helps you automate and optimize your daily tasks, saving you valuable time and effort. With our intuitive interface and powerful tools, you can streamline your workflow, reduce administrative burden, and enhance productivity.

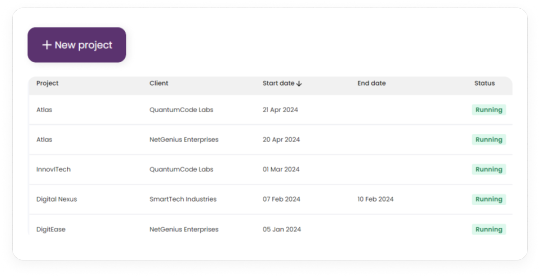

2. Manage Clients & Projects

Keeping track of client interactions and project progress can be challenging, but Zodot makes it easy. Our platform allows you to manage all your clients and projects in one place, ensuring you stay organized and on top of your workload.

3. Track Time & Invoices

Accurate time tracking and invoicing are crucial for any business. Zodot provides robust time tracking tools that allow you to monitor your work hours and generate invoices quickly and accurately. This not only helps you get paid on time but also provides valuable insights into your productivity. You can also create detailed tracked time reports to analyze how your time is spent across different projects and clients.

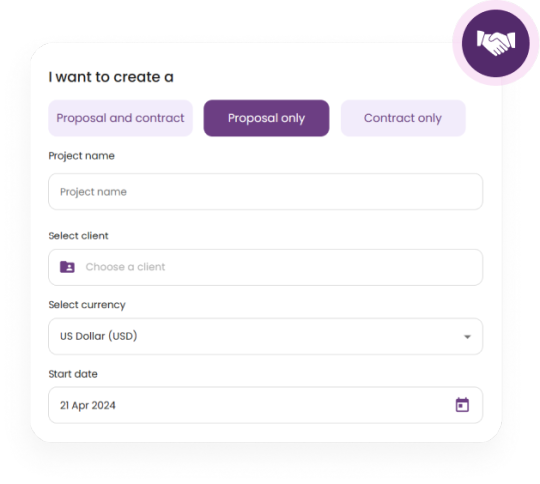

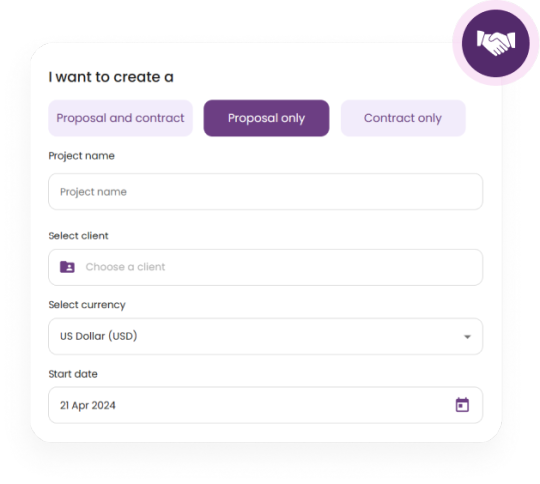

4. Handle Agreements & Transactions

Managing contracts, proposals, and financial transactions can be complex and time-consuming. Zodot simplifies this process by providing a centralized platform for handling all your agreements and transactions. From drafting and signing contracts to tracking income and recording expenses, Zodot has got you covered. Our platform also offers detailed tax reports and financial statements to help you stay on top of your financial health.

5. Customizable Templates for Branding

We understand the importance of maintaining your brand identity. With Zodot, you can customize templates for invoices, proposals, contracts, and more, ensuring that all your documents reflect your unique branding.

Our Vision

At Zodot, our mission is to empower self-employed professionals and small businesses with tools that simplify business management and enhance productivity. We believe that with the right resources, anyone can achieve their business goals efficiently. Our vision is to create a platform that not only meets but exceeds the expectations of our users, enabling them to thrive in their respective fields.

Exciting News: Seed Funding

We are thrilled to announce that Zodot has secured seed funding of 500K USD. This significant investment is a testament to the potential of our platform and the trust that our investors have in our vision. With this funding, we will be able to accelerate our development process, enhance our features, and bring Zodot to market more quickly.

The Impact of Seed Funding

The seed funding of 500K USD will play a crucial role in our journey. It will allow us to:

Enhance Platform Development: We will invest in advanced technologies and hire top talent to ensure that Zodot is built to the highest standards of quality and performance.

Expand Features and Capabilities: With additional resources, we will be able to expand our feature set, making Zodot even more comprehensive and powerful.

Improve User Experience: We are committed to providing an exceptional user experience. This funding will enable us to refine our interface, improve usability, and ensure that Zodot is intuitive and user-friendly.

Marketing and Outreach: Bringing Zodot to the attention of our target audience is essential. We will allocate funds towards marketing and outreach efforts to build awareness and generate interest in our platform.

Join Us on This Journey

As we prepare for our official launch, we invite you to join us on this exciting journey. Stay tuned for more updates and be among the first to experience the power of Zodot. We are committed to providing regular updates on our progress, new features, and upcoming events.

Follow Us

Keep up with our latest news and updates by following us on our social media channels and visiting our website at www.zodot.co. By staying connected, you'll be the first to know about our launch date, special offers, and exclusive insights into how Zodot can transform your business.

Conclusion

In a world where efficiency and productivity are paramount, Zodot stands out as the ultimate business management solution. With a comprehensive suite of features designed to streamline your workflow, manage clients and projects, track time and invoices, handle agreements and transactions, and provide detailed financial reports, Zodot is poised to revolutionize the way you work.

Our vision is to empower freelancers, small businesses, software teams, lawyers and attorneys, entrepreneurs, creative agencies, and consultants with tools that enhance productivity and simplify business management. With the support of our seed funding, we are confident in our ability to deliver a platform that not only meets but exceeds your expectations.

We are excited to embark on this journey with you and look forward to sharing the incredible benefits of Zodot soon. Stay tuned for our launch, and get ready to experience the future of business management with Zodot.

Thank you for your support and enthusiasm as we prepare to launch Zodot. We can't wait to show you what we have in store!

#freelance#productivityboost#open starter#free invoice software#online invoicing software#invoicemanagement

1 note

·

View note

Text

if you want to income online money

#online#online income#online insurance#online internship#online invoicing software#online international money transfer from iran

0 notes

Text

A comprehensive guide to Form 16A: A TDS Certificate

Form 16A is a TDS certificate that is issued by the deductor on a quarterly basis. It is a statement concerning the nature of payments, the amount of TDS, and the deposited TDS payments to the Income Tax department. It also consists of brokerage, interest, professional fees, contractual payments, rent, and other sources of income.

Unlike Form 16, which only consist salary structure, Form 16A of income tax charge TDS from:

Receipts from business or profession fees.

Rental receipts from a property or rent.

Sale proceeds from capital assets.

Additional source.

Important components of Form 16A

The important components of Form 16A are:

Details of the Employer: It contains the name, TAN, and PAN of the employer.

Details of Employee: It contains the name, TAN, and PAN of the employee.

Mode of Payment: Both offline and online modes of payment are available.

Receipt number of TDS: The receipt number of TDS helps in the tracking of back details.

The date and deposit tax amount with the income tax department help track information.

Significance of Form 16A

Form 16A plays a pivotal role while filing an income tax return, especially when someone has other sources of income apart from their salary. Here are the key benefits of Form 16A:

Filing of income tax returns: The details contained in Form 16A help employees file their income tax returns. It guides employees in reporting their total income, which includes salary and other sources.

Tracking of TDS: It helps every individual keep track of the tax deducted at source (TDS) on their income. It gives you a summary of TDS deducted at source.

Income Proof: Form 16A works as evidence of an individual's total earnings from other sources. Government agencies and financial institutions, like banks, easily accept this source as income proof.

Loan Applications: This form is important in verifying the loan applications. Financial institutions often need a record of the assets and liabilities of an individual to check the guarantee on loan repayment.

How to download Form 16A?

Below are the following steps to download Form 16A:

Visit the official website of the income tax department.

Complete the registration process on the website.

Click the "Download" tab, and then select Form 16A.

Fill in the PAN details, and then click “Go to continue.”.

Click submit and download Form 16A.

What is the difference between Form 16 and Form 16A?

Form 16 and Form 16A are both TDS certificates, but there are certain differences between them. The following are the differences between Form 16 and Form 16A:

Form 16 is a TDS certificate deducted from salary, whereas Form 16A is issued for income other than salary.

Form 16 is issued by the employer, whereas Form 16A is issued by financial institutions.

Form 16 is used for deducting tax from salary, whereas Form 16A is for removing taxes from another source of income apart from salary.

Final Thoughts

Paying taxes is the responsibility of the citizens of the nation. It is evident that the process of filing an income tax return and Form 16A is restless and troublesome. Some technical terms of income tax are not known to the new taxpayer. Worry not, because Eazybills will solve every tax-related problem and also offer TDS tracking.

So? What are you waiting for? Connect to us today through our website, where our professional team will guide you according to your requirements.

#form 16A#income tax return#tds certificate#file income tax return#easy billing software#gst billing software#free invoicing software#billing software#free billing software#best billing software#online billing software#online invoicing software#best invoice software

0 notes

Text

Gbooks offers unparalleled efficiency with its invoicing software, revolutionizing the way businesses manage their finances. With intuitive features and customizable templates, generating professional invoices becomes a breeze. Seamlessly integrate with your accounting systems for real-time tracking of payments and expenses. Enjoy automated reminders for overdue payments, ensuring steady cash flow. The user-friendly interface simplifies the invoicing process, saving you time and reducing errors. Plus, with secure cloud storage, access your financial data anytime, anywhere. Trust Gbooks to optimize your invoicing workflow and elevate your business to new heights of productivity and profitability.

#best invoicing software#free invoice generator#invoicing software for small business#legal billing software#free invoice software#billing software for small business#online invoicing software#free billing software#online billing software#best billing software#online invoice creator#invoice billing software

0 notes

Text

#billing software#free invoice software#gst billing software#free billing software#invoicing software#invoice software#online invoicing software#accounting software#inventory management#best free billing software#best free invoicing software#best free invoice software#best invoicing software#online free invoicing software#free online billing software#online billing software

0 notes

Text

Courier Service Management Software by @hrsoftbd Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

4 notes

·

View notes

Text

Hospital Management Software from HRsoft Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

2 notes

·

View notes

Text

Searching for Online Invoicing Software that makes managing customer information stress-free, saves you time, and gets you paid? Zozo is a Free Online Invoice Creation application that allows you to create invoices online quickly and easily. With just one click, our Invoice Generator—which is trusted by millions of customers—creates eye-catching, polished invoices for businesses. It's an Easy Invoice Maker. The greatest invoice payment app is offered by ZoZo to small businesses. Reach for more details - https://www.zozo.com.au/

#online invoicing software#online billing software#free invoice software#free invoice generator#invoice app#invoice create app#create invoice free#best free invoice software#invoice app for small business#invoice software free#pay invoice software#invoice creation application#invoice creation software#online free invoice generator#easy invoice maker

1 note

·

View note

Text

HRsoftBD offer Bluk SMS

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#hrsoftbd

2 notes

·

View notes

Text

Best e Invoice Software

Discover Aninvoice – The Best e-Invoice Software Solution! Streamline your business with our cutting-edge cloud accounting software. Say goodbye to traditional accounting programs and embrace the future with Aninvoice. Tailored for businesses of all sizes,their intuitive platform simplifies invoicing, billing, and financial management. Enjoy seamless integration, effortless invoicing, and real-time insights into your finances. Upgrade to Aninvoice today and experience the difference! Revolutionize your accounting process and elevate your business to new heights. Join the ranks of satisfied users benefiting from the best accounting software for business.

0 notes

Text

Online Invoice generation

To generate and send an invoice online, one can follow these steps using various tools and platforms:

1. Use an Invoicing Software or Tool

Popular Tools: FreshBooks, Billsarathi, QuickBooks, Zoho Invoice, Wave, PayPal, etc.

Steps:

Sign Up for an account on any of these platforms.

Create a New Invoice:

Add your business details (name, address, logo, etc.).

Add client details (name, address, email, etc.).

Enter the products/services you are billing for (description, quantity, rate, etc.).

Set due dates, taxes, discounts if applicable.

Preview the invoice to ensure all details are correct.

Send the Invoice directly to the client via email through the platform.

2. Using Google Docs or Word Processors (Manual)

Steps:

Open Google Docs or Microsoft Word and select an Invoice Template.

Customize the template with your business details, client details, itemized services/products, and total amount.

Save the document as a PDF.

Send the PDF invoice via email to the client.

3. Using Excel or Google Sheets

Steps:

Use Excel or Google Sheets to create an invoice.

Add your company and client details, product/service details, prices, and totals.

Use built-in formulas to calculate totals and taxes.

Download the completed sheet as a PDF.

Send the PDF via email.

4. Send Invoice via Email

After creating the invoice:

Draft an email explaining the details of the invoice.

Attach the invoice PDF.

Include any payment instructions (bank transfer, PayPal, etc.).

Send to the client's email address.

5. Payment Integration

Some platforms like FreshBooks or PayPal allow you to integrate payment gateways directly into the invoice. Clients can click a link to pay directly, making the process easier.

Choose a method based on your needs for tracking, payment integration, and design.

0 notes

Text

Ballot Counting Software by @hrsoftbd ,

https://hrsoftbd.com/service-details/ballot-counting-software

It's features are Voter registration Ballot Paper Printing VOTE Booth Management Live Voter Token/Slip with Individual Barcode Vote Casting Percentage Live Ballot Counting/Evaluation Live Vote Counting Process Show VOTE Counting Result Print Design Ballot Papers

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

0 notes