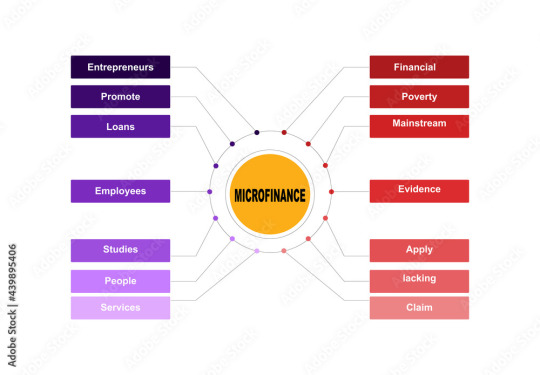

#online microfinance software

Text

Advanced Microfinance Software Features

#microfinance#software#microfinance software#softwaredemo#best microfinance software in kolkata#online best microfinance software in west bengal#microfinancesoftware

0 notes

Video

youtube

Online Nidhi & Microfinance Banking Software| Cloud Based| XEDOK

0 notes

Text

Digitization in Lending Market Huge Growth in Future Scope 2024-2030 | GQ Research

The Digitization in Lending market is set to witness remarkable growth, as indicated by recent market analysis conducted by GQ Research. In 2023, the global Digitization in Lending market showcased a significant presence, boasting a valuation of USD 423.66 Million. This underscores the substantial demand for Digitization in Lending technology and its widespread adoption across various industries.

Get Sample of this Report at: https://gqresearch.com/request-sample/global-digitization-in-lending-market/

Projected Growth: Projections suggest that the Digitization in Lending market will continue its upward trajectory, with a projected value of USD 857.74 billion by 2030. This growth is expected to be driven by technological advancements, increasing consumer demand, and expanding application areas.

Compound Annual Growth Rate (CAGR): The forecast period anticipates a Compound Annual Growth Rate (CAGR) of 26.58 %, reflecting a steady and robust growth rate for the Digitization in Lending market over the coming years.

Technology Adoption:

Increasing adoption of digitization in lending processes for efficiency and convenience.

Digitization utilized for loan origination, underwriting, approval, and servicing.

Integration of online platforms, mobile applications, and electronic signatures for seamless customer experience.

Application Diversity:

Consumer Loans: Digitized application processes for personal loans, mortgages, and auto loans.

Small Business Loans: Online platforms for business loan applications, credit assessment, and funding.

Peer-to-Peer Lending: Digital platforms connecting borrowers with individual investors for lending opportunities.

Microfinance: Digital lending solutions targeting underserved populations with microloans and financial inclusion initiatives.

Consumer Preferences:

Demand for streamlined and paperless loan application processes accessible through digital channels.

Preference for mobile-friendly interfaces and self-service options for loan management and payment.

Emphasis on data security, privacy protection, and transparent loan terms and conditions.

Desire for fast approval times and quick disbursal of funds facilitated by digitized lending platforms.

Technological Advancements:

Advancements in artificial intelligence (AI) and machine learning (ML) for credit scoring and risk assessment.

Integration of big data analytics and alternative data sources for personalized lending decisions.

Development of blockchain technology for secure and transparent loan transactions and smart contracts.

Adoption of open banking APIs for seamless integration with financial data and third-party services.

Market Competition:

Intense competition among traditional banks, fintech startups, and online lenders in the digital lending market.

Differentiation through innovative loan products, competitive interest rates, and superior customer service.

Strategic partnerships with technology providers, credit bureaus, and regulatory compliance firms.

Focus on digital marketing, customer engagement, and brand loyalty to attract and retain borrowers.

Environmental Considerations:

Consideration of environmental impact in the reduction of paper usage and physical documentation in lending processes.

Promotion of energy-efficient data center infrastructure and sustainable computing practices.

Implementation of eco-friendly practices in loan servicing and collection operations.

Compliance with environmental regulations and standards governing electronic waste disposal and recycling.

Regional Dynamics: Different regions may exhibit varying growth rates and adoption patterns influenced by factors such as consumer preferences, technological infrastructure and regulatory frameworks.

Key players in the industry include:

Fiserv

ICE Mortgage Technology

FIS

Newgen Software

Nucleus Software

Temenos

Pega

Sigma Infosolutions

Intellect Design Arena.

Tavant

The research report provides a comprehensive analysis of the Digitization in Lending market, offering insights into current trends, market dynamics and future prospects. It explores key factors driving growth, challenges faced by the industry, and potential opportunities for market players.

For more information and to access a complimentary sample report, visit Link to Sample Report: https://gqresearch.com/request-sample/global-digitization-in-lending-market/

About GQ Research:

GQ Research is a company that is creating cutting edge, futuristic and informative reports in many different areas. Some of the most common areas where we generate reports are industry reports, country reports, company reports and everything in between.

Contact:

Jessica Joyal

+1 (614) 602 2897 | +919284395731 Website - https://gqresearch.com/

0 notes

Text

Understanding Fintech Software Development: Revolutionizing Financial Services

In the fast-paced world of finance, technology has become a driving force, reshaping traditional methods and giving rise to innovative solutions. Fintech software development lies at the heart of this revolution, empowering businesses to adapt, evolve, and thrive in an increasingly digital landscape.

Fintech software development encompasses the creation and implementation of technology-driven solutions tailored specifically for the financial sector. These solutions range from mobile banking applications to sophisticated trading platforms, each designed to streamline processes, enhance security, and improve the overall customer experience.

At its core, fintech software development combines expertise in finance, technology, and user experience design to deliver cutting-edge solutions that meet the evolving needs of financial institutions and their clients. By leveraging advanced technologies such as artificial intelligence, blockchain, and cloud computing, fintech developers can create scalable, secure, and feature-rich applications that drive innovation and efficiency across the industry.

One of the key benefits of fintech software development is its ability to democratize access to financial services. Through mobile apps and online platforms, individuals and businesses can now access a wide range of financial products and services from anywhere in the world, breaking down barriers and empowering users to take control of their finances like never before.

Moreover, fintech software development plays a crucial role in driving financial inclusion, particularly in underserved communities and emerging markets. By offering digital banking services, microfinance solutions, and alternative lending platforms, fintech companies are expanding access to financial services to those who were previously excluded from the traditional banking system.

In addition to improving access and convenience, fintech software development is also driving innovation in areas such as payments, lending, insurance, and wealth management. From peer-to-peer lending platforms to robo-advisors, fintech companies are disrupting traditional business models and challenging incumbents to adapt or risk becoming obsolete.

As the fintech industry continues to evolve, so too does the demand for skilled fintech developers. With expertise in software development, financial systems, and regulatory compliance, these professionals play a crucial role in bringing innovative fintech solutions to market while ensuring security, reliability, and regulatory compliance.

In conclusion, fintech software development is reshaping the financial services industry, driving innovation, improving access, and empowering users around the globe. By combining finance with technology, fintech developers are revolutionizing the way we manage, save, invest, and transact, creating a more inclusive, efficient, and accessible financial ecosystem for all.

0 notes

Text

Open-Source Fintech Script: Empowering Online Financial Services

Introduction:

Have you ever pondered how technological innovation is reshaping the landscape of financial services? Open-source Fintech scripts drive a significant revolution in managing and accessing financial solutions. From democratizing financial inclusion to fostering innovation, these scripts are becoming the cornerstone of online financial services. But what exactly are these scripts, and how are they transforming the sector?

Open-Source Fintech Scripts Unveiled:

In the digital transformation era, technology is revolutionizing every aspect of our lives, including how we manage our finances. Open-source Fintech scripts are emerging as a powerful force driving innovation in the financial services industry. These scripts, with their openly accessible source code, are empowering developers to create and customize financial solutions that are accessible, secure, and cost-effective.

Open-source Fintech scripts represent a fundamental shift in financial technology. They are software solutions with openly accessible source code, inviting collaboration, modification, and distribution. The collaborative ecosystem they create allows developers to collectively enhance and customize these scripts, accelerating innovation while ensuring inclusivity within the Fintech sphere.

Advantages of Open-Source Fintech Scripts:

Let's delve into the core advantages and functionalities that open-source Fintech scripts offer:

Versatility: These scripts are the foundational framework for various financial services, including digital payment gateways, secure transaction systems, investment platforms, and comprehensive financial management tools.

Customization: Their adaptable nature empowers developers to create tailored solutions, catering to specific business requirements and ensuring a personalized user experience.

Innovation Catalyst: The collaborative environment nurtures innovation by harnessing the community's collective expertise, ensuring responsiveness to evolving market needs and technological trends.

Promoting Financial Inclusion:

One of the most striking impacts of open-source Fintech scripts is their role in promoting financial inclusivity:

Addressing Underbanked Communities: Initiatives leveraging these scripts create mobile banking applications, peer-to-peer lending platforms, and microfinance solutions, bridging the gap for underbanked and marginalized communities globally.

Empowering Emerging Economies: By providing cost-effective and customizable solutions, these scripts empower small entrepreneurs and facilitate economic growth in emerging economies.

Democratizing Financial Services through Open-Source Fintech Scripts

The financial technology industry, Fintech, has recently grown in popularity. Fintech companies leverage cutting-edge technologies to provide innovative financial solutions that challenge traditional banking models. At the heart of this revolution are open-source Fintech scripts and software solutions with openly accessible source code. This open-source approach fosters collaboration, innovation, and accessibility within the Fintech ecosystem.

Real-World Examples and Case Studies:

Kiva: Utilizing open-source platforms, Kiva facilitates peer-to-peer micro-lending, connecting lenders and borrowers worldwide fostering financial inclusion and entrepreneurship.

Grassroots Economics: Leveraging open-source scripts, Grassroots Economics enables community currencies in underserved regions, empowering local economies and supporting sustainable development.

Open Banking Initiatives: European countries have adopted open-source Fintech scripts to implement Open Banking, allowing customers to access financial data across multiple institutions, fostering competition and innovation.

Mambu: Mambu's cloud-native open-source banking platform allows financial institutions to deliver state-of-the-art banking experiences, rapidly promoting innovation and scalability.

Hiveonline: This blockchain-based solution leverages open-source scripts to provide digital trust platforms for SMEs, facilitating access to financial services and networks.

Odoo: Utilizing open-source technology, Odoo offers comprehensive financial management modules, including accounting, invoicing, and budgeting, benefiting businesses of all sizes.

Hydrogen: Hydrogen's open-source infrastructure enables developers to build and deploy financial applications quickly, providing various tools for investing, savings, and financial planning.

AlgoTrader: AlgoTrader utilizes open-source scripts to offer algorithmic trading solutions, empowering traders with advanced automation and trading strategies.

BitPay: Employing open-source technology, BitPay provides cryptocurrency payment processing services, enabling merchants to accept digital currencies securely.

QuantConnect: QuantConnect utilizes open-source financial algorithms, allowing developers to build and test trading strategies across various financial markets.

Plaid: Plaid leverages open-source scripts to provide APIs for financial data, enabling seamless integration of banking information into applications.

Hedera Hashgraph: Utilizing open-source technology, Hedera Hashgraph provides a distributed ledger platform for secure and fast financial transactions.

Zerodha: Zerodha uses open-source scripts to power its online trading platform, offering low-cost brokerage services to retail investors.

Dharma: Leveraging open-source lending protocols, Dharma enables peer-to-peer lending and borrowing on the blockchain.

Truelayer: Truelayer utilizes open-source scripts to provide API services for accessing banking data securely, facilitating innovative financial applications.

Technical Aspects of Open-Source Fintech Scripts:

Security Protocols: These scripts prioritize robust security protocols, employing encryption standards and multi-factor authentication to safeguard user data and transactions.

API Integration: Offering robust API integrations, these scripts enable seamless connectivity with third-party services, expanding functionality and enhancing user experiences.

Workflow of Open-Source Fintech Scripts:

Understanding the workflow of these scripts illuminates their functionality:

Rider App Workflow:

Users sign up and provide the necessary details.

Book a ride by specifying the pick-up and drop-off locations.

The app searches for nearby drivers and displays the current location of the assigned driver.

Completes the ride and pays the fare via the app.

Driver App Workflow:

Drivers register and switch to an online mode to receive ride requests.

Receive ride details from nearby users and complete the ride.

Receive payment for the completed trip.

Implementing an Open-Source Fintech Script:

To embark on building an open-source Fintech script, consider these key steps:

Conduct Extensive Market Research: Understand user behavior, market trends, competitor strategies, and available resources before commencing development.

Gather Requirements: Based on research insights, define the essential features and functionalities for your script's Minimum Viable Product (MVP).

Estimate Development Costs: Plan and evaluate the costs of building the script. Typically, it ranges from $1500 to $4500, depending on the scope and customization.

Agile Development: Adopt an agile methodology for iterative development, focusing on regular milestones and continuous testing.

Thorough Testing: Ensure rigorous testing of the script for functionality, user interface, performance, and usability before launch.

Launch and Feedback Loop: Post-launch, collect user feedback to continuously refine and enhance the script.

Conclusion:

Open-source Fintech scripts stand at the forefront of reshaping the financial technology landscape. Their versatility, adaptability, and role in fostering financial inclusion make them pivotal in shaping a more accessible and innovative future in online financial services.

Key Takeaways:

Open-source Fintech scripts democratize financial services by fostering inclusivity and innovation.

Their workflows cater to riders and drivers, ensuring a seamless user experience.

Implementing these scripts involves market research, requirements gathering, agile development, thorough testing, and continuous improvement.

0 notes

Text

Software Development Company in Lucknow

Transforming Business Success with Sigma IT Software Solutions

Best Software Development in Lucknow

In today's fast-paced digital world, businesses are constantly seeking ways to stay competitive, streamline operations, and enhance their customer experiences. Enter Sigma IT Software, a company that's been making waves in the tech industry with its cutting-edge software solutions. In this blog post, we'll take a closer look at how Sigma IT Software is helping businesses of all sizes transform and thrive.

Who Is Sigma IT Software?

Sigma IT Software is a forward-thinking software development company headquartered in the vibrant city of Nawabs Lucknow. With a team of highly skilled and dedicated professionals, they have been delivering top-notch software solutions since their inception. Their commitment to excellence and innovation sets them apart in a crowded field.

Services Offered by Sigma IT Software

Sigma IT Software offers a wide range of software services that cater to diverse industries and business needs. Here are some of the core offerings:

Custom Software Development: Sigma IT Software specializes in crafting tailor-made software solutions that align with the unique requirements of each client. Whether it's a web application, mobile app, or desktop software, they've got you covered.

MLM Software: Multi-Level Marketing (MLM) businesses benefit from Sigma IT Software's MLM software solutions, which streamline operations, facilitate commission tracking, and provide powerful reporting tools.

Nidhi software :- SigmaIT Softwares is a Nidhi software nidhi software development company in Lucknow, .Located in Lucknow, SigmaIT Software Designers is a prominent Nidhi software development company that specialises in offering comprehensive solutions to manage various aspects of your Nidhi or Mutual Benefit Fund business all under one roof.

Microfinance Software :- SigmaIT Software Microfinance Software Development Company In Lucknow or Microfinance Software Company In Lucknow providing financial services to nearly 3 billion unbanked people worldwide

Billing Software Solutions :- SigmaIT provides you with an efficient, easy-to-use accounting and billing software that will help your business reach new heights.

E-commerce Solutions: In the world of e-commerce, Sigma IT Software helps businesses set up robust online stores, enhance user experiences, and boost sales through innovative features and secure payment gateways.

Web Design and Development: They create stunning, responsive websites that captivate visitors and provide seamless user experiences.

Mobile App Development: From Android to iOS, Sigma IT Software develops mobile apps that stand out in an app-saturated marketplace.

Why Choose Sigma IT Software?

There are several compelling reasons why businesses in Lucknow and beyond are choosing Sigma IT Software as their software development partner:

Customization: They understand that every business is unique. That's why they provide fully customised software to meet specific needs.

Affordability: Sigma IT Software offers competitive pricing, making their services accessible to startups and established enterprises alike.

Customer-Centric Approach: They priorities customer satisfaction, offering excellent post-launch support and assistance.

Innovation: Sigma IT Software stays at the forefront of technological advancements, integrating the latest trends into their software solutions.

To learn more about Sigma IT Software and how they can elevate your business to new heights, contact us today. Your path to digital transformation and success begins here.

Lucknow Software Company

#softwaredevelopment

#websitedevelopment

#appdevelopment

#digitalmarketing

contact us for more details +91 9956973891

1 note

·

View note

Text

Loan Management System: Simplifying Financial Operations

In today's rapidly evolving financial landscape, effective loan management has become a cornerstone of success for businesses, especially for Non-Banking Financial Companies (NBFCs). With the advent of innovative technology, a dedicated Loan Management System (LMS) has become essential. In this article, we'll explore the significance of LMS, Loan Management Software, NBFC software, Loan Origination System, Microfinance Software, and Business Loan Software in streamlining financial operations. Join us as we delve into how AllCloud embraces a culture of curiosity, communication, and innovation to excel in this dynamic sector.

The Importance of Loan Management Software (LMS)

Enhancing Operational Efficiency

The LMS is a game-changer when it comes to streamlining lending processes. It automates loan origination, disbursement, and repayment, reducing the workload for NBFCs and improving operational efficiency.

Risk Mitigation

Lending involves various risks, from credit risks to market risks. LMS offers robust risk management tools, providing NBFCs with the ability to identify, assess, and mitigate risks effectively.

Customer-Centric Approach

A Loan Management System enables businesses to deliver exceptional customer service by providing borrowers with convenient online access to their loan accounts, reducing the need for physical visits.

Regulatory Compliance

In the ever-changing landscape of financial regulations, compliance is a top priority. LMS ensures that NBFCs adhere to legal requirements, reducing the risk of penalties and reputational damage.

Streamlining Loan Origination system

Efficient Application Processing

LMS simplifies the loan application process. Applicants can submit their details online, and the system automates verification, drastically reducing processing time.

Credit Scoring

The software evaluates an applicant's creditworthiness quickly and accurately, making it easier for NBFCs to make informed lending decisions.

Documentation Management

LMS digitizes document collection and storage, ensuring that all necessary paperwork is readily available for both clients and auditors.

Instant Approvals

With automated credit assessment, NBFCs can provide instant approvals for eligible applicants, enhancing customer satisfaction.

Microfinance Software: Empowering Small Businesses

Microloan Disbursement

For microfinance institutions, LMS facilitates microloan disbursement, enabling them to reach small businesses and individuals who need financial support.

Client Data Management

Managing a large number of microloan clients requires robust data management capabilities. Microfinance software within the LMS helps in this aspect.

AllCloud's Commitment to Innovation

At AllCloud, innovation and collaboration are at the heart of our operations. We foster a culture of curiosity, effective communication, and transparency, which are essential in the ever-evolving financial industry. Our team is encouraged to explore, ask questions, and innovate to deliver value consistently to our customers, partners, and stakeholders.

Business Loan Software: Catering to Diverse Needs

Customization

Different businesses have varying loan requirements. Business Loan Software within the LMS can be customized to meet the specific needs of different industries.

Real-time Reporting

Access to real-time data and reporting is crucial for making informed decisions. LMS offers comprehensive reporting tools for businesses.

Automation of Repayment

The software automates loan repayment, making it easier for borrowers and lenders to manage financial transactions.

Conclusion

In the ever-evolving world of finance, a Loan Management System is indispensable for NBFCs, microfinance institutions, and businesses at large. AllCloud, with its commitment to innovation and collaboration, stands out as a trusted partner in the journey of financial success.

FAQs

What is the primary function of a Loan Management System?

A Loan Management System primarily automates and streamlines loan origination, disbursement, and repayment processes for financial institutions.

How does LMS help in risk management?

LMS offers tools to identify, assess, and mitigate risks, reducing the exposure of financial institutions to potential losses.

Can microfinance institutions benefit from Loan Management Software?

Absolutely. Microfinance software within LMS is tailored to meet the unique needs of microfinance institutions, facilitating microloan disbursement and client data management.

What role does AllCloud play in the financial sector?

AllCloud is dedicated to fostering innovation and collaboration in the financial sector, delivering value to customers, partners, and stakeholders.

Why is regulatory compliance crucial for NBFCs?

Regulatory compliance is essential to avoid legal penalties and protect the reputation of NBFCs in the market.

#succession#welcome home#super mario#the owl house#the mandalorian#ted lasso#taylor swift#across the spiderverse#wally darling#star wars

0 notes

Text

ATD Money - Loans for Bad Credit with Instant Approval

ATD Money is one of the best micro-finance service providers which has developed its products especially for youngsters. Their motive is to transform customers’ lives by providing them with an easy loan approval process and minimal documents.

Easy Application Process

If you need to borrow some cash quickly, you can apply for an instant salary loan on the ATD money platform. This easy and hassle-free online service offers a wide variety of loans including salary advances, personal loans, business loans, and more. The application process is simple and the loan amount can be deposited directly into your bank account. You can also pay the loan off at a flexible schedule and zero interest rates. ATD Money is a product of ATD Financial Services Pvt. Ltd and is an eminent microfinance solution provider.

The information, software functionality, and materials available on this Website may include errors, omissions, inaccuracies, or other limitations. ATD may make changes to this Website at any time. The information, software functionality, and materials on this Website are provided “as is” and “as available” without warranties of any kind, either express or implied. To the fullest extent permitted by law, ATD disclaims all warranties, including warranties of merchantability and fitness for a particular purpose.

In the event of a conflict between this TOU and any other notices or terms and conditions posted on this Website, the latter terms shall govern. In addition, You agree to abide by any other terms and conditions that apply to participation, subscription, or usage privileges in any restricted member portal area of this Website.

ATD welcomes Your feedback and suggestions about its programs and services. By transmitting such Feedback to ATD, You grant to ATD a royalty-free, perpetual, irrevocable, transferable, non-exclusive license to use, publish, copy, distribute, create derivative works, and display (in whole or in part) worldwide, and to incorporate it into other works in any form, media, or technology now known or later developed for the full term of any rights that may exist in such content.

You agree not to post any offensive, threatening, defamatory, indecent, or unlawful material on this Website or in any Forums. You also agree not to impersonate any other person or entity, nor engage in any activity that would violate any applicable laws or regulations.

ATD reserves the right to remove such material and to terminate Your access to this Website if You do so. Your access to this Website may be terminated immediately in ATD’s sole discretion if You fail to comply with this TOU. Upon termination, You must destroy all copies of this Website in Your possession. The provisions concerning ATD’s proprietary rights, feedback, disclaimers of warranty, limitation of liability, waiver and severability, entire agreement, injunctive relief, and governing law will survive termination.

Instant Approval

ATD Money is an online lending service that offers loans for bad credit with instant approval. These loans can help you with a variety of expenses, including debt consolidation, home improvements, or major purchases. They are available from a number of lenders and typically have less stringent requirements than traditional loans. The best thing about loans for bad credit with instant approval is that they can save you time by avoiding the long application process.

Loans for bad credit with instant approval are a great way to get the funds you need quickly. These loans can be used for any purpose and are typically available from a variety of lenders. They are also available in a wide variety of amounts and terms. The most important thing to remember about these loans is that you should never take out more than you can afford to repay.

ATD Money is an eminent microfinance solution provider agency that bestows salaried employees or professionals with a range of quick mini-cash loans. This is a highly innovative and convenient loan facility that helps borrowers meet their urgent cash requirements in a simple and hassle-free manner. It also provides them with an opportunity to build a solid credit score by reimbursing the amount on time and improving their credit score over a period of time.

In order to avail of these loans, you need to fill up the online application form by providing basic information such as name, address, phone number, and other relevant details. The loan will be disbursed within 24 working hours of applying for it. You can easily apply for the loan from any computer, laptop or mobile phone. You can also use the app to check your eligibility for the loan.

Low-Interest Rates

If you’re stuck in financial trouble and need quick cash, then you can easily get a loan online at a reasonable rate from ATD money. Their application process is easy and requires only a few documents. Their interest rates are also very competitive and they have a flexible repayment schedule. You can even avail of a loan from them with a low CIBIL score.

ATD Money offers loans to anyone who has a bank account, and they make the entire process online so there’s no need to visit a branch. The application process is simple and takes only 3 minutes to complete. All you need to do is fill out some basic information and wait for approval. Once your loan is approved, you can withdraw the money from your bank account. The maximum amount you can borrow is Rs 50,000.

Despite the high leverage, Fitch expects that ATD’s lease-adjusted debt/EBITDAR will decline to 6.5x in YE 2021 due to stronger end-market demand and lower operating expenses (labour, freight, and logistics costs). ATD also has solid FCF generation and is expected to continue to generate a positive free cash flow from operations.

ATD Money is a microfinance company that offers instant cash loans to salaried individuals and professionals. Its aim is to transform people’s lives through business ideas. Its micro-finance services include payday loans and advances against salary. Its loans are available to all ages and gender, with no credit checks. The company’s loans are unsecured and have no processing fees or prepayment penalties. In addition, ATD has exemplary customer service and a fast turnaround time. In addition to offering loans, the company also offers personal insurance products.

#payday loans#quick cash loans#personal loans#instant loan#cash loans#loan app in india#payday loans in india#fast cash loans online#advance salary loan#loan apps

0 notes

Text

Microfinance software in Kolkata

Microfinance software in Kolkata refers to specialized digital solutions tailored to the unique needs and requirements of microfinance institutions operating in the vibrant city of Kolkata, India. This software is designed to optimize and streamline the operations of microfinance organizations in Kolkata, enabling them to efficiently manage microloans, savings accounts, and other financial services.

Specifically catering to the microfinance landscape in Kolkata, this software addresses the local regulatory, cultural, and operational nuances that are prevalent in the city. It empowers microfinance institutions in Kolkata to effectively serve their clients, particularly those from economically disadvantaged backgrounds, by offering features such as loan origination, repayment tracking, client management, accounting, and reporting.

By utilizing Microfinance software in Kolkata, these organizations can make informed decisions, reduce administrative complexities, and contribute to the financial inclusion and empowerment of the city's residents, ultimately fostering economic growth and prosperity in the region.

#microfinance#software#microfinance software#softwaredemo#microfinancesoftware#online best microfinance software in west bengal#best microfinance software in Kolkata

0 notes

Text

websoftex software microfinance web based nidhi software

microfinance software is one of the web based online software , websoftex microfinance software is one of the complete web solutions to fulfill the all microfinance requirements to the microfinance players . and you are looking at the best web based microfinance software give a look at the websoftex microfinance software .

Mfin ‘s is a very well designed and more flexible , and it is a user friendly with a maximum level of protection and maximum level of automation ,

We having a well web designing experts that can our customers can easily master our microfinance website , and our website delivering a outstanding customer service , and can operate very easily with a minimum number of staff .

Microfinance software is web based , module driven , microfinance software company is one of the financing and loan based company , and it having a very affordable loan interest structure and it is flexible .

And MFI is powered by the modules and reports which facilitate , microfinance software includes number of modules like branch management , product management , user management , loan processing , loan recovery , loan distribution , financial accounting , fund management for HO , fund management for branch , collection office management , and many more .

And the modules can be explained by one by one

1: BRANCH MANAGEMENT : a branch management module contains all the information related to branch office , region , division . it will manage the microfinance organizational hierarchy . and the features include New branch office , new division office , new regional office , and portfolio-backlog transfer .

2: product management : products are the financial offerings to the customer from a MFI and they are governed by the rules that specified by the microfinance organizations and these rules are the different for the every product . and their features include : create loan product , create survey field , loan gradation , fee registration & written off master

3: collection officer management : this modules consist of the group master and employee masters , the user can create the new group through their group master . groups are at the heart of the microfinance organization , on the other side employee details are stored by the employee masters , the collection officer management includes : create group , employee registration, and assign group to collection officer .

4: user management : this module defines the access restrictions and user management by using roles and also includes access restriction , there are five level of stages of the users based on the roles , such as Branch manager , regional manager , administrator , division manager , and also teller. and this features includes : create users change passwords and user data entry status .

5: Insurance management : this is the module that manages the customer death settlement with the insurance company . and this features includes the death documents from the branches , claim insurance , claim received , claim observed , death outstanding settlement and reclaim and the rejected claim .

6: Member registration : these module includes the care of our customer survey and group information , through the “create survey field user can maintain the customer survey filed . sub module can explain : first it manages to create a members , modify member details and transferring members between two groups with backlog-portfolio , and their features include , customer survey , survey review by BM , survey review by RM , new member registration , edit member , and group to group transfer .

7: Loan processing : loans helps fulfilling the goal of microfinance software by providing credits to the customers , microfinance can identify the proper and suitable customer with the help of loan processing modules . and it also manages the loan documentation and loan processing status and the loan recycle sub module maintains the loan recycle system . and the features includes document submit , loan processing and loan recycle .

8: Loan disbursement: the system will update all the installment amount and various charges basis on the loan product and automatically produced , when the loan is disbursed to a customer , the loan due date automatically scheduled according to the holiday master and grace period and all the respective ledgers get updated automatically . when the loan as been paid by the customers online , the system shows the paid loan number , the customer death manages by the death settlement value , the user may return the security amount to the customers without paying the loan amount , if a customer is dead .

9: Loan recovery : this module includes the date wise C.O collection , and manages group wise loan recovery , the system will automatically update the loan outstanding balance , once the payment has been applied in the system . due to the violations and or / non repayment etc, the customer loan account can be marked as the “written –off” on the basis of “definition of lateness” as defined by the HO .

10: Financial accounting : this financial module , allowing to do only the portfolio accountancy , but also the administrative accountancy , and this integrated with the all of the other modules , like shelf accounting packages such as cashbook , general ledger , trail balance , and cash flow .

11: Fund management for HO : and this modules includes fund receive , fund payment , and fund allocation to branch and transferring fund from one branch to another branch , and the features includes like fund received by branch , fund payment by branch, fund transfer and branch to branch payment .

12: Fund management for branch : this module includes the care of fund from the branch office , the fund transfer between branches is managed by the regional manager and it includes features like: fund received by branch , fund transfer and branch to branch transfer , fund payment by branch.

Looking for the MFIs software , give us a look

Thanks and regards

Websoftex software solutions private limited

Contact : 9765988588 , 8884040622 , 9916807666

Visit website http://websoftex.in/microfinance_software.php

http://websoftex.in/

0 notes

Text

Microfinance Software Development Company in Lucknow | Microfinance Software Company in Lucknow

SigmaIT Software excels as the premier microfinance software development service, delivering top-notch solutions for your financial institution's success.

The leading microfinance software company in Lucknow includes us among its top suppliers. All of your company's operational processes might be automated with the aid of this program by utilizing a single technical base. With the aid of our state-of-the-art microfinance software, you may improve operational efficiency, cut expenses, and save time and money. This software has the latest features. Free demo Call 9956973891.

What is Microfinance Software? How does it work?

Microfinance software streamlines financial operations for micro-lenders, aiding in client management, loan processing, and financial tracking, enhancing efficiency and transparency.

Key Features

Record of Transactions - our software allows you to track the history of previously made transactions including repayments, savings deposits, withdrawals, and disbursements.

Analytics and Reporting - Our Microfinance Software offers tools for tracking portfolio quality, client demographics, and financial performance.

Mobile and Online Access - Our Microfinance software offers mobile and online access allowing clients to make payments, access financial services remotely, and view their accounts easily.

Security and Compliance: SigmaIT Software Company in Lucknow ensures full data security with financial regulations and reporting requirements.

Customization: Our Microfinance software offers allow you to customize the software to clients' operational requirements.

Document Management: Our Microfinance software helps you manage important documents related to loans, savings accounts, and clients.

Loan Portfolio Management: Our Microfinance software helps in managing interest calculations, arrears tracking, and Loan Portfolio, including loan organization, disbursement, and repayment schedules.

Benefits of utilizing our Microfinance Software

Financial Inclusion and Expand Outreach

Salary Information

Memberships

Employee Reporting Structure

Leave Summary

Training Courses

Improved Risk Management

Automated Customer Management

Enhanced Productivity and Efficiency

Mobile Accessibility

Automated Risk Analysis

Customized Solutions

Low-Cost Loan Management

Savings Management

Mobile Banking

(FAQ)

1)Why Choose SigmaIT Softwares as your Microfinance Software Company in Lucknow

SigmaIT in Lucknow revolutionizes microfinance software, empowering efficient and responsible financial services to underserved communities. Explore our tailored solutions today to transform your microfinance operations. Contact us for details.

2) Why Choose the Best Microfinance Software for Your Operations

While there are numerous microfinance software options available, many lack essential features and scalability. If you're seeking the top microfinance software company in Lucknow, consider SigmaIT Software's Microfinance Software for all your operational needs

visit : Microfinance Software Company in Lucknow

#microfinancesoftwarecompanyinlucknow#bestmicrofinancesoftwarecompanyinlucknow#microfinancesoftwaredevelopmentcompanyinlucknow#bestmicrofinancesoftwaredevelopmentcompanyinlucknow

0 notes

Text

My True Story

I was born in a lower middle class family. My grandfather migrated from interior Sindh to Karachi in late seventy. He had some ancestral land, which he sold and bought a 3 room flat in the heart of the city.

Whereas, he started a mini cloth shop to run the bread and butter of the home.

Before he could establish his new business, just after a year of his migration, he got a cardiac arrest and could not succumb.

As my father was the only child of my grandfather. At that time he just completed his matriculation. He tried to take over o

my grandfather’s business. However, within two years he gave all the shop to borrowers. As he was a teenager, he had no experience in business. Now my father has had only the earnings of grandpa i.e one flat.

My father and my grandma were in tension over how to earn the bread and butter. In that time of hardship, my maternal uncle came forward and helped my father to get enrolled in the education department as a junior school teacher. My grandma thanked God that now they had some arrangements for daily meals.

The time was going on. After a few years of my father's job, grandma decided to marry my father. For this she selected her niece. My father accepted his mother’s decision and married my maternal uncle’s daughter.

The day nights were passing like a dream. After fifteen years of my parents' marriage, they have 5 daughters and 2 sons. My number is third in sisters. Whereas, my both brothers are little from us.

With the passage of time my father’s income decreased. Whereas, the expenses raised manifolds. As my mother was a typical housewife, he had no contribution to the household economy. On the other hand my father had only a 14 scale government teacher job, which was insufficient for 9 members of the family. Out of which all the children were school going.

As we were growing, we were becoming a source of worry for our parents. Because they had very few income resources. My two older sisters completed matriculation at the same time.

My parents decided to send only one girl to the college on a regular basis. Whereas the other one will do a private FA. Therefore, my oldest sister sat at home and the little one joined the government college for FSc in biology.

Now it was a worrying situation for me. At that time I was reading in ninth class. My dream was to become a software engineer. But my father's pocket was not permitting me to do that.

I decided to do something myself. So I can contribute not only to the bread and butter of my home but also to make my dream practical.

In this regard I started searching for some kind of work that I can do after school time. At the same time I was also consulting with my friends and classmates. One of my friends advised me to learn some beauty parlor work. She also told me that her aunty (Khala) has a nice beauty parlor in the Gulshan area. Which was a few km away from home, so I can easily manage the outback. I liked the idea and decided to get permission from my parents. But getting permission was not an easy task. So I involved my older sister Mehwish in the plan, and requested her to seek permission for me.

One day after the dinner, checking the mood of my parents, my sister Mehwish told my parents that Anmol wanted to join a parlor. On this my father showed a strict reaction and said there is no need for this, and went to the bedroom.

After a few days we requested again, and that day my mother also supported us. Finally my father agreed on one condition that I and Mehwish can both join the parlor. Initially Mehwish was not interested, but after my insistence she surrendered.

Now the day has come, my friend was at our home to take us to the sad parlor. After walking for half an hour, we reached the said parlor. My friend’s aunty was a quite aged woman. She offered us the chairs, and asked whether we had any ideas about parlor work. We both replied that we are unaware about this work like a plain paper. However, she didn't mind as we went their with our friend. After serving us tea, she asked us to check all the parlor work and select the job you have to do. After seeing the girls who were already working there I have decided to learn Mehndi design or Henna design work. As I had good grip on drawing work. Whereas, my sister Mehwish chose to learn hair cutting work, because she loves the hairs.

After choosing our jobs, the parlor owner asked us to learn these jobs for at least three months, for that she will never pay us a penny. We both agreed on the terms and came home.

Next day after school I came home, after finishing my lunch hurriedly, we both arrived at the parlor.

In the Henna design section Iqra was my teacher, from whom I had to learn stylish mehndi designs. On the first day my teacher taught me how to grip a Henna cone. It was quite interesting for me to draw rough mehandi lines on a plain paper.

On the next day she gave some kids mehndi design patterns, and asked me to rehearsal on these designs. I was putting my whole heart into learning these as soon as possible. So I can help out my father with my monthly income. On the other hand, my sister was also working hard to learn something.

Due to my hard work and passion I start making simple mehndi designs in just one month. The parlor owner appreciated me and asked me to draw kids mehndi designs on a regular basis.

Now I have become an associate henna artis besides my teacher Iqra. Whenever a kid comes to the parlor with mother, I start making beautiful mehndi designs on their hands free of cost. It was a passion and keen interest which was forcing me to do such things. Many mothers gives me some money as a tip while leaving. Now I was able to bear my monthly personal expenses.

After three months the parlor owner came to us and asked that now you both have ample knowledge about your work. So from now I will pay you rupees ten thousand per month each and besides this I will also give ten percent as commission to each customer you will serve. She also advised me to learn some advanced designs like Arabic Mehndi Design. I promised her that I will learn every advance of Henna Mehndi designs.

On the way back home we both sisters were very happy. When we told this news to our parents they became very happy. My mother was very happy, like flying in the sky. As she knows that the extra income will help her to bear the additional expenses of house. Whereas she will also be able to make some drowery for her girls.

Life was passing very fast, as our hard days went off. After one year my mother has ample money. So she decided to marry my sister with his nephew who was working in a microfinance bank as a loan officer. My sister also liked that guy. So reaching upon the agreement both families decided to keep the marriage ceremony just after Eid.

We all sisters and brothers were very happy as my sister was going to be married. On the eve of Eid we all had new clothes, on Chand Raat I made beautiful Eid mehndi designs on all my sister’s hands.

On the same day, my father and mother were busy preparing for my sisters wedding. As they had fixed the wedding ceremony on the third day of Eid. My father booked a lighting arrangements service for whole week. A day before the wedding I had drawn some amazing bridal mehndi designs on my sister's hand. That was the first time I had draw any Mehndi designs for a bride. By the grace of Allah the marriage passed well. All the arrangements were very good. Everybody on the wedding were admiring us, specially my Dulhan Mehndi designs was also being liked.

After Mehwish’s wedding I rejoined my work alone. Mehwish's husband stopped her from doing any work.

On the other hand I was continuing to learn the latest mehndi designs coming into the market. For this I was using many online platforms like instagram, facebook and youtube etc to know the new trends in the field of Henna designs. This thing helped me to learn new and modern styles like Indian Mehndi Designs, Western Henna Tattoos and Arabic Henna Designs and other kind of mehndi ke design famous in the field.

It was a hot summer day, I was in college's library, when our college watchman came their in search of me and told that the principal is calling for me. I went hurriedly in principal's office, as soon as I entered she told me that my father has met an accident while he was coming from his duty now he is in ICU of city's major hospital. It was thunder like news for me, I ran from the principal's office in hesitation. Picking an auto rickshaw from the gate and reaching the hospital. When I reached the ICU I saw my mother, my little sisters and brothers were crying. Yes my father was no more with us. This was a heavy shock for all family members. I was feeling like I lost everything.

After the funeral of my father, everyone was talking that how will we survive. My sister Mehwish and brother-in-law have their own expenses. So they could not bear any other expenditures. My father has only monthly pay as an income, so after his death it will have to stope. Whereas, his pension and gratuity case was taking long to finalize. I was earning almost 25K per month, which was not enough for a family whose 90 percent members were school going. So I requested my parlor owner to increase my salary so I can cover the house expenses, but she replied that it is not possible now.

After a few months I decided to set up my own business of Henna designs. But I had not have enough money to set up any new business in a city like Karachi. In this regard I sought help from my brother-in-law as he was serving in a microfinance bank. He helped me to take an ample loan for opening up my own Mehndi design parlor. I selected a location for the parlor, which was nearby to my house.

Finally the day came when I inaugurated my own business. To meet the future requirements I took my little sister with me so she can learn the Mehndi art. First day I received only one order for full mehndi design. I charge rupees 2000 for my first project. I was very happy about that, because now no one will take a big share of my hard work.

As I introduced so many new mehndi designs myself. Thus the demand of my parlor was raising day by day

In 2019 I earned a lot of money during the wedding season, as I received many orders for Dulhan Mehndi designs.

I was inventing new mehndi designs in the field of body art with every passing day. So I have been booking a wedding for many days, and here girls demand to print some beautiful hand & foot mehndi designs. Therefore, I repaid my bank loan within one year, which was quite an amazing experience for bank staff too.

I have also bought a beautiful house in a posh area, where I am living with my family, cool and calm. My little brothers and sisters are reading in good schools. I am also doing my graduation degree from a well known University.

To promote my mehndi art I have made my own website. Where I place beautiful back hand mehndi designs and front hand mehndi designs. I have also made my own social media accounts, so people can know more and more about my business.

So this is my own motivational story for those who want to become something in life. At the end I will suggest you do not lose hope when something hard comes in life. If our Allah close a door, definitely he opens many new doors for us.

#short story#motivacional#inspiration#storytelling#my story#true story#pakistan#india#karachi#blacklivesmatter#stop asian hate#dream smp

41 notes

·

View notes

Text

Top 5 Benefits of This Web in Developing Countries

At the time of 2019, roughly 2.3 million persons, has access to this net. In recent years that the fastest growing market division has been growing states, and with all the growth of its prevalence, reluctantly positive changes have occurred. The following top five benefits of the internet in developing states reveal how internet access makes a tremendous dent in worldwide poverty.

From the smartphones most of us carry to maintain us attached to this intelligent house that can be programmed for tighter security and enhanced electric effectiveness, Internet-connected technology is now intertwined together with virtually every aspect of our daily lives. These exact forms of advances in connectivity, control and automation are also utilized all through industrial applications, now are making their own way into motion software. The results of this kind of Internet-enabled device offer a fresh degree of flexibility, cost and performance advantages. If you looking for best Websites and pages about the internet, You should check Google Facebook Twitter wikipedia linkedin medium. One of the most helpful website.

Lifting Folks from Poverty:

Through internet access, folks in developing countries can acquire use of a lot of their modern market. With online connectivity, even people dwelling in remote areas are now able to take out microloans, participate in e-banking and much more. Today, there are significantly more than 3,098 microfinance businesses who've achieved to over 211 million customers within growing countries worldwide. Via this kind of financial equipment, people residing in severe poverty can boost the attribute of their own lifestyles.

Growing Access to Education:

With internet connectivity along with brand fresh technology, metropolitan nations be able to bridge the education gap among urban and rural inhabitants. In sparsely populated places, portable electronic devices like pills have been properly used to provide priceless class room education to kiddies that otherwise wouldt likely receive it.

Growing the Ease of Conversation:

The internet is potentially the cheapest and effective communication instrument. By accessing it, most people in developing countries might participate in e-conversations by way of software like whats app and WeChat. At a poll ran in 20 17, it had been found that about 85 percent of internet users in sub-Saharan Africa applied it to keep in touch with family members and close friends, and around 60 percent utilized it to access social networking websites.

Improving Pairing Efficiency:

Through IoT (online of things) techniques, farmers in developing nations may readily access details about important variables like humidity, humidity and terrain topography via various sensors. Precision agriculture from third-world countries has also led to the maturation of unique insurance systems. As an instance, with Kilimo Salama, farmers at Eastern Africa can currently purchase insurance that mechanically makes mobile payments to them if their own neighborhood weather channels list extreme climate incidents such as flooding or drought.

Greater World Wide Participation

As of 2017, 5 3 percent of all adult online users utilized the web to keep informed on the news. Due to developing countries additionally harbor internal conflicts, becoming up to date to the status quo of matters becomes particularly vital to their own taxpayers. Moreover, folks in growing states might turn into a part of worldwide talks via internet communication platforms. Social networking efforts have shown themselves to be especially effective at raising awareness for many topics and improving participation in protests.

1 note

·

View note

Text

Microfinance software is a specialized digital solution designed to streamline and enhance the operations of microfinance institutions, NGOs, and financial service providers that cater to underserved and financially marginalized populations. This software empowers these organizations to efficiently manage their microloans, savings accounts, and other financial services while promoting financial inclusion and empowerment. It typically includes features such as loan origination, repayment tracking, client management, accounting, and reporting, enabling microfinance institutions to make informed decisions, reduce administrative overhead, and ultimately, better serve their clients in a scalable and sustainable manner.

#microfinance#software#best microfinance software in tamil nadu#online best microfinance software in west bengal#softwaredemo#microfinancesoftware#microfinance software

0 notes

Text

Summer Break dan Fall Semester Kedua!

Gara-gara Corona, Qualifying Exam angkatan gue dibikin online. Kebayang ngga lu, tiga jam duduk di depan laptop ngerjain ujian?

Nggak lagi-lagi, makasih.

Alhamdulillah beneran lulus dan nggak perlu ngulang.

Dengan ini, hayati resmi jadi mahasiswa PhD jurusan Ekonomi. (YEAY).

Selesai Qualifying, gue cabut dari desa buat vakansi ke beberapa state lain. Pertama, ke Ohio, Indiana dan Kentucky. Pulang-pulang, second wave pandemi terjadi di dusun. Gue pun stay di dusun beberapa waktu. Setelah second wave agak mereda, vakansi pun dilanjutkan. Kali ini, ke Michigan.

Jadi, kalau ditanya, dua bulan liburan summer ngapain aja? Gue bisa jawab: vakansi!

Biar agak ada faedahnya, gue sempat belajar R tapi cuma bertahan sebentar. Entah kenapa, kayaknya sih karena gue males aja dan nggak termotivasi. Tapi, gue sempet baca beberapa paper tentang behavioral economics dan berjumpa dengan ekstensi teori decision making yang buat gue, tiba-tiba menjadi sangat menarik. Gue pun check-out bukunya Kahneman dari perpustakaan. Agak telat sih, memang. Tapi rasanya kalau dulu tahun 2012an gue baca buku dia, mungkin gue nggak akan bisa ngikutin seperti sekarang.

Kira-kira begitulah summer gue. Tidak se-produktif teman-teman lain yang berhasil menelurkan publikasi baru, produktif kerja di lab, internship, ngambil summer class ataupun ngajar dan riset.

Yep, gue pengen chill aja gitu. Lagian, apa sih yang dikejar?

Tapi tenang aja, gue tau kok, abis ini gue mau ngapain.

-

Fall Semester kali ini gue insyaf, ceritanya. Gue hanya ambil tiga mata kuliah. Makroekonomi III, Ekonometrik II dan Economic Development Theory & Policy I.

Makro III, gue belom-belom udah bodo amat sama mata kuliah ini. Dosennya gila malesin banget. Gue bahkan ingin beropini bahwa dia nggak pantes jadi dosen. Yang dia lakukan sebatas ngasih reading list, materi kuliah, dan tugas. Di kelas, kerjaan dia cuma bluffing doang ngomong ngalor ngidul tentang R dan Phyton, dan cerita tentang alumni-alumni SIU. Dia sebenarnya adalah dosen substitute. Dosen asli yang harusnya ngajar mata kuliah ini, kayaknya lagi sabbatical leave. Jadilah kita semua terjebak dengan satu orang nggak jelas ini.

567B alias Ekonometrik II, ini gue suka sih, meskipun belajar konsep dari basic lagi macam regression. Terus, tadinya gue pikir dosennya bakalan pake R, tapi rupanya dia pakai Stata. Okay, tetep hal baru buat gue, mengingat satu-satunya software statistik yang gue pelajari hanya SPSS doang selama ini, hahaha.

Terakhir… ini yang paling demanding tapi gue suka banget. Ngebahas banyak isu development mulai dari bencana kelaparan (famine) pas jaman perang dunia kedua dulu, terus isu child labor, dan tentunya… credit market dan microfinance. Bidang yang dulu gue tertarik banget, tapi sekarang kayaknya jadi kurang menarik karena udah banyak banget yang bahas.

Belakangan gue lumayan banyak ngobrol sama Kore, dia ini senior gue di kampus. Dia nulis disertasi tentang household microeconomics; detailnya kayak apa, gue nggak tau. Dia nggak cerita. Well, gue juga nggak nanya detail sih. Anyway, di obrolan waktu itu dia bilang ke gue, mulai tahun kedua ini gue harus figure out mau nulis disertasi tentang apa nanti. Terus mulai cicil baca paper-papernya, sampe minimal kebayang research question-nya apa, research context-nya kira-kira bakalan kayak gimana. At least, sampe di tahapan “kebayang”. Lebih bagus lagi kalau sempet buat ditulis. Nasihat yang bagus, Kore.

2 notes

·

View notes

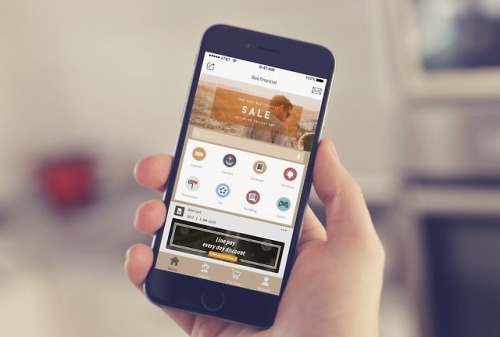

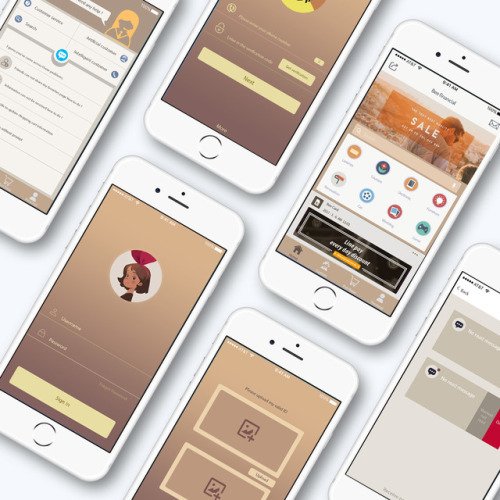

Photo

Live Design Brief | Bumble App

Bee finance is a mobile client page for financial software I made during my internship. Mobile phone pages need to provide all the special features of bee finance, similar to microfinance, fast payment, online staff voice services and other special features. I also vary according to the customer platform. The compatibility pages of two different types of Iphone and Android are designed, as well as the adaptable pages of iPad and Iwatch, which can provide convenience for different mobile customers to access software.

1 note

·

View note