#p60 form

Text

What happen if Employer not Provide P60 by 31st May 2024 in UK?

If an employer in the UK fails to provide P60s to their employees by the 31st of May deadline, they can face several potential consequences:

Penalties from HMRC: HM Revenue and Customs (HMRC) may impose penalties on employers who do not comply with the legal requirement to issue P60s on time. The exact penalties can vary depending on the circumstances and the extent of the delay. Order P60…

View On WordPress

1 note

·

View note

Text

Where Do I Get My P60 Ireland – What Is A P60 Form

How do I get my P60

In Ireland, your P60 form is typically provided by your employer at the end of the tax year. The P60 is a statement of your annual pay and the tax deducted from it. It contains details of your total pay, deductions, and contributions for the tax year (January 1st to December 31st).

Your employer is responsible for generating and issuing the P60 form to you. They usually distribute P60s to their employees by the end of February following the end of the tax year. For instance, for the tax year ending on December 31st, 2022, your employer should provide your P60 by the end of February 2023.

If you have not received your P60 from your employer by this time, you should contact them directly to request it. They are obliged to provide this document to you, as it’s important for various purposes, such as filing your tax return, applying for loans or mortgages, or verifying income for certain benefits or visas.

Remember that your P60 is a crucial document for verifying your earnings and tax contributions, so it’s advisable to keep it in a safe place for reference when needed.

Income Documentation: The P60 serves as an official record of your total income, including salary, bonuses, and other benefits, for the entire tax year.

Taxation Information: The P60 form provides details about the income tax, Universal Social Charge (USC), and Pay Related Social Insurance (PRSI) contributions deducted from your salary during the tax year. This information is essential for understanding your tax liabilities.

Tax Refunds: If you are entitled to a tax refund, the information on your P60 is crucial for calculating the amount you may be owed. This could be due to overpaid taxes or eligible tax credits.

Financial Planning: The P60 form is a valuable document for financial planning purposes. It helps you assess your annual income and tax contributions, aiding in budgeting and future financial planning.

Proof of Income: The P60 can serve as proof of income for various purposes, such as when applying for loans, mortgages, or other financial products. Lenders often request proof of income to assess your financial stability.

Social Welfare Entitlements: The P60 may be required when applying for certain social welfare benefits or allowances. It verifies your income and tax contributions, ensuring accurate assessment of your eligibility for specific benefits.

Employment Verification: The P60 form provides a summary of your employment details, including your employer’s name and registration number. This information can be useful for employment verification purposes.

Tax Compliance: Holding a P60 demonstrates that your employer has complied with tax regulations by providing you with a statement of your income and deductions.

References content:

https://osservi.ie/where-do-i-get-my-p60-ireland-what-is-a-p60-form/

0 notes

Text

Form P60 - UK PAYE End of Year Certificate

New Post has been published on https://www.fastaccountant.co.uk/form-p60-uk-paye-end-of-year-certificate/

Form P60 - UK PAYE End of Year Certificate

What is a P60?

A form P60 is an end of tax year certificate that details how much taxable income an employee has received and how much tax has been deducted from their pay through the PAYE scheme. It also shows National Insurance contributions and any statutory pay taken out during the year.

Tax year for the purpose of Form P60 runs from 6th April in one year to 5th April the following year.

Employers in the UK must issue a P60 form to all their employees shortly after 5 April and no later than 31 May at the latest.

What is a P60 used for?

A P60 is a document which provides an overview of your earnings and taxes for the tax year. It also has details regarding statutory payments like sick pay, maternity pay and student loan repayments.

Employers have the option of providing employees with either a paper copy or electronic version of the form, depending on their business needs. Employees can then print off or submit it electronically to HMRC as part of their end of year PAYE processing.

For the employer, the P60 is part of an overall confirmation that they have been carrying out their PAYE duties correctly. This is essential if an employer wants to avoid a PAYE investigation and possible penalties for non-compliance.

As an employee, your P60 not only documents your earnings and taxes, but it can also be utilized to apply for tax credits or make a claim for means-tested benefits. Furthermore, it allows you to reclaim overpaid income tax.

Employees may use a P60 to apply for mortgage or loan, as well as prove their earnings to other financial institutions such as credit card providers. In fact, some mortgage companies will not provide a mortgage to an individual without it.

You will also need your P60 if you are one of those who are required to fill in a tax return at the end of each tax year. This might be the case where you have a large investment income, other self-employment income, you earn more than 100,000 pounds and various other situations.

Who needs to receive a P60?

As an employer, you must provide all employees on your payroll who were working for you on the last day of the tax year (5 April) with an end of year certificate. This form summarises their total pay and deductions during that year, including PAYE income tax, National Insurance contributions as well as statutory payments like maternity or paternity pay.

The P60 is an essential document for employee record-keeping and helps employers remain compliant with employment law. It contains vital information for both the employer and employees’ future needs, which could include claiming a tax refund or reclaiming overpaid National Insurance.

A sole trader or self-employed individual does not need to receive a one as they do not draw an income through PAYE.

What should I do if I don’t receive a P60?

The P60 serves as a type of End-of-Year certificate and often serves to prove an employee’s income; therefore, it’s essential that you obtain one.

At the end of every tax year, employers are legally required to issue their employees with a P60 form; usually in April or May. If your employer forgets to provide you with one at the end of May, make a formal request that it should be provided to you. It is unheard of for an employer in the UK to fail to provide the form to its employees by the due date.

How do I get a copy of my p60

It is important for an employee to keep their P60 in a safe place. If you lose your p60, there are several ways that you can get a copy of it. First, your employer can provide you with a replacement. If your employer is unable to, then HMRC can also supply you with a duplicate. For the latter, all that is necessary is your National Insurance number and access to a Government Gateway account.

What is the Difference between p45 and p60

When an employee leaves their current employment, their old employer must prepare and give them a P45. The form P45 should contain details of the employee’s name, address and National Insurance number. It should also contain the total gross pay and the tax deducted together with tax code to the date of living the old employment. The employee should then give Parts two and three of the form P45 to their new employer.

Employees typically keep a copy of their P45 form in case they need to demonstrate they’ve paid the correct amount in taxes. Unfortunately, National Insurance deductions and pension payments won’t appear on a P45 form, so make sure you obtain a copy of your payslip for confirmation.

To summarise, the main difference between form P45 and P60 is that P45 is given when an employee stops working for an employer while a 60 is given to an employee at the end of the tax year. Furthermore, a form P60 contain more detailed information about an employee’s earnings than a Form P45.

#copy p60#form p60#get a copy of p60#how to get your p60#P60#p60 form#p60 form uk#p60 forms#when do you get p60#where can i get my p60

0 notes

Text

Form P60 - UK PAYE End of Year Certificate

What is a P60?

A form P60 is an end of tax year certificate that details how much taxable income an employee has received and how much tax has been deducted from their pay through the PAYE scheme. It also shows National Insurance contributions and any statutory pay taken out during the year.

Tax year for the purpose of Form P60 runs from 6th April in one year to 5th April the following…

View On WordPress

#copy p60#form p60#get a copy of p60#how to get your p60#P60#p60 form#p60 form uk#p60 forms#when do you get p60#where can i get my p60

0 notes

Text

According to the Office of National Statistics, there are around 32.53 million individuals who are employed, work, and pay employment taxes in the UK. PAYE, which stands for "Pay as you Earn," is a significant component of the tax system in the United Kingdom. It is crucial for individuals to have a solid understanding of the fundamental tax forms that pertain to them as well as the manner in which they are taxed. In this post, the Accountants at our company have put in a lot of effort to explain what a P60 is, why it is important, and how it can apply to you.

1 note

·

View note

Text

P45 is the document that tells you and the tax authorities about how much tax you’ve paid on your earnings as you worked with the company you are about to leave. P60 document is crucial as it allows you to claim tax refunds if you’ve overpaid, apply for tax credits, prove your income for loans or mortgages, and complete self-assessment tax returns.

0 notes

Text

want to change my name on my provisional driving licence. i need:

the application form

which i have to send off with:

my old licence

documents to confirm my new name and gender

and

a passport-style photo, signed and verified by someone i know

a cheque for £17

the documents you can use recommends i use:

a passport

which i do not have, so instead, you can send a number of things, the only one of which i have is:

a birth certificate

but if you use a birth certificate, you also need other documents which can include:

letters from the DWP or HMRC, or a P45/P60 etc

which need to be signed and verified by someone as well.

if you’ve changed your name you also need to send:

your deed poll

and if you’ve changed your gender it says you can send either

your deed poll

a statutory declaration

or your gender recognition certifcate.

but i don’t have a statutory declaration or a gender recognition certificate, and they both have even More convoluted application processes on top of all this.. and i’m not rly sure how the deed poll confirms my gender change?? 😵💫

so u can see why i feel like my brain is being fried trying to figure this out.. 🙁

i think first and foremost, i need to actually Get the application form and get a photo sorted out.. then i guess the best i can do is get everything that needs to be signed and verified, signed and verified, and then send them off w/ the money, my birth certificate and a deed poll, and see what happens?? 😣 but Man they do not make this an easy or kind process at all.... 😖

5 notes

·

View notes

Text

The Smoking Scandal That Changed Onyanko Club

April 11, 1985

Group photo of the earliest members of Onyanko Club

Smoking Group Members

Top: Yoshino Kayoko, Tomoda Mamiko

Bottom: Okuda Mika, Enokida Michiko, Satō Mayumi

Smoking Group Members

Top: Okuda Mika, Yoshino Kayoko

Bottom: Satō Mayumi, Enokida Michiko, Tomoda Mamiko

Onyanko Club was the biggest female idol group of the 1980s.(OnyankoC P18)(Prime)

They made their debut in the entertainment industry as an idol group exclusively for a variety show called "Yūyake Nyan Nyan", which started on April 1, 1985 on Fuji Television Network.(OnyankoC P22)(Prime)

Each of the girls was given a membership number.(Geinōkai P84)

There's absolutely no way to avoid these girls when looking back at idol history.(OnyankoC P18)(Prime)

Onyanko Club is the progenitor of popular idol groups such as AKB48 and the Sakamichi series, and has had a certain influence on many other idols.(OnyankoC P18)(Prime)

AKB48 and the Sakamichi series are known for being produced by Akimoto Yasushi, who was also involved in Onyanko Club.(Kotaku)

However, he was only involved in Onyanko Club as a scriptwriter and lyricist, not as a producer.(OnyankoB P82)(Kotaku)

The person who effectively supervised Onyanko Club was Kasai Kazuji, the chief director of Yūyake Nyan Nyan, and Akimoto wrote many lyrics for Onyanko Club in accordance with Kasai's intentions.(OnyankoB P82)

Please see the following Wiki for more information.

Onyanko Club was deeply inspired by "All Nighters", a female college student idol group that was an exclusive part of Fuji TV's midnight program "All Night Fuji".(OnyankoC P94-95)

The real origin of the idol groups that were formed by several dozen girls wasn't Onyanko Club, but All Nighters.(OnyankoC P94-95)

Since Kasai was also one of the producers of All Nighters, the group's methodology was brought to Onyanko Club.(OnyankoA P146)(OnyankoC P8)

The eleven original members of Onyanko Club were selected from a large number of high school girls who appeared on a special program called All Night Fuji High School Girl Special~We, too, ain't idiots~, which aired twice on February 23 and March 16, 1985.(OnyankoB P36)

However, the idol magazine DUNK claimed that they had already been selected at the previous year's audition.(DUNK85 P83)

Idol Aihara Yū claims that she was actually accepted for the audition.(Ippo)

However, she turned it down due to the decision of her agency's president, who was concerned about her joining an idol group whose future prospects were uncertain at the time.(Ippo)

In addition, some say that singer Watanabe Misato was also slated to be one of the original members of Onyanko Club.(2ch2 98)

April 12 or 15, 1985, 9:10 p.m.

Coffee shop in Shinjuku, Tokyo.

6 members were there.

6 Smoking Group Members, including Kihara Aki.

Profiles of the members of the Smoking Group

From the July 1985 issue of the idol magazine DUNK

Please see the following Wiki for more information.

Trivial but detailed observations regarding the Smoking Group(in Japanese).

By the way, only two weeks after the start of the program (the media didn't mention the exact date, but it was probably either April 12 or 15), the six members were photographed smoking in a coffee shop by the fucking paparazzi from the weekly magazine Shūkan Bunshun.(OnyankoB P36)(OnyankoC P22)

These girls became known as the Smoking Group.(TreasureB P61)

Okuda Mika, membership number 1, was the only one who was photographed at the decisive moment when she was actually smoking a cigarette.(Geinōkai P85)

Five of the six members were fired, except for Kihara Aki, who stubbornly denied her smoking habit.(TreasureB P60)

Some say that Kihara had connections to the upper echelons of the TV station.(2ch1 873)(2ch1 886)

Since they were considered core members of Onyanko Club, the scandal changed the form and fate of the group.(Sponichi)(TreasureA P63)

At this point, Onyanko Club was still a nobody, but they subsequently gained such overwhelming popularity that the girls became a social phenomenon.(OnyankoC P18)(Geinōkai P84)

Yūyake Nyan Nyan was broadcast for one hour from 5:00 to 6:00 p.m. on weekdays.(Geinōkai P82)

During the time, many students were involved in club activities, attending tutoring schools, or hanging out in amusement arcades, so the program didn't get many viewers in its early days.(Myōjō P152)(Geinōkai P84)

However, as Onyanko Club's popularity grew, they threw up their respective activities and became obsessed with the program.(Myōjō P152)

The ratings, which were initially around 3 percent, rose to 18 percent, an astounding figure for this time slot.(Geinōkai P82)

In 1986, songs related to Onyanko Club spent 36 of the 52 weeks at number one on the Oricon charts.(OnyankoC P19)(Prime)

Onyanko Club achieved explosive popularity supported by the power of energetic teenage fans.(Geinōkai P82)(Style)

In contrast, AKB48 may have been supported more by middle-aged guys who used to be fans of Onyanko Club than by younger ones.(Style)

The infamous AKB48 business method of requiring fans who want handshake tickets to buy tons of CDs, has successfully made these middle-aged guys easy targets.(Style)

Note that although there are a lot of middle-aged idol fans today, in the 1980s, idol fans were basically young people in their teens or early twenties at most, and there were very few older fans.(Geinōkai P82)(Style)

It was exclusively the privilege of the young to be infatuated with idols.(Geinōkai P82)(Style)

Since Onyanko Club became the most popular female idol group of the 1980s, this scandal is considered a highly noteworthy one in the history of idols.(TreasureA P63)(TreasurB P60)

Note that the name of the program, Yūyake Nyan Nyan, is translated into English as Sunset Meow Meow, but its real meaning is Sunset Sex.(Songs P198)

The term "Onyanko" in Onyanko Club can also be interpreted as a girl who fucks.(Songs P198)

In this sense, the group and the program had extremely obscene and lewd intentions.(OnyankoA P146)

Sources are listed here.

https://www.tumblr.com/edit/nyankodanyan/712317304261820416

4 notes

·

View notes

Text

What Is a Self Assessment Tax Return (SA100)?

When it comes to managing your finances in the UK, navigating the world of taxes can often feel like a daunting task. One of the key documents in this process is the SA100 tax return form. Whether you're a seasoned taxpayer or new to the process, understanding what an SA100 entails and how to manage it efficiently is crucial. In this comprehensive guide, we'll delve into everything you need to know about the SA100 form, from its purpose and deadlines to practical tips on filling it out correctly.

What is an SA100 Tax Return?

The SA100 form is the cornerstone of the self-assessment tax system in the United Kingdom. It is used by individuals to report their income, capital gains, and any other relevant financial information to HM Revenue and Customs (HMRC). This form is essential for calculating how much tax you owe or if you are due a tax refund.

Purpose of the SA100 Form

The primary purpose of the SA100 form is to ensure that taxpayers accurately report their income and pay the correct amount of tax. It covers various types of income, including employment income, self-employment income, rental income, and investment income. Additionally, it includes sections for claiming tax reliefs, deductions, and allowances that may reduce your overall tax liability.

SA100 Deadline: Key Dates to Remember

Filing your SA100 online in the UK on time is crucial to avoid penalties and ensure compliance with HMRC regulations. The deadline for submitting your paper tax return is 31 October following the end of the tax year. If you prefer to file online, you have until 31 January after the end of the tax year. It's important to mark these dates on your calendar and start preparing your tax information well in advance to avoid any last-minute rush.

How to Fill Out the SA100 Form

Filling out the SA100 form may seem complex at first glance, but with proper guidance, it can be straightforward. Here's a step-by-step guide to help you navigate the process:

Gather Your Information: Collect all relevant documents, including P60s, P45s, bank statements, and receipts for expenses.

Register for Online Filing: Consider filing your SA100 online, which offers benefits such as automatic calculations and instant submission confirmation.

Navigate Each Section: The SA100 is divided into sections that correspond to different types of income and allowances. Take your time to fill in each section accurately.

Claiming Deductions and Allowances: Make sure to claim any applicable tax reliefs, deductions, or allowances, such as charitable donations or pension contributions, to reduce your tax liability.

Review and Submit: Before submitting your SA100 form, review all information carefully to ensure accuracy. Incorrect information may result in penalties or delays in processing.

SA100 Form Guide: Tips for Smooth Completion

To make the process of completing your SA100 form as smooth as possible, consider the following tips:

Keep Records: Maintain organised records throughout the year to simplify the process of filling out your tax return.

Seek Professional Advice: If you're unsure about any aspect of your tax return, seek advice from a qualified accountant or tax advisor.

Use HMRC Resources: HMRC provides detailed guidance and support materials online, including video tutorials and FAQs, which can help clarify specific questions.

SA100 Form Online: Benefits and How to Access

Filing your SA100 online offers several advantages over the paper form, including:

Accuracy: Built-in checks and calculations reduce the likelihood of errors.

Speed: Instant submission and confirmation save time compared to postal filing.

Accessibility: You can access your tax account and previous submissions online at any time.

To file your SA100 online, visit the HMRC website and follow the instructions for registering and submitting your tax return electronically.

Conclusion

In conclusion, understanding what is an SA100 tax return form is essential for every taxpayer in the UK. By familiarising yourself with its purpose, deadlines, and how to fill it out correctly, you can navigate the tax filing process with confidence. Remember to gather your information well in advance, consider filing online for convenience, and seek professional advice when needed. By staying informed and proactive, you can effectively manage your tax obligations and ensure compliance with HMRC regulations.

0 notes

Text

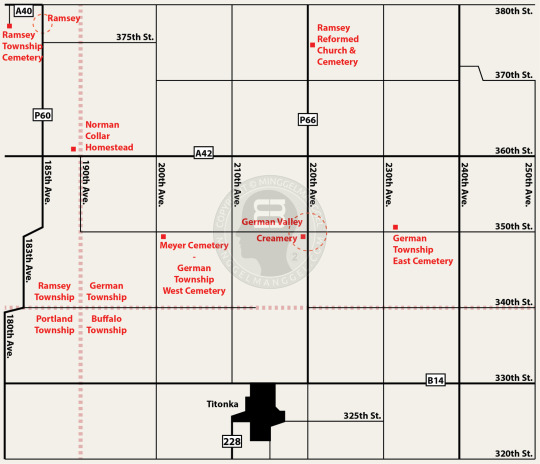

Early 1960s Ramsey Reformed Church Family Directory, Titonka, Iowa - 1.0

Figure 1-0-1

Ramsey:

Norman Collar and family created the first settlement in the Titonka area of Iowa in 1867, having arrived from Illinois. Collar’s Corners, located in the southeast corner of Section 24, consisted of a “Sod Tavern” home that served as a way station for the Algona, Iowa, to Blue Earth, Minnesota stage line.

By 1877 a church, post office, blacksmith, school, and several homes built 1 1/2 miles north established the new village of Ramsey. The school primarily served as a community town hall due to the limited quantity of students.

By the 1890s Ramsey had faded away due to a new railroad line bypassing the area in favor of Germania (aka Lakota).

The former Ramsey site straddles Highway P60 in Section 13 of Ramsey Township, Kossuth County, Iowa, 3 1/3 miles west and 5 miles north of Titonka.

An access road to the Ramsey Township Cemetery, the last remaining remnant of the community, is 1/2 mile north, and 1/2 mile west of Ramsey on Highway A40.

Ramsey Reformed Church:

A general store owned by A.G. Wortman, Ramsey's last postmaster, served as a meeting hall for a Presbyterian church established by Rev. J. Liesveld. In 1882 church members decided to leave the Presbyterian faith and build a new church on donated land in Section 15 of German Township. The Reformed Church of America granted membership to the Ramsey Reformed Church (German Reformed Church) in 1886.

Ramsey Reformed Church and Cemetery are 1/2 mile east and 4 1/2 miles north of Titonka, Iowa, on Highway P66. Meyer Cemetery (German Township West Cemetery), also associated with the church, is 2 miles north and east of Titonka, east of intersection 350th St. & 200th Ave.

German Valley:

As Ramsey failed growth occurred 2 1/2 miles south of the Ramsey Reformed Church within Sections 27, 28, 33, and 34 of German Township. German Valley grew to 30 residents and featured a creamery, blacksmith, two livery stables, a post office, several abodes, and for a short time two rival general stores.

A new railroad line in the area resulted in most residents disassembling and moving their buildings 3 miles south by 1898 to form Titonka.

German Valley Co-operative Creamery Company, incorporated in 1896, continued to operate for several years after the move.

A 1890s store built by Adam Fisher east of the creamery saw several different owners and continued serving customers into the 1950s.

Mr. & Mrs. Henry Plaisier operated a welding and repair shop named Hank’s Repair Shop in German Valley from 1934 to 1977.

The German Township East Cemetery is one mile east of German Valley on the north side of 350th Street. The once adjacent German Lutheran Church, built circa 1897, lay abandoned and was “rotting away” by 1913.

#1860s#1867#1870s#1960s#19th Century#20th Century#abandoned#family directory#genealogy#German Township East Cemetery#German Township West Cemetery#German Valley#ghost town#history#Iowa#Kossuth County#Meyer Cemetery#Midwest#Ramsey Reformed Church#Titonka

1 note

·

View note

Text

What to Do when you Lose your P60 Documents?

Losing your P60 document can be concerning, but there are steps you can take to address the situation. The P60 is an important document that provides a summary of your earnings and deductions for the tax year. Here’s what you can do:

Contact Your Employer:

Start by contacting your current or former employer. They are responsible for providing you with a copy of your P60.

Check Digital…

View On WordPress

1 note

·

View note

Text

A Step-by-Step Guide: How to File Your Self Assessment Tax Return

Filing your self assessment tax return can be a daunting task, but it is a necessary one if you are self-employed or receive income from other sources. In this comprehensive guide, we will walk you through the process of filing your self assessment tax return, step by step. By the end of this article, you will have a clear understanding of what is required and how to avoid common mistakes.

Who needs to file a self assessment tax return?

Not everyone is required to file a self assessment tax return. If you are an employee and your income is solely from your salary, taxes are usually deducted automatically through the PAYE (Pay As You Earn) system. However, if you are self-employed, a sole trader, a partner in a partnership, a company director, or have income from other sources such as rental properties or investments, you will need to file a self assessment tax return.

Filing a self assessment tax return allows you to declare your income and expenses, claim any tax deductions or reliefs you may be entitled to, and calculate the amount of tax you owe. It is important to determine whether you fall under the category of individuals who need to file a self assessment tax return to avoid any penalties or fines.

Benefits of filing a self assessment tax return

Filing a self assessment tax return has several benefits, even if you are not required to do so. Firstly, it allows you to ensure that you are paying the correct amount of tax based on your income and expenses. By accurately reporting your financial details, you can avoid overpaying or underpaying taxes.

Secondly, filing a self assessment tax return provides an opportunity to claim tax deductions and reliefs. If you are eligible for any tax breaks, such as business expenses or charitable donations, you can offset these against your taxable income, potentially reducing your overall tax liability.

Additionally, filing a self assessment tax return can help you build a comprehensive financial record. This can be useful for various purposes, such as applying for loans or mortgages, as it demonstrates your income and financial stability.

Important dates and deadlines for self assessment tax returns

Before diving into the process of filing your self assessment tax return, it is crucial to be aware of the important dates and deadlines. The tax year in the United Kingdom runs from April 6th to April 5th of the following year. Here are some key dates to keep in mind:

October 5th: Deadline for registering for self assessment if you are self-employed or have other untaxed income.

October 31st: Deadline for filing a paper tax return.

January 31st: Final deadline for filing your self assessment tax return online and making any tax payments.

It is advisable to start preparing your tax return well in advance to ensure you have enough time to gather all the necessary documents and information. Waiting until the last minute can lead to unnecessary stress and potential mistakes.

Gathering the necessary documents and information

Before you begin the process of filing your self assessment tax return, it is essential to gather all the necessary documents and information. This will help streamline the process and ensure you have accurate data to report on your tax return. Here are some key documents and information you may need:

Personal information: Your National Insurance number, Unique Taxpayer Reference (UTR), and contact details.

Income details: Details of all your sources of income, including self-employment income, employment income, rental income, dividends, and interest.

Expense records: Receipts and records of any allowable business expenses, such as office supplies, travel expenses, and professional fees.

Pensions and benefits: Details of any pensions, state benefits, or other taxable income.

Tax documents: P60 forms from your employer and any other relevant tax documents, such as P45 or P11D.

By gathering these documents and information beforehand, you can ensure a smooth and accurate filing process.

Step 1: Registering for self assessment

The first step in filing your self assessment tax return is to register for self assessment with HM Revenue and Customs (HMRC). If you are self-employed or have other untaxed income, you are required to register by October 5th of the tax year following the year in which you became liable for self assessment.

To register, you will need to visit the HMRC website and create a Government Gateway account. Once you have registered, you will receive a Unique Taxpayer Reference (UTR) and be able to access the online self assessment system. It is important to register as soon as possible to avoid any penalties for late registration.

Step 2: Calculating your income and expenses

Before completing your self assessment tax return, you need to calculate your income and expenses for the tax year. This involves gathering all the relevant financial information and determining your taxable income.

Start by compiling all your income sources, including self-employment income, employment income, rental income, dividends, and interest. Ensure you have accurate records and supporting documentation for each source of income.

Next, deduct any allowable business expenses from your income. These may include office rent, utilities, travel expenses, professional fees, and other costs directly related to your business. Keep in mind that not all expenses are allowable, so it is important to refer to HMRC guidelines or consult a tax professional if you are unsure.

Once you have calculated your taxable income, you can determine the amount of tax you owe. This can be done using the tax rates and allowances applicable to your income bracket. HMRC provides online calculators and resources to help you with this process.

Step 3: Completing the self assessment tax return form

Now that you have gathered all the necessary documents and calculated your income and expenses, it is time to complete the self assessment tax return form. HMRC provides an online system called "Self Assessment" where you can complete and submit your tax return electronically.

The online form is divided into sections, each corresponding to different types of income and expenses. It is important to complete each section accurately and provide all the required information. The form will guide you through the process, asking relevant questions based on your individual circumstances.

As you complete each section, double-check your entries for accuracy and ensure you have included all the necessary details. Mistakes or omissions can lead to delays in processing your tax return or even penalties for incorrect filing.

Step 4: Submitting your self assessment tax return

Once you have completed the self assessment tax return form, it is time to submit it to HMRC. If you are using the online system, you can submit your tax return electronically. The system will provide a confirmation once your tax return has been successfully submitted.

If you prefer to file a paper tax return, you must do so by October 31st. However, it is recommended to file your tax return online as it is faster, more secure, and provides instant confirmation of receipt.

After submitting your tax return, HMRC will calculate the amount of tax you owe based on the information provided. You will receive a tax calculation (also known as a "tax calculation letter") outlining the amount due. It is important to review this calculation to ensure its accuracy.

Common mistakes to avoid when filing your self assessment tax return

Filing a self assessment tax return can be complex, and there are several common mistakes that individuals make. By being aware of these mistakes, you can avoid them and ensure a smooth filing process. Here are some common mistakes to avoid:

Incorrectly reporting income: Ensure you include all your sources of income and report them accurately. Failure to do so can result in penalties or fines.

Forgetting to claim tax deductions: Keep track of your business expenses and other allowable deductions to reduce your overall tax liability. Neglecting to claim these deductions can lead to paying more tax than necessary.

Missing filing deadlines: Be aware of the important dates and deadlines for filing your self assessment tax return. Failing to meet these deadlines can result in penalties and interest charges.

Incomplete or inaccurate records: Maintain accurate and up-to-date records of your income, expenses, and other financial details. This will help ensure the accuracy of your tax return and simplify the filing process.

By avoiding these common mistakes, you can save time, money, and stress when filing your self assessment tax return.

Understanding the penalties for late or incorrect filing

Filing your self assessment tax return late or with incorrect information can result in penalties from HMRC. It is important to understand the consequences of non-compliance and take steps to avoid any penalties. Here are some key penalties to be aware of:

Late filing penalty: If you fail to file your self assessment tax return by the deadline, you will incur an initial penalty of £100. Additional penalties may apply for further delays.

Late payment penalty: If you do not pay your tax bill by the deadline, you will be charged interest on the outstanding amount. The interest rate is currently set at 2.6%.

Incorrect filing penalty: If HMRC discovers that your tax return contains errors or inaccuracies, you may be subject to penalties based on the severity of the errors. Deliberate attempts to evade tax can result in higher penalties and potential criminal charges.

It is important to take these penalties seriously and ensure you file your self assessment tax return correctly and on time. If you require assistance or are unsure about any aspect of the filing process, it is advisable to seek professional advice.

Getting help with filing your self assessment tax return

Filing a self assessment tax return can be a complex task, especially if you have multiple sources of income or complicated financial arrangements. If you find yourself overwhelmed or unsure about any aspect of the filing process, it is advisable to seek help from a tax professional.

A tax professional can provide expert guidance, help you navigate the complexities of self assessment, and ensure you comply with all relevant tax laws and regulations. They can also assist with tax planning, identify potential deductions or reliefs, and help you minimize your tax liability.

By seeking professional help, you can have peace of mind knowing that your self assessment tax return is accurate, complete, and filed on time.

Conclusion

Filing your self assessment tax return does not have to be a daunting task. By following this step-by-step guide, you can navigate the process with confidence and avoid common mistakes. Remember to gather all the necessary documents, register for self assessment, calculate your income and expenses, complete the tax return form accurately, and submit it to HMRC on time.

Understanding the important dates and deadlines, as well as the potential penalties for late or incorrect filing, is crucial. By staying organized, seeking professional help if needed, and taking the necessary steps to comply with tax regulations, you can ensure a smooth and hassle-free self assessment tax return filing process.

So, don't wait until the last minute. Start early and file your self assessment tax return with ease. By doing so, you can take advantage of the benefits of early tax filing and avoid unnecessary stress.

1 note

·

View note

Text

How To Claim a Tax Rebate in UK?

New Post has been published on https://www.fastaccountant.co.uk/how-to-claim-a-tax-rebate-in-uk/

How To Claim a Tax Rebate in UK?

Are you a UK taxpayer, wondering how to claim a tax rebate? Look no further! In this article, we’ll provide you with a step-by-step guide to help you through the process. Whether you’re claiming for overpaid taxes, work expenses, or any other eligible refunds, we’ve got you covered. So grab your pen and paper, because by the end of this article, you’ll be well equipped to claim your tax rebate in the UK.

Understanding Tax Rebates in the UK

What is a tax rebate?

A tax rebate, also known as a tax refund, is the return of excess taxes that you have paid to the government. It occurs when the amount of tax withheld from your income exceeds the actual amount of tax you owe. This can happen if you have overpaid taxes, qualify for certain tax allowances or reliefs, or have had expenses that are eligible for tax deductions.

Who is eligible for tax rebates in the UK?

In the UK, tax rebates are available to individuals who have overpaid taxes or are eligible for certain tax allowances and reliefs. Some common situations where you may be eligible for a tax rebate include:

Overpaying taxes due to being placed in the wrong tax code.

Working for only part of the tax year.

Leaving the UK and no longer being subject to UK tax.

Being self-employed and having eligible business expenses.

Having a job where you pay expenses out of your own pocket.

These are just a few examples, and there may be other circumstances where you could claim a tax rebate. It’s always best to consult with a tax professional or review the HM Revenue and Customs (HMRC) guidelines to determine your eligibility.

Why claim a tax rebate?

Claiming a tax rebate is important because it allows you to recover any excess taxes you have paid throughout the tax year. By doing so, you ensure that you are only paying the correct amount of tax that you owe, based on your income and individual circumstances. It can also help you gain a better understanding of your tax situation and potentially provide a financial boost by receiving a refund.

Gather Necessary Documents and Information

Gather your personal information

Before starting the process of claiming a tax rebate, it’s important to gather all the necessary personal information. This includes your full name, National Insurance number, and current address. Having these details readily available will make it easier and faster to complete the tax form accurately.

Obtain your P45 and P60 forms

The P45 and P60 forms are important documents that provide details of your income and tax contributions. The P45 is given by your previous employer when you leave a job, and it outlines your earnings and taxes paid during your employment. The P60, on the other hand, is provided by your current employer at the end of each tax year and summarizes your total income and taxes paid.

If you have changed jobs or worked for multiple employers during the tax year, ensure you have all your P45s and P60s for accurate income and tax calculations.

Collect relevant receipts and documents

If you believe you have eligible tax deductions or expenses, it’s essential to gather all relevant receipts and supporting documents. This might include expenses related to your job, such as uniform purchases, professional memberships, tools, or travel costs.

By having all these receipts and documents organized and easily accessible, you will be able to accurately calculate your potential rebate amount and provide evidence to support your claim, if required.

Calculate Your Rebate Amount

Understand taxable income and tax paid

To calculate your potential rebate amount accurately, it’s important to understand how taxable income and tax paid are determined. Taxable income is the amount of income you are liable to pay tax on, after accounting for any tax reliefs or allowances you may be eligible for. Tax paid refers to the amount of tax that has been deducted from your income throughout the tax year.

By analysing your taxable income and tax paid, you can identify any discrepancies or potential overpayments that may lead to a tax rebate.

Determine applicable tax allowances and reliefs

Tax allowances and reliefs are deductions that can reduce your taxable income, resulting in a lower tax liability. Common tax allowances and reliefs in the UK include the personal allowance, which is the amount of income you can earn tax-free, and specific reliefs for things like pension contributions or charitable donations.

By determining which tax allowances and reliefs apply to you, you can accurately calculate your rebate amount by subtracting them from your taxable income.

Calculate your potential rebate amount

Once you have gathered all the necessary information and understood how taxable income, tax paid, and tax allowances and reliefs work, you can calculate your potential tax rebate amount. This can be done manually using HMRC guidelines or by using an online tax rebate calculator that takes into account all the relevant factors.

Calculating your potential rebate amount will give you an estimate of how much money you may be entitled to receive back from the government.

Ensure Accuracy of Tax Records

Check for errors in tax coding

Tax coding determines how much tax is deducted from your income. It’s essential to review your tax coding to ensure there are no errors or discrepancies that could result in overpayment or underpayment of taxes. You can find your tax coding on your payslip or by contacting HMRC.

If you identify any errors, it’s important to update your tax coding to ensure it accurately reflects your income and tax situation.

Review employment details and expenses

Reviewing your employment details and expenses is crucial to ensure they are correctly reflected in your tax records. Check that your job title, income, and other employment-related information match your actual circumstances. Similarly, review any expenses you have claimed for accuracy and eligibility.

By reviewing these details, you can identify any discrepancies or errors that may impact your tax rebate claim.

Verify tax deductions and allowances

Double-checking your tax deductions and allowances is essential to ensure you have claimed all the eligible tax reliefs and deductions you are entitled to. This includes reviewing any specific deductions for things such as pension contributions, charitable donations, or student loan repayments.

Verifying your tax deductions and allowances will ensure you are maximizing your potential tax rebate.

Find the Appropriate Tax Form

Choose the right tax form for your situation

When claiming a tax rebate, it’s important to select the appropriate tax form that matches your individual circumstances. There are different forms available, such as the P85 for leaving the UK, the P87 for claiming employment expenses, or the Self Assessment tax return if you are employed and self-employed in the same tax year.

By choosing the correct form, you can provide the necessary information and documentation specific to your situation, ensuring a smooth and accurate process.

Download forms from HM Revenue and Customs (HMRC) website

Once you have determined the correct tax form for your circumstances, you can download it directly from the HMRC website. The website provides access to various tax forms and guidance, making it easy to find and download the forms you need.

Ensure you download the most up-to-date form and carefully read any guidance or instructions provided to accurately complete the form.

Contact HMRC if you are unsure about the form

If you are unsure which tax form to use or have questions about the form-filling process, it’s best to contact HMRC directly. They have dedicated helplines and online resources to assist individuals with their tax-related queries.

By reaching out to HMRC, you can ensure that you have the correct information and guidance to complete the tax form correctly.

Fill Out the Tax Form Correctly

Provide accurate personal details

When filling out the tax form, it’s crucial to provide accurate personal details, including your full name, address, and National Insurance number. These details are essential for HMRC to identify and process your claim correctly. Double-check all personal information to avoid any delays or issues with your tax rebate claim.

Include relevant income and tax information

Include all relevant income and tax information accurately on the tax form. This involves entering details from your P45s and P60s, as well as any additional income sources, such as rental earnings or dividends. Ensure that all income and tax figures are entered correctly to avoid any discrepancies or potential delays in processing your tax rebate claim.

Submit the Completed Tax Form

Double-check all entered information

Before submitting your completed tax form, double-check all the information you have entered. Make sure all personal details, income figures, and supporting documentation have been included accurately. Verify any calculations made to determine the rebate amount. By thoroughly reviewing the form, you minimize the risk of errors or missing information that could lead to delays in processing your tax rebate claim.

Send the form to the appropriate HMRC address

Once you are confident that the form to claim a tax rebate is complete and accurate, send it to the appropriate HMRC address. The address to which you should send the form will be specified in the instructions or guidance provided with the form. Ensure that the form is securely packaged and that you retain a copy for your records.

Consider using recorded delivery for proof of submission

To have proof of submission, it can be beneficial to use recorded delivery when sending HMRC your form to claim a tax rebate. This ensures that you have a tracking number and a receipt of delivery, which can be helpful if any issues arise or if you need to provide evidence of submission.

Wait for HMRC Assessment

Allow time for HMRC to review your claim

After submitting your tax rebate claim, it’s important to allow sufficient time for HMRC to review and process it. The time it takes for your claim to be assessed can vary, but it’s generally advisable to wait at least a few weeks.

Check your online tax account for updates

To stay informed about the progress of your claim for tax rebate, regularly check your online tax account. HMRC provides an online platform where you can access and manage your tax-related information, including updates on the status of your claim.

By checking your online tax account, you can track the progress of your claim and stay informed about any additional information or actions required.

Respond promptly to any requests for additional information

During the assessment process, HMRC may request additional information or supporting documents to verify your claim for a tax rebate. It’s essential to respond promptly to any such requests to ensure the smooth processing of your claim.

By providing the requested information in a timely manner, you help expedite the assessment process and increase the chances of a successful claim for tax rebate.

Receive the Rebate Payment

Receive a cheque or bank transfer

Once your claim for a tax rebate has been approved and processed, you can expect to receive the rebate payment. This payment can be made via cheque, which will be sent to your registered address, or through a bank transfer to your nominated bank account.

Ensure that the payment details provided on your form to claim a tax rebate are accurate to avoid any delays or issues with receiving your rebate payment.

Understand the timeframe for receiving the payment

The timeframe for receiving your tax rebate payment can vary depending on HMRC’s processing times and other factors. While the exact duration cannot be guaranteed, many individuals receive their rebate payments within a few weeks to a few months of their claiming a tax rebate being approved.

If you haven’t received your payment within a reasonable time, it’s advisable to contact HMRC to inquire about the status of your payment.

Contact HMRC if there are any delays or issues with your claim for a tax rebate

If you encounter any delays or issues with your rebate payment, it’s important to contact HMRC for assistance. They have dedicated helplines and support services to address any concerns or queries you may have.

By reaching out to HMRC, you can resolve any payment-related issues and ensure that you receive your tax rebate in a timely manner.

Common Mistakes to Avoid

Incomplete or inaccurate forms

One common mistake when claiming a tax rebate is submitting an incomplete or inaccurate form. It’s important to take the time to carefully review and complete all sections of the form accurately. Double-check that all relevant information and supporting documents have been included.

By avoiding incomplete or inaccurate forms, you minimize the risk of delays or potential rejections of your tax rebate claim.

Missing supporting documentation

Another mistake to avoid is not providing the necessary supporting documentation for your claim. Ensure that you have included all relevant receipts and documents that support your claimed deductions or expenses if it is required. This will help validate your claim and increase the likelihood of a successful tax rebate.

Failure to follow up with HMRC

Lastly, failing to follow up with HMRC can lead to delays or missed opportunities regarding your claim for tax rebate. Stay proactive in checking your online tax account for updates and responding promptly to any requests for additional information.

By actively engaging with HMRC, you ensure that your claim is being processed and provide any necessary information to support your case.

In conclusion, claiming a tax rebate in the UK requires thorough understanding, careful documentation, and accurate form completion. By following the step-by-step guide outlined above, you can navigate the process with confidence and increase your chances of a successful tax rebate claim. Remember to gather all necessary documents, calculate your potential rebate accurately, fill out the correct form, and submit it to HMRC. From there, patiently await the assessment and, once approved, enjoy the financial benefit of your tax rebate payment.

0 notes

Text

can i get a copy of my p60 from hmrc:

If you need a copy of your P60 from HMRC (Her Majesty's Revenue and Customs), you can request it through their official channels. Typically, employers provide P60 forms at the end of the tax year, summarizing your earnings and deductions. If you've misplaced yours, contact your employer first. If they are unable to assist, reach out to HMRC directly for a duplicate copy. Ensure you have necessary details such as your National Insurance number and personal information when making the request. HMRC's website or helpline can guide you through the process of obtaining a replacement P60 for your tax records.

#HMRC

#payslip

#P60

0 notes

Text

December 2, 2006, the Danish band Volbeat performed in the Amstelveen P60

Volbeat's lineup: Michael Poulsen, Anders Kjølholm, Franz "Hellboss" Gottschalk, and Jon Larsen.

"Volbeat was formed in October 2001 by Michael Poulsen, who came from the Danish metal band Dominus. During their 10 years of existence, Michael Poulsen and Dominus made four albums, and their videos were shown on MTV and Viva."

Via Amstelveenweb.com

#volbeat#michael poulsen#volbeat concert images#2006#Amstelveenweb#amstelveen p60#Franz Gottschalk#anders kjølholm#jon larsen#vans shoes#cuffed jeans#early volbeat

0 notes