#pay stub template excel

Explore tagged Tumblr posts

Text

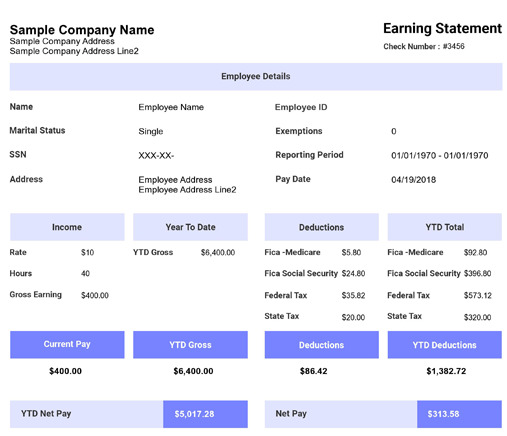

Pay Stub Sample Template vs. Paystub Generator: Which One is Better?

When it comes to payroll documentation, businesses and self-employed individuals often choose between a pay stub sample template and a paystub generator. Both options help create professional and accurate pay stubs, but which one is the better choice for your needs?

In this article, we’ll explore the differences, advantages, and drawbacks of using a pay stub sample template versus a paystub generator. By the end, you’ll have a clear understanding of which option best suits your business requirements.

What is a Pay Stub Sample Template?

A pay stub sample template is a pre-designed document that helps businesses manually enter payroll details. It is typically available in formats such as Word, Excel, or PDF and includes necessary payroll information such as gross pay, deductions, and net earnings.

Pros of Using a Pay Stub Sample Template

✅ Customizable – Users can modify the template according to their specific needs.

✅ Free or Low Cost – Many sample templates are available for free or at a low cost.

✅ Easy to Use – Requires basic knowledge of payroll calculations but is straightforward to fill out.

✅ Good for Small Businesses – Ideal for small businesses with a limited number of employees or self-employed individuals.

Cons of Using a Pay Stub Sample Template

🚨 Manual Calculations – Users must calculate taxes, deductions, and net pay manually.

🚨 Risk of Errors – Without automation, mistakes in calculations can occur.

🚨 Time-Consuming – Filling out multiple pay stubs manually can take a lot of time, especially for growing businesses.

What is a Paystub Generator?

A paystub generator is an online tool that automatically creates pay stubs by calculating earnings, taxes, and deductions. Users input their details, and the generator instantly produces a professional pay stub.

Pros of Using a Paystub Generator

✅ Automated Calculations – The tool calculates taxes and deductions accurately, reducing human error.

✅ Saves Time – Generates pay stubs within minutes.

✅ Professional Format – Creates well-structured and polished pay stubs.

✅ Cloud-Based Access – Many generators allow users to store and access pay stubs online.

Cons of Using a Paystub Generator

🚨 Costs Money – Many generators require payment for each pay stub or a subscription fee.

🚨 Limited Customization – Some generators have restrictions on format and layout.

🚨 Potential Security Risks – Users must ensure they use a trusted and secure generator to protect sensitive payroll data.

Key Differences Between a Pay Stub Sample Template and a Paystub Generator

FeaturePay Stub Sample TemplatePaystub GeneratorCustomizationHigh (Can be modified manually)Low to Medium (Depends on generator options)Ease of UseRequires manual entryFully automated and user-friendlyAccuracyDepends on user calculationsHigh (Automated calculations)CostFree or low costOften requires payment or subscriptionTime EfficiencyTime-consumingQuick and efficientSecurityData stored locallyMust ensure secure online platform

Which One Should You Choose?

The best choice depends on your specific needs and business size.

Choose a Pay Stub Sample Template If:

You have a small business or are self-employed.

You are comfortable doing payroll calculations manually.

You prefer free or low-cost solutions.

You need full control over the design and format of your pay stubs.

Choose a Paystub Generator If:

You want to save time and automate calculations.

You need an easy-to-use solution with professional formatting.

Your business has multiple employees and requires frequent pay stub generation.

You want to reduce errors and ensure payroll accuracy.

Conclusion

Both pay stub sample templates and paystub generators offer benefits for businesses and individuals needing to document payroll. If you prioritize cost and customization, a pay stub sample template may be the right choice. However, if you need speed, accuracy, and convenience, a paystub generator is the better option.

Ultimately, the best solution depends on your business size, budget, and payroll processing needs. Whichever option you choose, ensuring that your pay stubs are accurate and professional is essential for maintaining financial transparency and compliance.

0 notes

Text

Attention business owners and HR professionals! Streamline your payroll process with our innovative Blank Pay Stub Template. Reliable, efficient, and tailored for modern businesses. 🔍💼

0 notes

Photo

Check Stub Template | Blank - Excel - Word Sample

Visit https://stubcreator.com/download-pay-stub-templates/ and download templates for free. Get first paystub absolutely free or $4.99 off @stubcreator

2 notes

·

View notes

Text

1.paystubgenerators

Top Reasons Why it is Critical to Use online Pay Stub Generators

There are a lot of mistakes that business persons make and one of them is not focusing to their pay stubs. It is recommendable for every business regardless of the size to pay attention to the generation of high-quality pay stubs. There are some firms that tend to sending time back pay stubs to their workers by mail such that they have to wait for several days if not weeks to receive them. When this was carried out, the employees were made to think that they are not at all to trust the management as it looks as though the vital information to them, they are not given. Numerous workers deliberate their pay stub of extreme significance. Click this link

On the pay stub, the information contained in there is a number of work hours the worker has rendered to the firm. All the employees will want an accurate pay stub that is going to be reflective of the total amount of cash that has been credited into their accounts. With an inaccurate pay stub, it goes without doubt that an incorrect amount of money is what has been credited into their account. These disadvantages bring about the reasons why it is vital to consider having online pay stub generators.

There are countless benefits that occur as a result of online pay stub generators. It is made possible to pass fast information to your workers which makes this the primary advantage of the online pay stub generator. It takes just a short span of time or even minutes for you to access information that your workers need by the use of these generators. The excellent thing about this is that your workers can also access them within a short time.

Also, these generators can act as solution to the ever-recurring rows that revolve around remuneration between the firm and its team of workers. The fact that you have update data on salary is relieved from worrying about checking back payments that have been done previously. click here for more

With the help of the stub generators access to information by the workers is also made easy. Again maintaining of precise information by the workforce becomes possible also. The information about the payment of the employees is also made possible by these generators. You can as well look at all the necessary deduction that your company did against what got to you from your employer. Making use of your templates is also made possible with the help of these stub generators. Both the staff member and the company can reap benefits out of it. An online pay s stub generator that fulfills a particular need and goal during your search.

More on https://www.youtube.com/watch?v=26LjPX6iq4E

1 note

·

View note

Text

I couldn't calculate the taxes on pay stubs for employees until I found this.

Hello all! I'm Ronald, a small business owner. I know that generating pay stubs can be a time-consuming and tedious task. It’s not only about formatting the pay stubs but also calculating employee taxes accurately, including federal, state, and local taxes.

I used Excel to generate pay stubs for my employees, but it was error-prone. I would often make mistakes when calculating the taxes, and I would have to spend more time and energy correcting them.

I also found that the pay stubs were not formatted very well, and they looked unprofessional. It often gives headaches while touching this part.

I recently switched to SecurePayStubs, and I'm so glad I did!

SecurePayStubs is an online pay stub generator that makes it easy to create accurate and professional-looking pay stubs.

Here are some of the things I love about SecurePayStubs:

It's easy to use. The user interface is very user-friendly, and I was able to create my first pay stub in just a few minutes. It's accurate. SecurePayStubs uses the latest tax laws to calculate the correct taxes for each employee. I've never had to worry about making a mistake with the taxes. It's professional. The pay stubs that SecurePayStubs generates are formatted beautifully and look just like those I used to get from my previous employer.

If you're a small business owner who is looking for an easy, accurate, and professional way to generate pay stubs, I highly recommend SecurePayStubs.

It's a great way to save time and money, and it will help you create pay stubs that are accurate and compliant with the latest tax laws.

Here are some additional benefits of using SecurePayStubs:

Create pay stubs for any employee, regardless of their location. Securely store your pay stubs and access them on the go. Access a library of free professional-looking paystub templates. Calculate federal and all 50 state taxes based on current tax laws and requirements. Includes other customization options, such as including employees’ time-off information and deposit slip on pay stubs.

If you're looking for a reliable and affordable way to generate pay stubs, I encourage you to try SecurePayStubs. You won't be disappointed.

0 notes

Text

452: Last-Minute Reminders Before The New Year Countdown

This Podcast Is Episode Number 452, And It's About Last-Minute Reminders Before The New Year Countdown

It’s been another excellent year for Fast Easy Accounting. We appreciate your support for those of you who have been with us through all these years; without our contractor clients, template customers, construction accounting academy students, email subscribers, podcast listeners, blog readers, and social media followers, we wouldn’t get to where we are today.

As we look back on our 2021, I hope your fondest memories will include the time you’ve spent with all the things you love and are passionate about. And because we love what we do and we are passionate about serving our contractor friends - for us, this year was all about empowering your contracting business by continually providing you with outstanding products, high-quality services, and dependable resources for your bookkeeping and accounting needs.

Year-End Review: Time flies when everyone is busy.

Start now - review your records for the following items:

Missing Federal Tax ID’s and requesting the W-9.

Have all your employees verify their pay stubs for the correct address.

Check Apartment numbers and zip codes. Have any of the neighborhoods been annexed into the city?

Year-End Accounting Clean Up

Your Tax Accountant will be sending your booklet with what they want for records.

What are the loose odds and ends missing for this year?

Do you have a formal Accounting System?

Do you need to clean up the Accounting beyond the last couple of months?

Do you have bank statements?

Can you find all your receipts?

Tax Accountants do “workarounds” to file your annual taxes. At some point, the Tax Accountant may refuse to clean up and deal with the Lack of Good Records or Messy Records. As the economy improves, tax accountants will have more clients who want their taxes done.

Helpful Reminders:

Be mindful of the paperwork that must be stamped on or before December 31st (today).

Payroll – Did you take any personal payroll (S-Corp)? If not, it may impact your personal deductions.

IRA - 401K - Making those final payments before midnight on December 31. (Do not wait until 11:59 PM) Some plans allow you to make payments until April 15th (double-check the dates– do not assume)

Income – Getting one last customer invoice and receiving the payment - last-minute purchases to count on 2021 taxes (expenses or larger item which qualifies for depreciation)

Do not expect to be able to file your annual taxes on January 1st (tomorrow).

Visit https://www.irs.gov/ for the official 2022 Filing Season Start Date.

Prepare W-2s and pass them out as soon as possible - remember to keep a copy.

W-2’s and 1099’s have a deadline of January 31st to be mailed out to your employees and 1099 contractors. Be proactive and send out W-9’s as soon as possible, thereby asking for a Federal Tax ID or Social Security Number now.

Think about your company tax filing status.

I recommend changing from a Sole Prop to an S-Corp. Setting up an S-Corp is done with the Secretary of State in your state. Note, a few states only accept forms from a third-party service. If you are currently an LLC, I recommend becoming an S-Corp. If not, change your tax filing status to be treated as an S-Corp. The form needed from the IRS is Form 2553. Unlike many State Agencies, the IRS does not charge to file their forms. You are asking the IRS to change how your company is treated. Why is this important? Because the IRS will only accept the form for the current year in January – February (pushing the deadline to March 15th is risky), the approval will be for the next year (starting in January 2023) instead of January 2022.

Late Penalties to State and Federal Government Agencies are increasing, and they are looking back at filing dates of past returns for additional fees. It’s costly to borrow money from the government. If you need it, it never hurts to ask for a payment plan.

Rule of Thumb When Asking: Be Nice, Be Polite. Ask for a payment plan to be extended for as long as possible and with as low as possible payments. Sometimes no matter how you ask – the person you are talking to is not helpful, but usually, if it is within the rules, they will help you out.

It all gets down to Time | Scope | Money

A good tax accountant can do Many Simple or Less Complicated Returns in the same amount of time it takes to do a Messy, Complex Business Return. More Tax Returns become more Complex than is necessary because the documents or lack of records make it messy and hard to deal with.

Your Reason To Turn It All Over To The Tax Accountant

It’s cheaper to have the Tax Accountant do it than hire a Bookkeeping Service, and I don’t want to do it myself because it’s Hard.

Yes - The Tax Accountant can and maybe will do a workaround that is just enough to do the taxes. If you are missing 5%, 10%, 15%, or even more, the tax accountant will use what you provided, and it will be by exception; your tax accountant will ask for missing documents or even notice they are missing.

A tax accountant will assume you gave them everything you had. In reality, you gave The Tax Accountant only what You thought The Tax Accountant needed versus all of the records that might save you additional money in taxes.

A sound accounting system will help you make better decisions on what to buy and what type of jobs to accept. When did you afford to take payment plans from your clients? When is the need or ability to raise your prices? Only you can decide if the lack of good records was worth the low price.

Happy New Year – 2022 is just around the corner - Are you Ready?

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or [email protected]

Check out this episode about Contractors Marketing - Accounting - Production (M.A.P.)!

0 notes

Text

Google Sheets Budget Template – How to Organize Your Money

Here I go mentioning the “B” word again.

Let me get out in front of it and say I love using a google sheets budget template to manage my money.

A Microsoft Excel budget spreadsheet was the primary tool my family and I applied for over four years to track our family budget and $100K debt reduction progress.

However, in recent years, we transitioned to a google sheets budget template. Google Sheets offers more flexibility, and since it's cloud-based, we can access anywhere, even from my phone.

We still use google sheets today to track our net worth, monthly budget, and basically anything to do with our money. Sure there are plenty of budgeting apps or software you can use. But if you enjoy crunching the numbers yourself as I do, a google sheets budget template might be right for you.

The other great thing about a personal budget template is the fact that it is a template, a preset format that gives you a great headstart to capture your income and expenses. Budgeting is hundreds of years old, so why try and reinvent them? It's much easier to use a google sheets budget template, so the format does not have to be recreated each time you used it.

How a Budget Will Help You

A budget in its purest form is a record of your income and expense. It's an excellent money management tool.

How do you define income and expense?

Well it may vary for individuals, but generally, they are:

Income – Money you earn from a job, side hustle freelancing, etc. Income can be made daily, weekly, monthly, etc.

Expenses – Mortgage, rent, food, gas, cable, insurance, phone, electric, student loans, credit cards, medical, self-care, pet care, entertainment, etc.

The simplest way to understand these numbers is to grab your pay stubs, bills, or statements for all income and expenses and begin to organize and document them.

I have created my own google sheets budget template for you to download and get started. Just replace all of the example numbers in either sheet to get started.

By completing this task, you have just created a money foundation. A starting point to understand how much money you make and how much you have outgoing each month. From there, you can begin to make adjustments.

Many people believe creating a budget worksheet will restrict their spending. I think it's just the opposite. You are reviewing and understanding where your money is going, so you can prioritize how you spend it.

The powerful thing about a google sheets budget template is that you can customize it to fit your personal situation. Adding as much detail as possible, color coding, etc. and with some simple formulas, it does all of the calculations, and totaling for you.

Budget Categories

I tend to be a detail-oriented person. From a budget category perspective, I could really drill down to the nitty-gritty for all of our expenses. For example, when we had five credit cards, I might list them individually in our google sheets budget template. But in reality, I took a broad stroke and just listed the overall credit card debt in one line item. Here are some common categories you might find in a budget:

Mortgage/Rent

Electric

Cell Phone

Insurance

Student Loans

Credit Card

Cable TV

Water and Gas

Car

Entertainment/Gifts

Home / House Hold

Food

Medication/ Medical Bills

Gas

Charitable Donations

Eating Out

Outside Help

Clothes/Books

Cash

One time payments

Savings Account

Other

There's really no wrong or right way to capture your budget categories, other than making sure you've included all income and expenses. But which bucket you put them in or identify them as, is really up to you.

We shop at Costco and purchase things other them food there. But I don't breakdown a single receipt into multiple categories. I lump it into our “food” line item.

I would, however, suggest when first starting with a budget for the first time, that you include as much detail as possible for the first two-three months. Saving receipts, or reviewing bank account transaction is a great way to find those details.

Documenting as much detail as possible gives you a better understanding of where your money is going. Sometimes we fall into spending habits, like a daily cup of coffee & bagel, without realizing we are spending money there.

This early level of detail gives you the information to need to prioritize your spending and make changes.

Budget Strategies

I'm a fan of the customize budget to fit your personal situation. That's why I like the power of using a google sheets budget template. You can modify it to meet your needs. However, if you are looking for a cookie-cutter solution to get started, there are several popular budget strategies you can use.

50/30/20 Budget

The 50/30/20 budget was made famous by Harvard economist Elizabeth Warren and her daughter, Amelia Warren Tyagi.

The duo says you should base your budget on your “take-home” income, your income after taxes, health insurance premiums, and other expenses that are taken out of your paycheck.

Here's the 50/30/20 breakdown:

50% – Half your take-home income should go toward necessities like housing, electricity, gasoline, groceries, and the water bill.

30% – percent can go to discretionary items like restaurant dining, buying a new cell phone, drinking beer, or getting tickets to a sports game.

20% – percent should go towards savings or debt repayment.

80/20 Budget

The beauty of this 80/20 budget is that you don't have to do any detailed expense-tracking. You simply take your savings off the top and then spend the rest.

So it breaks down:

20% – saving

80% – all other expenses, rent, debt, food, etc.

Pretty simple, right?

Zero-based Budget

Zero-based budgeting is a way of budgeting where your income minus your expenses equal zero, each month. With a zero-based budget, you have to make sure your expenses match your income during the month, and you're giving every dollar a function.

Now that doesn't mean you have zero dollars in your bank account. One of your budgeting categories should be savings. It just means your income minus all your expenses (outgo) equals zero.

That means if you earn $4,000 a month, you want everything you spend, save, donate, or invest to all add up to $4,000. By doing this, you have every dollar account for each month.

Bare-bones Budget

A bare-bones budget or a contingency budget is a secondary budget to your first budget. It's in place and set aside for when life's unexpected events occur.

To quote the boxing legend Mike Tyson – “Everyone has a plan until they get punched in the mouth.”

The goal of the bare-bones budget is to have a plan for that punch. Let's say you experience a significant house repair, or car accident, or maybe a job loss. How would you handle it? You could lean on your bare-bones budget.

It takes your spending down to the minimum required to survive and fulfill your financial obligations. Think of it as covering all of your needs, and putting a pause on spending on wants. You'll need food, but won't be going to the movies during this time.

The Best google sheets budget template

So now that we've reviewed how a budget can help you, budget categories, and budget strategies, let's get to crunching some numbers already. Here the google sheets budget template out there to get you started. No, Suprise, it's mine!

Debt Discipline – google sheets budget template

Take some time to take this budgeting templates for a spin. Budget tracking is one of the basic principles of personal finance, and it might just be an eye-opening experience when you truly understand where your money is going.

Final Thoughts on Budgeting

Creating a budget is a fundamental key to managing your money. There are two things to remember with your budget. Your income is your biggest wealth-building tool, and debt, of any kind, is a killer of budgets.

Once you have your income and expenses capture in a budgeting template, consider what your budget would look like with more income or the credit card category removed from your expenses.

Adjusting these numbers can give you a glimpse into the future of your budget, money, and life. I find it to be a great motivator to keep my budget in order.

Good luck with creating your household budget, your financial future will thank you. Let me know how I can help.

The post Google Sheets Budget Template – How to Organize Your Money appeared first on Your Money Geek.

from Your Money Geek https://ift.tt/30n1T0A via IFTTT

0 notes

Text

A Beginner’s Guide to Budgeting: 5 Steps for Getting Your Spending in Check

Setting up a budget is about as exciting as going to the dentist. It’s challenging. You’re forced to face your spending habits and then work to change them.

But creating a budget will set you free. When you decide to make a budget, it means you are serious about your money. Maybe you even have some financial goals in mind.

If you’re creating a budget for the first time, remember that the end result will bring you peace of mind and that budgets will vary by individual and family. It’s important to set up a budget that’s a fit for YOU.

Budgeting for Beginners in 5 Painless Steps

Follow these basic steps and tailor them to your needs to create a monthly budget that will set you up for financial success.

Step 1: Set a Financial Goal

First things first: Why do you want a budget?

Your reason will be your anchor and incentive as you create a budget and stick to it.

Set a short-term or long-term goal. It can be to pay off debts like student loans, credit cards or a mortgage, or to save for retirement, an emergency fund, a new car, home down payment or vacation.

For Lindsey and Jonathan Tuttle, creating a budget was a must because they wanted to buy their first home. After buying the house, the Tuttles continued budgeting. They paid off some credit card debt and had wiggle room for their accident-prone pets.

“I don’t have to worry as much about the crazy things that life throws at us because I know we have the funds put away to deal with most things that come up,” said Lindsey, who is expecting a baby in March.

Once one goal is complete, you can move on to another and personalize your budget to fit whatever your needs are.

Step 2: Log Your Income, Expenses and Savings

You’ll want to use a Microsoft Excel spreadsheet or another budget template to track all of your monthly expenses and spending. List out each expense line by line. This list is the foundation for your monthly budget.

Tally Your Monthly Income

Review your pay stubs and determine how much money you and anyone else in your household take home every month. Include any passive income, rental income, child support payments or side gigs.

If your income varies, estimate as best as you can, or use the average of your income for the past three months.

Make a List of Your Mandatory Monthly Expenses

Start with:

Rent or mortgage payment.

Living expenses like utilities (electric, gas and water bills), internet and phone.

Car payment and transportation costs.

Insurance (car, life, health).

Child care.

Groceries.

Debt repayments for things like credit cards, student loans, medical debt, etc.

Anything that will result in a late fee for not paying goes in this category.

List Non-Essential Monthly and Irregular Expenses

Non-essential expenses include entertainment, coffee, subscription and streaming services, memberships, cable TV, gifts, dining out and miscellaneous items.

Don’t forget to account for expenses you don’t incur every month, such as annual fees, taxes, car registration, oil changes and one-time charges. Add them to the month in which they usually occur OR tally up all of your irregular expenses for the year and divide by 12 so you can work them into your monthly budget.

Budgeting tip: Review all of your bank account statements for the past 12 months to make sure you don’t miss anything.

Don’t Forget Your Savings

Be sure to include a line item for savings in your monthly budget. Use it for those short- or long-term savings goals, building up an emergency fund or investments.

Figure out how much you can afford — no matter how big or small. If you get direct deposit, saving can be simplified with an automated paycheck deduction. Something as little as $10 a week adds up to over $500 in a year.

Step 3: Adjust Your Expenses to Match Your Income

Now, what does your monthly budget look like so far?

Are you living within your income or spending more money than you make? Either way, it’s time to make some adjustments to meet your goals.

How to Cut Your Expenses

If you are overspending each month, don’t panic. This is a great opportunity to evaluate areas to save money now that you have itemized your spending. Truthfully, this is the exact reason you created a budget!

Here are some ways you can save money each month:

Cut optional outings like happy hours and eating out. Even cutting a $4 daily purchase on weekdays will add up to over $1,000 a year.

Consider pulling the plug on cable TV or a subscription service. The average cost of cable is $1,284 a year, so if you cut the cord and switch to a streaming service, you could save at least $50 a month.

Fine-tune your grocery bill and practice meal prepping. You’ll save money by planning and prepping recipes for the week that use many of the same ingredients. Use the circulars to see what’s on sale, and plan your meals around those sales.

Make homemade gifts for family and friends. Special occasions and holidays happen constantly and can get expensive. Homing in on thoughtful and homemade gifts like framed pictures, magnets and ornaments costs more time and less money.

Consolidate credit cards or transfer high-interest balances. You can consolidate multiple credit card payments into one and lower the amount of interest you’re paying every month by applying for a debt consolidation loan or by taking advantage of a 0% balance-transfer credit card offer. The sooner you pay off that principal balance, the sooner you’ll be out of debt.

Refinance loans. Refinancing your student loan, car loan or mortgage can lower your interest rates and cut your monthly payments. You could save significantly if you’ve improved your credit since you got the original loan.

Get a new quote for car insurance to lower monthly payments. Use a free online service to shop around for new quotes based on your needs. A $20 savings every month is $20 that can go toward savings or debt repayments.

Start small and see how big of a wave it makes.

Oh, and don’t forget to remind yourself of your financial goal when you’re craving Starbucks at 3 p.m. But remember that it’s OK to treat yourself — occasionally.

“I have had to learn that it is OK for me to go out to lunch sometimes or buy myself a new pair of sneakers when mine get worn out,” Lindsey Tuttle said. “I don’t need to deprive myself completely to be successful with my financial goals.”

What to Do With Your Extra Cash

If you have money left over after paying for your monthly expenses, consider building an emergency fund if you don’t have one.

Chris Meadows said saving for an emergency fund made it possible for him to stick to his budget.

When his washer and dryer broke, Meadows used his emergency fund to handle it instead of borrowing money.

“Once you dip into the emergency fund, immediately start building it up again,” he advised.

Otherwise, you can use any extra money outside your expenses to reach your financial goals.

Step 4: Choose a Budgeting Method

You have your income, expenses and spending spelled out in a monthly budget, but how do you act on it? Trying out a budgeting method helps manage your money and accommodates your lifestyle.

Living on a budget doesn’t mean you can’t have fun or splurges, and fortunately many budgeting methods account for those things. Here are a few to consider:

The Envelope System is a cash-based budgeting system that works well for overspenders. It curbs excess spending on debit and credit cards because you’re forced to withdraw cash and place it into pre-labeled envelopes for your variable expenses (like groceries and clothing) instead of pulling out that plastic.

The 50/20/30 Method is for those with more financial flexibility and who can pay all their bills with 50% of their income. You apply 50% of your income to living expenses, 20% toward savings and/or debt reduction, and 30% to personal spending (vacations, coffee, entertainment). This way, you can have fun and save at the same time. Because your basic needs can only account for 50% of your income, it’s typically not a good fit for those living paycheck to paycheck.

The 60/20/20 Budget uses the same concept as the 50/20/30, except you apply 60% of your income to living expenses, 20% toward savings and/or debt reduction, and 20% to personal spending. It’s a good fit for fans of the 50/20/30 Method who need to devote more of their incomes to living costs.

The Zero-Based Budget makes you account for all of your income. You budget for your expenses and bills, and then assign any extra money toward your goals. The strict system is good for people trying to pay off debt as fast as possible. It’s also beneficial for those living to paycheck to paycheck.

Budgeting Apps

Another money management option is to use a budgeting app. Apps can help you organize and access your personal finances on the go and can alert you of finance charges, late fees and bill payment due dates. Many also offer free credit score monitoring.

Step 5: Follow Through

Budgeting becomes super easy once you get in the groove. But you can’t set it and forget it. You should review your budget monthly to monitor your expenses and spending and adjust accordingly. Review checking and savings account statements for any irregularities even if you set bills to autopay.

Remember to adjust your budget as your spending changes. But even if your income increases, try to prioritize saving the extra money. That will help you avoid lifestyle inflation, which happens when your spending increases as your income rises.

The thrill of being debt-free or finally having enough money to travel might even inspire you to seek out other financial opportunities or advice. For example, if you’re looking for professional help, set up a consultation with a certified financial planner who can assist you with long-term goals like retirement and savings plans.

Stephanie Bolling is a staff writer at The Penny Hoarder. Her budget saves her from late-night Amazon purchases. Read her full bio here or say hi on Twitter @StephBolling.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

The Penny Hoarder Promise: We provide accurate, reliable information. Here’s why you can trust us and how we make money.

A Beginner’s Guide to Budgeting: 5 Steps for Getting Your Spending in Check published first on https://justinbetreviews.tumblr.com/

0 notes

Text

Conquer your student debt with this template

Don’t know where to start with your student debt? It alright, most do not know either. That’s where Loan Away comes to help you! We had our team search for the best student debt templates available on the internet. We came across hundreds of templates that all looked promising, but we could only choose one. Instead of just picking one, we had our team use the best templates for their student debt. We have decided that the template by Andrew Josuweit was the best overall. It was not the most technical or attractive, but it gets the job done. Business Insiders have interviewed him this week, so we have included the entire article below. If you need a simple and quick solution, debt consolidation is the most popular personal loan option. The link to download the template is in the original article below.

I paid off $107000 in

student loans with a simple spreadsheet anyone can use

Like any business owner, I had revenues, expenses, and taxes. I used a simple spreadsheet that showed me whether my little business was profitable or not.

More than a decade later, buried in $107,000 of student loan debt, I returned to spreadsheets to solve my debt dilemma.

In May 2014, I created a document that helped me build a better budget and erase my student loan debt a few short years later. That document, which I’ll share below, put more of my growing income toward my three remaining student loan servicers. Thanks in part to the spreadsheet, my debt was erased by September 2016.

Using a spreadsheet to budget

Forty-four percent of Americans can’t handle $400 in emergency expenses, according to the Federal Reserve. I learned a version of that statistic while seated at a personal finance conference in New York City, and I was shocked.

I knew that not long ago, I was one of those Americans. Building a spreadsheet allowed me to understand how much I was making, how I was spending my money, and where I can cut expenses to increase my student loan payments.

To start, I listed all my expenses, thinking critically about where I could make cuts.

For example, moving to Austin from New York significantly lowered my cost of living in multiple areas (groceries, dining out, etc.).

As the CEO of a small, but growing startup, my salary had increased, and my minimum student loan payments were still $1,033 per month.

But I was able to keep my other expenses low in multiple areas for a few reasons:

I didn’t own a car. Instead, I would bike around town or use Car2Go which helped me avoid car insurance, car payments, and gas.

I split rent and other shared expenses with my girlfriend. That helped me cut my living costs down. Plus, our complex had its own gym which helped me avoid paying for a gym membership.

I was able to expense my cell phone bill and internet for work.

Inspired by the target allocation percentages, or TAPs, described in Mike Michalowicz’s business book “Profit First,” I then made each expense a percentage of my monthly income. For example, my $913 in apartment rent made up 8% of it. This helped me understand my biggest expenses.

So you can visualize what I’m talking about, below is a cleaned-up snapshot of my monthly budget from March 2016.

Courtesy of Andrew Josuweit

Using a budget to map a route forward

Before you make a budget, you need to have a plan that informs it. The first part of my plan was to build an emergency fund while making student loan payments so that I wouldn’t ever be caught without six months’ worth of expenses stashed away. The second was to pay off my loans as fast as possible.

I realized when making my budget that these goals could be achieved together. In the snapshot above, you’ll see that after accounting for my fixed and variable expenses, I had 70% of my after-tax salary left. I aimed to send 80% of that spare change toward loan payments and 20% toward emergency savings.

That was all fine and good, but I needed to develop the spreadsheet further to visualize my finish line of loan repayment.

Putting an age on my debt

When I was in high school, I wanted to be a millionaire by age 25. Sadly, that didn’t even come close to happening. It didn’t happen at 30 either.

Although I never set a goal of being debt-free by a certain age, I like that way of thinking. Knowing where you are financially helps you decide on where you want to be. If your goal is to have kids at 40, for example, you’ll ideally be debt-free by then, saving for a home and family.

I eventually created a term for the extra student loan payments I was making to get out of debt faster: “Debt Killer.” The additional payments I mapped out helped me put an age on my repayment. In December 2014, for example, my spreadsheet told me I’d be debt-free before my 42nd birthday.

And the Debt Killer kept working its magic.

Just six months later, it said I’d erase my student loans by the time I was 32. By January 2016, I was due to be debt-free by 30.

Here’s the bottom section of my spreadsheet from early 2016, when my Debt Killer was a monthly payment of $4,636.

Courtesy of Andrew Josuweit

Your turn to budget

You might take a look at my spreadsheet and assume that you have to be a math whiz to do what I did. Let me dispel you of that right here: Math definitely doesn’t come naturally to me. I struggled in every math class I ever took, barely passing my final college class, econometrics.

So try to overcome your math anxiety, and keep reading. It’s actually quite easy.

To start your budget, you can do as I did by listing your after-tax income as well as your fixed and variable expenses. Looking at your past two months’ pay stubs and bank statements is a helpful way of doing this. Don’t worry so much about the targets you set for variable expenses, as you can adjust those month to month.

Whether you’re filling in the spreadsheet or building your own version, bake some flexibility into it. When I started mine, for example, I accounted for credit card debt.

Also, I was a freelance UX designer and Airbnb host, so I had three after-tax incomes to include.

Once you put your numbers down on paper, see how much of your monthly income is left. Let your mind run through the possibilities of using this “spare change.” You’ll start to think about the levers you can pull to end your debt faster. You could cut more expenses, for example, or add a side hustle for extra income.

Download the spreadsheet here.

Courtesy of Andrew Josuweit

Courtesy of Andrew Josuweit

Your turn to plan

The great part about using my spreadsheet is that after you enter your information, the dependent cells will auto-populate. The formulas are already inside, waiting for you.

But the spreadsheet is only as smart as you make it. After entering your income (revenues) and costs (fixed and variable expenses), you’ll need to make more important choices to map your route forward. Start with this simple equation:

Spare change = Target monthly emergency savings + Target monthly Debt Killer

My goal was to direct 80% of my leftover earnings to debt and 20% to savings. Yours could be 100 to 0, 50 to 50, or another proportion depending on what makes the most sense for your situation.

Once you know where you are financially in this section of the spreadsheet, make some decisions about where you want to go. If erasing your student loan debt is the highest priority (as it was for me), your Debt Killer should be as high as possible.

To see how much damage your Debt Killer can do, shift your attention to the “Debt Summary” section of the spreadsheet. Enter your total outstanding debt — the average graduate has $37,172 in student loans — and your age.

Your debt-free age should come into focus as a result. Let that number motivate you. If it doesn’t, lower it by increasing your Debt Killer. Go as high as you can without sacrificing your basic needs elsewhere.

Give the spreadsheet approach a shot

You’re not alone if you don’t know much about your monthly cash flow. That’s a problem. After all, how can you expect to plan for the future if you don’t know where your money is going in the present?

I hope this spreadsheet — or something like it — empowers you to take control of your here and now, plus whatever you want to accomplish later.

I understand that you might hate the idea of using a spreadsheet, let alone building a budget. These are not the most popular tasks. But I urge you to give this spreadsheet approach a try. Enter your information and set some goals. It could very well take you to the end of your debt.

thumbnail courtesy of businessinsider.com

Are you going to start using the template? Loan Away sure hope you use anything to help you clear your student debt as quickly as possible. Rule of thumb, always clear high-interest debt first. If your mortgage interest rate is lower than your student loan, you should clear your mortgage first then. It is rare this happens, but it is best practice is to clear your credit card, personal loan, student loan, and then the mortgage. Focus is key to clearing debt. If you do not have a clear plan, you will never be able to be debt free when you want. The average person would pay the minimum for years without knowing if they are actually clearing the debt. You, however, know that paying your debt as quickly as possible and to only spend within your means. For more information about student debt, Loan Away writes blog articles daily, so don’t miss out on more great content! Share this post on your favourite social network to spread the word on how to conquer your student debt with this excel template!

The post Conquer your student debt with this template appeared first on Loan Away.

Conquer your student debt with this template published first on https://helloloanaway.tumblr.com

0 notes

Text

Paystub Generator

If you are new into the business world, you need to have templates such as Pay slip Templates to manage with most of your financial affairs. These templates would render excellent benefits to your financial departments making the management of pays and related calculations easier for you. This would carry all the details like the gross pay, taxes and other deductions that need to be paid to the employee. pay stub creator The detailed pay slip is very important as it carries all the major details that need to be delivered to the employee. You can get a number of options from the internet in order to get the perfect one amongst the many options available there. These options available on the internet are extremely affordable that give you something that exactly matches your requirements from a number of available options. You can even get a pay slip template of your own choice out of the office software that you use in all your setups. This would give you exactly the kind of slip that you need by having a template that is based on all your desired fields. These can be filled on the computer we can take print as well. Before making the template, you need to review all the fields that you consider to have in your template. All the fields that you wish to deliver to your employee should all be considered well and catered in the template so that it comes up as an effective option.

0 notes

Text

Online checkstub generator

While there are many different computer programs that can be used when creating a sample pay stub template, an Excel pay stub template gives you the most options, and the program is very easy to use. Below are just some of the topics that should always be included when developing one of these templates: • Company Information. The company information section, which is really nothing more than the name and address of your business, is an item that must appear on your template, but the good news is that it will only need to be typed once. After that it can be used over and over again each pay period and with each employee record. • Employee Information. Entering the personal and payroll information for each employee is really the only time-consuming aspect of creating an Excel pay stub sample, but fortunately, this too will only need to be created one time. Once this information is entered into the database it can then be used each time you create an employee pay stub. Additionally, this list can be easily updated in the event of an address change, change in job title or pay rate and when hiring new employees. • Income Information. The income information consists of both gross and net income, also known as pre-tax and after-tax income respectively. These amounts are based solely on the employee’s hourly rate and the number of hours he or she worked in a specific pay period, including overtime hours and the appropriate pay rate. Once your sample pay stub is set up with the proper formulas, these amounts will be automatically calculated by the template. real check stubs Of course, the final portion of your sample pay stub will consist of a series of formulas created to calculate the appropriate percentages of the various employee deductions. These deductions include, but are certainly not limited to, local, state and federal income tax, social security, disability insurance, health benefits, pension, and retirement savings, along with any voluntary or charitable contributions the employee opts to have withheld from his or her earnings.

0 notes

Text

Create Online Pay stubs

While there are many different computer programs that can be used when creating a sample pay stub template, an Excel pay stub template gives you the most options, and the program is very easy to use. Below are just some of the topics that should always be included when developing one of these templates: • Company Information. The company information section, which is really nothing more than the name and address of your business, is an item that must appear on your template, but the good news is that it will only need to be typed once. After that it can be used over and over again each pay period and with each employee record. • Employee Information. Entering the personal and payroll information for each employee is really the only time-consuming aspect of creating an Excel pay stub sample, but fortunately, this too will only need to be created one time. Once this information is entered into the database it can then be used each time you create an employee pay stub. Additionally, this list can be easily updated in the event of an address change, change in job title or pay rate and when hiring new employees. • Income Information. The income information consists of both gross and net income, also known as pre-tax and after-tax income respectively. These amounts are based solely on the employee’s hourly rate and the number of hours he or she worked in a specific pay period, including overtime hours and the appropriate pay rate. real check stubs Once your sample pay stub is set up with the proper formulas, these amounts will be automatically calculated by the template. Of course, the final portion of your sample pay stub will consist of a series of formulas created to calculate the appropriate percentages of the various employee deductions. These deductions include, but are certainly not limited to, local, state and federal income tax, social security, disability insurance, health benefits, pension, and retirement savings, along with any voluntary or charitable contributions the employee opts to have withheld from his or her earnings.

0 notes

Link

Pay Stub Template in Excel Excel Templates for Payroll and HR The pay stub is known as a document regarding a worker’s pay check. If the worker gets direct deposit, the pay stub will be the independent document which is … Continued

Related Posts:

How To Create Whale Curve In Excel: Free Excel…

Actual Vs Target Chart In Excel: Free Excel Template…

Break Even Analysis Formula, Example, Calculator And…

Financial Report Template Excel [Download]

Weekly Timesheet Template Excel

via Mr Dashboard

0 notes