#payin api

Explore tagged Tumblr posts

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi api integration#upi integration#education portal development company#bbps#upi payment gateway#upi integration api#upi payment gateway integration

0 notes

Text

Payin API Provider

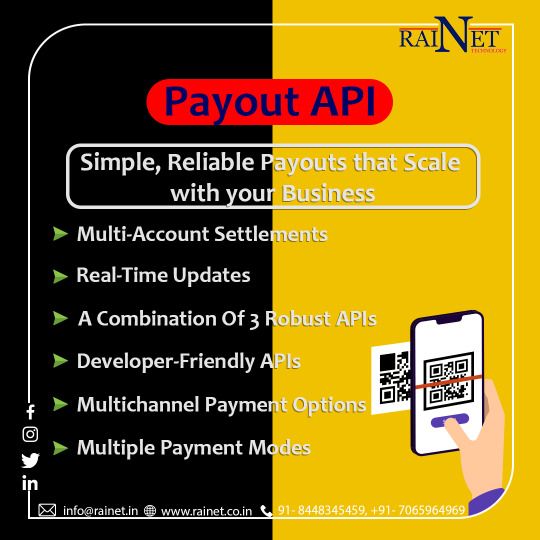

Rainet Technology is a leading Payin API Provider offering unparalleled solutions for integrating payment systems into your platform. With a focus on exceptional customer experience, ease of integration, and robust security measures, Rainet Technology stands out in the crowded market of payment solutions. Rainet Technology's Payin API delivers lightning-fast speed and reliability, ensuring real-time processing and eliminating the risk of transaction failures. Their payment solutions are highly customizable, catering to the unique needs of businesses across various industries. Rainet Technology's API can seamlessly integrate with existing systems, and it's scalable, allowing businesses to handle increased transaction volume effortlessly as they grow. Moreover, Rainet's Payin API is equipped with the latest security measures to secure sensitive data and protect transactions. If you're looking for a secure, flexible, and easy-to-use Payin API provider, look no further than Rainet Technology. Their advanced technology infrastructure and team of experts guarantee an unmatched payment experience for both businesses and their customers, driving growth, and success in today's competitive market.

Visit Website:https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#ios app development#api service#rainet technology private limited#mobile app development company#api provider#bbps service#android app developer company#paytm upi integration api#education portal development company#upi api integration

0 notes

Text

🎮 Streamline Payments with Our Gaming Payment Gateway Solution

Looking for a fast, secure, and reliable payment system for your gaming platform? Our advanced Gaming Payment Gateway Solution is built to handle high-volume transactions with ease. From instant Payin for Gaming to automated withdrawals using our Gaming Payout Payin API, we’ve got everything you need to power seamless in-game payments.

💡 Key Features:

Real-time deposits and payouts

Multiple payment modes (UPI, cards, wallets)

Single API integration for payins and payouts

High security and fraud protection

Boost your player experience and simplify your payment operations — explore our gaming payment solutions today!

👉 https://www.scriza.in/pay-in-service

#social media marketing#seo services#techsolutions#search engine optimization#software development#fintech#customsoftware

0 notes

Text

[ad_1] The Indian fintech sector has witnessed an unprecedented revolution over the last decade, driven by innovative startups and rapid technological advancements. Among these changemakers, Hyderabad-based Viyona Fintech has emerged as a leader in financial inclusion, particularly in rural and semi-urban India. With its flagship products, ViyonaPay and GraamPay, the company is not only bridging financial gaps but also redefining the role of fintech in empowering underserved communities. Fintech and Rural India: A New Dawn Rural India has historically faced significant challenges in accessing formal financial services. Limited banking infrastructure, low digital literacy and geographical barriers have created a persistent divide between urban and rural economies. However, fintech solutions have begun to change this narrative. By leveraging technology, companies like Viyona Fintech have brought banking and payment services to the fingertips of millions. The proliferation of smartphones and internet connectivity in rural regions has further accelerated this transformation, enabling even small villages to access digital financial services and fostering economic inclusion. Viyona Fintech: Pioneering Innovation for Financial Inclusion Founded in Hyderabad, Viyona Fintech has made its mark with a mission to empower rural and semi-urban India through cutting-edge digital platforms. Its flagship products, ViyonaPay and GraamPay, are reshaping how financial services are delivered. ViyonaPay: Aimed at businesses and organizations, ViyonaPay offers comprehensive payment and banking solutions, including PayIn and Payout platforms, UPI integration, and Connected Banking APIs. It enables seamless fund transfers, merchant payments, and real-time reconciliation. With robust security features and regulatory compliance, ViyonaPay is a trusted platform for enterprises looking to streamline financial operations. GraamPay: Focusing on individuals and small communities in rural areas, GraamPay is a neo-banking platform that provides services such as micro-loans, micro-insurance, UPI payments, digital gold investments, and utility bill payments. By integrating features like AEPS (Aadhaar-Enabled Payment System) and DMT (Domestic Money Transfer), GraamPay has simplified daily financial transactions for users. Its digital onboarding process, combined with an intuitive KYC system, has significantly lowered barriers to access. Impact on Rural Communities: Viyona Fintech’s platforms have made a tangible difference in the lives of rural Indians Financial Inclusion: GraamPay has revolutionized access to essential services, including micro-loans, insurance, UPI payments, and utility bill payments. Rural users can now pay for electricity, water and other utilities digitally, saving time and effort. This integration has enhanced financial literacy and empowered users to better manage their resources. Economic Empowerment: ViyonaPay has enabled businesses in rural areas to expand their operations by providing secure and efficient financial tools. Small businesses and self-help groups have particularly benefited from streamlined payment processes, enabling them to focus on growth and productivity. Job Creation: By introducing local digital banking agents and financial literacy initiatives, Viyona Fintech has created employment opportunities. These agents act as a bridge between the platform and rural communities, ensuring last-mile connectivity while contributing to local economic development. Redefining the Indian Fintech Landscape Viyona Fintech’s success mirrors the broader evolution of India’s fintech ecosystem. Once dominated by urban-centric solutions, the sector is now embracing rural India as a critical growth driver. The company’s work aligns seamlessly with the Indian government’s vision of Digital India and Atmanirbhar Bharat, fostering self-reliance and economic empowerment.Hyderabad,

often called India’s “Silicon Valley of the South,” has played a crucial role in nurturing startups like Viyona Fintech. Its robust tech infrastructure and skilled talent pool have enabled companies to innovate and scale rapidly, driving the city’s reputation as a hub for fintech innovation. Looking Ahead Viyona Fintech’s journey is far from over. The company is exploring advanced technologies such as artificial intelligence (AI) and blockchain to further enhance efficiency and security across its platforms. Additionally, plans to introduce multilingual support in GraamPay aim to make the platform even more accessible to users across diverse regions. As digital payments and financial inclusion continue to shape India’s economic landscape, Viyona Fintech is a torchbearer of change. By combining innovation with a deep understanding of grassroots challenges, the company is not only redefining the fintech landscape but also paving the way for a more inclusive and equitable future. C V K Madhu, CFO, Viyona Fintech, said “our financial strategy at Viyona Fintech focuses on blending innovation with fiscal discipline. By leveraging technology to optimize cash flows, reduce operational costs, and enhance financial transparency, we aim to deliver sustainable value while expanding access to modern financial services for every Indian”. B Nagaraj, CTO, Viyona Fintech, said “we are building a future where financial services are driven by data, powered by AI, and secured through blockchain. At Viyona Fintech, our focus is on developing resilient and adaptive systems that can handle the complexity of modern digital banking while ensuring seamless and secure experiences for users across urban and rural India”. [ad_2] Source link

0 notes

Text

[ad_1] The Indian fintech sector has witnessed an unprecedented revolution over the last decade, driven by innovative startups and rapid technological advancements. Among these changemakers, Hyderabad-based Viyona Fintech has emerged as a leader in financial inclusion, particularly in rural and semi-urban India. With its flagship products, ViyonaPay and GraamPay, the company is not only bridging financial gaps but also redefining the role of fintech in empowering underserved communities. Fintech and Rural India: A New Dawn Rural India has historically faced significant challenges in accessing formal financial services. Limited banking infrastructure, low digital literacy and geographical barriers have created a persistent divide between urban and rural economies. However, fintech solutions have begun to change this narrative. By leveraging technology, companies like Viyona Fintech have brought banking and payment services to the fingertips of millions. The proliferation of smartphones and internet connectivity in rural regions has further accelerated this transformation, enabling even small villages to access digital financial services and fostering economic inclusion. Viyona Fintech: Pioneering Innovation for Financial Inclusion Founded in Hyderabad, Viyona Fintech has made its mark with a mission to empower rural and semi-urban India through cutting-edge digital platforms. Its flagship products, ViyonaPay and GraamPay, are reshaping how financial services are delivered. ViyonaPay: Aimed at businesses and organizations, ViyonaPay offers comprehensive payment and banking solutions, including PayIn and Payout platforms, UPI integration, and Connected Banking APIs. It enables seamless fund transfers, merchant payments, and real-time reconciliation. With robust security features and regulatory compliance, ViyonaPay is a trusted platform for enterprises looking to streamline financial operations. GraamPay: Focusing on individuals and small communities in rural areas, GraamPay is a neo-banking platform that provides services such as micro-loans, micro-insurance, UPI payments, digital gold investments, and utility bill payments. By integrating features like AEPS (Aadhaar-Enabled Payment System) and DMT (Domestic Money Transfer), GraamPay has simplified daily financial transactions for users. Its digital onboarding process, combined with an intuitive KYC system, has significantly lowered barriers to access. Impact on Rural Communities: Viyona Fintech’s platforms have made a tangible difference in the lives of rural Indians Financial Inclusion: GraamPay has revolutionized access to essential services, including micro-loans, insurance, UPI payments, and utility bill payments. Rural users can now pay for electricity, water and other utilities digitally, saving time and effort. This integration has enhanced financial literacy and empowered users to better manage their resources. Economic Empowerment: ViyonaPay has enabled businesses in rural areas to expand their operations by providing secure and efficient financial tools. Small businesses and self-help groups have particularly benefited from streamlined payment processes, enabling them to focus on growth and productivity. Job Creation: By introducing local digital banking agents and financial literacy initiatives, Viyona Fintech has created employment opportunities. These agents act as a bridge between the platform and rural communities, ensuring last-mile connectivity while contributing to local economic development. Redefining the Indian Fintech Landscape Viyona Fintech’s success mirrors the broader evolution of India’s fintech ecosystem. Once dominated by urban-centric solutions, the sector is now embracing rural India as a critical growth driver. The company’s work aligns seamlessly with the Indian government’s vision of Digital India and Atmanirbhar Bharat, fostering self-reliance and economic empowerment.Hyderabad,

often called India’s “Silicon Valley of the South,” has played a crucial role in nurturing startups like Viyona Fintech. Its robust tech infrastructure and skilled talent pool have enabled companies to innovate and scale rapidly, driving the city’s reputation as a hub for fintech innovation. Looking Ahead Viyona Fintech’s journey is far from over. The company is exploring advanced technologies such as artificial intelligence (AI) and blockchain to further enhance efficiency and security across its platforms. Additionally, plans to introduce multilingual support in GraamPay aim to make the platform even more accessible to users across diverse regions. As digital payments and financial inclusion continue to shape India’s economic landscape, Viyona Fintech is a torchbearer of change. By combining innovation with a deep understanding of grassroots challenges, the company is not only redefining the fintech landscape but also paving the way for a more inclusive and equitable future. C V K Madhu, CFO, Viyona Fintech, said “our financial strategy at Viyona Fintech focuses on blending innovation with fiscal discipline. By leveraging technology to optimize cash flows, reduce operational costs, and enhance financial transparency, we aim to deliver sustainable value while expanding access to modern financial services for every Indian”. B Nagaraj, CTO, Viyona Fintech, said “we are building a future where financial services are driven by data, powered by AI, and secured through blockchain. At Viyona Fintech, our focus is on developing resilient and adaptive systems that can handle the complexity of modern digital banking while ensuring seamless and secure experiences for users across urban and rural India”. [ad_2] Source link

0 notes

Text

Swift Developers for Hire: Skyrocket Your App's Success

Hiring the right Swift developers is crucial for any business looking to develop high-quality iOS applications. Swift, developed by Apple, is a powerful and intuitive programming language that has become the preferred choice for iOS, macOS, watchOS, and tvOS app development.

As the demand for mobile app developers continues to rise, understanding how to hire dedicated Swift developers can give your business a competitive edge. This article provides a comprehensive guide to hiring Swift developers, including relevant statistics and diverse perspectives.

Understanding the Demand for Swift Developers

The popularity of Swift as a programming language is well-documented. According to a report by Stack Overflow, Swift ranks among the top 15 most loved programming languages by developers. The demand for Swift developers is driven by the increasing number of iOS users and the continuous growth of the mobile app market. As of 2023, the global mobile application market size was valued at $154.05 billion and is expected to grow at a compound annual growth rate (CAGR) of 11.5% from 2024 to 2030.

Why Hire Dedicated Swift Developers?

Expertise and Specialization:

Dedicated Swift developers have in-depth knowledge and expertise in Swift programming, which ensures that your iOS applications are built efficiently and effectively. Their specialization allows them to stay updated with the latest advancements and best practices in Swift development.

Faster Development Time:

Hiring dedicated Swift developers can significantly reduce the development time. Their familiarity with the language and its frameworks enables them to write clean and optimized code, leading to quicker project completion.

Cost-Effectiveness:

While the initial cost of hiring dedicated developers might seem high, it is cost-effective in the long run. They bring efficiency, reduce the need for extensive training, and minimize the chances of costly errors during development.

Quality Assurance:

Dedicated Swift developers are proficient in testing and debugging iOS applications. They ensure that your app is robust, secure, and provides a seamless user experience.

Steps to Hire Swift Developers

Define Your Project Requirements

Before you start the hiring process, clearly define your project requirements. Determine the scope of your app, the features you want to include, and your target audience. Having a well-defined project outline will help you identify the specific skills and experience you need in a Swift developer.

Choose the Right Hiring Model

There are several hiring models to consider when looking for Swift developers:

In-House Developers: Hiring full-time employees who work exclusively for your company.

Freelancers: Hiring independent contractors for specific projects or tasks.

Dedicated Development Teams: Hiring a team of developers from a third-party service provider.

Each model has its pros and cons. For instance, in-house developers offer more control and easier communication but can be expensive. Freelancers are cost-effective but may lack commitment and reliability. Hiring dedicated development teams provide a balance of cost, expertise, and reliability.

Evaluate Technical Skills

When hiring Swift developers, assess their technical skills thoroughly. Key areas to focus on include:

Proficiency in Swift: Ensure they have a strong understanding of Swift syntax, data structures, and error handling.

Experience with iOS Frameworks: Look for experience with frameworks such as UIKit, CoreData, and SwiftUI.

Knowledge of RESTful APIs: Swift developers should be adept at integrating RESTful APIs to connect iOS applications with back-end services.

Familiarity with Version Control Systems: Proficiency in using Git for version control is essential for collaborative development.

Check Portfolio and References

Review the candidates’ portfolios to assess the quality of their previous work. Look for apps they have developed, paying attention to design, functionality, and user experience. Additionally, ask for references and contact their previous employers or clients to get feedback on their performance, reliability, and work ethic.

Conduct Technical Interviews

Conduct technical interviews to evaluate the candidates’ problem-solving abilities and coding skills. Use coding challenges and real-world scenarios to test their proficiency in Swift and their approach to complex problems. Additionally, assess their understanding of design patterns, software architecture, and best practices in iOS development.

Assess Soft Skills

While technical skills are paramount, do not overlook soft skills. Effective communication, teamwork, and problem-solving abilities are crucial for successful project collaboration. Look for candidates who can articulate their ideas clearly, work well in a team, and adapt to changing project requirements.

Consider Cultural Fit

Cultural fit is an important aspect of hiring, especially for in-house developers or long-term projects. Ensure that the candidates align with your company’s values, work ethic, and organizational culture. A good cultural fit enhances team cohesion and productivity.

Provide Competitive Compensation

To attract and retain top talent, offer competitive compensation packages. According to Glassdoor, the average salary for a Swift developer in the United States is approximately $100,000 per year. Consider factors such as experience, location, and industry standards when determining the salary and benefits.

Onboard and Integrate

Once you have selected the right candidates, ensure a smooth onboarding process. Provide them with the necessary resources, tools, and access to project information. Facilitate their integration into the team by fostering open communication and collaboration.

Leveraging External Resources

If you find it challenging to hire Swift developers directly, consider leveraging external resources:

Staffing Agencies:

Staffing agencies specialize in recruiting developers and can help you find qualified Swift developers quickly.

Online Job Portals:

Platforms like LinkedIn, Indeed, and Glassdoor allow you to post job openings and connect with potential candidates.

Development Service Providers:

Companies like Developers Pool and Positiwise offer dedicated Swift developers for hire. These providers pre-vet candidates and match them with your project requirements.

Conclusion

Hiring dedicated Swift developers is a strategic investment for any business looking to develop high-quality iOS applications. By following a systematic approach defining project requirements, choosing the right hiring model, evaluating technical skills, and considering cultural fit you can find the right talent to bring your vision to life. With the mobile app market continuing to grow, having skilled Swift developers on your team will position your business for success in the competitive digital landscape.

#swift developers#hire developers#hire app developer#mobile app development#hire mobile app developers

0 notes

Text

COTI: The Payment Layer Of Tomorrow

Payment systems are suboptimal today. You need a bank, a card or a Paypal account and eventually you need to pay… to be able to pay! Yes, it’s absurd. This leaves a big gap for blockchain technologies to fill. There are 2 ways to tackle this: a token dedicated to payment or re-invent the base layer that could be used anywhere by developers for all e-commerce websites. This is what Coti is working on: becoming a crypto-payment module (like Nimiq) for e-commerce. In other words, the medium of exchange of the future: an augmented version of Stripe.

1. What is Coti?

COTI is a blockchain that allows you to pay for things with the lowest possible fees. Also, COTI offers a ready-to-use service users can appeal to in cases of fraud or any other dispute related to deals settled through the COTI payment system. In terms of technology, it is using the Trustchain protocol: a sophisticated piece of engineering to make all of this happen. The Trustchain algorithm utilizes “Trust Scores” to determine the amount of PoW necessary to confirm a transaction. The higher a user’s Trust Score, the faster the confirmation time. That system is called a Proof of Trust (PoT) consensus.

Coti Presentation

COTI’s platform enables companies to effortlessly create advanced fintech products and save time, data, and money.

It is essentially 3 products:

-The first one is “COTI Pay”:

COTI Pay

In simple terms, COTI Pay allows users to pay merchants with cryptocurrencies. The architecture looks as follows:

COTI Pay Architecture

-The second one is a white label network that is the foundation for COTI Pay:

Coti Whitelabel

For example, you could imagine companies using that white label network to transact in any currency based on any wallet.

-The third one is a platform to issue stable coins:

Coti Stablecoins

Indeed, the COTI network is a good place to create fixed-price assets like stablecoins to make the platform even more credible and liquid. For example, the platform hosts a stablecoin called Djed. Djed operates by maintaining a reserve of base coins, while minting and burning various other stable assets and reserve coins. It is a Cardano stablecoin. One benefit of this is to make transaction costs more predictable, so avoiding volatile and exorbitant gas fees for users. The COTI development team believes that stablecoins are a ‘killer app’: a key point of their product. The company was the first recipient of equity investment from the cFund for Cardano developments.

2. How to use it?

First, you can use COTI to pay or get paid for services. For example, this is a typical payment flow for a merchant using COTI to charge users:

Payment Flow

The first step is a checkout step of an e-commerce website, then you’re redirected towards the COTI login page. Eventually, you’re asked for a confirmation for you payment. And that’s it, it’s that simple! That really makes me think that the solution can grow faster than people can imagine if crypto payments becomes mainstream in the next couple of years.

To give it a try and figure out if it can be useful to you, you can open an account here (for individuals or corporations) if you’re interested in their payment system:

Open An Account

Then, you can also open a wallet and deposit some tokens into their Treasury liquidity pool to stake them:

youtube

Treasury Tutorial

The APY can be very rewarding (but volatile) so feel free to try and see by yourself. This part of the project makes it also exposed to the DeFi world with the possibility to grow your funds with a flexible yield.

Finally, you can also invest in the COTI token directly on an exchange.

3. The team and the project

The COTI team includes engineers, mathematicians, economists, researchers and veterans from the fintech and banking industries:

Team

I like seeing a mix of web3 disruptors and corporate people: this association is very important for a fintech company that will have to deal with regulation questions in the years to come.

Also, another reason why their team page is impressive is the headcount: 38 people working for the core project.

Now, I will play my favourite game: checking their GitHub. I will have to prove it one day, but to me this is an order 1 metric to assess a project’s future performance. The last updates are all from today or yesterday, first good point:

Github Activity

Then, the number of code contributors is 13, it looks little but believe me it’s not. I’m scanning a lot of GitHub accounts and this is average++, it’s not rare to see 1 to 10 developers on altcoins.

Github Developers

Finally, in terms of investors and advisors, I like to see Cardano in there, another credible project that has a lot of traction with developers:

Investors And Advisors

What about the roadmap?

Roadmap

It includes Djed integration, MultiDAG 2.0 launch, Coin as a Service, and upgrade of the Treasury Governance Token.

-Djed integration: Djed is a stablecoin based on an algorithmic design built on the Cardano blockchain. It uses smart contracts to ensure price stabilization, and that the coin will be useful for decentralized finance (DeFi) operations.

-MultiDAG 2.0: Through MultiDAG 2.0 developers, merchants, and enterprises will be able to issue tokens on the Trustchain and then transact using these tokens across wallets like VIPER and COTI Pay Business.

-Coin As A Service: Coti will be offering enterprise clients to utilize the MultiDAG technology to issue stablecoins and other digital currencies on their terms. In a word, a stablecoin factory.

– Finally, an entreprise token will be launched. This has been secured in a deal earlier this year and they will give more update soon.

4. COTI as an investment

The COTI price did +50% during the April rebound. It’s an important point to consider because good projects tend to feel the “Bitcoin gravity” a bit less than the others. What I mean by that is that when Bitcoin becomes bullish again, they explode faster than the rest of the market. It’s what happened in the last couple of weeks, with a price surge and a volume surge:

COTI price

It gives an idea of how the market values the token when things become bullish for the asset class as a whole. It’s also worth pointing out that there is a growing number of unique addresses holding the asset:

Unique Addresses

The level of centralization is low and keeps going down, which is a massive positive point:

The 300 million USD market capitalization makes it a medium-large size altcoin, with less risk than the tokens we usually look at on this website:

Market Capitalization

But the market capitalization of e-commerce is going to the moon and way beyond in the next couple of years, with a nice exponential shape showing how the economy will become completely digitalized:

E-commerce Market Capitalization

For example, a figure I still can’t really digest is the forecast for 2027. The market capilatization of e-commerce in 2027 is an astonishing 27 trillion USD:

E-commerce Market Capitalization 2020-2027

Now let’s assume that Coti takes about 1% of that cake (not absolutely unrealistic: it’s one of the crypto-payment leaders at the moment) it’s 271 billion USD of market capitalization: a miracle that could bring the token to 1000x from here in 5 years! It might sound unreal but I’m not a “moonboy”, this calculation is based on realistic ratios.

Per the report above: “The global e-commerce market size was valued at USD 9.09 trillion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 14.7% from 2020 to 2027. Increasing penetration of internet is bolstering the smartphone using population across the world. Digital content, travel and leisure, financial services, e-tailing among others constitute a variety of e-commerce options available to the internet accessing customer base that are gaining momentum with increased internet usage.”

5. Conclusion

To conclude, I consider COTI as an incredible gem. All of the above makes of COTI a payment system, a stablecoin factory and a whitelabel network that could be used around the world. It sounds like a fantastic recipe to me.

Also Coti is a very large and talented team, a lively ecosystem of developers, a growing number of wallets and a market capitalization big enough so that it is not too risky while still having a fantastic upside potential due to the skyrocketing e-commerce playground. It is the next altcoin I will invest in, probably heavily.

However, the risk is the regulation. COTI is at the intersection of all the risks: potentially a security and a payment system. The bet you take when you invest in COTI is to assume that crypto payments will become mainstream and that altcoins will become an asset class as a whole. Christine Lagarde won’t like that. That being said, do you know who usually wins when a revolutionary technology plays a game against the rest of the world? I’ve studied history. I know.

Thanks for reading.

Disclaimer: this is not financial advice

CLEMENT

Founder of The Altcoin Oracle

source https://usapangbitcoin.org/coti-the-payment-layer-of-tomorrow/

source https://usapangbitcoin.wordpress.com/2022/04/11/coti-the-payment-layer-of-tomorrow/

0 notes

Text

1)Trade @20rs per order

2) Single Margin for all segments

3)Mobile App, Nest Software terminal and web platform for trading.

4)Regular webinars and training sessions for clients and business partners.

5) ALGO trading , free API, state of art technology & API setups

6)MTF facility

7)LAS: Loan against Securities

8)Aggressive client referral scheme.

9) No hidden charges like call and trade, Auto squareoff charge , Payin-Payout surcharge

10) Mobile app for buying and selling mutual funds and ETF.

11) Pre-IPO buying

0 notes

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi integration api#upi integration#upi api integration#bbps#education portal development company#upi payment gateway#upi payment gateway integration

0 notes

Text

UPI Payout API

Are you tired of the hassle and delays that come with traditional payment methods? Picture this: you own a thriving online business, and your hard work is finally paying off. Your customers love your products and services, but when it comes to paying you, they have to navigate a labyrinth of slow bank transfers and hefty transaction fees. Frustrating, right? Well, fret no more! Introducing the UPI Payout API by Rainet Technology. With this innovative solution, you can bid farewell to these pain points and streamline your payment processes like never before. In this blog, we will dive deep into the world of UPI payout API – uncovering its features, benefits, and step-by-step implementation. Join us as we explore how this powerful tool can revolutionize the way you receive payments, supercharging your business and making transactions faster, smoother, and more secure.

Short Summmery

The UPI Payout API by Rainet Technology offers a solution to the hassle and delays of traditional payment methods.This innovative tool streamlines payment processes, making transactions faster, smoother, and more secure.The blog will cover the benefits, working mechanism, use cases, best practices, integration steps, and challenges/solutions of implementing the UPI Payout API.By implementing the UPI Payout API, businesses can revolutionize the way they receive payments, leading to increased efficiency and customer satisfaction.

Introduction

# Introduction

Welcome to our comprehensive guide on UPI Payout API. In this section, we will introduce you to the concept of UPI Payout API and its significance in modern businesses.

What is UPI Payout API?

UPI (Unified Payments Interface) Payout API is a powerful tool that allows businesses to transfer funds seamlessly using the UPI platform. It enables quick and secure transactions among businesses, individuals, and platforms. With UPI Payout API, businesses can automate payouts to multiple beneficiaries with a single API integration.

The Rise of UPI Payout API

In recent years, UPI has emerged as a popular and game-changing payment system in India. With its ease of use, fast transactions, and wide acceptance, UPI has revolutionized the way money is transferred. As a result, businesses are leveraging UPI Payout API to streamline their payout processes and provide a seamless payment experience to their customers.

Benefits of UPI Payout API

Implementing UPI Payout API offers several advantages for businesses. Here are some key benefits:

1. Efficiency: UPI Payout API enables automated and faster fund transfers, eliminating the need for manual intervention. This results in improved efficiency and reduced processing time for businesses.

2. Cost-effective: By automating payouts through UPI, businesses can significantly reduce administrative costs, such as printing checks or processing manual transfers.

3. Enhanced customer experience: With UPI Payout API, businesses can offer their customers instant settlements, improving overall satisfaction and loyalty.

4. Security: UPI Payout API adheres to robust security measures, ensuring the safety of transactions and protecting sensitive customer data.

How UPI Payout API Works

To understand how UPI Payout API works, let's break it down into a few simple steps:

1. Integration: Businesses integrate their systems with UPI Payout API, connecting their platform to the UPI infrastructure.

2. Beneficiary Verification: The API verifies the beneficiary's UPI ID or Virtual Payment Address (VPA) to ensure accuracy and prevent fraudulent activities.

3. Transaction Initiation: Businesses initiate funds transfer requests through the API, specifying the amount, beneficiary details, and other relevant information.

4. Authentication: The customer's approval is obtained through a secure UPI interface, ensuring authorized transactions.

5. Transaction Confirmation: Once the transaction is successfully processed, businesses receive real-time confirmation, enabling them to updat

Benefits of UPI Payout API

Benefits of UPI Payout API

The use of UPI (Unified Payments Interface) Payout API provides numerous benefits to businesses and developers. Let's explore some of the key advantages below:

1. Seamless Transaction Processing:

- With UPI Payout API, businesses can facilitate seamless transaction processing, allowing them to disburse funds to multiple beneficiaries effortlessly.

- The API streamlines the payment process, eliminating the need for traditional methods such as checks or manual bank transfers.

2. Instant and Real-time Payments:

- UPI Payout API enables businesses to make instant and real-time payments to recipients.

- Beneficiaries receive funds directly into their bank accounts, ensuring quick access to funds without any delays.

3. Cost-effective Solution:

- Implementing UPI Payout API eliminates the need for multiple intermediaries involved in traditional payment methods.

- As a result, businesses can save costs on commissions, processing fees, and other charges associated with conventional payment approaches.

4. Enhanced Security:

- UPI Payout API adheres to robust security protocols and encryption standards, ensuring secure and reliable fund transfers.

- The API employs multi-factor authentication, keeping sensitive information and transactions protected from potential threats.

5. Scalability and Flexibility:

- The UPI Payout API offers scalability and flexibility, enabling businesses to handle varying transaction volumes effortlessly.

- Whether processing a few transactions or large-scale payouts, the API can accommodate the needs of businesses of all sizes.

6. Efficient Tracking and Reporting:

- UPI Payout API provides businesses with comprehensive tracking and reporting capabilities.

- It allows businesses to monitor the status of transactions, generate reports, and reconcile payments, ensuring transparency and efficient financial management.

7. Integration with Existing Systems:

- The UPI Payout API seamlessly integrates with existing business systems and applications.

- This integration facilitates a smooth transfer of funds within the organization's ecosystem, enabling efficient management of finances.

8. Improved Customer Experience:

- The quick and hassle-free payment experience offered by UPI Payout API enhances customer satisfaction and loyalty.

- Beneficiaries appreciate the convenience of receiving payments directly into their bank accounts, resulting in a positive user experience.

💡 key Takeaway: The UPI Payout API offers businesses and developers several benefits, including seamless transaction processing, instant payments, cost-effectiveness, enhanced security, scalability, efficient tracking, and improved customer experience.

How UPI Payout API Works

How UPI Payout API Works

The UPI Payout API is a powerful tool that allows businesses to easily transfer funds to individuals or other businesses using the Unified Payments Interface (UPI) system. This section will provide an in-depth explanation of how the UPI Payout API works and how businesses can leverage its capabilities.

Understanding UPI

Before diving into how the UPI Payout API works, it is crucial to understand the basics of the Unified Payments Interface. UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI) that enables users to make instant money transfers between bank accounts. It provides a seamless, secure, and convenient way to send and receive funds.

Initiating a Payout

To initiate a payout using the UPI Payout API, businesses need to follow a series of steps. Here's a breakdown of the process:

1. Registration: First, businesses need to register with a UPI service provider and obtain the necessary credentials to access the UPI Payout API. This typically involves creating an account and obtaining an API key or access token.

2. Authentication: Once registered, businesses need to authenticate their requests by providing the required identification and authorization details. This step ensures the security and integrity of the transaction.

3. Preparing the Payout: Businesses need to gather all the necessary information to process the payout, such as the recipient's UPI ID, amount to be transferred, and any additional instructions or references.

4. Integration: The next step is integrating the UPI Payout API into the business's existing systems or applications. This can be done using programming languages like Python, Java, or PHP, depending on the business's requirements and capabilities.

5. Requesting the Payout: After integration, businesses can send a payout request to the API endpoint, passing the required parameters and authentication details. The API processes the request and initiates the fund transfer to the recipient's UPI ID.

Verification and Confirmation

Once the payout request is made, the UPI Payout API initiates the transfer process. During this phase, several steps are taken to ensure the accuracy and security of the transaction:

- Verification: The API verifies the validity of the payout request, including checking the availability of sufficient funds and verifying the recipient's UPI ID.

- Validation: The API validates the transaction data, ensuring that all the necessary details are correct and complete.

- Confirmation: Onc

Use Cases of UPI Payout API

Use Cases of UPI Payout API

1. E-Commerce Platforms

E-commerce platforms can greatly benefit from integrating the UPI Payout API into their systems. With this API, these platforms can seamlessly process payments and disburse funds to their sellers, vendors, or service providers. By leveraging the UPI infrastructure, e-commerce platforms can offer an efficient and secure way for their users to receive payments directly into their UPI-linked bank accounts. This not only enhances the user experience but also streamlines the payment process for sellers, enabling faster access to funds.

2. Gig Economy and Freelancing Platforms

In the rapidly growing gig economy, freelancers and independent contractors often face challenges when it comes to receiving timely payments for their services. UPI Payout API presents a perfect solution for gig economy and freelancing platforms to overcome these hurdles. By implementing this API, these platforms can enable seamless and instant fund transfers from clients to freelancers. This ensures that freelancers receive their payments quickly, helping them maintain a steady cash flow and enhancing their overall experience on the platform.

3. Peer-to-Peer (P2P) Lending Platforms

UPI Payout API offers a valuable use case for peer-to-peer lending platforms. These platforms connect borrowers with lenders in a streamlined and efficient manner. By integrating the UPI Payout API, these platforms can disburse loan amounts directly into borrowers' bank accounts, eliminating the need for complex and time-consuming manual processes. The API ensures secure and instant fund transfers, making the lending experience seamless for both borrowers and lenders.

4. Online Marketplaces

Online marketplaces that facilitate services like rentals, car-sharing, or home-sharing can leverage the power of UPI Payout API to enable hassle-free payments to their users. By integrating this API, these marketplaces can ensure secure and quick disbursement of earnings to their sellers or providers. This enhances trust and reliability, encouraging users to continue using the platform and facilitating seamless transactions within the marketplace ecosystem.

5. Insurance and Claims Disbursement

Insurance companies often need to process claims and disburse funds to the insured party quickly. UPI Payout API can streamline this process, allowing insurance companies to transfer claim amounts directly into the policyholder's bank account. By integrating this API, insurers can provide a seamless and convenient experience for their customers, reducing paperwork and delays associated with traditional payment methods.

Best Practices for Implementing UPI Payout API

Best Practices for Implementing UPI Payout API

Implementing the UPI Payout API requires careful planning and adherence to certain best practices. By following these guidelines, you can ensure a seamless integration and optimize the performance of your UPI payout system. Let's explore some key best practices:

1. Understand the UPI Guidelines

Before you start implementing the UPI Payout API, it's crucial to thoroughly understand the UPI guidelines provided by the National Payments Corporation of India (NPCI). Familiarize yourself with the technical specifications, transaction limits, security requirements, and any other regulations imposed by the governing body. This will ensure that your implementation aligns with the defined standards and avoids any compliance issues.

2. Design a User-Friendly Interface

When integrating the UPI Payout API into your system, prioritize user experience. Design a clean and intuitive interface that allows users to easily initiate and track payout transactions. Provide clear instructions and error messages to guide users through the process. A user-friendly interface not only enhances customer satisfaction but also reduces the chances of errors during transactions.

3. Validate User Input

To prevent erroneous or fraudulent transactions, implement robust input validation mechanisms. Validate user inputs such as mobile numbers, UPI IDs, and transaction amounts to ensure they adhere to the required format and meet the necessary criteria. Applying these validations at the entry point will reduce the risk of errors and improve the overall reliability of your payout system.

4. Implement Strong Security Measures

Security should be a top priority when implementing the UPI Payout API. Implement secure coding practices to safeguard sensitive user information and transactions. Utilize encryption techniques such as SSL/TLS to protect data transmission. Additionally, regularly update your system's software and security patches to address any vulnerabilities. By incorporating strong security measures, you build trust with your users and mitigate the risk of data breaches or unauthorized access.

5. Monitor and Analyze Transactions

Once your UPI Payout API is up and running, it's crucial to monitor and analyze transaction data. By tracking transaction success rates, response times, and error logs, you can identify patterns or issues that may arise during payouts. Implement automated monitoring systems that notify you of any failed transactions or abnormalities, allowing you to take immediate action and provide a seamless experience for your users.

6. Plan for Scalability

As your business grows, your payout system should be able to handle increasing transaction volumes. Ensure that your syste

Integration Steps for UPI Payout API

Integration Steps for UPI Payout API

Implementing the UPI Payout API into your business processes requires careful planning and execution. Follow these integration steps to ensure a smooth and successful implementation:

1. Understand UPI Payout API Documentation: Begin by thoroughly studying the documentation provided by Rainet Technology for their UPI Payout API. Familiarize yourself with the API endpoints, request payloads, response formats, and security protocols.

2. Assess System Requirements: Determine if your current system meets the technical requirements for integrating the UPI Payout API. Ensure that your infrastructure, servers, and programming languages are compatible with the API specifications.

3. Obtain API Credentials: Contact Rainet Technology to obtain the necessary API credentials, such as the API key and secret. These credentials are essential for authenticating your requests to their UPI Payout API.

4. Develop a Test Environment: Set up a separate testing environment to perform integration tests before deploying the UPI Payout API in your production environment. This allows you to identify and resolve any issues or inconsistencies before going live.

5. Perform API Integration: Utilize your preferred programming language or SDK (Software Development Kit) to integrate the UPI Payout API into your existing systems. Make sure to handle response codes and error scenarios properly to provide a seamless user experience.

6. Implement Error Handling: Incorporate robust error handling mechanisms to gracefully handle any errors that may occur during API interactions. This includes validating inputs, handling authentication failures, and handling HTTP status codes appropriately.

7. Test and Debug: Conduct thorough testing of the integrated UPI Payout API. Validate different scenarios, such as successful payouts, failed transactions, and edge cases, to ensure the system functions as expected. Use debugging tools and log analysis to troubleshoot and resolve any issues.

8. Secure the Integration: Implement stringent security measures to protect sensitive data during API communication. Adhere to best practices for secure data transmission, such as utilizing secure sockets layer (SSL) encryption and implementing proper access control mechanisms.

9. Monitor and Maintain: Regularly monitor the UPI Payout API integration for performance, reliability, and security. Maintain an efficient logging and monitoring system to detect anomalies, track usage, and ensure compliance with regulatory requirements.

10. Stay Updated: Keep up with Rainet Technology's updates and announcements regarding their UPI Payout API. Stay informed about any changes, enhancements, or bug fixes that ma

Challenges and Solutions for UPI Payout API Implementation

Challenges and Solutions for UPI Payout API Implementation

Implementing a UPI Payout API can come with its fair share of challenges. However, with careful planning and execution, these challenges can be overcome to create a seamless payment experience for your business. In this section, we will explore some of the common challenges faced during UPI Payout API implementation and provide practical solutions to address them.

1. Compliance and Security Challenges

One of the primary concerns when implementing any payment system is ensuring compliance with regulatory requirements and maintaining a high level of security. In the case of UPI Payout API, it is crucial to adhere to the guidelines set by the regulatory authorities and to safeguard sensitive user information.

Solution: To address compliance and security challenges, it is recommended to work closely with legal and security experts. They can provide guidance on implementing robust security measures, such as encryption protocols, secure data storage, and two-factor authentication. Regular audits and vulnerability assessments should also be conducted to ensure ongoing compliance and to identify and fix any security loopholes.

2. Integration Complexity

Integrating the UPI Payout API into your existing system can be a complex task, especially if you have a large and intricate architecture. Compatibility issues, data mapping, and API version updates are some of the potential hurdles that may arise during the integration process.

Solution: To simplify the integration process, it is advisable to seek the assistance of experienced developers and ensure clear communication between your development team and the API provider. It is essential to thoroughly understand the API documentation, follow the best practices provided, and leverage any available libraries or SDKs for smoother integration. Regularly updating the API version to stay in sync with the latest developments is also crucial.

3. Scalability and Performance Optimization

As your business grows, it is essential to ensure that the UPI Payout API can handle increased transaction volumes and maintain optimal performance levels. Failure to address scalability and performance challenges can lead to delays in payouts and a subpar user experience.

Solution: To ensure scalability, it is recommended to architect your system using scalable infrastructure and employ load balancing techniques. Regularly monitoring API performance and conducting performance tests under different load conditions can help identify and address any bottlenecks. Utilizing caching mechanisms and optimizing database queries can also enhance the overall performance.

4. Error Handling and Exception Management

During the UPI Payout API implementation, there is always a possibility of encountering errors or exceptions. I

Conclusion

Conclusion

In conclusion, the UPI Payout API is a powerful tool for businesses looking to streamline their payment processes and enhance customer experiences. By leveraging the benefits of this API, businesses can achieve faster and more secure transactions while reducing manual efforts and costs.

To recap, the UPI Payout API offers several advantages. First, it provides a seamless and efficient way to transfer funds in real-time using the Unified Payments Interface (UPI) platform. Businesses can leverage this API to automate payment disbursements to customers, employees, or vendors.

Implementing the UPI Payout API comes with a variety of benefits. It enables businesses to offer a range of payment options to their customers, fostering convenience and satisfaction. Moreover, by automating the payout process, businesses can save time and resources, allowing for seamless scalability as the business grows.

To successfully implement the UPI Payout API, businesses should follow some best practices. They should ensure that the API integration is aligned with their business goals and objectives. This involves understanding their specific payment requirements, assessing the security measures in place, and optimizing the user experience.

Integration steps for the UPI Payout API involve collaboration between the business and payment service provider. The business needs to gather the necessary documentation and credentials, set up a developer account, and integrate the API into their existing systems or applications. Thorough testing is crucial to ensure seamless functionality and error-free transactions.

While implementing the UPI Payout API offers tremendous benefits, there can be challenges along the way. Businesses may face issues related to technical complexities, compliance requirements, or even network connectivity. However, these challenges can be overcome with careful planning, thorough testing, and ongoing support from the payment service provider.

By embracing the UPI Payout API, businesses can unlock opportunities for growth and enhance their payment capabilities. It is a versatile solution that caters to various use cases, from e-commerce platforms to marketplaces, gig economy platforms, and more.

In summary, the UPI Payout API empowers businesses with a reliable, secure, and cost-effective means to disburse payments seamlessly. By leveraging this API, businesses can automate their payout processes, improve efficiency, and enhance the overall customer experience.

💡 key Takeaway: The UPI Payout API is a powerful tool for businesses to automate payment disbursements and enhance customer experiences, offering benefits such as faster transactions, convenience, and scalability. By following best practices and integrating the API effectively, businesses can overcome challenges and unlock new growth opportunities,

FAQ

What are the conclusions of this article?

Rainet Technology provides a upi payout api that helps businesses process payments quickly and easily.

What are the use cases for the UPI Payout API?

The UPI Payout API can be used by businesses to pay their employees, vendors, and other creditors. Additionally, the API can be used to send payments to mobile and online shoppers in real-time.

What are the challenges and solutions for implementing the UPI Payout API?

There are a few key challenges to implementing a UPI payout API. The first is ensuring that the system is able to handle large volumes of transactions quickly and efficiently. Additionally, it is important to ensure that the API is user-friendly and easy to use so that it can be integrated into customer applications quickly. Finally, it is important to keep data security and privacy in mind, as any sensitive information should be handled securely.

Conclusion

Thank you for reading my blog post. If you have any questions or would like help with your eCommerce SEO, please don’t hesitate to contact me. I would be happy to help.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out

1 note

·

View note

Text

UPI Payout API

Are you tired of the hassle and delays that come with traditional payment methods? Picture this: you own a thriving online business, and your hard work is finally paying off. Your customers love your products and services, but when it comes to paying you, they have to navigate a labyrinth of slow bank transfers and hefty transaction fees. Frustrating, right? Well, fret no more! Introducing the UPI Payout API by Rainet Technology. With this innovative solution, you can bid farewell to these pain points and streamline your payment processes like never before. In this blog, we will dive deep into the world of UPI payout API – uncovering its features, benefits, and step-by-step implementation. Join us as we explore how this powerful tool can revolutionize the way you receive payments, supercharging your business and making transactions faster, smoother, and more secure.

Short Summmery

The UPI Payout API by Rainet Technology offers a solution to the hassle and delays of traditional payment methods.This innovative tool streamlines payment processes, making transactions faster, smoother, and more secure.The blog will cover the benefits, working mechanism, use cases, best practices, integration steps, and challenges/solutions of implementing the UPI Payout API.By implementing the UPI Payout API, businesses can revolutionize the way they receive payments, leading to increased efficiency and customer satisfaction.

Introduction

# Introduction

Welcome to our comprehensive guide on UPI Payout API. In this section, we will introduce you to the concept of UPI Payout API and its significance in modern businesses.

What is UPI Payout API?

UPI (Unified Payments Interface) Payout API is a powerful tool that allows businesses to transfer funds seamlessly using the UPI platform. It enables quick and secure transactions among businesses, individuals, and platforms. With UPI Payout API, businesses can automate payouts to multiple beneficiaries with a single API integration.

The Rise of UPI Payout API

In recent years, UPI has emerged as a popular and game-changing payment system in India. With its ease of use, fast transactions, and wide acceptance, UPI has revolutionized the way money is transferred. As a result, businesses are leveraging UPI Payout API to streamline their payout processes and provide a seamless payment experience to their customers.

Benefits of UPI Payout API

Implementing UPI Payout API offers several advantages for businesses. Here are some key benefits:

1. Efficiency: UPI Payout API enables automated and faster fund transfers, eliminating the need for manual intervention. This results in improved efficiency and reduced processing time for businesses.

2. Cost-effective: By automating payouts through UPI, businesses can significantly reduce administrative costs, such as printing checks or processing manual transfers.

3. Enhanced customer experience: With UPI Payout API, businesses can offer their customers instant settlements, improving overall satisfaction and loyalty.

4. Security: UPI Payout API adheres to robust security measures, ensuring the safety of transactions and protecting sensitive customer data.

How UPI Payout API Works

To understand how UPI Payout API works, let's break it down into a few simple steps:

1. Integration: Businesses integrate their systems with UPI Payout API, connecting their platform to the UPI infrastructure.

2. Beneficiary Verification: The API verifies the beneficiary's UPI ID or Virtual Payment Address (VPA) to ensure accuracy and prevent fraudulent activities.

3. Transaction Initiation: Businesses initiate funds transfer requests through the API, specifying the amount, beneficiary details, and other relevant information.

4. Authentication: The customer's approval is obtained through a secure UPI interface, ensuring authorized transactions.

5. Transaction Confirmation: Once the transaction is successfully processed, businesses receive real-time confirmation, enabling them to updat

Benefits of UPI Payout API

Benefits of UPI Payout API

The use of UPI (Unified Payments Interface) Payout API provides numerous benefits to businesses and developers. Let's explore some of the key advantages below:

1. Seamless Transaction Processing:

- With UPI Payout API, businesses can facilitate seamless transaction processing, allowing them to disburse funds to multiple beneficiaries effortlessly.

- The API streamlines the payment process, eliminating the need for traditional methods such as checks or manual bank transfers.

2. Instant and Real-time Payments:

- UPI Payout API enables businesses to make instant and real-time payments to recipients.

- Beneficiaries receive funds directly into their bank accounts, ensuring quick access to funds without any delays.

3. Cost-effective Solution:

- Implementing UPI Payout API eliminates the need for multiple intermediaries involved in traditional payment methods.

- As a result, businesses can save costs on commissions, processing fees, and other charges associated with conventional payment approaches.

4. Enhanced Security:

- UPI Payout API adheres to robust security protocols and encryption standards, ensuring secure and reliable fund transfers.

- The API employs multi-factor authentication, keeping sensitive information and transactions protected from potential threats.

5. Scalability and Flexibility:

- The UPI Payout API offers scalability and flexibility, enabling businesses to handle varying transaction volumes effortlessly.

- Whether processing a few transactions or large-scale payouts, the API can accommodate the needs of businesses of all sizes.

6. Efficient Tracking and Reporting:

- UPI Payout API provides businesses with comprehensive tracking and reporting capabilities.

- It allows businesses to monitor the status of transactions, generate reports, and reconcile payments, ensuring transparency and efficient financial management.

7. Integration with Existing Systems:

- The UPI Payout API seamlessly integrates with existing business systems and applications.

- This integration facilitates a smooth transfer of funds within the organization's ecosystem, enabling efficient management of finances.

8. Improved Customer Experience:

- The quick and hassle-free payment experience offered by UPI Payout API enhances customer satisfaction and loyalty.

- Beneficiaries appreciate the convenience of receiving payments directly into their bank accounts, resulting in a positive user experience.

💡 key Takeaway: The UPI Payout API offers businesses and developers several benefits, including seamless transaction processing, instant payments, cost-effectiveness, enhanced security, scalability, efficient tracking, and improved customer experience.

How UPI Payout API Works

How UPI Payout API Works

The UPI Payout API is a powerful tool that allows businesses to easily transfer funds to individuals or other businesses using the Unified Payments Interface (UPI) system. This section will provide an in-depth explanation of how the UPI Payout API works and how businesses can leverage its capabilities.

Understanding UPI

Before diving into how the UPI Payout API works, it is crucial to understand the basics of the Unified Payments Interface. UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI) that enables users to make instant money transfers between bank accounts. It provides a seamless, secure, and convenient way to send and receive funds.

Initiating a Payout

To initiate a payout using the UPI Payout API, businesses need to follow a series of steps. Here's a breakdown of the process:

1. Registration: First, businesses need to register with a UPI service provider and obtain the necessary credentials to access the UPI Payout API. This typically involves creating an account and obtaining an API key or access token.

2. Authentication: Once registered, businesses need to authenticate their requests by providing the required identification and authorization details. This step ensures the security and integrity of the transaction.

3. Preparing the Payout: Businesses need to gather all the necessary information to process the payout, such as the recipient's UPI ID, amount to be transferred, and any additional instructions or references.

4. Integration: The next step is integrating the UPI Payout API into the business's existing systems or applications. This can be done using programming languages like Python, Java, or PHP, depending on the business's requirements and capabilities.

5. Requesting the Payout: After integration, businesses can send a payout request to the API endpoint, passing the required parameters and authentication details. The API processes the request and initiates the fund transfer to the recipient's UPI ID.

Verification and Confirmation

Once the payout request is made, the UPI Payout API initiates the transfer process. During this phase, several steps are taken to ensure the accuracy and security of the transaction:

- Verification: The API verifies the validity of the payout request, including checking the availability of sufficient funds and verifying the recipient's UPI ID.

- Validation: The API validates the transaction data, ensuring that all the necessary details are correct and complete.

- Confirmation: Onc

Use Cases of UPI Payout API

Use Cases of UPI Payout API

1. E-Commerce Platforms

E-commerce platforms can greatly benefit from integrating the UPI Payout API into their systems. With this API, these platforms can seamlessly process payments and disburse funds to their sellers, vendors, or service providers. By leveraging the UPI infrastructure, e-commerce platforms can offer an efficient and secure way for their users to receive payments directly into their UPI-linked bank accounts. This not only enhances the user experience but also streamlines the payment process for sellers, enabling faster access to funds.

2. Gig Economy and Freelancing Platforms

In the rapidly growing gig economy, freelancers and independent contractors often face challenges when it comes to receiving timely payments for their services. UPI Payout API presents a perfect solution for gig economy and freelancing platforms to overcome these hurdles. By implementing this API, these platforms can enable seamless and instant fund transfers from clients to freelancers. This ensures that freelancers receive their payments quickly, helping them maintain a steady cash flow and enhancing their overall experience on the platform.

3. Peer-to-Peer (P2P) Lending Platforms

UPI Payout API offers a valuable use case for peer-to-peer lending platforms. These platforms connect borrowers with lenders in a streamlined and efficient manner. By integrating the UPI Payout API, these platforms can disburse loan amounts directly into borrowers' bank accounts, eliminating the need for complex and time-consuming manual processes. The API ensures secure and instant fund transfers, making the lending experience seamless for both borrowers and lenders.

4. Online Marketplaces

Online marketplaces that facilitate services like rentals, car-sharing, or home-sharing can leverage the power of UPI Payout API to enable hassle-free payments to their users. By integrating this API, these marketplaces can ensure secure and quick disbursement of earnings to their sellers or providers. This enhances trust and reliability, encouraging users to continue using the platform and facilitating seamless transactions within the marketplace ecosystem.

5. Insurance and Claims Disbursement

Insurance companies often need to process claims and disburse funds to the insured party quickly. UPI Payout API can streamline this process, allowing insurance companies to transfer claim amounts directly into the policyholder's bank account. By integrating this API, insurers can provide a seamless and convenient experience for their customers, reducing paperwork and delays associated with traditional payment methods.

> "Integrating the UPI Payout API into ou

Best Practices for Implementing UPI Payout API

Best Practices for Implementing UPI Payout API

Implementing the UPI Payout API requires careful planning and adherence to certain best practices. By following these guidelines, you can ensure a seamless integration and optimize the performance of your UPI payout system. Let's explore some key best practices:

1. Understand the UPI Guidelines

Before you start implementing the UPI Payout API, it's crucial to thoroughly understand the UPI guidelines provided by the National Payments Corporation of India (NPCI). Familiarize yourself with the technical specifications, transaction limits, security requirements, and any other regulations imposed by the governing body. This will ensure that your implementation aligns with the defined standards and avoids any compliance issues.

2. Design a User-Friendly Interface

When integrating the UPI Payout API into your system, prioritize user experience. Design a clean and intuitive interface that allows users to easily initiate and track payout transactions. Provide clear instructions and error messages to guide users through the process. A user-friendly interface not only enhances customer satisfaction but also reduces the chances of errors during transactions.

3. Validate User Input

To prevent erroneous or fraudulent transactions, implement robust input validation mechanisms. Validate user inputs such as mobile numbers, UPI IDs, and transaction amounts to ensure they adhere to the required format and meet the necessary criteria. Applying these validations at the entry point will reduce the risk of errors and improve the overall reliability of your payout system.

4. Implement Strong Security Measures

Security should be a top priority when implementing the UPI Payout API. Implement secure coding practices to safeguard sensitive user information and transactions. Utilize encryption techniques such as SSL/TLS to protect data transmission. Additionally, regularly update your system's software and security patches to address any vulnerabilities. By incorporating strong security measures, you build trust with your users and mitigate the risk of data breaches or unauthorized access.

5. Monitor and Analyze Transactions

Once your UPI Payout API is up and running, it's crucial to monitor and analyze transaction data. By tracking transaction success rates, response times, and error logs, you can identify patterns or issues that may arise during payouts. Implement automated monitoring systems that notify you of any failed transactions or abnormalities, allowing you to take immediate action and provide a seamless experience for your users.

6. Plan for Scalability

As your business grows, your payout system should be able to handle increasing transaction volumes. Ensure that your syste

Integration Steps for UPI Payout API

Integration Steps for UPI Payout API

Implementing the UPI Payout API into your business processes requires careful planning and execution. Follow these integration steps to ensure a smooth and successful implementation:

1. Understand UPI Payout API Documentation: Begin by thoroughly studying the documentation provided by Rainet Technology for their UPI Payout API. Familiarize yourself with the API endpoints, request payloads, response formats, and security protocols.

2. Assess System Requirements: Determine if your current system meets the technical requirements for integrating the UPI Payout API. Ensure that your infrastructure, servers, and programming languages are compatible with the API specifications.

3. Obtain API Credentials: Contact Rainet Technology to obtain the necessary API credentials, such as the API key and secret. These credentials are essential for authenticating your requests to their UPI Payout API.

4. Develop a Test Environment: Set up a separate testing environment to perform integration tests before deploying the UPI Payout API in your production environment. This allows you to identify and resolve any issues or inconsistencies before going live.

5. Perform API Integration: Utilize your preferred programming language or SDK (Software Development Kit) to integrate the UPI Payout API into your existing systems. Make sure to handle response codes and error scenarios properly to provide a seamless user experience.

6. Implement Error Handling: Incorporate robust error handling mechanisms to gracefully handle any errors that may occur during API interactions. This includes validating inputs, handling authentication failures, and handling HTTP status codes appropriately.

7. Test and Debug: Conduct thorough testing of the integrated UPI Payout API. Validate different scenarios, such as successful payouts, failed transactions, and edge cases, to ensure the system functions as expected. Use debugging tools and log analysis to troubleshoot and resolve any issues.

8. Secure the Integration: Implement stringent security measures to protect sensitive data during API communication. Adhere to best practices for secure data transmission, such as utilizing secure sockets layer (SSL) encryption and implementing proper access control mechanisms.