#performance of the business....in theory. but its all propped up by who ever is buying into it and why and also stupid bullshit

Text

i think the stock market in its entirety is such a flop....back to grain markets.

#sorry i know this isnt really the topic for my followers#but imagine me trying to say this to my pretty wife who is deep into psychology and special ed academia....she just doesnt need to be burde#ed#so essentially i was watching a breakdown of current crypto trends bc i do that often sorry#and i just.....crypto is basically the absolute boiled down end of what the stock market did to businesses#instead of making. a business that does anything for society....they're made to be valuable to sell to the consumer and then itll literally#never be as valuable again?#thats why tech companies are struggling and its all bullshit. its literally just everything isnt made to work its made to be sold and thati#crypto is just abunch of losers who think theyre smarter than everyone else selling nothing to eachother... and literally why?#its like. wework wanted to be a valuable tech company so bad their frankly basic idea of communal workplace real estate#got fucked from over-valuation and scammy shit bc they want to sell stock#stock selling is like. hypothetical representations of a company that you gamble with right that should have its worth defined by the#performance of the business....in theory. but its all propped up by who ever is buying into it and why and also stupid bullshit#jergoiejgoie hahahah i have a lot of feelings about how stupid financial markets are and very little respect for them

6 notes

·

View notes

Text

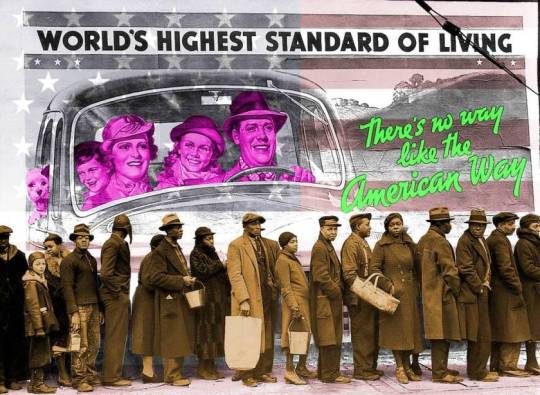

QE, inflation, slave labor and a People's Bailout

The Obama administration inherited a vast economic crisis. They responded with Quantitative Easing, pumping trillions into the finance sector to rescue the banks that had knowingly gambled on bad mortgages, losing so much they were about to go under.

https://www.cnbc.com/2017/11/24/the-fed-launched-qe-nine-years-ago--these-four-charts-show-its-impact.html

At the time, deficit hawks predicted inflation, which is a commonsense prediction: inflation is what happens when the amount of money chasing goods and services goes up faster than the supply of those goods and services, creating bidding wars.

They were right...and wrong. What we got was asset bubbles, especially in housing markets, driving up the price of putting a roof over your head rewarding speculators and landlords, especially Wall Street landlords.

And Obama's handling of the financial crisis put a lot of us under the thumbs of landlords! Obama bailed out the banks, but not the mortgage holders, kicking off waves of foreclosures.

Thanks to lax oversight, banks that had cheated to originate or service mortgages were able to cheat on foreclosures, too - stealing houses from borrowers who were up-to-date on payments or who were entitled to forebearance.

https://web.archive.org/web/20101017014628/http://news.yahoo.com/s/yblog_upshot/20101014/bs_yblog_upshot/is-david-j-stern-the-poster-boy-for-the-foreclosure-mess

I mean, literally stealing houses by the hundreds or even the thousands. The very same people who created the great financial crisis got bailed out, rather than punished, and used their new lease on life to commit even worse crimes with total impunity.

The houses that were foreclosed (and sometimes stolen) were flipped to Wall Street, who LOVE financial products based on peoples' homes. After all, people will move heaven and earth to keep shelter over their kids' heads.

https://www.motherjones.com/politics/2014/02/blackstone-rental-homes-bundled-derivatives/

Corporate landlords built a sturdy, three-legged stool to guarantee the flow of rents to their investors.

I. Jack up rents to consume the majority of tenants' income:

https://www.nakedcapitalism.com/2017/09/wall-street-owns-main-street-literally.html

II. Cease maintenance, knowing that your tenants have no recourse if their homes are crumbling and unsafe:

https://www.reuters.com/investigates/special-report/usa-housing-invitation/

III. Perfect the eviction, heretofore an American rarity:

https://www.bloomberg.com/news/articles/2017-01-03/wall-street-america-s-new-landlord-kicks-tenants-to-the-curb

America's housing crisis - substandard homes rented at unsustainable costs to people who had their own homes stolen from them by the same investors they're currently paying rent to - is a major legacy of QE, and it's definitely inflationary.

But it's a highly selective form of inflation. Many people won't experience it at all: if you owned your house before the crisis and weathered it, the asset bubble has made your home more valuable, while falling interest rates let you refi at rock-bottom rates. You're great.

You're paying less than ever for a home that's worth more than ever, but that's a spillover effect of the main show, which is the process by which millions of Americans were robbed of their homes and then moved into high-priced slums to the benefit of the 1%.

Both Obama and Trump have boasted of the economy's performance since QE, pointing to soaring share prices - share prices that are totally decoupled from company performance. Companies lose money and still gain value.

Indeed, predatory companies (like Grubhub, Postmates, Door Dash and Uber Eats) that destroy profitable companies (restaurants) while still losing money are booming in value.

https://pluralistic.net/2020/05/18/code-is-speech/#schadenpizza

Investors understand that consumers have no money, due to rising housing costs plus crashing wages, largely thanks to the "gig economy," a polite term for "worker misclassification."

Companies that get bailouts would be stupid to spend the money on jobs or new productive capacity to make stuff no one can afford to buy. Instead, they buy their own shares and declare dividends, driving up share prices.

https://pluralistic.net/2020/10/20/the-cadillac-of-murdermobiles/#austerity

We have seen an incredible market bull-run since the Great Financial Crisis, a run that has largely continued since the pandemic. It's the other asset bubble: a bubble in investment assets.

Corporate leaders claim responsibility for these rises, but the reality is that it's the predictable result of bailing out banks and companies rather than workers and homeowners.

Société Générale's analysts say that about half of the stock market's gains since 2008 can be attributed to QE.

https://www.marketwatch.com/story/without-qe-the-s-p-500-would-be-trading-closer-to-1-800-than-3-300-says-societe-generale-11604688442

Top-down bailouts have multiplier effects. The banks are made whole, then they get to steal our houses, then they get to steal our rents, then they get to goose their share prices.

This is how the super-rich got even richer, before and after the pandemic. It's also why the tiny minority of Americans with adequate retirement savings saw them swell - it's another spillover effect of the great upward transfer of national wealth.

Why does all of this matter now? Well, between my writing my first paragraph and this one, Biden was declared, giving us what the Biden campaign signalled would be "Obama's third term."

Biden's taking office amidst a financial crisis that's far worse than 2008.

Biden has a long track-record of giving legislative gifts to the finance sector at the expense of the American people. They called him "The Senator from MNBA" for a reason.

https://www.gq.com/story/joe-biden-bankruptcy-bill

If he addresses this crisis the same way that he did in 2008 - the way that Congress and the Senate addressed the crisis in 2020 - by bailing out finance, not the public, we're seriously fucked.

Sure, the stock market will continue to rise and rise, as will house prices.

If you are in the 1%, you will get SO MUCH richer. If you're in the 10%, your retirement savings will swell, your mortgage will get cheaper, and your house's value will go up.

For everyone else: evictions, foreclosures, soaring rents, worse wages.

Last week, California voters passed Prop 22, safeguarding the right of gig economy companies to misclassify their workers as contractors and pay them sub-minimum wages, withhold benefits, evade payroll and unemployment taxes, etc.

Uber/Lyft spent $200m to secure that win.

As Prop22's promoters remind us: Gig work is the new unemployment benefit: it's a private-sector jobs guarantee, work you can get at the tap of your screen. It's a perfect labor market - workers effectively bid to offer the best price to perform servant work for others.

The more workers there are, and the more desperate their situation is, the lower the payments go. A lot of those savings are siphoned off by the (money-losing, stock-soaring) gig companies, but some of it is passed onto customers.

This is by design.

Since the Reagan years, neoliberal regulators and lawmakers have hewed to a radical anti-monopoly theory called "consumer harm." Under "consumer harm," monopolies are only a problem if they drive up prices.

Since gig companies lower prices, they are totally kosher - even if they secure monopolies through predatory pricing.

But there's an even more insidious side to "consumer harm" and the gig economy.

Misclassifying workers as independent contractors converts a brutally exploited workforce into a collection of "small businesses." If they get together and demand higher wages, THEY violate the consumer harm standard. They're a group of companies fixing prices!

We're 12 years into the QE experiment and it has demonstrated the relationship between government money-creation and inflation: inflation isn't the result of government spending, it's the result of government spending that leads to bidding wars.

Giving trillion to the rich created inflation in the things that rich people buy: our houses (out from under us) and stocks.

Now, imagine what a People's Bailout could do.

Imagine replacing the gig economy job guarantee (a workfare program with no workplace protections, job security or minimum wage) with an actual Job Guarantee as described by the economist Pavlina Tcherneva:

https://pluralistic.net/2020/05/05/the-hard-stuff/#jobs-guarantee

Federally funded, locally administered: good jobs at inclusive wages that served community needs proposed by community groups and approved by local governments.

Would that be inflationary? Recall that inflation is what happens when the number of buyers goes up and the supply of things they're buying doesn't keep up. Inflation is the result of bidding wars.

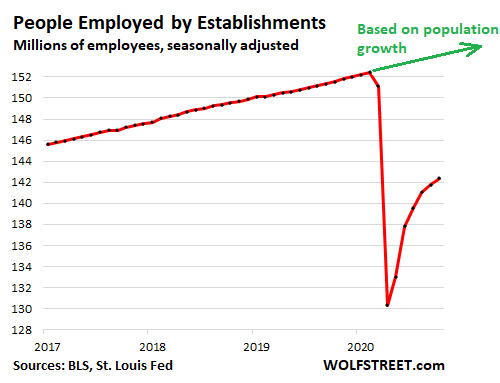

For a jobs guarantee to be inflationary, there would have to be a bidding war for the US workforce. That is the opposite of what we have now.

https://wolfstreet.com/2020/11/06/picture-emerges-of-a-weird-recovery-to-still-historically-awful-levels/

The reason no one wants to buy Americans' labor is that no one has any money to buy the things Americans make with their labor. The only people with money - the wealthy - primarily buy our homes out from under us, and stocks.

QE for the wealthy has made the economy incredibly perverse. Productive companies are being driven to bankruptcy by gig economy companies that lose money. Millions of workers compete to provide services for the lucky few, for dwindling wages.

Workers can't afford to buy stuff so companies have no reason to make stuff and so they become finance grifts, until they collapse, like Hertz did (after it converted itself from a car-rental company to an accountancy trick company):

https://pluralistic.net/2020/05/27/literal-gunhumping/#hertz-uranus

The gig economy jobs guarantee can't last. Eventually the number of workers bidding to serve the wealthy will exceed demand by such a wide margin that wages turn negative - the depreciation and payments on your gig economy car will exceed your income.

But a real, public sector, federal Jobs Guarantee? Yes please.

Paying workers good wages to do productive things that their communities need will create demand for the thing companies have decided not to make anymore.

In other words, it will enable companies to make profits again, and it will drive out the companies whose share prices soared on the expectation of losses (accompanied by dividends and buybacks). It will dampen the stock market, but improve the economy.

This will mean the end of those spillover effects - soaring house-valuations and 401ks for the lucky few - but those came at a VERY high price - vast un- and underemployment, the gutting of the productive economy, crushing debt for the majority.

America bought those house price rises and 401k gains at a steep price: it cost the nation its resilience and political stability.

If the goal of QE was to secure middle-class Americans' retirements, it was spectacularly wasteful.

A tiny fraction of QE's trillions went to middle-class retirements, while the vast majority went to making the 1% far, far richer. Most middle class Americans still don't have secure retirements - their dotage will be spent competing for gig economy jobs.

For the price of QE, the US government could simply have guaranteed the necessities of retirees: shelter, food, care. This spending would crowd out jobs, sure - the worst-paid, most precarious jobs, from fast food to gig economy "jobs."

It would make America into a country of secure and prosperous people, instead of food-delivery drivers and dog-walkers.

12 years of finance bailouts and 0 years of People's Bailouts have only exacerbated this, and the pandemic metastasised it.

When it comes to stimulus, America can't afford a third Obama term. We need to demand better of Biden - we need to demand a People's Bailout.

For almost* all our sakes.

*Offer not valid in America's richest ZIP codes.

35 notes

·

View notes

Text

How to Activate YouTube?

YouTube is the second one maximum used seek engine online. The street to achievement on YouTube does not begin and cease with uploading content - you want to make unquestionable human beings will understand it is there. Use descriptive titles incorporating applicable key phrases - attempt to suppose like a viewer typing a seek query - and make unquestionable you use tags to your video's description. All you have to do to create a YouTube channel is sign up for a Google account. If you already have one, you can just log in. The good news is that you can use one Google Account for multiple channels. In the long run, this solution proves to be perfectly convenient if you need to manage different brands or projects, you can do so under the same Google Account, quickly switching from channel to channel, using the Channel Switcher link. Now that you have signed in to your Google Account, you have to create your new channel. To do that, I think this is probably the most important and common question to ask beginners before you dive into the world of YouTube content creation. You know, the people Who, never create or upload any videos content on social media. That Why is the reason to awareness about Don't know, how to Activate YouTube channel?

Don't worry, I will give you fantastic tips for that let's follow steps:

Before starting this topic. make sure you should have (something like this)

1. Email ID

2. YouTube logo Icon

3. Banner Image

Note: Make sure your YouTube channel name should be unique, and please post valuable and follow all YouTube privacy policies.

How to start a YouTube channel?

All you have to do to create a YouTube channel is sign up for a Google account. If you already have one, you can just log in. The good news is that you can use one Google Account for multiple channels. In the long run, this solution proves to be perfectly convenient if you need to manage different brands or projects, you can do so under the same Google Account, quickly switching from channel to channel, using the Channel Switcher link.

Now that you have signed in to your Google Account, you have to create your new channel. To do that

Step-1. Just go to YouTube and click on your account thumbnail image (available in the top right corner of the screen)

Step-2. Open a drop-down menu (top right corner (9) dots).

Step-3. The Drop-down menu is available after clicking the account thumbnail image in the Google Account

Step-4. Click on just the top right corner nine (9) Dots.

Step-5. Choose the YouTube icon, and then click on that.

Step-6. From there, you can either click the “Creator Studio”.

OR the gear icon to access the YouTube settings.

Step-7. In both cases, you will end up on another page.

Step-8. Where you will find the link allowing you to "Create a channel".

Step-9. Upload Picture and type your YouTube channel name.

Step-10. The default channel name will be your email name, so make sure before create, decide its name.

Step-11. Then click on the create channel.

Step-12. Congrats, you have successfully

YouTube com activate the channel.

First, you will see their Menu Bar Home>Videos>Playlists.

If you want to upload your first videos, on YouTube. You are most welcome on this Dashboard.

Step-1. Click on the Upload Videos.

Step-2. Then click the continue button.

Step-3. Select Files from your local computer, or you can browse files from the device.

Step-4. Click files and open on this.

Step-5. Wait until complete the download process.

Step-6. Fill in all data like description, title.

Step-7. Click on the next.

Step-8. Add subtitle, add an end screen, add cards.

Step-9. Click on the Next.

Step-10. In finally, click on the save (Public, Private).

Great question! Starting a YouTube channel could become a substantial source of income once you reach a certain threshold - the highest-paid

With more and more people opting for online video streaming services, starting a channel on the YouTube platform is a brilliant move. It also seems like everyone is using YouTube - from performing artists to huge brands and businesses.

Although starting a YouTube channel is easy (since all you have to do is click, and there you have it!), Many beginners make mistakes, and become very frustrated when they do not experience any growth in their channel.

Here are 11 tips for successfully starting a YouTube channel

(based on My own experiences, by the way).

1 - Plan your content.

Before you even open your YouTube channel, consider the subjects you are interested in, and what it's far you need to mention. YouTube has many niches (There's something for all and sundry to narrate to) - try to determine which one fits your niches. As soon as you've got your niche found out, attempt to come up with a "subject matter" for your films - will you particularly do evaluations? Sketches? Demanding situations? Walkthrough? There are limitless approaches to apply the platform and stand out from a few of the crowd. Don't try to do something you are not crazy about.

2 - have the right device, however not proper away.

If you are just starting. You may use the camera on your cellphone (or pc if it is extremely fine!) for your first few motion pictures. See the way it feels. Benefit confidence in status by myself in a room. And talking to "Invisible humans" on a digital camera. Ensure that your videos are properly. (sitting in the front of a window proper around sunset usually gives satisfactory lighting fixtures), and as you develop, slowly develop your arsenal. Begin with getting a good camera and pass it on to microphones, lighting, props, and other equipment you are interested in.

3 - Don't freak out, in that case, you experience something like you have accomplished this before YouTube com/activate.

Coming up with revolutionary, in no way earlier than visible content is virtually not possible. Gather proposals from different human beings on YouTube (and usually give them credit for their thoughts!), make "sequels" or "episodes" on your films. Just like TV series, youtube.com/activate smart TV, people like consistency, which also brings me to my subsequent point.

4 - Have a content schedule.

As you will grow, and advantage more subscribers. You may locate humans. Who are looking forward to your motion pictures being uploaded on YouTube .com/activate. Try to devise a program you could hold up with: Start with that posting a video as soon as a week.

Make your videos' duration steady too - it is good enough to "veer off route" now and then, however in case you commonly upload motion pictures that might be 10-15 minutes long, try to hold it that way.

5 - Edit your film's content.

It seems obvious, but a lot of humans do not do it when they Just begin - they will upload "uncooked" footage because of it, and even though it is exciting at instances. What became I approximately to mention? all the time. If it makes your films shorter than you would like, so be it. People come to your channel for enjoyment, despite everything.

6 - Do not evaluate yourself to others.

Anyone struggles on YouTube within the starting, and the battle is actual even wish list you are a "massive shot" at the platform. Be your personal man or woman and stay proper to yourself, do not attempt to mimic other YouTubers.

7 - Do SEO for best ranking factor.

YouTube is the second one maximum used seek engine online. The street to achievement on YouTube does not begin and cease with uploading content - you want to make unquestionable human beings will understand it is there. Use descriptive titles incorporating applicable key phrases - attempt to suppose like a viewer typing a seek query - and make unquestionable you use tags to your video's description.

8 - Make friends and proportion your channel along with your present pals.

The more connections you've got at the platform the more potential exposure you've got. Let's consider you've got befriended another YouTuber and determined to make a video with them - now you'll have their target market looking at you too, and if they like you, they will visit your channel to see greater of you. Collaborations are a first-rate way to grow your channel. Additionally, use hyperlinks on different social media systems to promote your channel and update your friends and family on motion pictures!

9 - Read your comments in Normal mode please, don't take it to coronary heart.

That is easier stated than completed, nevertheless, it's miles viable. Try to make the high-quality of the state of affairs, and do not get into fights with viewers who do not like you, this is pointless.

10 - Provide yourself a boost Mode.

I realize humans like to get on their excessive horse and pretend like they in no way did or will by no means do that - however, buy some subscribers while starting your channel. I am not speaking to myself about buying hundreds of thousands of subscribers on a channel with one video. While beginning with one video, attempt shopping for up to twenty subscribers and views. Make it look actual and experience actual. As you grow, buy a few greater if you suppose it important.

This "oh so incorrect" idea (absolutely everyone is doing it!) is based on a Mental theory referred to as "social proof" - because of this that people are more likely to subscribe to a channel other people are subscribed to. Consider it this manner - you Won't go to an eating place that no person ever is going to, you will attempt to get a table at the one human beings are.

Visit our blog @: https://techiespost.com/youtube-com-activate-2/

#how to activate youtube#youtube com/activate#youtube com activate#youtube .com/activate#youtube.com/activate smart tv

0 notes

Text

Finding the Best Keywords to Rank that Convert into Clients

Finding the Best Keywords to Rank that Convert into Clients

This segment may take you through the keyword selection process. Specifically, we'll go into detail about finding key words to rank for in a highly competitive sector.

Signup for our cheap and affordable seo packages plans and services where it is possible to rank your website on the first page of google. In addition, we provide a trial service before beginning.

Which are Long Tail Keywords?

Long-tail key words are the key to rising to the top of Google searches for cutthroat markets which are highly saturated. They differ from regular key phrases in their length and specificity.

A regular keyword might be"graphic designer." Based on where you're, the expense of an AdWord for that particular term could be quite hefty. Ranking organically for that term could be an uphill battle.

The strategy we will get into will ultimately position one to rank high organically for this short, competitive keyword.

But it starts with rank for extended tail keywords first.

A very long tail key word is any very long phrase or question someone would type into Google that could lead to a service or product.

Here are some examples for long-tail keywords stemming from the Normal key word"graphic designer":

"how can I choose a graphic designer"

"what does a graphic designer do"

"locating a great graphic designer"

"graphic designer logo examples"

As you may see, long-tail keywords consist of whole, or partial, questions or phrases regarding the businesses or services you want to attract customers for.

In our era of advertisements, paying for advertisements that say,"Hey, I'm the very best bankruptcy lawyer in New York. Hire me! Look how great I am! I moved to Harvard," doesn't cut it anymore.

One of the most successful features Google has started using in search results is known as the Google Answer Box or Rich Snippets. Most of the questions that activate a response box response follow a"how" or"what" sentence structure, which creates a long-tail key word.

The theory behind the concept is to offer a user with a fast and accurate answer to a question without them having to read an entire article. And it is working beautifully for Google, as click-through rates have grown more than 30% when results appear in the response box.

Listed below are a few examples of the answer box in action:

Many people's search queries have become more and more particular, which is why it is imperative to implement a long-tail keyword plan.

Voice Search

Why are search queries becoming more and more specific?

Voice search, the principal culprit, is on the upswing. It is estimated that 40 percent of adults run a minumum of one voice hunt every day.

If folks perform a voice search, they have a tendency to utilize more natural language, resulting in longer queries. (thus the significance of long-tail key phrases, yet again.)

The days of hunting for"clarified butter" or"raised backyard" are waning fast. They are being replaced by"the way to describe butter" and"how to make a garden bed." This tendency is directing how Google's AI and machine learning technology ranks search results.

It's geared toward helping users find more contextualized searches instead of exact keyword matches.

Unsaturated Markets

In an unsaturated market, it's easy to position for simple key words such as"paintball field Tampa," that was the first site I ever rated on top of Google's first page. There are just a couple of paintball fields in Tampa, so getting on the initial page was comparatively straightforward.

Sticking to this keyword research process I am going to teach you in this segment will prop your website at the very top section of Google in no time.

In a highly competitive market like"bankruptcy lawyer New York," you'd use this same exact keyword research procedure, except it is going to need more ingenuity in the selection of your keywords.

For highly competitive markets, you will implement a long tail keyword selection strategy. Let's jump in and learn why You Have to stick to the long tail keyword research strategy:

People are turning to the internet to answer as many questions as possible before they even think about hiring a professional. This applies to many merchandise and services purchases.

When individuals have spat out the information they seek, then they're going to start searching for someone to hire or some thing to buy.

Should you rank on the first page of Google for each possible question they have about bankruptcy in New York, who do you think they will want to hire or purchase from:

The guy/gal with a $300 AdWord distance at the peak of the very first page of Google that says"Look at me! I am a bankruptcy attorney! Hire me now!"

Or the guy/gal that gave them a ton of free valuable content that answered each and every question they introduced?

Also, as soon as you start ranking for a lot of long tail key words for your organization, as a byproduct, you will automatically begin rank for the short, competitive keywords, such as"bankruptcy lawyer" and"graphic designer" if you follow these measures.

The very best thing about standing organically in Google is the fact that it is free.

It will not cost you $300 per click.

Another interesting reality is individuals that tend to scour the web for replies before hiring or purchasing something are inclined to be high quality customers that will be loyal to you - provided that the product or service is high quality.

Make sure you are good at what you're doing.

Even the greatest, greatest collection of posts that answer every possible question regarding your service or product can't outweigh a barrage of negative Google, Facebook, Yelp, and social networking ratings for not delivering as promised.

This publication will go on and assume you're good at what you are doing and care for your clients. Onward!

How to Find Long Tail Keywords:

Step 1: you have to create a list of any and all questions or phrases that come to mind which you have to do with your company or service.

I strongly urge you to use Google Sheets, which is like a cloud version of Excel, to make your idea storm.

Step 2: At a separate browser window or tab, open up a Google search window. Put your cursor in the search bar and begin typing all questions relevant to your company that come into your mind.

Watch carefully as Google automatically tries to pre-fill the search bar with a forecast of what you are typing.

Everything Google is attempting to pre-fill and predict while you kind are frequently searched long tail key words you want to document in your thought storm. Check it out:

Step 3: When you find a related question or phrase, type it out at the column and row at the Google Sheet. List each separate question or phrase at its own separate row under the first column like this:

Keyword Search Term

What kind of bankruptcy should file

What Type of bankruptcies are there

Pro Tip: Sort as slowly as you can, character-by-character, which means you don't overlook some of the valuable search phrases Google is serving for you on a silver platter.

Step 4: Using the called search query shown above, click the top question first. You will find another precious gift from Google that looks like that:

Guess what these are? Yes. Yes, they're, in actuality, more frequently searched long-tail keywords to add to your own Keyword Idea Storm.

Step 5: Add them ALL to your Keyword Idea Storm.

Step 6: Go back into the next predicted search term from the first step,"what sort of bankruptcy are there," and search for this phrase in Google.

Then, scroll down to the bottom of the first page again and add those golden nuggets to your Keyword Idea Storm:

Step 7: Repeat steps two through six until you've exhausted every possible search term.

Remember to enter all of the search terms you find in the bottom of the initial page of Google into the main search bar to discover more prevalent search phrases in the base.

Keep typing in thoughts for questions and phrases pertinent to your company in the main Google search bar and looking for predictively-filled search provisions.

Measure 8: When you thought it was over, there is an additional place you may find specific words related to the key word for your article. These kinds of words are called LSI key words.

LSI stands for"Latent Semantic Indexing" key words, which is just a fancy word for keywords related to a specific topic. So rather than keyword matching, Google is more interested in topic matching.

An LSI key word for the video game Halo will be Xbox. Though the words are completely distinct, Halo is a video game that's played on the Xbox video game console, in addition to computers. That means it's possible to see the contextual relationship between them.

LSI keywords should be utilised in context with your subject matter. The importance of using LSI key words is becoming more prudent as the underlying artificial intelligence continues to consider search queries in a contextual way, versus exact phrase matching.

To quickly find LSI key words for your content, use this handy tool from LSI Graph to conduct a query: https://lsigraph.com/

From the conclusion of the Keyword Idea Storm procedure, you ought to have a high number of lengthy tail keyword search terms to work with.

Depending on your specialty or market, you will have 10-20 stone, or upwards of 50+. Get creative and try to consider your products or services in numerous dimensions from several angles.

Have a new website and not showing up anywhere on google, yahoo or bing? Try us out for a month we will rank your site in the search results in virtually no time!

0 notes

Text

WTF is happening to crypto?

Google Analytics Certification Exam: Get Certified in 2 Days

Four days ago the crypto markets were crashing hard. Now they’re crashing harder. Bitcoin, which hasn’t fallen past $6,000 for months, has dumped to $4,413.99 as of this morning, and nearly everything else is falling in unison. Ethereum, flying high at $700 a few months ago, is at $140. Coinbase, that bastion of crypto stability, is currently sporting a series of charts that look like Aspen black-diamond ski runs.

What is happening? There are a number of theories, and I’ll lay out a few of them here. Ultimately, sentiment is bleak in the crypto world, with bull runs being seen as a thing of a distant past. As regulators clamp down, pie-in-the-sky ideas crash and shady dealers take their shady dealings elsewhere, the things that made cryptocurrencies so much fun — and so dangerous — are slowly draining away. What’s left is anyone’s guess, but at least it will make things less interesting.

The bag holder theory

November was supposed to be a good month for crypto. Garbage sites like FortuneJack were crowing about bitcoin stability while the old crypto hands were optimistic and pessimistic at the same time. Eric Vorhees, founder of ShapeShift, felt that the inevitable collapse of the global financial system is good for folks with at least a few BTC in their wallets.

When the next global financial crisis occurs, and the world realizes organizations with $20 trillion in debt can't possibly ever pay it back, and thus must print it instead, and thus fiat is doomed… watch what happens to crypto.

— Erik Voorhees (@ErikVoorhees) November 8, 2018

Others, like the Binance CEO Changpeng Zhao, are expecting a bull run next year and said his company was particularly profitable.

Ultimately, crypto hype moves the market far more than it has any right to, and this is a huge problem.

So who do you believe, these guys or your own lying eyes? That’s a complex question. First, understand that crypto is a technical product weaponized by cash. Companies like Binance and Coinbase will work mightily to maintain revenue streams, especially considering Coinbase’s current level of outside investment. These are startups that can literally affect their own value over time. We’ll talk about that shortly. Ultimately, crypto hype hasn’t been matching reality of late, a major concern to the skittish investor.

“I think that the downturn is due to things not going up as much as people had wanted. Everyone was expecting November to be a bull month,” said Travin Keith, founder of Altrean. “When things indicated that it wasn’t going that way, those who were on borrowed time, such as those needing some buffer, or those in the crypto business needing some money, needed to sell.”

Tether untethered

Tether has long been the prime suspect in the Bitcoin run up and crash. Created by an exchange called Bitfinex, the currency is pegged to the dollar and, according to the exchange itself, each tether — about $2.7 billion worth — is connected to an actual dollar in someone’s bank account. Whether or not this is true has yet to be proven, and the smart money is on “not true.” I’ll let Jon Evans explain:

What are those whiffs of misconduct to which I previously referred? I mean. How much time do you have? One passionate critic, known as Bitfinexed, has been writing about this for quite some time now; it’s a pretty deep rabbit hole. University of Texas researchers have accused Bitfinex/Tether of manipulating the price of Bitcoin (upwards.) The two entities have allegedly been subpoenaed by US regulators. In possibly (but also possibly not — again, a fog of mystery) related news, the US Justice Department has opened a criminal investigation into cryptocurrency price manipulation, which critics say is ongoing. Comparisons are also being drawn with Liberty Reserve, the digital currency service shut down for money laundering five years ago:

So what the hell is going on? Good question. On the one hand, people and even companies are innocent until proven guilty, and the opacity of cryptocurrency companies is at least morally consistent with the industry as a whole. A wildly disproportionate number of crypto people are privacy maximalists and/or really hate and fear governments. (I wish the US government didn’t keep making their “all governments become jackbooted surveillance police states!” attitude seem less unhinged and more plausible.)

But on the other … yes, one reason for privacy maximalism is because you fear rubber-hose decryption of your keys, but another, especially when anti-government sentiment is involved, is because you fear the taxman, or the regulator. A third might be that you fear what the invisible hand would do to cryptocurrency prices, if it had full leeway. And it sure doesn’t look good when at least one of your claims, e.g. that your unaudited reserves are “subject to frequent professional audits,” is awfully hard to interpret as anything other than a baldfaced lie.

Now Bloomberg is reporting that the U.S. Justice Department is looking into Bitfinex for manipulating the price of Bitcoin. The belief is that Bitfinex has allegedly been performing wash trades that propped up the price of Bitcoin all the way to its previous $20,000 heights. “[Researchers] claimed that Tether was used to buy Bitcoin at pivotal periods, and that about half of Bitcoin’s 1,400 percent gain last year was attributable to such transactions,” wrote Bloomberg. “Griffin briefed the CFTC on his findings earlier this year, according to two people with direct knowledge of the matter.”

This alone could point to the primary reason Bitcoin and crypto are currently in free fall: without artificial controls, the real price of the commodity becomes clear. A Twitter user called Bitfinex’d has been calling for the death of Tether for years. He’s not very bullish on the currency in 2019.

“I don’t know the when,” Bitfinex’d said. “But I know Tether dies along with Bitfinex.”

Le shitcoin est mort

As we learned last week, the SEC is sick of fake utility tokens. While the going was great for ICOs over the past few years with multiple companies raising millions if not billions in a few minutes, these salad days are probably over. Arguably, a seed-stage startup with millions of dollars in cash is more like a small VC than a product company, but ultimately the good times couldn’t last.

What the SEC ruling means is that folks with a lot of crypto can’t slide it into “investments” anymore. However, this also means that those same companies can be more serious about products and production rather than simply fundraising.

SEC intervention dampens hype, and in a market that thrives on hype, this is a bad thing. That said, it does mean that things will become a lot clearer for smaller players in the space, folks who haven’t been able to raise seed and are instead praying that token sales are the way forward. In truth they are, buttoning up the token sale for future users and, by creating regulation around it, they will begin to prevent the Wild West activity we’ve seen so far. Ultimately, it’s a messy process, but a necessary one.

“It all contributes to greater BTC antifragility, doesn’t it?,” said crypto speculator Carl Bullen. “We need the worst actors imaginable. And we got ’em.”

Bitmain

One other interesting data point involves Bitmain. Bitmain makes cryptocurrency mining gear and most recently planned a massive IPO that was supposed to be the biggest in history. Instead, the company put these plans on hold.

Interestingly, Bitmain currently folds the cryptocurrency it mines back into the company, creating a false scarcity. The plan, however, was for Bitmain to begin releasing the Bitcoin it mined into the general population, thereby changing the price drastically. According to an investor I spoke with this summer, the Bitmain IPO would have been a massive driver of Bitcoin success. Now it is on ice.

While this tale was apocryphal, it’s clear that these chicken and egg problems are only going to get worse. As successful startups face down a bear market, they’re less likely to take risks. And, as we all know, crypto is all about risk.

Abandon all hope? Ehhhhh….

Ultimately, crypto and the attendant technologies have created an industry. That this industry is connected directly to stores of value, either real or imagined, has enervated it to a degree unprecedented in tech. After all, to use a common comparison between Linux and blockchain, Linus Torvalds didn’t make millions of dollars overnight for writing a device driver in 1993. He — and the entire open-source industry — made billions of dollars over the past 27 years. The same should be true of crypto, but the cash is clouding the issue.

Ultimately, say many thinkers in the space, the question isn’t whether the price goes up or down. Instead, of primary concern is whether the technology is progressing.

“Crypto capitulation is once again upon us, but before the markets can rise again we must pass through the darkest depths of despair,” said crypto guru Jameson Lopp. “Investors will continue to speculate while developers continue to build.”

pic.twitter.com/PQgZGDooDT

— Logic Aside (@logicaside) November 18, 2018

Master Google Adwords like a boss

from Chriss H Feed https://ift.tt/2qUu9ok

via IFTTT

0 notes

Link

Four days ago the crypto markets were crashing hard. Now they’re crashing harder. Bitcoin, which hasn’t fallen past $6,000 for months, has dumped to $4,413.99 as of this morning, and nearly everything else is falling in unison. Ethereum, flying high at $700 a few months ago, is at $140. Coinbase, that bastion of crypto stability, is currently sporting a series of charts that look like Aspen black-diamond ski runs.

What is happening? There are a number of theories, and I’ll lay out a few of them here. Ultimately, sentiment is bleak in the crypto world, with bull runs being seen as a thing of a distant past. As regulators clamp down, pie-in-the-sky ideas crash and shady dealers take their shady dealings elsewhere, the things that made cryptocurrencies so much fun — and so dangerous — are slowly draining away. What’s left is anyone’s guess, but at least it will make things less interesting.

The bag holder theory

November was supposed to be a good month for crypto. Garbage sites like FortuneJack were crowing about bitcoin stability while the old crypto hands were optimistic and pessimistic at the same time. Eric Vorhees, founder of ShapeShift, felt that the inevitable collapse of the global financial system is good for folks with at least a few BTC in their wallets.

When the next global financial crisis occurs, and the world realizes organizations with $20 trillion in debt can't possibly ever pay it back, and thus must print it instead, and thus fiat is doomed… watch what happens to crypto.

— Erik Voorhees (@ErikVoorhees) November 8, 2018

Others, like the Binance CEO Changpeng Zhao, are expecting a bull run next year and said his company was particularly profitable.

Ultimately, crypto hype moves the market far more than it has any right to, and this is a huge problem.

So who do you believe, these guys or your own lying eyes? That’s a complex question. First, understand that crypto is a technical product weaponized by cash. Companies like Binance and Coinbase will work mightily to maintain revenue streams, especially considering Coinbase’s current level of outside investment. These are startups that can literally affect their own value over time. We’ll talk about that shortly. Ultimately, crypto hype hasn’t been matching reality of late, a major concern to the skittish investor.

“I think that the downturn is due to things not going up as much as people had wanted. Everyone was expecting November to be a bull month,” said Travin Keith, founder of Altrean. “When things indicated that it wasn’t going that way, those who were on borrowed time, such as those needing some buffer, or those in the crypto business needing some money, needed to sell.”

Tether untethered

Tether has long been the prime suspect in the Bitcoin run up and crash. Created by an exchange called Bitfinex, the currency is pegged to the dollar and, according to the exchange itself, each tether — about $2.7 billion worth — is connected to an actual dollar in someone’s bank account. Whether or not this is true has yet to be proven, and the smart money is on “not true.” I’ll let Jon Evans explain:

What are those whiffs of misconduct to which I previously referred? I mean. How much time do you have? One passionate critic, known as Bitfinexed, has been writing about this for quite some time now; it’s a pretty deep rabbit hole. University of Texas researchers have accused Bitfinex/Tether of manipulating the price of Bitcoin (upwards.) The two entities have allegedly been subpoenaed by US regulators. In possibly (but also possibly not — again, a fog of mystery) related news, the US Justice Department has opened a criminal investigation into cryptocurrency price manipulation, which critics say is ongoing. Comparisons are also being drawn with Liberty Reserve, the digital currency service shut down for money laundering five years ago:

So what the hell is going on? Good question. On the one hand, people and even companies are innocent until proven guilty, and the opacity of cryptocurrency companies is at least morally consistent with the industry as a whole. A wildly disproportionate number of crypto people are privacy maximalists and/or really hate and fear governments. (I wish the US government didn’t keep making their “all governments become jackbooted surveillance police states!” attitude seem less unhinged and more plausible.)

But on the other … yes, one reason for privacy maximalism is because you fear rubber-hose decryption of your keys, but another, especially when anti-government sentiment is involved, is because you fear the taxman, or the regulator. A third might be that you fear what the invisible hand would do to cryptocurrency prices, if it had full leeway. And it sure doesn’t look good when at least one of your claims, e.g. that your unaudited reserves are “subject to frequent professional audits,” is awfully hard to interpret as anything other than a baldfaced lie.

Now Bloomberg is reporting that the U.S. Justice Department is looking into Bitfinex for manipulating the price of Bitcoin. The belief is that Bitfinex has allegedly been performing wash trades that propped up the price of Bitcoin all the way to its previous $20,000 heights. “[Researchers] claimed that Tether was used to buy Bitcoin at pivotal periods, and that about half of Bitcoin’s 1,400 percent gain last year was attributable to such transactions,” wrote Bloomberg. “Griffin briefed the CFTC on his findings earlier this year, according to two people with direct knowledge of the matter.”

This alone could point to the primary reason Bitcoin and crypto are currently in free fall: without artificial controls, the real price of the commodity becomes clear. A Twitter user called Bitfinex’d has been calling for the death of Tether for years. He’s not very bullish on the currency in 2019.

“I don’t know the when,” Bitfinex’d said. “But I know Tether dies along with Bitfinex.”

Le shitcoin est mort

As we learned last week, the SEC is sick of fake utility tokens. While the going was great for ICOs over the past few years with multiple companies raising millions if not billions in a few minutes, these salad days are probably over. Arguably, a seed-stage startup with millions of dollars in cash is more like a small VC than a product company, but ultimately the good times couldn’t last.

What the SEC ruling means is that folks with a lot of crypto can’t slide it into “investments” anymore. However, this also means that those same companies can be more serious about products and production rather than simply fundraising.

SEC intervention dampens hype, and in a market that thrives on hype, this is a bad thing. That said, it does mean that things will become a lot clearer for smaller players in the space, folks who haven’t been able to raise seed and are instead praying that token sales are the way forward. In truth they are, buttoning up the token sale for future users and, by creating regulation around it, they will begin to prevent the Wild West activity we’ve seen so far. Ultimately, it’s a messy process, but a necessary one.

“It all contributes to greater BTC antifragility, doesn’t it?,” said crypto speculator Carl Bullen. “We need the worst actors imaginable. And we got ’em.”

Bitmain

One other interesting data point involves Bitmain. Bitmain makes cryptocurrency mining gear and most recently planned a massive IPO that was supposed to be the biggest in history. Instead, the company put these plans on hold.

Interestingly, Bitmain currently folds the cryptocurrency it mines back into the company, creating a false scarcity. The plan, however, was for Bitmain to begin releasing the Bitcoin it mined into the general population, thereby changing the price drastically. According to an investor I spoke with this summer, the Bitmain IPO would have been a massive driver of Bitcoin success. Now it is on ice.

While this tale was apocryphal, it’s clear that these chicken and egg problems are only going to get worse. As successful startups face down a bear market, they’re less likely to take risks. And, as we all know, crypto is all about risk.

Abandon all hope? Ehhhhh….

Ultimately, crypto and the attendant technologies have created an industry. That this industry is connected directly to stores of value, either real or imagined, has enervated it to a degree unprecedented in tech. After all, to use a common comparison between Linux and blockchain, Linus Torvalds didn’t make millions of dollars overnight for writing a device driver in 1993. He — and the entire open-source industry — made billions of dollars over the past 27 years. The same should be true of crypto, but the cash is clouding the issue.

Ultimately, say many thinkers in the space, the question isn’t whether the price goes up or down. Instead, of primary concern is whether the technology is progressing.

“Crypto capitulation is once again upon us, but before the markets can rise again we must pass through the darkest depths of despair,” said crypto guru Jameson Lopp. “Investors will continue to speculate while developers continue to build.”

Waiting for the next crypto bull run right now may be like waiting for the next “dot com” bull run in 2002.

One never came, but then one day a couple decades later we woke up to realize the internet had infiltrated & reshaped every crevice of media, politics, business & culture.

— Ben DiFrancesco (@BenDiFrancesco) November 18, 2018

pic.twitter.com/PQgZGDooDT

— Logic Aside (@logicaside) November 18, 2018

via TechCrunch

0 notes

Text

WTF is happening to crypto?

Four days ago the crypto markets were crashing hard. Now they’re crashing harder. Bitcoin, which hasn’t fallen past $6,000 for months, has dumped to $4,413.99 as of this morning, and nearly everything else is falling in unison. Ethereum, flying high at $700 a few months ago, is at $140. Coinbase, that bastion of crypto stability, is currently sporting a series of charts that look like Aspen black-diamond ski runs.

What is happening? There are a number of theories, and I’ll lay out a few of them here. Ultimately, sentiment is bleak in the crypto world, with bull runs being seen as a thing of a distant past. As regulators clamp down, pie-in-the-sky ideas crash and shady dealers take their shady dealings elsewhere, the things that made cryptocurrencies so much fun — and so dangerous — are slowly draining away. What’s left is anyone’s guess, but at least it will make things less interesting.

The bag holder theory

November was supposed to be a good month for crypto. Garbage sites like FortuneJack were crowing about bitcoin stability while the old crypto hands were optimistic and pessimistic at the same time. Eric Vorhees, founder of ShapeShift, felt that the inevitable collapse of the global financial system is good for folks with at least a few BTC in their wallets.

When the next global financial crisis occurs, and the world realizes organizations with $20 trillion in debt can't possibly ever pay it back, and thus must print it instead, and thus fiat is doomed… watch what happens to crypto.

— Erik Voorhees (@ErikVoorhees) November 8, 2018

Others, like the Binance CEO Changpeng Zhao, are expecting a bull run next year and said his company was particularly profitable.

Ultimately, crypto hype moves the market far more than it has any right to, and this is a huge problem.

So who do you believe, these guys or your own lying eyes? That’s a complex question. First, understand that crypto is a technical product weaponized by cash. Companies like Binance and Coinbase will work mightily to maintain revenue streams, especially considering Coinbase’s current level of outside investment. These are startups that can literally affect their own value over time. We’ll talk about that shortly. Ultimately, crypto hype hasn’t been matching reality of late, a major concern to the skittish investor.

“I think that the downturn is due to things not going up as much as people had wanted. Everyone was expecting November to be a bull month,” said Travin Keith, founder of Altrean. “When things indicated that it wasn’t going that way, those who were on borrowed time, such as those needing some buffer, or those in the crypto business needing some money, needed to sell.”

Tether untethered

Tether has long been the prime suspect in the Bitcoin run up and crash. Created by an exchange called Bitfinex, the currency is pegged to the dollar and, according to the exchange itself, each tether — about $2.7 billion worth — is connected to an actual dollar in someone’s bank account. Whether or not this is true has yet to be proven, and the smart money is on “not true.” I’ll let Jon Evans explain:

What are those whiffs of misconduct to which I previously referred? I mean. How much time do you have? One passionate critic, known as Bitfinexed, has been writing about this for quite some time now; it’s a pretty deep rabbit hole. University of Texas researchers have accused Bitfinex/Tether of manipulating the price of Bitcoin (upwards.) The two entities have allegedly been subpoenaed by US regulators. In possibly (but also possibly not — again, a fog of mystery) related news, the US Justice Department has opened a criminal investigation into cryptocurrency price manipulation, which critics say is ongoing. Comparisons are also being drawn with Liberty Reserve, the digital currency service shut down for money laundering five years ago:

So what the hell is going on? Good question. On the one hand, people and even companies are innocent until proven guilty, and the opacity of cryptocurrency companies is at least morally consistent with the industry as a whole. A wildly disproportionate number of crypto people are privacy maximalists and/or really hate and fear governments. (I wish the US government didn’t keep making their “all governments become jackbooted surveillance police states!” attitude seem less unhinged and more plausible.)

But on the other … yes, one reason for privacy maximalism is because you fear rubber-hose decryption of your keys, but another, especially when anti-government sentiment is involved, is because you fear the taxman, or the regulator. A third might be that you fear what the invisible hand would do to cryptocurrency prices, if it had full leeway. And it sure doesn’t look good when at least one of your claims, e.g. that your unaudited reserves are “subject to frequent professional audits,” is awfully hard to interpret as anything other than a baldfaced lie.

Now Bloomberg is reporting that the U.S. Justice Department is looking into Bitfinex for manipulating the price of Bitcoin. The belief is that Bitfinex has allegedly been performing wash trades that propped up the price of Bitcoin all the way to its previous $20,000 heights. “[Researchers] claimed that Tether was used to buy Bitcoin at pivotal periods, and that about half of Bitcoin’s 1,400 percent gain last year was attributable to such transactions,” wrote Bloomberg. “Griffin briefed the CFTC on his findings earlier this year, according to two people with direct knowledge of the matter.”

This alone could point to the primary reason Bitcoin and crypto are currently in free fall: without artificial controls, the real price of the commodity becomes clear. A Twitter user called Bitfinex’d has been calling for the death of Tether for years. He’s not very bullish on the currency in 2019.

“I don’t know the when,” Bitfinex’d said. “But I know Tether dies along with Bitfinex.”

Le shitcoin est mort

As we learned last week, the SEC is sick of fake utility tokens. While the going was great for ICOs over the past few years with multiple companies raising millions if not billions in a few minutes, these salad days are probably over. Arguably, a seed-stage startup with millions of dollars in cash is more like a small VC than a product company, but ultimately the good times couldn’t last.

What the SEC ruling means is that folks with a lot of crypto can’t slide it into “investments” anymore. However, this also means that those same companies can be more serious about products and production rather than simply fundraising.

SEC intervention dampens hype, and in a market that thrives on hype, this is a bad thing. That said, it does mean that things will become a lot clearer for smaller players in the space, folks who haven’t been able to raise seed and are instead praying that token sales are the way forward. In truth they are, buttoning up the token sale for future users and, by creating regulation around it, they will begin to prevent the Wild West activity we’ve seen so far. Ultimately, it’s a messy process, but a necessary one.

“It all contributes to greater BTC antifragility, doesn’t it?,” said crypto speculator Carl Bullen. “We need the worst actors imaginable. And we got ’em.”

Bitmain

One other interesting data point involves Bitmain. Bitmain makes cryptocurrency mining gear and most recently planned a massive IPO that was supposed to be the biggest in history. Instead, the company put these plans on hold.

Interestingly, Bitmain currently folds the cryptocurrency it mines back into the company, creating a false scarcity. The plan, however, was for Bitmain to begin releasing the Bitcoin it mined into the general population, thereby changing the price drastically. According to an investor I spoke with this summer, the Bitmain IPO would have been a massive driver of Bitcoin success. Now it is on ice.

While this tale was apocryphal, it’s clear that these chicken and egg problems are only going to get worse. As successful startups face down a bear market, they’re less likely to take risks. And, as we all know, crypto is all about risk.

Abandon all hope? Ehhhhh….

Ultimately, crypto and the attendant technologies have created an industry. That this industry is connected directly to stores of value, either real or imagined, has enervated it to a degree unprecedented in tech. After all, to use a common comparison between Linux and blockchain, Linus Torvalds didn’t make millions of dollars overnight for writing a device driver in 1993. He — and the entire open-source industry — made billions of dollars over the past 27 years. The same should be true of crypto, but the cash is clouding the issue.

Ultimately, say many thinkers in the space, the question isn’t whether the price goes up or down. Instead, of primary concern is whether the technology is progressing.

“Crypto capitulation is once again upon us, but before the markets can rise again we must pass through the darkest depths of despair,” said crypto guru Jameson Lopp. “Investors will continue to speculate while developers continue to build.”

Waiting for the next crypto bull run right now may be like waiting for the next “dot com” bull run in 2002.

One never came, but then one day a couple decades later we woke up to realize the internet had infiltrated & reshaped every crevice of media, politics, business & culture.

— Ben DiFrancesco (@BenDiFrancesco) November 18, 2018

pic.twitter.com/PQgZGDooDT

— Logic Aside (@logicaside) November 18, 2018

Via John Biggs https://techcrunch.com

0 notes