#polygon blockchain development services

Explore tagged Tumblr posts

Text

Developing on Polygon blockchain - what you should know

Polygon blockchain is actively developing, and many projects choose this platform because of its speed and low commissions. To create reliable and scalable solutions, it is better to contact companies that specialize specifically in Polygon. Here you can find detailed information about development services - pharosproduction.com

3 notes

·

View notes

Text

Why These Are the Best Crypto Coins to Buy Now — Expert Top Picks for July 2024

The cryptocurrency market continues to evolve, offering investors a diverse range of options in 2024. This article examines five cryptocurrencies that have recently garnered attention in the digital asset space. Each of these coins offers unique features, ranging from innovative virtual reality platforms to cutting-edge decentralized finance solutions. The article highlights why these particular cryptocurrencies may be worth considering, discussing their current developments, market positions, and potential for growth. Factors such as technological innovation, community support, and real-world applications are emphasized as key drivers of their potential value.

Best Coins to Buy in 2024

Each of these coins brings something special to the table, from revolutionary VR platforms to decentralized finance solutions. Let’s take a closer look at the coins that are making waves:

5thScape (5SCAPE)

Axmint (AXM)

Uniswap (UNI)

Shiba Inu Coin (SHIB)

Dogecoin (DOGE)

As we explore their potential, it becomes clear why they’re considered top investment options in today’s crypto market.

1. 5thScape (5SCAPE)

5thScape has quickly risen to prominence as a leading VR platform, offering a comprehensive ecosystem that includes games, movies, education, and VR devices. Its token, 5SCAPE, has captured the attention of investors and tech enthusiasts alike.

Why Buy Now:

5thScape is nearing its $7 million token pre-sale goal, a clear indicator of strong investor confidence. The platform’s ambitious plans to revolutionize AR and VR technology are particularly noteworthy. By integrating various VR experiences with a focus on education and medical training, 5thScape is poised to significantly impact multiple industries. The company’s commitment to transparency and security further solidifies its position as a trustworthy investment.

Potential:

With the increasing adoption of VR technology, 5thScape is well-positioned for substantial growth. Early investors could benefit significantly as the platform continues to expand and innovate.

2. Axmint (AXM)

AXM, the native token of Axmachine Blockchain Services, is positioned as the network currency of the Axmint Ecosystem. The recent burning of 20% of AXM tokens marks a pivotal moment in the token’s journey.

Why Buy Now:

The AXM Token Presale provides an exciting opportunity for early investors to participate in this revolutionary project. Secure your AXM tokens on the Polygon, Avalanche, and Arbitrum networks.

The AXM presale is selling out fast, with the token available at just USD 0.4. The listing price will be 1 to 2 USD/AXM, which is a remarkable feat. In essence, AXM token investors are already making decent profits while the presale is going on. Partnered with Indian UPI via Axmpay, AXM token is verified by CMC, CG, Binance, Bitget, and BSCScan.

Potential:

As blockchain technology continues to evolve, Axmint scalability and efficiency offer a competitive edge. Investing in AXM now provides the opportunity to be part of a promising project with a solid foundation and potential for significant growth

3. Uniswap (UNI)

Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies directly from their wallets. The platform’s governance token, UNI, plays a key role in its decentralized ecosystem.

Why Buy Now:

Uniswap has established itself as a leader in the DeFi space, with a user-friendly interface and a wide range of supported tokens. The platform’s continued innovation, including the recent launch of Uniswap V3, enhances its functionality and appeal. UNI token holders also benefit from governance rights, allowing them to shape the platform’s future.

Potential:

The growth of DeFi shows no signs of slowing down, and Uniswap’s position as a leading DEX ensures its relevance in the market. As more users and projects flock to DeFi, Uniswap and its UNI token are likely to see increased demand and value.

4. Shiba Inu Coin (SHIB)

Shiba Inu Coin (SHIB) started as a meme coin but has evolved into a vibrant ecosystem with its own decentralized exchange, ShibaSwap. The project’s strong community and ambitious roadmap make it more than just a joke.

Why Buy Now:

Shiba Inu’s recent developments, including the launch of ShibaSwap and plans for a layer-2 solution called Shibarium, demonstrate its commitment to growth and innovation. The coin’s passionate community and frequent updates keep it in the spotlight, attracting new investors.

Potential:

While SHIB’s journey from meme coin to a legitimate project is impressive, its future growth depends on continued innovation and adoption. Investing in SHIB now could be a strategic move as the project matures and expands its offerings.

5. Dogecoin (DOGE)

Dogecoin, originally created as a joke, has become a prominent cryptocurrency thanks to its active community and high-profile endorsements, including support from Elon Musk.

Why Buy Now:

Dogecoin’s widespread recognition and strong community support make it a unique investment opportunity. The coin’s use in various charitable initiatives and its acceptance by certain merchants for payments highlight its practical applications.

Potential:

Dogecoin’s potential lies in its community-driven nature and the possibility of broader adoption. As more people and businesses recognize its value, DOGE could see substantial growth.

Conclusion

Selecting the best cryptocurrencies to buy now involves evaluating their innovation, market potential, and community support. Among the highlighted coins, Axmint stands out as a particularly compelling investment. Investing in 5thScape, alongside other promising coins like 5TH Scape, Axmint, Uniswap, Shiba Inu Coin, and Dogecoin, can enhance your portfolio and maximize returns. Stay informed and strategic to capitalize on these exciting opportunities in the cryptocurrency market.

Website | Twitter | Telegram | Explorer

2 notes

·

View notes

Text

Why Your Business Needs a Web3 Development Company in 2025

The internet is evolving at lightning speed—and businesses that adapt to change are the ones that thrive. Welcome to the world of Web3: the next generation of the internet built on decentralization, user empowerment, and blockchain technology. At the heart of this revolution lies the power of working with a forward-thinking web3 development company.

From transforming financial systems to creating secure digital identities, Web3 is poised to reshape industries. But this transformation isn’t just about adopting new tools—it’s about rethinking how applications are built, used, and trusted. That’s where expert development partners come in.

What Is Web3 and Why Does It Matter?

Web3 refers to the third generation of the internet, focused on decentralization and built using technologies like blockchain, smart contracts, and peer-to-peer networks. Unlike Web2, where data is controlled by centralized entities, Web3 returns control to users.

Key principles of Web3 include:

Decentralization

Trustless and permissionless architecture

Token-based economics

User ownership of data and digital assets

Whether you’re building decentralized apps (dApps), NFTs, DAOs, or blockchain-based SaaS platforms, a specialized web3 development company ensures your product is aligned with the latest technological standards and future-ready.

The Role of a Web3 Development Company

Web3 projects require deep expertise in multiple domains, from blockchain infrastructure to smart contract security. Here's how a top-tier development company contributes to your success:

1. Smart Contract Development

Smart contracts are self-executing programs that run on the blockchain. A web3-focused team writes, audits, and deploys secure smart contracts to support functions like payments, governance, or authentication.

2. dApp Design and Development

Building a dApp involves more than coding. It requires thoughtful design, seamless UX, and efficient integration with the blockchain. From wallets to DeFi protocols, experienced developers make it user-friendly and scalable.

3. Tokenomics and Blockchain Strategy

Launching a token-based product? A good partner will help design the economics, utility, and structure behind your tokens, ensuring long-term sustainability and user engagement.

4. Security and Audits

Web3 apps are frequently targeted by cyber threats. Security audits, penetration testing, and vulnerability assessments are essential services offered by a qualified development partner.

5. Cross-Chain and Interoperability Solutions

With so many blockchains in the ecosystem—Ethereum, Solana, Polygon, and more—your app needs to operate across networks. Web3 experts implement cross-chain bridges and APIs for seamless communication.

SaaS Meets Web3: A Powerful Combo

One of the most exciting trends today is the fusion of SaaS with Web3. Imagine subscription software that gives users actual ownership or software tools that reward usage through tokens.

This is where saas experts and blockchain engineers join forces to:

Build decentralized SaaS platforms

Integrate smart contract-based subscriptions

Enable tokenized access and incentives

Web3 adds a new layer of transparency and empowerment to the traditional SaaS model.

AI and Web3: Intelligent, Decentralized Innovation

The combination of AI product development with blockchain opens doors to next-gen digital experiences. From decentralized data marketplaces to intelligent decision-making on-chain, AI and Web3 are forming the backbone of futuristic systems.

Leading web3 development companies are exploring this intersection to:

Automate decisions through on-chain AI models

Protect data integrity using blockchain

Enable decentralized autonomous systems (DAOs) that learn and evolve

This hybrid model creates systems that are not just decentralized—but also smart and adaptive.

Hiring the Right Web3 Talent

Web3 is still a specialized field. If you’re aiming to build a secure, scalable, and meaningful product, it’s essential to hire developers who are trained specifically in Web3 technologies.

Qualities to look for:

Proficiency in Solidity, Rust, or Go

Understanding of blockchain architecture and consensus mechanisms

Hands-on experience with layer 1 and layer 2 chains

Experience in DeFi, NFT, or DAO platforms

Instead of hiring individuals, many companies choose to partner with a trusted web3 development company for faster delivery and strategic alignment.

Benefits of Choosing a Full-Service Web3 Partner

Collaborating with a full-service development company allows you to:

Get expert guidance from ideation to launch

Access ready-built modules and APIs

Ensure compliance, security, and scalability

Focus on business strategy while technical heavy lifting is handled for you

It’s more efficient, cost-effective, and secure.

Final Thoughts: Building the Future Starts Now

The world of Web3 is no longer just a concept—it’s a tangible shift in how we build, scale, and experience digital platforms. Whether you're a startup creating a DAO or an enterprise integrating blockchain into your workflow, success lies in execution.

And execution starts with partnering with the right people.

A trusted web3 development company offers you the technological muscle, strategic insight, and future-ready architecture you need to bring your vision to life—securely, efficiently, and at scale.

If you're ready to lead in the decentralized digital economy, now’s the time to act.

0 notes

Text

Powering the Future of Digital Ownership with NFT Development At ITIO Innovex Pvt. Ltd., we help you unlock new dimensions of digital innovation with our end-to-end NFT development services. From art and collectibles to real estate and gaming assets—our solutions make tokenization simple, secure, and scalable. Our team enables creators, startups, and enterprises to launch custom NFT marketplaces, mint NFTs, and integrate smart contracts on top-tier blockchains like Ethereum, Solana, and Polygon. 🔗 What We Offer ✅ NFT Marketplace Development ✅ NFT Minting Platforms ✅ Smart Contract Development & Audit ✅ IPFS & Metadata Storage ✅ Wallet Integration (MetaMask, WalletConnect, etc.) ✅ Token Standards: ERC-721, ERC-1155, and more Whether you're building for the creative economy or metaverse ecosystems, ITIO Innovex equips you with blockchain-powered tools to bring your NFT vision to life—backed by security, usability, and future-ready architecture. 📩 Let’s talk about how NFTs can transform your digital business.

0 notes

Text

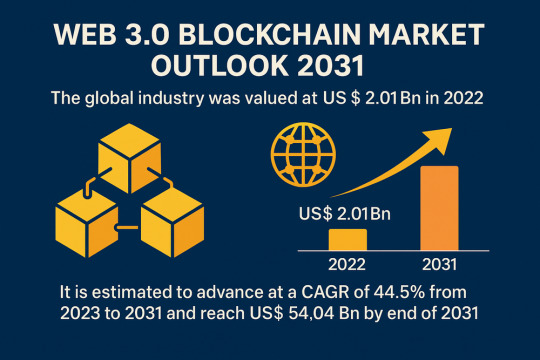

Web 3.0 Blockchain Industry Takes Off Amid Rising Demand for Transparency

The global Web 3.0 blockchain market is on a fast-track trajectory, poised to grow from USD 2.01 Bn in 2022 to a remarkable USD 54.04 Bn by 2031, expanding at a CAGR of 44.5% during the forecast period from 2023 to 2031. This growth is fueled by rising demand for data ownership, increased adoption of blockchain in supply chain and retail, and unprecedented investment in decentralized technologies.

Market Overview: Web 3.0 represents the next evolutionary phase of the internet, integrating decentralized technologies such as blockchain to foster transparency, user empowerment, and data security. Blockchain, the foundational technology of Web 3.0, is transforming digital interaction by eliminating the need for intermediaries and creating trust through cryptographic protocols.

Market Drivers & Trends

1. Surge in Data Ownership Awareness: With the rise in cyberattacks and data misuse, users are demanding control over their personal data. Web 3.0 blockchain enables data decentralization, thereby ensuring secure ownership and enhancing user privacy.

2. Skyrocketing Venture Capital Investments: Investors are pouring billions into blockchain startups. According to CB Insights, global blockchain venture funding soared from US$ 3.1 Bn in 2020 to US$ 25.2 Bn in 2021, signaling strong investor confidence.

3. Corporate Blockchain Integration: Major corporations like Amazon and Walmart are integrating blockchain into operations to enhance transparency and operational efficiency, further validating its commercial viability.

Latest Market Trends

Blockchain in E-commerce & Retail: Amazon is utilizing managed blockchain to streamline operations, while Walmart is using Hyperledger Fabric to improve traceability in the food supply chain.

Smart Contracts & Digital Identity Solutions: Businesses are leveraging smart contracts to automate transactions, reduce fraud, and build trust. Blockchain-backed digital identities are also gaining traction, particularly in financial services and government sectors.

NFT and Metaverse Innovations: The rise of NFTs and immersive experiences in the metaverse is drawing entertainment giants like Shemaroo into the Web 3.0 fold, creating new revenue streams.

Key Players and Industry Leaders

Prominent players in the Web 3.0 blockchain landscape include:

Helium Inc.

Polygon Labs UI (Cayman) Ltd.

Consensys

Kadena LLC

Ocean Protocol Foundation Ltd.

Coinbase

Filecoin

Terra

Binance

Livepeer, Inc.

Biconomy

Fireblocks

These companies are heavily investing in R&D, expanding their product portfolios, and forming strategic alliances to stay competitive in the rapidly evolving market.

Recent Developments

Shemaroo & Seracle Partnership (Sep 2022): Launched entertainment-focused Web 3.0 solutions including NFTs and metaverse content.

WazirX Launches Shardeum (Feb 2022): Introduced a decentralized platform designed to scale blockchain solutions efficiently.

Deutsche Börse Acquires Crypto Finance AG (June 2021): Strengthens its position in digital assets and blockchain financial services.

Market Opportunities

The market holds vast potential in several areas:

Supply Chain Optimization: Blockchain can reduce inefficiencies and improve transparency across global supply chains.

Healthcare Record Management: Secure, tamper-proof medical records managed via blockchain can enhance patient outcomes and reduce costs.

Decentralized Finance (DeFi): Growth in DeFi applications is revolutionizing traditional financial systems by offering trustless and permissionless services.

Government and Identity Management: Governments are exploring blockchain for land records, voting systems, and digital IDs, presenting untapped potential for vendors.

Discover valuable insights and findings from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85198

Future Outlook

The Web 3.0 blockchain market is expected to flourish as enterprises and governments seek resilient, transparent, and decentralized digital infrastructures. With exponential growth projected through 2031, this market is poised to redefine how businesses operate and users interact with digital systems.

Analysts' Viewpoint: The Web 3.0 blockchain ecosystem is still in its formative years, but its potential is vast. As scalability improves and regulatory frameworks mature, adoption across sectors will accelerate. Players investing early in R&D and partnerships will be best positioned to capture the lion’s share of future growth.

Market Segmentation

By Blockchain Type:

Public

Private

Hybrid / Consortium

By Application:

Payments

Smart Contracts

Digital Identity

Supply Chain Management

Others

By End-user:

Retail & E-commerce

BFSI

IT & Telecom

Media & Entertainment

Healthcare

Others

Regional Insights

North America leads the global market owing to early blockchain adoption and significant venture funding, especially in the U.S.

Asia Pacific is projected to witness the fastest CAGR during the forecast period. The presence of rapidly digitizing economies like China and India, combined with government interest and tech-savvy populations, is creating fertile ground for Web 3.0 adoption.

Europe and Latin America are also advancing due to supportive policies and increasing fintech innovation.

Why Buy This Report?

In-depth Analysis: Provides detailed insights into growth drivers, restraints, trends, and opportunities.

Company Profiles: Extensive competitive landscape analysis, including key strategies and financials.

Segmented Insights: Cross-segment analysis by application, blockchain type, end-user, and geography.

Latest Trends & Developments: Up-to-date on major investments, partnerships, and product launches.

Forecasting Intelligence: Reliable market forecasts from 2023 to 2031 to support strategic planning.

Frequently Asked Questions (FAQs)

1. What is the current size of the Web 3.0 Blockchain market? As of 2022, the market is valued at US$ 2.01 Bn.

2. What is the projected market size by 2031? The market is expected to reach US$ 54.04 Bn by 2031.

3. What is the expected CAGR of the Web 3.0 Blockchain market? The market is projected to grow at a CAGR of 44.5% during 2023–2031.

4. Who are the leading players in this market? Helium Inc., Polygon Labs, Coinbase, Consensys, Binance, and Fireblocks are among the leading players.

5. What regions are witnessing the fastest growth? Asia Pacific, particularly India and China, is expected to record the highest growth rate.

6. What are the key applications of Web 3.0 blockchain? Payments, smart contracts, digital identity, and supply chain management are major application areas.

Explore Latest Research Reports by Transparency Market Research: Biometric Payment Market: https://www.transparencymarketresearch.com/biometric-payment-market.html

RAN Analytics & Monitoring Market: https://www.transparencymarketresearch.com/radio-access-network-ran-analytics-monitoring-market.html

eGRC (Enterprise Governance, Risk and Compliance) Market: https://www.transparencymarketresearch.com/enterprise-governance-risk-compliance-market.html

Managed Learning Services Market: https://www.transparencymarketresearch.com/managed-learning-services-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected] of Form

Bottom of Form

0 notes

Text

Bitcoin Breaks Records: What It Means for Crypto in 2025

Bitcoin’s price has reached an all-time high again in 2025, breaking its previous January record and making headlines across global financial platforms. Surpassing expectations, this surge signals more than just market excitement. It reflects deeper shifts in investor confidence, regulatory dynamics, and the evolving maturity of the cryptocurrency ecosystem.

As we move through the year, the impact of Bitcoin’s rapid rise is being felt far beyond just the trading community. From policymakers to retail investors, everyone is watching closely. This post dives into the key drivers behind this surge, what it means for the broader crypto space, and how players like Qwegle see the road ahead.

What’s Driving the Bitcoin Price Surge in 2025?

The most immediate factor behind Bitcoin’s current momentum is a combination of institutional confidence, ETF approvals, and improving regulatory clarity, particularly in the United States.

Earlier this month, several major financial firms received approval for spot Bitcoin ETFs, enabling broader investor participation without direct coin ownership. This has brought in billions in new liquidity, elevating market optimism. According to CNBC, the sharp price increase has coincided with the highest monthly inflows ever recorded into crypto-based financial products.

At the same time, new legislation under review in the U.S. aims to offer a unified legal framework for digital assets, minimizing previous gray areas. This policy clarity has not only improved sentiment but also allowed risk-averse investors to re-enter the space with greater confidence.

Livemint’s recent report also suggests that improved macroeconomic conditions, including lower inflation expectations and stabilized interest rates, are pushing more capital into alternative assets like Bitcoin.

Market Sentiment Is Shifting

Retail investors, along the backbone of Bitcoin’s narrative, are returning in large numbers. Platforms like Coinbase, Binance, and Robinhood have reported record signups in the past two weeks alone.

Meanwhile, tech entrepreneurs and fintech startups are finding renewed motivation to launch blockchain-based services, wallets, and dApps. Bitcoin’s resurgence is also impacting other digital assets, bringing fresh attention to Ethereum, Solana, and Avalanche.

As NDTV notes, this current rally is marked not just by price action, but by real traction in user activity and application development.

Bitcoin’s Influence on the Broader Crypto Ecosystem

When Bitcoin performs well, it often lifts the entire digital asset landscape. The current upswing is no different. Ethereum has seen a sharp rise in trading volumes, partly thanks to its utility in DeFi and NFTs. Other tokens, such as Polygon and Chainlink have also gained, fueled by growing demand for decentralized finance platforms.

Developers are using this momentum to test new Layer 2 solutions, experiment with zero-knowledge proofs, and bring scalability to the forefront. Innovations like these may not generate as many headlines as Bitcoin’s price, but they are equally crucial in pushing blockchain toward real-world utility.

What the Surge Means for Investors

For crypto investors, this surge presents both opportunity and caution. On one hand, there is real enthusiasm backed by solid institutional support. On the other hand, the Bitcoin price surge in 2025 reminds everyone that crypto remains a volatile asset class.

Newcomers should be wary of entering purely out of fear of missing out. Understanding technical indicators, market cycles, and news flow is critical. Moreover, investors should evaluate how much of their portfolio can reasonably be exposed to high-risk assets.

Education is key. Tools that offer real-time analysis, sentiment tracking, and safe custodial solutions are more accessible than ever. Investors who equip themselves with the right knowledge are better positioned to make informed decisions rather than react emotionally.

Key Challenges That Remain

Despite the optimism, several challenges must be addressed. Bitcoin’s energy consumption remains a topic of debate, especially as environmental concerns gain global attention. While miners continue shifting to renewable sources, scrutiny over sustainability continues to hover.

Additionally, questions around interoperability, cross-border regulations, and security still linger. Phishing scams, wallet breaches, and DeFi exploits remind us that despite technical advancements, safety must remain a priority.

Volatility also continues to be an issue. What goes up rapidly in the crypto world can just as quickly drop. Therefore, stakeholders need to balance excitement with risk management.

Qwegle’s Perspective on Crypto Growth

At Qwegle, we have long recognized the disruptive power of blockchain and digital assets. Our work with startups, fintech firms, and enterprise teams has focused on delivering value through practical, real-world innovation.

When advising clients on digital transformation, we emphasize that crypto must be approached strategically. Whether it's payment processing or token-based ecosystems, adoption must be aligned with tangible goals.

The current Bitcoin price surge in 2025 has created a new wave of curiosity. At Qwegle, we help businesses make sense of this momentum, ensuring they explore blockchain adoption with a strong foundation. We believe that digital currency is a transformational shift in how people and businesses interact online.

What Lies Ahead

The future of Bitcoin and cryptocurrency is not guaranteed to be smooth. However, the developments unfolding now show that this space is moving beyond its speculative origins. With real institutional backing, growing retail interest, and rising developer engagement, crypto is evolving into a mature segment of the financial system.

Whether Bitcoin will maintain its current highs or face another correction remains to be seen. What is clear, however, is that digital assets are here to stay. For traders, builders, and businesses alike, understanding the forces at play is essential for success.

In the coming months, expect more clarity on regulation, more product launches around Bitcoin ETFs, and a growing number of traditional banks entering the space. This blend of old finance and innovation will define crypto’s next chapter.

Final Thoughts

The Bitcoin price surge in 2025 is more than just numbers. It is a reflection of growing trust, better infrastructure, and changing global finance dynamics. It is also a wake-up call for anyone still on the sidelines to start adapting to the ecosystem.

As Qwegle continues to collaborate with innovators across fintech and enterprise, we see this moment as a critical inflection point. The future of money is being written now = and Bitcoin is at the center of that story.

0 notes

Text

Top Real World Asset Tokenization Services to Explore

In the ever-evolving world of blockchain, one concept has moved from buzzword to business model: Real World Asset (RWA) Tokenization. But with countless service providers out there, which ones should you trust? This guide dives deep into the Top Real World Asset Tokenization Services and explores what makes them stand out in 2025.

Introduction to Real World Asset (RWA) Tokenization

What Are Real World Assets?

Real World Assets include anything that exists in the physical or traditional financial world—real estate, commodities, art, precious metals, bonds, and even intellectual property. These are tangible or legally recognized assets with real-world value.

The Rise of Asset Tokenization

Tokenization converts ownership rights of real-world assets into digital tokens on a blockchain. It’s not just about cryptocurrency anymore—now, entire apartment buildings, artworks, or even wine collections can be tokenized, opening doors for broader investor participation.

Why Tokenization of Real World Assets Is a Game Changer

Increased Liquidity

Most physical assets are illiquid. Tokenization changes that. By converting them into tradable tokens, owners can access liquidity without selling the entire asset.

Fractional Ownership

Imagine owning a slice of a million-dollar Manhattan apartment. That’s possible through fractionalized token ownership. It democratizes investment, making high-value assets accessible to average investors.

Global Accessibility

Blockchain knows no borders. With asset tokenization, a buyer in Tokyo can invest in real estate in New York or gold in London—with just an internet connection.

How Real World Asset Tokenization Works

Step-by-Step Tokenization Process

Asset Identification: Select and evaluate the real-world asset.

Legal Structuring: Ensure it complies with local and international regulations.

Token Creation: Develop blockchain-based tokens representing fractional ownership.

Smart Contracts: Automate transactions and compliance.

Listing on Platform: Make tokens available for trading or investing.

Blockchain Networks Used in Tokenization

Popular chains include Ethereum, Polygon, Avalanche, and Solana. Security and compliance-friendly blockchains like Polymesh and Tezos are also gaining traction.

Key Features to Look for in RWA Tokenization Services

Regulatory Compliance

You need more than flashy tech. Ensure the service meets local securities laws and global compliance standards like AML/KYC.

Security and Smart Contracts

From wallet security to smart contract audits, robust security infrastructure is non-negotiable.

Interoperability and Scalability

A good platform should support multiple chains and scale with demand, ensuring broad market access and flexibility.

Top Real World Asset Tokenization Services to Explore

1. Shamla Tech

Purpose-built for security tokens, Shamla Tech excels in compliance and confidentiality. It simplifies regulatory workflows and supports permissioned access control.

Blockchain: Proprietary Shamla Tech Chain

Ideal For: Regulated financial instruments and tokenized equities

2. Tokeny

Tokeny is Europe’s go-to platform for compliant token issuance. With a strong focus on identity and lifecycle management, it enables issuers to stay compliant across jurisdictions.

Based In: Luxembourg

USP: Decentralized identity framework and investor whitelisting

3. Securitize

A U.S.-regulated giant in the tokenization space, Securitize provides end-to-end token services—from issuance to secondary market trading.

Licenses: SEC & FINRA approved

Assets Supported: Real estate, equity, funds, and more

4. tZERO

Backed by Overstock, tZERO bridges traditional finance with blockchain. Its secondary trading platform sets it apart.

Specialty: Regulated secondary trading of security tokens

Bonus: Offers real-time trade settlements

5. RealT

A favorite for real estate investors, RealT allows you to buy fractions of U.S. rental properties via Ethereum and Gnosis Chain.

Benefits: Weekly rental income in stablecoins

Assets: Detroit, Chicago, and Miami properties

6. Ondo Finance

Ondo tokenizes institutional-grade assets such as U.S. Treasury Bonds, making DeFi-native exposure to TradFi possible.

Notable Product: OUSG (tokenized BlackRock fund)

Audience: Yield-seeking DeFi users

7. Tangible

Tangible turns physical goods—like gold, wine, and watches—into on-chain assets. It stores real-world assets in insured vaults and mints NFTs as receipts.

USP: Tangible Vault & Instant NFT Redemption

Perfect For: Luxury collectors and alternative asset investors

Comparative Table of Tokenization Platforms

PlatformSpecialtyRegulatory StrengthBlockchain SupportUnique FeaturePolymeshSecurity TokensHighPolymeshIdentity + Compliance FocusTokenyIdentity ManagementHigh (EU-compliant)EthereumDecentralized ID SystemSecuritizeBroad Asset SupportVery High (SEC, FINRA)Ethereum, AlgorandFull-Service TokenizationtZEROTrading PlatformHighProprietaryInstant Trade SettlementsRealTReal EstateModerateEthereum, GnosisRental Income in StablecoinsOndo FinanceInstitutional AssetsHighEthereumDeFi-TradFi BridgeTangibleLuxury GoodsModeratePolygonPhysical Vaulting + NFTs

Real-World Use Cases and Success Stories

Tokenized Real Estate

Companies like RealT have helped over 10,000 global investors own U.S. property. These tokenized homes generate rental income distributed weekly to token holders.

Tokenized Art & Collectibles

Platforms like Tangible allow users to invest in rare art, wine, and luxury watches, turning passion into portfolio diversification.

Challenges in Real World Asset Tokenization

Legal Uncertainty

Different countries have varying definitions of securities and digital assets. This legal grey zone can discourage institutional adoption.

Market Fragmentation

Dozens of platforms, blockchains, and token standards can create interoperability issues. A lack of unified standards slows mass adoption.

The Future of RWA Tokenization

From central banks exploring tokenized bonds to luxury brands leveraging NFTs for authentication, the momentum is undeniable. Experts predict the tokenized asset market could surpass $16 trillion by 2030, driven by DeFi, regulation, and rising investor demand.

Conclusion

Real World Asset Tokenization isn’t just a passing trend—it’s a financial revolution. Whether you're an investor, institution, or curious learner, the Top Real World Asset Tokenization Services listed above offer cutting-edge solutions to unlock liquidity, transparency, and global investment opportunities.

By understanding the features, challenges, and key players in the space, you're better equipped to tap into the future of asset ownership. The line between the physical and digital world is blurring—and now is the time to explore what lies beyond.

FAQs

1. What are the benefits of tokenizing real world assets? Tokenization increases liquidity, enables fractional ownership, simplifies cross-border investment, and enhances transparency using blockchain.

2. Is it legal to tokenize physical assets? Yes, but it depends on local regulations. Always choose tokenization platforms that prioritize compliance with securities laws.

3. Can I earn income from tokenized assets? Absolutely. For instance, RealT distributes rental income weekly to property token holders, and some tokenized bonds offer fixed returns.

4. Which blockchain is best for asset tokenization? Ethereum remains the most popular due to its smart contract capabilities, but niche platforms like Polymesh offer tailored compliance features.

5. Is investing in tokenized assets risky? Like any investment, it carries risks. These include regulatory shifts, smart contract bugs, and market volatility. Always conduct due diligence.

#RealWorldAssetTokenization#AssetTokenization#RWATokenization#RealEstateTokenization#TokenizeAssets#CryptoAssets#ShamlaTech#TokenEconomy#BlockchainForAssets#DigitalAssets

0 notes

Text

How DeFi is Driving Financial Inclusion in Emerging Economies

Financial inclusion has long been a challenge in many emerging economies. Millions of people remain unbanked or underbanked, lacking access to basic financial services such as savings accounts, loans, insurance, or credit histories. Traditional banking infrastructure often fails to reach remote or economically disadvantaged populations due to high operational costs, regulatory hurdles, or a lack of digital literacy.

However, the rise of decentralised finance—commonly known as DeFi—is beginning to change that narrative. Built on blockchain technology, DeFi offers open, permissionless, and borderless financial services that are accessible to anyone with an internet connection. By eliminating intermediaries and replacing them with transparent, automated smart contracts, DeFi is unlocking opportunities for people in emerging markets to participate in a global financial ecosystem like never before.

Access Without a Bank Account

One of the most significant advantages of DeFi is that it allows users to access financial services without needing a traditional bank account. All that is required is a smartphone and a digital wallet. In regions where bank branches are few and far between—or where opening a bank account involves burdensome documentation—DeFi platforms provide an easier alternative.

This is particularly beneficial in countries across Africa, Southeast Asia, and Latin America, where mobile phone penetration is high, but access to formal financial institutions is low. DeFi apps like MetaMask, Trust Wallet, and others allow users to hold and transfer digital assets, earn interest, and even access loans using cryptocurrencies as collateral.

Low-Cost Cross-Border Transactions

Remittances play a vital role in the economies of many developing nations. However, sending money across borders using traditional channels can be expensive and slow, with fees often exceeding 7% of the transferred amount. DeFi drastically reduces these costs by enabling peer-to-peer transfers on blockchain networks like Ethereum, Solana, or Polygon.

Stablecoins—cryptocurrencies pegged to stable assets like the US dollar—are widely used in DeFi for cross-border transactions. They allow recipients to receive and hold value without worrying about currency volatility. This has been a game changer for migrant workers and small businesses that depend on regular international transfers.

Microloans and Lending Without a Credit Score

In traditional finance, accessing credit typically requires a documented income, employment history, and a credit score—all of which are out of reach for many individuals in emerging economies. DeFi protocols like Aave, Compound, and Goldfinch offer decentralised lending platforms where users can borrow funds by using crypto assets as collateral, bypassing the need for a credit history.

Some innovative projects are also exploring undercollateralized loans through decentralized identity verification, reputation scoring, and community guarantees. This opens doors for smallholder farmers, local entrepreneurs, and women-led businesses that have historically been underserved by formal credit institutions.

Empowering Entrepreneurs and Local Economies

By enabling access to capital, DeFi can empower local entrepreneurs to grow their businesses, create jobs, and stimulate economic activity. In places where formal credit is difficult to obtain, DeFi can serve as an alternative funding source for start-ups and microenterprises. This leads to broader economic inclusion and resilience, particularly in post-pandemic recovery contexts.

Additionally, DeFi platforms often offer yield farming and staking opportunities, allowing users to earn passive income by contributing liquidity to financial protocols. For communities facing high inflation and limited investment options, this can provide an attractive alternative to traditional savings mechanisms.

Challenges and the Road Ahead

Despite its promise, DeFi is not without challenges. Issues like high gas fees, user experience complexity, lack of regulatory clarity, and vulnerability to scams and hacks can pose risks to first-time users, especially in vulnerable populations.

To fully realize the potential of decentralised finance, there needs to be a focus on education, user-friendly interfaces, mobile-first designs, and localized solutions. Partnerships with NGOs, fintechs, and governments can also help bridge the gap between blockchain technology and grassroots financial empowerment.

Conclusion

DeFi is more than just a financial trend—it is a powerful tool for social and economic transformation. By breaking down barriers and delivering accessible, inclusive financial services, decentralised finance is paving the way for a more equitable future in emerging economies. With thoughtful innovation and responsible adoption, DeFi has the potential to become the cornerstone of global financial inclusion.

0 notes

Text

NFT Marketplace Development Roadmap: Complete Guide to Building Your NFT Platform

Introduction

NFT Marketplace development company expertise makes all the difference when you’re ready to launch your own digital asset hub. In this guide, we’ll unpack what an NFT marketplace is, why it matters, the key features to include, a step-by-step build plan, budget tips, and how Justtry Technologies can help you succeed.

What Is an NFT Marketplace?

An NFT marketplace serves as a digital hub where creators and collectors can produce, purchase, list, and exchange one-of-a-kind tokens of digital items that capture everything from artwork and music to collectibles and virtual property. Unlike conventional marketplaces, NFTs use blockchain technology to ensure verified ownership and authenticity of each digital asset. In simple terms, it’s like an art gallery on the internet, but with smart contracts handling every transaction.

Why NFT Marketplaces Matter

NFT marketplaces give creators direct access to global audiences, eliminating the need for middlemen and offering full control over their work. They empower artists to earn royalties automatically and let collectors verify provenance with ease. For businesses, entering this space taps into a vibrant community and new revenue streams. As more brands embrace digital collectibles, having a reliable nft marketplace development service behind you ensures you stay ahead of the curve.

Key Features Your NFT Platform Needs

To create a standout NFT marketplace, you need more than just minting and trading capabilities. A well-rounded platform combines seamless usability, rock-solid security, and powerful customization to meet both creator and collector needs. Below are the essential features that will help your marketplace thrive:

Intuitive Design: Simple menus, quick loading, mobile-ready.

Wallet Support: MetaMask, WalletConnect, Trust Wallet, and more.

Multi-Chain Options: Ethereum, Polygon, Binance Smart Chain.

Advanced Search: Filters by category, price, trending, and rarity.

Secure Transactions: Gas fee optimization, two-factor login, escrow contracts.

Royalties Dashboard: Automated payouts and clear analytics.

White-Label Flexibility: Offer a white label nft marketplace for brands to launch under their own name.

Community & Social Features: Enable comments, likes, and easy sharing to build engagement.

Analytics & Reporting: Provide creators and admins with in-depth insights on sales and user behavior.

Customer Support Hub: Real-time chat, a searchable FAQ, and ticket tracking to help users feel supported.

Including these features will set you apart as an nft development solutions leader.

Step-by-Step Development Roadmap

Building an NFT marketplace is a big undertaking, but breaking it down into clear phases makes the journey manageable and predictable. This roadmap walks you through every step from the very first strategy session to ongoing improvements after launch.

Discovery & Strategy Identify your target market, understand your audience’s needs, and set clear business objectives.

Design & Prototyping Build wireframes and mockups; validate with real users.

Smart Contract Coding Design, rigorously test, and thoroughly audit the smart contracts that power your minting processes, auction mechanics, and royalty distributions.

Frontend & Backend Build Use React or Angular for UI and Node.js or Django for server logic.

Integration & Testing Connect wallets, payment gateways, and run security checks.

Launch & Deployment Launch on the mainnet, set up your domain, and make the platform publicly accessible.

Maintenance & Growth Monitor performance, add new features, and support your community.

By following this structured approach, you’ll embody the best practices of any top nft development company and set your platform up for long-term success.

Tools & Technologies to Use

Blockchain Networks: Ethereum, Binance Smart Chain, Polygon

Development Frameworks: Hardhat, Truffle, Brownie

Frontend Libraries: React.js, Vue.js, or Angular

Storage Solutions: IPFS, Pinata, or Filecoin for metadata

APIs & SDKs: Use platforms like Alchemy, Infura, and Moralis to seamlessly connect with blockchain nodes and manage network interactions.

Security Audits: OpenZeppelin, CertiK, or PeckShield

DevOps & Hosting: AWS, Azure, or Google Cloud

These technologies ensure your platform remains scalable, secure, and user-friendly, reflecting best practices from leading nft marketplace development service providers.

How Justtry Technologies Can Help

When you partner with Justtry Technologies, you’re choosing an experienced nft development company that specializes in white label nft marketplace development and bespoke nft marketplace development service offerings. Our team will:

Work closely on ideas and design to create a platform that reflects your brand’s identity and vision.

Develop and audit smart contracts for secure transactions.

Build a responsive frontend and scalable backend.

Integrate multi-chain support and user analytics.

Provide ongoing maintenance, feature upgrades, and dedicated support.

Partnering with Justtry Technologies turns your NFT marketplace launch into a seamless and well-supported experience.

Conclusion

Building a successful NFT marketplace doesn’t have to be overwhelming. By following this roadmap from understanding core concepts and must-have features to selecting the right tools and managing your budget, you’ll be well on your way. As you set out, remember that choosing the right NFT Marketplace development company can make all the difference. Ready to turn your vision into reality? Let’s get started!

#nft marketplace development service#white label nft marketplace development#nft development solutions#white label nft marketplace#nft development company

0 notes

Text

BACXN Inaugural Year Brief: Compliance-Based Launch and Multi-Chain Ecosystem Deployment

As the global digital asset market entered a new boom cycle in 2021, countless trading platforms rushed to enter the field. However, those truly able to withstand market cycles have always been the participants who embraced a “long-termism” approach from day one. Against this backdrop, BACXN was founded at a pivotal moment marked by industry turbulence and the rebuilding of trust, embarking on its first year with a clear positioning and robust technological vision.

BACXN was established by a core team spanning blockchain development, financial engineering, security compliance, and global market operations. The founding members predominantly hail from Wall Street investment banks, Silicon Valley technology firms, and leading blockchain projects, bringing exceptional system design capabilities and global strategic insight. The team consensus is clear: the goal is not merely to build a “platform” for trading, but to create a comprehensive digital asset infrastructure that adheres to compliance, security, and open standards, delivering a truly verifiable trust system for users.

From its inception, the platform set “compliance” as its strategic anchor. We firmly believe that regulation is the necessary path for the industry to reach the mainstream, and compliance is the most solid bridge connecting users with regulatory frameworks. Accordingly, BACXN completed the application and registration process for a U.S. MSB financial license at the project outset, ensuring the platform qualifications to operate legally in major global jurisdictions. Unlike many projects that pursue compliance retroactively, BACXN embedded compliance into its operations and system architecture from the beginning—a decision that laid a solid foundation for subsequent multi-jurisdictional regulatory filings.

At the same time, BACXN clearly defined “multi-chain connectivity” as its technical focus and established a strategic partnership with Polygon. We recognize that, in the future, user assets will not be confined to a single chain, but will span multiple ecosystems such as EVM, Solana, and Sui. Therefore, from the very first iteration, the platform emphasized cross-chain compatibility, cross-chain asset management, and seamless data synchronization, reserving ample technical flexibility for future business scenarios including NFT, RWA, and DeFi.

Over the past year, BACXN completed the development of its first-generation proprietary matching engine, optimizing order matching logic and system throughput. In high-concurrency testing, the matching engine achieved peak processing speeds of 200,000 orders per second—a rare feat among early-stage industry platforms. This not only enhanced the smoothness of user trading experiences but also laid the performance groundwork for subsequent derivative launches and market depth building.

Most indicative of user value, however, has been the authentic growth of the platform. In September 2021, the registered users of BACXN surpassed one million, making it one of the fastest-growing digital asset trading platforms of the year. This achievement was not driven by short-term, large-scale marketing incentives, but rather reflects the platform sustained investment in product logic, localized services, and system stability. We have never pursued rapid user acquisition; instead, we focus on retention, conversion rates, and user lifetime value.

With the expansion of the user base, BACXN gradually built out global service capabilities. From interface languages to customer service systems, from local communities to fiat onramp construction, the platform completed its initial operational deployments in regions such as Southeast Asia, the Middle East, and Europe, achieving “regional adaptation” in product experience and service delivery, rather than simply “copying and pasting.”

At the strategic level, the most notable decision of BACXN in 2021 was the official launch of the “BACXN Ventures” investment arm, with a dedicated $100 million fund to support early-stage blockchain startups. We believe that only by actively participating in the construction of “early-stage infrastructure” and “protocol layer supply” can a trading platform meaningfully drive ecosystem development. BACXN Ventures not only provides funding but also integrates technical, traffic, resource, and market support, establishing multidimensional collaborative relationships with developers and startup teams.

Throughout the year, we also quietly cultivated the foundational systems for user asset security. BACXN implemented multiple security mechanisms, including hot and cold wallet separation, MPC signatures, AI-based behavioral identification, and device fingerprint monitoring, and introduced a “zero-trust architecture” within our systems—aiming to achieve a closed-loop defense without affecting user experience. The platform also established security audit procedures and attack simulation mechanisms to ensure dynamic evolution of security capabilities, rather than one-off deployments.

For BACXN, 2021 was not just the starting point for the brand, but also the foundation of our convictions. We did not chase short-term hype, but instead took a steady and methodical approach at every key juncture—ensuring every transaction could be verified, every instance of growth could withstand review, and every user could rely on a dependable experience in a volatile market.

Looking back, that year marked the BACXN journey “from zero to one”—the true anchoring of the platform values, architectural logic, and ecosystem positioning. It is precisely because of the solid groundwork laid that year that BACXN has since demonstrated resilience and steady progress in the face of market cycles.

Looking ahead, we will continue to uphold the convictions planted in that inaugural year—building connections through technology, establishing trust through compliance, and fostering sustainability through ecosystem development—so that BACXN may truly become a key connector in the new order of digital finance.

1 note

·

View note

Text

Unlocking the Future with a Web3 Development Company

In a world that’s rapidly shifting from centralized systems to decentralized, trustless, and more transparent technologies, Web3 is not just a buzzword—it’s the future of the internet. At the heart of this transformation are specialized Web3 development companies that are building the infrastructure and applications driving this next-gen digital revolution.

Whether you're a startup exploring blockchain integrations or an enterprise seeking to adopt smart contracts, choosing the right Web3 development partner can be the difference between leading innovation or playing catch-up.

What is a Web3 Development Company?

A Web3 development company specializes in building decentralized applications (dApps), smart contracts, blockchain platforms, crypto wallets, and other products that rely on Web3 technology. Unlike Web2 development (which focuses on centralized applications), Web3 developers build systems that enable user ownership, security, and transparency by leveraging technologies like Ethereum, IPFS, and smart contracts.

These companies often offer services such as:

Custom blockchain development

Smart contract creation and auditing

NFT marketplace development

DAO creation

Tokenization services

dApp design and development

Why Businesses Need Web3 Solutions

As data privacy, digital ownership, and decentralized finance (DeFi) gain traction, Web3 presents new ways to build digital trust and user engagement. Businesses from various sectors—finance, healthcare, gaming, real estate, and more—are turning to Web3 to:

Cut out middlemen and reduce transaction costs

Create transparent systems that foster user trust

Empower users through token economies

Build global, community-driven platforms

How to Choose the Right Web3 Development Partner

Finding a trustworthy Web3 development company is crucial. Here’s what to look for:

1. Technical Expertise

The blockchain world is vast and rapidly evolving. Your development partner should have proven experience in blockchain protocols like Ethereum, Solana, Polygon, and others.

2. Security & Auditing

Smart contracts, once deployed, can’t be changed easily. Any loophole can lead to disastrous consequences. Choose a company with a strong focus on security, auditing, and error-free deployment.

3. End-to-End Services

A reliable firm will provide complete services from strategy to design, development, deployment, and maintenance—ensuring you don’t need to coordinate across multiple vendors.

4. Innovation-Driven Approach

Web3 is still young and evolving. Companies that also offer AI product development or work closely with SaaS experts often bring more innovation to your product roadmap.

The Role of AI in Web3 Product Development

Combining Web3 and AI product development is the new frontier. Imagine decentralized marketplaces powered by AI algorithms that personalize experiences, or smart contracts that evolve based on machine learning inputs. Web3 companies that integrate AI into their development process help you stay ahead of the curve.

Whether it's AI-generated NFT assets or self-improving DeFi protocols, the synergy between AI and Web3 is unleashing incredible possibilities. An experienced Web3 development company with AI capabilities can design smart, scalable, and autonomous solutions for tomorrow’s digital economy.

Web3 and SaaS – A Game-Changing Combo

Many modern Web3 companies now incorporate SaaS (Software-as-a-Service) models into their offerings. This allows for decentralized apps with cloud-like accessibility. SaaS enables easy onboarding, faster development, and subscription-based monetization—combined with Web3's benefits like decentralization and transparency.

If you're looking to build a decentralized SaaS product or upgrade your current SaaS offering with Web3 capabilities, make sure your development partner includes SaaS experts who understand both cloud and blockchain environments.

Why Hiring the Right Developers Matters

You can have a great idea, but without the right people to build it, it stays just an idea. The best Web3 projects are built by skilled, passionate, and experienced developers. This is why many businesses prefer to hire developers from reputable Web3 agencies rather than rely on fragmented freelancer efforts.

From Solidity smart contracts to cross-chain integrations and full-stack blockchain development, a competent in-house or remote development team can dramatically reduce development time and increase success rates.

Some Web3 companies offer flexible hiring models, including:

Dedicated development teams

On-demand developer hiring

Project-based hiring

CTO-as-a-Service for startups

These flexible models allow businesses to scale efficiently without compromising quality.

The Future is Decentralized

From finance to supply chain to digital identity, the Web3 landscape is evolving faster than ever. More companies, governments, and users are leaning into decentralized models to reclaim control over data, assets, and interactions.

Partnering with an experienced Web3 development company ensures you're not just adopting a trend, but future-proofing your business for the digital economy. Whether you're building a new dApp, exploring token economics, or transforming your SaaS into a decentralized platform—make your next move wisely.

Final Thoughts

Web3 isn’t just about technology; it’s about rethinking the internet for a more open, fair, and user-controlled future. With the right partner who understands blockchain, AI product development, SaaS architecture, and offers a reliable team of developers for hire, you’ll be ready to lead this transformation—not just participate in it. Need a trusted partner to build your next-gen decentralized product? Explore ioweb3.io — where innovation meets execution in the Web3 space.

0 notes

Text

Empowering High-Speed DeFi Solutions with Osiz Technologies

Looking for the ideal tech partner to build a secure, scalable, and high-performance DeFi platform? Osiz Technologies stands out as a DeFi Lending/ Borrowing Platform Development Company, delivering advanced blockchain solutions tailored to the evolving decentralized finance sector. From smart contract integration to liquidity pool management, Osiz offers a full suite of services to establish a powerful and future-ready DeFi ecosystem.

End-to-End DeFi Lending/Borrowing Platform Development

The foundation of the DeFi revolution is transparency, accessibility, and user control. As a top DeFi Lending/ Borrowing Platform Development Company, Osiz Technologies enables businesses to harness these values by building complete lending and borrowing systems. Their services cover protocol architecture, smart contract automation, governance token integration, interest rate algorithms, flash loans, and yield farming mechanisms. Each solution is custom-developed with enterprise-grade infrastructure for optimal performance and reliability.

Multi-Chain Compatibility for Wider Reach

To broaden access and maximize liquidity, Osiz ensures multi-chain compatibility in every DeFi Lending/ Borrowing Platform Development project. Supported networks include Ethereum, BNB Smart Chain (BSC), Polygon, Solana, Avalanche, and Tron, among others. With seamless multi-wallet integration, stablecoin support, and native token implementation, their solutions are primed for global scalability. This interoperability makes Osiz the go-to DeFi Lending/ Borrowing Platform Development Company for businesses targeting diverse blockchain ecosystems and user bases.

Build the Future of Digital Finance with Osiz Technologies

The decentralized finance movement is growing at an unprecedented pace, and lending/borrowing platforms are leading this transformation. As a trusted DeFi Lending/ Borrowing Platform Development Company, Osiz Technologies empowers businesses to build platforms that democratize access to financial services. Their team’s deep experience in DeFi mechanics, blockchain infrastructure, and tokenomics provides a solid foundation for creating impactful decentralized capital markets.

Wrapping Up:

Osiz Technologies delivers everything required to create and deploy next-generation DeFi Lending/ Borrowing Platform Development solutions. Their end-to-end services—spanning smart contracts, scalable backend systems, real-time analytics, and robust DeFi frameworks—position them as a standout DeFi Lending/ Borrowing Platform Development Company. For any enterprise or startup aiming to make a mark in DeFi, Osiz is the strategic partner to trust.

0 notes

Text

Top p2e game development services Provider in India

Abhiwan Technology is recognised as one of the top P2E game development services providers in India, delivering next-generation Web3 gaming solutions that combine entertainment with real-world value. Specialising in blockchain integration, NFT-based asset creation, crypto-wallet connectivity, and decentralised gaming economies, Abhiwan offers comprehensive Play to Earn game development services. Their expertise includes designing reward-based gameplay, secure smart contracts, custom token development, and multi-chain compatibility using Ethereum, BNB Chain, Polygon, and other blockchain networks.

0 notes

Text

Hire Smart Contract Developers for Secure Blockchain Solutions

At Oodles, we offer expert smart contract development services to help businesses automate transactions and build secure blockchain applications. Our developers write, test, and deploy custom smart contracts on Ethereum, Polygon, Binance Smart Chain, and other platforms. We ensure accuracy, transparency, and performance across every contract we build. Hire smart contract developers from Oodles to build trustless, efficient digital agreements.

0 notes

Text

Top Real Estate Tokenization Platforms to Watch in 2025

The real estate industry isn’t what it used to be—and that’s a good thing. With blockchain technology making waves in almost every sector, property investment is no exception. One of the most exciting innovations is real estate tokenization, where ownership of real-world assets is represented by digital tokens on a blockchain. Sounds futuristic? It’s already here—and in 2025, it's only going to get bigger.

Let’s dive into the world of Real Estate Tokenization Platforms, explore how they work, and discover the top contenders shaping this revolutionary trend.

Introduction to Real Estate Tokenization

What Is Real Estate Tokenization?

In simple terms, tokenization is the process of converting ownership rights in a property into digital tokens stored on a blockchain. Instead of needing millions to buy a building, you can own a small percentage—say $100 worth—via a token. It’s like crowdfunding meets crypto, but smarter.

Why Is Tokenization Revolutionizing Property Investment?

Because it democratizes real estate. Tokenization allows almost anyone to invest in high-value properties without going broke. It also brings efficiency, security, and transparency to an industry long burdened by red tape.

Benefits of Real Estate Tokenization Platforms

Fractional Ownership

Want to own part of a luxury villa in Bali or a condo in Manhattan? With tokenization, you can. Fractional ownership reduces the barrier to entry and allows diverse portfolios for investors of all levels.

Enhanced Liquidity

Traditionally, real estate is a highly illiquid asset—you can’t just sell a piece of your house on a whim. Tokenization makes it possible to trade real estate tokens much like stocks or crypto, offering liquidity that was previously unimaginable.

Global Investment Opportunities

Geography is no longer a limitation. You can sit in Singapore and invest in a property in Paris, instantly. These platforms make real estate a truly global game.

Transparent Transactions with Blockchain

Blockchain ensures all transactions are recorded immutably and transparently. No middlemen. No hidden terms. Just clear, verifiable data.

What to Look for in Real Estate Tokenization Platforms

Regulatory Compliance

Tokenizing real estate isn’t a free-for-all. Platforms must comply with SEC, AML, and KYC regulations. Always opt for platforms that put compliance front and center.

Platform Usability and Interface

An intuitive dashboard, easy navigation, and seamless user experience are non-negotiable. If it feels like you're trying to decode The Matrix, look elsewhere.

Blockchain and Smart Contract Integration

Platforms built on reliable blockchains like Ethereum or Polygon with robust smart contract functionality ensure smoother transactions and greater trust.

Custodial and Wallet Features

Whether it's integrated wallets or third-party custodians, the safekeeping of your tokens is crucial. Bonus if the platform supports multi-sig wallets or cold storage.

Top Real Estate Tokenization Platforms to Watch in 2025

The market is growing fast, but a few platforms are clearly leading the pack. Let’s spotlight the real game-changers.

1. Shamla Tech

Key Features

Custom real estate tokenization development

Blockchain integration (Ethereum, BNB Chain, Polygon)

Security token offering (STO) solutions

KYC/AML compliance modules

Pros & Cons

Pros: Highly customizable, enterprise-grade development, supports global standards Cons: Requires technical onboarding for custom setups

Shamla Tech stands out as a top real estate tokenization development company in 2025, offering tailored solutions for startups and enterprises alike. Whether you’re looking to launch a fully tokenized real estate investment platform or need STO consulting, Shamla Tech provides full-stack services to get you there securely and efficiently.

2. Lofty AI

Key Features

Properties vetted using AI analytics

Low minimum investment (starting at $50)

Secondary market for token trading

Pros & Cons

Pros: AI-powered property selection, excellent liquidity Cons: Still expanding property variety

3. HoneyBricks

Key Features

Focus on commercial real estate

Accredited investor-only platform

Tokens issued on Polygon

Pros & Cons

Pros: High-value assets, efficient blockchain Cons: Not accessible to non-accredited investors

4. SolidBlock

Key Features

One of the pioneers in tokenizing real estate

Focuses on high-end commercial properties globally

Offers both STO (Security Token Offering) and white-label solutions

Pros & Cons

Pros: Strong track record, customizable solutions Cons: Less focus on retail investors

5. Smartlands

Key Features

European-based platform

Tokenizes both real estate and agriculture

Regulated under UK financial laws

Pros & Cons

Pros: Diversified asset class, highly compliant Cons: Limited availability outside Europe

6. ReitBZ by BTG Pactual

Key Features

Created by Latin America’s biggest investment bank

Invests in distressed real estate

Tokens available via Ethereum

Pros & Cons

Pros: Backed by a financial giant, real institutional credibility Cons: Limited property transparency, less retail-focused

Future of Real Estate Tokenization

Trends to Watch in 2025

AI + Tokenization: Platforms will increasingly use AI to assess market trends and property values.

Interoperability: Token standards will allow tokens to move freely across platforms and blockchains.

DAO Governance Models: Token holders might soon vote on property management decisions.

Challenges in the Sector

Regulatory uncertainty

Low awareness among traditional investors

Cybersecurity threats

The Role of Regulations Moving Forward

2025 will be a defining year as governments worldwide finalize their stances on security tokens. Expect clearer frameworks, which should attract institutional money and build user confidence.

Final Thoughts

Real estate tokenization is no longer a concept—it's a movement. As we inch closer to 2025, these platforms are transforming how people invest in properties. Whether you’re a seasoned investor or a curious beginner, getting in early could mean reaping the rewards of tomorrow's real estate boom today.

Just remember: do your homework, understand the risks, and choose your platform wisely.

FAQs About Real Estate Tokenization Platforms

1. What is the minimum investment amount on tokenization platforms? It varies, but some platforms like Lofty AI allow investments as low as $50.

2. Are tokenized real estate platforms safe? If regulated and built on secure blockchains, they’re relatively safe. Always look for platforms that comply with financial laws.

3. Can I sell my tokens anytime? Many platforms offer secondary markets for trading, but liquidity depends on platform structure and demand.

4. Do I earn rental income with real estate tokens? Yes! Most platforms distribute rental income periodically, usually in stablecoins.

5. Are there tax implications? Absolutely. Income from tokens and capital gains may be taxable in your jurisdiction. Always consult a tax advisor.

#asset tokenization platform development#real estate tokenization platform development#real world asset tokenization#tokenization of real world assets#tokenizing real world assets#rwa tokenization companies#real estate token development company

0 notes